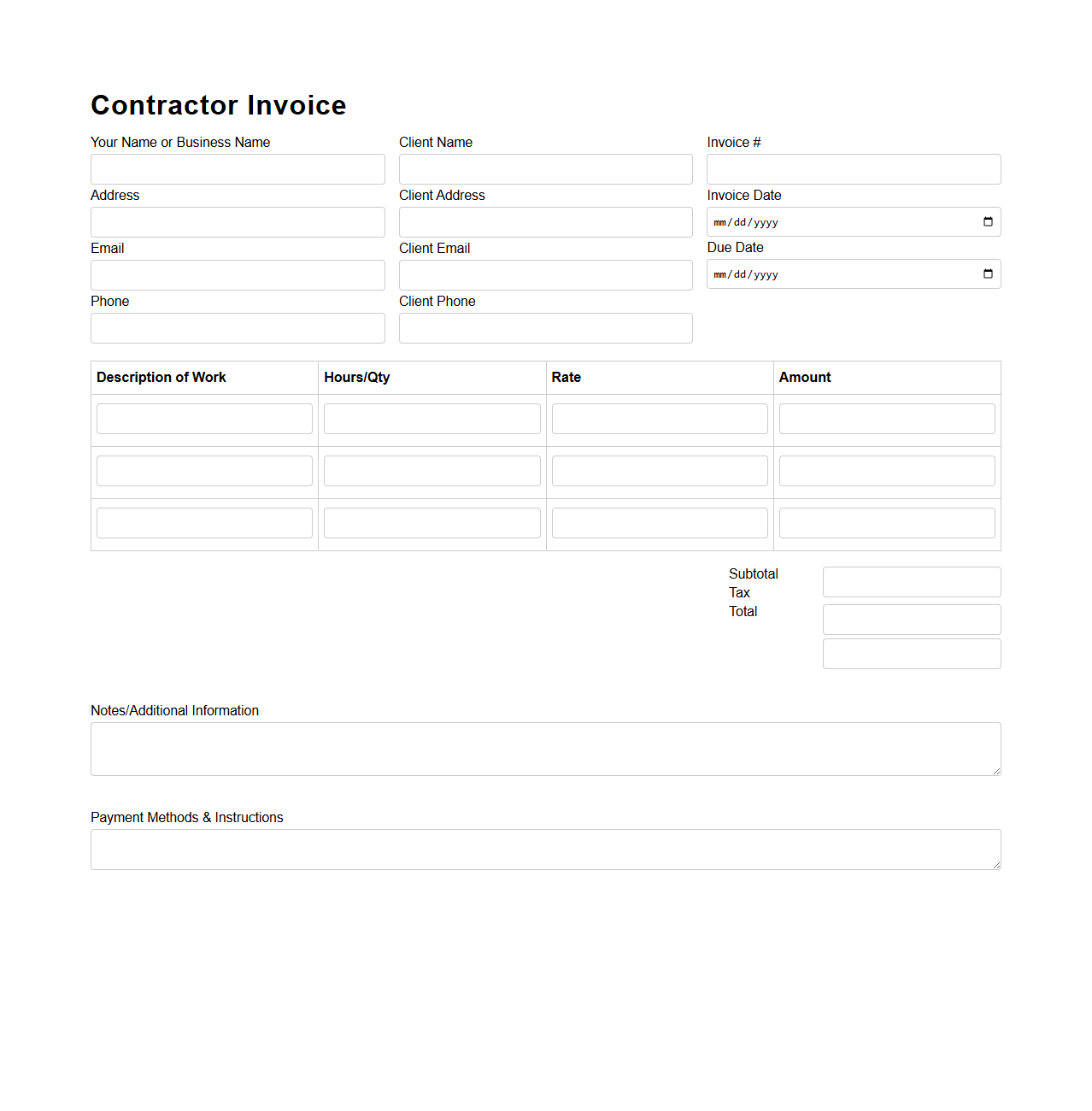

A Blank Invoice Template for Contractors provides a professional and customizable format to streamline billing processes. It includes essential fields such as client information, job details, payment terms, and itemized charges. Using this template helps contractors maintain accurate records and ensures timely payments.

