A Blank Invoice Template for Consulting Fees provides a professional and customizable format to bill clients for consulting services rendered. It includes essential sections such as client information, service descriptions, hourly rates, and payment terms to ensure accurate and transparent invoicing. This template streamlines the billing process, enhancing financial management for consulting businesses.

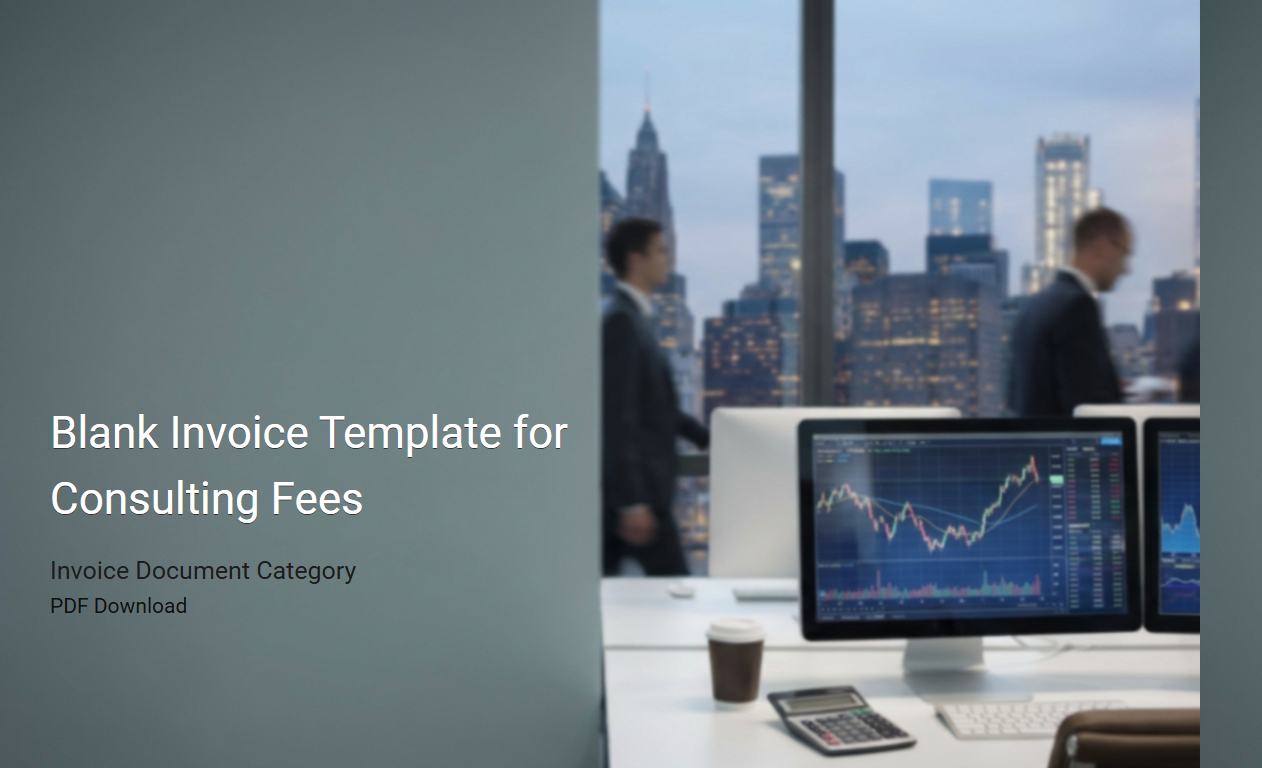

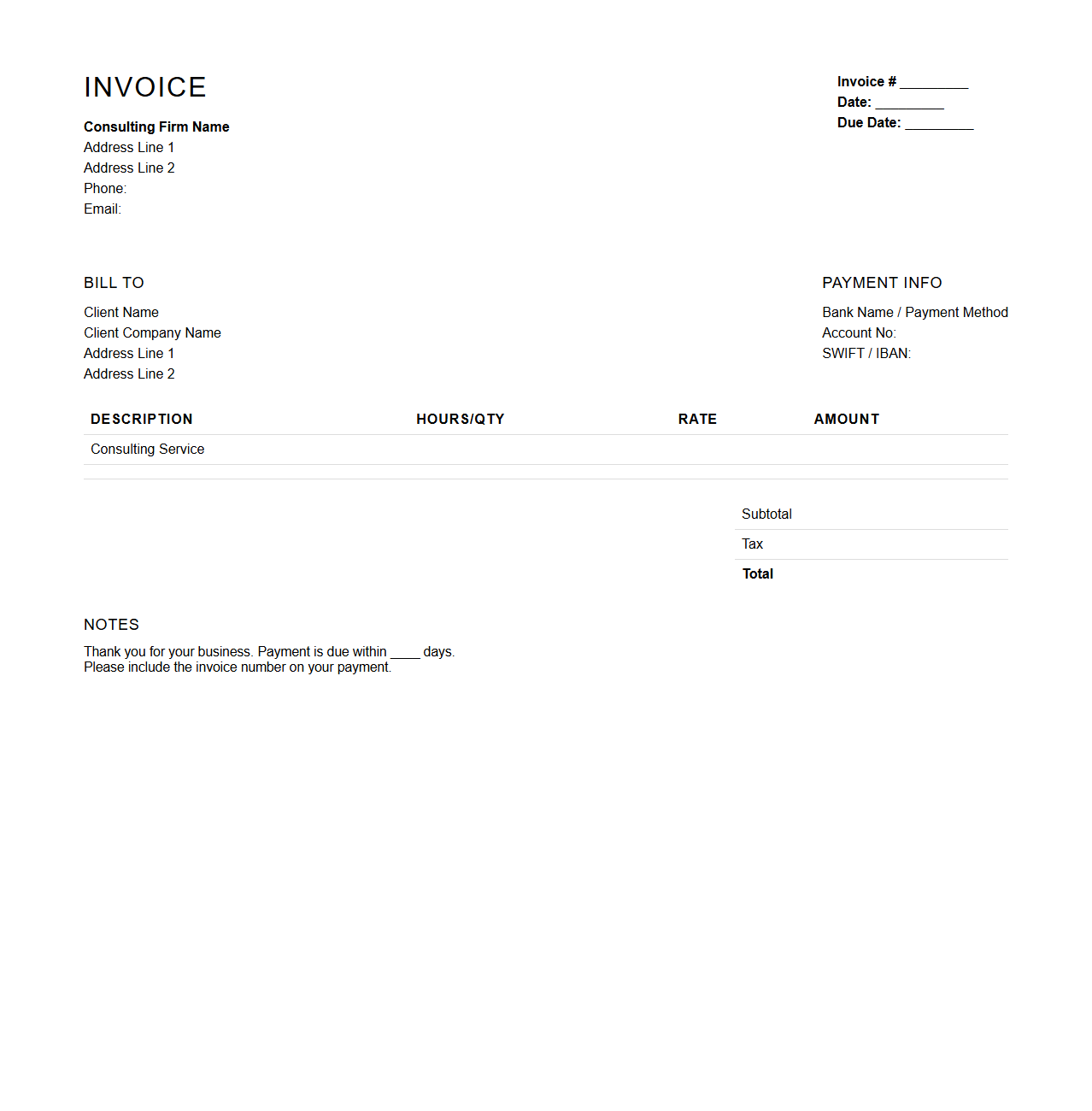

Consulting Fee Invoice Template Blank Format

A

Consulting Fee Invoice Template Blank Format document is a pre-designed layout used by consultants to bill clients for services rendered. It typically includes sections for client details, service descriptions, hours worked, rates, and total amount due, facilitating clear and professional invoicing. This template streamlines the billing process and ensures accurate record-keeping for both consultants and clients.

