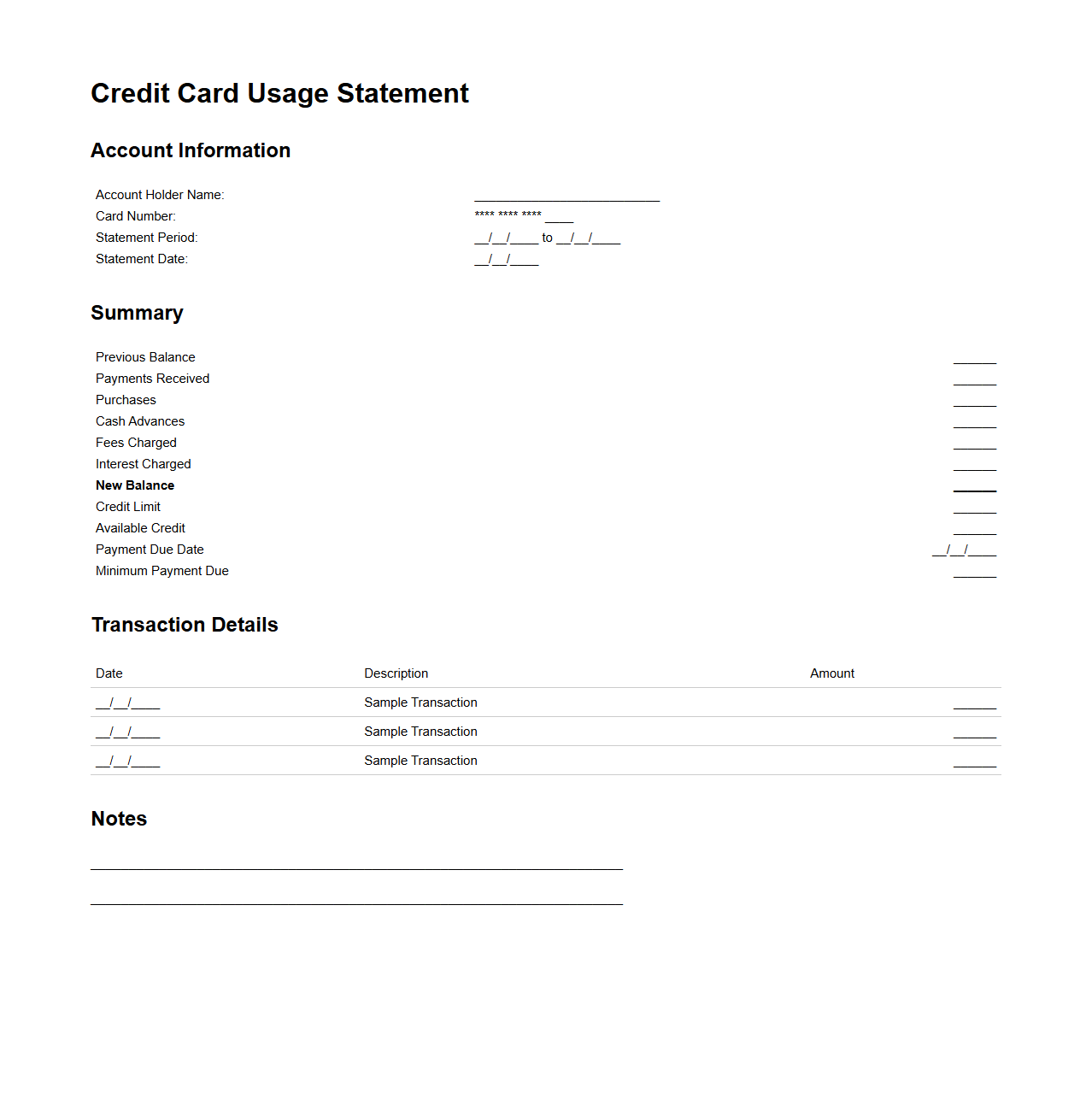

Credit Card Usage Statement Template

A

Credit Card Usage Statement Template document provides a structured format for recording and tracking credit card transactions, including purchase details, amounts, dates, and merchant information. It helps users maintain clear financial records for budgeting, expense management, and reconciliation purposes. This template streamlines monthly statements, making it easier to monitor credit card usage and detect any discrepancies or fraudulent activities.