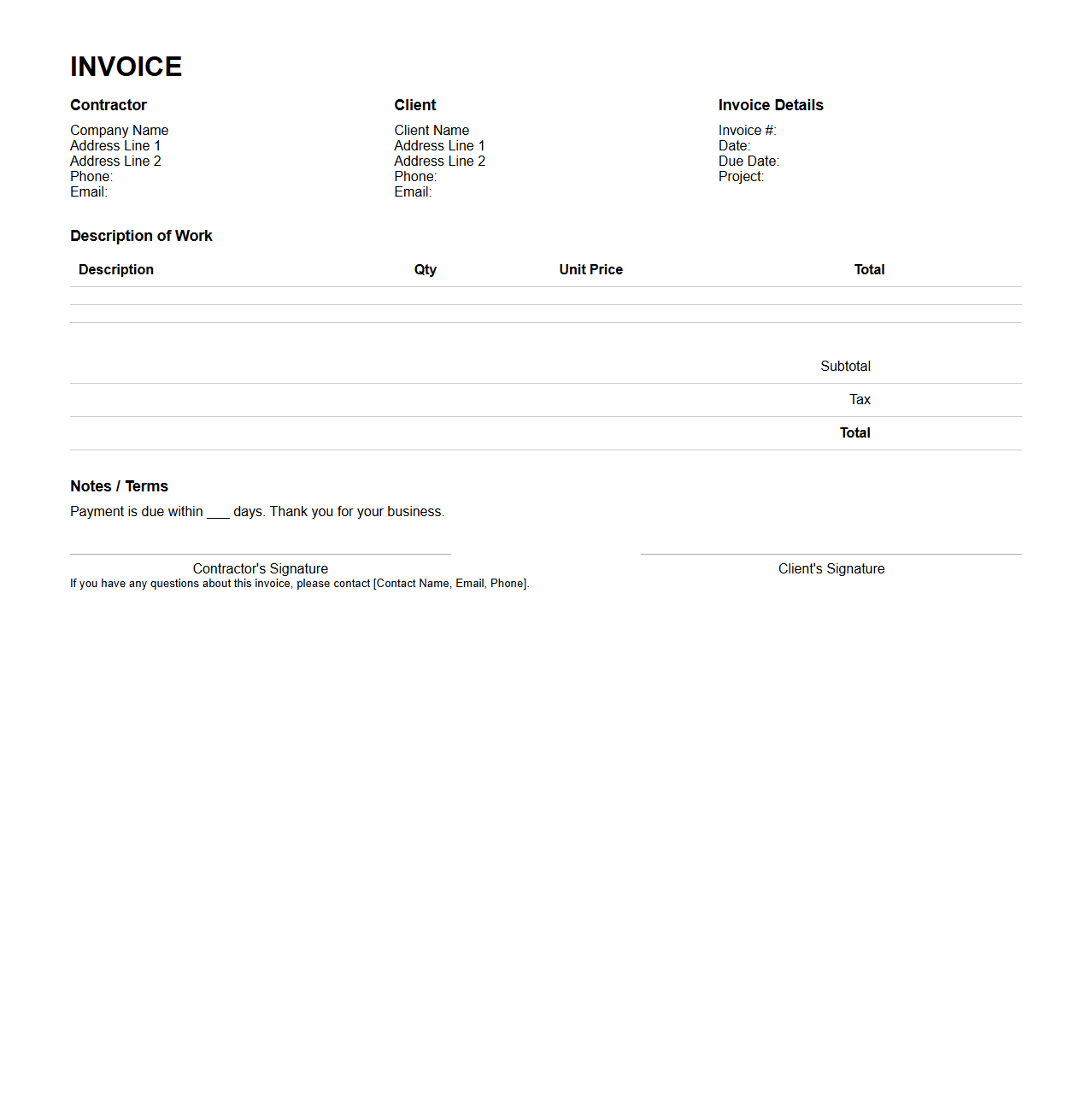

Construction Contractor Invoice Template

A

Construction Contractor Invoice Template is a structured document designed to itemize and request payment for services rendered in construction projects. It includes essential details such as labor costs, materials used, project milestones, and payment terms to ensure clear communication between contractors and clients. This template streamlines billing processes, enhances accuracy in financial transactions, and supports project management efficiency.

