A Blank Loan Application Template for Financial Institutions provides a structured format to collect essential borrower information, ensuring a streamlined and consistent evaluation process. This template typically includes sections for personal details, financial background, loan purpose, and repayment plans, facilitating efficient data gathering. Using such a template helps financial institutions reduce errors and speed up loan processing times.

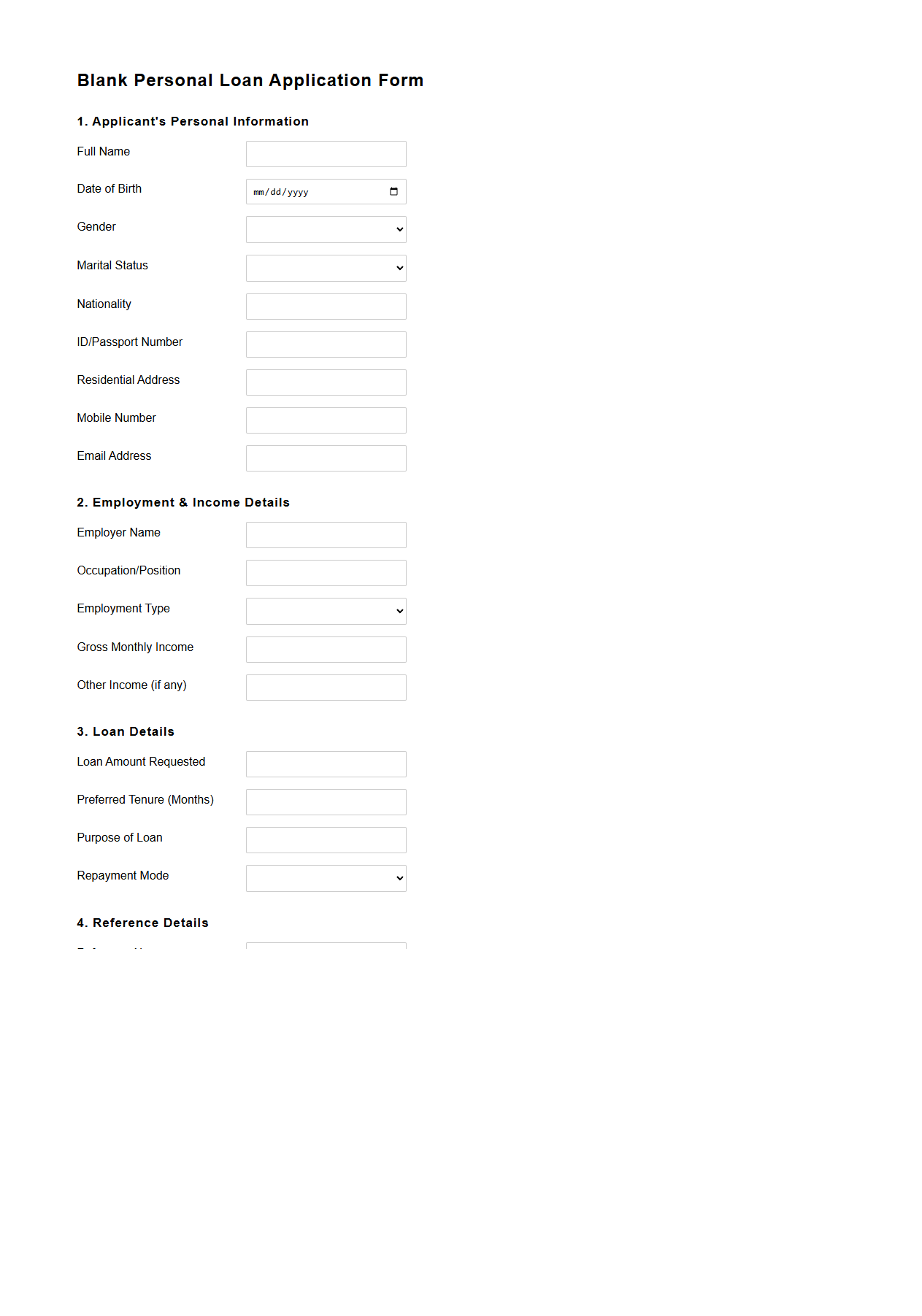

Blank Personal Loan Application Form Template for Banks

A

Blank Personal Loan Application Form Template for banks is a standardized document used to collect essential information from applicants seeking a personal loan. It typically includes sections for personal details, employment information, income verification, loan amount requested, and consent for credit checks. This template streamlines the loan approval process by ensuring all necessary data is provided in a clear and organized format.