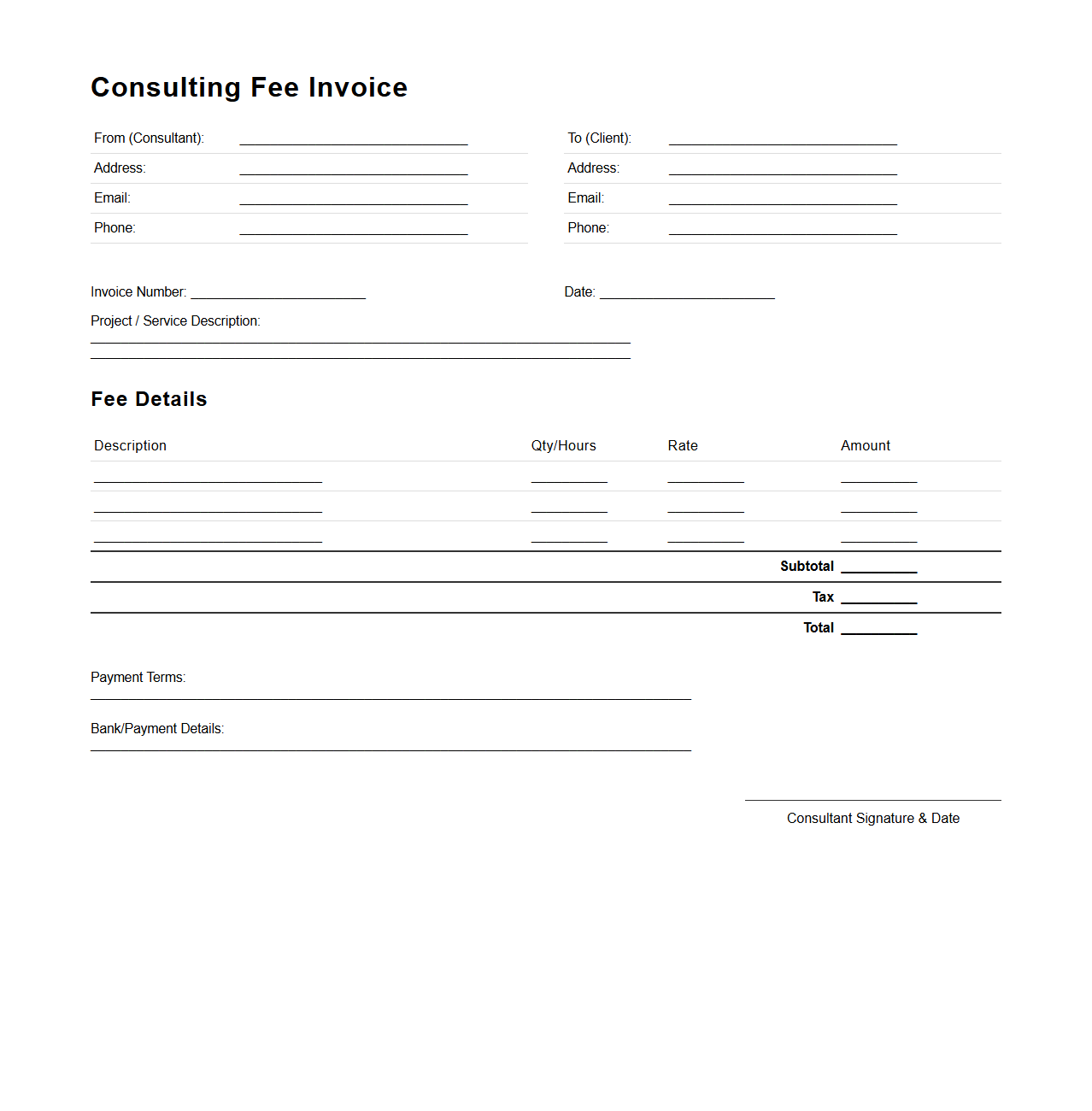

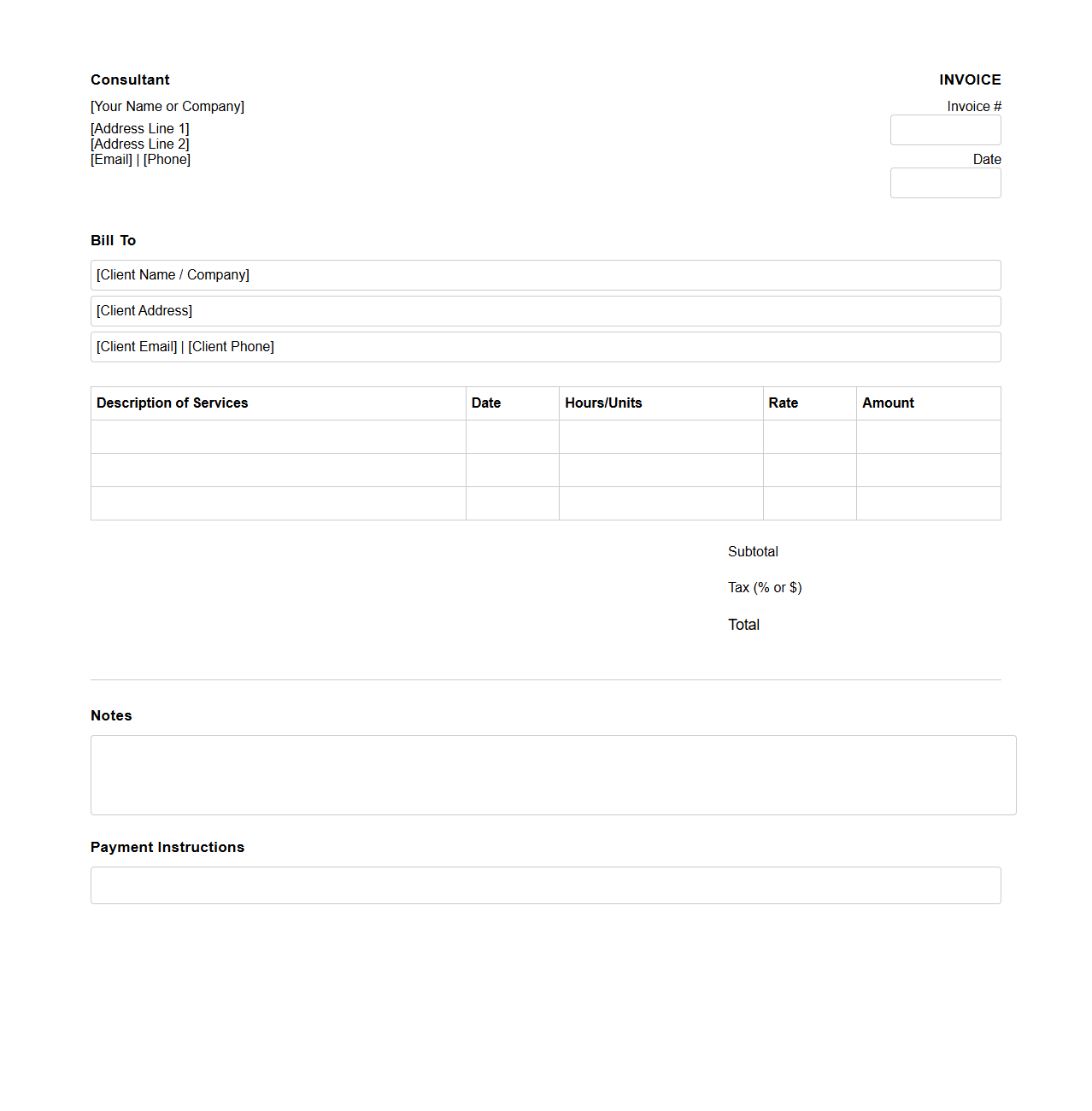

Simple Consultant Invoice Template Blank Sheet

A

Simple Consultant Invoice Template Blank Sheet document serves as a pre-formatted, customizable tool designed for consultants to bill clients efficiently. It typically includes sections for client information, service descriptions, hours worked, rates, and total amounts due, ensuring clear and professional invoicing. This template streamlines the billing process, enhances accuracy, and supports timely payment collection.

