The Blank Family Budget Template for Expense Management helps organize household finances by tracking income and expenses efficiently. This customizable tool allows families to monitor spending habits, set financial goals, and maintain control over their budget. Using this template simplifies expense management and promotes better financial planning.

Household Expense Tracker Template

A

Household Expense Tracker Template document is a structured tool designed to help individuals or families systematically record and monitor their daily, weekly, or monthly expenses. It typically includes categories such as utilities, groceries, transportation, and entertainment, enabling users to analyze spending habits and identify areas for potential savings. By maintaining accurate financial records through this template, users can improve budget management and achieve better financial stability.

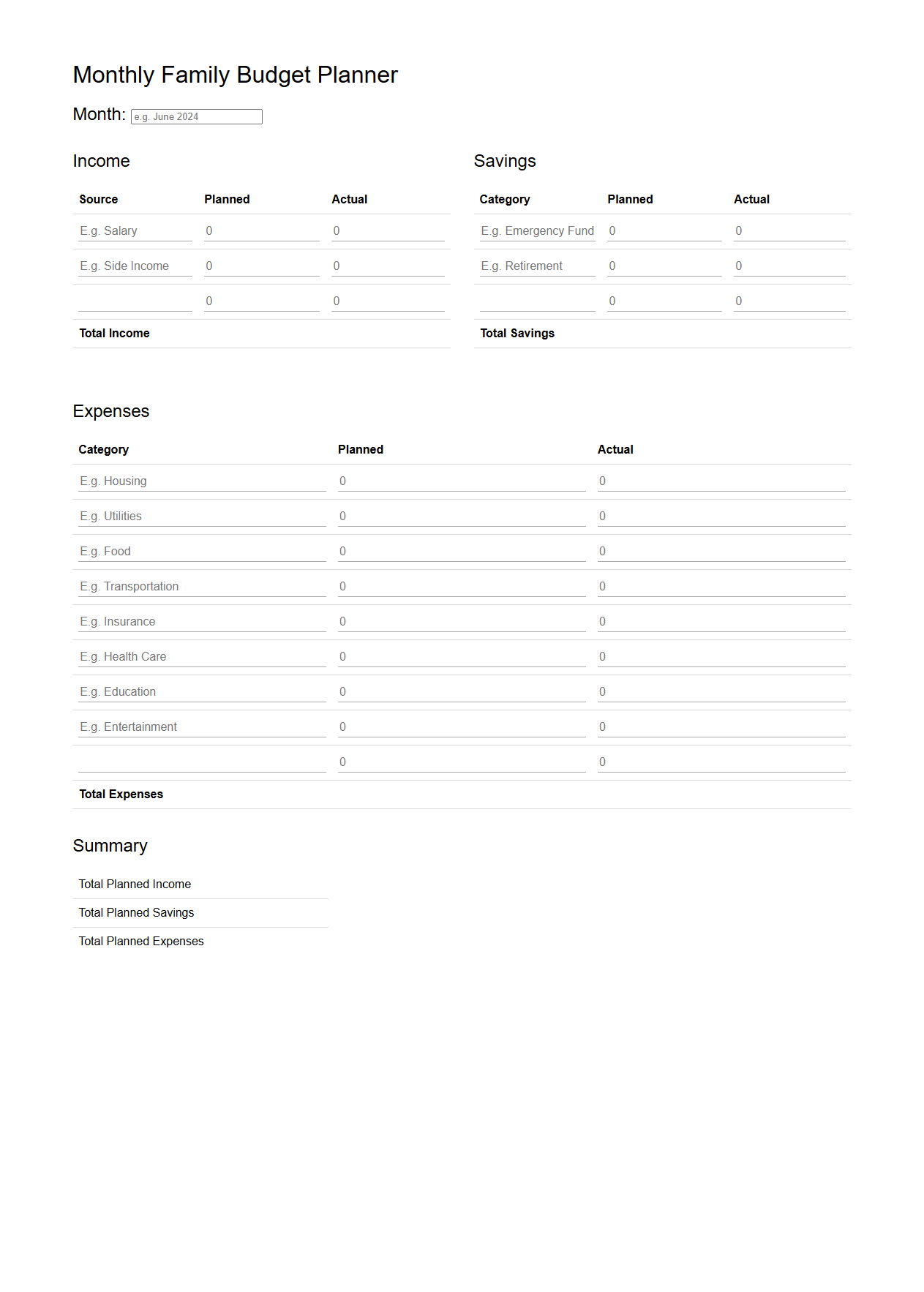

Monthly Family Budget Planner

A

Monthly Family Budget Planner document is a tool designed to help households systematically track income, expenses, and savings on a monthly basis. It enables families to allocate funds efficiently, set financial goals, and monitor spending patterns to avoid debt. By using this planner, families gain better control over their finances and can make informed decisions for future financial stability.

