A Blank Deposit Receipt Template for Bank Transactions provides a standardized form to document deposits made into a bank account, ensuring accurate record-keeping. This template typically includes fields for the depositor's information, deposit amount, date, and transaction details, helping both the bank and customer maintain clear financial records. Using a well-organized receipt template minimizes errors and enhances transparency in banking processes.

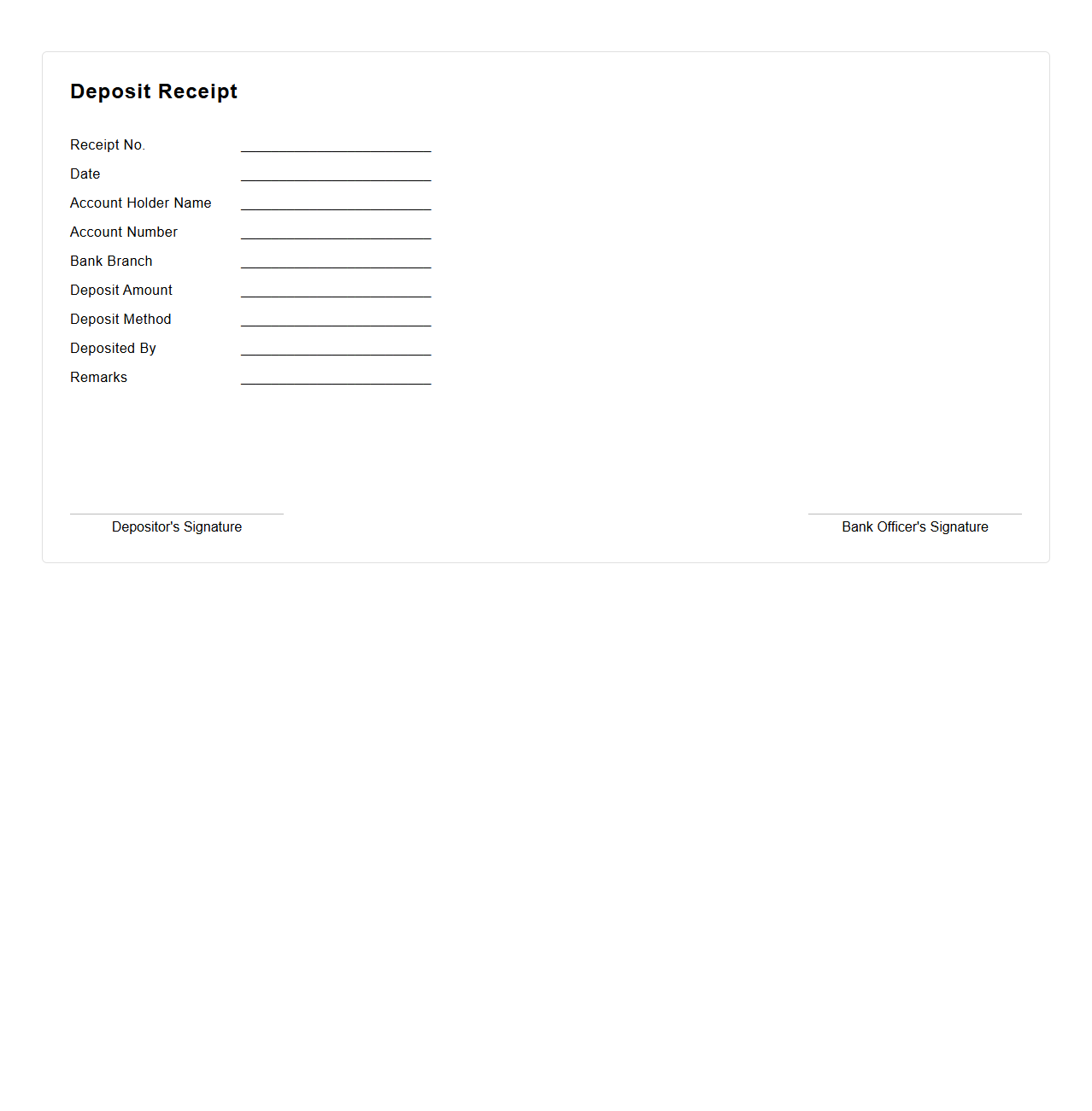

Simple Deposit Receipt Template for Bank Transactions

A

Simple Deposit Receipt Template for bank transactions is a standardized document used to acknowledge the receipt of funds deposited into an account. It typically includes essential details such as the depositor's name, deposit amount, date, and transaction reference number, ensuring clear and accurate record-keeping. This template helps streamline bank operations by providing a consistent format for verifying and tracking deposits efficiently.

