A Blank Indemnity Agreement Template for Liability Protection serves as a customizable legal document designed to allocate risk between parties and safeguard against potential claims or damages. This template outlines the responsibilities and obligations of each party, ensuring clarity on liability coverage. Using such an agreement helps prevent disputes and provides a clear framework for indemnification.

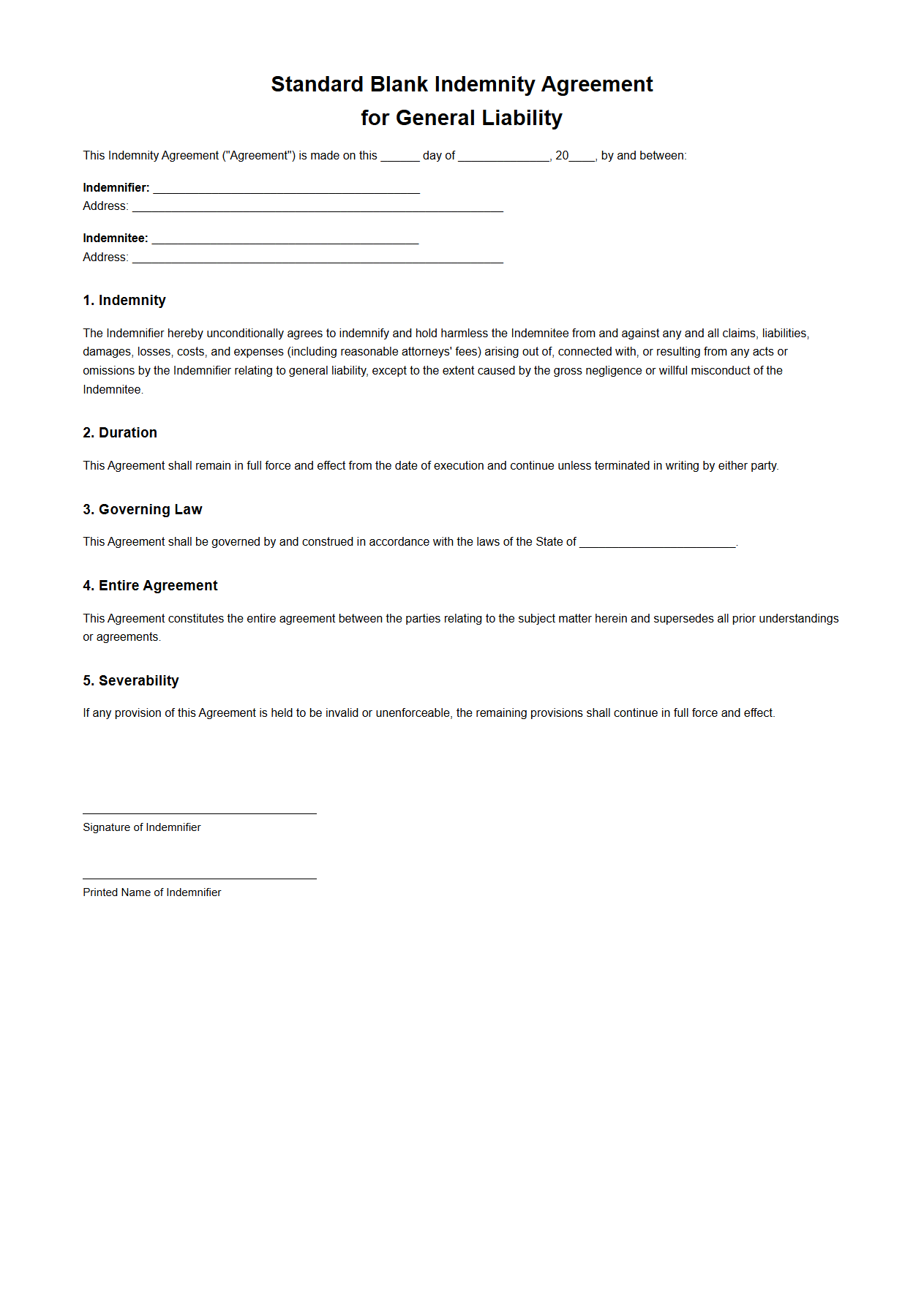

Standard Blank Indemnity Agreement for General Liability

A

Standard Blank Indemnity Agreement for General Liability is a legal contract used to allocate risk by requiring one party to compensate another for any liabilities arising from certain activities or incidents. This document outlines the terms under which indemnification is provided, protecting parties from financial loss due to claims, damages, or lawsuits related to general liability. It serves as a crucial tool in industries such as construction, real estate, and service contracts to ensure clear responsibility and risk management.

