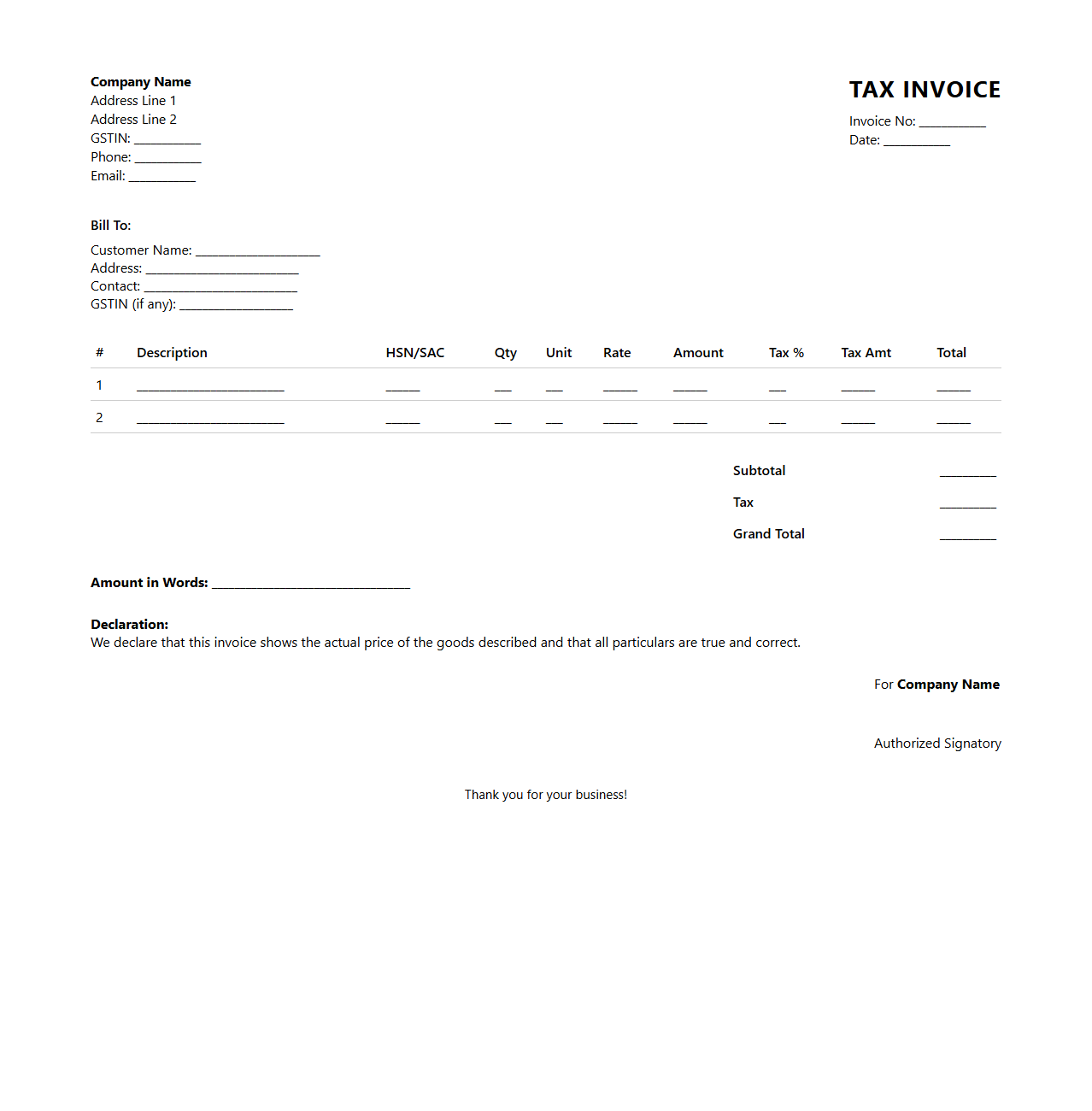

Simple Tax Invoice Template for Retail Businesses

A

Simple Tax Invoice Template for Retail Businesses is a standardized document designed to record sales transactions while ensuring compliance with tax regulations. It includes essential details such as item description, quantity, price, tax rates, and total amount due, facilitating accurate financial tracking and reporting. This template helps retail businesses streamline billing processes and maintain transparent records for tax audits.

