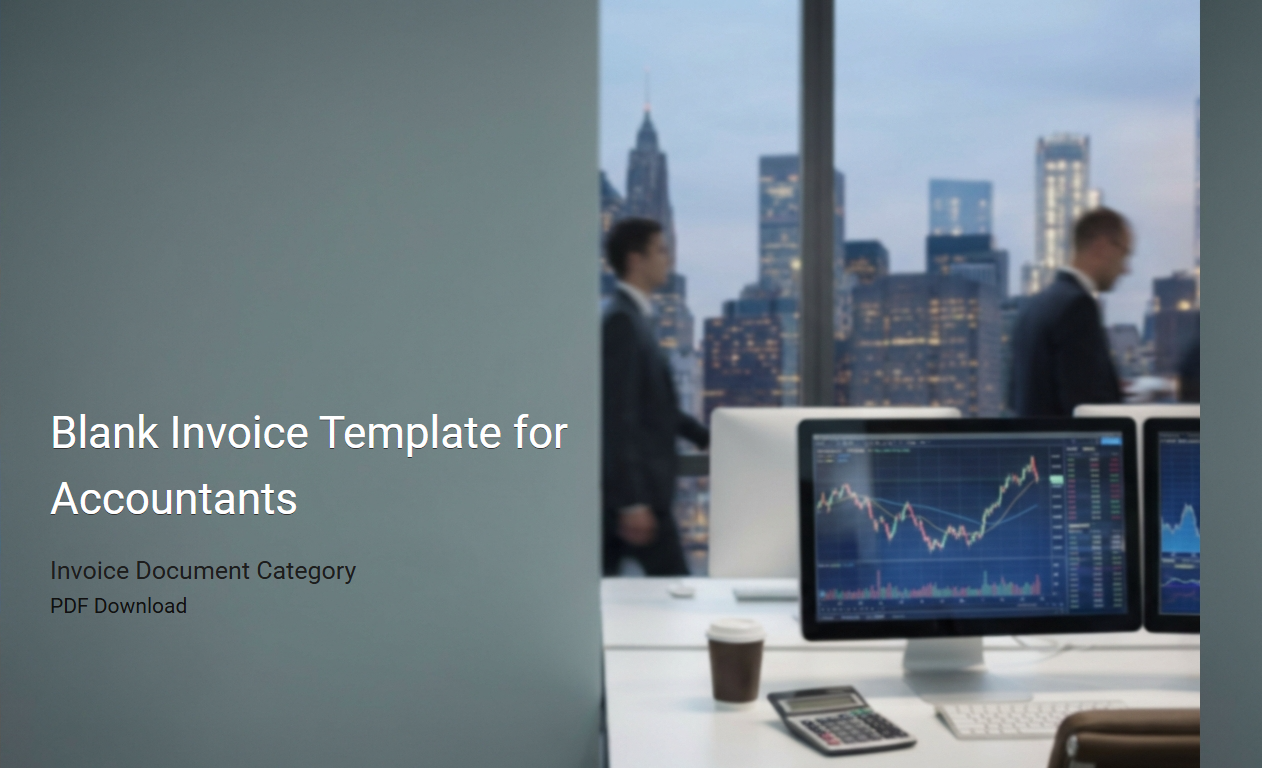

Blank Tax Invoice Template for Accountants

A

Blank Tax Invoice Template for accountants is a pre-formatted document used to record and itemize sales transactions for tax purposes. It includes essential fields such as invoice number, date, client details, description of goods or services, quantity, price, tax rates, and total amount due. This template ensures compliance with tax regulations while streamlining the invoicing process and maintaining accurate financial records.

