A Blank Monthly Budget Template for Personal Finance helps individuals track income and expenses, ensuring better money management. It provides a clear format to categorize spending, set financial goals, and monitor progress over time. Using this template enhances financial discipline and supports informed decision-making.

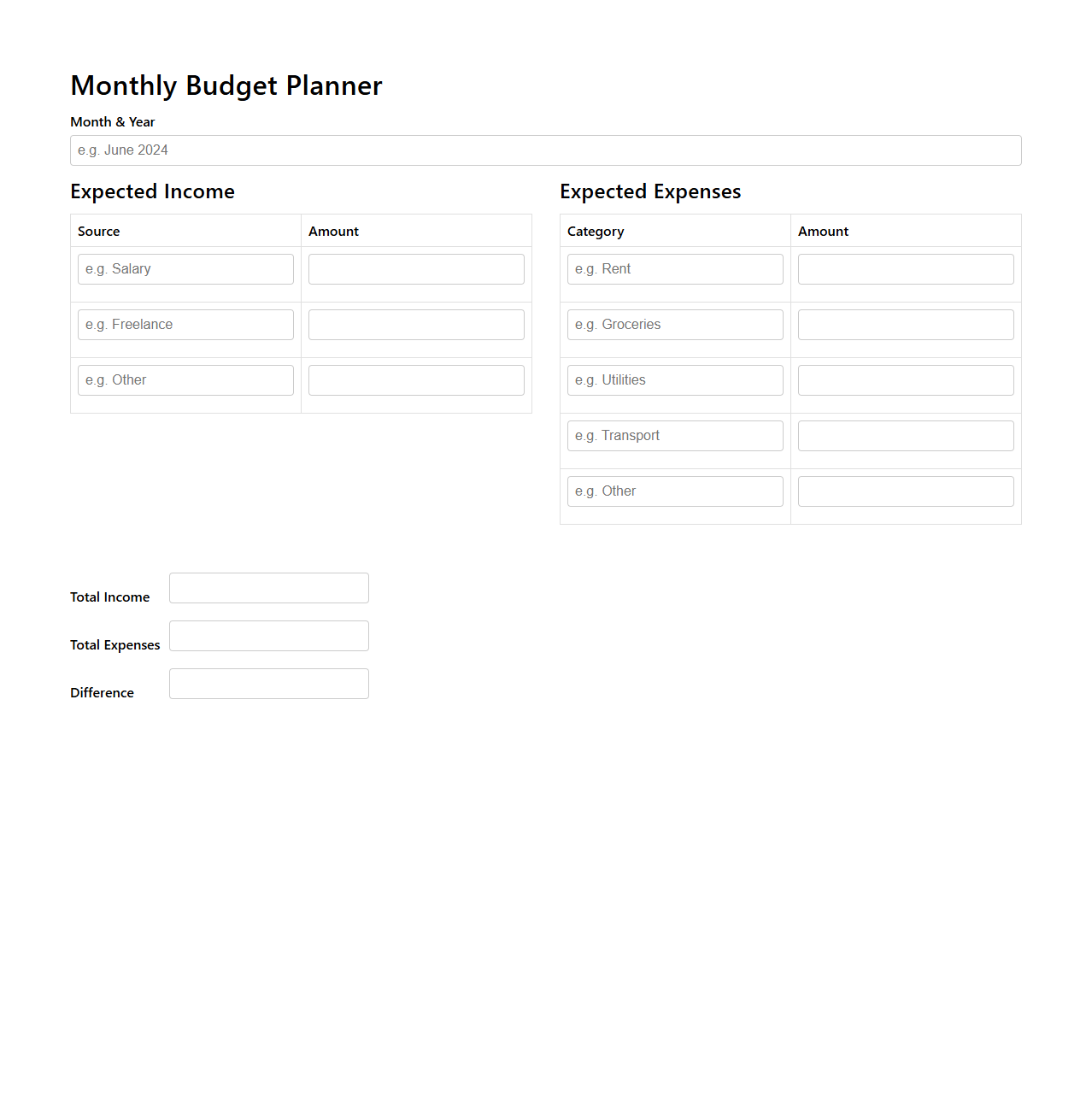

Minimalist Monthly Budget Planner for Personal Use

A

Minimalist Monthly Budget Planner for personal use is a streamlined financial tracking document designed to simplify expense management and income monitoring. It focuses on essential categories, helping individuals allocate funds efficiently while minimizing clutter and distractions. This planner enhances financial clarity, making it easier to set savings goals and control spending each month.

Simple Monthly Expense Tracker Template

A

Simple Monthly Expense Tracker Template is a practical document designed to help individuals or households monitor and categorize their monthly spending efficiently. It enables users to input income, track various expenses such as bills, groceries, and entertainment, and analyze spending patterns to maintain better financial control. By organizing expenses in one place, this template facilitates budget management and promotes informed financial decisions.

