A Blank Cash Receipt Template for Transactions is a customizable document designed to record payment details accurately and professionally. It simplifies the process of providing proof of payment for both buyers and sellers, ensuring clear tracking of cash exchanges. This template often includes fields for date, amount, payer and payee information, and transaction purpose.

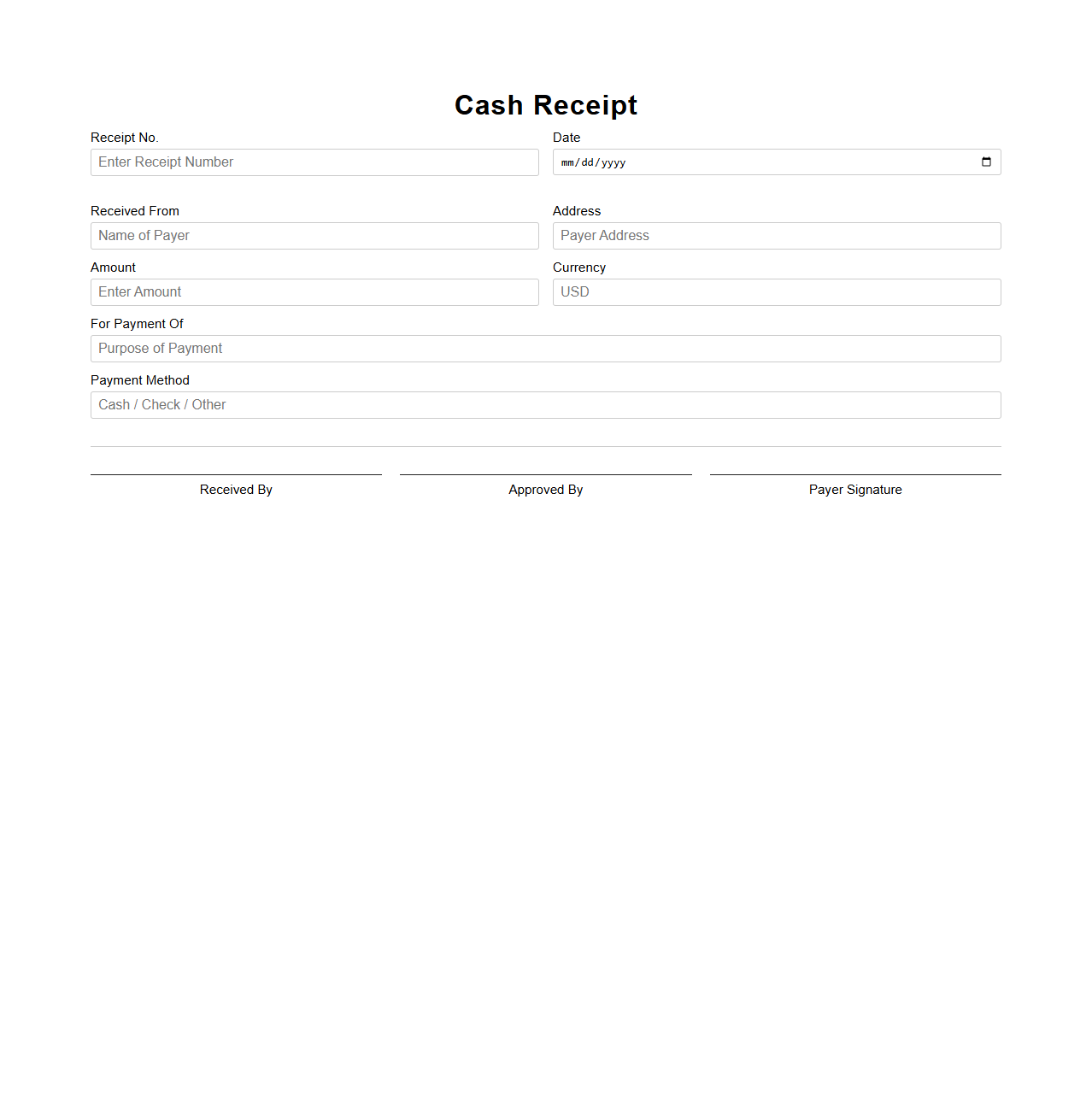

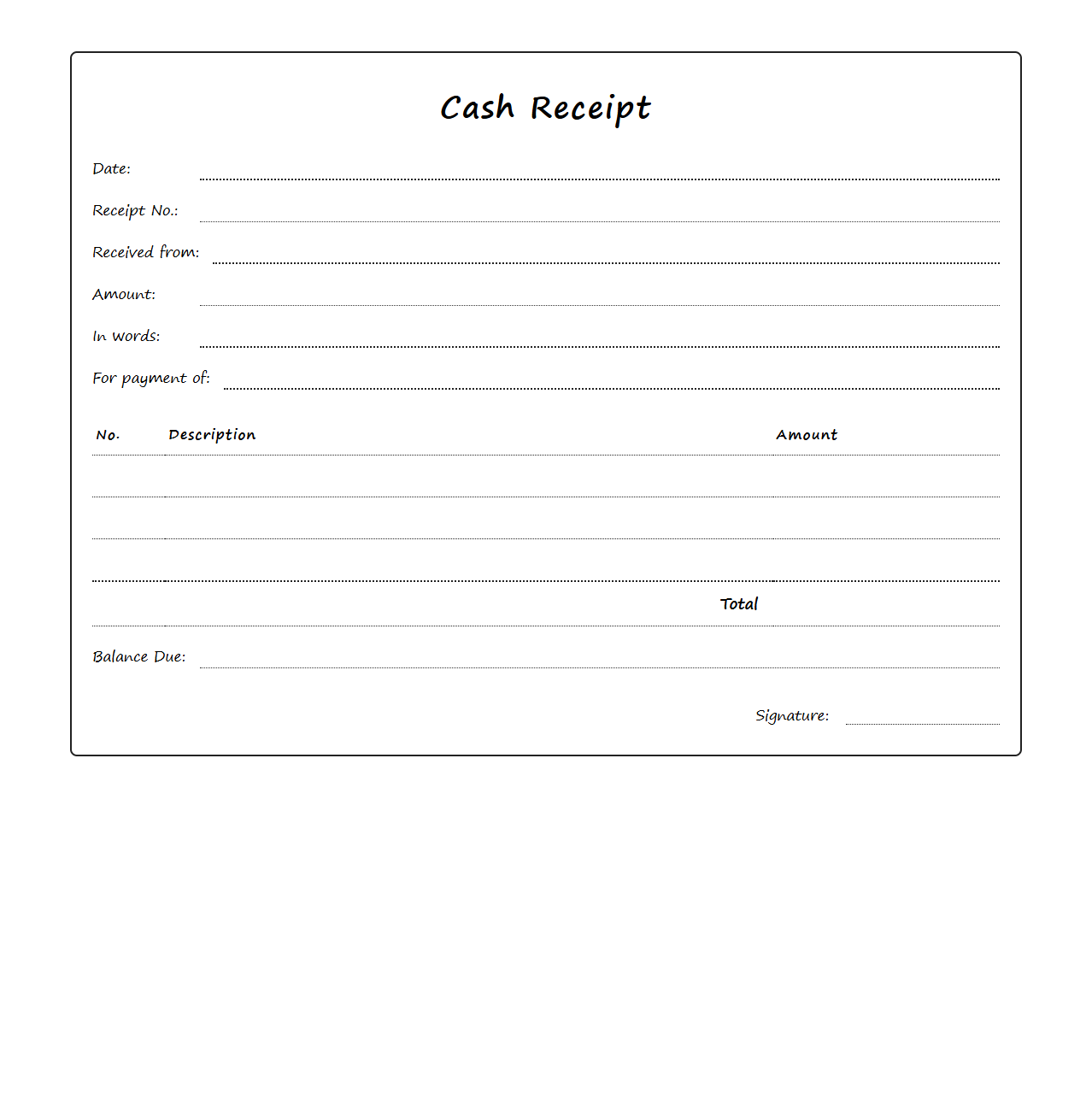

Basic Cash Receipt Template for Payment Recording

A

Basic Cash Receipt Template for Payment Recording document is a standardized form used to document cash transactions accurately and efficiently. It captures essential details such as the payer's name, payment amount, date, and purpose, ensuring transparent financial tracking for businesses or individuals. This template supports proper bookkeeping and audit trails by providing clear evidence of payments received.

