A Blank Invoice Template for Nonprofit Organizations streamlines the billing process by providing a clear, customizable format tailored to nonprofit needs. This template helps track donations, services, and expenses efficiently while maintaining professional documentation. It supports transparency and financial accuracy essential for nonprofit operations.

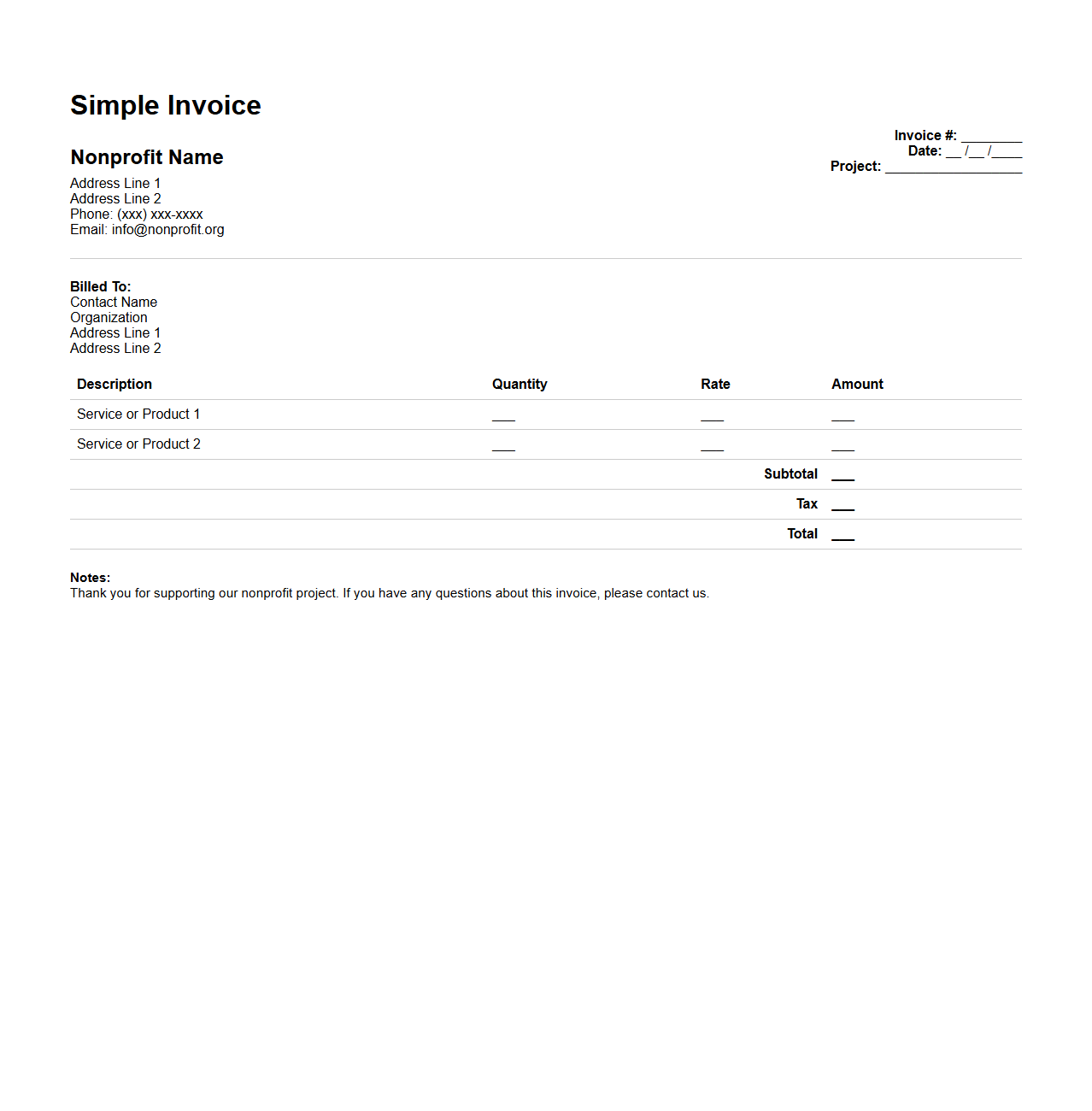

Simple Invoice Template for Nonprofit Projects

A

Simple Invoice Template for Nonprofit Projects is a structured document designed to streamline billing and payment tracking for nonprofit organizations. It includes essential fields such as project details, services rendered, payment terms, and donor or client information to ensure clear financial communication. This template helps nonprofits maintain transparent records, support budget management, and facilitate grant compliance.