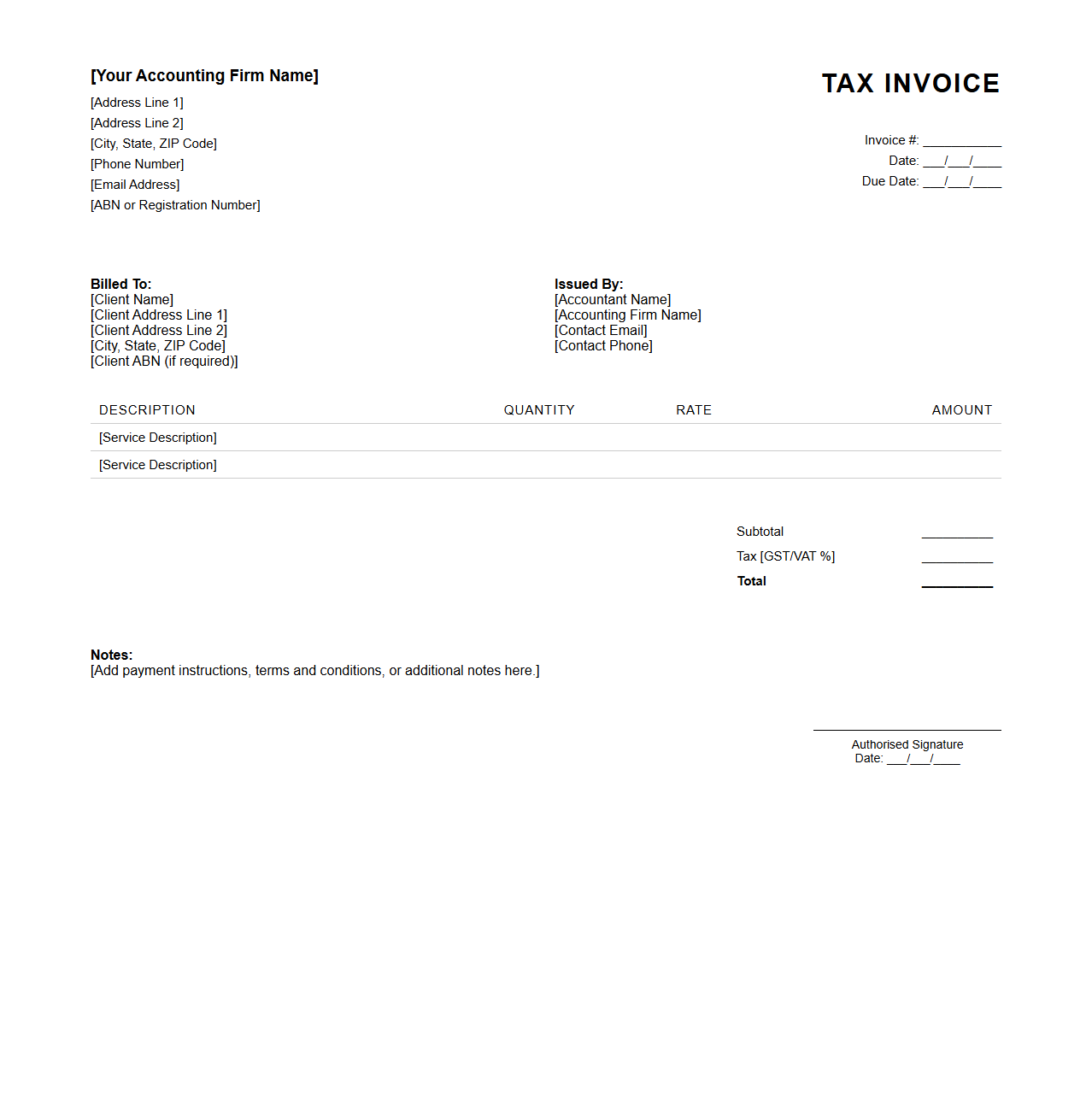

Blank VAT Invoice Template for Accountants

A

Blank VAT Invoice Template for accountants is a standardized document designed to streamline the invoicing process by including essential fields such as supplier details, VAT registration number, itemized list of goods or services, VAT rates, and total payable amount. This template ensures compliance with tax regulations by clearly separating VAT amounts, facilitating accurate record-keeping and easy submission for tax returns. Accountants use this document to maintain consistency, reduce errors, and speed up financial transactions involving value-added tax.

