A Blank Confidentiality Agreement Template for Mergers provides a customizable framework to protect sensitive information during merger negotiations. It outlines the obligations of involved parties to maintain confidentiality, ensuring legal security and trust throughout the process. This template helps streamline the drafting of non-disclosure terms tailored to the complexities of merger transactions.

Standard Confidentiality Agreement Template for Mergers

A

Standard Confidentiality Agreement Template for Mergers is a legal document designed to protect sensitive information disclosed between parties involved in a merger process. It outlines the obligations of each party to maintain confidentiality, specifies the scope of confidential information, and sets terms for handling and prohibiting unauthorized disclosures. This template ensures legal compliance and mitigates risks associated with information leaks during merger negotiations.

Non-Disclosure Agreement Template for Business Mergers

A

Non-Disclosure Agreement Template for Business Mergers is a legal document designed to protect sensitive information shared during the merger process between companies. It outlines the confidential information that parties agree not to disclose to third parties, ensuring proprietary data and trade secrets remain secure. This template helps establish clear terms for confidentiality, reducing risks of information leaks that could jeopardize the merger's success.

Basic Confidentiality Contract Template for M&A

A

Basic Confidentiality Contract Template for M&A document establishes the terms under which parties agree to protect sensitive information exchanged during mergers and acquisitions. It outlines obligations to maintain privacy, restrict disclosure, and specify permitted use of confidential data to safeguard proprietary business details. This template is essential for ensuring trust and legal protection throughout the negotiation and due diligence processes.

