A Blank Personal Budget Template for Income Tracking allows users to systematically record and monitor their earnings, ensuring accurate financial management. This customizable template helps in identifying income sources, tracking payment dates, and calculating total monthly income. It simplifies budgeting processes, making financial planning more efficient and transparent.

Simple Personal Budget Template for Income and Expense Tracking

A

Simple Personal Budget Template for Income and Expense Tracking is a structured spreadsheet designed to help individuals monitor their monthly earnings and expenditures efficiently. It categorizes income sources and expense items, enabling clear visualization of cash flow and financial habits. This tool supports better money management by highlighting spending patterns and aiding in achieving savings goals.

Household Monthly Income Tracker Template

A

Household Monthly Income Tracker Template is a practical document designed to help individuals or families monitor and organize their monthly earnings from various sources systematically. It facilitates accurate record-keeping of salary, bonuses, rental income, and other revenue streams, enabling efficient budgeting and financial planning. This template improves visibility into cash flow patterns and supports informed decisions for managing expenses and savings effectively.

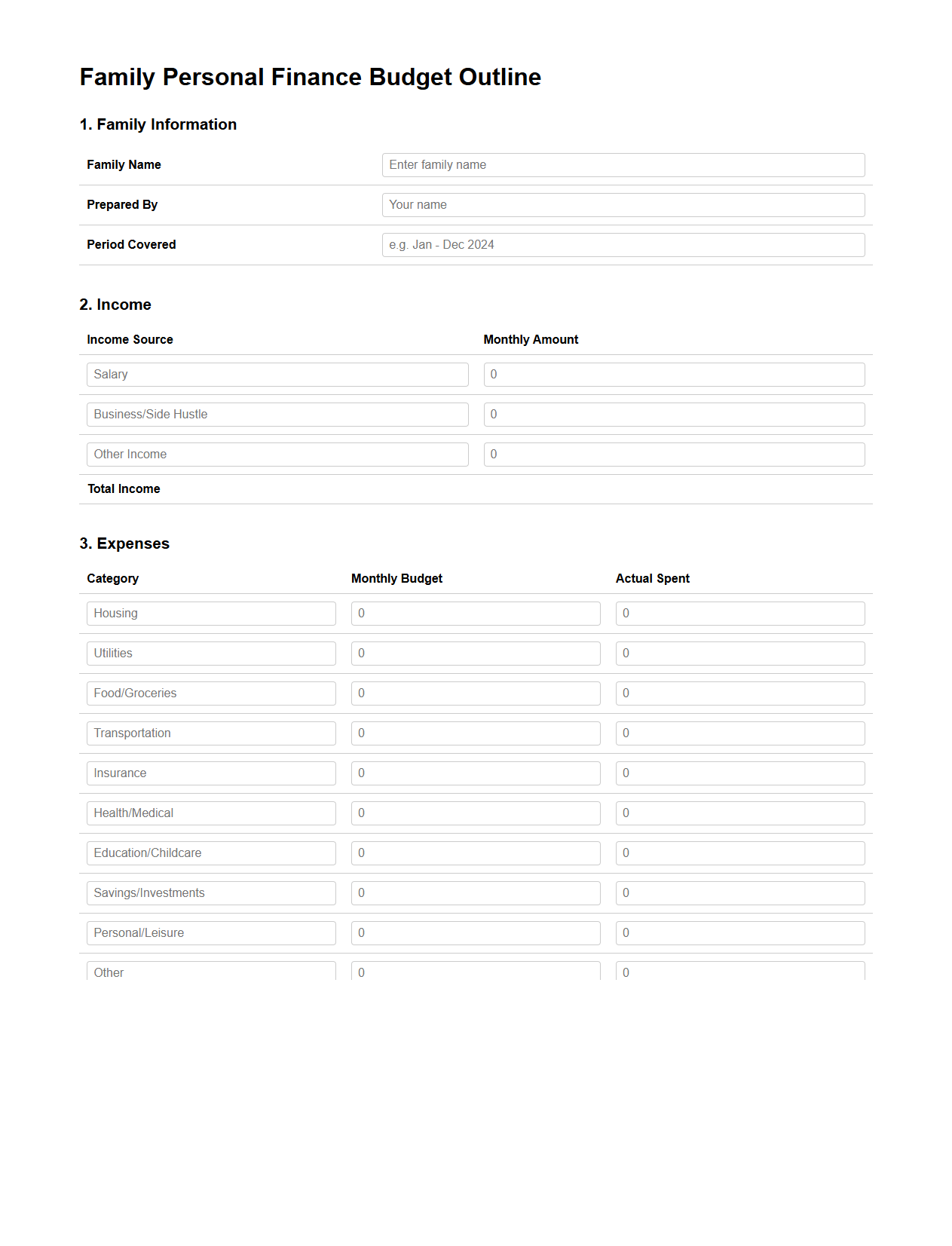

Family Personal Finance Budget Outline

A

Family Personal Finance Budget Outline document is a structured plan that helps families organize their income, expenses, savings, and financial goals. It provides a clear overview of monthly cash flow, identifies spending patterns, and assists in managing debt and allocating funds effectively. This document serves as a practical tool for improving financial discipline and securing long-term economic stability for the household.

