A Blank Loan Agreement Template for Personal Lending provides a customizable document to outline terms between borrowers and lenders, ensuring clarity and legal protection. This template includes essential elements such as loan amount, interest rate, repayment schedule, and default consequences. Using a well-structured agreement helps prevent misunderstandings and secures the interests of both parties in personal financial transactions.

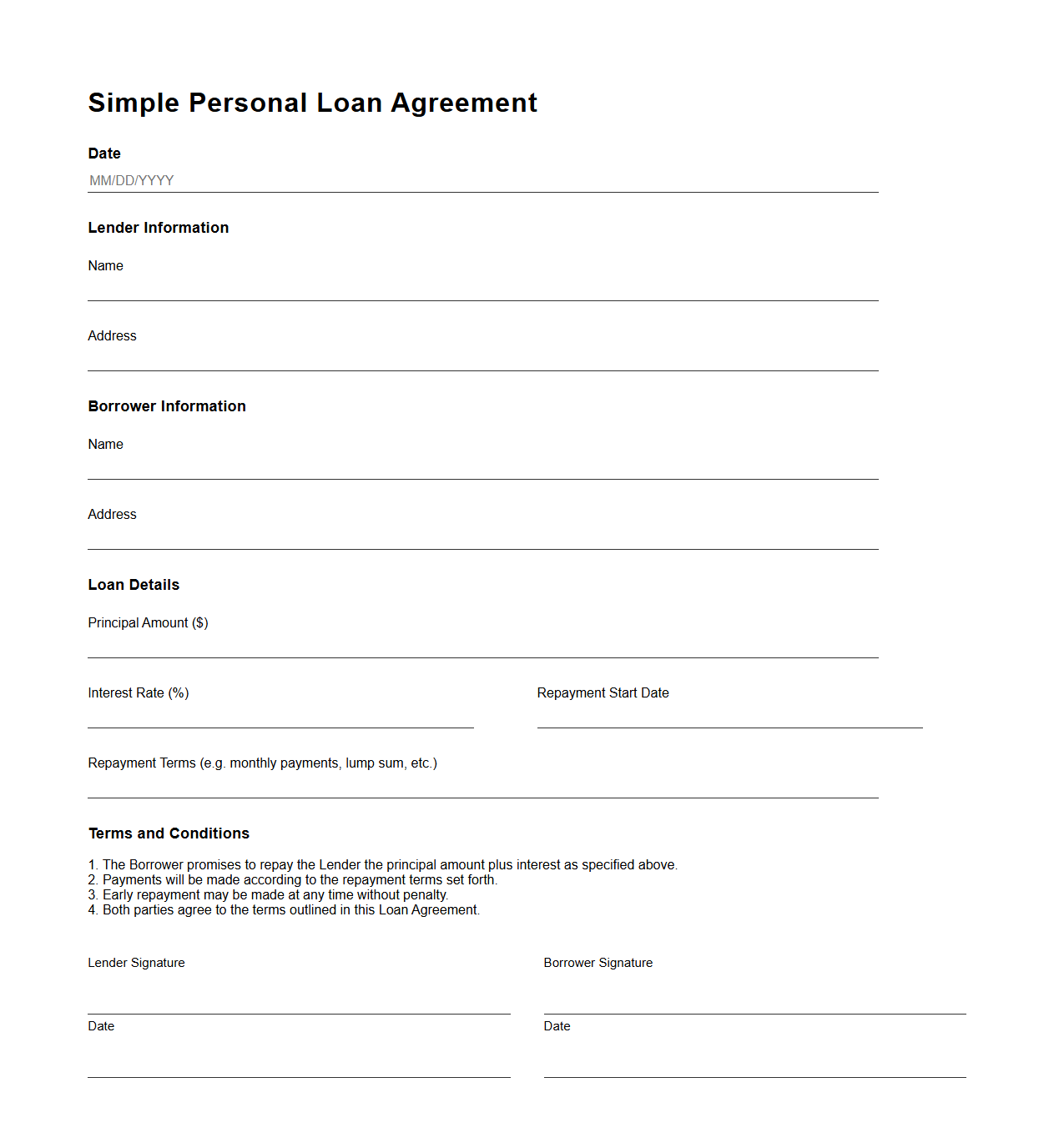

Simple Personal Loan Agreement Blank Form

A

Simple Personal Loan Agreement Blank Form is a legally binding document used to outline the terms and conditions of a personal loan between two parties. It typically includes essential details such as the loan amount, repayment schedule, interest rate, and signatures of both lender and borrower. This form helps ensure clear communication and protects the rights of both parties by providing a written record of the loan agreement.

