A Blank Donation Receipt Template for Nonprofits provides a standardized and professional way to acknowledge contributions. This template helps organizations document donor information, donation amounts, and dates efficiently. Customizable fields ensure compliance with tax regulations while maintaining clear communication with supporters.

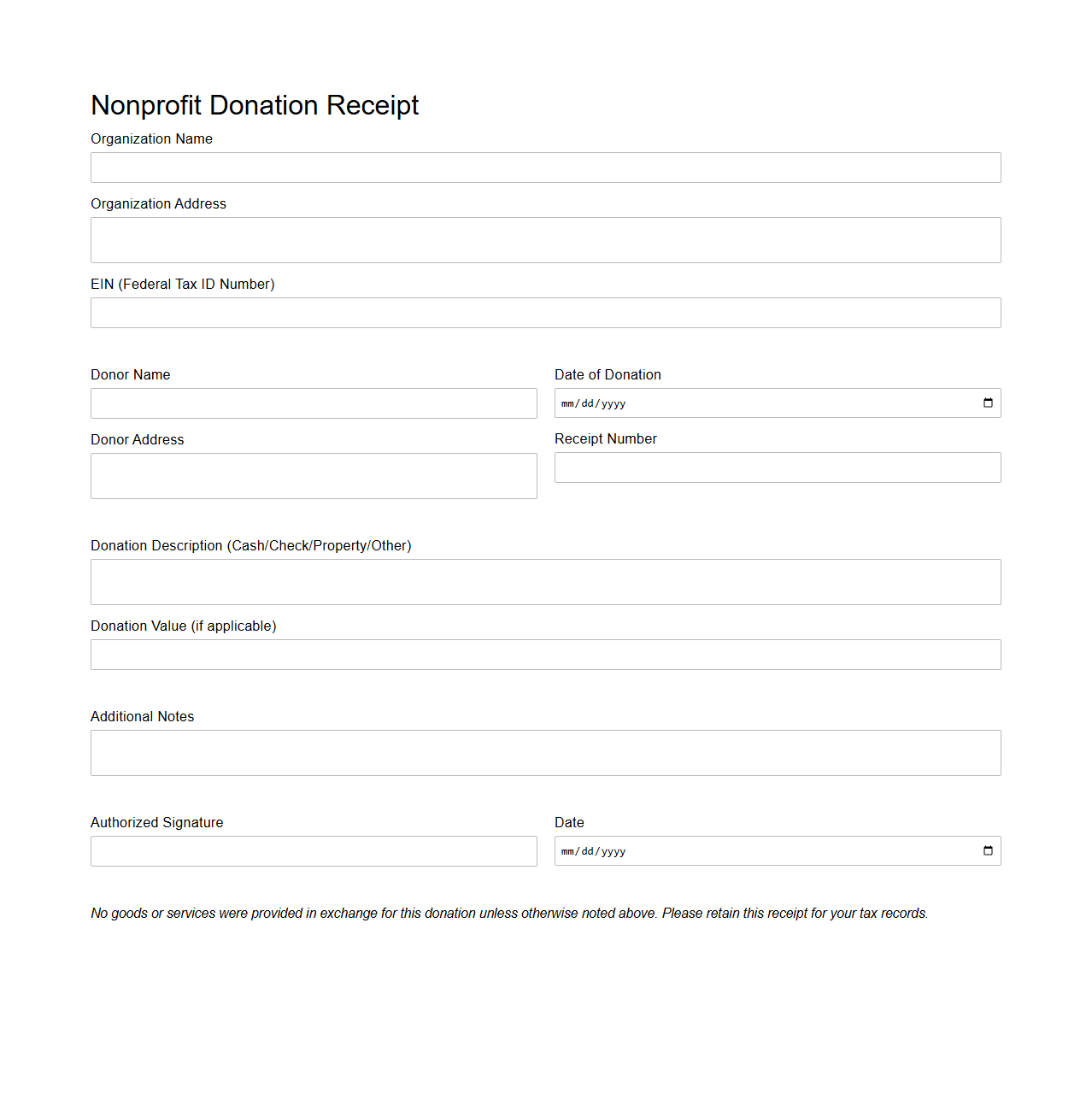

Blank Nonprofit Donation Receipt Form Template

A

Blank Nonprofit Donation Receipt Form Template is a standardized document used by nonprofit organizations to provide donors with official proof of their charitable contributions. This receipt typically includes essential details such as the donor's name, donation amount, date, and a statement confirming that no goods or services were exchanged. Utilizing this template ensures compliance with tax regulations and facilitates accurate record-keeping for both donors and nonprofits.

