A Blank Shareholder Agreement Template for Corporate Governance provides a customizable framework to outline the rights, responsibilities, and obligations of shareholders within a corporation. This template ensures clear governance structures, decision-making processes, and dispute resolution mechanisms to protect shareholder interests effectively. Utilizing a standardized agreement promotes transparency and helps prevent conflicts in corporate management.

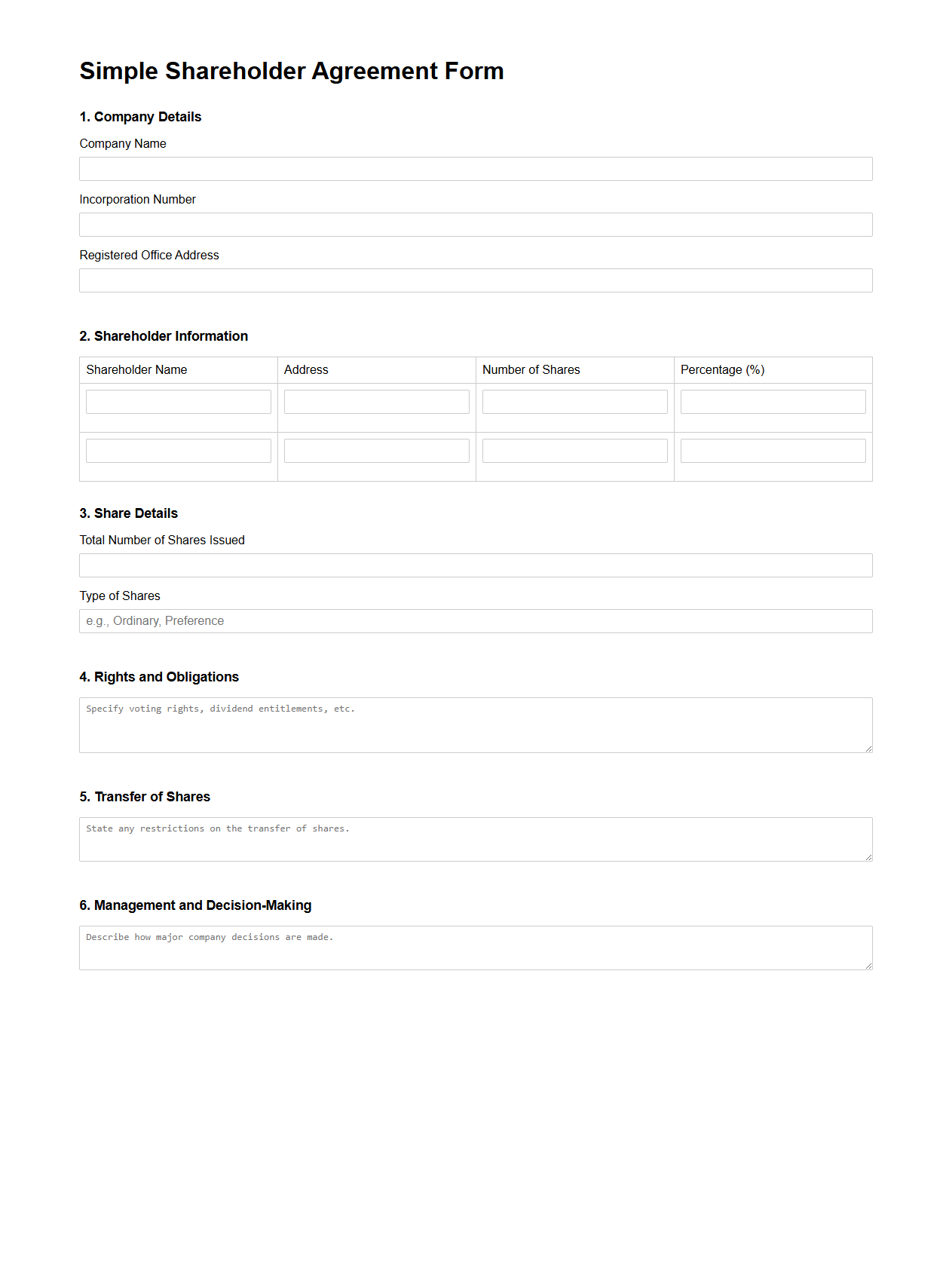

Simple Shareholder Agreement Form for Corporate Structure

A

Simple Shareholder Agreement Form for corporate structure is a legal document that outlines the rights, responsibilities, and obligations of shareholders within a company. It establishes rules for share ownership, decision-making processes, dispute resolution, and transfer of shares to protect the interests of all parties involved. This form streamlines corporate governance by providing a clear framework tailored for small to medium-sized enterprises.

