A Blank Loan Application Template for Financial Requests provides a structured format to gather essential information from applicants seeking financial assistance. It ensures consistency and completeness in collecting personal, employment, and financial details necessary for loan evaluation. This template streamlines the application process, making it easier for lenders to assess eligibility and make informed decisions.

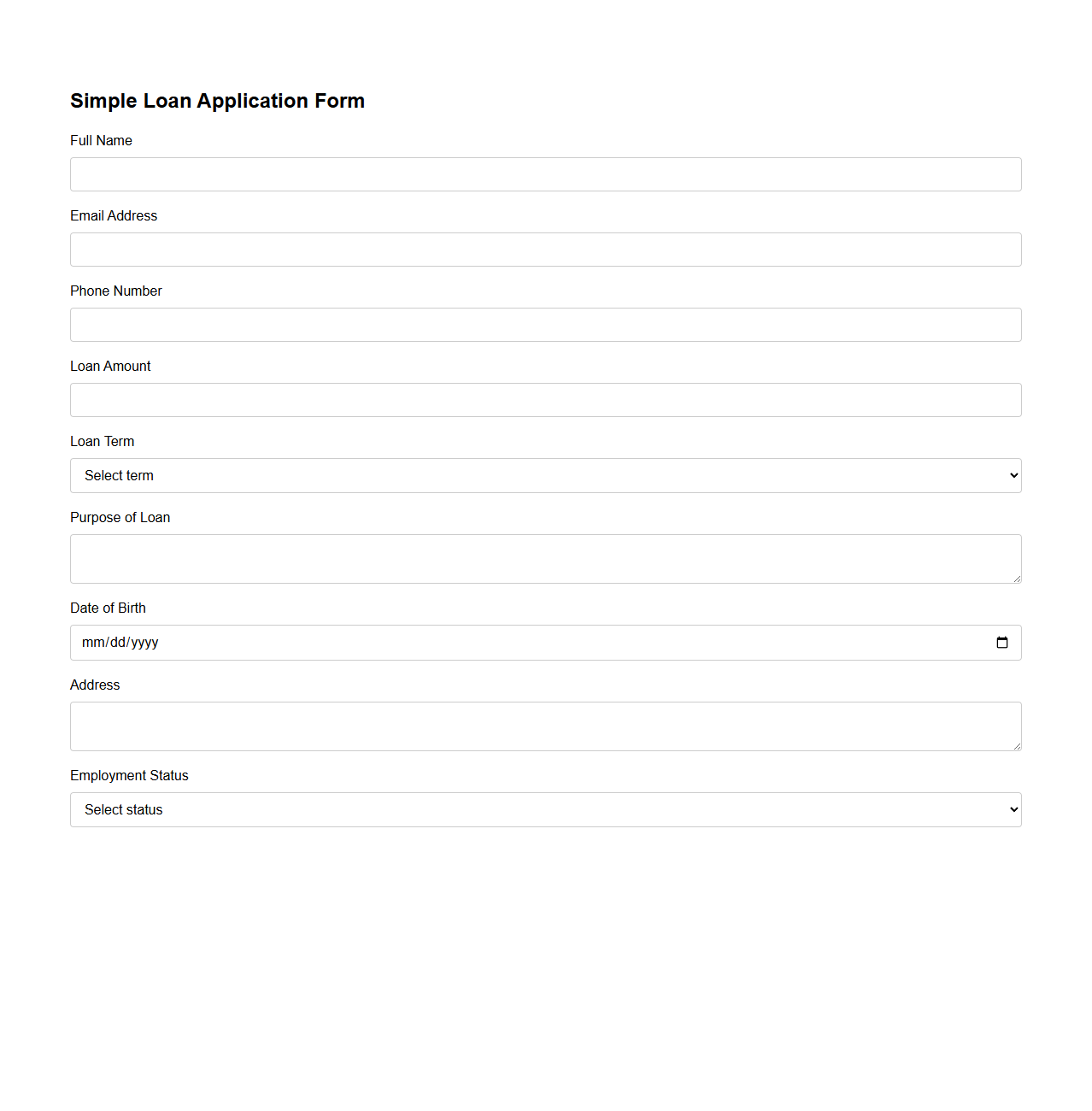

Simple Loan Application Form Template

A

Simple Loan Application Form Template is a standardized document designed to collect essential borrower information for loan processing. It typically includes fields for personal details, financial status, loan amount, and purpose, ensuring accuracy and consistency in the application process. This template streamlines data collection, making it easier for lenders to evaluate and approve loan requests efficiently.

