A Blank Investment Agreement Template for Investors serves as a foundational document outlining the terms and conditions between investors and businesses. This customizable template ensures clarity on investment amounts, equity distribution, and rights of parties involved. Using a clear, legally sound template helps streamline negotiations and protects both investors and companies.

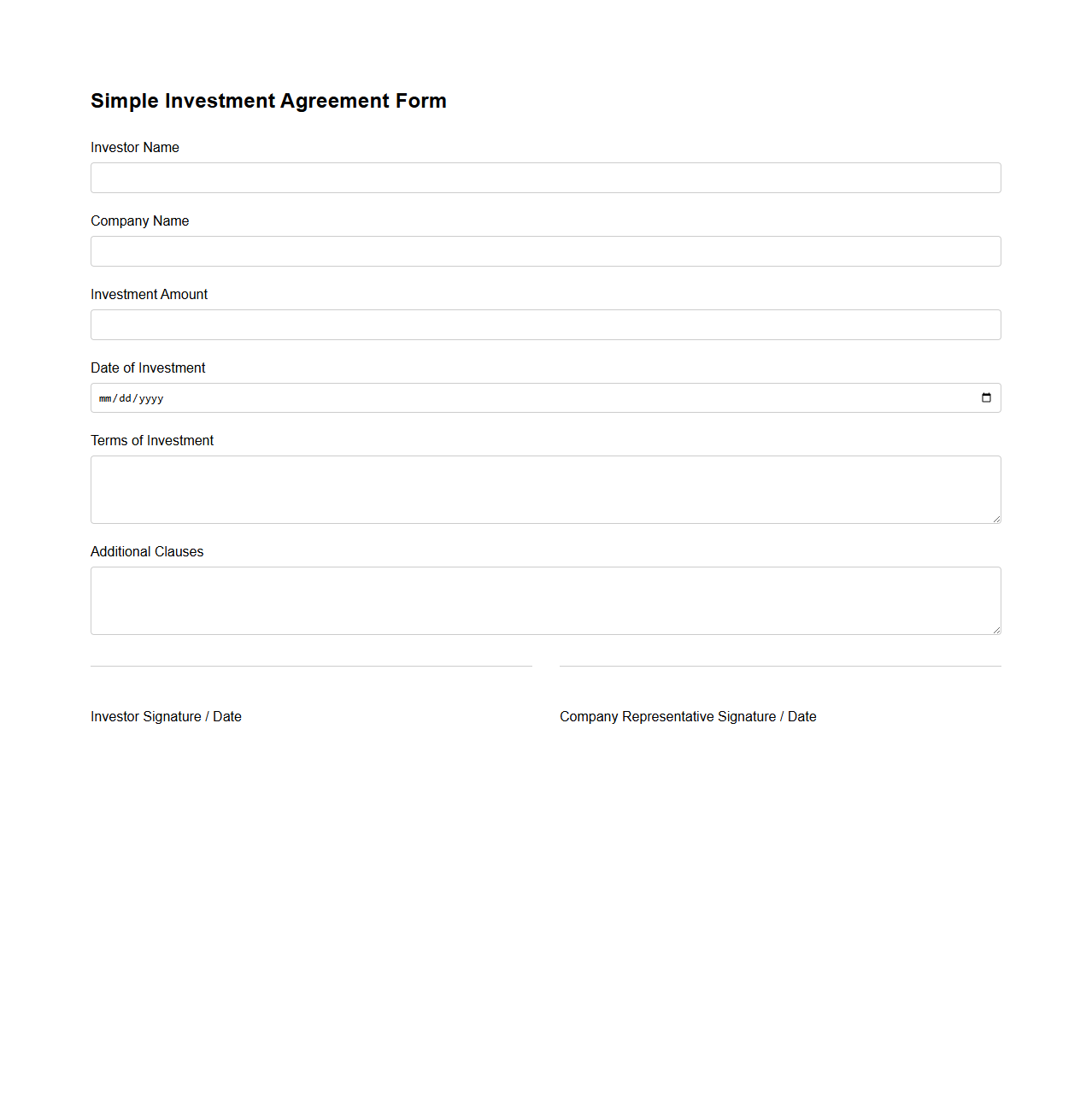

Simple Investment Agreement Form

A

Simple Investment Agreement Form document outlines the terms and conditions between an investor and a company, specifying the investment amount, equity stake, and rights of both parties. It serves as a legally binding contract to protect the interests of investors while facilitating transparent and straightforward funding arrangements. This form is essential for startups and small businesses seeking to secure capital efficiently without complex legal procedures.