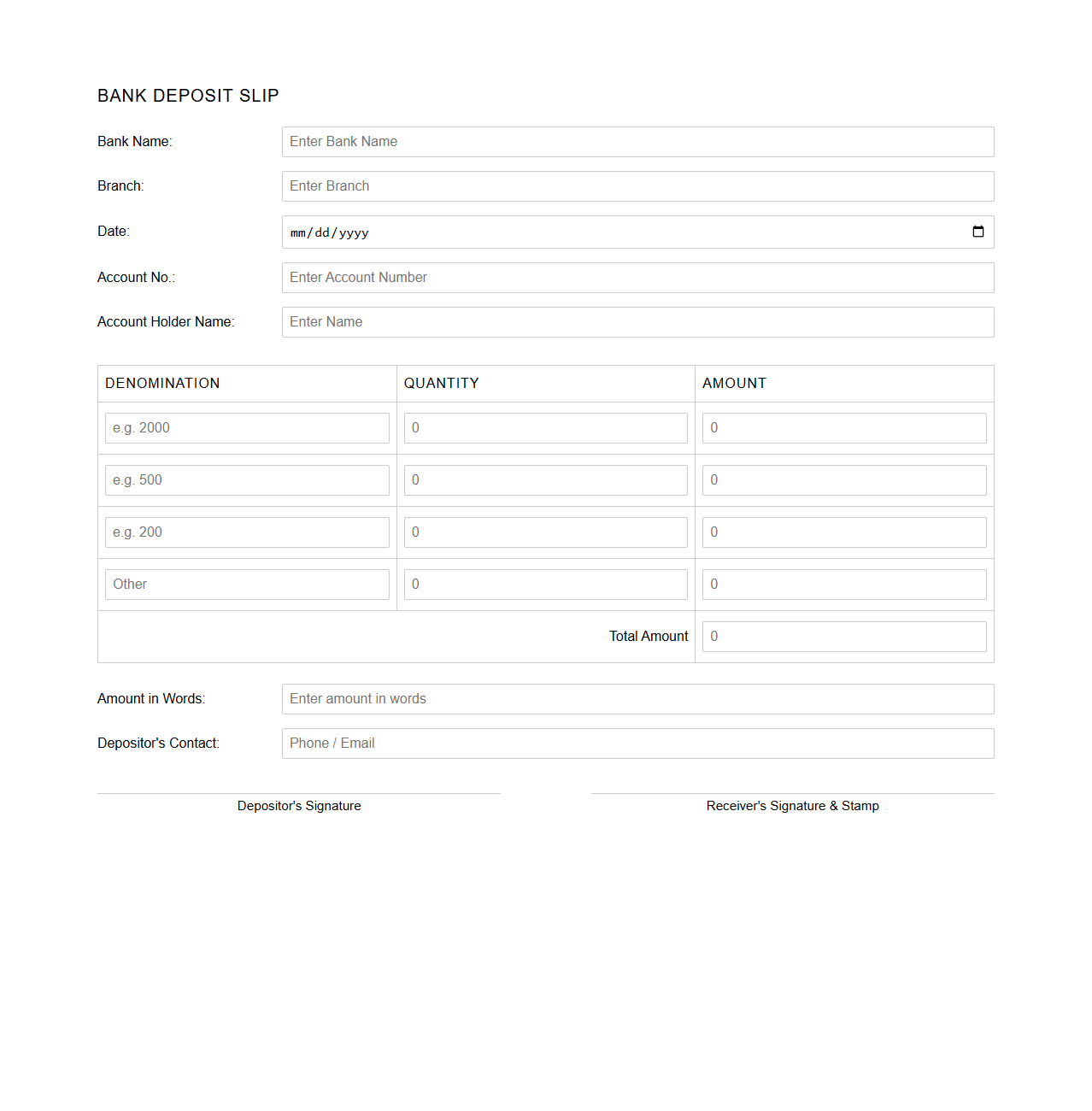

Basic Bank Deposit Slip Format

A

Basic Bank Deposit Slip Format document is a standardized form used by banks to record the details of a deposit transaction. It typically includes fields for the depositor's name, account number, date, amount being deposited, and the type of deposit such as cash or cheque. This format ensures accurate and efficient processing of deposits while maintaining clear records for both the bank and the customer.

