A Blank Credit Card Application Template for Financial Institutions streamlines the process of gathering essential applicant information, ensuring compliance with regulatory standards. This customizable template facilitates efficient data collection, including personal details, financial status, and credit history verification. Financial institutions benefit from its clarity and consistency, enhancing both customer experience and internal processing accuracy.

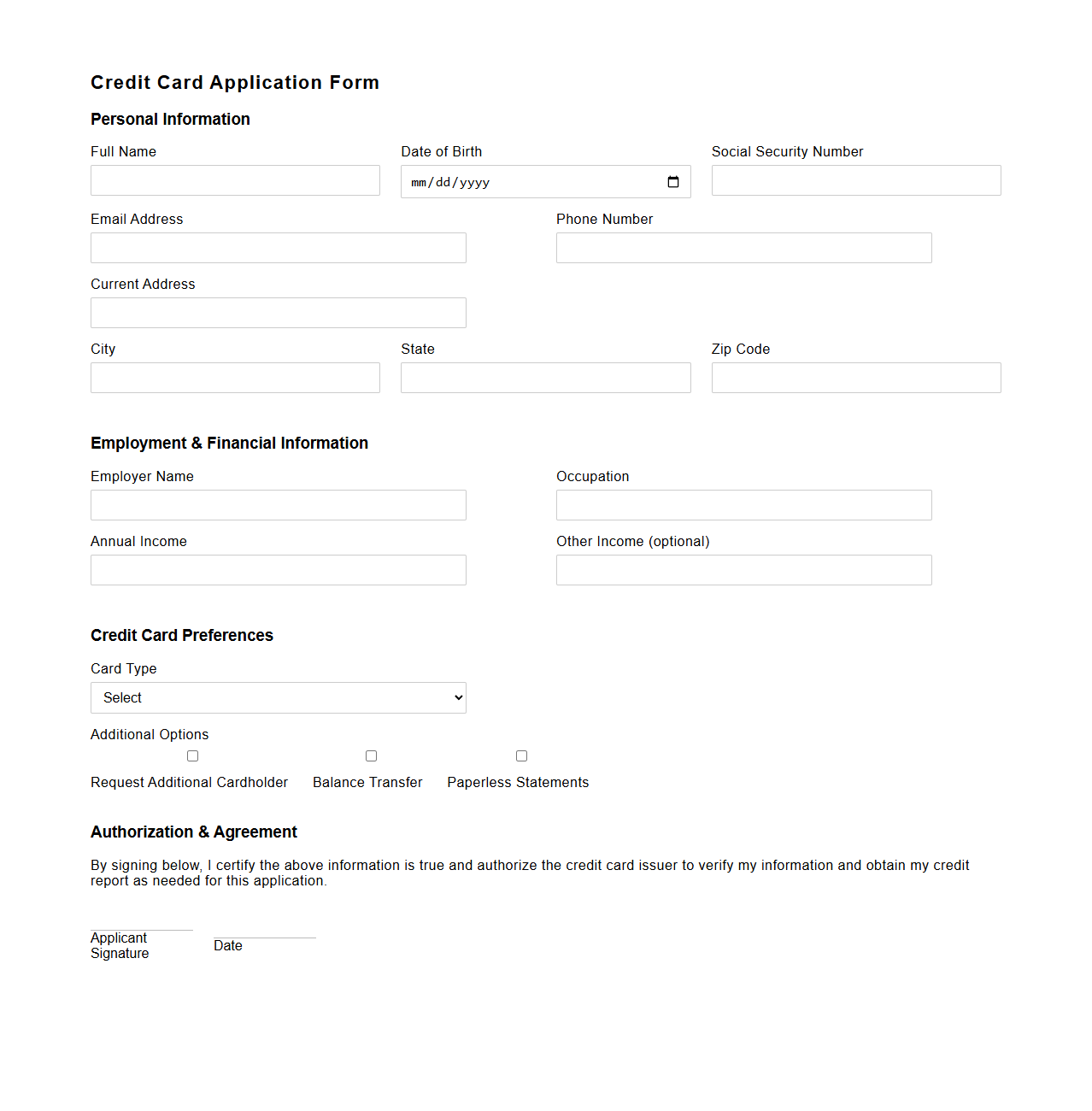

Standard Blank Credit Card Application Form Template

A

Standard Blank Credit Card Application Form Template is a pre-designed document used by financial institutions to collect necessary personal and financial information from applicants seeking a credit card. This template ensures consistent data capture, including details like applicant name, contact information, employment status, income, and authorization consent. Its standardized format streamlines the credit approval process and enhances accuracy in creditworthiness evaluation.

