A Blank Zero-Based Budget Template for Savings helps you allocate every dollar of your income toward expenses, debts, and savings goals, ensuring no money is left unassigned. This budgeting method promotes disciplined financial planning by requiring you to assign a purpose to each dollar, maximizing your ability to save. Using this template simplifies tracking your spending and helps build a solid savings habit.

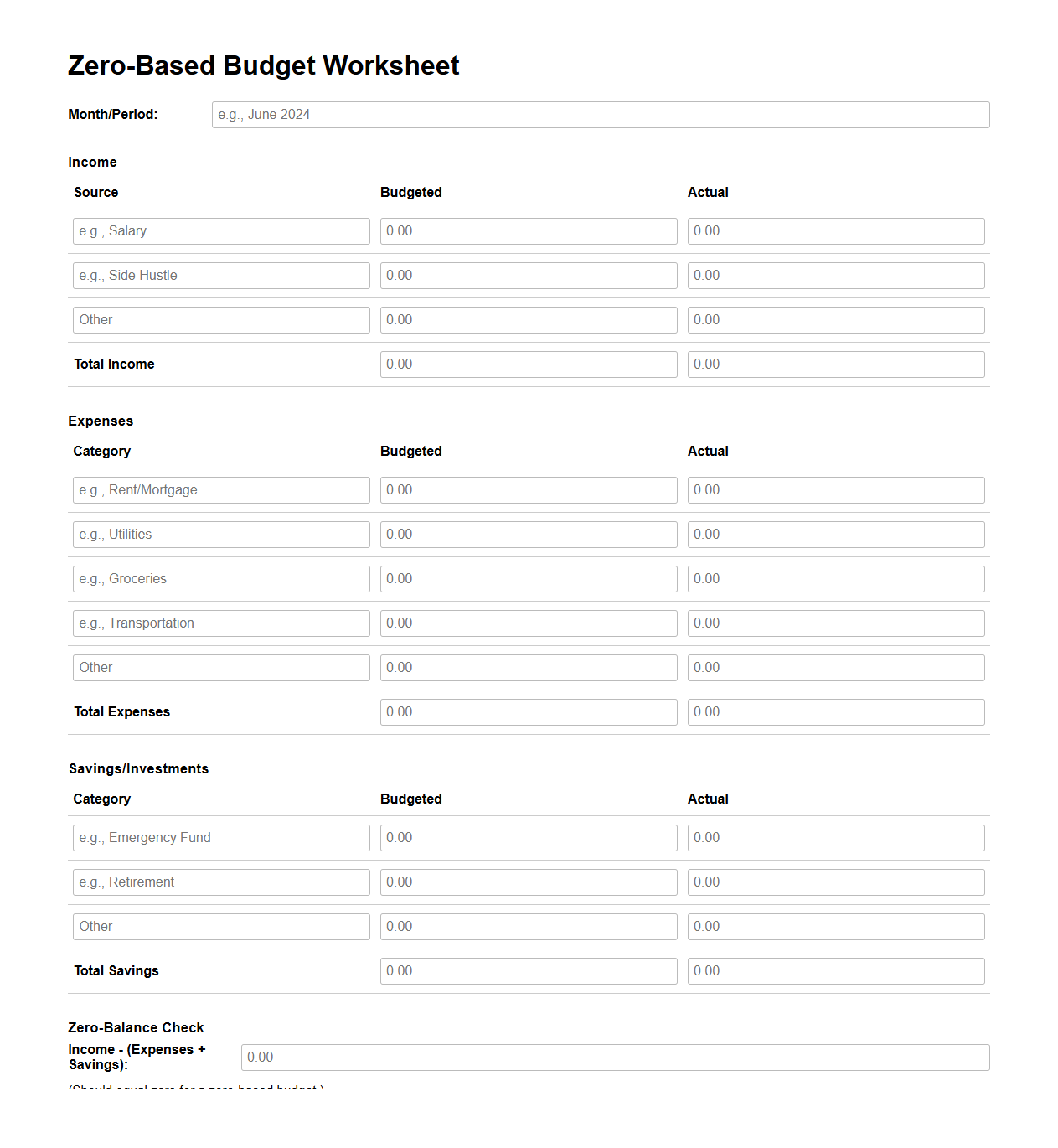

Zero-Based Budget Worksheet for Personal Savings

A

Zero-Based Budget Worksheet for personal savings is a financial planning tool designed to allocate every dollar of income toward expenses, savings, and investments, ensuring no funds are left unassigned. This document helps individuals gain complete control over their finances by subtracting total expenses from total income to achieve a zero balance, promoting disciplined saving habits. It enhances clarity in tracking savings goals and adjusting spending patterns to maximize personal financial growth.