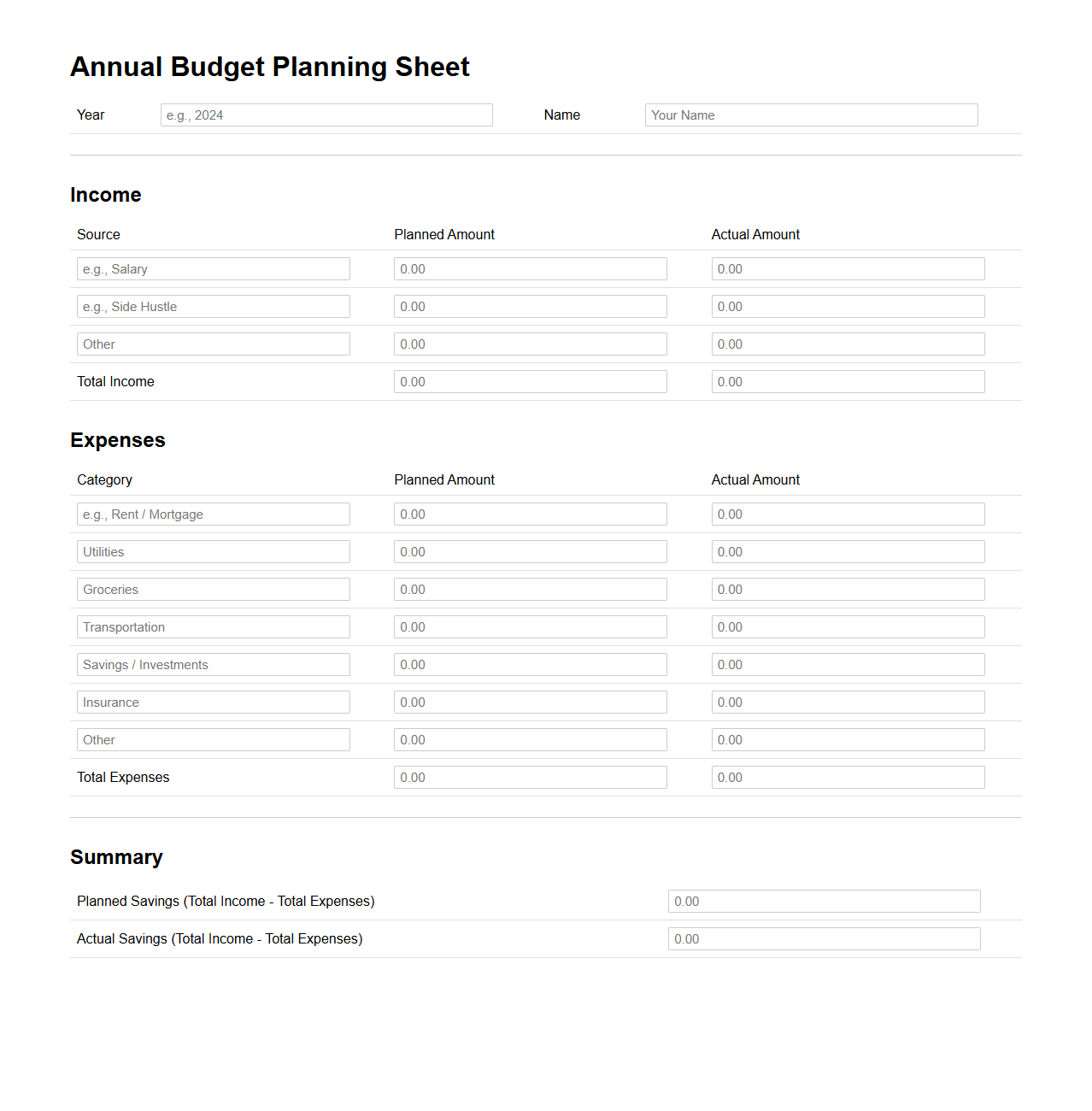

Annual Budget Planning Sheet for Individuals

An

Annual Budget Planning Sheet for individuals is a detailed financial tool designed to help track income, expenses, and savings goals over a 12-month period. This document allows users to allocate funds effectively, monitor spending habits, and adjust financial priorities to ensure fiscal responsibility. By providing a clear overview of financial inflows and outflows, it supports informed decision-making and long-term financial stability.