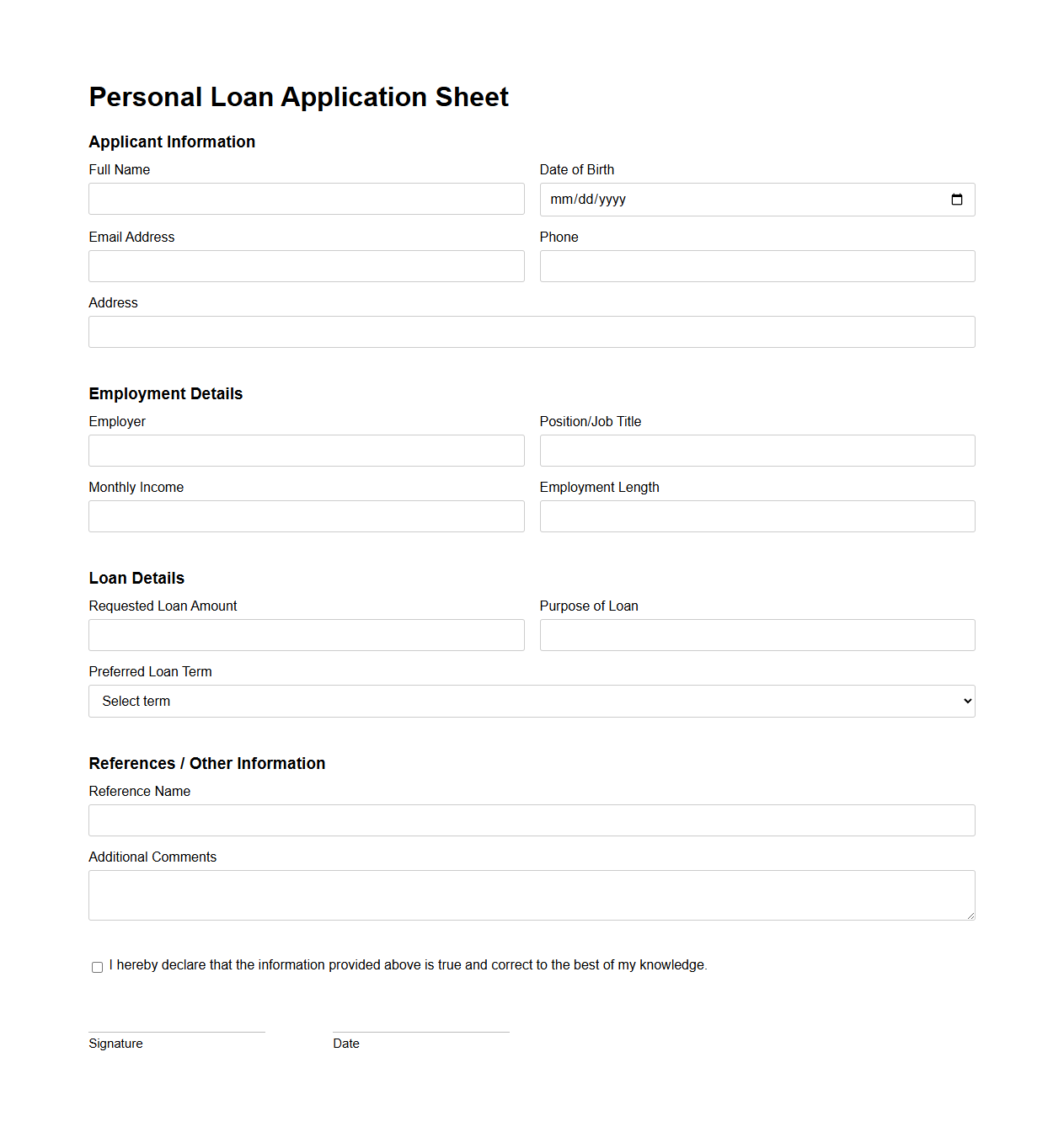

Personal Loan Application Sheet

A

Personal Loan Application Sheet is a formal document used by individuals to request a personal loan from financial institutions. It typically includes essential information such as the applicant's personal details, employment status, income, and loan amount requested. This document helps lenders assess the borrower's creditworthiness and eligibility for the loan.