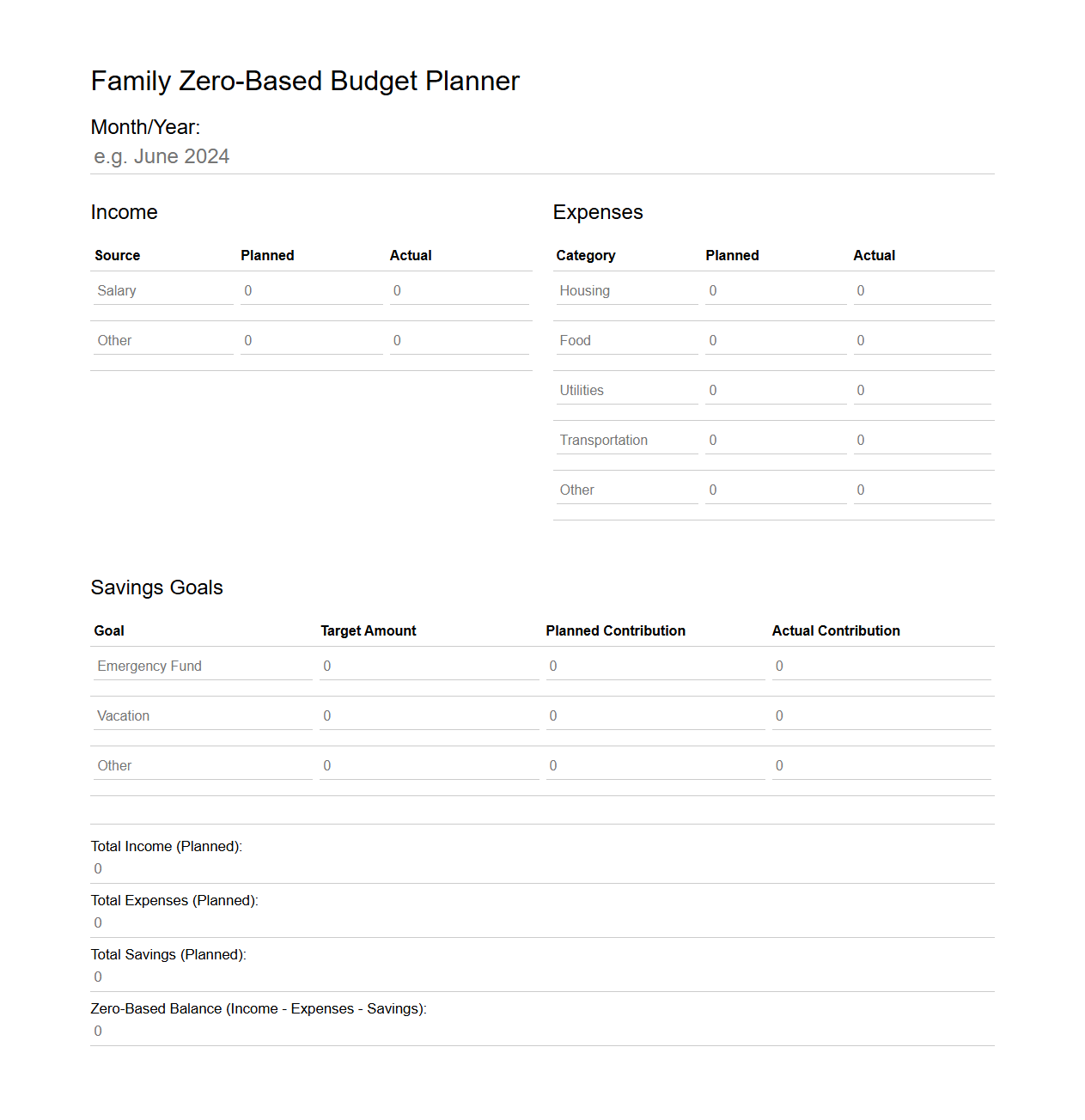

Family Zero-Based Budget Planner for Savings Goals

The

Family Zero-Based Budget Planner for Savings Goals document is a financial tool designed to help families allocate every dollar of their income toward specific expenses and savings targets, ensuring no money is left unassigned. This planner supports detailed tracking of monthly income, fixed and variable expenses, and prioritization of savings goals such as emergency funds, education, or vacations. By promoting disciplined budgeting habits, it enables families to optimize their cash flow and achieve financial stability effectively.