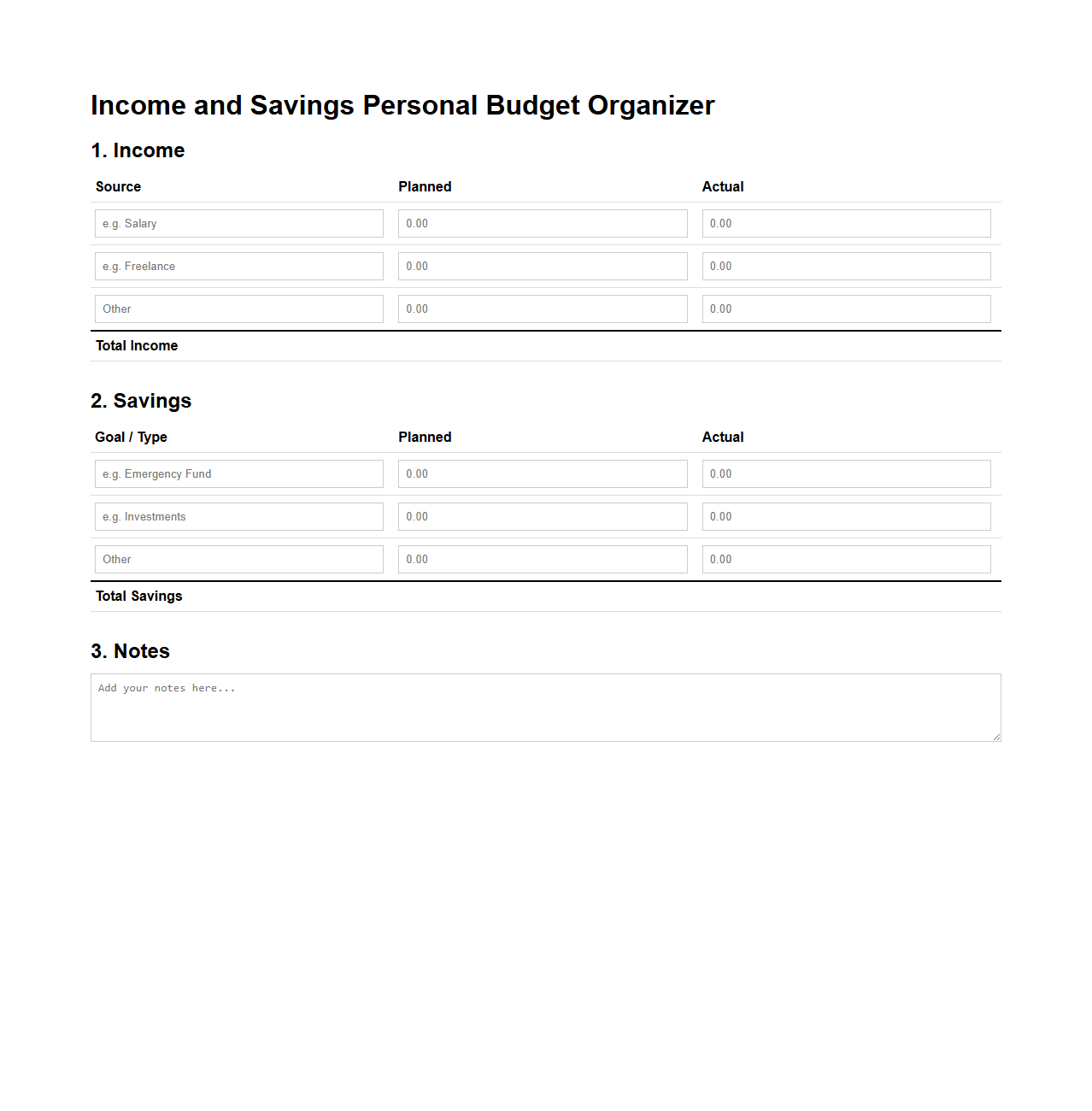

Income and Savings Personal Budget Organizer

The

Income and Savings Personal Budget Organizer document is a financial tool designed to track and manage individual earnings and accumulated savings effectively. It allows users to categorize sources of income, record regular savings contributions, and monitor budget goals for improved financial planning. This organizer helps in identifying spending patterns and optimizing resource allocation for better money management.

