A Blank Insurance Application Template for Coverage Requests provides a structured format for individuals or businesses to accurately submit their insurance coverage needs. This template ensures all necessary information, such as personal details, coverage types, and risk factors, is clearly documented to streamline the approval process. Using a standardized form reduces errors and accelerates communication between applicants and insurance providers.

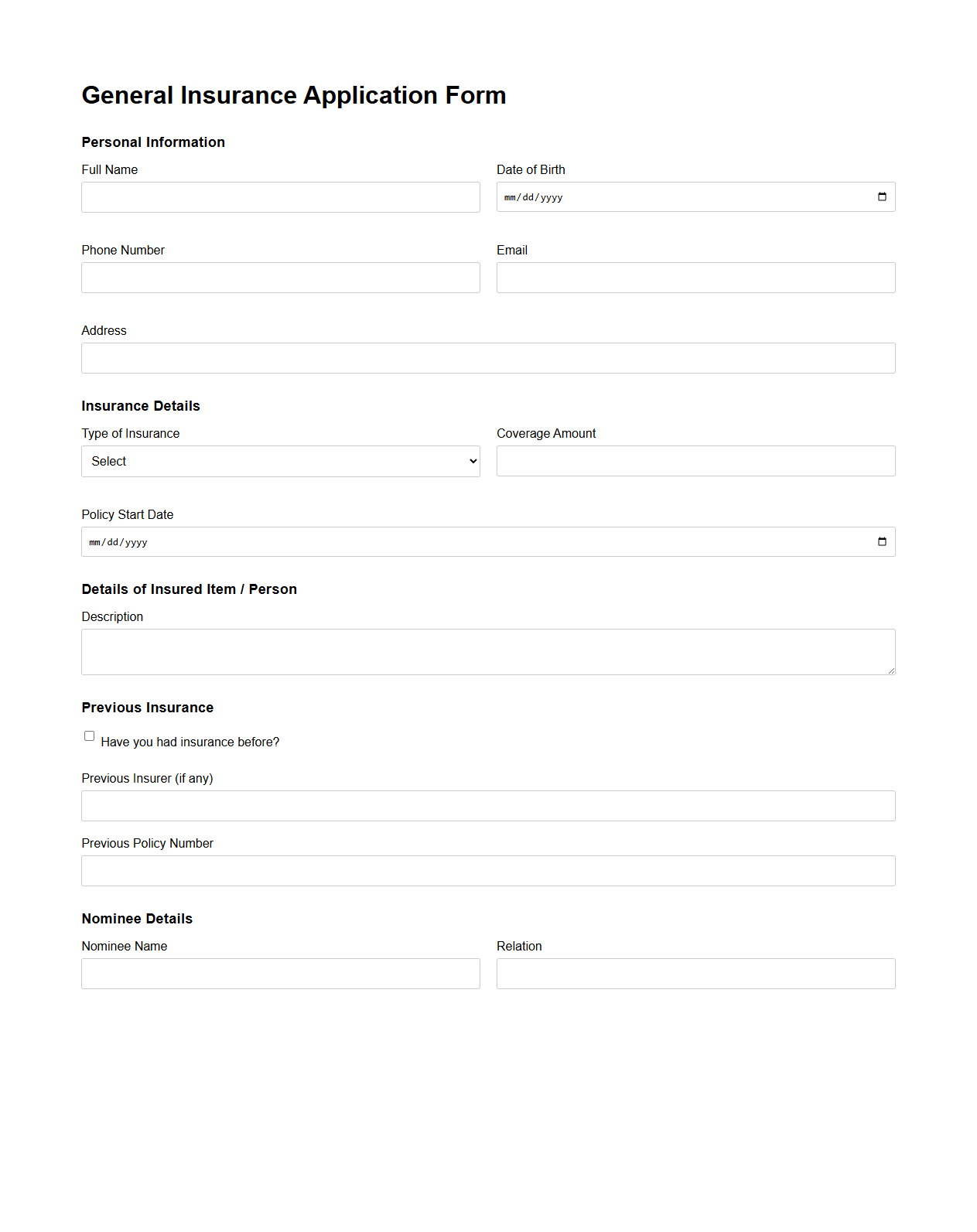

General Insurance Application Form Template

A General Insurance Application Form Template is a structured document designed to collect essential information from applicants seeking insurance coverage. It typically includes sections for personal details, coverage options, risk assessment, and policy preferences, enabling insurers to evaluate and process applications efficiently. Using a

General Insurance Application Form Template streamlines data collection and ensures uniformity across different insurance products.