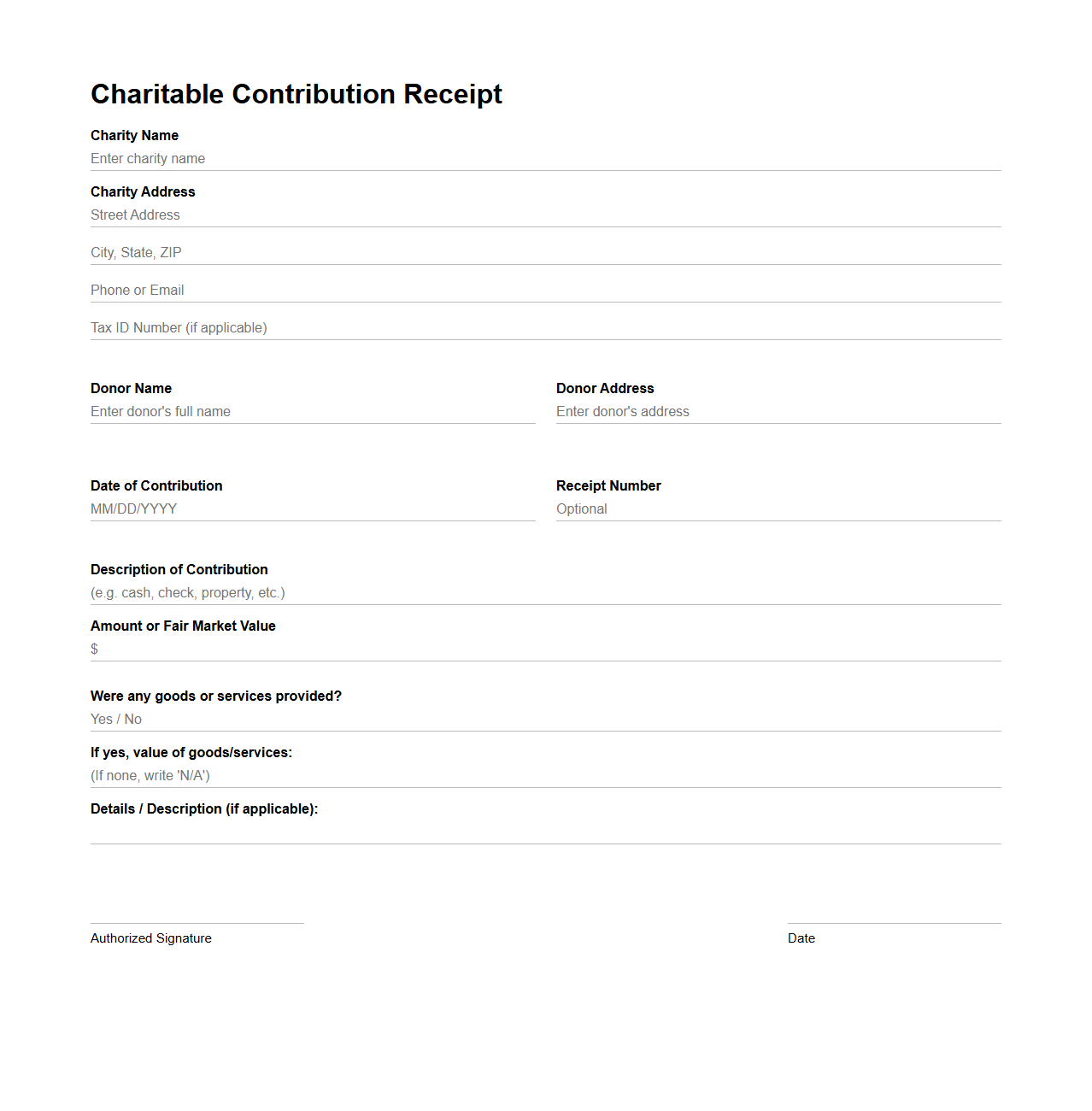

Blank Charitable Contribution Receipt Template

A

Blank Charitable Contribution Receipt Template document serves as a standardized form used by nonprofit organizations to acknowledge donations received from contributors. It typically includes essential information such as donor details, donation amount, date, and description of the gift, ensuring compliance with tax regulations and providing proof for tax deductions. This template streamlines the receipt issuance process, enhancing accuracy and record-keeping efficiency.

