The Blank Statement Template for Account Summary provides a clear and organized layout to present financial information efficiently. It allows users to customize account details, transactions, and balances without predefined data, ensuring flexibility for various reporting needs. This template enhances clarity and helps maintain consistent documentation across different accounts.

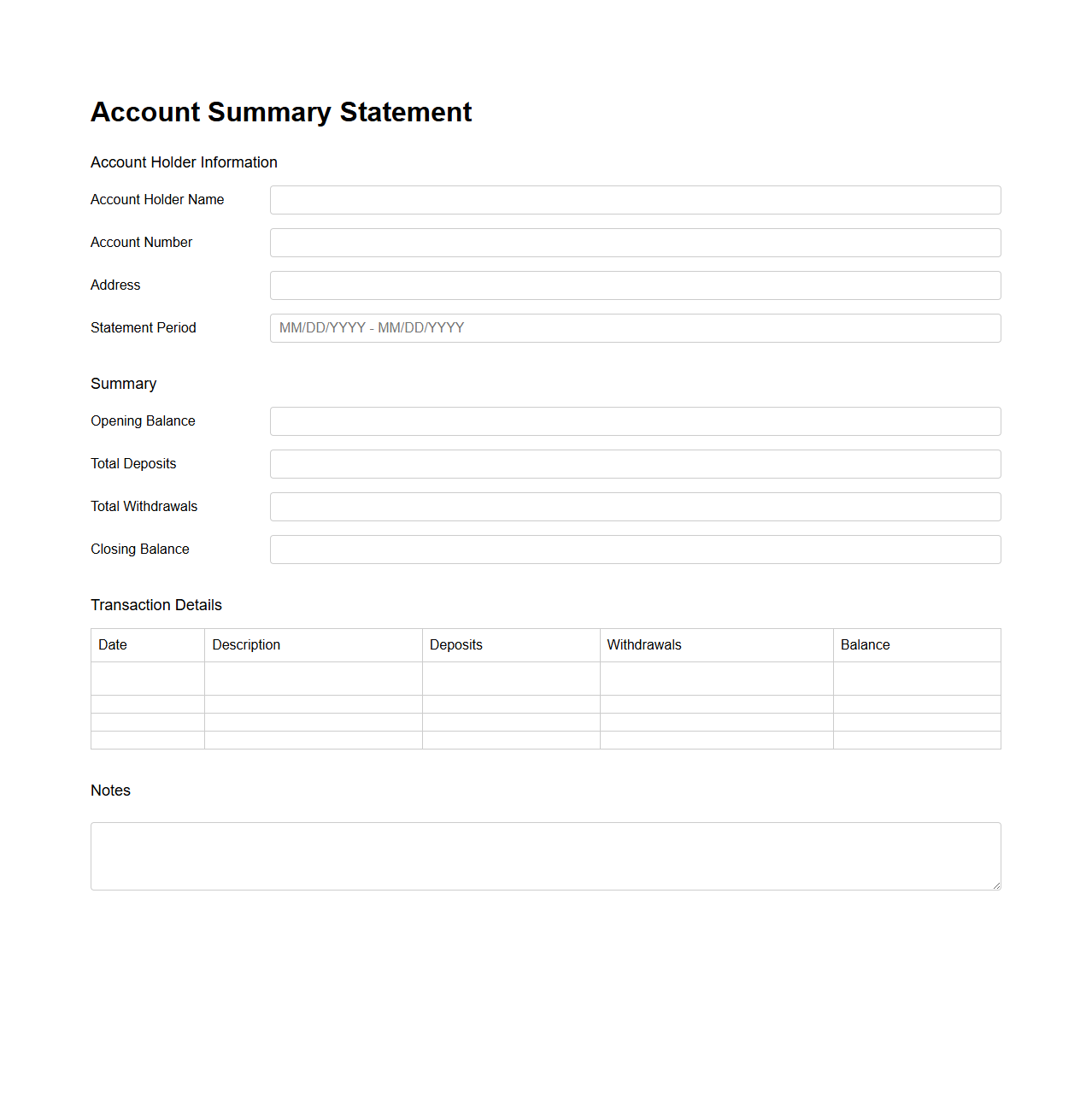

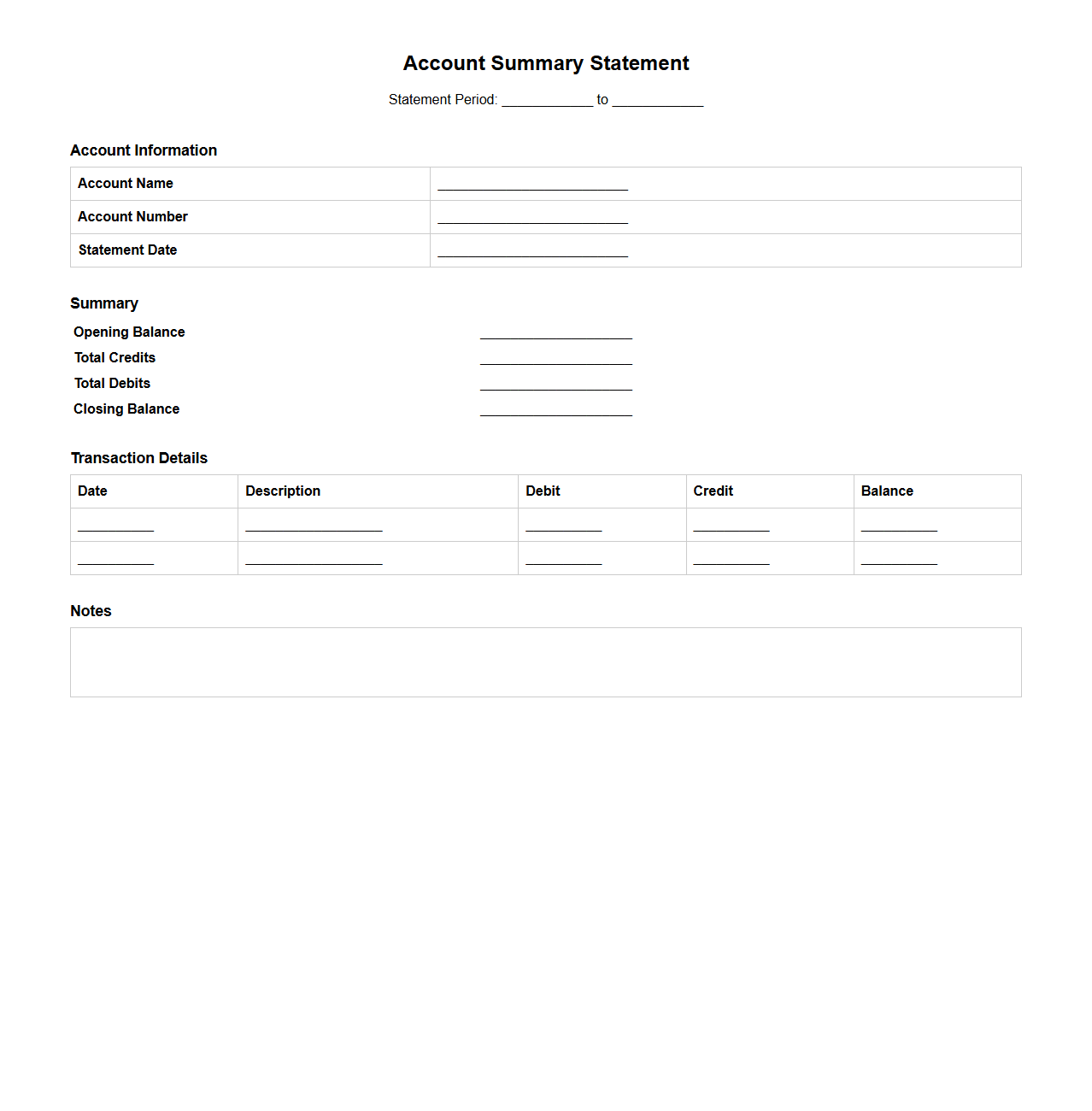

Account Summary Statement Blank Form

An

Account Summary Statement Blank Form is a structured template used by financial institutions to organize and present an overview of an account holder's financial activities. This document typically includes sections for recording balances, transactions, fees, and interest earned, allowing for accurate and comprehensive reporting. It serves as a standardized tool to ensure clarity and consistency in financial communication between institutions and clients.