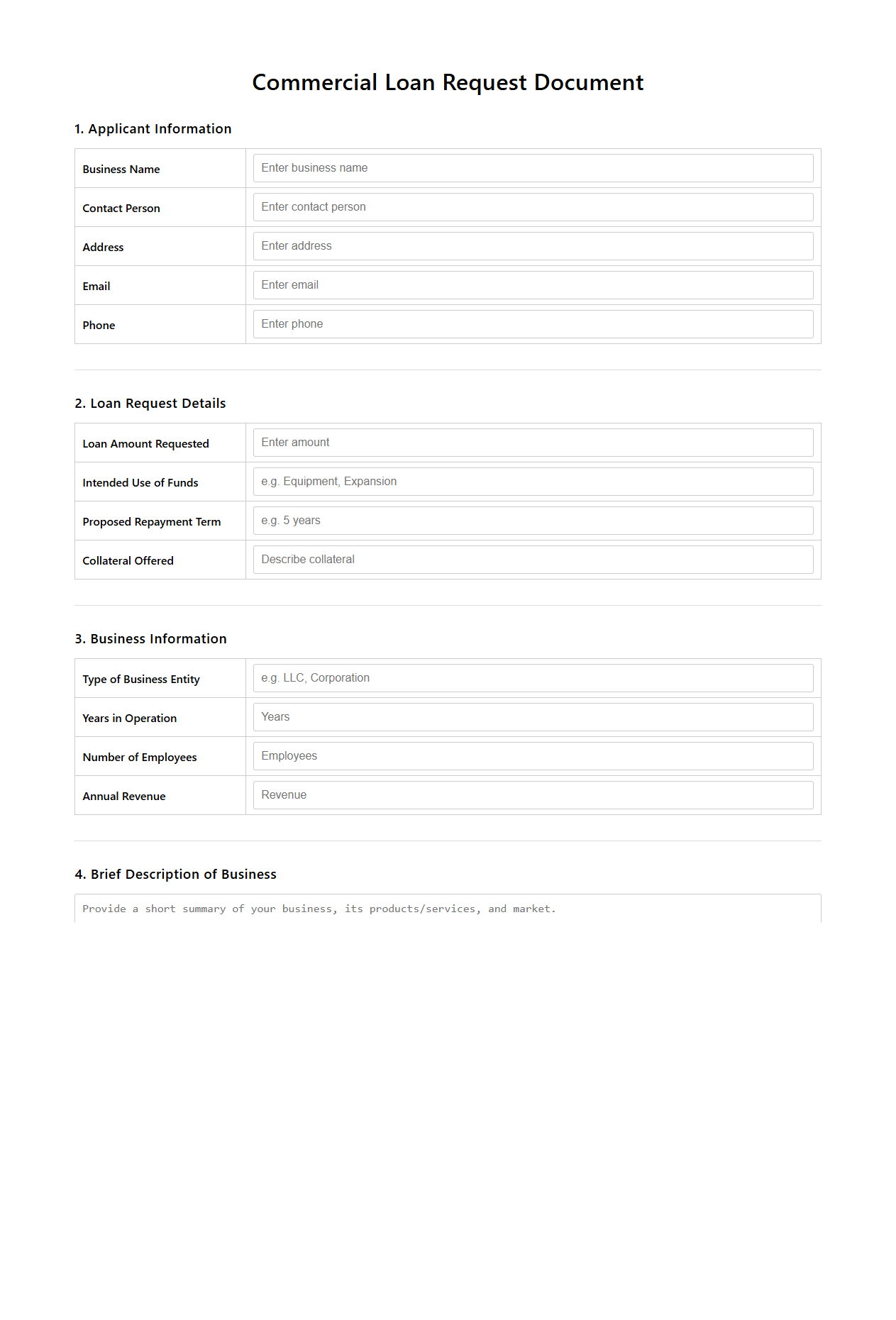

Commercial Loan Request Document

A

Commercial Loan Request Document is a formal application submitted by businesses to financial institutions seeking funding for various purposes, such as expansion, equipment purchase, or working capital. It typically includes detailed financial statements, business plans, credit history, and the intended use of the loan proceeds. This document serves as a critical tool for lenders to assess the creditworthiness and repayment capability of the borrowing entity.

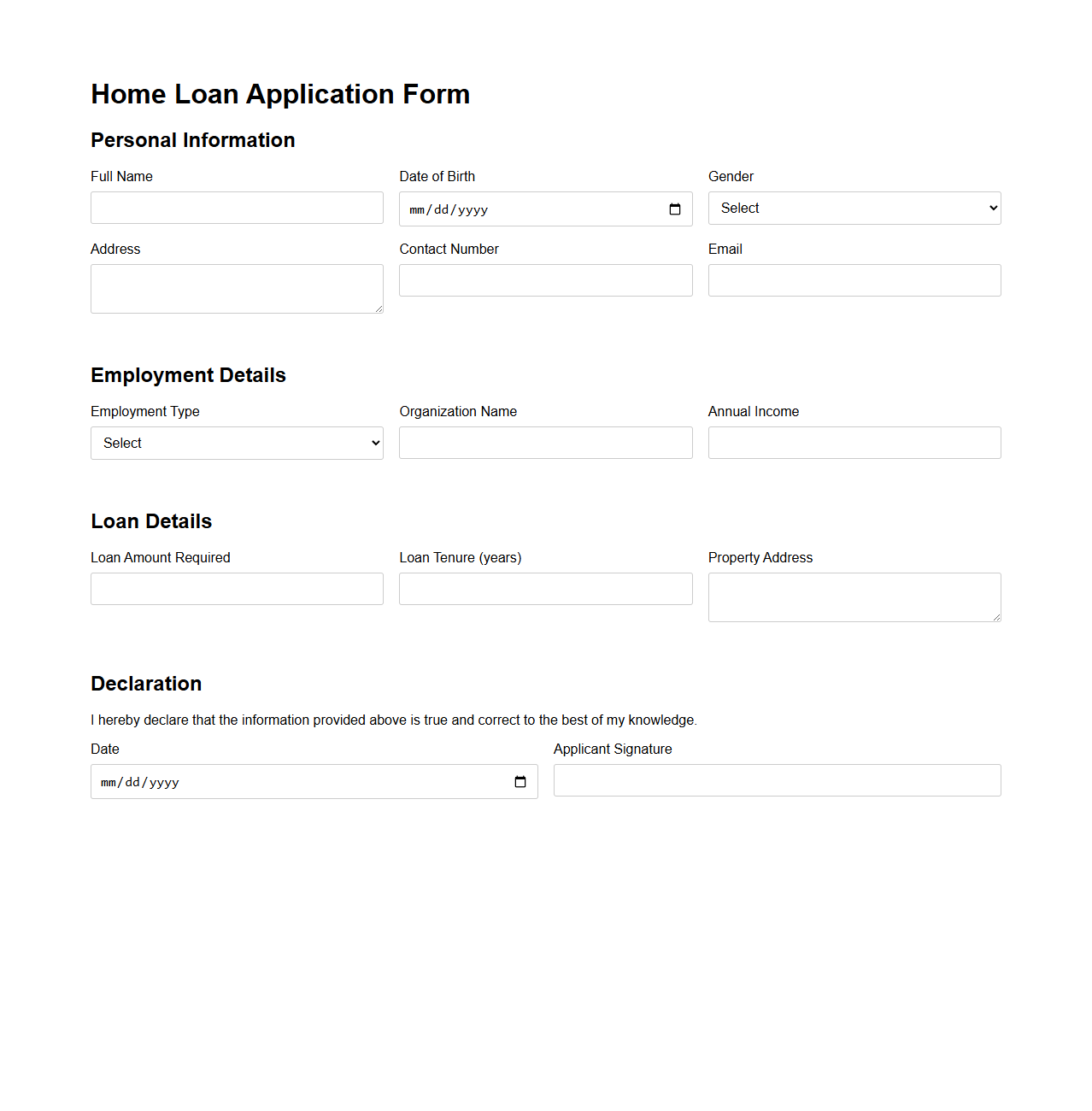

Home Loan Application Format

A

Home Loan Application Format document is a structured template used by individuals to formally apply for a home loan from financial institutions. It typically includes essential personal information, employment details, income proof, property information, and loan amount required to streamline the approval process. Using this format ensures that all necessary data is presented clearly, facilitating faster verification and processing by banks or lending agencies.

