A Blank Donation Receipt Template for Charitable Contributions provides a structured format to document donations accurately. This template ensures donors receive official acknowledgment for tax purposes by including essential details such as donation amount, date, and organization information. Utilizing this template helps charities maintain transparent records and build trust with supporters.

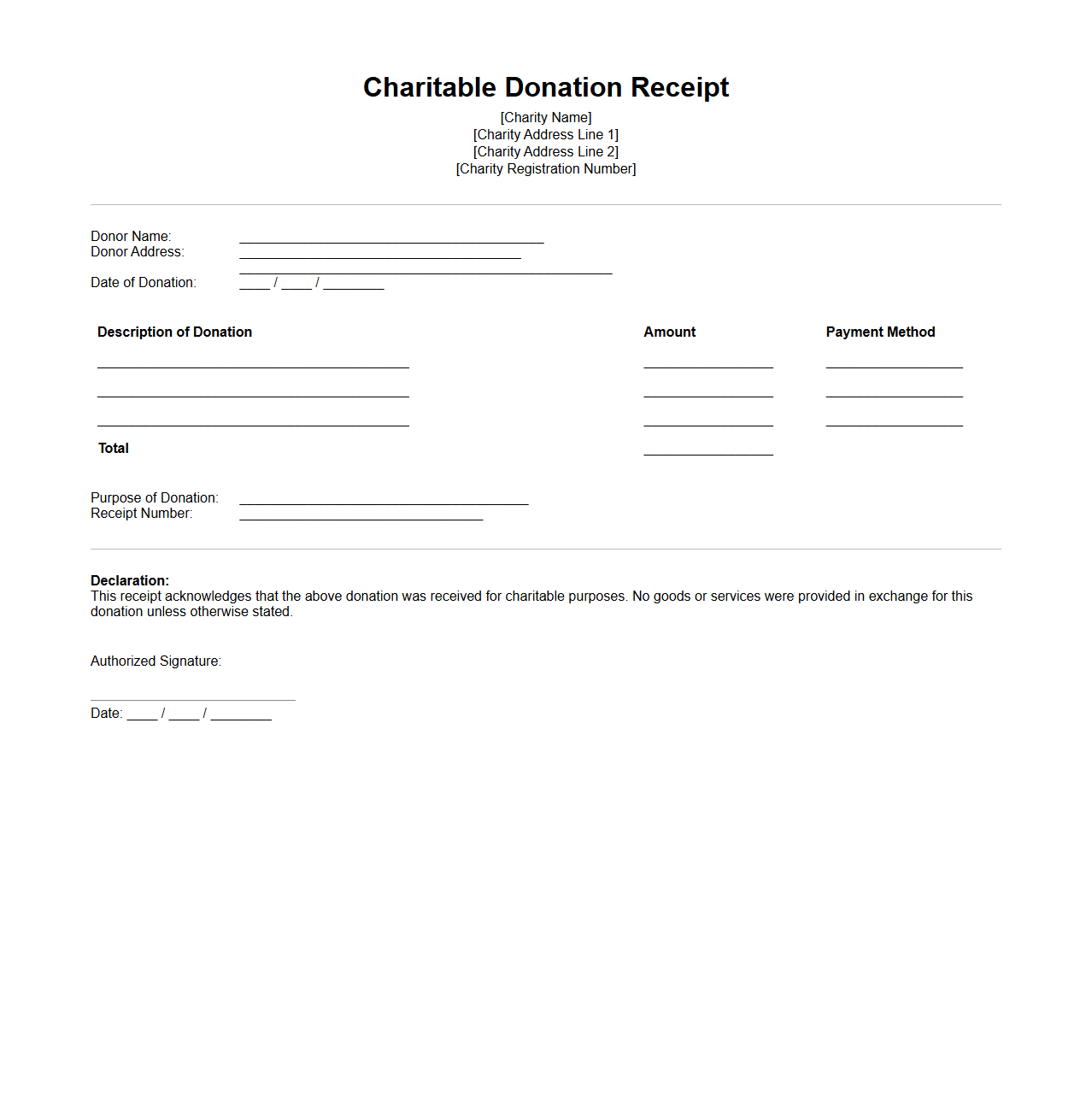

Charitable Donation Receipt Template

A

Charitable Donation Receipt Template is a standardized document used by nonprofit organizations to provide donors with proof of their contributions for tax deduction purposes. This template typically includes essential details such as the donor's name, donation amount, date of the gift, and a description of the donated item or funds. Utilizing a clear and compliant donation receipt template ensures transparency and helps maintain accurate financial records for both parties.