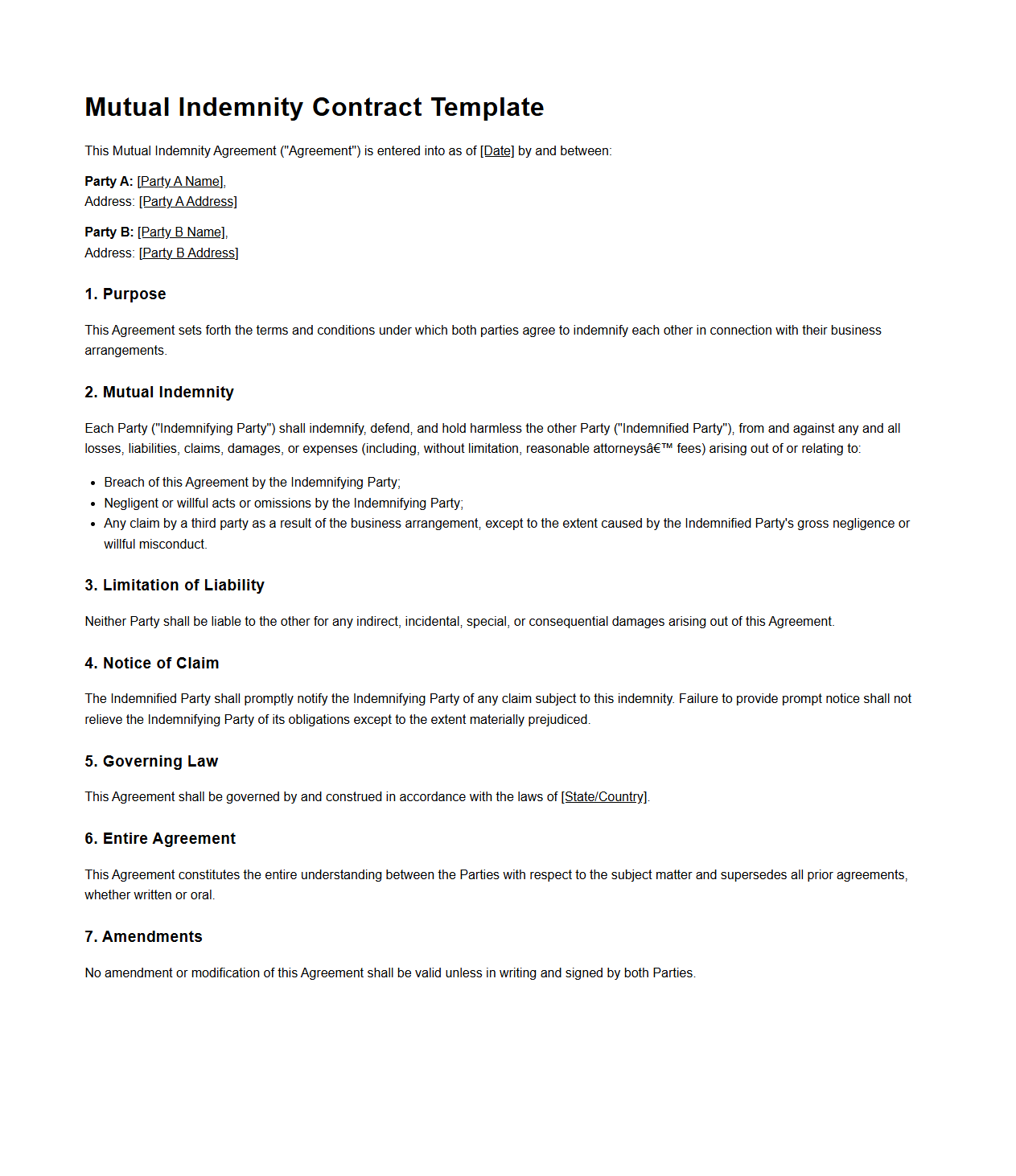

Mutual Indemnity Contract Template for Business Arrangements

A

Mutual Indemnity Contract Template for business arrangements is a legal document designed to allocate risk and liability between parties by ensuring each party agrees to compensate the other for certain damages or losses. This template typically outlines the scope of indemnity, obligations, procedures for claims, and limitations of liability to protect both businesses from potential financial harm arising from third-party claims or breaches. Using a mutual indemnity contract helps establish clear responsibilities and promotes trust in business partnerships.

