The Blank Annual Budget Template for Small Business provides a clear and organized framework to track income, expenses, and financial goals throughout the year. It helps small business owners manage cash flow effectively while ensuring accurate forecasting and expense control. Using this template enhances financial planning and supports informed decision-making for sustainable growth.

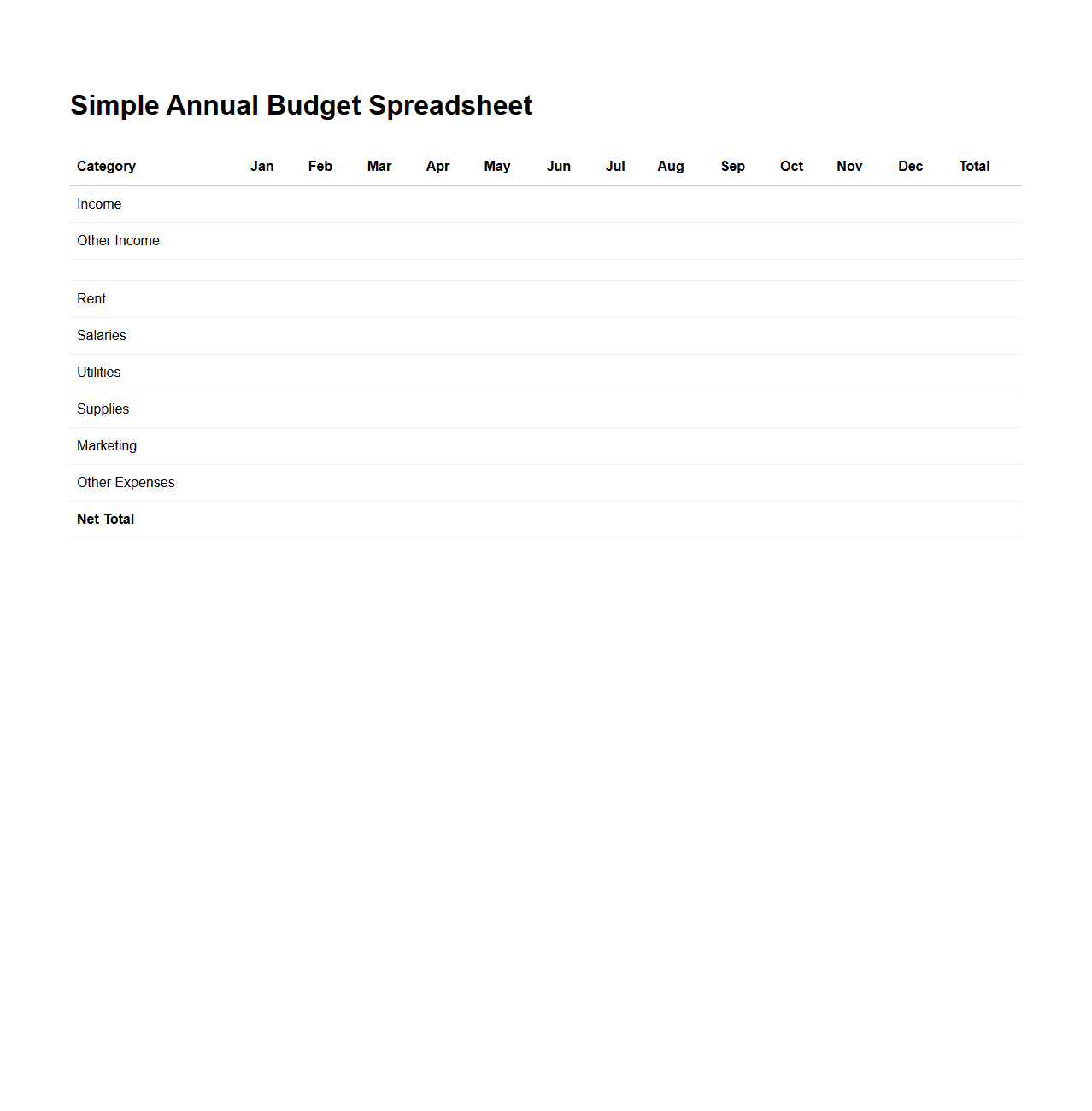

Simple Annual Budget Spreadsheet for Small Business

A

Simple Annual Budget Spreadsheet for Small Business is a financial planning tool designed to help entrepreneurs track income, expenses, and profit over a 12-month period. It organizes revenue streams, fixed and variable costs, and projections in an easy-to-understand format, enabling effective cash flow management and strategic decision-making. This document supports small business owners in maintaining financial discipline and achieving sustainability by providing a clear overview of their economic performance throughout the year.

