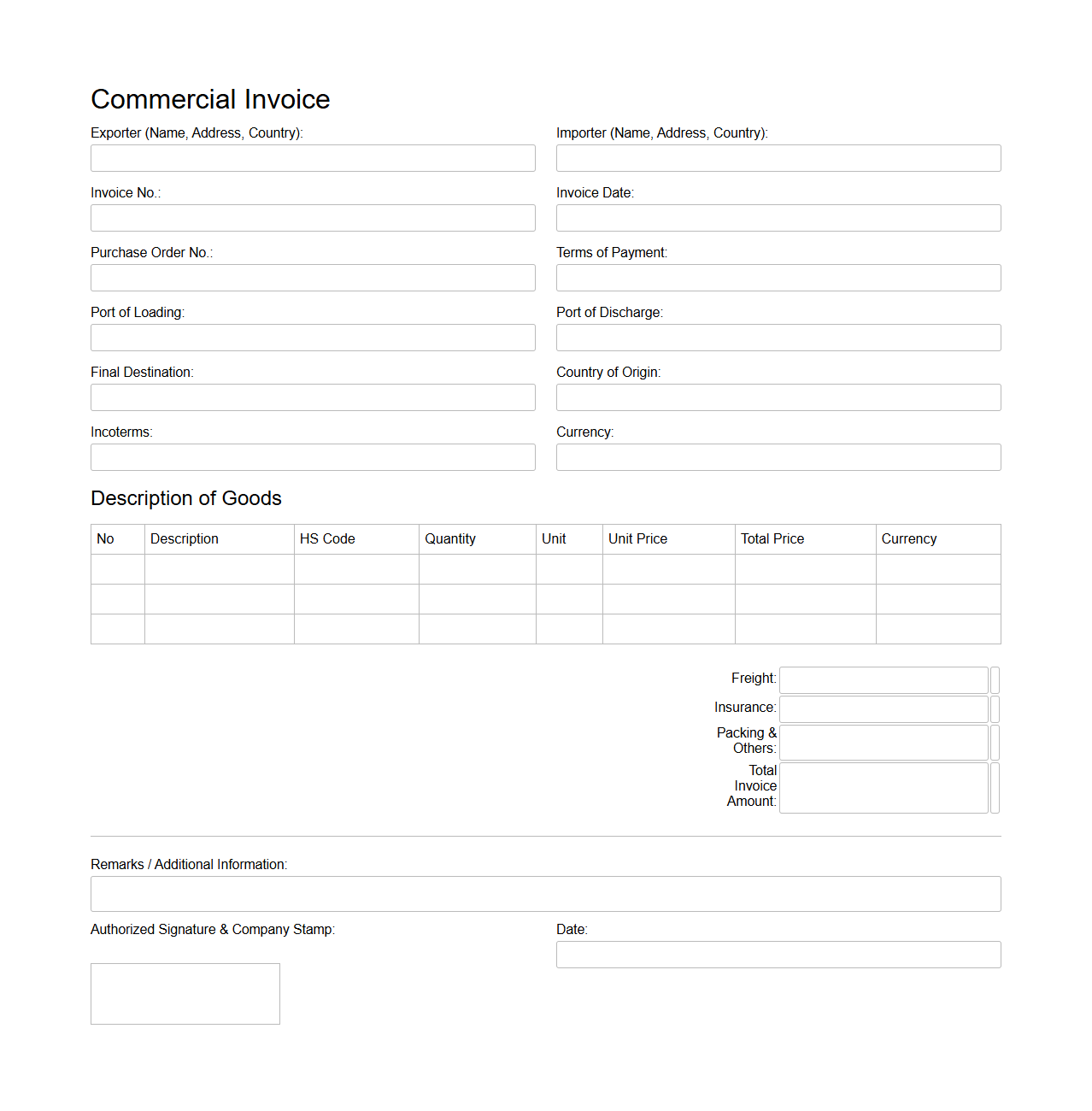

A Blank Commercial Invoice Template for International Trade is an essential document that facilitates smooth transactions between exporters and importers by clearly outlining product details, prices, and terms. This template ensures compliance with customs regulations, helping to avoid delays and penalties during international shipping. Businesses can customize the invoice to meet specific trade requirements and streamline payment processing.