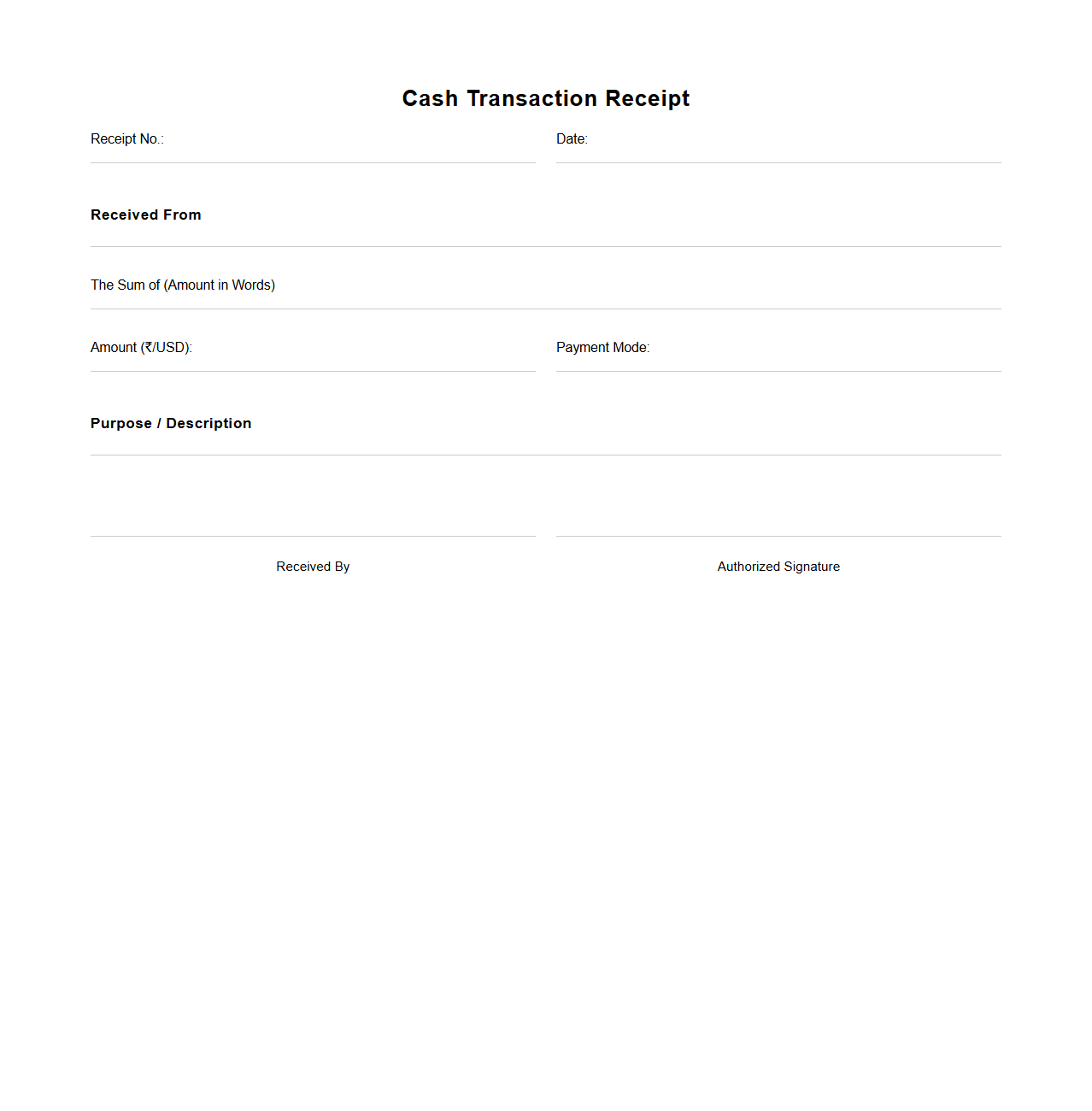

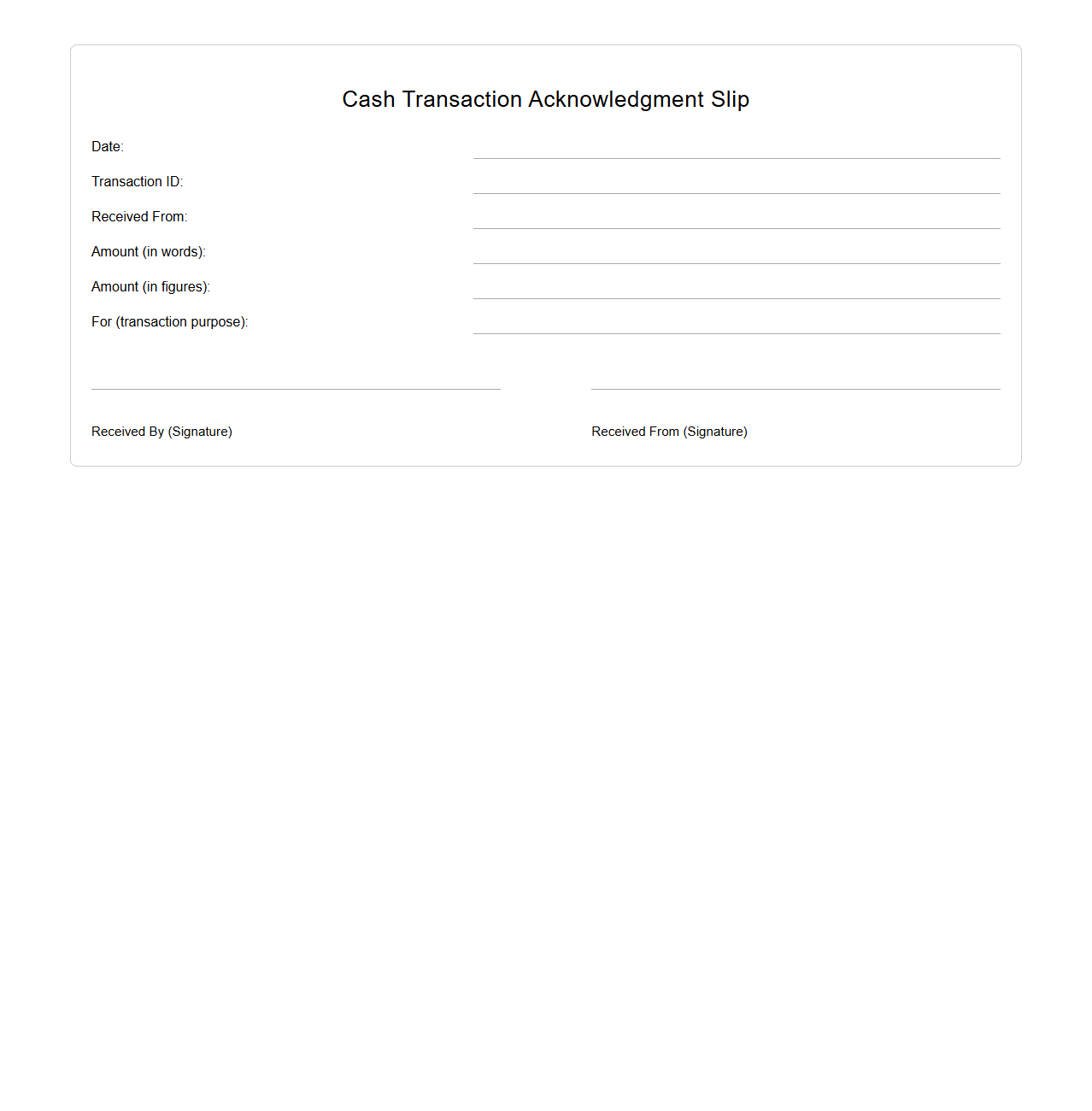

Simple Cash Transaction Receipt Format

A

Simple Cash Transaction Receipt Format document serves as a straightforward record of cash exchanges between parties, detailing essential information such as date, amount, payer, and receiver. It ensures transparency and accountability in financial dealings by providing proof of payment and receipt. This format is widely used in retail, personal transactions, and small business operations for quick and efficient documentation.