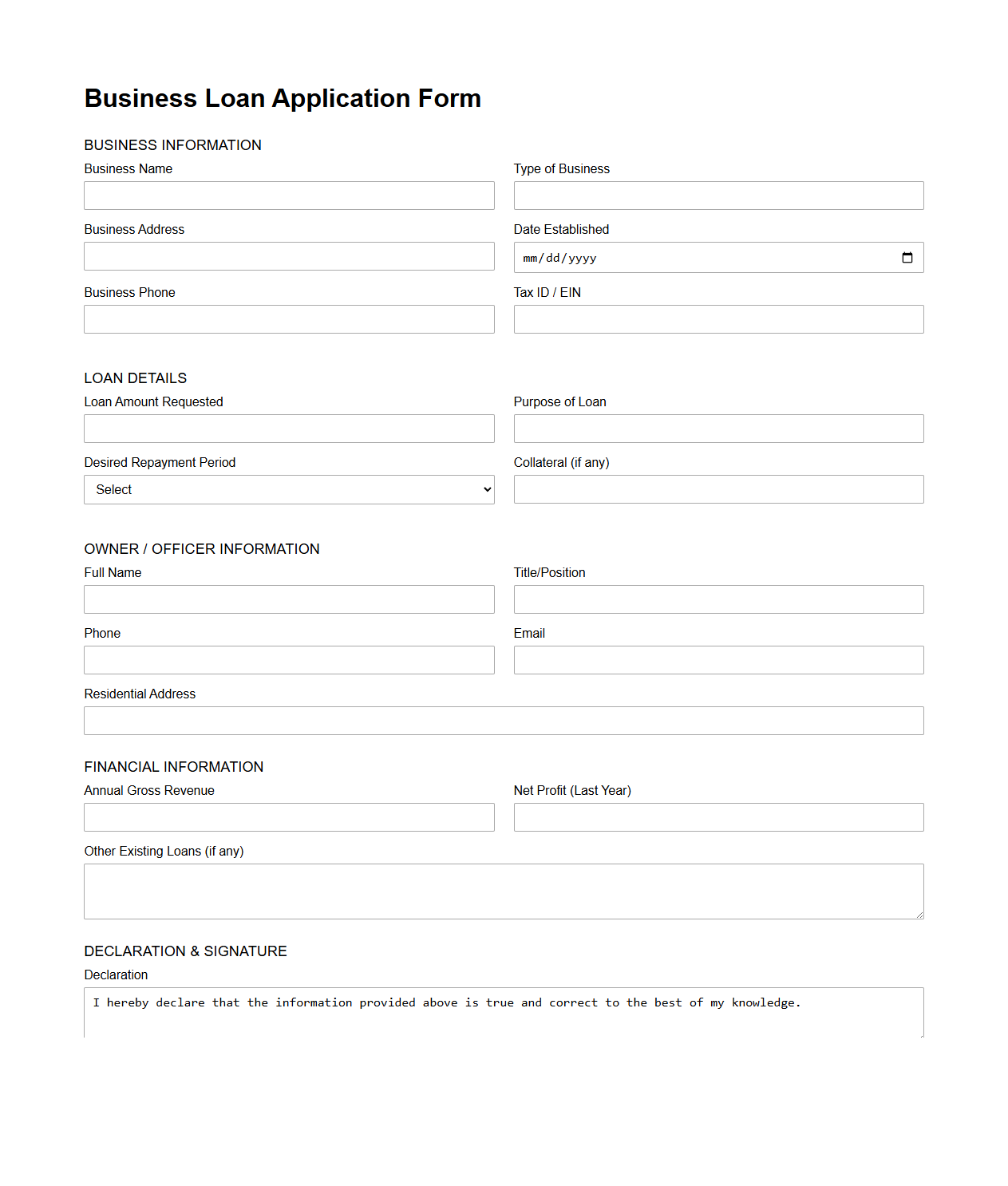

Business Loan Application Form Sample

A

Business Loan Application Form Sample document serves as a template that outlines the necessary information a borrower must provide to apply for a business loan. This sample includes sections for company details, financial statements, loan amount requested, and purpose of the loan, ensuring applicants submit complete and accurate data. Using a standardized form helps streamline the loan approval process by allowing lenders to efficiently assess the borrower's creditworthiness and business viability.

