A Blank Loan Application Template for Banks provides a structured format for borrowers to submit essential financial and personal information required by lending institutions. This template ensures all necessary details are captured efficiently, streamlining the loan review and approval process. Customized for various loan types, it helps banks maintain consistency and accuracy in evaluating applications.

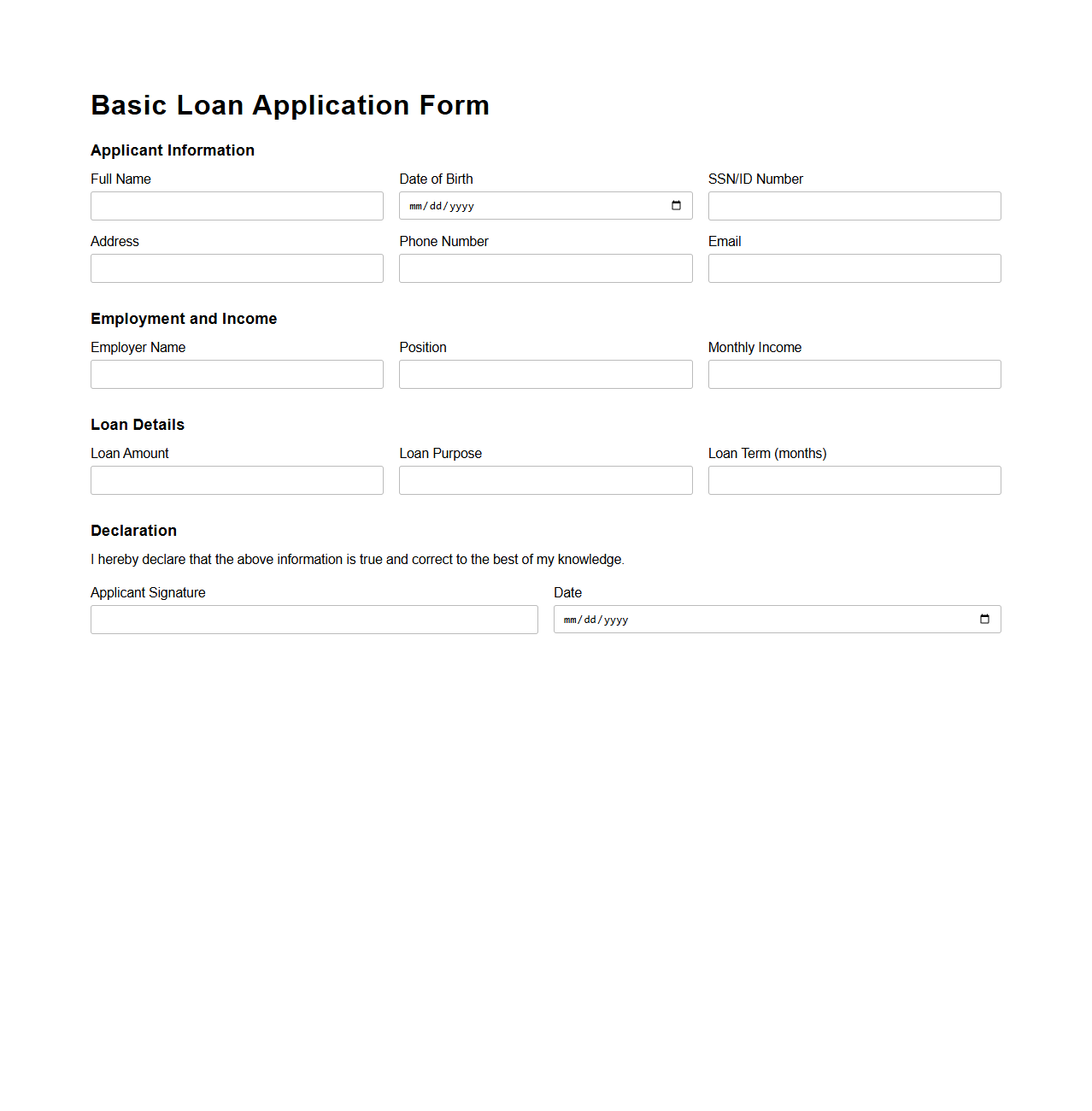

Basic Loan Application Template for Bank Use

A

Basic Loan Application Template for Bank Use is a standardized document designed to collect essential borrower information, including personal details, financial status, and loan purpose. This template streamlines the loan approval process by ensuring consistent data submission and facilitating quick assessment by bank officers. It typically includes fields for income verification, credit history, and collateral details to help banks evaluate the applicant's creditworthiness effectively.