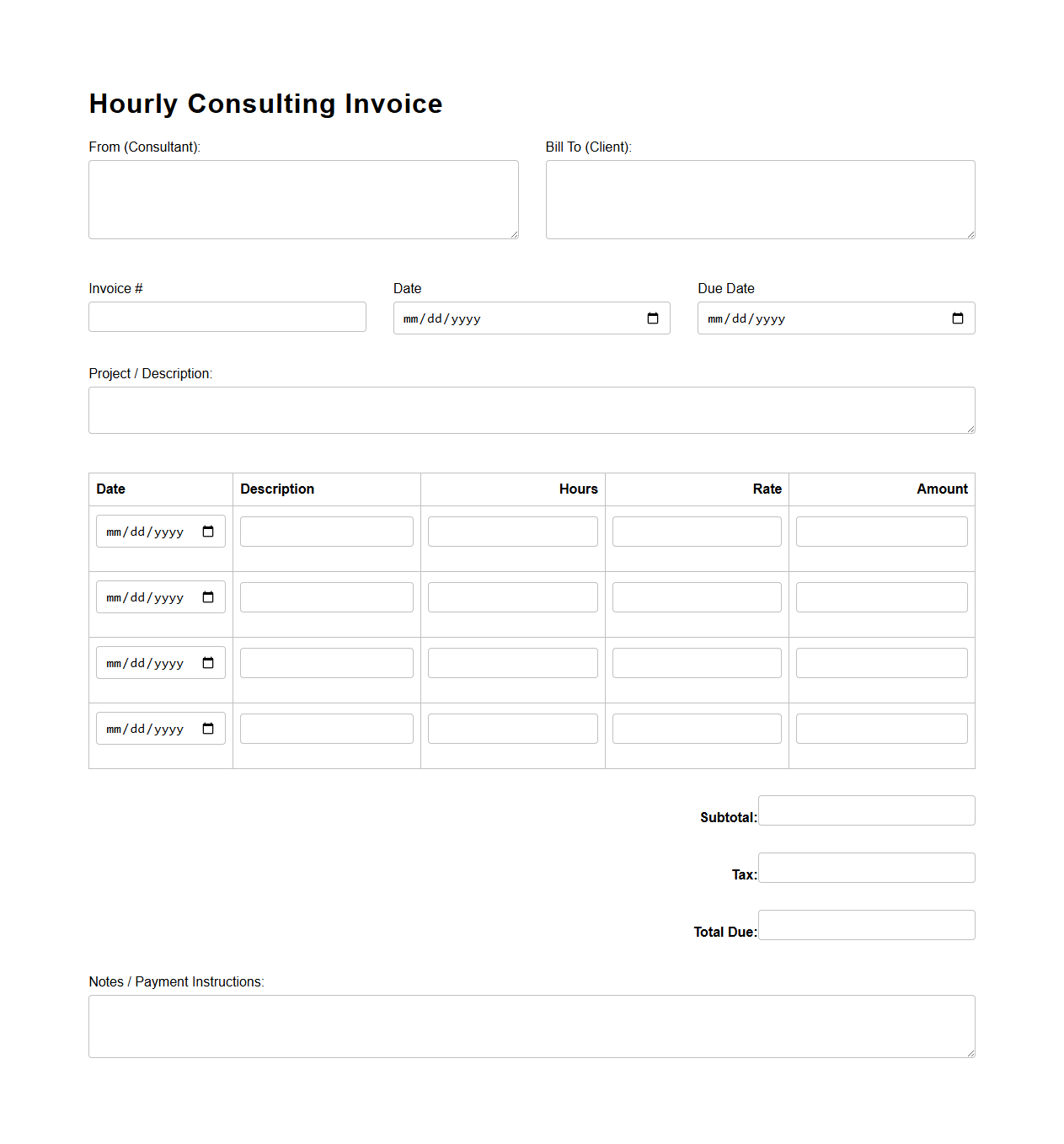

Blank Hourly Consulting Invoice Form

A

Blank Hourly Consulting Invoice Form is a customizable document used by consultants to bill clients for services based on the number of hours worked. It typically includes fields for the consultant's information, client details, hourly rate, description of services provided, hours worked, and the total amount due. This form streamlines the invoicing process, ensuring accurate tracking of billable hours and prompt payment.