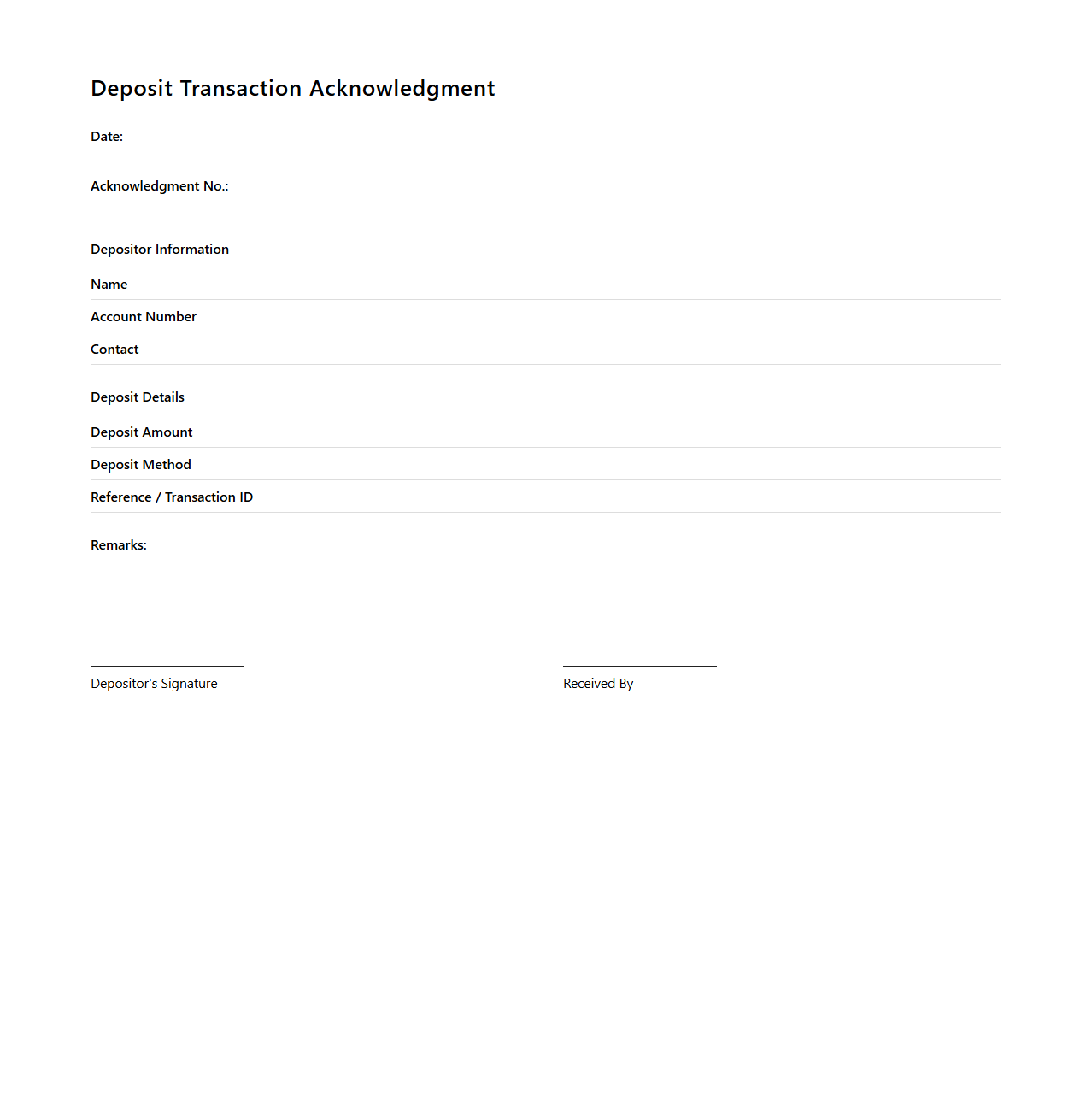

Deposit Transaction Acknowledgment Template

A

Deposit Transaction Acknowledgment Template document serves as a standardized form used by financial institutions or businesses to formally confirm receipt of a deposit made by a customer or client. It includes critical details such as deposit amount, date, account information, and transaction reference number, ensuring transparency and accurate record-keeping. This template enhances communication efficiency and provides an official acknowledgment that can be used for auditing or reconciliation purposes.

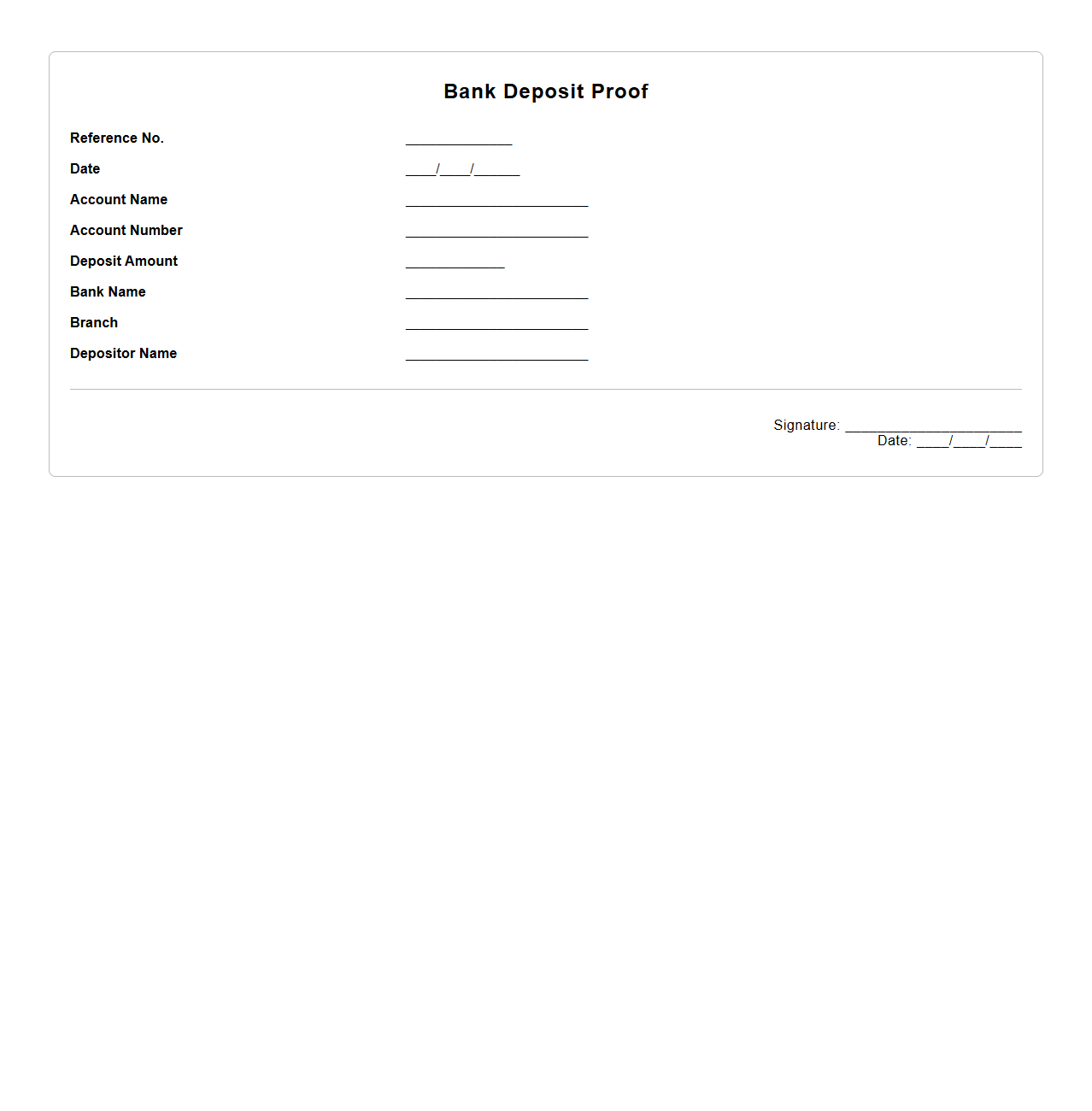

Minimalist Bank Deposit Proof Template

A

Minimalist Bank Deposit Proof Template is a simplified document designed to verify a financial transaction, specifically deposits made into a bank account. It typically includes essential details such as depositor's name, account number, transaction date, and amount deposited, ensuring clear and concise proof of the deposit. This template streamlines record-keeping and enhances transparency for personal or business financial activities.