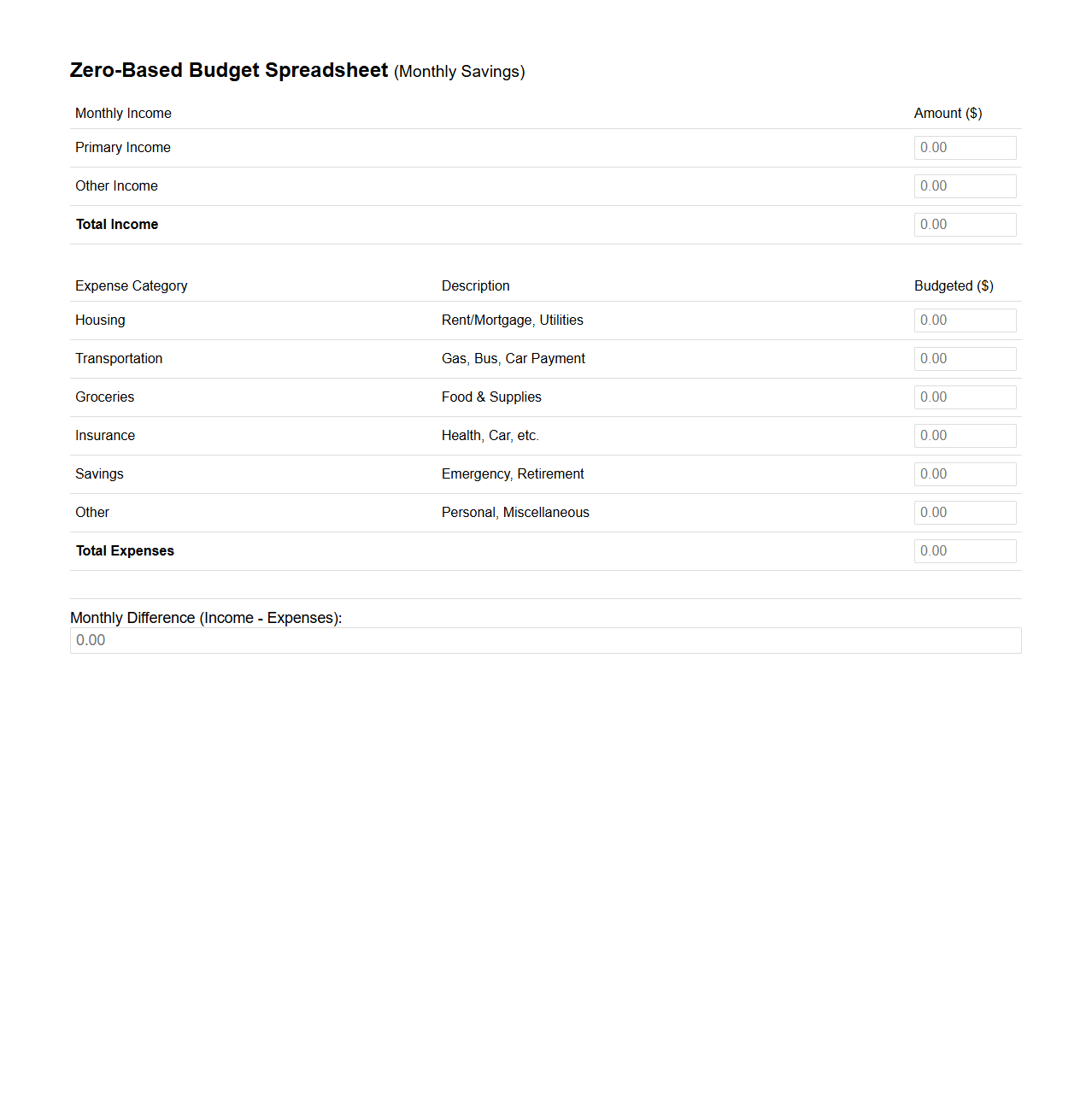

Simple Zero-Based Budget Spreadsheet for Monthly Savings

A

Simple Zero-Based Budget Spreadsheet for monthly savings is a financial tool designed to allocate every dollar of income to specific expenses or savings goals, ensuring that total income minus total expenses equals zero. It helps users maintain strict control over their finances by detailing income sources, fixed and variable expenses, and prioritized savings, thereby promoting disciplined money management. This spreadsheet format enhances clarity in budgeting, making it easier to track spending and optimize monthly savings efforts effectively.