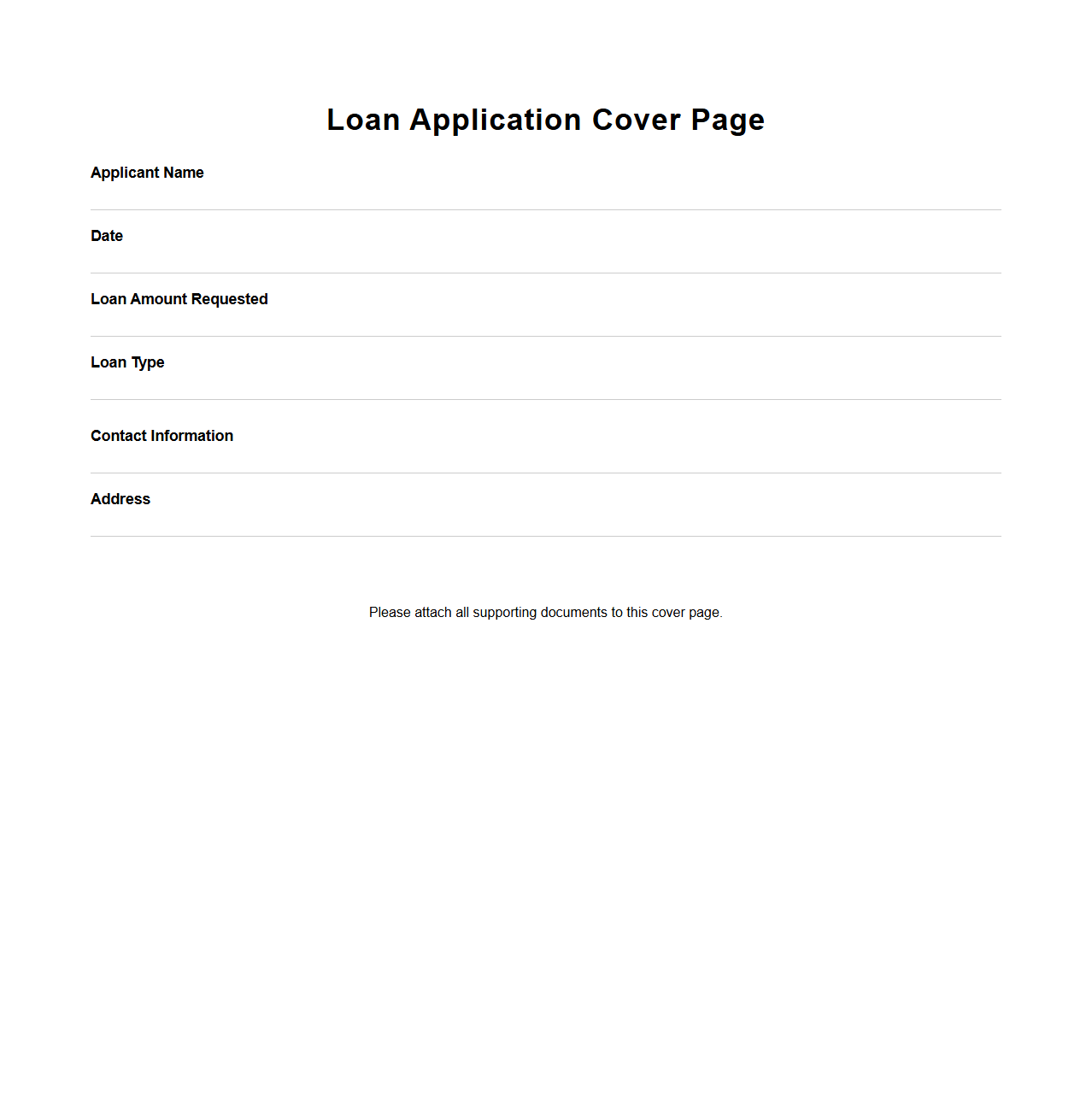

Basic Loan Application Cover Page

A

Basic Loan Application Cover Page serves as the initial summary document that accompanies a loan application, providing essential information such as the applicant's name, loan amount requested, and purpose of the loan. It helps financial institutions quickly identify and categorize the application for efficient processing and review. This cover page also often includes contact details and a brief overview of the applicant's financial background to support the loan assessment process.