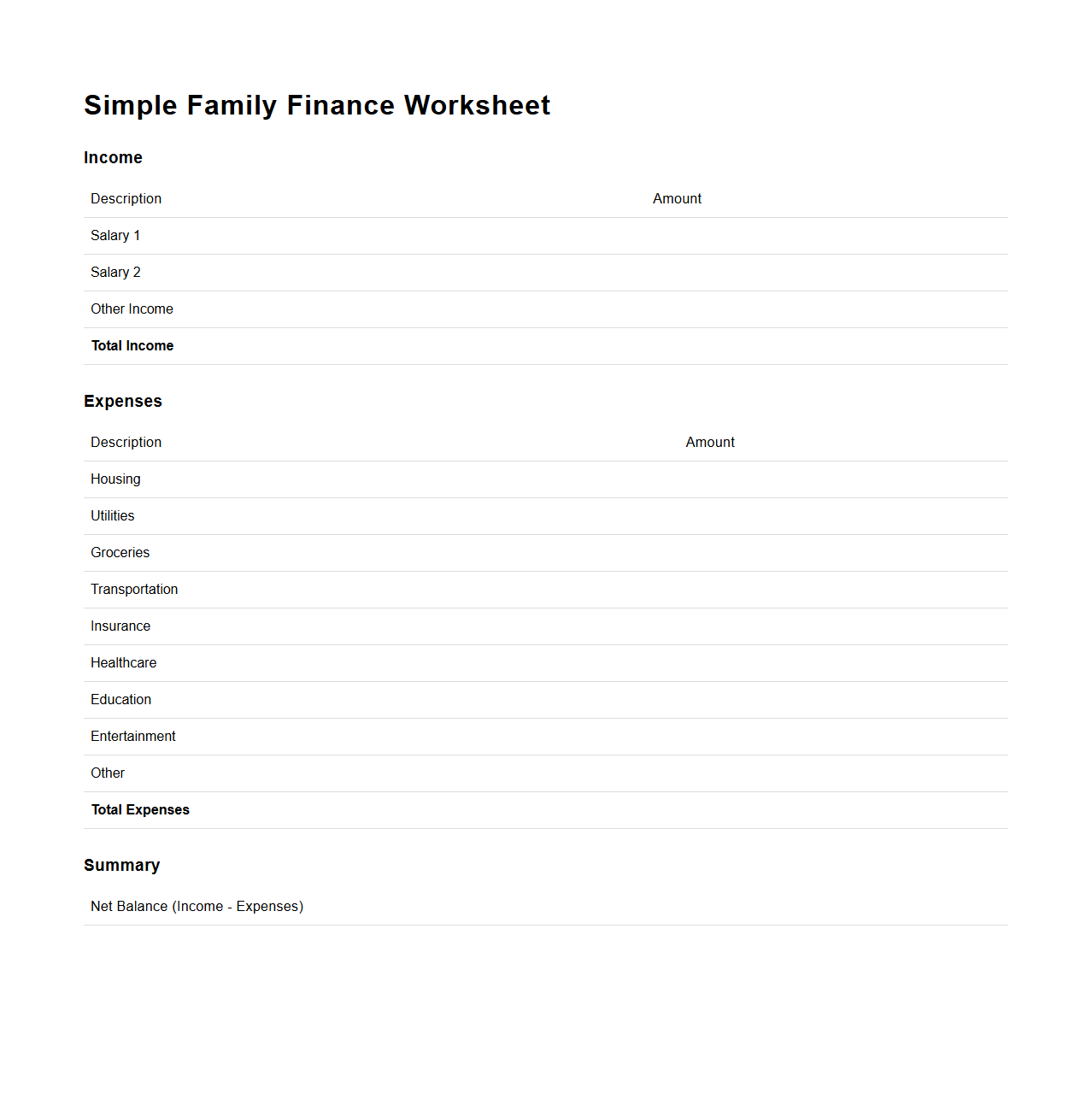

Simple Family Finance Worksheet

The

Simple Family Finance Worksheet is a practical tool designed to help families track and manage their income, expenses, and savings efficiently. It organizes financial data into clear categories, enabling users to monitor spending habits and budget effectively. By using this worksheet, families can achieve better financial planning and gain control over their monetary decisions.