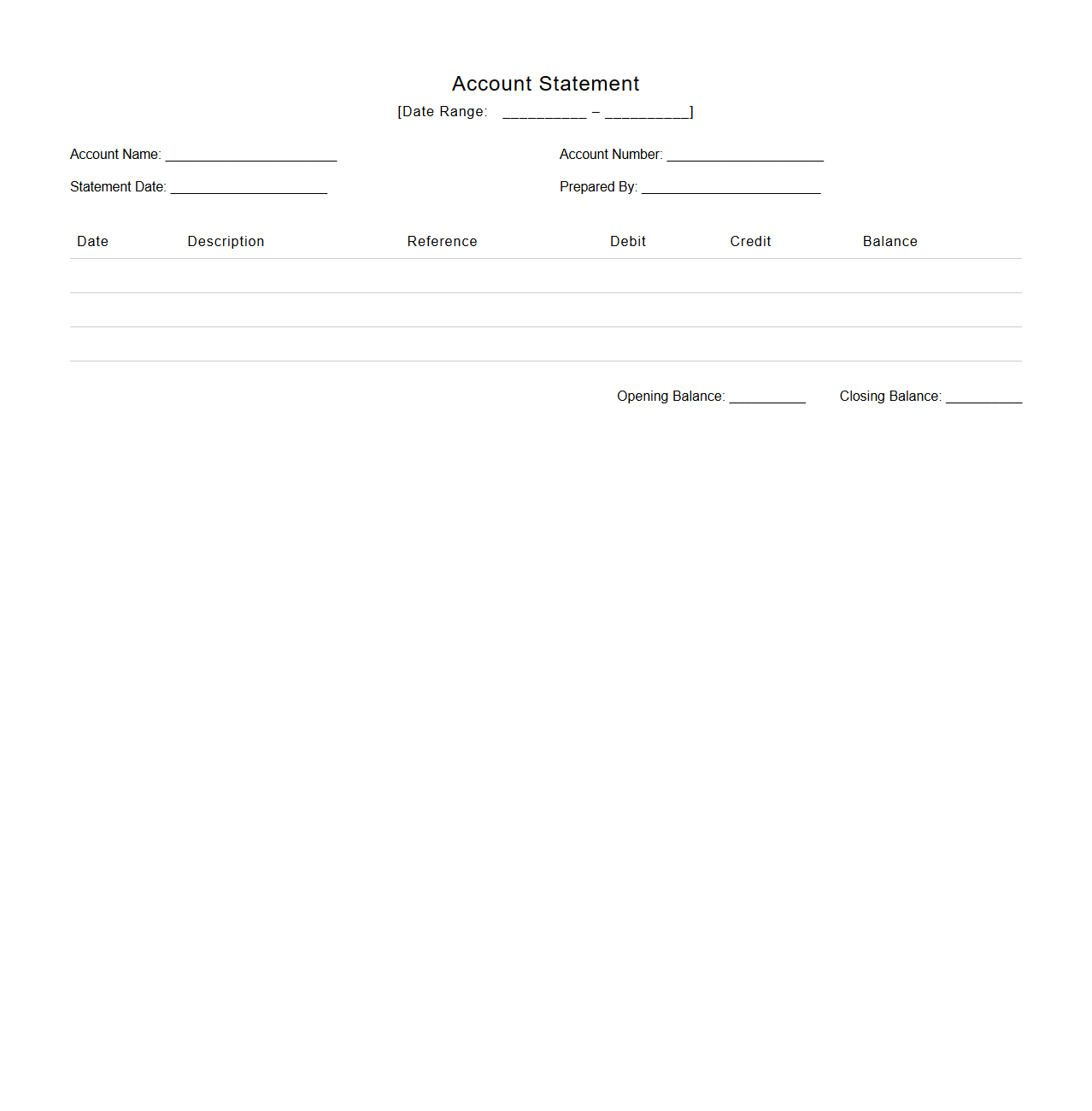

Empty Account Statement Template

An

Empty Account Statement Template is a pre-formatted document designed to record financial transactions and account balances without any pre-filled data. It provides a standardized format for users to input details such as date, description, debit, credit, and balance, ensuring consistency and clarity in financial record-keeping. This template is essential for businesses and individuals to track account activities accurately and maintain organized financial statements.