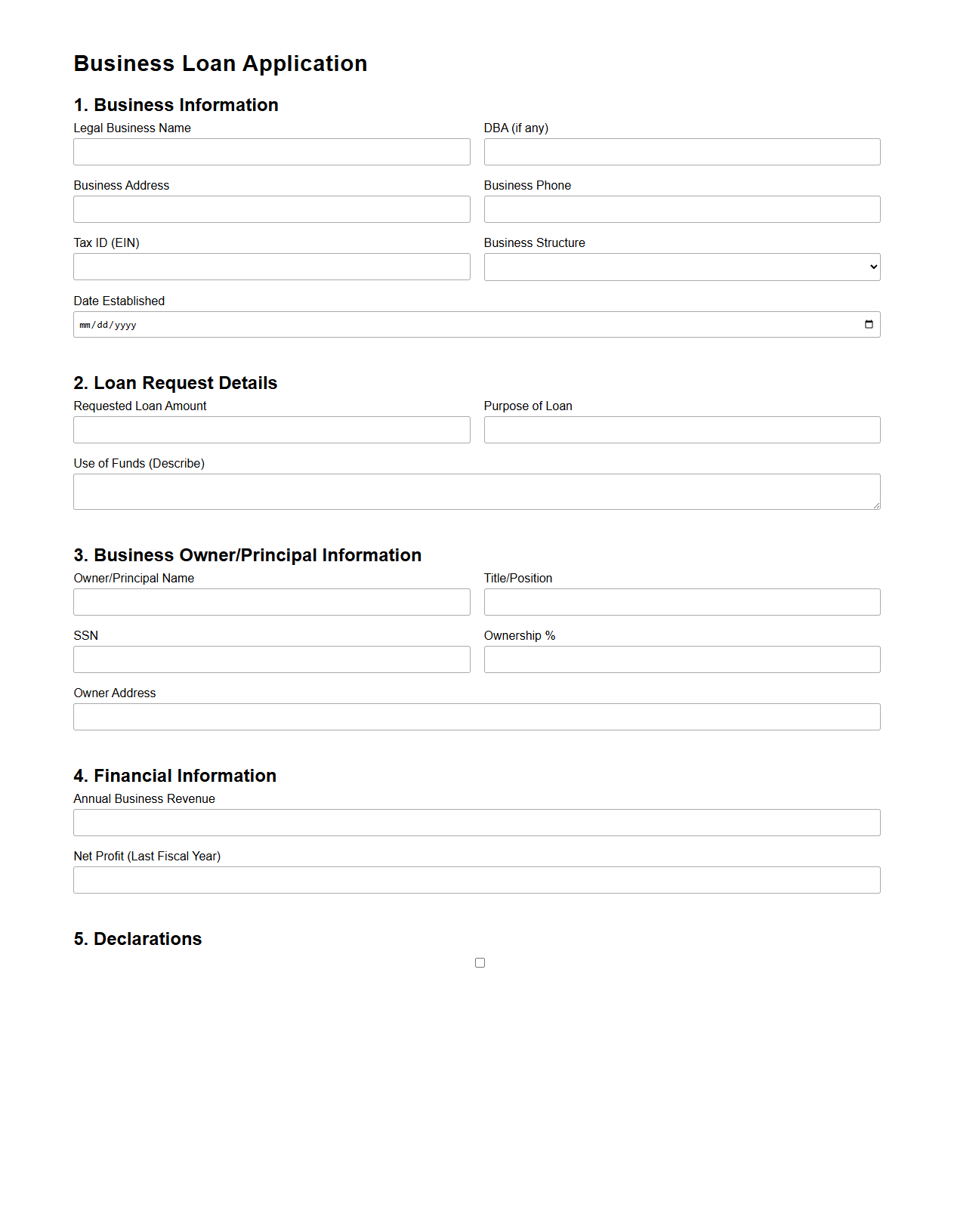

Blank Business Loan Application Document for Credit Unions

A

Blank Business Loan Application Document for Credit Unions serves as a standardized form that businesses use to apply for financing from credit unions. It typically includes sections to detail the applicant's financial information, business plan, collateral, and loan purpose, ensuring comprehensive data collection for credit assessment. This document streamlines the loan approval process by providing credit unions with consistent and essential information to evaluate creditworthiness and risk.