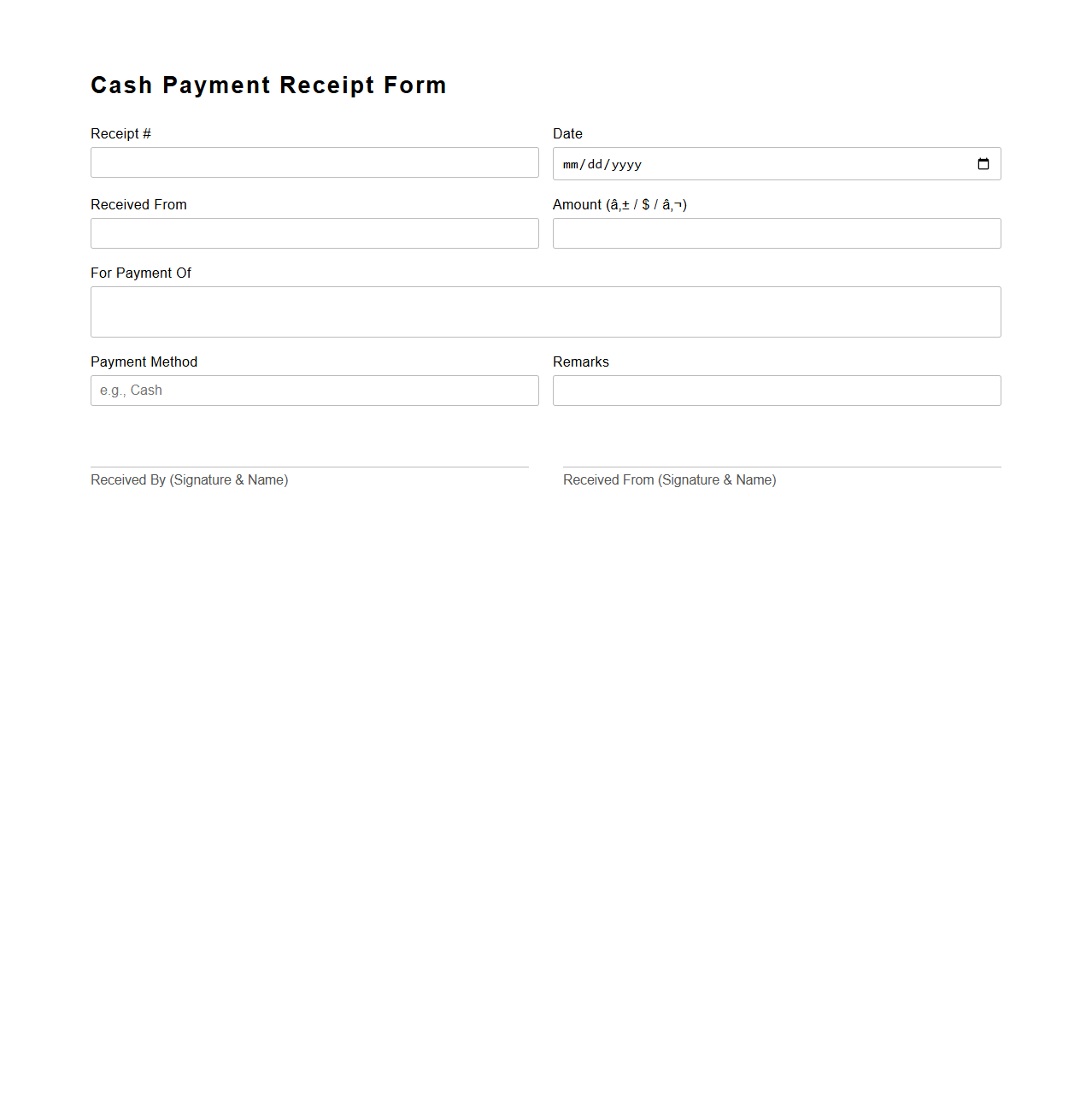

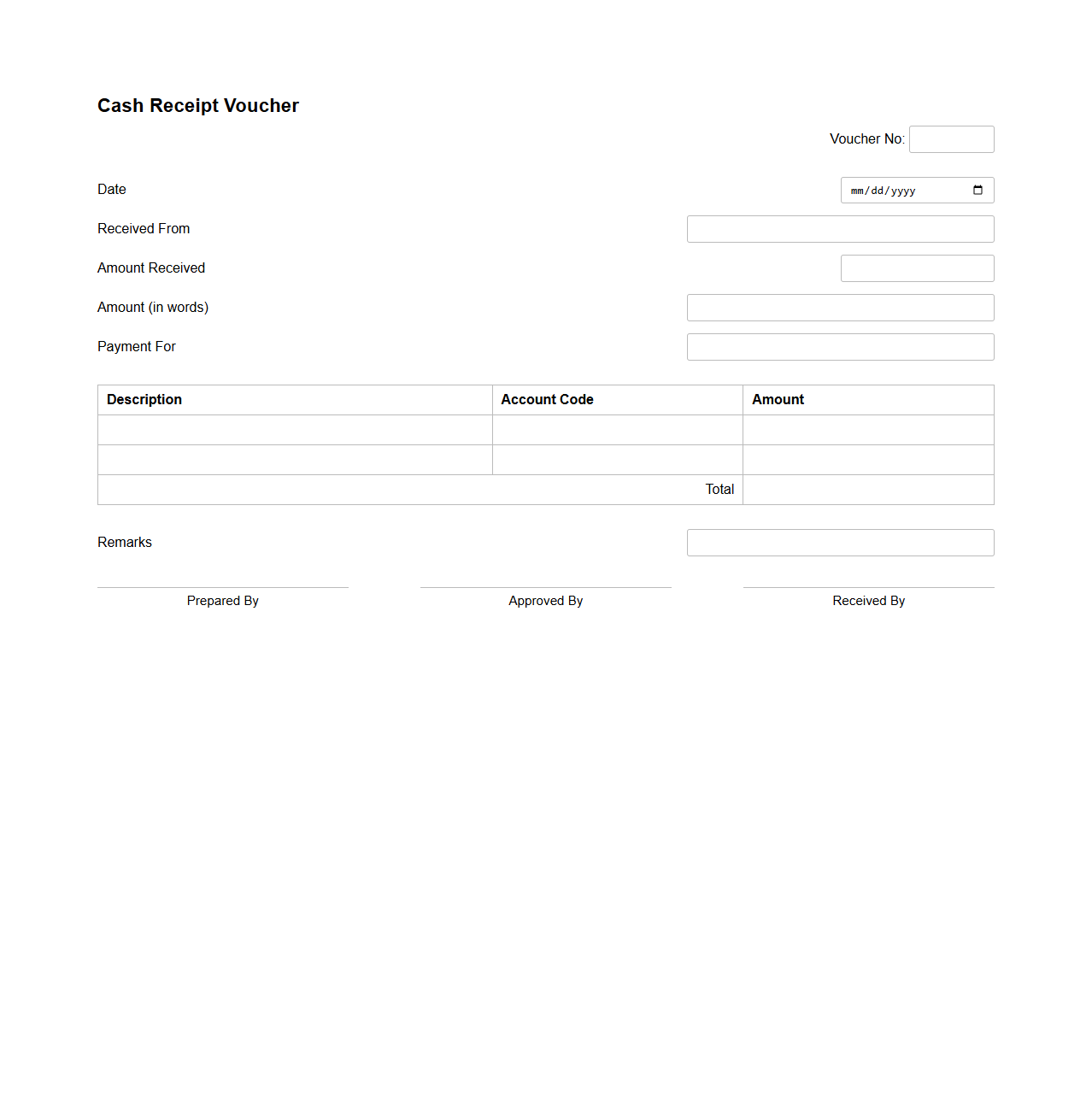

Cash Payment Receipt Form for Business Records

A

Cash Payment Receipt Form is a crucial document used in business records to acknowledge the receipt of cash payments from customers or clients. It serves as proof of transaction, detailing payment amount, date, payer information, and purpose, which helps maintain accurate financial tracking and accountability. This form supports transparent bookkeeping and simplifies audit processes by providing verifiable evidence of cash exchanges.