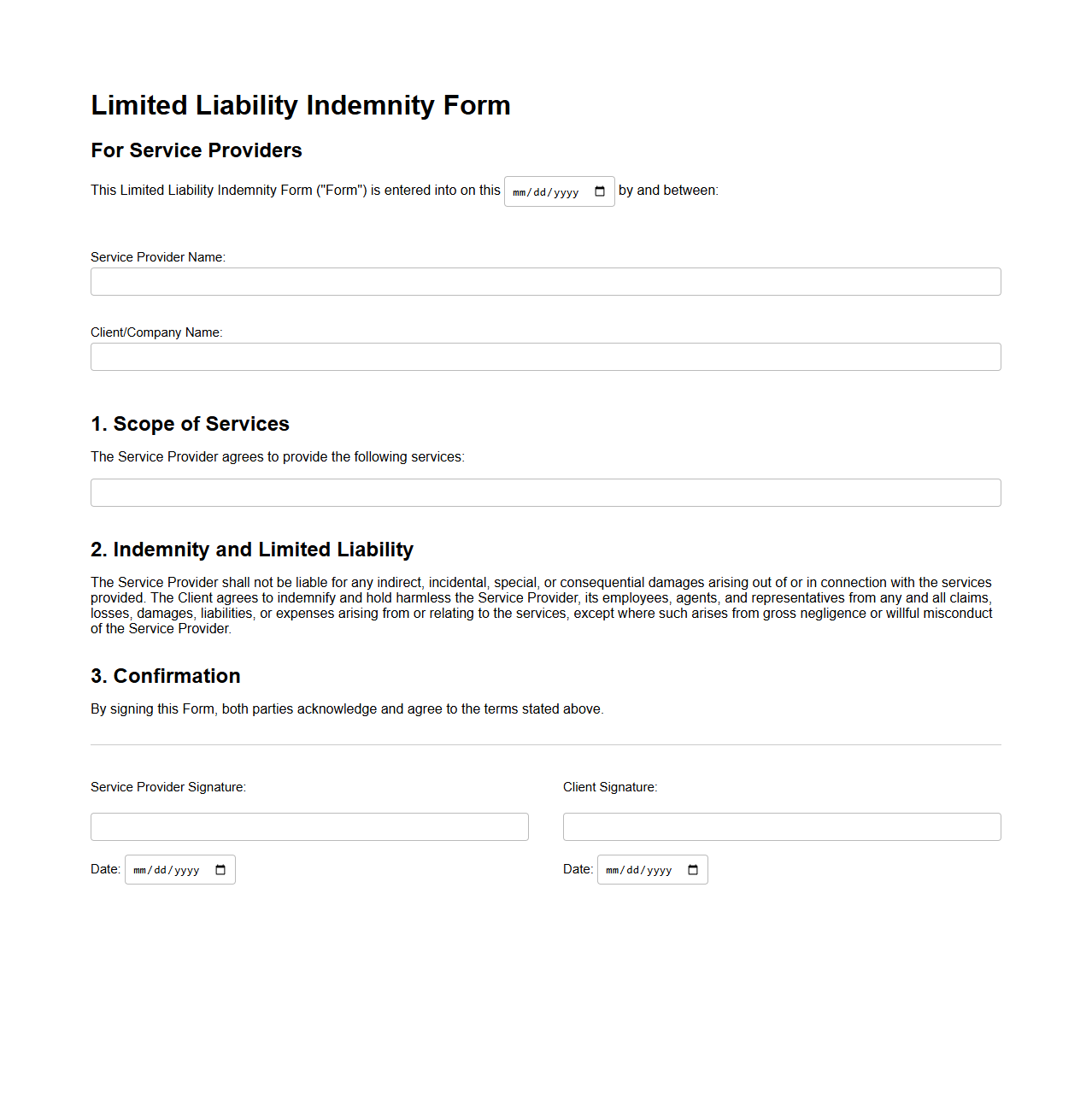

Limited Liability Indemnity Form for Service Providers

A

Limited Liability Indemnity Form for Service Providers is a legal document that protects service providers from excessive financial responsibility by capping their liability in case of damages or losses during service delivery. It outlines specific terms under which the provider agrees to indemnify the client, limiting exposure to claims beyond an agreed-upon amount. This form ensures clear risk management and helps prevent costly legal disputes between parties.

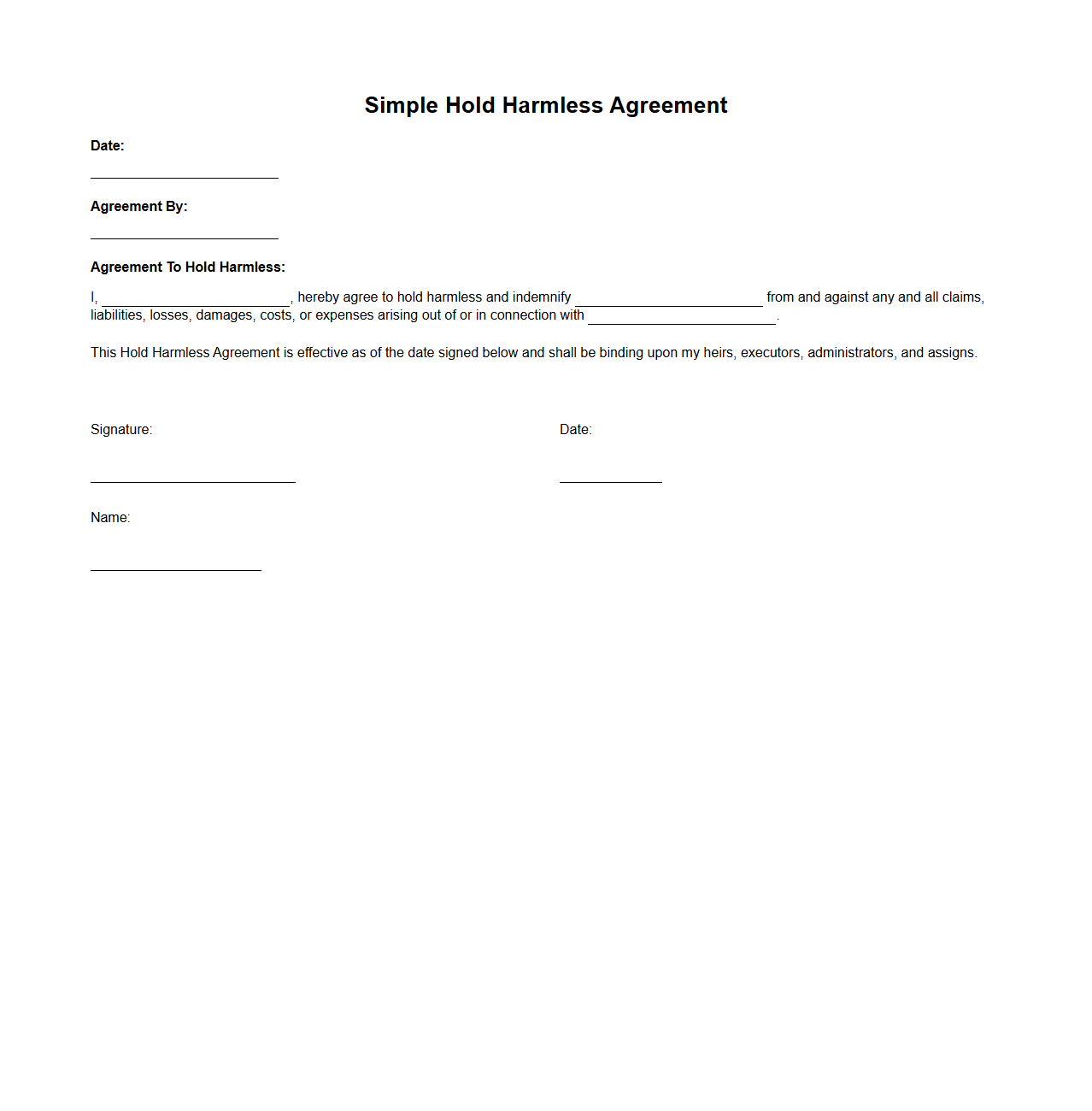

Simple Hold Harmless Agreement Template

A

Simple Hold Harmless Agreement Template document is a legal form used to protect one party from liability or claims arising from a specific activity or transaction. This template clearly outlines the responsibilities and indemnification obligations, ensuring that one party agrees not to hold the other accountable for any damages or losses. It is essential for businesses and individuals seeking to minimize legal risks and establish clear, enforceable protection in contracts.

