A blank invoice template for hourly work provides a structured format to accurately record hours worked and corresponding rates, ensuring clear and professional billing. This template typically includes sections for client information, hourly rate, total hours, and payment details. Using a customizable blank invoice template helps freelancers and contractors maintain organized financial records and streamline the invoicing process.

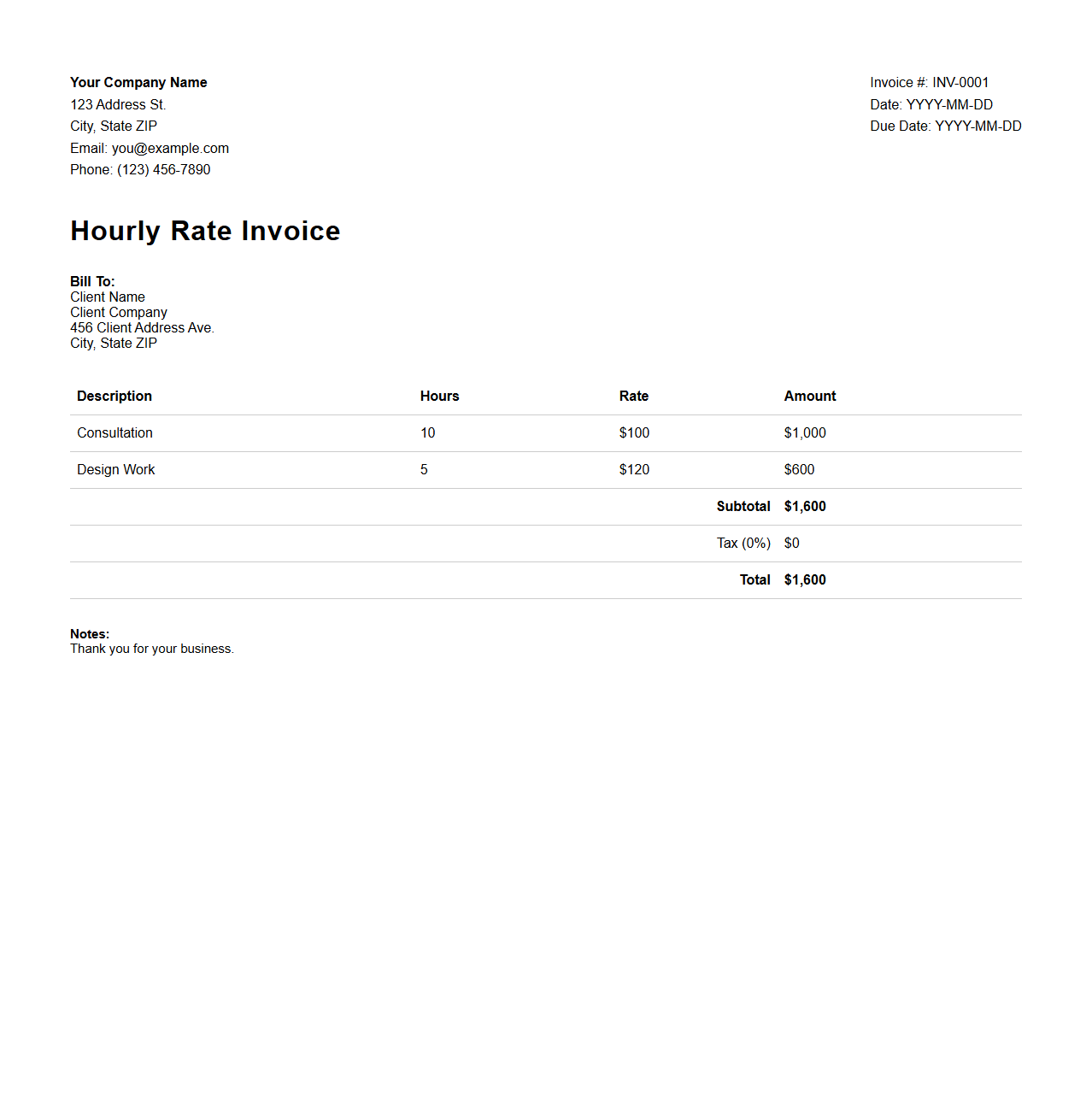

Hourly Rate Invoice Template

An

Hourly Rate Invoice Template is a structured document designed to record and bill services rendered based on the amount of time worked. It typically includes fields for hours worked, hourly rate, client details, project description, and total payment due, facilitating accurate and professional invoicing. Using this template helps freelancers and businesses streamline their billing process and ensure clear communication of payment expectations.