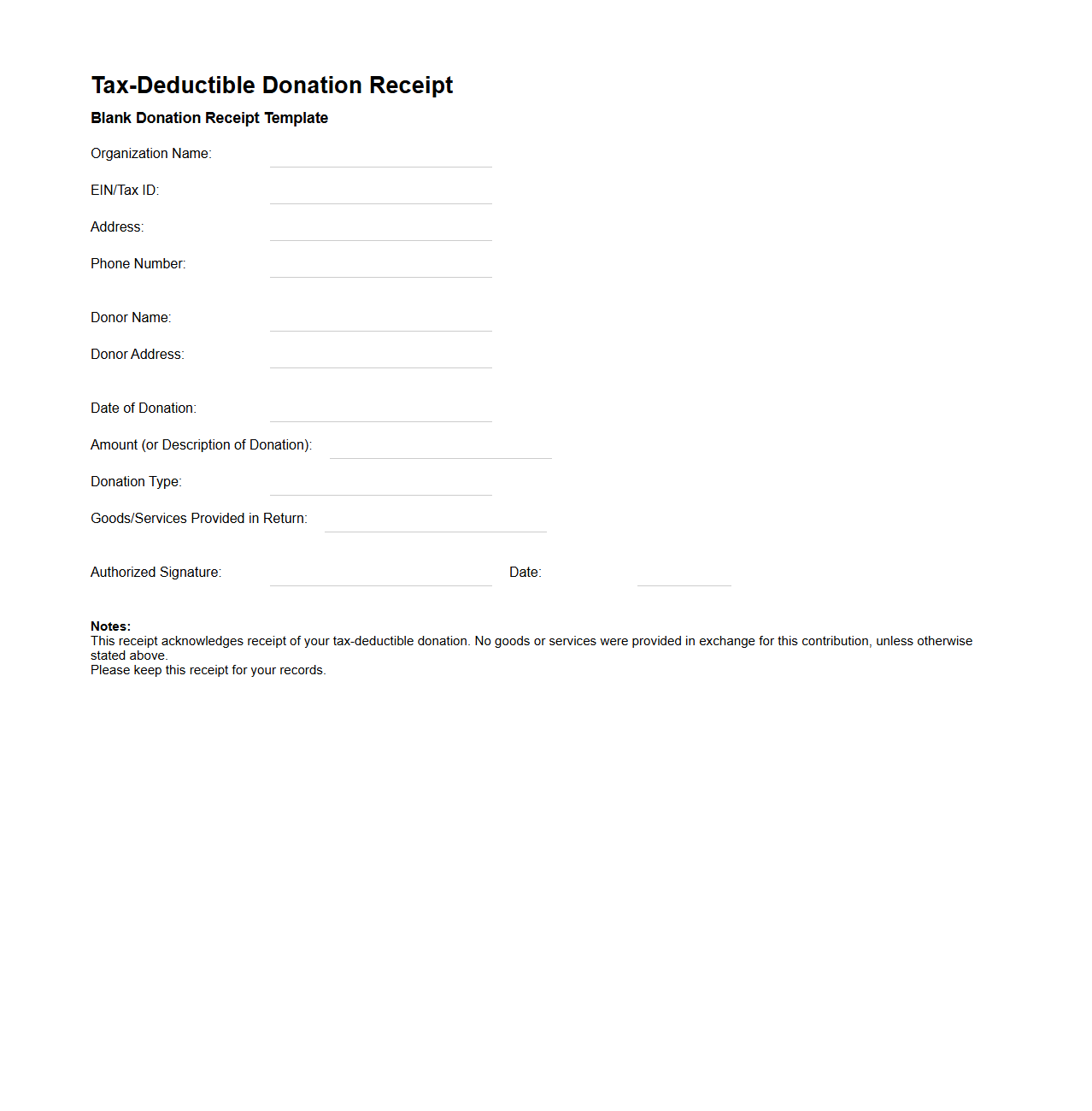

Blank Tax-Deductible Donation Receipt Template

A

Blank Tax-Deductible Donation Receipt Template document serves as a standardized form that organizations provide to donors as proof of charitable contributions eligible for tax deductions. It includes essential information such as the donor's name, donation amount, date, and the organization's tax-exempt status to ensure compliance with tax authority requirements. This template ensures clarity and consistency, making the donation process transparent and efficient for both donors and nonprofit entities.

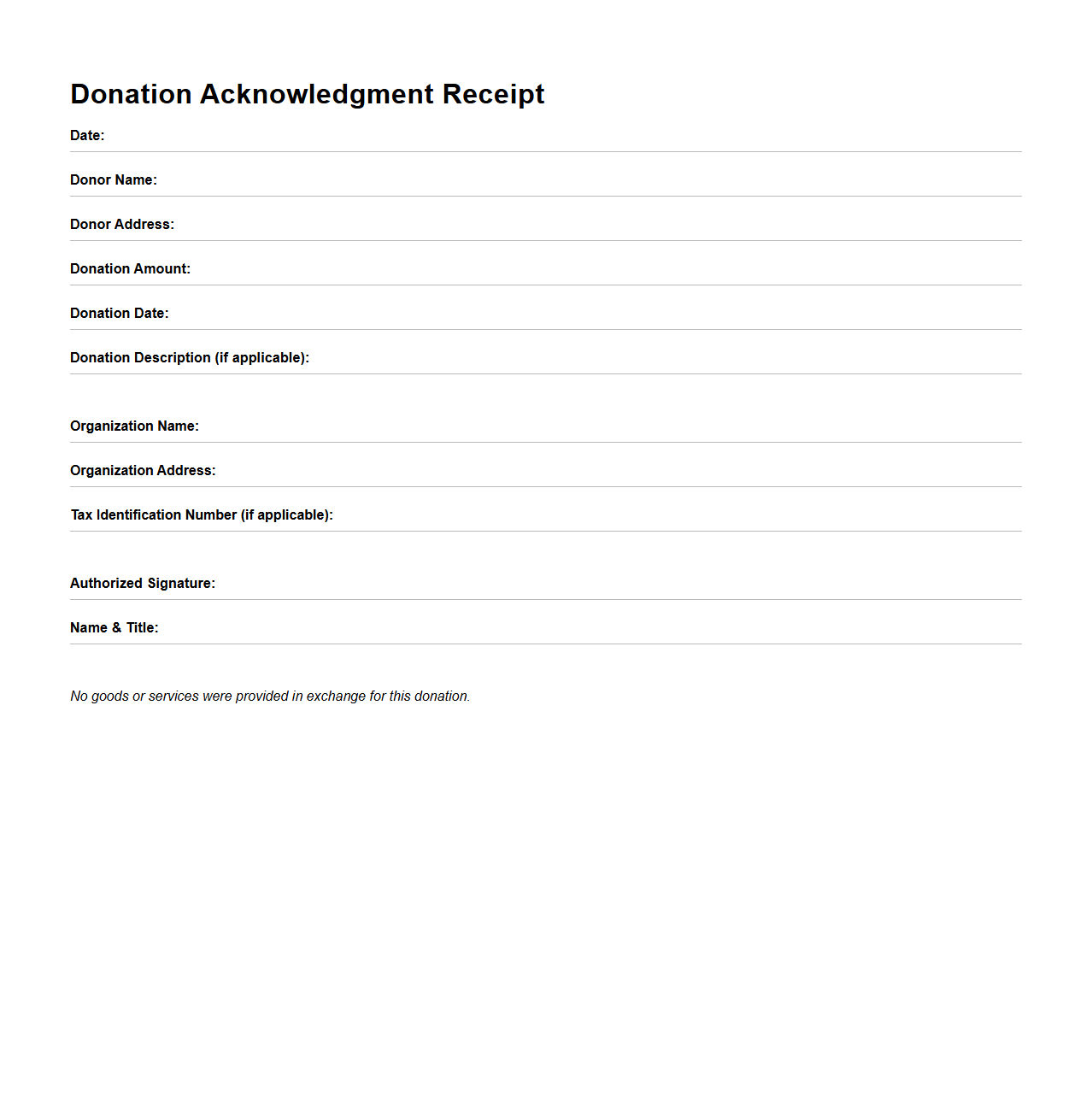

Blank Simple Nonprofit Donation Acknowledgment Template

A

Blank Simple Nonprofit Donation Acknowledgment Template document serves as a straightforward tool for organizations to formally recognize and thank donors for their contributions. It typically includes key details such as the donor's name, donation amount, date of donation, and a brief statement confirming the nonprofit's tax-exempt status for IRS purposes. This template ensures compliance with legal requirements while fostering donor trust and encouraging future support.

