A Blank Retirement Plan Template for Future Security provides a structured framework to organize your financial goals and savings strategies efficiently. It helps you track contributions, investments, and projected income to ensure a comfortable retirement. Using this template promotes disciplined planning and long-term financial stability.

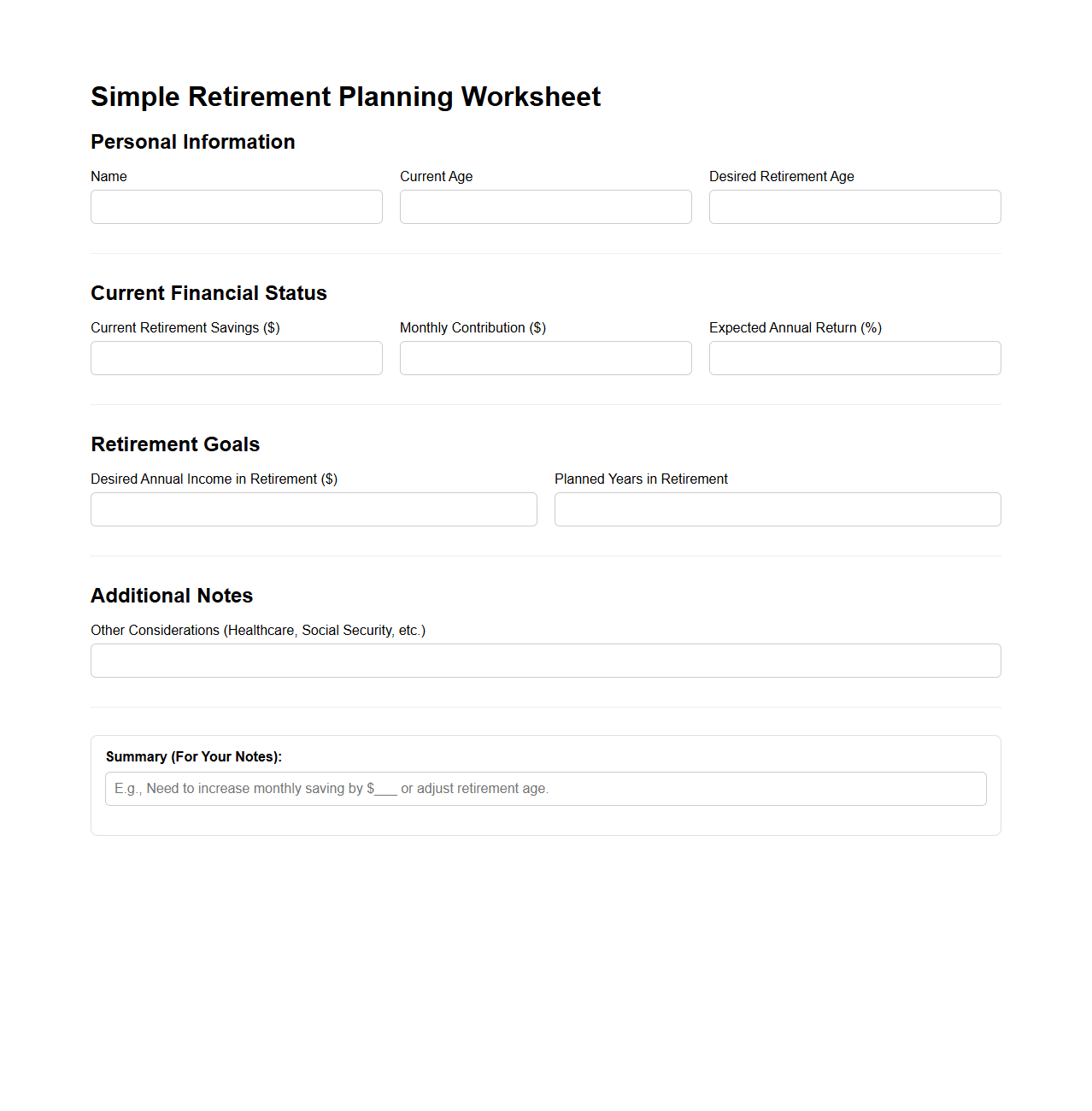

Simple Retirement Planning Worksheet for Long-Term Security

A

Simple Retirement Planning Worksheet for Long-Term Security is a practical tool designed to help individuals systematically calculate their future financial needs and savings goals for retirement. It typically includes sections to estimate income sources, projected expenses, inflation adjustments, and investment growth over time. By organizing key financial data, this worksheet facilitates informed decision-making to ensure sustainable retirement income and long-term financial security.