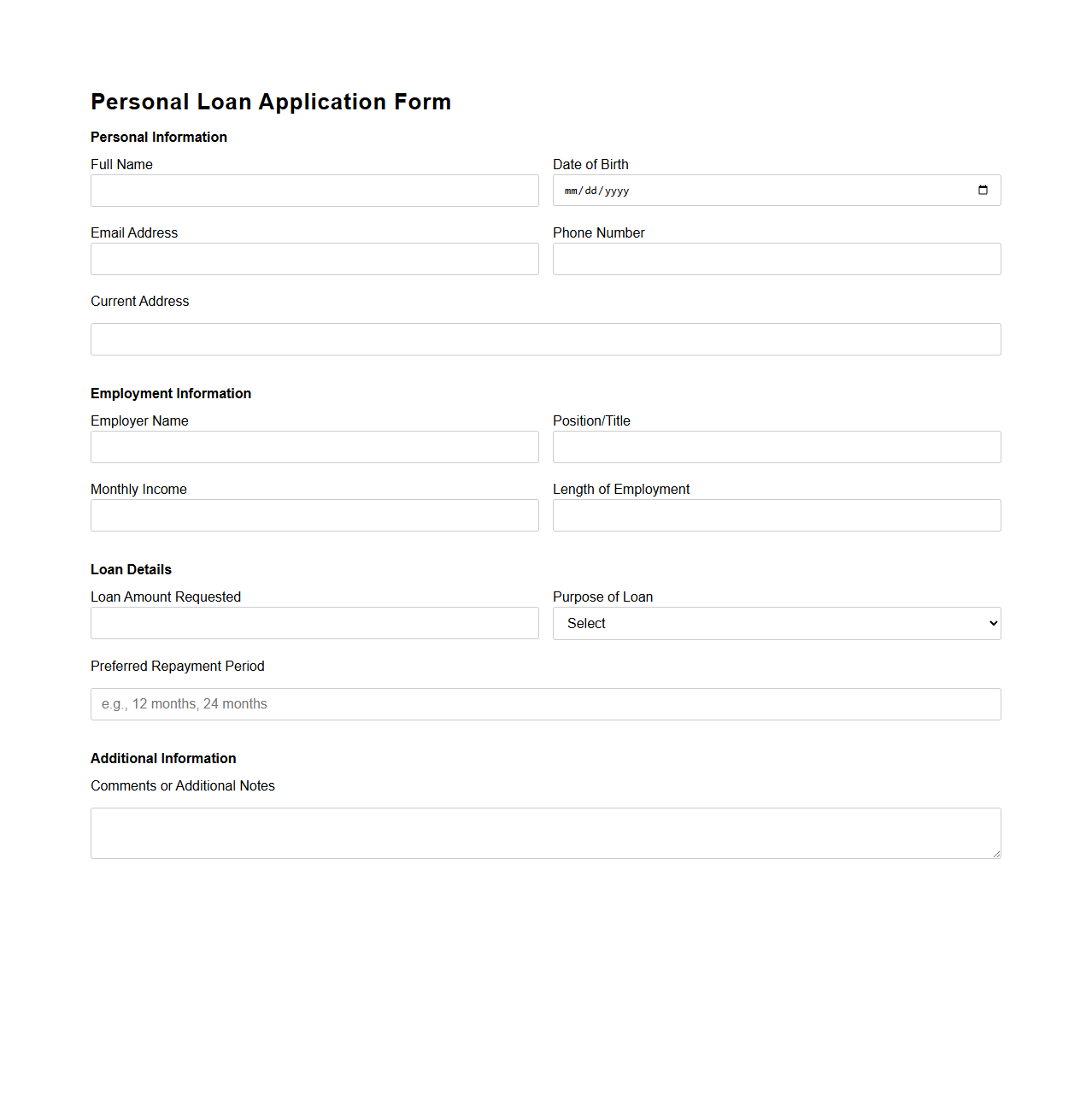

Personal Loan Application Form Template

A

Personal Loan Application Form Template is a standardized document designed to collect essential information from applicants seeking personal loans. It typically includes fields for personal identification details, financial information, employment status, and loan amount requested, enabling lenders to evaluate creditworthiness efficiently. Using this template streamlines the application process, ensuring consistency and compliance with lending policies.