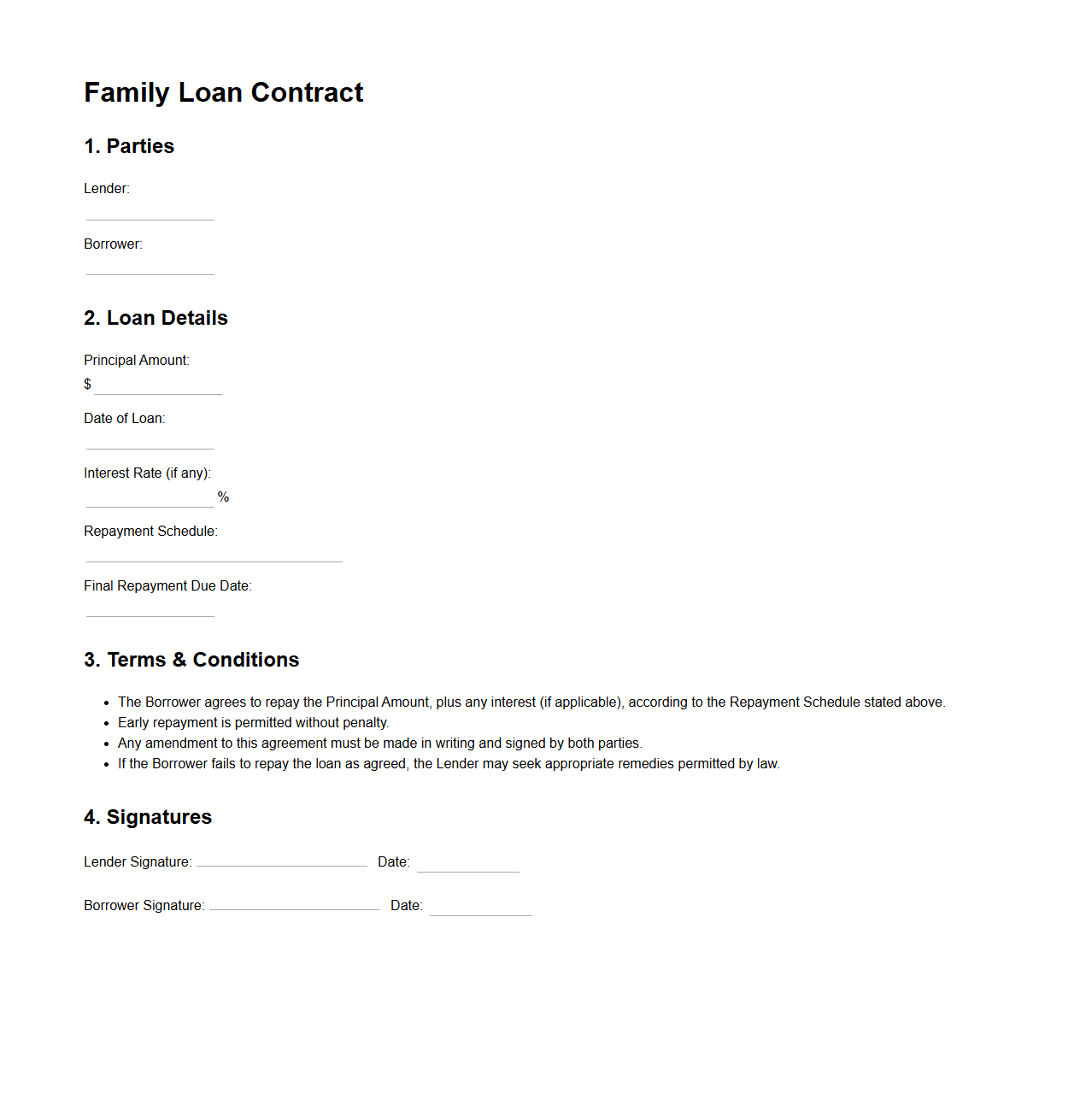

Blank Family Loan Contract Template

A

Blank Family Loan Contract Template document is a pre-formatted legal agreement designed to outline the terms and conditions of a loan between family members. It specifies the loan amount, repayment schedule, interest rate if applicable, and responsibilities of both lender and borrower to ensure clear communication and prevent potential disputes. This template helps formalize informal family loans, providing legal protection and clarity for all parties involved.