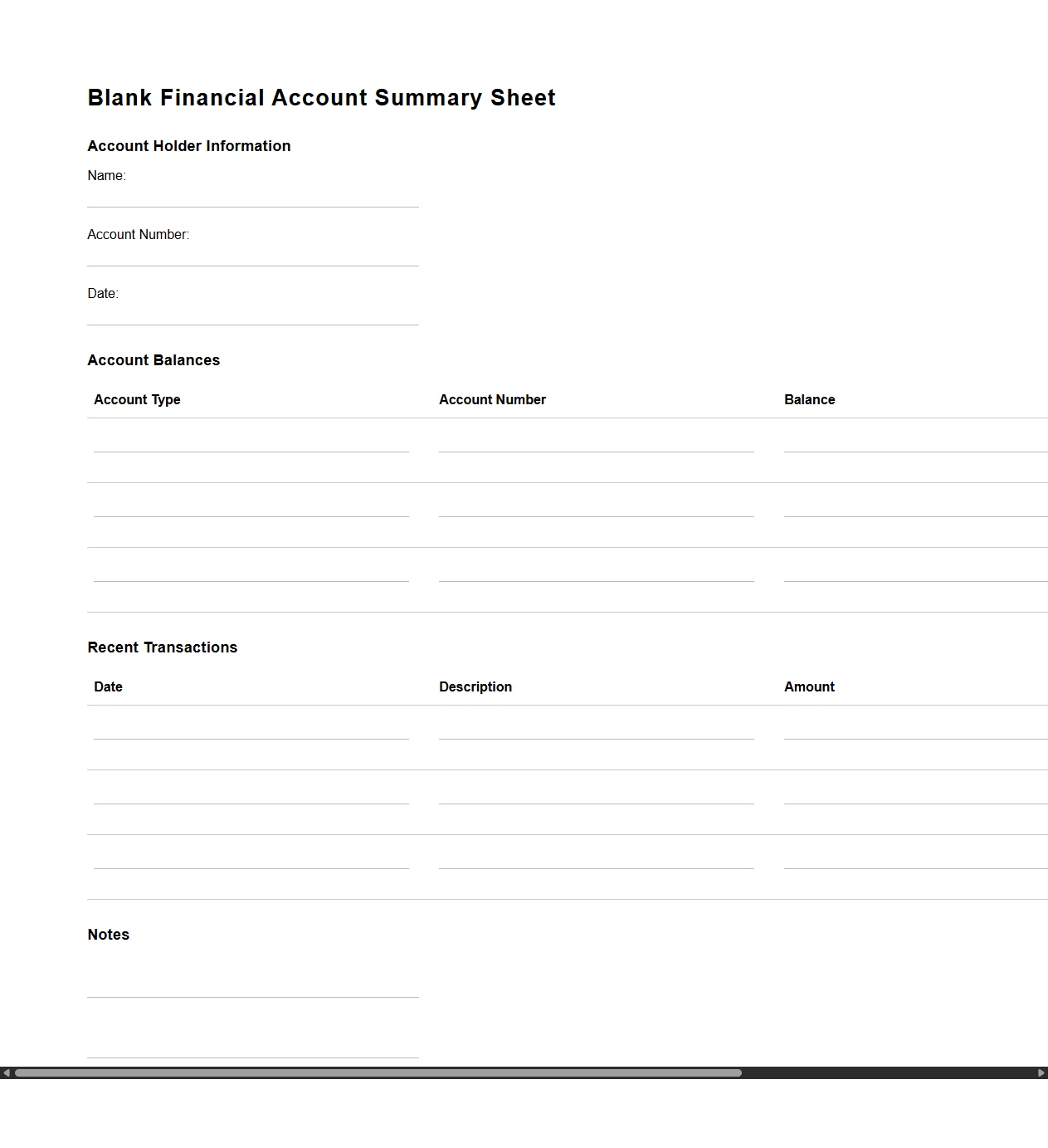

Blank Financial Account Summary Sheet

A

Blank Financial Account Summary Sheet document is a template designed to organize and present key financial information, including account balances, transaction histories, and budgeting details. It helps individuals or businesses maintain clear and concise records of multiple financial accounts in one place for easier tracking and analysis. This document supports effective financial management by providing an at-a-glance overview of assets, liabilities, income, and expenses.