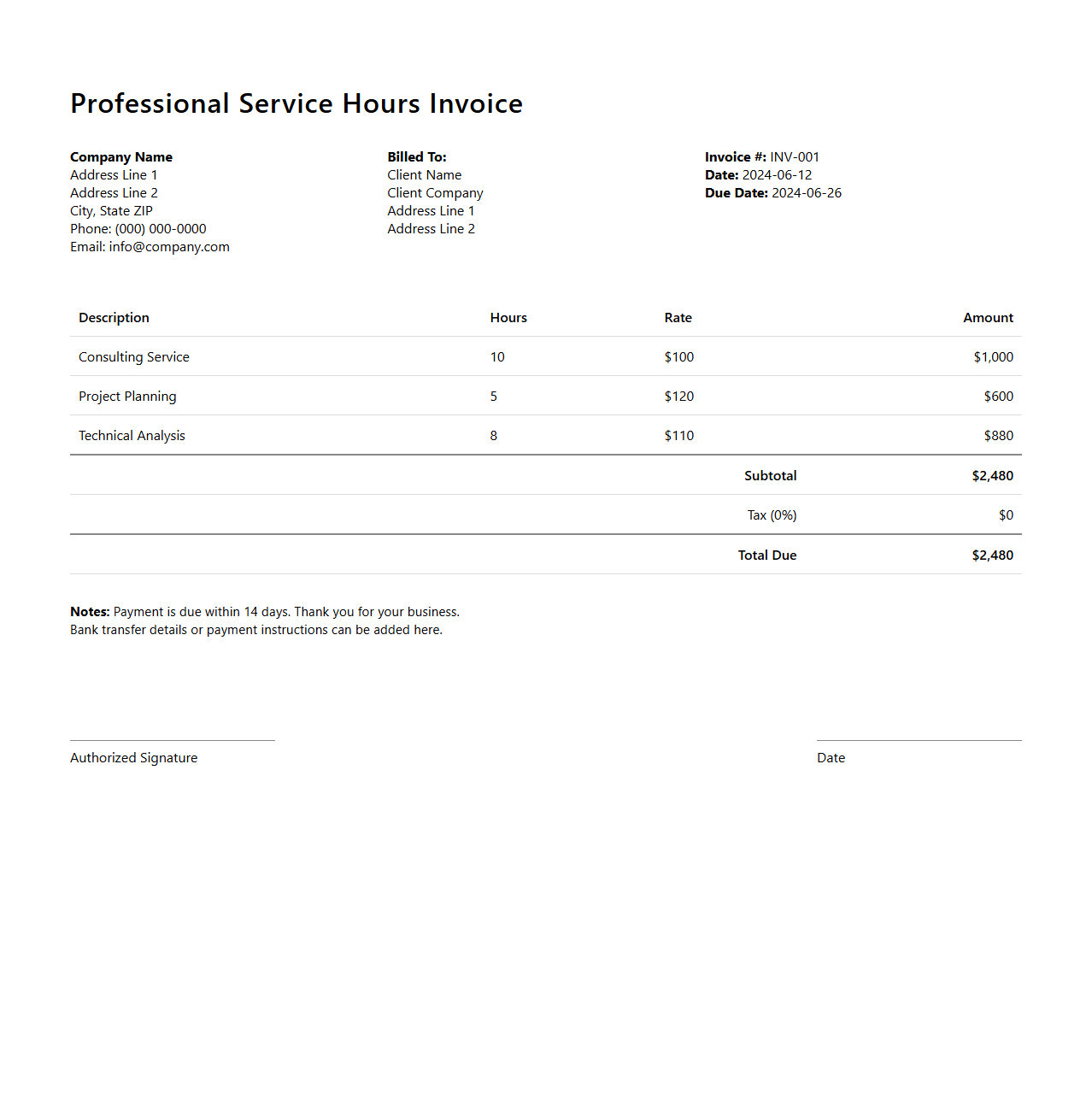

Professional Service Hours Invoice

A

Professional Service Hours Invoice document itemizes the hours worked by a service provider, detailing the time spent on specific tasks or projects. It serves as an official request for payment, including client information, hourly rates, total hours billed, and the corresponding amount due. This document ensures transparent communication and accurate billing between professionals and their clients.