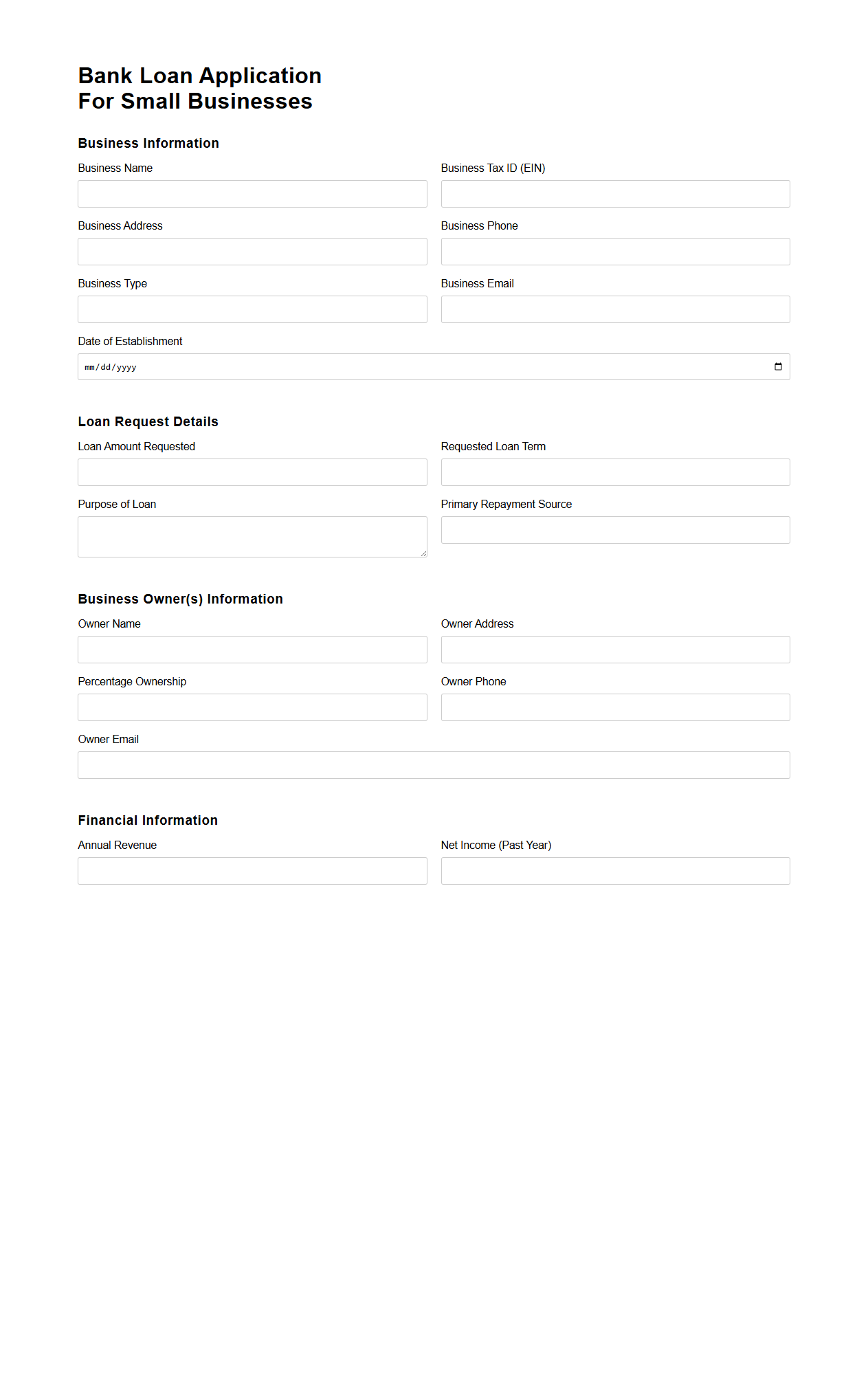

Bank Loan Application Template for Small Businesses

A

Bank Loan Application Template for Small Businesses is a structured document designed to help entrepreneurs systematically present financial information, business plans, and credit history when applying for a loan. This template ensures all critical details such as loan amount, purpose, repayment terms, and collateral are clearly outlined to increase the chances of approval. Using a standardized format simplifies communication with banks and speeds up the evaluation process.

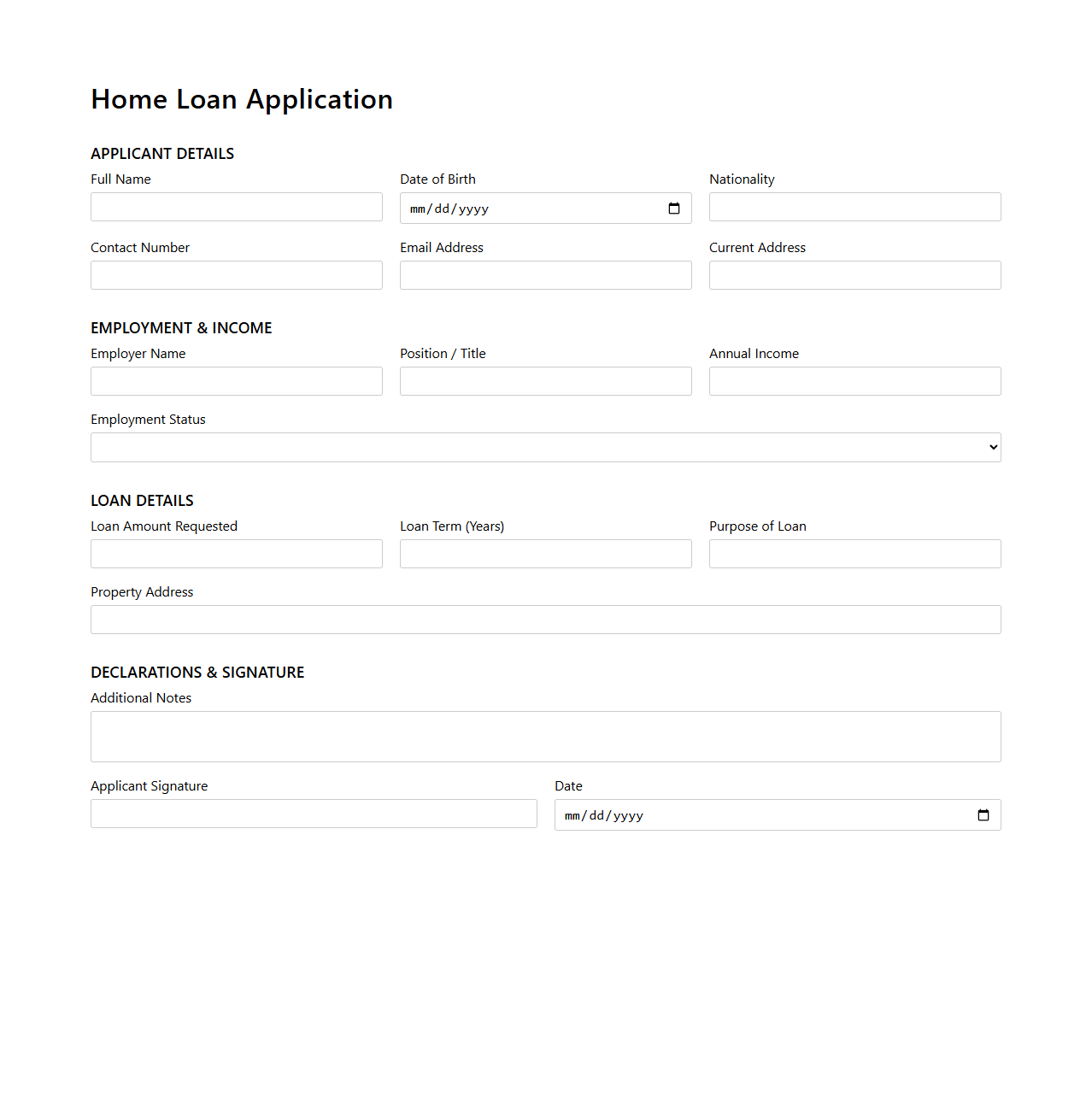

Home Loan Application Document Template

A

Home Loan Application Document Template is a structured form designed to collect essential information from borrowers seeking mortgage financing. It typically includes sections for personal details, employment history, income verification, credit information, and property specifics, ensuring lenders receive comprehensive data for loan assessment. Using this template streamlines the application process, enhances accuracy, and facilitates faster approval decisions by providing a consistent format for all applicants.