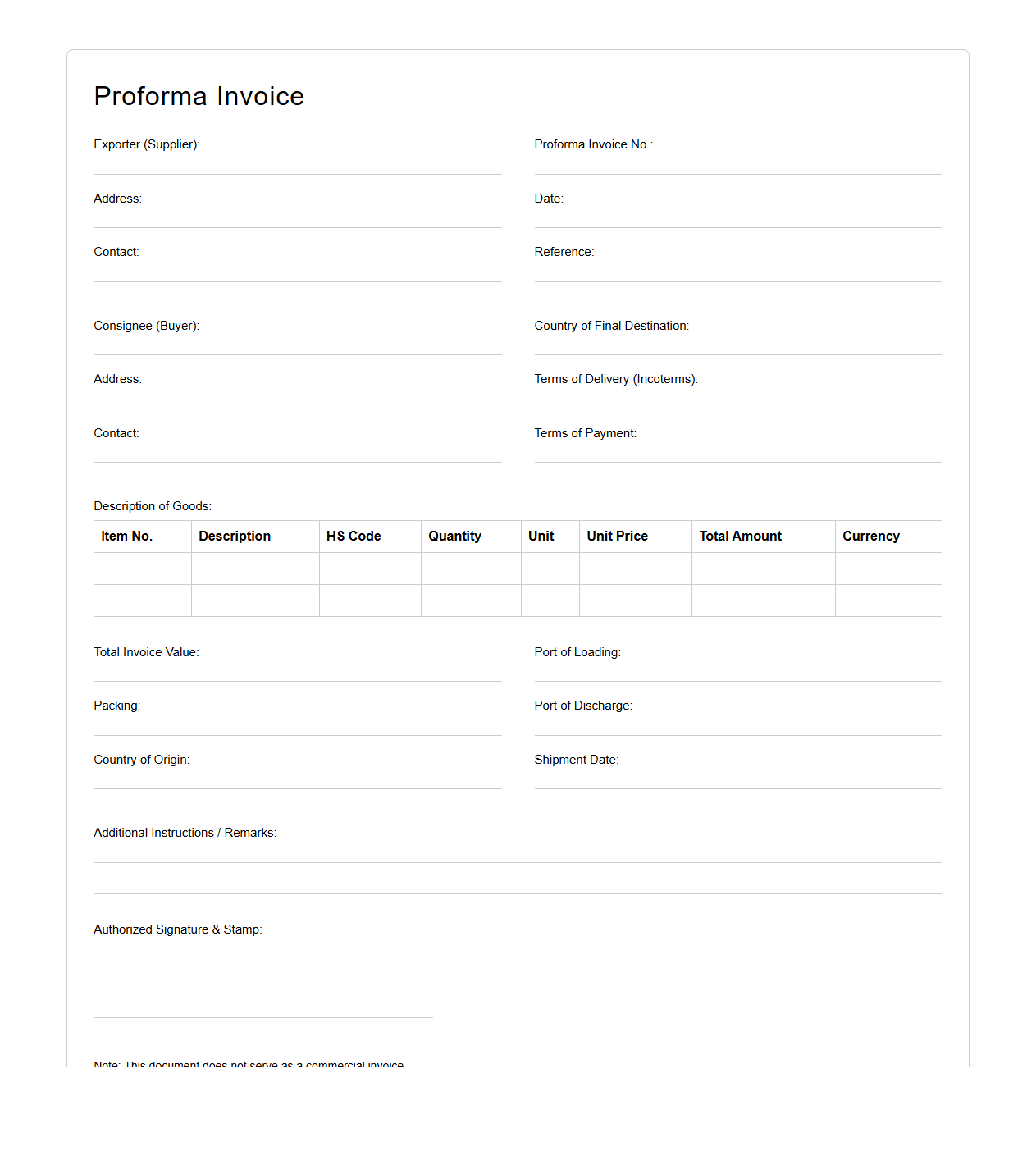

Blank Proforma Invoice Template for Export Transactions

A

Blank Proforma Invoice Template for Export Transactions is a pre-formatted document used by exporters to outline the details of goods or services to be shipped internationally. It serves as a preliminary bill of sale, providing essential information such as product descriptions, quantities, prices, terms of sale, and shipment details to the buyer before the final commercial invoice is issued. This template helps streamline communication, ensure clarity in trade agreements, and expedite customs clearance processes.