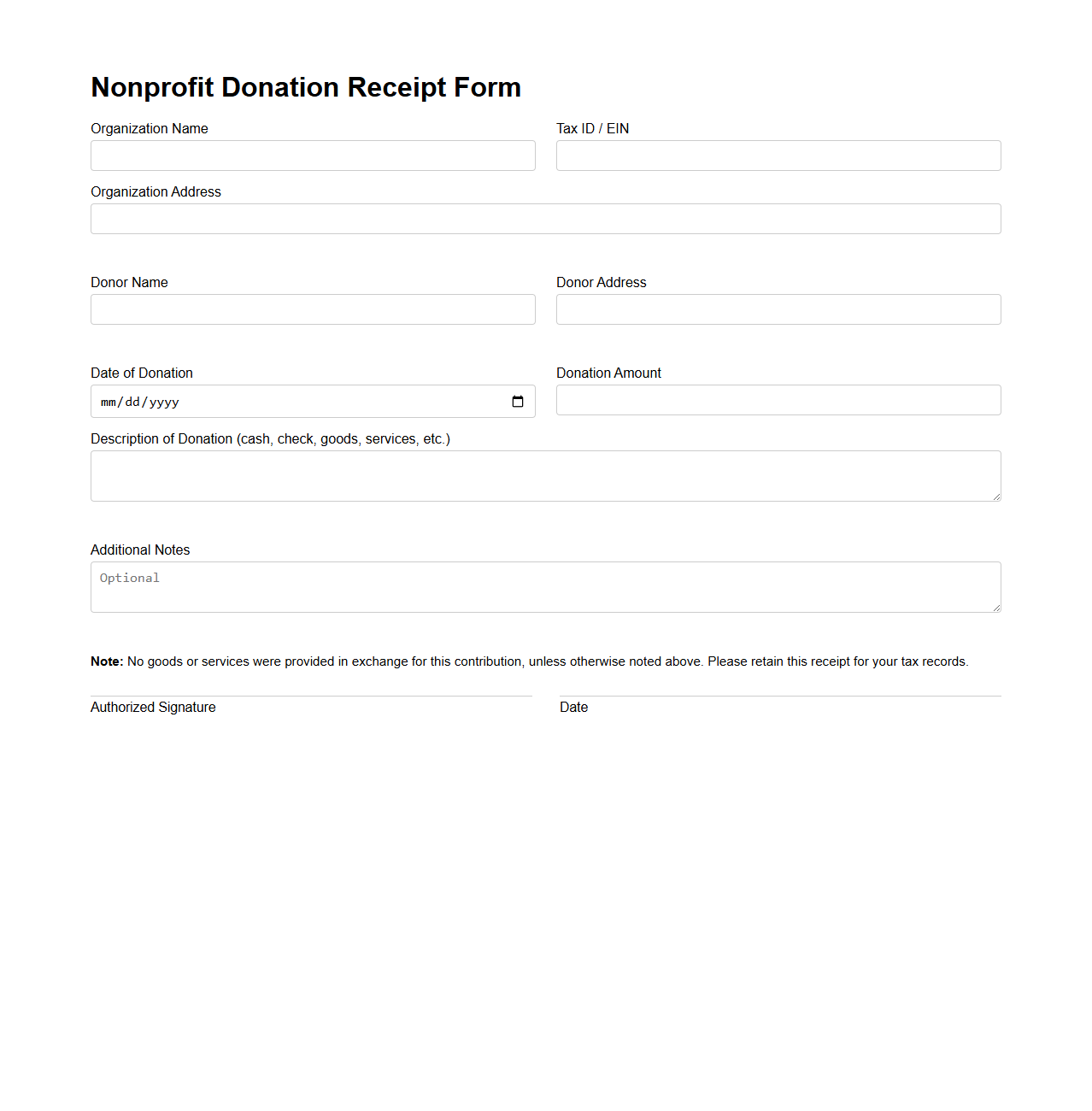

Nonprofit Donation Receipt Form

A

Nonprofit Donation Receipt Form is an official document provided by charitable organizations to donors as proof of their contributions. It includes essential information such as the donor's name, donation amount, date of the gift, and the nonprofit's tax-exempt status. This form is crucial for donors to claim tax deductions and ensure transparency in charitable giving.