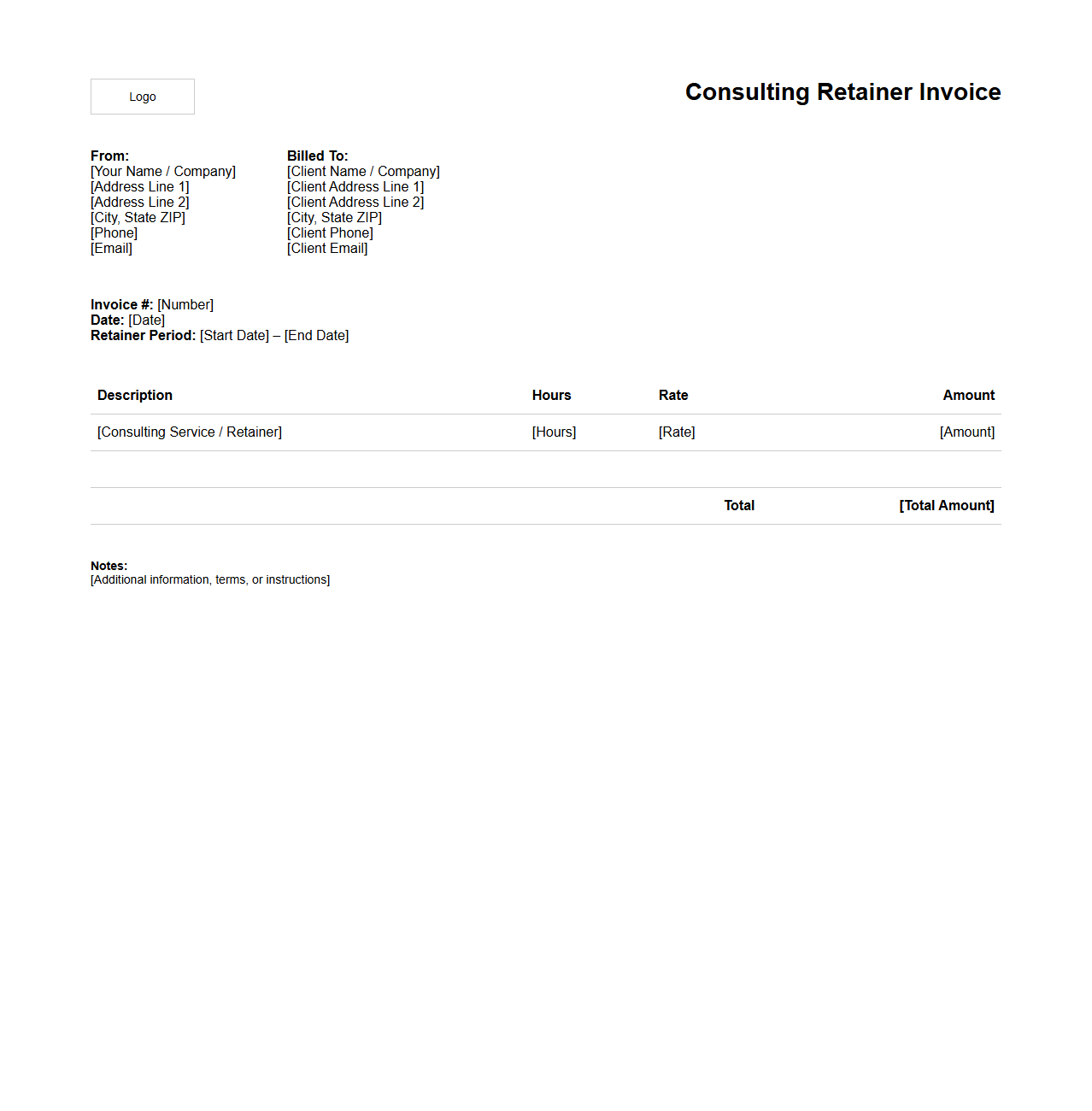

Consulting Retainer Invoice Blank Layout

A

Consulting Retainer Invoice Blank Layout document serves as a customizable template designed for consultants to bill clients on a retainer basis, ensuring timely and accurate payment for ongoing services. This layout typically includes key elements such as client details, retainer fee amounts, payment schedules, service descriptions, and invoice numbers, streamlining the invoicing process. Using a standardized blank layout helps maintain consistent financial records and improves communication between consultants and clients regarding billing terms.