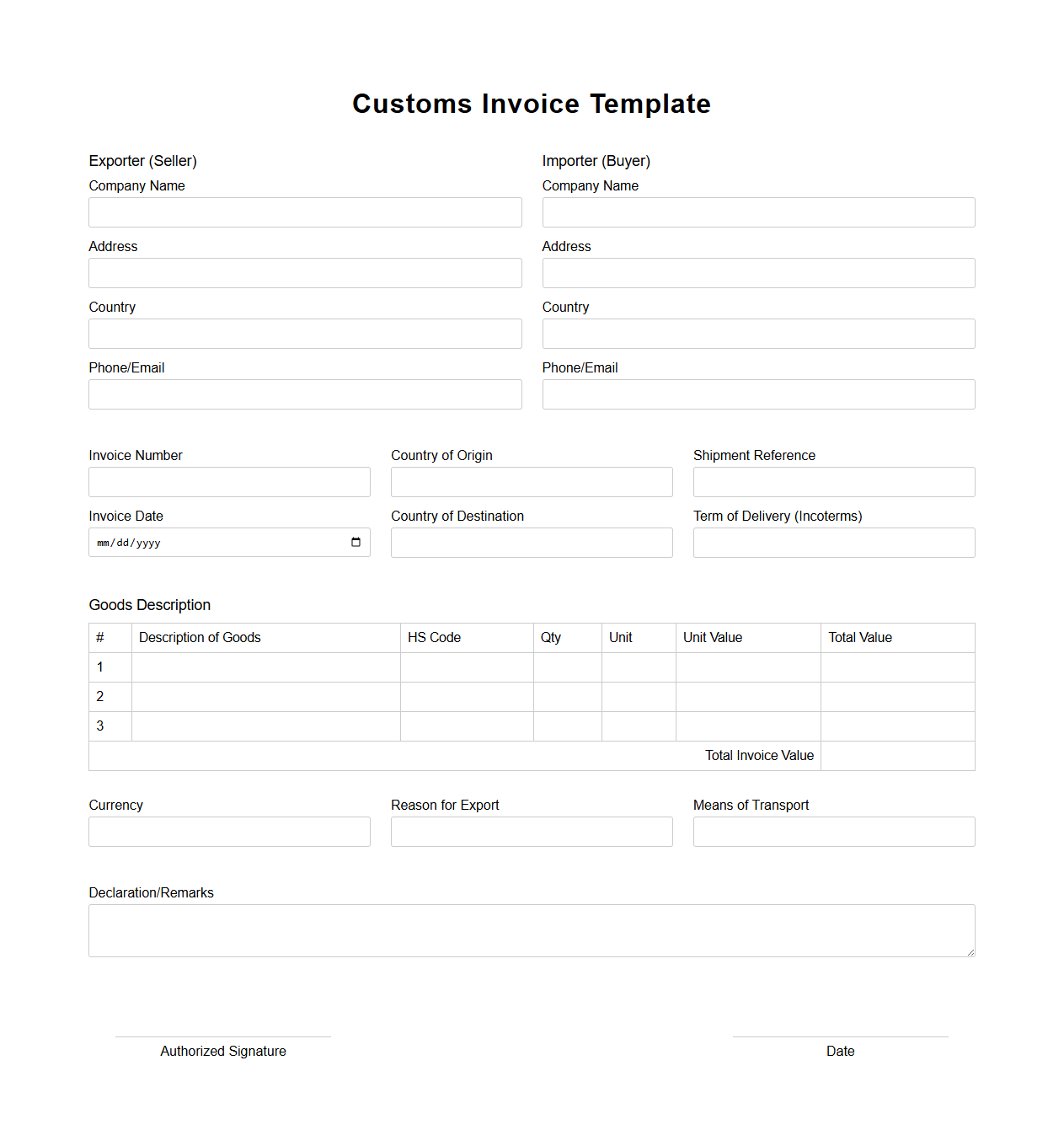

Basic Customs Invoice Template for Global Shipments

A

Basic Customs Invoice Template for Global Shipments is a standardized document used to declare the contents, value, and origin of goods being shipped internationally. It ensures compliance with customs regulations by providing necessary details such as product descriptions, quantities, and harmonized system codes. This invoice facilitates smooth clearance through customs, reduces shipment delays, and helps determine applicable duties and taxes.

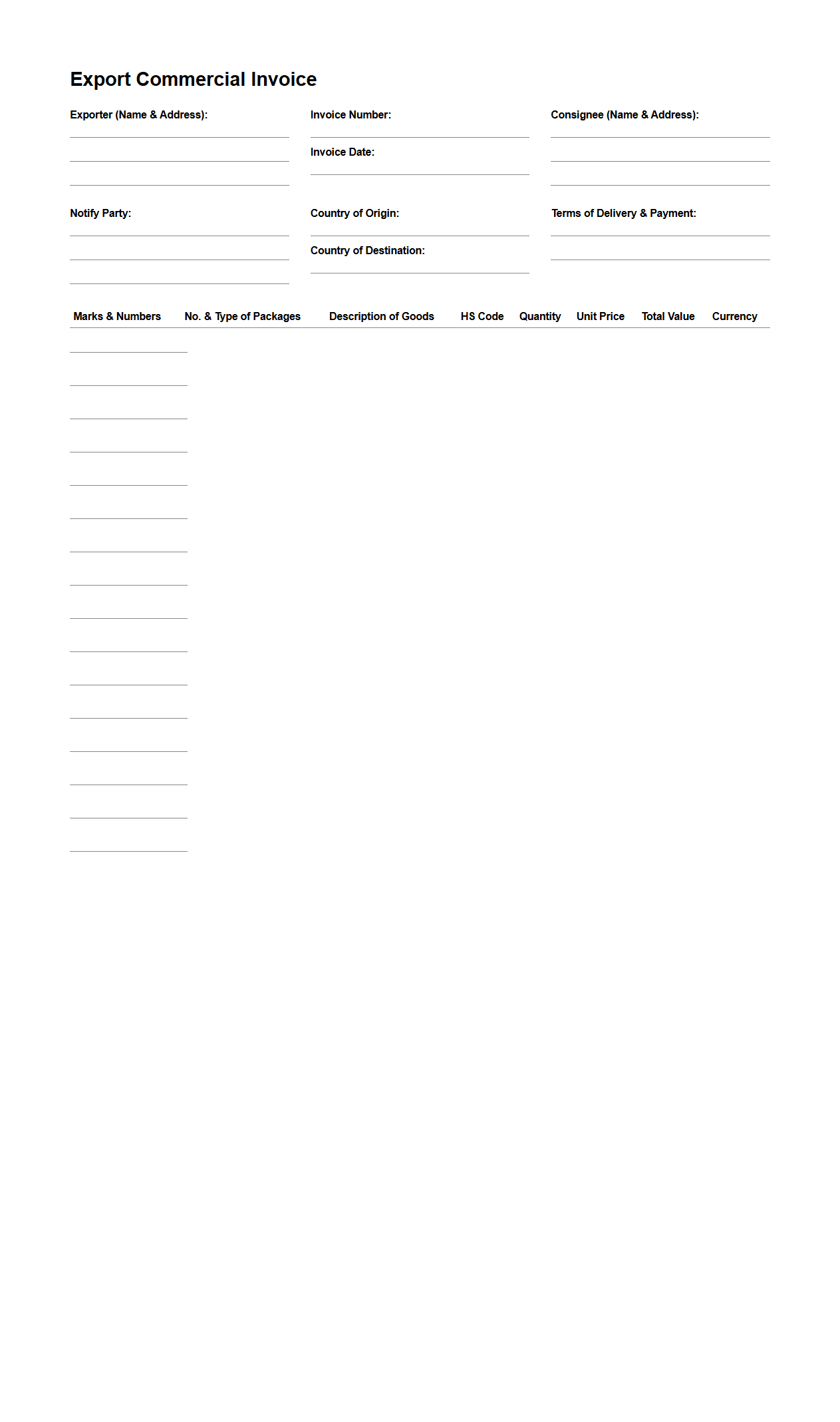

Blank Export Commercial Invoice for Freight Forwarders

A

Blank Export Commercial Invoice for Freight Forwarders is a standardized document template used to detail shipment information when exporting goods internationally. It serves as a crucial record for customs clearance, listing product descriptions, quantities, values, and exporter/importer details without pre-filled data, allowing freight forwarders to tailor the invoice per shipment. This form ensures compliance with international trade regulations and facilitates smooth logistics and payment processing.