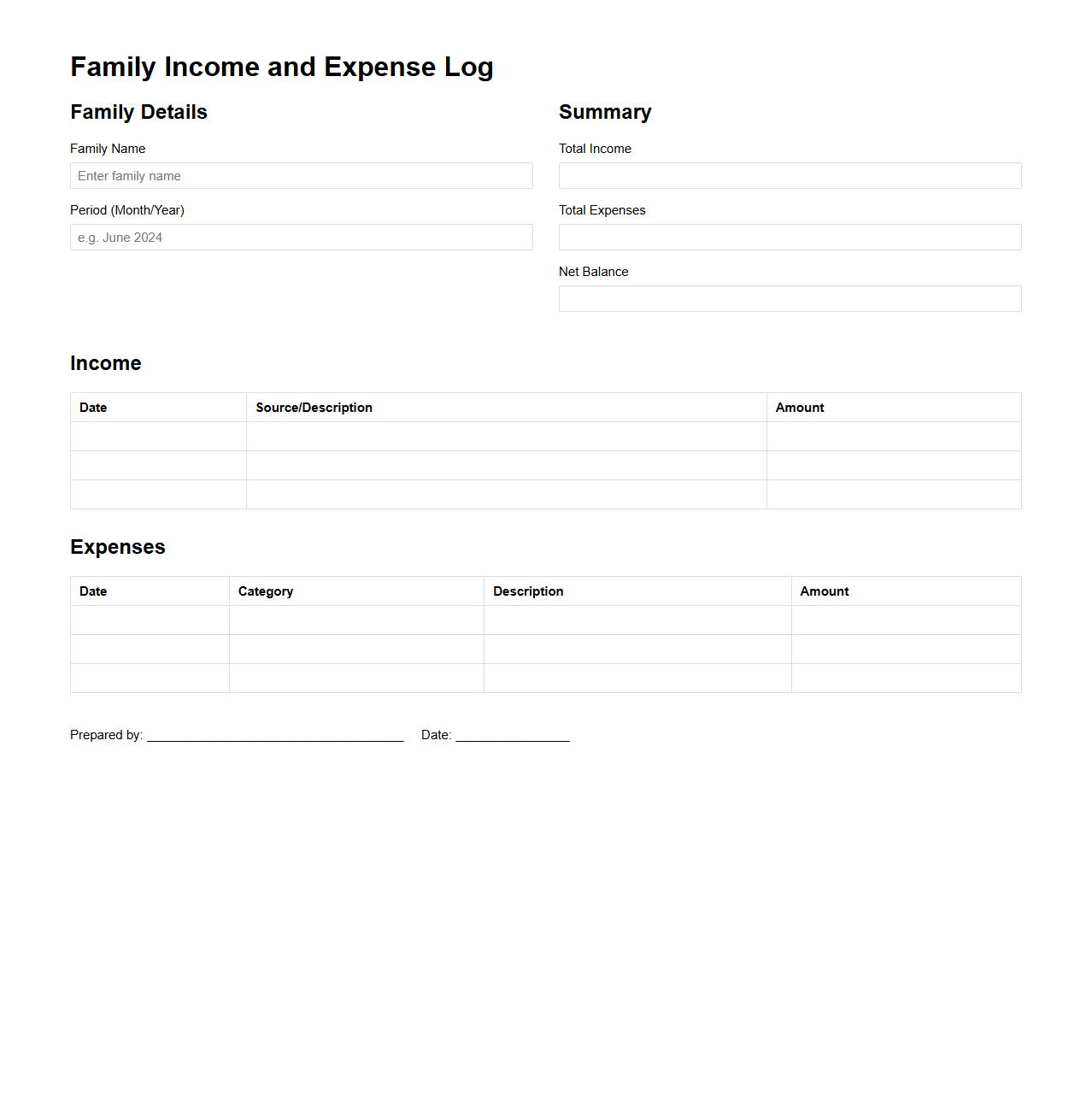

Family Income and Expense Log

A

Family Income and Expense Log document is a financial record used to track all sources of household income and categorize monthly expenses. It helps families monitor cash flow, identify spending patterns, and make informed budgeting decisions to improve financial stability. Maintaining this log promotes transparency and accountability in managing personal finances.