Basic Account Statement Outline

A

Basic Account Statement Outline document provides a structured summary of financial transactions within a specified period, offering clear insights into debits, credits, and balances. This outline serves as a foundational tool for both individual and corporate accounting, ensuring transparency and accurate record-keeping. It typically includes essential elements such as transaction dates, descriptions, reference numbers, and ending balances for effective financial review and auditing.

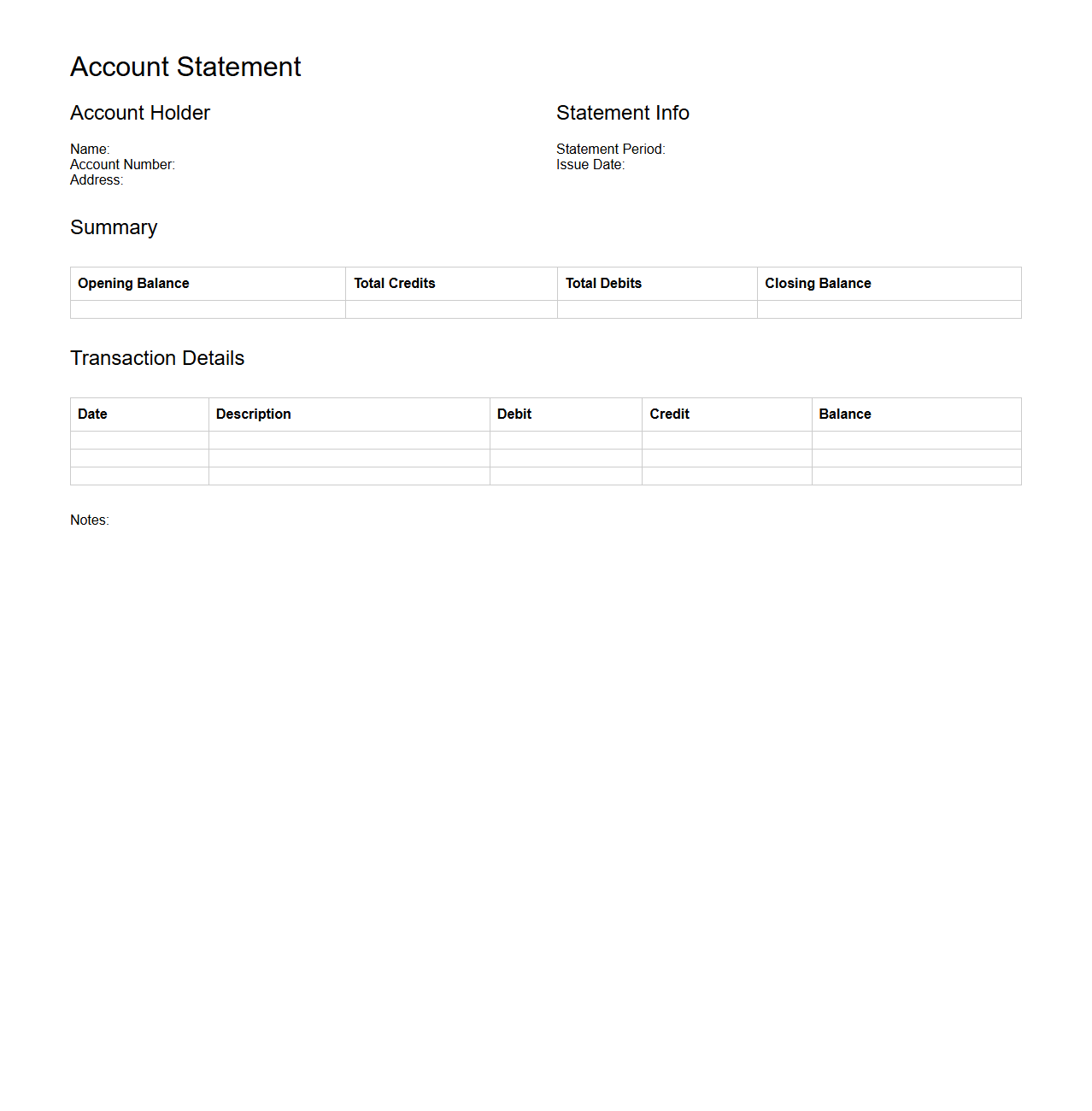

Account Summary Statement Sample Template

The

Account Summary Statement Sample Template is a structured document used to provide a clear overview of financial transactions, balances, and account activities over a specified period. It helps businesses and individuals track income, expenses, payments, and outstanding balances in an organized format that enhances financial transparency and reporting accuracy. This template is essential for maintaining detailed records and supporting informed financial decisions.

