The Blank Expense Report Template for Employees simplifies the process of tracking business expenses by providing a clear and organized format. Employees can easily input travel, meal, and office supply costs, ensuring accurate reimbursement and budget management. This template enhances financial transparency and streamlines expense reporting within organizations.

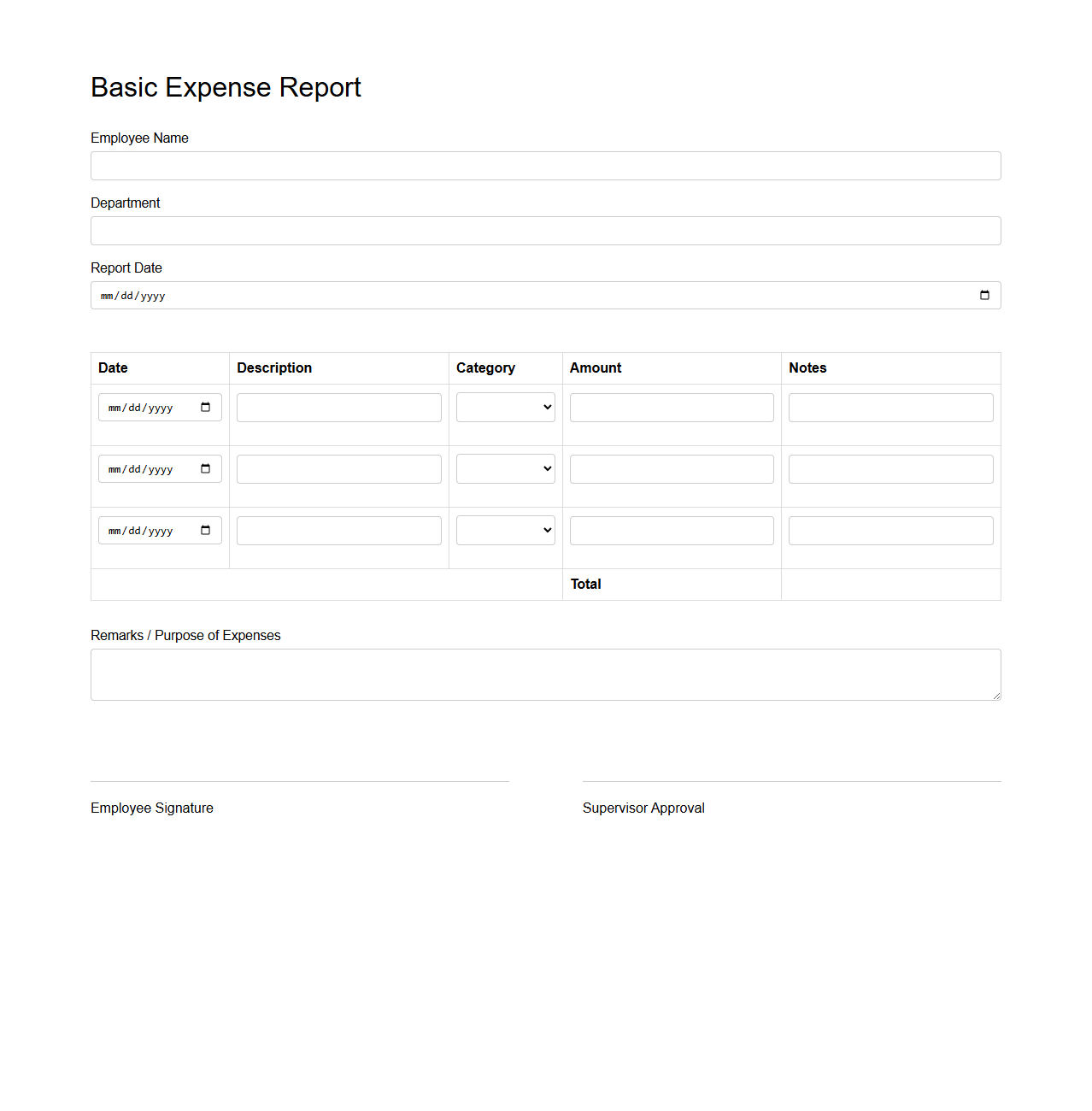

Basic Expense Report Template for Employees

A

Basic Expense Report Template for Employees is a standardized document used to record and track employee expenditures related to business activities. It helps ensure accurate reimbursement by detailing expenses such as travel, meals, and supplies with corresponding dates, amounts, and descriptions. This template streamlines financial reporting and supports compliance with company policies and accounting procedures.