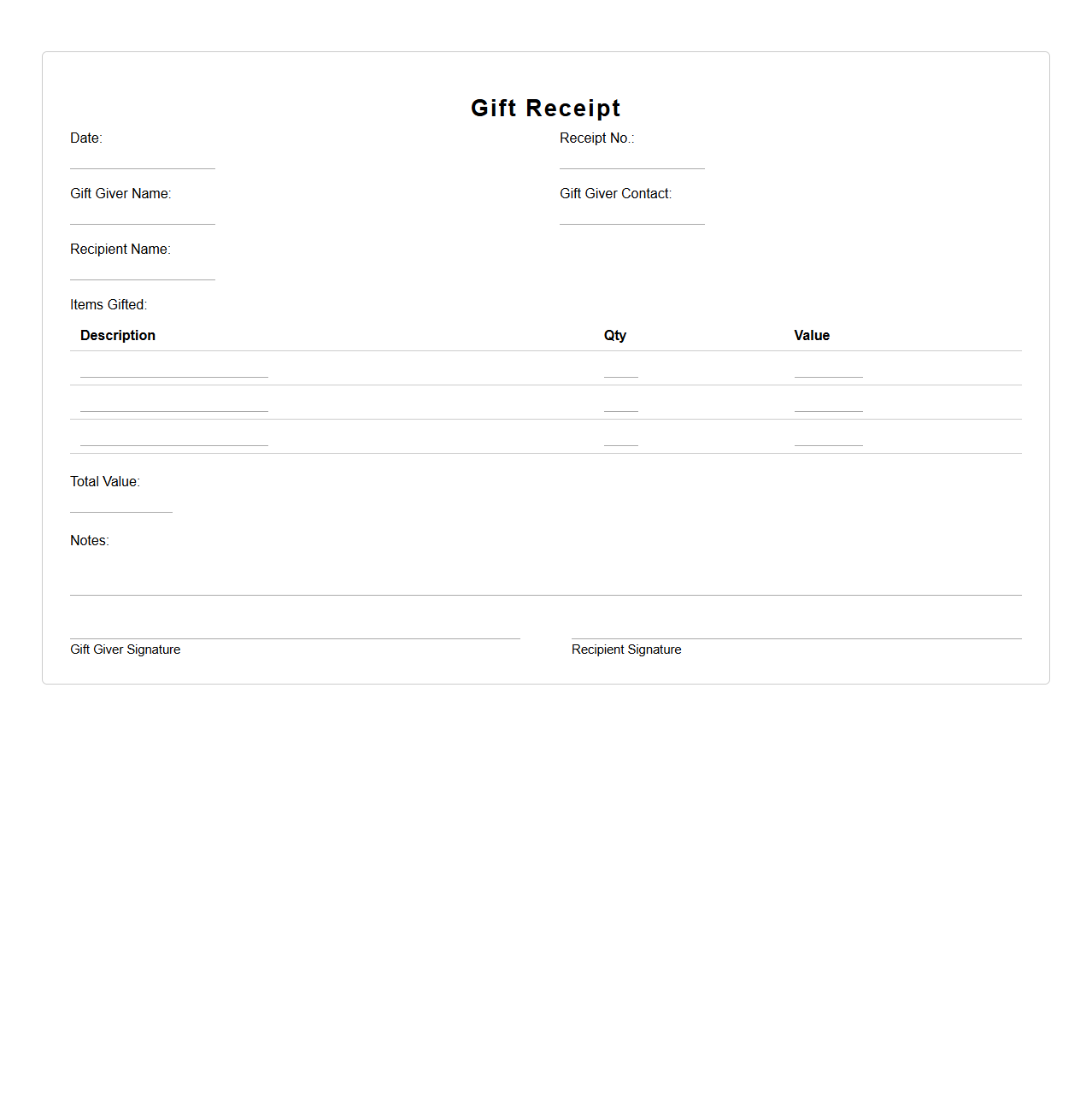

Simple Gift Receipt Template

A

Simple Gift Receipt Template document serves as a formal acknowledgment issued by a retailer or individual to confirm the purchase of a gift item without revealing its price. It includes essential details such as the item description, date of purchase, and store information, allowing recipients to return or exchange the gift if necessary. This template helps streamline gift transactions while maintaining privacy and transparency.

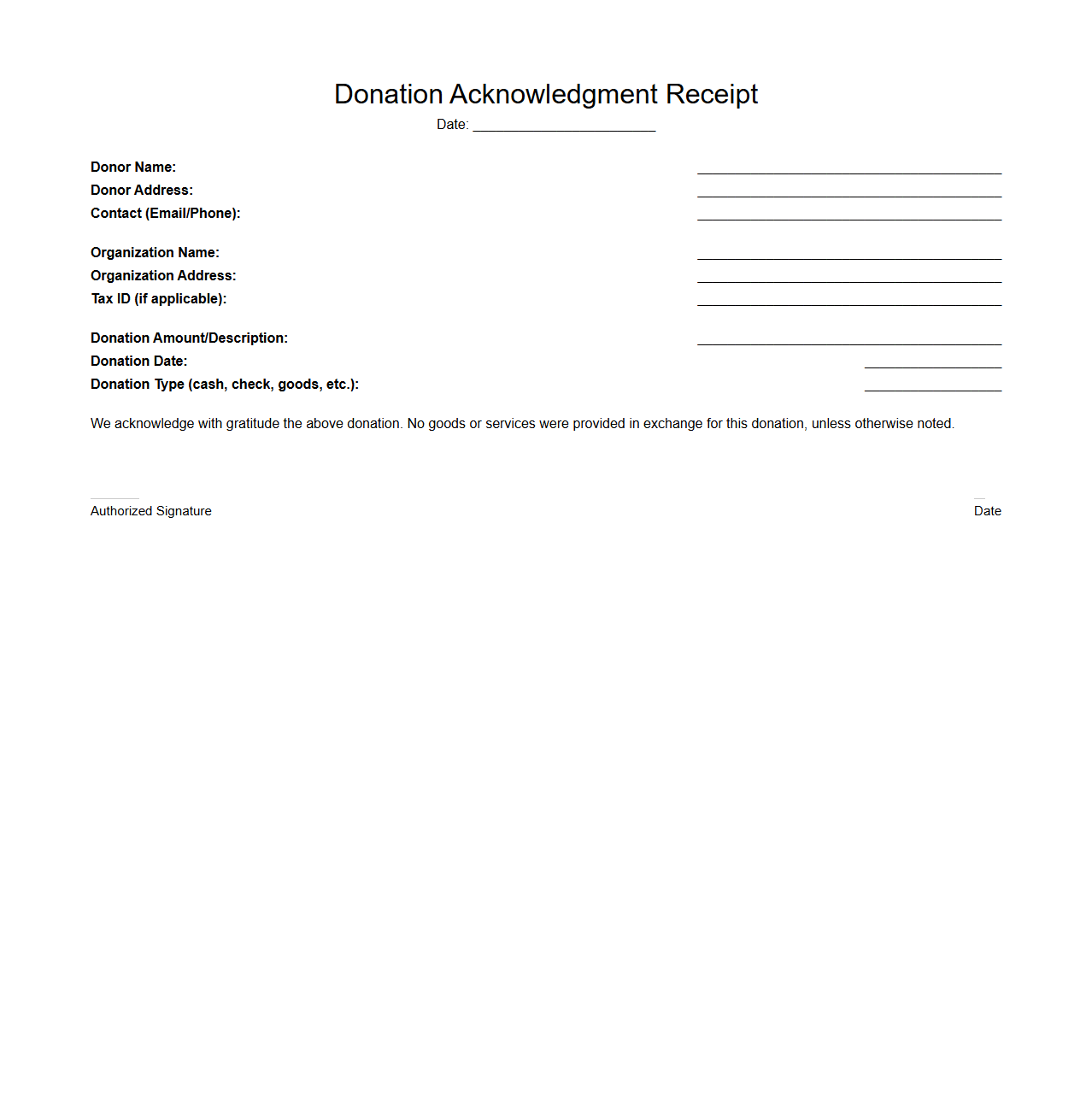

Donation Acknowledgment Receipt Template

A

Donation Acknowledgment Receipt Template document serves as a formal record confirming the receipt of contributions made to a nonprofit or charitable organization. It includes essential details such as donor information, donation amount, date of donation, and a statement of thanks, which helps donors for tax deduction purposes. This template ensures consistency, compliance with tax regulations, and enhances donor trust by providing official proof of their generosity.