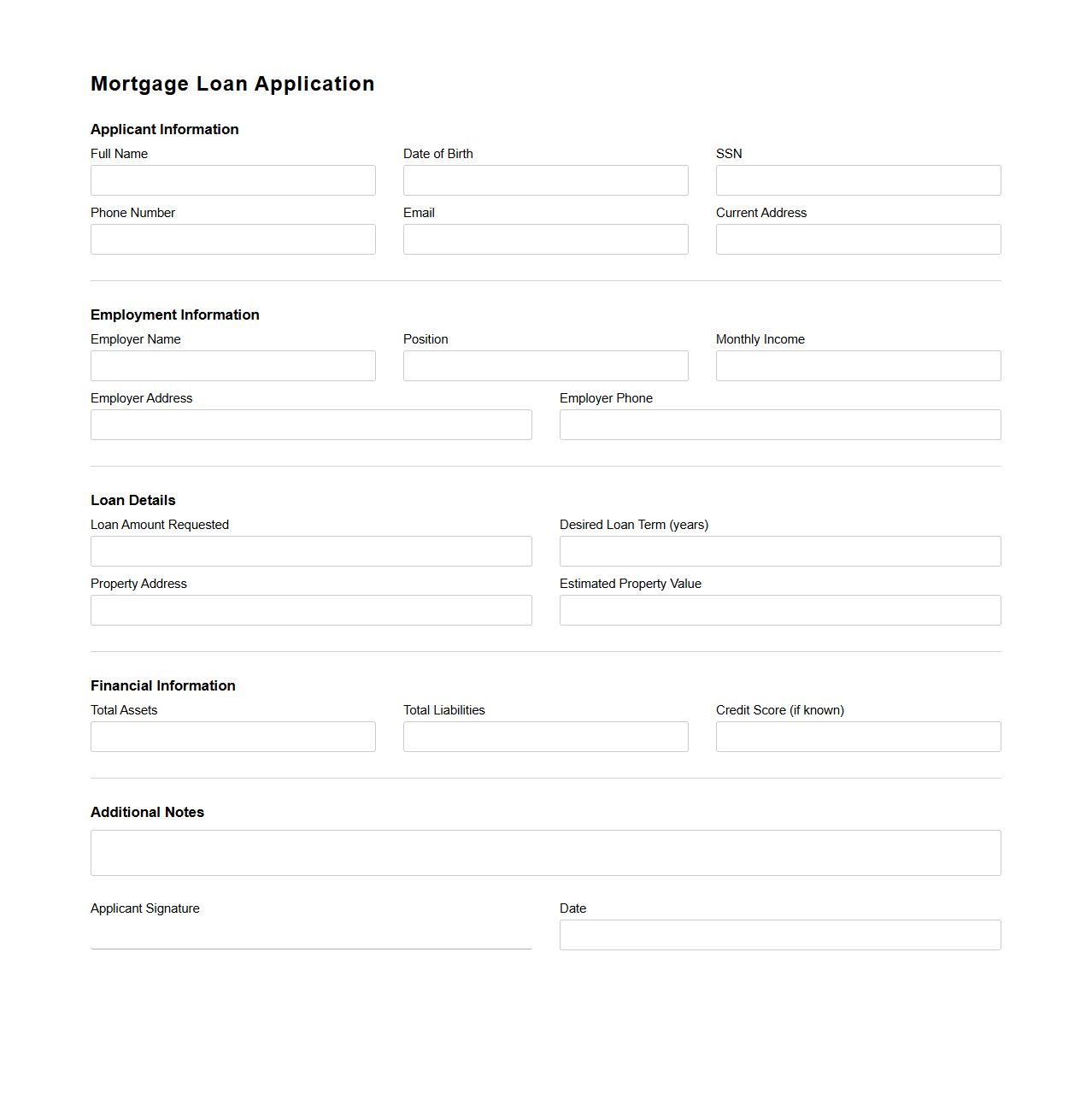

Blank Mortgage Loan Application Sheet for Lenders

A

Blank Mortgage Loan Application Sheet for lenders is a standardized form used to collect detailed financial and personal information from borrowers applying for a mortgage. This document facilitates efficient assessment of creditworthiness by capturing essential data such as income, employment history, assets, liabilities, and property details. Lenders rely on this sheet to streamline the underwriting process and ensure compliance with regulatory requirements.

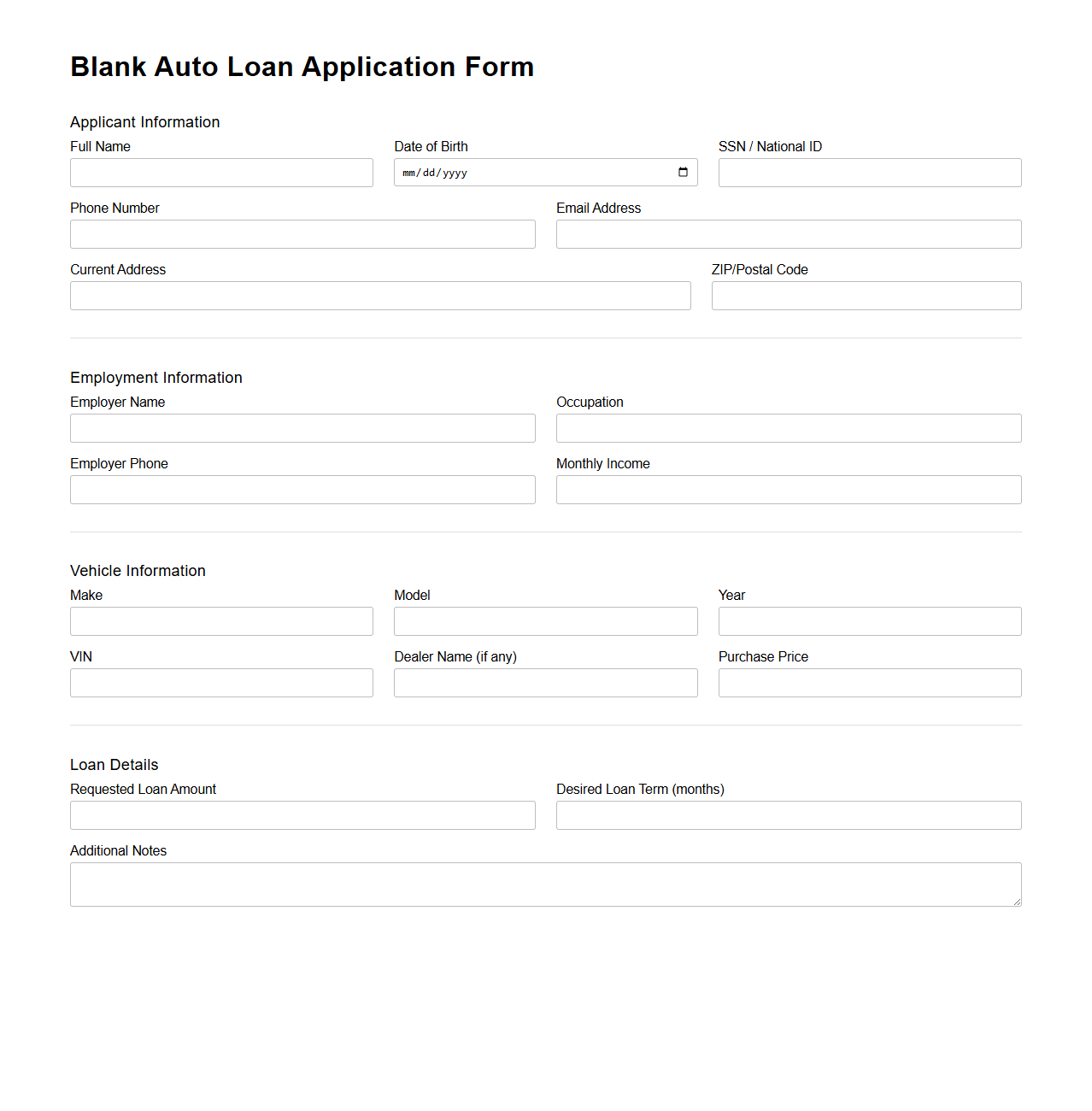

Blank Auto Loan Application Form for Financial Services

A

Blank Auto Loan Application Form for financial services is a standardized document used by lenders to collect essential information from applicants seeking auto financing. It typically includes sections for personal details, employment status, income verification, and vehicle information to assess creditworthiness. This form streamlines the loan approval process by providing a clear framework for evaluating the applicant's eligibility and financial stability.

