A Blank Deposit Receipt Template for Banks provides a standardized format for recording customer deposits efficiently and accurately. This template ensures all necessary details, such as depositor information, amount, and date, are clearly documented for both bank and customer records. It enhances transparency and simplifies the transaction verification process in banking operations.

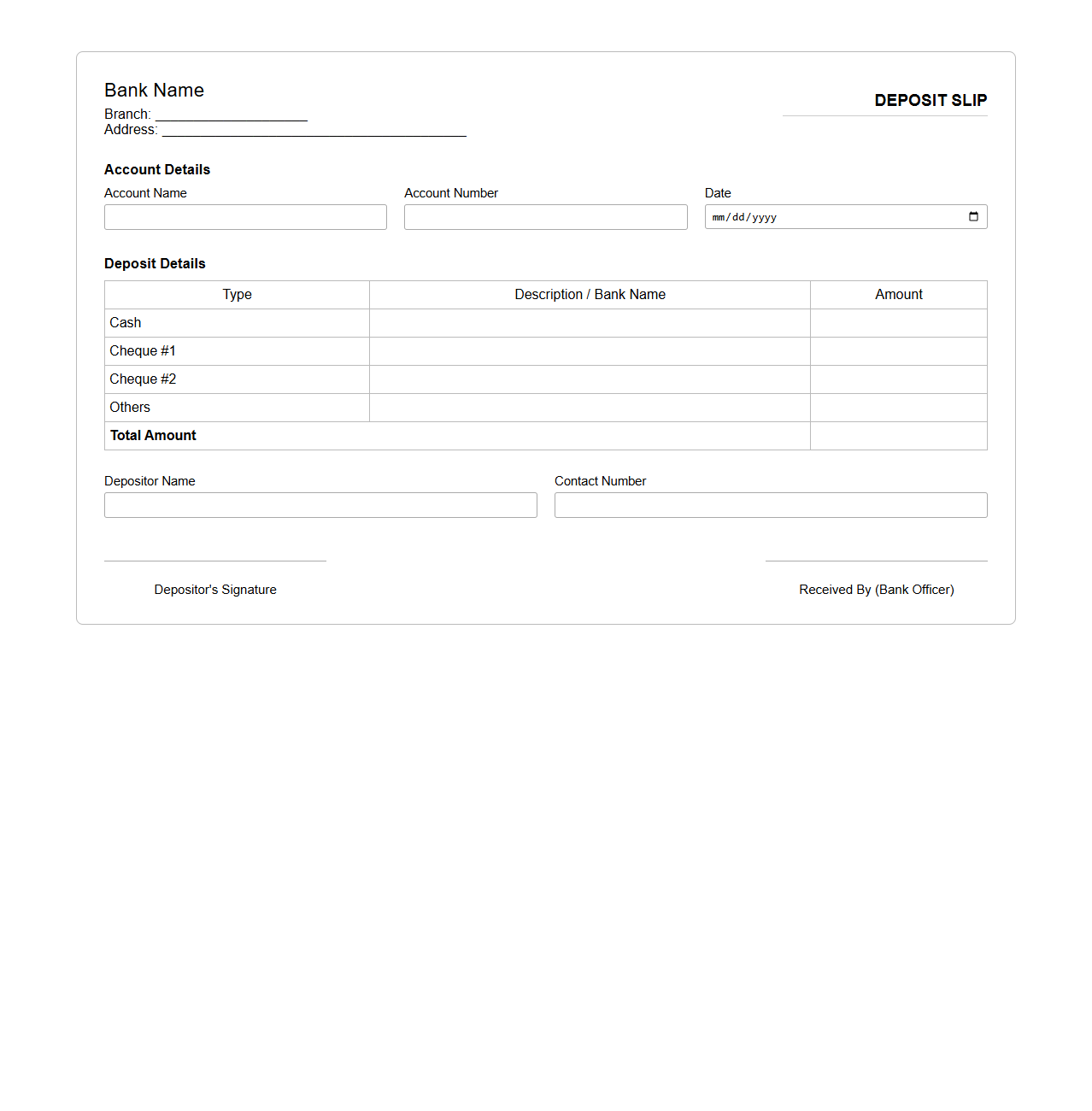

Bank Deposit Slip Template

A

Bank Deposit Slip Template is a standardized form used by customers to record details of cash or check deposits made into their bank accounts. This document typically includes fields for date, account number, depositor's name, and the amount being deposited, ensuring accurate and efficient processing by the bank. Utilizing this template helps maintain clear transaction records and facilitates smooth financial operations for both individuals and businesses.