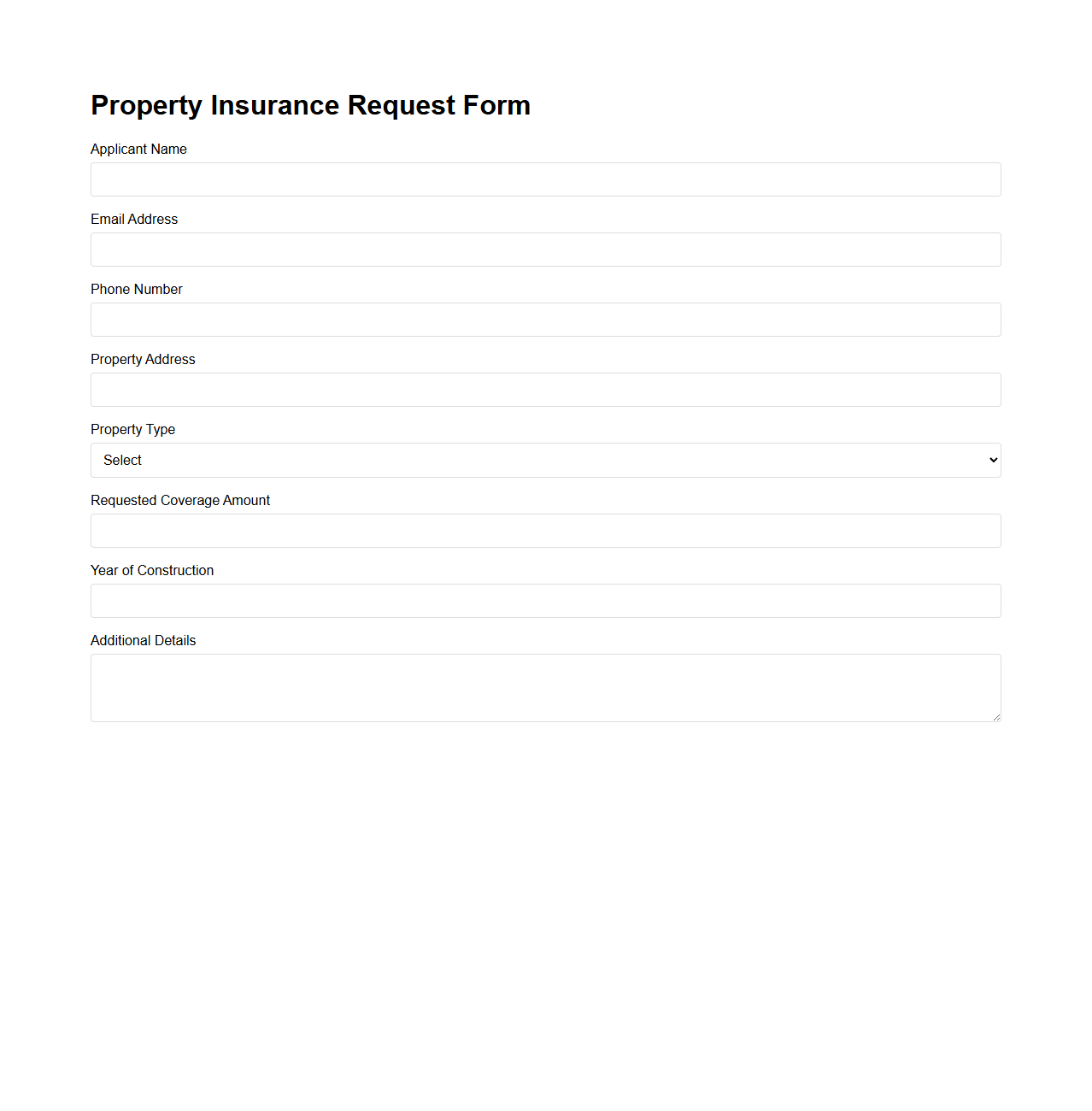

Property Insurance Request Form Template

A

Property Insurance Request Form Template is a standardized document used to facilitate the submission of property insurance coverage requests. It collects essential details such as property location, valuation, and coverage requirements, enabling insurance providers to assess risk and provide accurate quotations. This template streamlines the application process by ensuring consistent and comprehensive information exchange between policyholders and insurers.