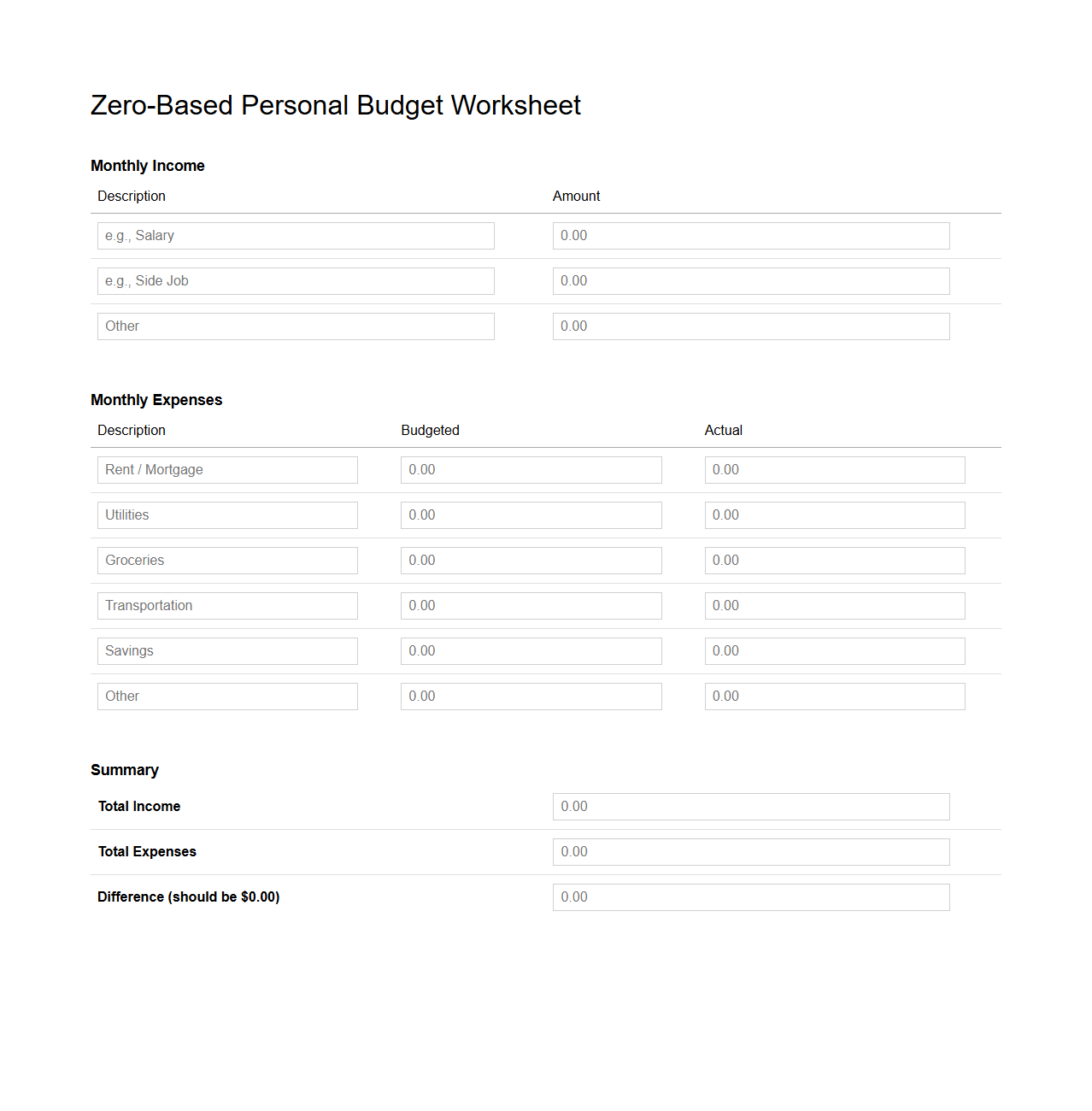

Zero-Based Personal Budget Worksheet

A

Zero-Based Personal Budget Worksheet is a financial planning tool that helps individuals allocate every dollar of their income to specific expenses, savings, or debt repayment, ensuring the total income minus total expenses equals zero. This method promotes disciplined spending and precise tracking by requiring one to plan each expense category in detail. It is particularly useful for improving money management, preventing overspending, and maximizing financial goals.