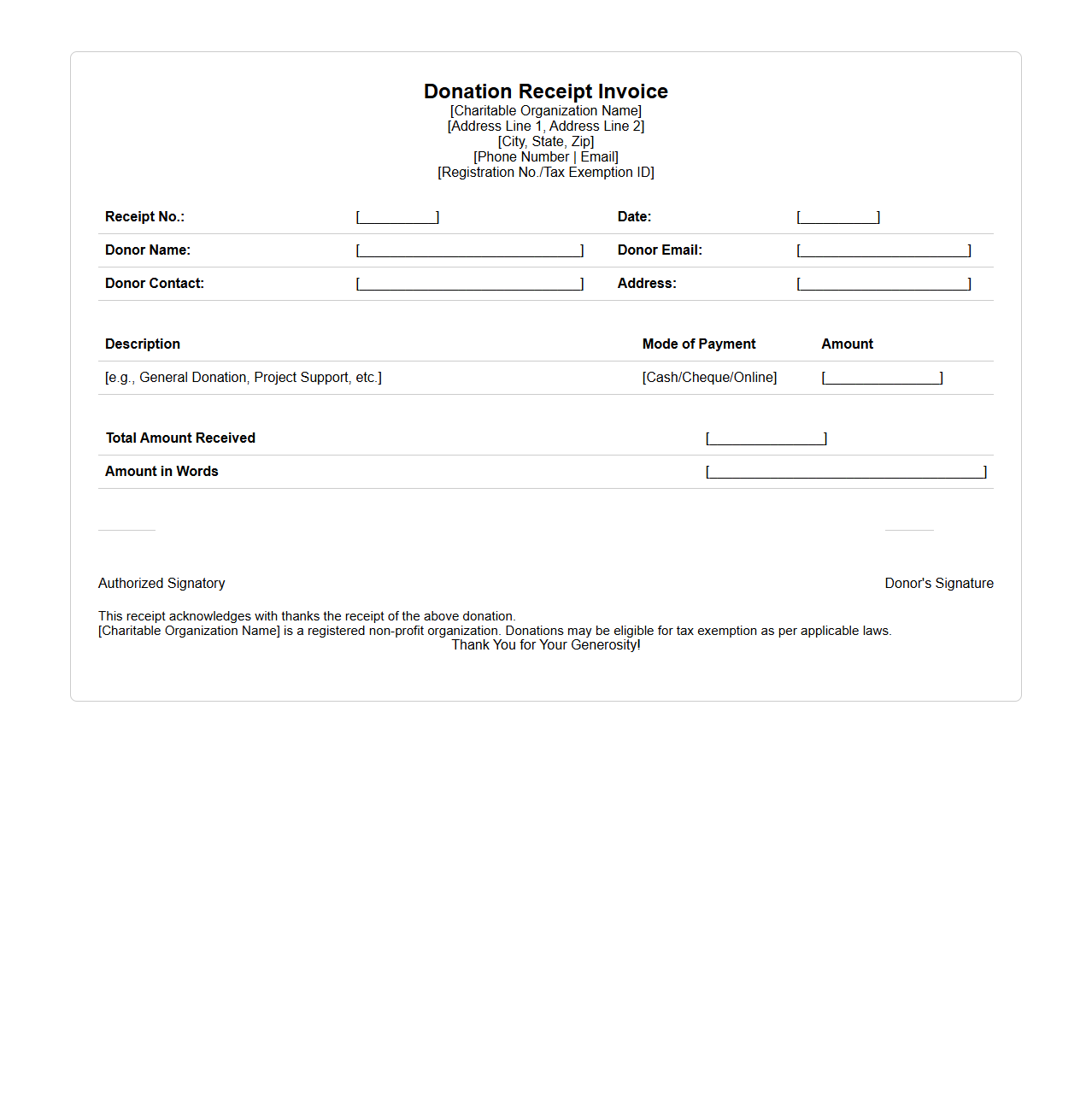

Donation Receipt Invoice Format for Charitable Organizations

A

Donation Receipt Invoice Format for Charitable Organizations is a standardized document used to acknowledge and record contributions made by donors. It includes essential details such as donor information, donation amount, date of contribution, and the organization's tax identification number to ensure transparency and compliance with legal requirements. This format helps both the charity and donor maintain accurate financial records for tax deduction purposes and audit trails.