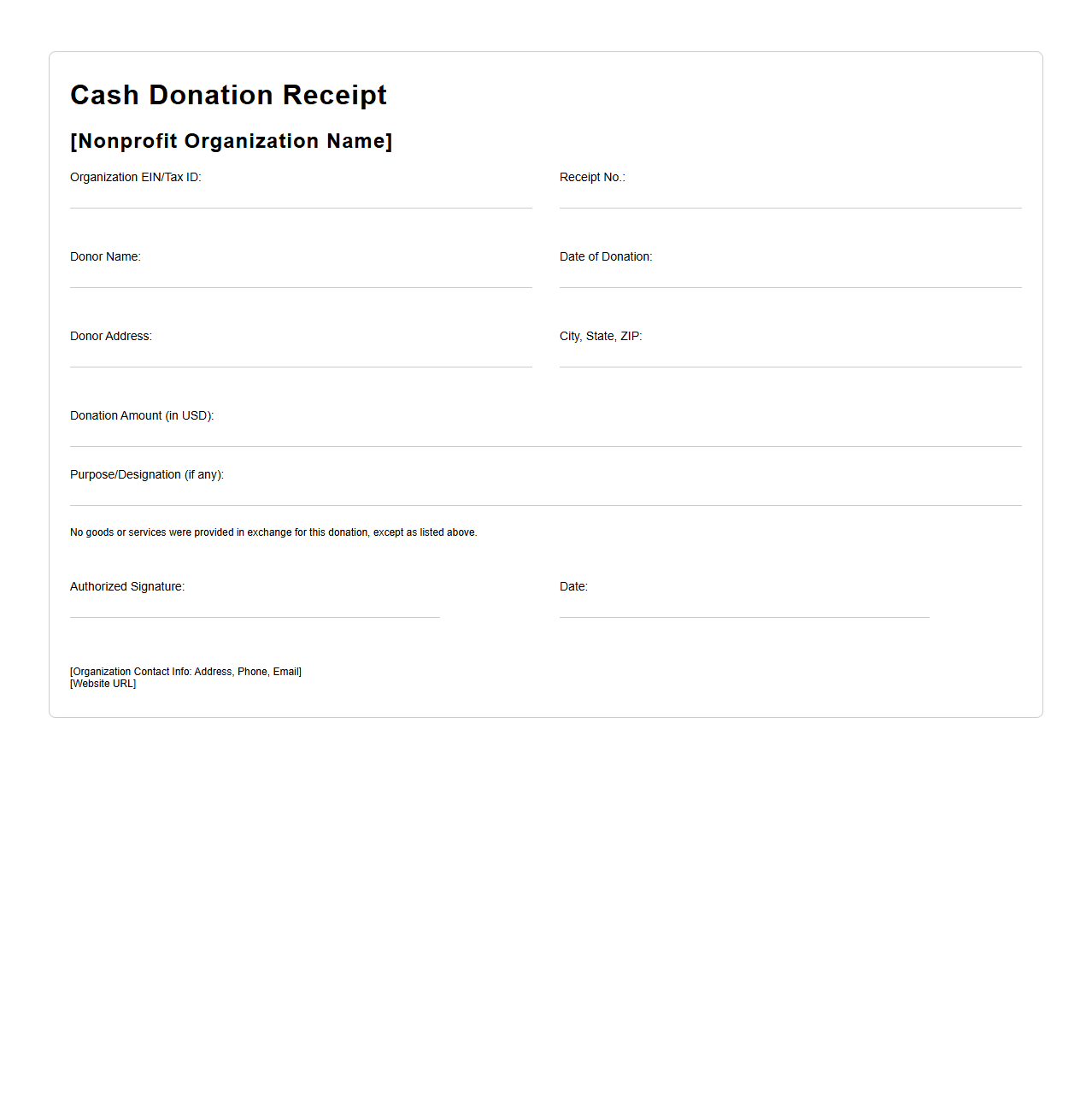

Blank Cash Donation Receipt Template for Nonprofits

A

Blank Cash Donation Receipt Template for Nonprofits is a pre-formatted document designed to help nonprofit organizations accurately record and acknowledge monetary contributions from donors. This template includes essential fields such as donor information, donation amount, date of contribution, and purpose or designation of the funds, ensuring compliance with tax regulations and transparency in financial reporting. Utilizing this template streamlines the donation acknowledgment process, promoting trust and accountability between nonprofits and their supporters.