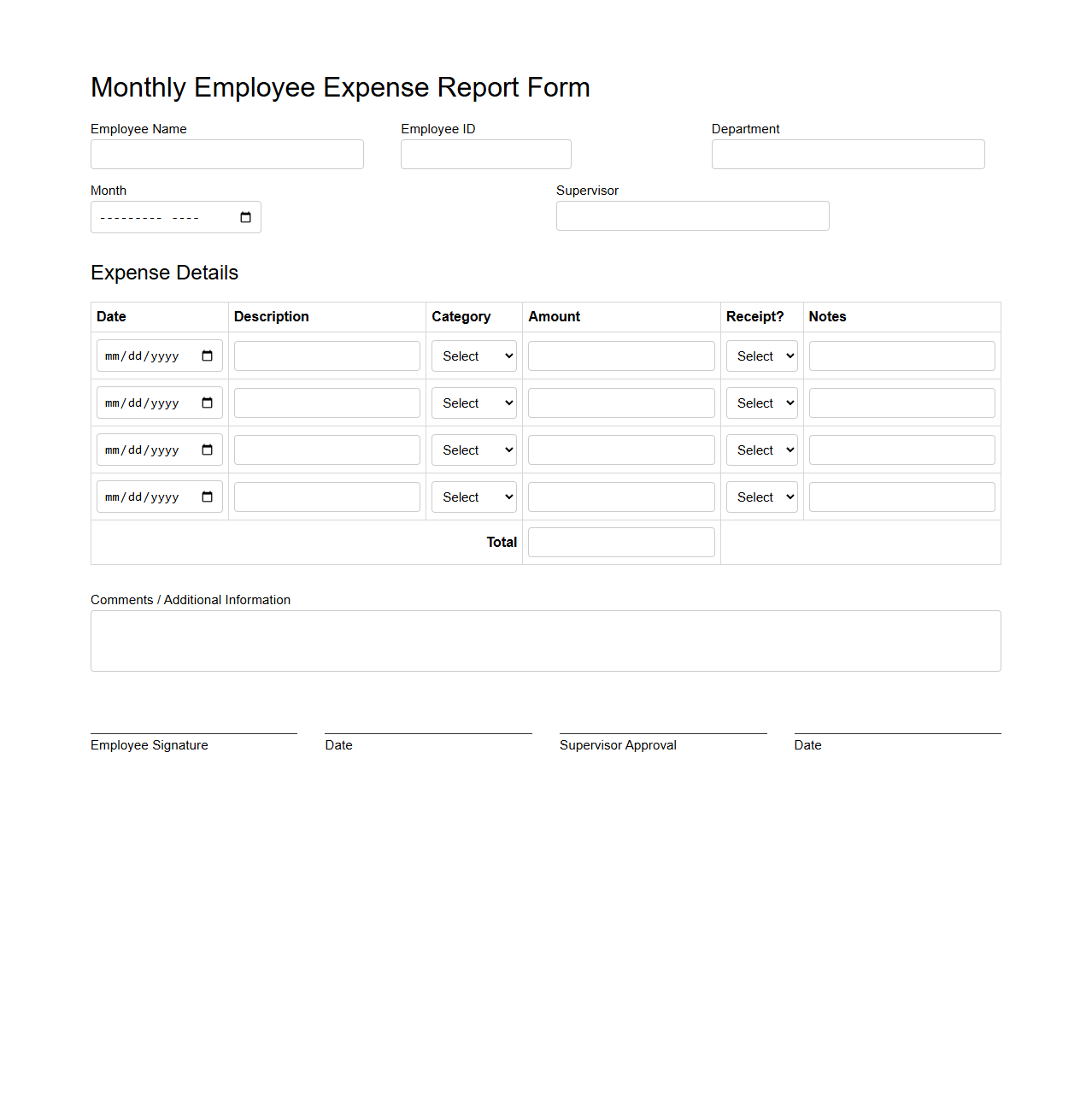

Monthly Employee Expense Report Form

The

Monthly Employee Expense Report Form is a standardized document used by organizations to track and manage employees' reimbursable expenses incurred during a specific month. It typically includes fields for employee identification, detailed expense descriptions, dates, amounts, and approval signatures, ensuring accurate financial record-keeping and compliance with company policies. This form streamlines the reimbursement process, enhances transparency, and supports budget analysis within the finance department.