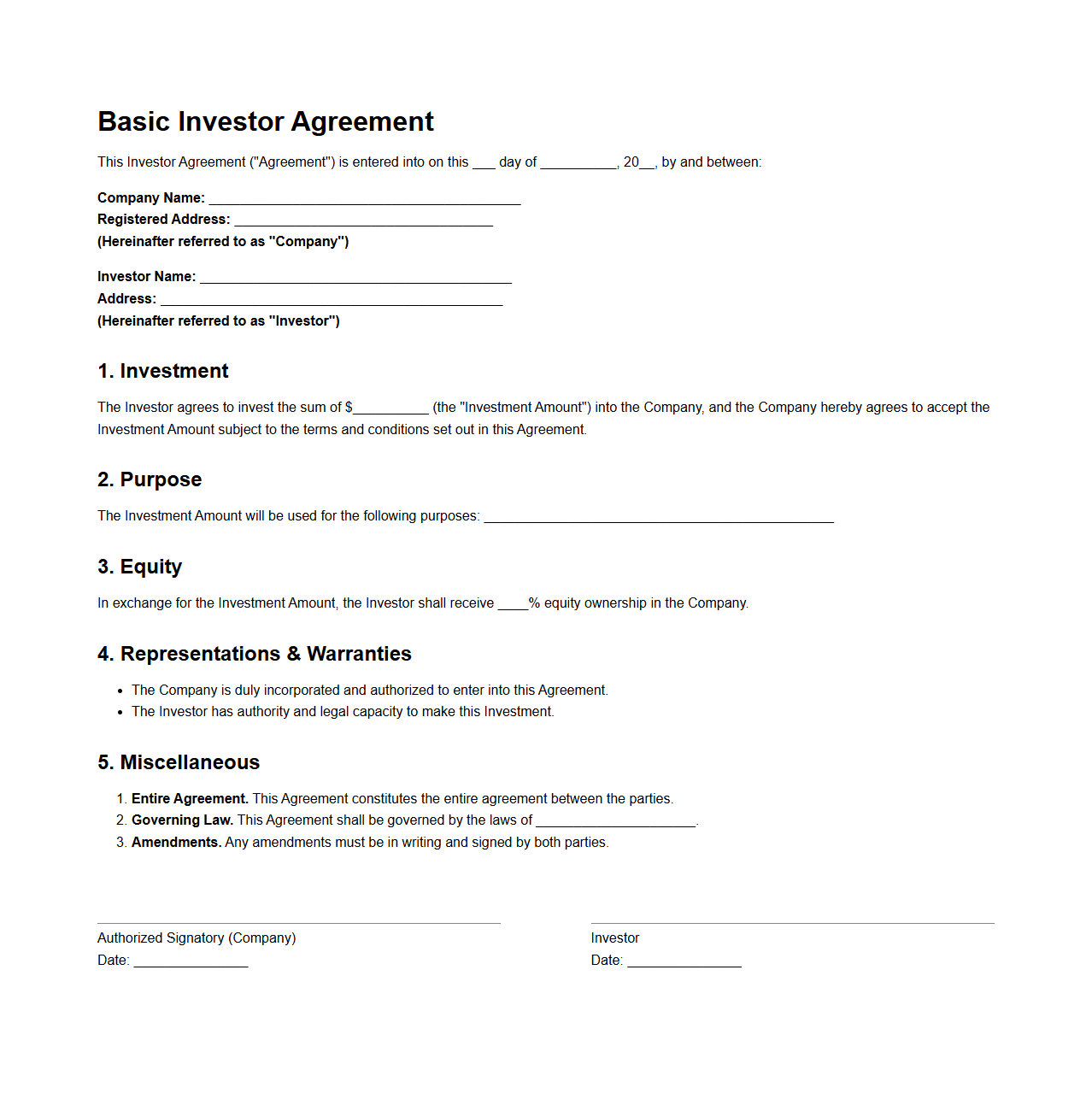

Basic Investor Agreement Sample

A

Basic Investor Agreement Sample document outlines the fundamental terms and conditions between an investor and a company, detailing investment amount, equity shares, rights, and obligations. It serves as a reference to ensure clarity and legal protection for both parties during initial funding stages. This sample helps streamline negotiations and establish a standard framework for future agreements.

