A Blank Sales Invoice Template for Small Business provides a simple and customizable format to record sales transactions accurately. This template helps streamline billing processes, ensuring all essential details such as product descriptions, quantities, prices, and total amounts are clearly documented. Small businesses benefit from its ease of use, improving financial record-keeping and professional presentation.

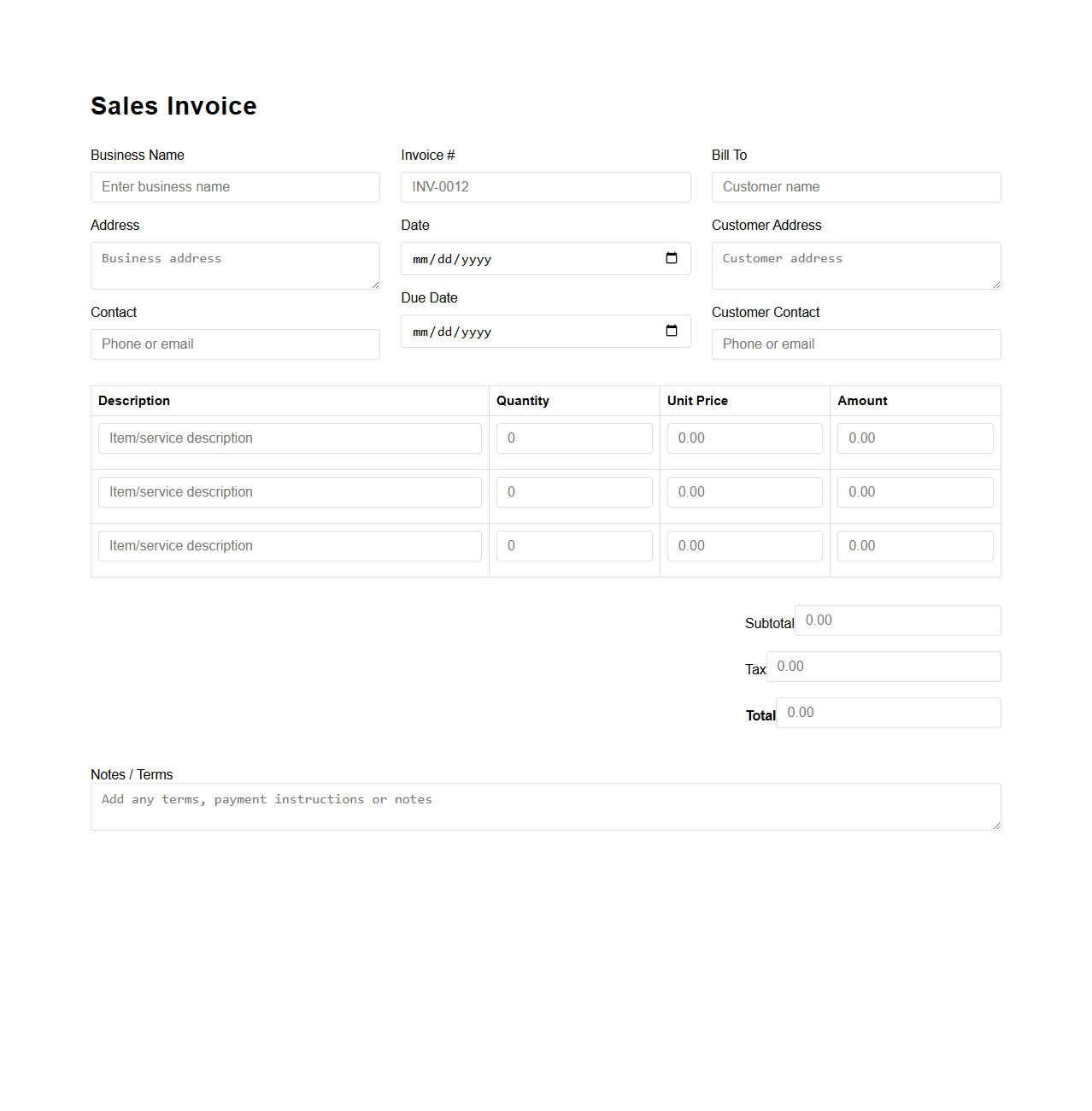

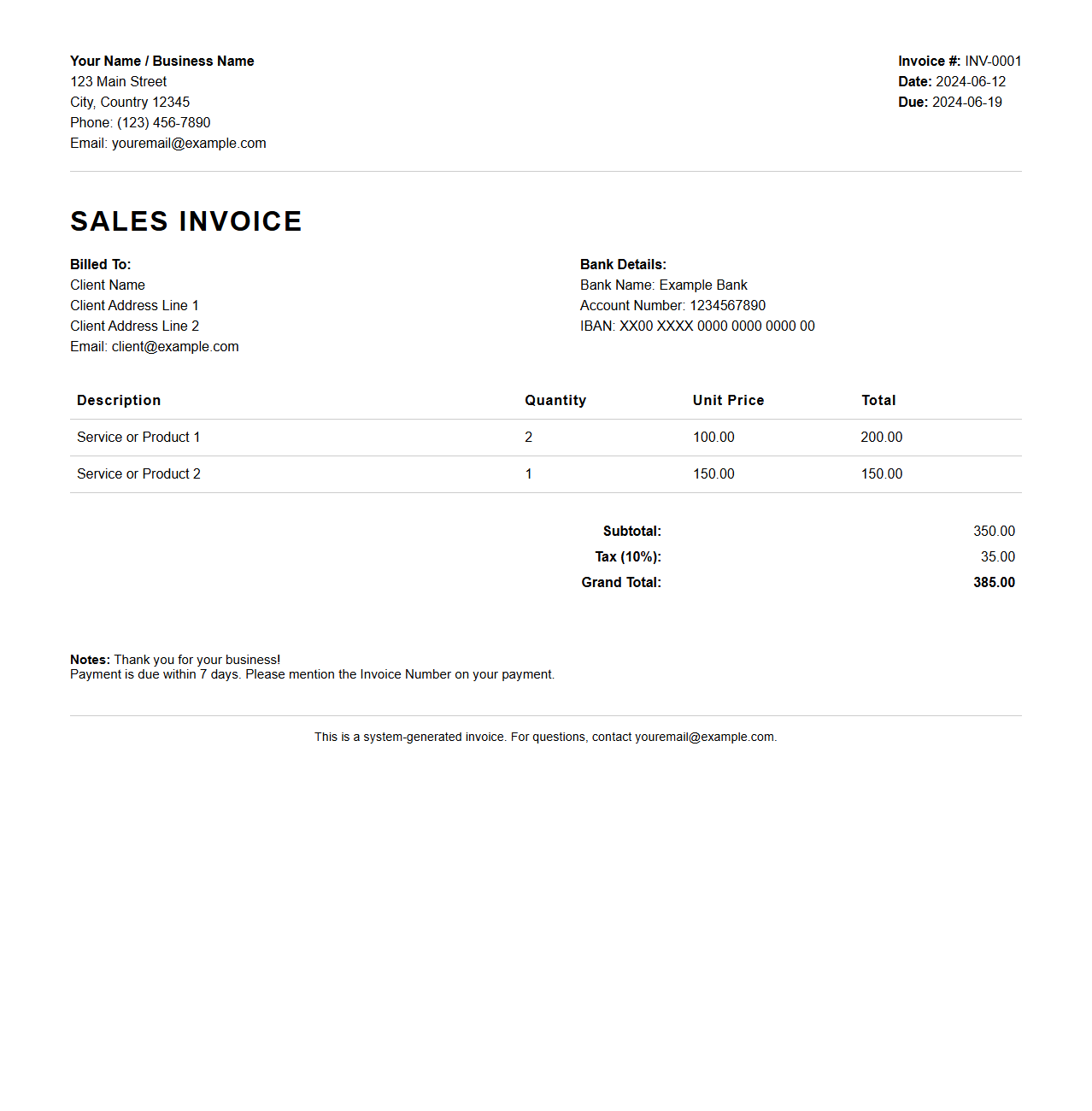

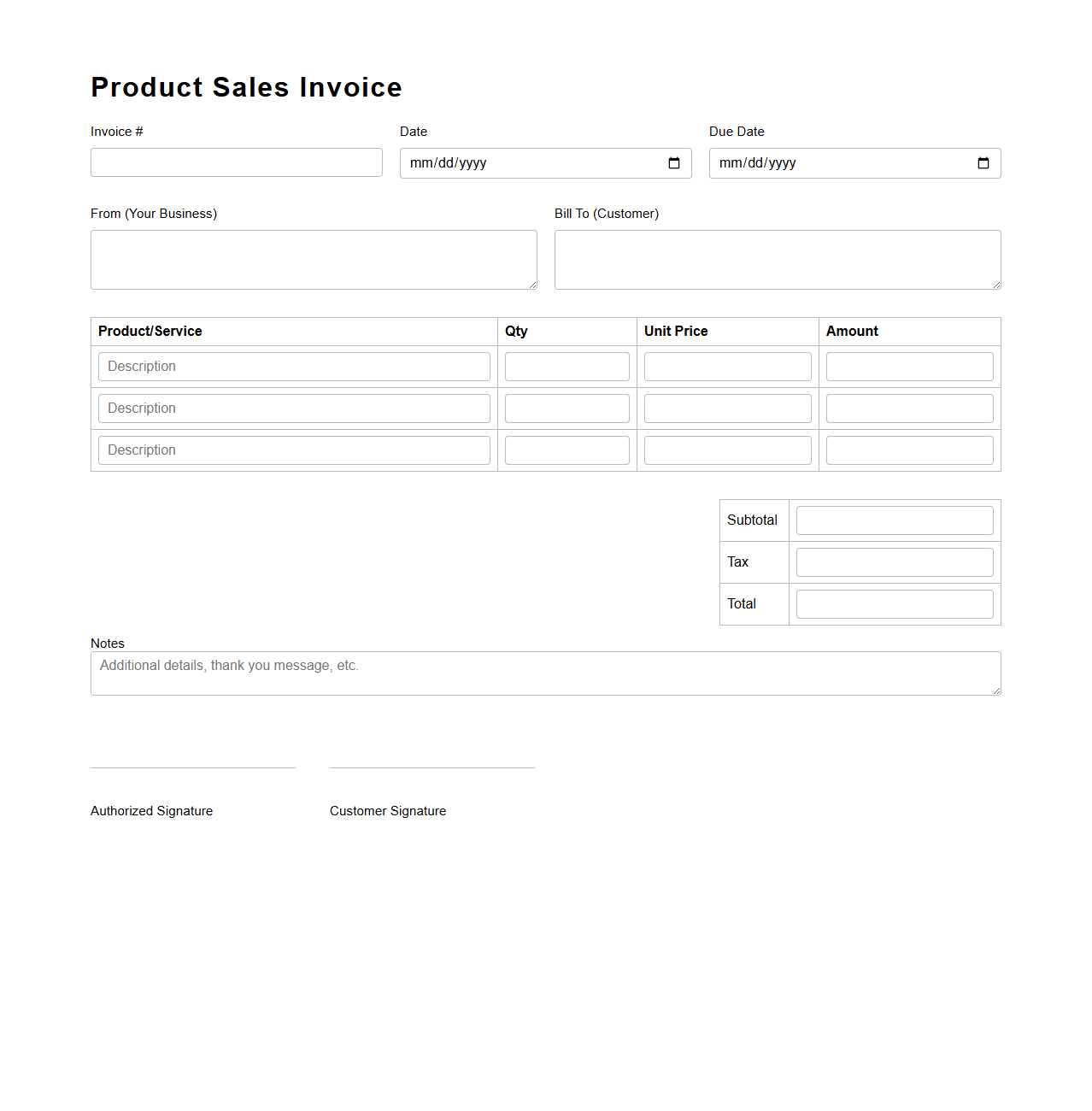

Simple Sales Invoice Form for Small Businesses

A

Simple Sales Invoice Form for small businesses is a streamlined document used to itemize products or services