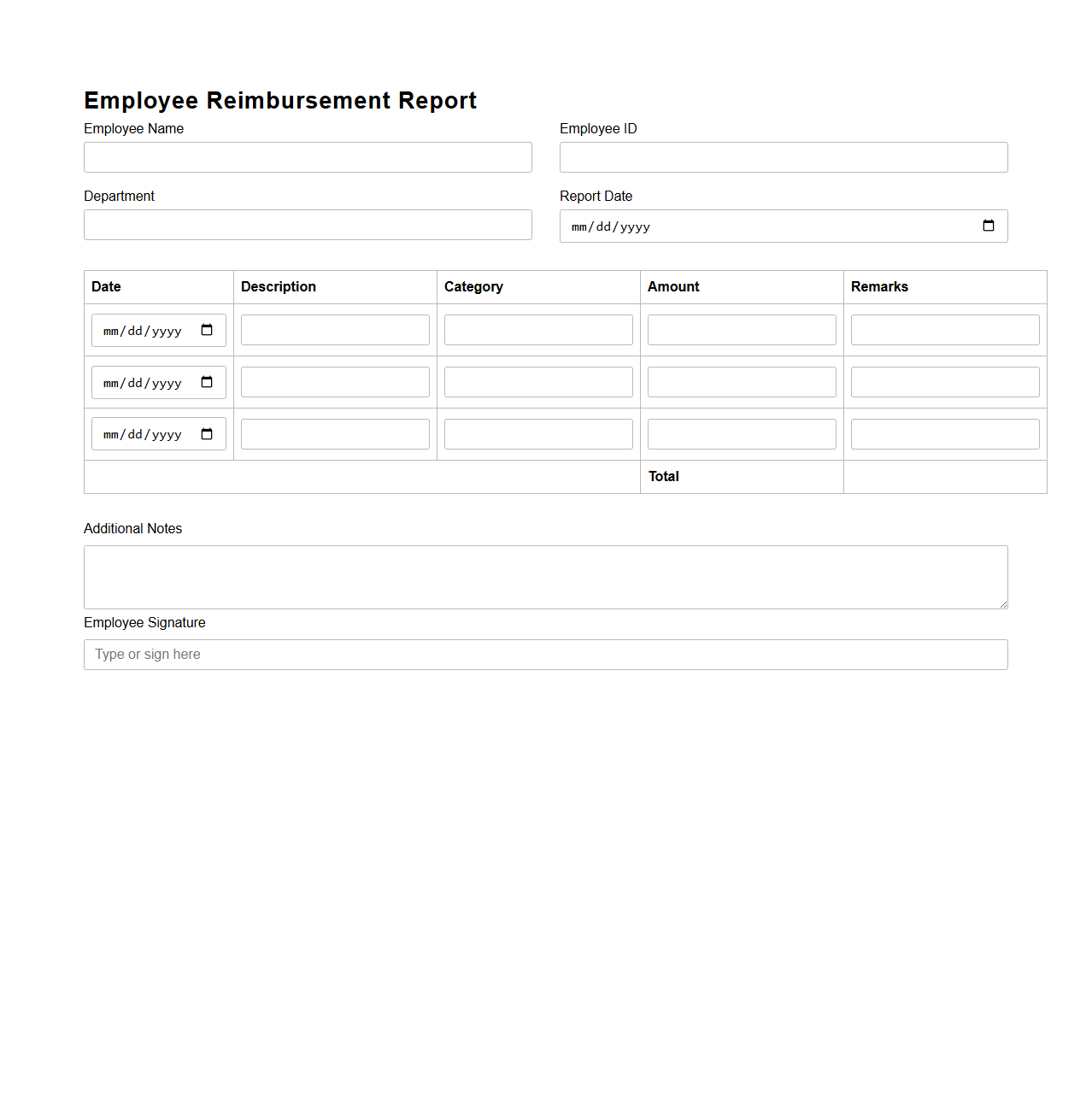

Simple Employee Reimbursement Report Template

A

Simple Employee Reimbursement Report Template document is a standardized form used to record and track expenses incurred by employees during business activities. It captures essential details such as date, expense category, amount, and purpose, facilitating accurate reimbursement processing. This template enhances financial transparency and streamlines expense management within organizations.