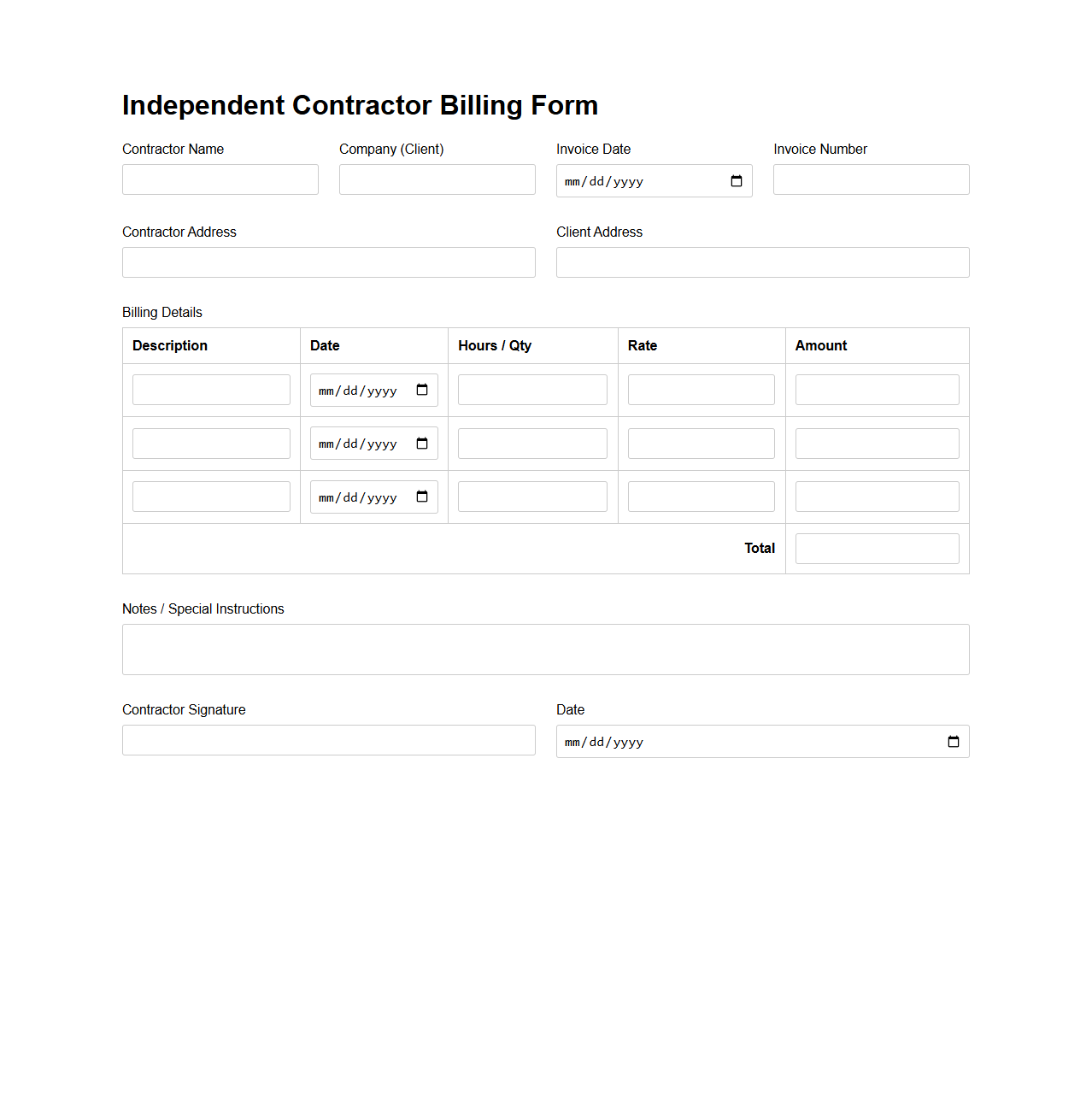

Independent Contractor Billing Form

An

Independent Contractor Billing Form is a document used by contractors to submit invoices for services rendered, detailing hours worked, rates, and project descriptions. This form facilitates accurate payment processing by providing essential financial and contractual information to clients. It ensures clear communication of billing terms and supports compliance with tax and accounting requirements.

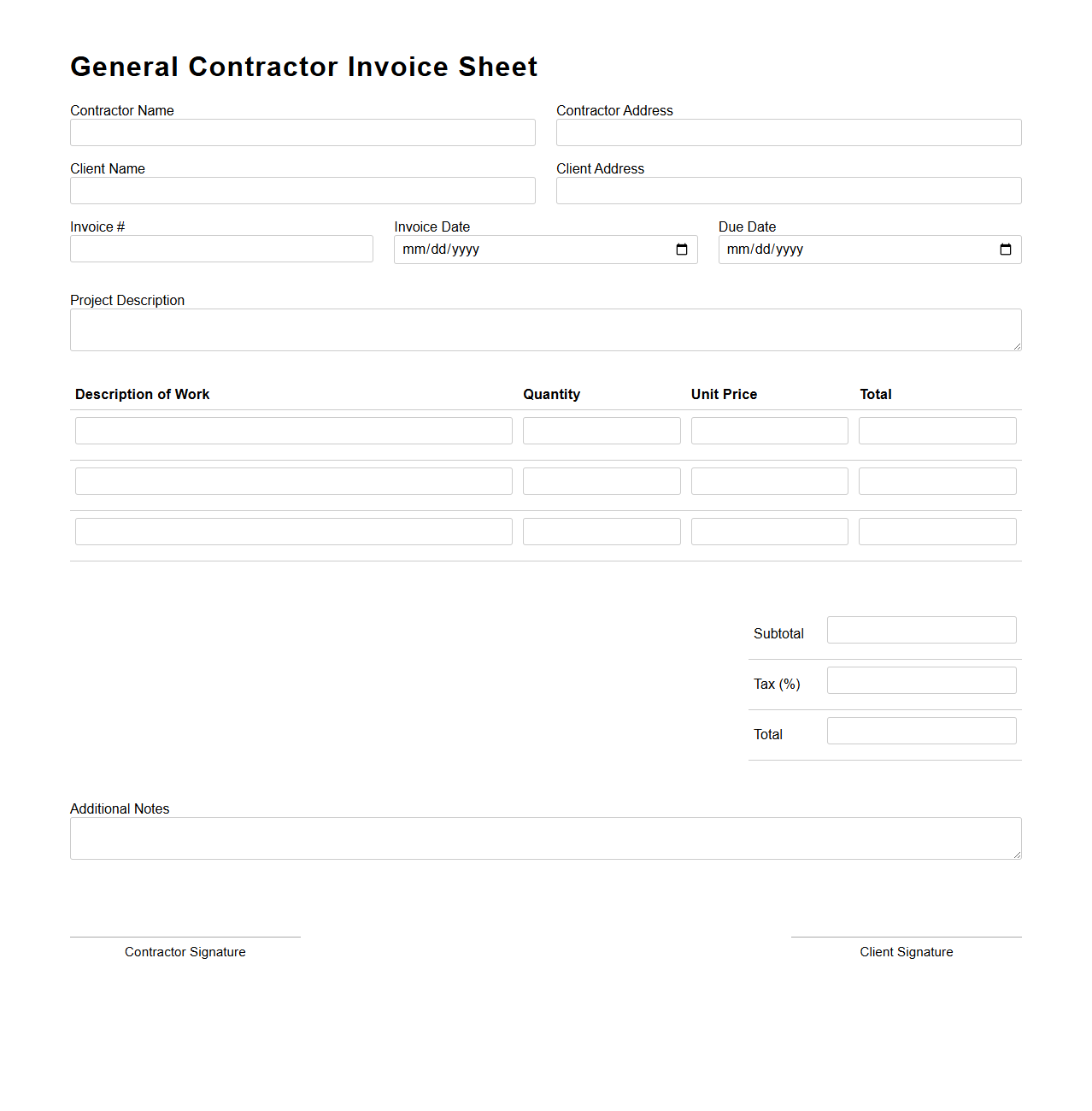

General Contractor Invoice Sheet

A

General Contractor Invoice Sheet is a detailed financial document used by contractors to itemize and request payment for labor, materials, equipment, and services provided on a construction project. It includes project information, payment terms, line-by-line costs, and often tracks progress against the contract budget. This document ensures transparent communication of expenses between contractors, clients, and subcontractors to facilitate accurate and timely payments.