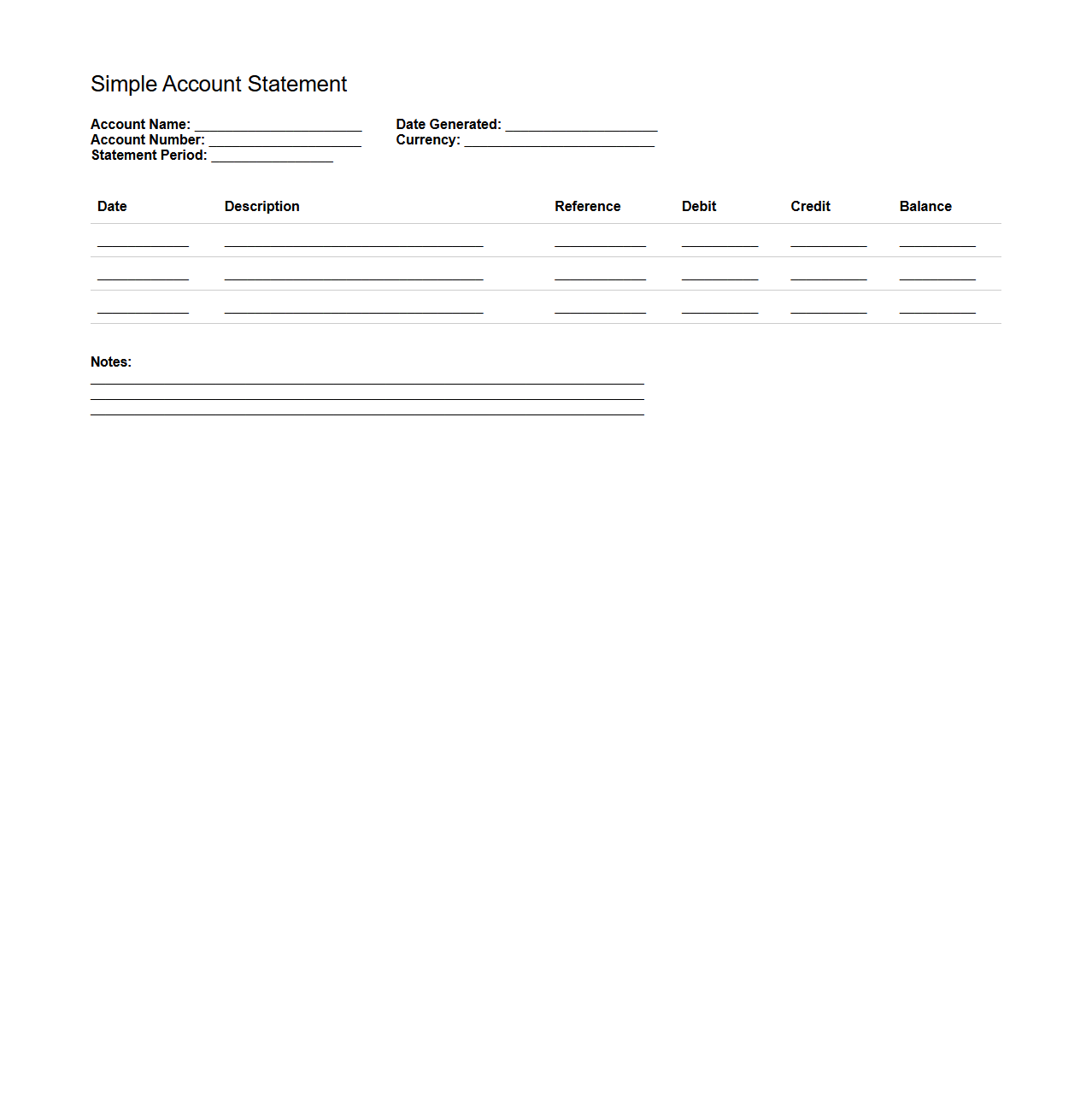

Simple Account Statement Blank Format

A

Simple Account Statement Blank Format document is a template used to record and present financial transactions in a clear and organized manner. It typically includes columns for date, description, debit, credit, and balance, allowing users to track account activity easily. This format is essential for maintaining accurate financial records and facilitating audits or reviews.