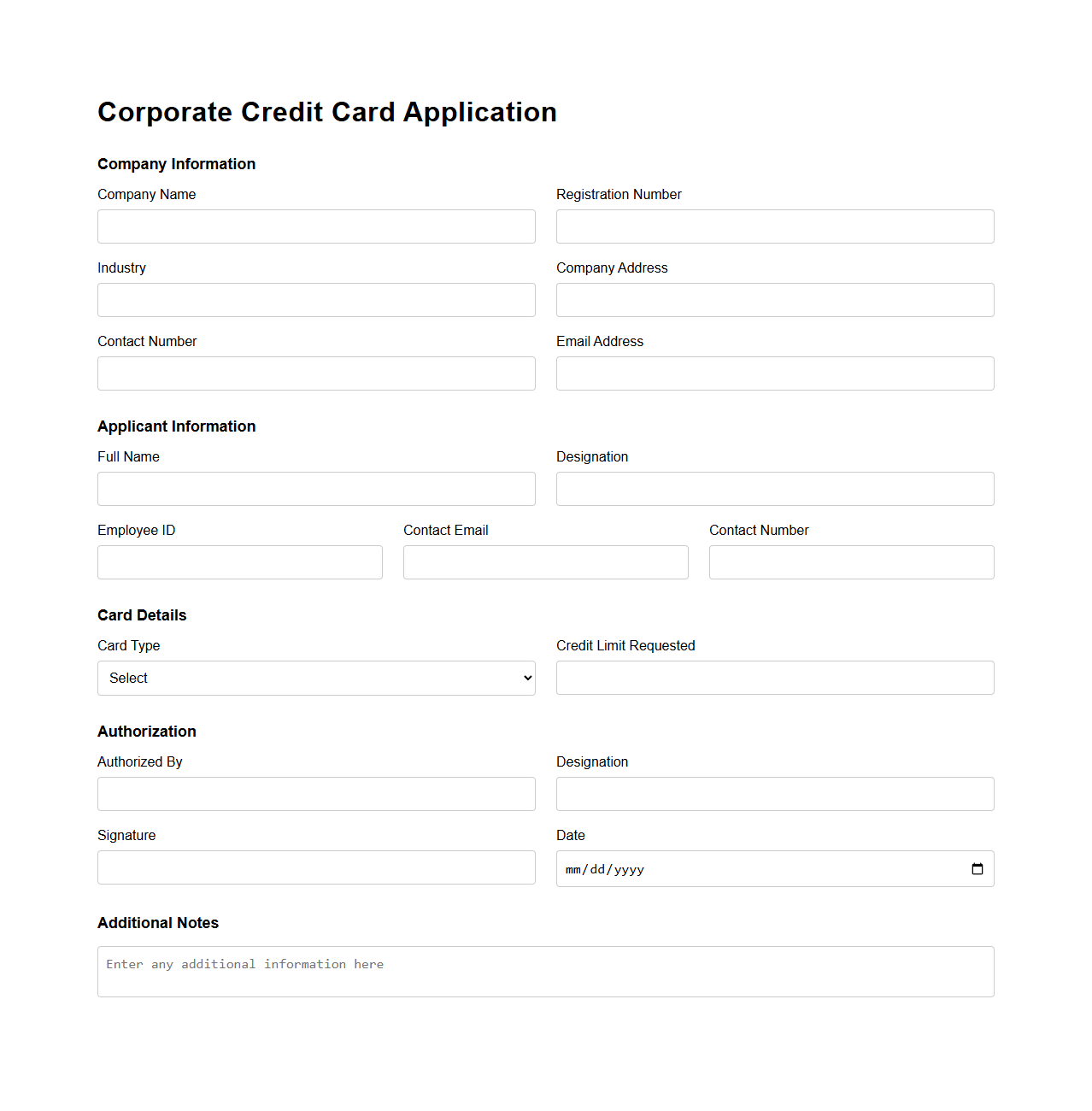

Corporate Credit Card Application Blank Template

A

Corporate Credit Card Application Blank Template document serves as a standardized form used by businesses to collect essential information from employees or departments requesting company credit cards. It typically includes fields for personal details, department information, credit limit requests, and required approvals, ensuring compliance with corporate policies. This template streamlines the application process and enables efficient tracking and management of issued corporate credit cards.

