A Blank Credit Card Application Template for Banks provides a streamlined format for customers to submit essential personal and financial information required to apply for a credit card. This template ensures consistency and compliance with banking regulations while simplifying the approval process. Customizable fields allow banks to tailor applications to specific credit products and risk assessment criteria.

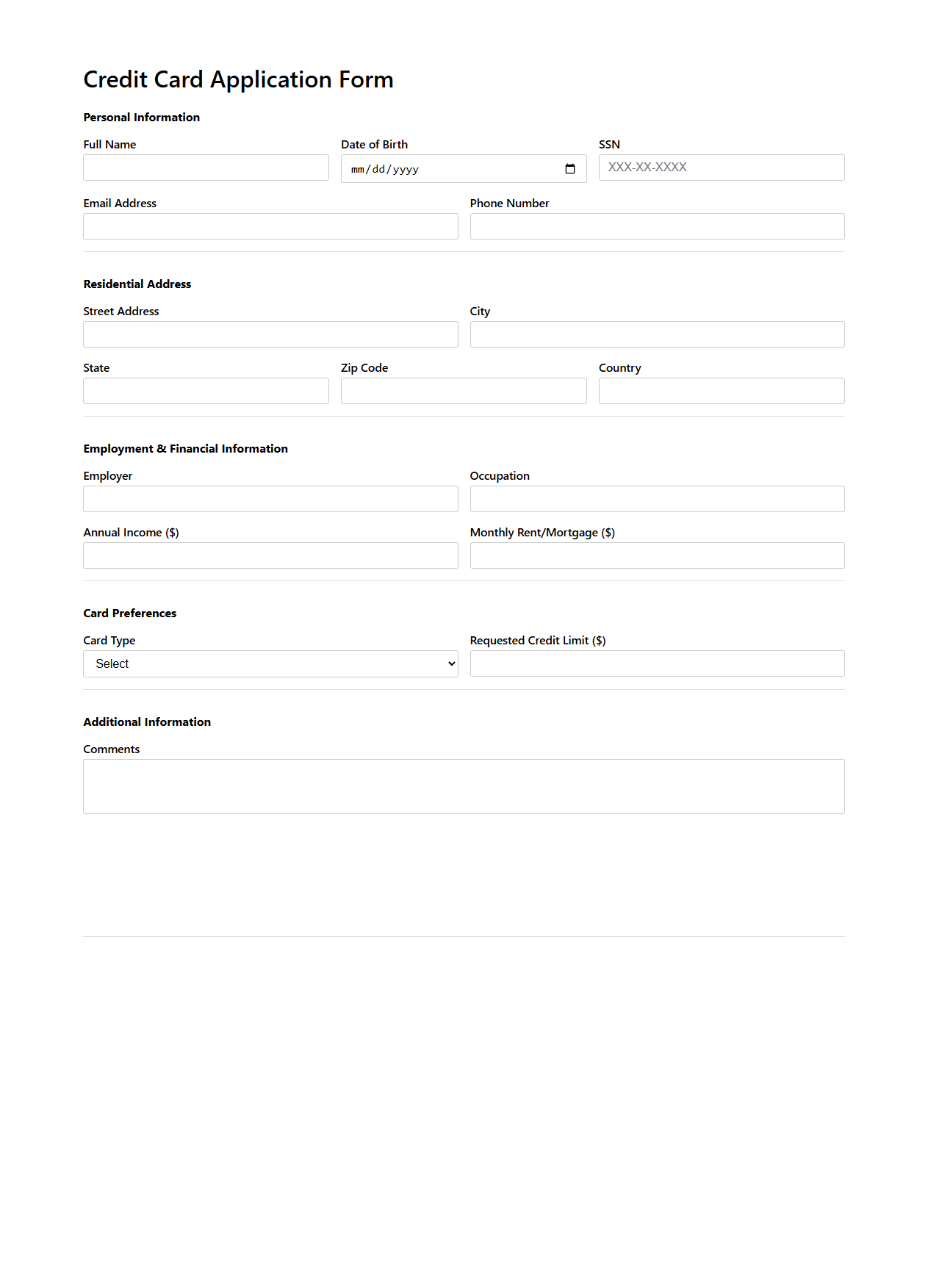

Standard Credit Card Application Form Template

The

Standard Credit Card Application Form Template is a structured document designed to capture essential applicant information for credit card issuance, including personal details, financial status, and authorization consent. This template streamlines the application process, ensuring compliance with regulatory requirements and facilitating accurate risk assessment by issuing banks. Using a standardized format enhances data consistency, improves processing efficiency, and supports seamless integration with financial institution systems.