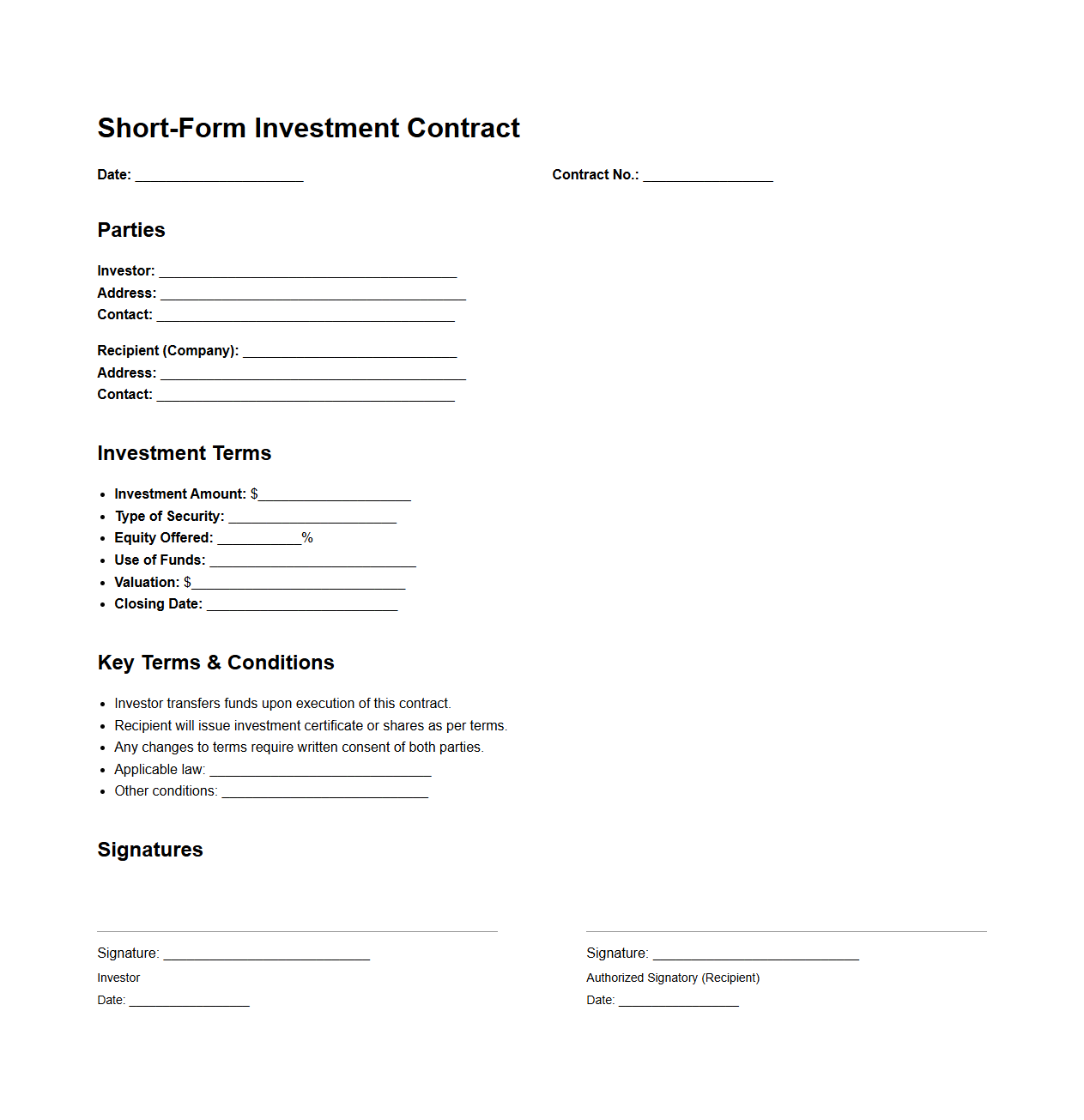

Short-Form Investment Contract Layout

A

Short-Form Investment Contract Layout document outlines the essential terms and conditions for a streamlined investment agreement, designed to simplify the process for both investors and issuers. It typically includes key components such as investment amount, rights and obligations of parties, and dispute resolution methods, ensuring clarity and legal compliance. This concise format facilitates faster negotiation and execution, making it ideal for startups and small-scale funding rounds.