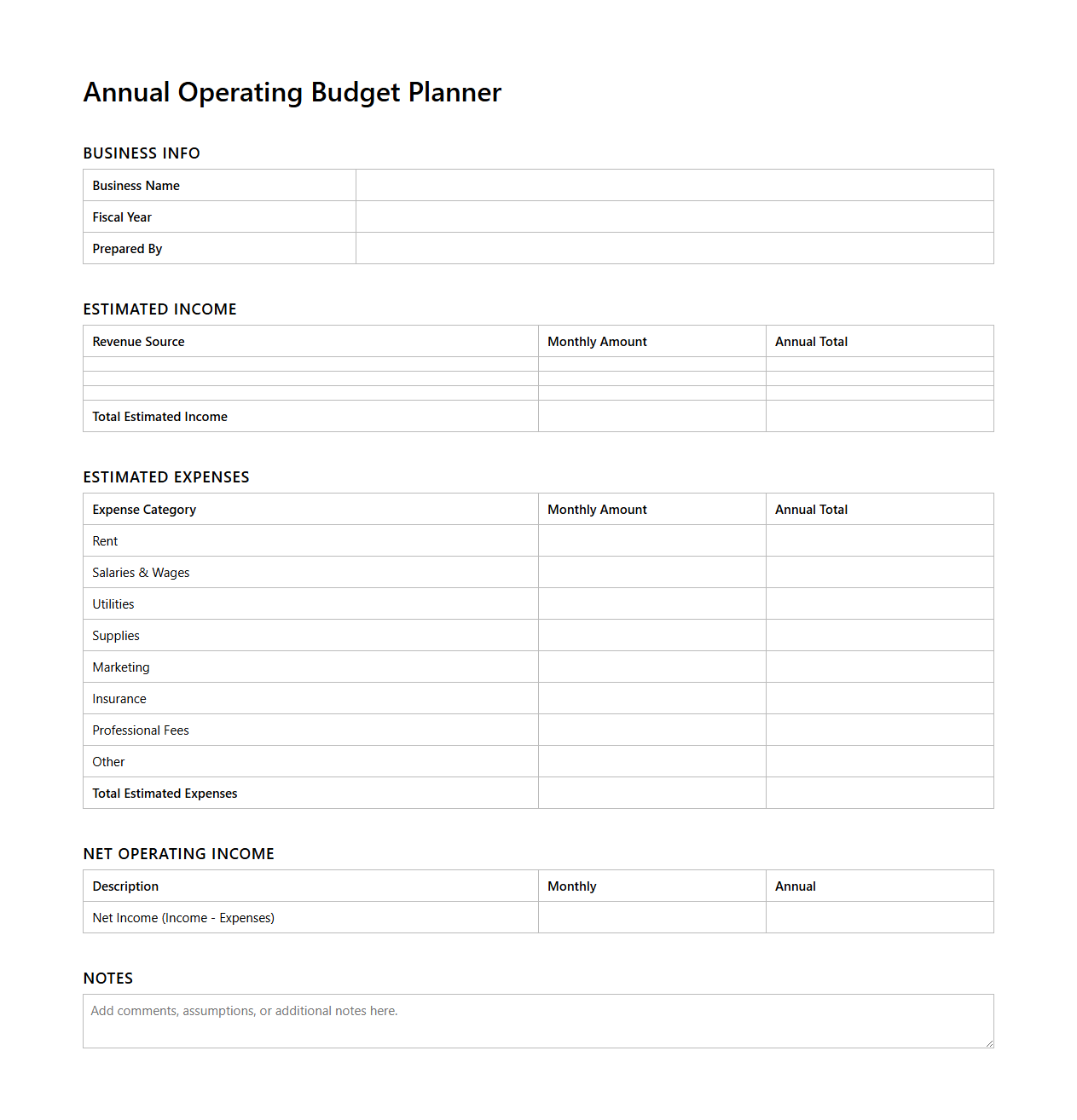

Annual Operating Budget Planner for Small Business

The

Annual Operating Budget Planner for Small Business is a financial tool designed to help entrepreneurs effectively allocate resources and forecast expenses and revenues over a 12-month period. It enables precise tracking of operational costs such as salaries, utilities, and inventory, ensuring better cash flow management and informed decision-making. This planner supports strategic planning by providing a clear overview of financial commitments and anticipated income, ultimately driving business growth and stability.