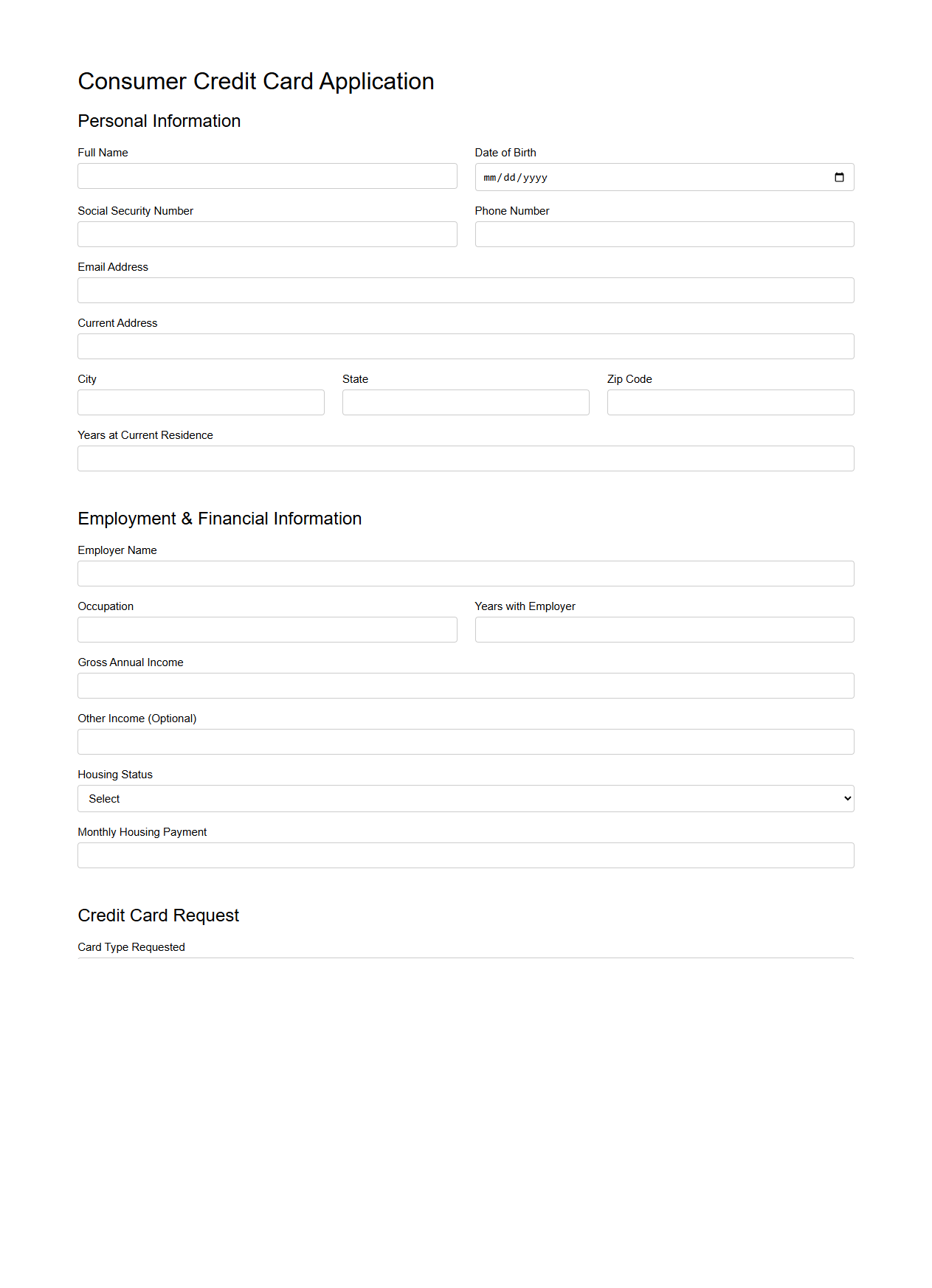

Consumer Blank Credit Card Application Template

A

Consumer Blank Credit Card Application Template is a standardized form designed to collect essential personal and financial information from individuals seeking to apply for a credit card. It typically includes fields for name, address, income, employment details, and authorization signatures, ensuring compliance with banking regulations and facilitating efficient processing. This template streamlines the application process for both consumers and financial institutions by providing a clear, organized framework for data collection.

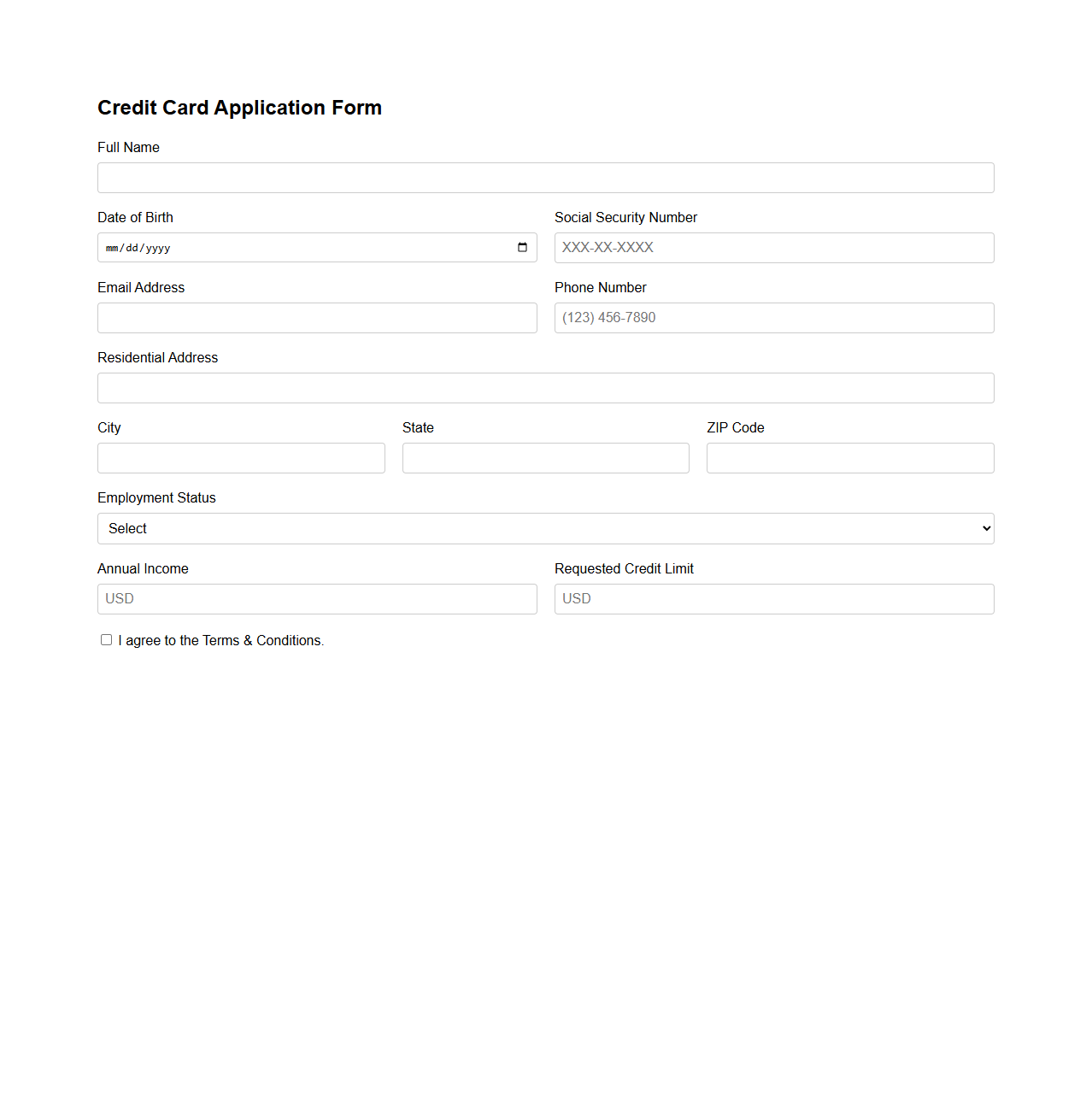

Basic Blank Credit Card Application Form for Banks

A

Basic Blank Credit Card Application Form for banks is a standardized document used to collect essential personal and financial information from applicants seeking credit card approval. This form typically includes fields for applicant details, income verification, employment history, and consent for credit checks. Banks utilize this form to evaluate creditworthiness and process credit card requests efficiently.