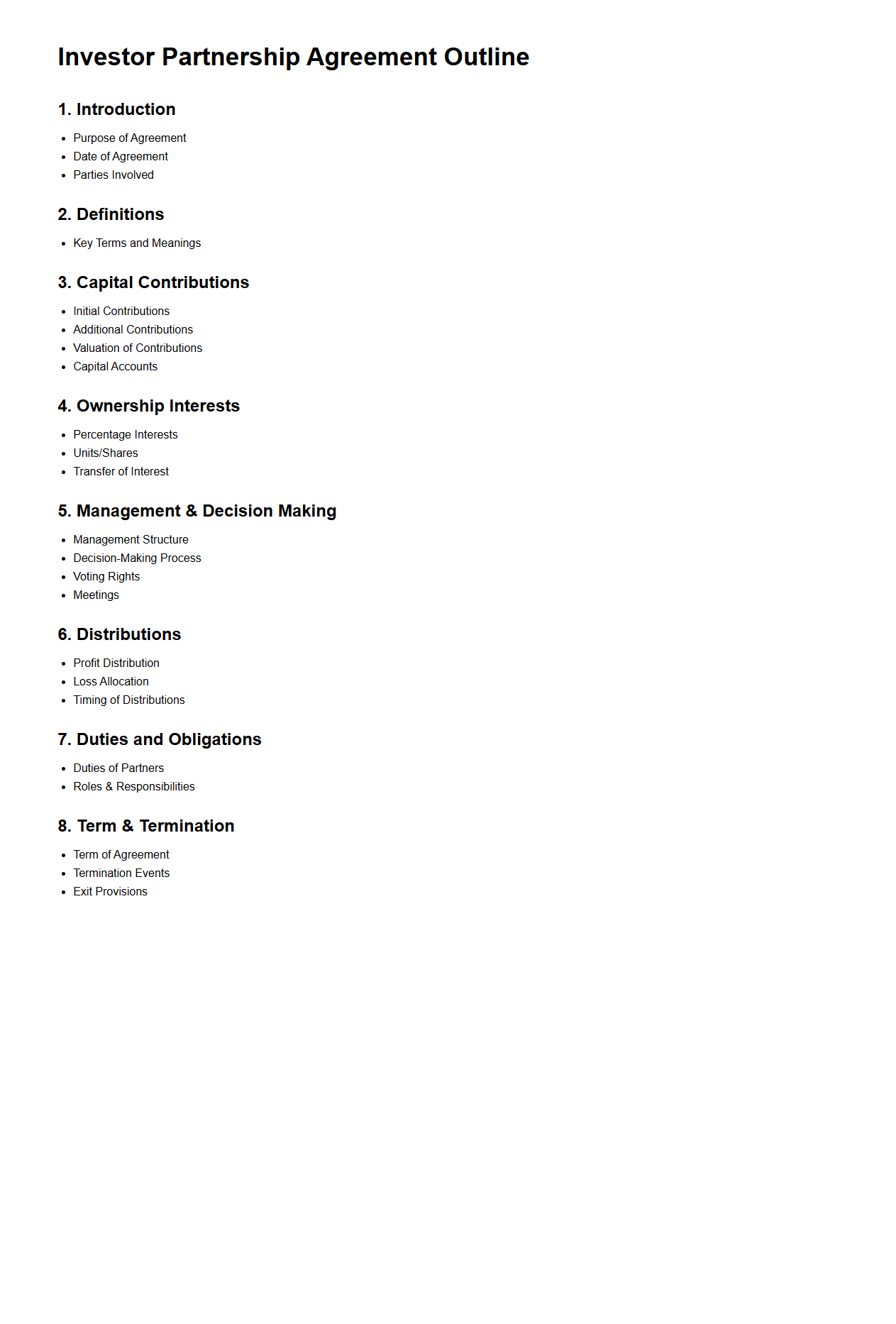

Investor Partnership Agreement Outline

An

Investor Partnership Agreement Outline document serves as a foundational framework that delineates the roles, responsibilities, and expectations of investors within a partnership. It typically covers crucial elements such as capital contributions, profit sharing, decision-making authority, dispute resolution, and exit strategies. This outline ensures clear communication and legal alignment among all parties involved, promoting transparency and reducing potential conflicts.

Startup Investment Agreement Sheet

A

Startup Investment Agreement Sheet is a crucial legal document outlining the terms and conditions between investors and a startup company during funding rounds. It specifies key details such as investment amount, equity ownership, valuation, and investor rights, ensuring clear understanding and protection for all parties involved. This document serves as a foundation for formal investment deals, minimizing disputes and facilitating smooth capital infusion.