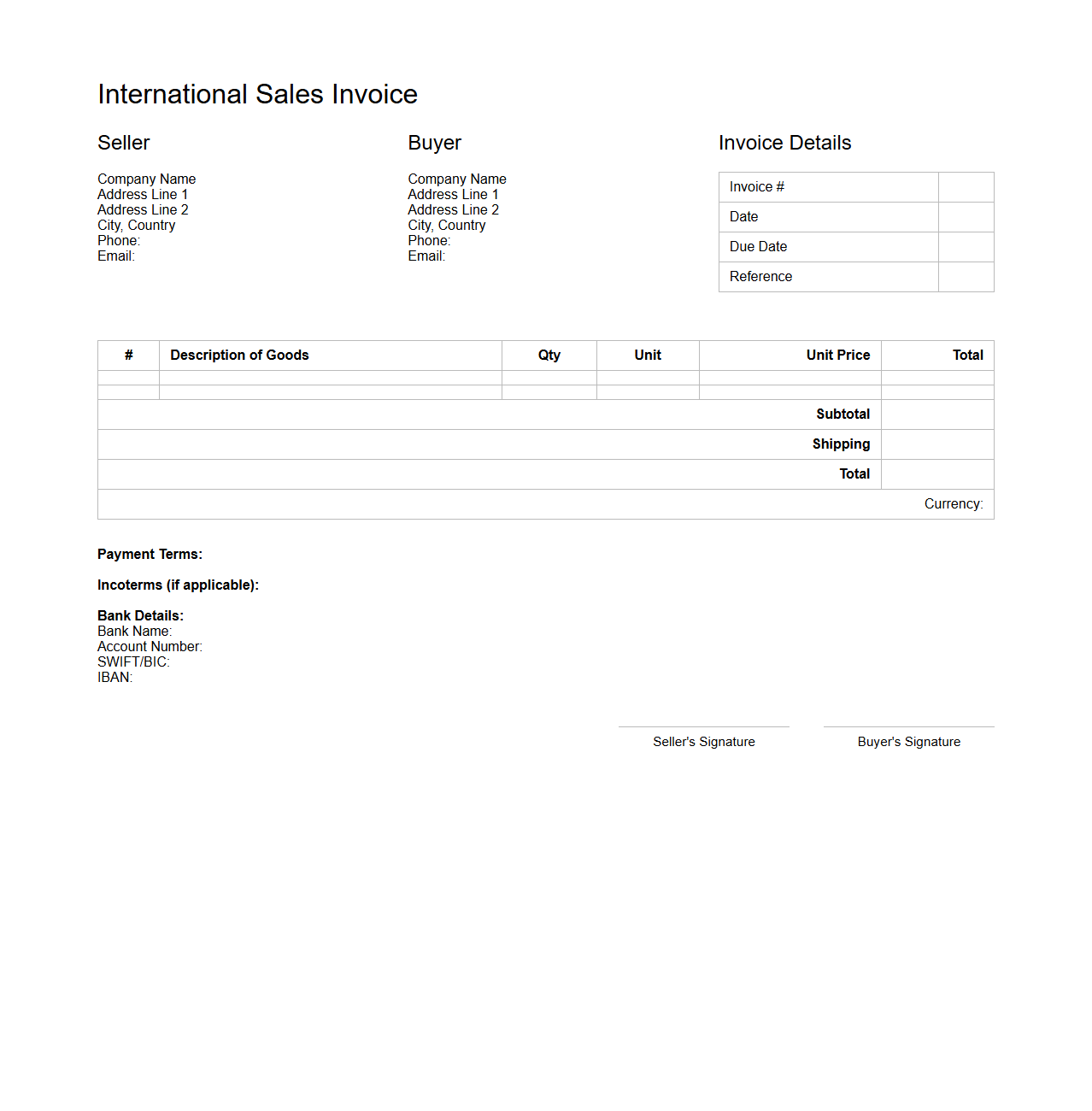

Simple International Sales Invoice Template

A

Simple International Sales Invoice Template is a streamlined document designed for recording and communicating transaction details between buyers and sellers across different countries. It typically includes essential information such as product descriptions, quantities, prices, payment terms, shipping details, and currency specifications to ensure clarity in cross-border trade. This template helps businesses maintain accurate financial records while complying with international invoicing standards and regulations.