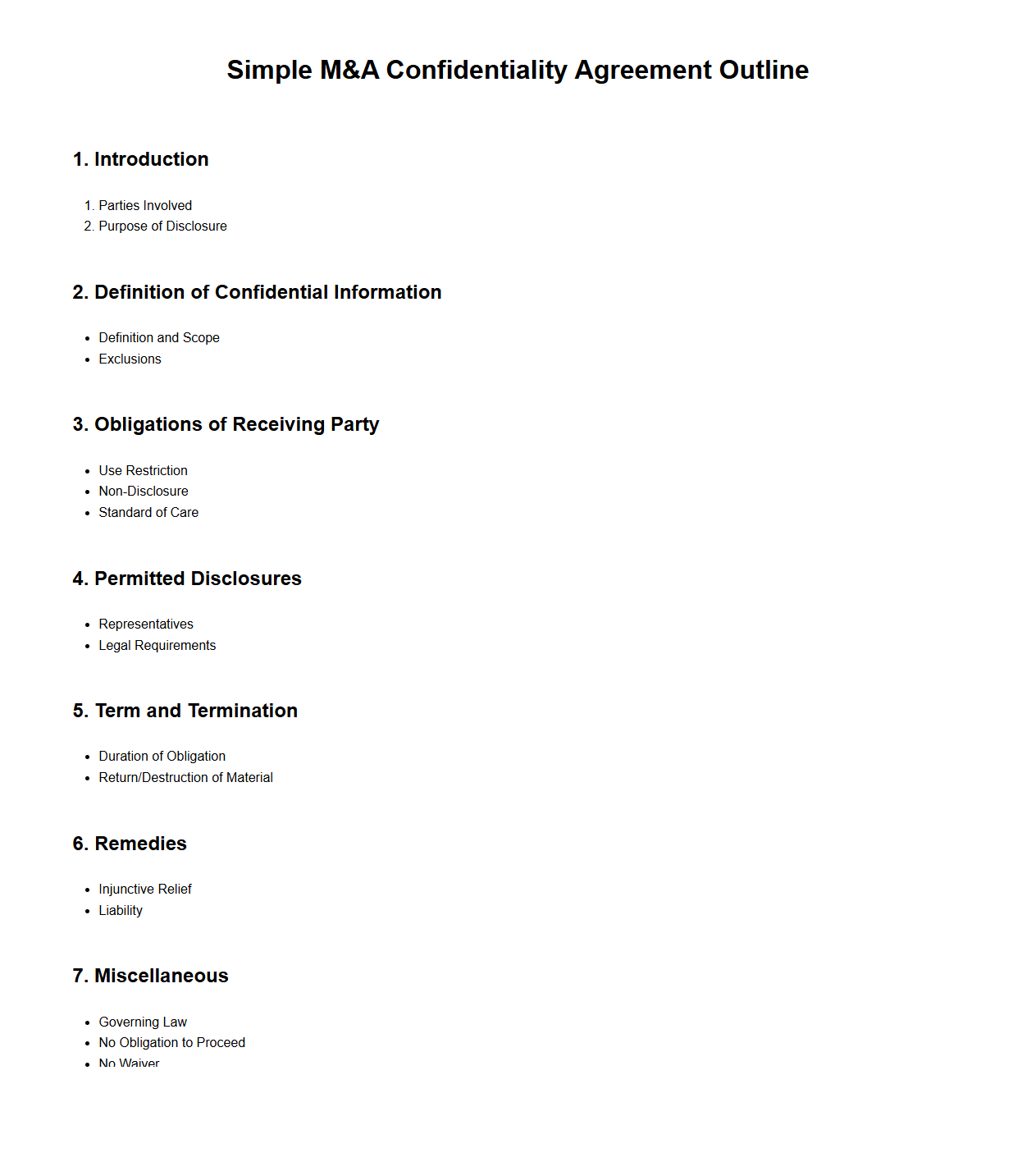

Simple M&A Confidentiality Agreement Outline

A

Simple M&A Confidentiality Agreement Outline document serves as a foundational framework that defines the terms and obligations regarding the protection of sensitive information exchanged during mergers and acquisitions. It ensures that both parties commit to non-disclosure of confidential business data, trade secrets, and intellectual property throughout negotiations and due diligence. This document is essential for maintaining trust, minimizing legal risks, and facilitating a smooth transaction process.