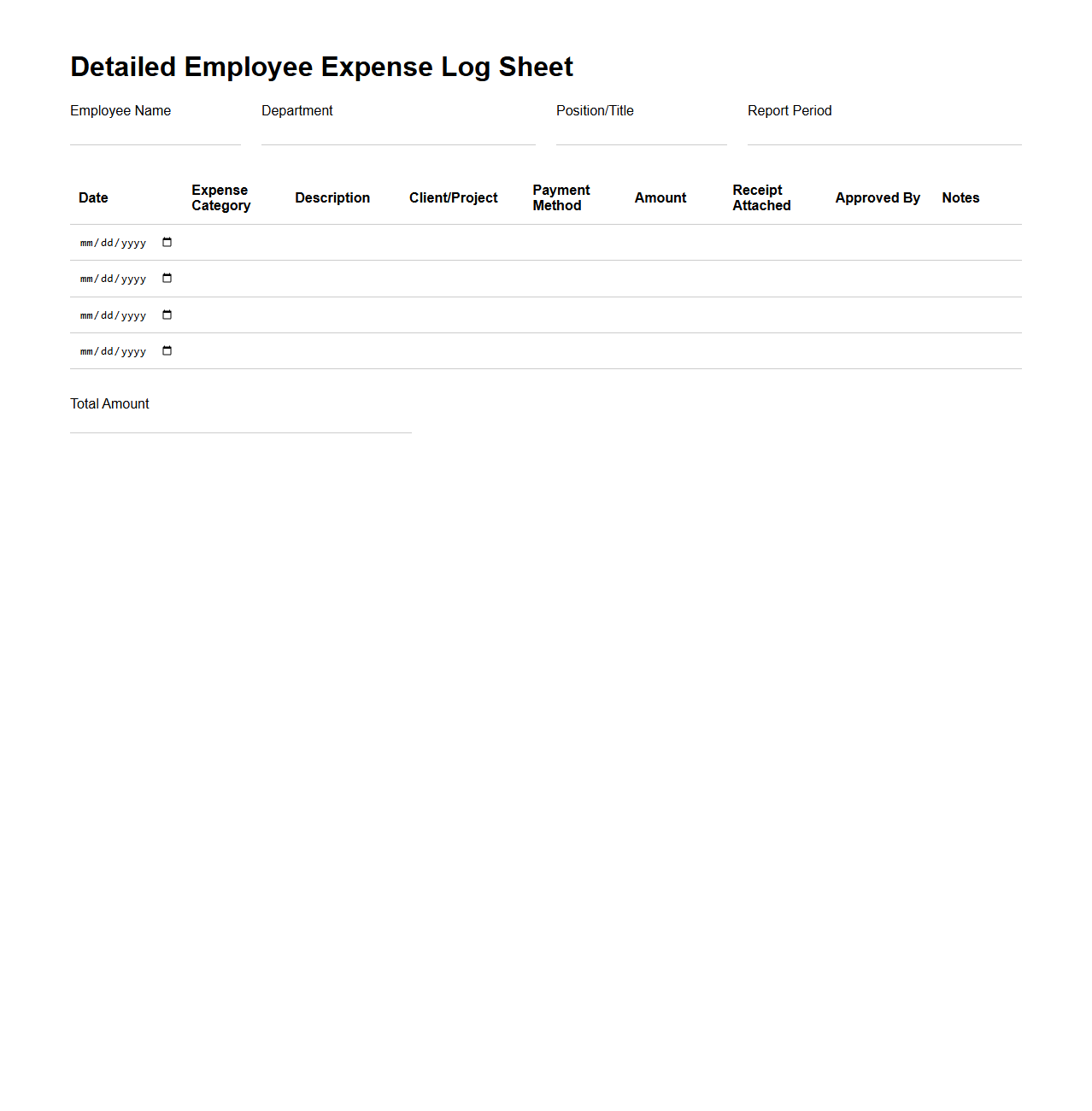

Detailed Employee Expense Log Sheet

A

Detailed Employee Expense Log Sheet document systematically records all business-related expenses incurred by employees, including dates, amounts, categories, and descriptions. It facilitates accurate tracking and reimbursement of expenses while ensuring compliance with company policies and tax regulations. This document is essential for maintaining transparent financial records and supporting audit processes.