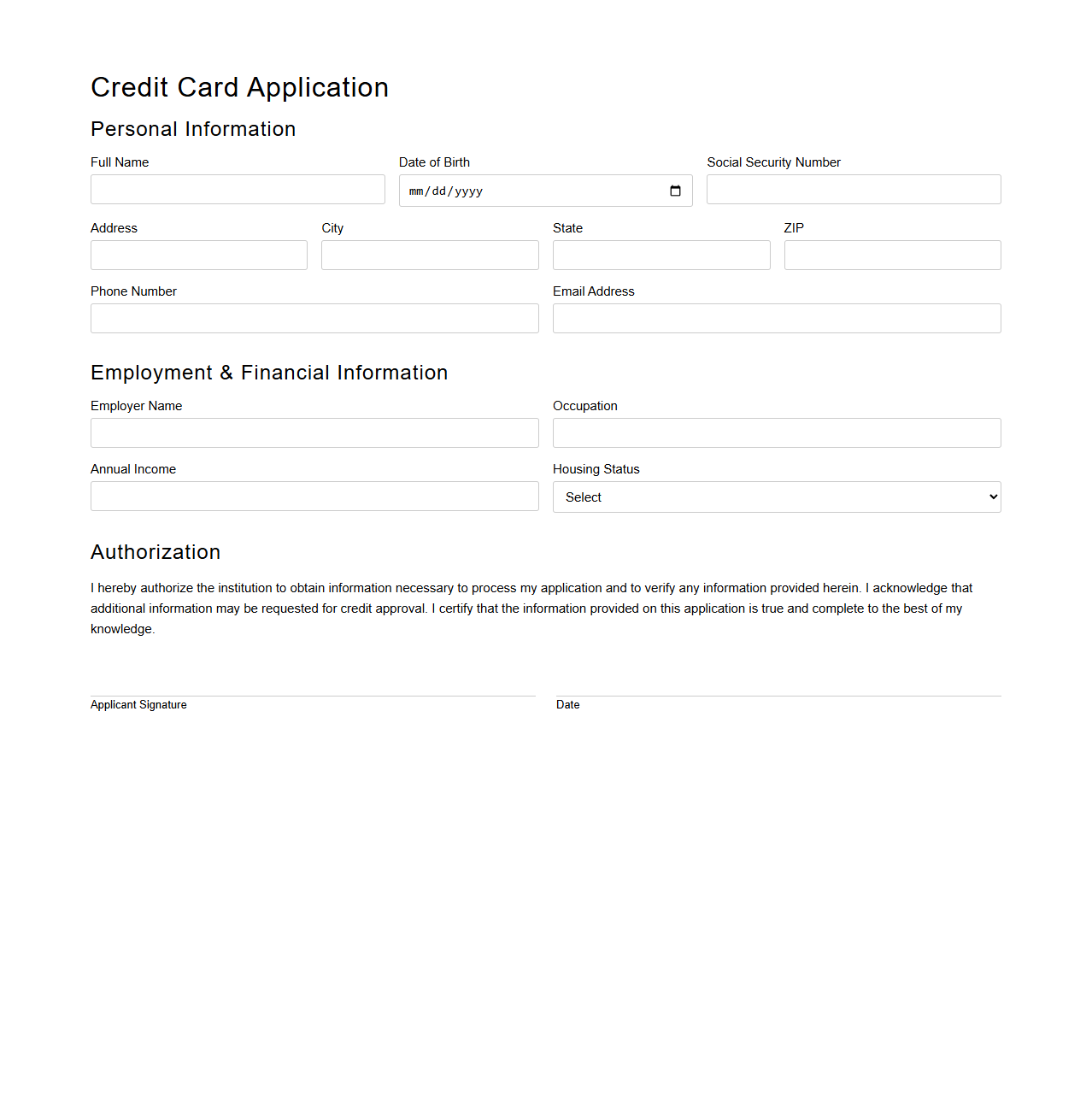

Blank Credit Card Application Template With Authorization Section

A

Blank Credit Card Application Template With Authorization Section is a pre-designed form used by financial institutions to gather essential applicant information and obtain explicit consent for credit evaluation and processing. This document streamlines the application process by including fields for personal details, financial data, and a legally binding authorization statement, ensuring compliance with regulatory standards. Utilizing this template enhances efficiency, accuracy, and secure handling of sensitive applicant information.