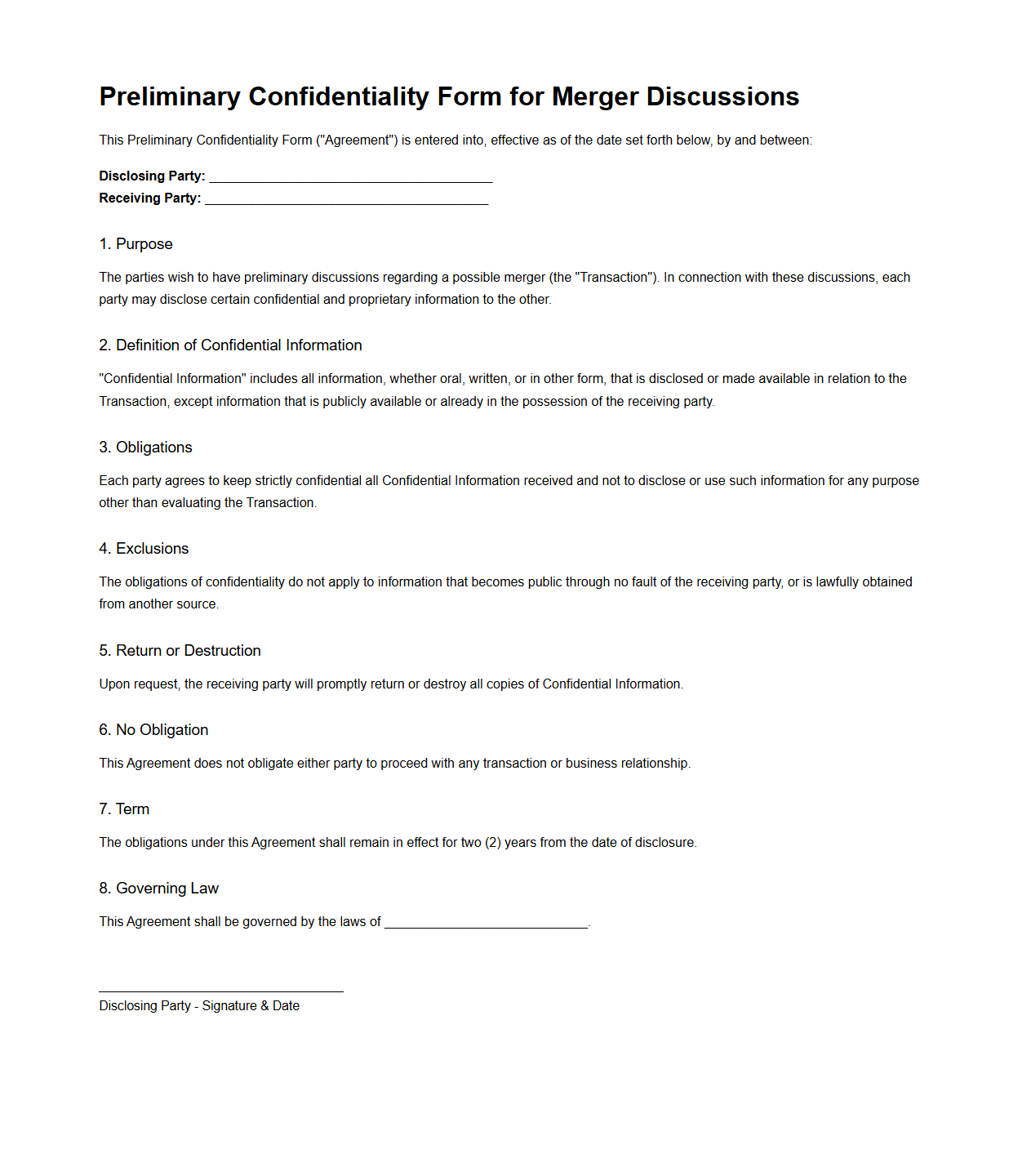

Preliminary Confidentiality Form for Merger Discussions

A

Preliminary Confidentiality Form for Merger Discussions is a legal document designed to protect sensitive information shared between parties exploring a potential merger. It outlines the obligations of each party regarding the confidentiality of proprietary data, trade secrets, and any other non-public information exchanged during the negotiation process. This form establishes the foundation for trust and ensures that discussions remain secure, preventing unauthorized disclosure or misuse of critical business information.