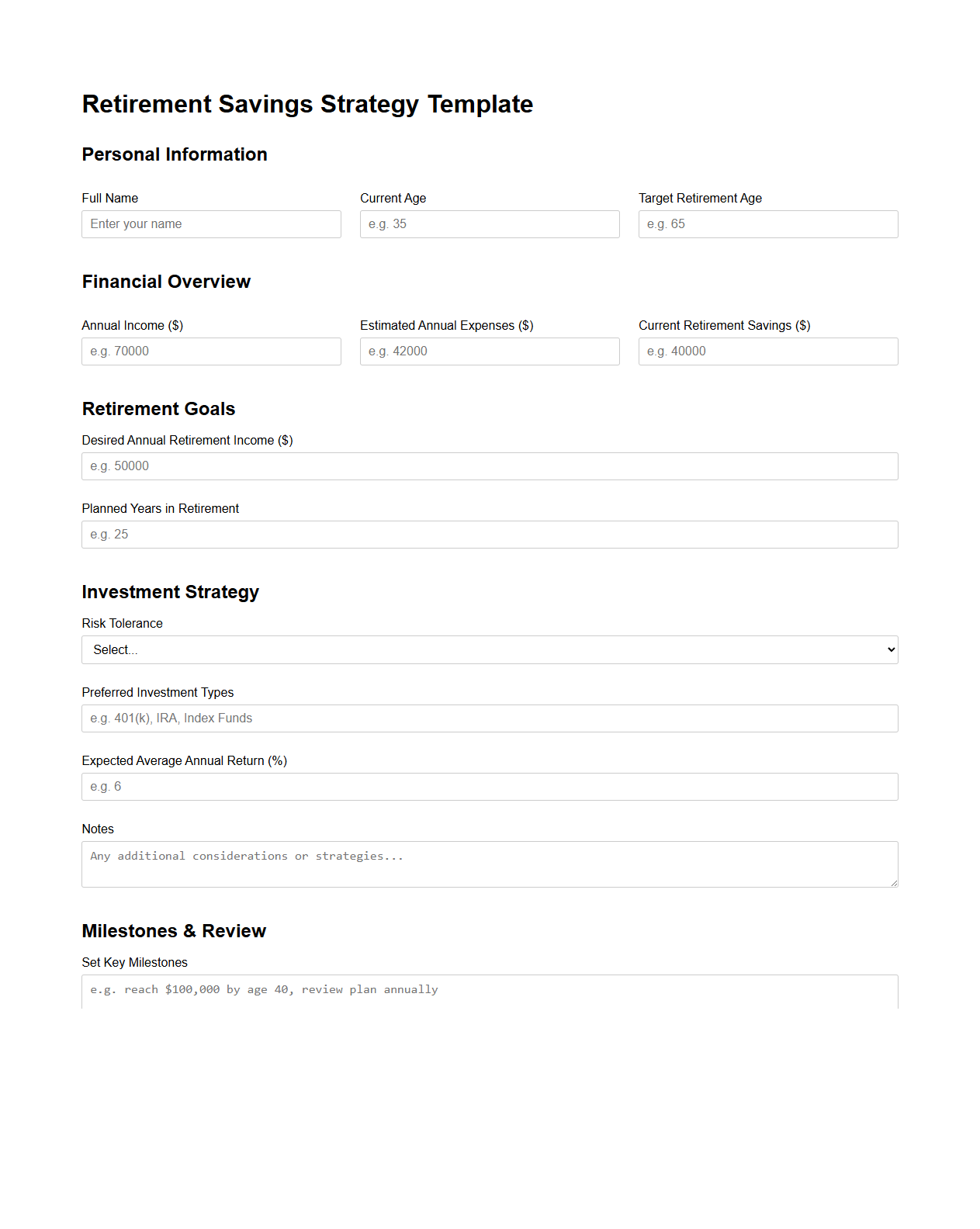

Customizable Retirement Savings Strategy Template

A

Customizable Retirement Savings Strategy Template is a practical tool designed to help individuals tailor their retirement planning based on personalized financial goals, risk tolerance, and income projections. This document enables users to systematically organize their savings, investment options, and timeline while adjusting variables to reflect changes in market conditions or personal circumstances. By providing a clear framework, it enhances decision-making and maximizes the potential for a secure and comfortable retirement.