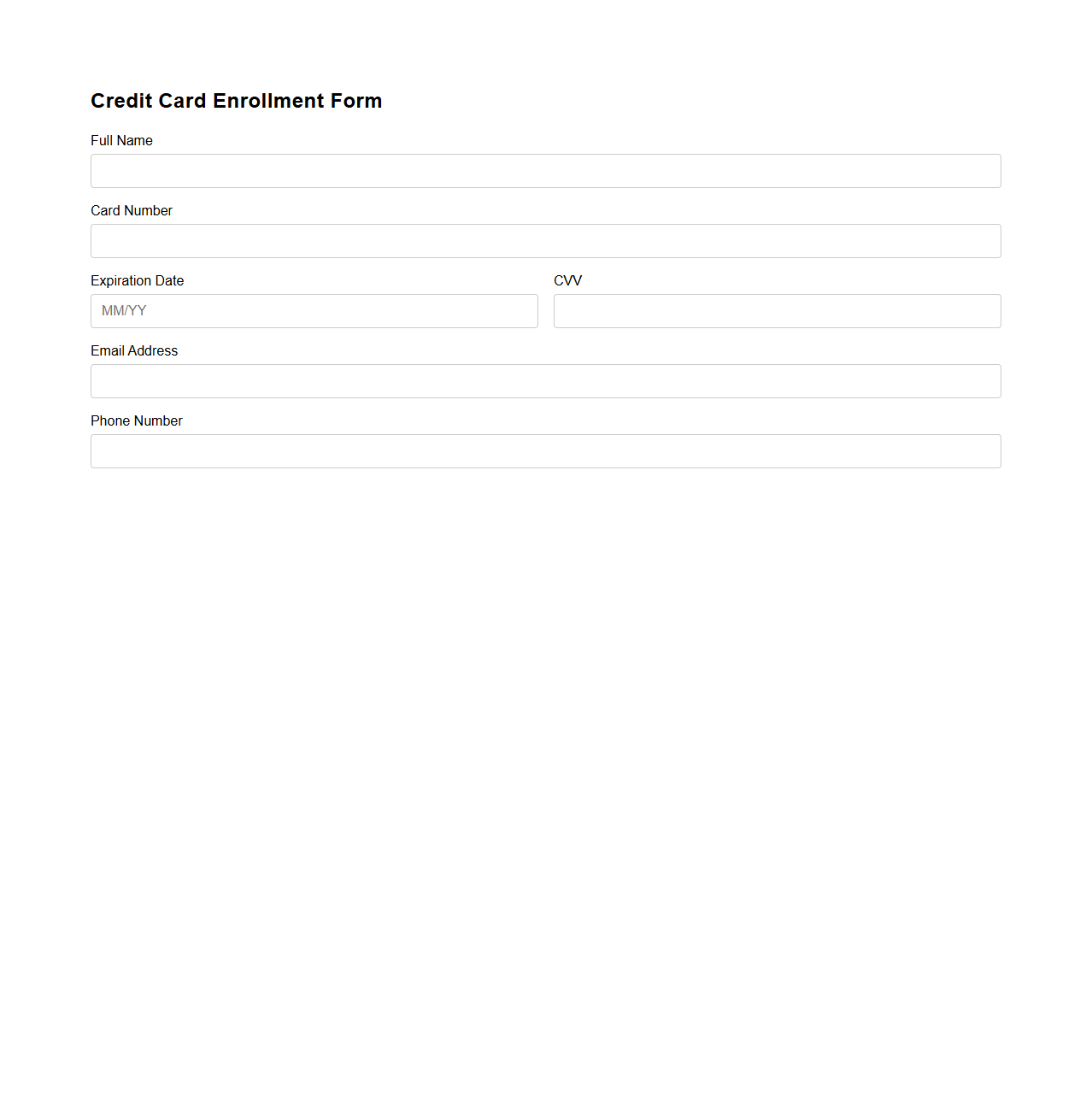

Basic Credit Card Enrollment Form

The

Basic Credit Card Enrollment Form is a standardized document used by banks and financial institutions to collect essential personal and financial information from applicants seeking credit card services. This form typically includes fields for personal details, contact information, employment status, income verification, and consent for credit checks. Accurate completion of this document facilitates credit evaluation and approval, ensuring a smooth enrollment process for the applicant.