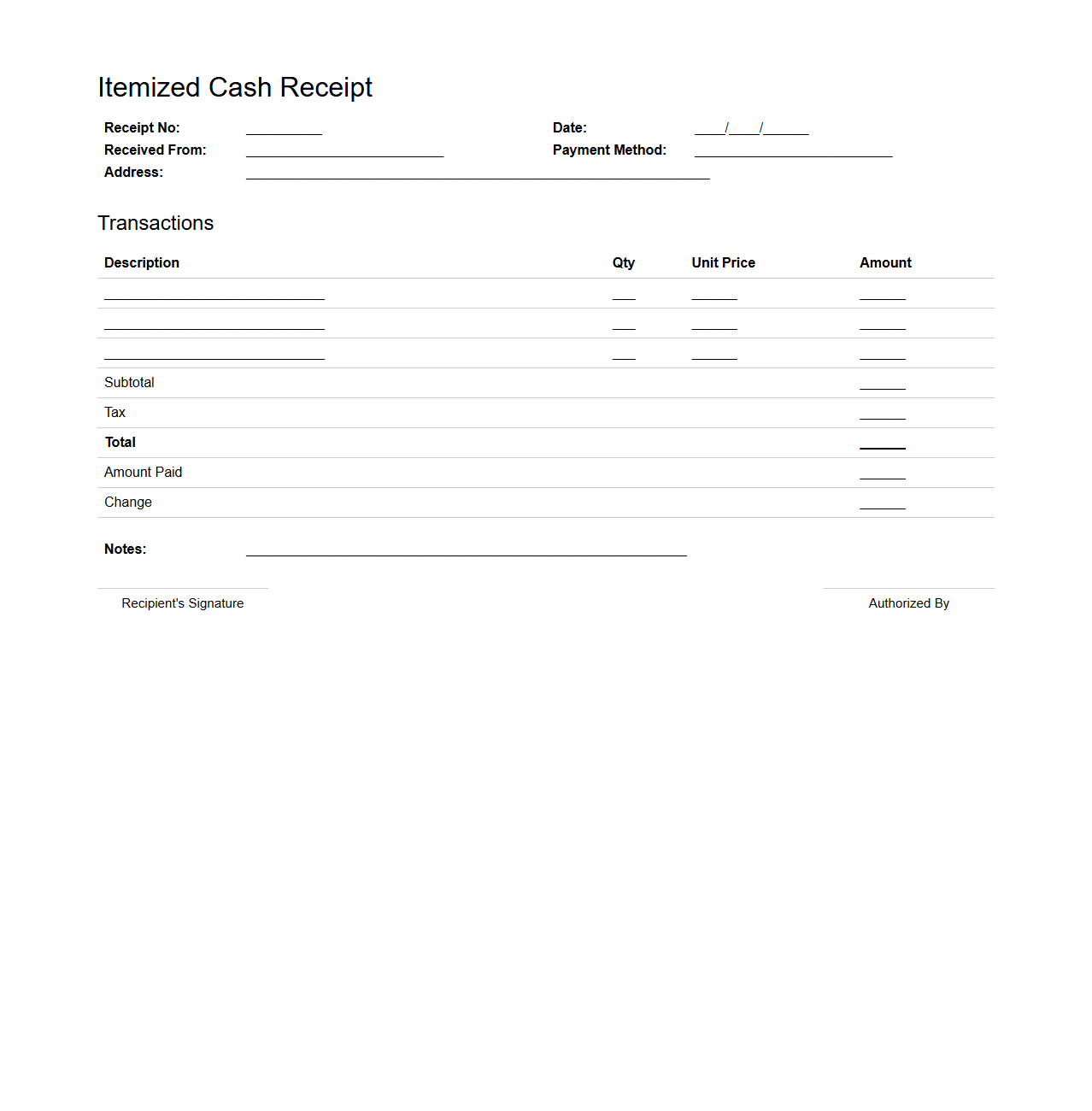

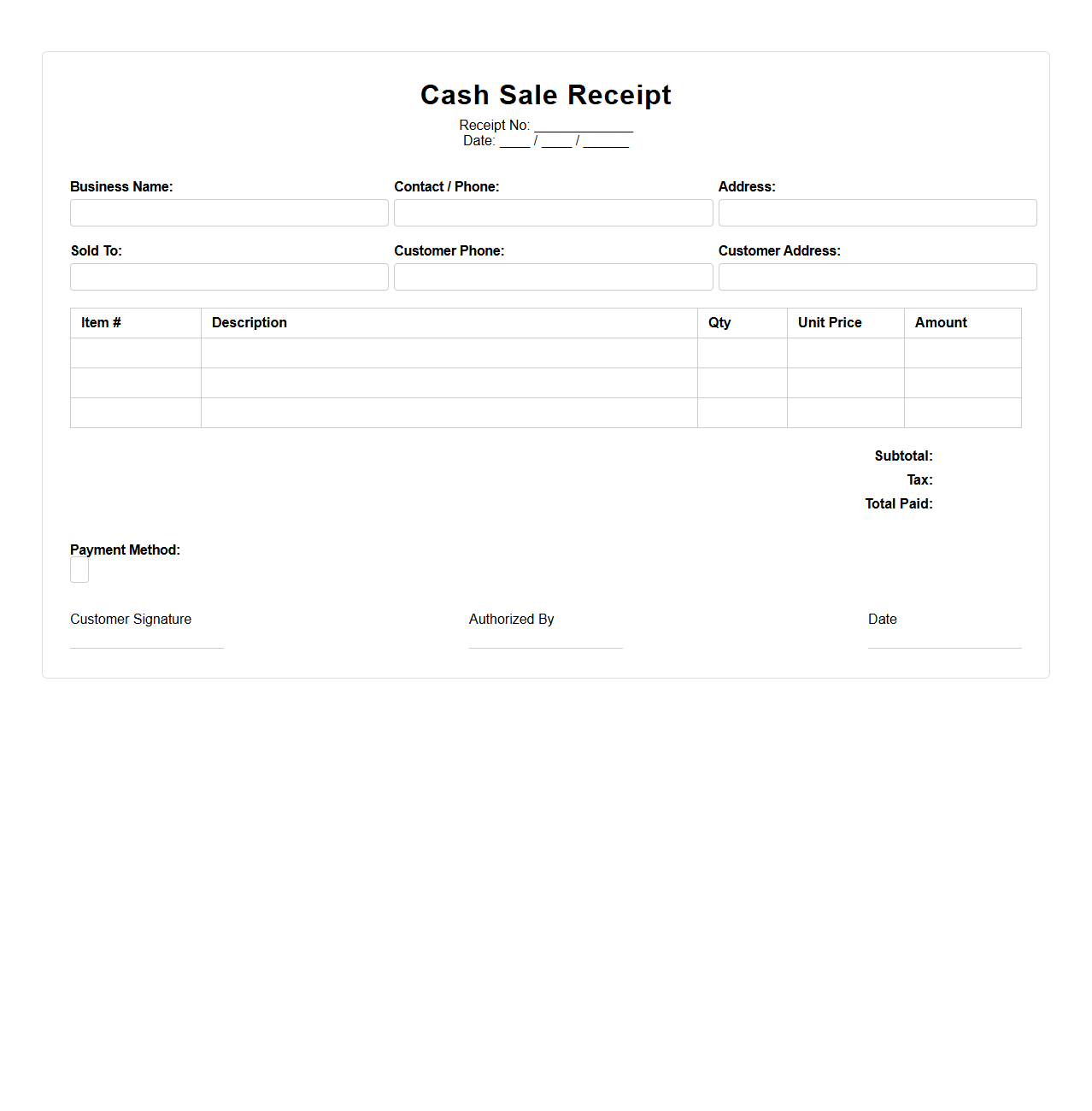

Itemized Cash Receipt Example for Transactions

An

Itemized Cash Receipt for Transactions document provides a detailed record of cash payments made, listing each item or service purchased with corresponding prices and quantities. It serves as proof of payment and helps both buyers and sellers maintain accurate financial records for accountability and auditing purposes. This document typically includes essential details such as the date of transaction, payment method, item descriptions, unit prices, total amounts, and the seller's identification.

Handwritten Style Cash Receipt Layout

A

Handwritten Style Cash Receipt Layout document simulates the appearance of a manually written receipt while maintaining digital accuracy and organization. It features customizable elements such as date, item descriptions, quantities, prices, and total amounts presented in a clear, legible handwritten font style. This format is widely used by businesses to combine the personal touch of a hand-drawn record with the efficiency of modern accounting systems.

Cash Sale Receipt Template for Small Businesses

A

Cash Sale Receipt Template for small businesses is a pre-designed document used to record transactions where payment is made immediately in cash. It helps track sales, provide proof of payment to customers, and maintain accurate financial records for bookkeeping and tax purposes. This template typically includes essential details such as the date, amount received, description of goods or services, and seller and buyer information.

Two-Part Cash Receipt Stub for Tracking

A

Two-Part Cash Receipt Stub is a financial document designed to provide both the payer and the payee with proof of payment while facilitating accurate transaction tracking. This stub includes essential details such as the payment amount, date, payer information, and receipt number to ensure transparency and accountability. Businesses use these receipts to maintain organized records and simplify reconciliation processes.

Minimalist Cash Transaction Acknowledgment Slip

A

Minimalist Cash Transaction Acknowledgment Slip is a streamlined financial document used to confirm the receipt or payment of cash, containing only essential details such as the date, amount, parties involved, and purpose of the transaction. Its purpose is to provide a clear, concise, and legally acceptable record while minimizing paperwork and complexity. This type of slip is ideal for businesses and individuals seeking efficient cash handling documentation without unnecessary information.

Cash Receipt Voucher for Office Use

A

Cash Receipt Voucher for Office Use is an essential financial document that records cash received by a company or organization. It serves as proof of transaction and helps maintain accurate accounting records by detailing the amount, date, payer, and purpose of the cash received. This voucher ensures proper internal control and audit trail for managing office cash inflows effectively.