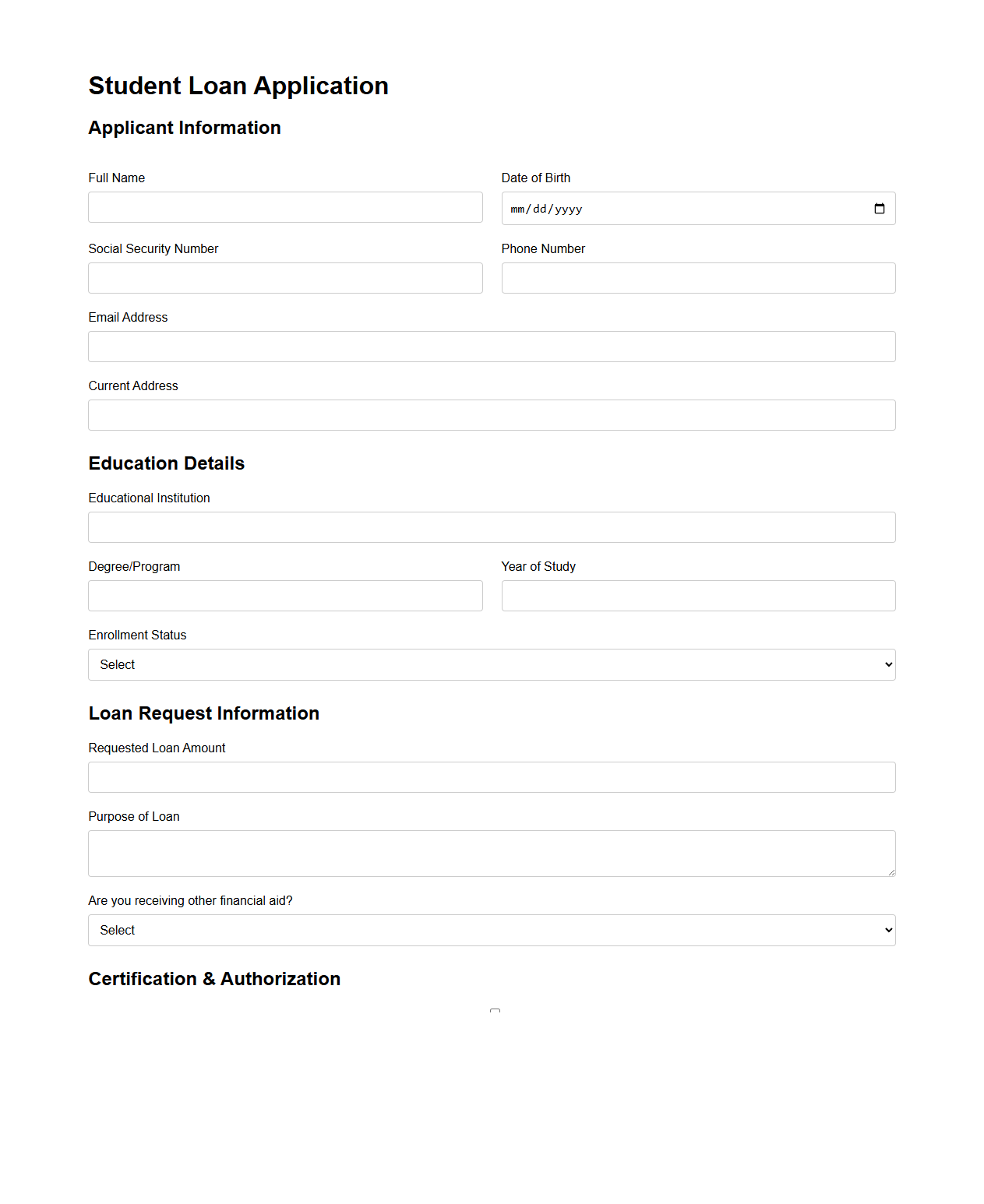

Blank Student Loan Application Template for Educational Lenders

A

Blank Student Loan Application Template for Educational Lenders is a standardized document designed to capture essential borrower information such as personal details, educational institution data, loan amount requested, and repayment terms. This template streamlines the loan approval process by ensuring consistency and completeness in applications submitted to financial institutions. It serves as a crucial tool for lenders to assess creditworthiness and manage student loan portfolios effectively.