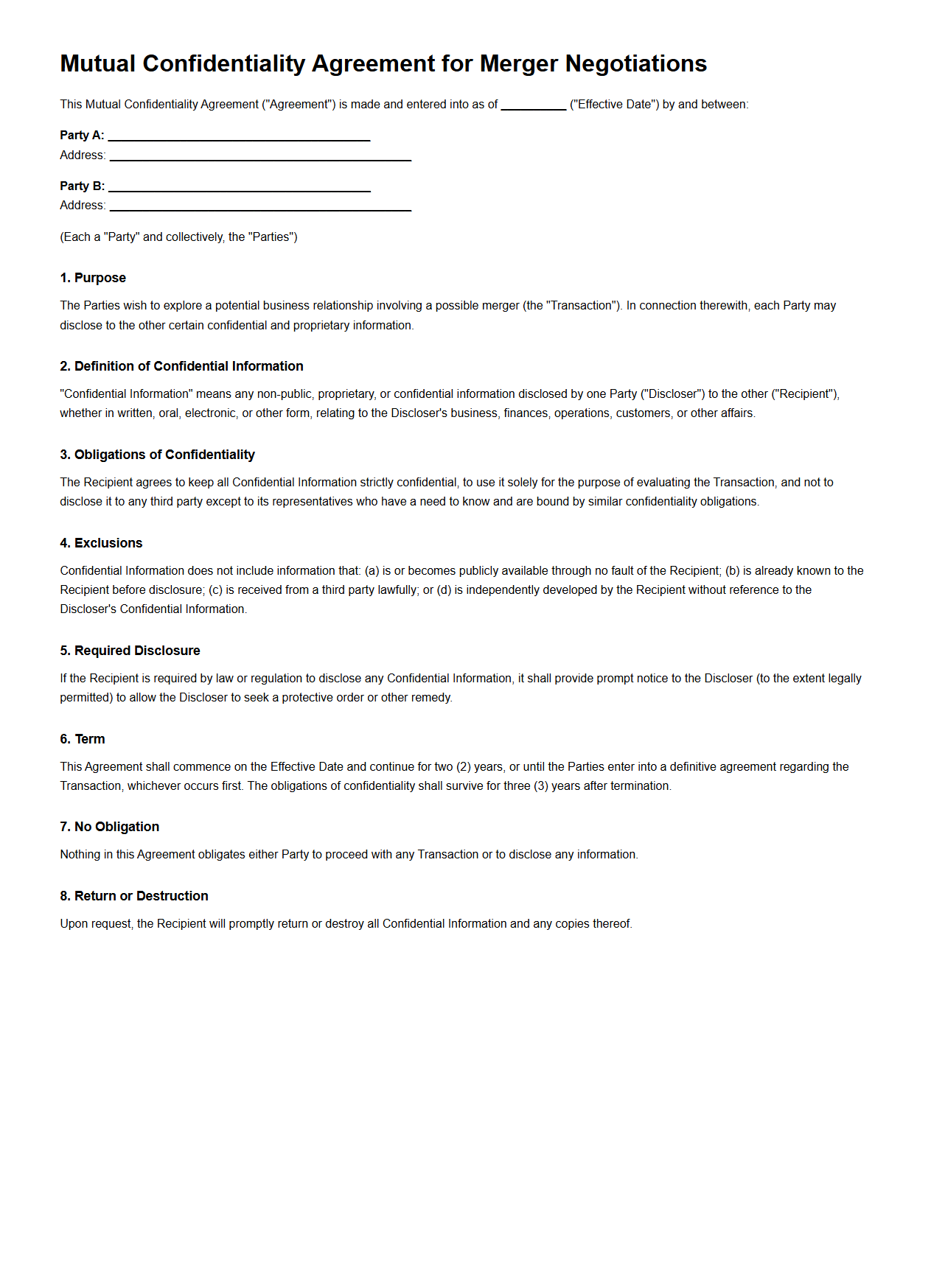

Mutual Confidentiality Agreement for Merger Negotiations

A

Mutual Confidentiality Agreement for Merger Negotiations is a legal contract that ensures both parties involved in merger discussions protect sensitive information from unauthorized disclosure. This agreement outlines specific terms about the handling, sharing, and use of proprietary data such as financial records, business strategies, and intellectual property during the negotiation process. It safeguards the interests of both companies by maintaining trust and preventing competitive risks before a formal merger is finalized.