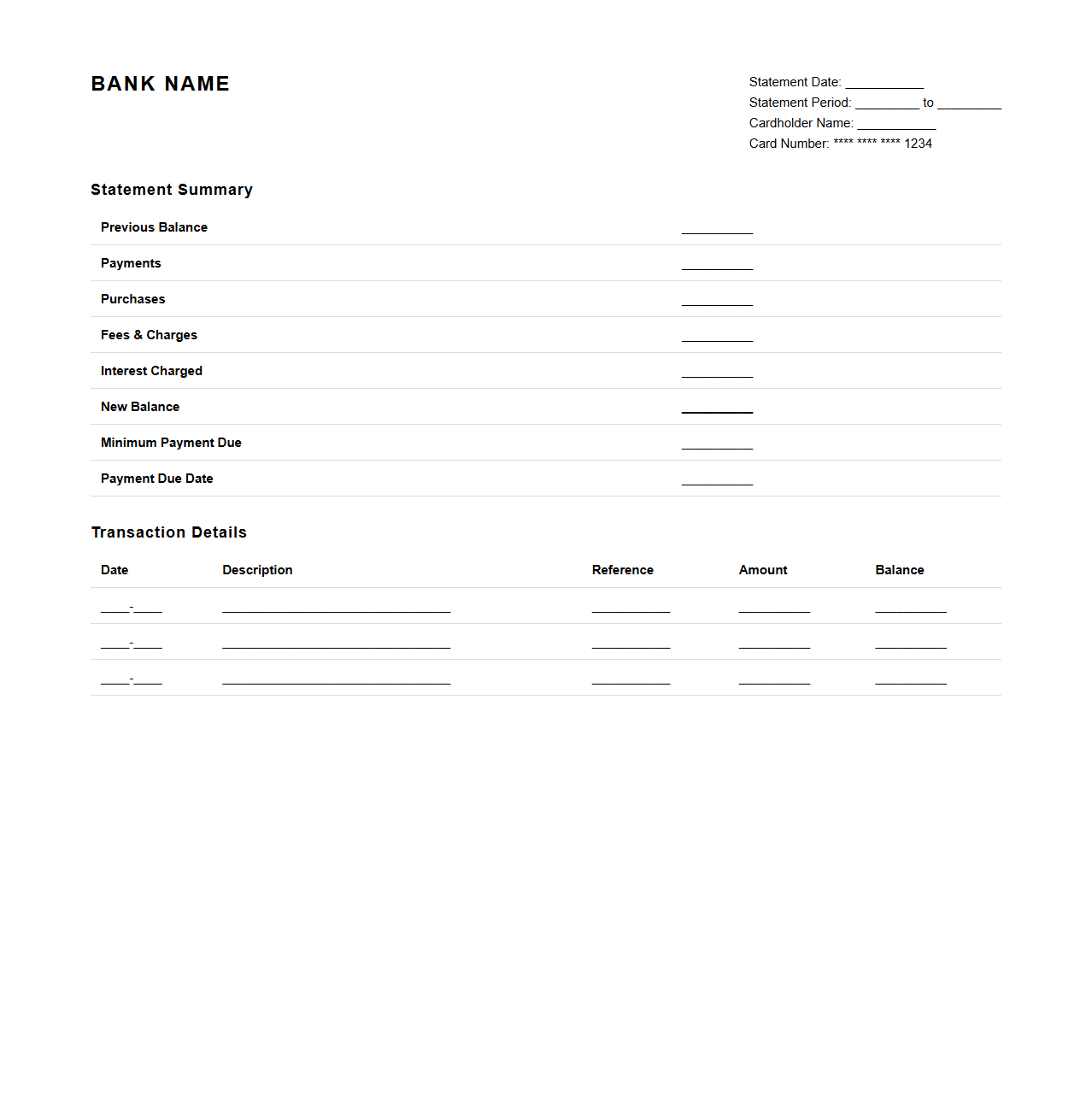

Credit Card Expenditure Statement Format

A

Credit Card Expenditure Statement Format document itemizes all transactions made using a credit card, detailing the date, merchant, amount, and category of each expense. It serves as a crucial financial record for budgeting, expense tracking, and dispute resolution. This format ensures clarity and organization, helping users monitor their spending patterns efficiently.