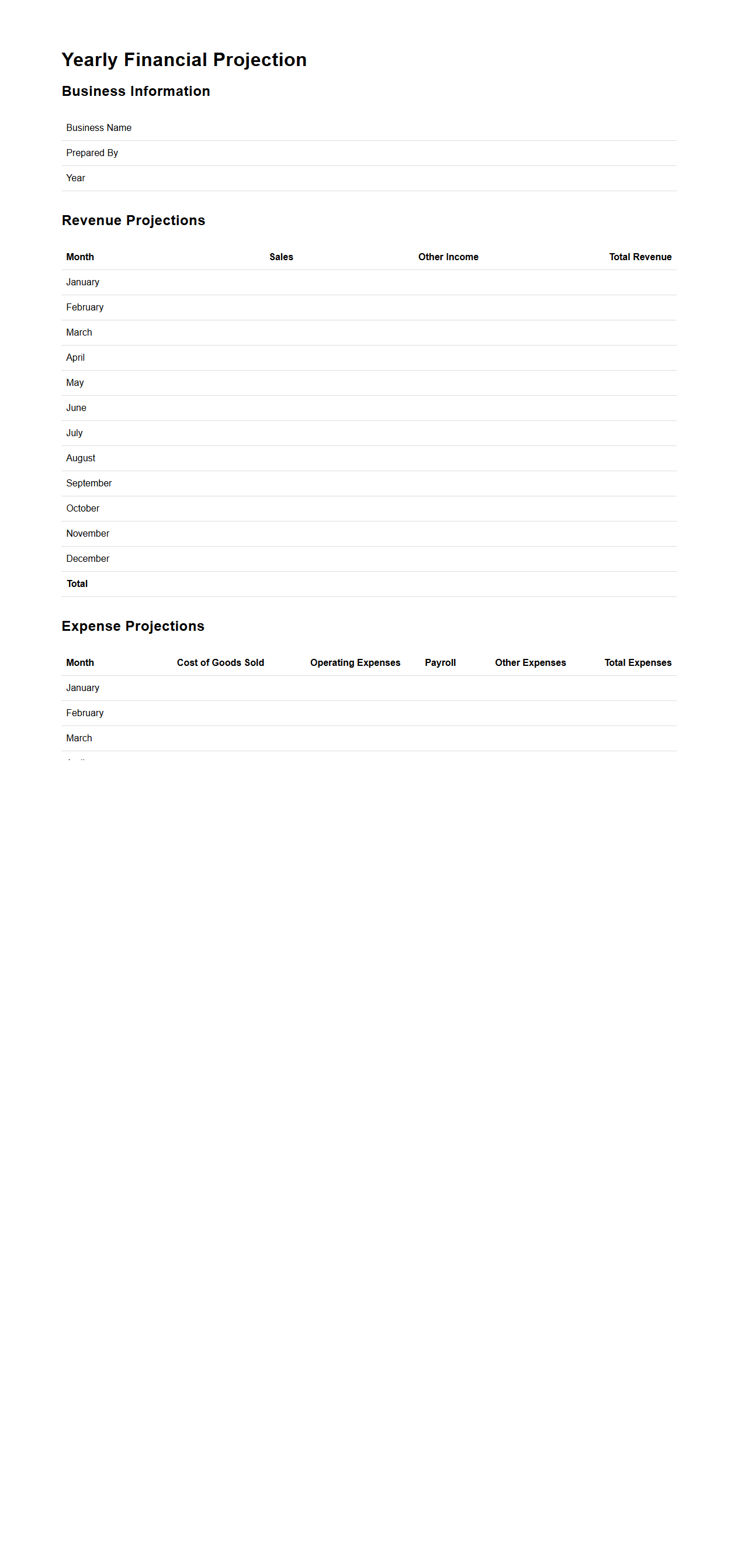

Small Business Yearly Financial Projection Template

A

Small Business Yearly Financial Projection Template document is a structured tool designed to estimate a company's revenue, expenses, and profitability over a 12-month period. It helps business owners forecast cash flow, budget effectively, and plan for growth by providing detailed financial insights based on historical data and market trends. This template is essential for making informed decisions, securing funding, and tracking financial performance throughout the fiscal year.