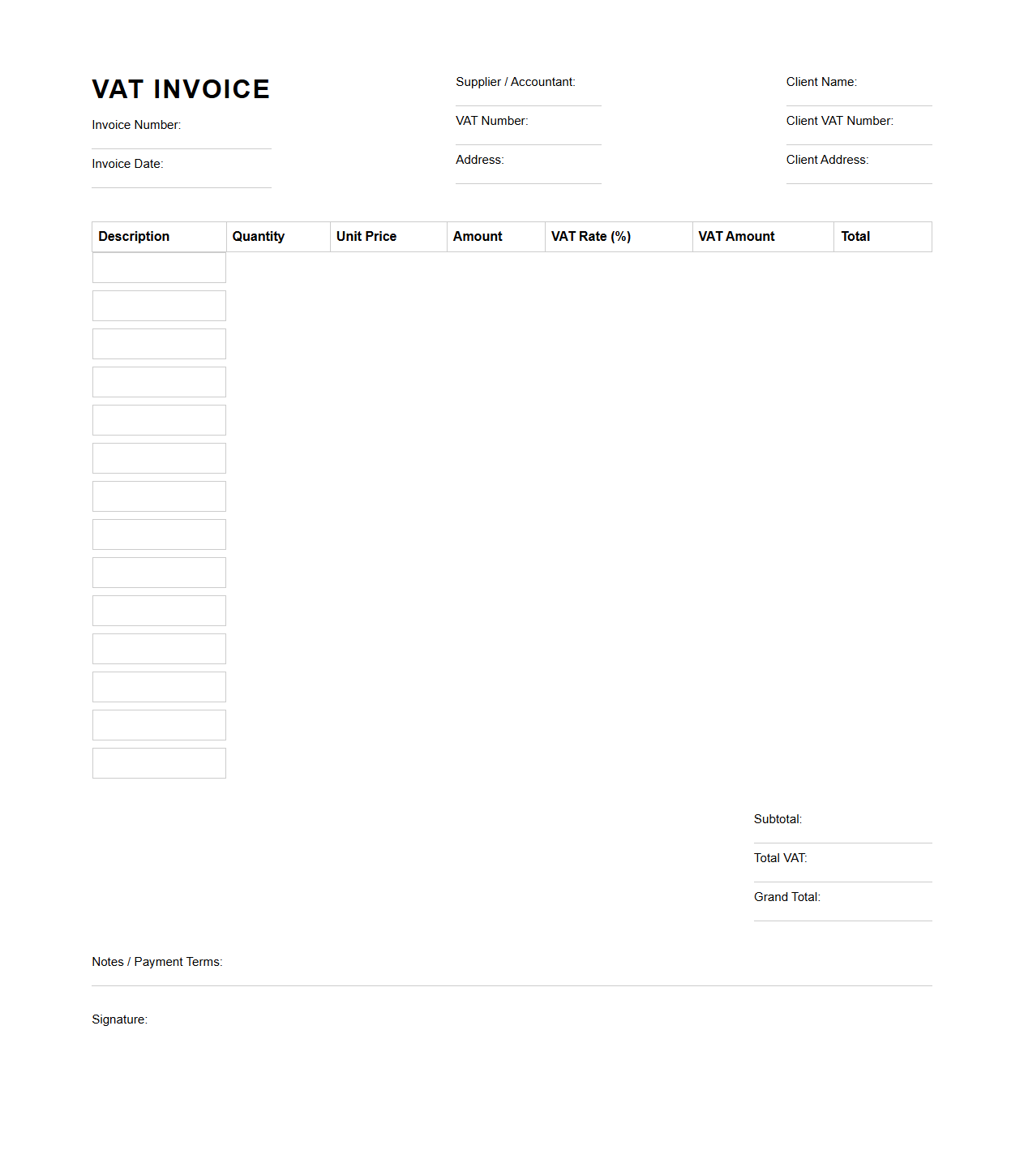

Blank Proforma Invoice Template for Accountants

A

Blank Proforma Invoice Template for accountants is a standardized document used to provide a preliminary bill of sale to clients before finalizing a transaction. It outlines estimated costs, item descriptions, quantities, and payment terms without serving as a legal invoice. This template helps accountants ensure accuracy and consistency in client communications and financial record-keeping.

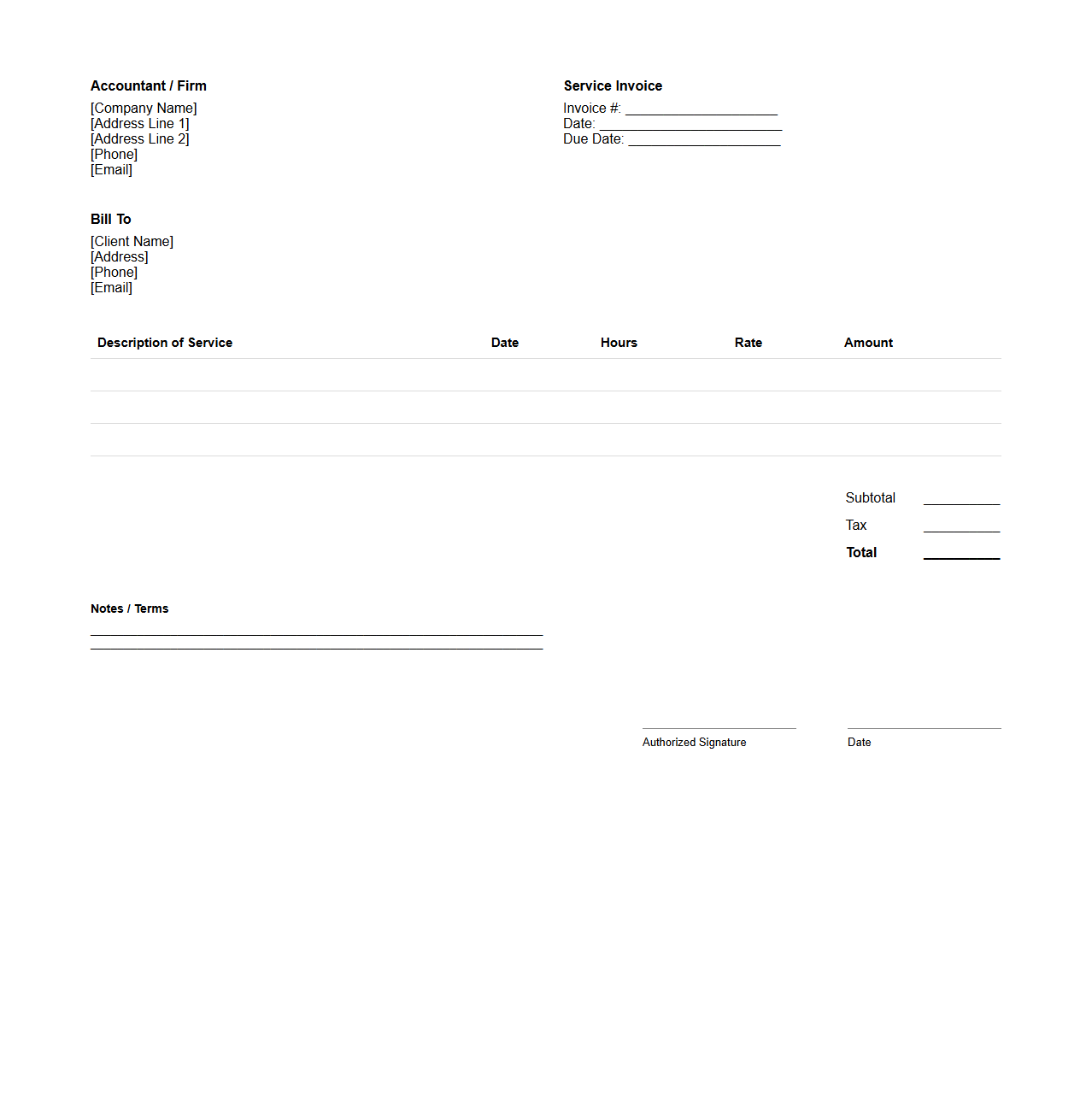

Blank Service Invoice Template for Accountants

A

Blank Service Invoice Template for Accountants is a customizable document designed to streamline billing processes by providing a structured format for detailing services rendered, payment terms, and client information. It includes essential fields such as service descriptions, hourly rates, total amounts, and tax calculations, ensuring accuracy and professionalism in financial transactions. This template helps accountants improve efficiency, maintain consistency, and facilitate clear communication with clients during invoicing.