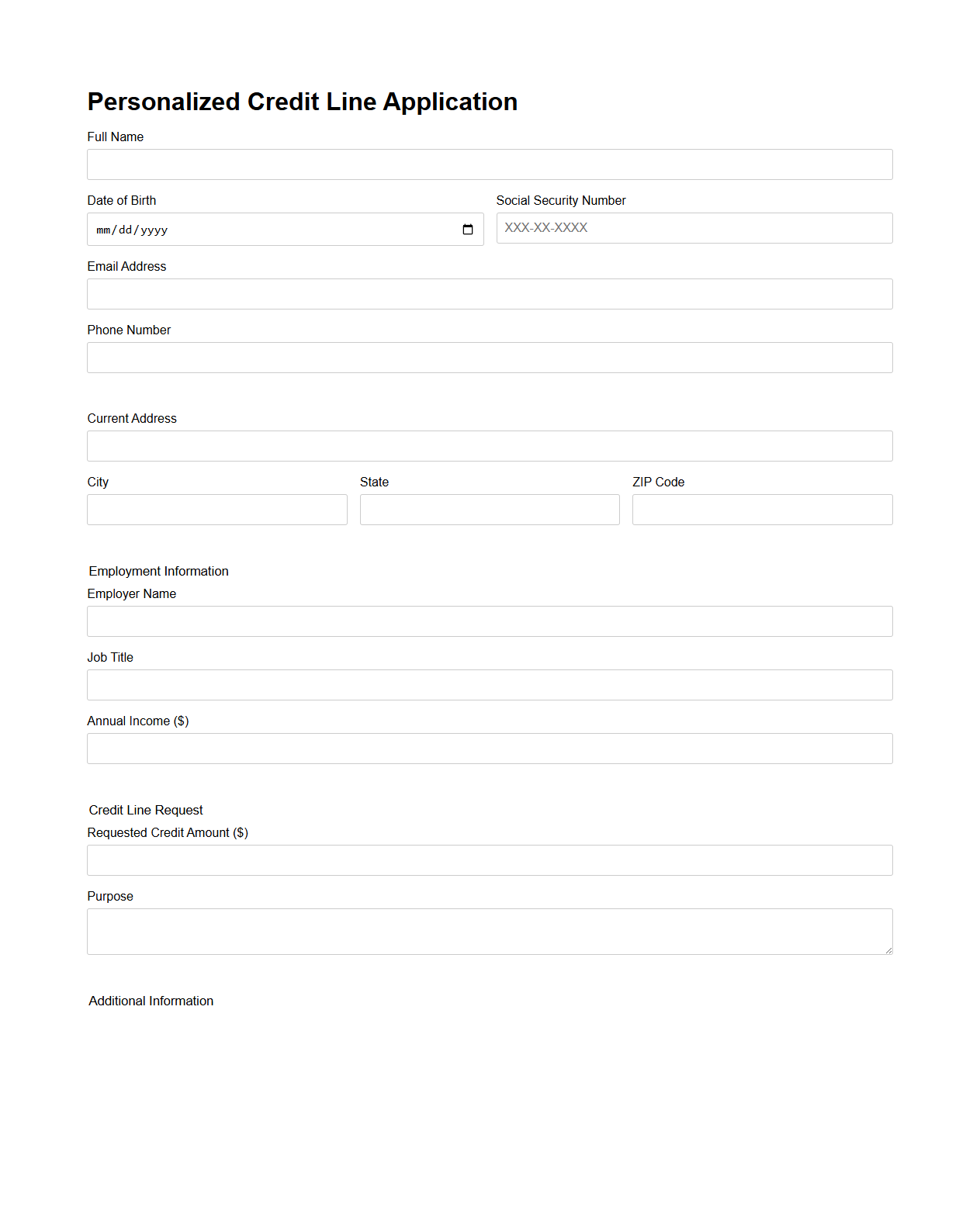

Personalized Credit Line Application Template

A

Personalized Credit Line Application Template document is a customizable form designed to streamline the process of applying for a credit line tailored to an individual's financial profile. It typically includes sections for personal information, financial details, credit history, and specific borrowing needs, enabling lenders to assess creditworthiness efficiently. This template helps ensure consistent data collection while facilitating faster decision-making in credit approval processes.

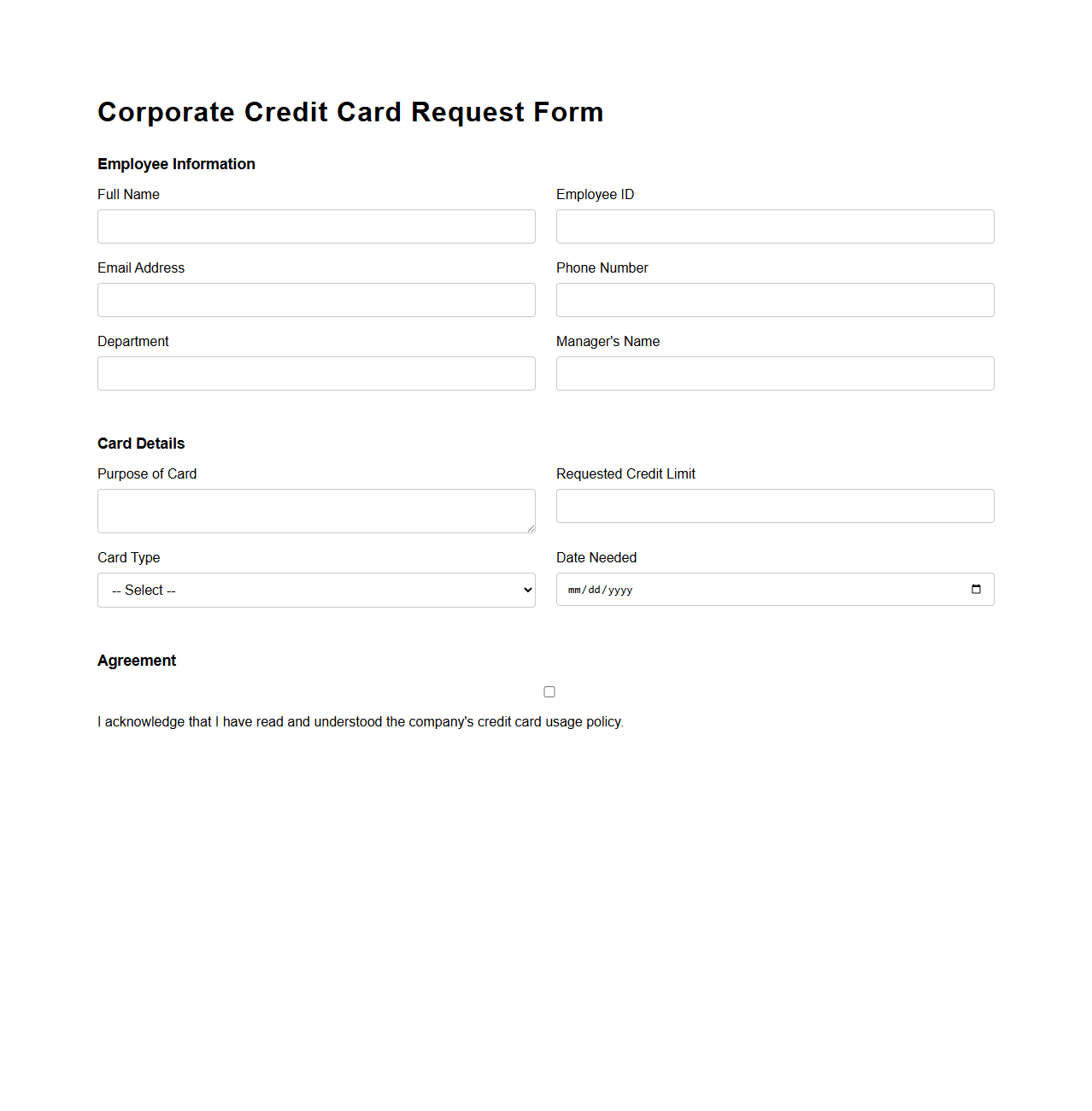

Corporate Credit Card Request Form

A

Corporate Credit Card Request Form is a formal document used by employees or departments to apply for a company-issued credit card. It captures essential information such as applicant details, purpose of the card, spending limits, and approval signatures to ensure proper authorization and accountability. This form streamlines the process of issuing corporate credit cards while maintaining financial control and compliance.