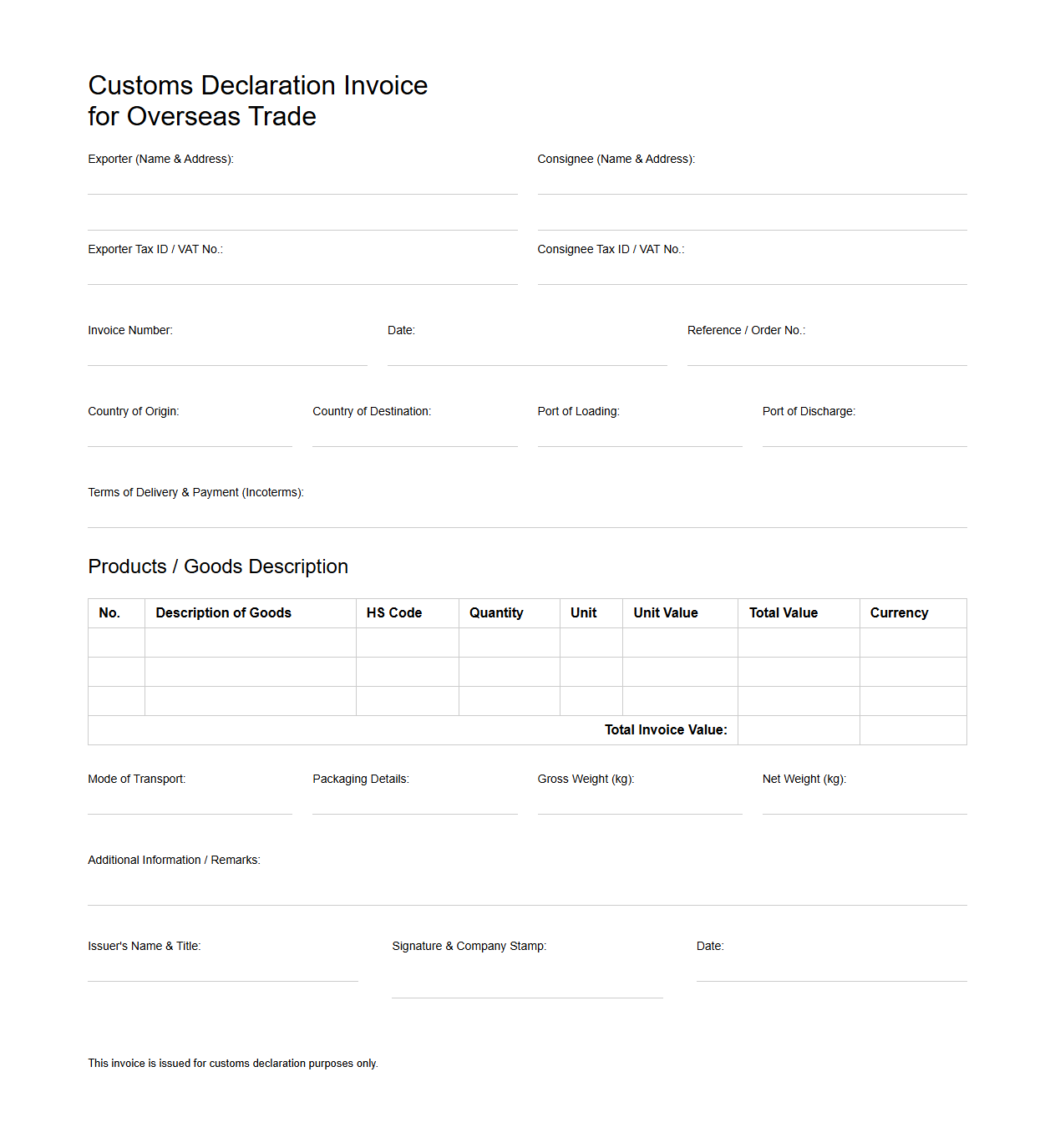

Blank Customs Declaration Invoice for Overseas Trade

A

Blank Customs Declaration Invoice is a standardized document used in overseas trade to declare goods being imported or exported without specifying the detailed item information initially. It serves as a preliminary customs declaration, allowing traders to facilitate the shipping process while awaiting complete invoice details. This document helps streamline customs clearance and ensures compliance with international trade regulations.