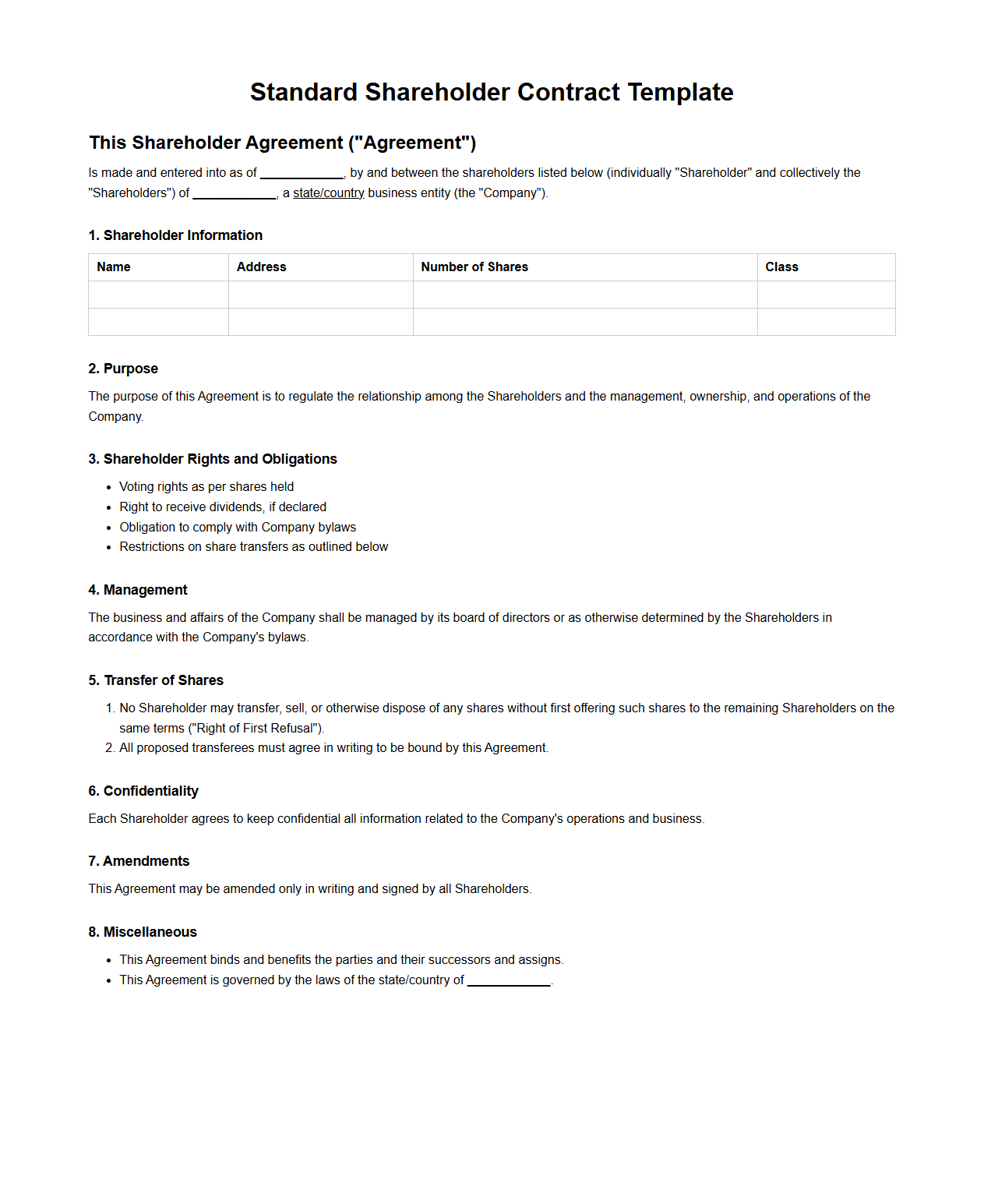

Standard Shareholder Contract Template for Business Entities

A

Standard Shareholder Contract Template for Business Entities is a pre-designed legal document outlining the rights, responsibilities, and obligations of shareholders within a company. This template ensures clarity on issues such as share ownership, voting rights, dividend distribution, and dispute resolution, helping prevent conflicts among stakeholders. Utilizing this standardized contract aids businesses in maintaining consistent governance and protecting shareholder interests efficiently.