sold, including quantities, prices, and total amounts due. It facilitates accurate billing and record-keeping, ensuring transparent communication between sellers and customers. This form typically includes essential details such as business contact information, payment terms, and invoice number to support efficient transaction management and financial tracking.

Basic Sales Invoice Sheet for Entrepreneurs

A

Basic Sales Invoice Sheet for entrepreneurs is a structured document that records details of sales transactions, including item descriptions, quantities, prices, and total amounts due. It serves as an essential tool for tracking revenue, ensuring accurate billing, and maintaining financial records for tax and regulatory compliance. This sheet helps entrepreneurs manage cash flow efficiently by providing clear documentation for both the seller and the buyer.

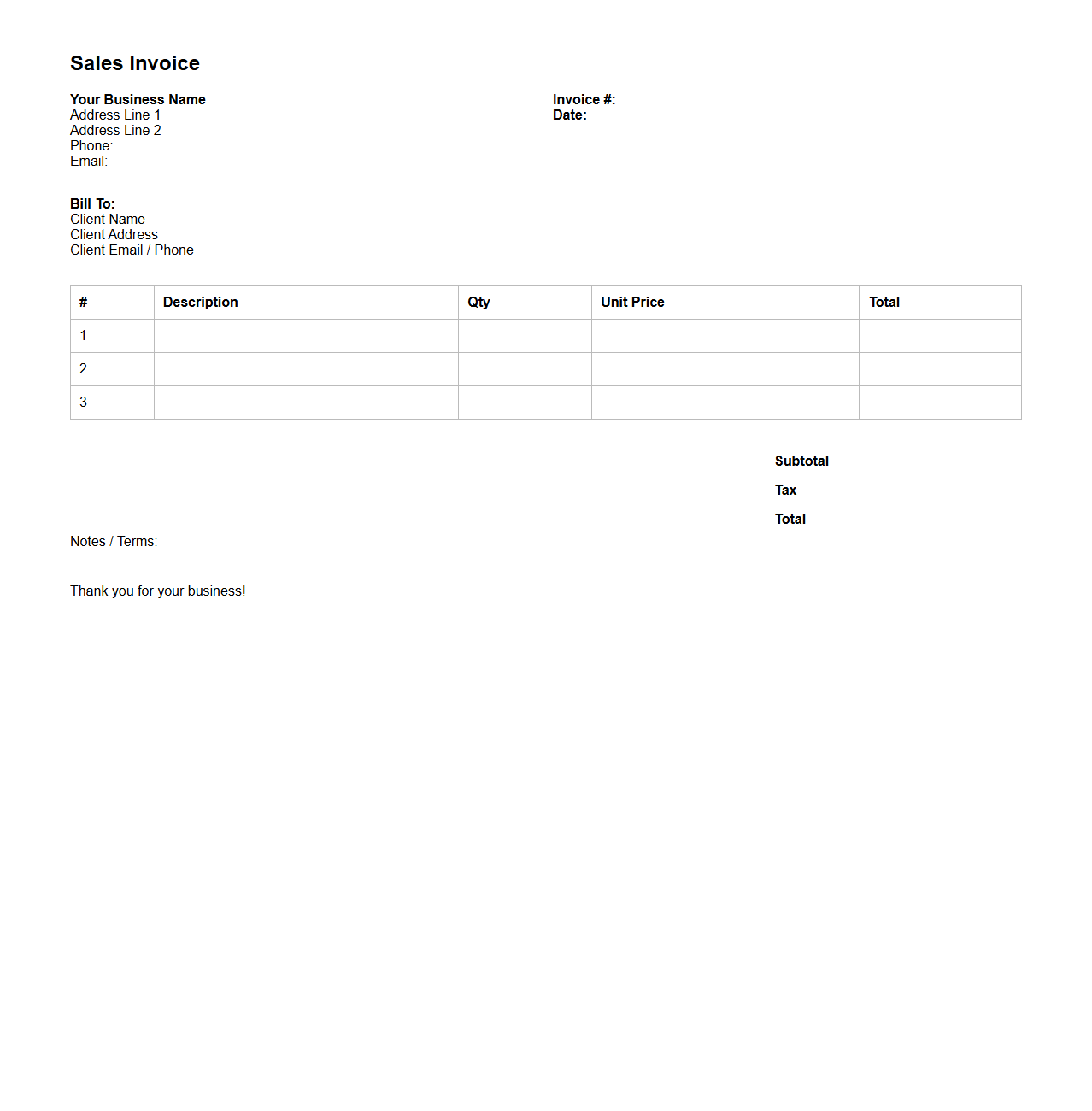

Small Business Sales Invoice Template Layout

A Small Business Sales Invoice Template Layout document provides a structured format for creating invoices that detail products or services sold, prices, quantities, taxes, and payment terms. This template ensures consistency and professionalism, making it easier for small businesses to bill clients accurately and track transactions efficiently. Utilizing a

Small Business Sales Invoice Template helps streamline accounting processes and improves cash flow management.