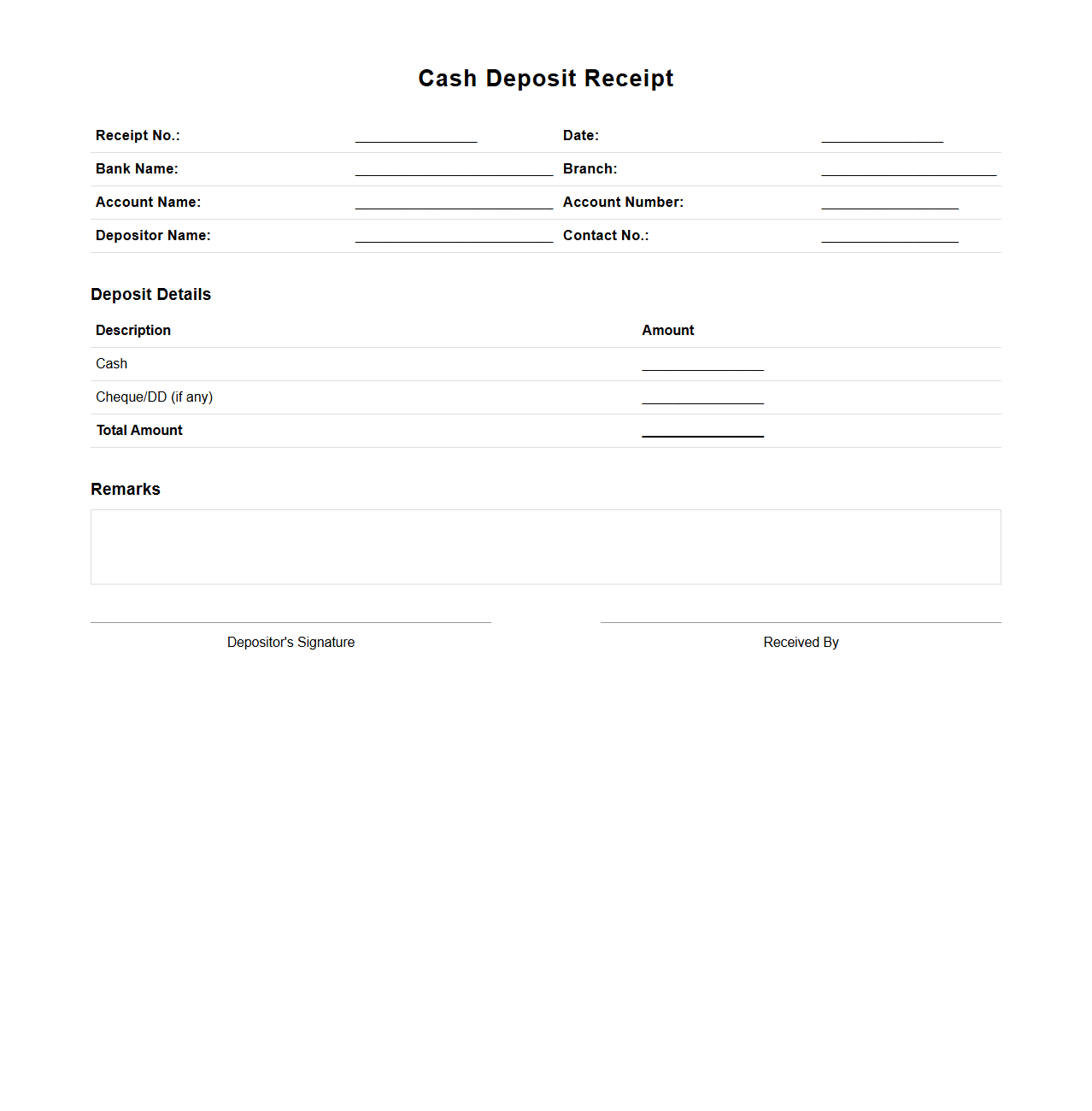

Cash Deposit Receipt Sample

A

Cash Deposit Receipt Sample document serves as an official proof of payment, confirming that a specific amount of cash has been successfully deposited into a bank account. It typically includes key details such as the depositor's name, date and time of the transaction, deposited amount, account number, and bank branch information. This receipt is essential for record-keeping, reconciliation, and resolving any discrepancies related to cash deposits.