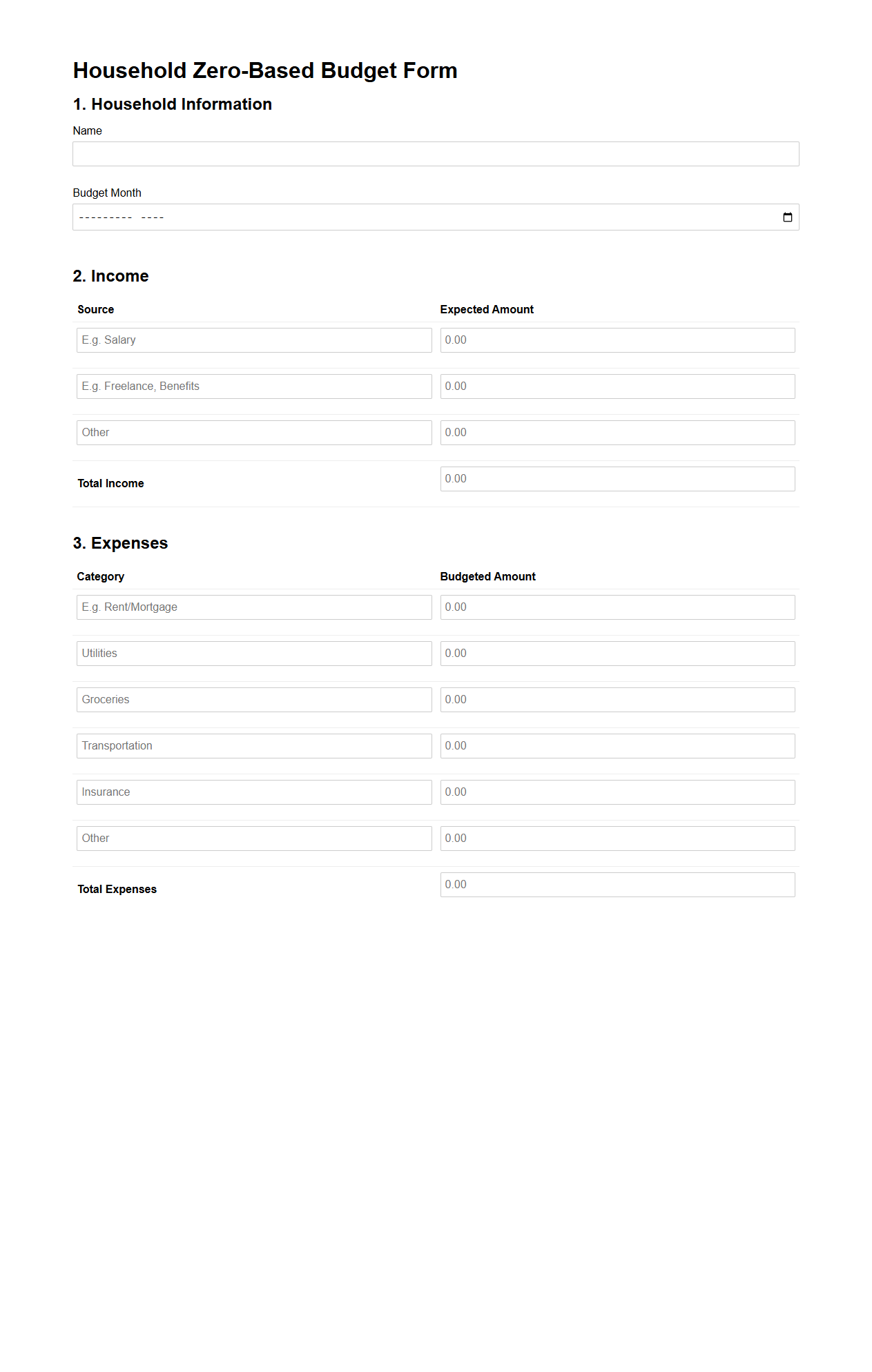

Household Zero-Based Budget Form for Saving Plans

A

Household Zero-Based Budget Form is a financial planning tool designed to allocate every dollar of income toward specific expenses, savings, and debt repayment, ensuring no money is left unassigned. This document helps households create detailed saving plans by tracking monthly income and expenses, allowing for precise control over spending habits and maximizing savings potential. By balancing income and expenditures to zero, it fosters disciplined budgeting and efficient management of financial resources.