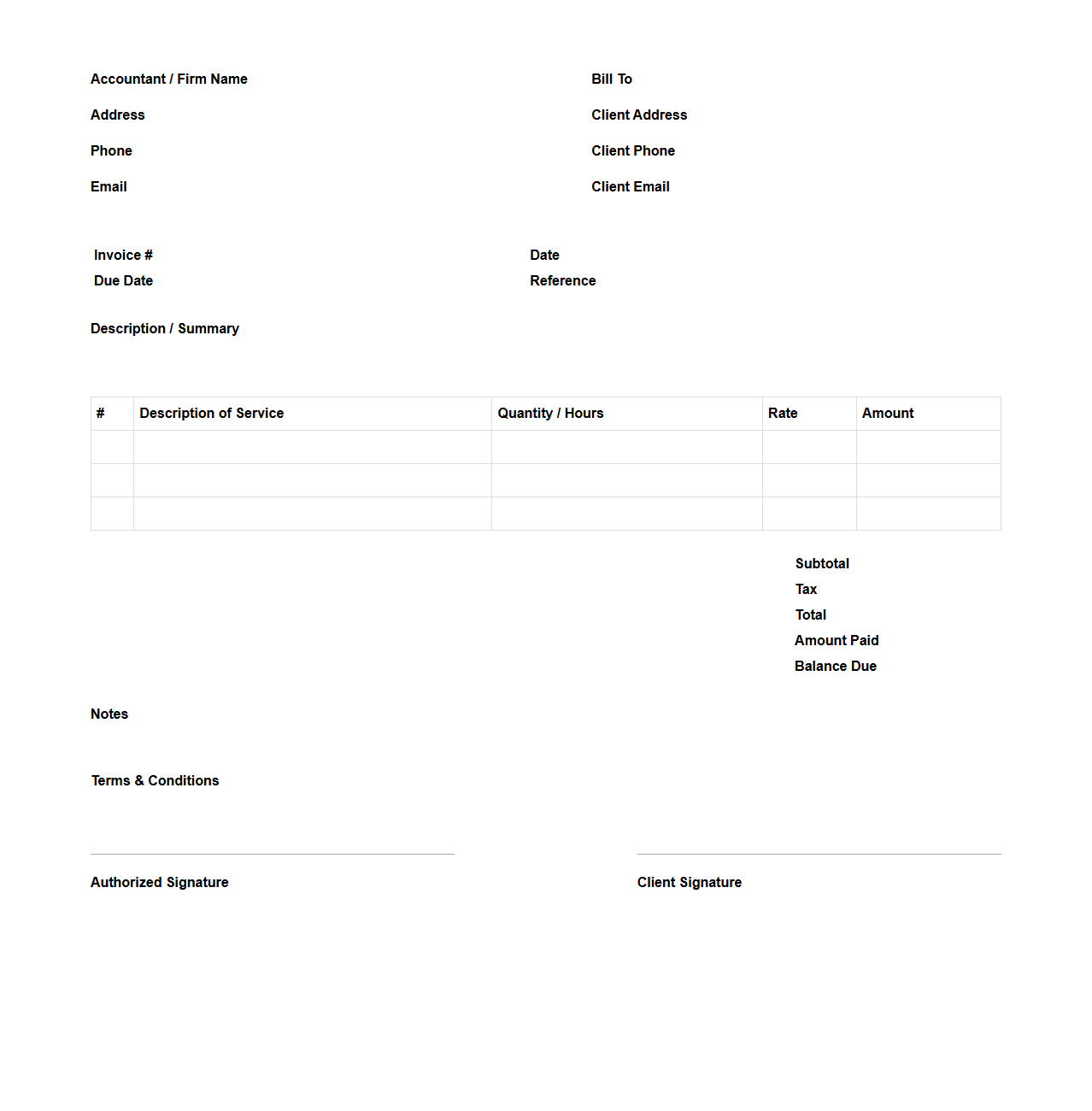

Blank Detailed Invoice Template for Accountants

A

Blank Detailed Invoice Template for Accountants is a customizable document designed to help accounting professionals itemize services, fees, and expenses clearly for clients. This template ensures accurate financial records by including essential fields such as invoice number, date, client details, service descriptions, quantities, rates, and totals. Using this template streamlines billing processes, improves transparency, and supports efficient payment tracking within accounting workflows.