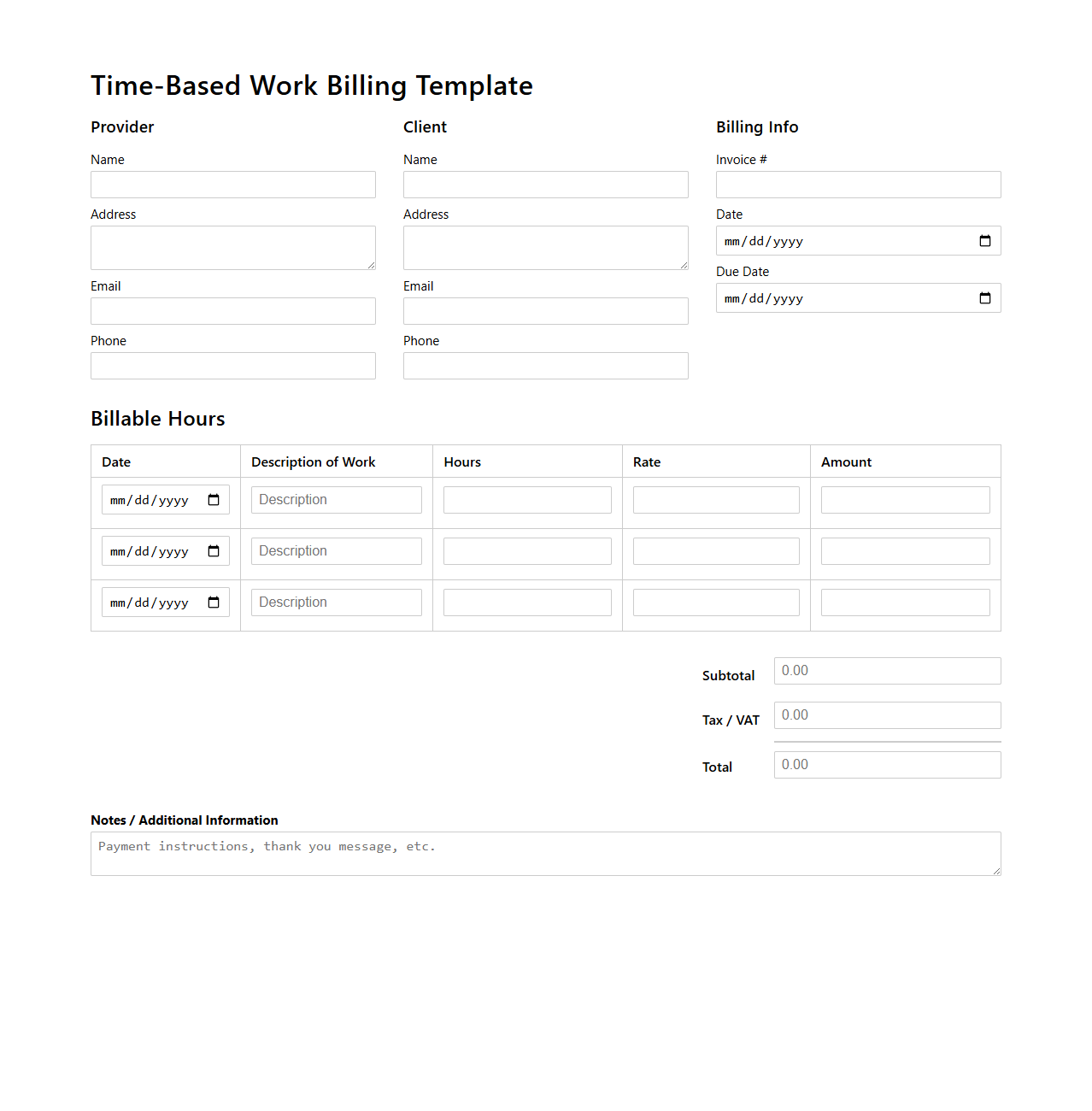

Time-Based Work Billing Template

A

Time-Based Work Billing Template document is designed to accurately record and calculate billable hours for services rendered, ensuring precise invoicing. It typically includes fields for date, task description, hours worked, hourly rate, and total amount due, streamlining the billing process for freelancers and service providers. This template helps maintain transparency with clients and improves financial tracking for businesses focused on hourly or project-based billing.

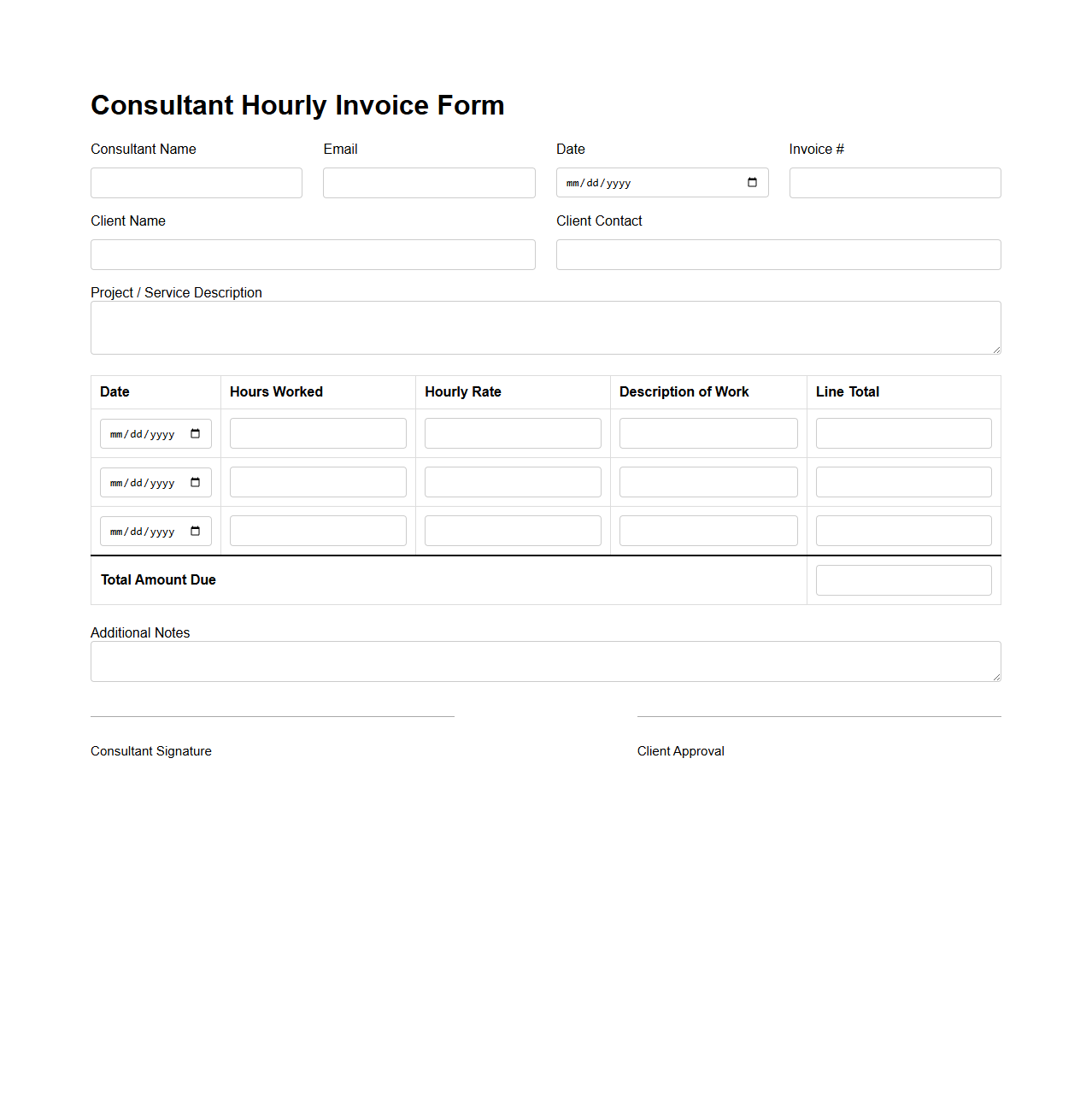

Consultant Hourly Invoice Form

A

Consultant Hourly Invoice Form document itemizes hours worked by a consultant, detailing services provided and corresponding rates. It serves as a formal request for payment, ensuring transparent tracking of billable time and facilitating accurate financial records. This document is essential for maintaining clarity between consultants and clients regarding compensation.