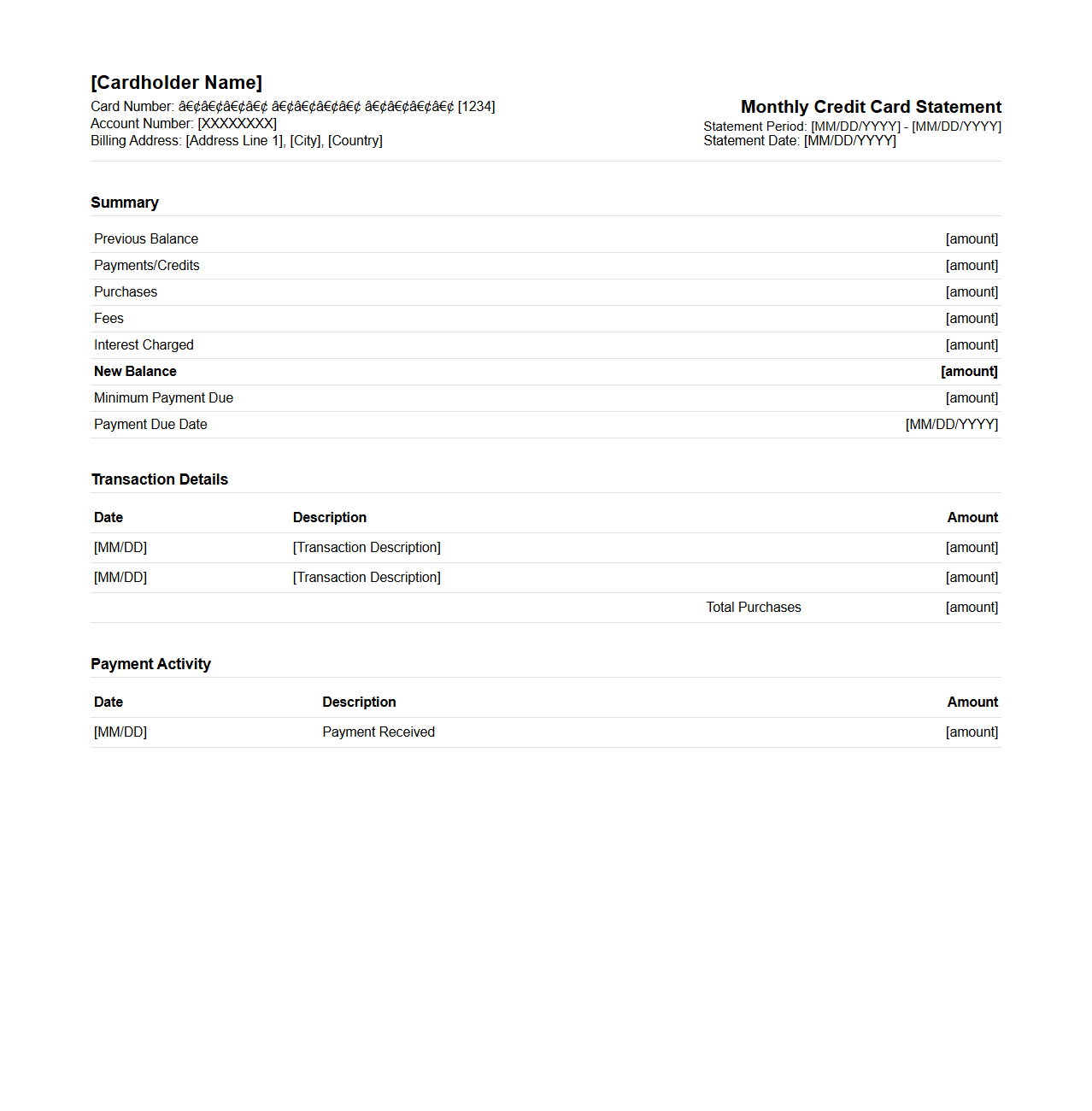

Monthly Credit Card Transaction Statement

A

Monthly Credit Card Transaction Statement is a detailed record provided by credit card issuers that summarizes all transactions made using the card within a billing cycle. It includes information such as purchase dates, merchant names, transaction amounts, payments, fees, and the outstanding balance. This document is essential for tracking expenses, verifying charges, and managing credit card accounts effectively.

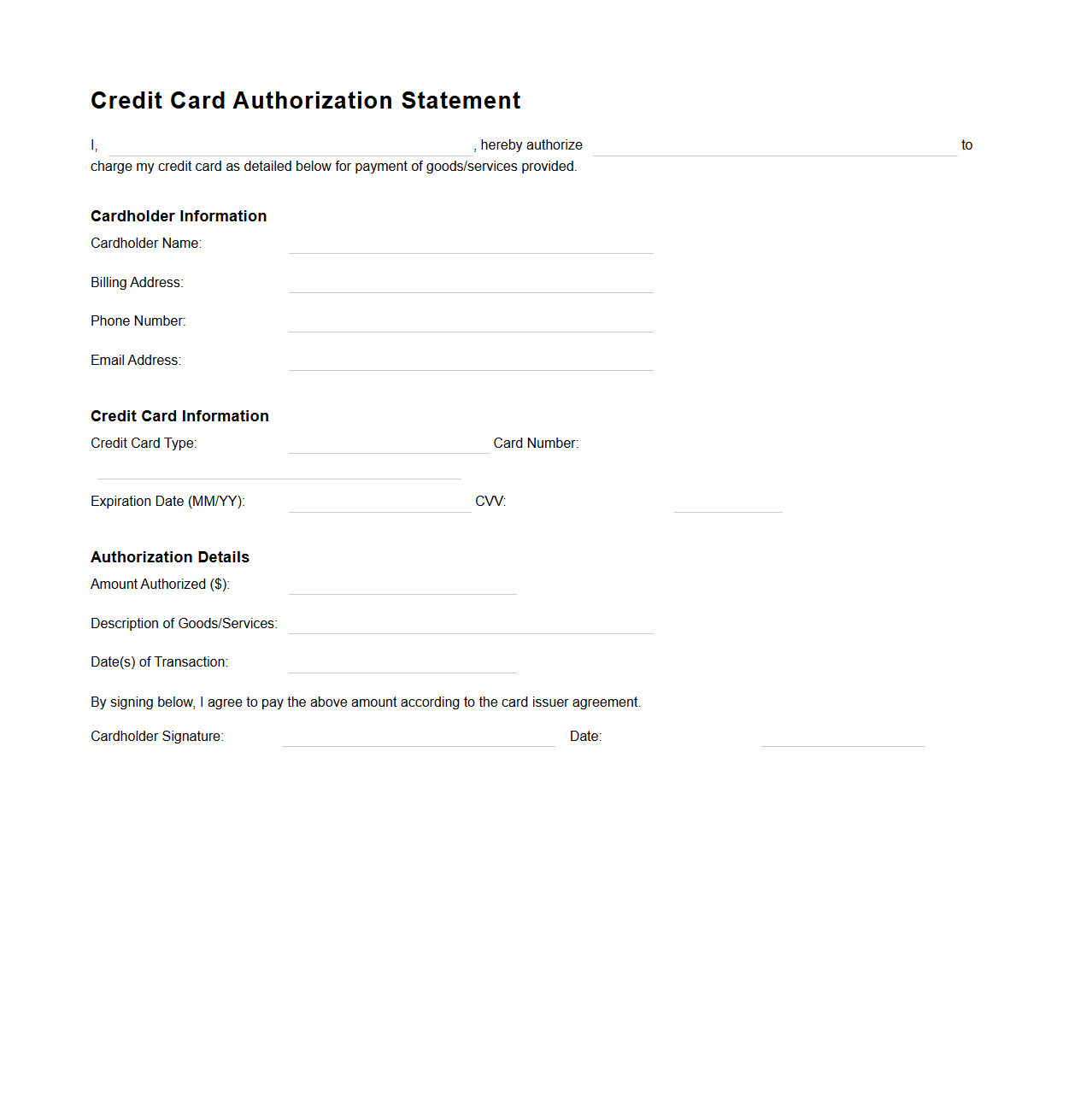

Credit Card Authorization Statement Sample

A

Credit Card Authorization Statement Sample document is a template used to obtain consent from a cardholder to charge their credit card for specified transactions. It typically includes essential details such as the cardholder's name, card number, transaction amount, date, and signature, ensuring compliance with payment processing regulations. This document helps businesses secure authorization while preventing fraudulent charges and disputes.