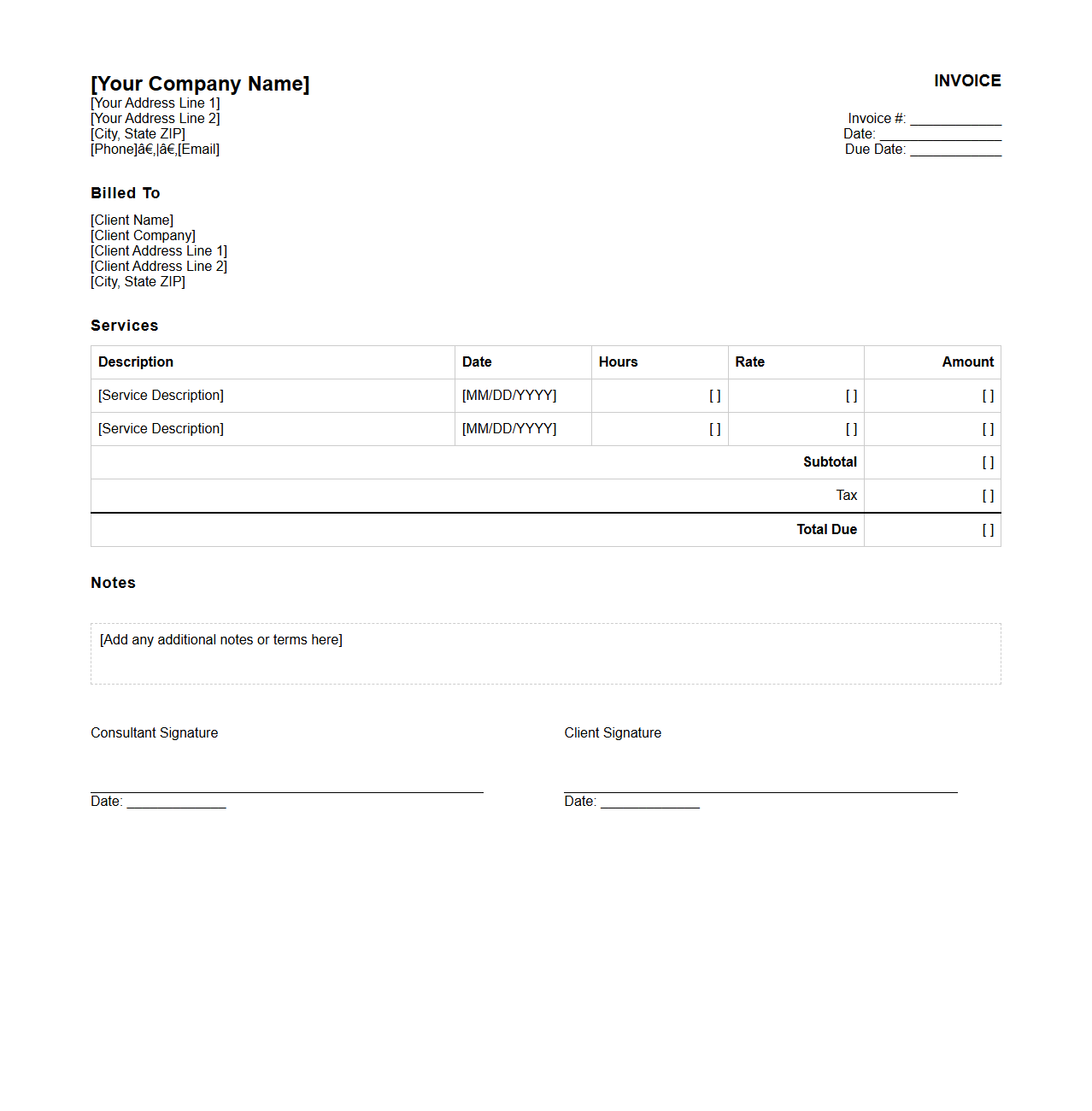

Blank Professional Services Consulting Invoice

A

Blank Professional Services Consulting Invoice document is a template used by consultants to bill clients for services rendered without pre-filled information. It includes sections for service descriptions, hours worked, rates, and payment terms, allowing customization for each project. This invoice facilitates clear communication and accurate payment processing between consultants and clients.

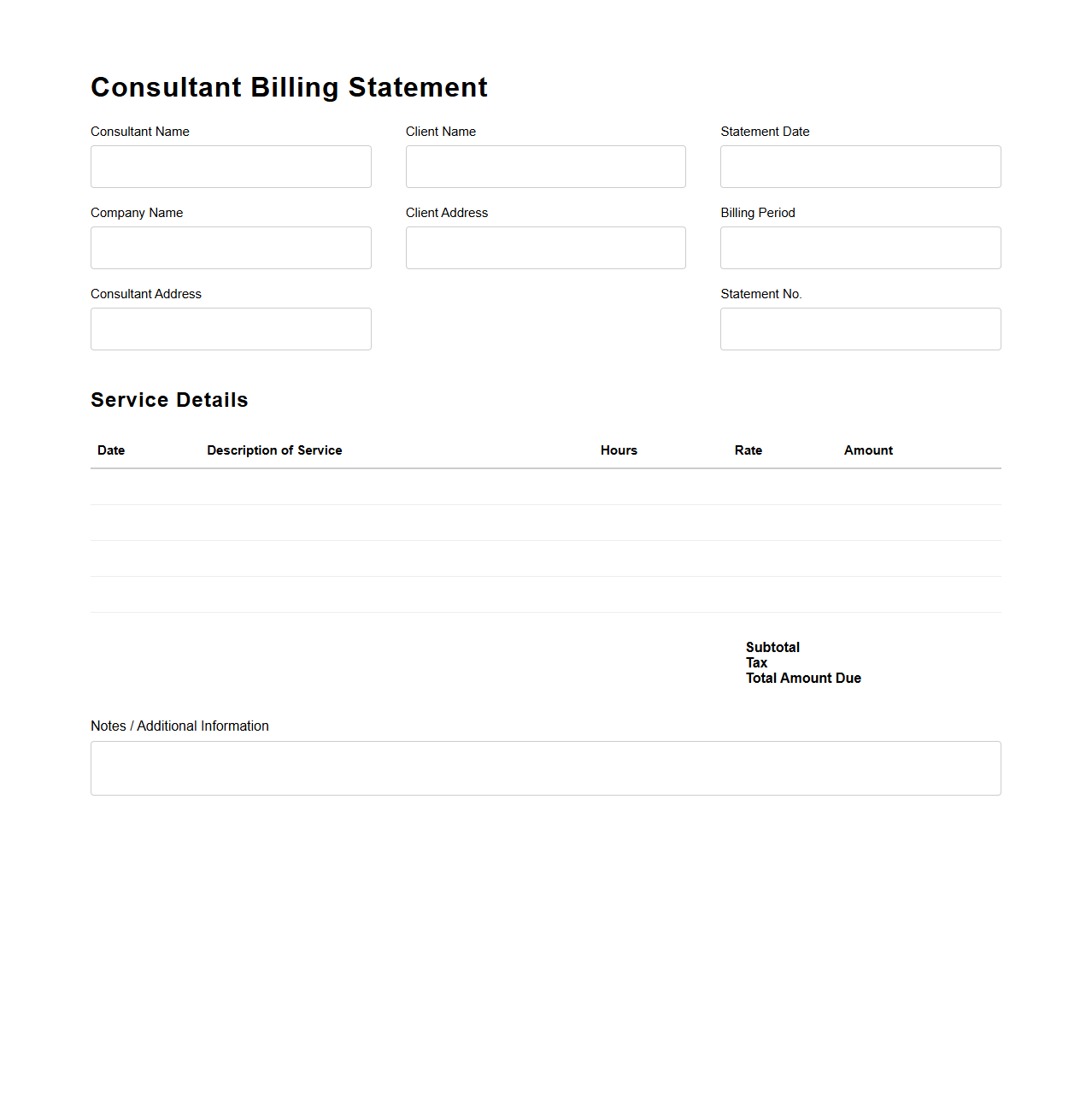

Blank Detailed Consultant Billing Statement

A

Blank Detailed Consultant Billing Statement is a pre-formatted document used by consultants to itemize services rendered, hours worked, and corresponding charges without any pre-filled data. It serves as a template for transparent billing, enabling consultants to provide clients with a clear and organized record of consulting activities and associated costs. This type of statement ensures accuracy and professionalism in financial communication between consultants and their clients.