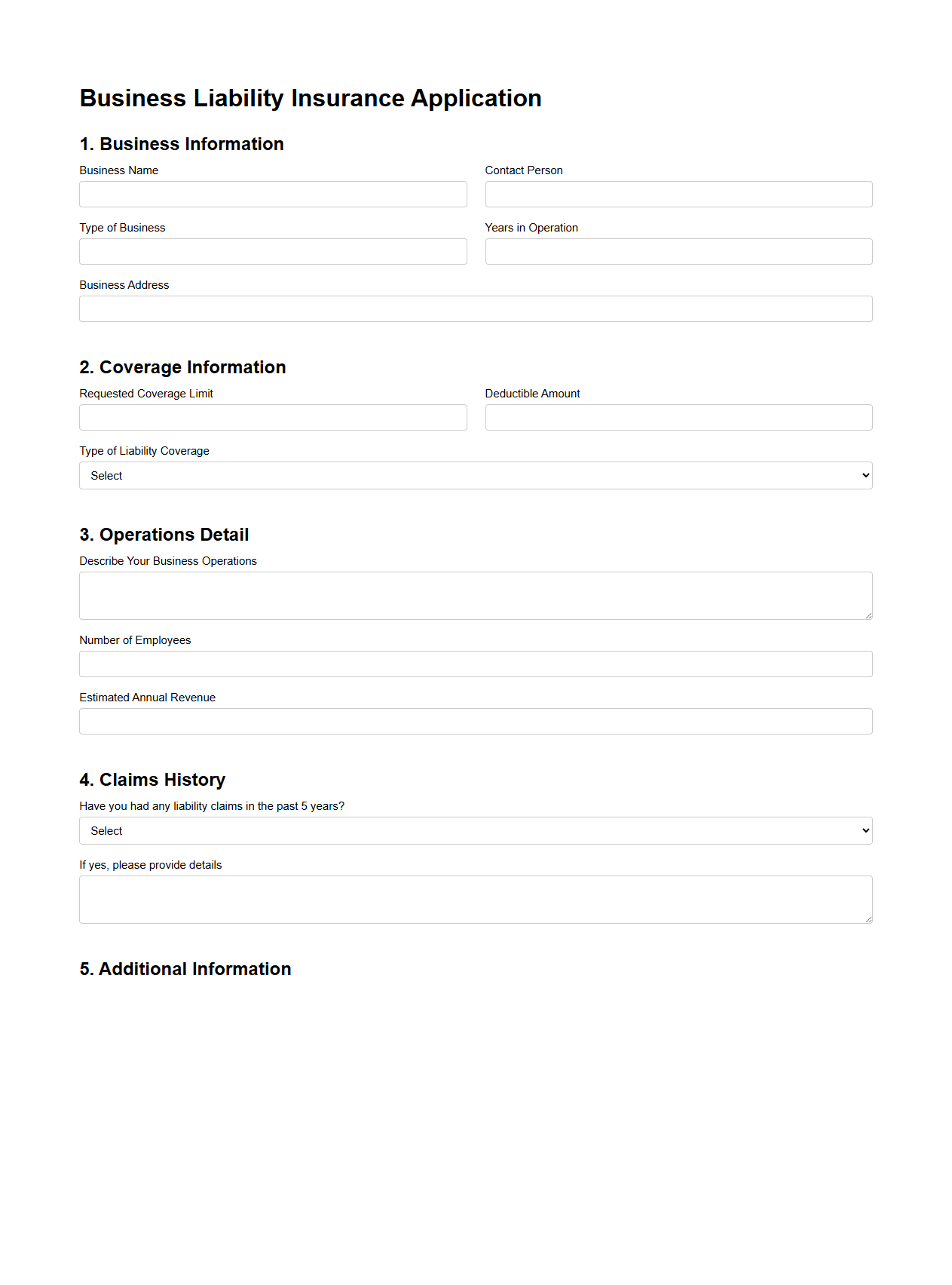

Business Liability Insurance Application Template

A

Business Liability Insurance Application Template is a structured document designed to collect essential information from businesses seeking liability insurance coverage. It typically includes sections for business details, risk assessment, coverage requirements, and prior claims history, enabling insurers to evaluate the level of risk and determine appropriate policy terms. This template streamlines the application process, ensuring accuracy and consistency in gathering critical data for underwriting purposes.

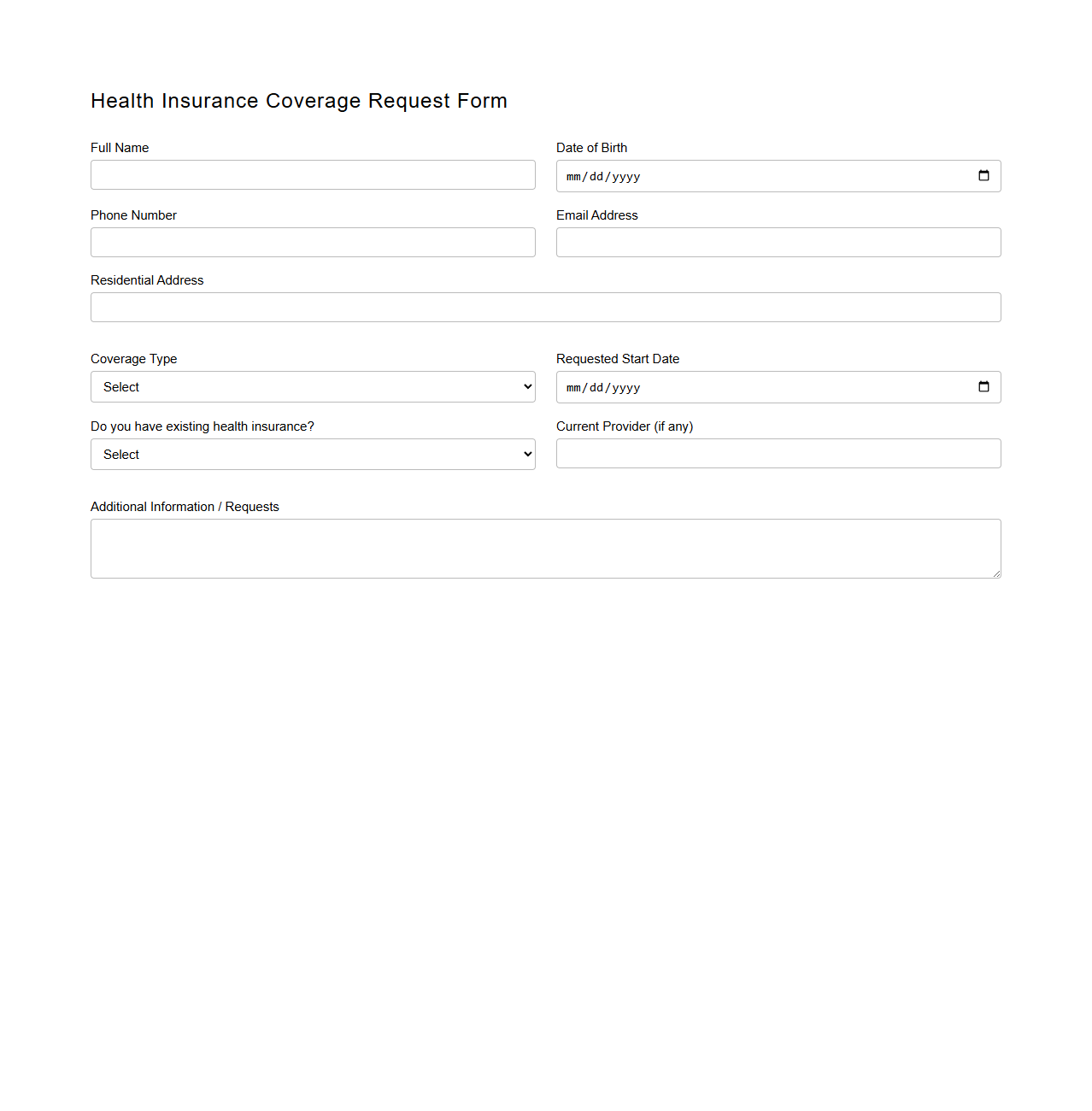

Health Insurance Coverage Request Form

A

Health Insurance Coverage Request Form is a document used to apply for or modify health insurance benefits, ensuring the applicant's medical care is financially supported. It captures essential personal information, policy details, and specific coverage requirements to facilitate the insurer's evaluation and approval process. Accurate completion of this form is crucial for timely access to insured medical services and claims processing.