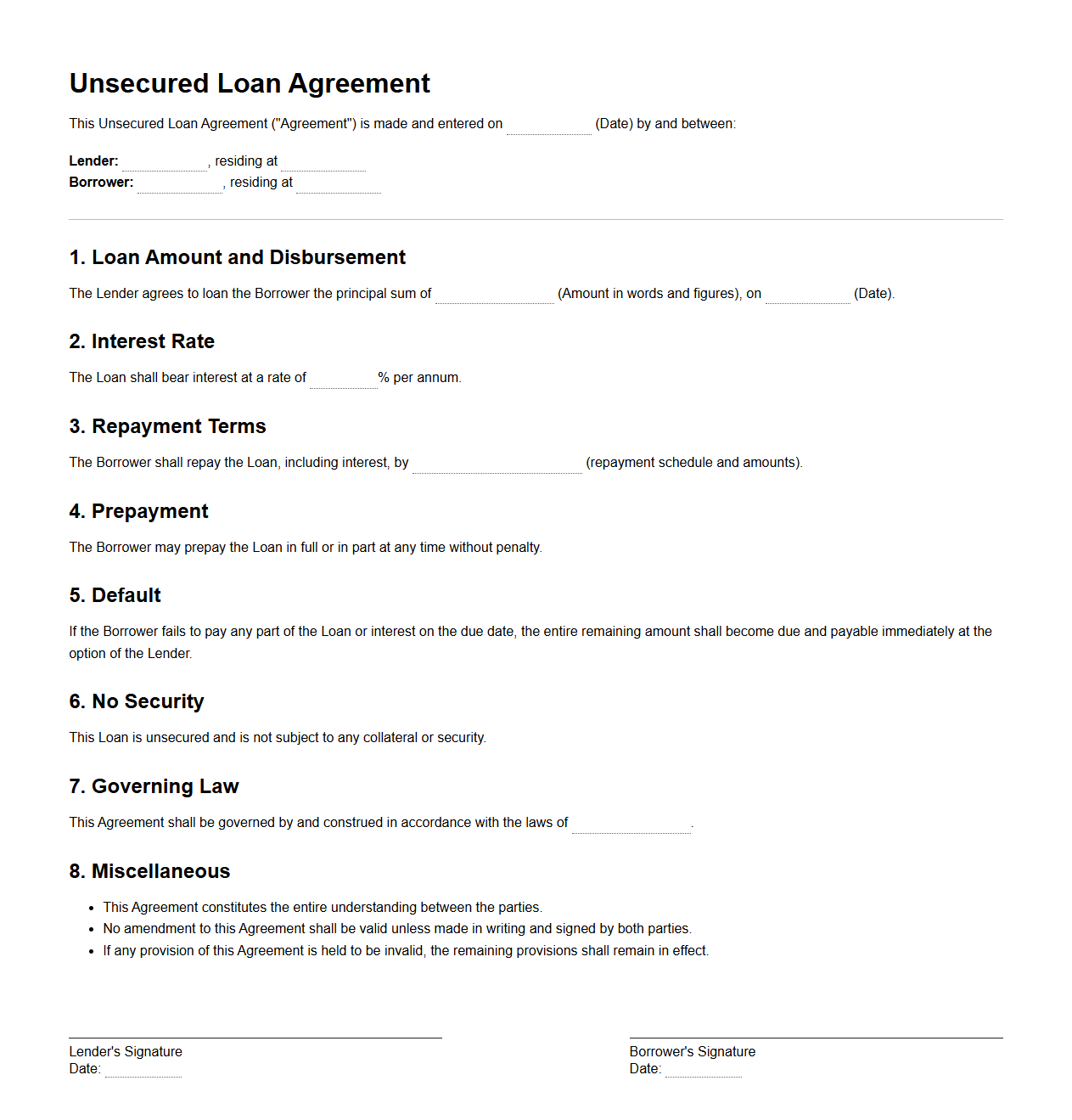

Blank Unsecured Loan Agreement Format

A

Blank Unsecured Loan Agreement Format document serves as a template outlining the terms and conditions between a lender and borrower without requiring collateral. It includes essential details such as loan amount, interest rate, repayment schedule, and responsibilities of both parties. This format ensures clarity and legal protection while facilitating straightforward loan transactions.