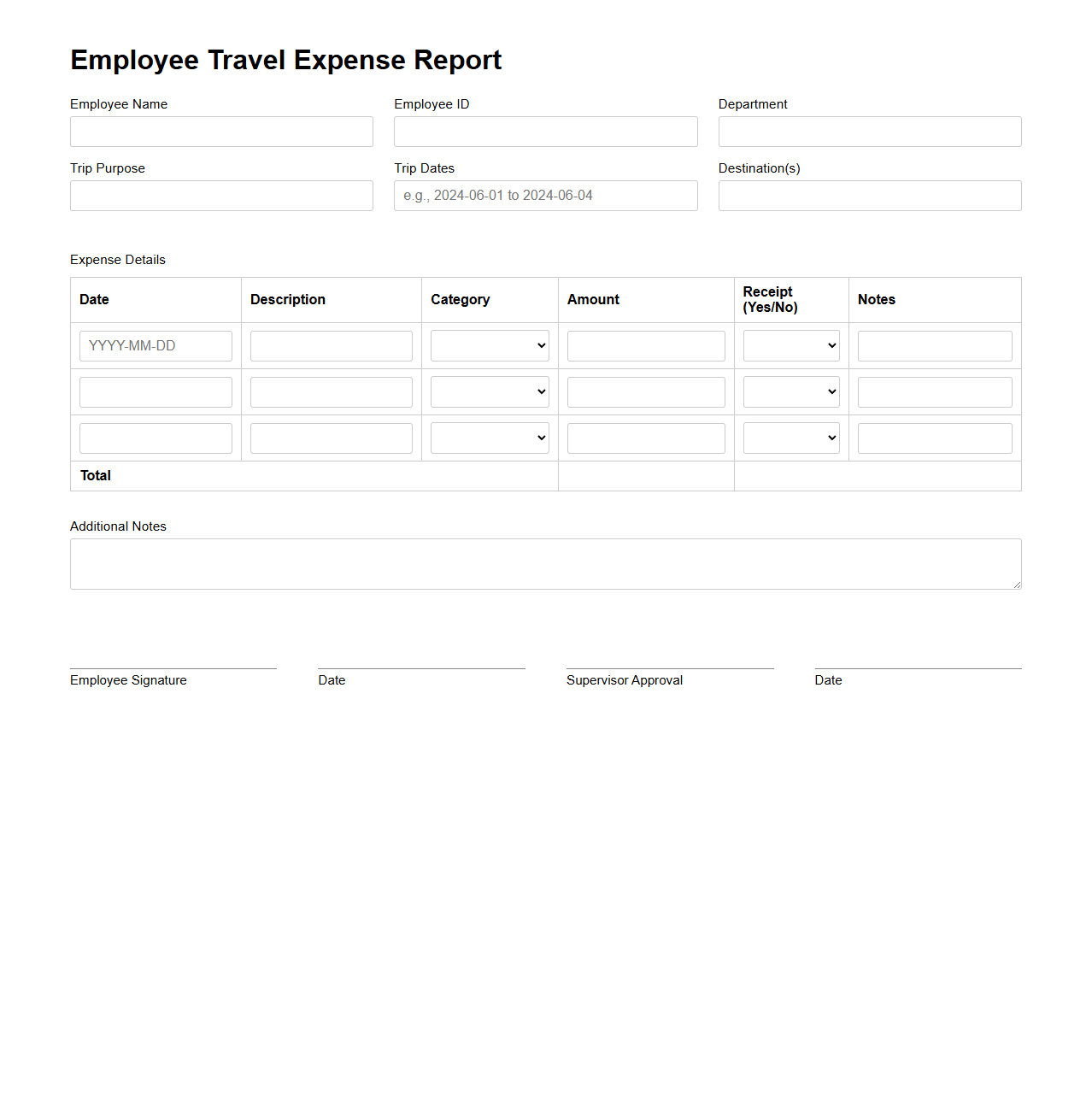

Employee Travel Expense Report Template

An

Employee Travel Expense Report Template document is a structured form used by organizations to record and track expenses incurred by employees during business trips. It typically includes fields for listing transportation costs, accommodation, meals, and other travel-related expenses, ensuring accurate reimbursement and budgeting. This template helps streamline the approval process and maintain transparent financial records.

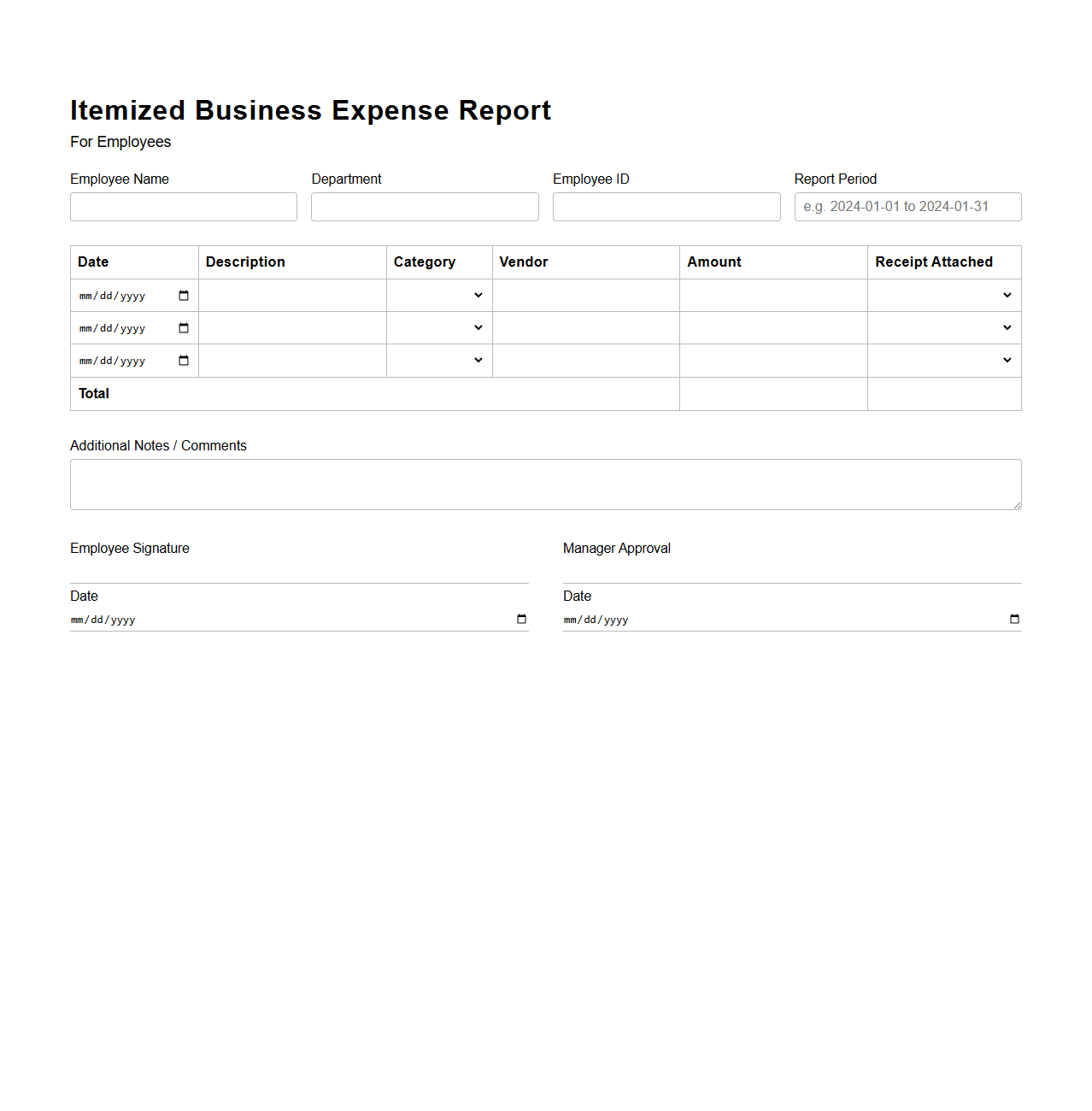

Itemized Business Expense Report for Employees

An

Itemized Business Expense Report for Employees document is a detailed record used to track and verify individual business-related expenses incurred by employees during work activities. It typically includes categories such as travel, meals, lodging, and supplies, providing a clear breakdown for reimbursement and accounting purposes. This report ensures compliance with company policies and tax regulations by documenting expenses with attached receipts and descriptions.