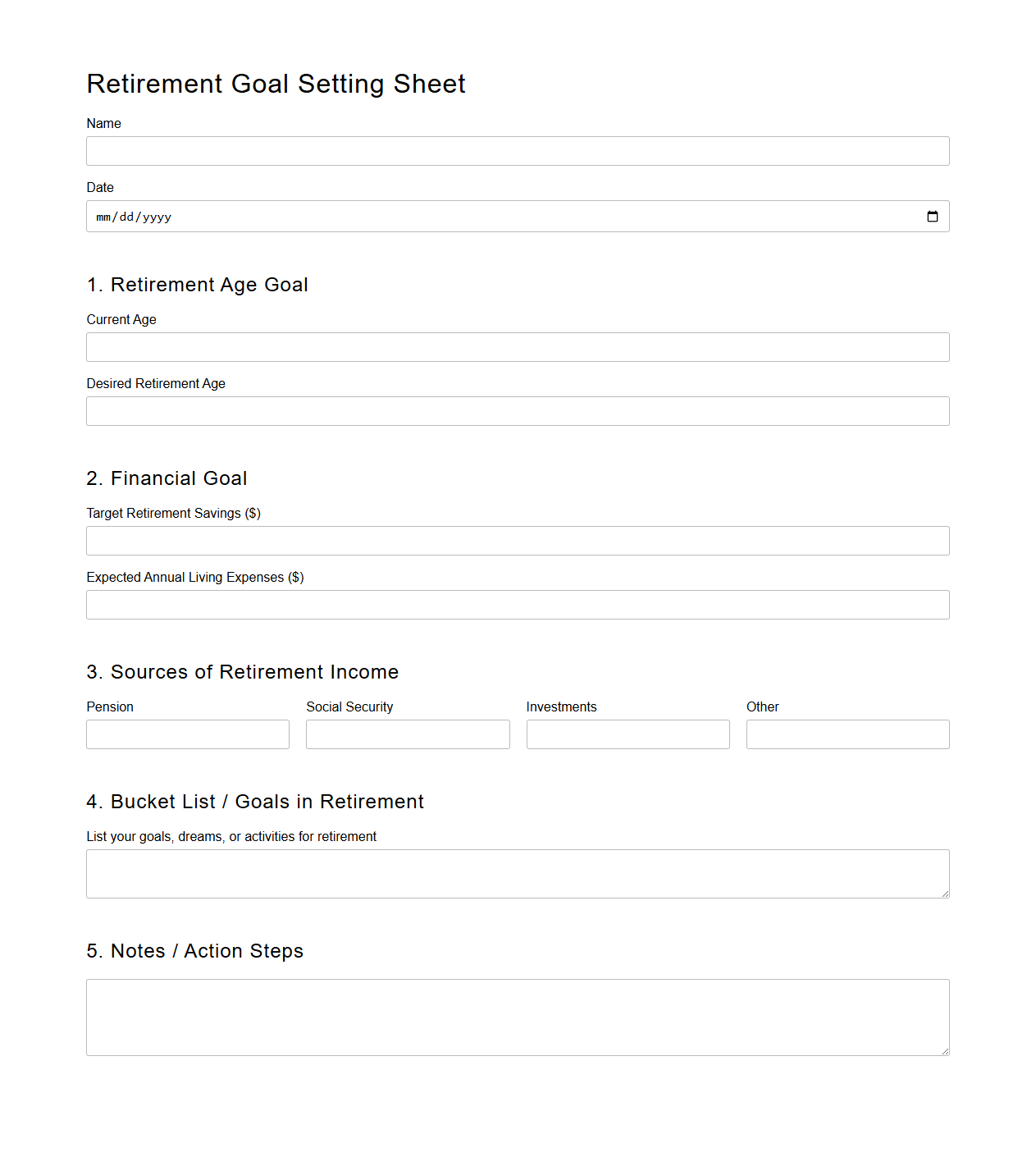

Basic Retirement Goal Setting Sheet

A

Basic Retirement Goal Setting Sheet document serves as a strategic tool to identify and outline individual retirement objectives, including desired retirement age, income targets, and savings milestones. It helps users analyze current financial status and project future needs to create a clear, actionable retirement plan. This document enhances financial preparedness by organizing key retirement goals, enabling effective decision-making and progress tracking.