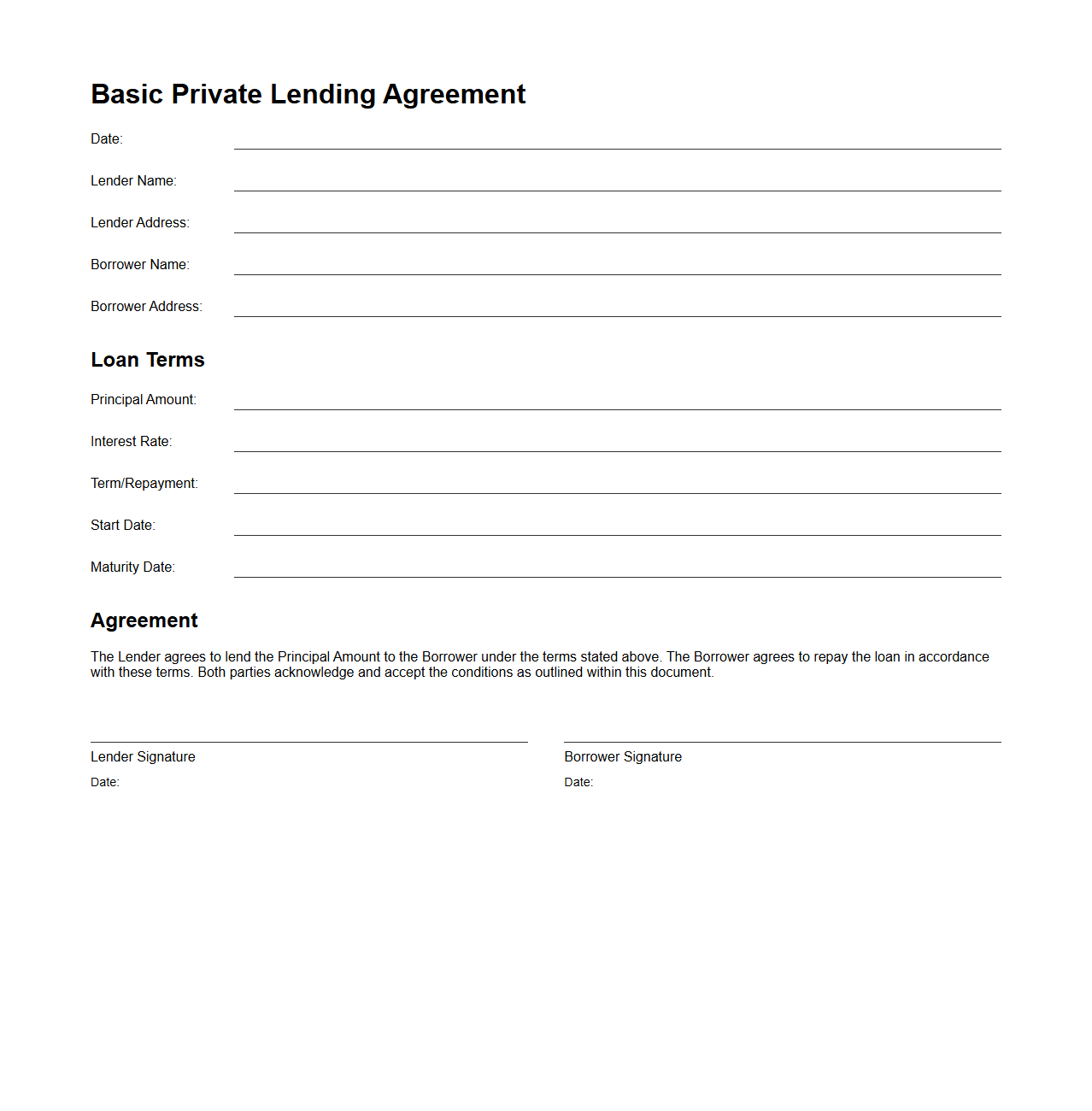

Basic Private Lending Agreement Blank Document

A

Basic Private Lending Agreement Blank Document serves as a customizable legal template designed to outline the terms and conditions between a private lender and borrower. It typically includes essential components such as loan amount, interest rates, repayment schedule, and default consequences, ensuring clear understanding and protection for both parties. This document helps facilitate secure private lending transactions by formalizing obligations and expectations without engaging an attorney initially.

Blank Borrower-Lender Agreement Form

A

Blank Borrower-Lender Agreement Form document is a legally binding contract template used to outline the terms and conditions between a borrower and a lender. It specifies critical details such as the loan amount, repayment schedule, interest rates, and obligations of both parties. This form ensures clarity and protects the rights of both borrowers and lenders by providing a clear record of the lending agreement.