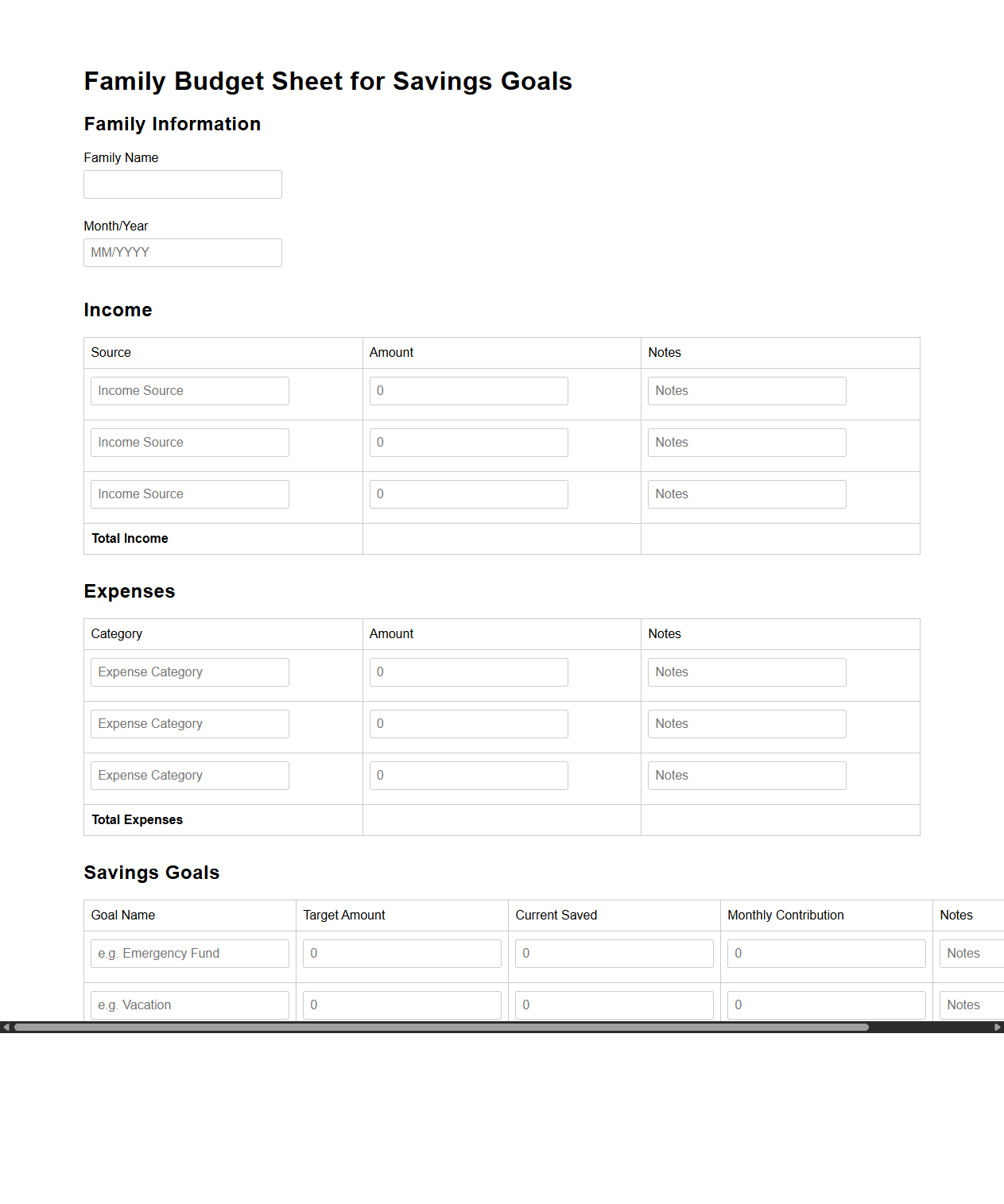

Family Budget Sheet for Savings Goals

A

Family Budget Sheet for Savings Goals document is a financial planning tool that helps households allocate income toward specific savings objectives, such as emergencies, education, or vacations. It tracks monthly income, expenses, and savings contributions to ensure disciplined money management. This sheet provides clear visibility of financial progress, promoting accountability and effective goal achievement.