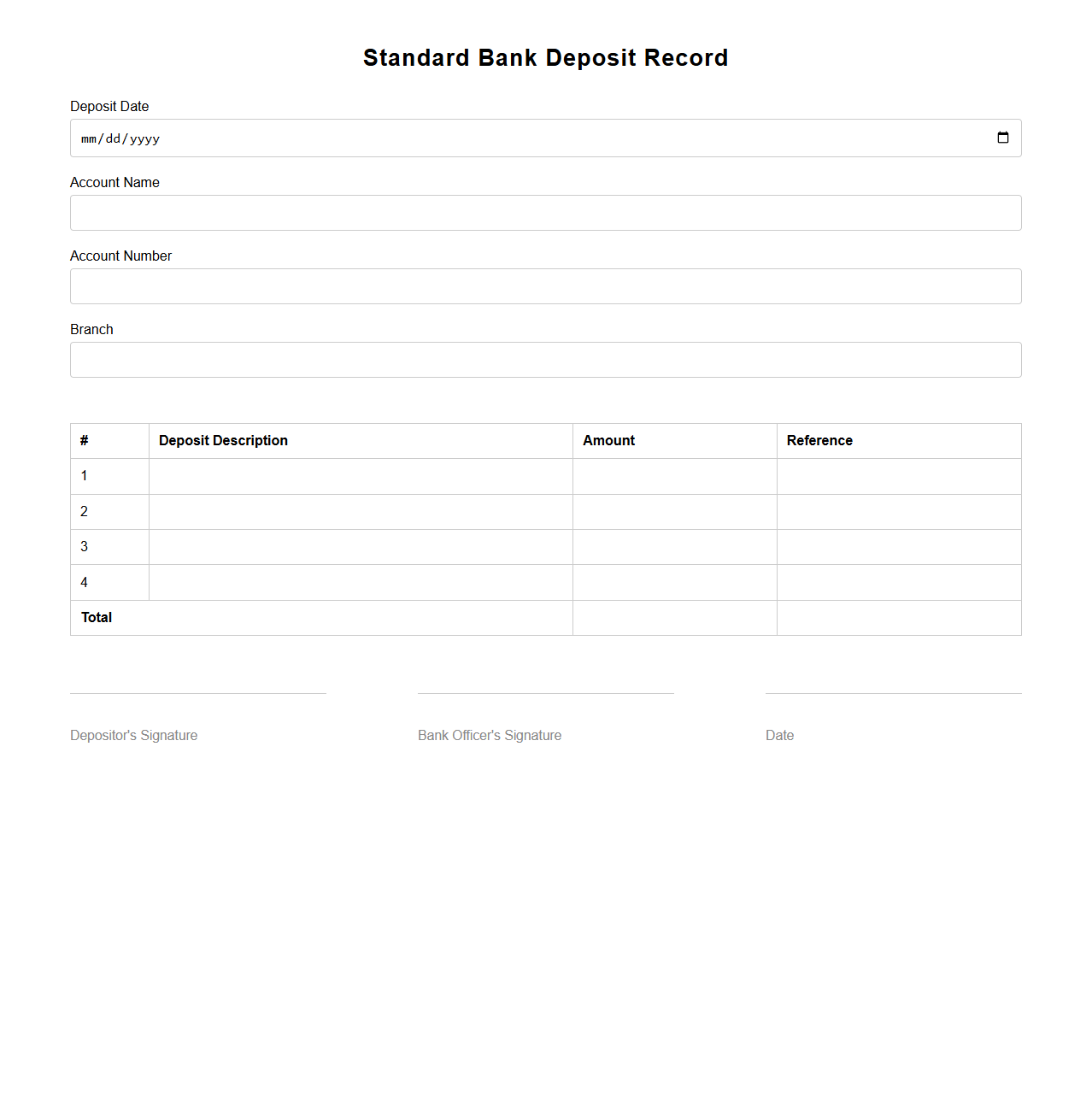

Standard Bank Deposit Record Template

A

Standard Bank Deposit Record Template document is a structured form used to accurately document and track deposits made into a bank account. It typically includes fields for the date, deposit amount, account identification, and depositor details, ensuring consistent record-keeping for reconciliation and auditing purposes. This template enhances financial transparency and simplifies the monitoring of cash inflows for businesses and individuals.