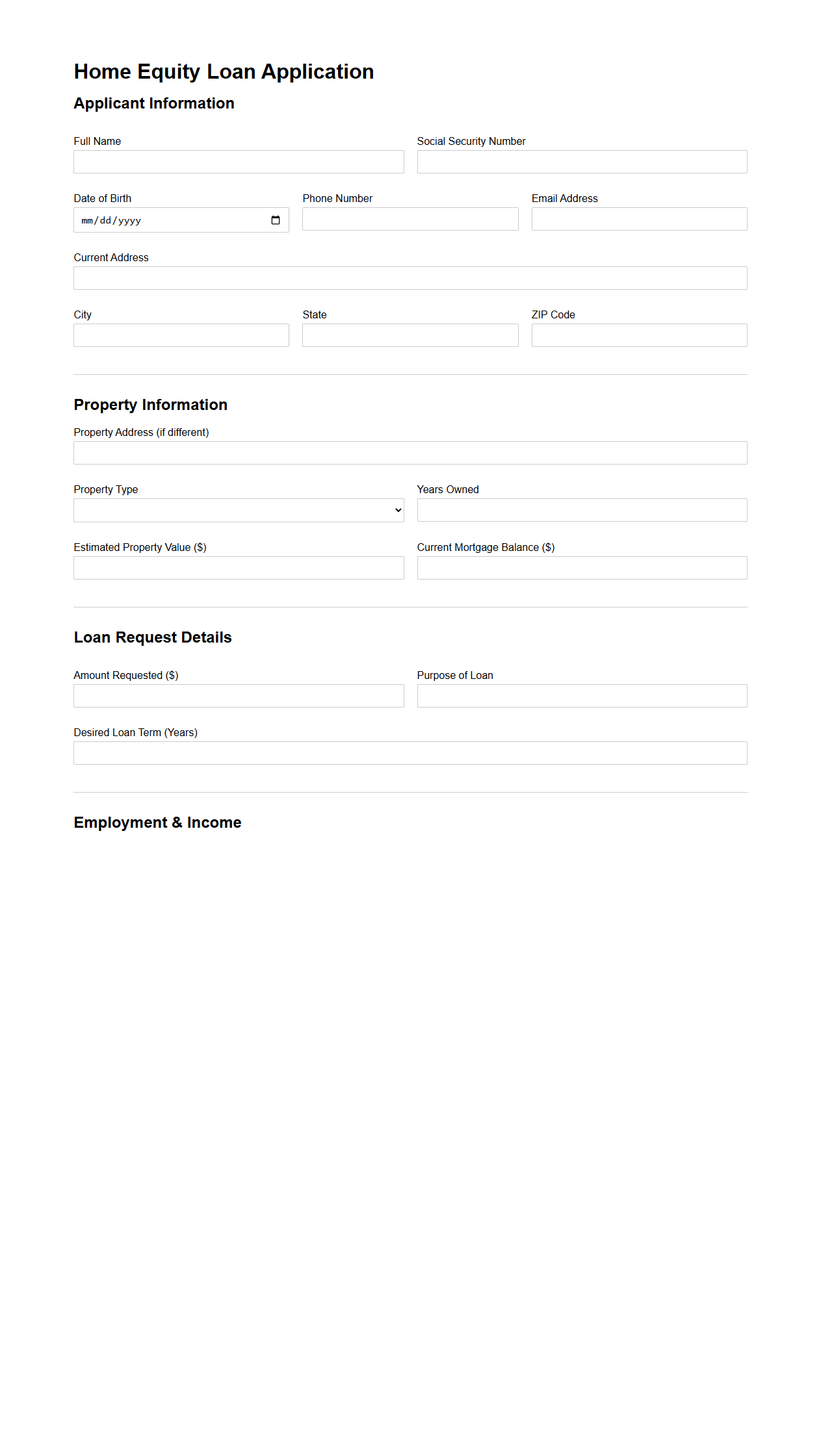

Blank Home Equity Loan Application Document for Mortgage Companies

The

Blank Home Equity Loan Application Document for mortgage companies serves as a standardized form used to collect essential financial and personal information from applicants seeking a home equity loan. This document includes sections detailing income, employment history, property details, and credit information, which mortgage companies analyze to assess loan eligibility and risk. Accurate completion of this form is crucial for streamlining the approval process and ensuring compliance with lending regulations.