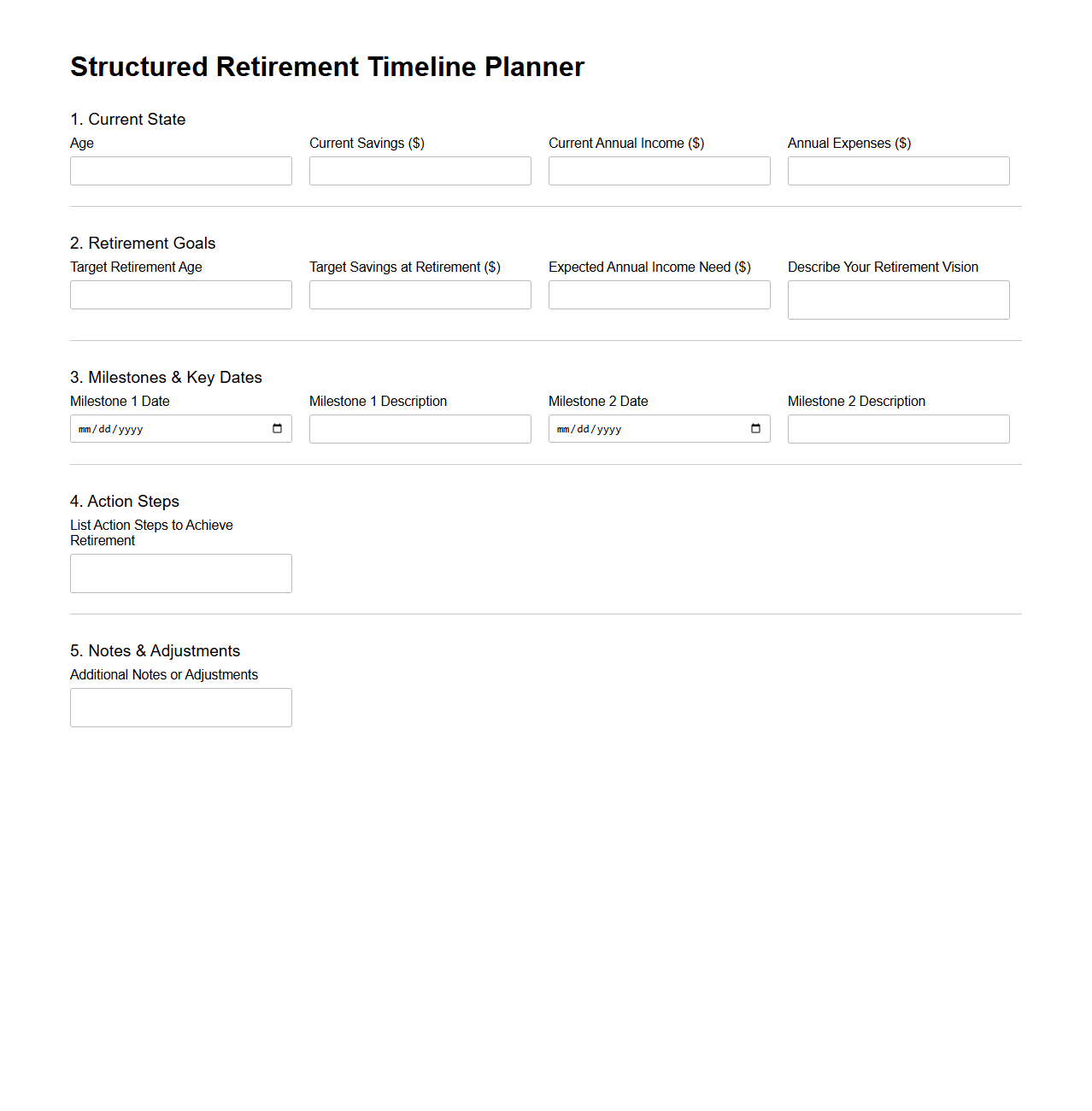

Structured Retirement Timeline Planner

A

Structured Retirement Timeline Planner document organizes key milestones and financial goals leading up to and during retirement, ensuring a clear and actionable roadmap. It outlines critical phases such as asset allocation adjustments, Social Security claiming strategies, and required minimum distributions to optimize income streams. This planner enhances decision-making by aligning retirement objectives with specific timelines and personalized financial considerations.

Retirement Income and Expense Tracker

A

Retirement Income and Expense Tracker document is a financial tool designed to help retirees monitor and manage their cash flow by recording all sources of income and tracking monthly expenses. This tracker enables individuals to maintain a clear overview of their financial situation, ensuring they can meet their essential needs and adjust spending habits accordingly. Accurate usage of this document supports long-term financial stability and informed retirement planning decisions.