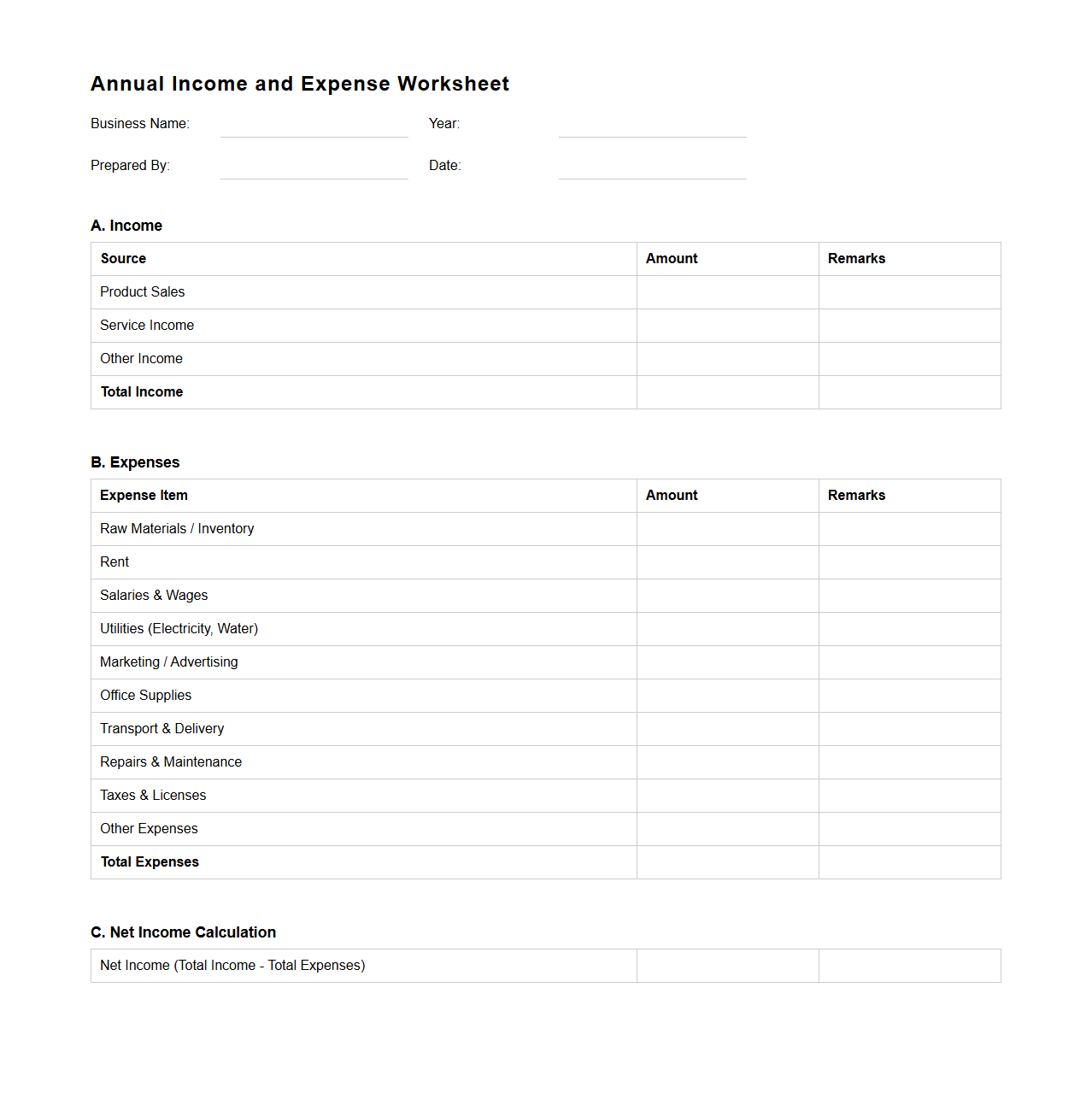

Annual Income and Expense Worksheet for Small Enterprise

An

Annual Income and Expense Worksheet for Small Enterprises is a financial document used to track and summarize a business's total revenues and expenditures over a fiscal year. It helps small business owners assess their profitability, manage cash flow, and prepare accurate tax filings. This worksheet typically includes categories such as sales income, operating expenses, salaries, and other financial transactions.