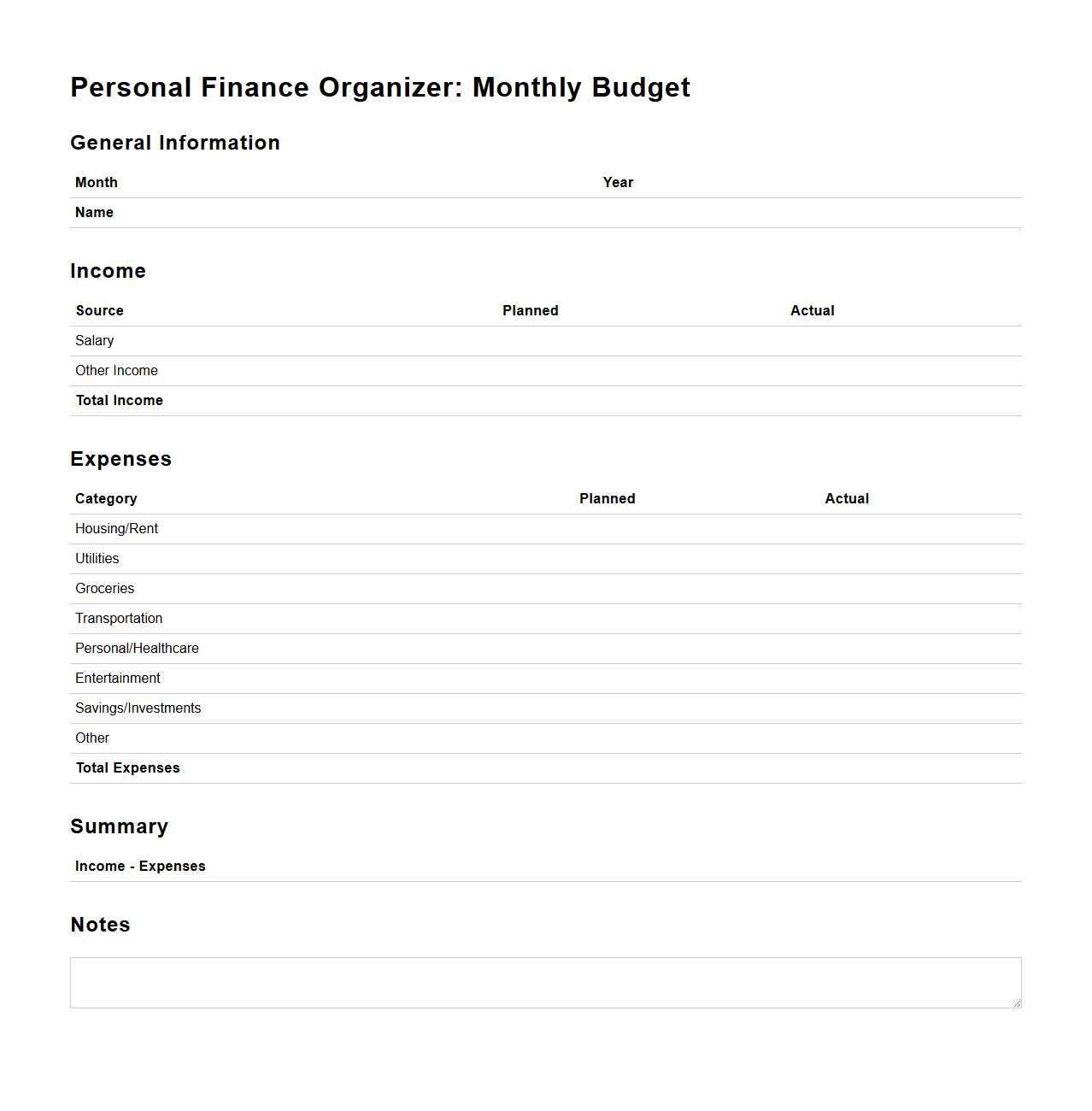

Personal Finance Organizer: Monthly Budget Layout

A

Personal Finance Organizer: Monthly Budget Layout document is designed to help individuals systematically track and manage their income, expenses, and savings over a monthly period. It provides structured sections for categorizing various financial transactions, setting budgeting goals, and monitoring spending habits to ensure financial discipline. This tool enhances financial visibility and enables better decision-making for improving overall financial health.