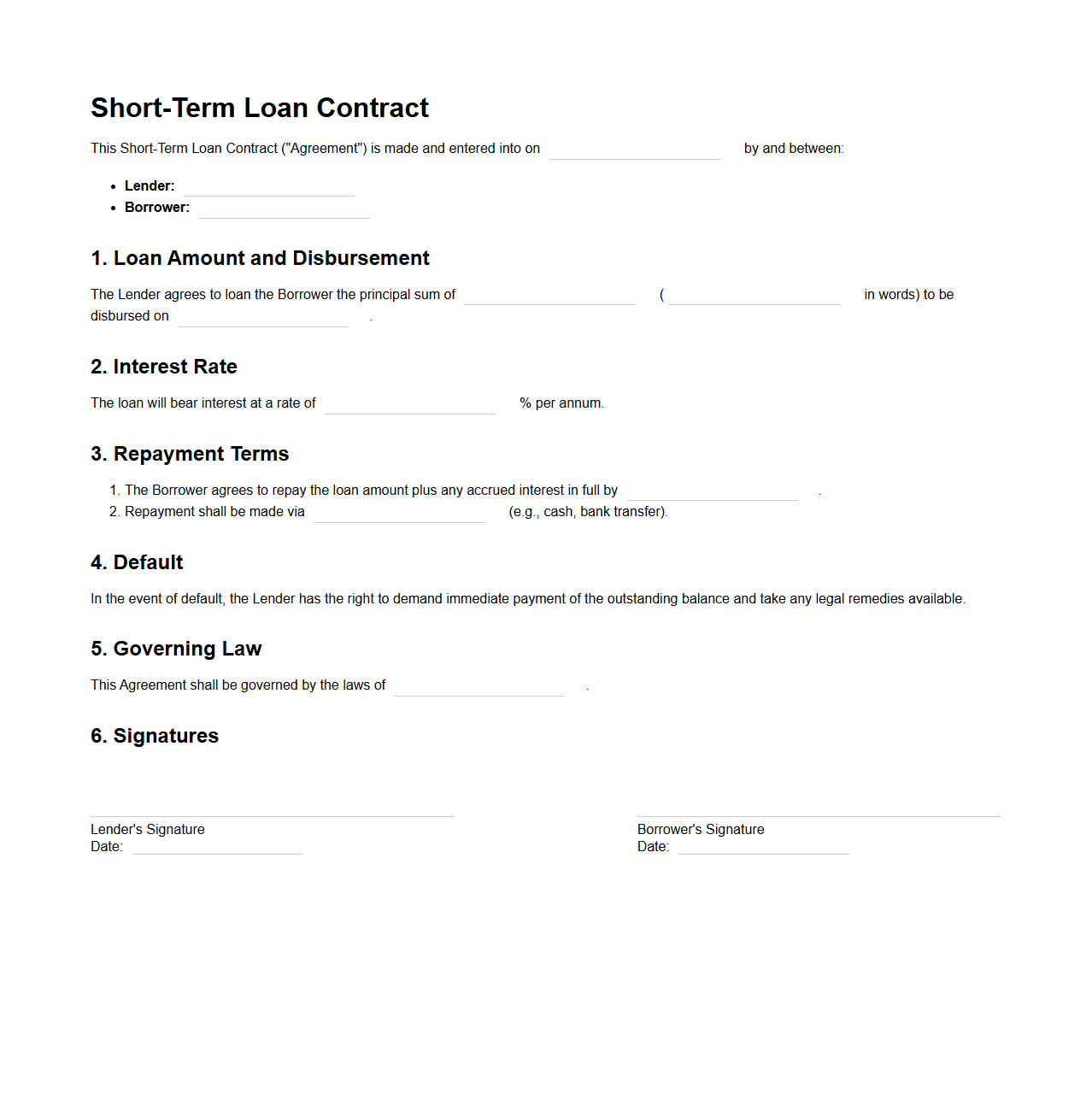

Blank Short-Term Loan Contract Template

A

Blank Short-Term Loan Contract Template document is a pre-formatted agreement designed to outline the terms and conditions of a short-term loan between a lender and borrower. It includes essential details such as loan amount, interest rate, repayment schedule, and default consequences, ensuring clarity and legal protection for both parties. This template simplifies the loan process by providing a clear, customizable framework, minimizing disputes and enhancing financial transparency.