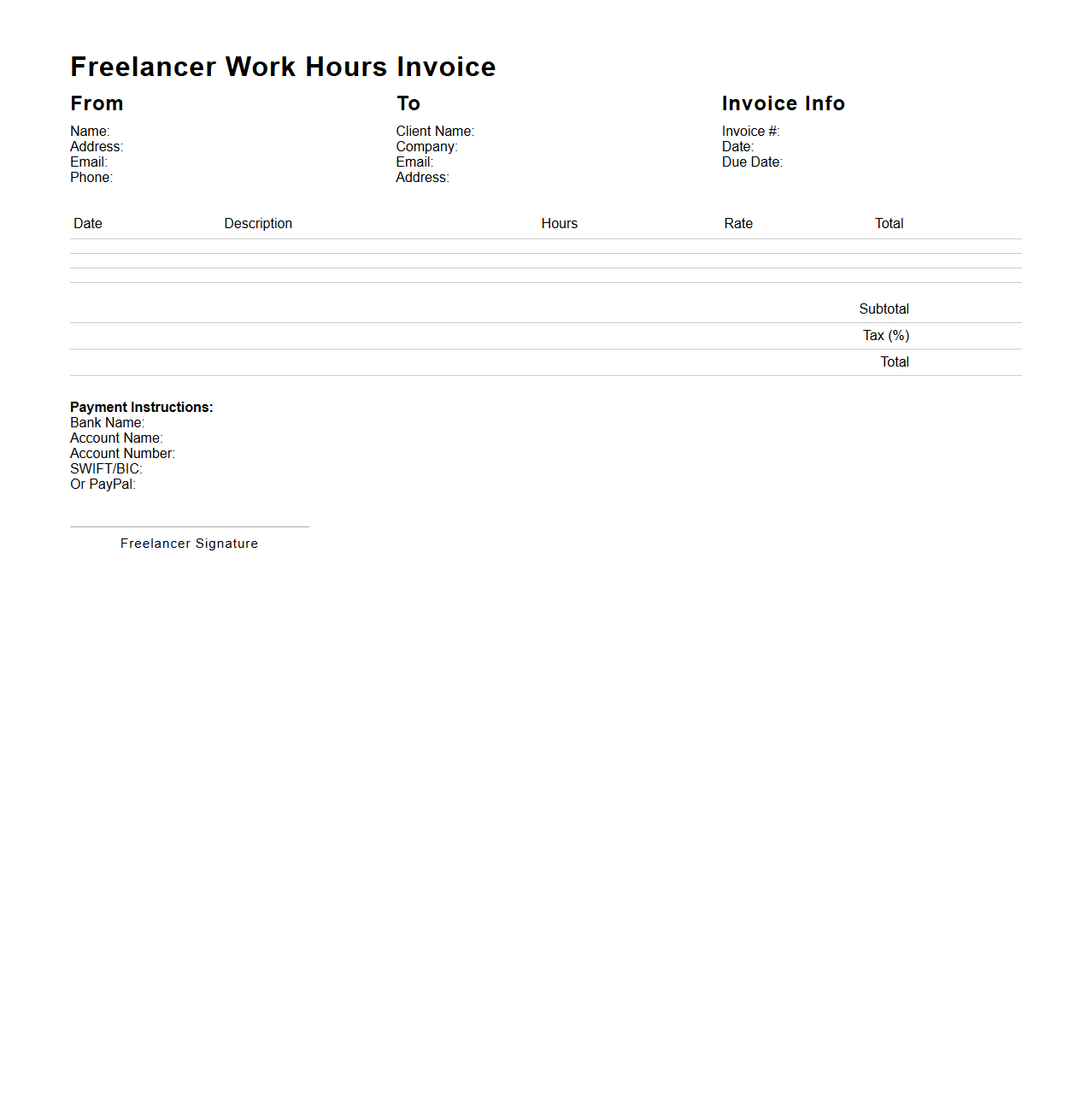

Freelancer Work Hours Invoice

A

Freelancer Work Hours Invoice document details the number of hours a freelancer has worked on a specific project or task, providing a clear record for billing purposes. It typically includes the freelancer's name, client details, dates worked, hourly rates, total hours, and the overall amount due. This invoice ensures transparent communication between freelancers and clients, facilitating timely and accurate payments.