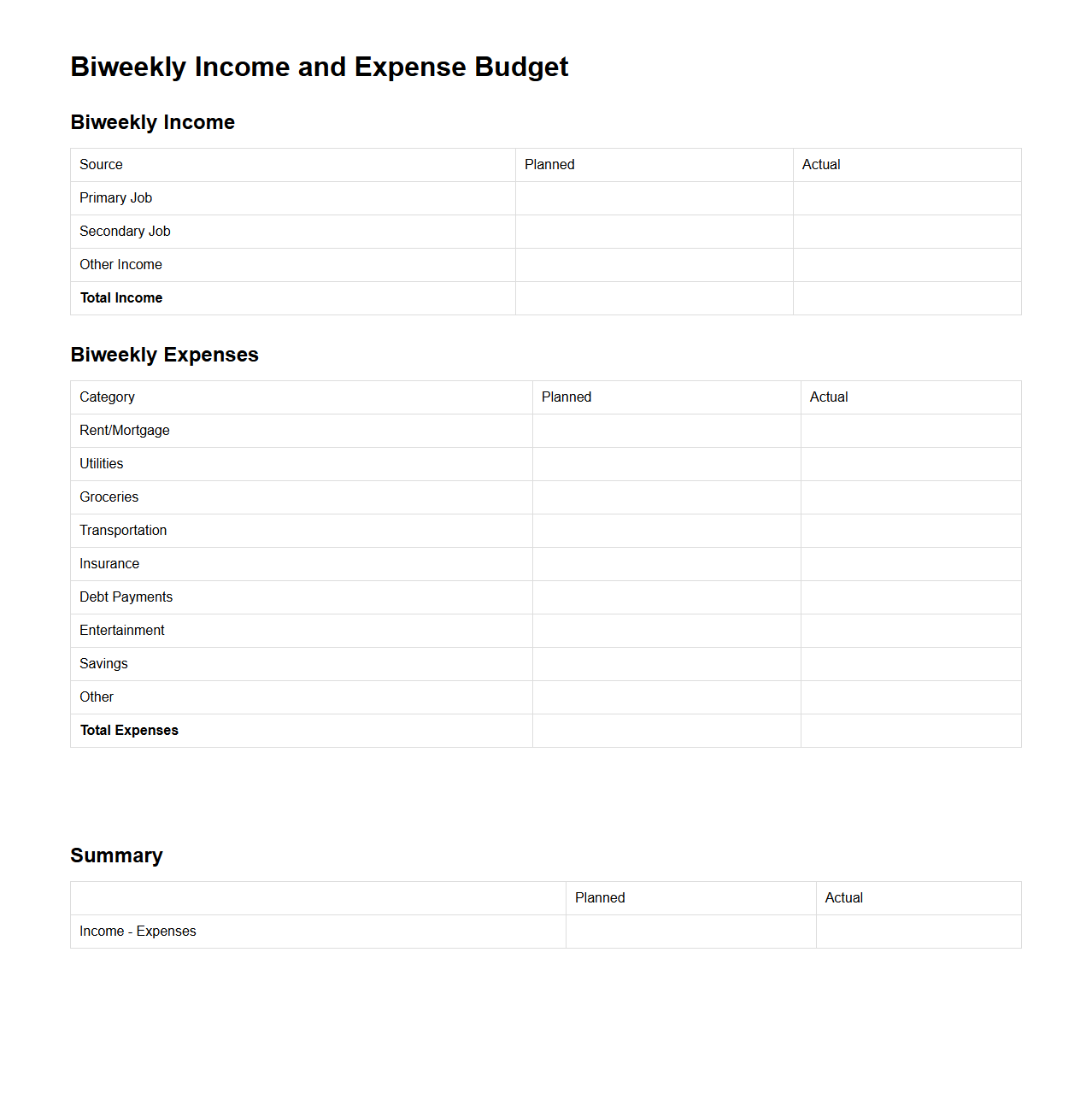

Biweekly Income and Expense Budget Template

A

Biweekly Income and Expense Budget Template document helps individuals manage their finances by tracking income and expenses every two weeks. It organizes cash flow within a 14-day period, enabling more accurate budgeting for pay periods that occur twice a month. This template simplifies financial planning by providing a clear overview of earnings, fixed costs, and variable spending in a structured format.