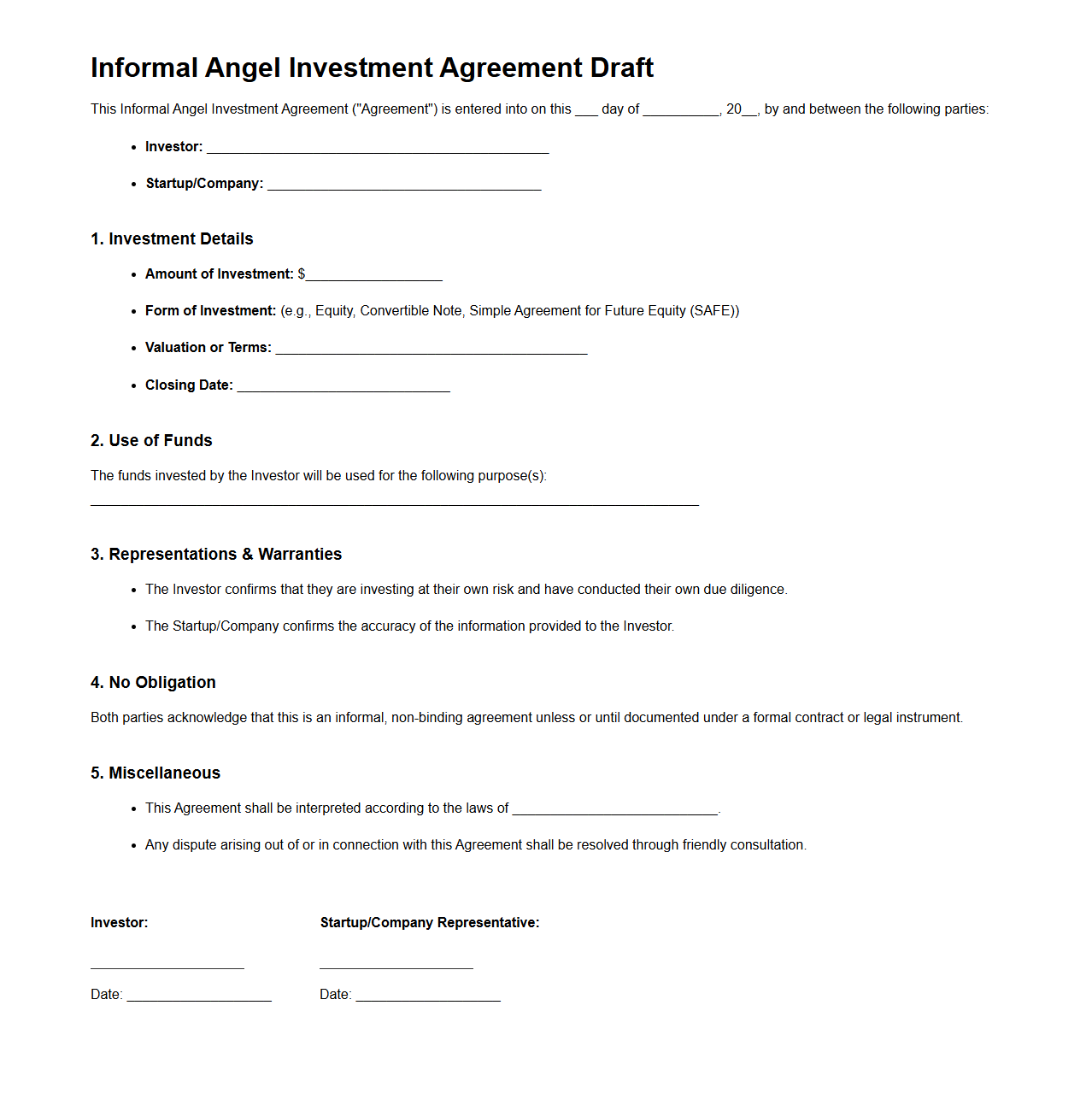

Informal Angel Investment Agreement Draft

An

Informal Angel Investment Agreement Draft document outlines the preliminary terms and conditions between an angel investor and a startup without the formalities of a legal contract. It provides a flexible framework for investment amounts, equity stakes, and investor rights, helping to clarify expectations before finalizing a formal agreement. This draft serves as a negotiation tool to ensure mutual understanding and protect both parties during early-stage funding discussions.