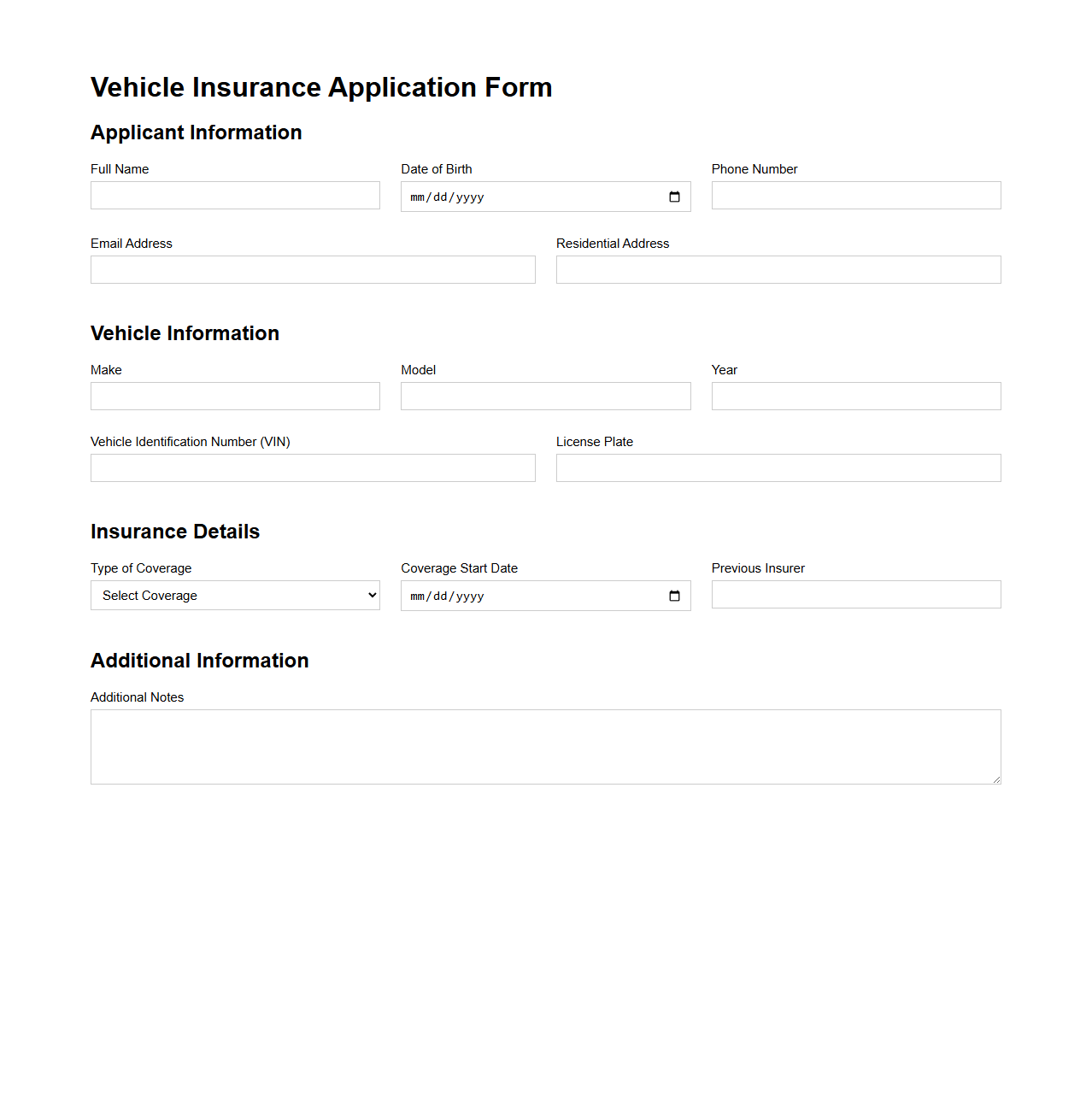

Vehicle Insurance Application Form Template

A

Vehicle Insurance Application Form Template is a standardized document used to collect essential information from applicants seeking vehicle insurance coverage. It typically includes sections for personal details, vehicle specifications, coverage preferences, and previous insurance history, streamlining the application process. This template aids insurers in assessing risk accurately and facilitating prompt policy issuance.