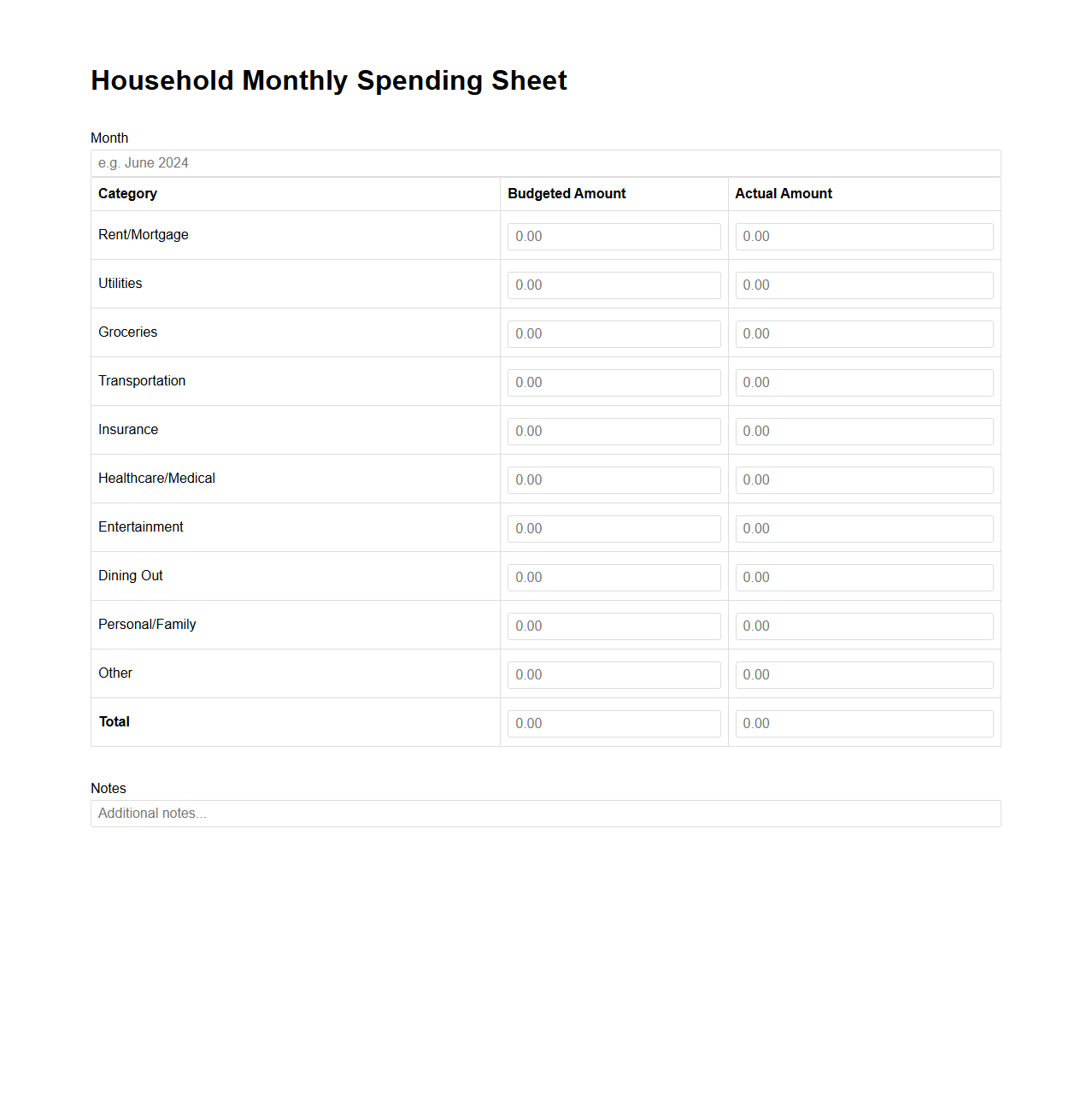

Household Monthly Spending Sheet

A

Household Monthly Spending Sheet is a financial document designed to track and organize all monthly expenses within a household. It typically includes categories such as rent or mortgage, utilities, groceries, transportation, and entertainment, allowing users to monitor spending patterns and identify areas for budget adjustment. Maintaining this sheet helps improve financial discipline, supports effective budgeting, and enhances overall money management.