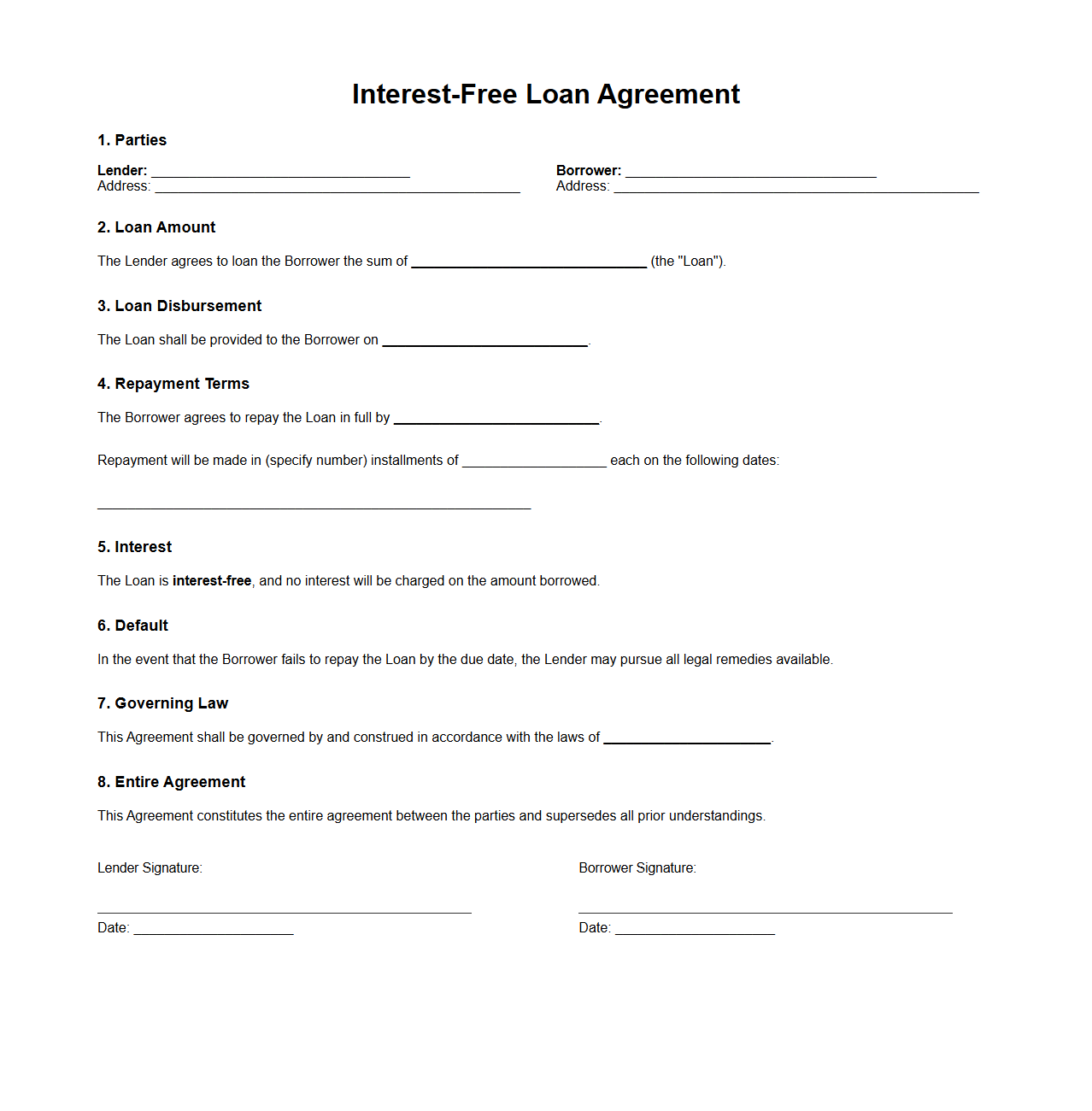

Blank Interest-Free Loan Agreement Sample

A

Blank Interest-Free Loan Agreement Sample document serves as a template to outline the terms and conditions of a loan without any interest charges between two parties. It typically includes essential details such as loan amount, repayment schedule, borrower and lender information, and conditions for default, helping to formalize the arrangement legally. Using this sample ensures clarity and mutual understanding while protecting both parties' rights in interest-free lending transactions.

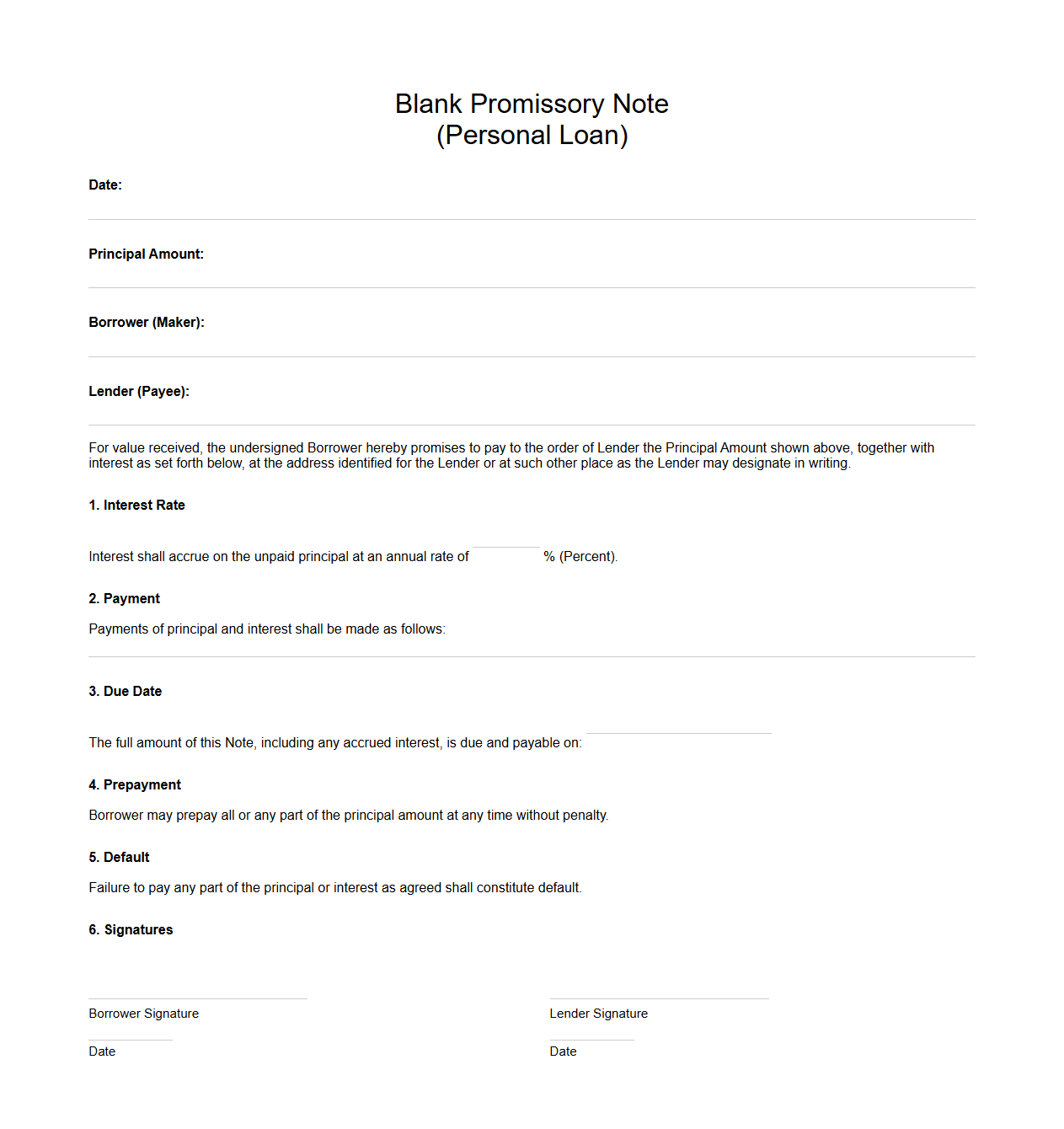

Blank Promissory Note for Personal Loans

A

Blank Promissory Note for Personal Loans is a financial document that outlines the borrower's promise to repay a loan without specifying the loan amount or repayment terms at the time of signing. This note serves as a legally binding agreement that can be completed later with specific details, offering flexibility in personal lending arrangements. It is essential in ensuring formal recognition of debt while allowing customization according to the borrower's and lender's needs.