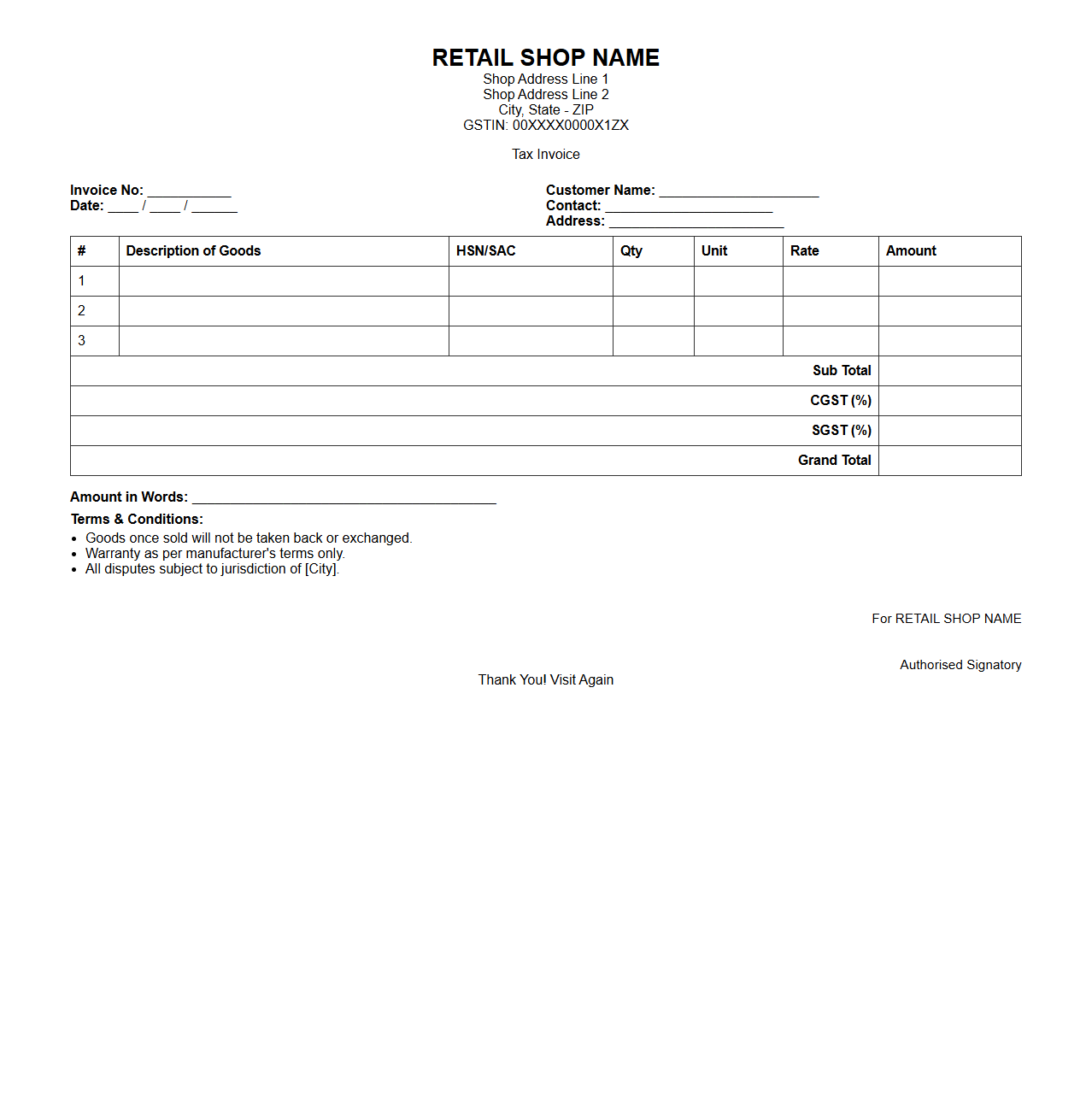

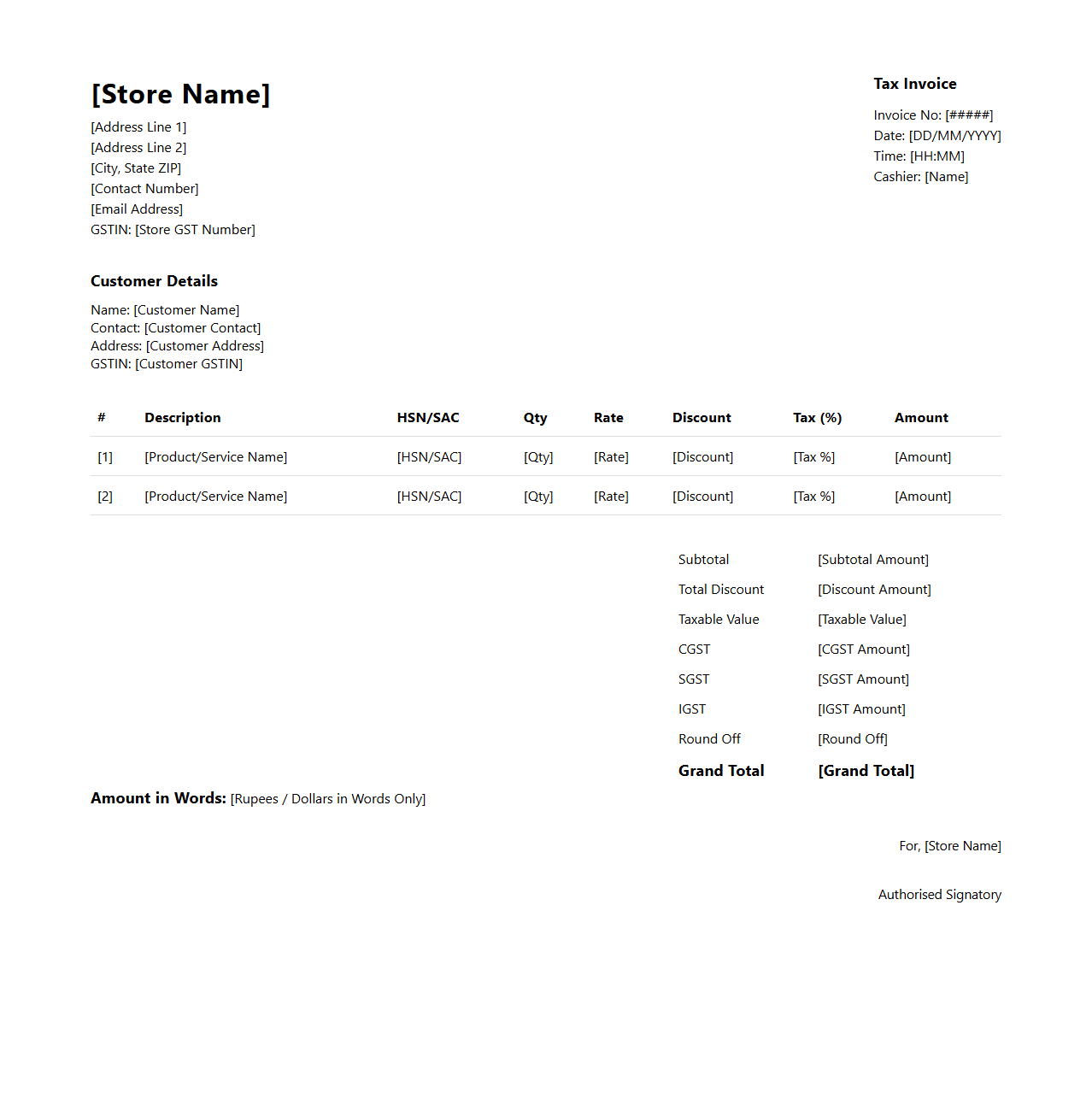

Retail Shop Tax Invoice Format

A

Retail Shop Tax Invoice Format document is a standardized template used by retailers to provide detailed billing information to customers for purchased goods or services. It includes essential data such as item descriptions, quantities, rates, applicable taxes like GST or VAT, total payable amount, and business identification details like GSTIN or PAN. This format ensures legal compliance, facilitates accurate tax reporting, and enhances transparency in commercial transactions.