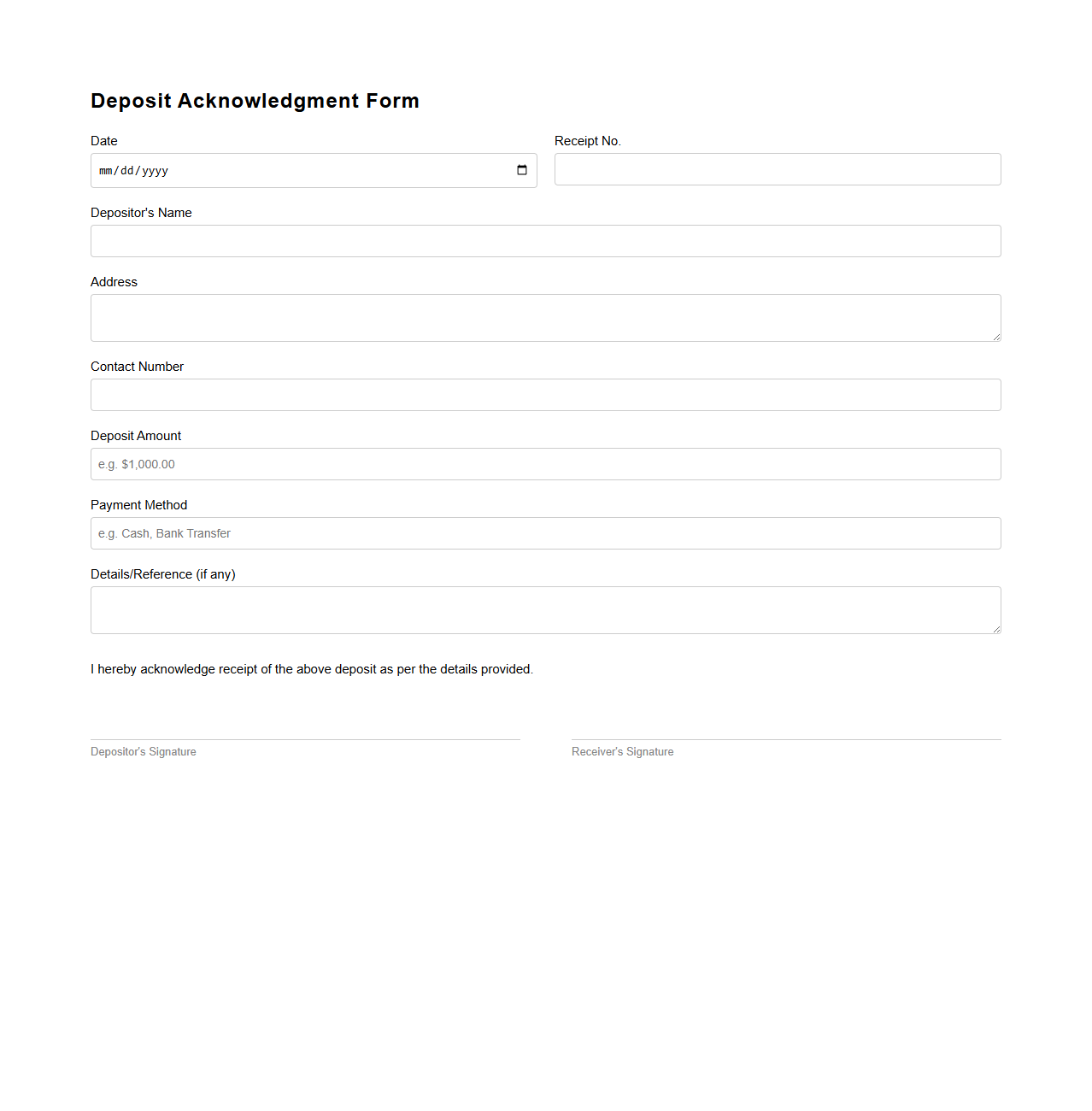

Deposit Acknowledgment Form Template

A

Deposit Acknowledgment Form Template document is a standardized form used to confirm receipt of a deposit payment between parties. It includes essential details such as the depositor's name, amount received, date of deposit, and purpose of the payment, ensuring clear communication and record-keeping. This template streamlines transaction processing and provides legal proof of the financial exchange.

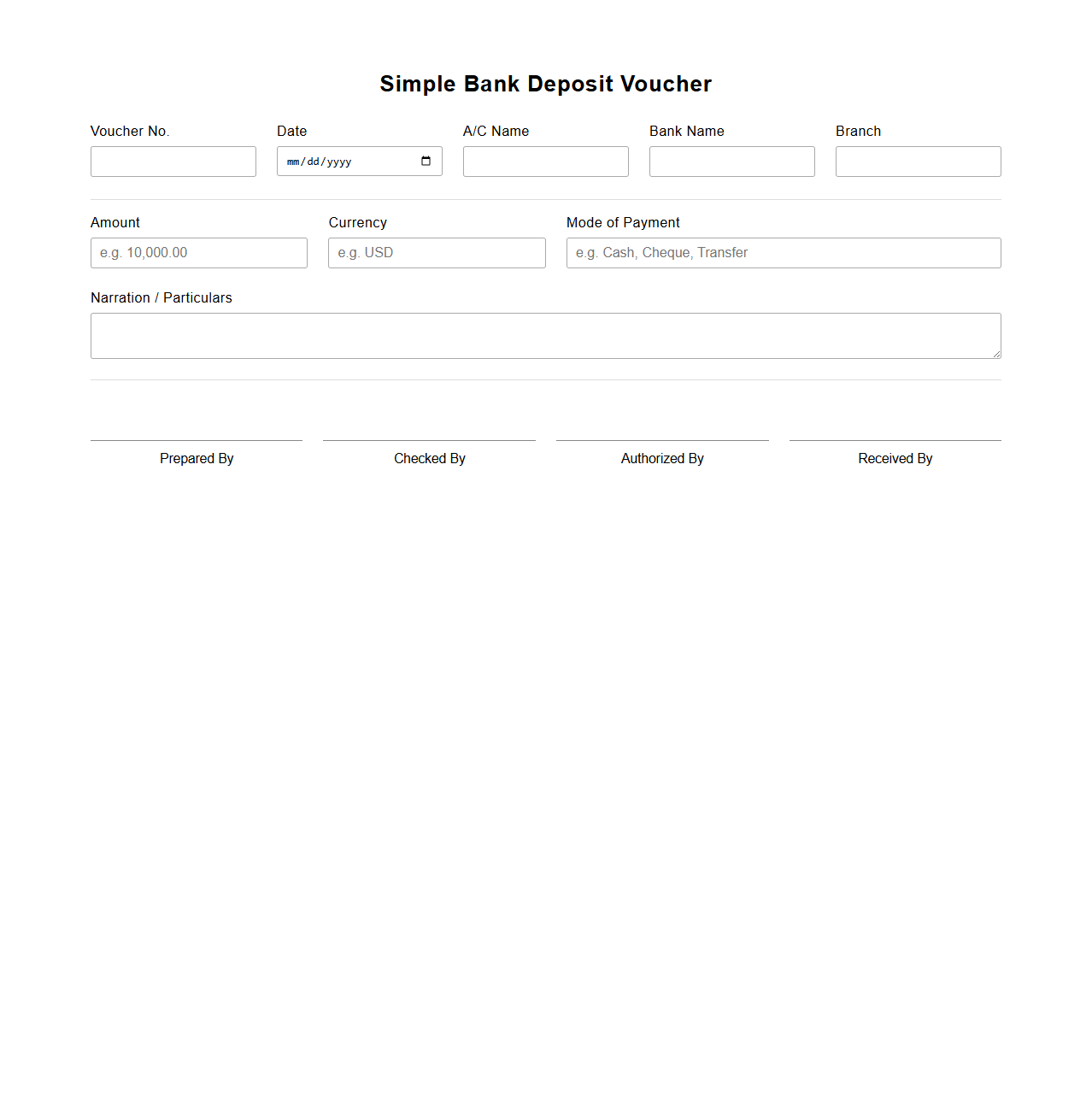

Simple Bank Deposit Voucher

A

Simple Bank Deposit Voucher is a financial document used to record the details of money deposited into a bank account. It typically includes information such as the depositor's name, date, amount deposited, and account number, serving as proof of the transaction. This voucher helps maintain accurate financial records and assists in reconciling bank statements.