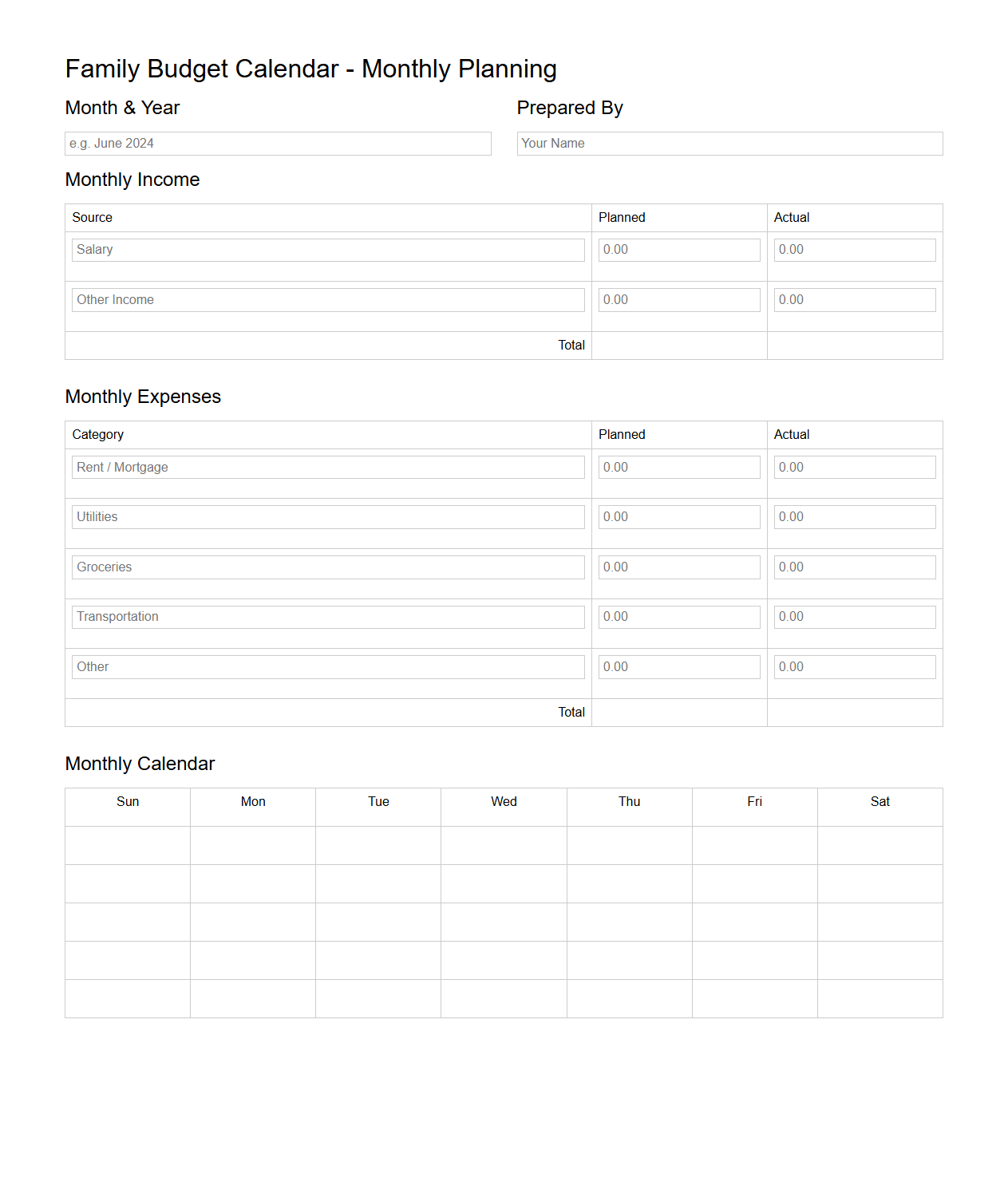

Family Budget Calendar for Monthly Planning

A

Family Budget Calendar for Monthly Planning is a practical tool designed to organize and track household income, expenses, and savings goals within a monthly timeframe. It helps families allocate funds for bills, groceries, entertainment, and emergencies, ensuring better financial control and avoiding overspending. Using this document promotes transparent financial communication among family members and supports effective money management.