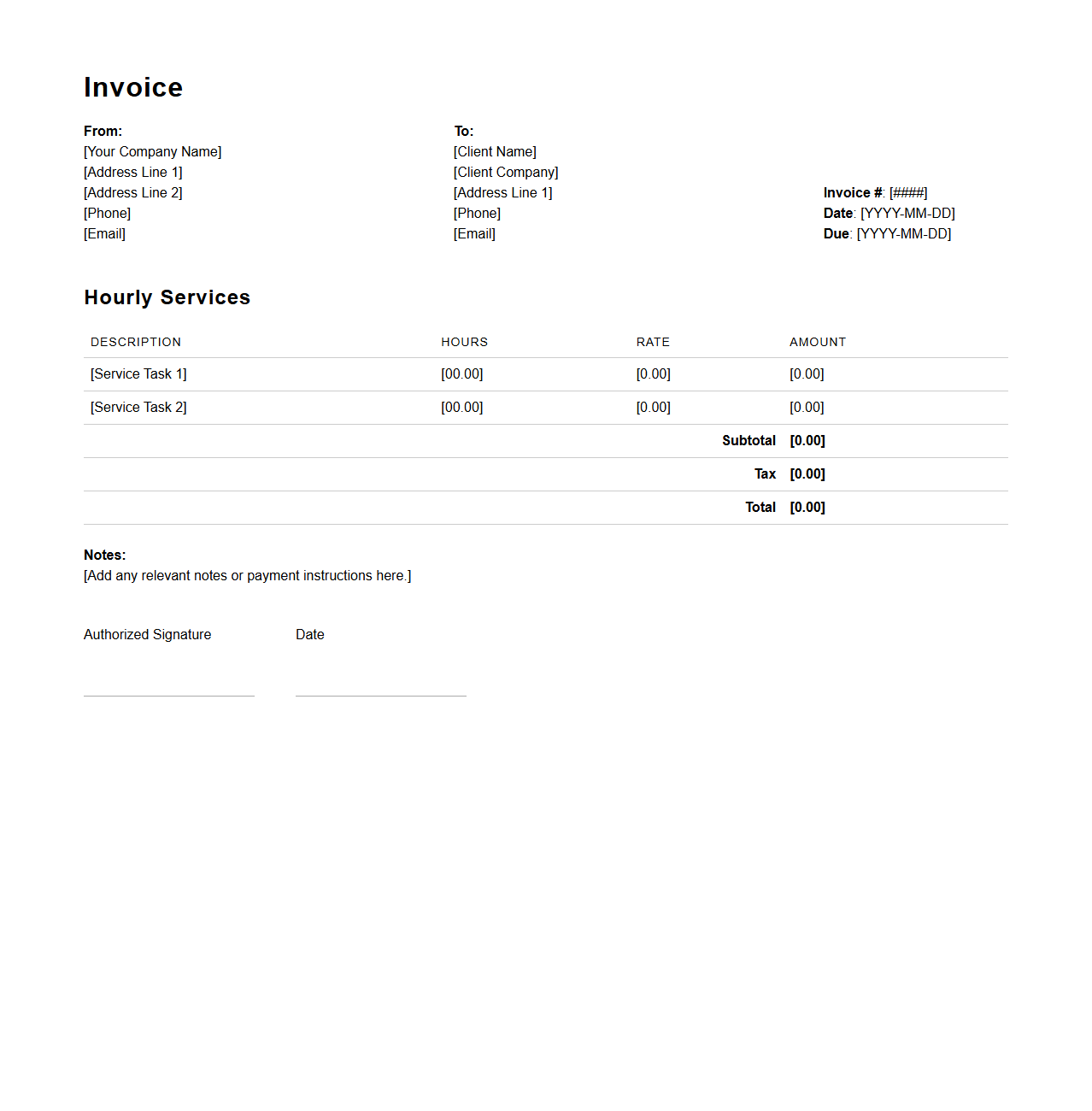

Simple Hourly Services Invoice

A

Simple Hourly Services Invoice document is a billing statement that itemizes the hours worked on a project along with the agreed-upon hourly rate. It provides a clear breakdown of services rendered, total hours, and the corresponding cost, facilitating transparent payment processes between service providers and clients. This invoice ensures accurate tracking of labor charges and streamlines financial record-keeping for both parties.