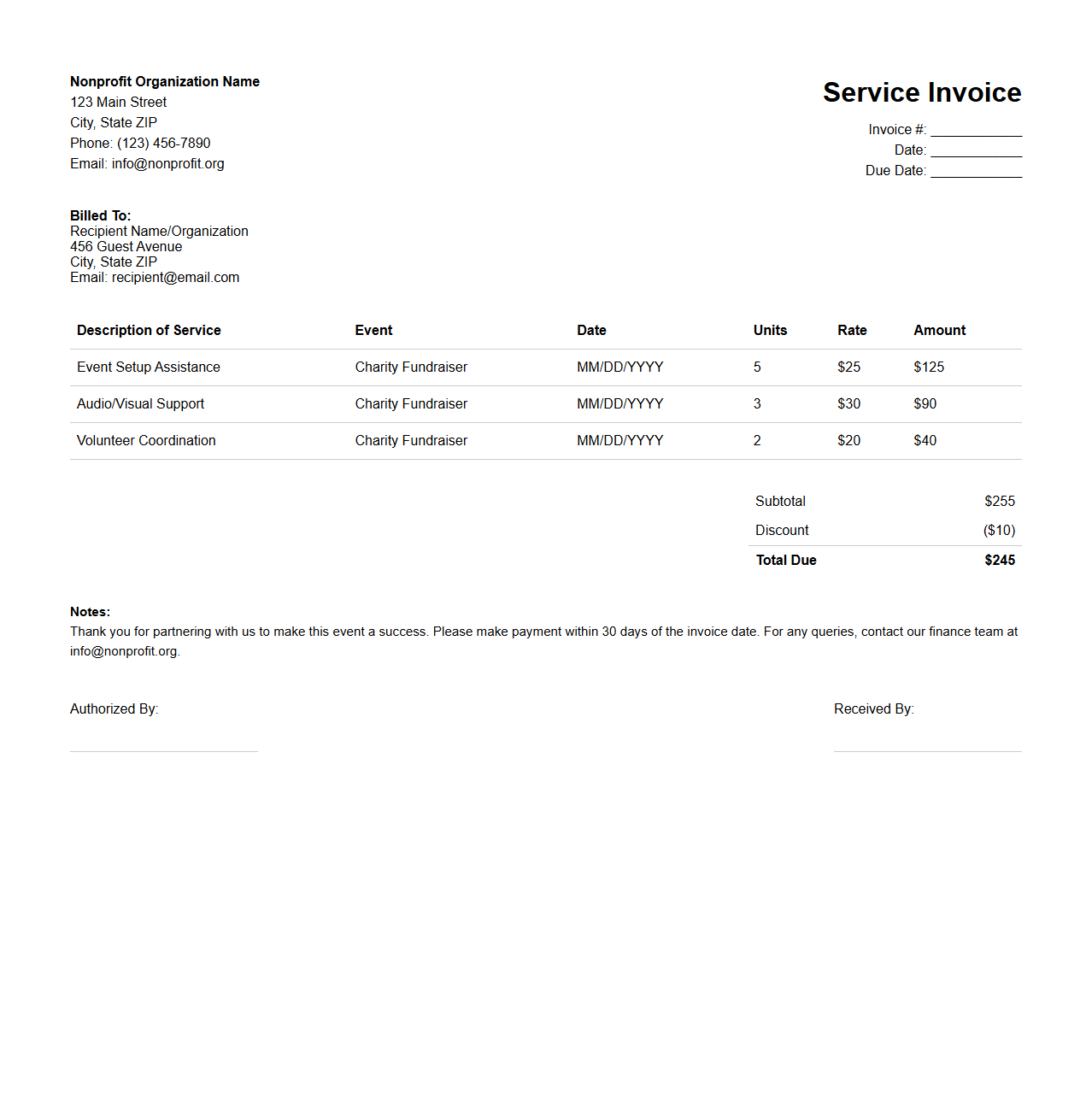

Service Invoice Layout for Nonprofit Events

A

Service Invoice Layout for Nonprofit Events document outlines the structure and essential components for billing services provided during nonprofit functions. It includes details such as service descriptions, quantities, rates, event-specific information, and payment terms tailored for nonprofit organizations. This layout ensures clarity, professionalism, and accurate financial tracking for event-related services.