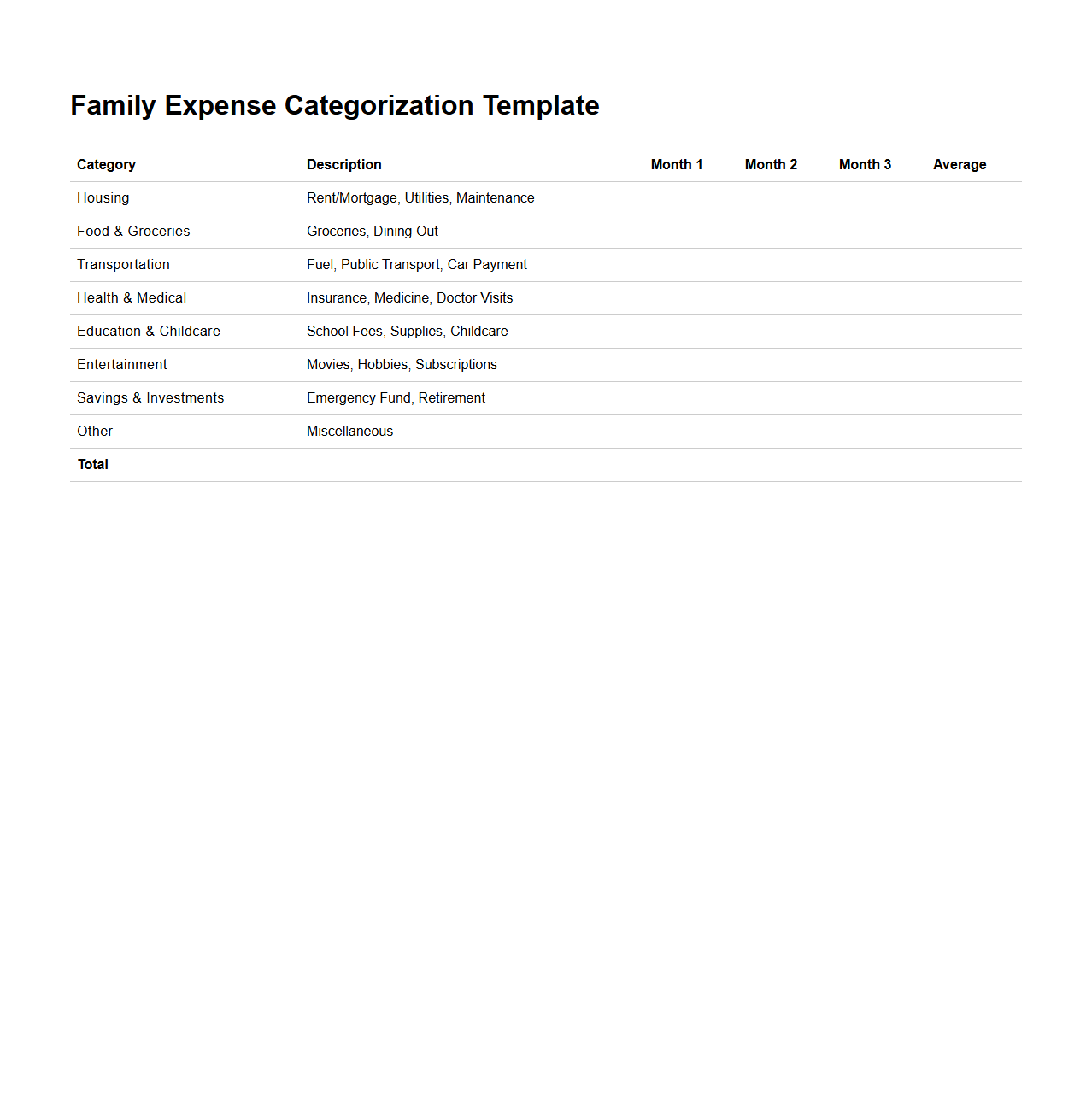

Family Expense Categorization Template

The

Family Expense Categorization Template document is a structured tool designed to organize household spending into predefined categories such as groceries, utilities, transportation, and entertainment. It helps family members track their expenses systematically, making budgeting more efficient and financial planning clearer. By clearly categorizing expenses, this template aids in identifying spending patterns and areas for potential savings.