Weekly Employee Expense Tracking Template

The

Weekly Employee Expense Tracking Template is a structured document designed to record and monitor employee expenses on a weekly basis. It helps organizations maintain accurate financial records, streamline reimbursement processes, and ensure compliance with company policies. By categorizing expenses and tracking dates, amounts, and purpose, this template enhances transparency and budget management.

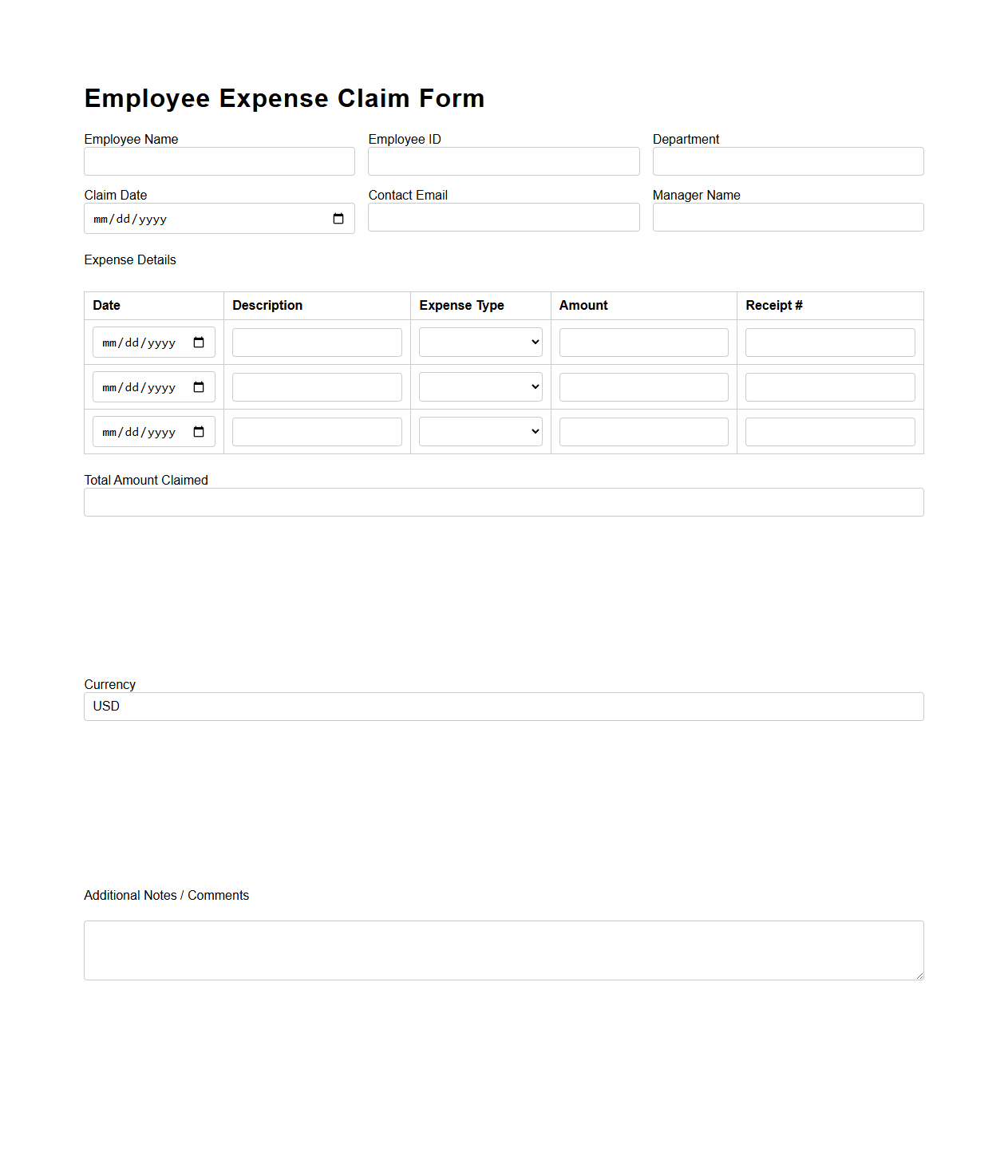

Professional Employee Expense Claim Form

A

Professional Employee Expense Claim Form document is used by employees to accurately report and request reimbursement for work-related expenses incurred during their professional duties. This form typically includes fields for itemizing expenses, dates, amounts, and necessary approvals, ensuring compliance with company policies and tax regulations. Proper use of this document streamlines the expense reimbursement process and maintains transparent financial records.