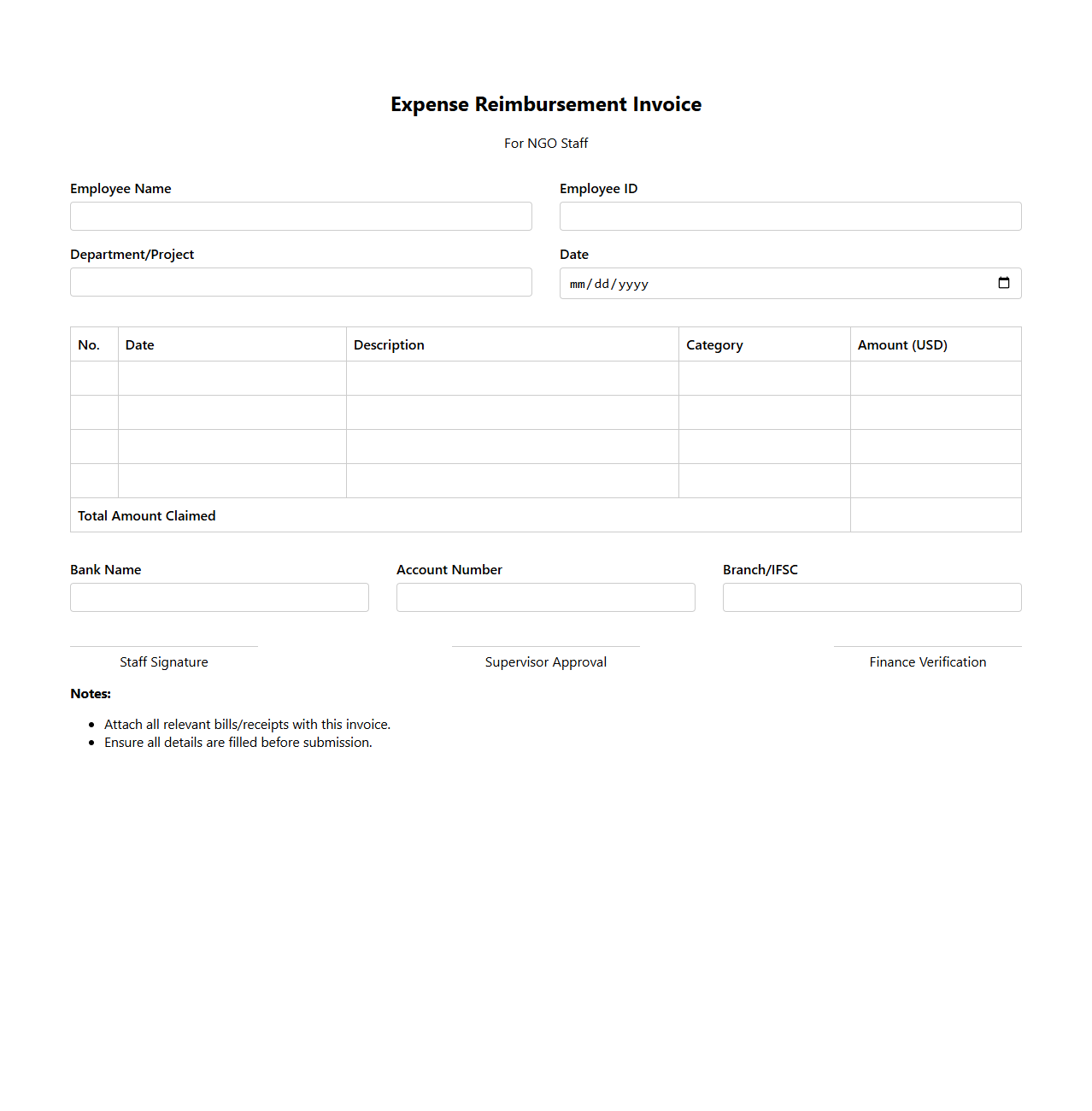

Expense Reimbursement Invoice for NGO Staff

An

Expense Reimbursement Invoice for NGO staff is a formal document used to request payment for out-of-pocket expenses incurred during official duties. It details the nature of each expense, date, amount, and supporting receipts to ensure transparency and accountability in financial reporting. This invoice helps NGOs maintain accurate budget tracking and supports compliance with organizational and donor financial policies.