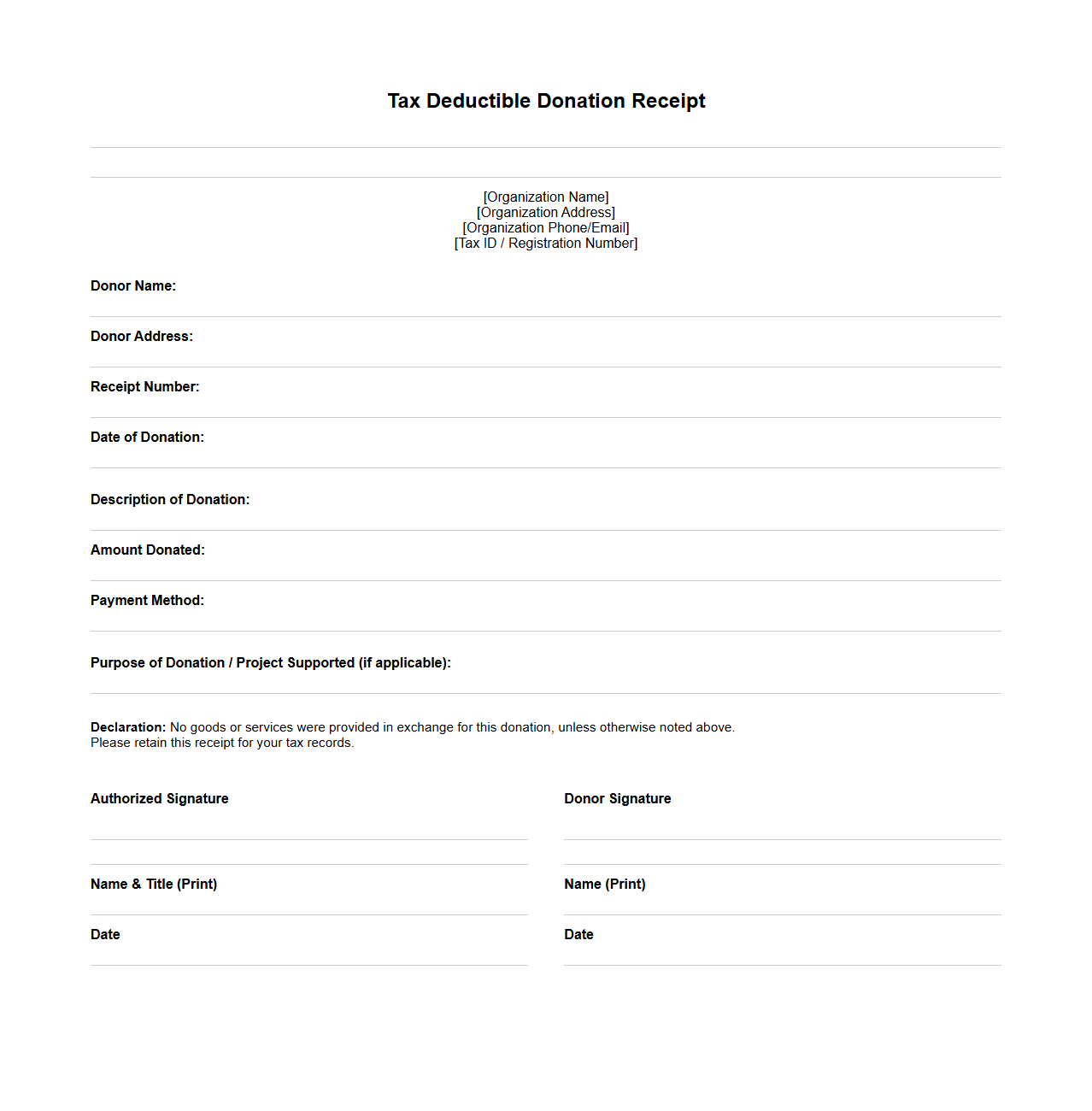

Tax Deductible Donation Receipt Format

A

Tax Deductible Donation Receipt Format document serves as an official acknowledgment provided by charities or nonprofit organizations to donors, verifying the amount donated for tax deduction purposes. It typically includes essential details such as the donor's name, donation amount, date of contribution, and the organization's tax identification number. This receipt ensures donors can legally claim tax deductions on their taxable income when filing returns, promoting transparency and compliance with tax regulations.