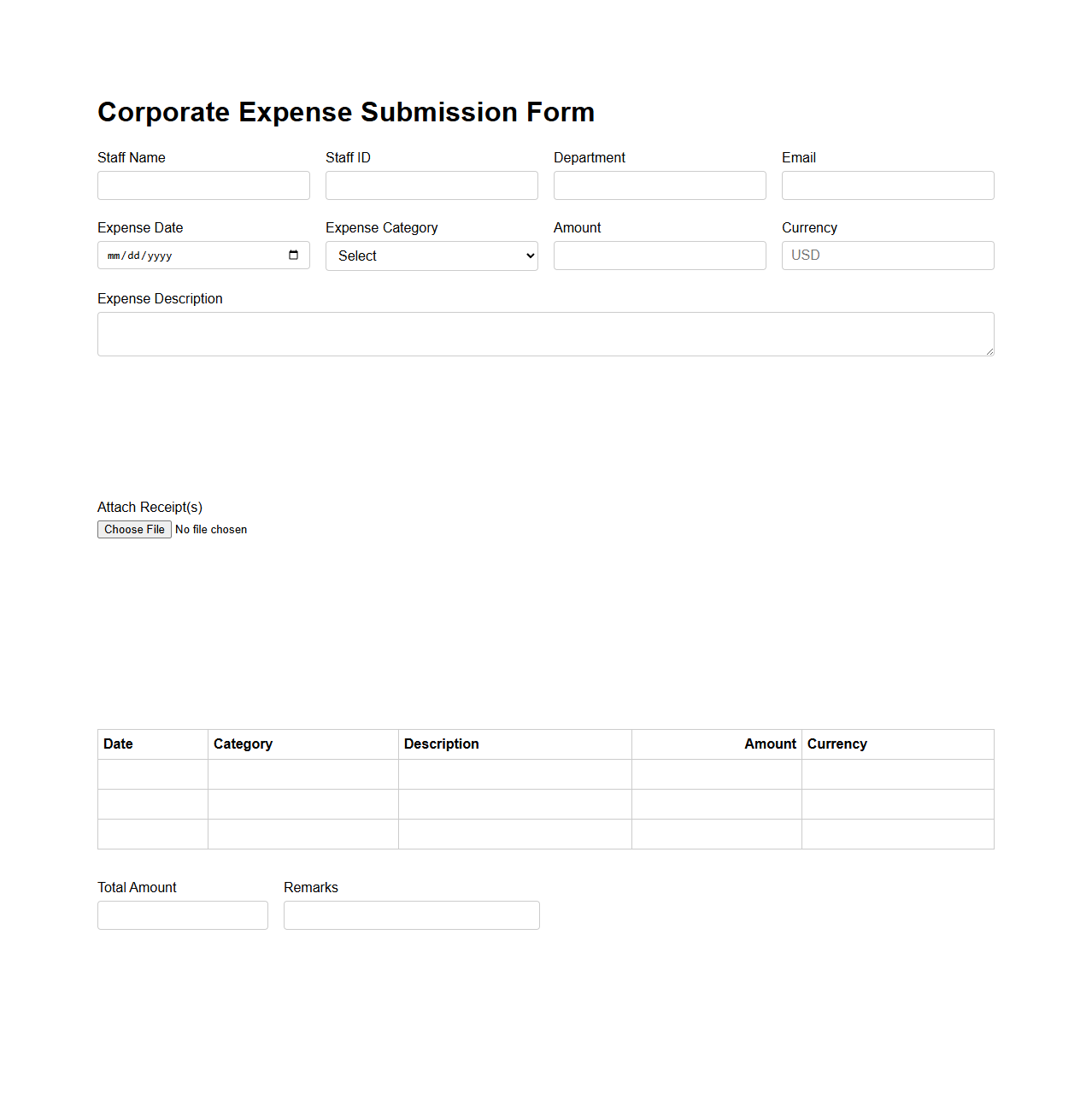

Corporate Expense Submission Form for Staff

A

Corporate Expense Submission Form for staff is a standardized document used to report and request reimbursement for business-related expenses incurred by employees. It typically includes fields for expense categories, dates, amounts, and supporting receipts, ensuring accurate tracking and compliance with company policies. This form streamlines the expense approval process and maintains clear financial records for auditing purposes.