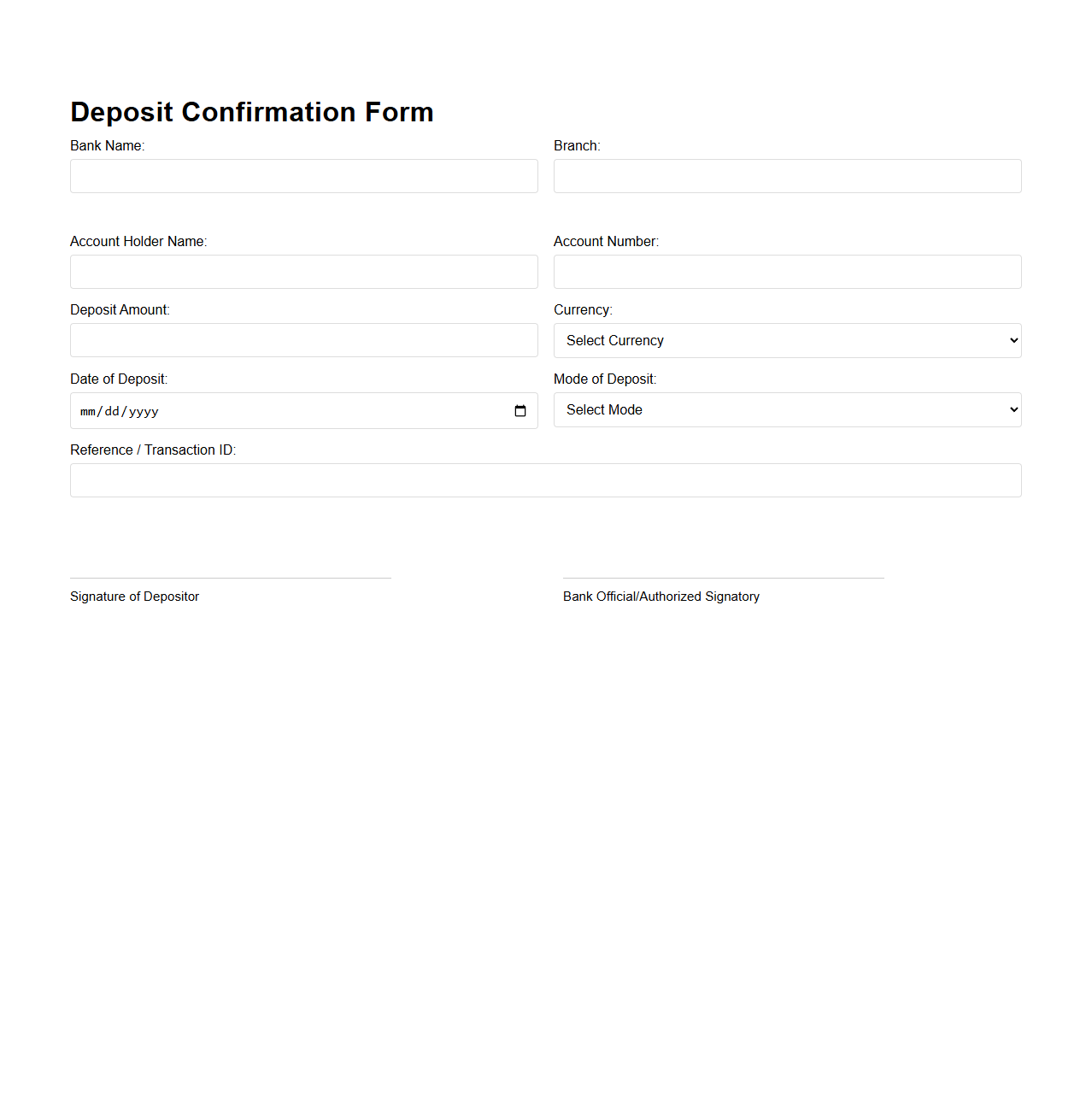

Classic Deposit Confirmation Form for Banks

A

Classic Deposit Confirmation Form for banks is an official document used to verify the details of a fixed deposit or savings account held by a customer. It typically includes information such as the depositor's name, account number, deposit amount, maturity date, and interest rate, ensuring accuracy and authenticity for both the bank and the client. This form is essential for confirming deposit holdings during audits, loan applications, or financial verifications.

