A Blank Payment Order Template for Financial Transactions provides a standardized format to initiate and authorize payments efficiently. This template ensures clarity by including essential details such as payer and payee information, transaction amount, and payment instructions. Utilizing this template helps streamline financial processes while minimizing errors and delays.

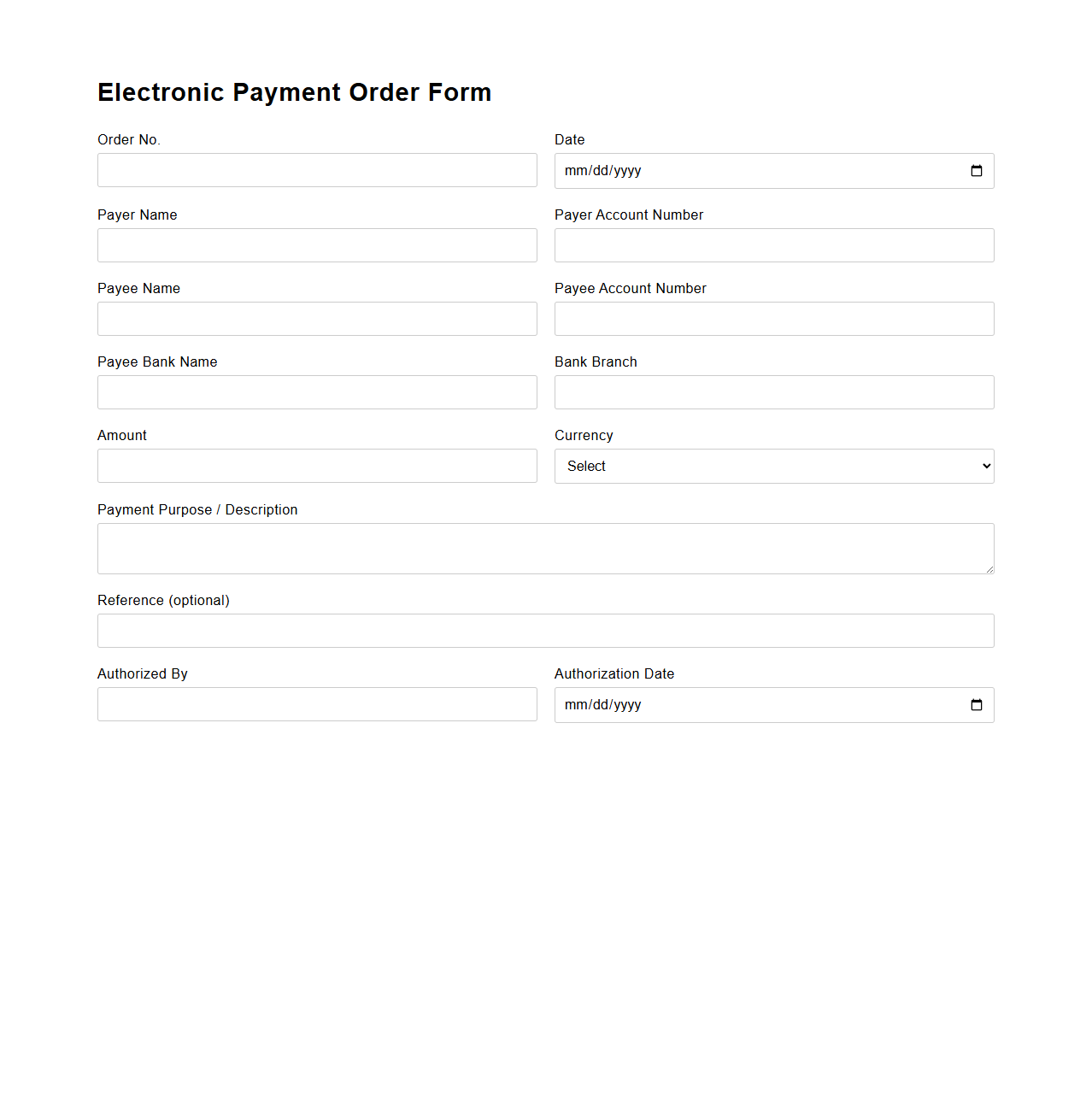

Blank Electronic Payment Order Form Template

A

Blank Electronic Payment Order Form Template is a standardized digital document designed to facilitate seamless financial transactions by capturing essential payment details such as payer information, payment amount, recipient details, and transaction reference. This template ensures accuracy and compliance by providing a structured format for electronic authorization of payments, reducing errors and processing time. It is widely used in businesses and organizations to streamline accounts payable processes and maintain comprehensive audit trails.