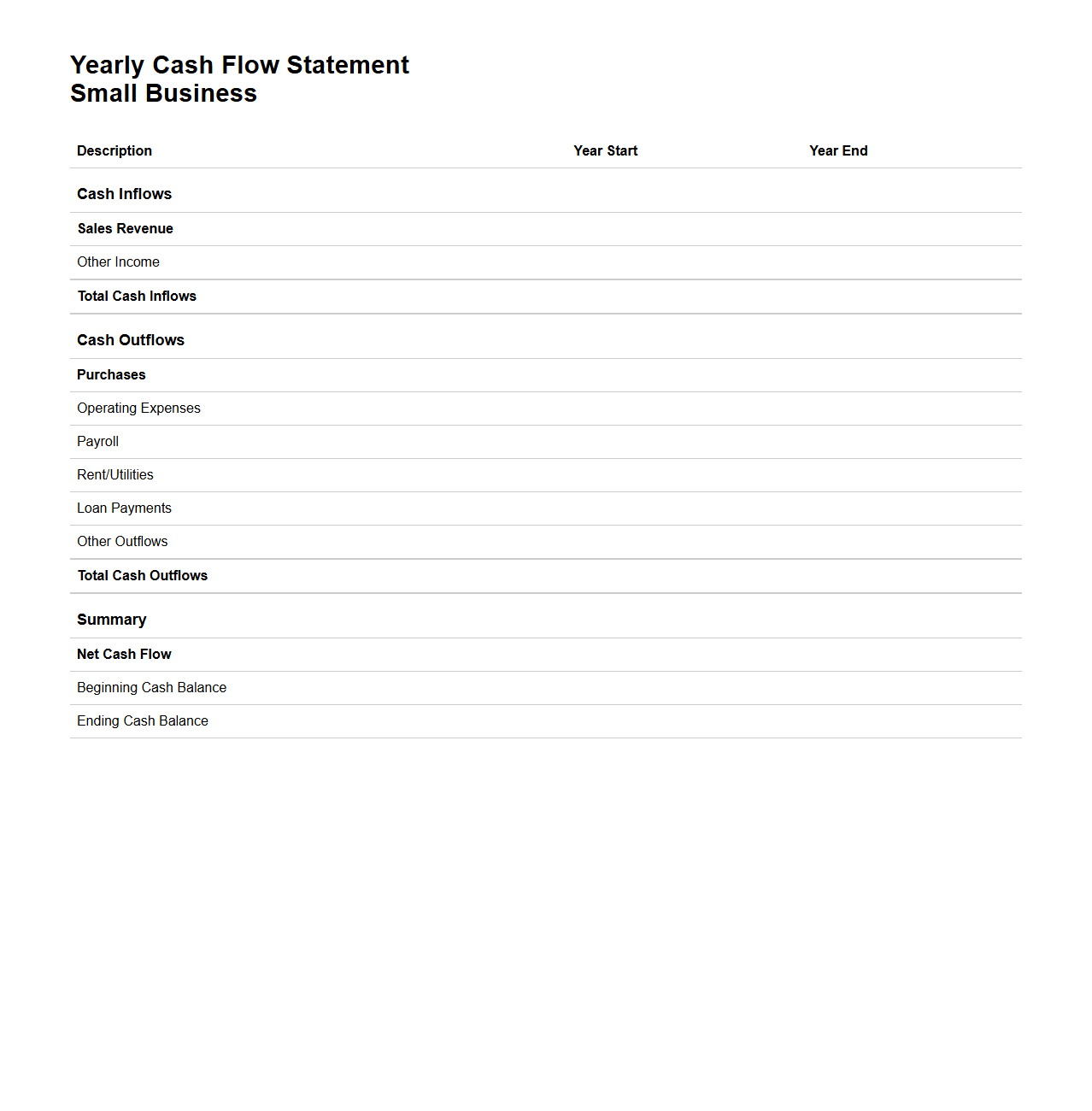

Yearly Cash Flow Statement Template for Small Business

A

Yearly Cash Flow Statement Template for Small Business is a financial document designed to track and project the inflows and outflows of cash over a 12-month period. It helps small business owners monitor liquidity, manage expenses, and forecast future financial health. This template typically includes sections for operating activities, investing activities, and financing activities, ensuring comprehensive cash flow management.

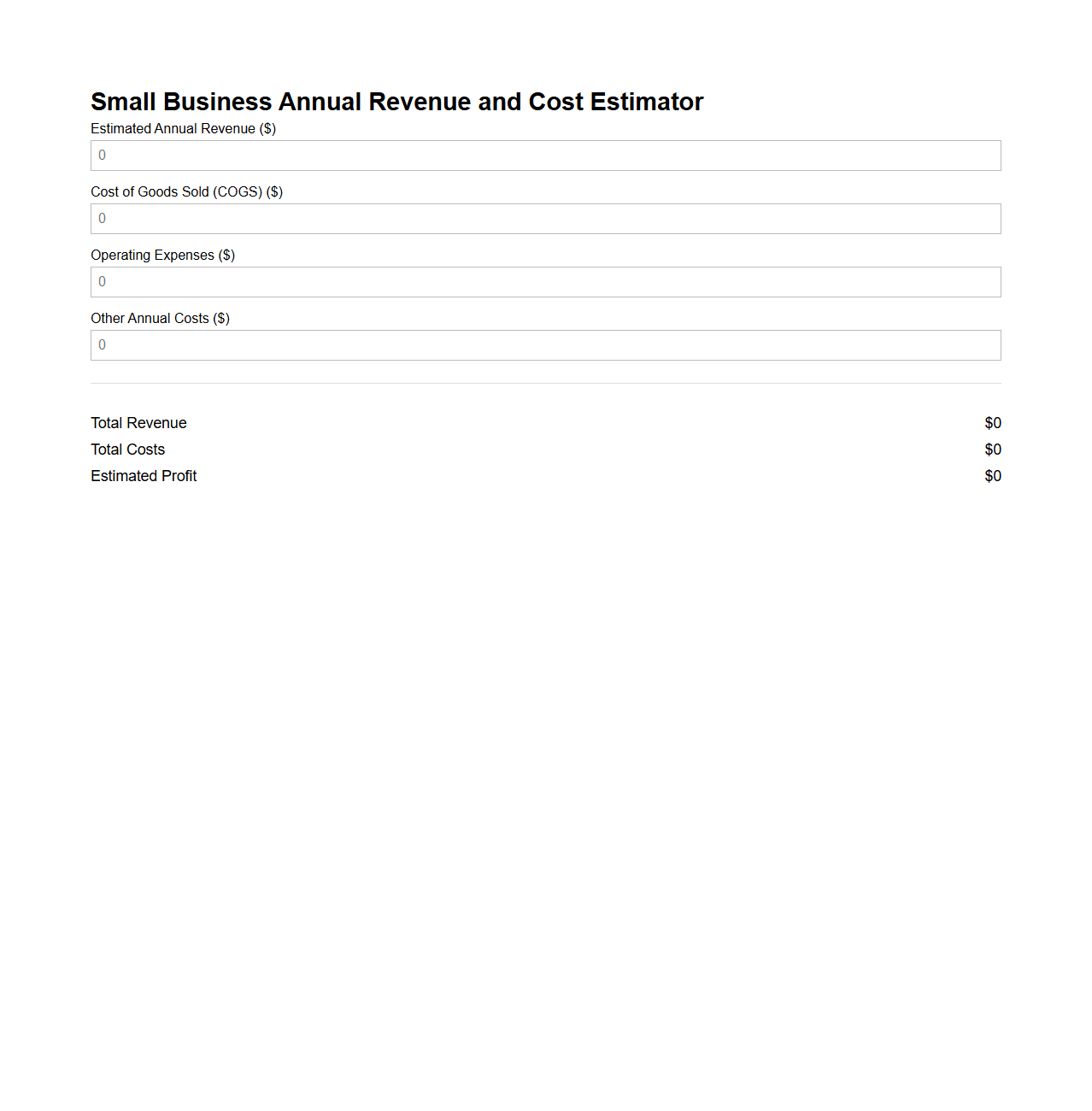

Small Business Annual Revenue and Cost Estimator

The

Small Business Annual Revenue and Cost Estimator document is a crucial financial planning tool designed to help small businesses project their yearly income and expenses accurately. This document typically includes detailed breakdowns of expected sales, operating costs, fixed and variable expenses, enabling business owners to make informed budgeting decisions. Accurate estimations within this document support cash flow management, profitability analysis, and strategic growth planning for small enterprises.