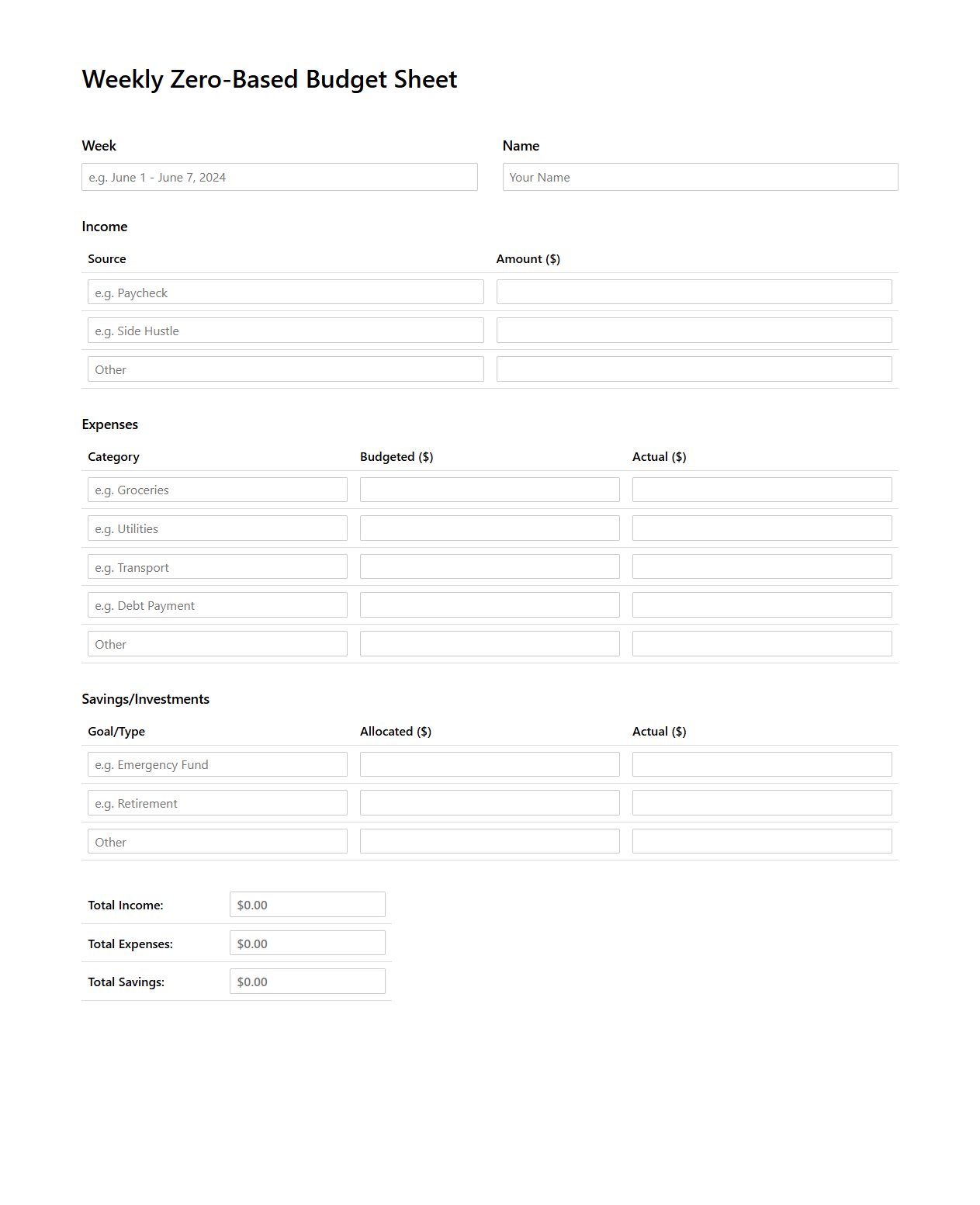

Weekly Zero-Based Budget Sheet for Increased Savings

The Weekly Zero-Based Budget Sheet is a financial planning tool designed to allocate every dollar of income towards expenses, savings, or debt repayment, ensuring no money is left unassigned. This document helps users prioritize spending, track weekly cash flow, and identify areas to increase

savings effectively. By balancing income with expenses each week, it promotes disciplined money management and reduces financial waste.