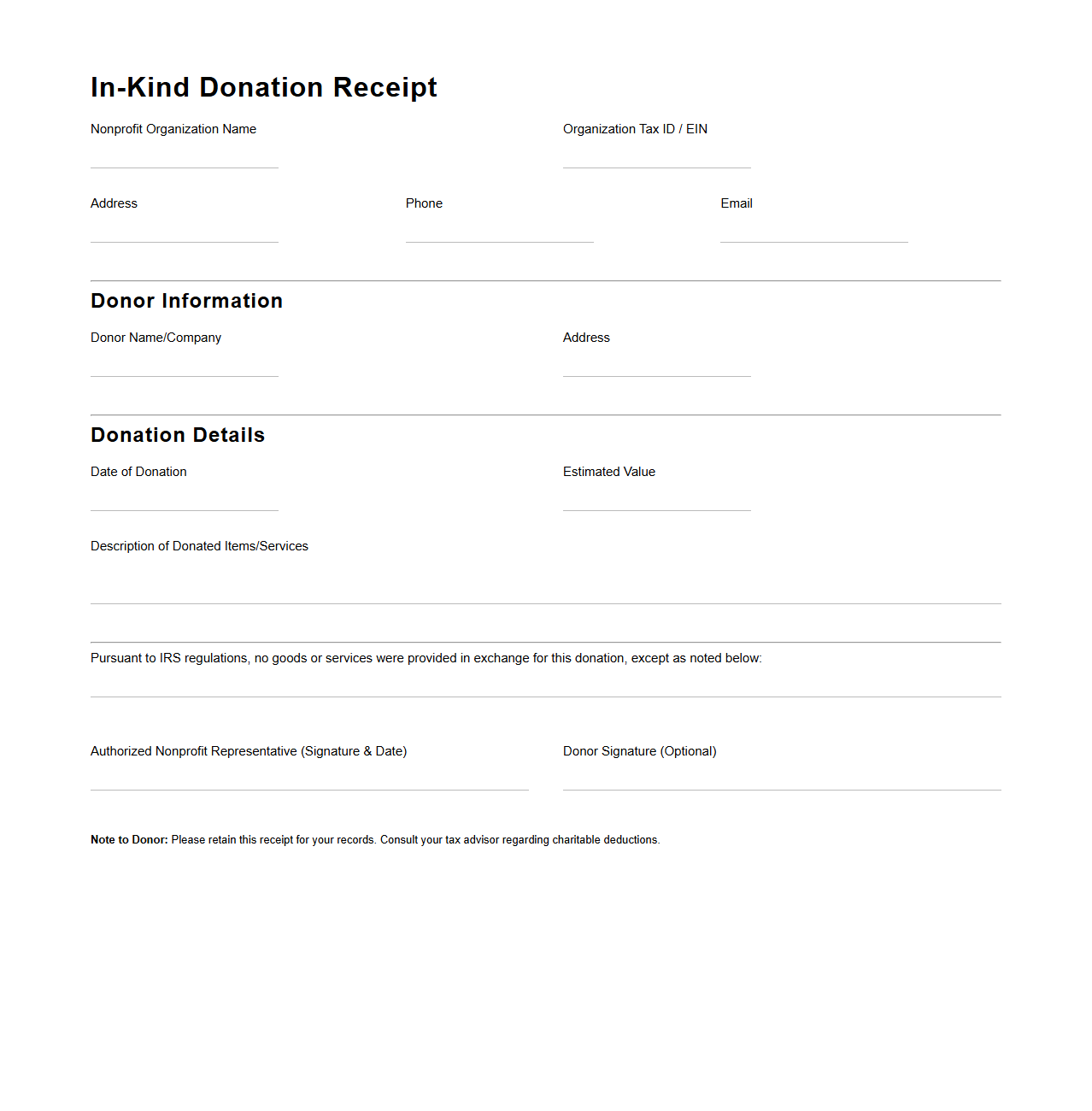

Blank In-Kind Donation Receipt Template for Nonprofits

A

Blank In-Kind Donation Receipt Template for Nonprofits is a crucial document that organizations use to acknowledge non-monetary contributions such as goods or services. This template ensures donors receive formal recognition for their in-kind gifts, facilitating accurate record-keeping and compliance with tax regulations. Nonprofits can customize the receipt with details including donor information, donation description, estimated value, and date, promoting transparency and accountability.