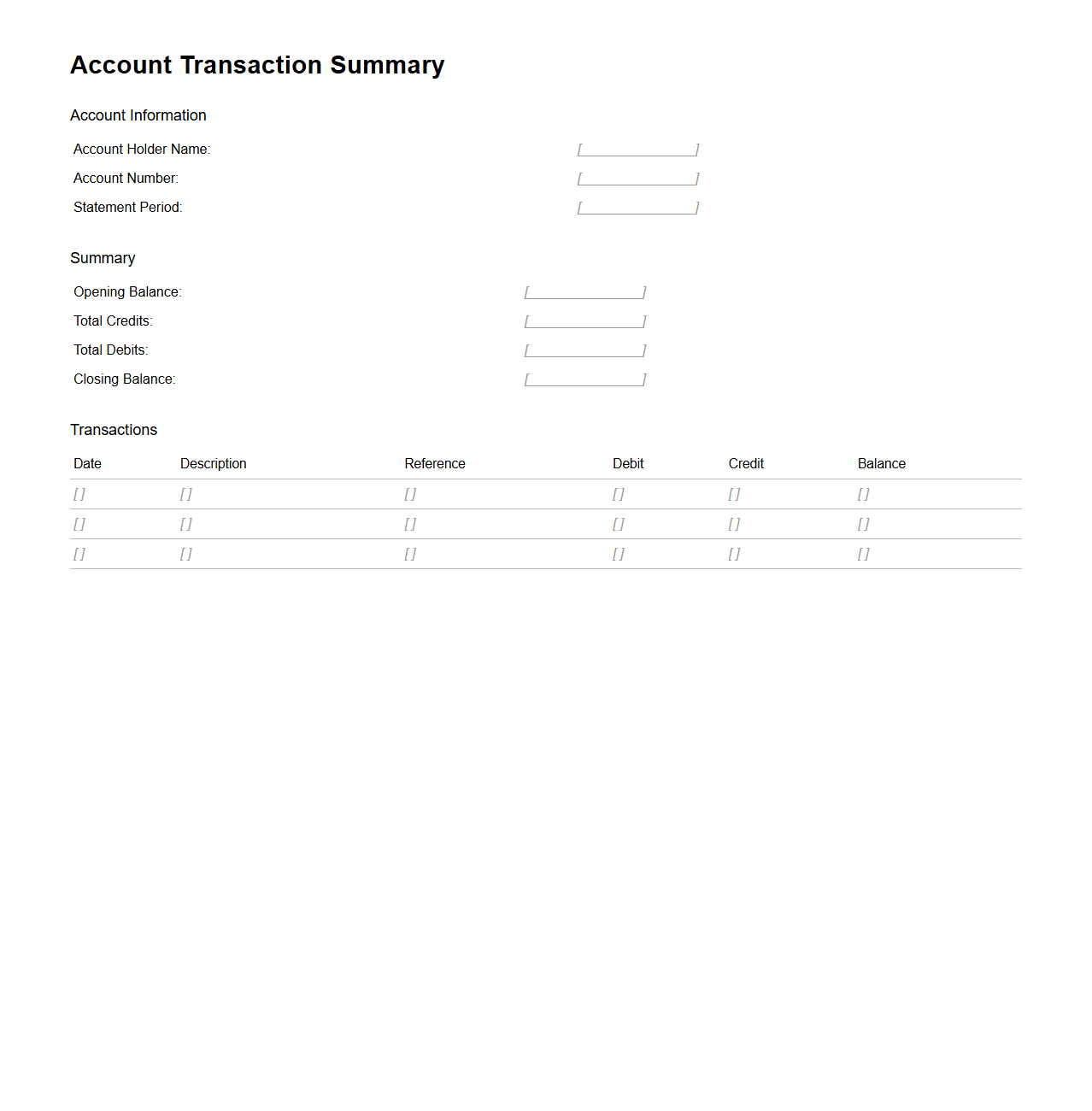

Account Transaction Summary Blank Document

An

Account Transaction Summary Blank Document is a template used to record and organize all financial transactions within a specific account over a given period. It provides a structured format for tracking debits, credits, dates, descriptions, and balances, facilitating accurate financial management and reporting. This document is essential for accountants, auditors, and business owners to monitor account activity and ensure transparency.