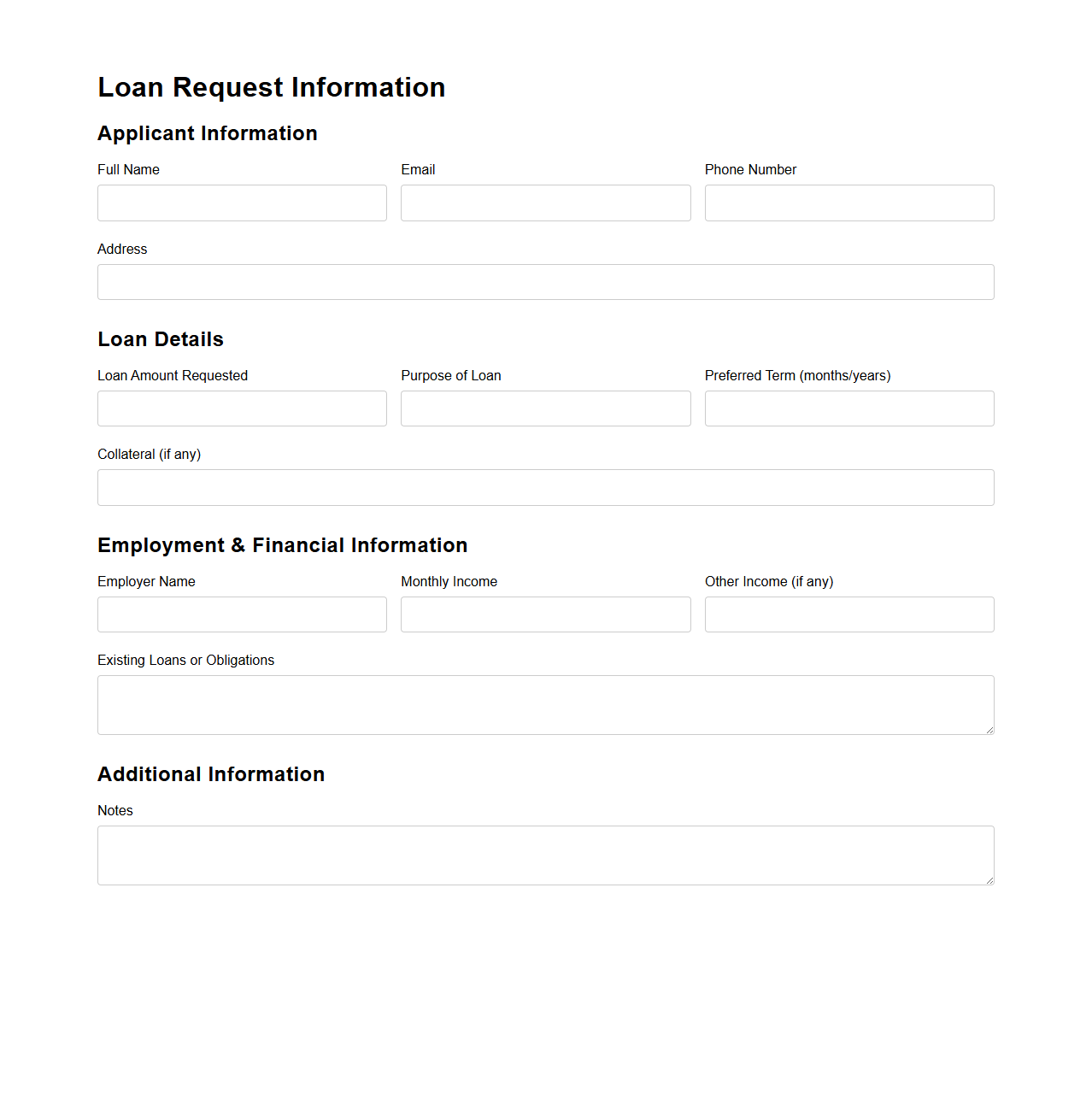

Loan Request Information Template

A

Loan Request Information Template document is a structured form used by borrowers to provide lenders with essential details about their loan application. It typically includes sections for personal information, loan amount, purpose, financial statements, and repayment plans. This template streamlines the loan evaluation process by ensuring all relevant data is accurately and consistently presented.