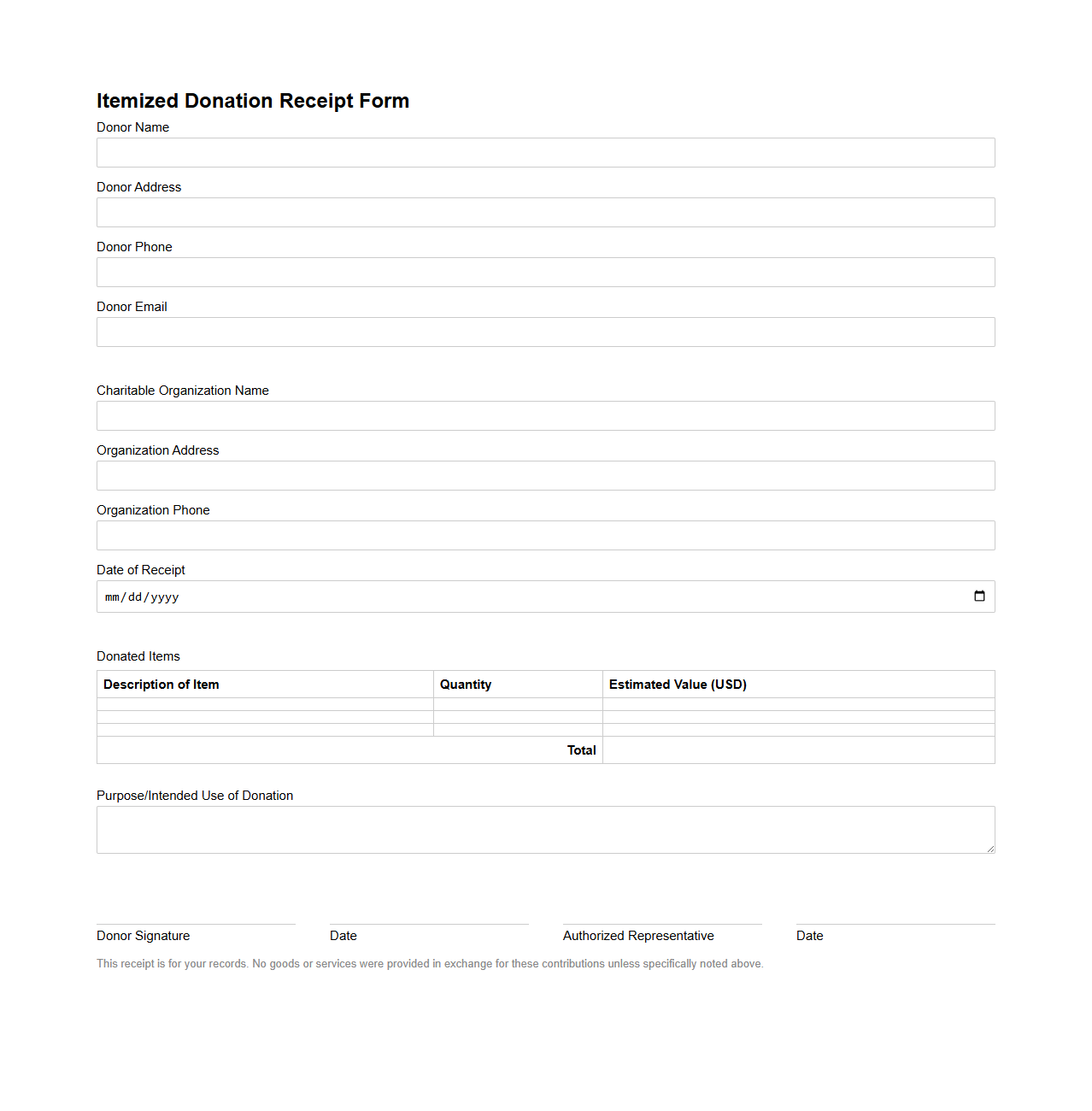

Itemized Donation Receipt Form

An

Itemized Donation Receipt Form is a detailed document provided to donors that lists the specific items and their estimated values contributed to a charitable organization. This form is essential for tax purposes, allowing donors to claim accurate deductions by itemizing each donated asset. It ensures transparency and compliance with IRS regulations by documenting the nature and worth of non-cash donations.