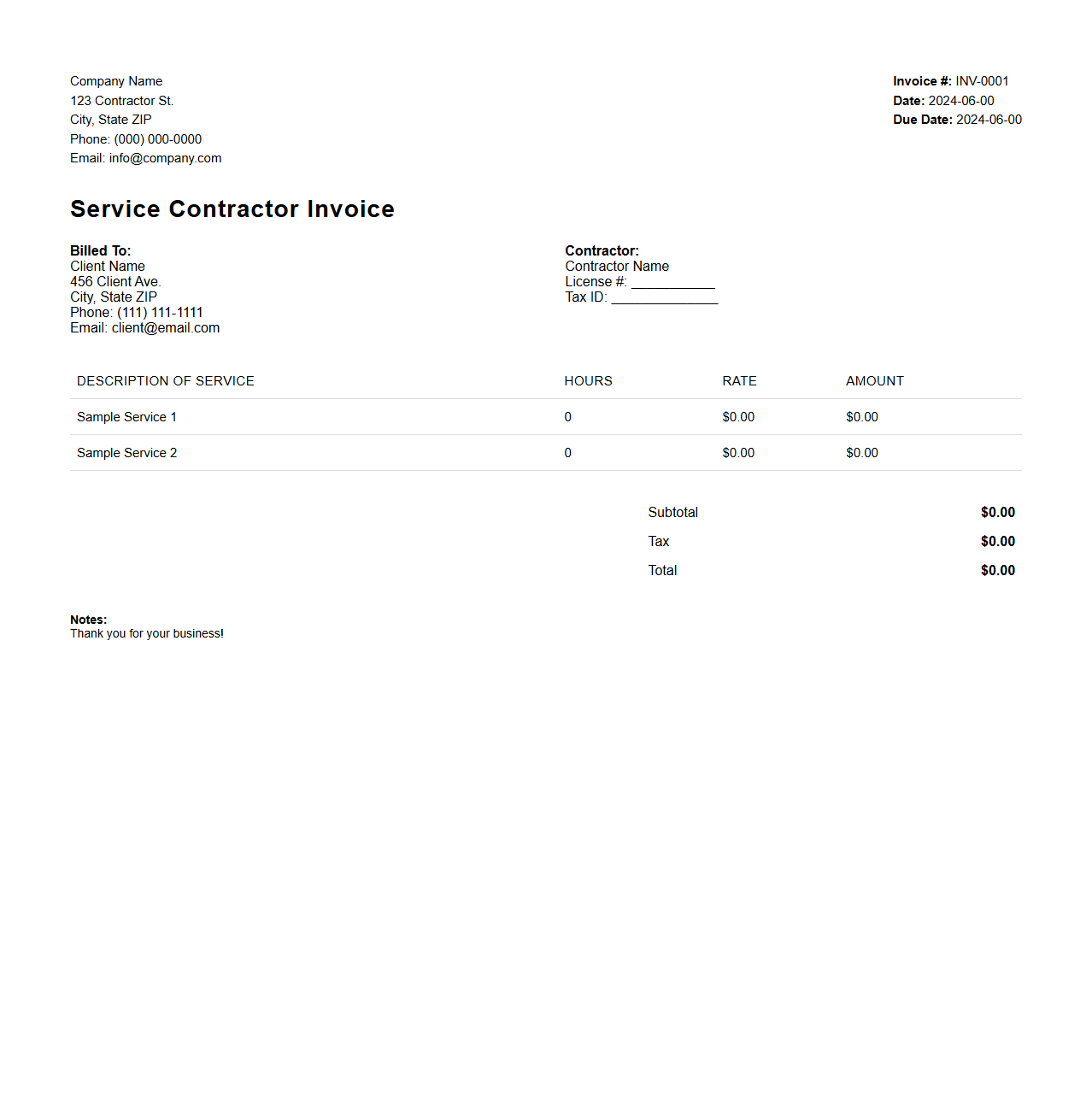

Service Contractor Invoice Layout

A

Service Contractor Invoice Layout document outlines the format and structure used by service contractors to bill clients for completed work. It typically includes sections for labor costs, materials, taxes, payment terms, and detailed descriptions of services rendered. This standardized layout ensures clear communication, accurate payment processing, and legal compliance between contractors and clients.