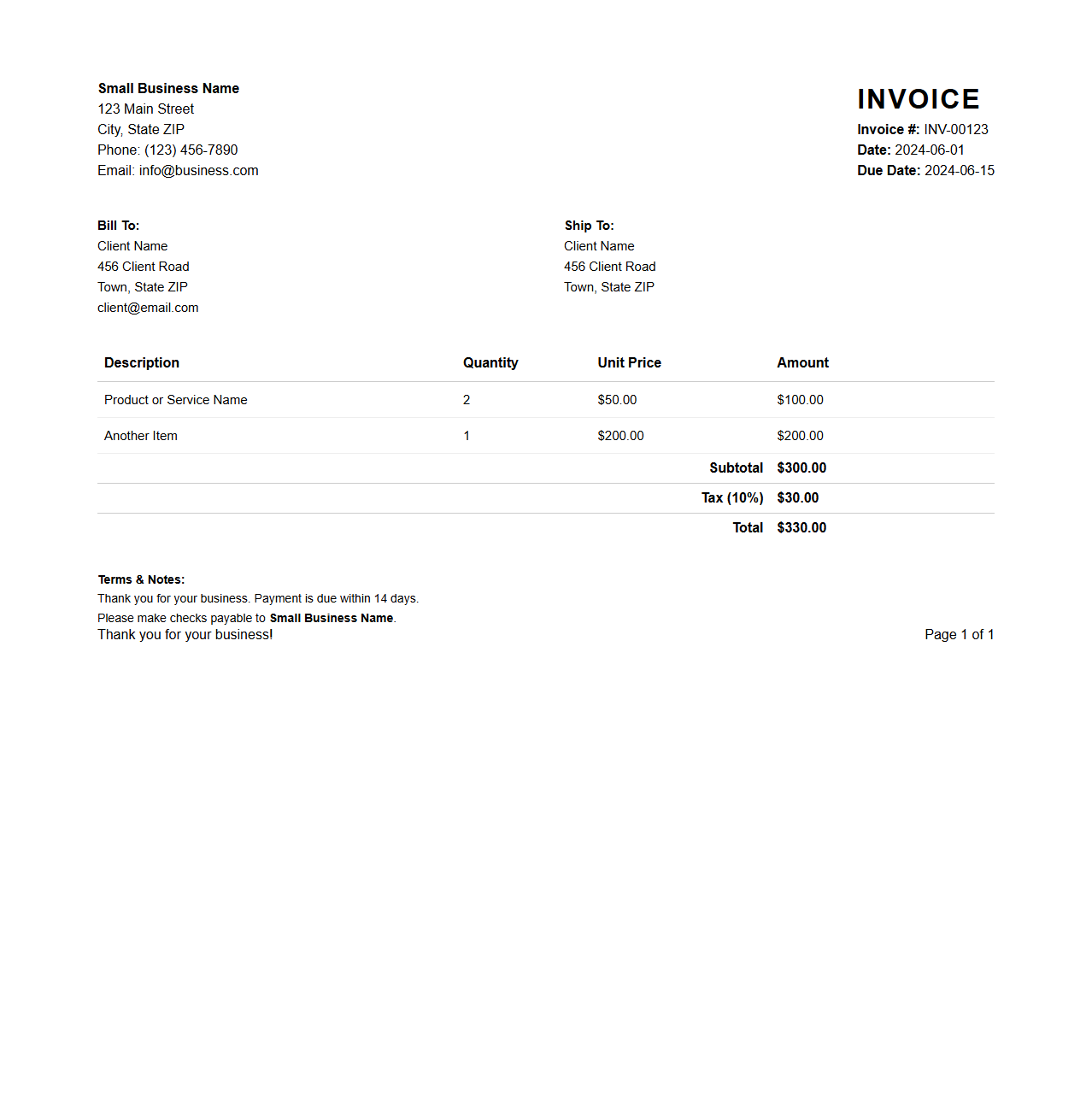

Minimalist Sales Invoice Format for Local Shops

A

Minimalist Sales Invoice Format for local shops is a simplified, easy-to-read document designed to record sales transactions with essential details such as item descriptions, quantities, prices, and total amounts. This format prioritizes clarity and efficiency, making it ideal for small businesses that require a straightforward invoicing method without excessive information. It ensures accurate record-keeping and facilitates transparent communication between sellers and customers.