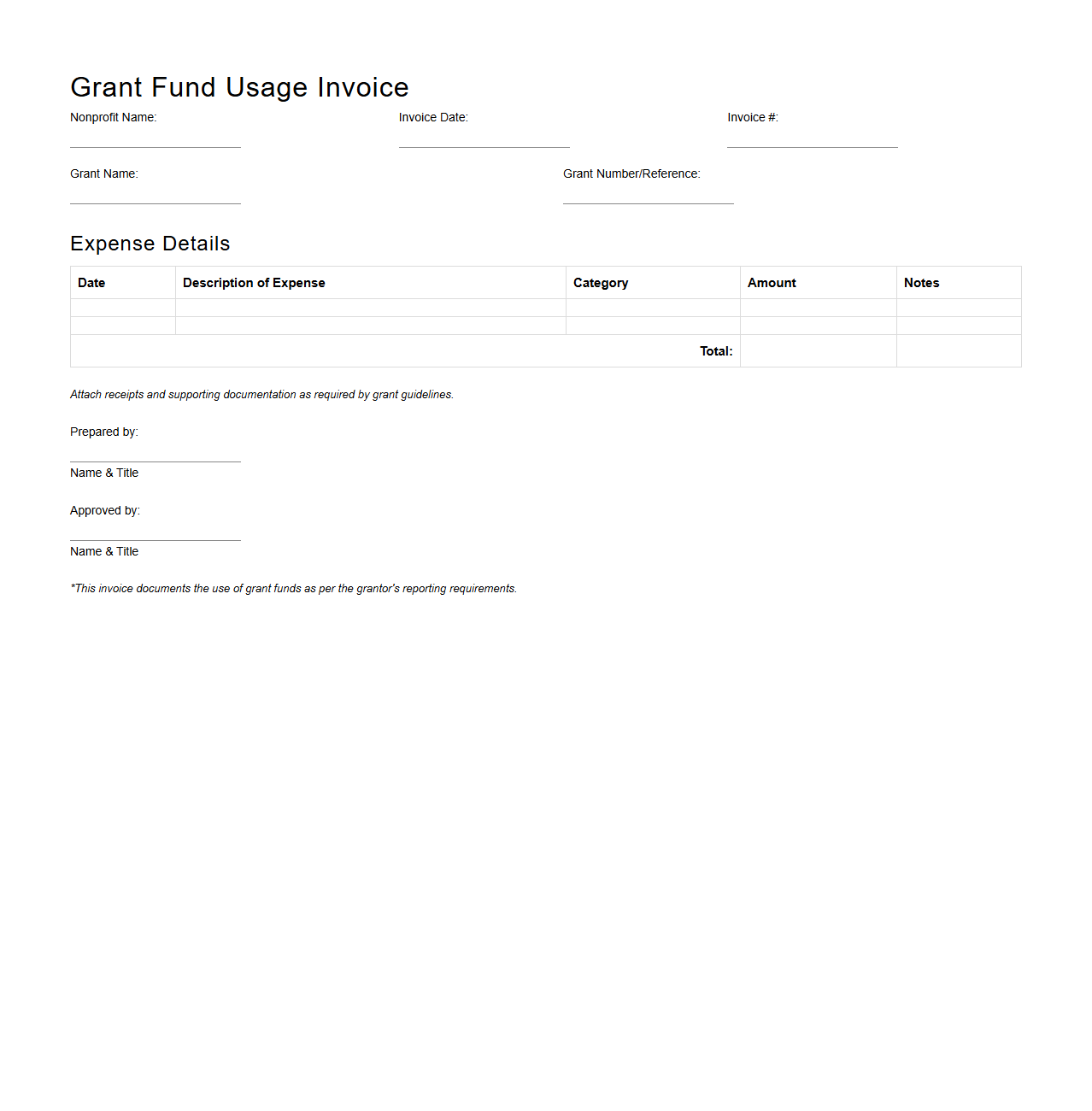

Grant Fund Usage Invoice for Nonprofit Accounting

A

Grant Fund Usage Invoice is a critical document in nonprofit accounting that details the expenditures of grant funds allocated to a specific project or program. It provides a transparent and itemized record of how the funds were used, ensuring compliance with donor requirements and grant agreements. This invoice supports financial reporting, audit processes, and facilitates accurate budgeting for future grant applications.

Volunteer Time Invoice Sheet for Nonprofit Tracking

A

Volunteer Time Invoice Sheet for nonprofit tracking is a document designed to accurately record and monitor the hours contributed by volunteers. It helps organizations quantify volunteer work for reporting, grant applications, and resource allocation. This sheet ensures transparency and accountability by providing detailed logs of volunteer activities and time commitments.