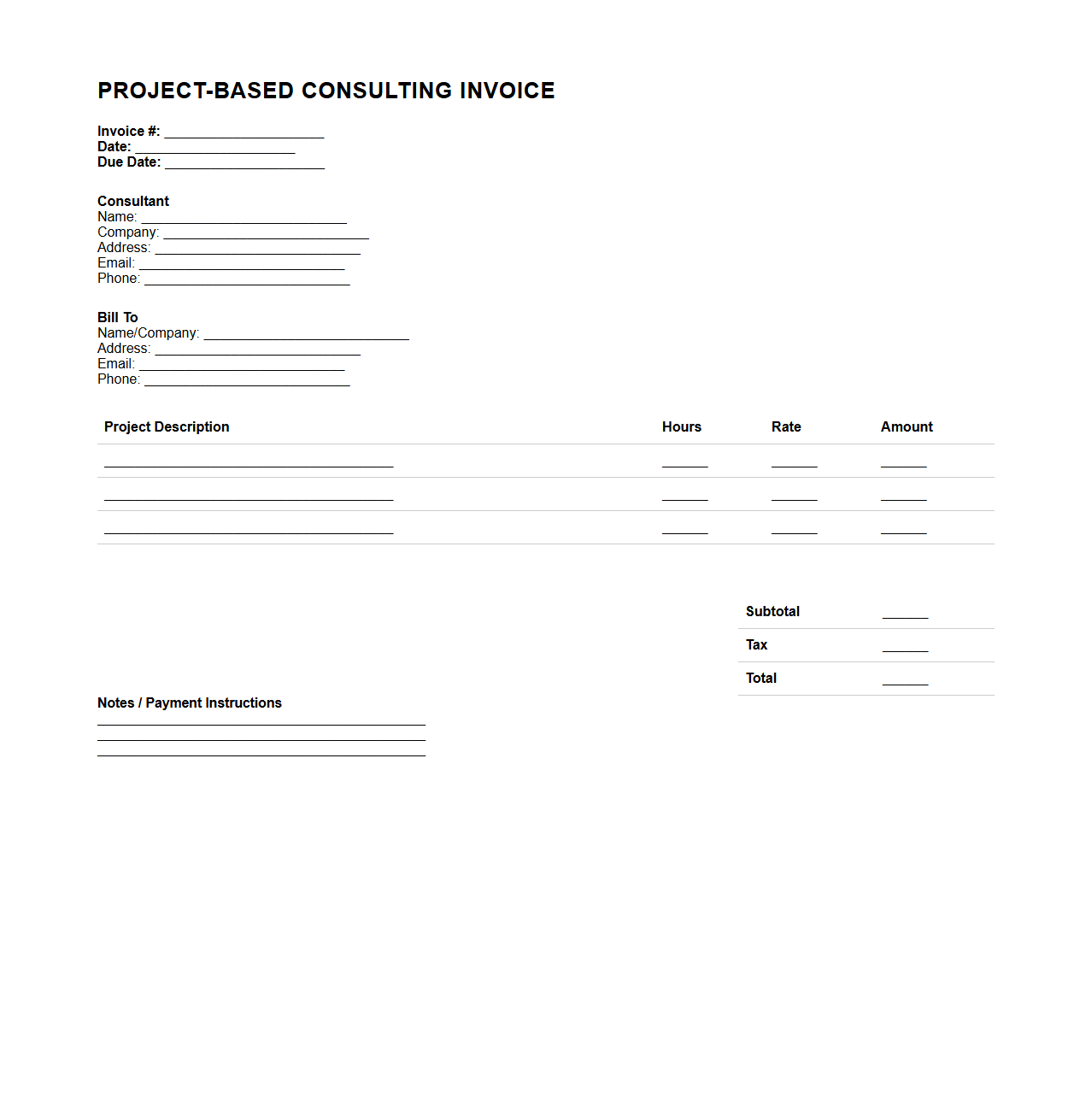

Blank Project-Based Consulting Invoice Template

A

Blank Project-Based Consulting Invoice Template is a customizable document designed for consultants to bill clients accurately based on project milestones or deliverables. It typically includes sections for project details, hours worked, rates, payment terms, and client information to ensure clear communication and streamlined financial transactions. This template helps maintain organized records, reduce billing errors, and improve cash flow management for consulting professionals.

Minimalist Blank Consulting Payment Invoice

A

Minimalist Blank Consulting Payment Invoice document serves as a streamlined financial record for consulting services rendered, focusing on essential details such as client information, service description, payment amount, and due date. This blank template is designed to be easily customizable, allowing consultants to efficiently generate professional invoices without unnecessary clutter. Its simplicity enhances clarity and professionalism, facilitating timely payment and accurate bookkeeping.

Blank Tax-Ready Consultant Invoice Sheet

A

Blank Tax-Ready Consultant Invoice Sheet is a customizable document designed to help consultants accurately itemize services rendered, fees, and tax information for billing purposes. It ensures compliance with tax regulations by providing designated fields for tax rates, client details, and payment terms. This sheet streamlines record-keeping and simplifies the invoicing process for tax preparation and financial reporting.