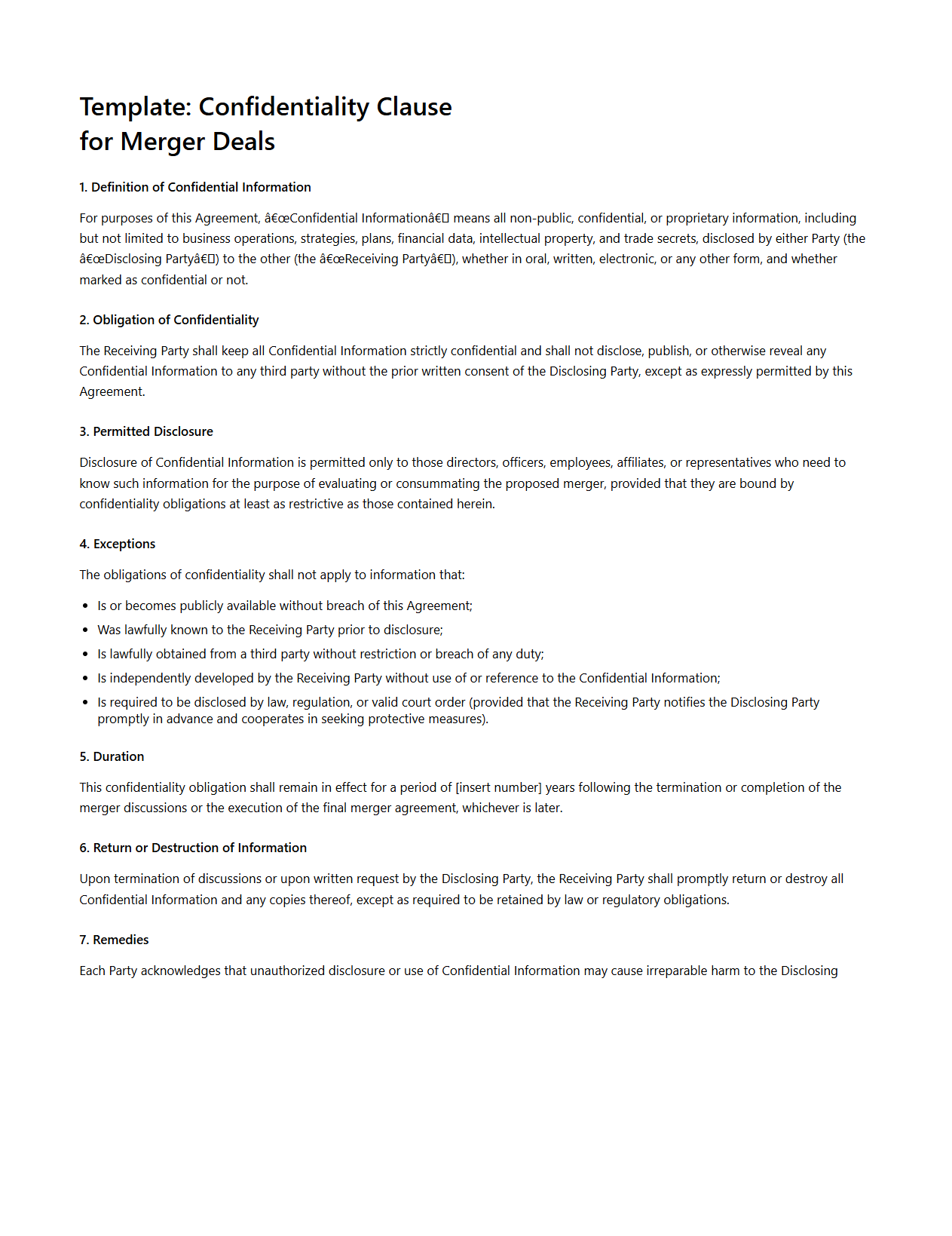

Template for Confidentiality Clause in Merger Deals

A

Template for Confidentiality Clause in Merger Deals document provides a standardized legal framework to protect sensitive information exchanged between merging parties. It outlines obligations to prevent unauthorized disclosure of trade secrets, financial data, and strategic plans during negotiations. This template ensures both parties maintain trust and comply with regulatory requirements throughout the merger process.