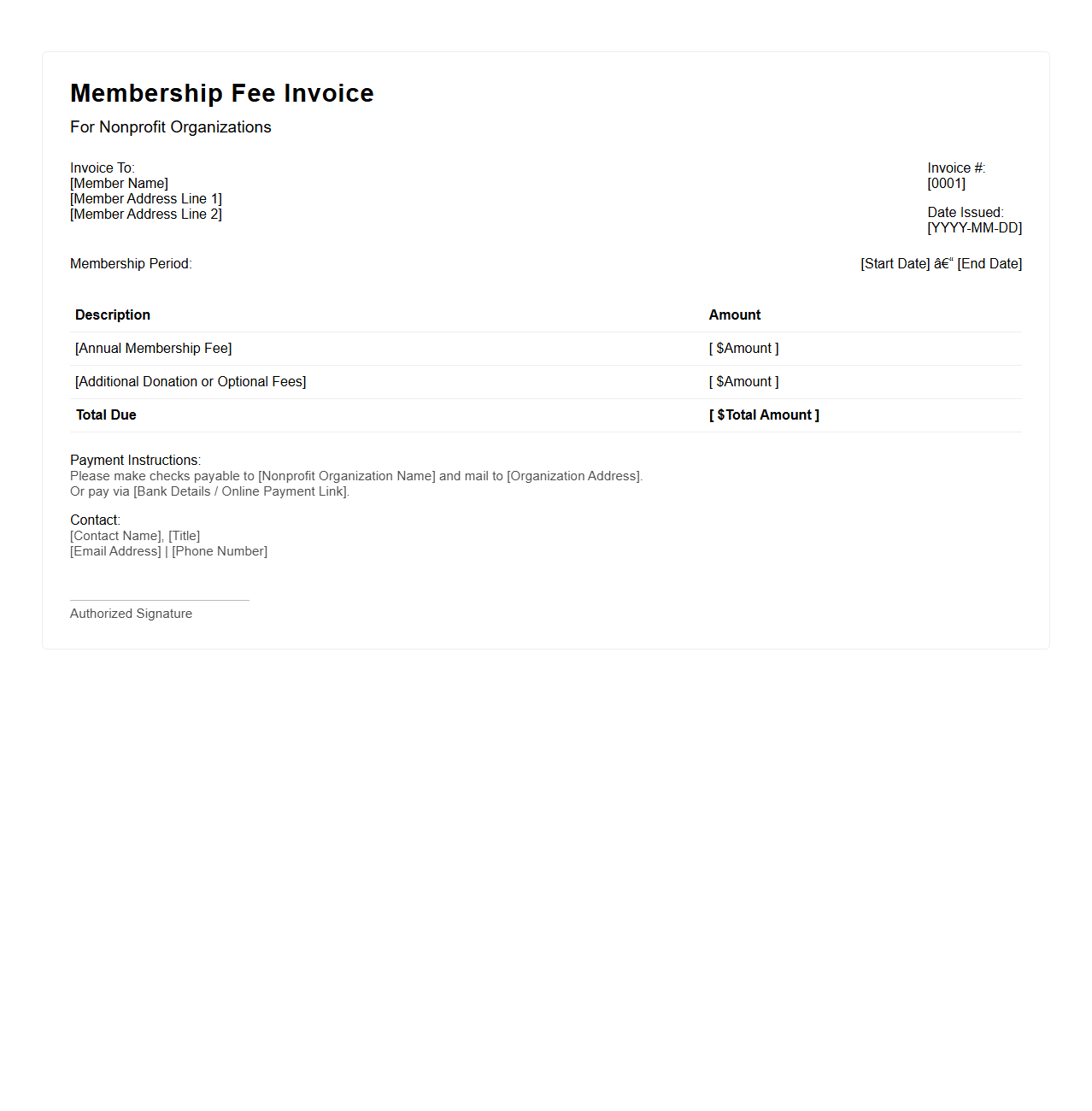

Membership Fee Invoice Template for Nonprofits

A

Membership Fee Invoice Template for Nonprofits is a structured document designed to streamline the billing process for nonprofit organizations collecting membership dues. This template standardizes invoicing by including essential details such as member information, fee amounts, payment deadlines, and accepted payment methods, ensuring transparency and consistency. Utilizing this template helps nonprofits maintain accurate financial records and enhances communication with members about their financial obligations.

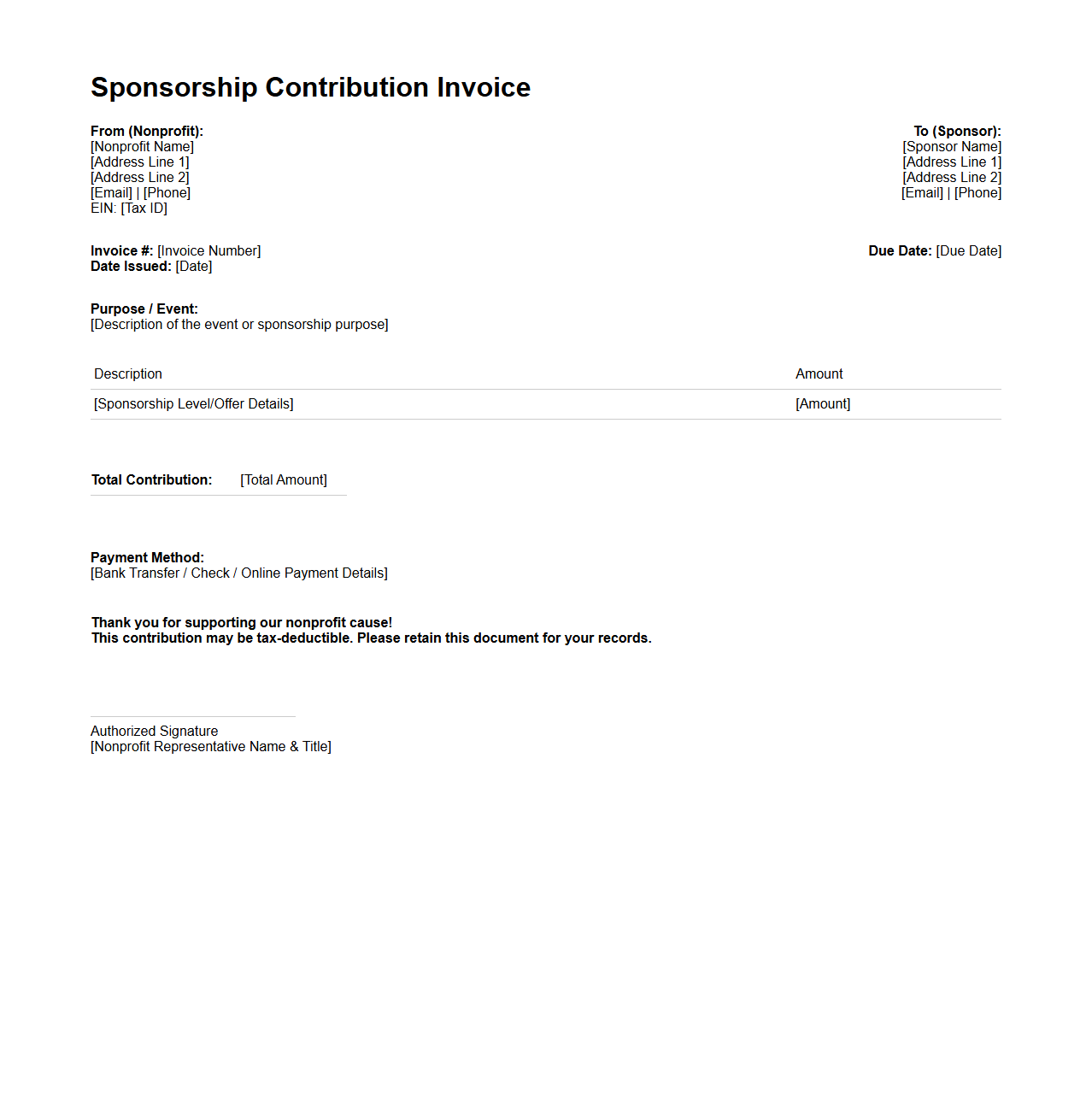

Sponsorship Contribution Invoice for Nonprofit Causes

A

Sponsorship Contribution Invoice for Nonprofit Causes document serves as a formal request for payment from sponsors supporting charitable events or initiatives. It details the agreed sponsorship amount, payment terms, and specific nonprofit cause benefiting from the contribution. This invoice ensures transparent financial tracking and reinforces accountability between sponsors and nonprofit organizations.