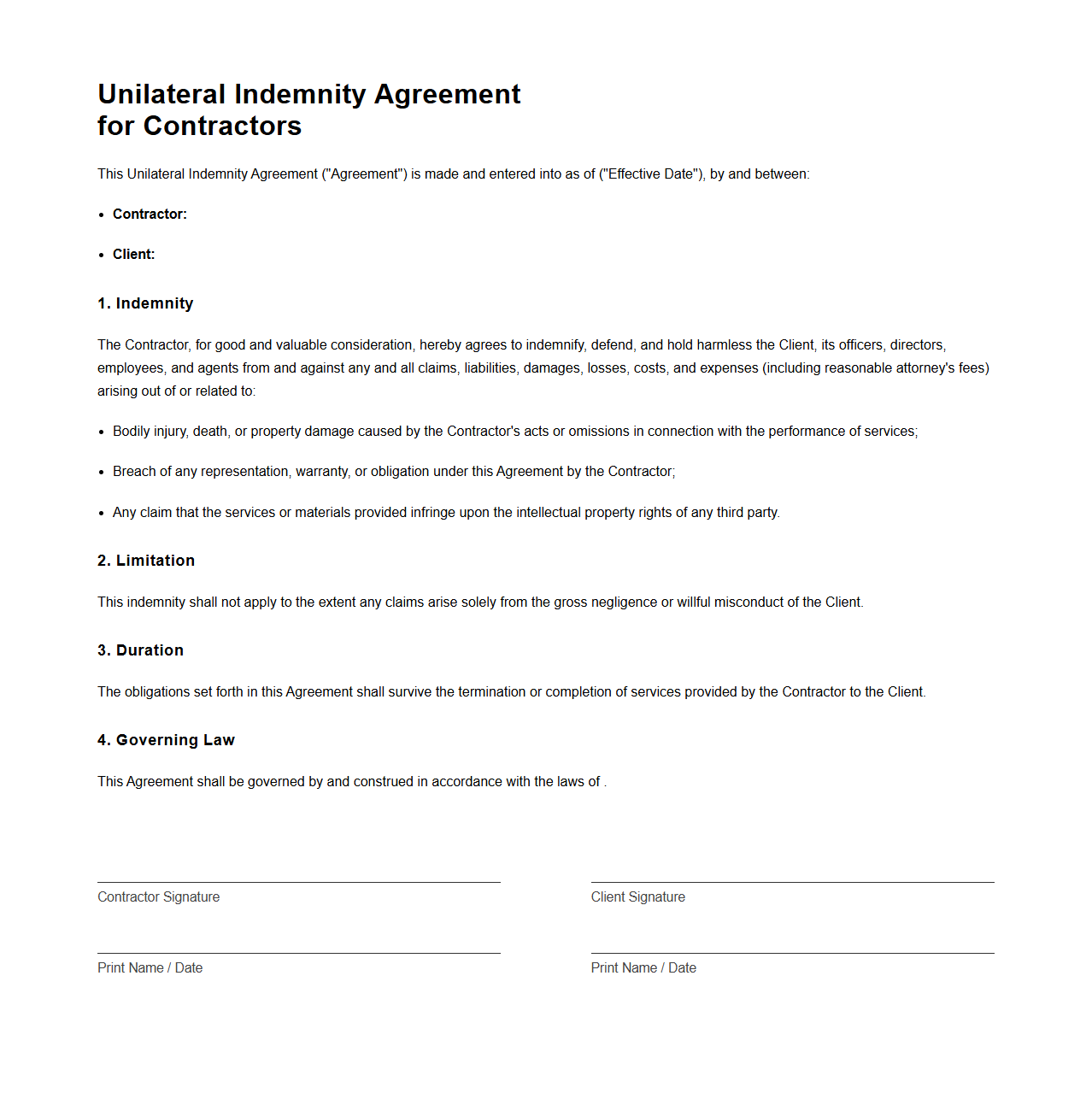

Unilateral Indemnity Agreement for Contractors

A

Unilateral Indemnity Agreement for Contractors is a legal document where one party, typically the contractor, agrees to assume full responsibility for any damages, losses, or liabilities arising from their work. This agreement protects the other party, such as the client or project owner, by ensuring they are indemnified against claims related to accidents, property damage, or third-party injuries connected to the contractor's activities. It is crucial in construction or service contracts to clearly define risk allocation and avoid future legal disputes.