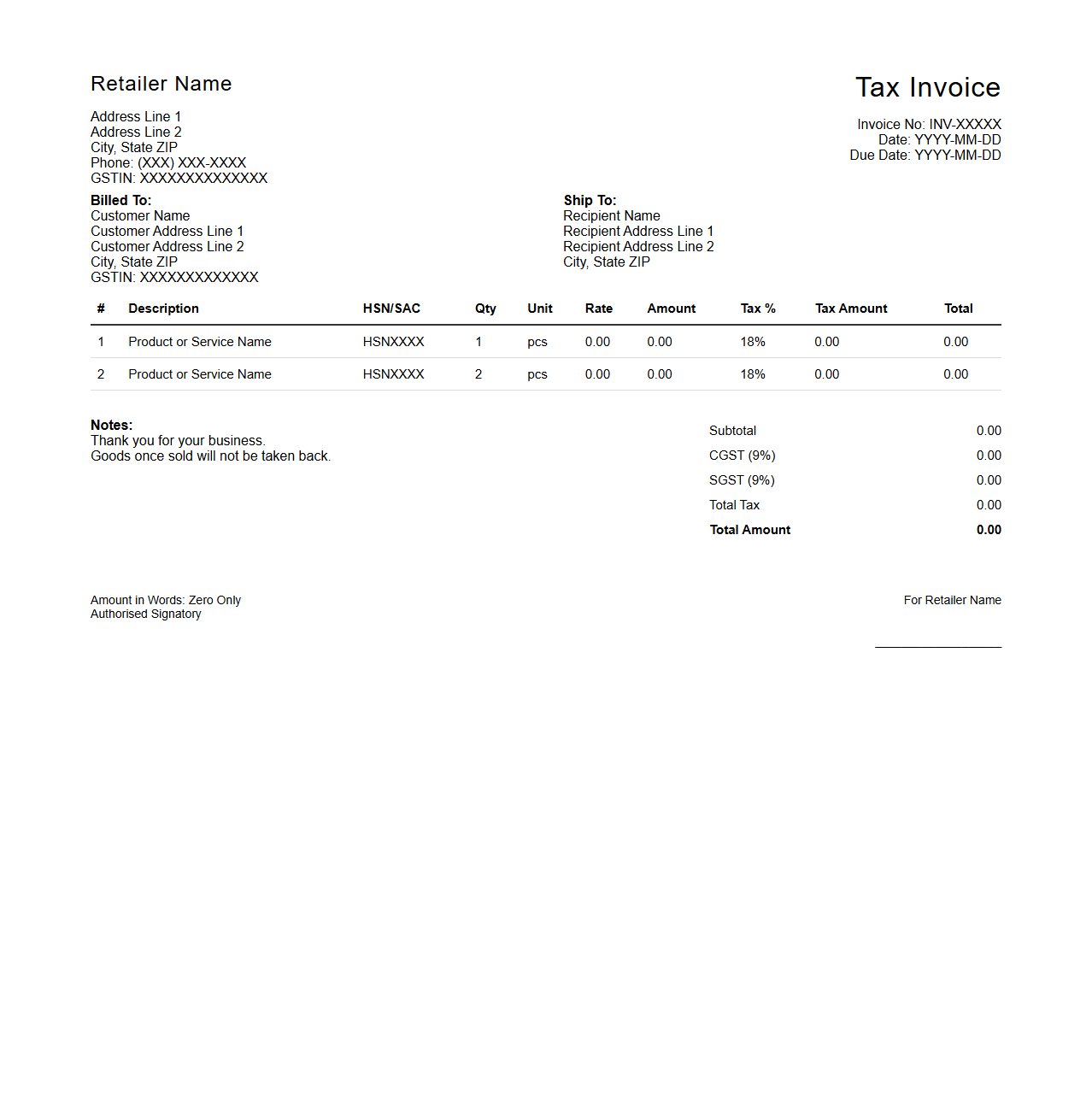

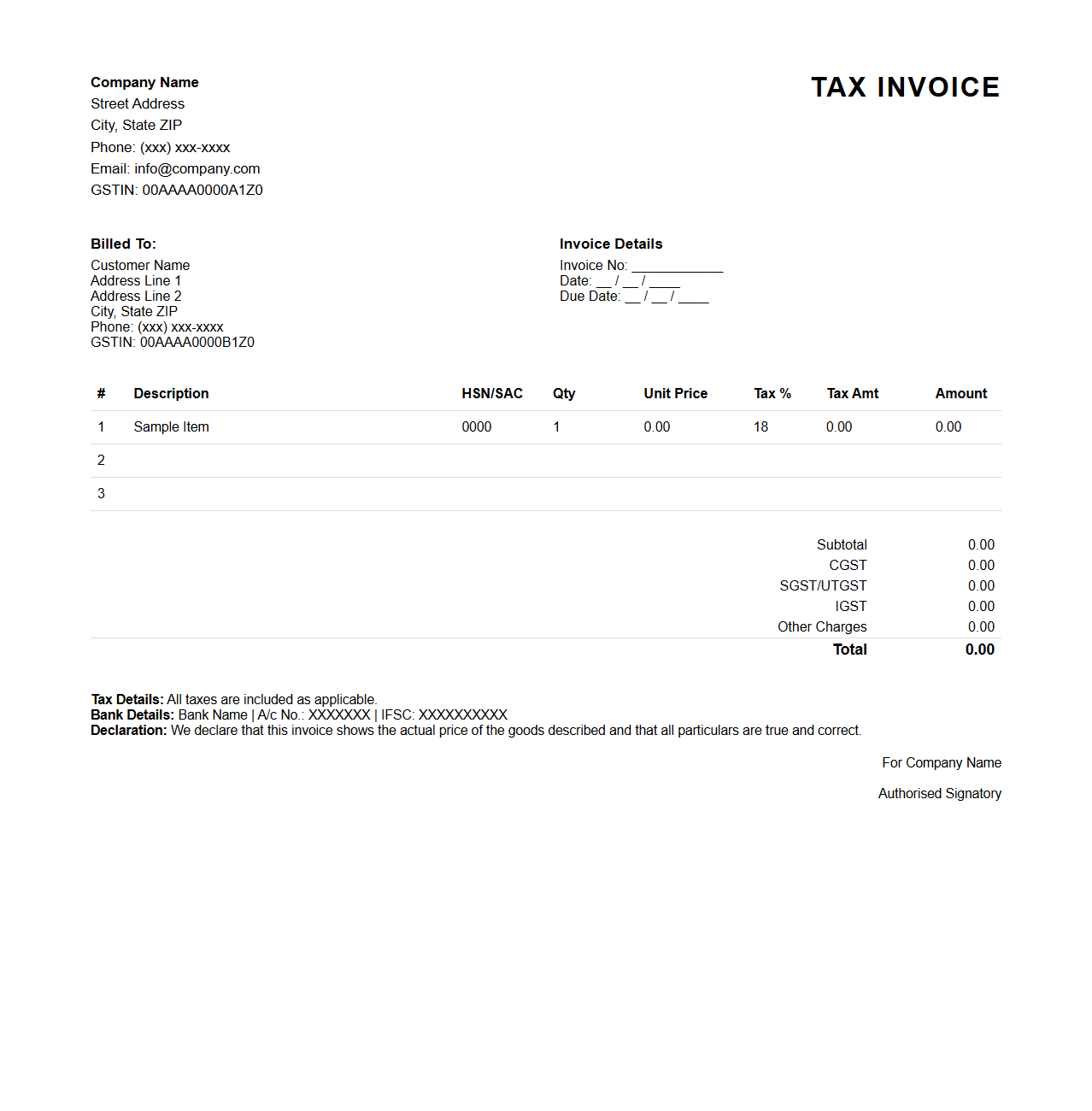

Detailed Tax Invoice Layout for Retail

A

Detailed Tax Invoice Layout for Retail document clearly itemizes all products or services sold, including quantities, unit prices, tax rates, and total amounts, ensuring compliance with tax regulations. It serves as a precise record for both retailers and customers to verify transaction details and tax calculations. This layout supports accurate bookkeeping, tax filing, and audit processes in retail businesses.