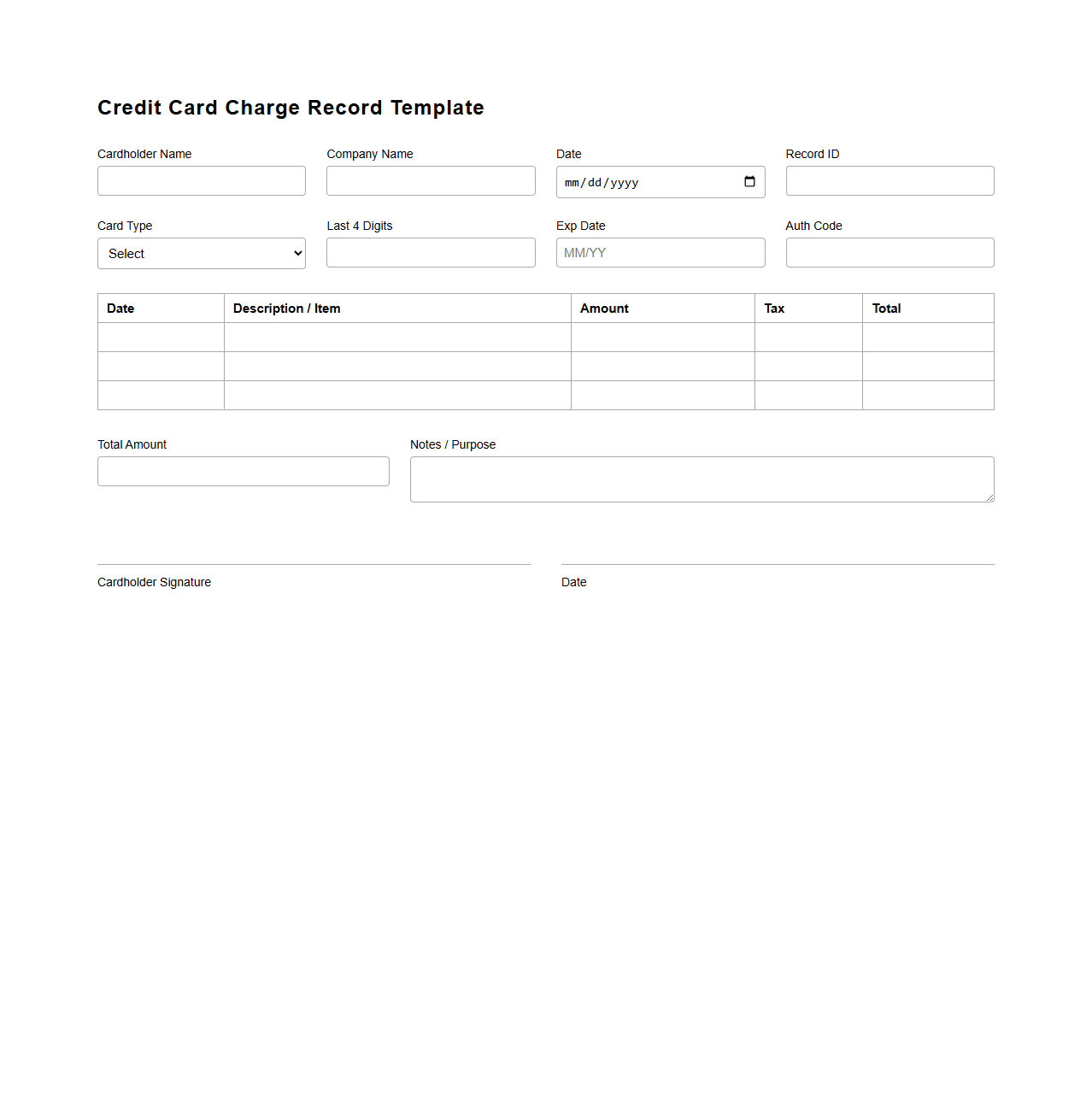

Credit Card Charge Record Template

A

Credit Card Charge Record Template document is a structured form designed to systematically track and document credit card transactions, including purchase amounts, dates, merchant details, and transaction IDs. This template aids in maintaining accurate financial records, simplifying expense monitoring, and facilitating reconciliation for businesses or individuals. It ensures transparency and accountability by providing a clear overview of credit card charges for audit and reporting purposes.