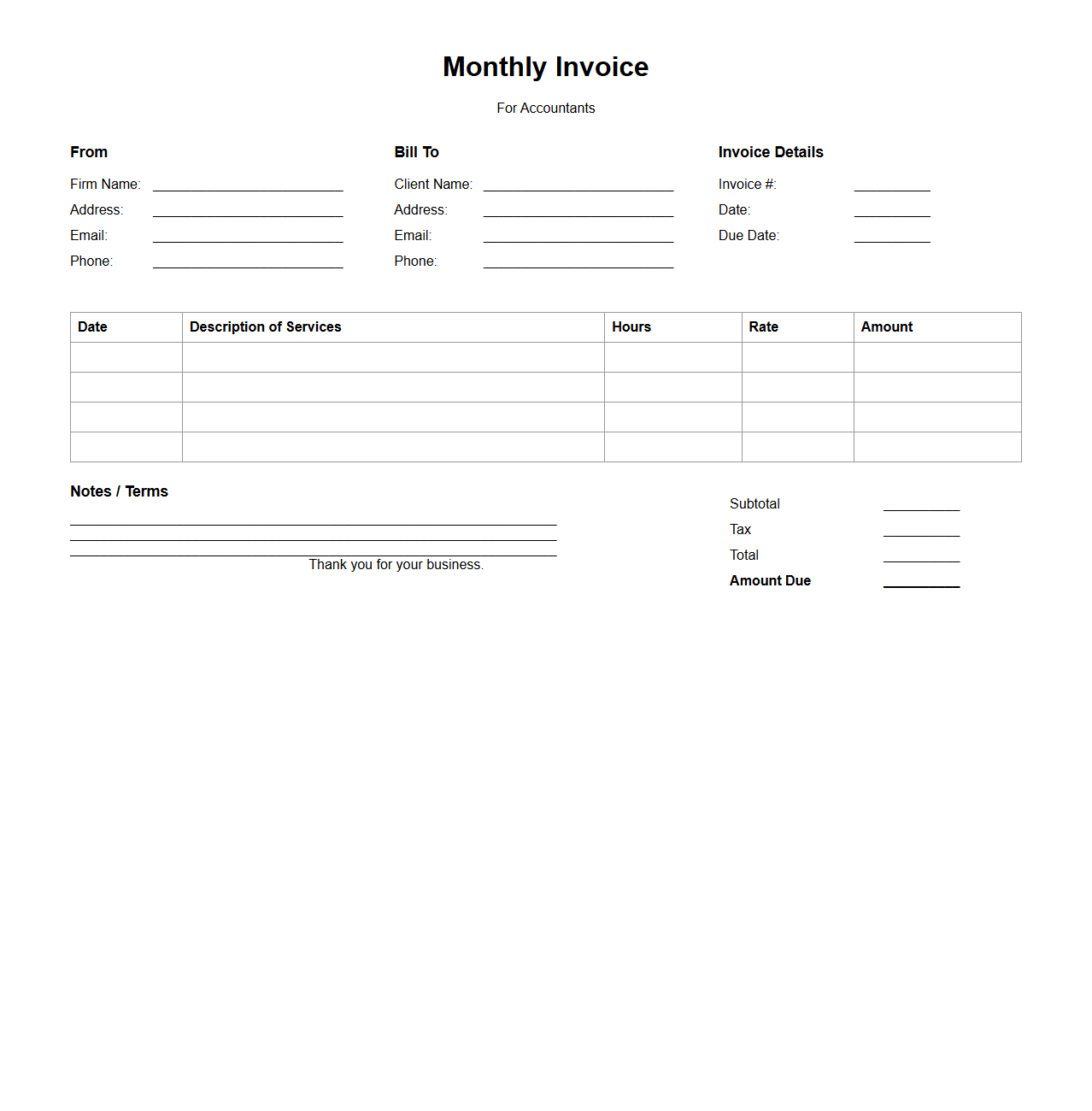

Blank Monthly Invoice Template for Accountants

A

Blank Monthly Invoice Template for Accountants is a structured document designed to streamline billing processes by providing a clear format for recording client charges each month. It includes sections for client details, invoice number, service descriptions, hours worked, rates, and total amounts due, ensuring accurate financial tracking and professional presentation. Using this template helps accountants maintain consistency, improve efficiency, and simplify record-keeping for recurring invoicing cycles.

Blank Itemized Invoice Template for Accountants

A

Blank Itemized Invoice Template for accountants is a customizable document used to detail individual services or products provided, including quantities, rates, and total amounts due. This template helps ensure accurate billing, clear communication with clients, and proper record-keeping for accounting purposes. Accountants use it to streamline invoicing processes and maintain financial transparency.