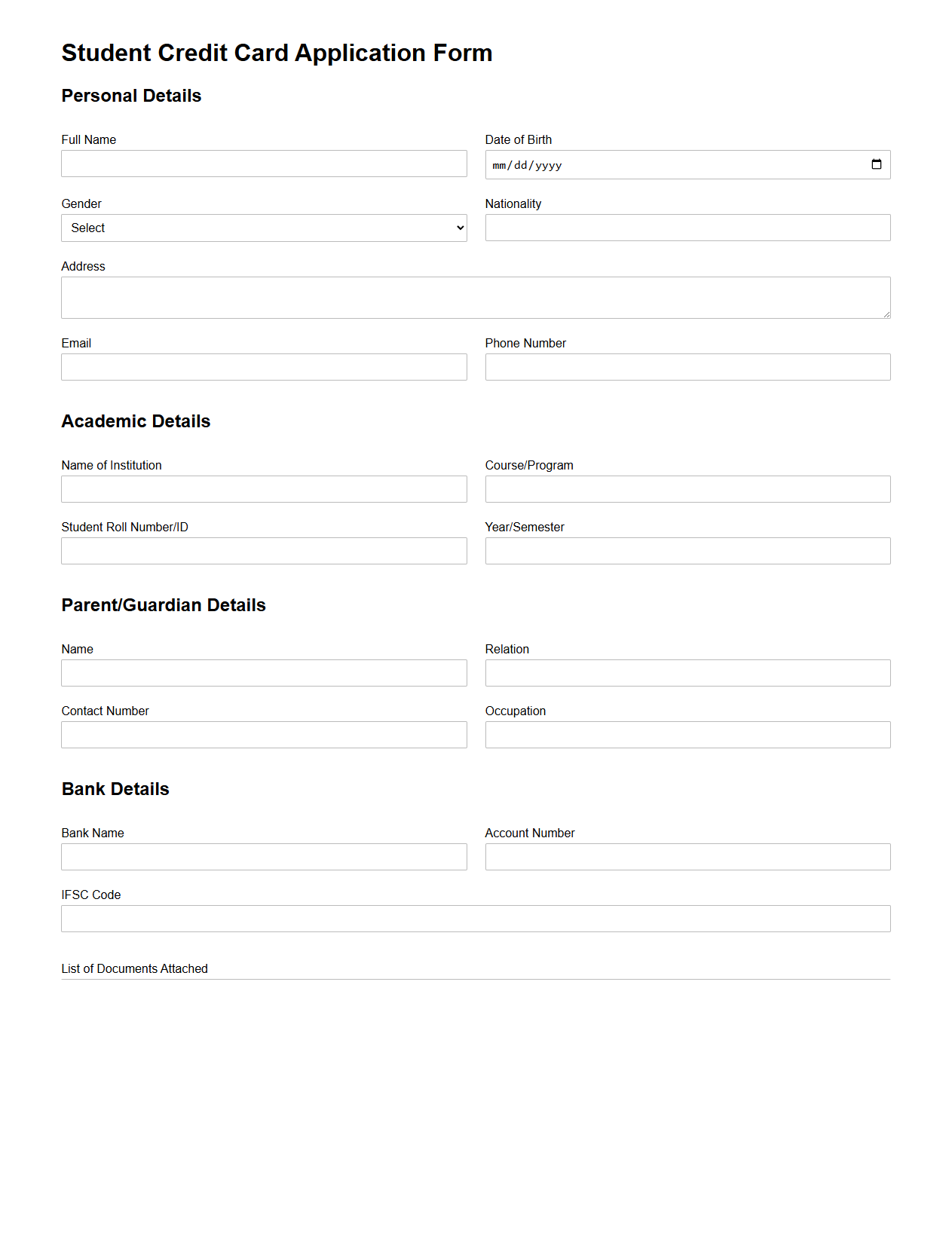

Student Credit Card Application Format

A

Student Credit Card Application Format document outlines the structured layout and required information for students to apply for a credit card tailored to their financial needs. It typically includes sections for personal details, academic information, income sources, and consent for credit verification. This format ensures that banks collect consistent data to evaluate creditworthiness and streamline the approval process.