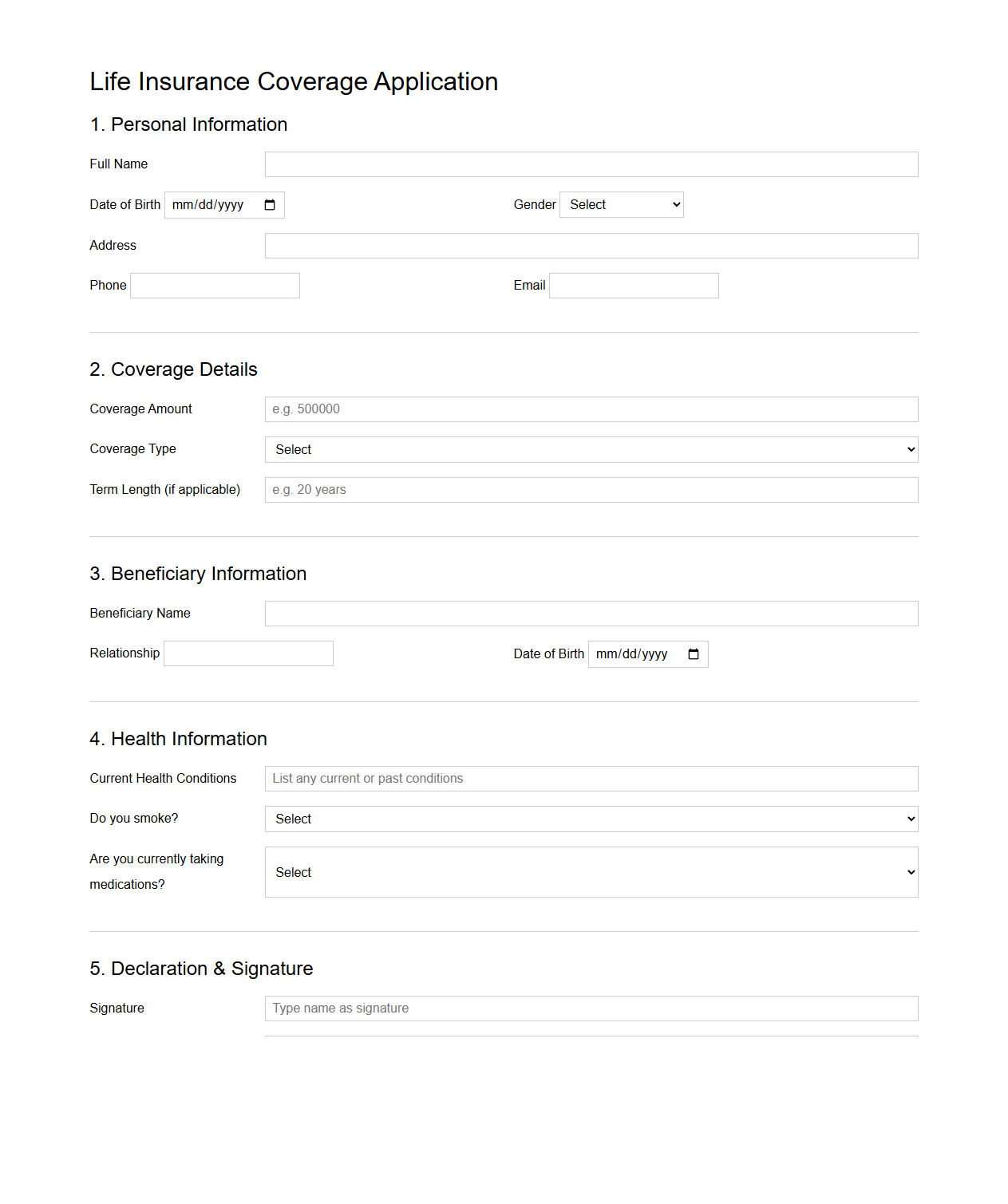

Life Insurance Coverage Application Template

A

Life Insurance Coverage Application Template document streamlines the process of applying for life insurance by providing a standardized format for collecting essential personal, health, and beneficiary information. This template helps ensure accuracy and consistency in submitting applications, reducing errors and processing time. It serves as a critical tool for both applicants and insurers to facilitate efficient evaluation and approval of life insurance coverage.