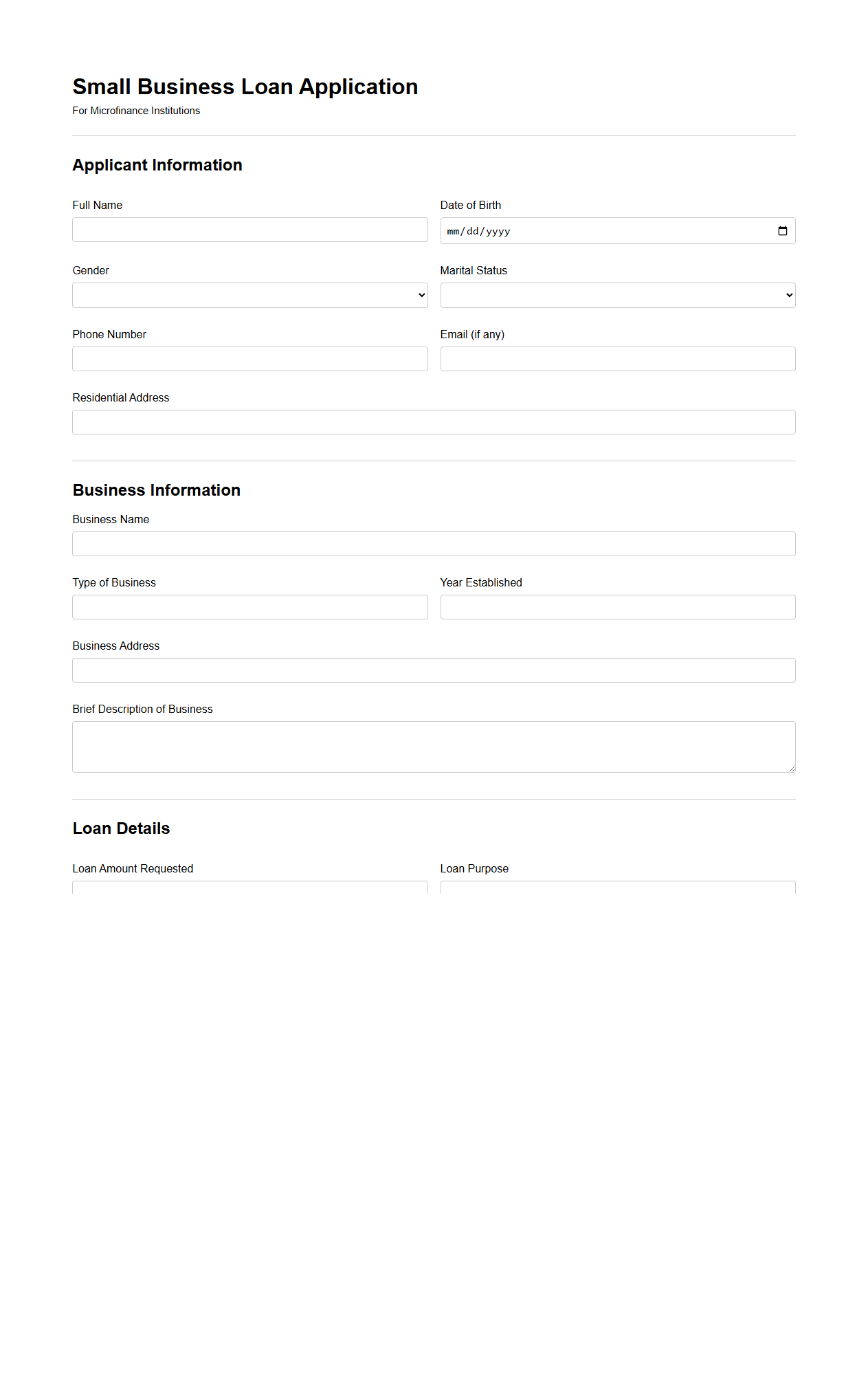

Blank Small Business Loan Application Format for Microfinance Institutions

A

Blank Small Business Loan Application Format for Microfinance Institutions document is a standardized template designed to collect essential information from applicants seeking financial assistance. It includes sections for personal details, business information, loan requirements, and financial statements to assess creditworthiness. This format helps microfinance institutions streamline the evaluation process and ensure consistency in loan approval decisions.