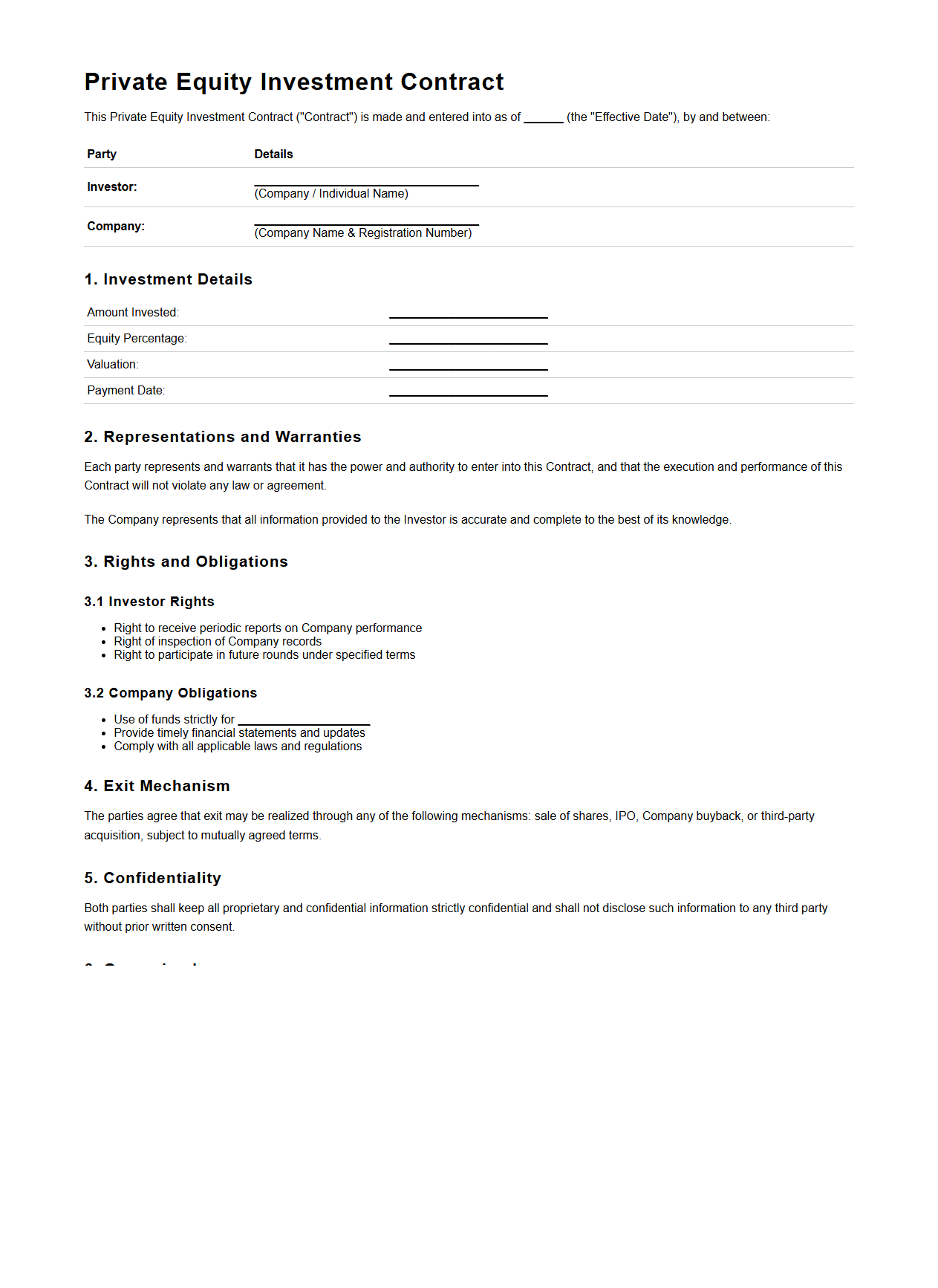

Private Equity Investment Contract Format

A

Private Equity Investment Contract Format document outlines the legal terms and conditions agreed upon between investors and private equity firms during investment transactions. It typically includes details about capital commitments, shareholder rights, profit distribution, and exit strategies, ensuring clarity and protection for all parties involved. This format serves as a crucial blueprint for structuring the investment relationship and managing potential risks.

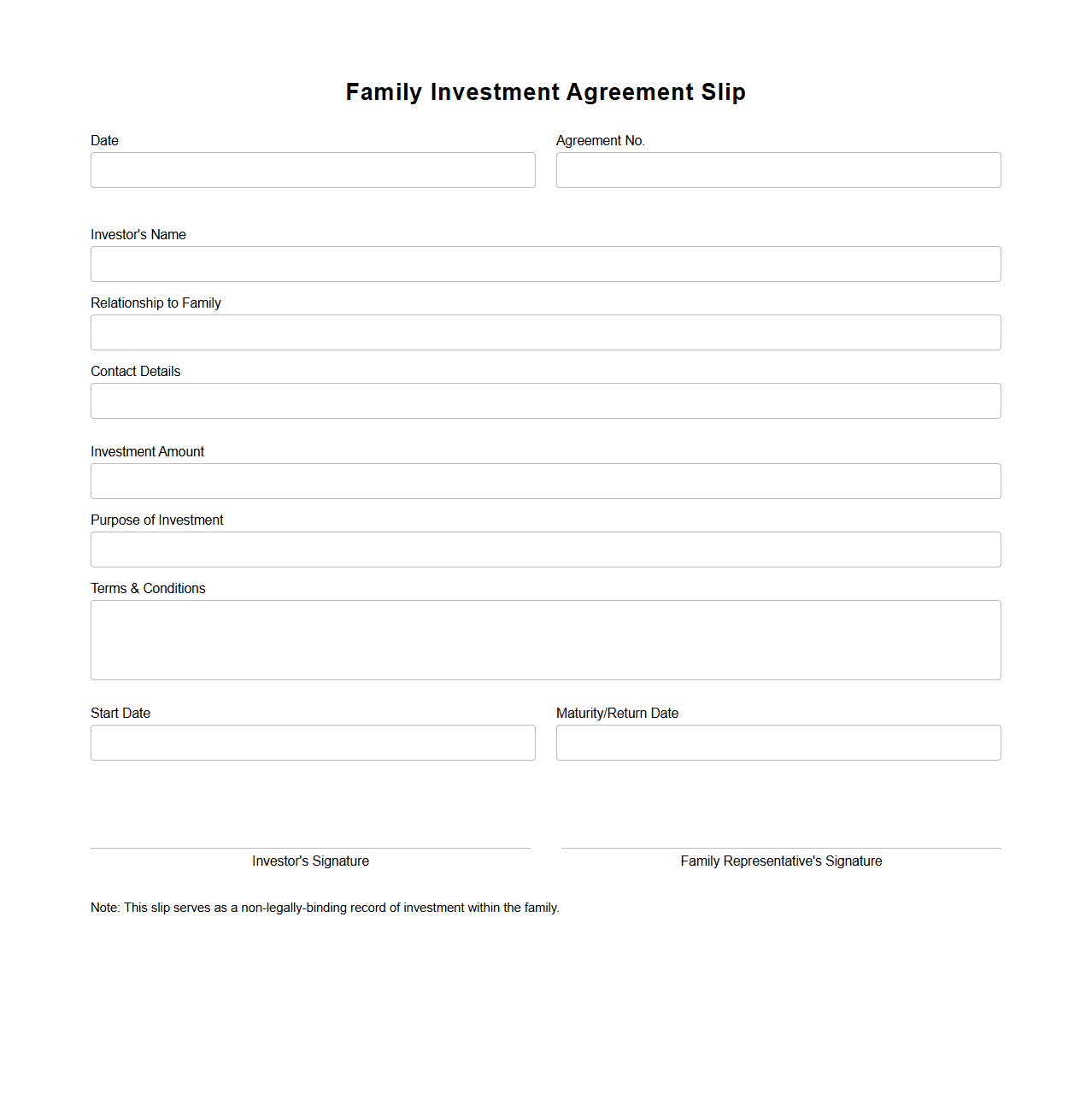

Family Investment Agreement Slip

A

Family Investment Agreement Slip is a formal document that outlines the terms and conditions for investment contributions among family members, specifying roles, responsibilities, and profit-sharing arrangements. It serves as a binding record to ensure transparency, prevent disputes, and facilitate smooth management of collective family investments. This document typically includes detailed information on investment amounts, timelines, and decision-making processes to protect the interests of all parties involved.