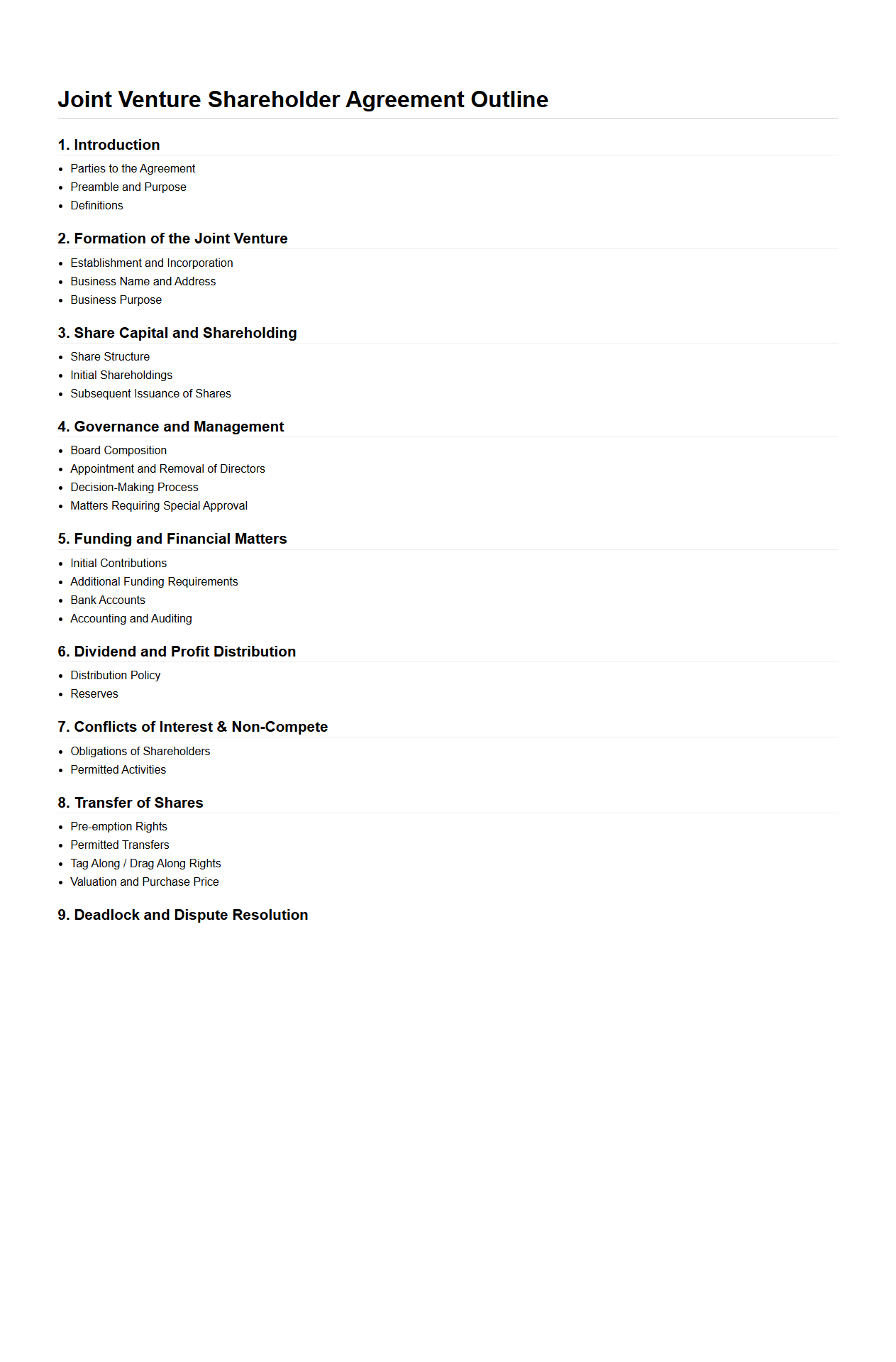

Basic Joint Venture Shareholder Agreement Outline

A

Basic Joint Venture Shareholder Agreement Outline document serves as a foundational framework detailing the rights, responsibilities, and obligations of shareholders involved in a joint venture. It defines the structure of ownership, decision-making processes, profit sharing, dispute resolution, and exit strategies to ensure clarity and protect all parties' interests. This outline is essential for establishing transparent governance and minimizing conflicts in collaborative business ventures.

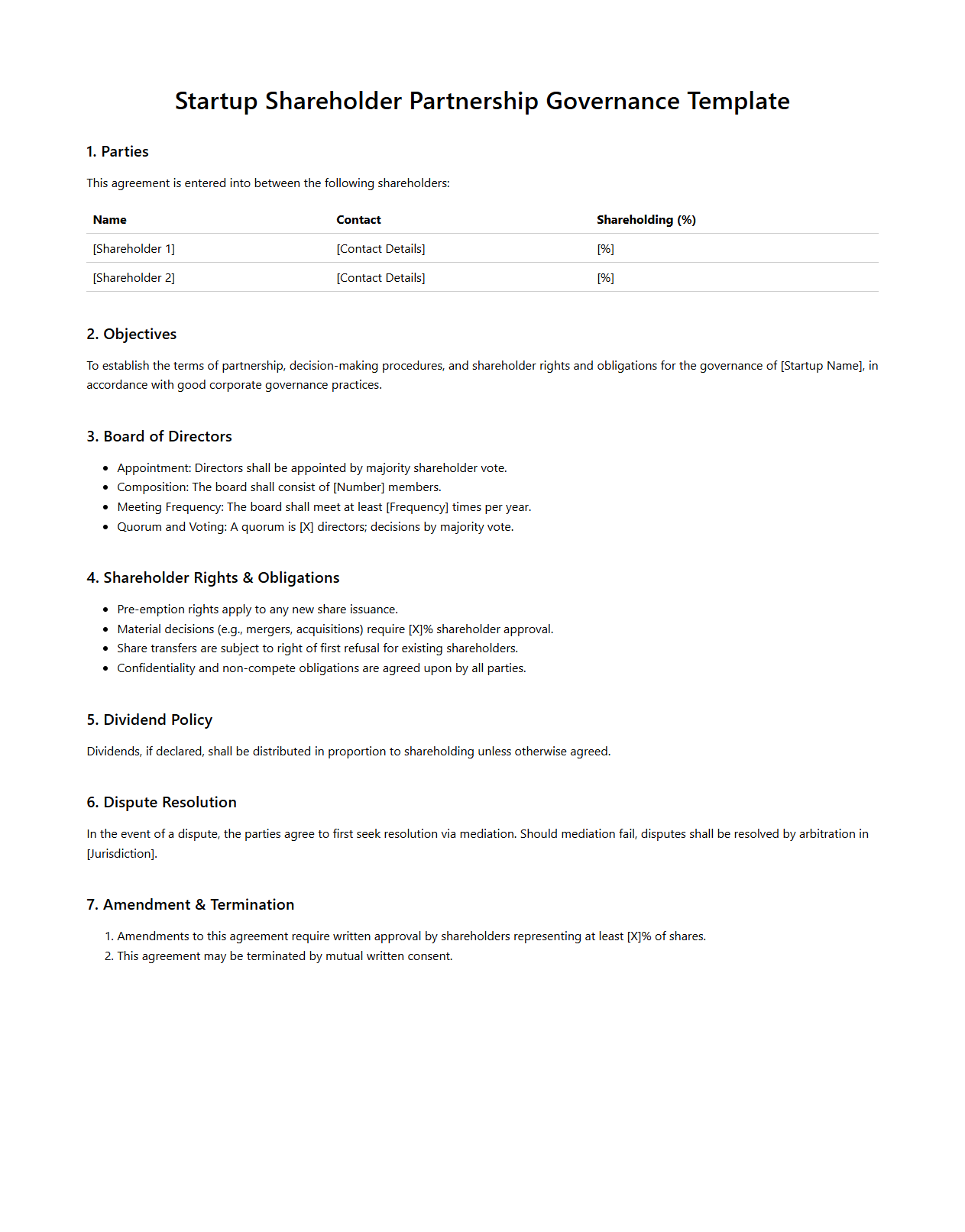

Startup Shareholder Partnership Template for Governance

A

Startup Shareholder Partnership Template for Governance document outlines the rights, responsibilities, and roles of shareholders within a startup, providing a clear framework for decision-making and conflict resolution. It establishes protocols for equity distribution, voting procedures, and governance policies to ensure alignment among co-founders and investors. This template is essential for maintaining transparency and protecting stakeholder interests during the company's early growth stages.