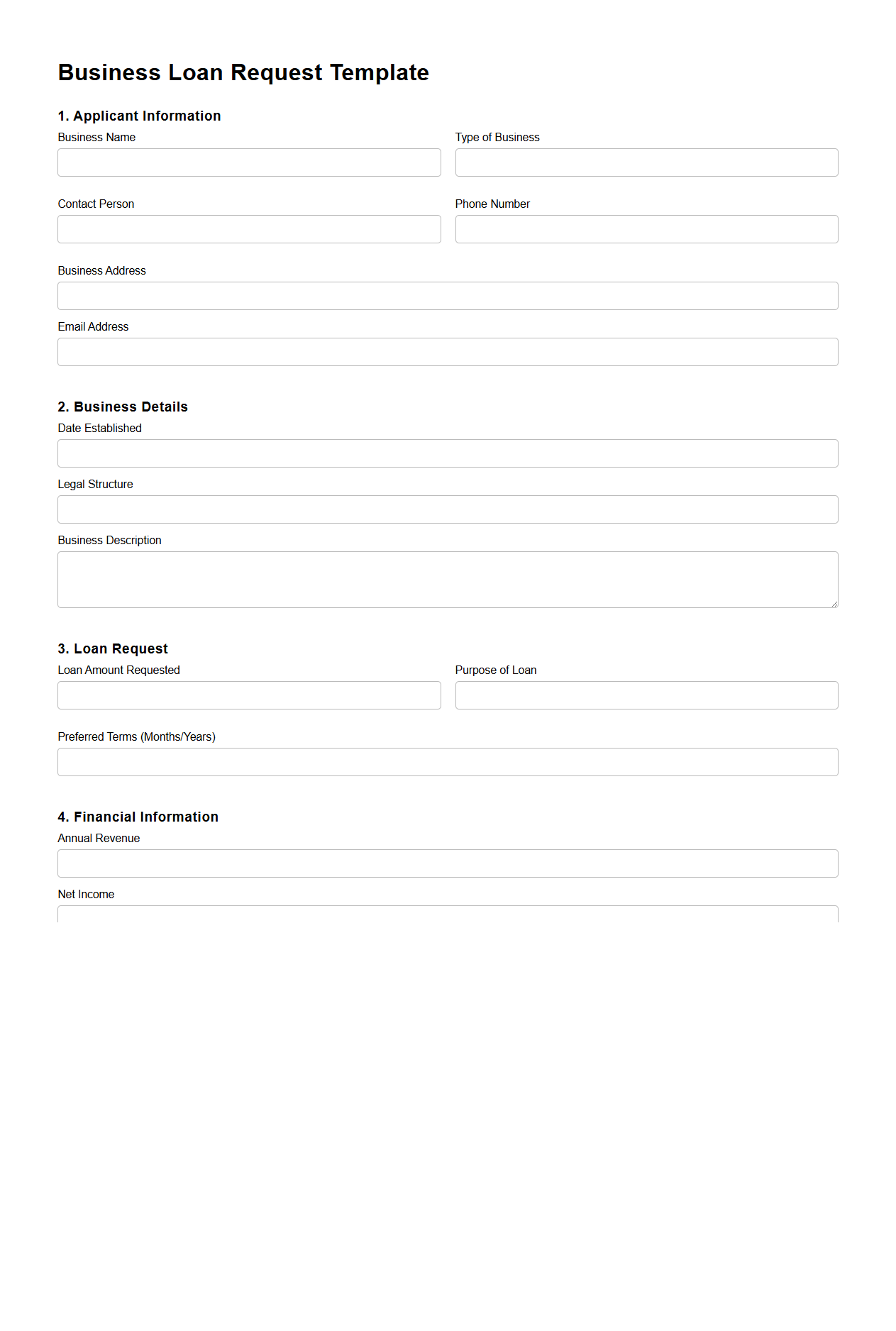

Business Loan Request Template for Banks

A

Business Loan Request Template for Banks is a structured document designed to help entrepreneurs formally present their financing needs to financial institutions. It includes essential information such as the loan amount, purpose, repayment plan, business financials, and supporting documents to increase approval chances. Using this template ensures clarity and professionalism, streamlining communication between the borrower and the bank.