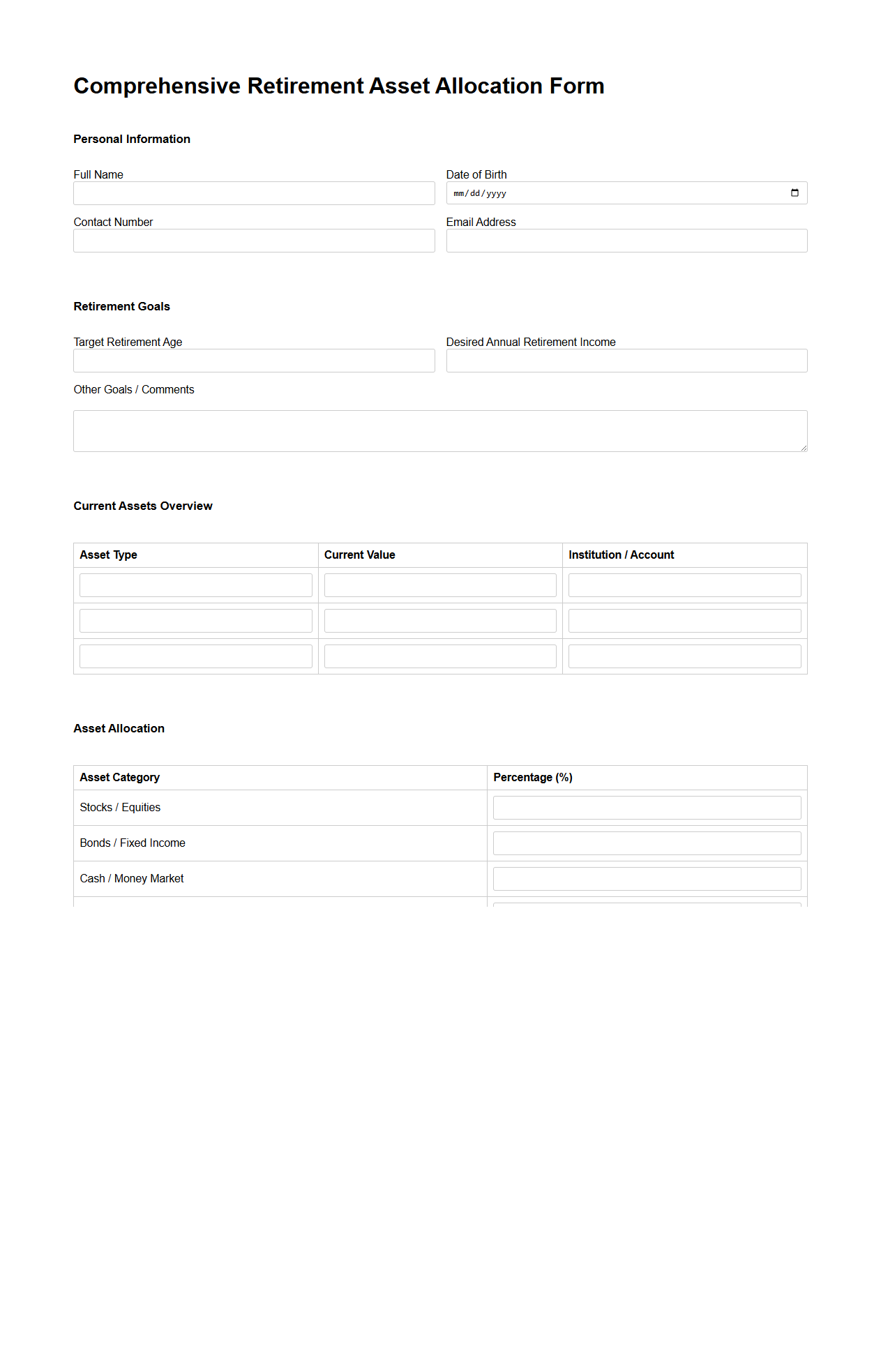

Comprehensive Retirement Asset Allocation Form

The

Comprehensive Retirement Asset Allocation Form is a detailed document used to outline and organize an individual's investment distribution across various asset classes such as stocks, bonds, and cash equivalents for retirement planning. It helps in assessing risk tolerance, financial goals, and time horizon to create a balanced portfolio aimed at maximizing returns while minimizing risk. This form serves as a critical tool for financial advisors and retirees to strategically manage and adjust retirement savings.