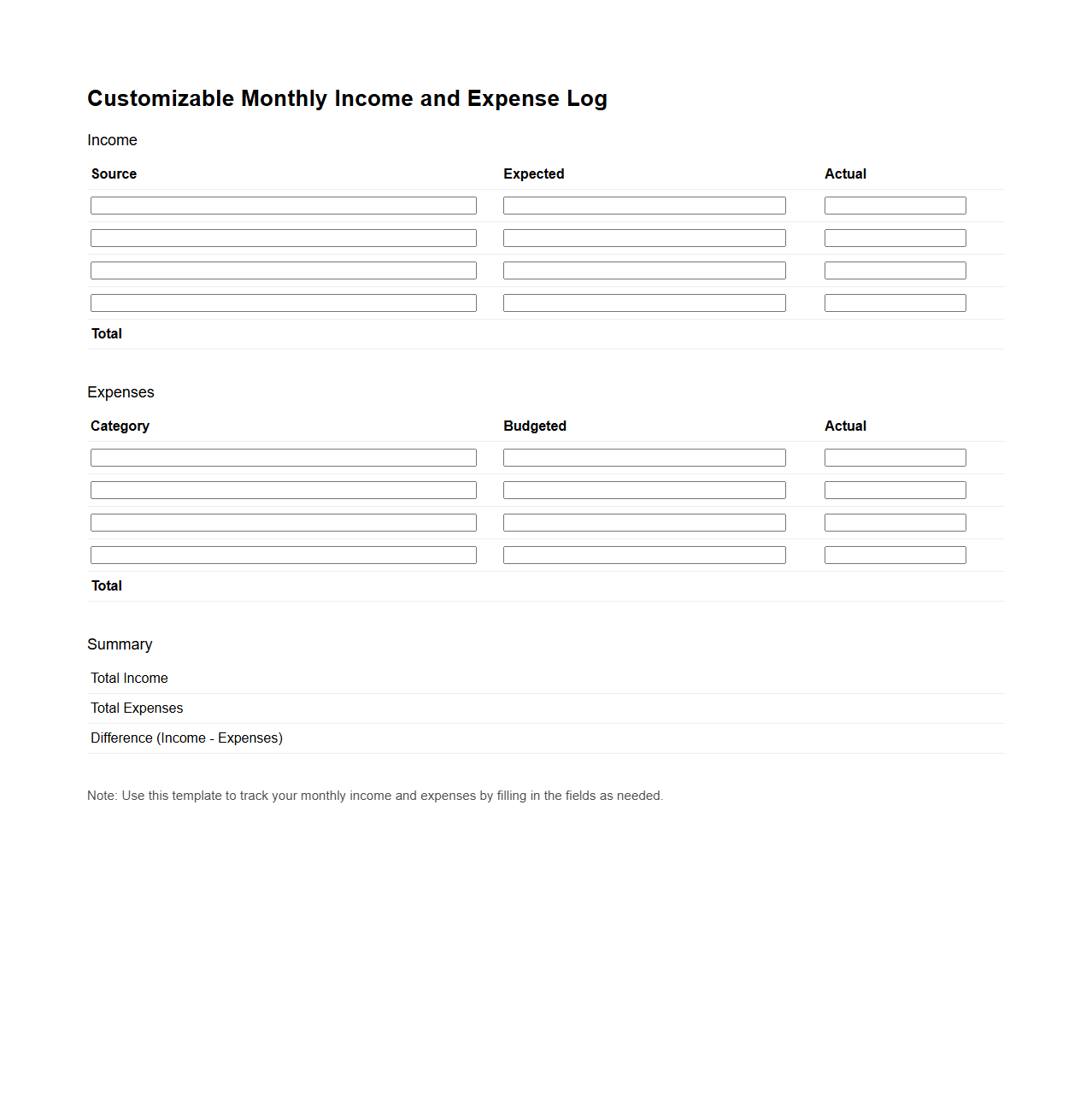

Customizable Monthly Income and Expense Log

A

Customizable Monthly Income and Expense Log document is a financial tracking tool designed to record and organize personal or business income and expenditures on a monthly basis. It allows users to tailor categories and fields according to their specific financial situation, enhancing accuracy and relevance in budgeting and financial analysis. By providing a clear overview of cash flow patterns, this log helps improve money management and supports informed decision-making.