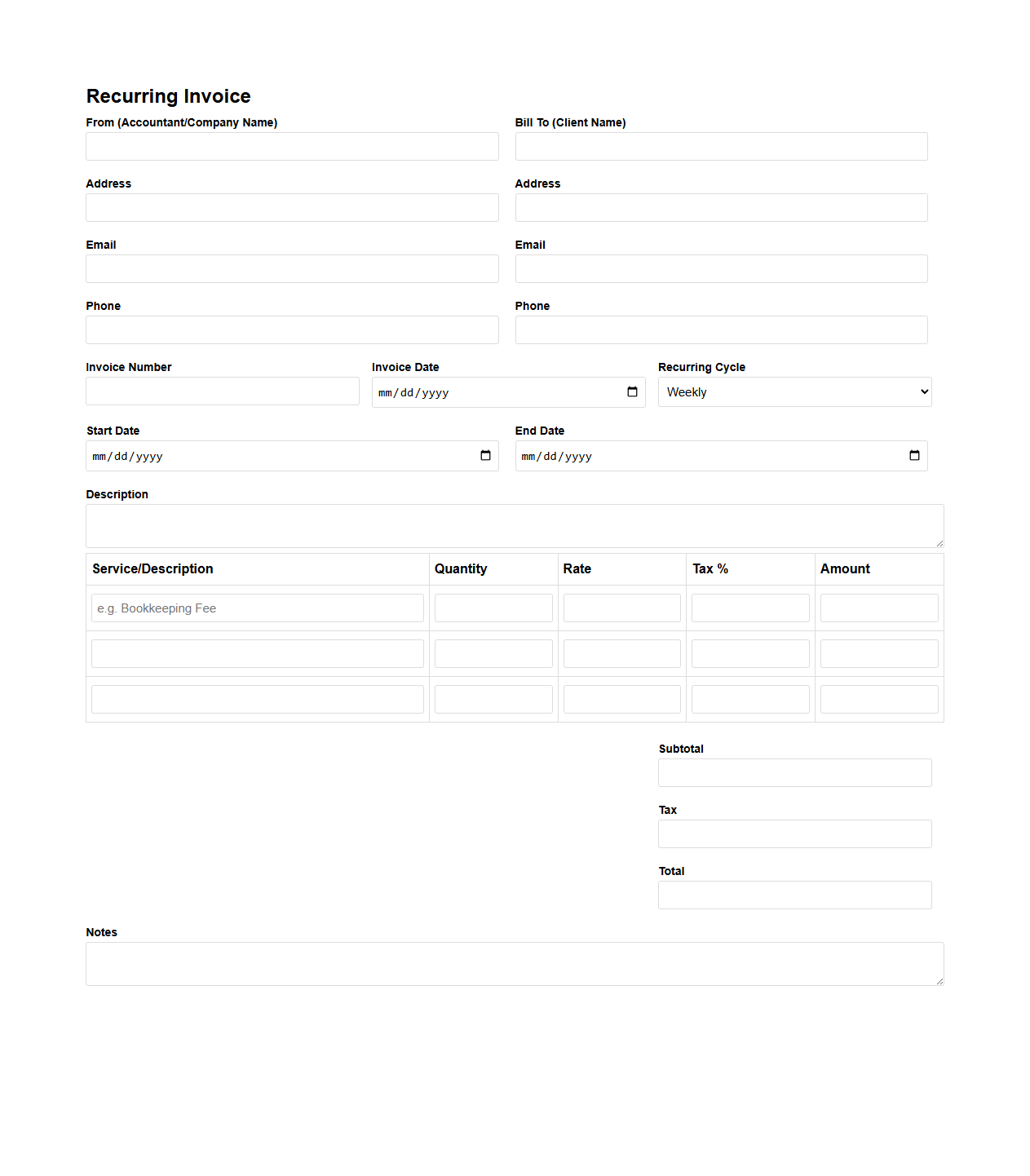

Blank Recurring Invoice Template for Accountants

A

Blank Recurring Invoice Template for accountants is a structured document designed to automate and streamline the billing process for repeated transactions. It allows accountants to set consistent invoicing schedules, ensuring timely and accurate charges without the need to recreate invoices manually for each billing cycle. This template typically includes essential fields such as client information, payment terms, and itemized services, enhancing financial management efficiency.