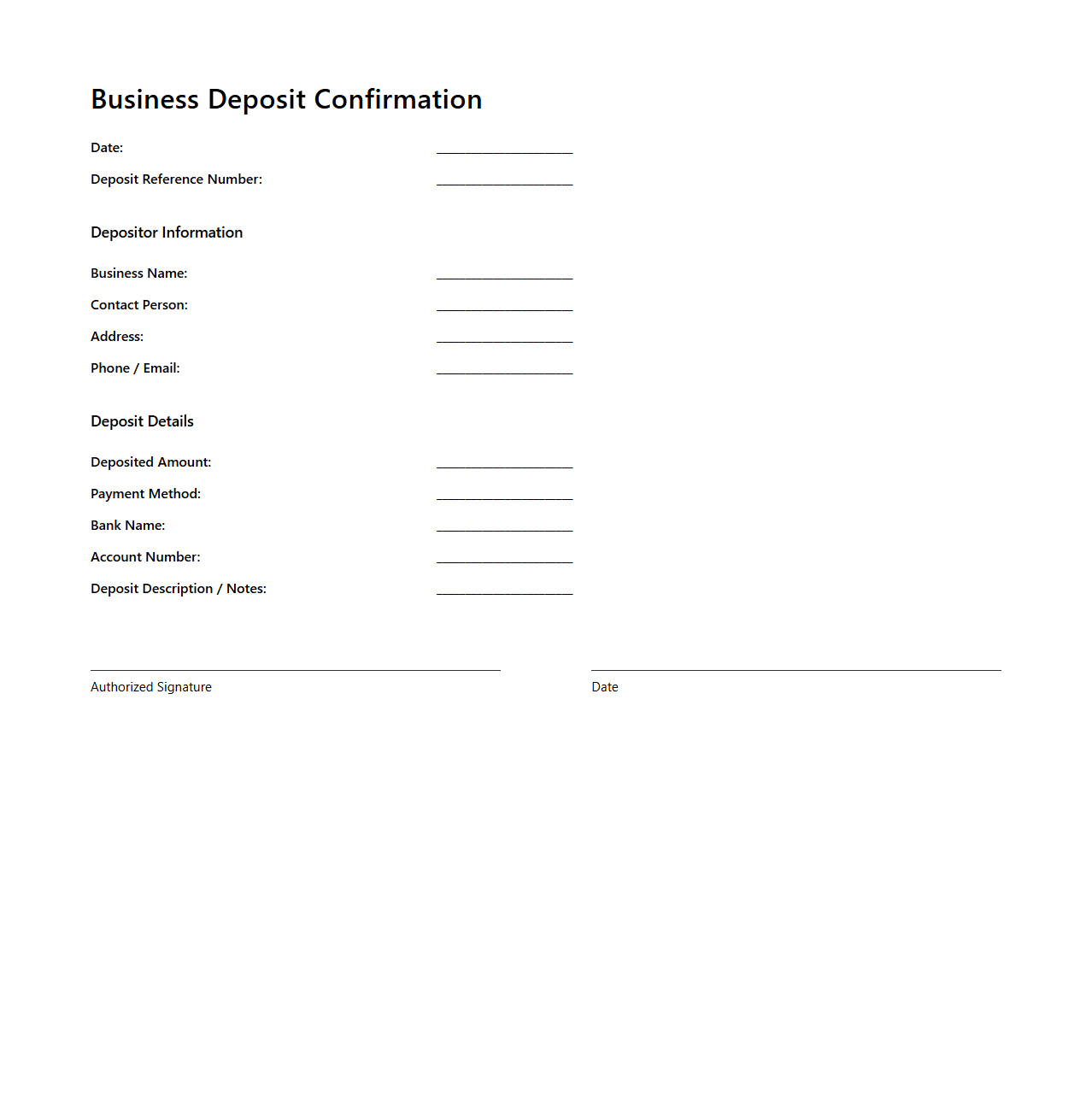

Business Deposit Confirmation Template

A

Business Deposit Confirmation Template is a formal document used by companies to verify and acknowledge the receipt of funds deposited into a business bank account. This template typically includes essential details such as the depositor's name, deposit amount, date of transaction, and the account number receiving the funds. It serves as a crucial record for financial reconciliation, audit purposes, and maintaining transparent business transactions.