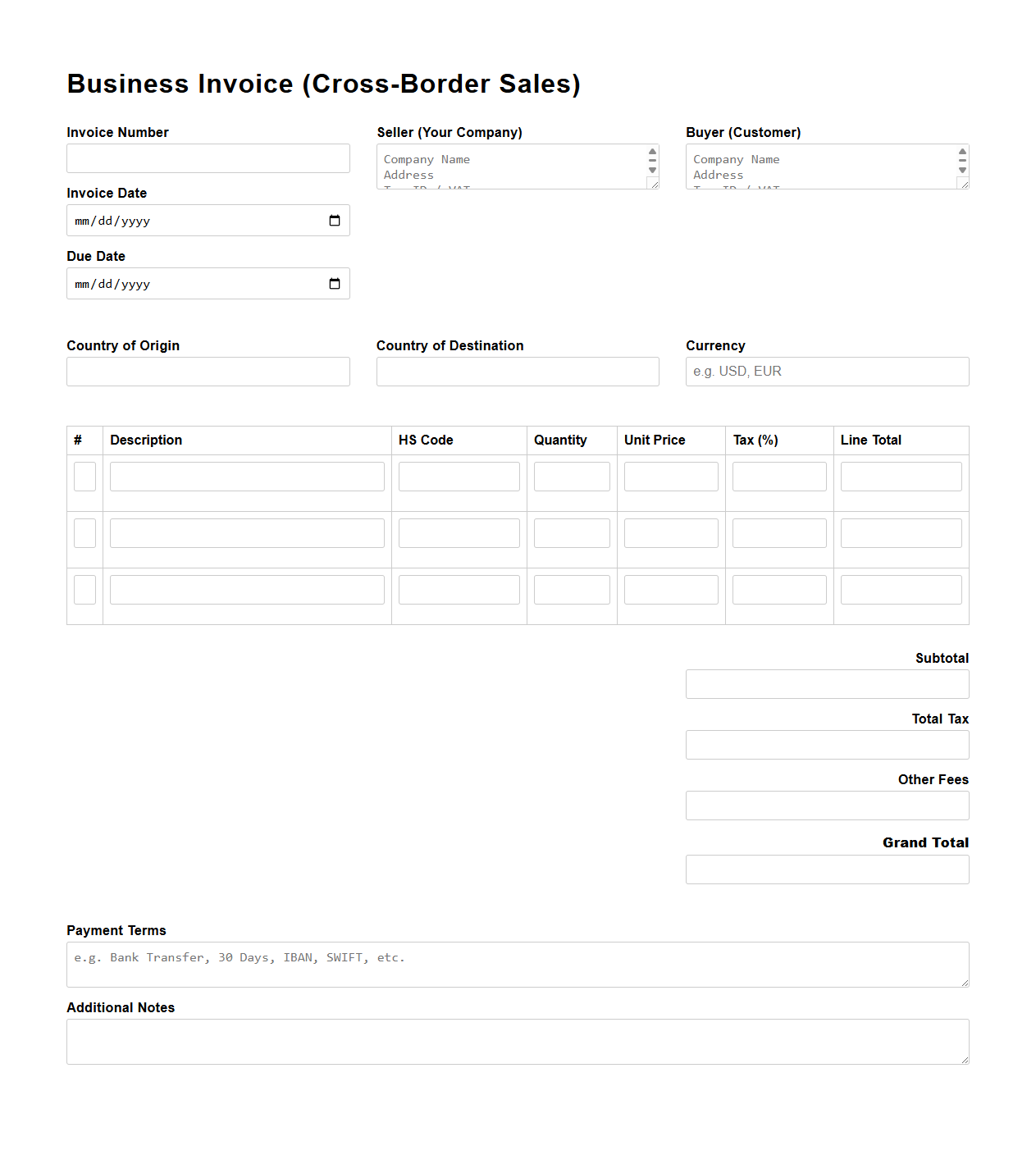

Blank Business Invoice Form for Cross-Border Sales

A

Blank Business Invoice Form for Cross-Border Sales is a standardized document used by companies to detail transactions involving international buyers and sellers. It typically includes information such as product descriptions, quantities, prices, taxes, shipping details, and payment terms, ensuring compliance with customs and international trade regulations. This form facilitates clear communication, accurate record-keeping, and smooth customs clearance during cross-border commerce.

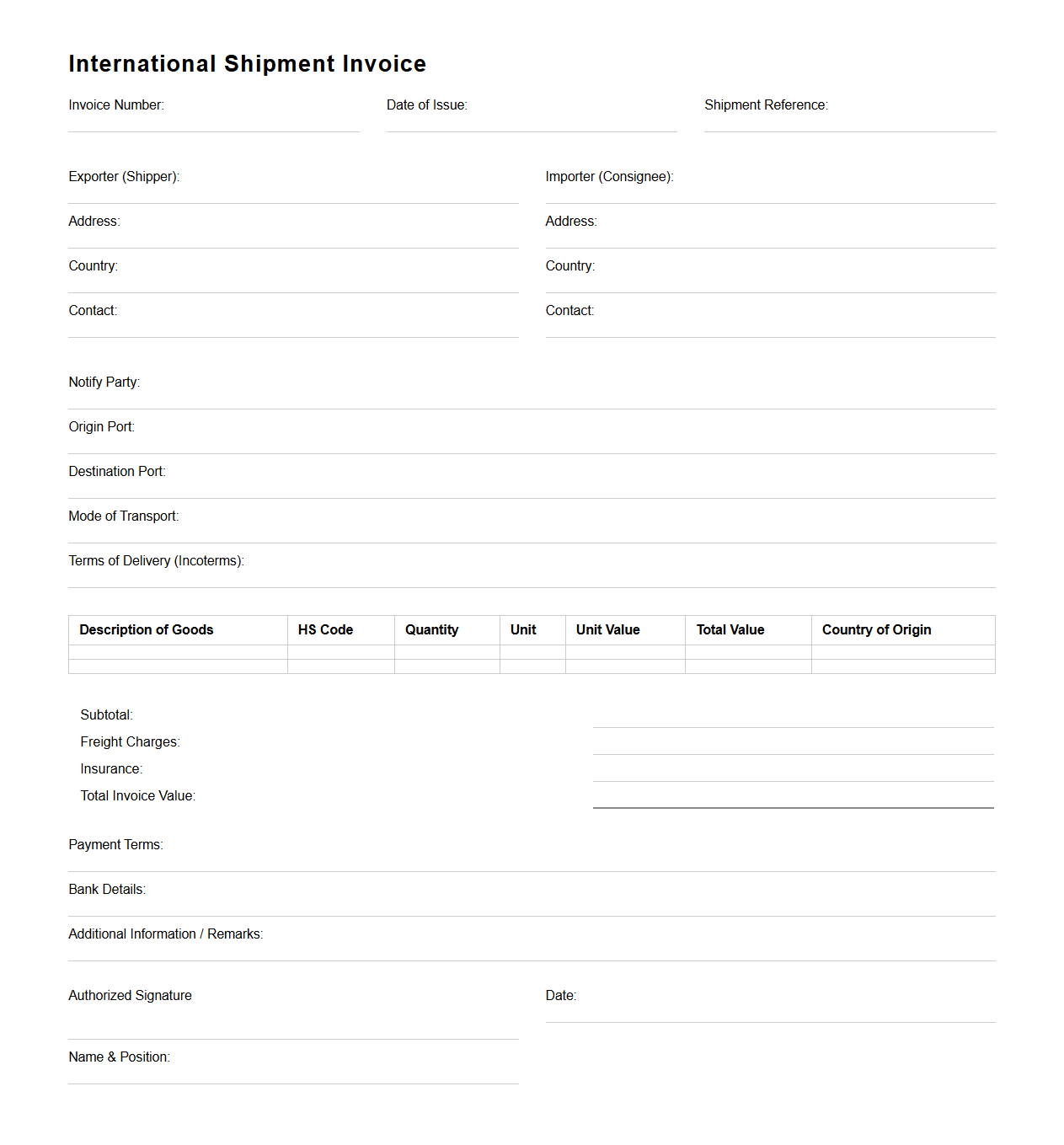

International Shipment Invoice Template for Logistics

An

International Shipment Invoice Template for logistics documents serves as a standardized record detailing the goods being transported across borders, including descriptions, quantities, values, and shipment terms. It facilitates customs clearance by providing essential information required by customs authorities to assess duties and taxes accurately. This template ensures consistency and compliance with international trade regulations, streamlining the shipping process and reducing delays.