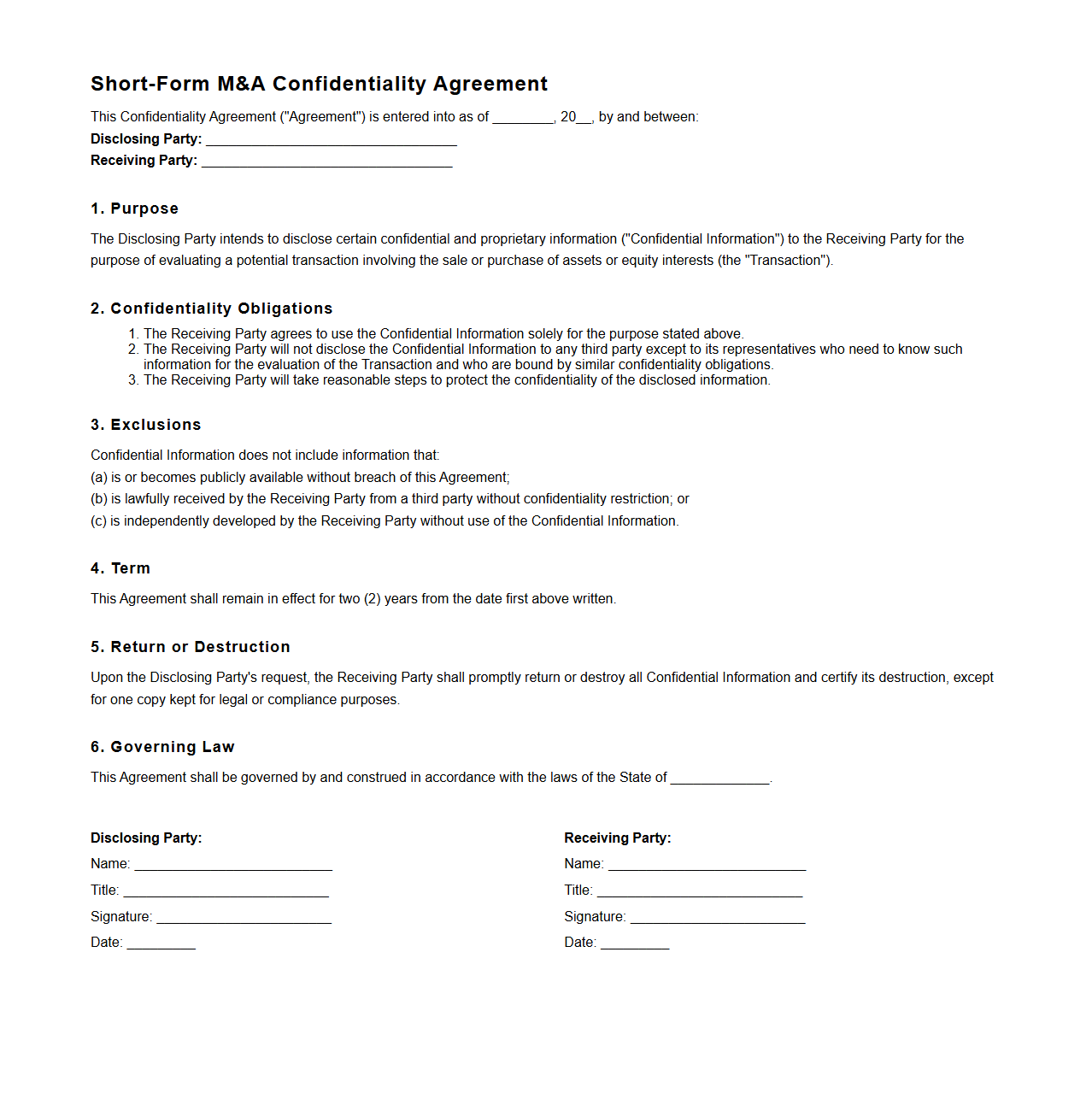

Short-Form M&A Confidentiality Agreement

A

Short-Form M&A Confidentiality Agreement is a concise legal document designed to protect sensitive information shared between parties during merger and acquisition negotiations. It outlines the obligations for maintaining confidentiality and restricts unauthorized disclosure of proprietary data. This streamlined agreement facilitates faster execution while ensuring critical business details remain secure throughout the deal process.