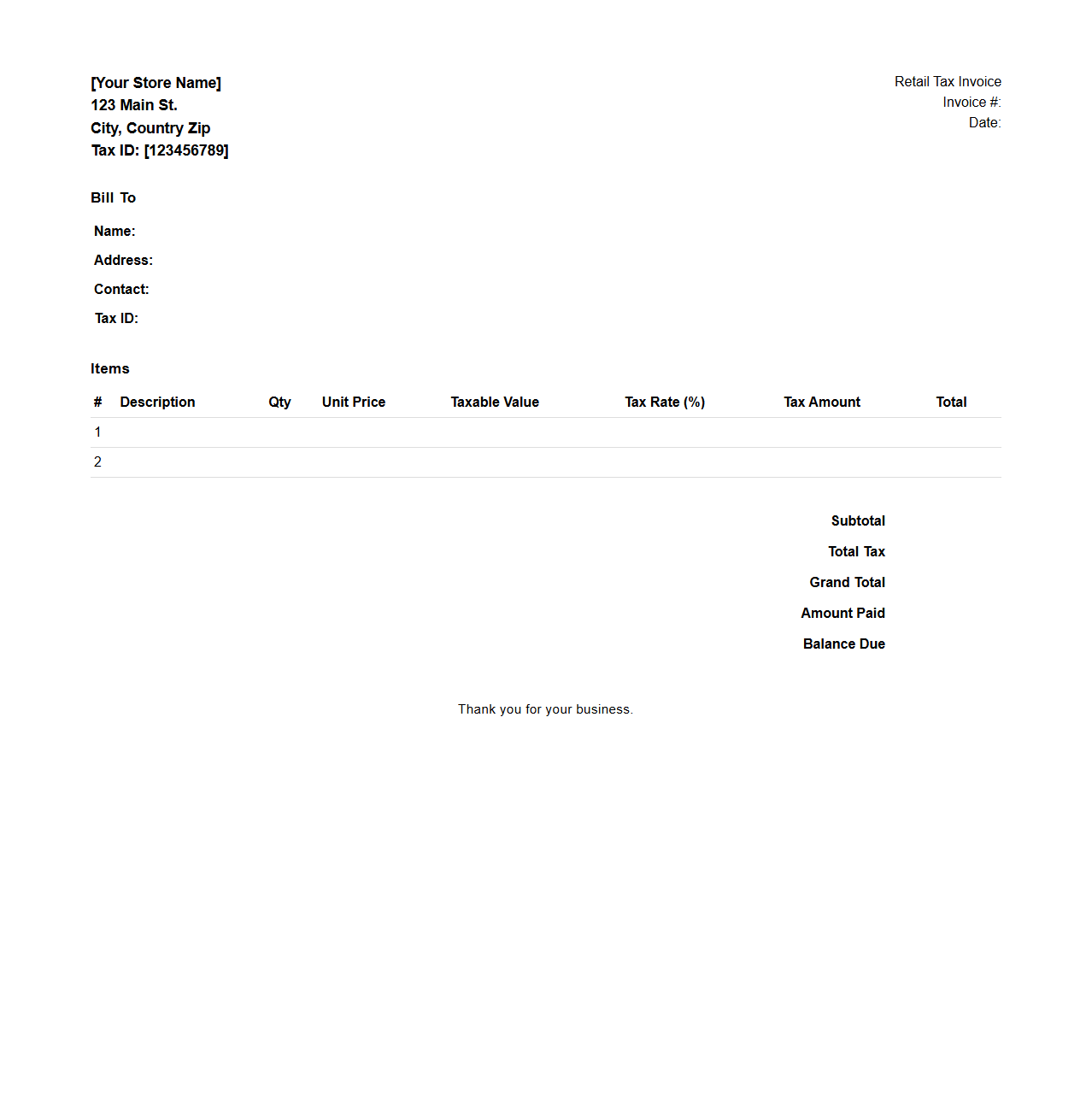

Minimalist Retail Tax Invoice Sample

A

Minimalist Retail Tax Invoice Sample document provides a clear, concise template designed for retail businesses to record sales transactions efficiently. It includes essential information such as seller and buyer details, invoice number, date of sale, item descriptions, quantities, unit prices, and applicable taxes. This streamlined format ensures compliance with tax regulations while maintaining simplicity for easy bookkeeping and customer reference.

Customizable Retail Store Tax Invoice Design

A

Customizable Retail Store Tax Invoice Design document outlines the layout and format specifications tailored to meet legal and business requirements for invoicing in retail operations. It includes elements such as company details, itemized product listings, tax calculations, and payment information, ensuring compliance with tax regulations while enhancing the customer experience. Customization allows retailers to incorporate branding elements and adapt the invoice format to various sales scenarios and tax jurisdictions.

Professional Retail Tax Invoice Sheet

A

Professional Retail Tax Invoice Sheet is a detailed financial document issued by retailers to customers, listing purchased items, quantities, prices, and applicable taxes. It serves as proof of transaction for both buyers and sellers, ensuring compliance with tax regulations and facilitating accurate bookkeeping. This document is essential for claiming tax credits, warranty claims, and auditing purposes.