Blank Multicurrency Commercial Invoice for Importers

A

Blank Multicurrency Commercial Invoice for importers is a standardized document used in international trade to declare the value and details of imported goods in multiple currencies. It facilitates accurate customs clearance, accounting, and payment processing by providing clear transaction information regardless of currency fluctuations. This invoice helps streamline import operations and ensures compliance with global trade regulations.

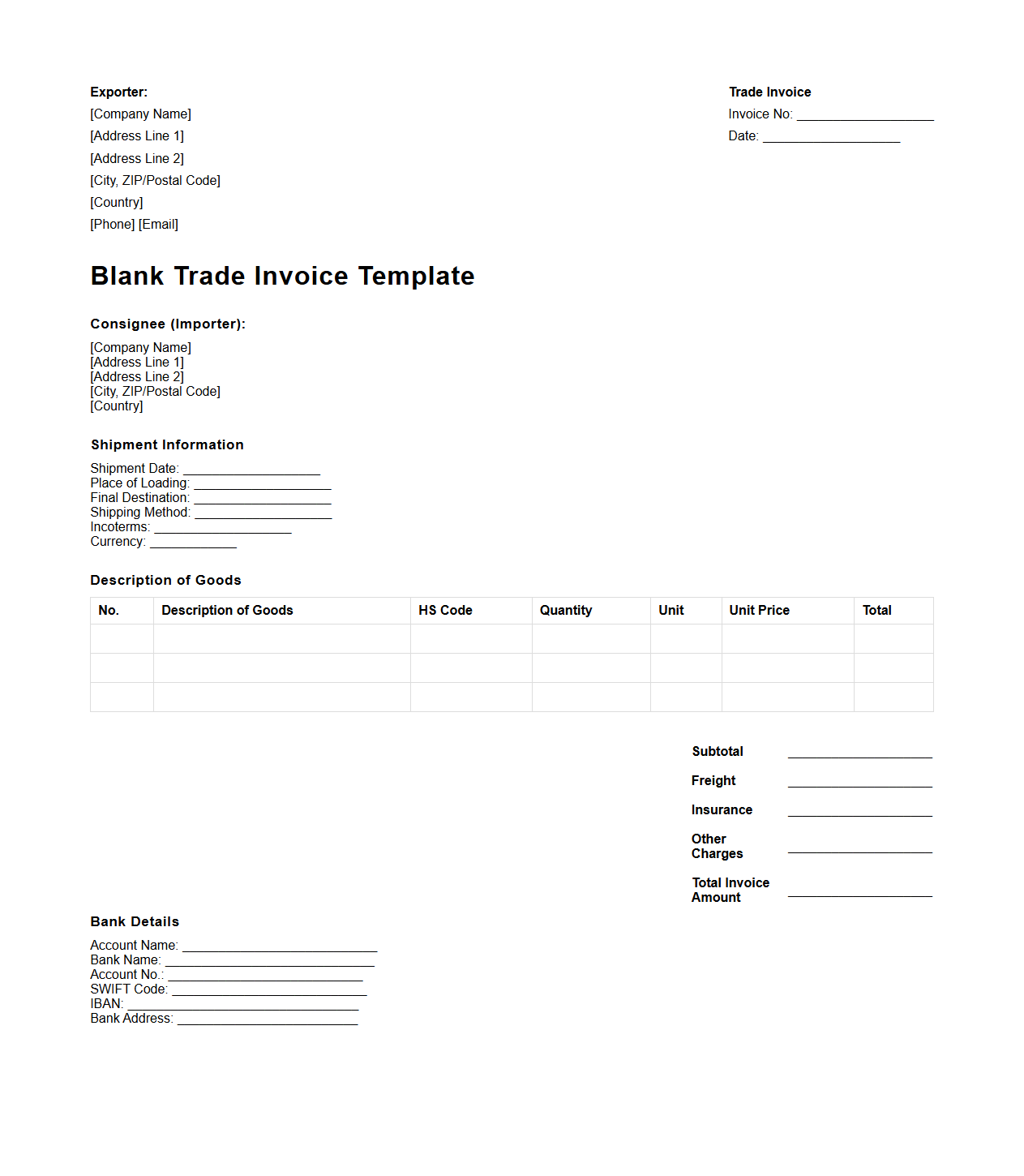

Blank Trade Invoice Template for Global Commerce

A

Blank Trade Invoice Template for Global Commerce is a standardized document used to itemize goods, services, quantities, and prices in international trade transactions. It facilitates clear communication between exporters and importers by detailing crucial information such as product descriptions, shipment terms, payment methods, and customs declarations. This template ensures compliance with international trade regulations, streamlining cross-border business processes and minimizing errors during customs clearance.