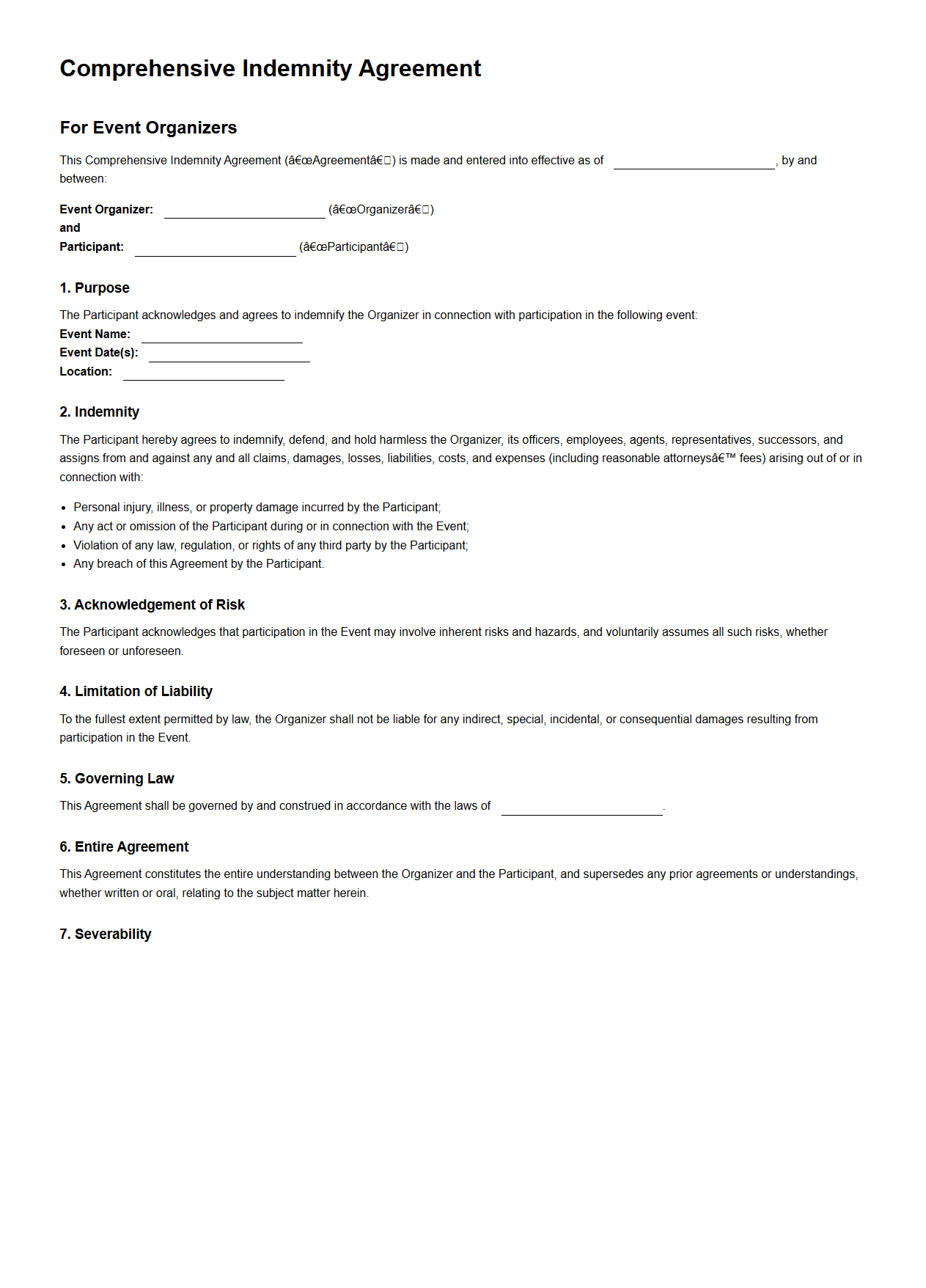

Comprehensive Indemnity Template for Event Organizers

A

Comprehensive Indemnity Template for Event Organizers is a legal document designed to protect event organizers from liabilities and claims arising during an event. It outlines the responsibilities and obligations of all parties involved, ensuring that any damages, injuries, or losses are covered by the appropriate entity. This template is essential for minimizing financial risks and establishing clear legal boundaries in event management contracts.