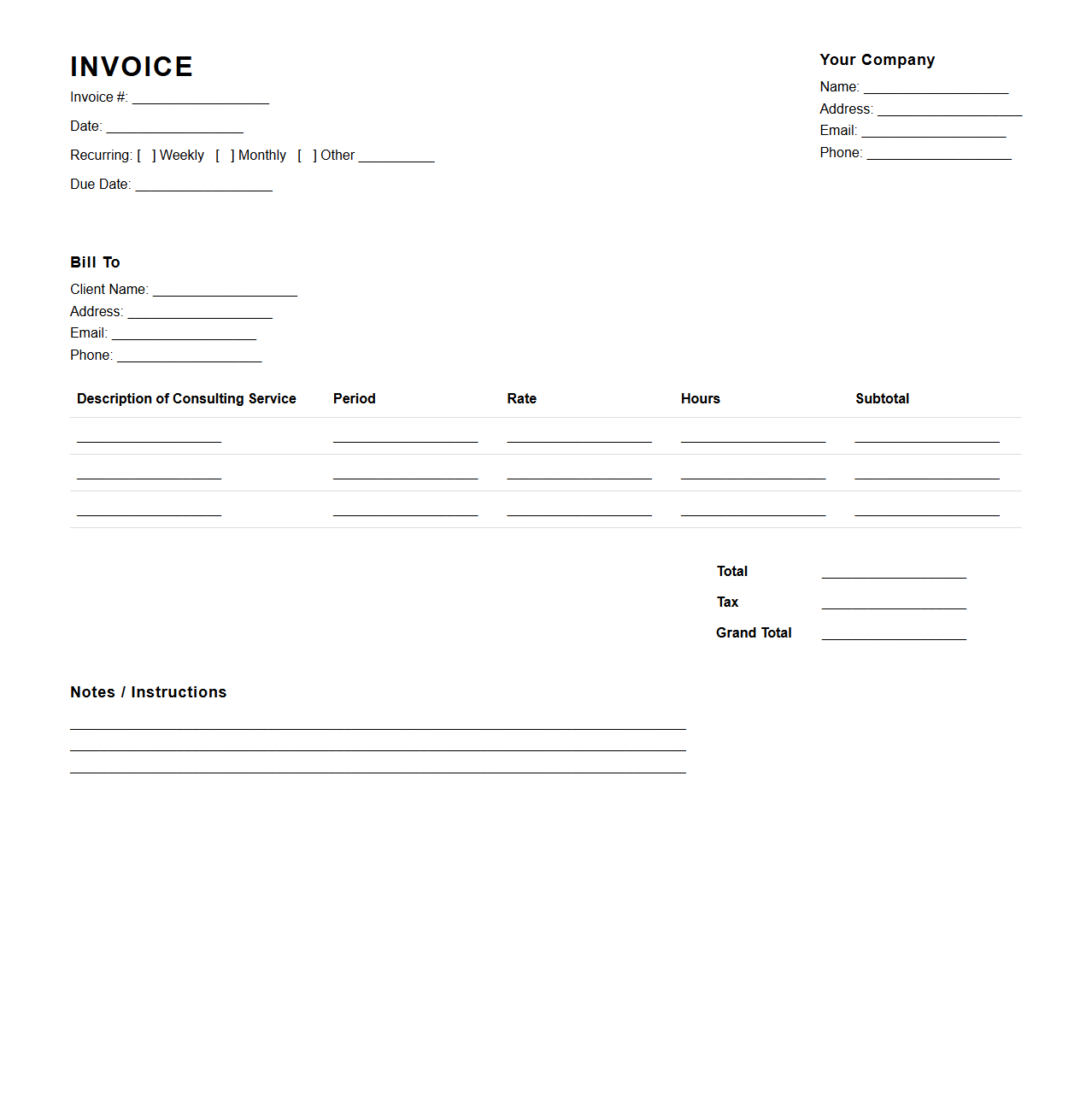

Blank Recurring Consulting Invoice Template

The

Blank Recurring Consulting Invoice Template document is a customizable form designed for consultants to bill clients regularly for ongoing services. It includes fields for client information, service descriptions, billing intervals, and payment terms, ensuring streamlined and consistent invoicing. This template helps maintain professional financial records and improves cash flow by automating repetitive billing cycles.

What essential details should a blank invoice for consulting fees include?

A blank invoice for consulting fees must contain the consultant's name and contact information to ensure client identification. It should also include the invoice number and date for record-keeping and future reference. Additionally, detailed descriptions of services rendered, along with the fee amount and payment terms, are critical for clarity.

How do you customize a blank invoice template for various consulting projects?

Customizing a blank invoice template involves updating the service descriptions to reflect specific project tasks clearly. You should also adjust the billing rates and payment schedules based on project agreements. Including project-specific details like client name and project codes helps streamline administrative processing.

Which legal disclosures are required on a consulting fee invoice?

Legal disclosures such as tax identification numbers and applicable tax rates must be included to comply with regulations. The invoice should also contain a statement about payment terms including late payment penalties if any. Disclosure of the consultant's business registration details may be required depending on jurisdiction.

How can automated tools streamline filling blank consulting invoices?

Automated tools can pre-fill repetitive information like contact details and payment terms, saving time. Integration with accounting software allows for automatic calculation of fees and taxes, reducing manual errors. These tools can also generate invoice sequences to maintain consistency and track payments efficiently.

What common mistakes should be avoided on blank consulting fee invoices?

Avoid omitting essential details such as invoice number, date, or payment terms, which can cause payment delays. Ensure the service descriptions are clear to prevent client confusion and disputes. Additionally, double-check all figures for accuracy to maintain professionalism and trust.