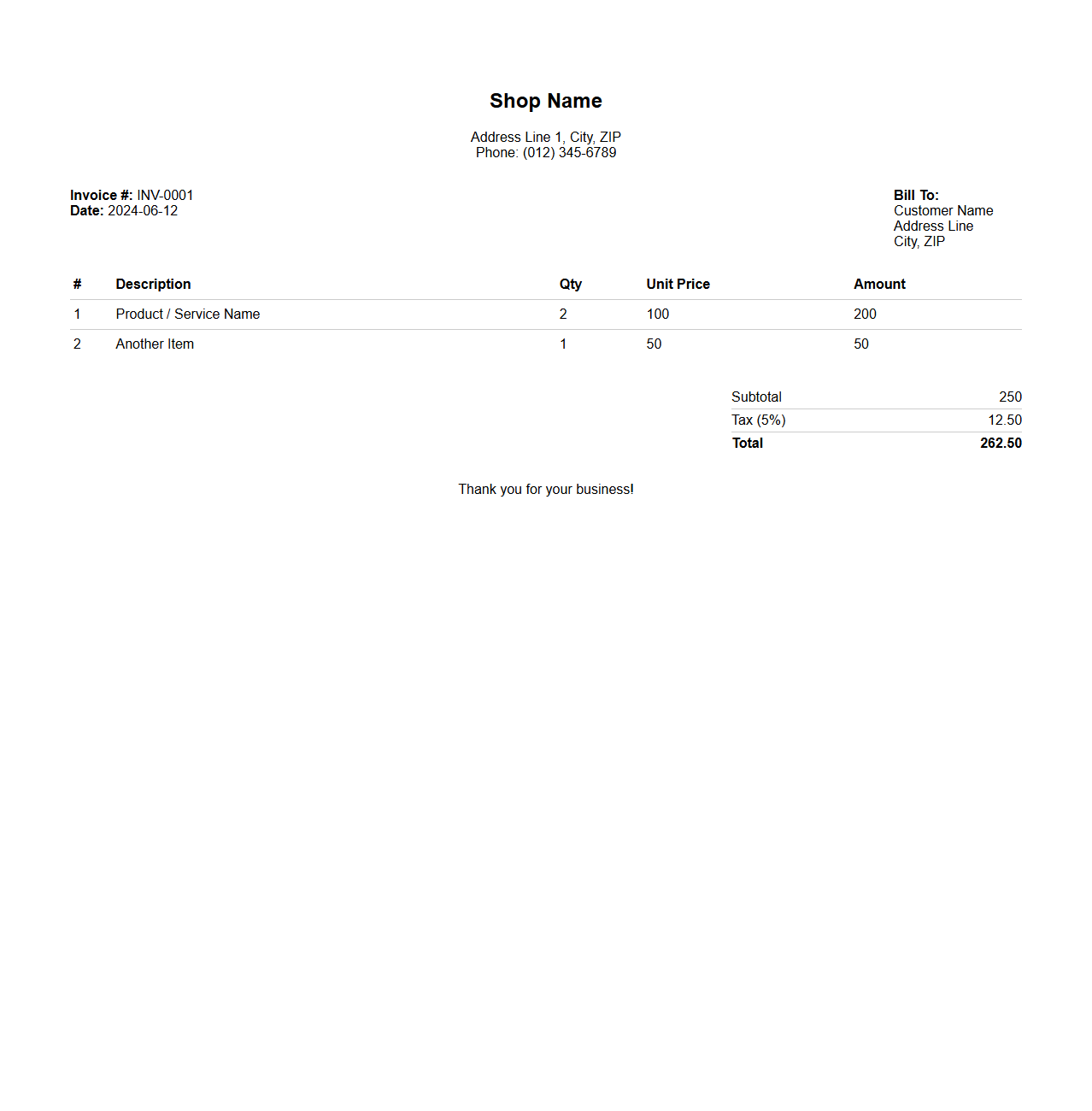

Single-Page Sales Invoice for Sole Proprietors

The

Single-Page Sales Invoice for Sole Proprietors is a streamlined financial document designed for individual business owners to record sales transactions efficiently. It typically includes essential details such as the seller's name, business address, itemized list of products or services sold, prices, total amount due, and payment terms. This invoice format simplifies bookkeeping and enhances transparency in financial dealings for sole proprietors.