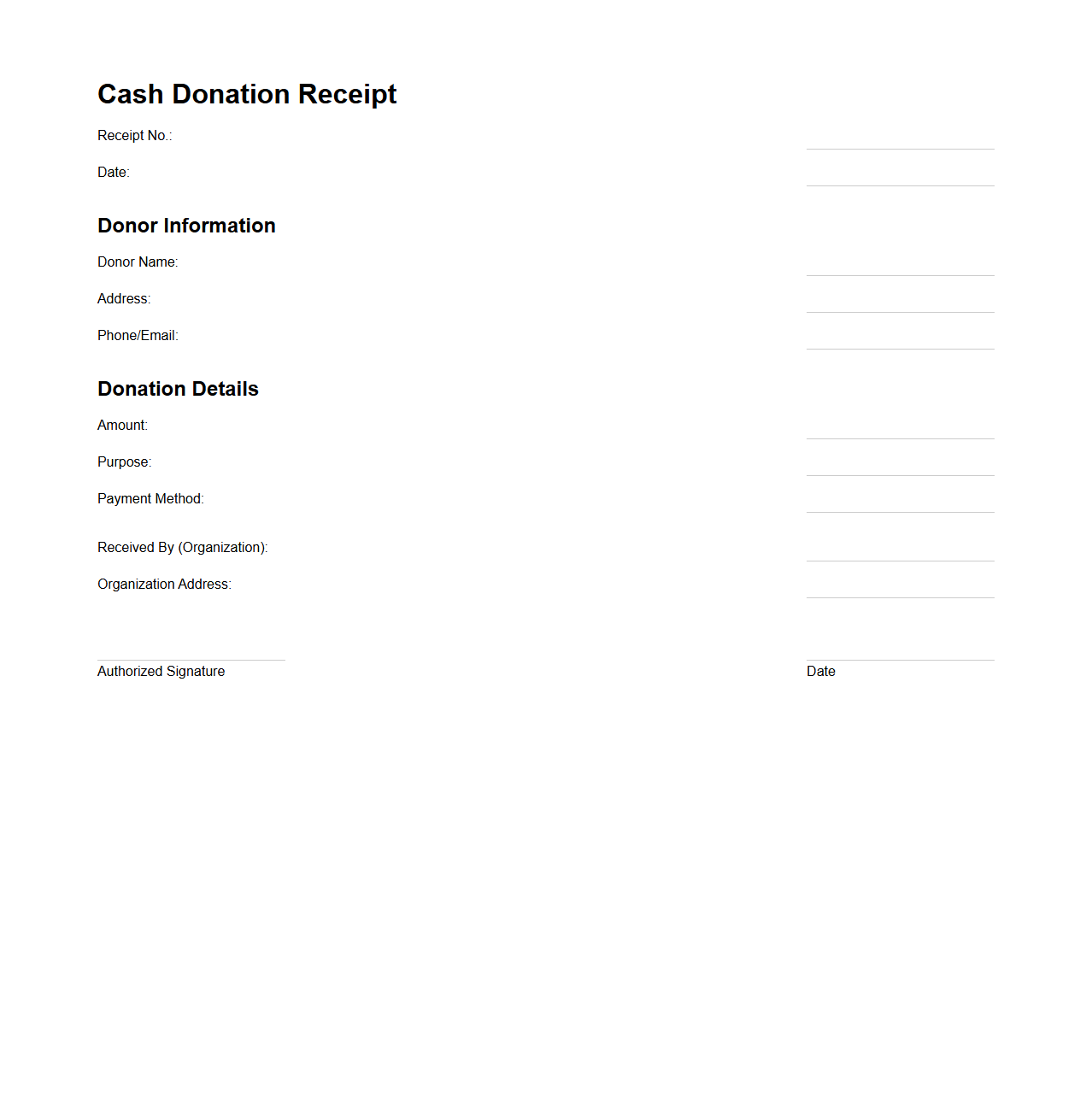

Cash Donation Receipt Template

A

Cash Donation Receipt Template document serves as a formal acknowledgment provided by organizations to individuals or entities after receiving monetary contributions. This template ensures compliance with legal and tax requirements by detailing the donor's information, donation amount, date, and purpose of the gift. Using a standardized receipt template streamlines record-keeping and enhances transparency in charitable transactions.