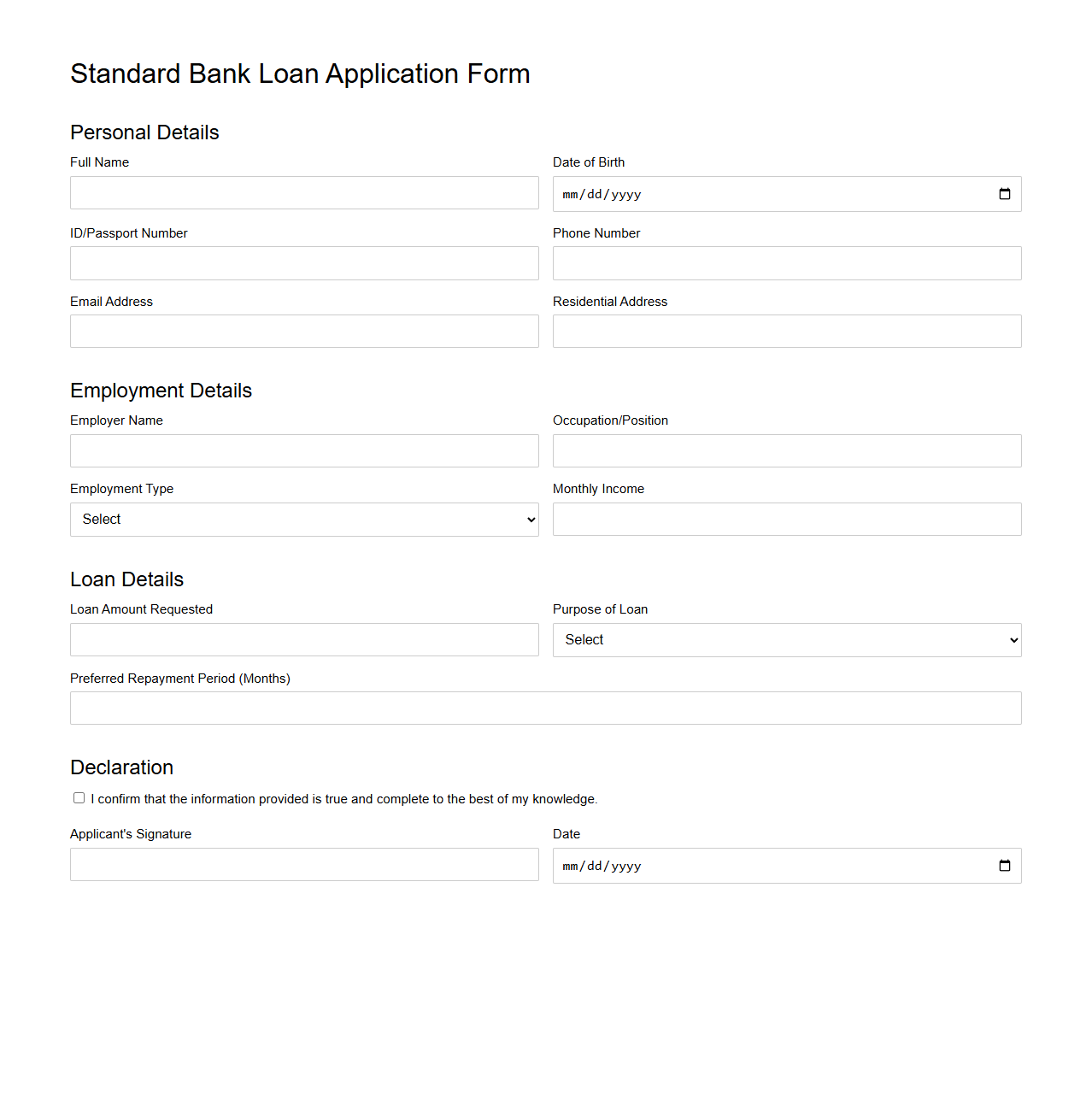

Standard Bank Loan Application Format

A

Standard Bank Loan Application Format document is a structured template used by financial institutions to collect essential information from loan applicants. It typically includes personal details, income sources, loan amount requested, and purpose of the loan, ensuring a uniform evaluation process. This format helps streamline loan processing by providing banks with consistent and organized data for credit assessment.