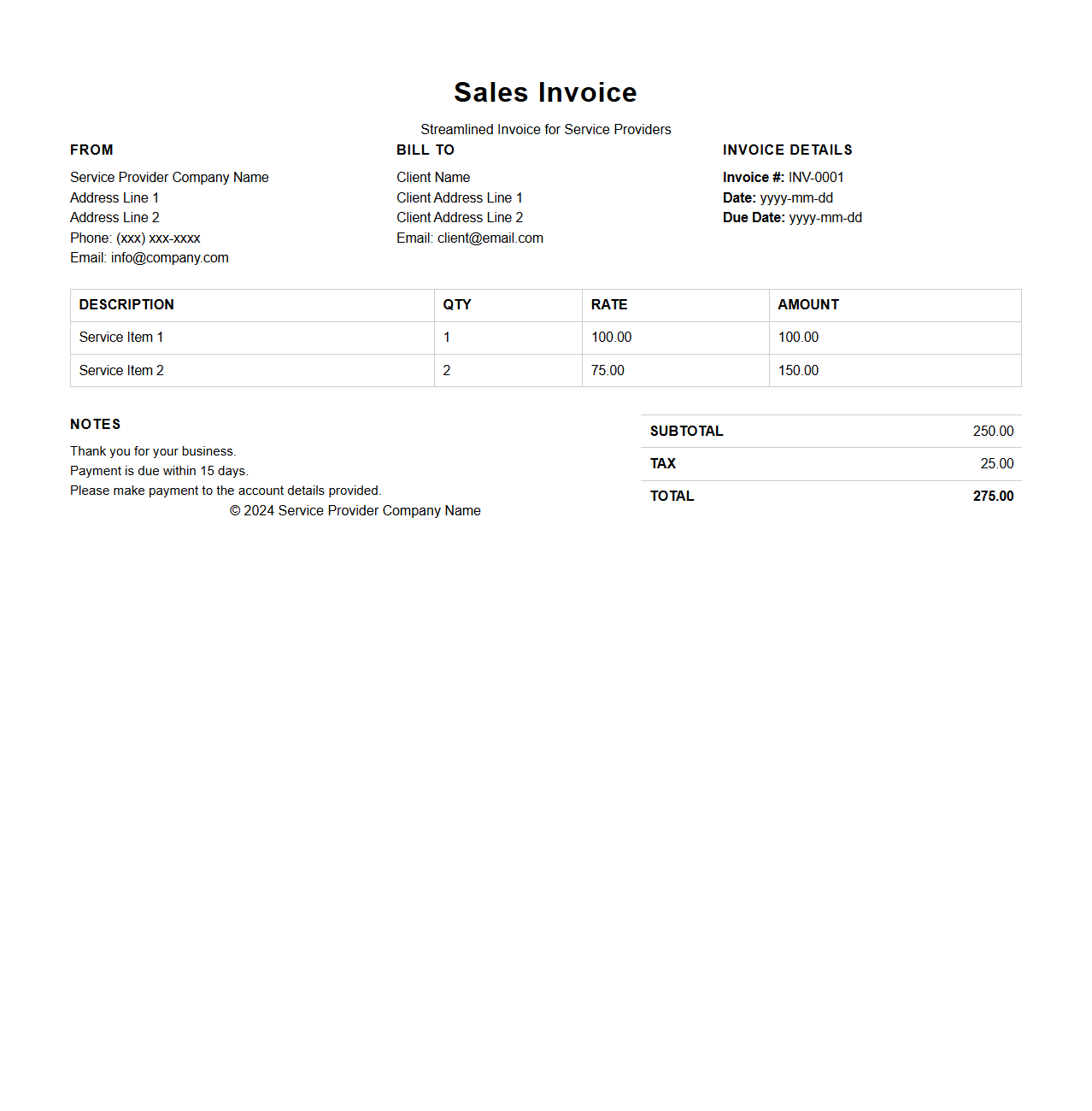

Streamlined Sales Invoice for Service Providers

The

Streamlined Sales Invoice for Service Providers document is designed to simplify billing processes by consolidating essential transaction details into a clear, organized format tailored for service-based businesses. It includes key information such as service descriptions, hourly rates or flat fees, client details, payment terms, and tax calculations to ensure compliance with financial regulations. This document enhances accuracy, speeds up payment cycles, and improves record-keeping efficiency for both service providers and their clients.

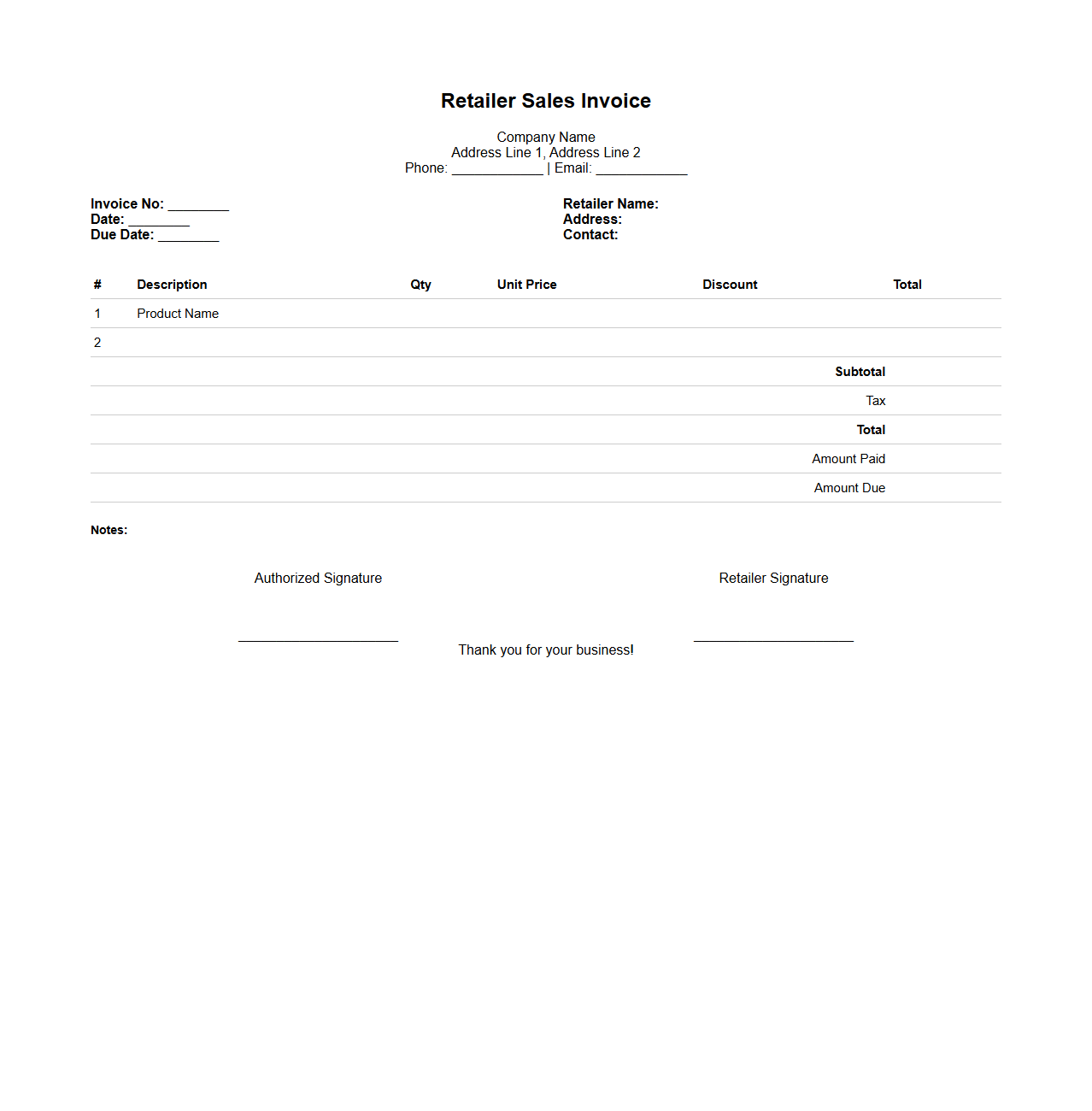

Customizable Sales Billing Invoice for Retailers

A

Customizable Sales Billing Invoice for Retailers is a document tailored to streamline sales transactions by allowing retailers to modify invoice templates according to their specific business needs, such as branding, tax calculations, and payment terms. This flexibility enhances accuracy in billing, improves customer communication, and facilitates efficient financial record-keeping. Retailers can integrate detailed item descriptions, discounts, and dynamic pricing to reflect real-time sales information accurately.