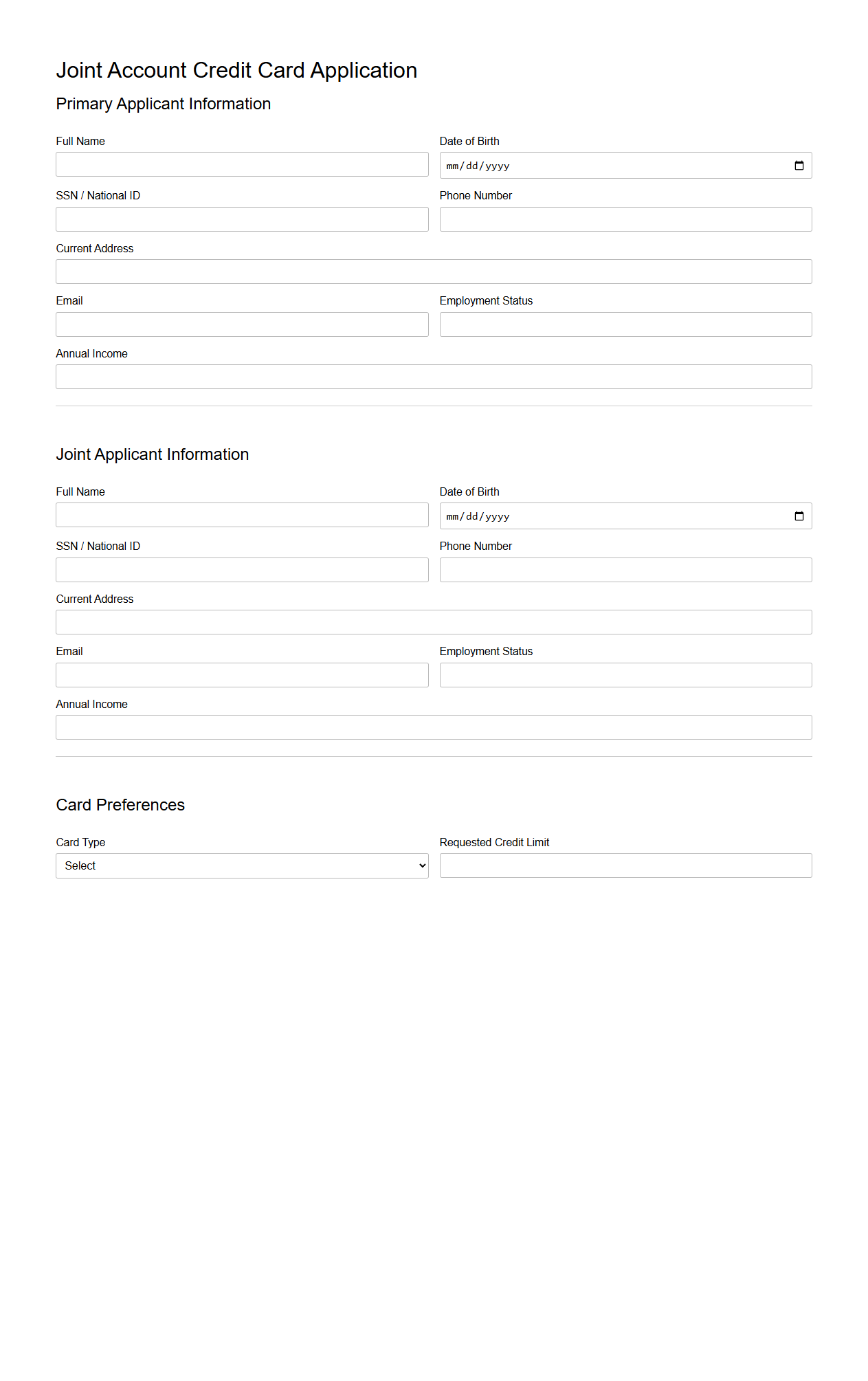

Joint Account Blank Credit Card Application Template

The

Joint Account Blank Credit Card Application Template document serves as a standardized form designed for multiple applicants who wish to apply for a credit card together. It includes sections for personal information, financial details, and consent agreements for each applicant, streamlining the submission and approval process. This template enhances accuracy and efficiency by ensuring all necessary data is collected uniformly for joint credit card applications.