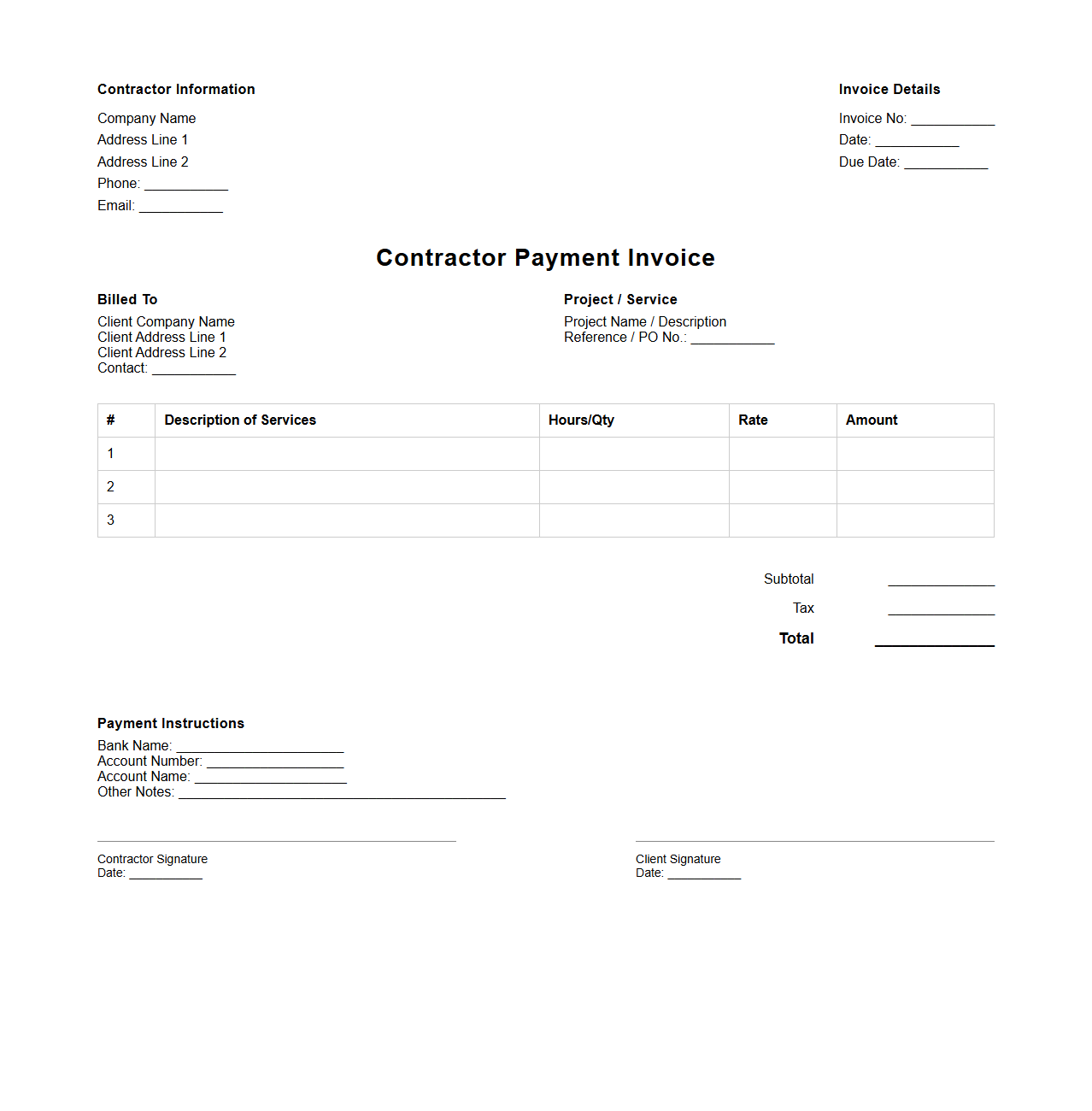

Contractor Payment Invoice Format

A

Contractor Payment Invoice Format document is a standardized template used by contractors to request payment for services rendered or work completed. It typically includes essential details such as project description, labor hours, materials used, payment terms, and total amount due. This format ensures clear communication and accurate record-keeping between contractors and clients, facilitating timely and efficient financial transactions.