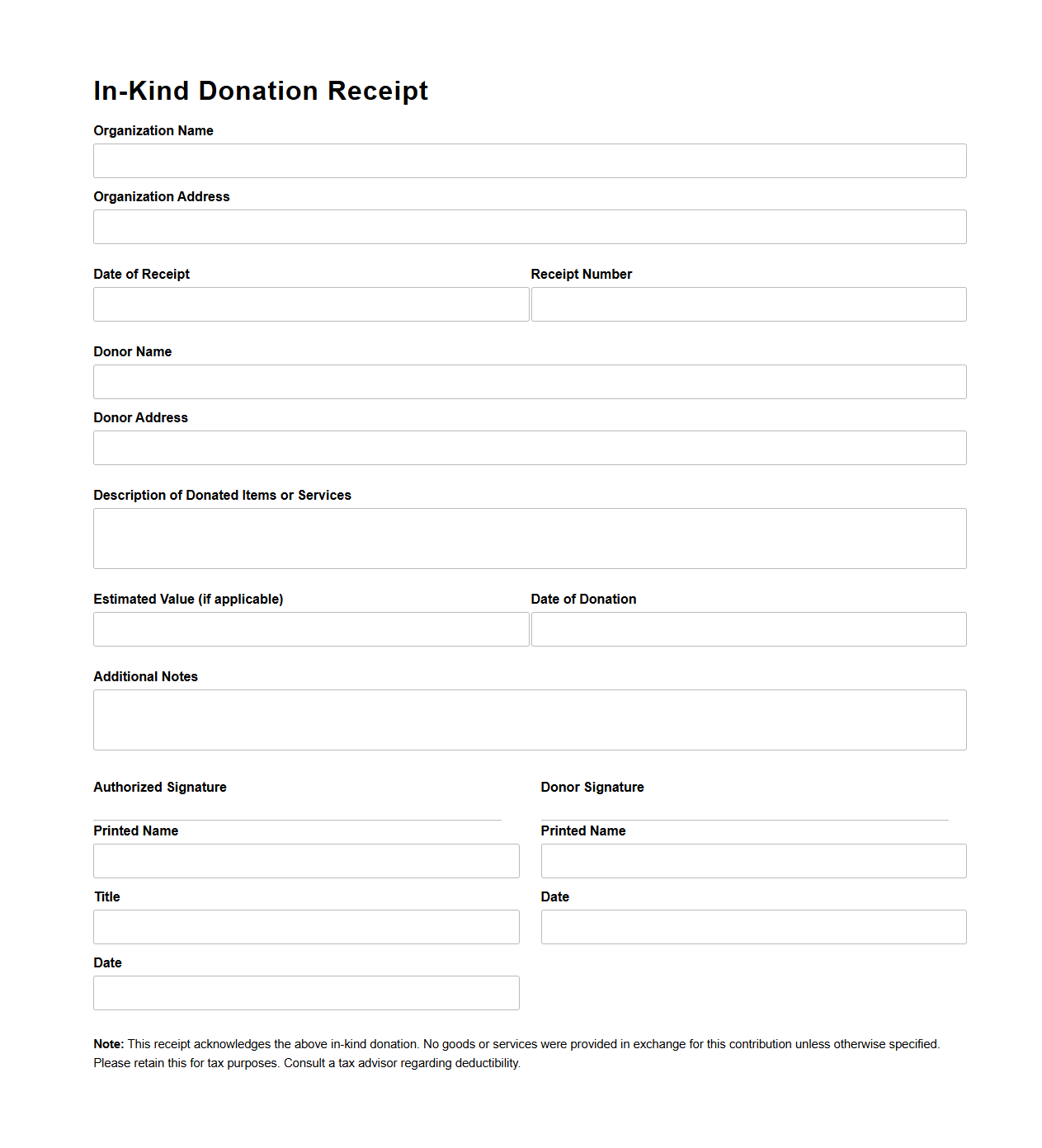

In-Kind Donation Receipt Template

An

In-Kind Donation Receipt Template is a pre-designed document used by organizations to formally acknowledge non-cash contributions donated by individuals or entities. This template typically includes essential details such as the donor's information, a description of the donated goods or services, the estimated fair market value, and the date of donation for accurate record-keeping and tax purposes. Utilizing this template ensures compliance with tax regulations and strengthens donor relations by providing clear, professional receipts.

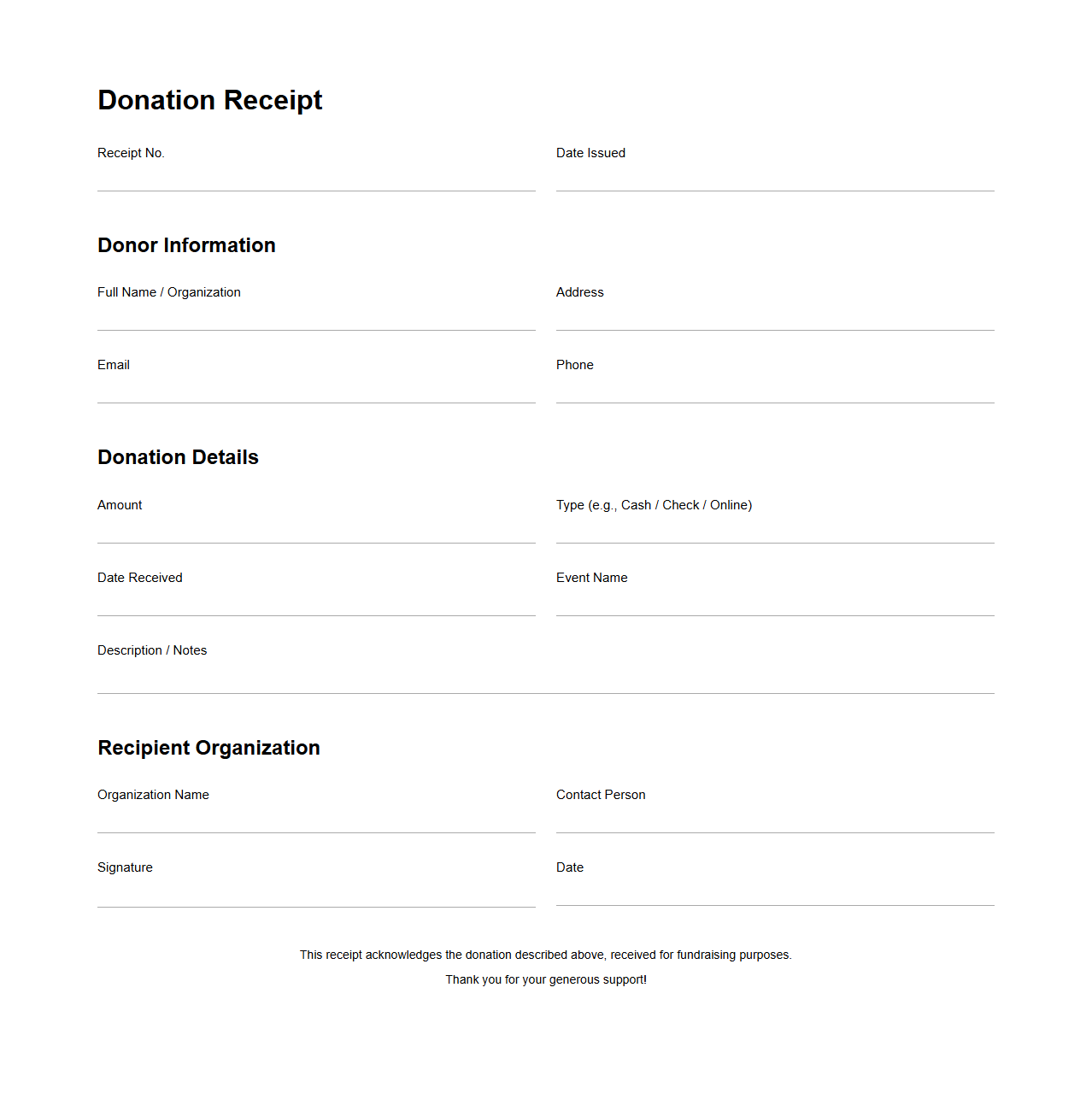

Donation Receipt for Fundraising Events

A

Donation Receipt for Fundraising Events is an official document provided to donors as proof of their financial or in-kind contributions to a charitable cause. It contains crucial details such as the donor's name, date of donation, amount or description of the donation, and the nonprofit organization's information, ensuring transparency and compliance with tax regulations. This receipt enables donors to claim tax deductions and supports accurate record-keeping for both the fundraiser and the donor.