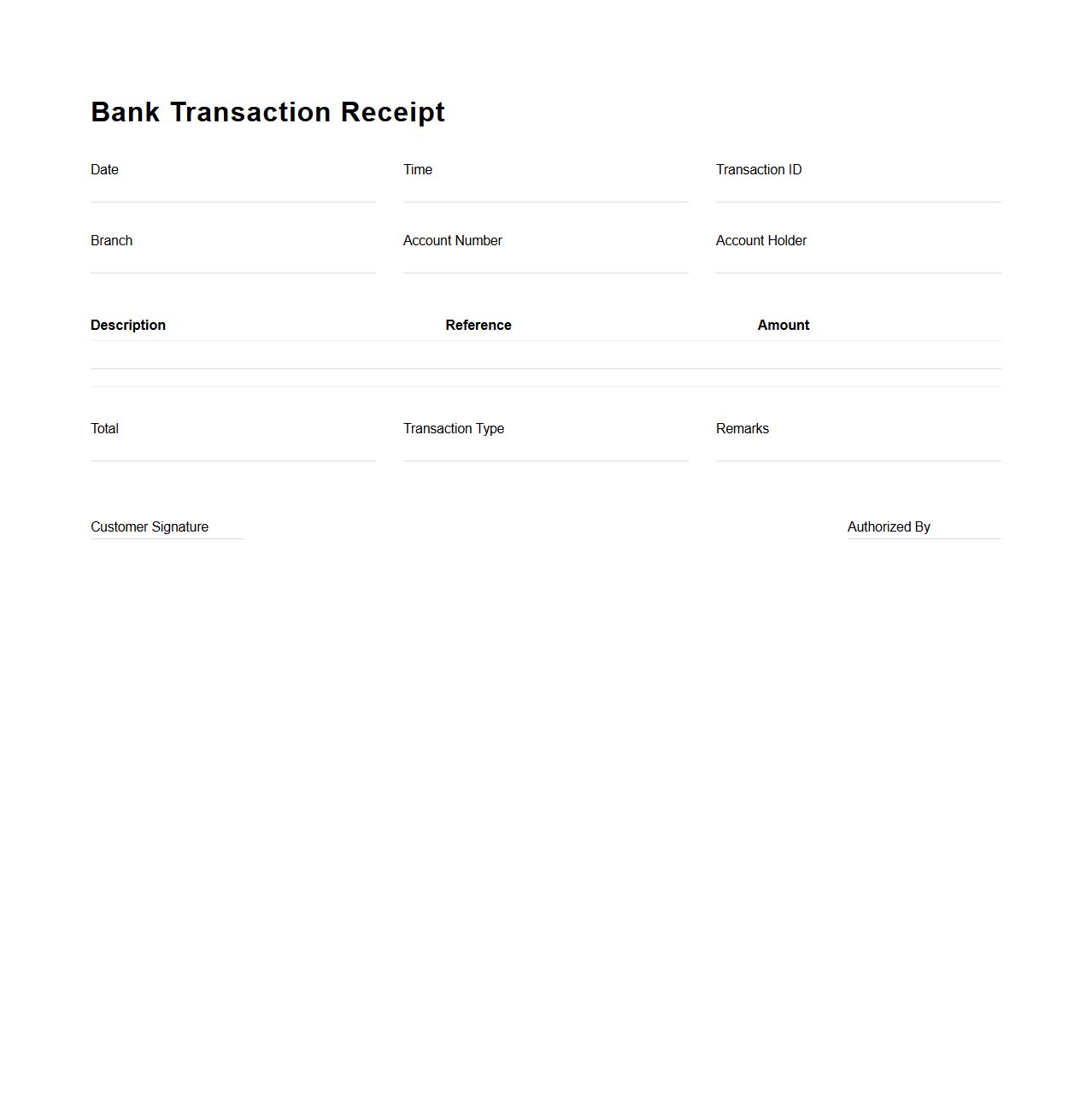

Bank Transaction Receipt Blank Layout

A

Bank Transaction Receipt Blank Layout document is a predefined template used by financial institutions to record and present details of individual bank transactions. This document typically includes fields for transaction date, amount, account number, transaction type, and authorization details, enabling standardized and clear documentation. It serves as an official record for both the bank and the customer, ensuring transparency and accuracy in financial dealings.