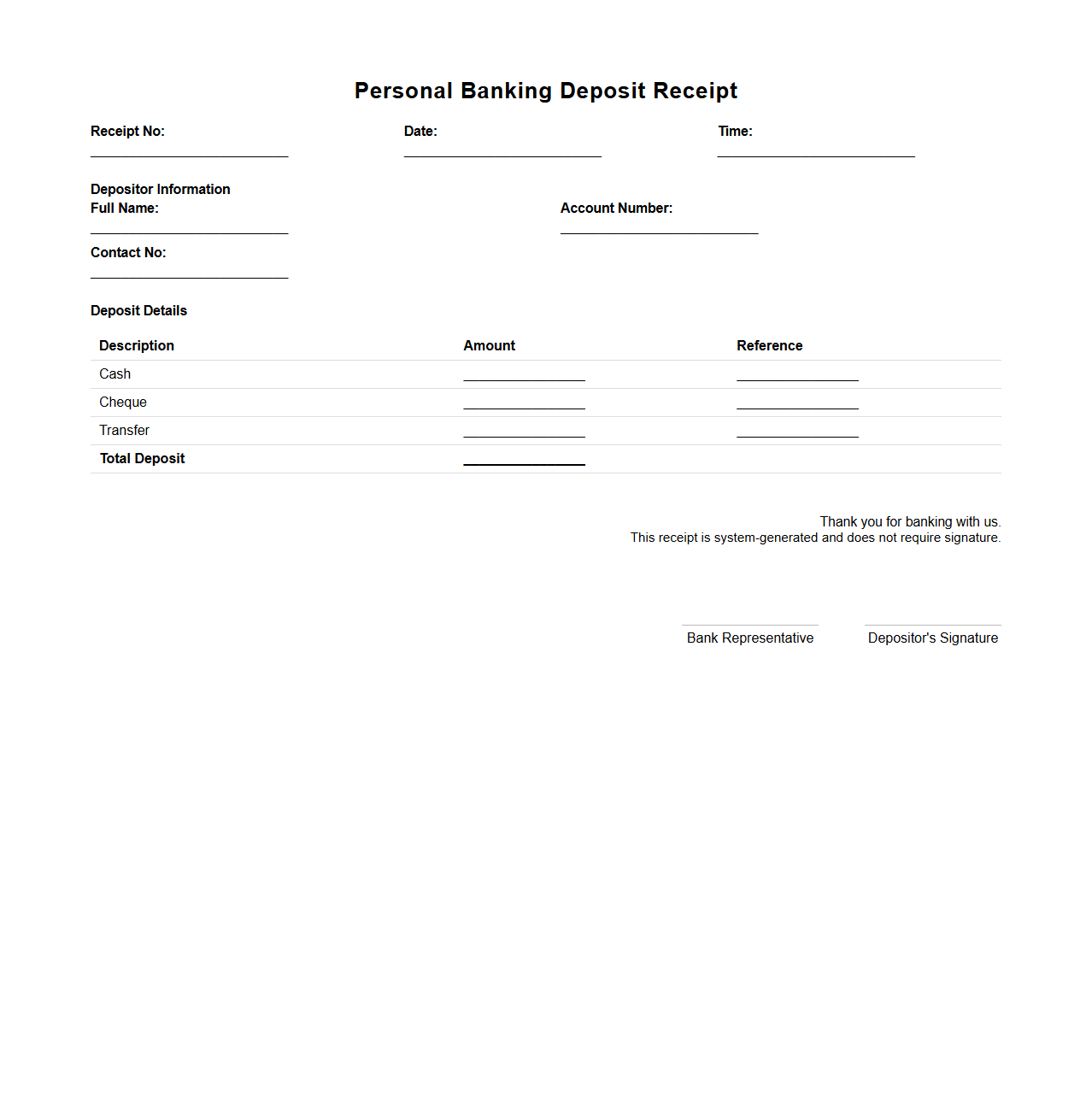

Personal Banking Deposit Receipt

A

Personal Banking Deposit Receipt is an official document issued by a bank to confirm the successful deposit of funds into a customer's account. It typically includes essential details such as the account holder's name, account number, date of deposit, amount deposited, and a unique transaction reference number. This receipt serves as proof of the transaction and is important for record-keeping and resolving any discrepancies related to the deposit.