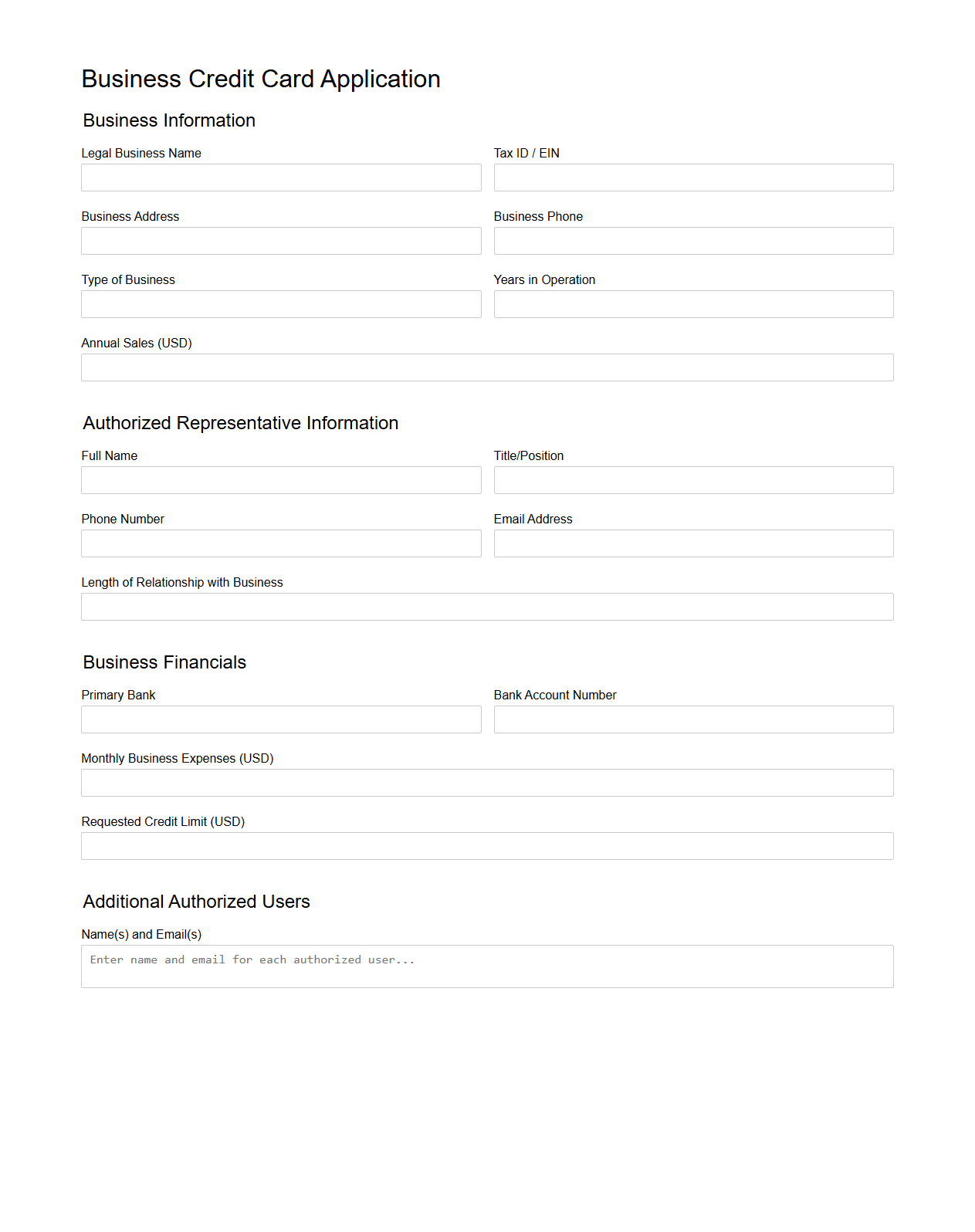

Blank Credit Card Application Template for Business Clients

A

Blank Credit Card Application Template for Business Clients is a standardized form designed to streamline the process of applying for a business credit card. It typically includes essential fields such as company information, financial details, authorized user data, and credit terms. This template ensures consistency, reduces errors, and expedites approval by collecting all necessary information in a clear, organized manner.