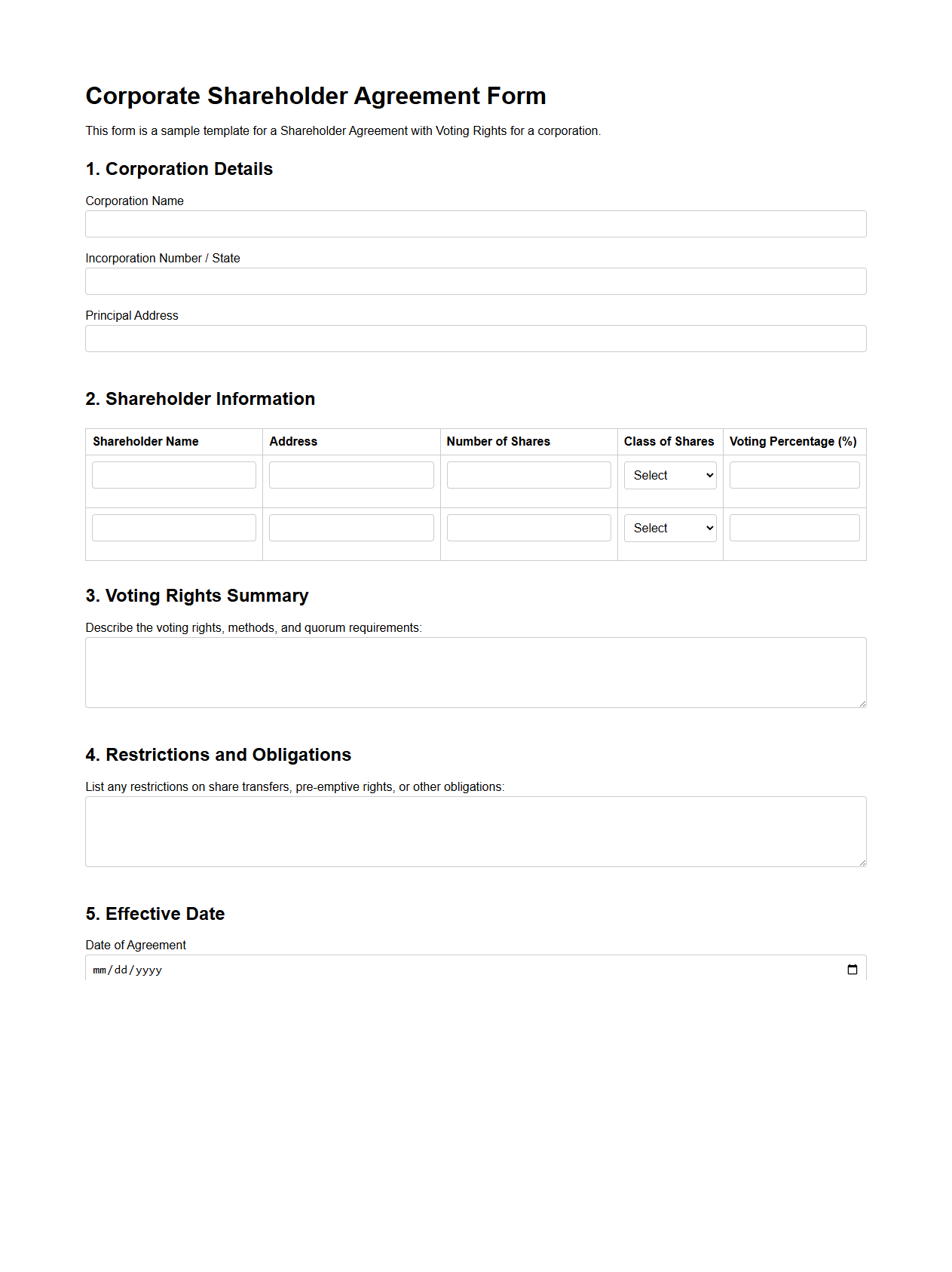

Corporate Shareholder Agreement Form with Voting Rights

A

Corporate Shareholder Agreement Form with Voting Rights is a legal document that outlines the rights and obligations of shareholders within a corporation, specifically detailing how voting rights are distributed and exercised. This agreement ensures clarity on decision-making processes, protecting minority shareholders while defining the influence each shareholder holds in corporate governance. It is essential for establishing control mechanisms, dispute resolution protocols, and procedures for transferring shares, thereby maintaining organizational stability.