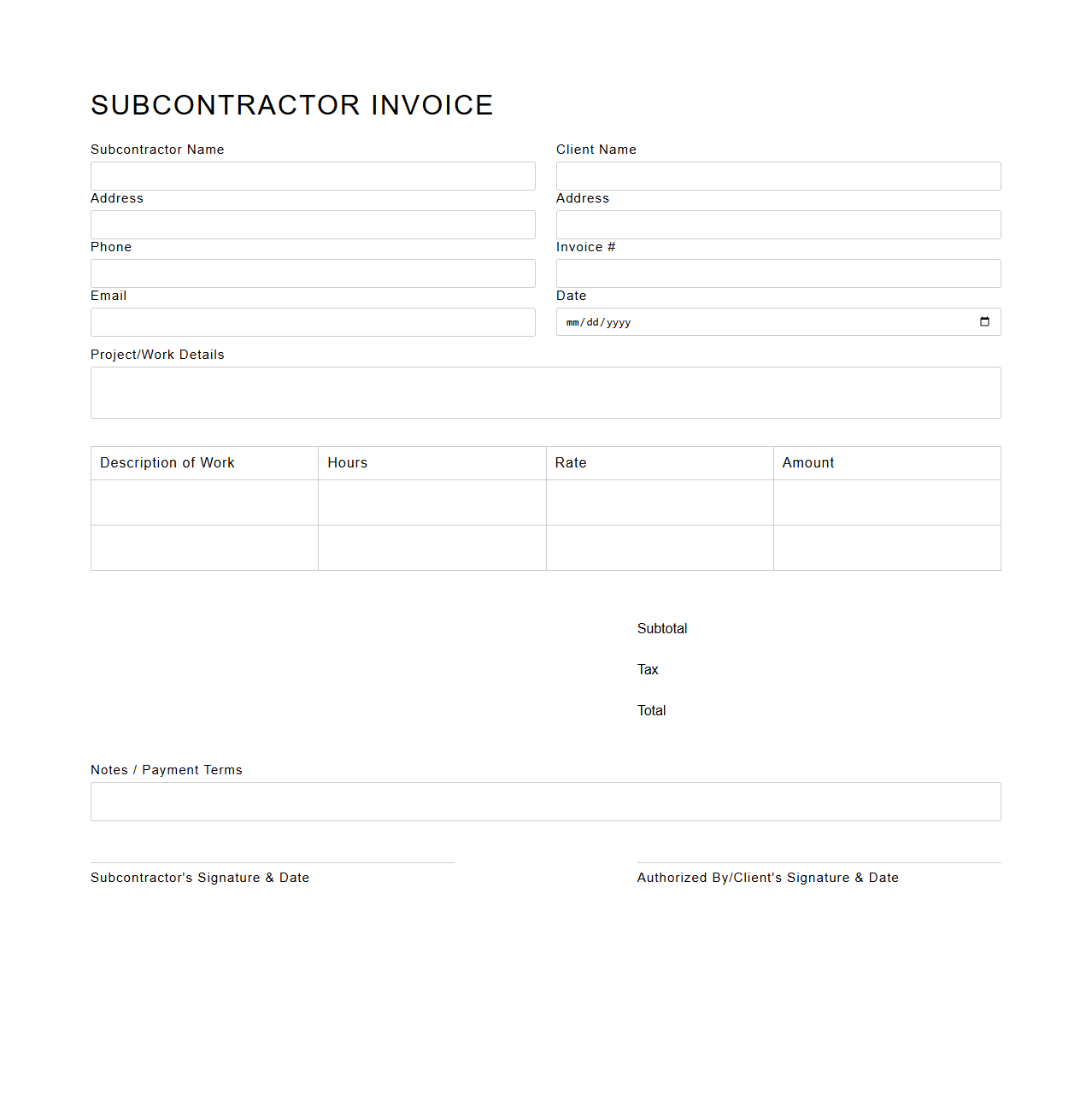

Subcontractor Invoice Template

A

Subcontractor Invoice Template is a pre-designed document used to streamline the billing process between subcontractors and primary contractors by clearly outlining services provided, payment terms, and total amounts due. This template ensures consistent and professional invoicing that includes essential details such as project name, invoice number, labor costs, materials used, and tax information. Utilizing this document helps subcontractors facilitate timely payments and maintain accurate financial records for each contract.

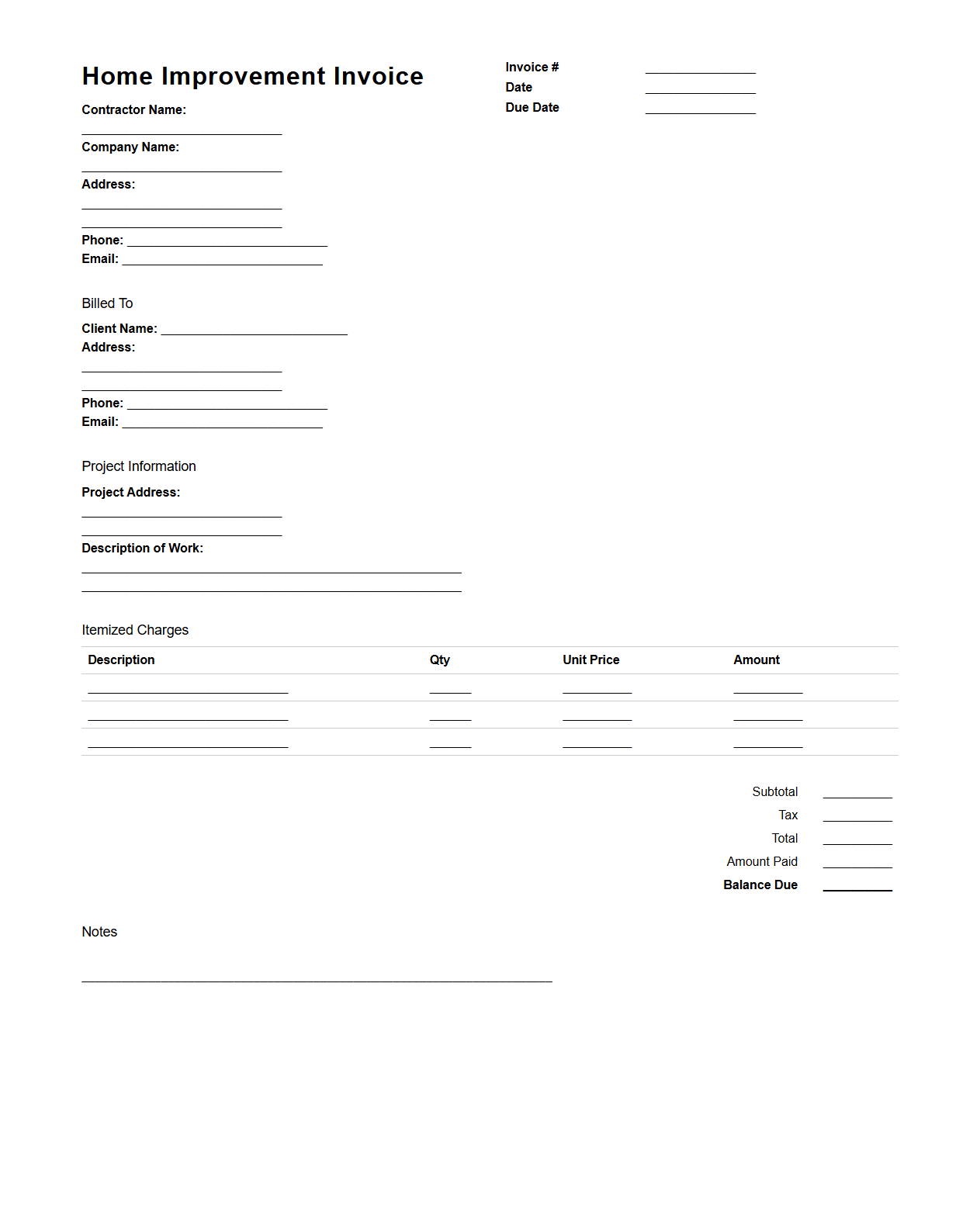

Home Improvement Contractor Invoice

A

Home Improvement Contractor Invoice is a detailed financial document issued by contractors to clients, outlining the costs of labor, materials, and services provided during a home renovation or repair project. It serves as a formal request for payment and includes essential information such as project scope, itemized charges, payment terms, and contact details. This invoice ensures transparency, facilitates accurate record-keeping, and helps prevent disputes by clearly documenting the agreed-upon work and associated expenses.