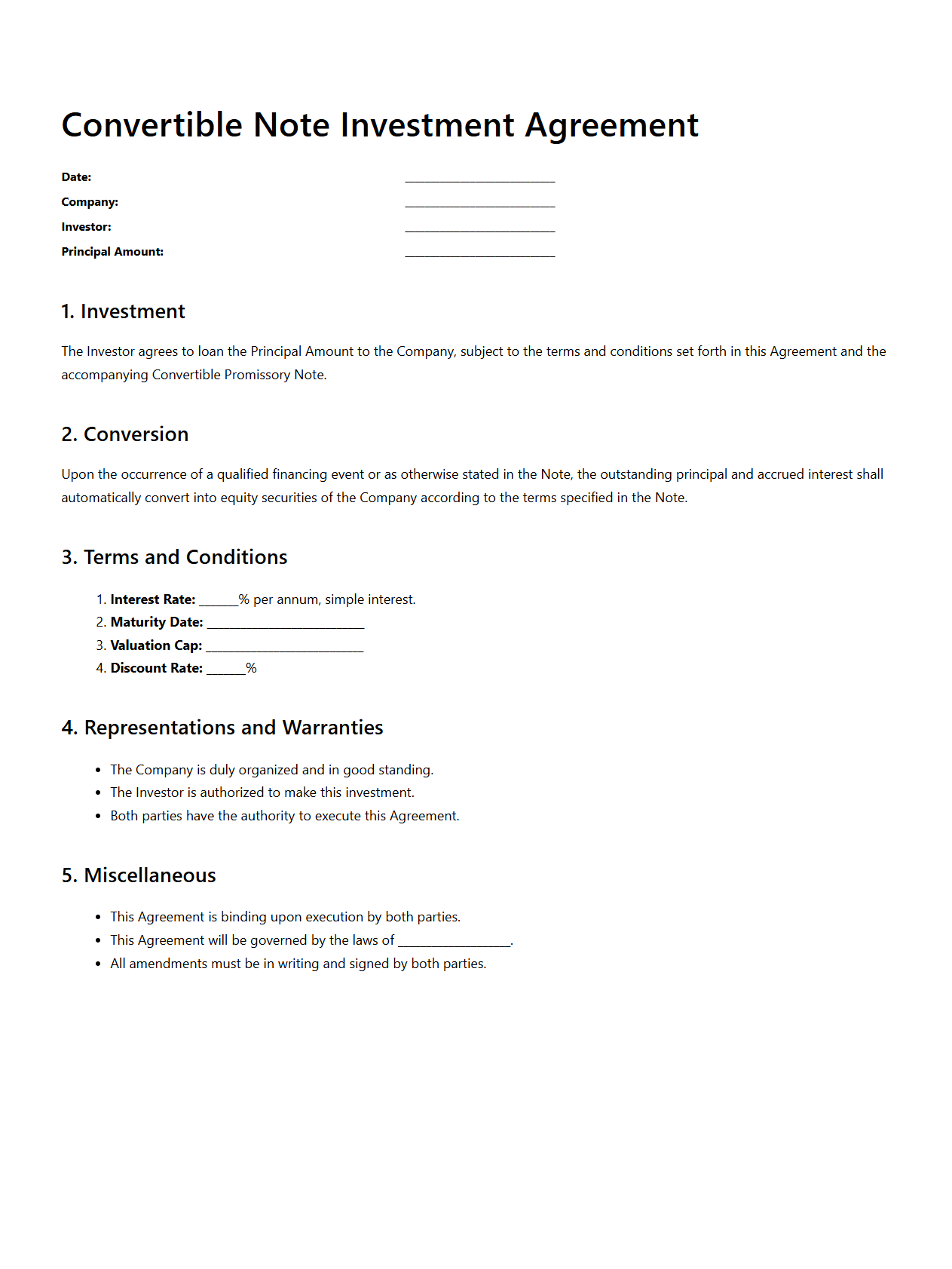

Convertible Note Investment Agreement Page

A

Convertible Note Investment Agreement is a legal document outlining the terms under which an investor provides funds to a startup as a convertible note. This agreement specifies key details such as the principal amount, interest rate, maturity date, and conversion terms into equity. It protects both parties by defining investor rights and conditions for conversion during future financing rounds.