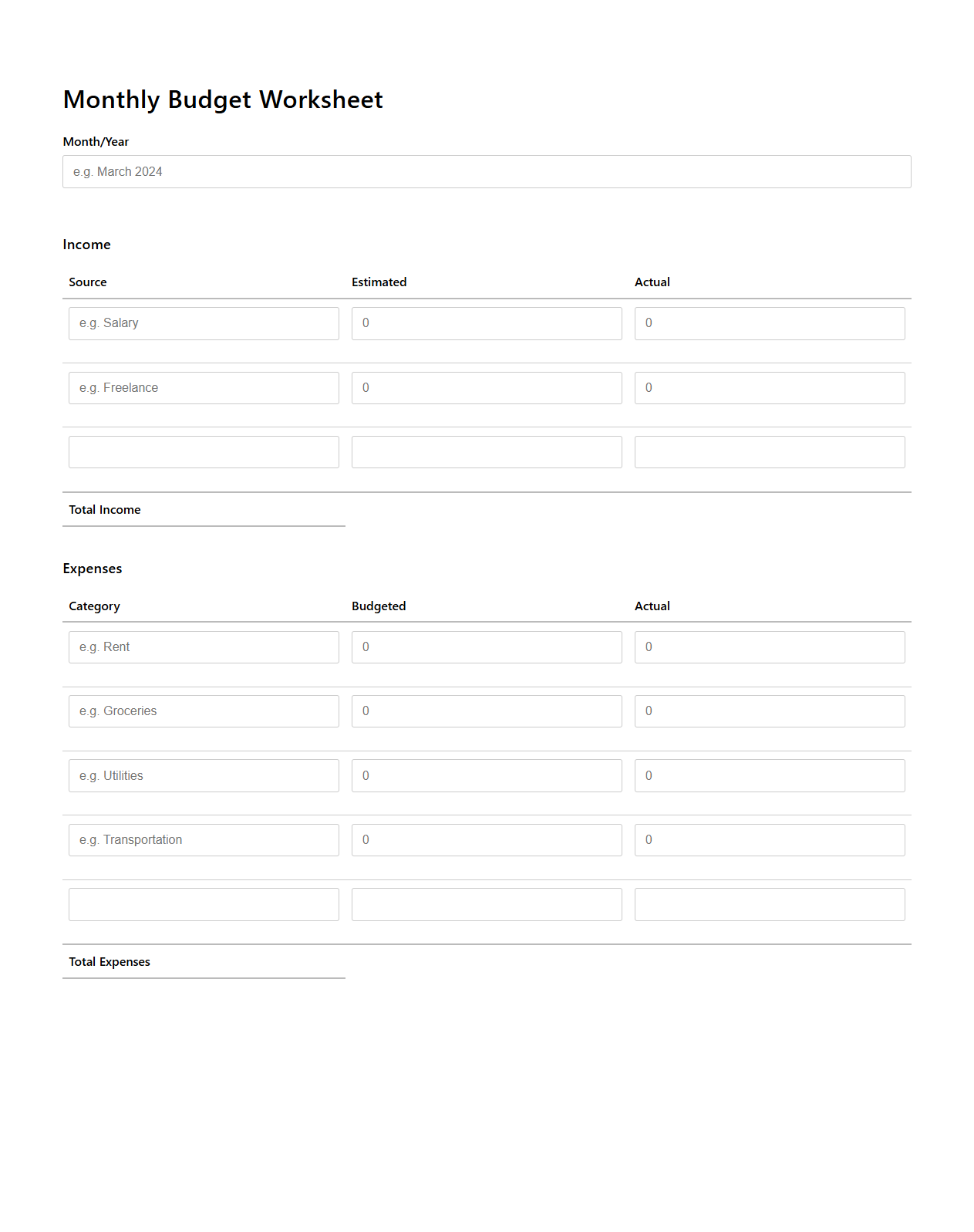

Undated Monthly Budget Worksheet for Individuals

A

Undated Monthly Budget Worksheet for Individuals is a financial planning tool designed to help track and manage personal income and expenses without being tied to a specific start date. It offers flexibility for users to begin budgeting at any time, allowing for ongoing adjustments to spending habits and savings goals. The worksheet typically includes categories for fixed and variable costs, enabling clear visualization of monthly cash flow and financial priorities.

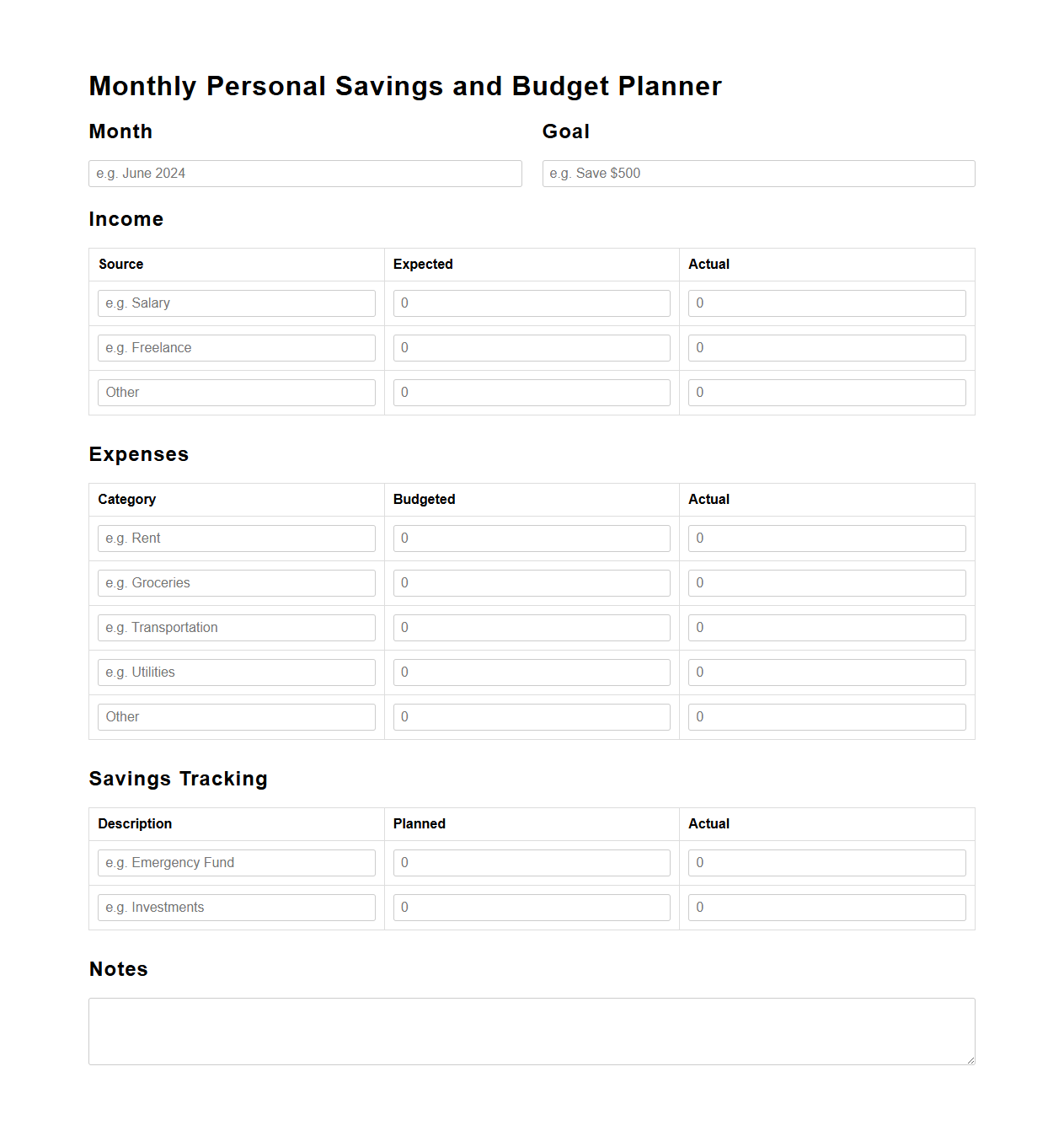

Monthly Personal Savings and Budget Planner

A

Monthly Personal Savings and Budget Planner document is a financial tool designed to help individuals track income, expenses, and savings goals over a monthly period. It provides a structured format to allocate funds for daily needs, bills, and discretionary spending while monitoring progress toward financial objectives. Using this planner enhances money management skills and promotes disciplined saving habits for long-term financial stability.