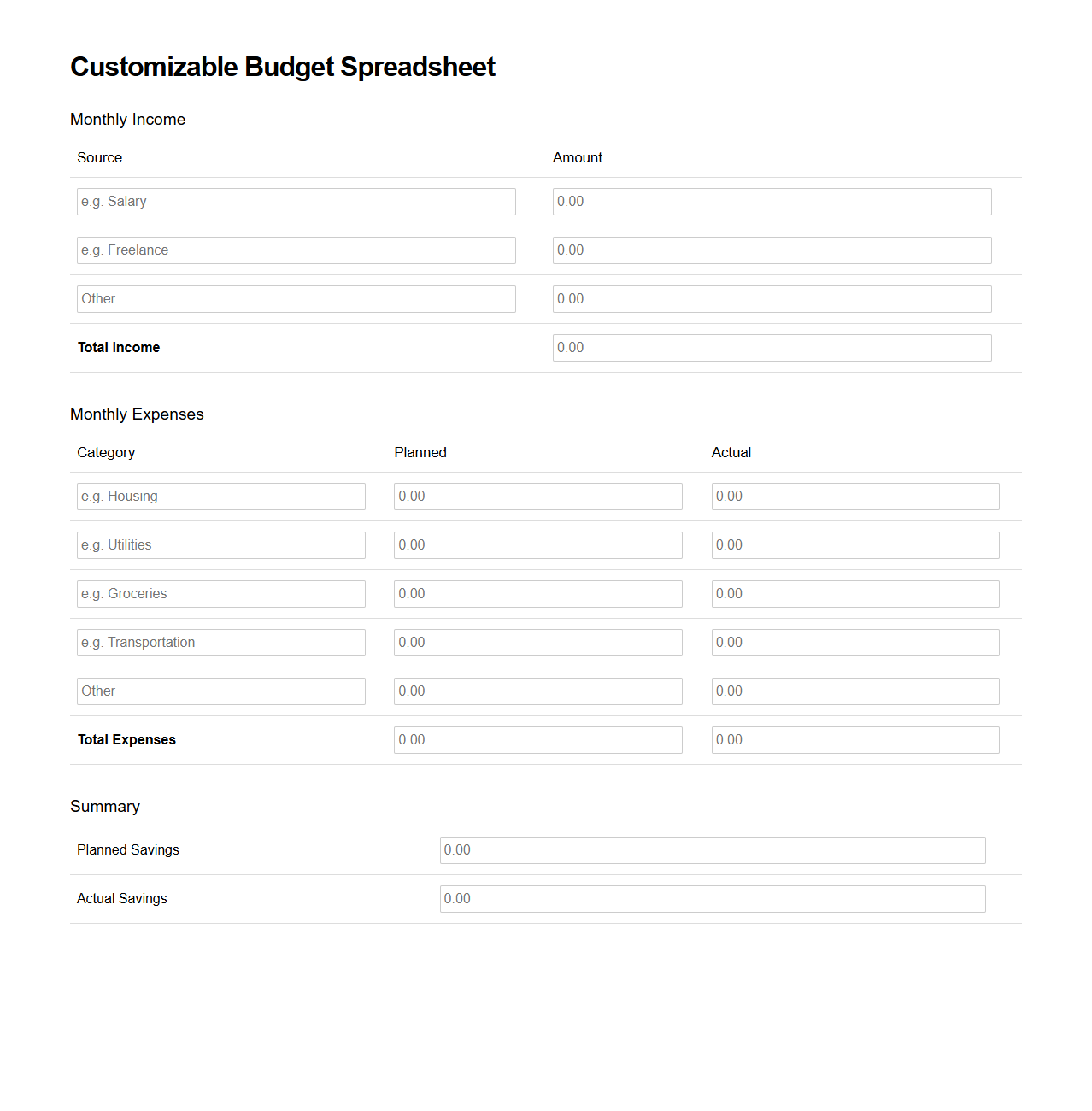

Customizable Budget Spreadsheet for Personal Finance Management

A

Customizable Budget Spreadsheet for Personal Finance Management is a dynamic tool designed to track income, expenses, and savings with tailored categories and formats. It enables users to input and adjust financial data for accurate budgeting and forecasting, enhancing money management and goal setting. This spreadsheet supports better financial decisions by providing insights into spending patterns and cash flow.