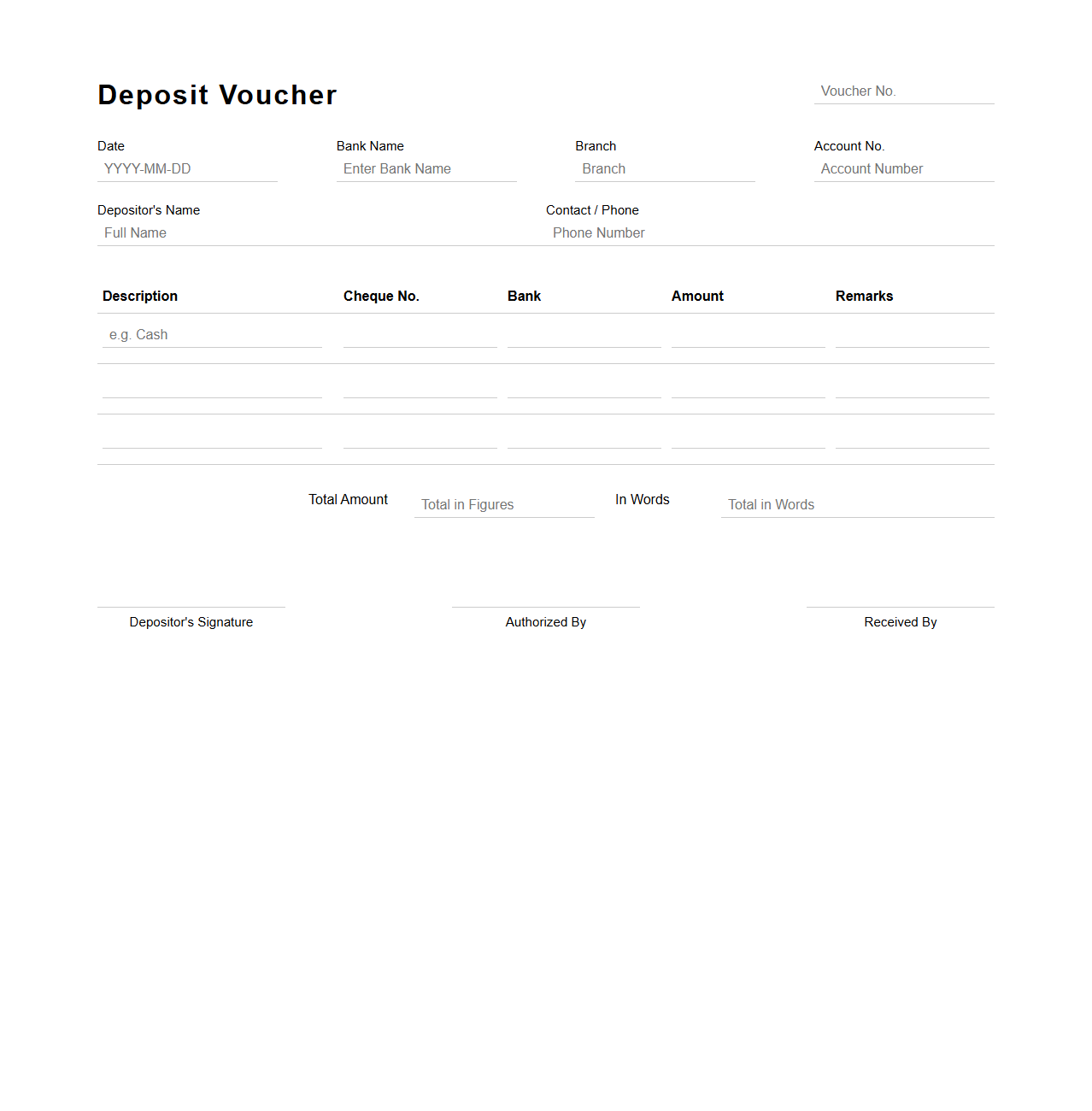

Clean Bank Deposit Voucher Template

A

Clean Bank Deposit Voucher Template is a standardized financial document used to record deposit transactions clearly and accurately. It details essential information such as the date, depositor's name, deposit amount, and account number, ensuring transparency and ease of reconciliation. This template minimizes errors and streamlines banking processes by providing a consistent format for documenting deposits.

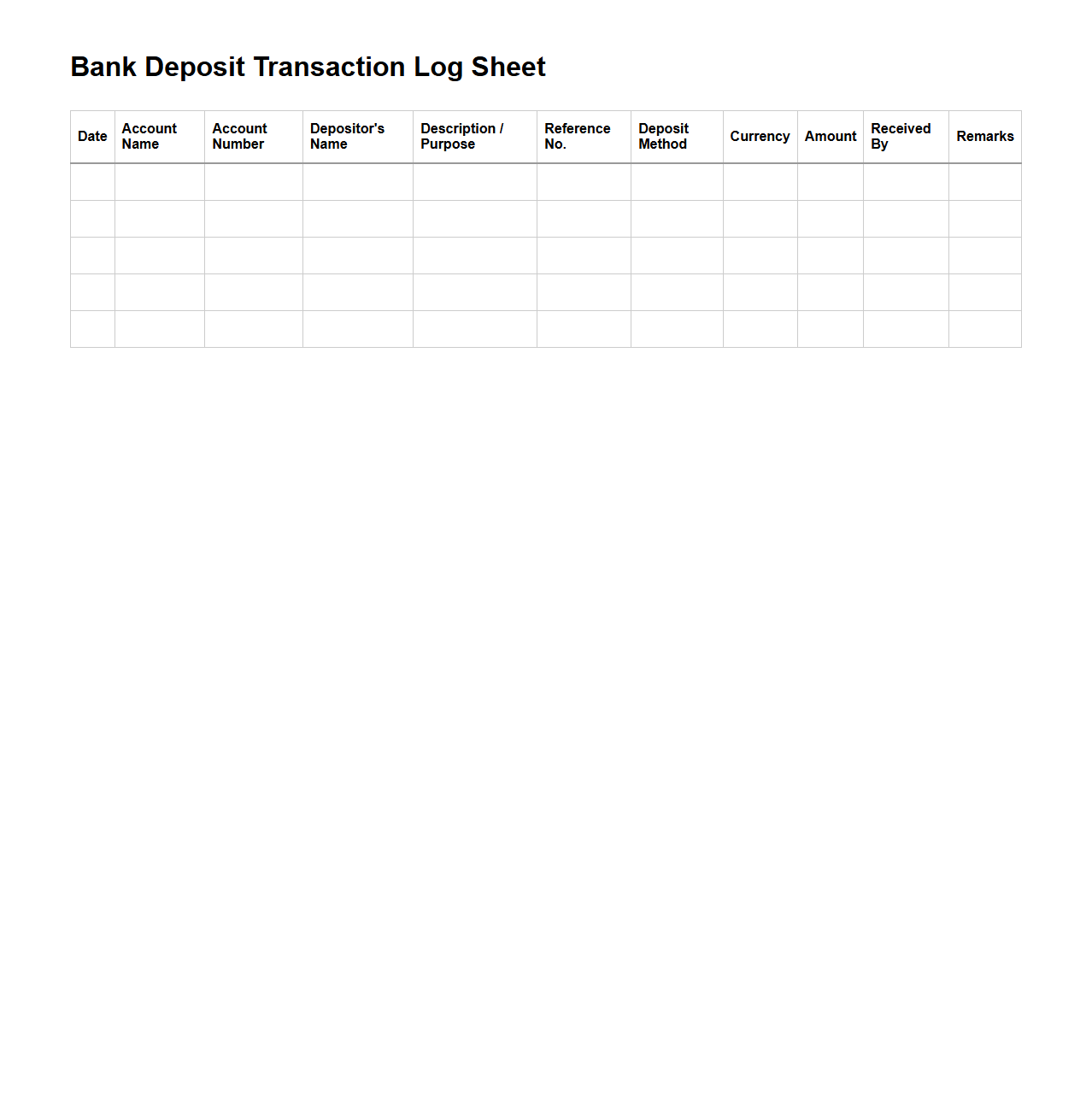

Bank Deposit Transaction Log Sheet

A

Bank Deposit Transaction Log Sheet is a detailed record used by businesses or individuals to track and document every deposit made into a bank account. This document typically includes critical information such as the date of deposit, amount, source of funds, and transaction reference numbers, ensuring accurate financial reporting and reconciliation. Maintaining a transaction log sheet helps prevent errors, supports audit trails, and enhances overall transparency in financial management.