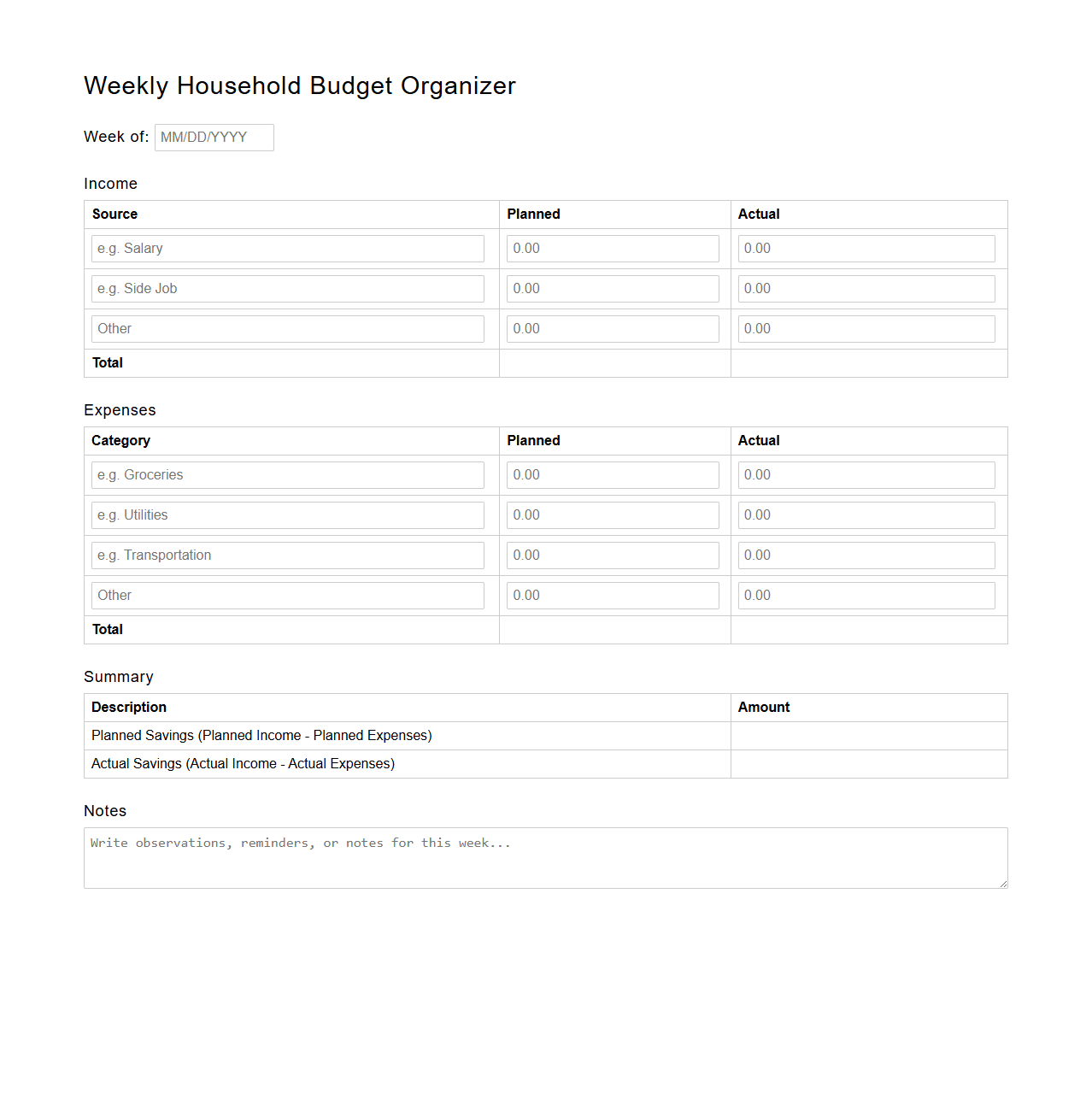

Weekly Household Budget Organizer

The

Weekly Household Budget Organizer document is a practical tool designed to track and manage weekly income and expenses within a household. It helps users categorize spending, monitor financial goals, and maintain control over cash flow by providing a clear overview of budgeting patterns. This organizer promotes responsible financial planning and reduces the risk of overspending by highlighting areas of excess or savings opportunities.

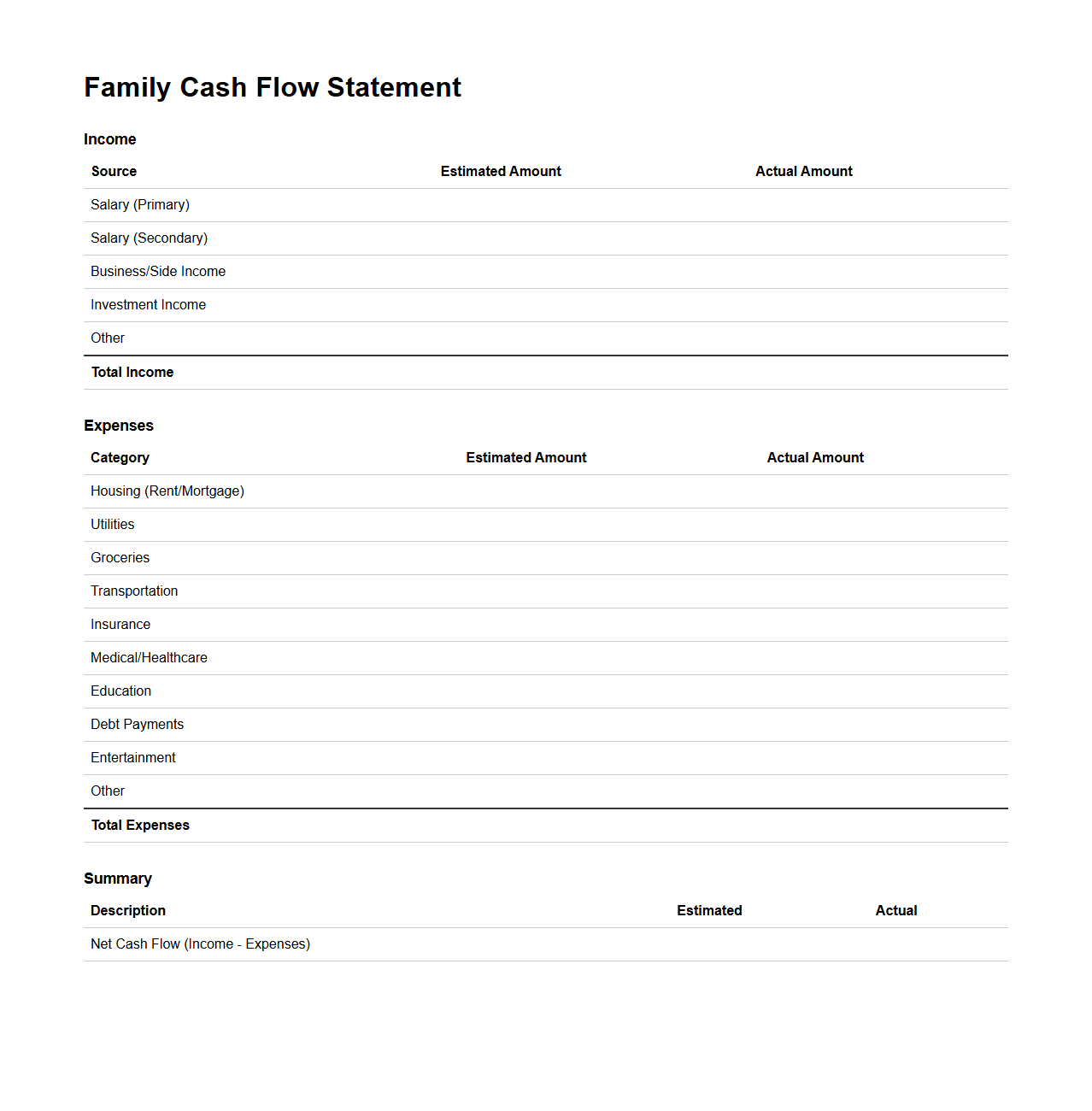

Family Cash Flow Statement Template

A

Family Cash Flow Statement Template document is a financial tool designed to help households track income and expenses over a specific period. It provides a clear overview of cash inflows such as salaries, investments, and other earnings, alongside outflows including bills, groceries, and discretionary spending. This detailed record enables families to manage budgets efficiently, identify saving opportunities, and maintain financial stability.