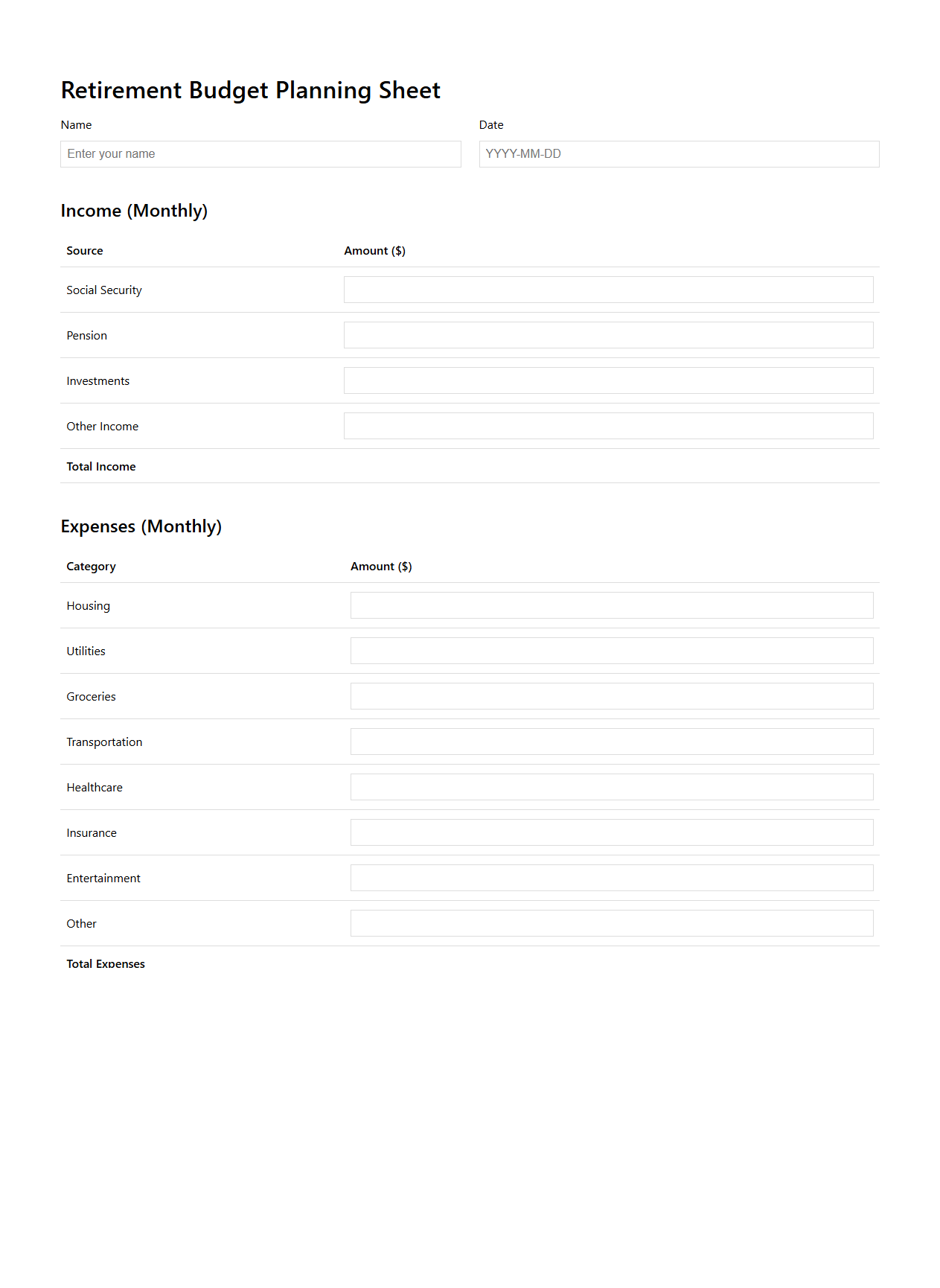

Minimalist Retirement Budget Planning Sheet

A

Minimalist Retirement Budget Planning Sheet is a streamlined financial tool designed to help individuals organize and track essential retirement income and expenses efficiently. It emphasizes simplicity by focusing on core budget categories, reducing unnecessary details, and promoting clarity in financial decision-making. This document aids retirees in maintaining financial stability and managing their resources effectively without overwhelming complexity.

Detailed Pension and Investment Tracker

A

Detailed Pension and Investment Tracker document is a comprehensive record designed to monitor and manage various retirement accounts, investment portfolios, and related financial assets. It helps users track contributions, growth, dividends, and withdrawals, ensuring clear visibility over long-term financial health and performance. This tool is essential for making informed decisions about asset allocation and retirement planning.