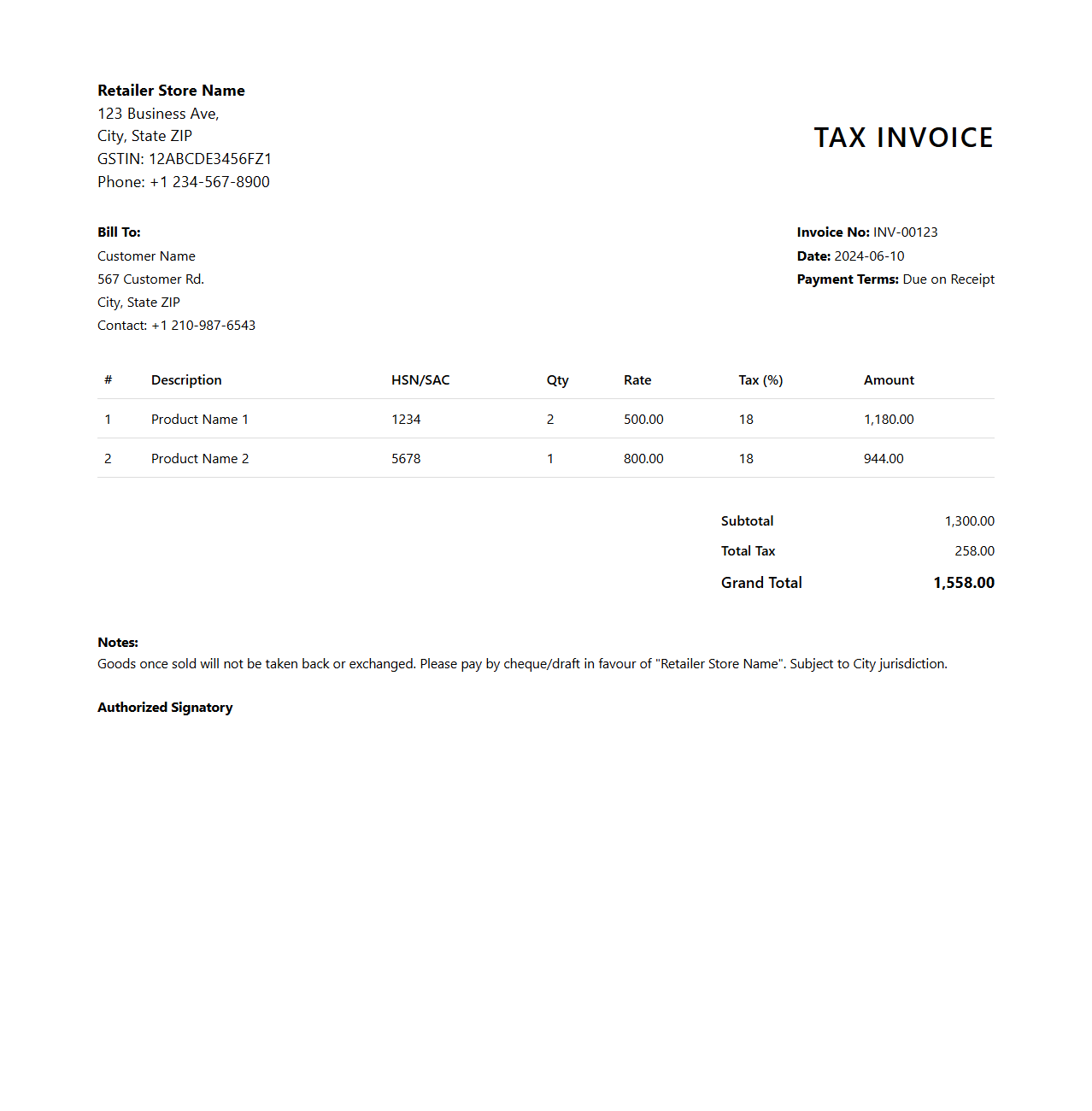

Modern Tax Invoice Template for Retailers

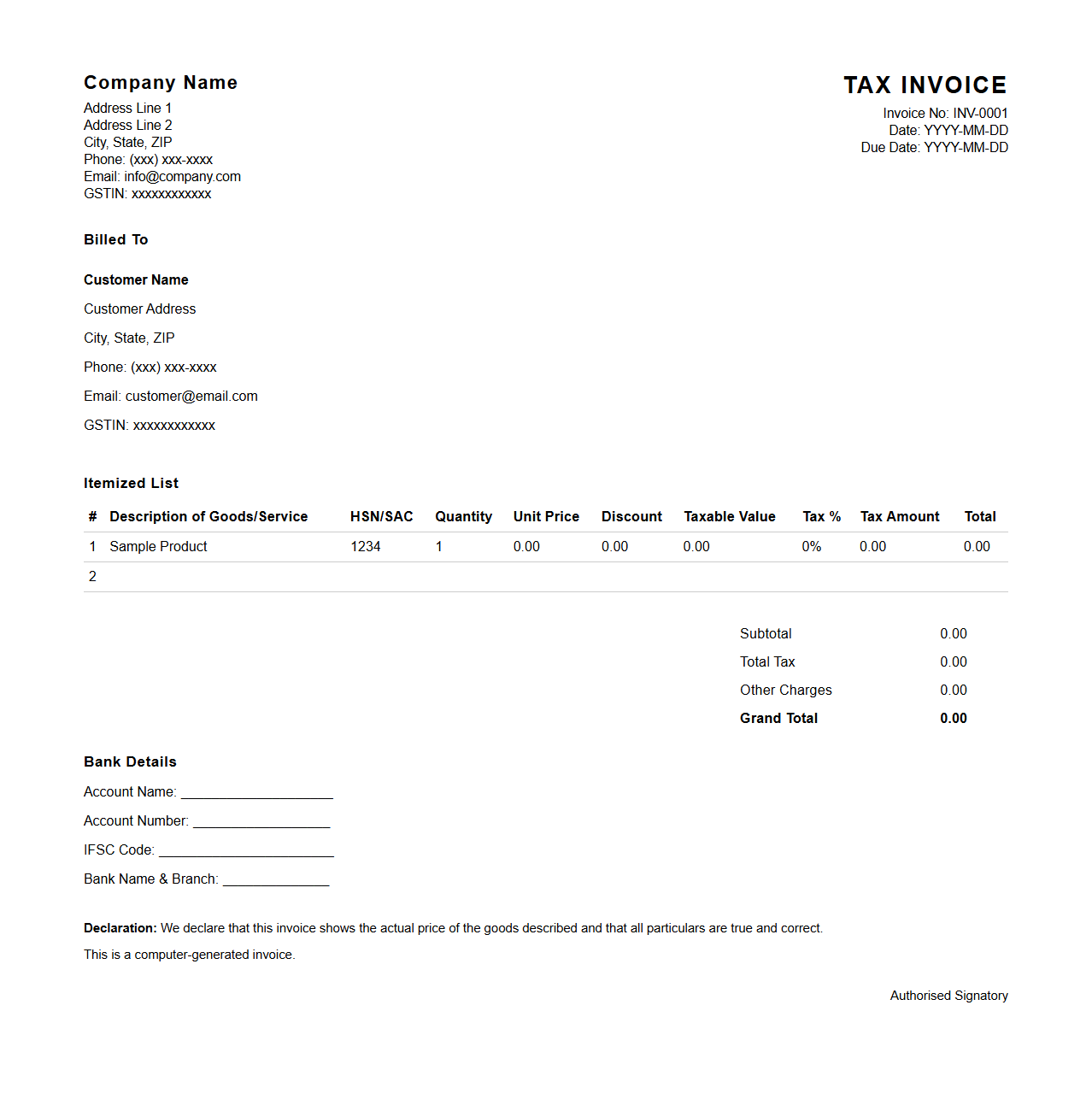

A

Modern Tax Invoice Template for Retailers is a professionally designed document used to record sales transactions, ensuring compliance with tax regulations while enhancing clarity and professionalism. It includes essential elements such as retailer information, buyer details, itemized list of products or services, applicable taxes, total amounts, and payment terms. This template streamlines invoice generation, helps maintain accurate financial records, and supports seamless auditing and reporting processes for retail businesses.