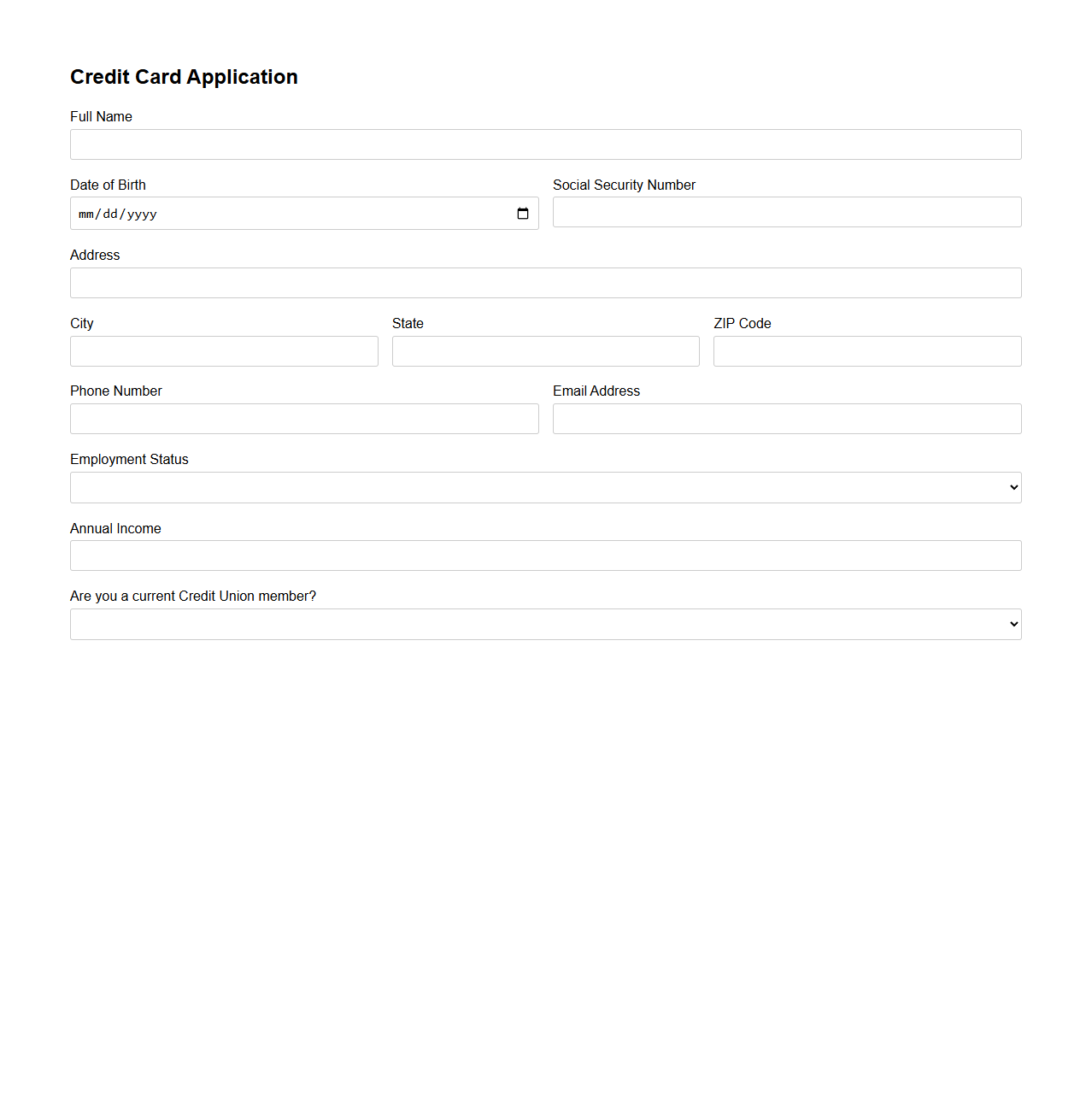

Simple Blank Credit Card Application Form for Credit Unions

A

Simple Blank Credit Card Application Form for Credit Unions is a standardized document designed to collect essential personal and financial information from applicants seeking credit cards. This form typically includes fields for identification details, employment status, income verification, and contact information, streamlining the approval process. Utilizing this document helps credit unions efficiently assess creditworthiness while maintaining compliance with regulatory standards.

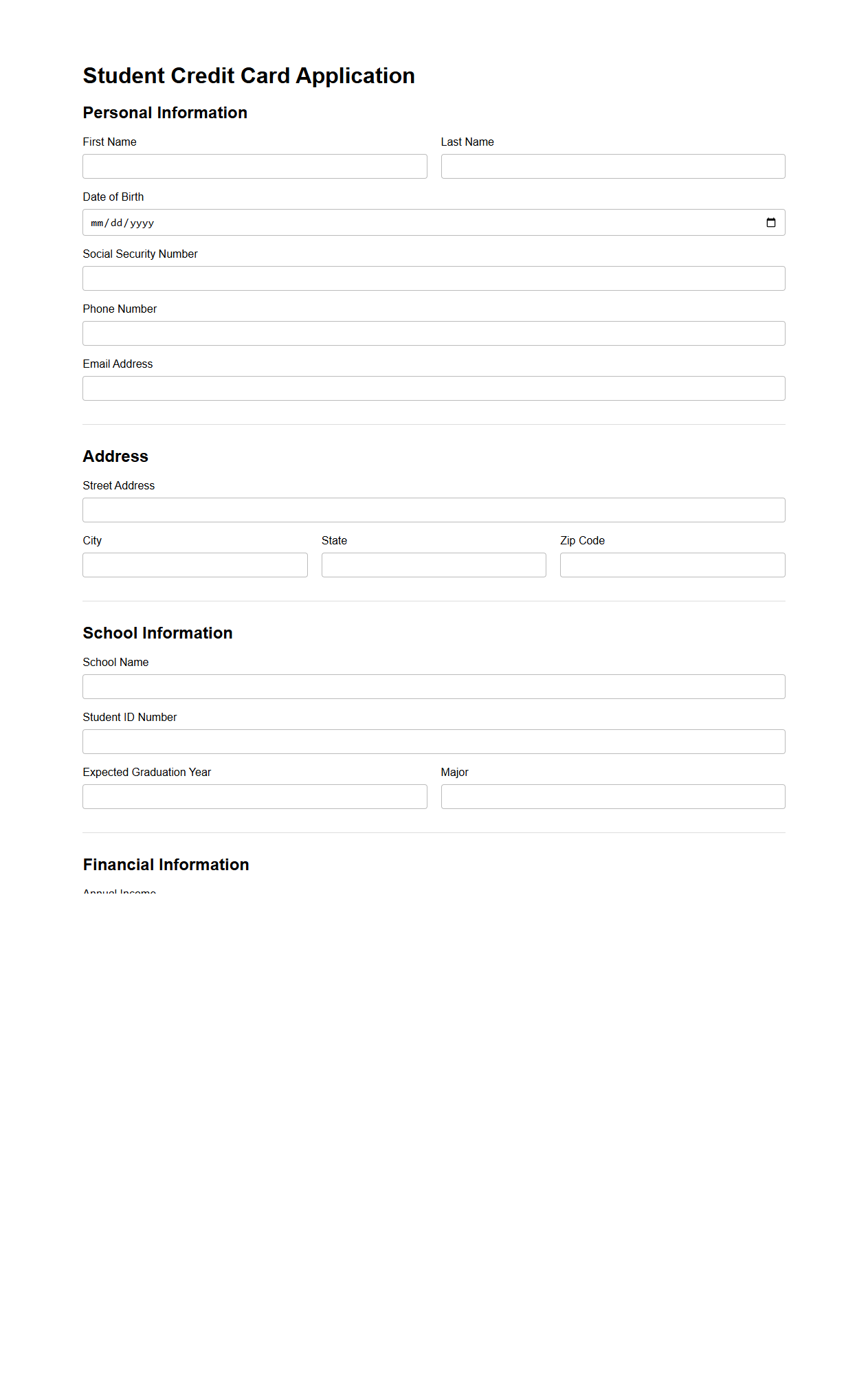

Student Blank Credit Card Application Template

A

Student Blank Credit Card Application Template is a customizable form designed to streamline the process of applying for a student credit card. It typically includes sections for personal information, educational details, financial background, and consent agreements, ensuring all essential data is captured accurately. This template helps financial institutions and applicants by providing a clear, easy-to-fill document that facilitates faster processing and approval of student credit card applications.