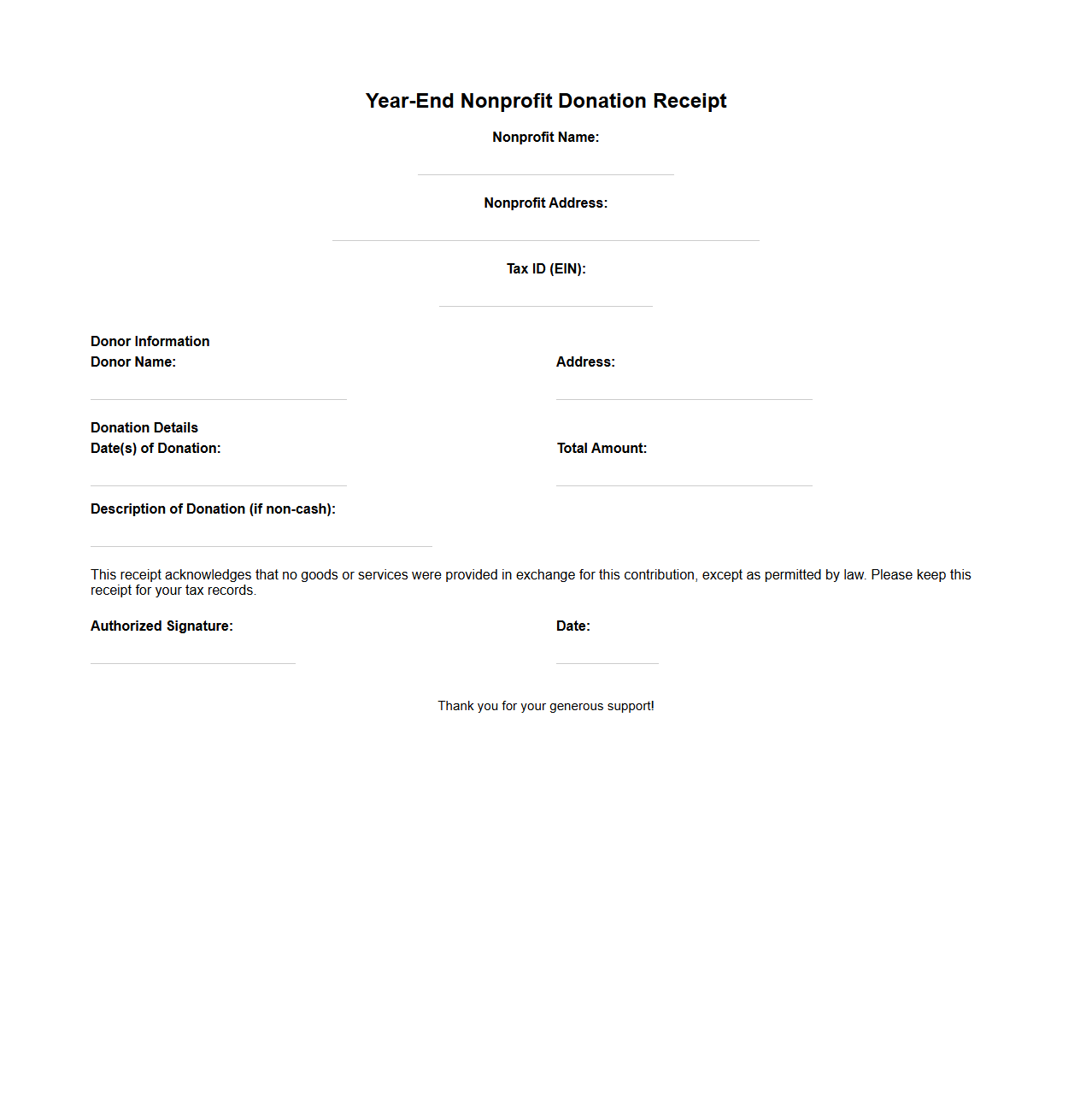

Blank Year-End Nonprofit Donation Receipt Template

A

Blank Year-End Nonprofit Donation Receipt Template document is a pre-formatted form designed for nonprofits to acknowledge and record donations received throughout the fiscal year. It ensures compliance with tax regulations by providing essential details such as donor information, donation amount, date, and purpose. This template streamlines year-end reporting and enhances transparency for both organizations and contributors.