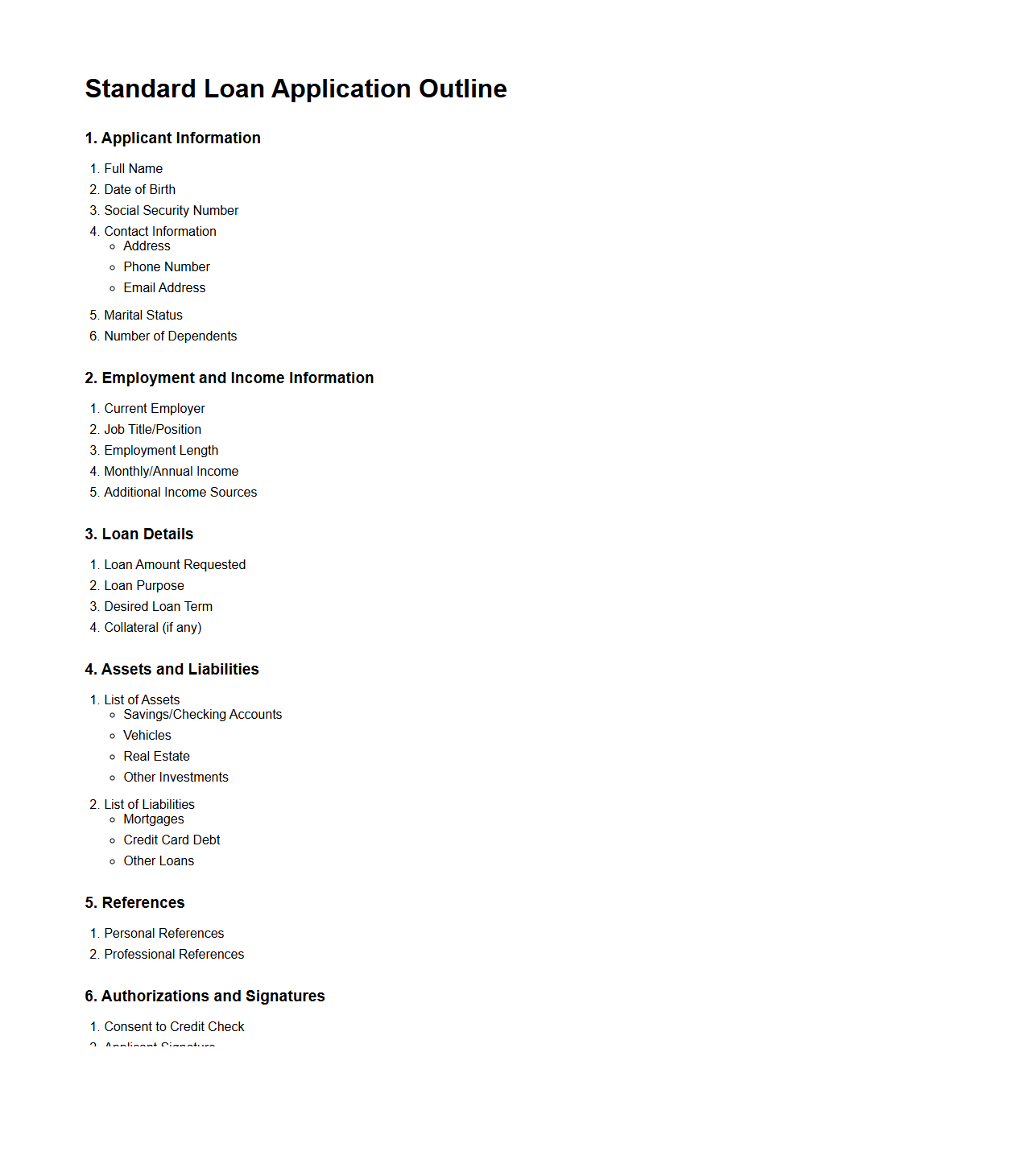

Standard Loan Application Outline

A

Standard Loan Application Outline document serves as a structured framework guiding applicants through the necessary information and documentation required to apply for a loan. It typically includes sections on personal details, financial status, loan purpose, and repayment plan, ensuring clarity and completeness in the application process. This outline helps lenders assess risk and eligibility efficiently, streamlining loan approval decisions.

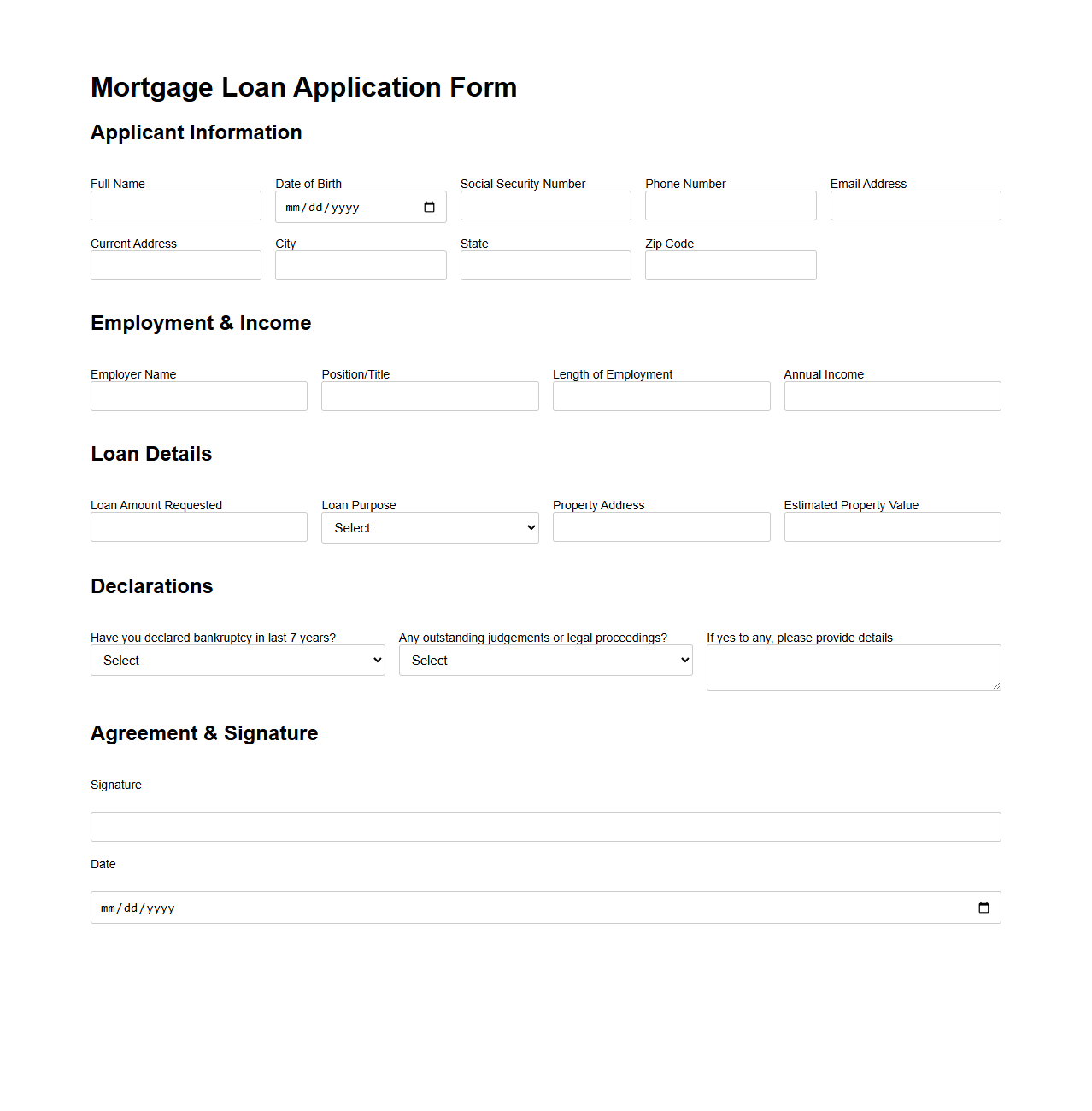

Mortgage Loan Application Form

A

Mortgage Loan Application Form is a critical document used by lenders to collect detailed financial and personal information from borrowers seeking home financing. This form typically includes sections for income verification, employment history, credit information, and property details, allowing lenders to assess the applicant's eligibility and risk. Accurate completion of this form is essential for a smooth approval process and securing favorable loan terms.