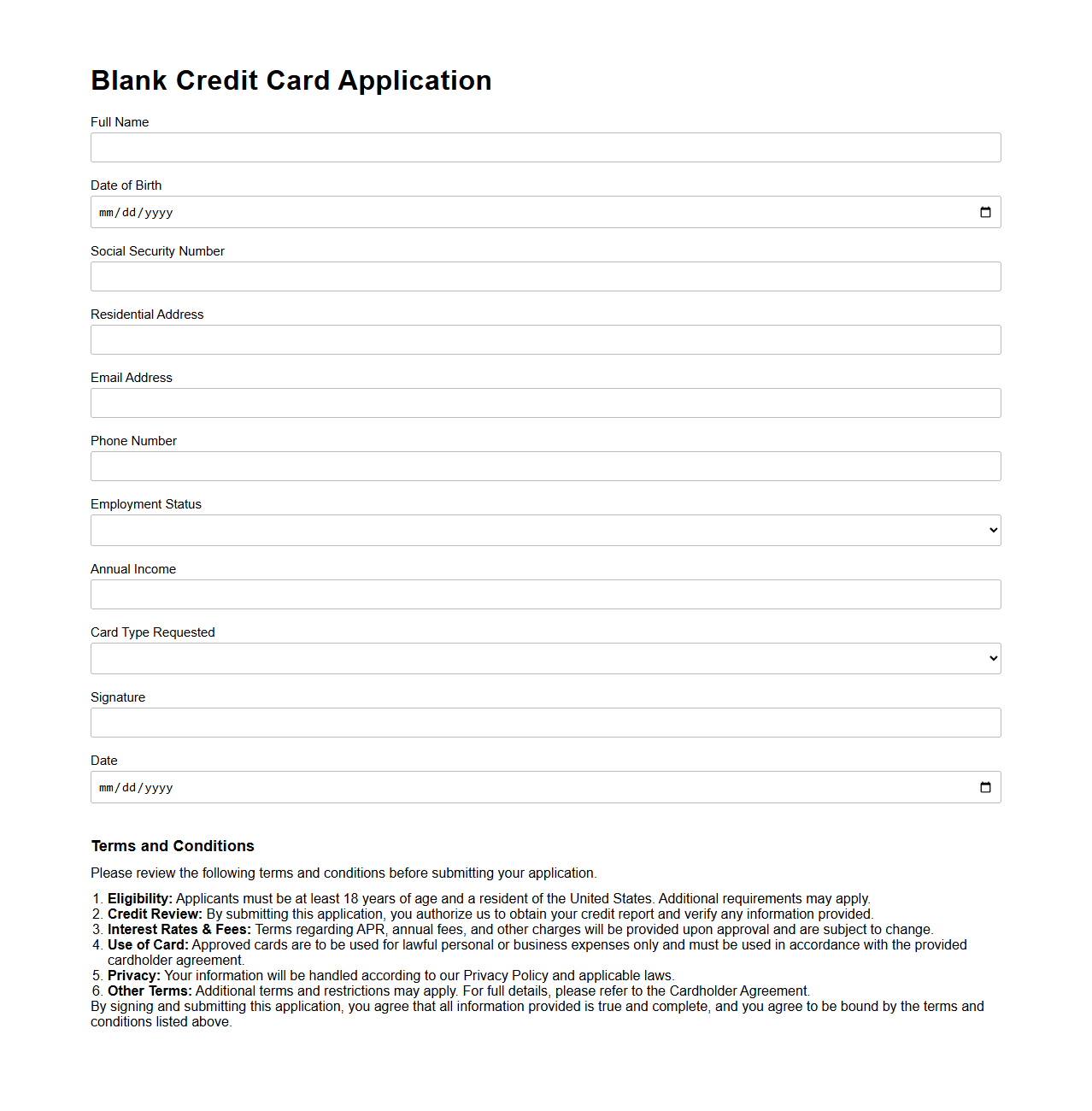

Blank Credit Card Application Template with Terms and Conditions

A

Blank Credit Card Application Template with Terms and Conditions document is a pre-designed form that financial institutions use to collect applicant information for credit card processing while clearly outlining the contractual rules. It typically includes fields for personal details, income information, credit history, and agreement sections specifying interest rates, fees, payment obligations, and user responsibilities. This template ensures compliance with regulatory requirements and provides transparency to applicants about their rights and liabilities before submitting their application.

Mandatory Data Fields for Regulatory Compliance on Credit Card Applications

The mandatory data fields on blank credit card applications typically include full legal name, date of birth, Social Security Number (SSN), and residential address. These fields ensure compliance with KYC (Know Your Customer) and anti-money laundering regulations. Additionally, income information and employment status are often required to assess creditworthiness and regulatory eligibility.

Consent Language for Data Sharing in Credit Card Applications

Consent language should be clear, concise, and transparent, explicitly stating the purpose of data sharing and with whom the data will be shared. It must include a statement about the applicant's rights to withdraw consent at any time. Using affirmative language such as "I agree to share my information with third parties for credit evaluation and marketing purposes" enhances legal compliance.

Standard Validation Markers for Digital Credit Card Onboarding Forms

Digital credit card forms commonly include validation markers like real-time field verification, format checks (e.g., SSN with 9 digits), and mandatory field completion alerts. Additional markers may include CAPTCHA to prevent bots and email verification to confirm applicant identity. These validations ensure data integrity and smooth onboarding workflow.

Recommended Anti-Fraud Features for Physical Credit Card Applications

Physical credit card applications benefit from anti-fraud features such as secure watermarked paper, tamper-evident ink, and microprint patterns to prevent forgery. Incorporating a unique barcode or QR code linked to the applicant's data helps in authentication. Also, requiring double verification signatures reduces the risk of fraudulent submissions.

Updating Credit Card Templates for Interest Rate Disclosure Rules

Credit card application templates must be regularly reviewed to reflect changes in interest rate disclosure regulations. Updating involves clearly stating APRs, penalty rates, and calculation methods in a dedicated section of the form. Ensuring these updates comply with federal and state guidelines improves transparency and regulatory adherence.

More Application Templates