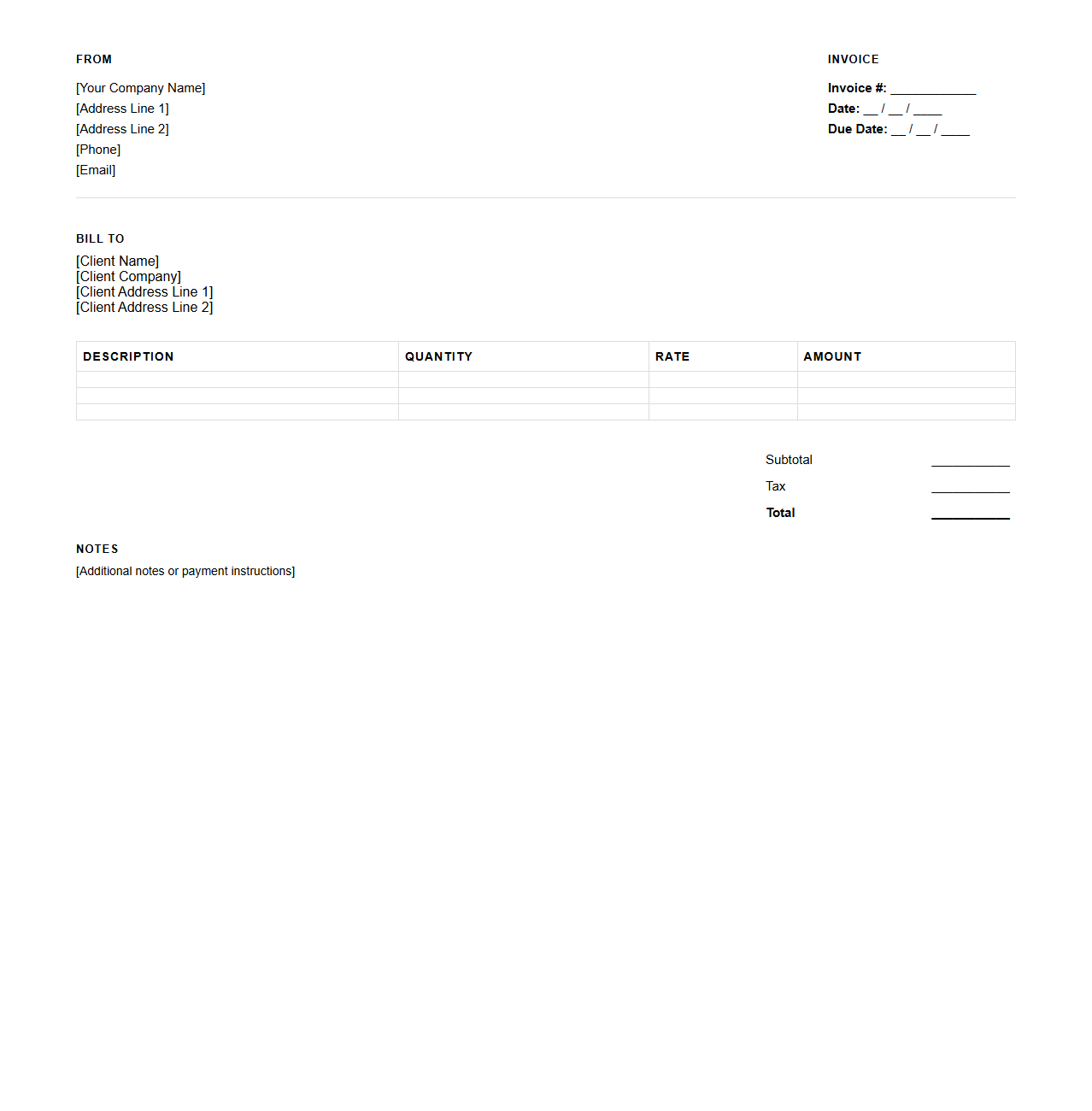

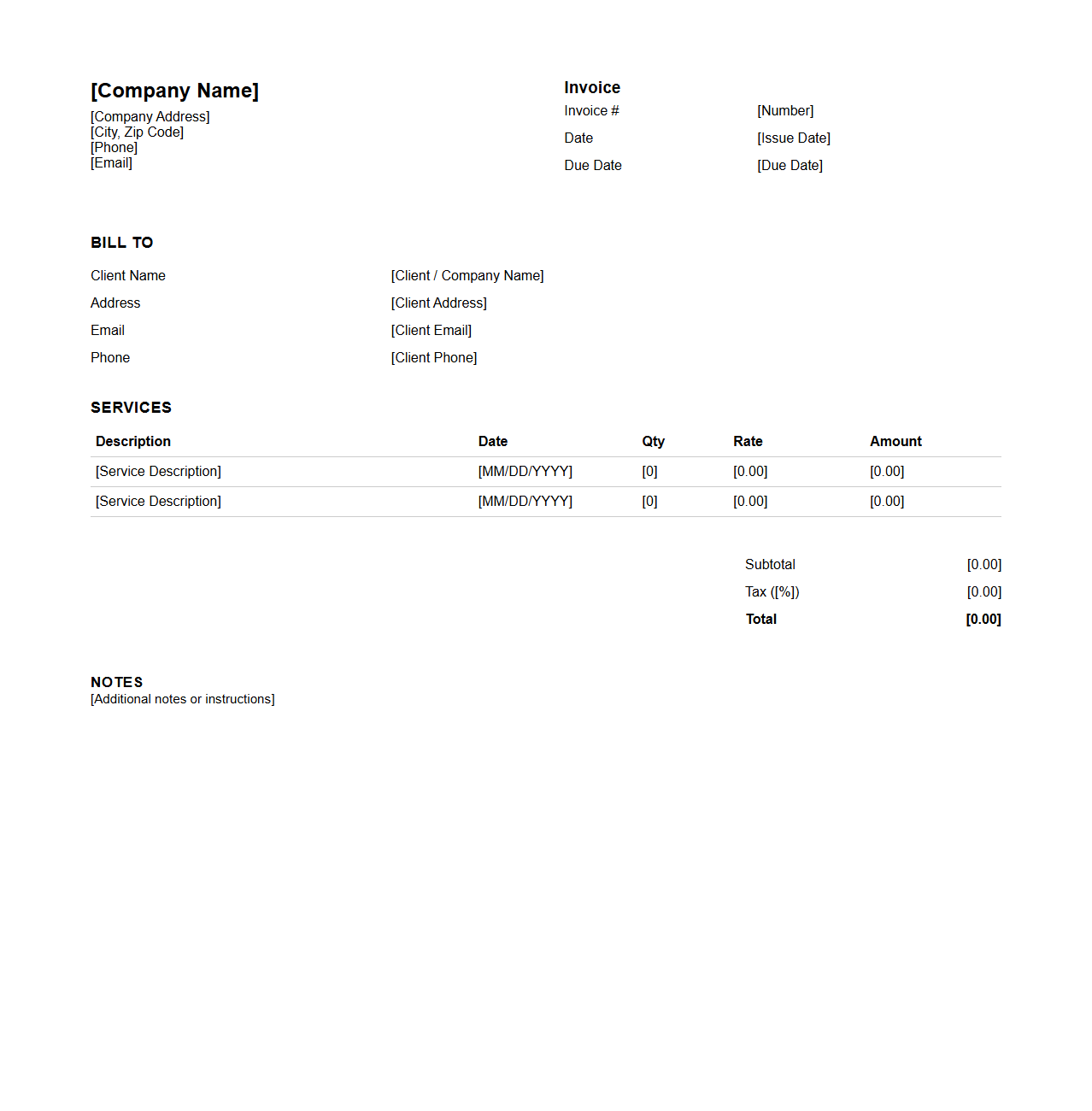

Blank Professional Invoice Template for Accountants

A

Blank Professional Invoice Template for Accountants is a customizable document designed to streamline billing processes by providing a structured format for listing services, fees, and payment terms. This template includes essential elements such as client details, invoice number, itemized services, hourly rates, total amount due, and payment instructions, ensuring accuracy and professionalism. Accountants benefit from using this template to maintain consistent financial records and facilitate timely payments.