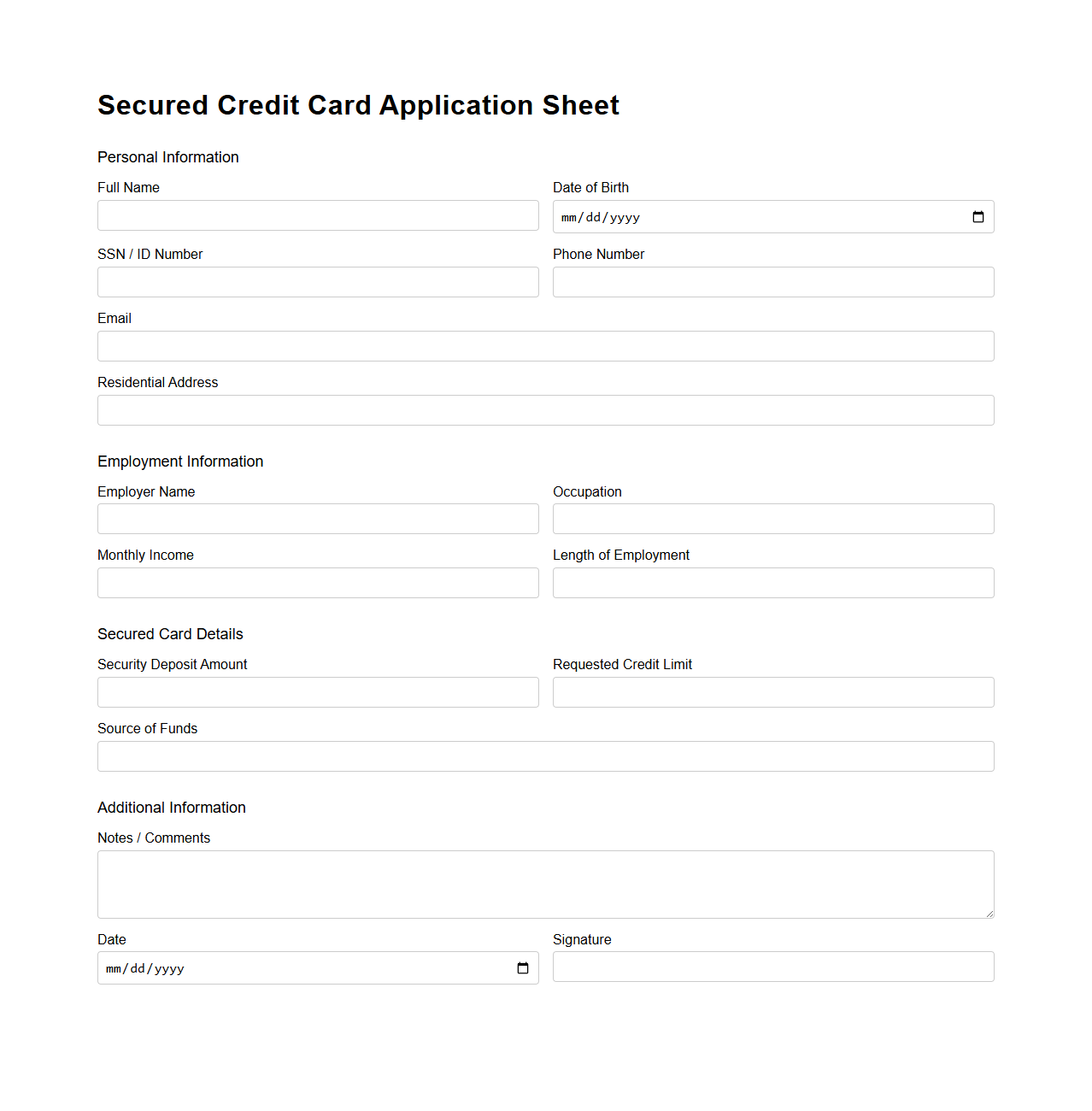

Secured Credit Card Application Sheet

A

Secured Credit Card Application Sheet is a document used by financial institutions to collect personal and financial information from applicants seeking a secured credit card. It includes fields for details such as identification, income, and security deposit amounts, which serve as collateral to minimize lending risk. This sheet is essential for verifying eligibility and processing the secured credit card application efficiently.