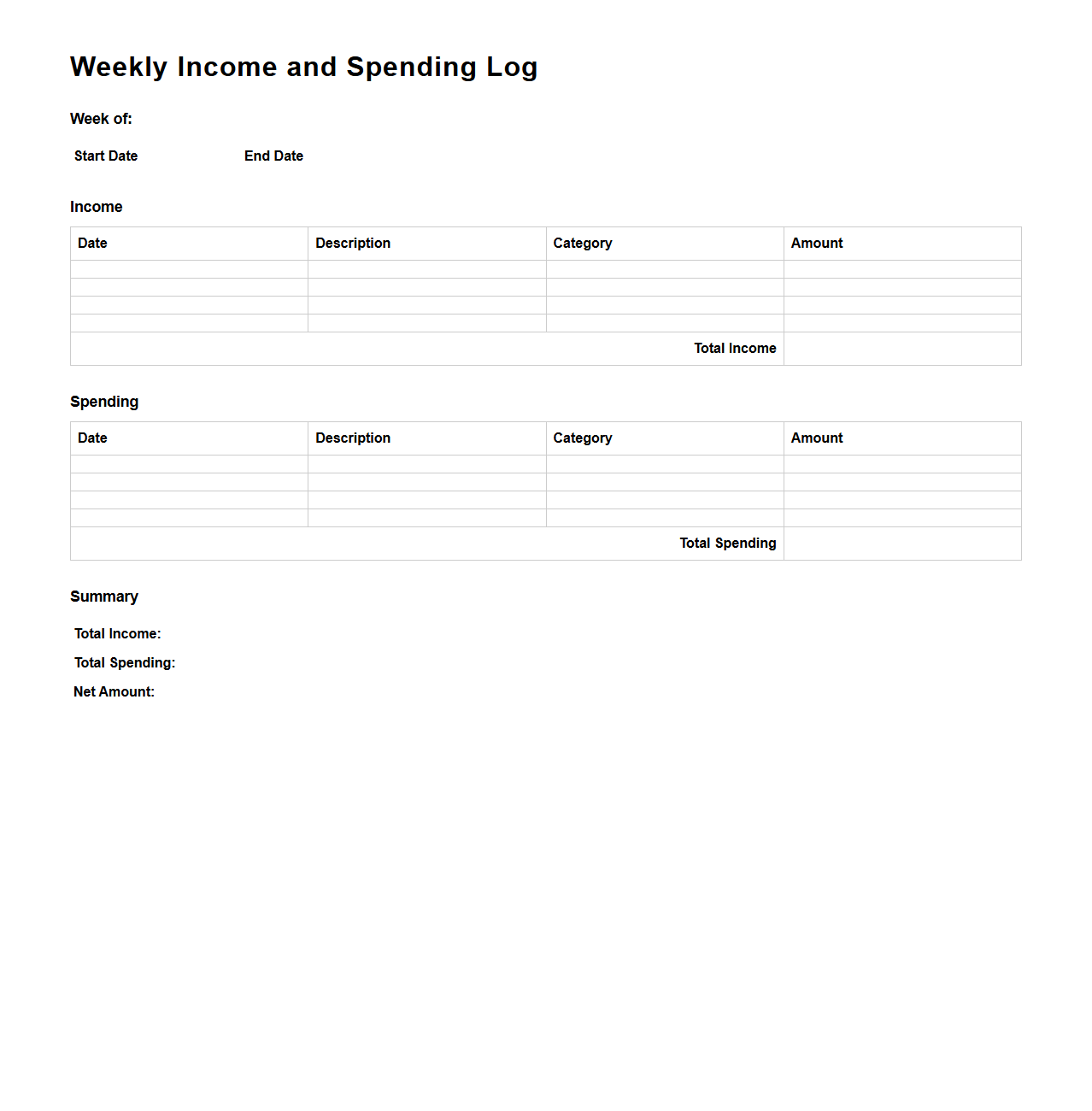

Weekly Income and Spending Log Template

A

Weekly Income and Spending Log Template document is a structured tool designed to help individuals track and manage their financial inflows and outflows over a seven-day period. It categorizes sources of income and expenditure, enabling users to analyze spending patterns, budget effectively, and improve financial decision-making. This template promotes financial awareness by providing clear visibility into weekly cash flow and supports goal-oriented money management.