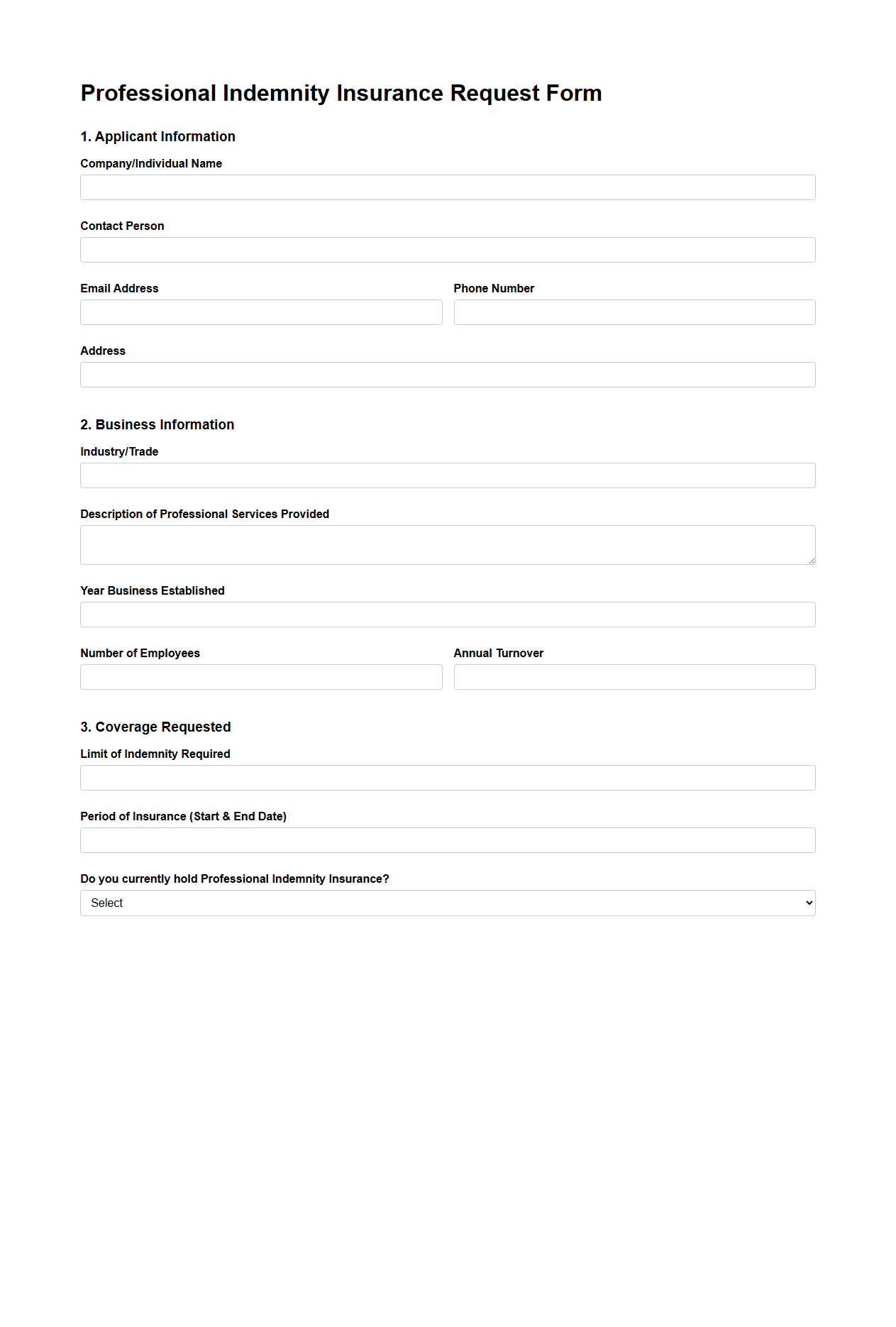

Professional Indemnity Insurance Request Form

The

Professional Indemnity Insurance Request Form is a crucial document used by professionals to apply for coverage that protects against claims of negligence, errors, or omissions during their services. This form gathers essential information about the applicant's business activities, previous claims history, and coverage requirements to assess risk accurately. Submitting this document enables insurance providers to create tailored policies that safeguard professionals from potential financial liabilities.