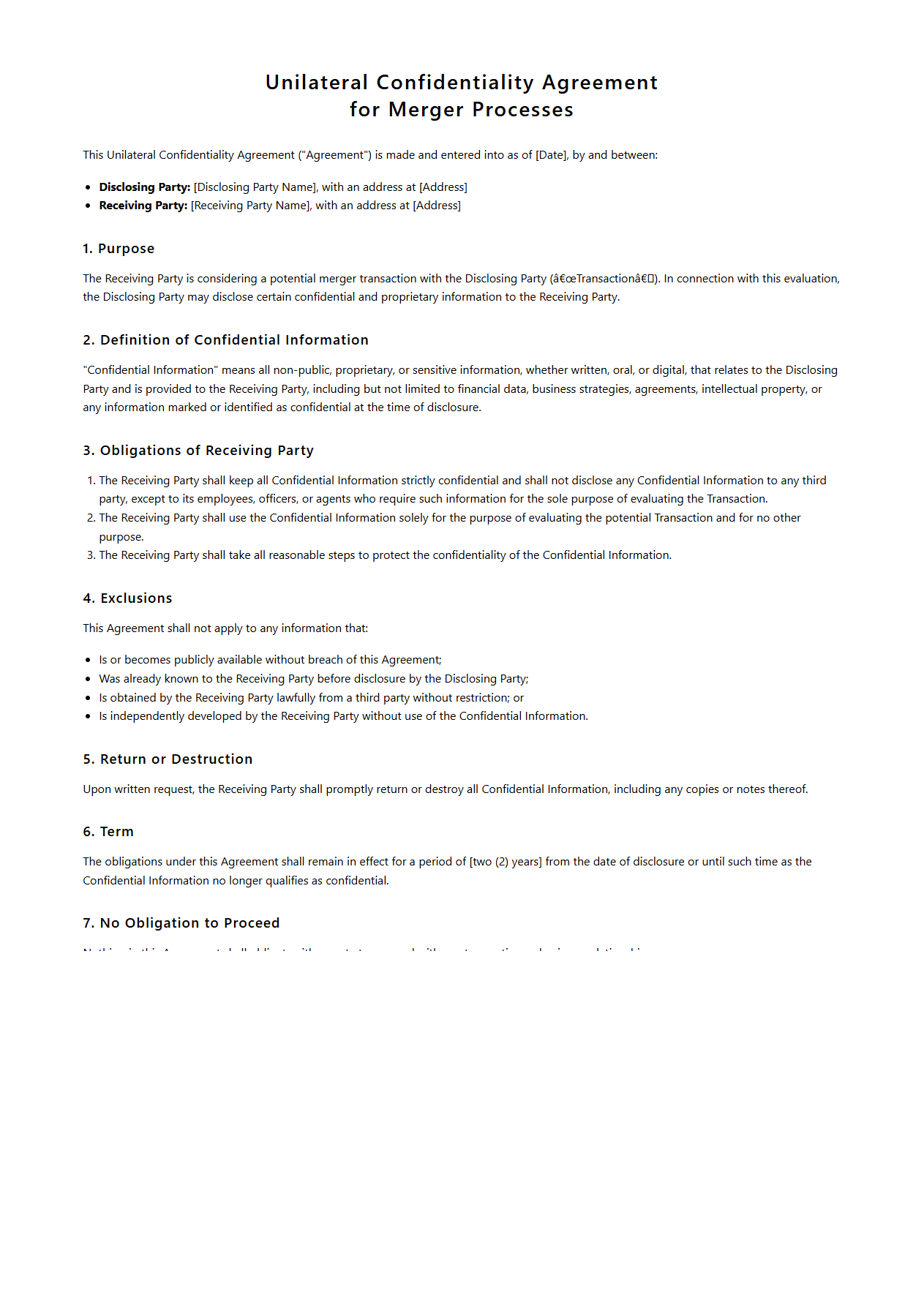

Unilateral Confidentiality Agreement for Merger Processes

A

Unilateral Confidentiality Agreement for merger processes is a legal contract where one party agrees to protect sensitive information shared by another during merger discussions. It ensures the receiving party maintains strict confidentiality to prevent unauthorized use or disclosure of proprietary data. This document is essential for safeguarding business interests and facilitating trust in complex merger negotiations.