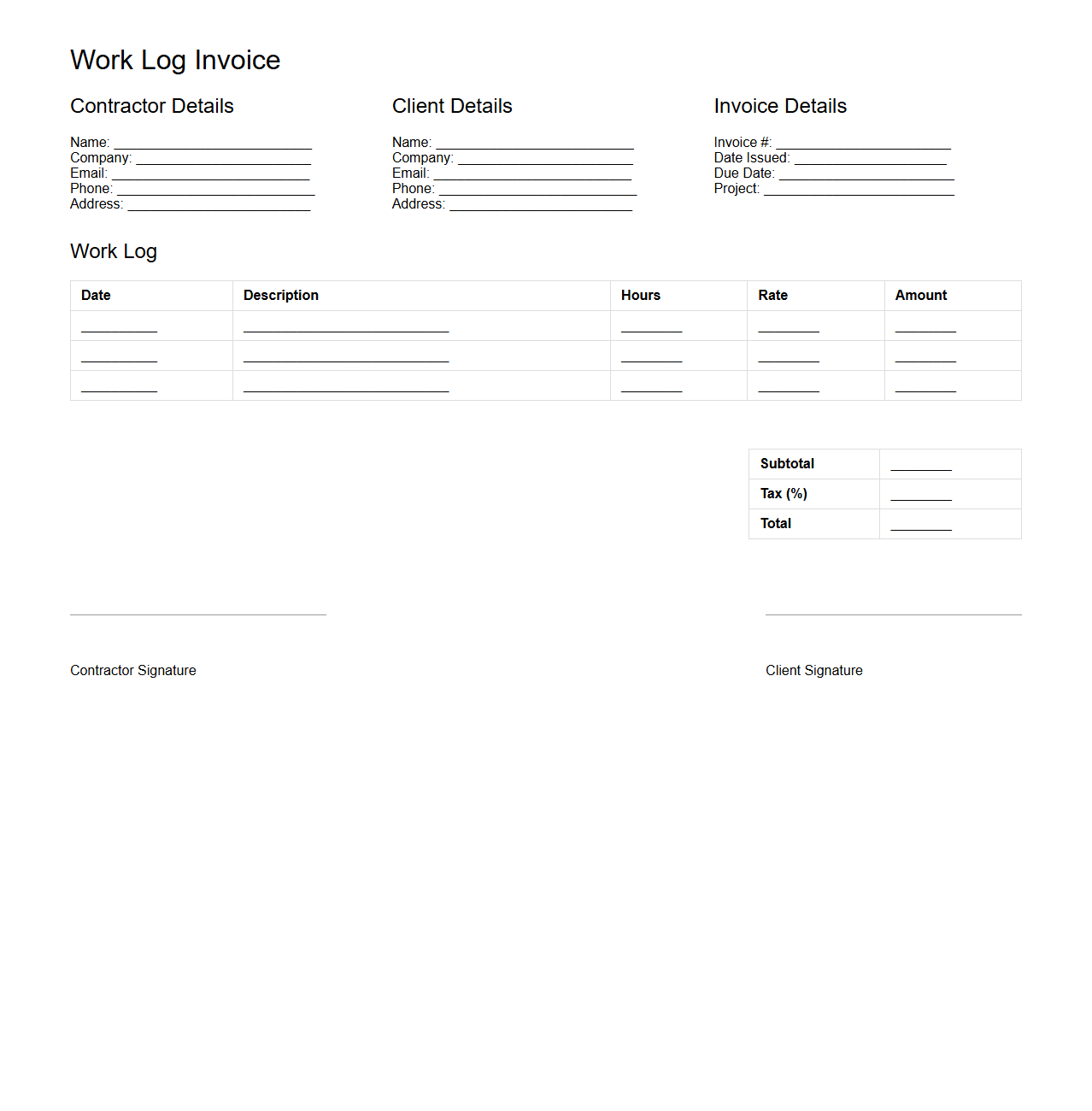

Work Log Invoice for Contractors

A

Work Log Invoice for Contractors document details the hours worked, tasks completed, and associated charges for services provided by contractors. It serves as a formal record to ensure accurate billing and payment based on agreed project rates or hourly fees. This document helps maintain transparency and accountability in contractor-client financial transactions.