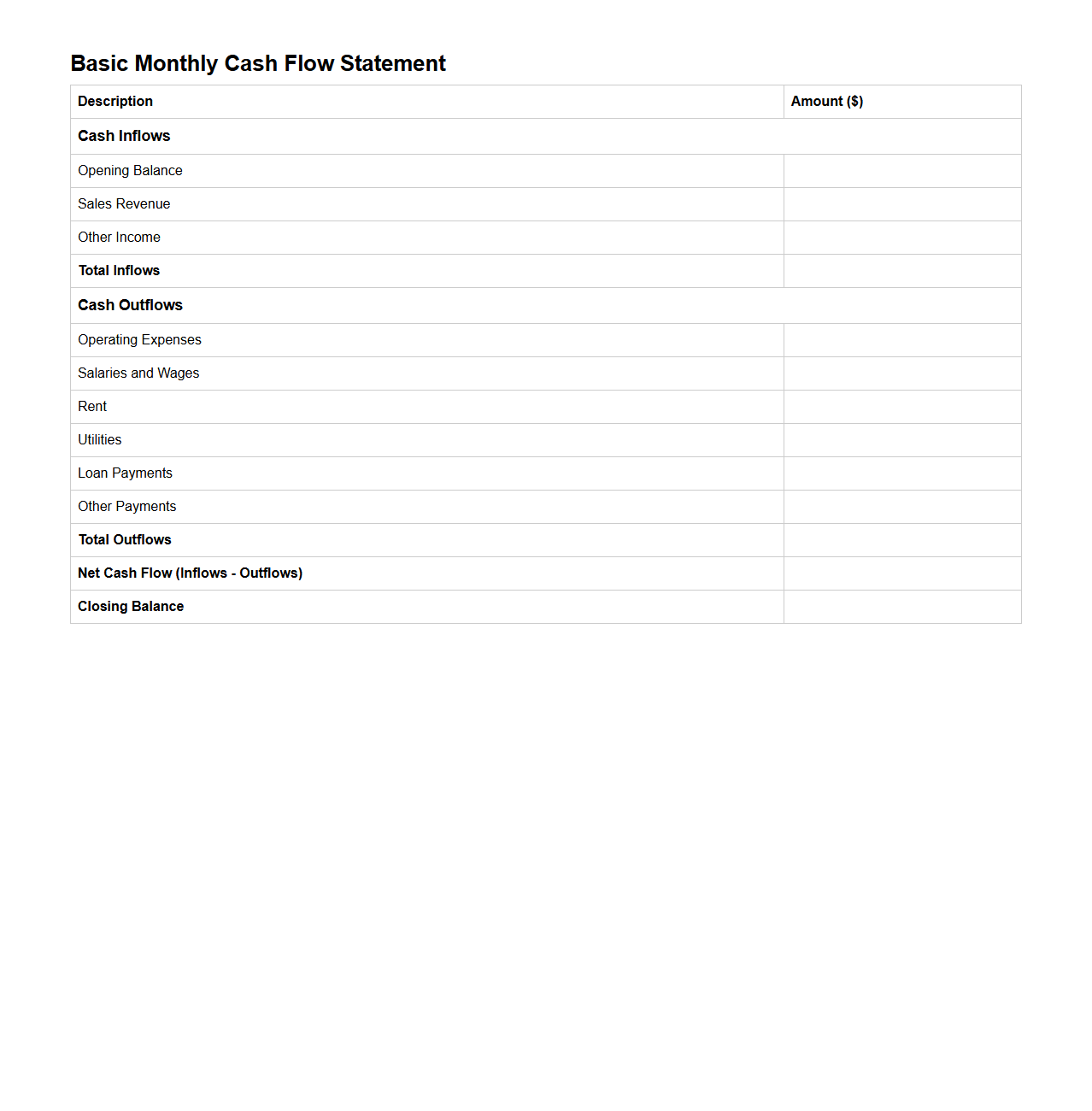

Basic Monthly Cash Flow Statement Template

A

Basic Monthly Cash Flow Statement Template is a financial tool used to track and manage the inflows and outflows of cash on a monthly basis. It helps businesses and individuals monitor liquidity by summarizing income, expenses, and net cash flow, ensuring effective budgeting and financial planning. This template provides a structured format to record all cash transactions, enabling accurate forecasting and improved decision-making.