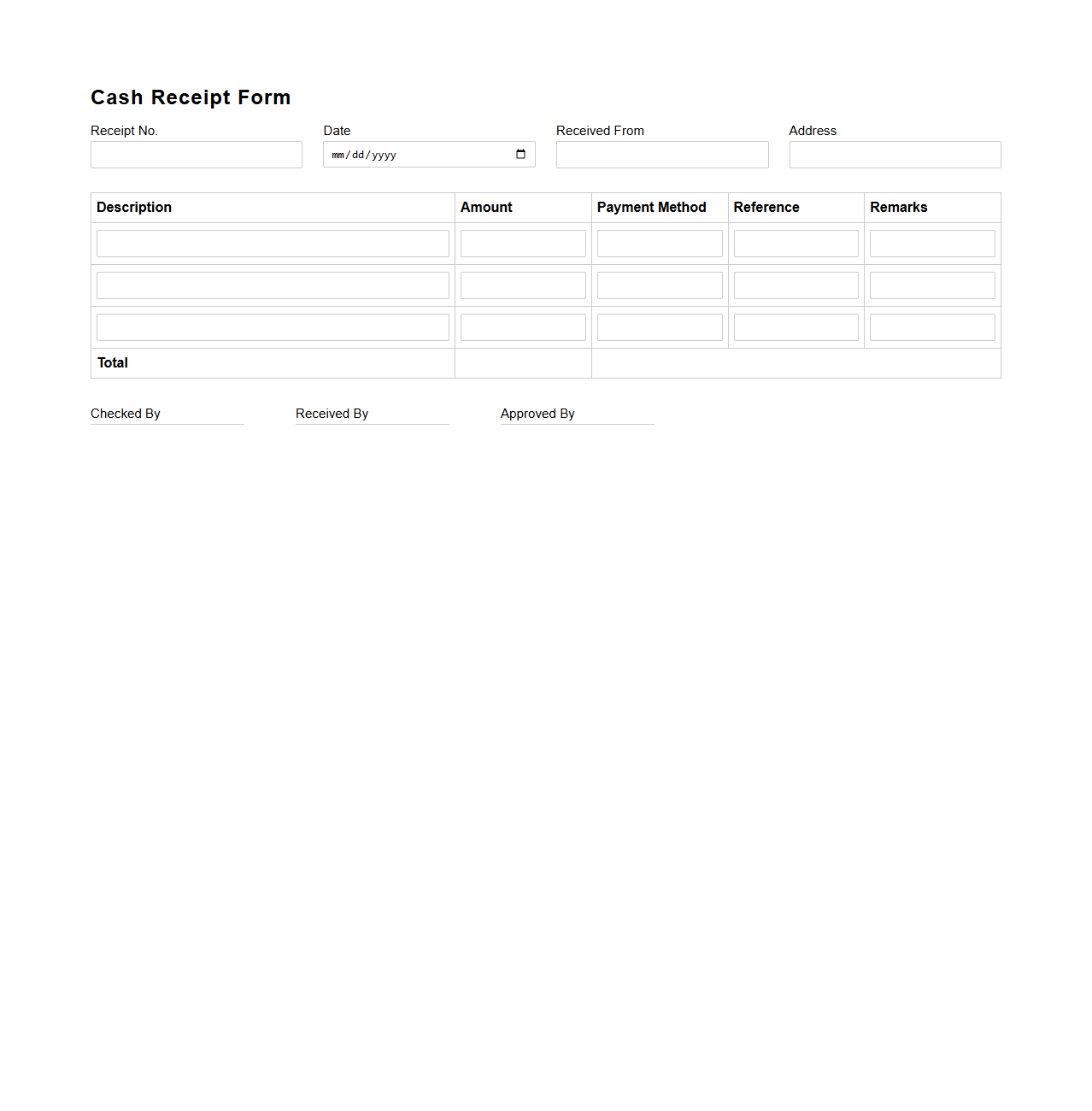

Customized Cash Receipt Form for Multiple Entries

A

Customized Cash Receipt Form for Multiple Entries is a tailored document designed to record several cash transactions within a single form, streamlining financial tracking and improving accuracy. It allows businesses to document multiple payments, dates, and payer details efficiently, reducing paperwork and administrative errors. This form is essential for organizations handling numerous daily cash receipts, ensuring thorough record-keeping and easy reconciliation.

How do I validate authenticity on a blank cash receipt template for audit purposes?

To validate authenticity on a blank cash receipt template, incorporate unique identifiers such as serial numbers or QR codes. Ensure that each receipt includes a distinct watermark or security feature to deter tampering. Additionally, cross-check the receipt details against your internal transaction records during audits.

What essential fields are required in a legal blank cash receipt for business transactions?

A legal blank cash receipt must include key fields such as the date of the transaction, the amount received, and the payer's name or company details. It should also have the signature of the authorized person issuing the receipt to validate authenticity. Finally, a clear description of the transaction purpose is crucial for legal and accounting clarity.

How can I prevent unauthorized duplication of blank cash receipts in my organization?

Prevent unauthorized duplication by using security paper with watermarks or holograms for your blank receipts. Implementing a controlled distribution system ensures only authorized personnel can access blank templates. Digital solutions like encrypted templates also help maintain tight security over receipt documents.

Which digital tools best automate numbering and tracking on blank cash receipt documents?

Consider using cloud-based accounting software like QuickBooks or Zoho Books to automate numbering and tracking of cash receipt documents. These platforms offer integrated real-time tracking with audit trails for every receipt issued. Additionally, document management tools with barcode or QR code generation improve accuracy and retrieval.

What are the tax implications of issuing blank cash receipts for unregistered transactions?

Issuing blank cash receipts for unregistered transactions can lead to potential tax liabilities and penalties due to lack of proper documentation. Tax authorities may view such receipts as non-compliant, posing risks during tax audits. It is vital to maintain transparent records and issue receipts only for registered transactions to ensure compliance and avoid legal issues.