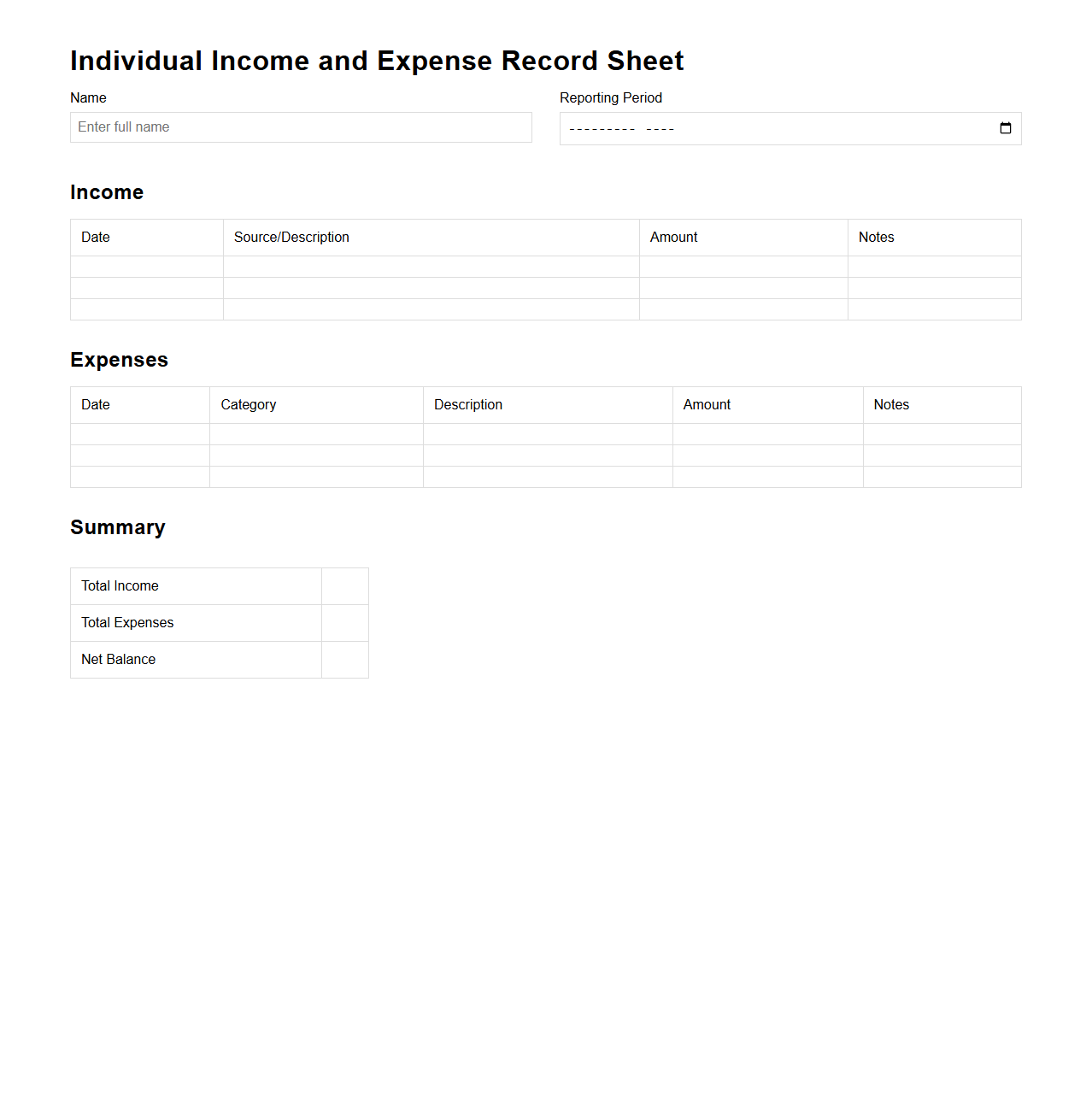

Individual Income and Expense Record Sheet

An

Individual Income and Expense Record Sheet document is a financial tool used to systematically track personal earnings and expenditures over a specific period. It helps individuals monitor cash flow, categorize spending, and maintain accurate records for budgeting or tax purposes. Maintaining this document ensures better financial management and aids in identifying areas for potential savings or necessary adjustments.

How to categorize irregular income streams on a blank personal budget letter?

Irregular income streams should be labeled under a separate category to distinguish them from stable earnings. Use headings like "Freelance Income" or "Variable Earnings" to track these amounts effectively. This helps in maintaining clarity and accurately forecasting your financial situation.

What are the essential fields to include for monthly versus weekly income tracking?

For monthly tracking, include fields such as total income, date received, and source to capture a broad overview of finances. Weekly tracking requires more granular fields like day of the week, amount earned, and payment method to monitor short-term cash flow. Both methods should have space for notes to record any irregularities or bonuses.

How can budget letters be adapted for joint income documentation?

When documenting joint income, create separate fields for each individual's earnings as well as a combined total. Include columns to indicate the source of income and contribution percentage for clarity. This format ensures transparent and organized financial records for both parties.

What tracking methods improve accuracy for freelance or gig income on budget templates?

Implement detailed entry logs with dates, client names, and payment status to enhance accuracy in freelance income tracking. Utilize categorization for different types of gigs to better understand income patterns. Regularly updating and reconciling these entries prevents discrepancies and improves financial planning.

How should errors or corrections be documented on a blank personal budget letter?

Errors should be struck through clearly with a single line and followed by the correct entry to maintain a transparent audit trail. Add a date and brief explanation near the correction to provide context. This method strengthens the integrity of your financial records while avoiding confusion.

![]()