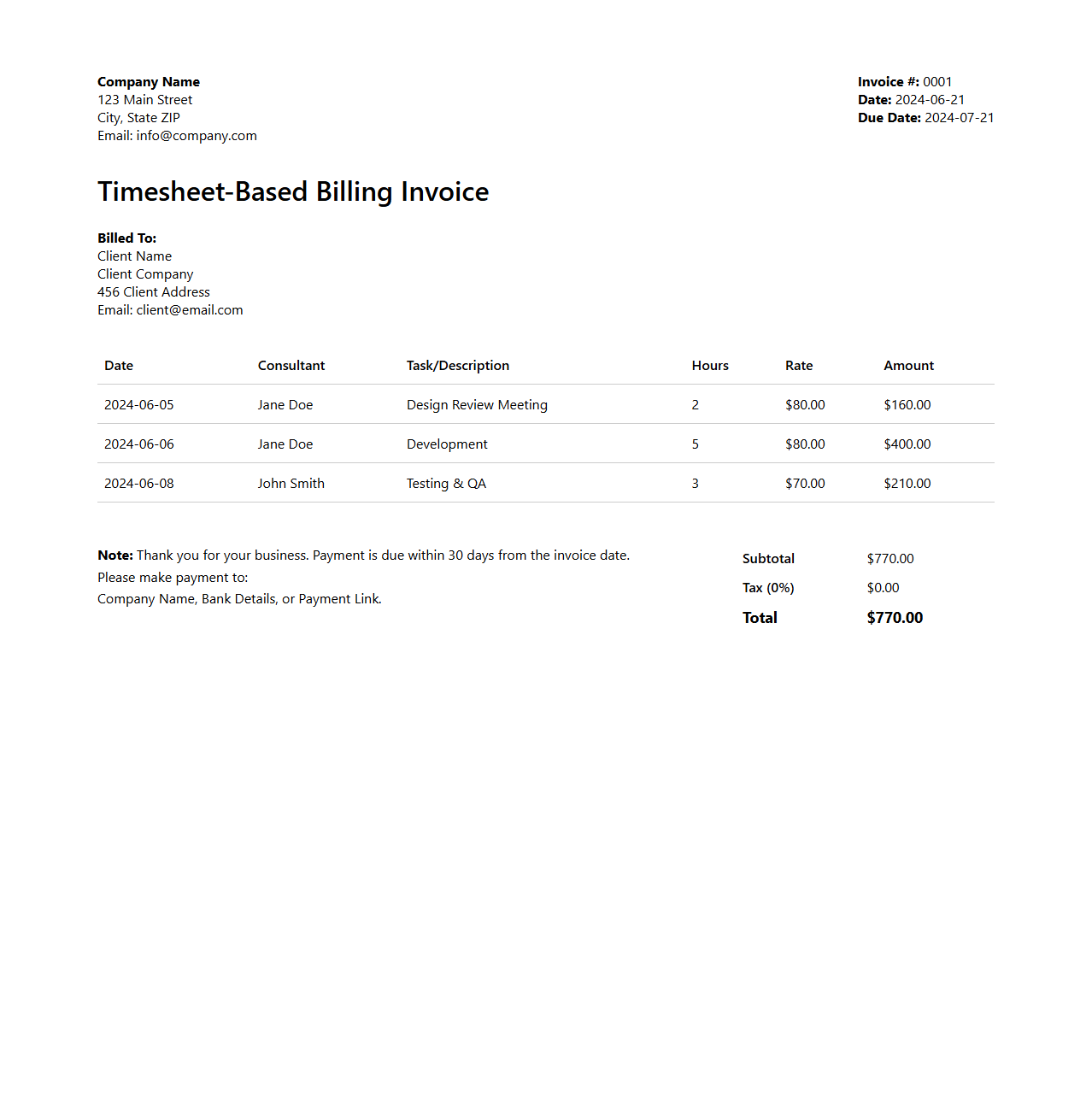

Timesheet-Based Billing Invoice

A

Timesheet-Based Billing Invoice document itemizes the hours worked by employees or contractors and calculates charges based on agreed hourly rates. It ensures accurate billing by detailing dates, tasks performed, hours logged, and corresponding costs. This type of invoice supports transparency and efficient financial management in service-oriented businesses.

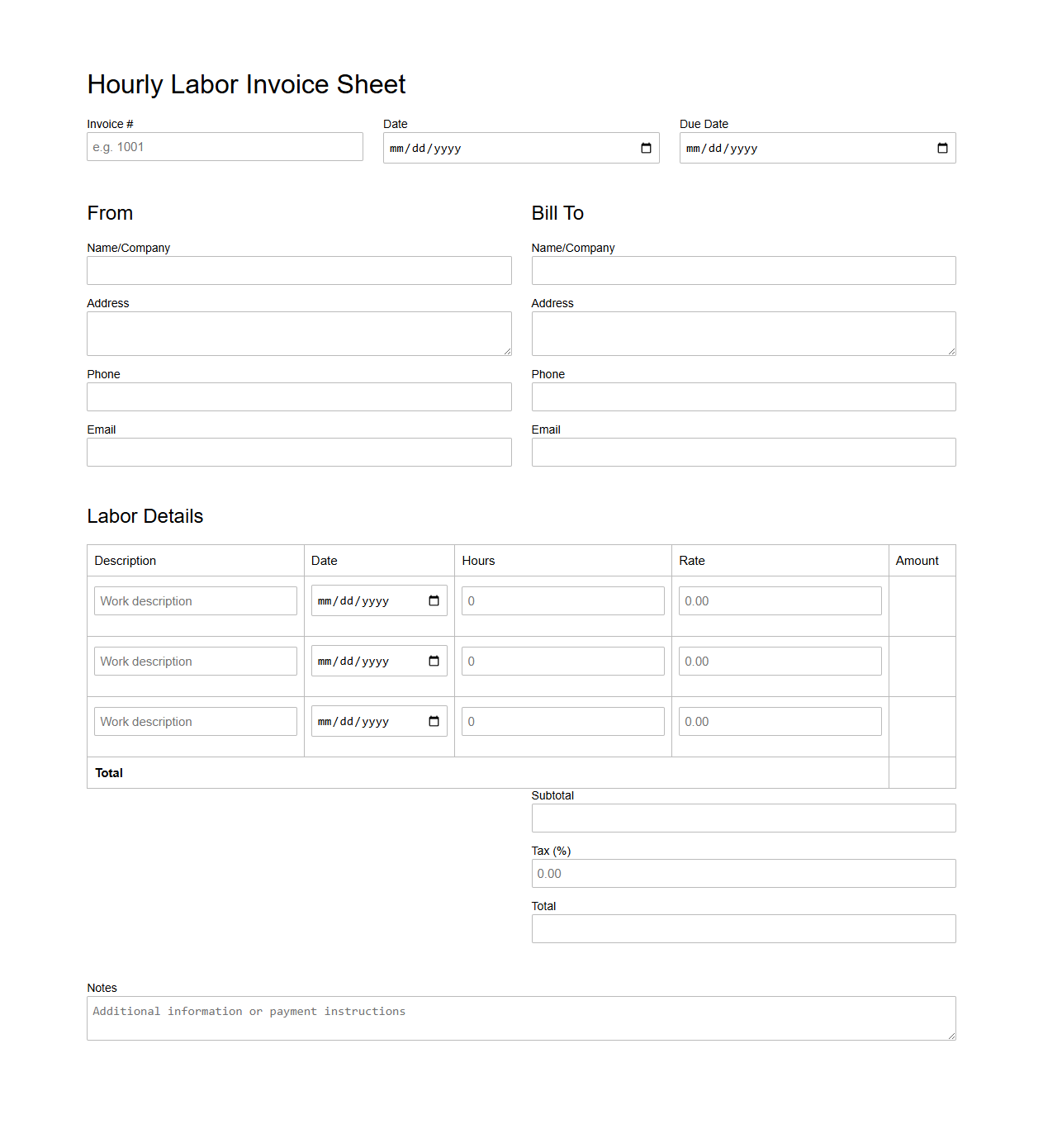

Hourly Labor Invoice Sheet

The

Hourly Labor Invoice Sheet is a detailed document used to record and bill the hours worked by employees or contractors on a specific project or task. It includes essential data such as employee names, hourly rates, total hours worked, and the corresponding charges, ensuring accurate and transparent labor cost tracking. This sheet facilitates efficient invoicing, payroll processing, and project cost management for businesses across various industries.