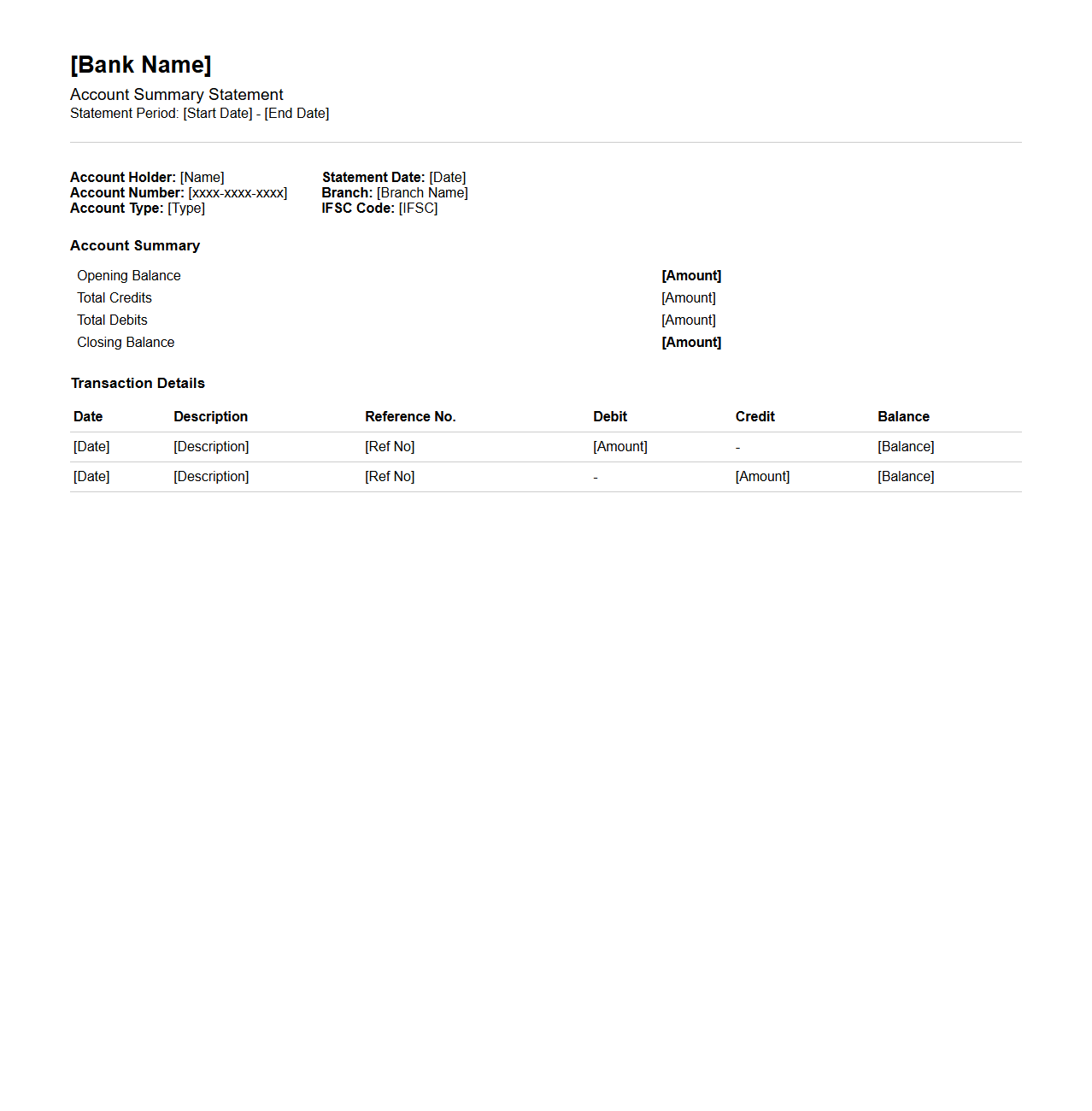

Bank Account Summary Statement Layout

A

Bank Account Summary Statement Layout document organizes essential financial details, such as account balances, transaction history, and interest earned, into a clear, concise format. It helps banks and customers quickly review account activity and overall status for a specific period. This layout ensures standardized presentation, enhancing readability and facilitating efficient financial management.

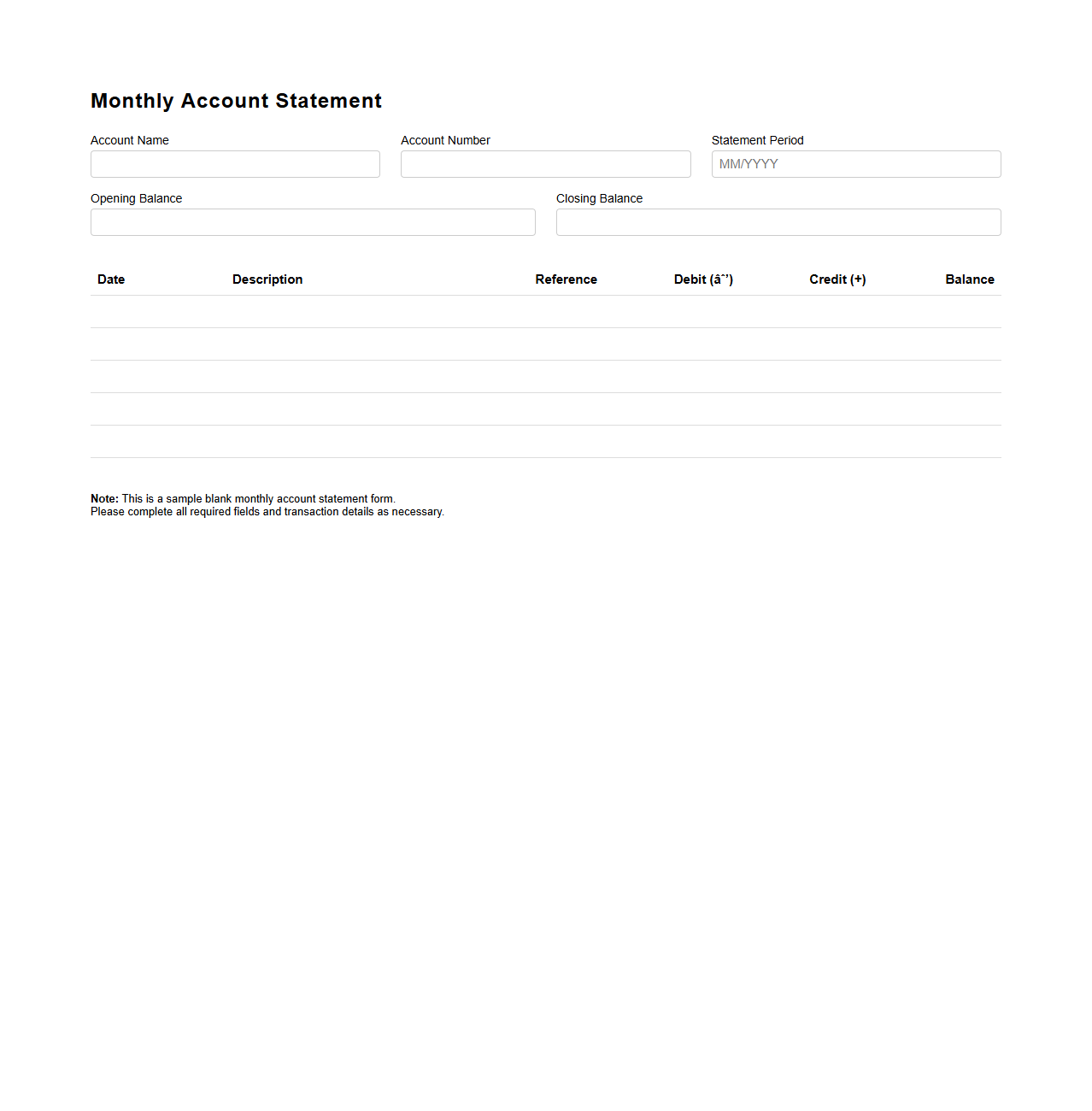

Blank Monthly Account Statement Form

A

Blank Monthly Account Statement Form is a standardized document used by financial institutions to provide a detailed summary of an account holder's transactions over a specific month. It typically includes fields for recording deposits, withdrawals, interest earned, fees charged, and the account balance at the beginning and end of the period. This form facilitates the accurate tracking and verification of financial activities, ensuring transparency and account management efficiency.