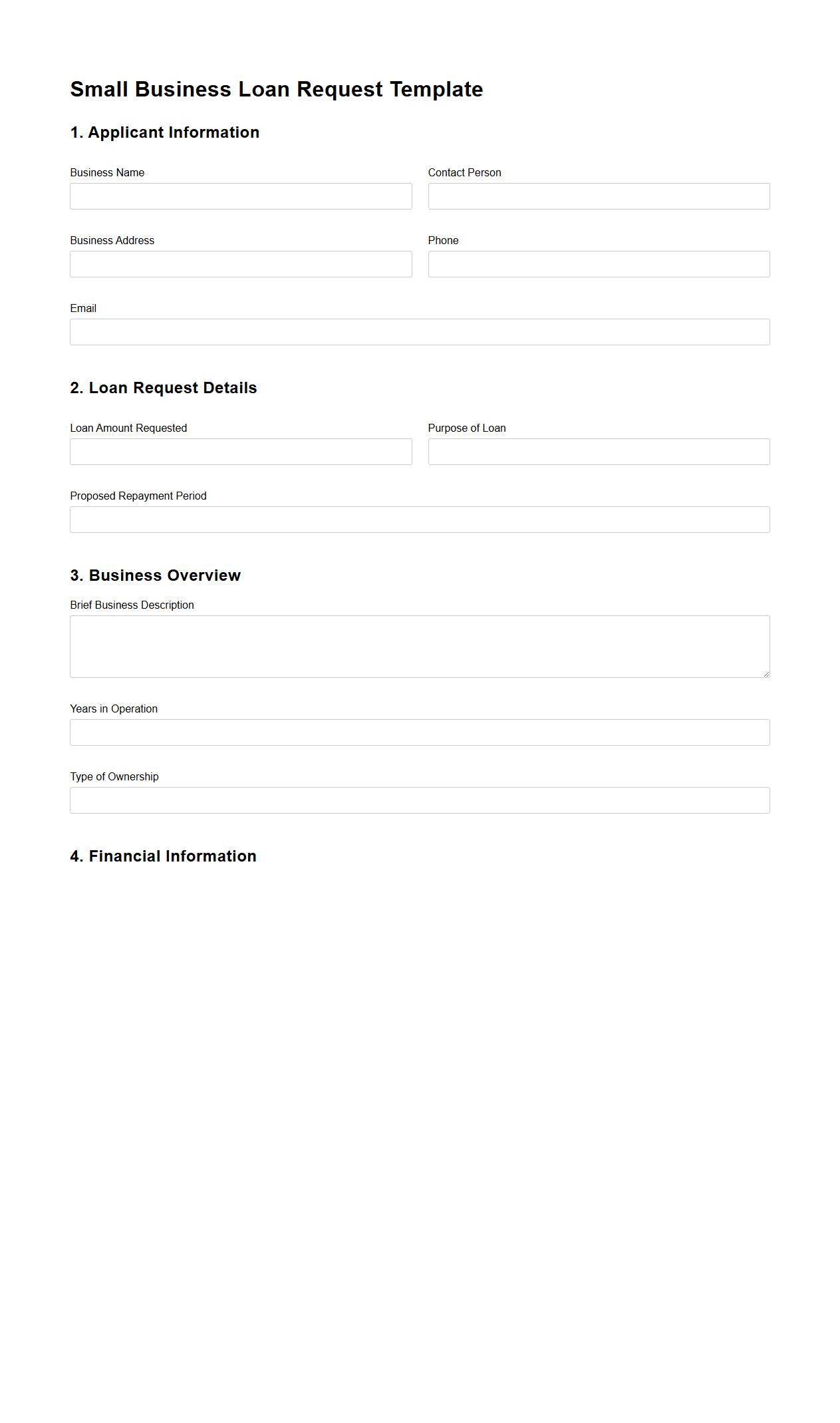

Small Business Loan Request Template

A

Small Business Loan Request Template is a structured document designed to help entrepreneurs formally present their funding needs to lenders. It typically includes sections for business background, loan amount, purpose of the loan, and financial projections, ensuring clarity and professionalism. Using this template increases the chances of approval by clearly communicating the business's financial requirements and repayment plans.

What information is mandatory on a blank loan application for first-time borrowers?

The mandatory information on a blank loan application for first-time borrowers includes personal identification details such as full name, date of birth, and Social Security number. Contact information like address, phone number, and email address must also be completed. Additionally, employment information and the loan amount requested are essential to evaluate the borrower's eligibility.

How should collateral details be formatted on a blank loan application template?

Collateral details should be clearly organized into sections specifying the type of asset, description, and estimated value. Each asset must have a dedicated field for identification numbers such as VIN for vehicles or serial numbers for equipment. Including a checkbox or signature area for authorization to verify collateral ensures completeness and clarity.

Are there compliance disclaimers required in a blank loan application for corporate entities?

Yes, compliance disclaimers are crucial in loan applications for corporate entities to meet legal requirements and protect both parties. These include statements about data privacy, truthfulness of provided information, and adherence to anti-money laundering regulations. The disclaimers should be clearly visible and acknowledged by an authorized corporate representative.

What is the preferred section layout for income sources on a blank loan application?

The preferred layout for income sources features separate fields for each type of income such as salary, business income, and other revenue streams. Each section should allow detailed entries including employer name, position, duration, and monthly or annual income amount. Grouping income sources by stability and verification requirements helps streamline the application review.

How do you indicate co-applicant details on a blank loan application form?

Co-applicant details should be entered in a distinct section labeled clearly as Co-applicant Information. This section must mirror the primary applicant's fields, including personal, contact, and employment data to facilitate joint application processing. Providing a signature line for the co-applicant ensures consent and legal acknowledgment of the loan terms.

More Application Templates