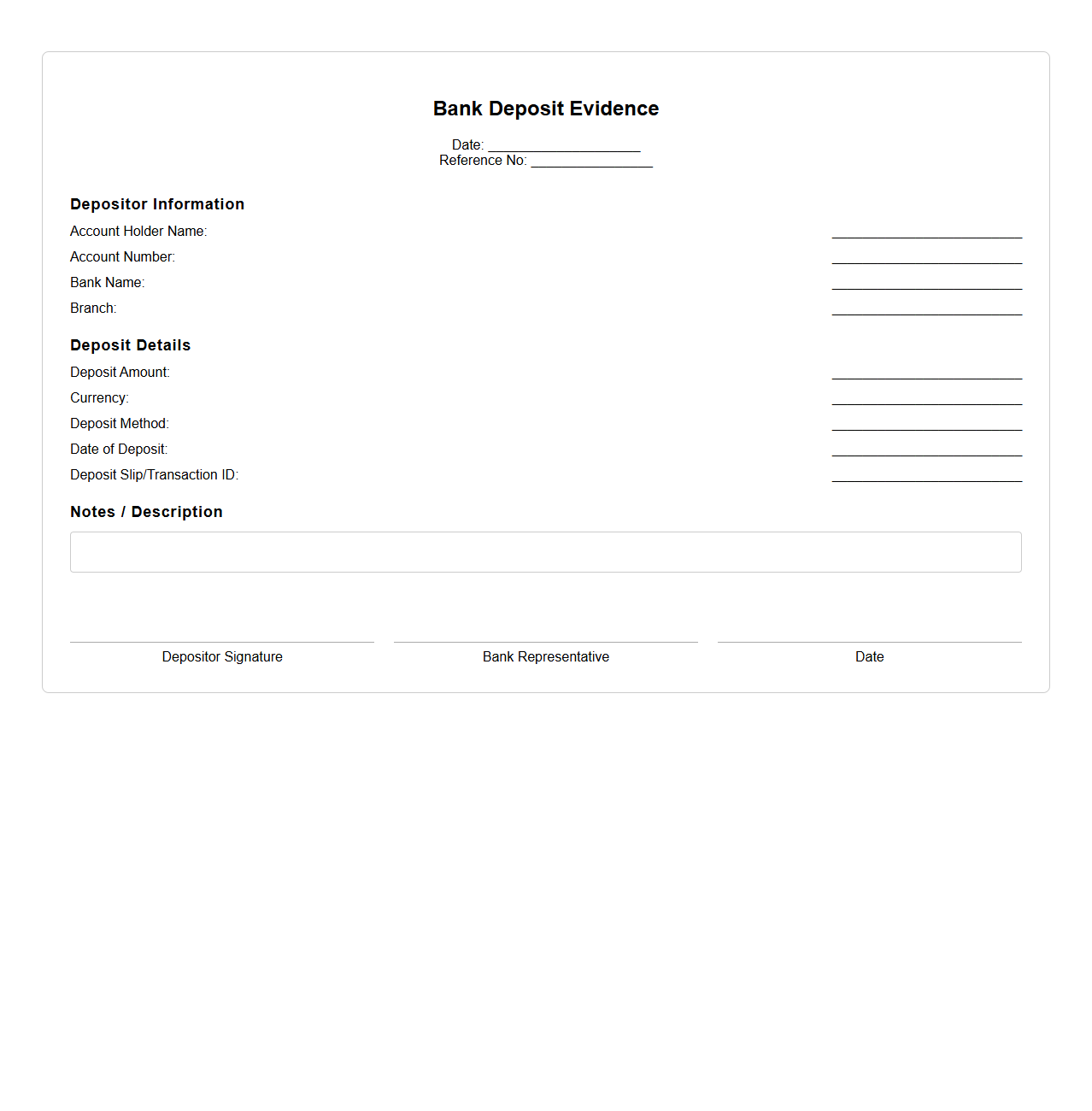

Professional Bank Deposit Evidence Template

A

Professional Bank Deposit Evidence Template document serves as a standardized format to record and verify bank deposit transactions accurately. It typically includes key details such as the depositor's information, deposit amount, date, transaction reference number, and bank details, ensuring clarity and accountability. This template aids businesses and professionals in maintaining organized financial records and streamlining audit processes.

What essential details should be included in a blank deposit receipt for bank transactions?

A blank deposit receipt must include the depositor's name, account number, and the date of the transaction. It should also detail the amount being deposited, broken down by cash and checks, for clear record-keeping. Additionally, the receipt must have a space for the bank teller's signature and a unique receipt number to ensure traceability.

How can a blank deposit receipt template help prevent errors in manual bank deposits?

Using a blank deposit receipt template standardizes the information collected during deposits, minimizing human error. The template guides depositors and bank staff to fill in all necessary fields systematically, reducing omissions or incorrect entries. This organized approach ensures accurate documentation and facilitates easier audits and reconciliation processes.

Are digital blank deposit receipts legally valid for online banking transactions?

Digital blank deposit receipts are legally valid provided they comply with regulatory standards and include necessary authentication elements like timestamps and electronic signatures. Many banks accept digital receipts as official proof of deposit, especially when generated through secure banking platforms. Proper encryption and data integrity measures further reinforce their legal standing during online transactions.

What security features can be added to a blank deposit receipt to prevent forgery?

To prevent forgery, security features like watermarks, micro-printing, and holograms can be integrated into deposit receipts. Additionally, unique serial numbers and QR codes linked to the bank's database improve traceability and verification. These elements make it difficult for counterfeiters to replicate the receipt and help bank staff authenticate genuine transactions efficiently.

In which scenarios is a blank deposit receipt required for business banking audits?

A blank deposit receipt is essential during business banking audits to verify cash flow and transaction authenticity. Auditors rely on these receipts to cross-check deposit amounts against bank statements and internal records. They are particularly important when scrutinizing large transactions or resolving discrepancies in financial reporting.