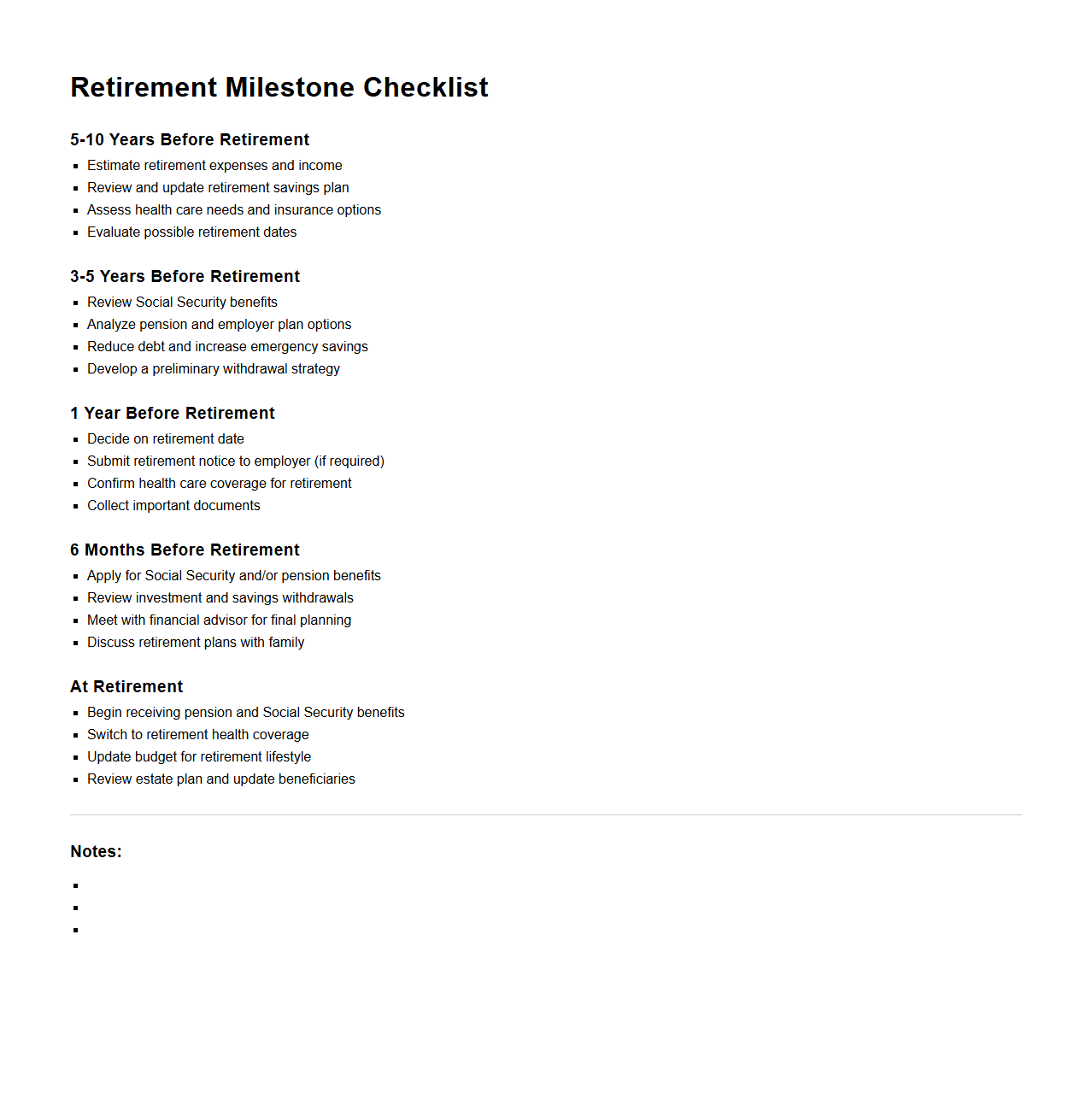

Retirement Milestone Checklist Template

A

Retirement Milestone Checklist Template document is a structured tool designed to guide individuals through critical financial, legal, and lifestyle steps essential for a successful retirement transition. It typically includes key tasks such as reviewing pension plans, updating estate documents, and planning healthcare coverage to ensure comprehensive preparedness. This template helps users systematically track progress and meet important deadlines, minimizing potential retirement challenges.