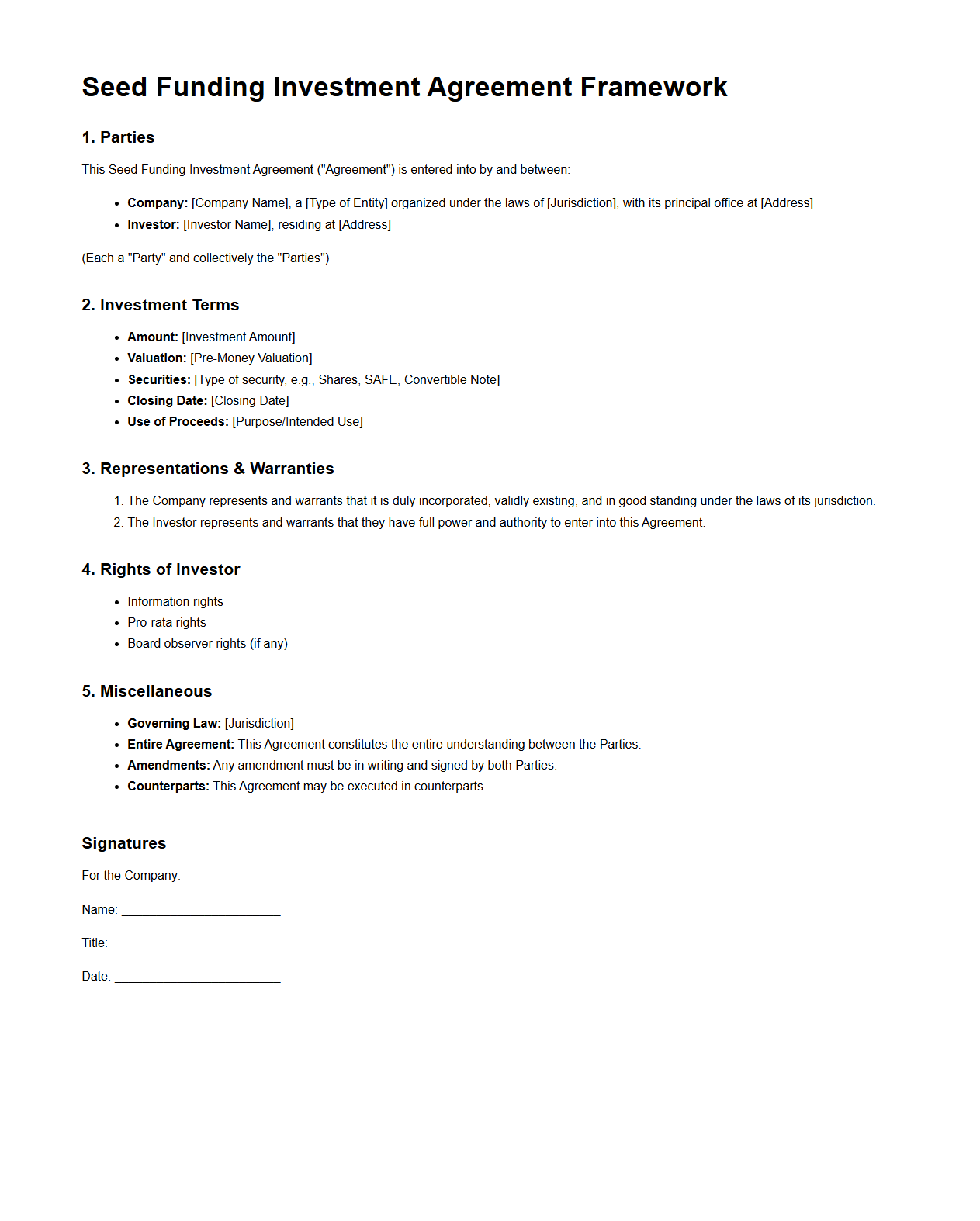

Seed Funding Investment Agreement Framework

A

Seed Funding Investment Agreement Framework document outlines the terms and conditions under which early-stage capital is invested in a startup or new business. It defines the rights, responsibilities, equity distribution, and obligations of both the investor and the entrepreneur to ensure clarity and legal protection. This framework serves as a foundational contract that guides the initial investment process, minimizes risks, and aligns expectations between parties.

Key Clauses in a Blank Investment Agreement for Angel Investors

A blank investment agreement should include clauses that define the amount and type of investment, ownership percentages, and valuation of the company. It must also specify investor rights, such as voting power and information access. Additionally, provisions on representations, warranties, and conditions precedent protect both parties.

Addressing Investor Exit Strategies in a Blank Investment Agreement

Investor exit strategies are crucial and commonly addressed through liquidity events such as IPOs, acquisitions, or buybacks. Agreements often include tag-along and drag-along rights to protect minority investors and ensure smooth exits. Clear timelines and processes for exit facilitate alignment between founders and angel investors.

Common Dispute Resolution Methods in Blank Investment Agreements

Dispute resolution clauses typically specify arbitration or mediation as preferred methods to avoid lengthy litigation. Many agreements require that disputes be settled through confidential and binding arbitration panels. Including jurisdiction and governing law clauses ensures clarity in case of conflicts.

Structuring Rights to Future Funding Rounds in a Blank Investment Agreement

Rights to participate in future funding rounds, such as preemptive rights or pro-rata rights, are essential to prevent dilution of investors' stakes. Agreements can also include anti-dilution protections to preserve the investor's equity value. These provisions encourage investor confidence and support ongoing capital raises.

Standard Confidentiality Requirements in a Blank Investment Agreement for Investors

Confidentiality clauses typically require investors to keep all non-public company information strictly confidential. These provisions restrict information disclosure except as necessary for legal or regulatory purposes. Enforcing confidentiality helps protect the company's competitive advantage and sensitive data.