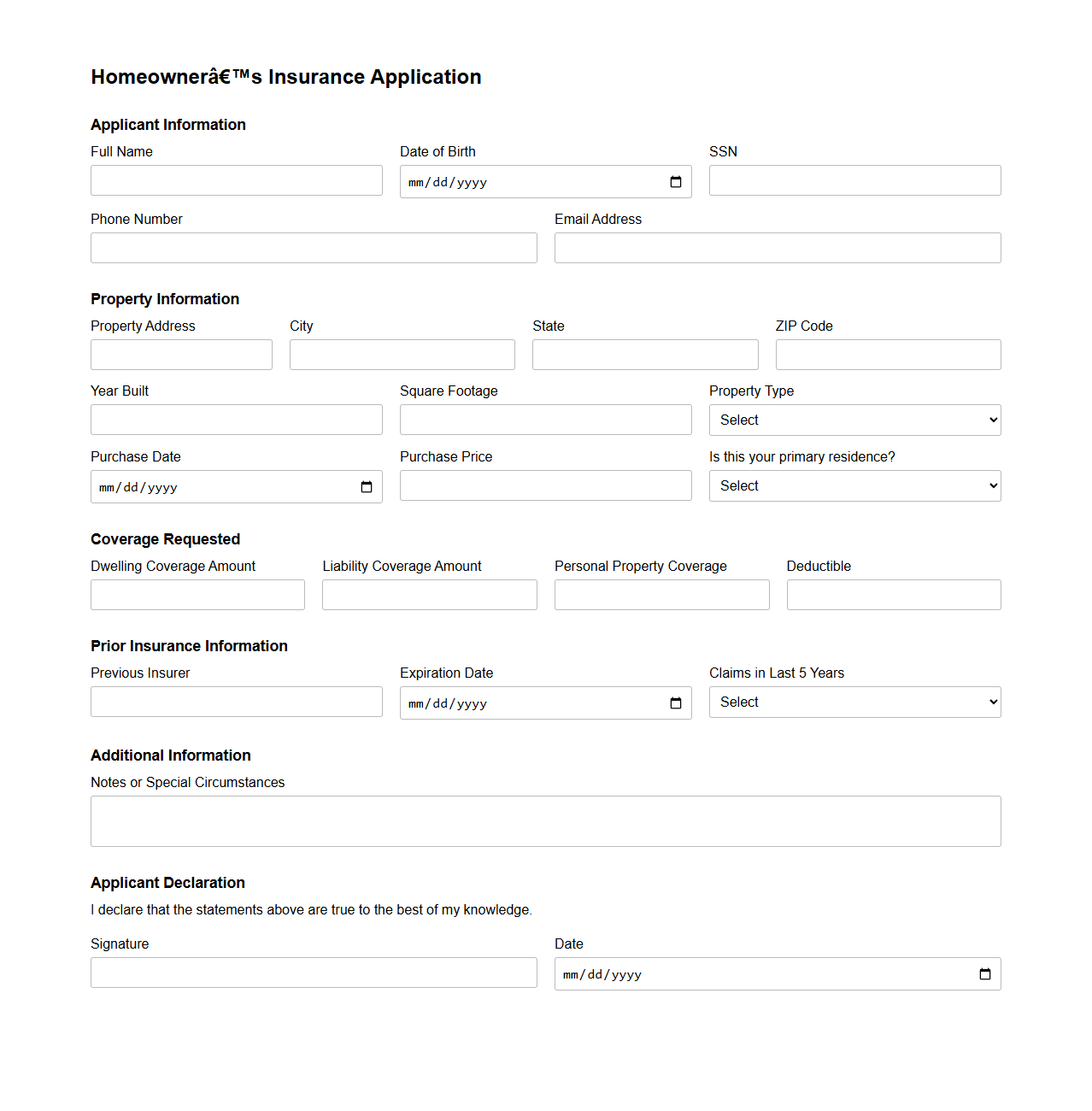

Homeowner’s Insurance Application Blank

A

Homeowner's Insurance Application Blank is a standardized form used to collect essential information from applicants seeking property insurance coverage. It typically includes details about the property, coverage preferences, and the applicant's personal and financial information to assess risk accurately. Insurance companies use this document to determine eligibility and calculate premiums for homeowner's insurance policies.

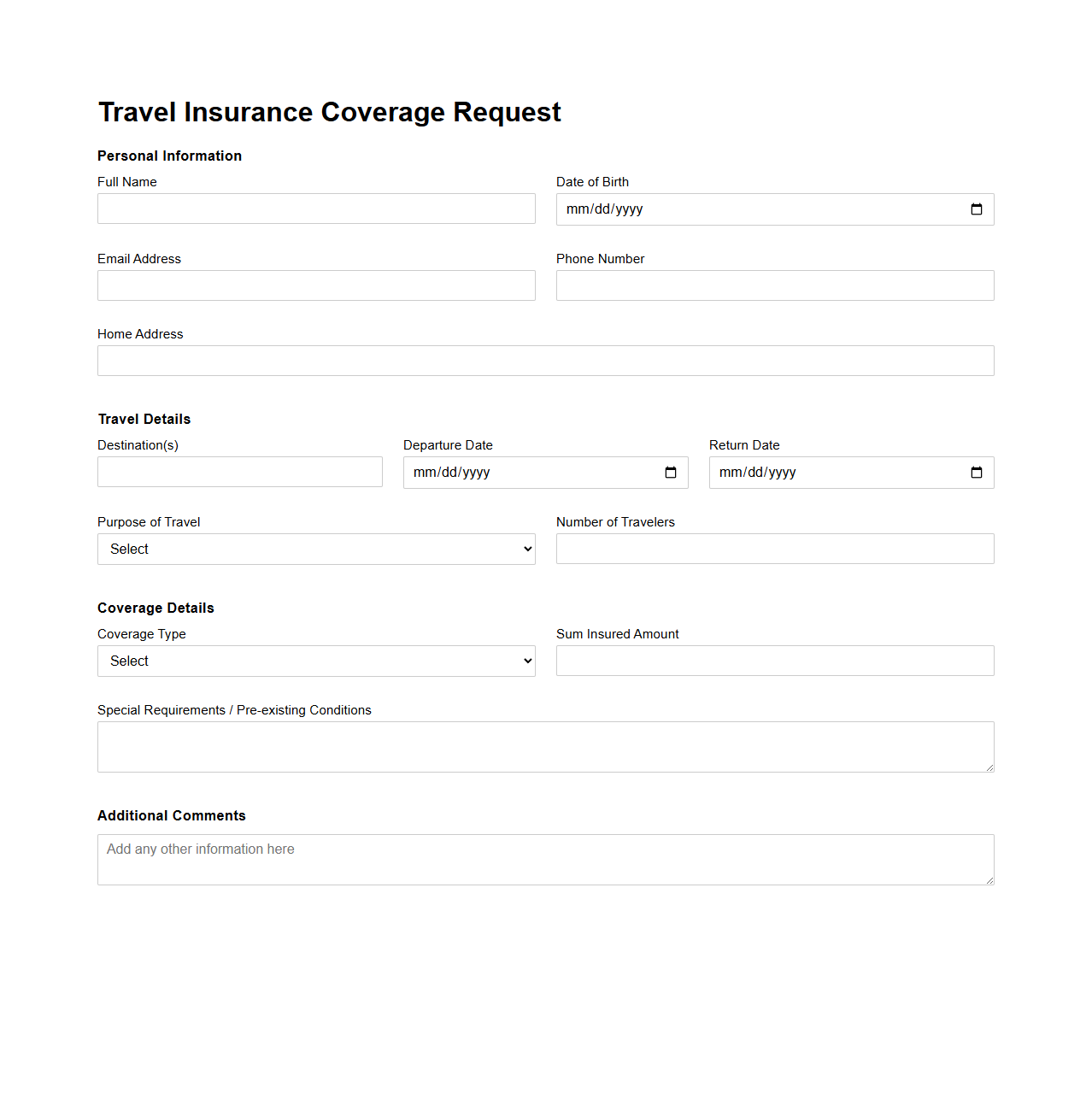

Travel Insurance Coverage Request Template

A

Travel Insurance Coverage Request Template document is a structured form used by policyholders to formally request the details or activation of their travel insurance benefits. It outlines essential information such as the insured's personal details, trip specifics, coverage types, and any claims or inquiries related to the policy. This template ensures clear communication between the traveler and the insurance provider, facilitating efficient processing of coverage verification or claim requests.