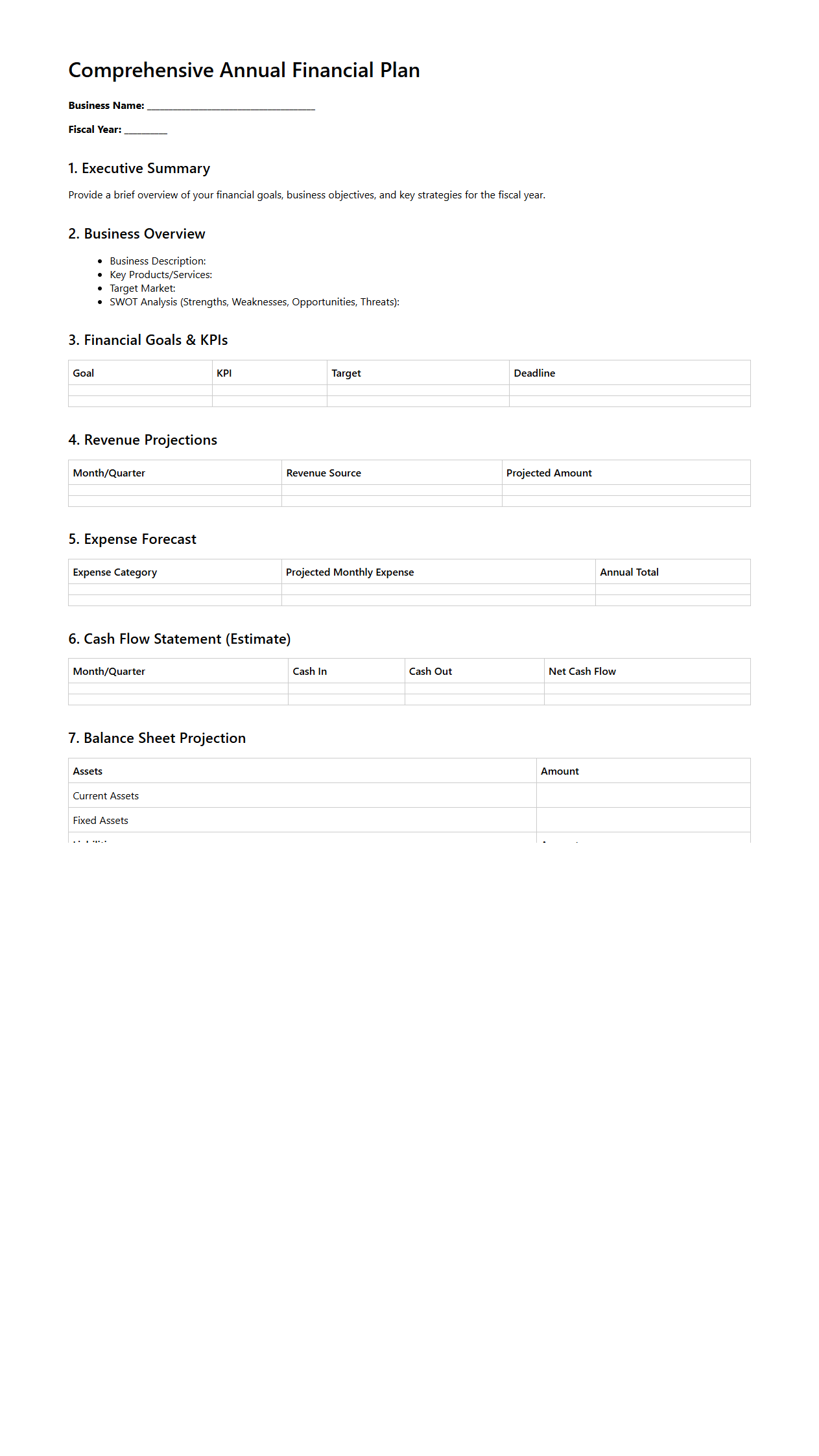

Comprehensive Annual Financial Plan Template for Small Business

A

Comprehensive Annual Financial Plan Template for small businesses is a structured document designed to outline projected revenues, expenses, cash flow, and budgeting strategies over a one-year period. It helps entrepreneurs manage financial resources effectively by providing clear forecasts and benchmarks for performance evaluation. This template serves as a crucial tool for strategic planning, securing funding, and ensuring sustainable business growth.

12-Month Budget Tracking Sheet for Small Business

A

12-Month Budget Tracking Sheet for small businesses is a financial tool designed to monitor income, expenses, and cash flow over an entire year. It enables business owners to set monthly budget goals, track actual spending against projections, and identify variances to maintain financial control. This document supports informed decision-making and helps ensure profitability and sustainability by providing a clear overview of financial performance.