Self-Employed Contractor Invoice Form

A

Self-Employed Contractor Invoice Form is a formal document used by independent contractors to request payment for services rendered to clients. This form typically includes essential details such as the contractor's name, contact information, description of services provided, hours worked, rates, total amount due, and payment terms. It serves as a professional record that ensures clear communication and timely compensation between contractors and their clients.

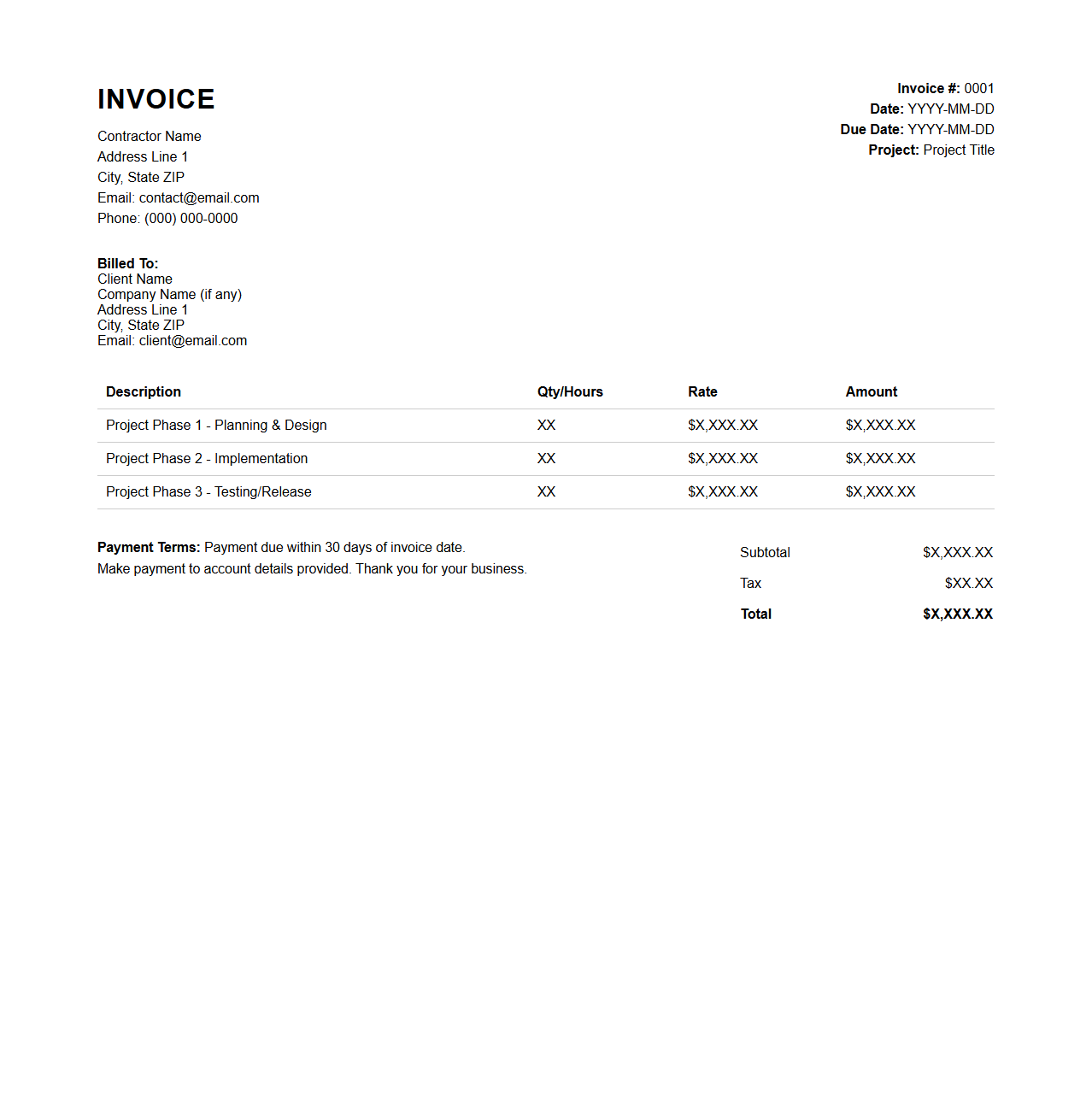

Project-Based Contractor Invoice

A

Project-Based Contractor Invoice document details the costs and services provided by a contractor specific to a particular project, itemizing labor, materials, and other expenses incurred. It serves as an official request for payment, ensuring transparency and accountability between the contractor and client. This invoice typically includes project name, invoice number, dates of service, payment terms, and breakdown of charges related to the project scope.