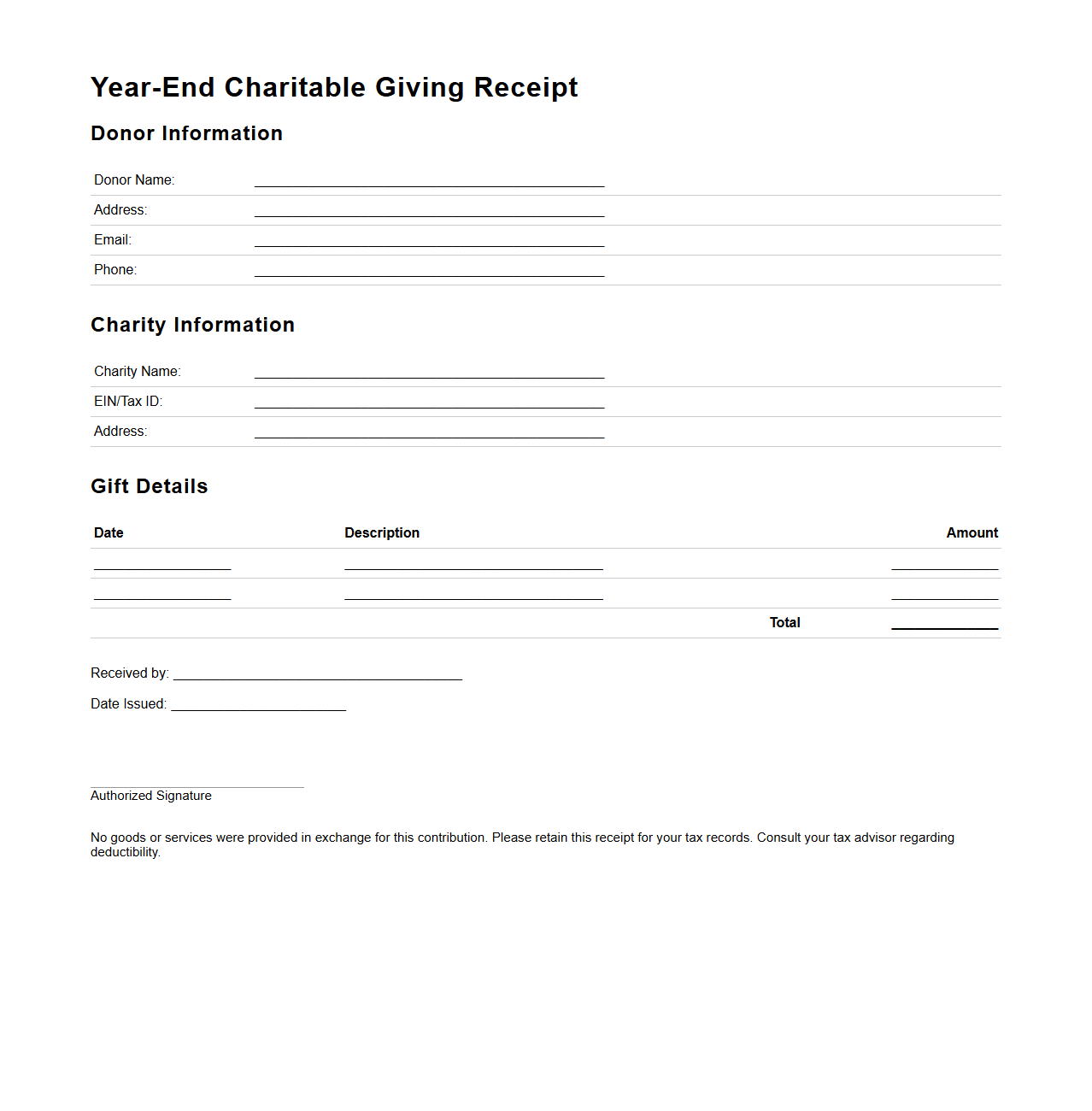

Year-End Charitable Giving Receipt Template

A

Year-End Charitable Giving Receipt Template document serves as an official record for donors, detailing their contributions made throughout the year to nonprofit organizations. This template includes essential information such as donor name, donation amount, date of contribution, and the organization's tax-exempt status, ensuring compliance with IRS regulations. Utilizing this document helps nonprofits streamline their accounting and provides donors with necessary proof for tax deduction purposes.

What IRS-required details must appear on a blank donation receipt for charitable contributions?

A blank donation receipt must include the organization's name and tax-exempt status identification. It should also have a space for the donor's name and the date of the contribution. Additionally, the receipt must contain a statement verifying whether any goods or services were provided in exchange for the donation.

How should in-kind donations be documented on a blank receipt template?

In-kind donations should be recorded with a detailed description of the items or services donated. The receipt must include the estimated fair market value of these goods or services. It is essential to clarify that the value is a donor's estimate, as the IRS requires this for tax purposes.

What language ensures a blank donation receipt complies with donor tax deduction rules?

The receipt should contain a clear statement that the donation is tax-deductible to the extent allowed by law. It must indicate that no goods or services were exchanged for the donation, or specify the value of any benefits received. This language helps the donor claim the correct tax deduction.

Can a blank donation receipt be digitally signed or handwritten for validity?

Both digital and handwritten signatures are acceptable to validate a donation receipt. The IRS does not require the signature to be in a specific format but it must be authentic and verifiable. This ensures the receipt is recognized during tax audits.

What disclaimers are needed on a blank donation receipt to clarify non-monetary gifts?

The receipt should include a disclaimer stating that the organization did not provide goods or services, or specify the value of any such services. It should also clarify that the donor is responsible for determining the value of non-monetary gifts for tax purposes. This protects both the organization and donor from misunderstandings regarding tax deductions.