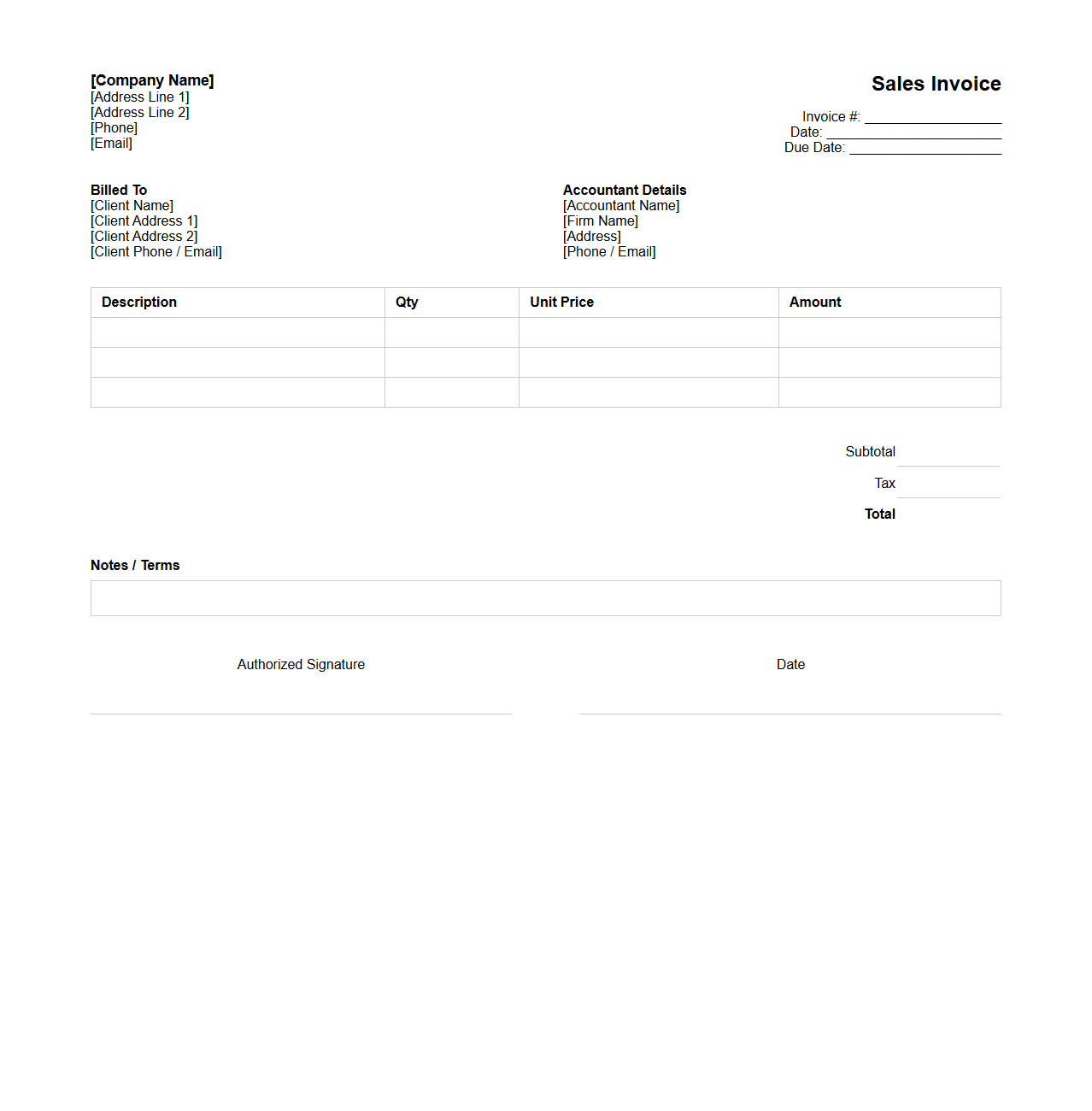

Blank Sales Invoice Template for Accountants

A

Blank Sales Invoice Template for accountants is a pre-formatted document designed to streamline the billing process by providing a clear and professional layout for recording sales transactions. It includes essential fields such as invoice number, date, client details, item descriptions, quantities, prices, taxes, and total amount due, ensuring accuracy and consistency in financial records. Accountants use this template to enhance efficiency, maintain organized documentation, and facilitate timely payment collection from clients.

What essential fields should be included in a blank invoice template for accountants?

A blank invoice template for accountants should include the client's name and contact information, as well as the accountant's details. It must feature the invoice number, date, and due date to track payments effectively. Additionally, essential fields like a detailed description of services, quantity, rate, and total amount must be clearly stated.

How can accountants customize a blank invoice for recurring client billing?

Accountants can customize a blank invoice for recurring client billing by adding automated billing dates and customizing the billing cycle terms. Incorporating a client-specific pricing structure helps manage different service tiers efficiently. Using invoice templates with placeholders allows quick updates and consistent formatting for recurring invoices.

What legal compliance elements are needed on a blank invoice for accounting services?

Legal compliance requires including the accountant's tax identification number or VAT number on the invoice to meet tax regulations. The invoice should also display payment terms and any applicable late payment penalties clearly. Additionally, ensuring the invoice date and unique invoice number are present is critical for record-keeping and audits.

Which invoicing software offers editable blank invoice templates for accountants?

Popular invoicing software like QuickBooks, FreshBooks, and Xero offers editable blank invoice templates tailored for accountants. These platforms provide easy customization options for adding logos, adjusting fields, and setting payment terms. They also support automatic template saving and multiple formats to fit diverse accounting needs.

How can accountants automate data entry in a blank invoice for faster processing?

Accountants can automate data entry by integrating accounting software with client databases to auto-fill client details on invoices. Using optical character recognition (OCR) technology allows scanning of receipts or previous invoices to extract data quickly. Moreover, implementing API connections between invoicing and bookkeeping systems ensures seamless synchronization and faster invoice processing.