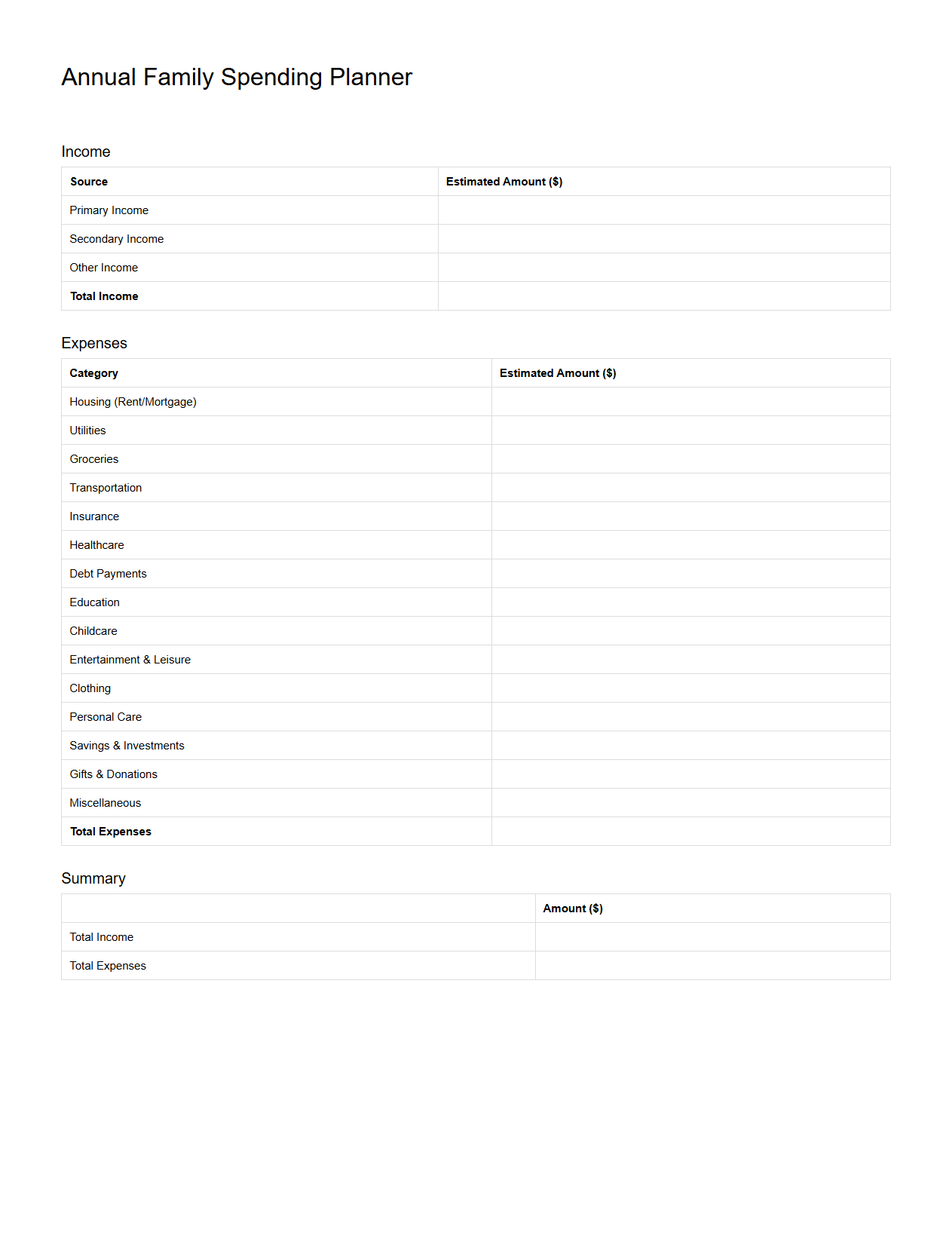

Annual Family Spending Planner

The

Annual Family Spending Planner is a comprehensive financial document that helps households systematically track and manage yearly expenses across various categories such as housing, utilities, groceries, education, and entertainment. It provides a clear overview of income versus expenditures, enabling families to set realistic budgets, identify spending patterns, and make informed decisions to improve savings and reduce debt. Using this planner regularly fosters disciplined money management and promotes long-term financial stability for the entire family.