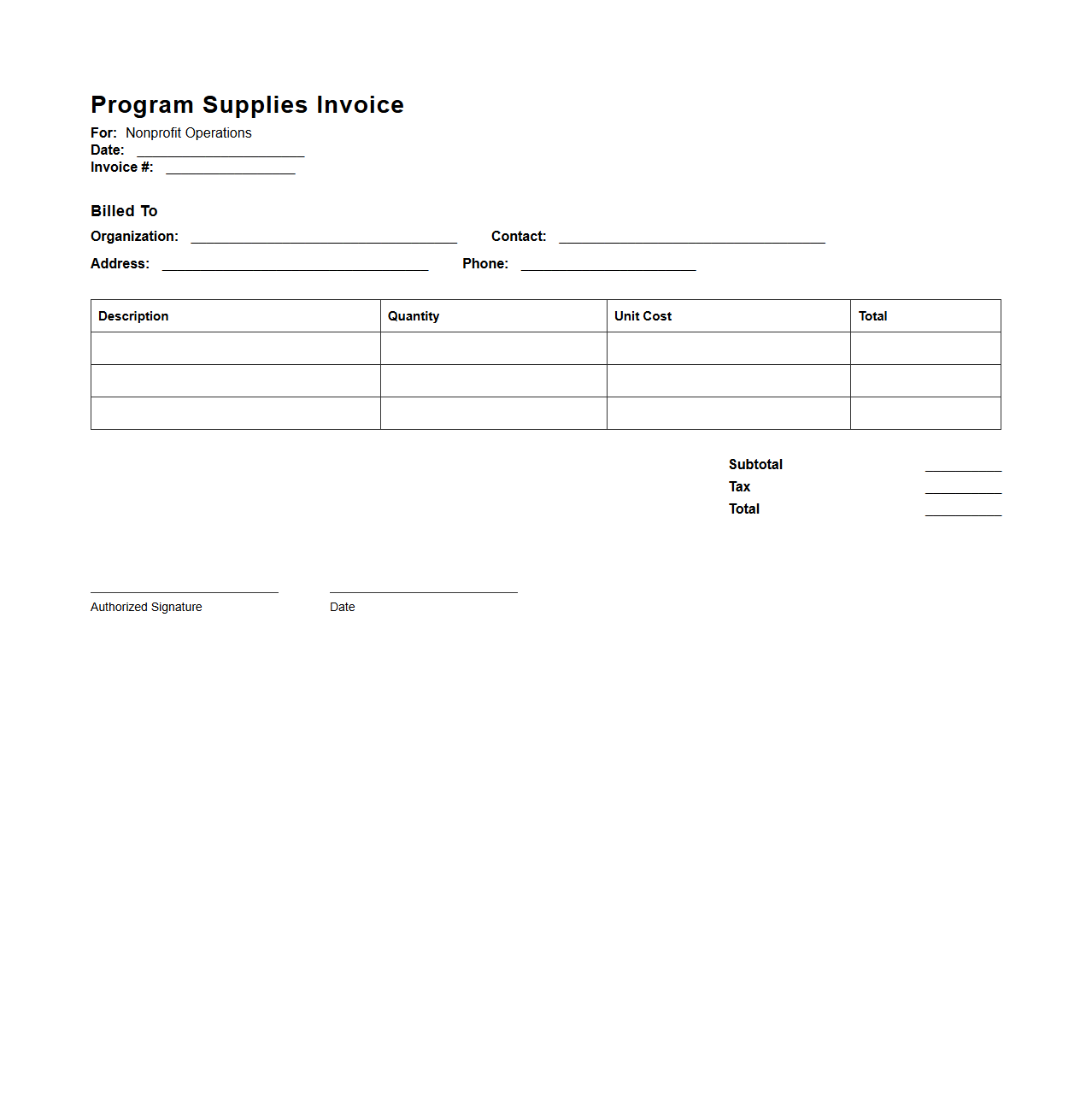

Program Supplies Invoice for Nonprofit Operations

A

Program Supplies Invoice for Nonprofit Operations document itemizes the purchased materials essential for executing nonprofit programs and services. It helps track expenses related to specific projects, ensuring transparent budget management and compliance with grant requirements. This invoice supports accurate financial reporting and accountability in nonprofit operations.