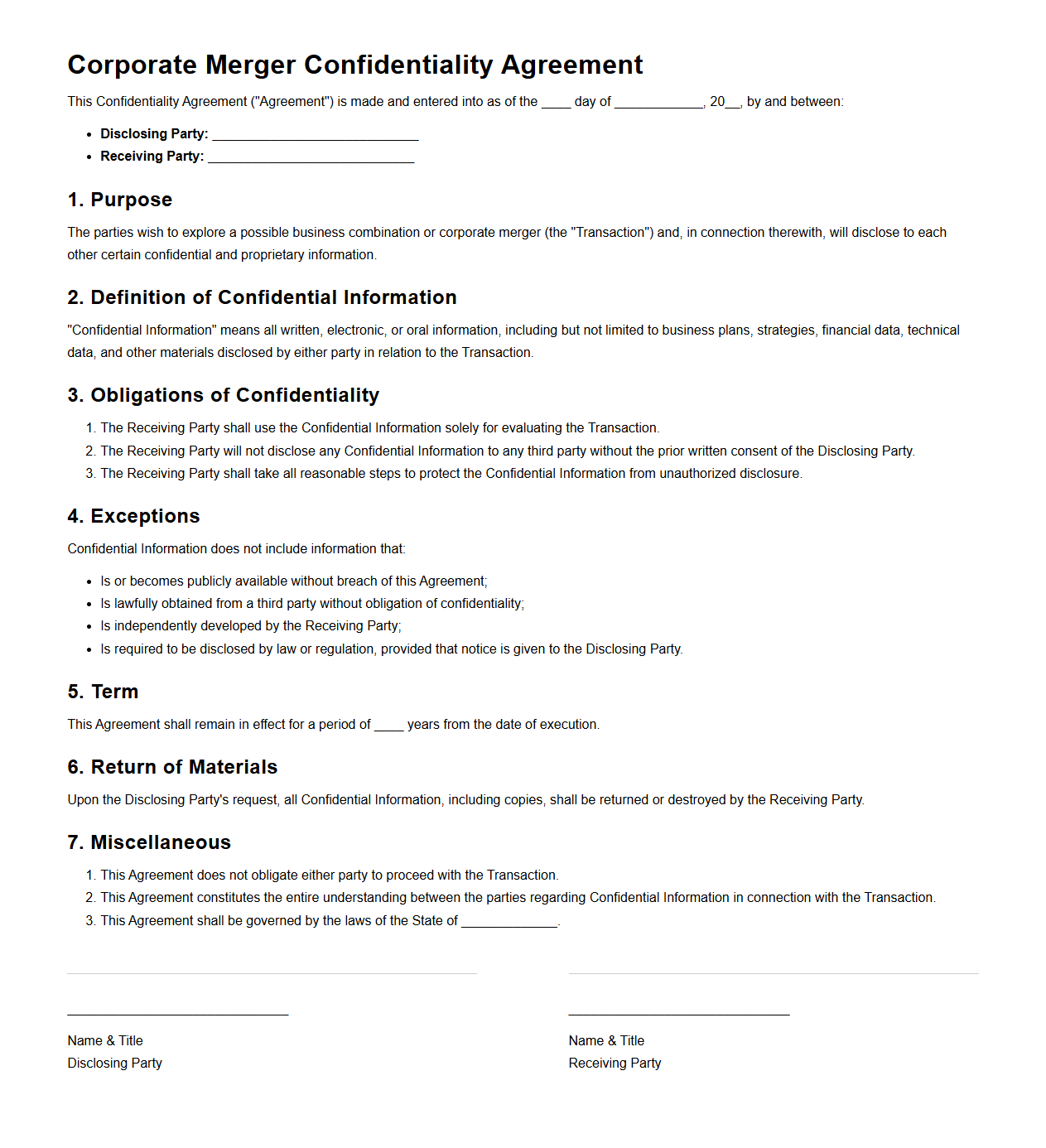

Corporate Merger Confidentiality Agreement Sample

A

Corporate Merger Confidentiality Agreement Sample document is a legal template used to protect sensitive information during the negotiation and due diligence phases of a corporate merger. It outlines the obligations of involved parties to maintain confidentiality and restrict unauthorized disclosure of proprietary data. This agreement is essential to safeguard trade secrets, financial details, and strategic plans, ensuring trust and compliance between merging companies.

What clauses protect trade secrets in a blank confidentiality agreement for mergers?

Trade secrets are protected through specific clauses that restrict unauthorized use and disclosure during and after the merger process. These clauses often include non-disclosure obligations, limited access to information, and stipulations on safeguarding sensitive data. Additionally, the agreement binds all parties to maintain strict confidentiality to prevent any leakage of proprietary information.

How is "confidential information" precisely defined in these merger documents?

The term "confidential information" is broadly defined to encompass all non-public data shared between parties during the merger process. This can include financial records, business strategies, customer lists, and technological innovations. The definition explicitly excludes information already known publicly or independently developed outside the agreement.

What are the limitations on information sharing between merger parties?

Information sharing is tightly controlled to ensure that only authorized personnel have access to confidential data. The agreement specifies permissible uses of the information, typically restricting it solely to the review and evaluation of the merger opportunity. Parties are prohibited from disclosing sensitive information to third parties without prior written consent.

How long does the non-disclosure obligation extend post-merger?

The non-disclosure obligation typically extends for a defined period after the merger's completion or termination, often ranging from two to five years. This duration ensures ongoing protection of sensitive information even after the business transaction concludes. Some agreements allow for indefinite confidentiality regarding a company's trade secrets.

What remedies are specified for breaches in a blank merger confidentiality agreement?

Remedies for breaches include injunctive relief to prevent further disclosures and monetary damages for losses incurred. The confidentiality agreement often provides the right to seek equitable relief and specific performance in court. Additionally, breaching parties may face termination of merger negotiations and potential legal liabilities.