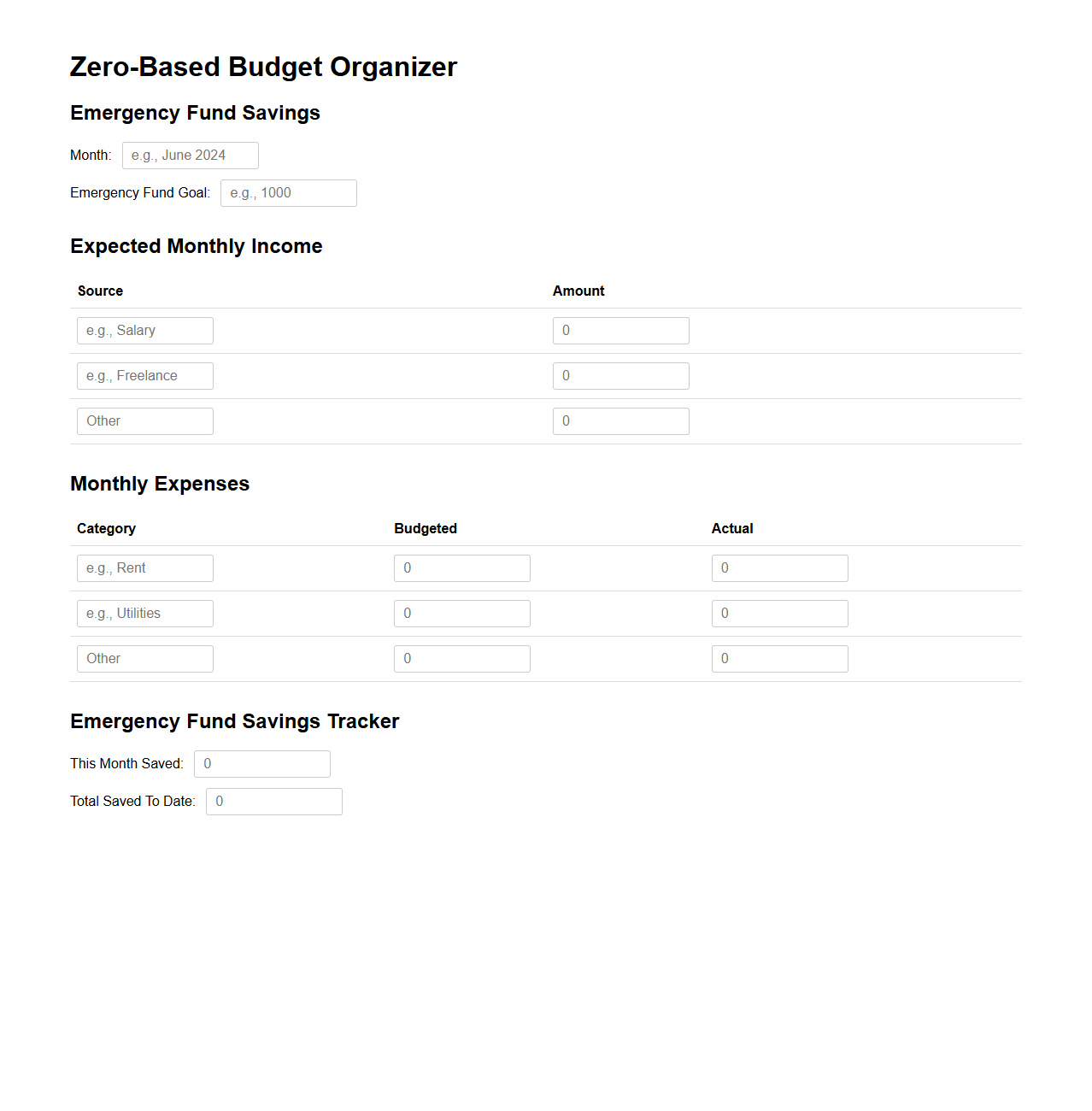

Zero-Based Budget Organizer for Emergency Fund Savings

The

Zero-Based Budget Organizer for Emergency Fund Savings is a financial planning tool designed to allocate every dollar of income toward specific expenses, savings, and debt repayment with the goal of building an emergency fund. This document helps users systematically track income and expenses, ensuring that funds are prioritized to cover essential needs while steadily growing their safety net. By meticulously planning each dollar, it promotes disciplined saving habits critical for financial security during unexpected events.

Minimalist Zero-Based Budget Outline for Savings Tracking

The

Minimalist Zero-Based Budget Outline for Savings Tracking is a streamlined financial planning tool that allocates every dollar of income to specific expenses, debt repayment, and savings goals, ensuring no funds are left unassigned. This method promotes disciplined spending by requiring individuals to justify all expenses, fostering better control over finances and maximizing savings potential. The simplicity of the outline makes it ideal for users seeking clarity and efficiency in managing income and tracking progress toward financial targets.