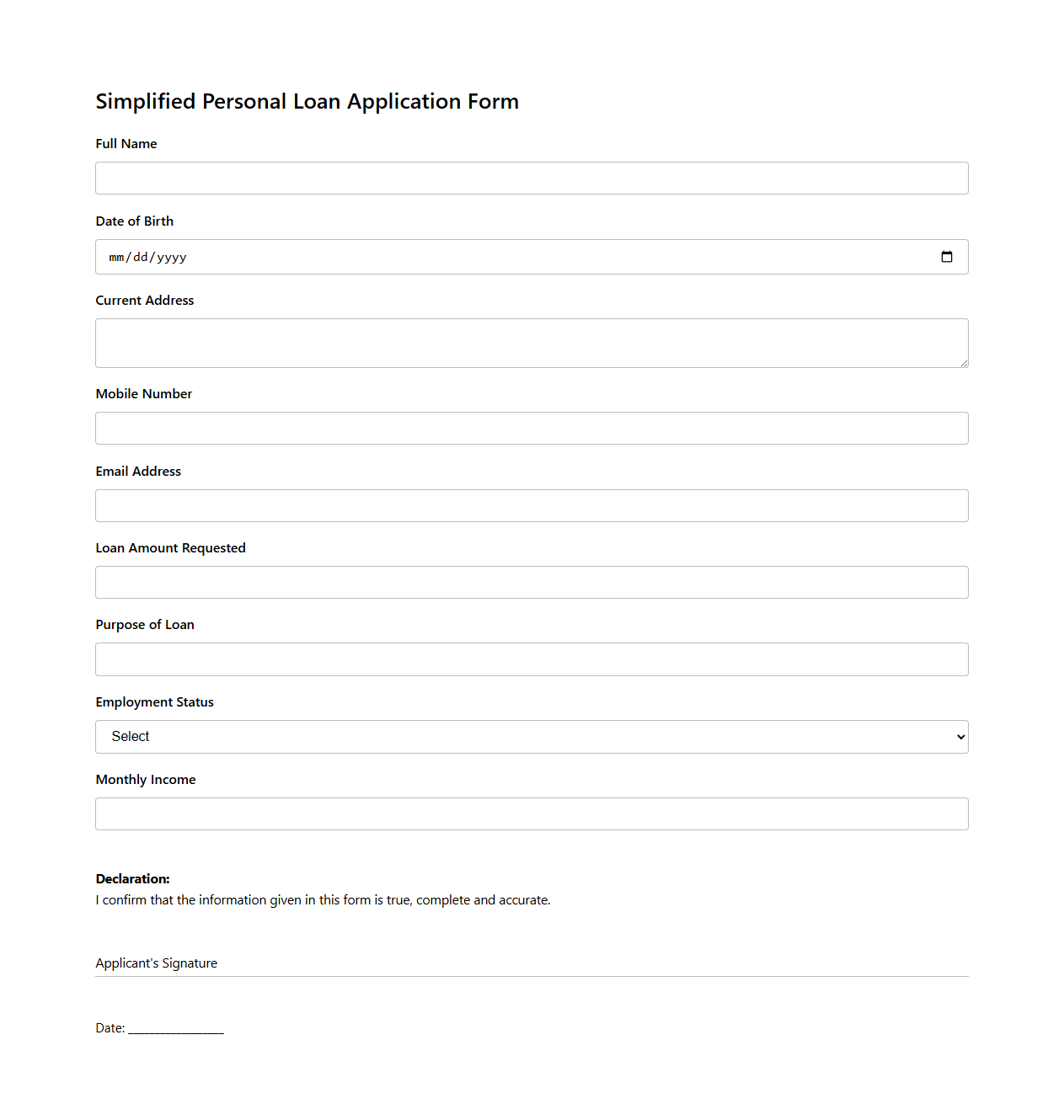

Simplified Personal Loan Application Form

A

Simplified Personal Loan Application Form is a streamlined document designed to collect essential borrower information quickly and efficiently for loan processing. It typically includes fields for personal details, employment status, income verification, and loan amount requested, reducing complexity compared to traditional forms. This format improves user experience while maintaining compliance with financial institution requirements for personal loan approval.