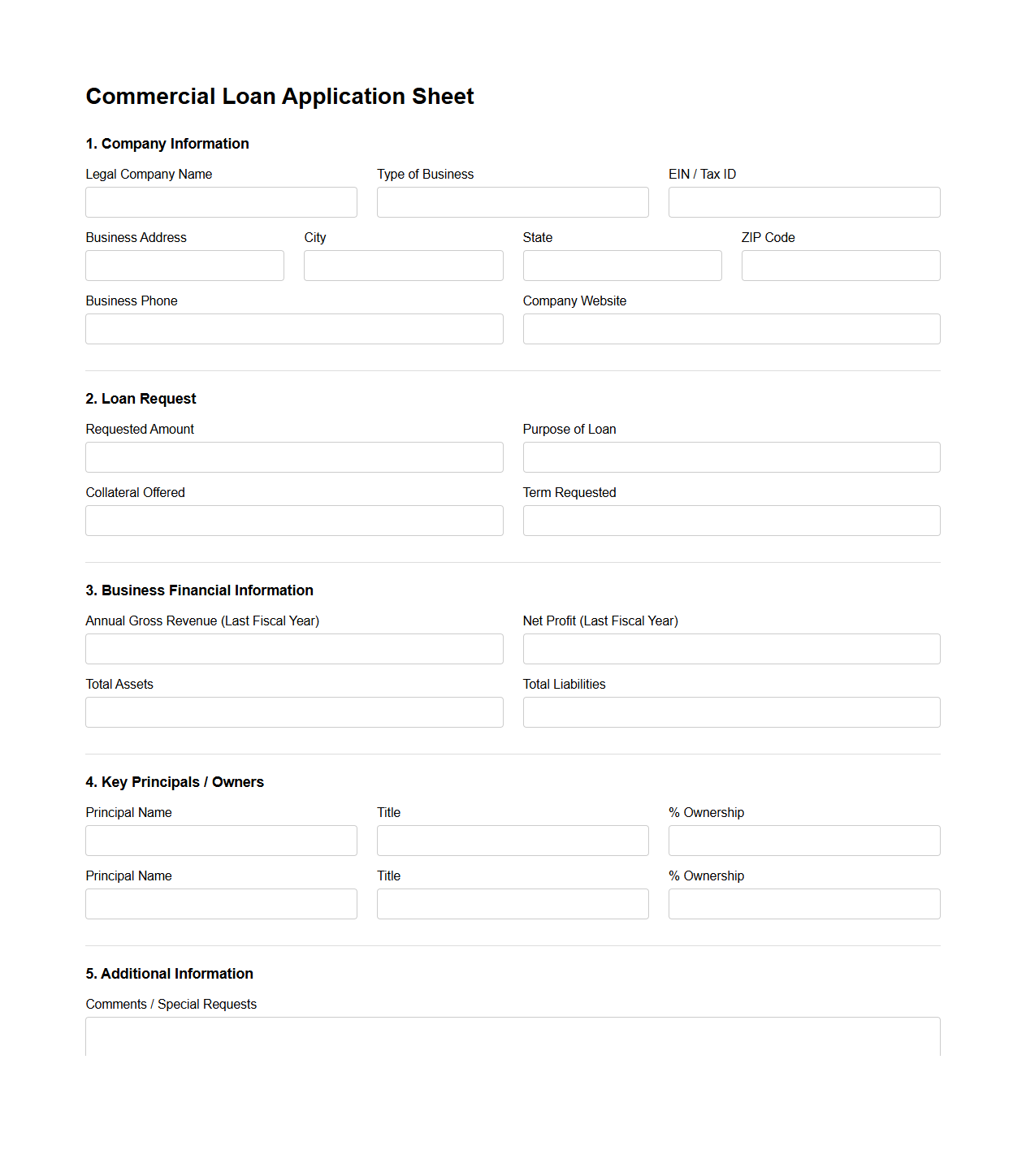

Blank Commercial Loan Application Sheet for Corporate Financing

A

Blank Commercial Loan Application Sheet for Corporate Financing is a standardized form used by businesses to request funding from financial institutions. This document collects essential information such as company details, financial statements, loan purpose, and repayment plans to assess creditworthiness. Accurate completion ensures streamlined processing and expedites approval for corporate loans.

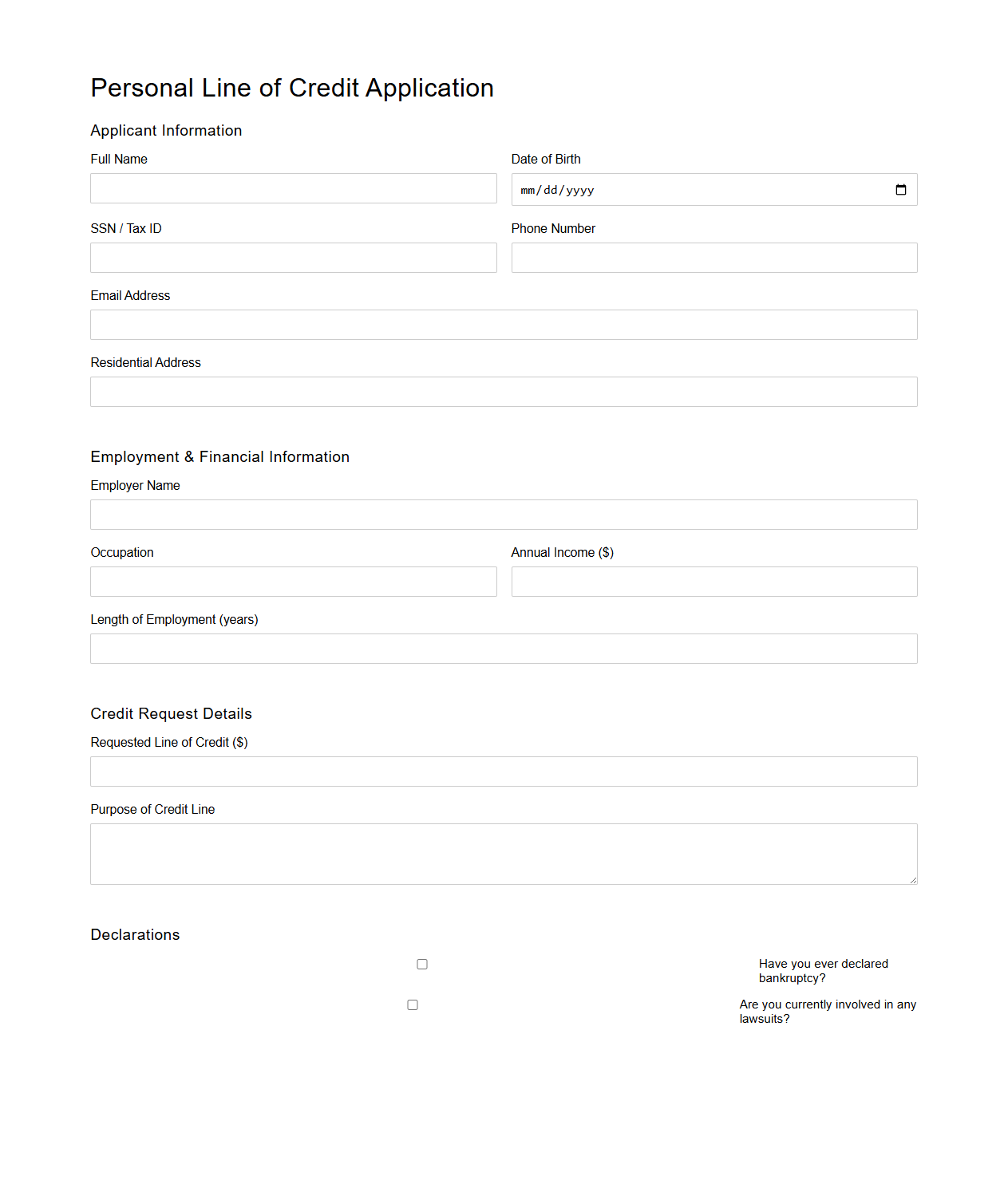

Blank Personal Line of Credit Application Template for Banks

A

Blank Personal Line of Credit Application Template for banks is a standardized form used to collect essential financial and personal information from applicants seeking a revolving credit facility. This document facilitates the efficient processing and evaluation of creditworthiness by capturing details such as income, employment, liabilities, and credit history. Banks rely on this template to ensure consistent data collection, streamline approval workflows, and maintain regulatory compliance.