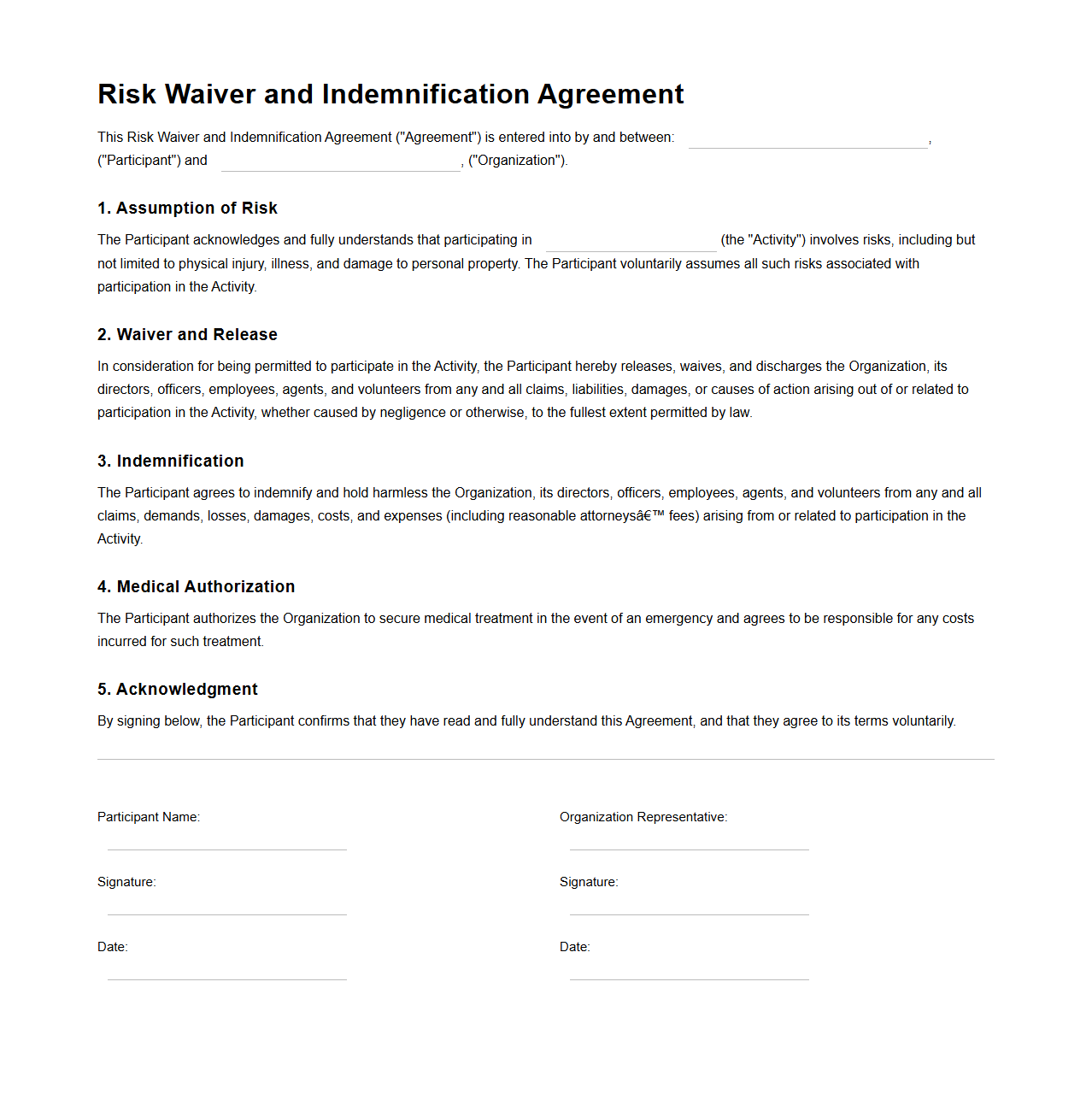

Risk Waiver and Indemnification Agreement Template

A

Risk Waiver and Indemnification Agreement Template is a legal document designed to outline the terms under which one party agrees to waive their right to hold another party liable for potential risks or damages. This template clearly defines the responsibilities, liabilities, and protections to ensure both parties understand their rights and obligations in case of injury, loss, or damage. It is commonly used in activities involving physical risk, such as sports, events, or service contracts, to minimize legal disputes.