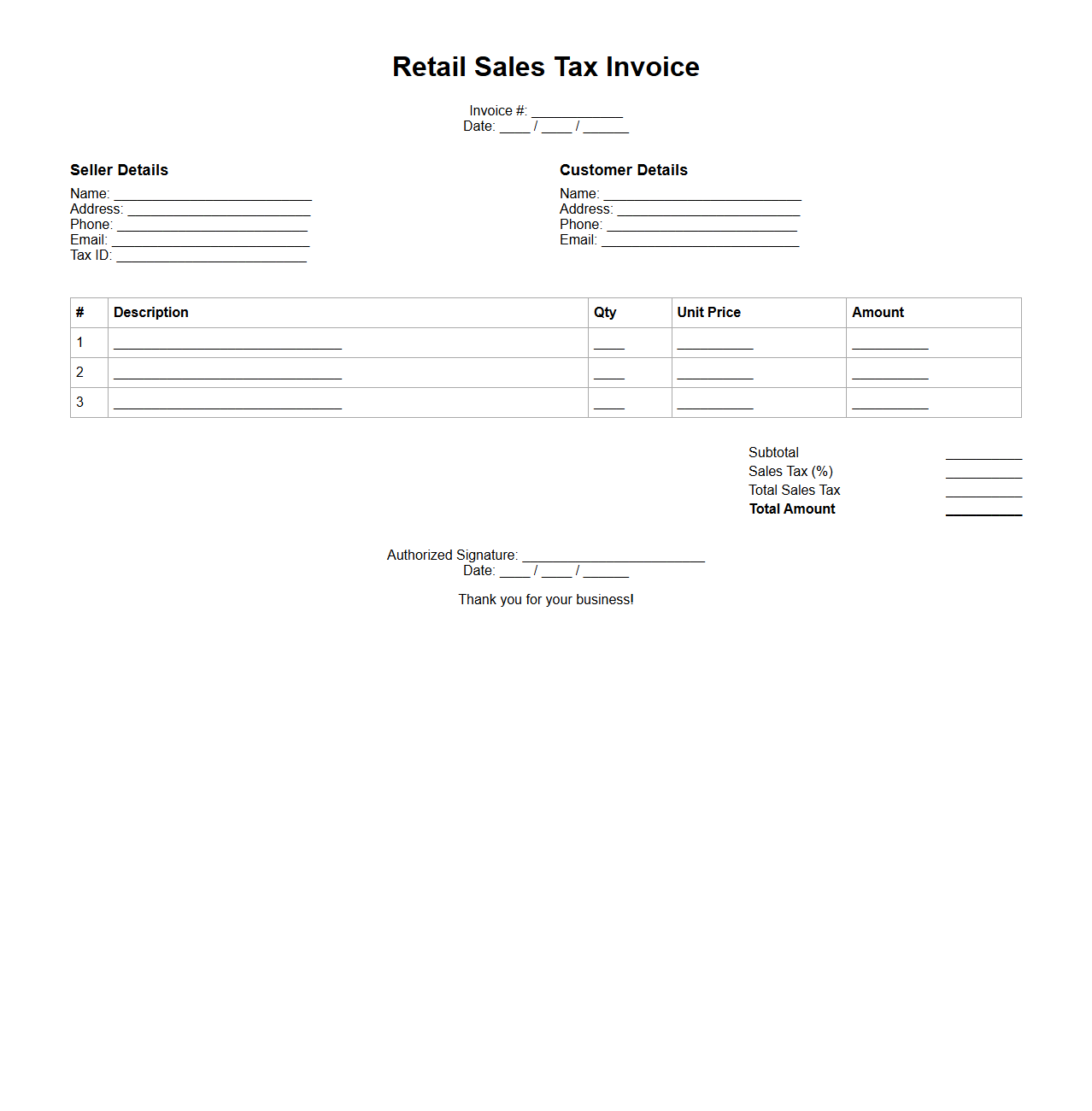

Retail Sales Tax Invoice Document

A

Retail Sales Tax Invoice Document serves as an official record detailing the sale of goods or services, including item descriptions, quantities, prices, and applicable taxes. This document ensures compliance with tax regulations by clearly displaying the sales tax amount charged to the customer. It facilitates accurate bookkeeping, audit processes, and customer transparency in retail transactions.