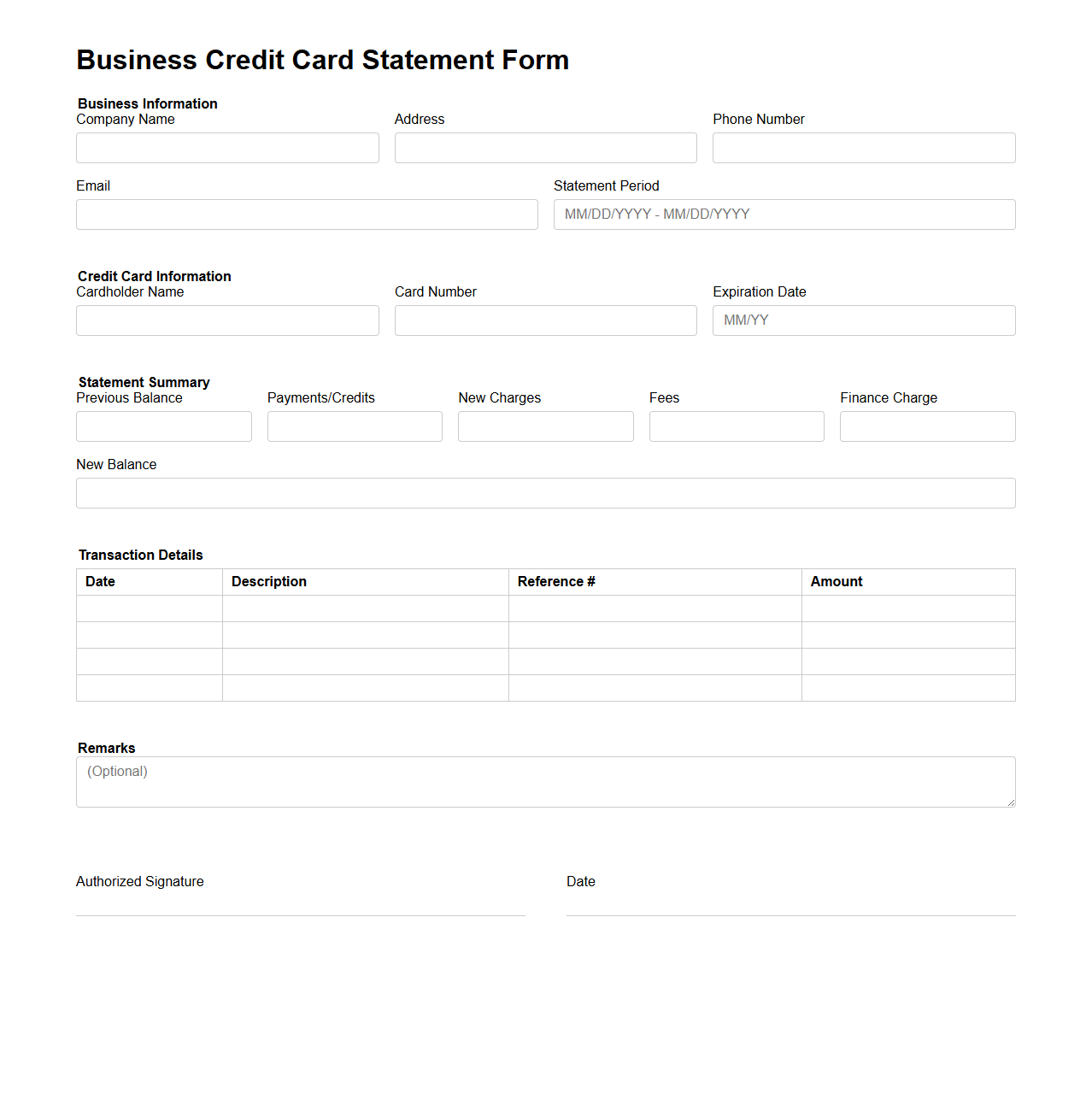

Credit Card Statement Form for Businesses

A

Credit Card Statement Form for Businesses is a financial document that details all transactions made using a business credit card within a specific billing cycle. It includes essential data such as transaction dates, merchant details, amounts spent, and any fees or interest charged, providing a clear overview for expense tracking and reconciliation. This form helps businesses monitor spending, verify payments, and maintain accurate accounting records.