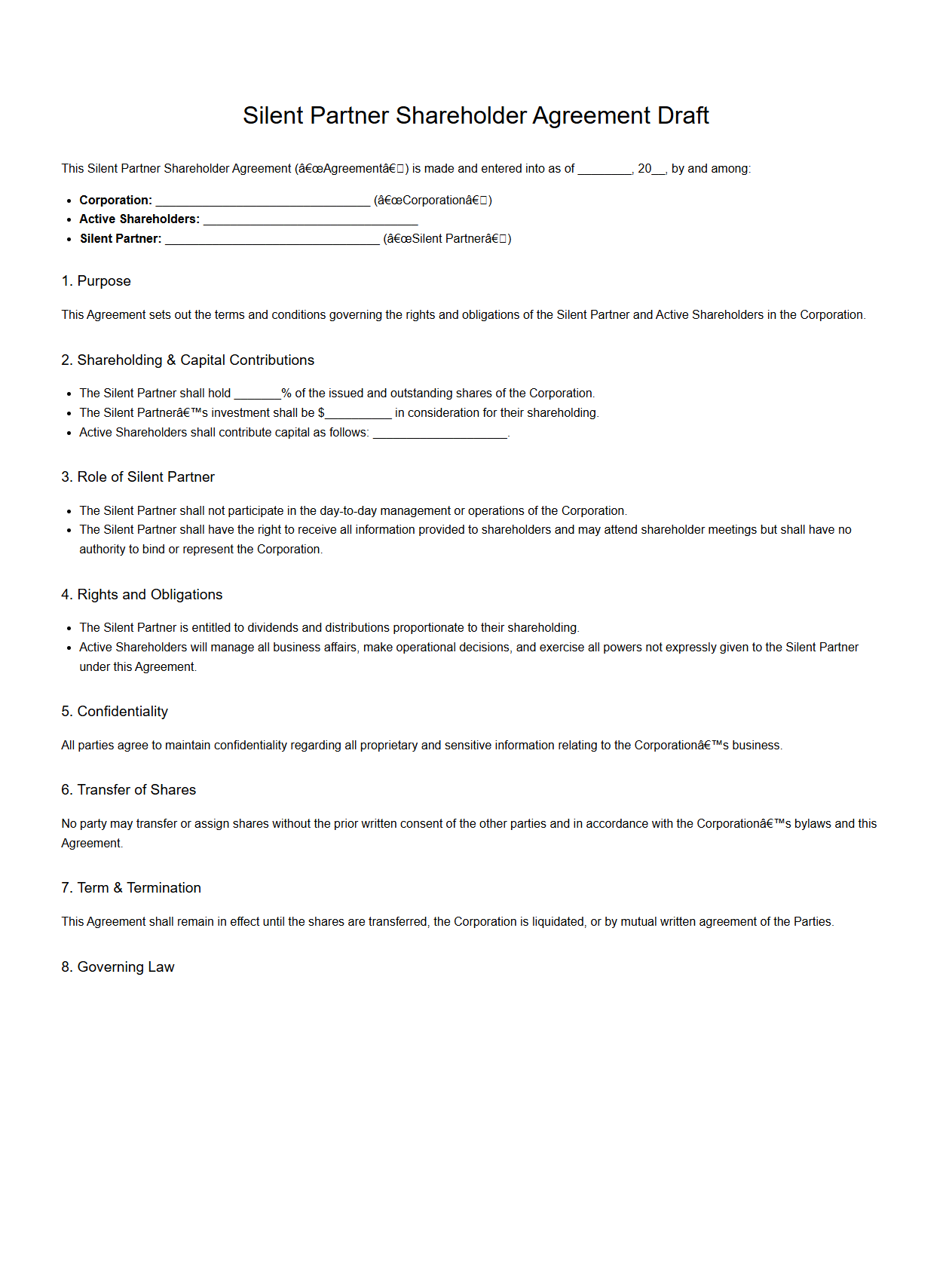

Silent Partner Shareholder Agreement Draft for Corporations

A

Silent Partner Shareholder Agreement Draft for corporations is a legal document that outlines the rights, responsibilities, and limitations of a silent partner in a business. It specifies the extent of the silent partner's involvement, typically focusing on financial investment without active management or decision-making roles. This agreement protects both the silent partner and active shareholders by clearly defining profit sharing, liability, and confidentiality terms.