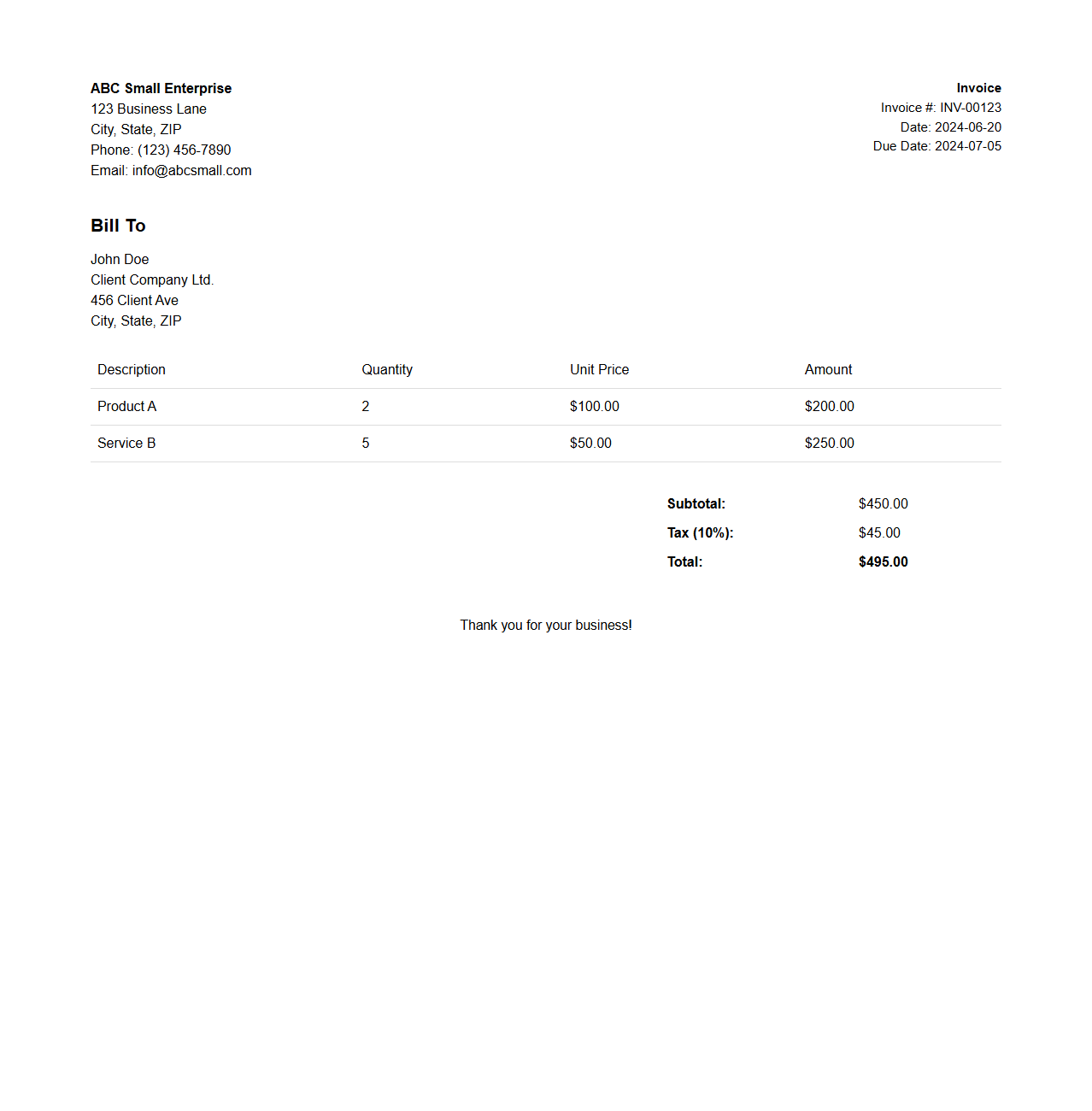

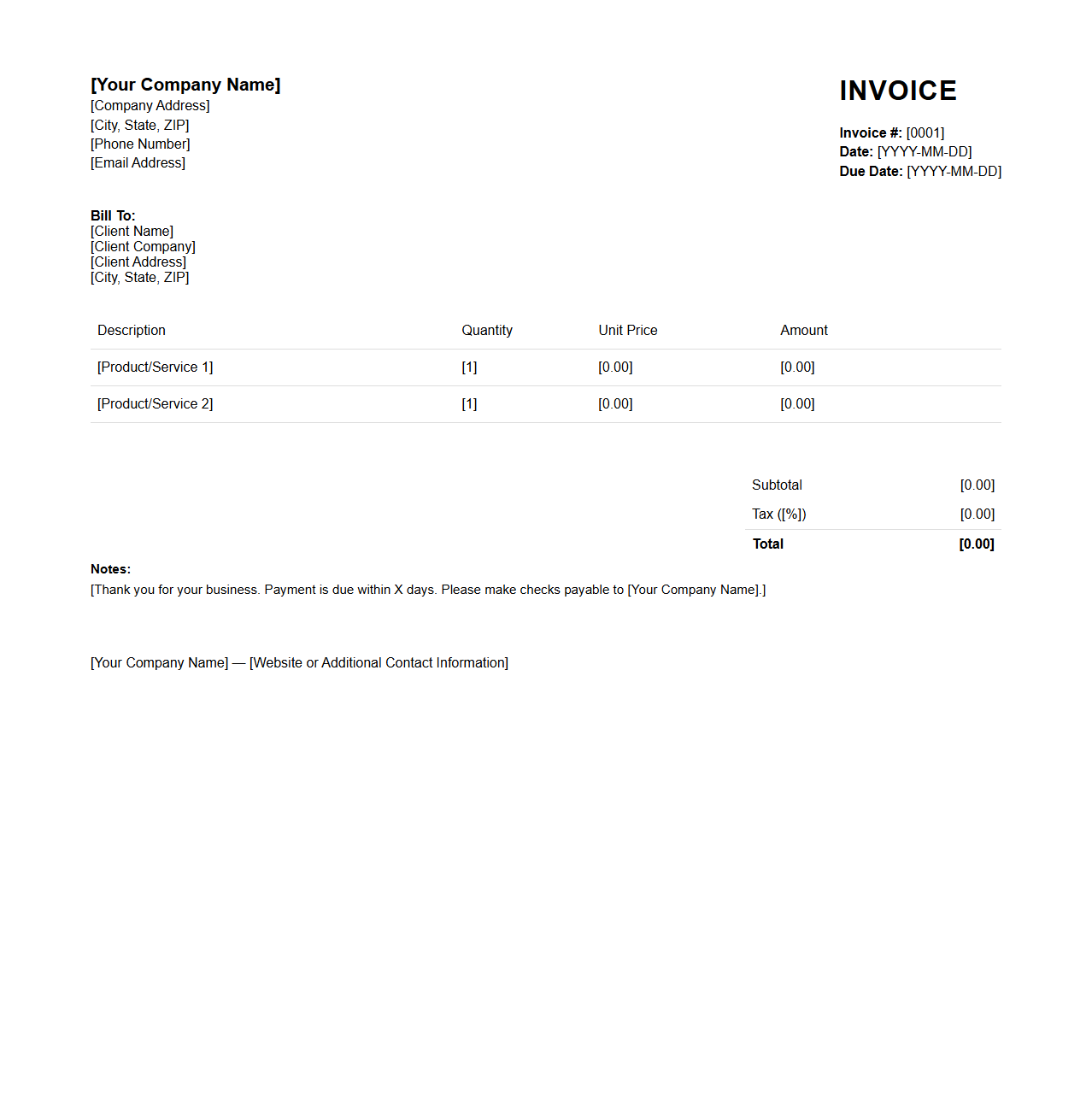

Clean Sales Invoice Sample for Small Enterprises

A

Clean Sales Invoice Sample for Small Enterprises is a professionally formatted document template that clearly itemizes products or services sold, quantities, prices, and total amounts due. It ensures accurate transaction records, supports timely payments, and complies with accounting standards to facilitate smooth financial management. This sample helps small businesses streamline invoicing processes and maintain transparency with clients.

Small Business Product Sales Invoice Form

A

Small Business Product Sales Invoice Form is a crucial document used to itemize and record the sale of products between a small business and its customers. It details essential information such as product descriptions, quantities, prices, payment terms, and customer details, ensuring accurate transaction records. This form helps streamline accounting processes, supports tax compliance, and enhances communication between sellers and buyers.

Professional Sales Invoice for Small Companies

A

Professional Sales Invoice for Small Companies document is a detailed record of a sale transaction that includes essential elements such as item descriptions, quantities, prices, taxes, and payment terms. It serves as a formal request for payment and a legal proof of the sale between a small business and its customer. This document helps small companies maintain accurate financial records, streamline billing processes, and ensure compliance with tax regulations.

What key fields should a blank sales invoice template include for small businesses?

A blank sales invoice template must include essential fields such as the invoice number, date of issue, and seller information. It should also contain buyer details, a detailed list of products or services, and payment terms to ensure clarity. These fields help maintain accurate records and support legal and financial compliance for small businesses.