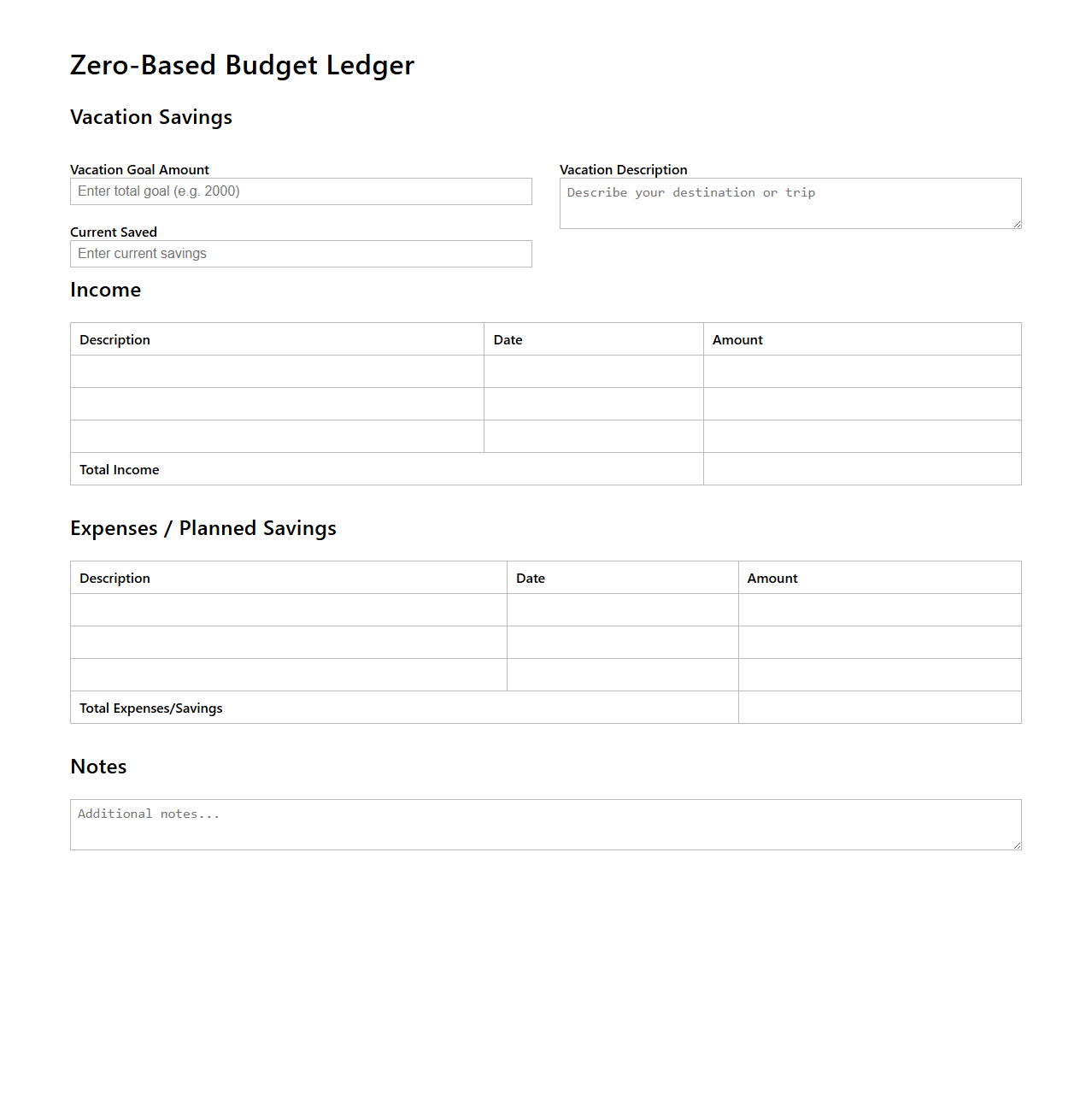

Zero-Based Budget Ledger for Vacation Savings

The

Zero-Based Budget Ledger for Vacation Savings is a financial tool designed to allocate every dollar of income towards specific expenses or savings goals, ensuring that no money is left unassigned. This ledger helps travelers systematically plan and track their vacation funds by assigning precise amounts to categories such as transportation, accommodation, and activities. By maintaining a zero-based budget, users can maximize their savings efficiency and avoid overspending on their planned trips.