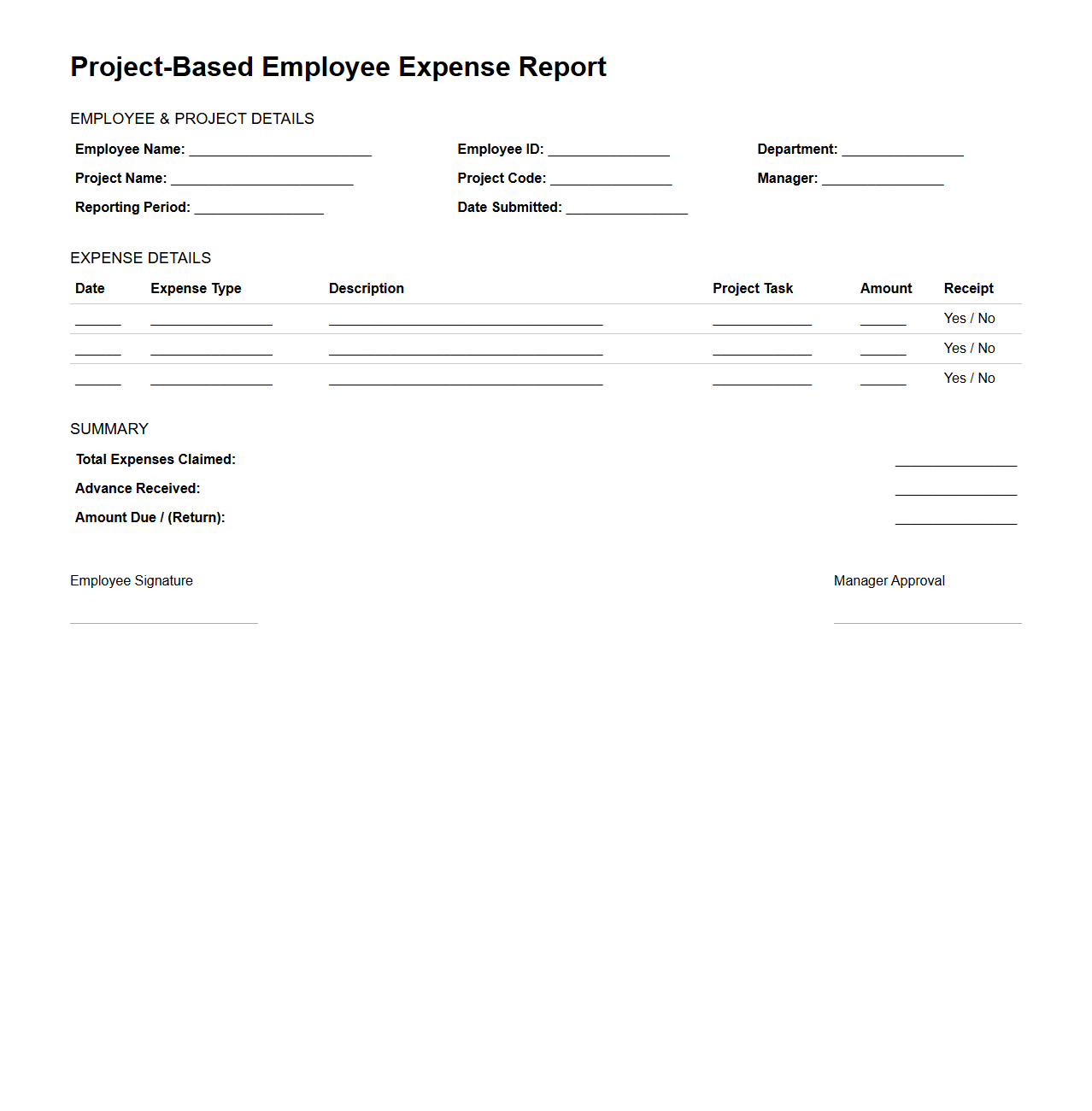

Project-Based Employee Expense Report Template

The

Project-Based Employee Expense Report Template is a structured document designed to track and categorize expenses incurred by employees for specific projects. It ensures accurate financial reporting by detailing costs such as travel, supplies, and labor linked directly to individual projects. This template facilitates budget management, simplifies reimbursement processes, and supports auditing and compliance efforts within project-based organizations.

What fields must be included in a compliant blank employee expense report template?

A compliant blank employee expense report template must include employee details such as name, ID, and department. It should clearly list expense categories like travel, meals, and accommodation along with date, amount, and description fields. Additionally, fields for receipts and approvals ensure transparency and proper record keeping.

How can digital signatures be integrated into a blank expense report letter?

Digital signatures can be integrated using secure electronic signature platforms that comply with legal standards. Embedding signature fields directly into the expense report allows employees and managers to sign authentically and efficiently. This integration enhances security and speeds up the approval process while maintaining compliance.

What department approval workflows are recommended for a blank employee expense report?

A recommended workflow involves initial submission by the employee followed by sequential approval from the direct manager and then the finance department. Workflow automation tools can facilitate notifications and status tracking to ensure timely approvals. It's essential to document each approval step to maintain audit trails and accountability.

Which expense categories should be standardized on a blank report form for employees?

Standard expense categories typically include transportation, lodging, meals, and office supplies. Defining these categories clearly helps with consistent expense tracking and policy adherence. Including an other expenses category allows flexibility for unusual or miscellaneous costs.

How can a blank expense report ensure GDPR compliance for sensitive employee data?

Ensuring GDPR compliance involves collecting only necessary personal data and securing it with encryption measures. The form should include consent statements explaining how the data will be used and stored. Access control mechanisms must be in place to restrict data access to authorized personnel only, protecting employee privacy.