How can I customize a blank sales invoice for different product lines?

Customizing a blank sales invoice for various product lines involves adding or modifying item descriptions, unit prices, and quantities specific to each line. You can use separate sections or columns to clearly differentiate products, enhancing readability and organization. Incorporating unique codes or SKU numbers further optimizes the invoice for inventory tracking and reporting.

Are there compliant formats for digital blank sales invoices in my region?

Many regions mandate specific compliant formats for digital sales invoices to ensure legal validity and tax compliance. These formats usually follow local regulations regarding required fields, electronic signatures, and data privacy. It is essential to verify regional guidelines to adopt the correct digital invoice format and avoid penalties.

What software options offer editable blank sales invoice templates?

Popular software like Microsoft Excel, Google Sheets, and specialized invoicing tools such as QuickBooks and FreshBooks provide editable sales invoice templates. These platforms allow small businesses to customize templates easily while maintaining professional formatting. Additionally, many cloud-based solutions offer real-time collaboration and automated features enhancing invoice management.

How do I add automated tax calculations on a blank sales invoice?

Automated tax calculations can be added to a blank sales invoice by incorporating formula fields that calculate tax based on predefined rates. Using software with built-in tax modules simplifies this process, ensuring accuracy and compliance with current tax laws. This automation reduces manual errors and speeds up the invoicing workflow for small businesses.