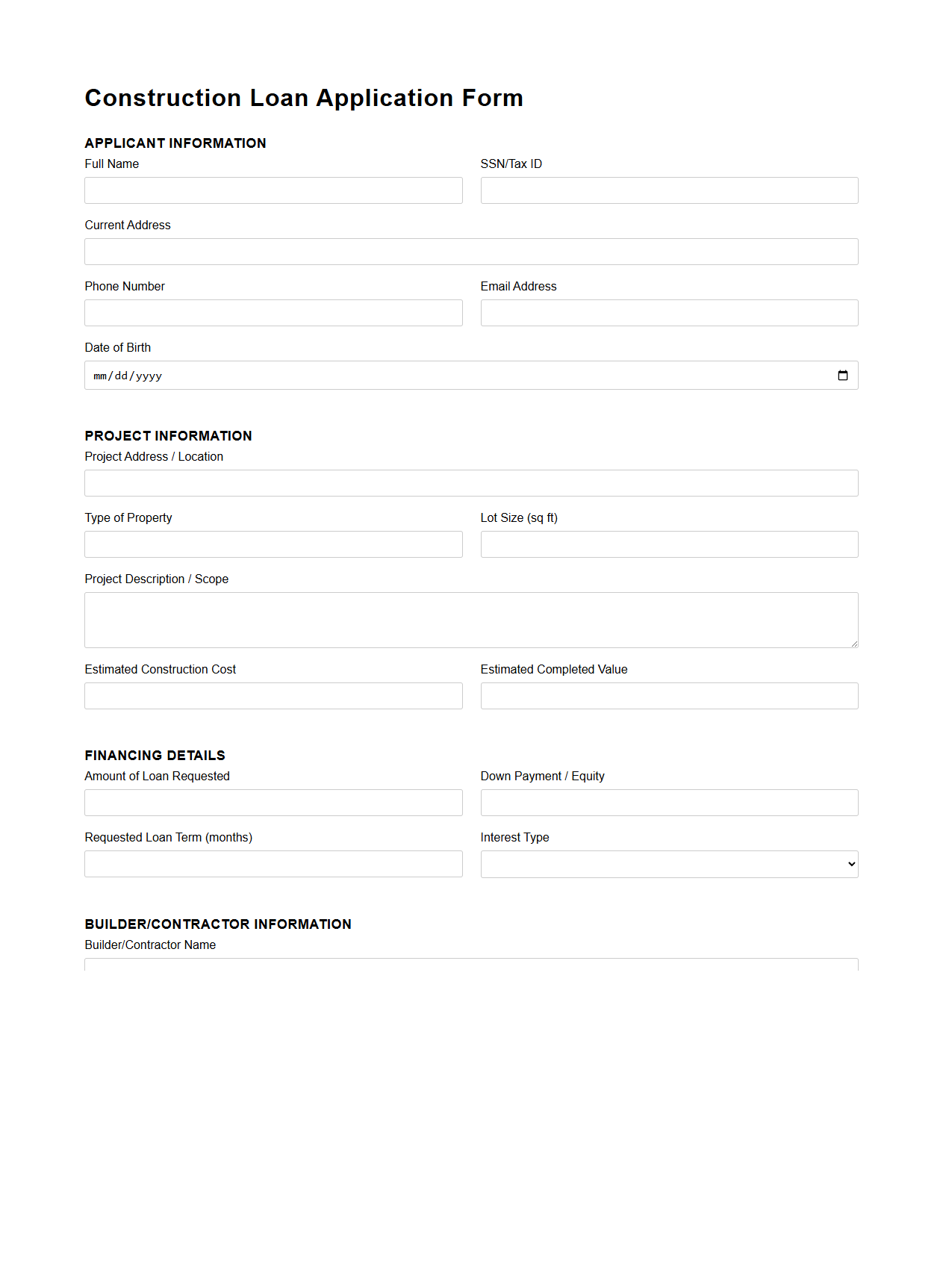

Blank Construction Loan Application Form for Real Estate Financing

The

Blank Construction Loan Application Form is a standardized document used in real estate financing to apply for funds specifically allocated for construction projects. This form captures essential borrower information, loan details, project specifications, and financial disclosures necessary for lenders to evaluate the viability and risk of financing a construction loan. Accurate completion of this form is critical to streamline the approval process and secure timely funding for real estate development.

What sections are mandatory in a Blank Loan Application for small business clients?

The mandatory sections in a blank loan application for small business clients typically include Business Information, Financial Statements, and Loan Details. It is essential to have Owner Information and Business History sections to provide comprehensive background data. Additionally, the Purpose of Loan and Collateral sections ensure the lender understands the loan's intent and security.

How should personal guarantor information be disclosed in a Blank Loan Application?

Personal guarantor information must be disclosed under a dedicated Guarantor Details section in the loan application. This disclosure should include full name, contact details, financial standing, and a signed consent for credit checks. Transparency in guarantor information helps lenders assess additional credit risk effectively.

Which financial ratios are most commonly requested on a Blank Loan Application?

Commonly requested financial ratios on a blank loan application include the Debt-to-Income ratio, Current Ratio, and Profit Margin. These ratios give lenders insight into the business's liquidity, profitability, and debt management capabilities. Providing accurate financial ratios enhances the credibility of the loan application.

What supporting documents are typically referenced in a Blank Loan Application cover letter?

The cover letter for a blank loan application usually references financial statements, tax returns, business licenses, and personal identification documents. These documents validate the information provided and support the borrower's creditworthiness. Including a comprehensive set of supporting documents streamlines the loan approval process.

How do financial institutions ensure compliance with KYC on Blank Loan Application forms?

Financial institutions ensure KYC compliance by requiring verified identity documents and conducting background checks on applicants. They incorporate strict data collection policies and employ anti-fraud technologies during the application process. This rigorous verification safeguards both the lender and borrower from financial crime risks.

More Application Templates