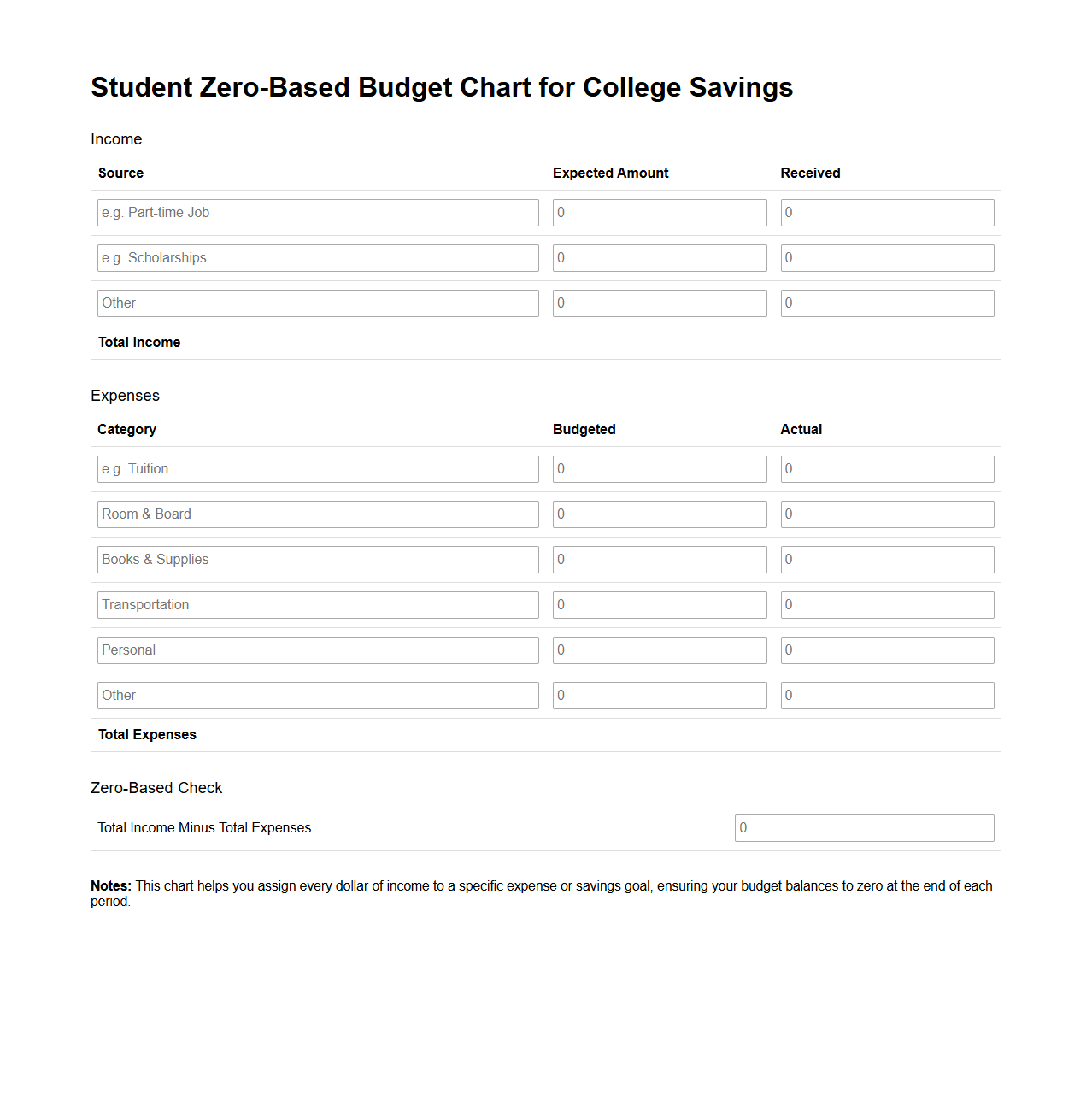

Student Zero-Based Budget Chart for College Savings

The

Student Zero-Based Budget Chart for College Savings is a financial planning tool that helps students allocate every dollar of their income or funds toward specific expenses and savings goals, ensuring no money is left unassigned. This document emphasizes disciplined budgeting by balancing income with expenditures, allowing students to systematically save for college tuition, books, and other related expenses. By using this chart, students can effectively track their spending habits and maximize their savings potential for higher education.

Detailed Zero-Based Budget Plan for Long-Term Savings

A

Detailed Zero-Based Budget Plan for Long-Term Savings is a financial document that allocates every dollar of income to specific expenses, savings, or debt repayment with the goal of maximizing future financial security. This budgeting approach requires meticulously tracking income and expenses to ensure that spending is purpose-driven and aligned with long-term savings objectives. By starting each budgeting period at zero and justifying all expenditures, individuals can optimize cash flow and build a sustainable savings plan.

What expenses categories are essential in a blank zero-based budget focused on savings?

Essential expense categories in a zero-based budget include housing, utilities, and groceries to cover basic needs. Allocating amounts for debt repayment and emergency funds strengthens financial security. Prioritizing a dedicated savings category ensures your goals progress consistently each month.

How do you allocate unexpected income in a zero-based budget template for savings?

Unexpected income should be fully allocated to ensure every dollar has a purpose in a zero-based budget. Prioritize adding to your emergency or high-interest debt funds first. Remaining amounts can boost long-term savings or investment goals.

Which tools can automate the creation of a blank zero-based budget letter for saving goals?

Digital tools like budgeting apps and spreadsheet templates simplify zero-based budget creation. Software such as YNAB or EveryDollar offers automatic tracking and allocation suggestions. These tools help maintain accurate records aligned with your savings objectives.

How should you structure savings priorities in a zero-based budget document?

Organize your savings priorities by listing short-term and long-term goals clearly in your budget document. Allocate specific dollar amounts to each category based on their urgency and importance. This structure promotes disciplined saving aligned with overall financial plans.

What common mistakes occur when drafting a blank zero-based budget letter for savings?

Common errors include failing to assign every dollar a role, leading to untracked spending. Another mistake is underestimating variable expenses, disrupting the budget balance. Not updating the budget regularly can also hinder savings progress and accuracy.