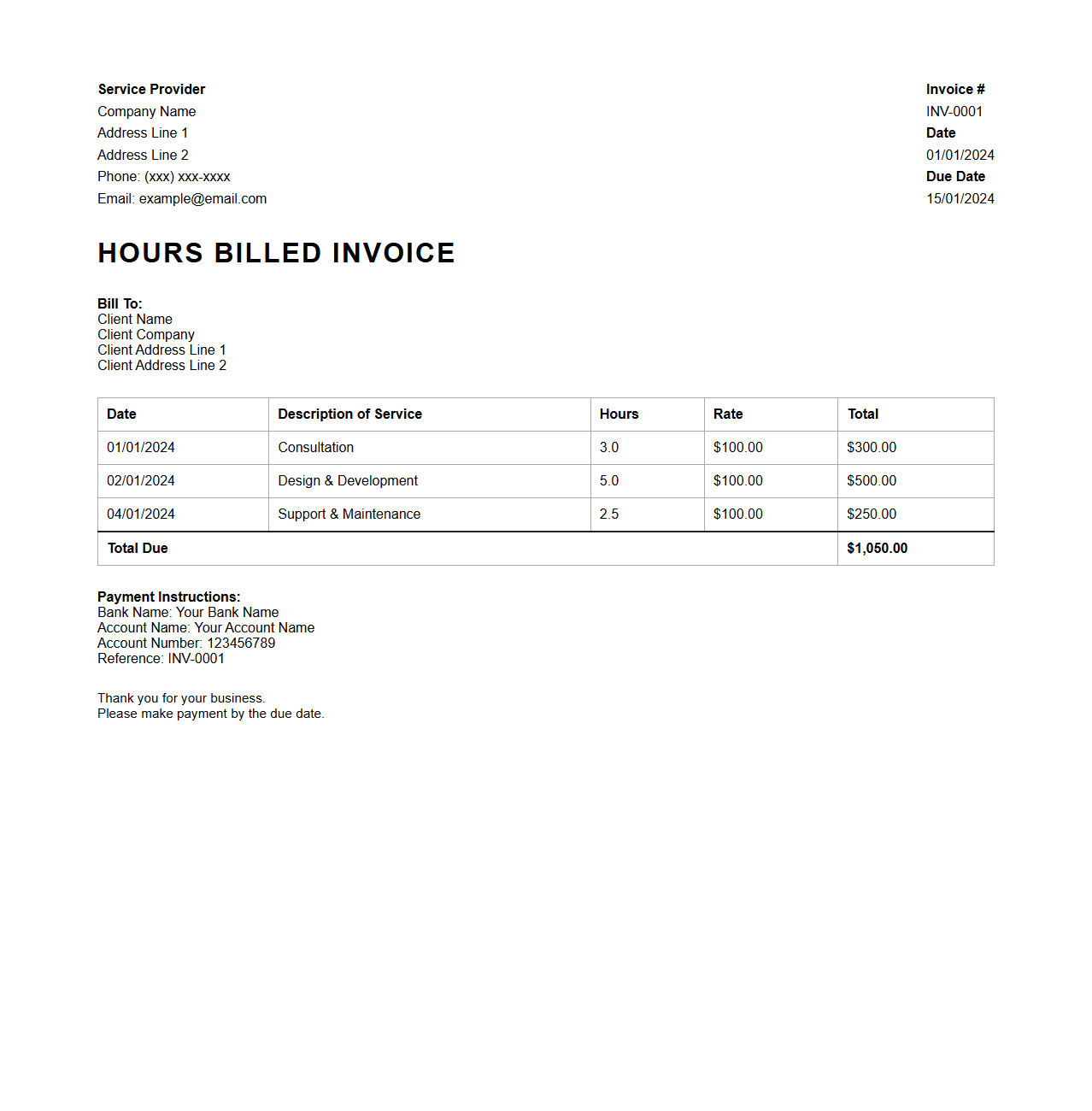

Service Provider Hours Billed Invoice

The

Service Provider Hours Billed Invoice document details the total hours a service provider has billed to a client for specific services rendered within a billing period. It itemizes the hours worked, the rate per hour, and the total amount due, ensuring transparency and accuracy in the billing process. This document serves as a crucial record for both clients and service providers to track work completed and payments owed.

What details must a blank invoice for hourly work include for legal compliance?

A blank invoice for hourly work must include the service provider's name and contact information to meet legal standards. It should clearly state the client's details, invoice number, and the date of issue for proper record keeping. Additionally, the invoice must provide a detailed breakdown of hours worked, rates, and the total amount due.

How should overtime hours be itemized on a blank hourly invoice template?

Overtime hours on a blank hourly invoice template should be distinctly separated from regular hours to ensure clarity and compliance. Include a specific line item for overtime hours with the applicable higher rate clearly indicated. This helps clients easily identify and approve additional charges related to overtime work.

Which fields are essential for tracking project phases on a blank invoice for hourly work?

To effectively track project phases, the invoice should have designated fields for each phase or milestone with corresponding hours and rates listed. This breakdown allows both parties to monitor progress and manage budgets efficiently. Incorporating a description section helps clarify the work performed during each phase.

How can tax or VAT fields be optimally formatted on a blank hourly invoice?

Tax or VAT fields on a blank hourly invoice should be clearly labeled and positioned near the subtotal for easy identification. Use separate lines for tax rates and amounts, ensuring transparency and compliance with taxation laws. Including the tax identification number boosts the invoice's credibility and aligns with legal requirements.

What digital signature options are best suited for blank hourly work invoices?

The best digital signature options for blank hourly work invoices include platforms like DocuSign and Adobe Sign, which offer secure and legally recognized authentication. These tools enable seamless signing directly on the invoice, ensuring both parties can validate the document promptly. Integrating a digital signature field in the invoice template improves efficiency and trustworthiness.