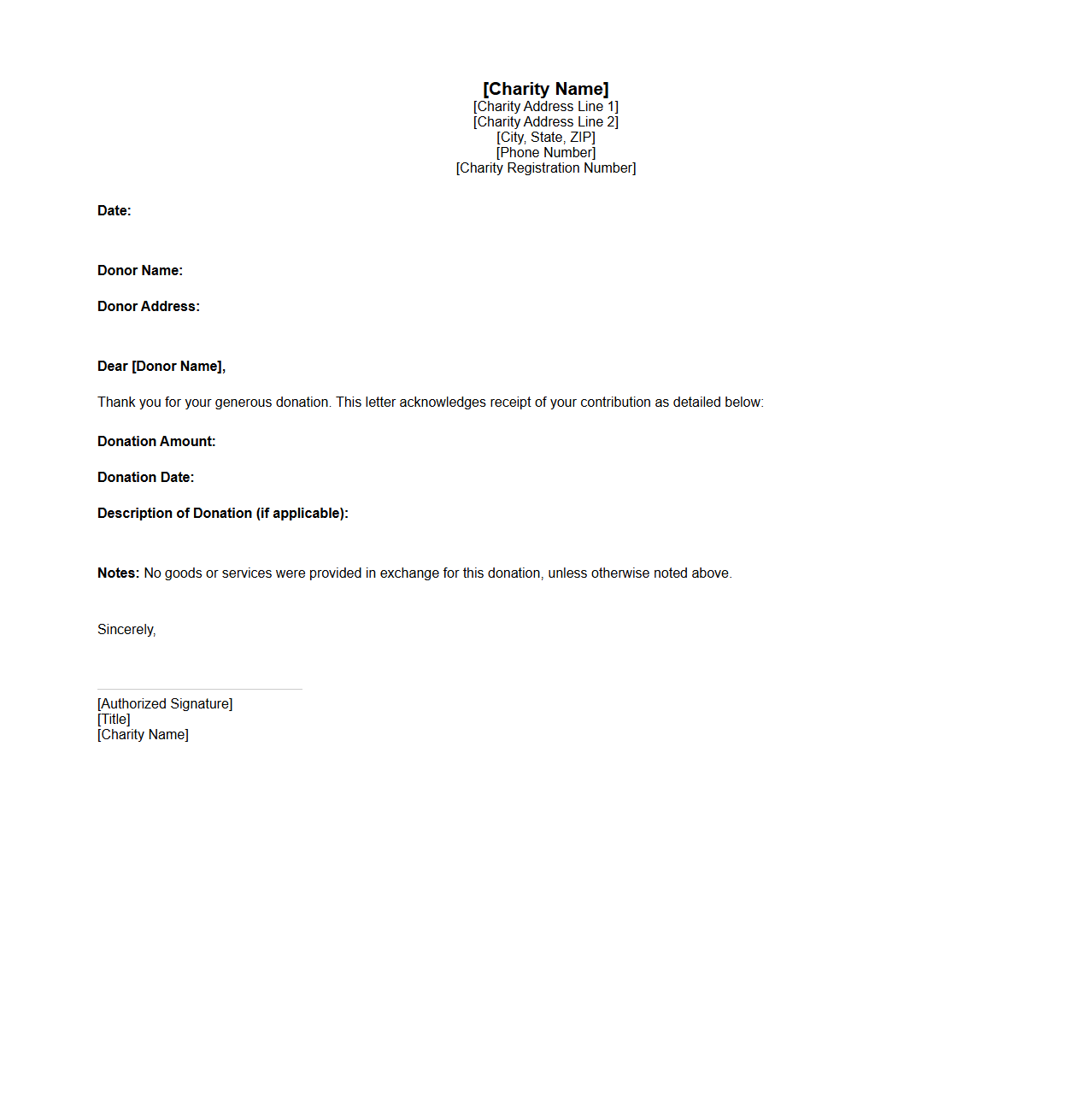

Blank Donation Receipt Letter Template for Charities

A

Blank Donation Receipt Letter Template for Charities is a customizable document used by nonprofit organizations to formally acknowledge contributions from donors. It includes fields for essential information such as donor details, donation amount, date, and purpose of the gift, ensuring accurate record-keeping and compliance with legal requirements. This template helps charities maintain transparency and build trust with supporters by providing clear proof of donation for tax deduction purposes.

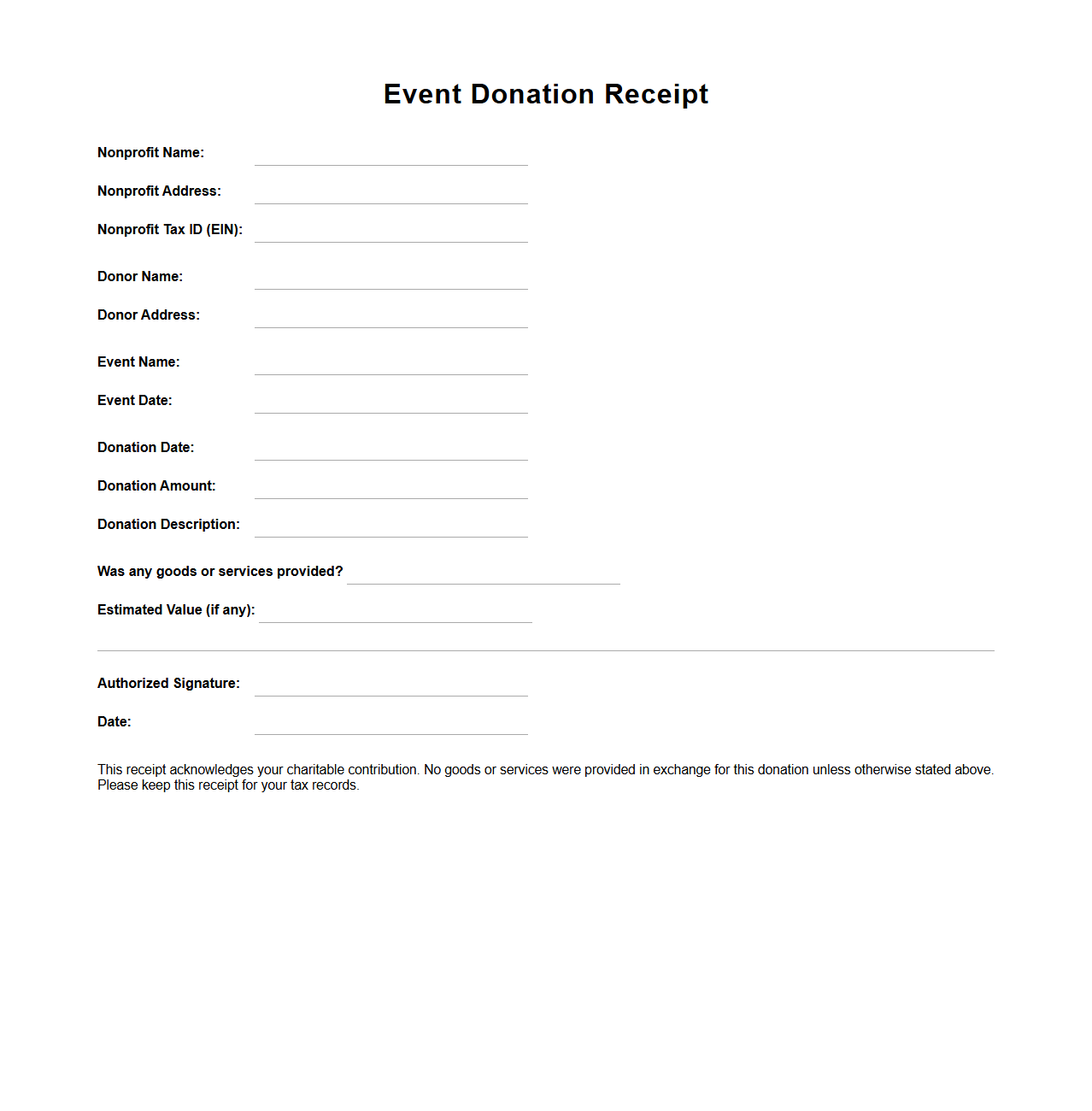

Blank Event Donation Receipt Template for Nonprofits

A

Blank Event Donation Receipt Template for Nonprofits document serves as a customizable form that organizations use to acknowledge and record donations received during fundraising events. It includes essential details such as donor information, donation amount, date, and event specifics, ensuring compliance with tax regulations and facilitating transparent record-keeping. This template supports nonprofits in maintaining accurate financial documentation and enhancing donor trust through professional receipts.