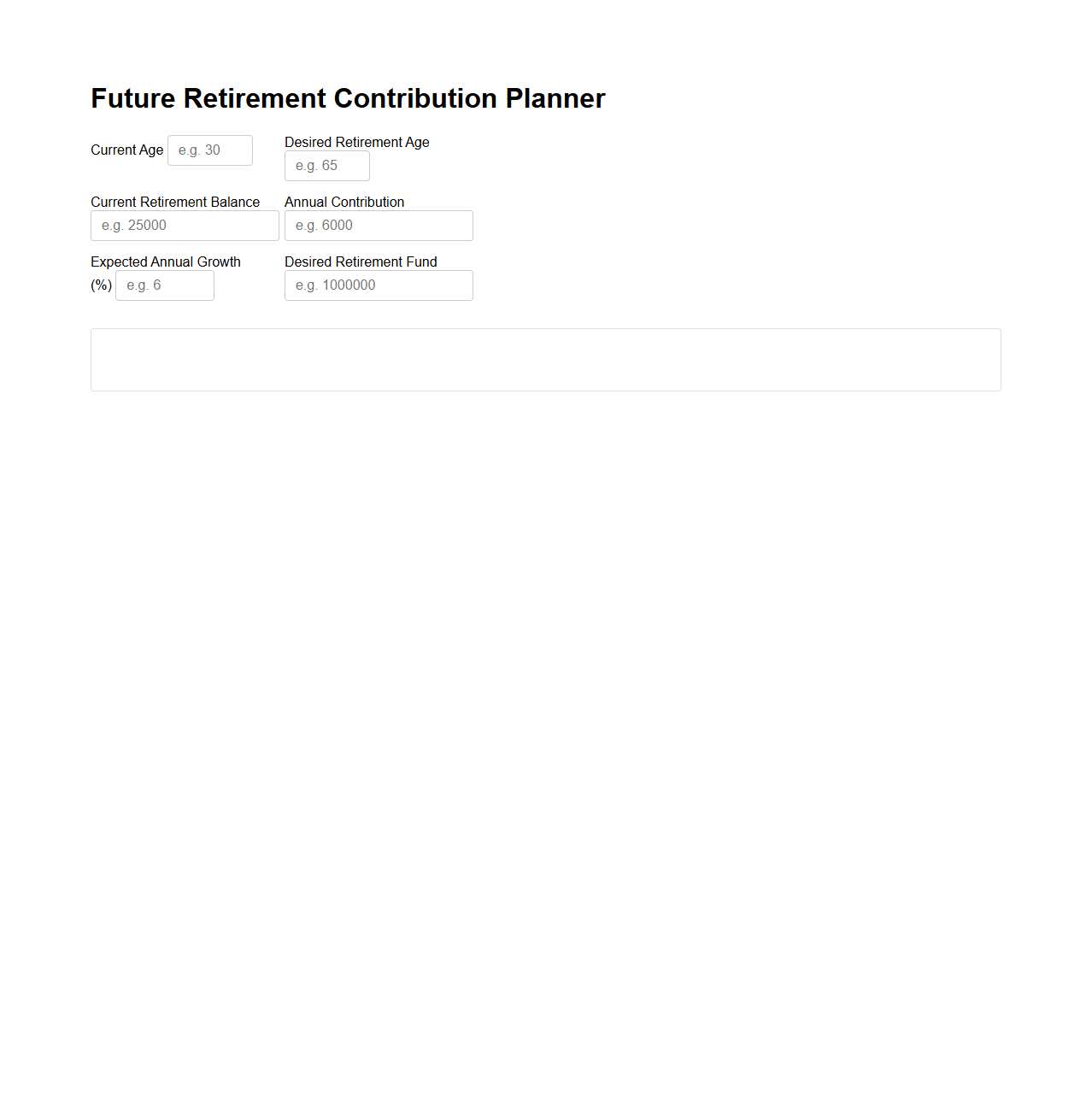

Future Retirement Contribution Planner

The

Future Retirement Contribution Planner document serves as a strategic tool to estimate and organize retirement savings based on expected income, contribution limits, and investment growth rates. It helps individuals project future financial security by calculating optimal contribution amounts to various retirement accounts such as 401(k), IRA, or pension plans. This planner enables users to adjust variables like contribution frequency, inflation rates, and retirement age for a tailored savings strategy.

What legal clauses should a blank retirement plan letter include for future financial security?

A blank retirement plan letter should include clauses defining the plan's purpose and scope to ensure clarity and legal compliance. It must incorporate provisions addressing fiduciary duties, ensuring that plan administrators act in the best interest of participants. Additionally, clauses related to amendment and termination protocols are essential for managing future uncertainties.

How can beneficiaries be effectively addressed in a blank retirement plan letter template?

Beneficiaries should be clearly identified with specific instructions on designation and changes to avoid ambiguity in the retirement plan letter. The document must provide procedures for beneficiary claims and dispute resolution to safeguard their rights. Including language about contingent beneficiaries ensures protection if the primary beneficiary is unable to inherit.

What language ensures tax compliance in a blank retirement plan letter?

The letter should reference compliance with applicable tax laws, such as the Internal Revenue Code (IRC) and Employee Retirement Income Security Act (ERISA). It must state the plan's adherence to tax-qualified status requirements, preventing disqualification and penalties. Clear wording on contribution limits, tax-deferred growth, and required minimum distributions (RMDs) is critical for compliance.

Which sections should highlight employer and employee responsibilities in a blank retirement plan letter?

The responsibilities of both employer and employee should be distinctively outlined in dedicated sections of the letter. Employer duties often include plan administration, funding, and compliance oversight. Employee obligations should cover enrollment, contribution decisions, and communication of beneficiary changes.

How to structure distribution options clearly in a blank retirement plan letter?

Distribution options should be presented in a separate section with clear headings to guide participants smoothly through their choices. Include definitions of available methods, such as lump sum, annuity, or periodic withdrawals, alongside eligibility criteria. Detailed instructions on timing, tax implications, and required minimum distributions (RMDs) help avoid confusion.