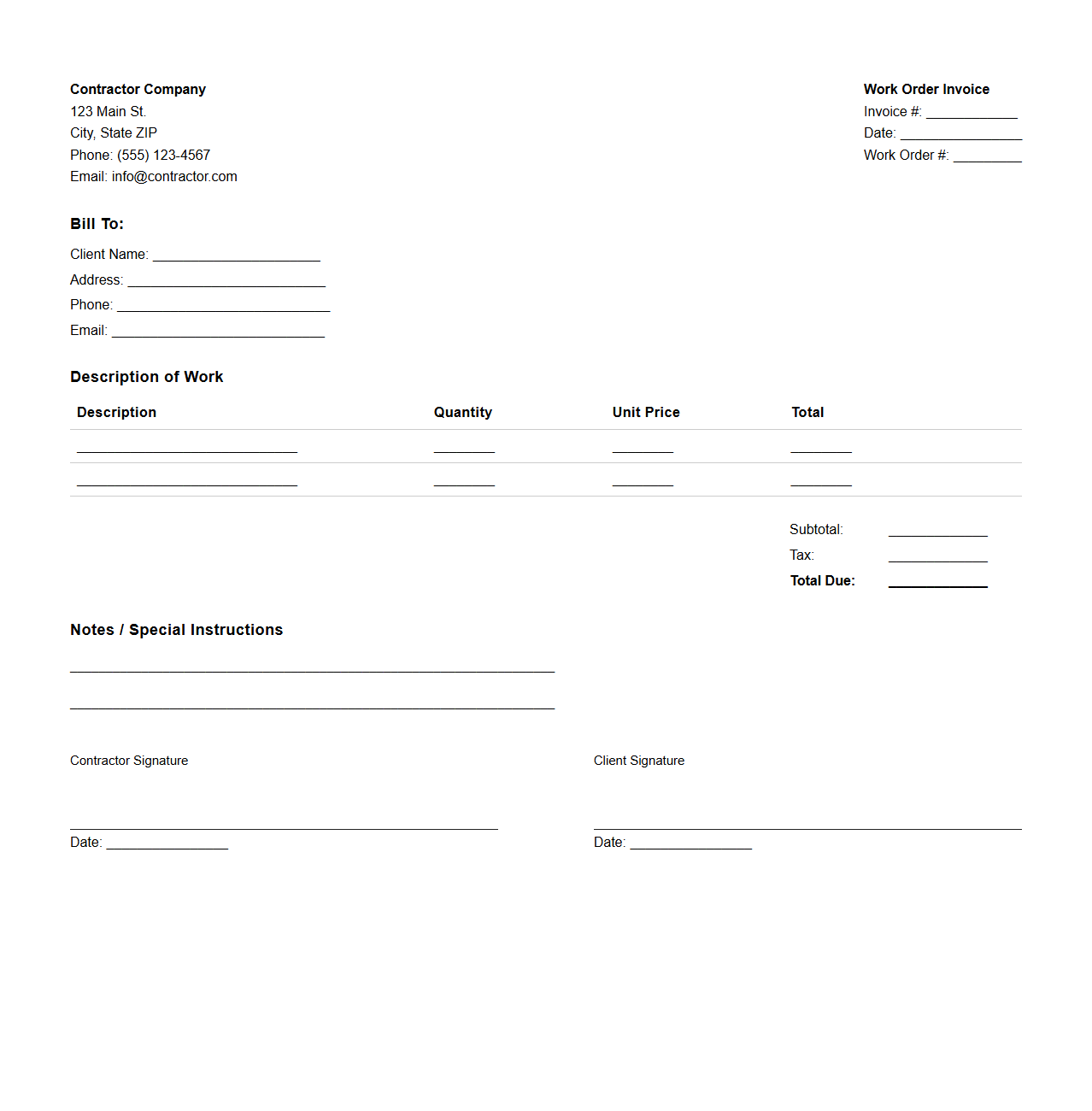

Contractor Work Order Invoice

A

Contractor Work Order Invoice document serves as an official request for payment issued by a contractor after completing specific tasks outlined in a work order. It details the scope of work performed, labor hours, materials used, and agreed-upon rates to ensure accurate billing and record-keeping. This document facilitates transparent financial transactions between contractors and clients, helping to maintain clear project accountability and cash flow management.

What essential fields should a blank contractor invoice template include for legal compliance?

A blank contractor invoice template must include the contractor's name, address, and contact information to ensure traceability. It should also have the client's details, invoice number, and date for proper documentation. Legally compliant invoices require a clear description of services rendered and the total amount due, including payment terms.

How can a contractor indicate variable labor rates on a blank invoice form?

To indicate variable labor rates, the invoice should have separate line items specifying each task or service and its corresponding rate. Include the hours worked or quantity for each rate along with the associated amount. This breakdown provides clarity and transparency for both the contractor and client.

Which tax sections are required on blank invoices for independent contractors?

Invoices for independent contractors must display the applicable tax details, such as the contractor's tax identification number or VAT number. They should also specify any sales tax, service tax, or withholding tax applied to the invoice total. Clearly stating tax amounts ensures legal compliance and facilitates accurate accounting.

How do contractors document milestone payments using a blank invoice?

Contractors document milestone payments by listing each milestone as a separate line item with the agreed payment amount. The invoice should reference the milestone description, completion date, and percentage of the total project value. This method tracks progress payments and ensures clarity in financial transactions.

What details should be included for expense reimbursement on contractor invoices?

Expense reimbursement sections must include a detailed list of expenditures, including dates, descriptions, and amounts for each item. Contractors should attach or reference receipts to validate the expenses. Clearly distinguishing reimbursable costs from labor charges provides transparency and facilitates approval.