Retail Transaction Tax Invoice Form

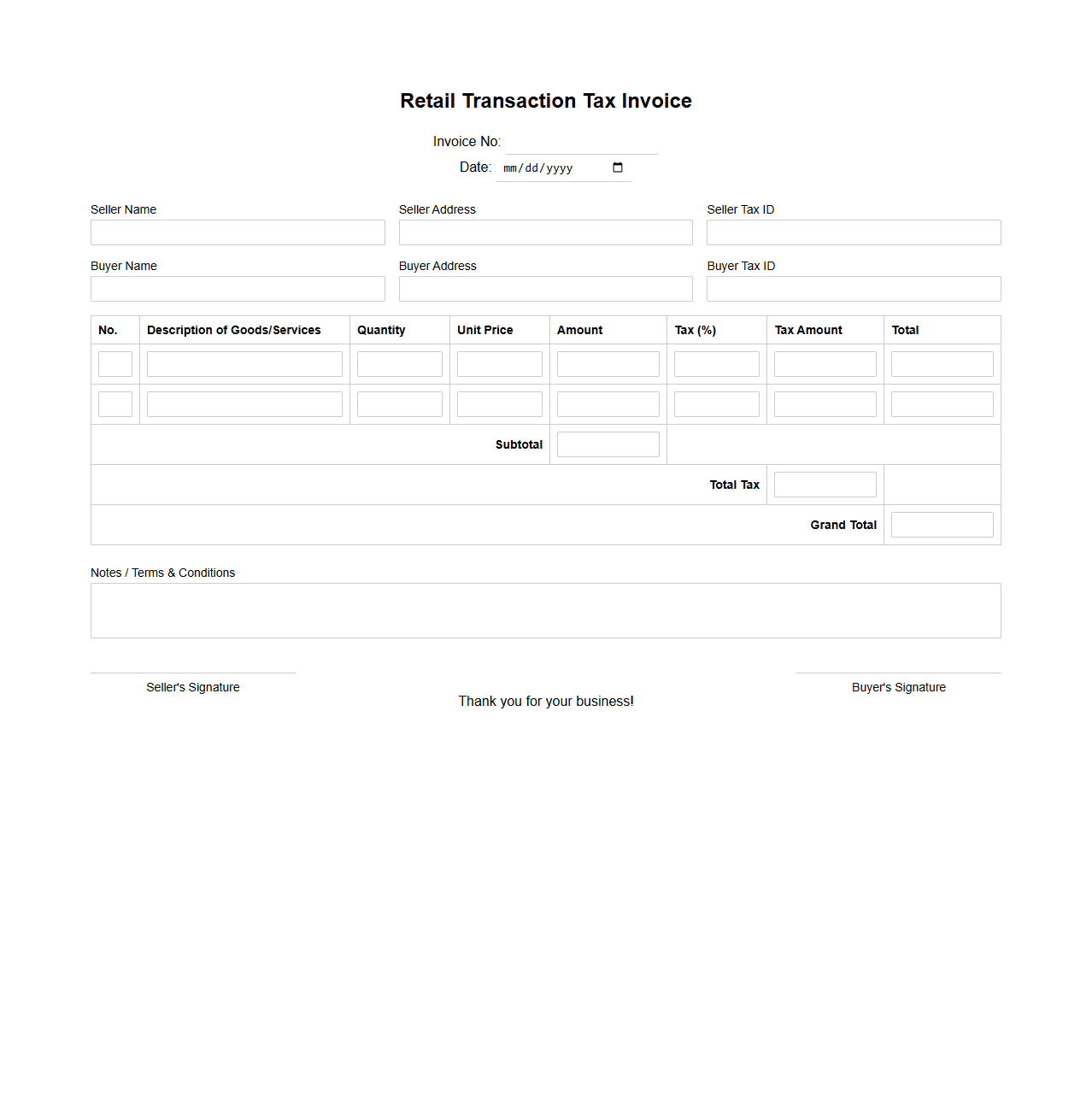

The

Retail Transaction Tax Invoice Form is a legal document used to record the sale of goods or services in retail settings, ensuring compliance with tax regulations. This form itemizes the transaction details, including the buyer's and seller's information, description of goods or services, quantity, price, and applicable tax amounts, facilitating accurate tax reporting and audit trails. Businesses use this document to provide proof of purchase to customers and to support their tax filings with government authorities.

Standard Retail Tax Invoicing Template

The

Standard Retail Tax Invoicing Template document serves as a predefined format for issuing tax invoices in retail transactions, ensuring compliance with legal and financial regulations. It typically includes essential details such as seller and buyer information, item descriptions, quantities, prices, applicable taxes, and the total amount payable. This template streamlines the invoicing process, enhances accuracy, and supports record-keeping for tax filing and auditing purposes.

What mandatory elements must a blank tax invoice for retail include to comply with local regulations?

A blank tax invoice must include the seller's legal name and tax identification number to ensure compliance. It should also display a unique invoice number for proper record-keeping and audit tracking. Additionally, the invoice must specify the date of issue and the applicable tax rate for transparency.

How can digital platforms securely handle the issuance of a blank retail tax invoice?

Digital platforms should implement secure encryption protocols to protect invoice data during issuance and transmission. They must also include user authentication features to prevent unauthorized access. Automated audit trails enhance security by recording every transaction related to the invoice.

What are common pitfalls when customizing blank tax invoice templates for retail businesses?

One common error is omitting essential fields like tax identification numbers, which leads to non-compliance. Over-customization can also cause confusion if standard legal requirements are altered or removed. Additionally, failing to update templates according to changing tax laws can result in invalid invoices.

How should voided or canceled blank tax invoices be documented and stored in retail?

Voided or canceled invoices must be clearly marked with a "CANCELED" stamp or watermark to avoid misuse. These documents should be retained securely for the legally mandated retention period. Proper digital or physical storage ensures audit readiness and prevents fraudulent reuse.

What security features can help prevent fraud with blank tax invoices in retail environments?

Incorporating watermarks and holograms can significantly reduce the risk of invoice forgery in retail. Using serialized invoice numbers allows for accurate tracking and verification of each document. Multi-factor authentication adds an extra layer of protection when accessing or issuing invoices digitally.