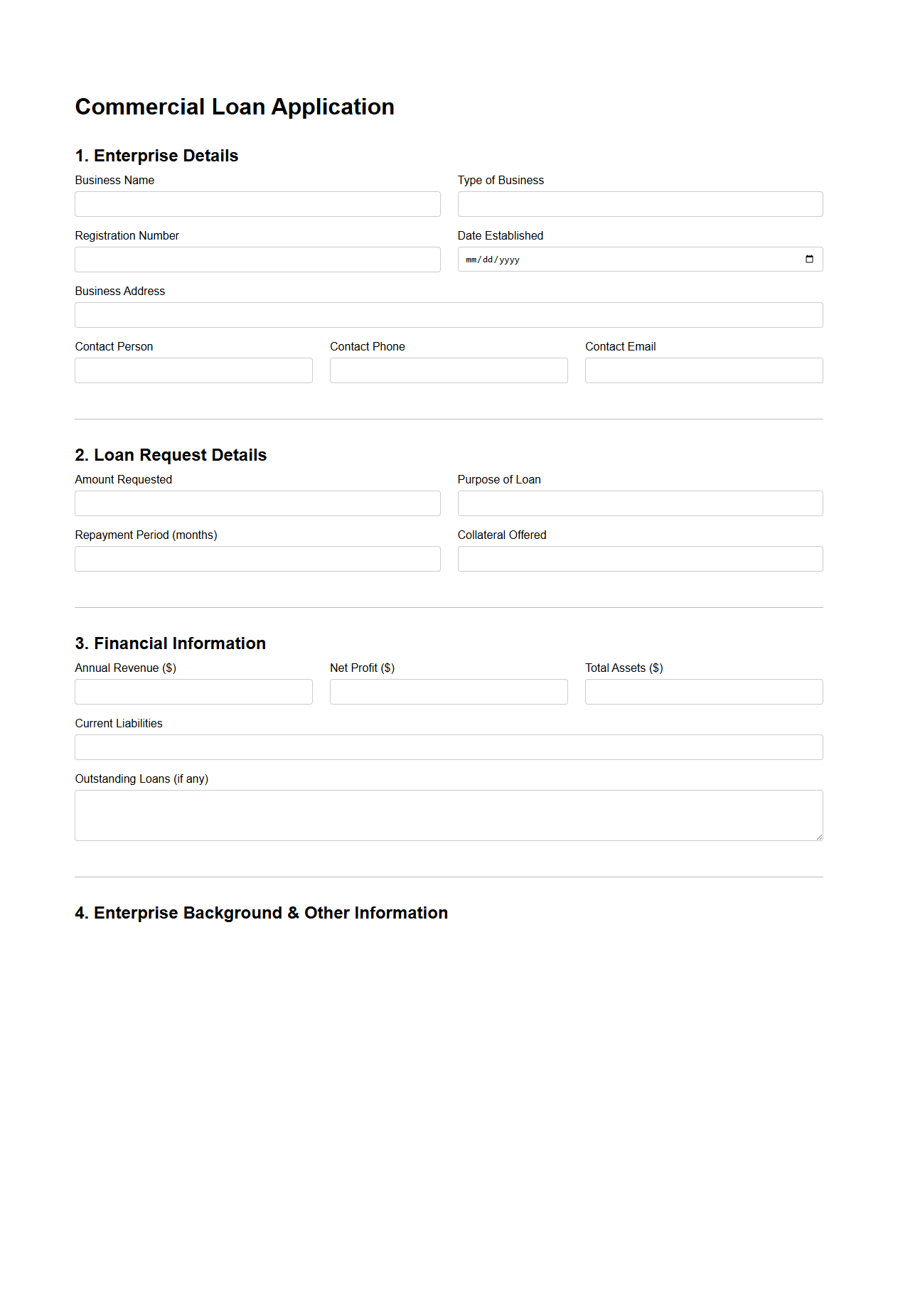

Commercial Loan Application Template for Enterprises

A

Commercial Loan Application Template for Enterprises is a structured document designed to streamline the process of applying for business financing. It collects essential information such as company details, financial statements, loan amount requested, and repayment plans, ensuring consistency and completeness in submissions. This template aids lenders in assessing creditworthiness efficiently while helping businesses present their funding needs clearly.

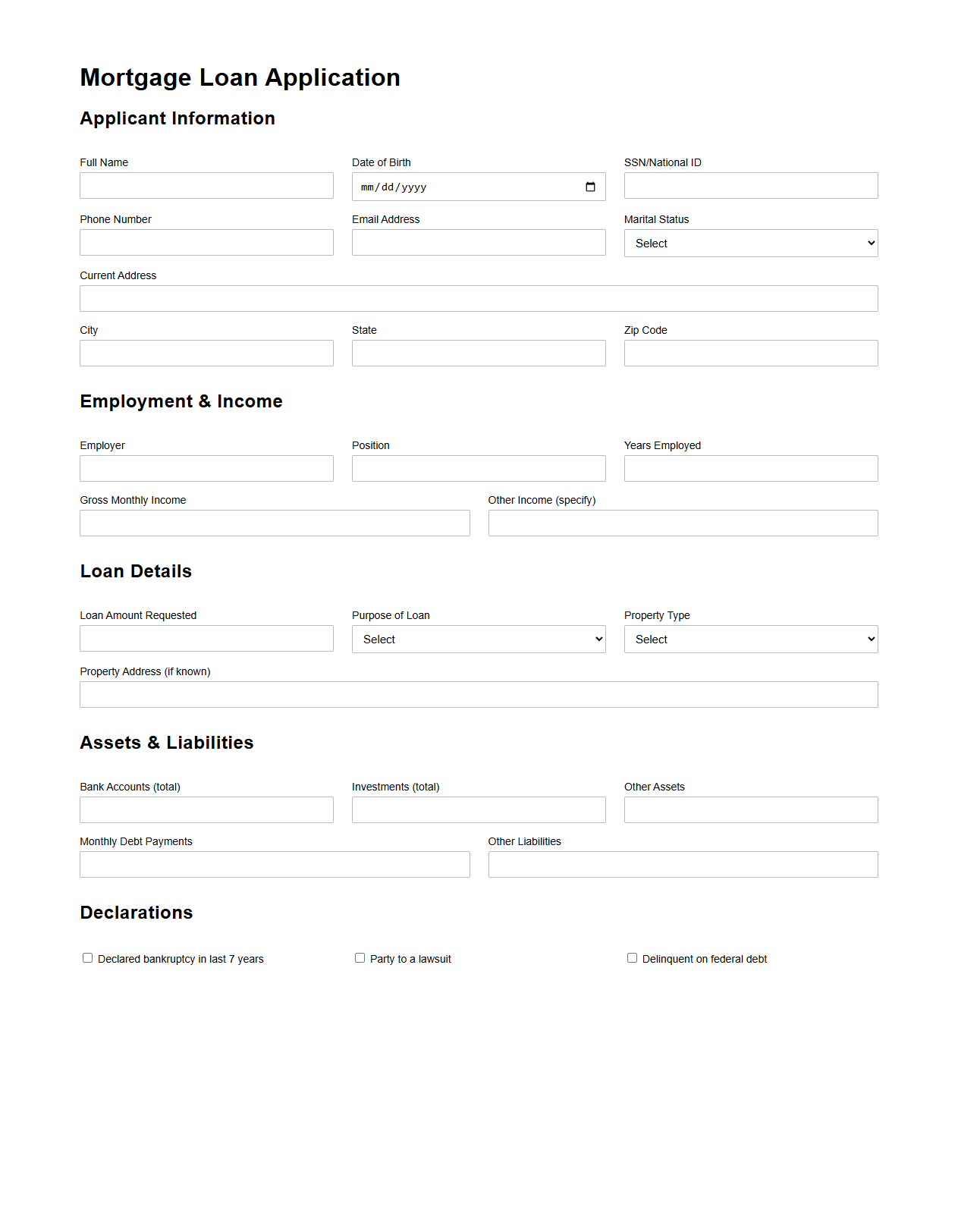

Mortgage Loan Application Template for Banks

A

Mortgage Loan Application Template for banks is a standardized document designed to collect essential financial and personal information from applicants seeking home loans. This template streamlines the underwriting process by ensuring consistent data entry, including income details, credit history, property information, and loan terms. It helps banks efficiently evaluate borrower eligibility and make informed lending decisions while maintaining regulatory compliance.