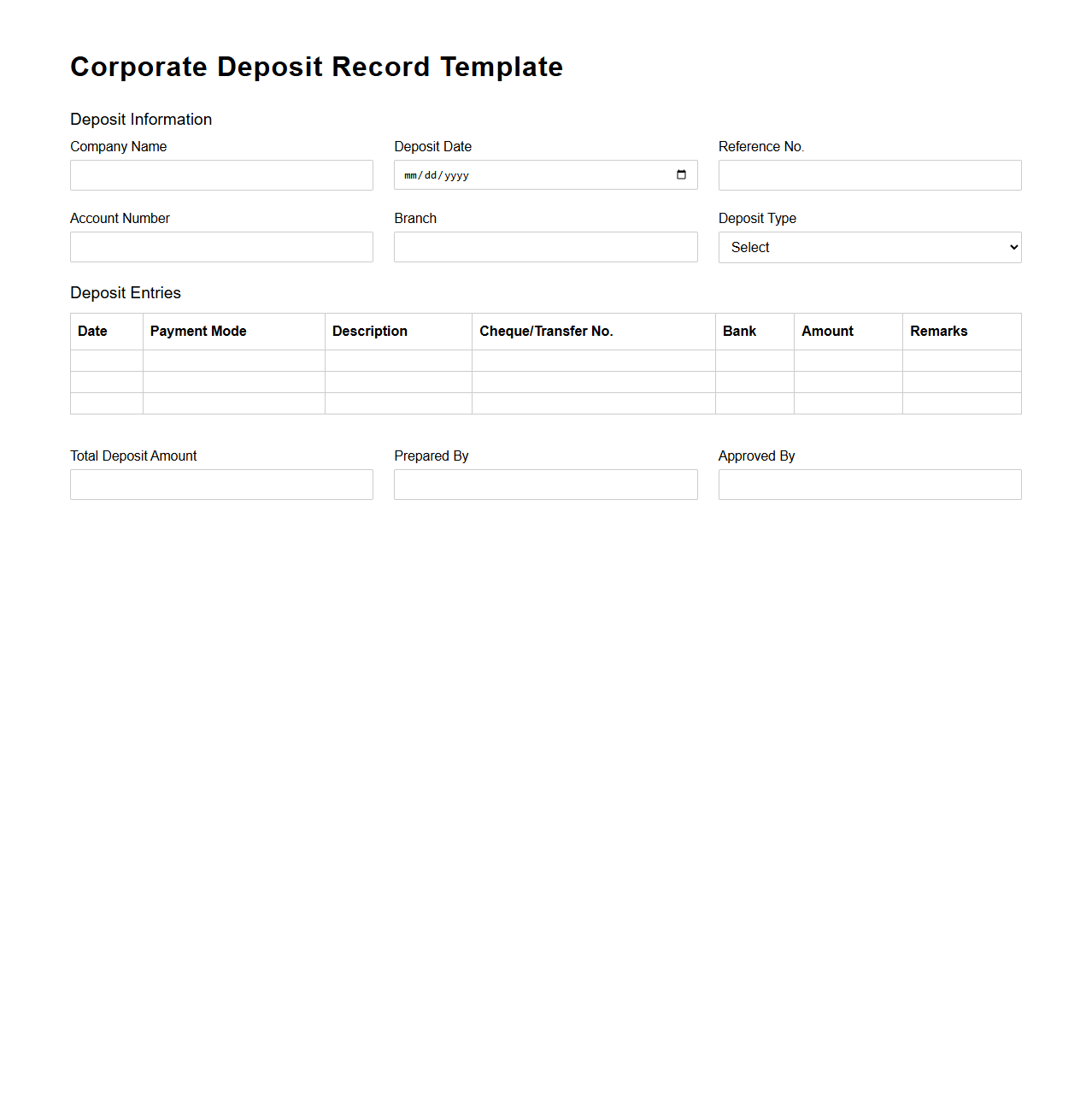

Corporate Deposit Record Template

A

Corporate Deposit Record Template is a structured document designed to systematically capture and track all deposit transactions made by a corporation. It includes essential details such as deposit dates, amounts, sources, and reference numbers, ensuring accurate financial record-keeping and easy reconciliation. This template enhances transparency, supports audit processes, and facilitates efficient cash flow management within corporate finance departments.