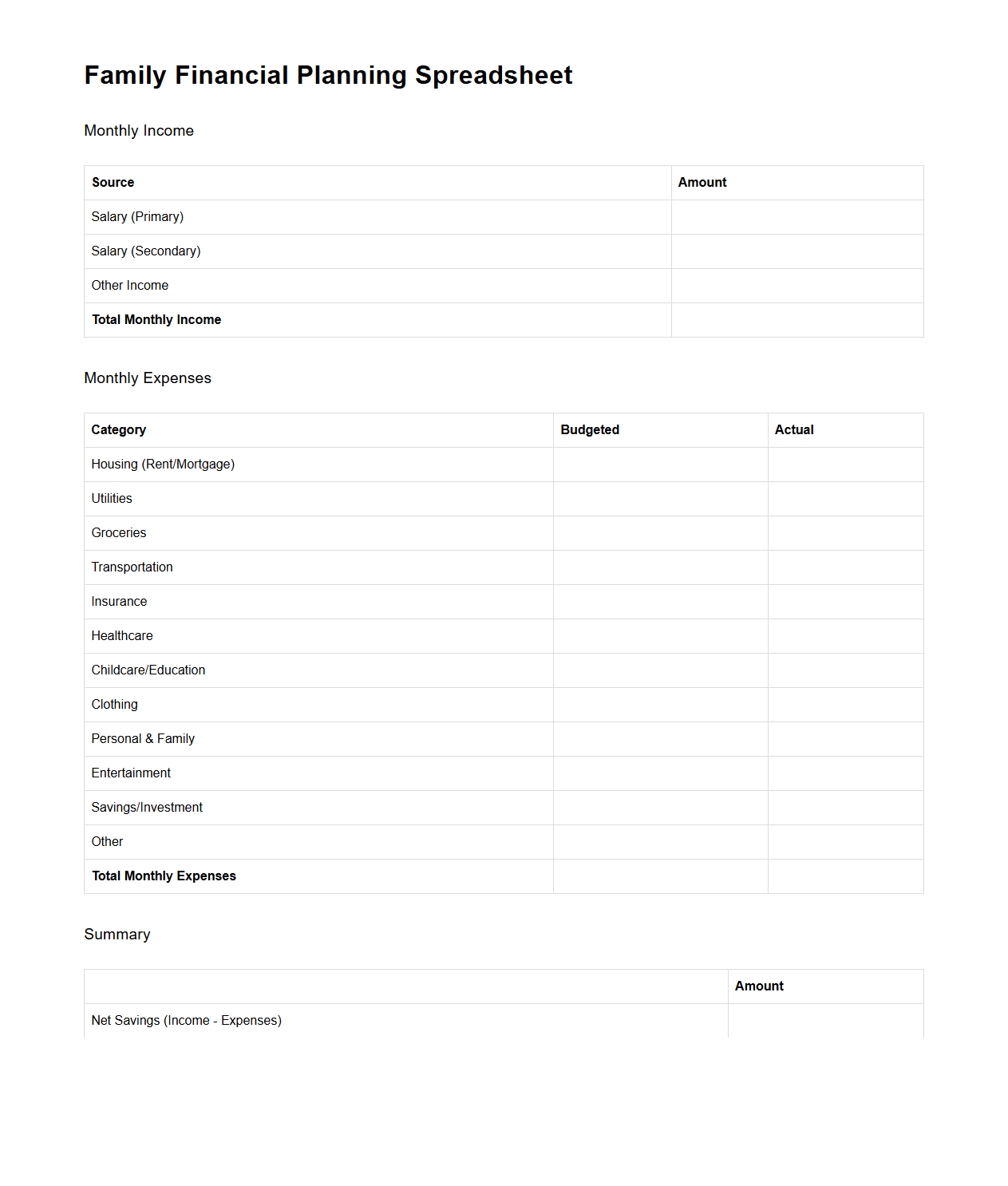

Family Financial Planning Spreadsheet

A

Family Financial Planning Spreadsheet is a digital tool designed to organize and track household income, expenses, savings, and budgeting goals. It enables families to visualize cash flow, manage debt, and plan future financial milestones such as education or retirement. This document helps ensure long-term financial stability by providing clear insights into spending habits and financial priorities.

How can a blank family budget document optimize monthly expense tracking?

A blank family budget document allows for personalized tracking of all income and expenses, making it easier to monitor financial flow monthly. By providing a clear visual overview, it helps families identify spending patterns and areas where costs can be reduced. Regularly updating this document ensures better control over finances and prevents overspending.

What categories should be included in a blank family budget for comprehensive expense management?

A comprehensive family budget should include categories such as housing, utilities, groceries, transportation, healthcare, education, entertainment, savings, and debt repayment. Including both fixed and variable expenses ensures complete financial visibility. This structure helps families allocate funds efficiently and avoid unexpected financial shortfalls.

Which template formats work best for customizing a blank family budget letter?

Effective templates for a family budget letter typically come in spreadsheet formats like Excel or Google Sheets for easy customization. These formats allow dynamic calculations and visual chart integration, enhancing budget management. Additionally, printable PDF templates are useful for physical tracking and sharing among family members.

How does a blank family budget document assist in identifying unnecessary expenditures?

A blank family budget document highlights all expenses clearly, making it easier to spot unnecessary expenditures that do not contribute to financial goals. Comparing budgeted amounts with actual spendings reveals overspending areas. This insight empowers families to make informed decisions on cutting costs and optimizing savings.

What digital tools integrate seamlessly with a blank family budget for real-time expense management?

Digital tools like Mint, YNAB (You Need A Budget), and Google Sheets integrate seamlessly with blank family budgets for real-time expense tracking. These apps offer synchronization with bank accounts, automatic transaction categorization, and budget alerts. Utilizing such tools enhances accuracy and convenience in managing family finances.