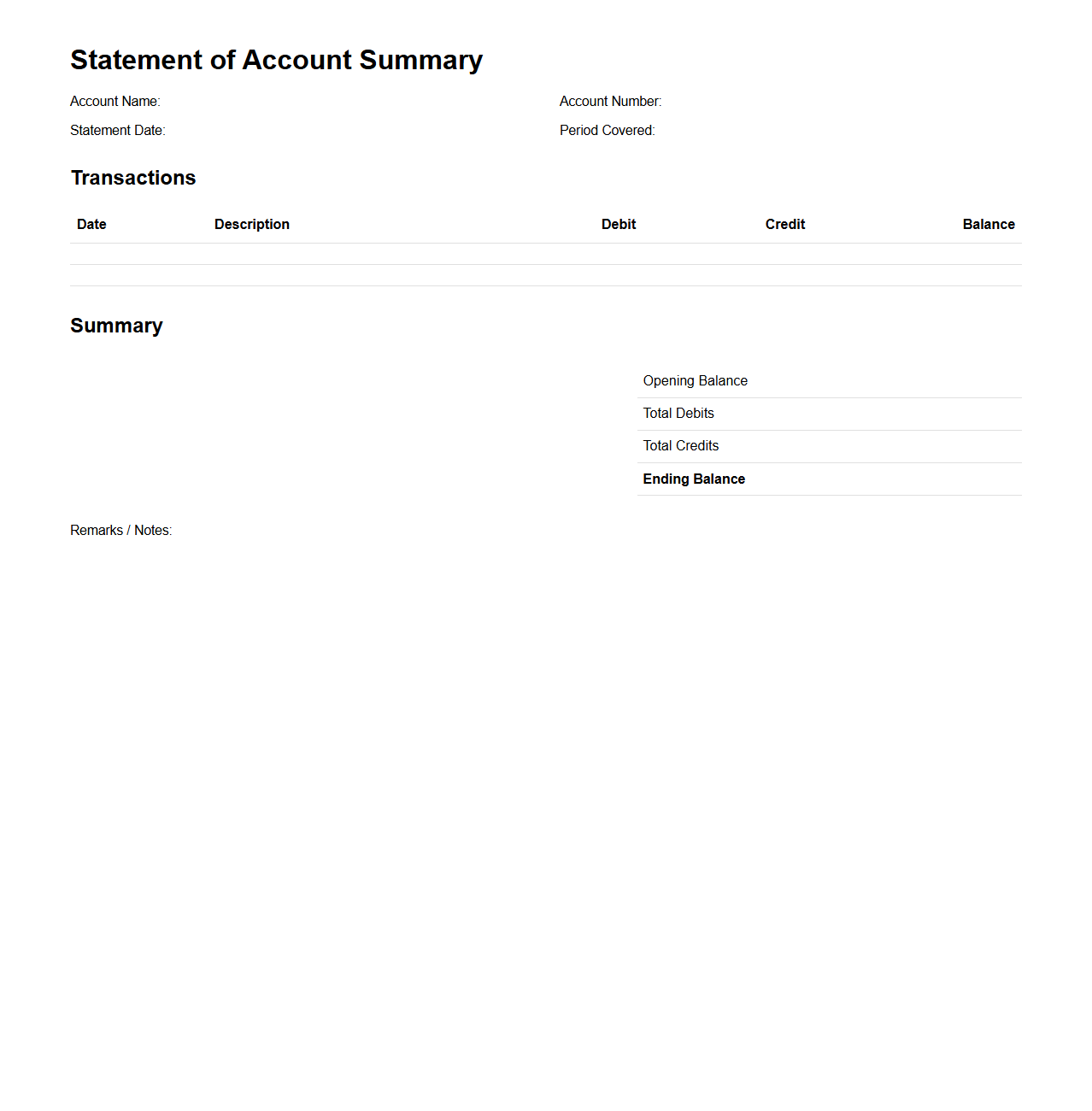

Statement of Account Summary Template

A

Statement of Account Summary Template is a structured document used to provide an overview of financial transactions within a specific period between a business and its customer or client. It summarizes debits, credits, and outstanding balances, making it easier to track payment history and account status. This template enhances clarity and organization in financial reporting, facilitating more efficient account management and communication.

What key elements are required in a blank statement for an account summary template?

A blank statement for an account summary template must include sections for the account holder's name, account number, and reporting period. It should feature placeholders for transaction details, balances, and interest calculations to provide a comprehensive overview. Including a summary section that highlights the total deposits, withdrawals, and ending balance is essential for clarity.

How is sensitive information protected on a blank account summary statement?

Protecting sensitive information in a blank account summary involves masking or encrypting personal identifiers such as Social Security numbers and account numbers. The use of secure digital formats and restricted access ensures that data confidentiality is maintained. Additionally, compliance with data protection regulations like GDPR or CCPA is critical in safeguarding client information.

What legal disclosures must be included in a blank account summary letter?

A blank account summary letter must contain mandatory legal disclosures related to privacy policies, terms and conditions, and the institution's liability. It should also inform the account holder of their rights to dispute transactions and receive regular statements. Including disclaimers about potential errors and the scope of the summary's accuracy helps mitigate legal risks.

How can a blank account summary statement be customized for different financial institutions?

Customization of a blank account summary statement is achieved by incorporating the financial institution's branding, such as logos, color schemes, and fonts. Tailoring the layout to align with the institution's standard reporting formats enhances consistency and user familiarity. Additionally, customizable fields for institution-specific disclosures and product details make the template versatile.

What are common errors to avoid when preparing a blank statement for account summaries?

Common errors include omitting critical data fields like transaction dates or balances, leading to incomplete summaries. Avoiding the use of ambiguous terms and ensuring proper alignment and formatting maintains readability and professionalism. Lastly, failing to update legal disclosures or security measures can result in compliance breaches and customer distrust.