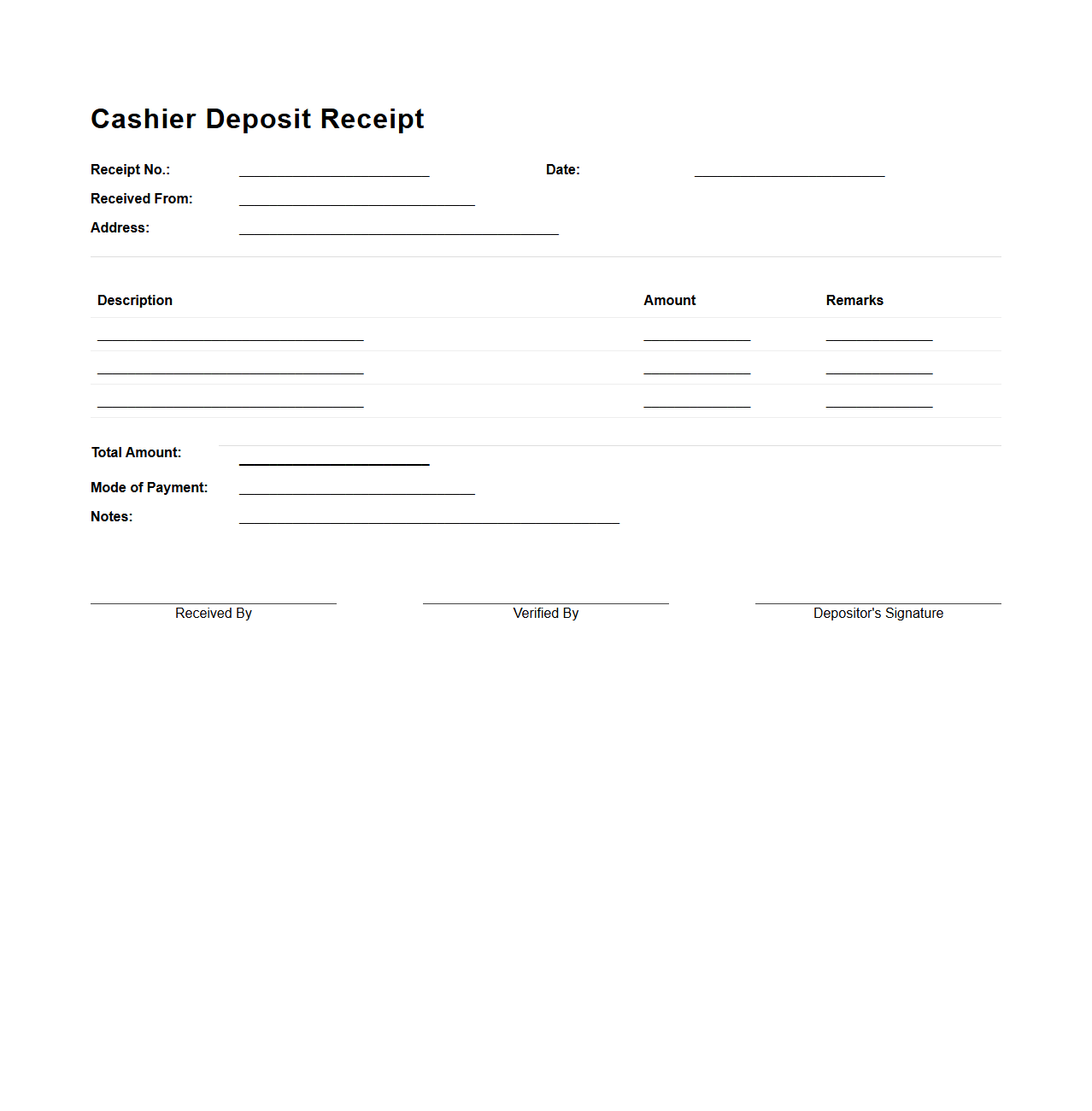

Cashier Deposit Receipt Format

A

Cashier Deposit Receipt Format document serves as an official record confirming the deposit of funds by a cashier into a bank or financial institution. It typically includes essential details such as the depositor's name, amount deposited, date of transaction, and receipt number for verification and auditing purposes. This format ensures transparency and accountability in financial transactions between businesses or individuals and banks.

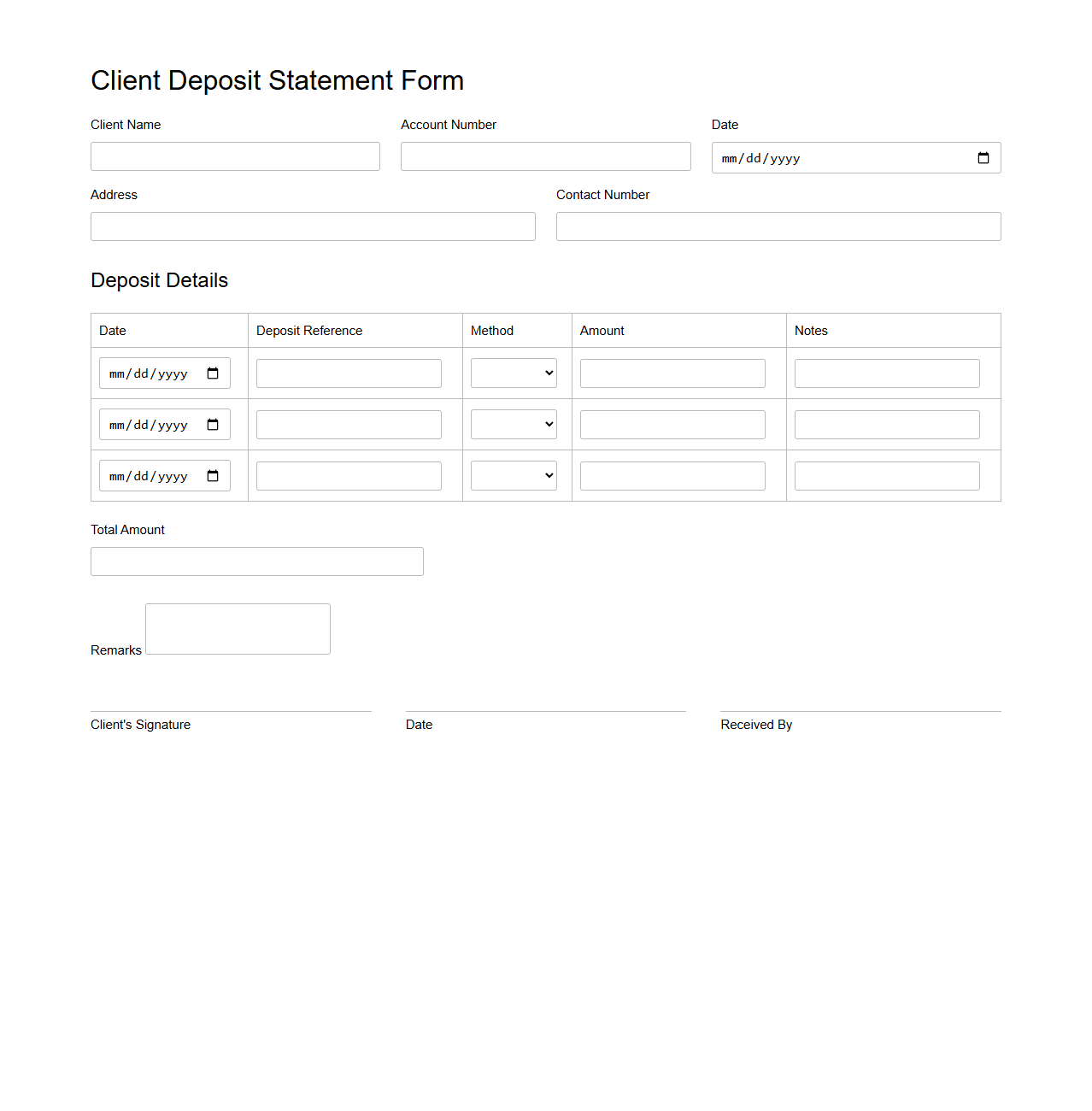

Client Deposit Statement Form

The

Client Deposit Statement Form serves as an official record detailing deposits made by a client into an account or service. This document includes critical information such as deposit dates, amounts, payment methods, and client identification to ensure accurate financial tracking and transparency. Businesses and financial institutions use it to reconcile accounts and maintain clear communication with clients about their deposit activities.