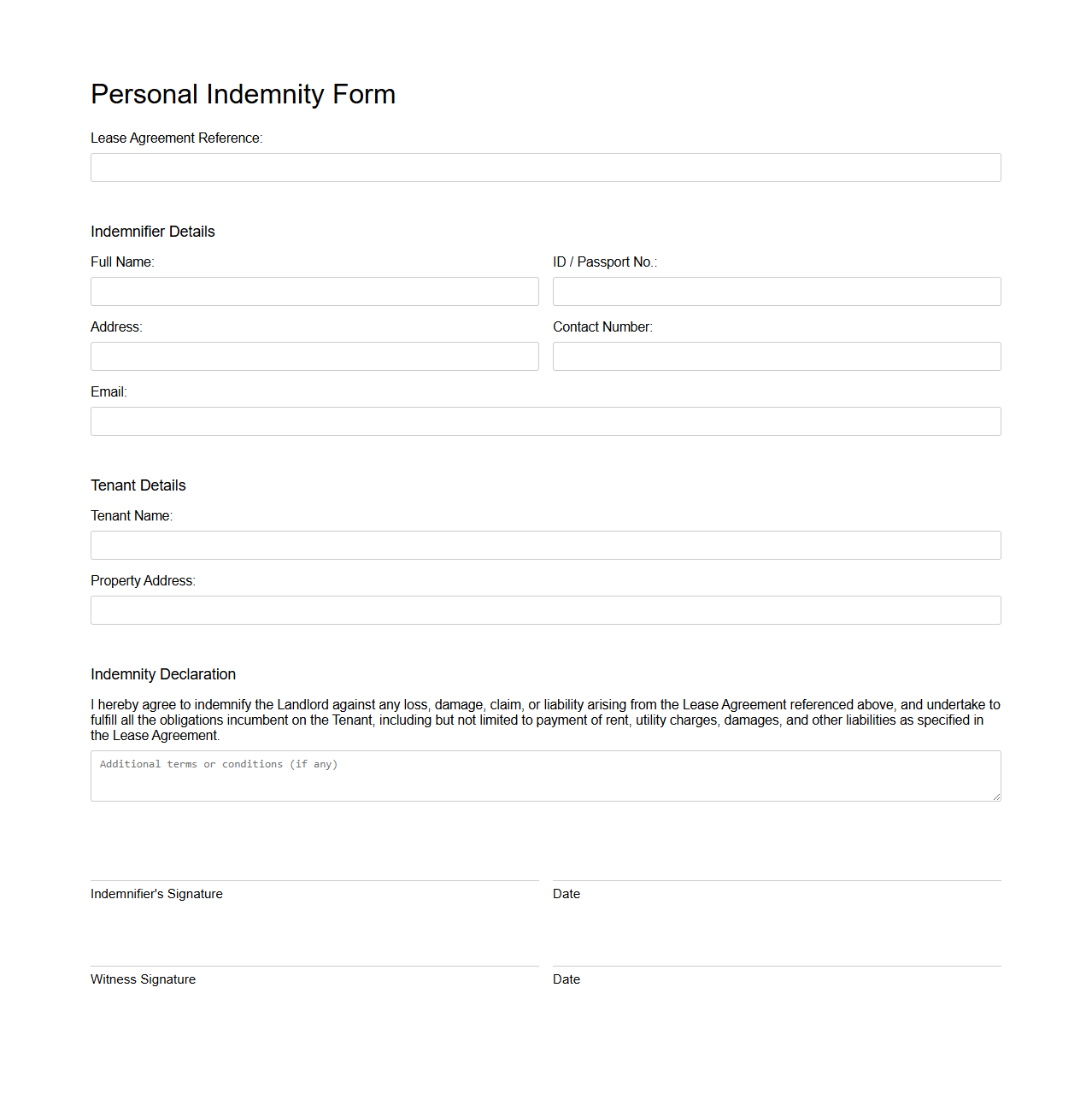

Personal Indemnity Form for Lease Agreements

A

Personal Indemnity Form for Lease Agreements is a legal document where an individual agrees to personally guarantee the obligations of a tenant under a lease. This form provides landlords with additional security by ensuring that the guarantor will cover any financial losses or damages if the tenant defaults on rent or lease terms. It is commonly used in residential and commercial lease agreements to mitigate risks associated with tenant reliability.

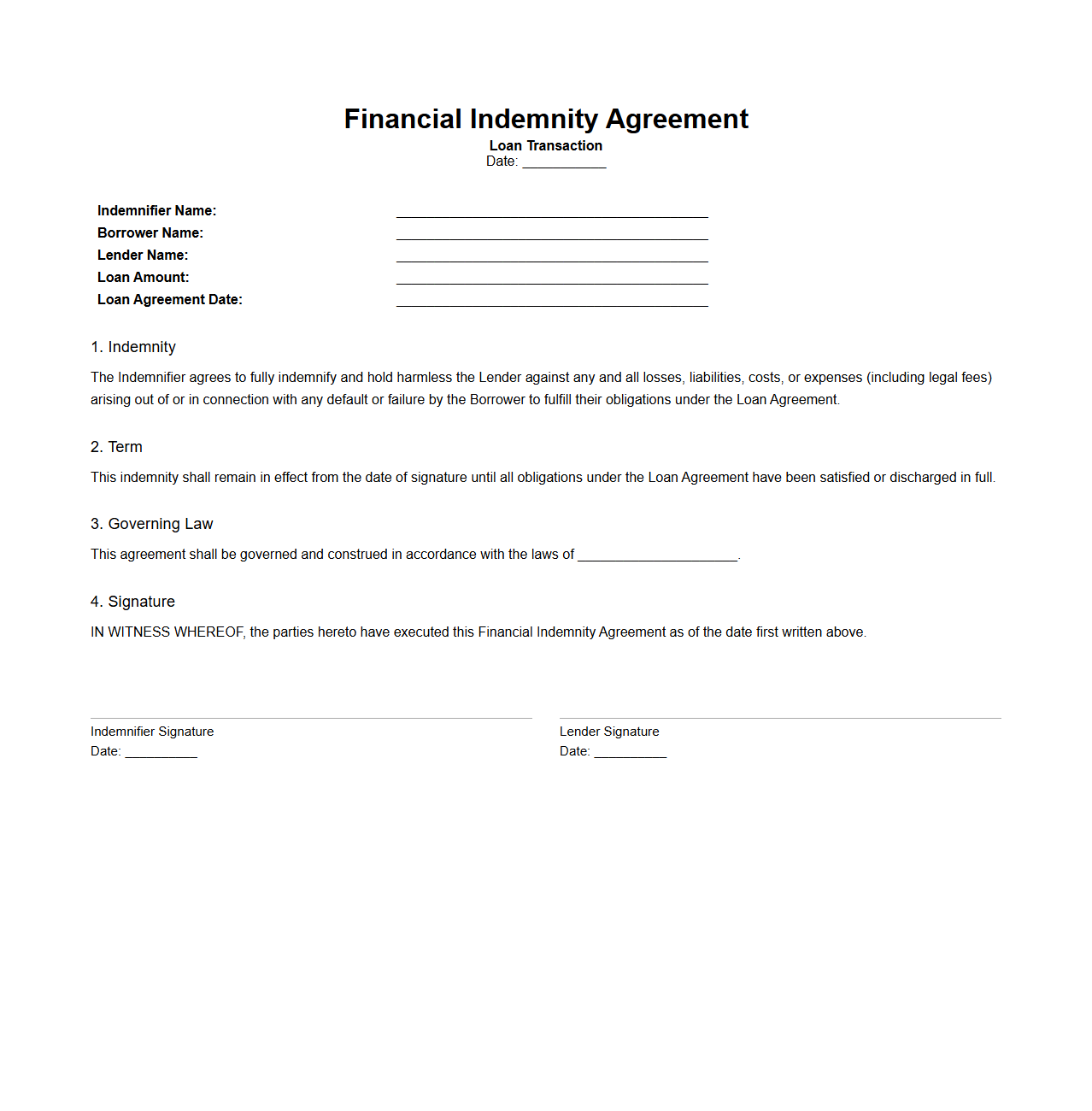

Financial Indemnity Template for Loan Transactions

A

Financial Indemnity Template for Loan Transactions is a legally binding document designed to protect lenders from potential financial losses arising from a loan agreement. It outlines the terms under which one party agrees to compensate another for specific damages or defaults related to the loan. This template ensures clarity on liabilities, providing a standardized format that reduces disputes and enhances the enforceability of indemnity claims in loan dealings.