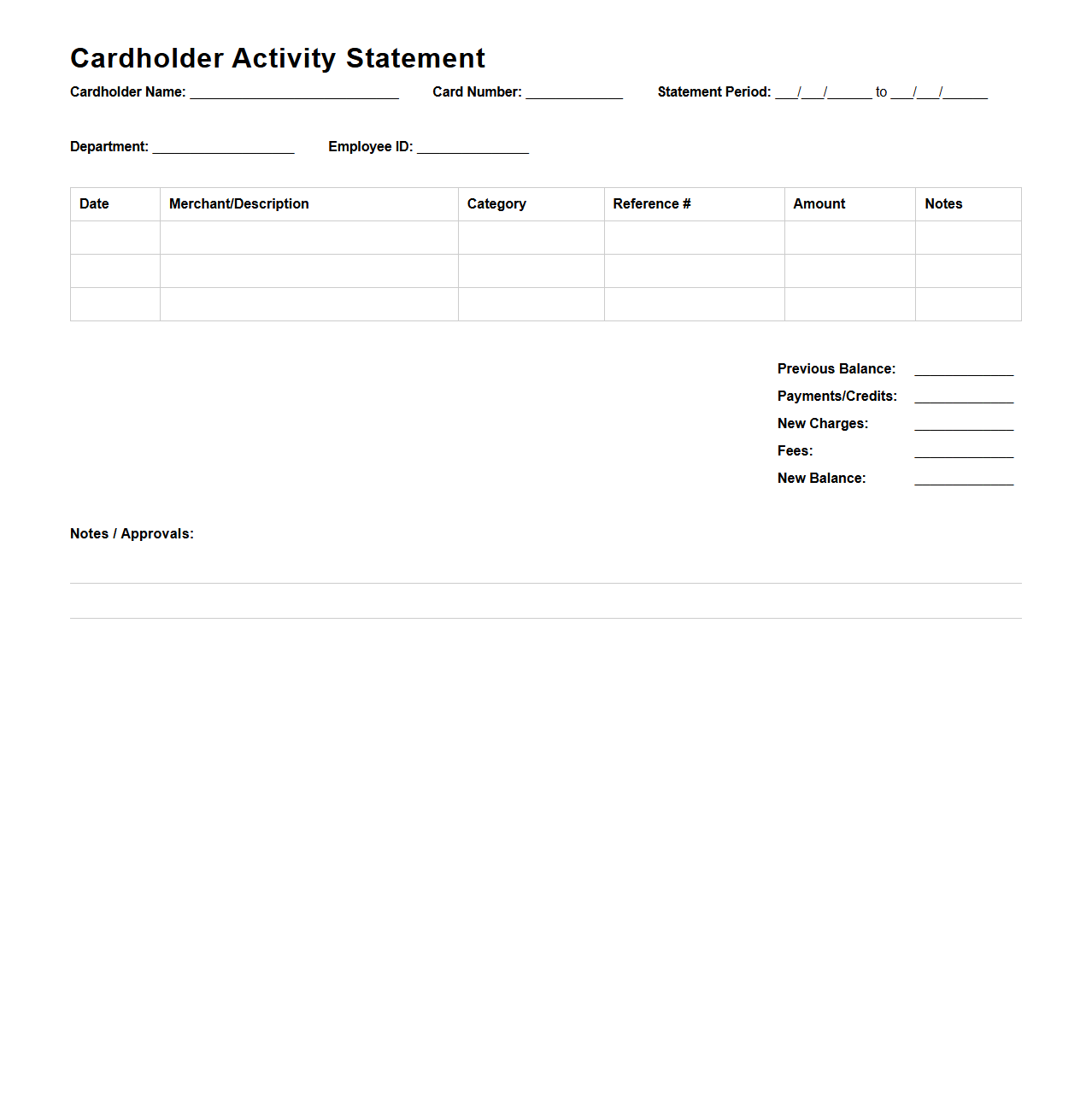

Cardholder Activity Statement Template

A

Cardholder Activity Statement Template is a structured document used to record and summarize transactions made by a cardholder over a specific period. It typically includes details such as transaction dates, merchant names, amounts spent, and any relevant notes to facilitate expense tracking and reconciliation. This template aids in maintaining accurate financial records for budgeting, auditing, and reporting purposes.