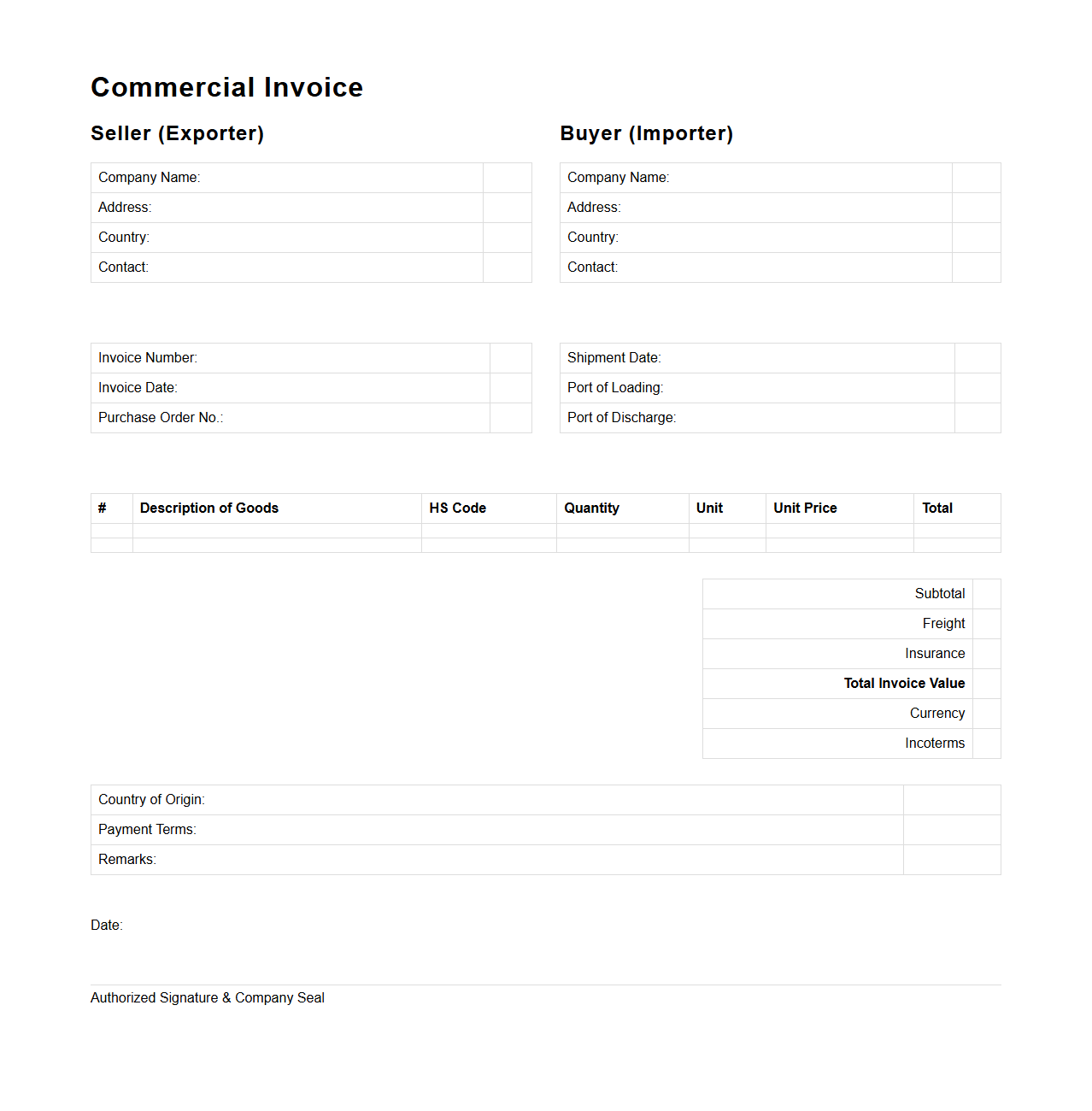

Commercial Goods Invoice Template for International Buyers

A

Commercial Goods Invoice Template for International Buyers is a standardized document used to detail the sale transaction between exporters and overseas purchasers. It includes essential information such as product descriptions, quantities, prices, shipping terms, and payment instructions, facilitating customs clearance and financial settlements. This template ensures consistency, accuracy, and legal compliance across global trade operations.

How do I specify Incoterms on a blank commercial invoice template?

To specify Incoterms on a blank commercial invoice, clearly include the chosen term near the shipping details or payment terms section. Use the latest version of Incoterms, such as Incoterms 2020, to avoid any confusion during international trade. This ensures both buyer and seller understand their responsibilities and risks.

What essential HS codes must be included in a blank commercial invoice for customs clearance?

Include the Harmonized System (HS) codes for all products listed to facilitate customs clearance and accurate tariff classification. These codes should align with the international standards of the World Customs Organization (WCO). Having precise HS codes helps prevent delays and additional inspections during shipment.

How should I format multi-currency values on a blank commercial invoice for global shipments?

Format multi-currency values by listing the currency code (e.g., USD, EUR) alongside each amount to ensure clarity for all international parties. It is recommended to show the total invoice value in the buyer's currency and the seller's currency separately. This approach avoids confusion and simplifies payment processing in global shipments.

What fields are mandatory for a blank commercial invoice to meet WTO documentation standards?

A blank commercial invoice must include mandatory fields such as buyer and seller information, detailed description of goods, quantity, unit price, and total value. Additionally, include country of origin and the HS code to comply with WTO standards. Accurate and complete information speeds customs clearance and supports legal trade compliance.

How can I indicate dual-use goods on a blank commercial invoice for export control compliance?

To indicate dual-use goods, clearly mark the relevant items and include the appropriate export control classification number (ECCN) on the invoice. Add a statement referencing the dual-use nature of the goods to inform customs and regulators. This ensures adherence to export control laws and avoids potential shipment delays or penalties.