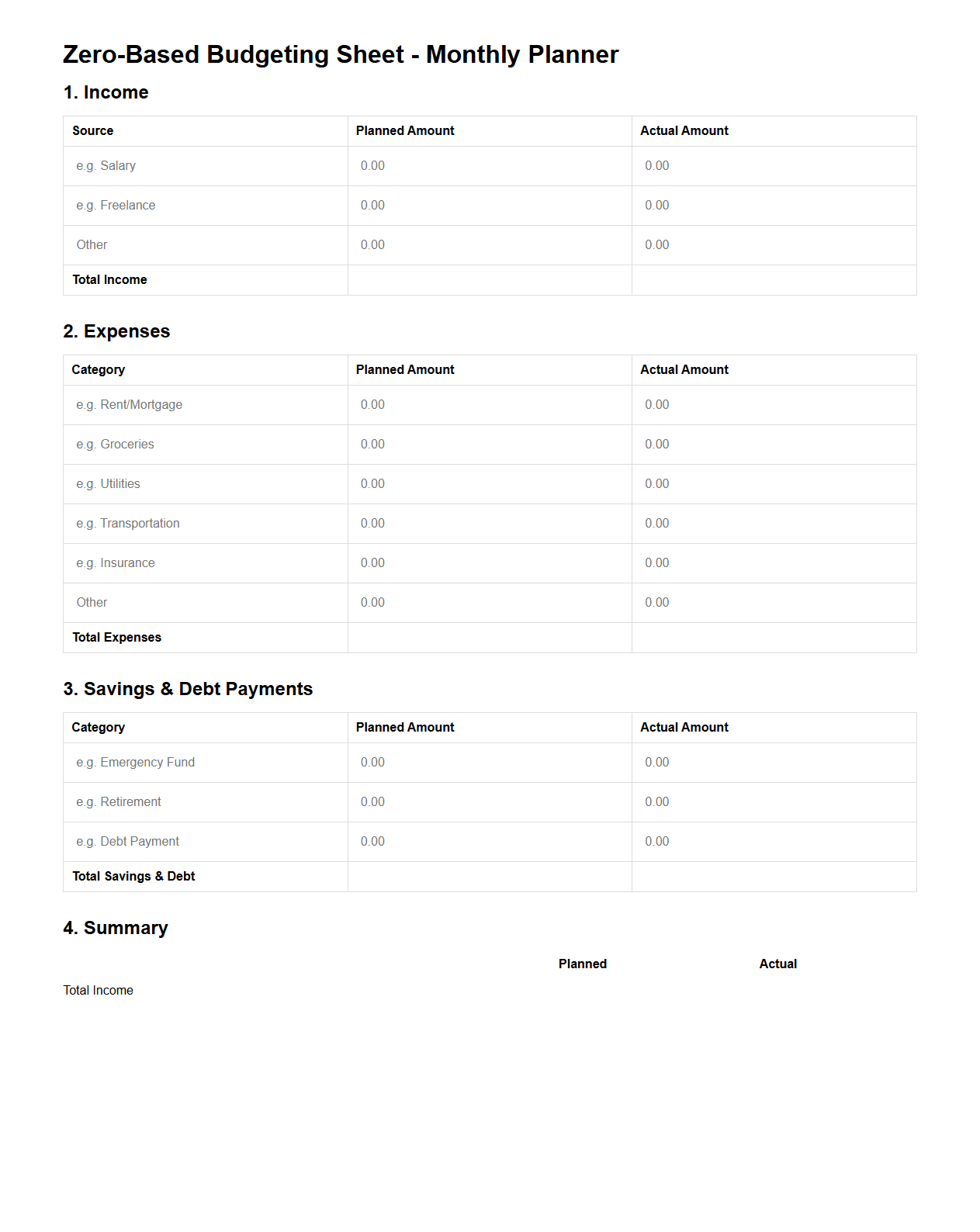

Zero-Based Budgeting Sheet for Monthly Planning

A

Zero-Based Budgeting Sheet for monthly planning is a financial tool designed to allocate every dollar of income to specific expenses, savings, and investments, ensuring that total income minus total expenses equals zero. This approach promotes detailed expense tracking and prioritization by requiring justification for each budget item from scratch every month. It enhances financial discipline and enables more accurate control over spending, helping individuals or businesses optimize cash flow and avoid unnecessary costs.

What are the essential categories to include in a blank monthly budget for personal finance tracking?

A blank monthly budget should include income sources to track all money coming in. Essential expense categories include housing, utilities, groceries, transportation, and debt payments. Additionally, allocating funds for entertainment, savings, and emergency funds ensures comprehensive financial tracking.

How can a blank monthly budget template help in identifying recurring expenses?

A blank monthly budget template helps by providing a clear structure to list all fixed and variable expenses. By categorizing costs such as rent, subscriptions, and loan payments, it highlights consistent financial commitments. This visibility allows individuals to spot patterns and prepare for regular outgoing funds.

What strategies improve the accuracy of estimates on a blank monthly budget letter?

Using historical bank statements improves the precision of expense estimates by reflecting actual spending habits. Categorizing every transaction in detail helps reduce unforeseen costs. Additionally, including a buffer for unexpected expenses ensures the budget remains realistic and adaptable.

How do you organize a blank monthly budget letter to highlight savings opportunities?

Organizing the budget with clear categories for discretionary and non-discretionary expenses spotlights where cuts can be made. Including a separate section for monthly savings goals motivates disciplined financial management. Comparing planned versus actual spendings helps identify potential excesses within the budget.

What are common mistakes to avoid when filling out a blank monthly budget form for personal use?

Avoid underestimating variable expenses as they often fluctuate unexpectedly. Neglecting to track non-monthly expenses such as annual subscriptions can disrupt accuracy. Finally, failing to update the budget regularly makes it ineffective for real-time financial decision-making.