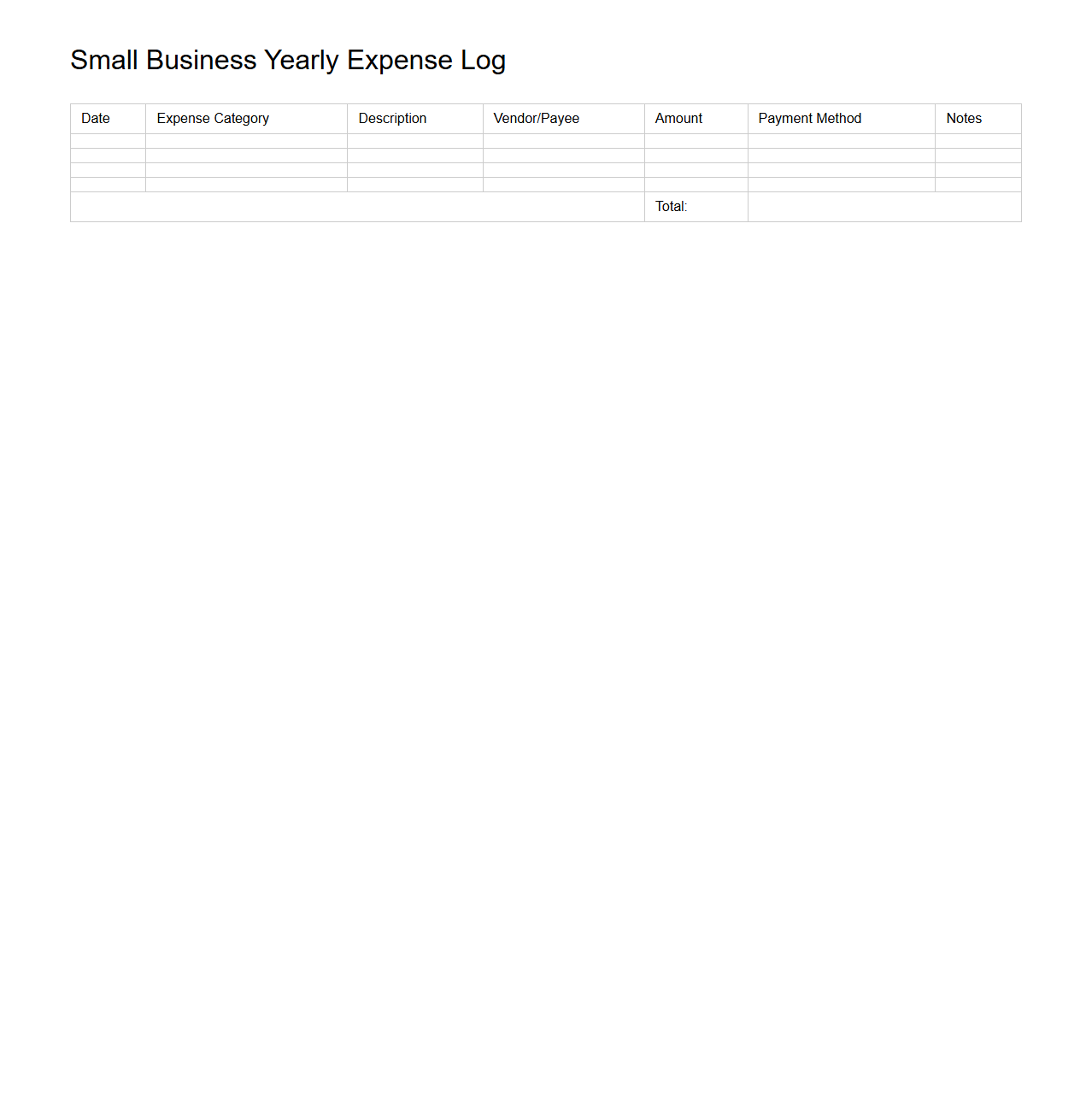

Small Business Yearly Expense Log Template

A

Small Business Yearly Expense Log Template document is a structured tool designed to help entrepreneurs systematically track and categorize their annual expenses. This template ensures accurate financial record-keeping by organizing costs such as rent, utilities, payroll, and supplies in one easy-to-reference format. Using this log supports efficient budgeting, tax preparation, and financial analysis for small business owners.