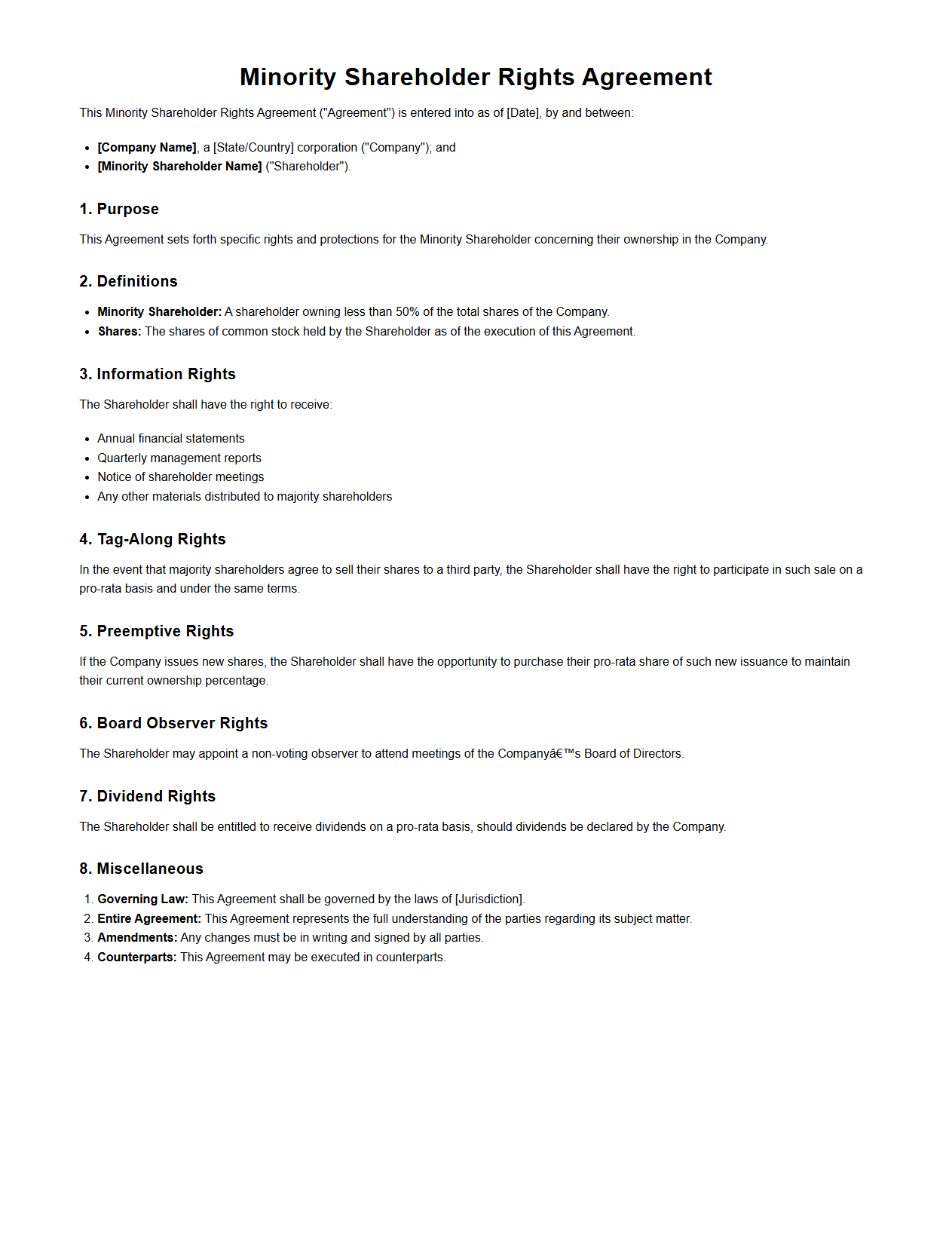

Minority Shareholder Rights Agreement Template

A

Minority Shareholder Rights Agreement Template is a legal document designed to protect the interests of minority shareholders in a corporation. It outlines specific rights, such as voting power, information access, and restrictions on the transfer of shares, to ensure fair treatment and avoid majority shareholder oppression. This template serves as a standardized framework for negotiating and formalizing these rights within shareholder agreements.