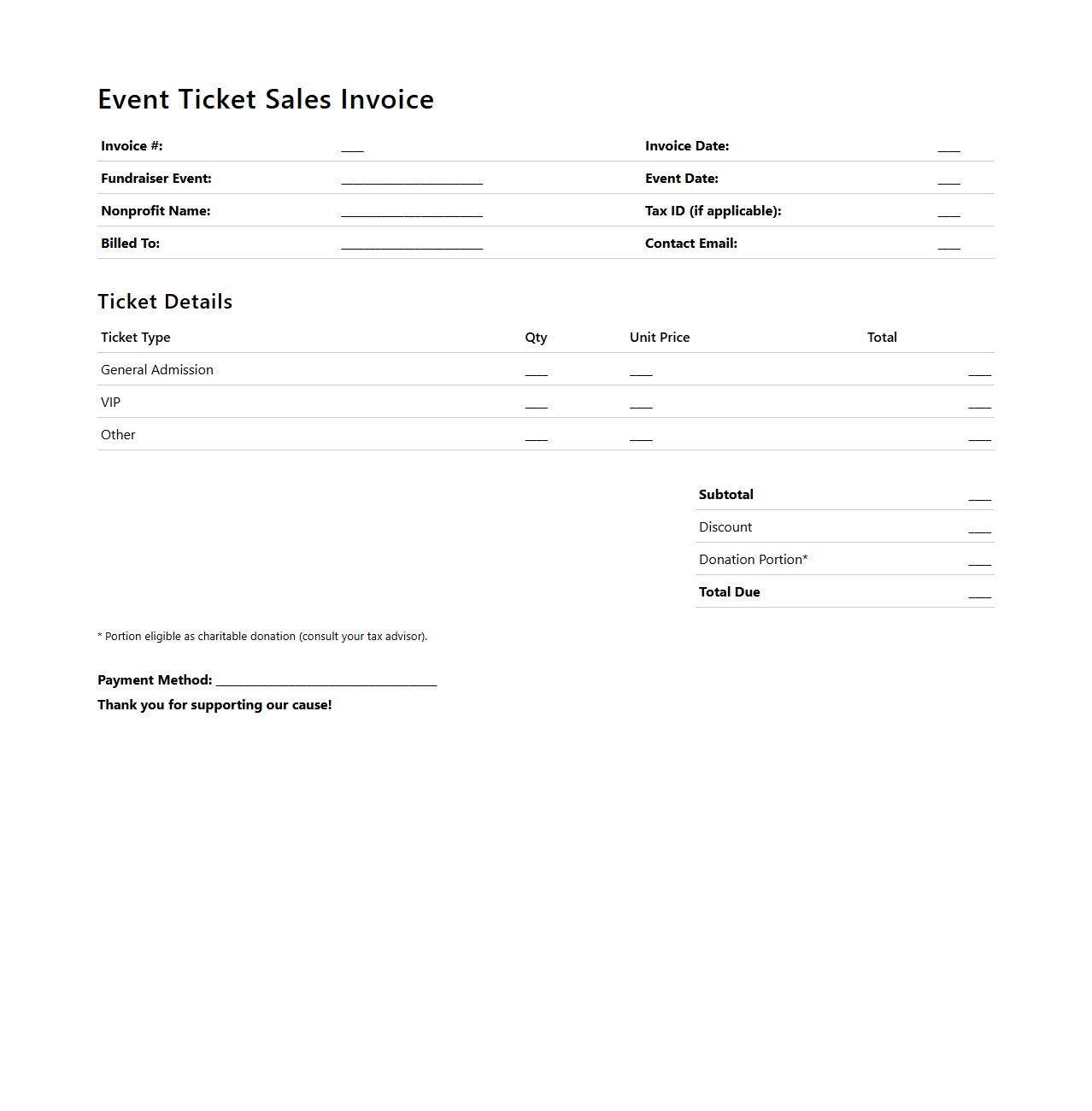

Event Ticket Sales Invoice for Nonprofit Fundraisers

An

Event Ticket Sales Invoice for nonprofit fundraisers is a detailed document that outlines the sale of tickets for charity events, providing essential information such as buyer details, number of tickets purchased, price per ticket, and total amount due. This invoice serves as a formal record for both the nonprofit organization and the donor, ensuring transparency in financial transactions and accurate tracking of funds raised during the event. It also facilitates accounting processes and compliance with nonprofit regulations by documenting sales and supporting tax deduction claims.

What key fields should a blank invoice template for nonprofit organizations include?

A blank invoice template for nonprofit organizations should include donor or client information, such as name and contact details. It must have a clear breakdown of services or goods provided alongside the donation amount or fee. Additionally, the invoice should feature an invoice number, date, and payment terms to track transactions efficiently.

How can donation-specific language be integrated into a nonprofit invoice letter?

Donation-specific language can be included by using terms like "gift," "contribution," or "donation" instead of standard billing phrases. The invoice letter should emphasize the impact of the donation and how funds will be used for the nonprofit's mission. Including a thank you message and a reminder of the tax-deductible nature of donations encourages ongoing support.

What compliance details are required for nonprofit invoicing in grant-funded programs?

Invoices for grant-funded programs must include grant identification numbers and references to the specific funding source. Compliance with federal or state regulations requires detailed documentation of expenditures linked to the grant's scope. Additionally, timely reporting and auditing information should be clearly stated to maintain transparency.

How should tax-exempt status be referenced on nonprofit invoice documents?

Nonprofit invoice documents should prominently display the organization's tax-exempt status along with the IRS determination letter number. A brief statement explaining the organization's exemption under the Internal Revenue Code section 501(c)(3) helps clarify the legal status. This ensures donors and clients recognize the tax benefits associated with their payment.

What payment instructions best suit recurring donors on nonprofit invoice letters?

Payment instructions for recurring donors should include clear details on automatic payment options such as online portals or direct debit. The invoice should provide a convenient way to update payment information and offer contact details for donor support. Including a reminder of the recurring schedule helps ensure consistent and reliable contributions.