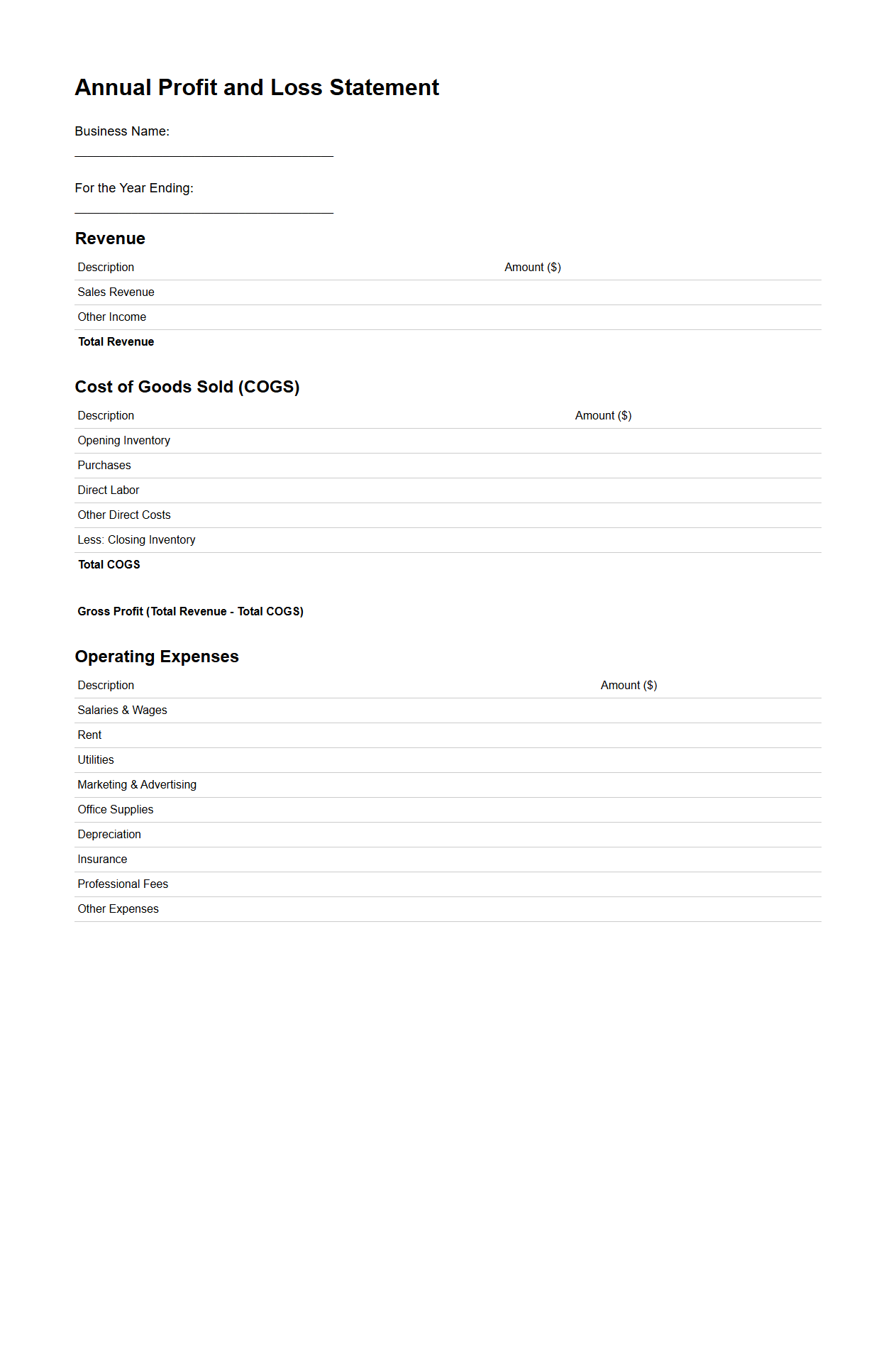

Annual Profit and Loss Statement Format for Small Business

The

Annual Profit and Loss Statement Format for Small Business document provides a structured template to summarize a company's revenues, costs, and expenses over a fiscal year. It helps small business owners analyze their financial performance by detailing income streams, operational costs, and net profit or loss. This format ensures clear financial reporting, aiding in strategic decision-making and tax preparation.

What are the essential line items to include in a blank annual budget template for a small business?

A small business annual budget template should include key line items such as revenue streams, cost of goods sold (COGS), and operating expenses. It is critical to list all fixed and variable expenses separately to track costs accurately. Additionally, include capital expenditures and cash flow projections to maintain a comprehensive budget overview.

How can you project variable versus fixed expenses in a small business budget letter?

To project variable versus fixed expenses, start by categorizing costs based on their behavior relative to sales volume. Fixed expenses remain constant regardless of sales, while variable expenses fluctuate with production or sales levels. Use historical data and industry benchmarks to forecast these expenses accurately in the budget letter.

What best practices ensure accuracy when filling out a blank annual budget document for small businesses?

Ensuring accuracy requires thorough data collection from past financial records and realistic forecasting assumptions. Regularly reviewing and updating the budget document as new information arises helps maintain precision. Moreover, involving multiple stakeholders can reduce errors and improve the budget's overall reliability and alignment with business goals.

Which financial ratios should be monitored in a small business's annual budget letter?

Key financial ratios to monitor include the gross profit margin, current ratio, and debt-to-equity ratio. The gross profit margin indicates profitability, while liquidity is assessed by the current ratio. Monitoring the debt-to-equity ratio helps track financial leverage and risk over the budget period.

How do you address seasonal revenue fluctuations in a blank business budget document?

Seasonal revenue fluctuations should be accounted for by incorporating monthly or quarterly revenue forecasts rather than annual lump sums. Adjust cash flow projections accordingly to reflect peak and off-peak periods. This strategy helps maintain accurate spending plans and avoids cash shortages during slower months.