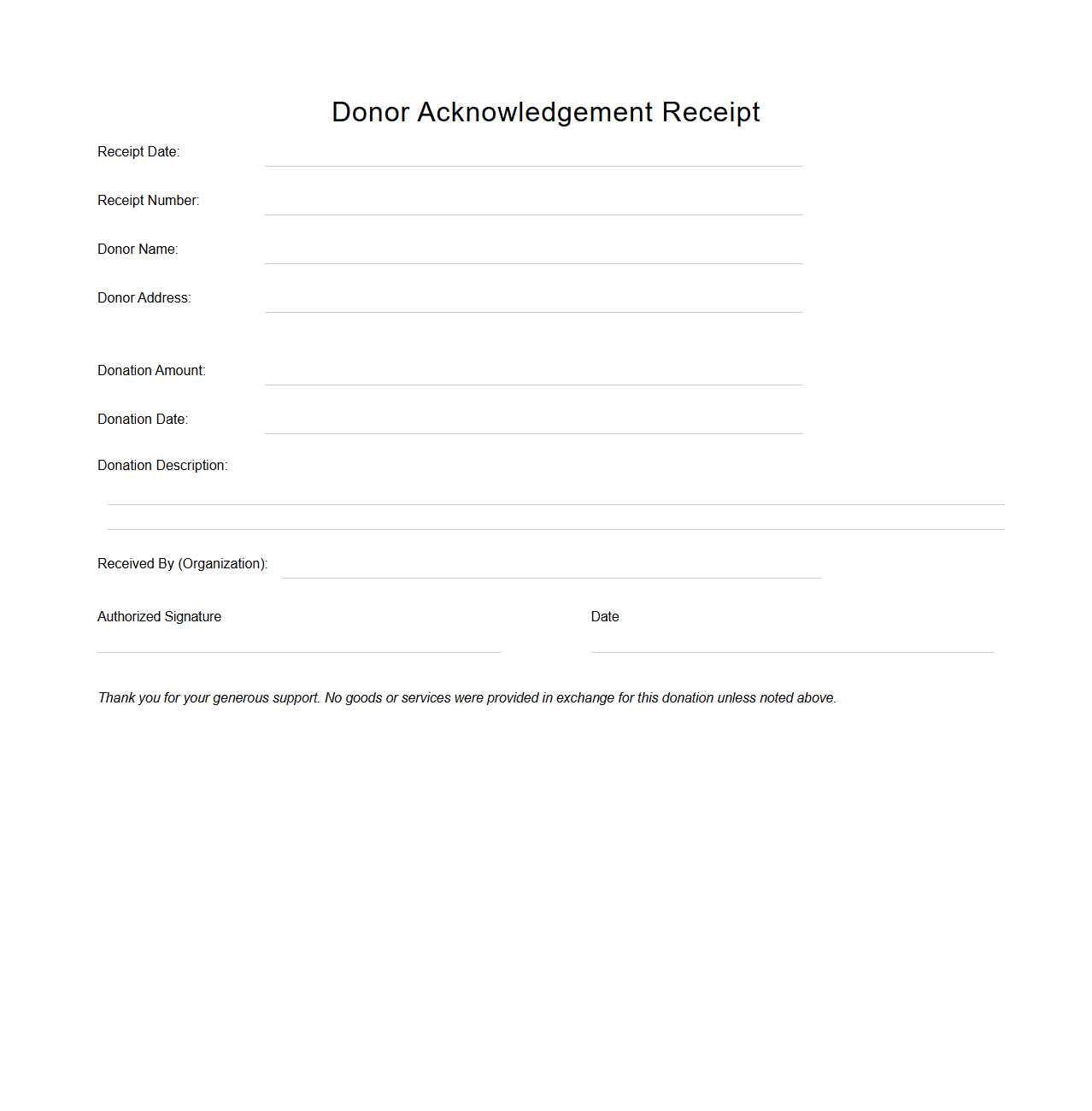

Blank Donor Acknowledgement Receipt Template

A

Blank Donor Acknowledgement Receipt Template document serves as a standardized form used by organizations to formally recognize and record donations received from donors. It typically includes fields for donor details, donation amount, date of donation, and the purpose or program supported. This template ensures transparency, facilitates accurate record-keeping, and helps donors claim tax deductions by providing official proof of their charitable contributions.

What IRS-required details must a blank donation receipt template for nonprofits include?

A blank donation receipt template must include the donor's name and the nonprofit organization's name to comply with IRS guidelines. It should also state the date of the contribution and a description of the donation made. Additionally, receipts must include a statement about whether any goods or services were provided in exchange for the gift.

How should a blank donation receipt address non-cash contributions?

Non-cash contributions must be described in detail on the receipt, including type and condition of the items donated. The receipt should indicate if the fair market value is estimated by the donor or the organization. This ensures proper documentation for IRS valuation and tax purposes.

Can a blank donation receipt template specify restrictions for designated funds?

Yes, the receipt can include a section specifying any donor-imposed restrictions on the use of funds. This clarifies the purpose the donation is intended to support, such as a particular program or project. Including such details helps maintain transparency and accountability with donors and the IRS.

How to format donor acknowledgment on a blank donation receipt for online gifts?

For online gifts, the receipt should clearly capture the donor's full name and contact information, as well as the date and amount of the donation. It should also include a clear statement of tax deductibility and acknowledgment of any non-cash items if applicable. This ensures the receipt meets IRS standards for electronic transactions.

What disclaimers should appear on a blank donation receipt for tax compliance?

The receipt should contain a disclaimer stating that no goods or services were provided, or if they were, an estimate of their value. It must inform donors that the receipt is for tax purposes only and does not constitute legal advice. Including these disclaimers is essential for maintaining IRS compliance and protecting the nonprofit.