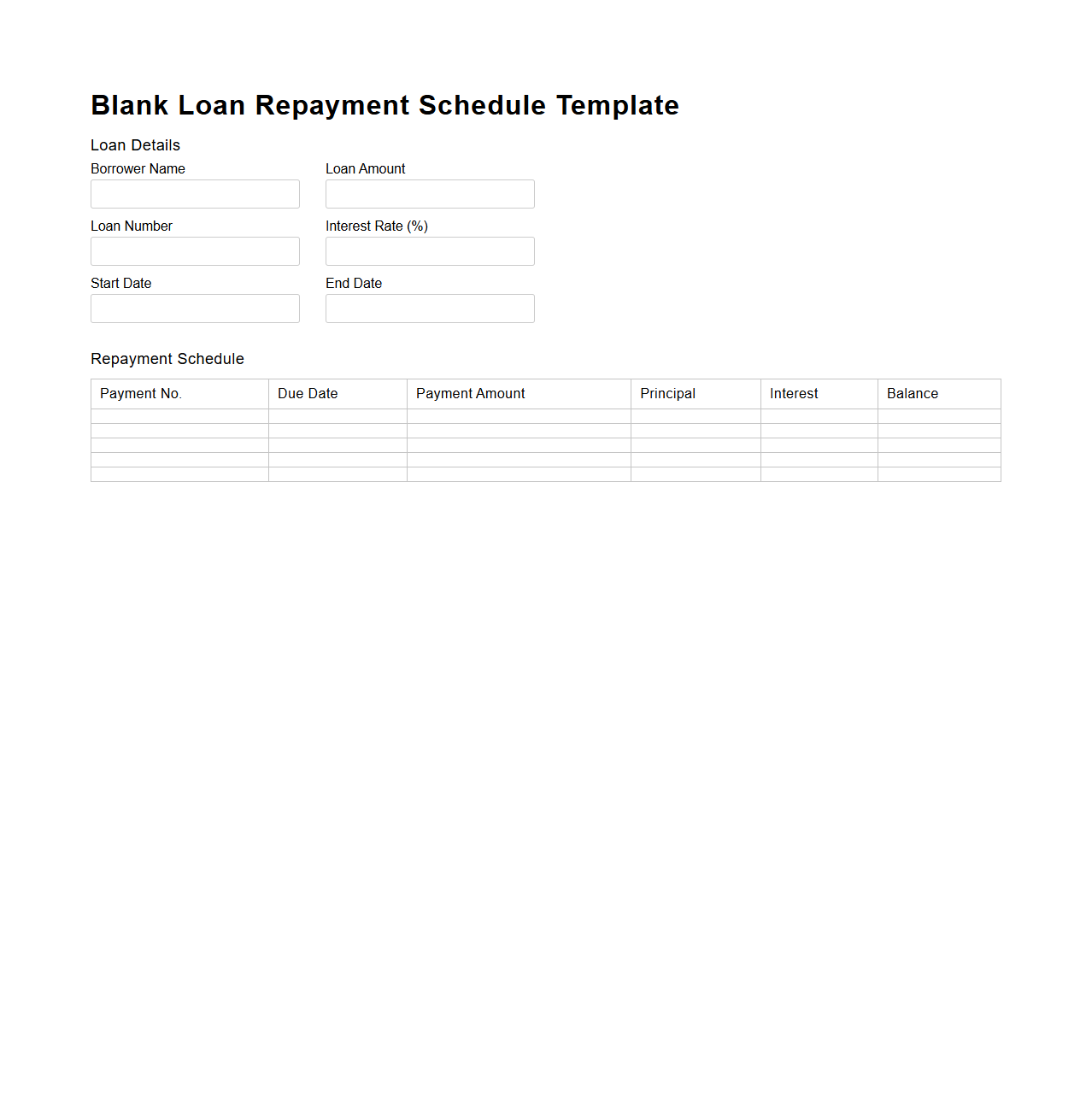

Blank Loan Repayment Schedule Template

A

Blank Loan Repayment Schedule Template document provides a structured format to track loan payments over time, detailing principal amounts, interest rates, payment dates, and outstanding balances. It serves as a financial planning tool for borrowers and lenders to ensure accurate and timely repayment management. The template enhances transparency and simplifies forecasting by clearly outlining each installment's impact on the loan balance.