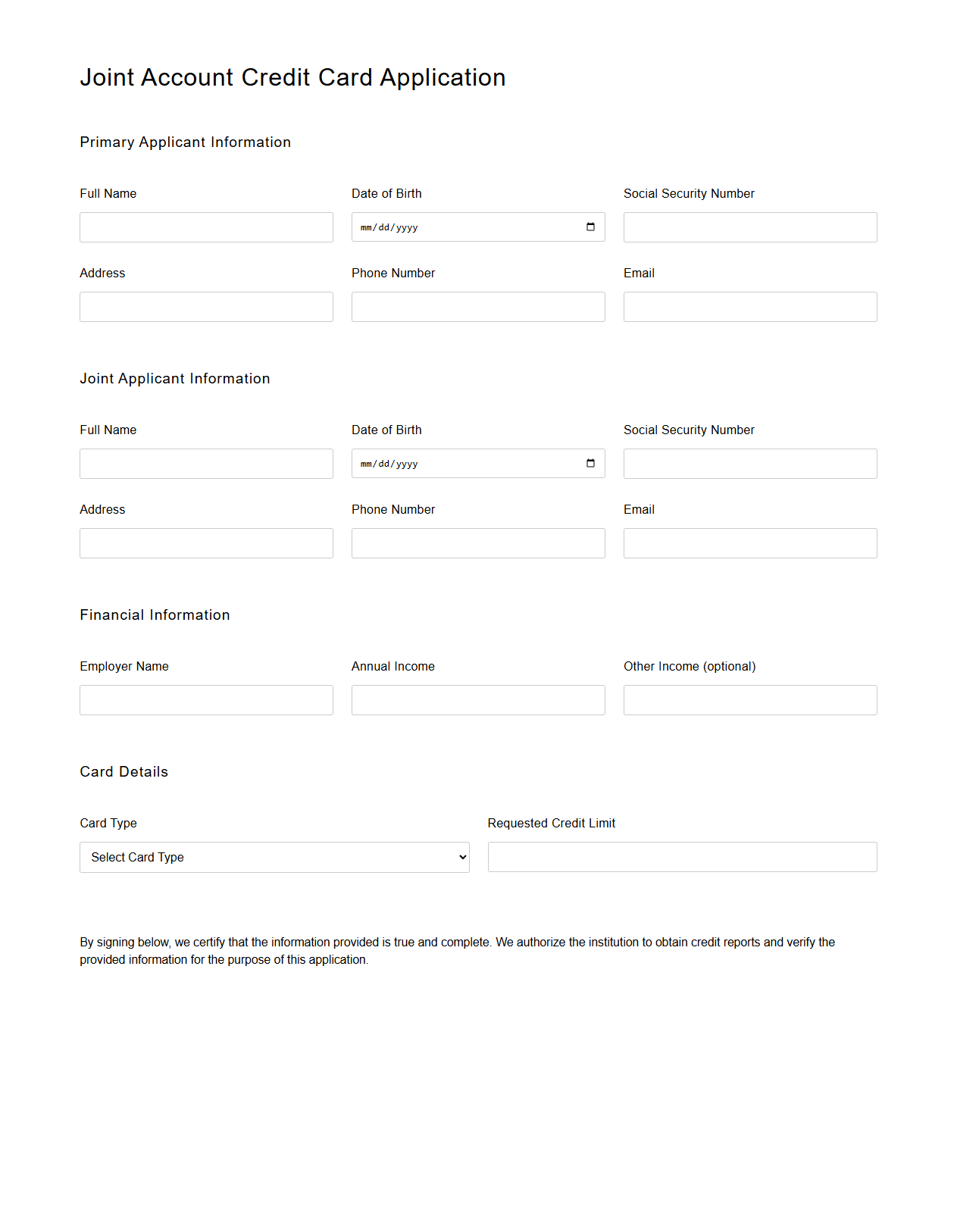

Joint Account Credit Card Application Template

The

Joint Account Credit Card Application Template document serves as a standardized form designed to facilitate the application process for credit cards held jointly by two or more individuals. It captures essential applicant details such as personal information, financial history, and authorization signatures, ensuring compliance with banking regulations. This template streamlines data collection, reduces errors, and accelerates approval timelines for joint account credit card issuances.