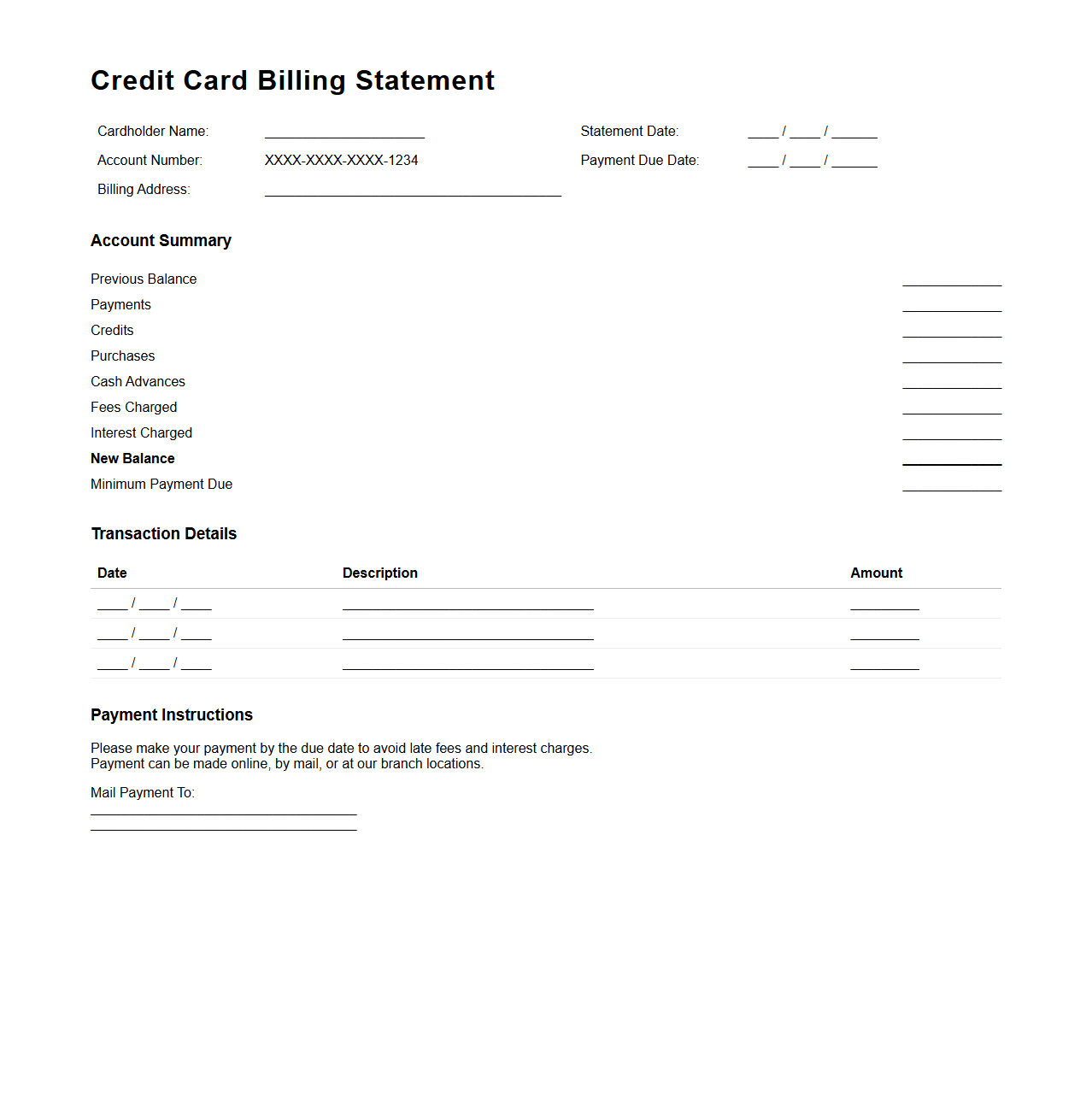

Credit Card Billing Statement Outline

A

Credit Card Billing Statement Outline document serves as a structured template that details the essential components of a credit card bill. It typically includes sections for the account summary, transactions, payments, fees, interest charges, and important dates such as the payment due date and billing period. This outline helps both issuers and cardholders clearly understand and organize the financial information related to credit card usage.

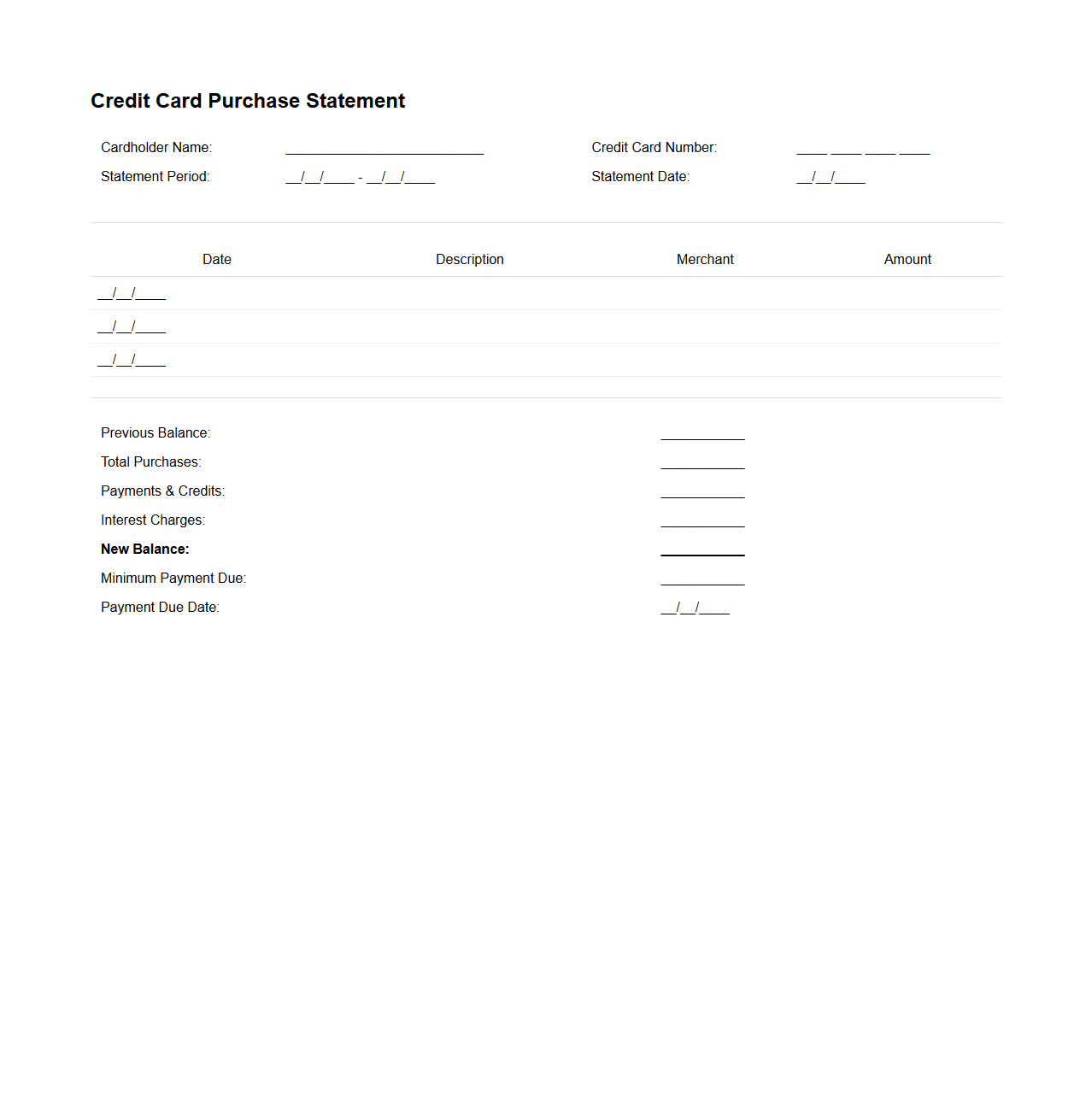

Credit Card Purchase Statement Sheet

A

Credit Card Purchase Statement Sheet document itemizes all transactions made using a credit card within a specific billing cycle. It provides detailed information on purchase dates, merchant names, amounts spent, and any applicable fees or interest charges. This statement is essential for tracking expenses, verifying charges, and managing credit card payments effectively.