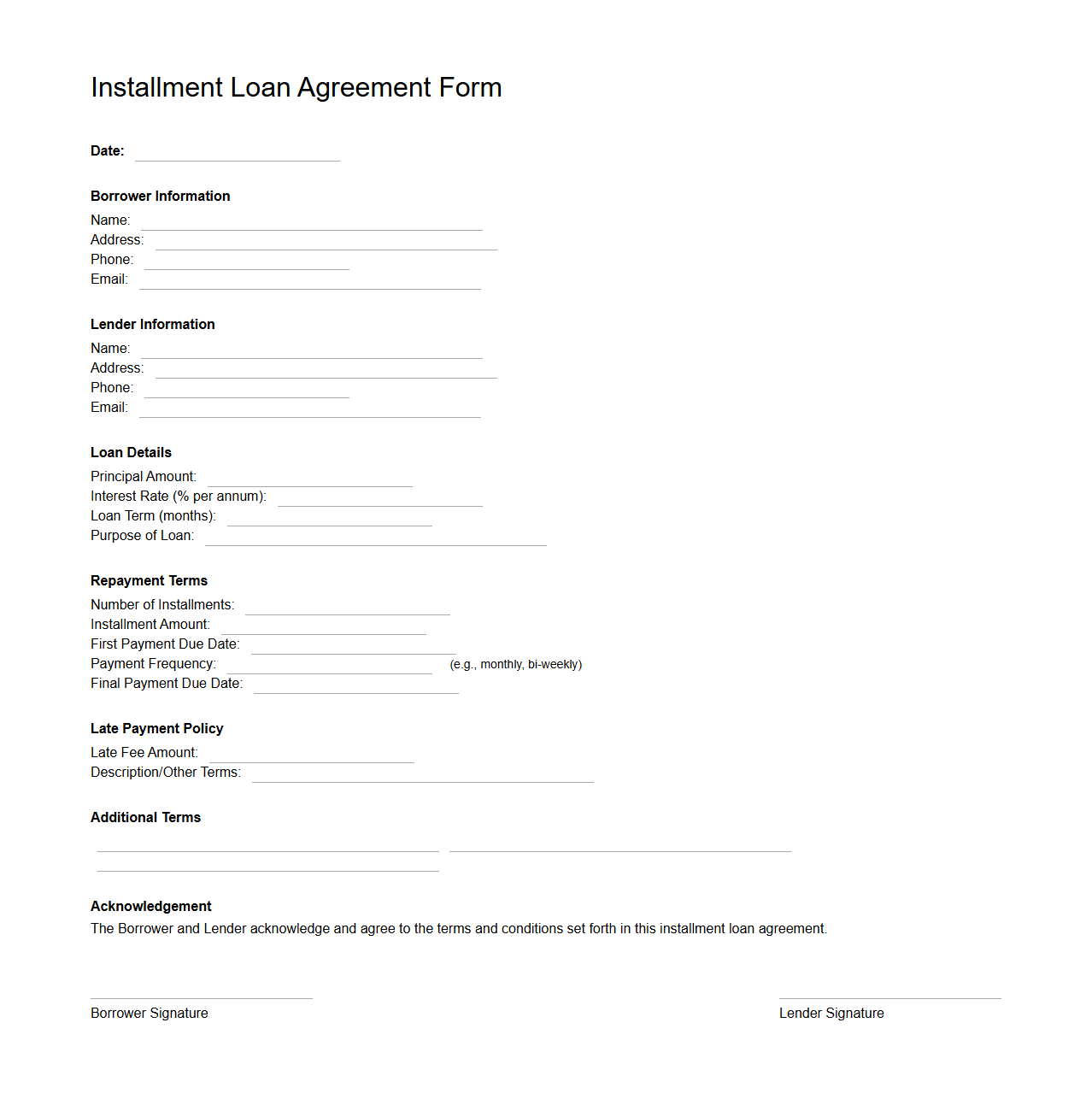

Blank Installment Loan Agreement Form

A

Blank Installment Loan Agreement Form document serves as a customizable template outlining the terms and conditions for repaying a loan in scheduled payments over time. It includes essential details such as loan amount, interest rate, repayment schedule, and borrower and lender obligations. This document ensures clarity and legal protection for both parties involved in the installment loan transaction.

What clauses are essential in a blank loan agreement for informal personal lending?

A blank loan agreement must include principal amount and interest rate clauses to clarify the loan's financial terms. It should also contain a repayment schedule clause, ensuring both parties understand when and how payments will be made. Additionally, default and dispute resolution clauses are essential to protect both lender and borrower.

How should repayment terms be structured to protect both parties in a simple loan letter?

Repayment terms should specify a clear payment timeline, including due dates and frequency, to avoid confusion. Incorporating a detailed payment method clause ensures transparency on how payments should be made. Precise terms help prevent misunderstandings and foster trust between lender and borrower.

Which identification details are necessary to validate a personal loan agreement document?

To validate a personal loan agreement, include the full names and addresses of both parties prominently. Detailed government-issued ID numbers, such as a driver's license or passport, are critical for identity confirmation. Including contact information helps verify and maintain communication throughout the loan term.

What default and late payment provisions should a blank loan agreement template include?

The agreement should outline specific late payment penalties, such as fees or increased interest rates, to discourage overdue payments. A well-defined default clause detailing consequences if the borrower fails to pay protects the lender's rights. Including clear communication requirements for late payments ensures transparency between both parties.

How can a witness or notary section be incorporated into a personal lending contract letter?

A designated witness section should include spaces for names, signatures, and dates to authenticate the contract. For added legal validation, a notary acknowledgment block can be inserted where a notary public affirms the identities of signatories. This inclusion strengthens the agreement's enforceability and reduces potential disputes.