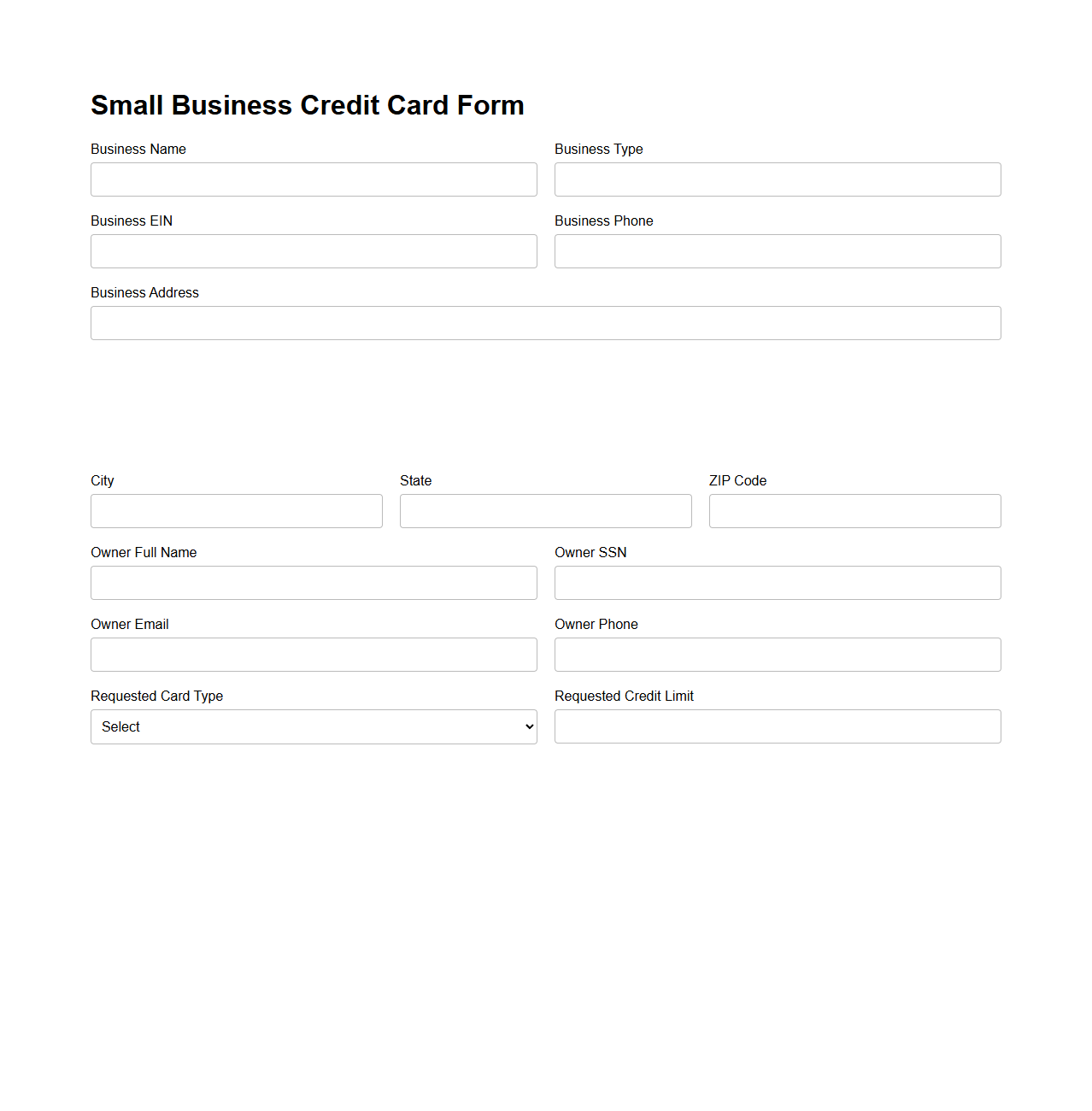

Small Business Credit Card Form

A

Small Business Credit Card Form is a document used by lenders to collect essential information about a business applying for a credit card. It typically includes fields for financial data, business identification details, and owner personal information to assess creditworthiness. Completing this form accurately helps expedite the approval process and secures access to business financing options.

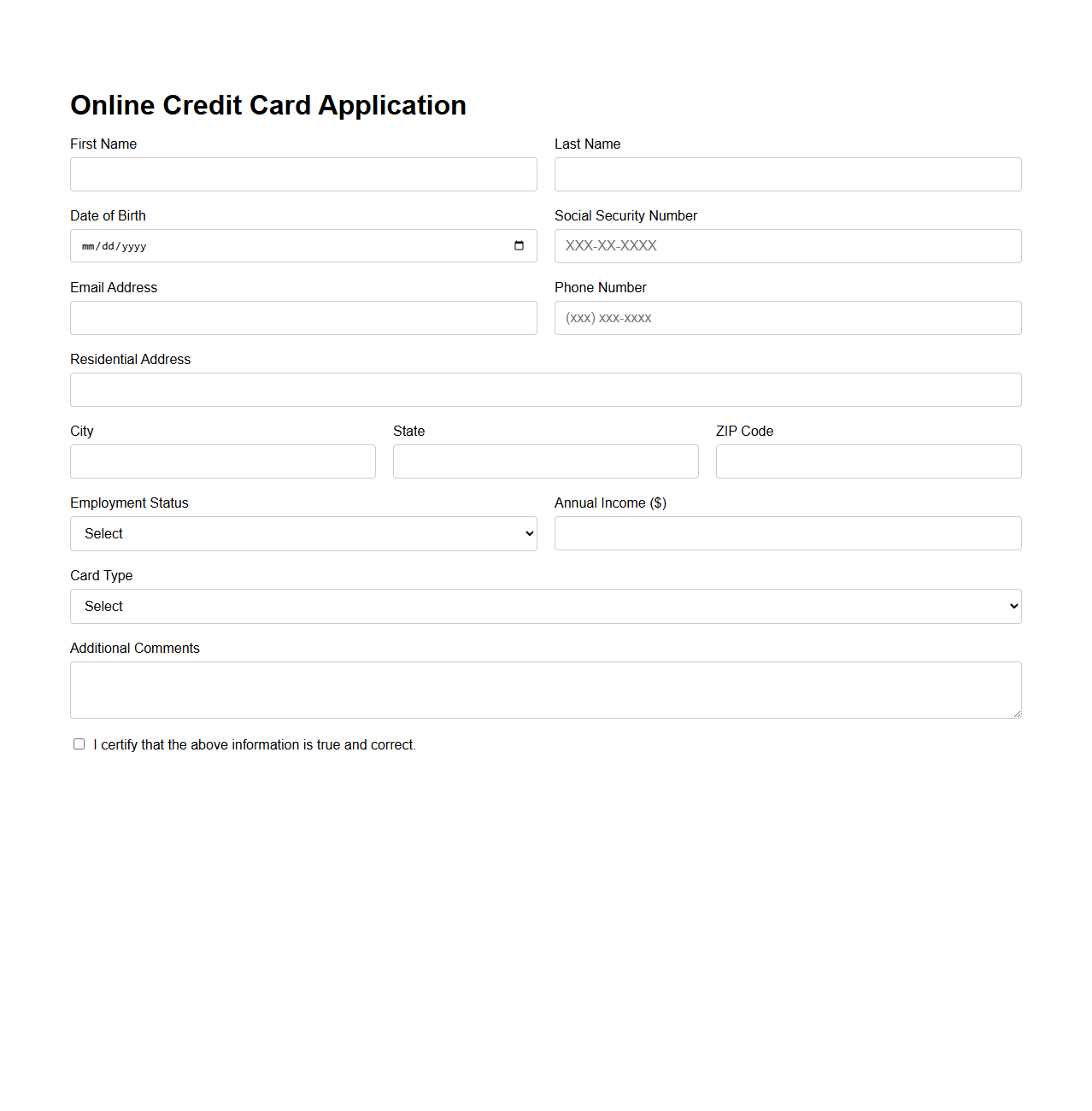

Online Credit Card Application Template

An

Online Credit Card Application Template is a structured digital form designed to streamline the process of collecting applicant information for credit card issuance. It typically includes fields for personal details, financial information, and consent for credit checks, ensuring compliance with regulatory standards. This template enhances efficiency by enabling institutions to process applications quickly and securely, reducing errors and improving customer experience.