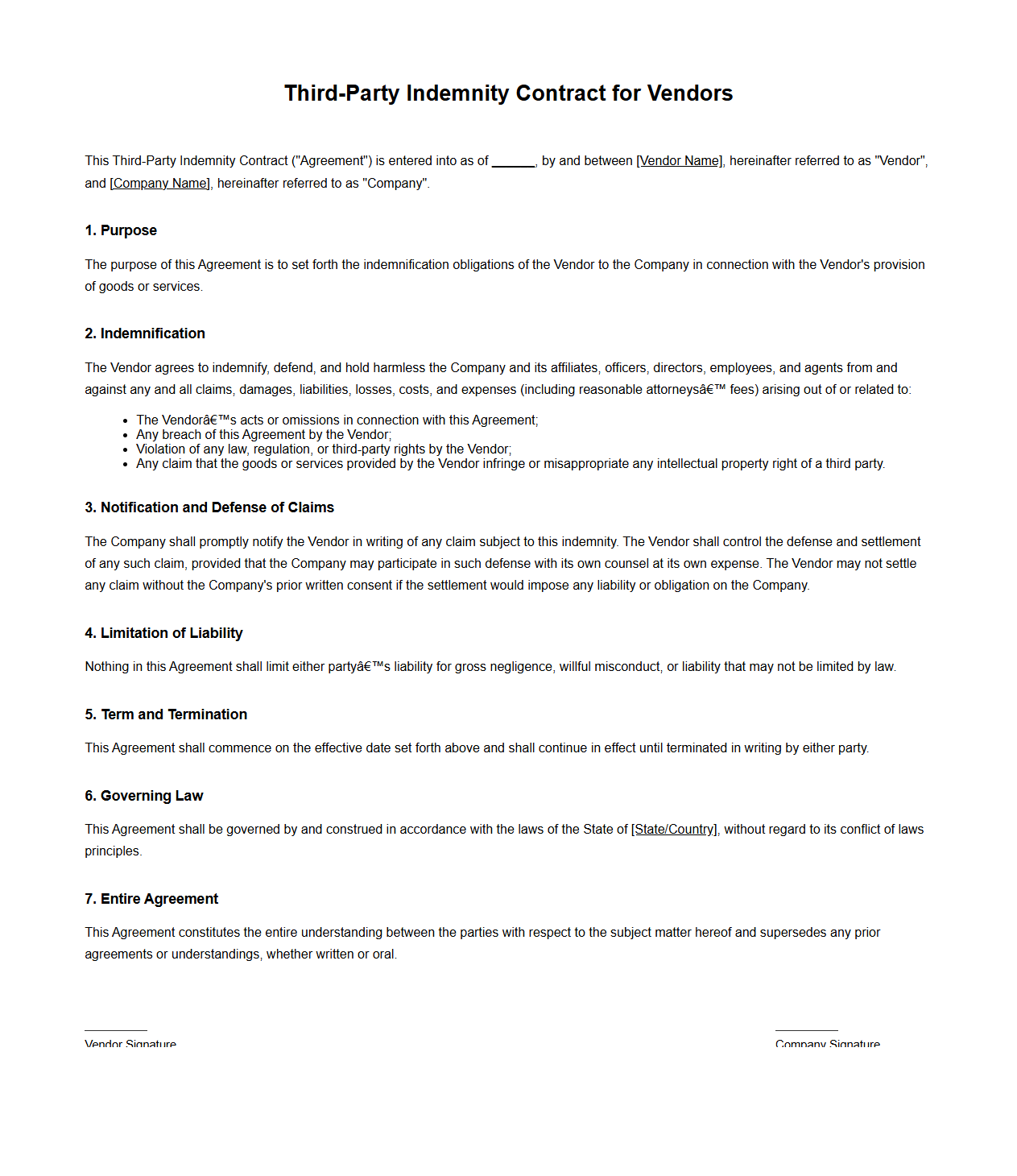

Third-Party Indemnity Contract for Vendors

A

Third-Party Indemnity Contract for Vendors is a legal agreement in which a vendor agrees to protect and compensate another party against claims or damages arising from third-party actions related to the vendor's products or services. This contract outlines the scope of indemnification, including the types of claims covered, the responsibilities of the vendor, and the limits of liability. It serves as a critical risk management tool to ensure that the party receiving the service or product is shielded from potential legal and financial liabilities caused by third-party issues.

What specific liabilities does a Blank Indemnity Agreement typically cover?

A Blank Indemnity Agreement generally covers liabilities related to damages, losses, and claims arising from the actions or omissions of the indemnitor. These liabilities include financial losses, legal costs, and third-party claims directly connected to the agreed subject matter. The agreement aims to protect the indemnitee from unexpected or contingent risks.

How should parties define "indemnified events" in the agreement?

Parties must clearly outline indemnified events to specify which incidents or circumstances trigger the indemnity obligation. This typically involves defining events such as negligence, breach of contract, or specific hazardous occurrences. Precise definitions help avoid disputes and ensure clarity on the scope of protection.

Are there any jurisdiction-specific clauses for enforcing a Blank Indemnity Agreement?

Enforcement of a Blank Indemnity Agreement often depends on jurisdiction-specific laws, requiring tailored clauses to comply with local regulations. Such clauses may address governing law, dispute resolution methods, and statutory limitations on indemnity obligations. Incorporating these ensures the agreement is legally enforceable within the intended jurisdiction.

What exclusions are commonly included to limit liability protection?

Common exclusions in a Blank Indemnity Agreement often exclude gross negligence, willful misconduct, and illegal activities from liability protection. These exclusions prevent the indemnitor from covering liabilities arising from intentional or egregious actions. Including such clauses safeguards against unlimited or unfair liability coverage.

How does a Blank Indemnity Agreement address third-party claims?

A Blank Indemnity Agreement typically includes provisions requiring the indemnitor to defend and indemnify the indemnitee against third-party claims. This means the indemnitor must cover legal fees, settlements, or judgments related to claims brought by external parties. Such clauses are critical for managing risk from external litigation.