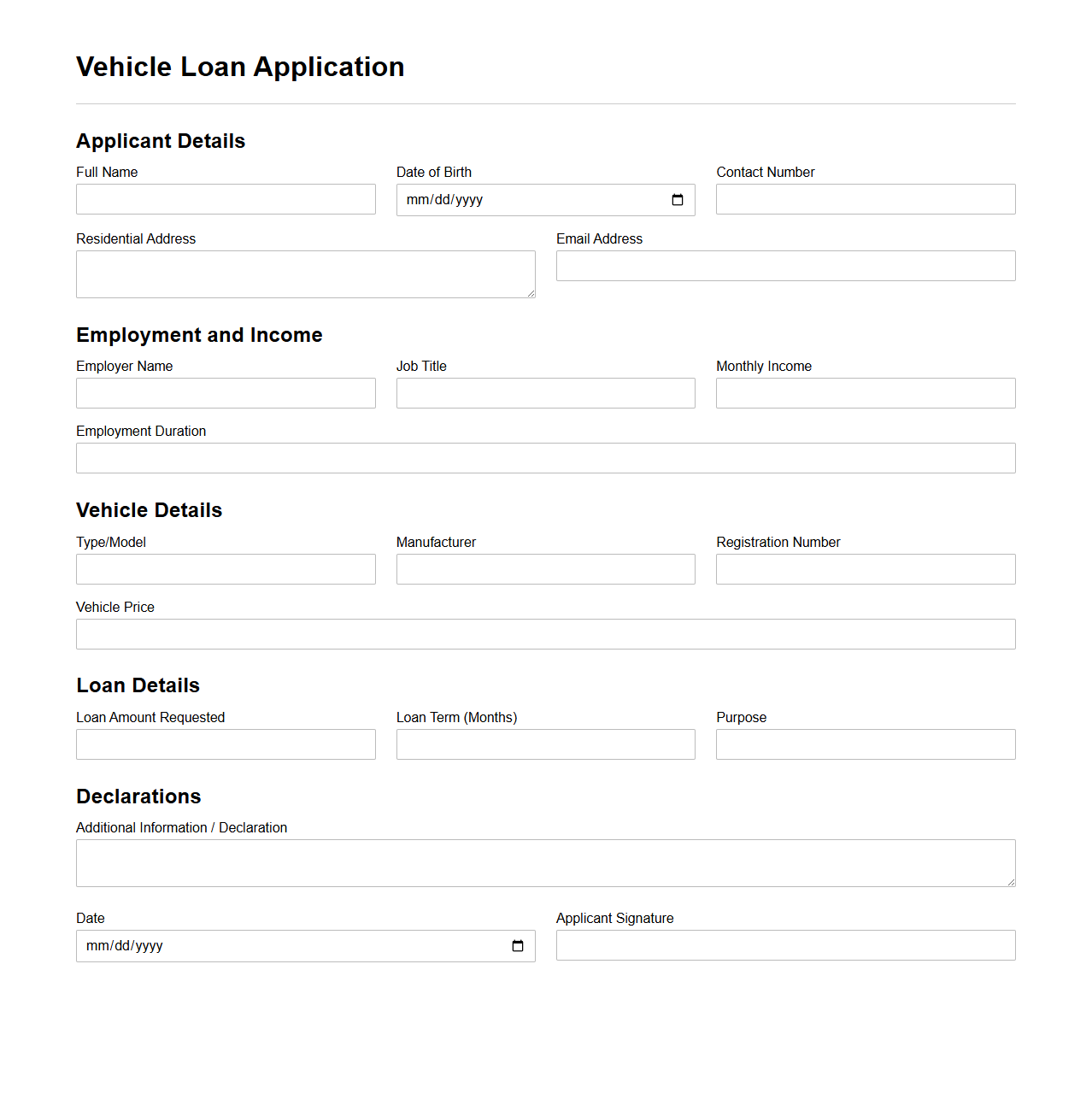

Vehicle Loan Application Document Format

A

Vehicle Loan Application Document Format serves as a standardized template that outlines the necessary information and documentation required to apply for a vehicle loan. It typically includes personal details of the applicant, vehicle information, income proof, and loan amount requested, ensuring consistency and completeness in the application process. This format helps streamline loan processing by providing lenders with all relevant data in an organized manner.

What key sections should a blank loan application for banks include to ensure compliance?

A blank loan application must include borrower identification details, loan amount requested, and purpose of the loan. Banks require sections for financial disclosures, collateral information, and employment history for thorough risk assessment. Additionally, compliance statements, borrower consent, and signatures ensure legal adherence and protect both parties.

How can a blank loan application template be customized for different loan types?

Customizing a loan application template involves adding specific sections related to the loan type, such as property details for mortgages or business financials for commercial loans. The repayment plans and required documentation fields differ depending on whether the loan is personal, auto, or commercial. Tailoring the template streamlines the review process and captures all pertinent details for each loan category.

Which borrower information fields are essential in a blank bank loan form?

Essential borrower information fields include full name, contact information, Social Security number, and date of birth for identity verification purposes. Employment status, income details, and existing debts help banks assess creditworthiness accurately. These fields form the foundation for evaluating the applicant's ability to repay the loan responsibly.

How does a blank commercial loan application differ from a personal loan form?

A commercial loan application typically requires detailed business financial statements, tax returns, and ownership information unlike a personal loan form focused on individual income and personal debts. Commercial loans also request data on business plans, cash flow projections, and collateral specific to business assets. These additional details address the higher risk and complexity associated with lending to businesses.

What digital tools best support filling and securing blank bank loan applications?

Digital tools like secure online forms with encryption and e-signature capabilities enhance the safety and convenience of loan application submissions. Loan management software allows for easy customization, automated validation, and real-time data storage reducing errors and improving compliance. Cloud-based platforms also facilitate secure access and collaboration between applicants and loan officers.

More Application Templates