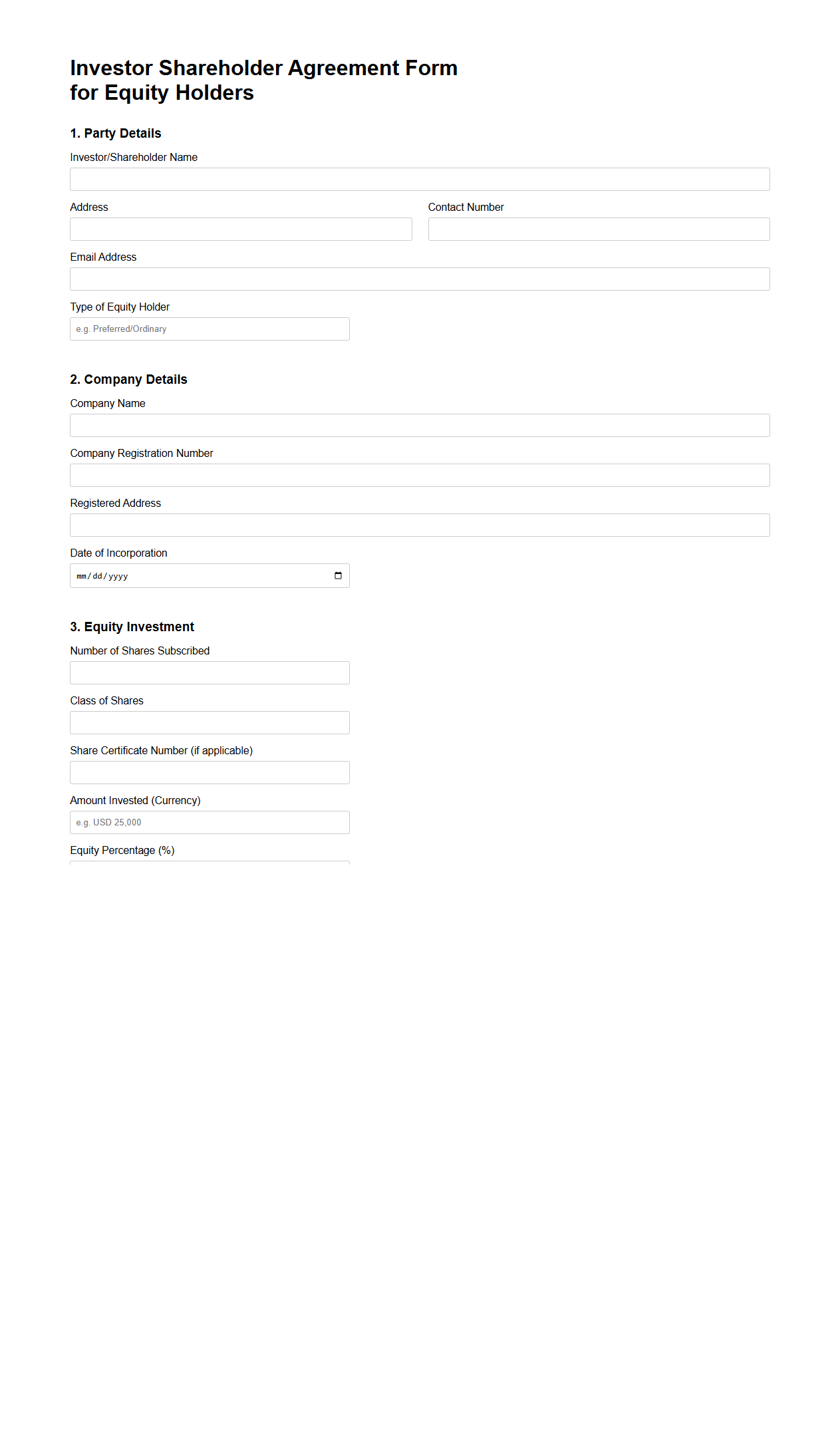

Investor Shareholder Agreement Form for Equity Holders

The

Investor Shareholder Agreement Form for Equity Holders is a legally binding document that outlines the rights, responsibilities, and obligations of investors who hold equity in a company. It specifies terms related to share ownership, voting rights, transfer restrictions, dividend policies, and dispute resolution mechanisms. This agreement ensures clarity and protection for both the company and its shareholders by establishing clear governance and operational guidelines.

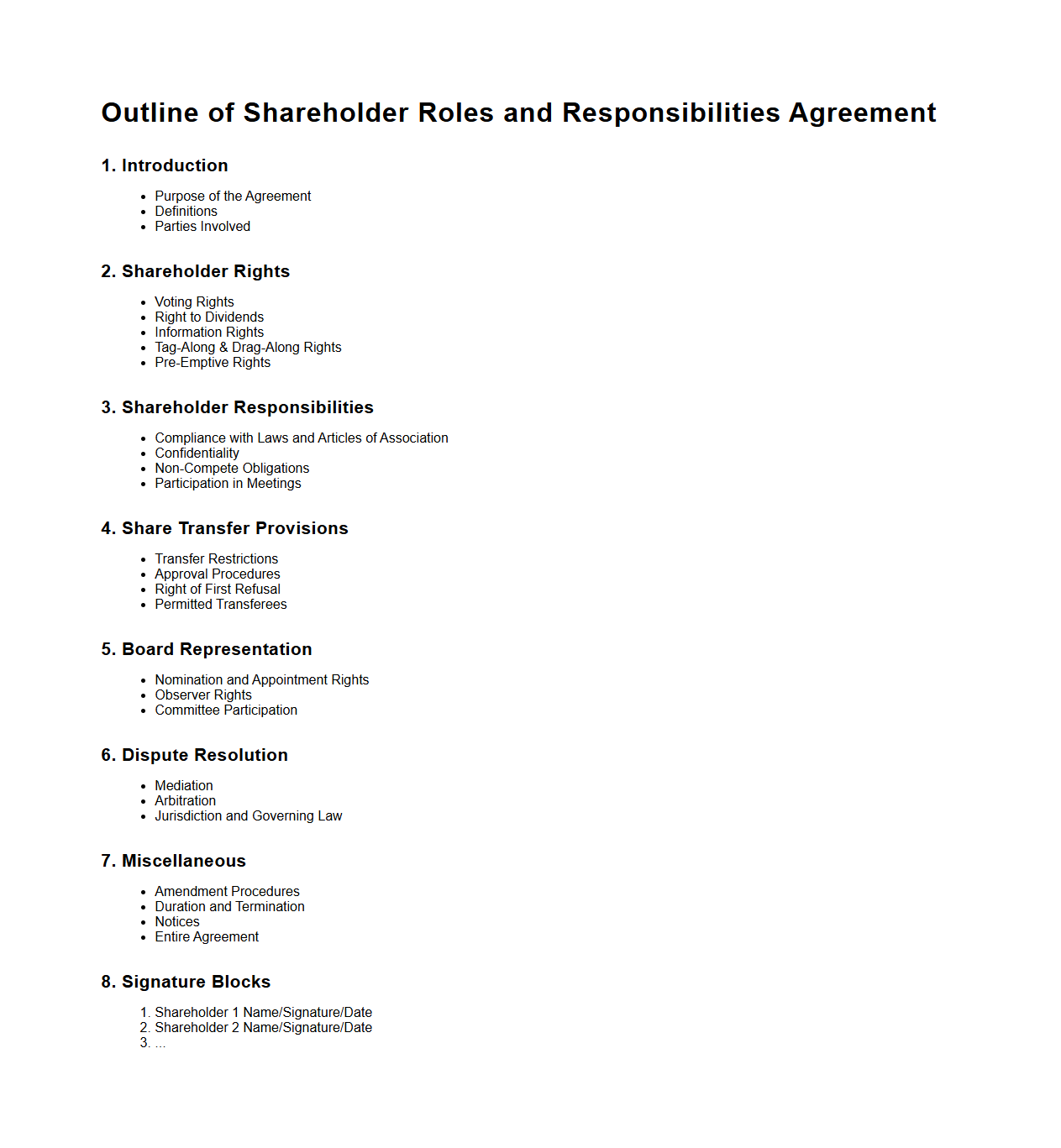

Outline of Shareholder Roles and Responsibilities Agreement

The

Outline of Shareholder Roles and Responsibilities Agreement document defines the specific duties, rights, and obligations of each shareholder within a corporation, ensuring clarity and preventing disputes. It typically includes governance structures, decision-making protocols, and mechanisms for resolving conflicts among shareholders. This agreement fosters transparent communication and aligns shareholder expectations to support effective company management.