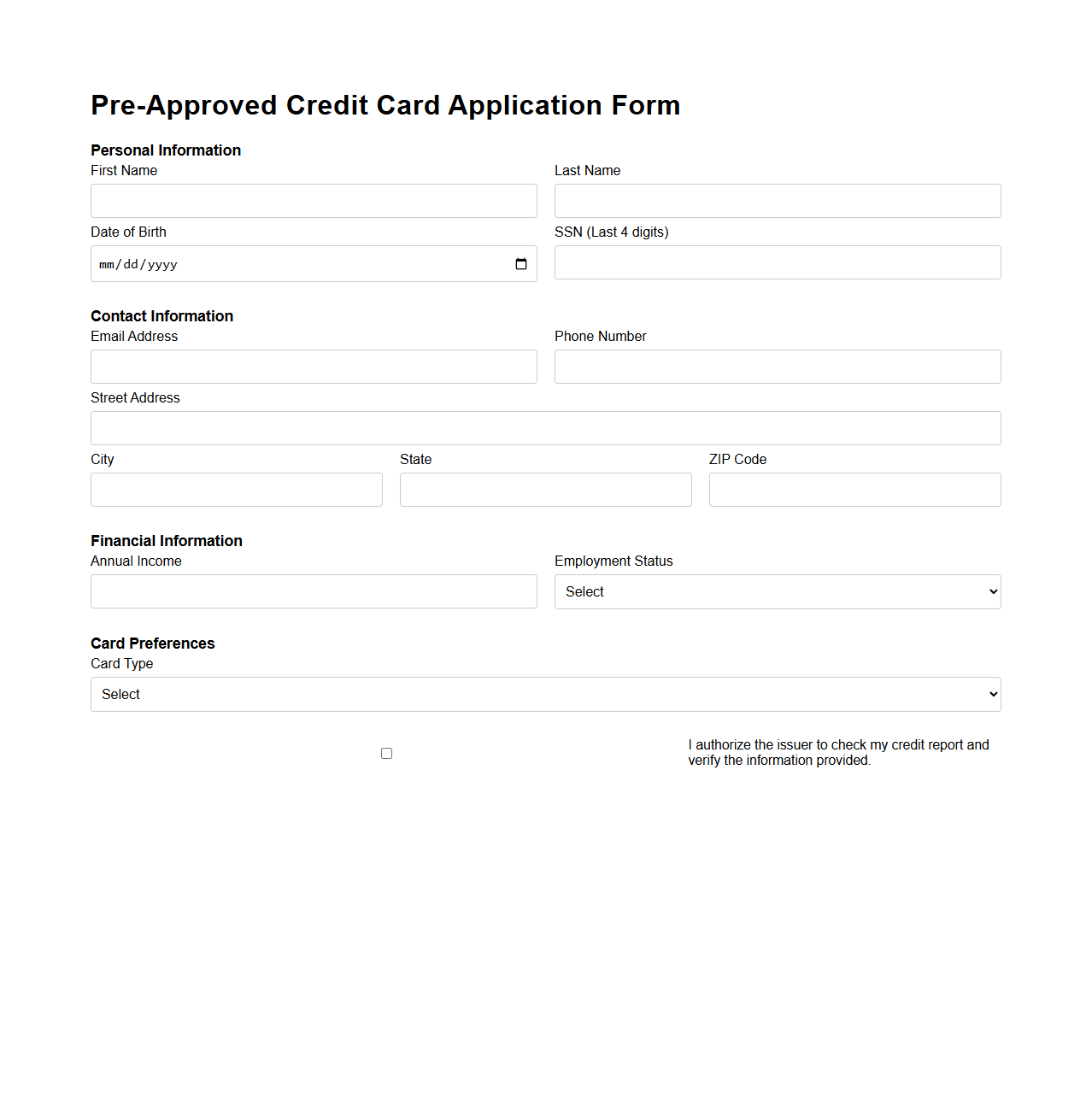

Pre-Approved Credit Card Application Form

A

Pre-Approved Credit Card Application Form is a document offered by financial institutions to streamline the credit card issuance process for eligible customers based on their credit history and financial status. This form simplifies the application by pre-filling certain customer information and indicating preliminary approval, reducing the need for extensive credit checks. It enhances customer convenience and expedites credit card processing, ensuring faster access to credit services.

What identity verification steps are required on a Blank Credit Card Application for banks?

Banks require multiple identity verification steps on a blank credit card application to ensure authenticity. These steps typically include submitting government-issued identification, proof of address, and Social Security Number verification. Additionally, some banks use biometric or two-factor authentication to further secure the application process.

Which compliance regulations must a blank credit card form adhere to?

A blank credit card form must comply with data protection and financial regulations such as the Fair Credit Reporting Act (FCRA) and the Gramm-Leach-Bliley Act (GLBA). It must also adhere to Anti-Money Laundering (AML) and Know Your Customer (KYC) guidelines to prevent fraudulent activities. Ensuring compliance avoids legal penalties and protects consumer privacy.

How should sensitive fields be formatted on the template for data privacy?

Sensitive fields on credit card applications should be formatted with input masks and encryption mechanisms to protect user data. For example, Social Security Numbers and income details should have masked characters while typing. Additionally, these fields must be clearly labeled and securely stored according to data privacy standards.

What optional sections can enhance customer profiling on the application?

Including optional sections such as employment details, annual income, and credit preferences can significantly improve customer profiling. Banks may also collect information about spending habits or additional contact methods to tailor credit offers. These data points help banks make more informed lending decisions and provide personalized services.

How do banks track revisions and versions of blank credit card templates?

Banks maintain revision control by implementing versioning systems that log changes and updates to blank credit card templates. Every modification is timestamped and associated with an authorized user to ensure accountability. This practice ensures regulatory compliance and consistency in the application process.

More Application Templates