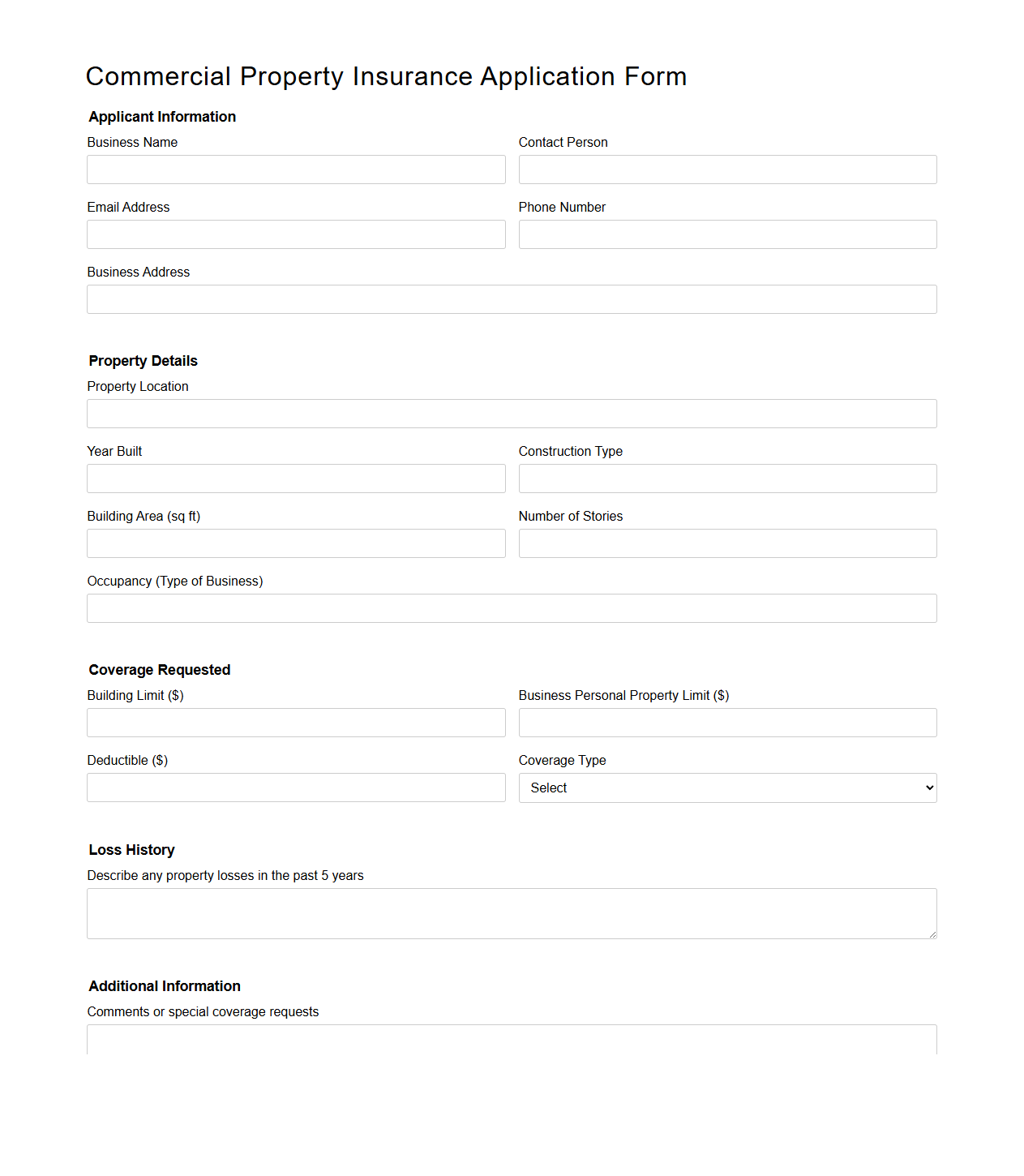

Commercial Property Insurance Application Form

The

Commercial Property Insurance Application Form is a crucial document used by businesses to request coverage for their physical assets, including buildings, equipment, and inventory. It collects detailed information about the property's location, value, ownership, and risk factors to assess eligibility and determine premium rates. Accurate completion of this form ensures appropriate protection against losses from events like fire, theft, or natural disasters.

What essential personal details are required on a blank insurance application for coverage requests?

When filling out a blank insurance application, it is crucial to provide accurate personal details such as full name, date of birth, and social security number. Contact information including address, phone number, and email must also be included to facilitate communication. Additionally, employment details and income information are often required to assess risk and eligibility.

Which supporting documents must accompany a blank insurance application form?

A blank insurance application must be accompanied by essential supporting documents like a government-issued ID for identity verification. Proof of income, such as recent pay stubs or tax returns, is necessary to validate financial status. Medical records or health reports may also be required depending on the type of insurance coverage requested.

How do you specify coverage limits in a blank insurance application letter?

Coverage limits should be clearly specified in the application by stating the desired maximum coverage amount for the policy. Applicants must indicate the type of coverage they need and detail any specific limits per category if applicable. This clarity helps the insurer tailor the policy to the applicant's needs accurately.

What are the common errors to avoid when filling out a blank insurance application?

Common errors include providing incomplete or inconsistent information, which can lead to application delays or denial. It's important to avoid leaving any fields blank unless instructed and to double-check all entries for accuracy. Misunderstanding coverage terms or unintentionally underestimating required coverage limits are mistakes that should also be avoided.

How is beneficiary information recorded on a blank insurance application?

Beneficiary information must be recorded by providing the full name, relationship to the applicant, and contact details of the individual(s) designated to receive benefits. It's essential to specify the distribution percentages if multiple beneficiaries are named. Clear and precise beneficiary details ensure that insurance benefits are distributed according to the applicant's wishes.

More Application Templates