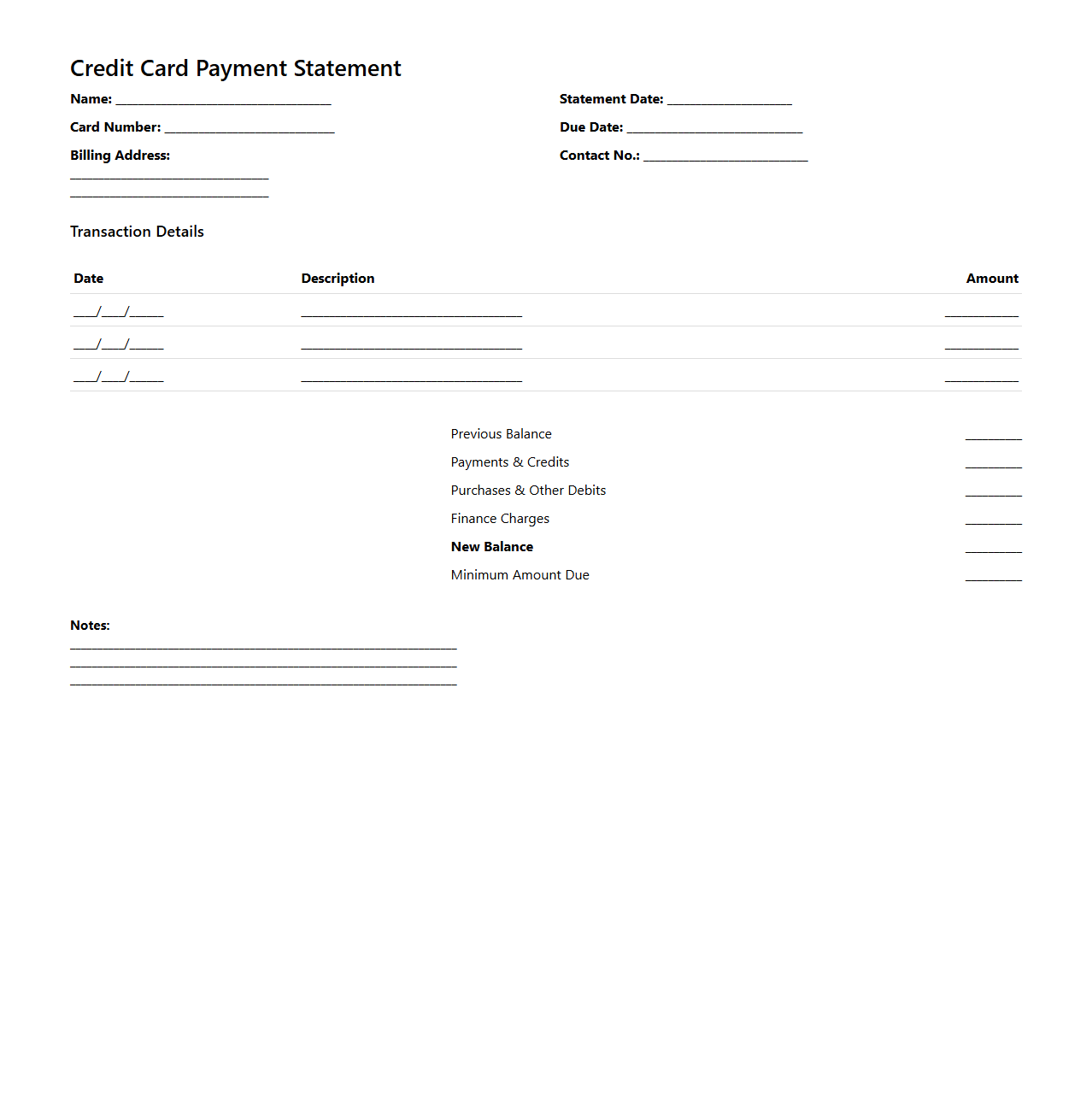

Credit Card Payment Statement Format

A

Credit Card Payment Statement Format document outlines the structured layout used by financial institutions to present details of a credit card account's transactions, balances, and payment information. It typically includes sections for the billing period, total amount due, minimum payment required, payment due date, transaction history, and interest charges. This standardized format ensures clarity and helps cardholders track spending and manage payments effectively.

What information should be included in a blank statement for credit card use authorization?

A blank statement for credit card use authorization must include the cardholder's full name and authorized signature. It should clearly state the terms and conditions for the authorized use of the credit card. Additionally, specifying the permitted transaction limits and duration of authorization is essential.

Are there legal requirements for formatting a blank statement for credit card use?

There are legal requirements that vary by jurisdiction, but typically the statement must be clear, concise, and unambiguous. It should comply with consumer protection laws to ensure the cardholder understands the scope of the authorization. Proper formatting also involves including contact information and date of consent for validation.

How can a blank statement for credit card use protect against fraud?

A blank credit card use authorization can protect against fraud by limiting unauthorized transactions through defined spending limits. It provides a formal record that the cardholder consents to specific use, making any deviation easier to identify. This documentation acts as evidence in disputes regarding fraudulent charges.

When is a blank statement for credit card use considered invalid?

A blank statement becomes invalid if it lacks the cardholder's signature or if the authorization terms are vague or incomplete. It is also considered invalid if the cardholder withdraws consent or if the statement contradicts regulatory guidelines. Unauthorized alterations or expired authorizations further render the statement void.

Can a blank statement for credit card use be submitted electronically?

Yes, a blank credit card use authorization can be submitted electronically when it complies with electronic signature laws. Secure and encrypted methods must be used to protect sensitive cardholder information. Electronic submissions also require proper verification to maintain legal validity.