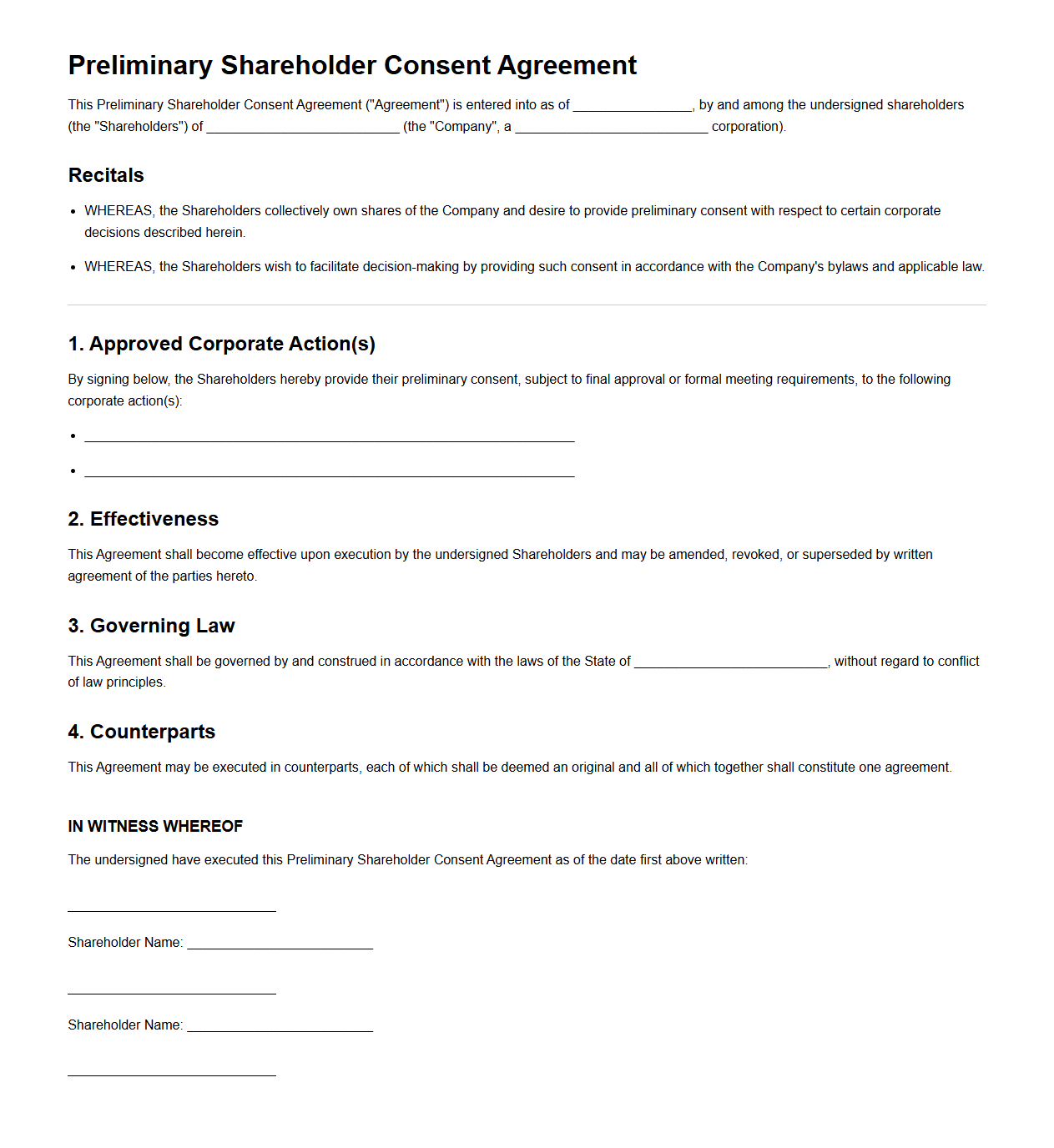

Preliminary Shareholder Consent Agreement for Corporate Decisions

A

Preliminary Shareholder Consent Agreement for corporate decisions is a formal document outlining the initial approval of shareholders regarding proposed actions within a corporation, such as mergers, acquisitions, or major strategic shifts. This agreement serves to document the shareholders' intention to support specific corporate resolutions before formal voting or implementation. It helps ensure transparency and alignment among stakeholders, providing a basis for legal and operational compliance in corporate governance.

What key clauses should a blank shareholder agreement include for minority rights protection?

A blank shareholder agreement must include minority rights protection clauses to safeguard the interests of smaller investors. These clauses typically cover rights such as pre-emptive rights, tag-along rights, and veto powers on critical decisions. Ensuring these protections balances power and builds trust between majority and minority shareholders.

How does a blank shareholder agreement address dispute resolution among investors?

A well-drafted blank shareholder agreement incorporates dispute resolution clauses to manage conflicts efficiently. Common mechanisms include mediation, arbitration, and escalation procedures before resorting to litigation. Clear dispute resolution terms help preserve business relationships and avoid costly legal battles.

What governance terms are essential for board composition in a shareholder agreement template?

The shareholder agreement template must define board composition to ensure balanced governance. Key terms include the number of board seats, appointment rights, and mechanisms for replacement or removal of directors. These provisions protect shareholder interests and maintain effective oversight.

How should share transfer restrictions be structured in a blank shareholder agreement?

Share transfer restrictions are critical to controlling ownership changes and protecting company stability. Provisions usually include right of first refusal, tag-along rights, and drag-along rights to regulate selling, buying, and transferring shares. Structuring these restrictions clearly prevents unwanted third-party involvement and maintains shareholder harmony.

What confidentiality provisions are standard in shareholder agreements for startups?

Confidentiality provisions in startup shareholder agreements safeguard sensitive business information against unauthorized disclosure. These clauses typically mandate non-disclosure during and after the shareholder's involvement with the company. Ensuring robust confidentiality protections preserves competitive advantage and trust between shareholders.