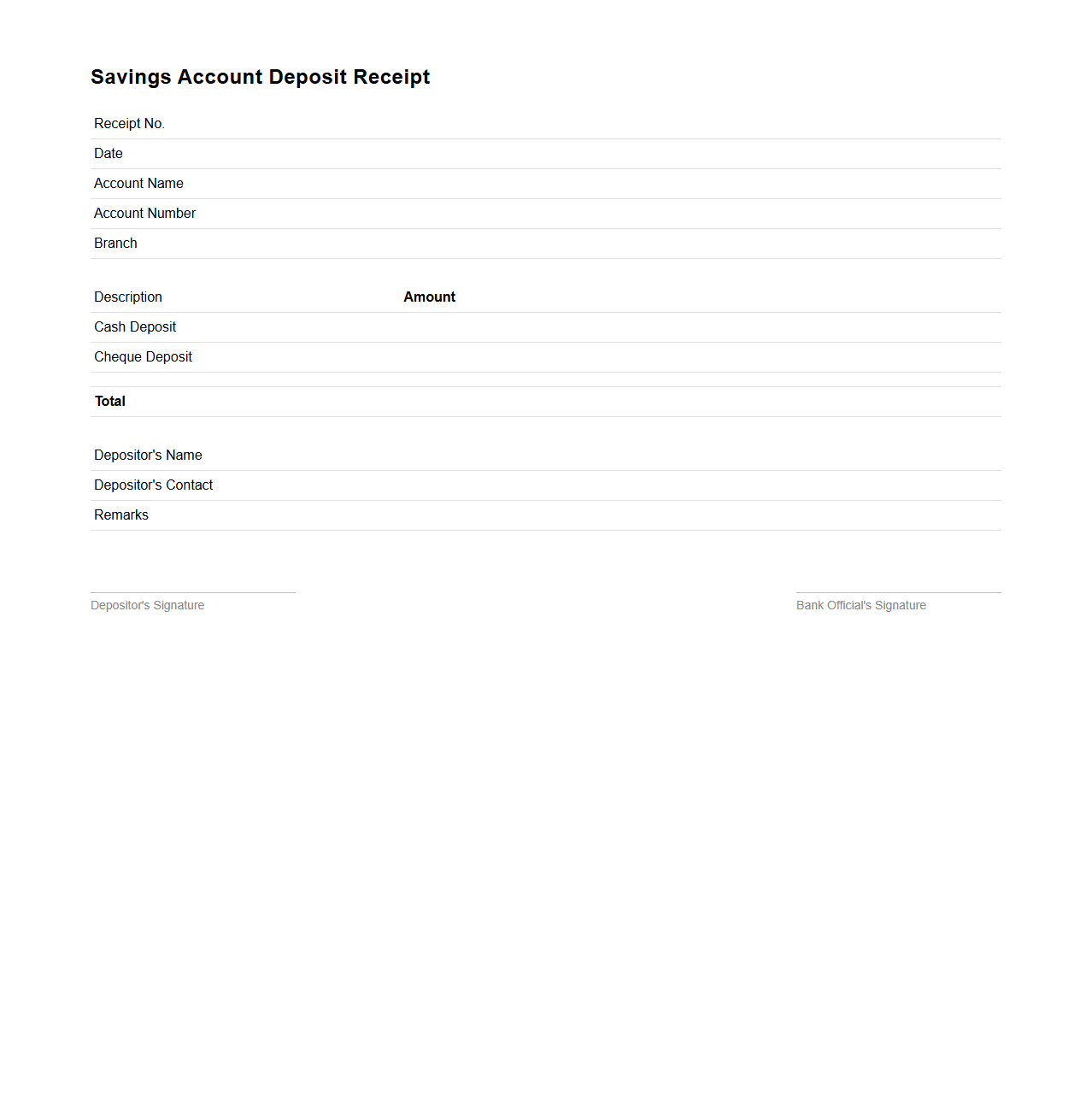

Savings Account Deposit Receipt Template

A

Savings Account Deposit Receipt Template is a standardized document used by banks or financial institutions to provide customers with written proof of their deposit transactions into savings accounts. It typically includes essential details such as the depositor's name, account number, amount deposited, date, and transaction reference number. This template ensures accuracy, enhances record-keeping, and provides customers with official documentation of their savings deposits.

What essential fields should a Blank Deposit Receipt for banks include?

A Blank Deposit Receipt must include key fields such as the depositor's name, account number, and the deposit amount. Additionally, the receipt should capture the date and time of the transaction to ensure accuracy. Including a unique receipt or reference number is essential for tracking the deposit within the banking system.

How does a Blank Deposit Receipt ensure transaction traceability?

Transaction traceability is achieved through the inclusion of a unique receipt number that links the deposit to the specific account and customer. Detailed fields such as date, time, and depositor's information further enhance traceability by allowing precise verification. Banks often cross-reference this information with internal records to maintain accurate audit trails.

What security features are recommended on a Blank Deposit Receipt template?

Recommended security features include watermarks, microprinting, and unique serial numbers to prevent fraudulent duplication. Additionally, incorporating holograms or special inks can further protect the document's authenticity. These measures help banks and customers verify the legitimacy of the deposit receipt.

How are blank deposit receipts validated by bank staff upon submission?

Bank staff validate blank deposit receipts by checking the completeness of all required fields, including depositor details and transaction information. Verification against the bank's transaction records ensures that the deposit corresponds to a genuine deposit event. Staff may also inspect security features to confirm the receipt's authenticity before processing.

What are common compliance errors found in drafting blank bank deposit receipts?

Common compliance errors include omitting the depositor's identification, failing to record the exact deposit amount, and missing transaction dates. Inaccurate or incomplete account numbers can also lead to processing delays or errors. Ensuring all mandatory fields are correctly filled is vital for regulatory compliance and effective transaction tracking.