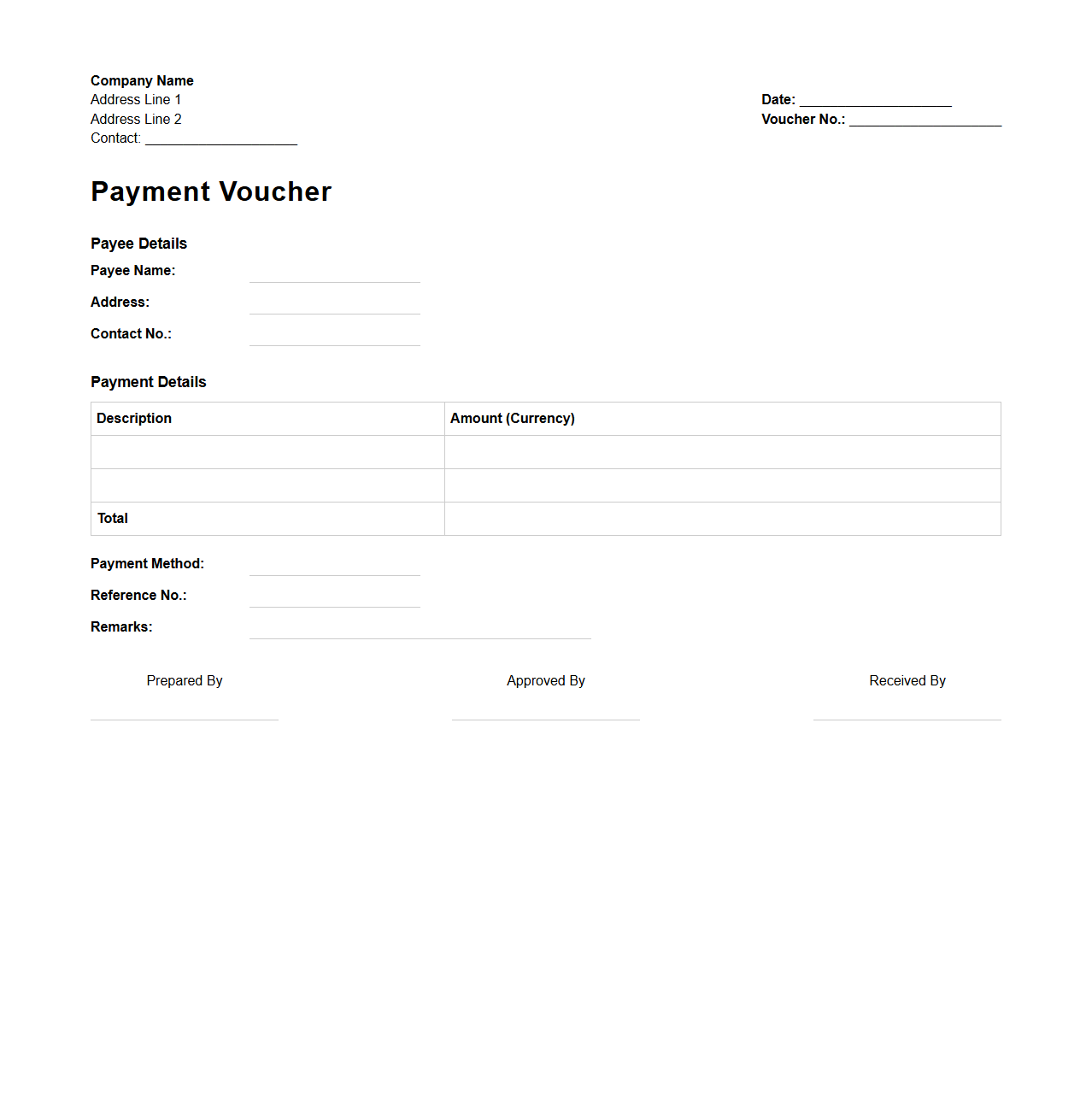

Generic Payment Voucher Template for Business Transactions

A

Generic Payment Voucher Template for business transactions is a standardized document used to record payment authorizations and details in a systematic manner. It typically includes fields for the payee's name, payment amount, date, purpose, and approval signatures, ensuring accuracy and accountability in financial processes. This template streamlines payment tracking, supports auditing requirements, and enhances transparency in business operations.

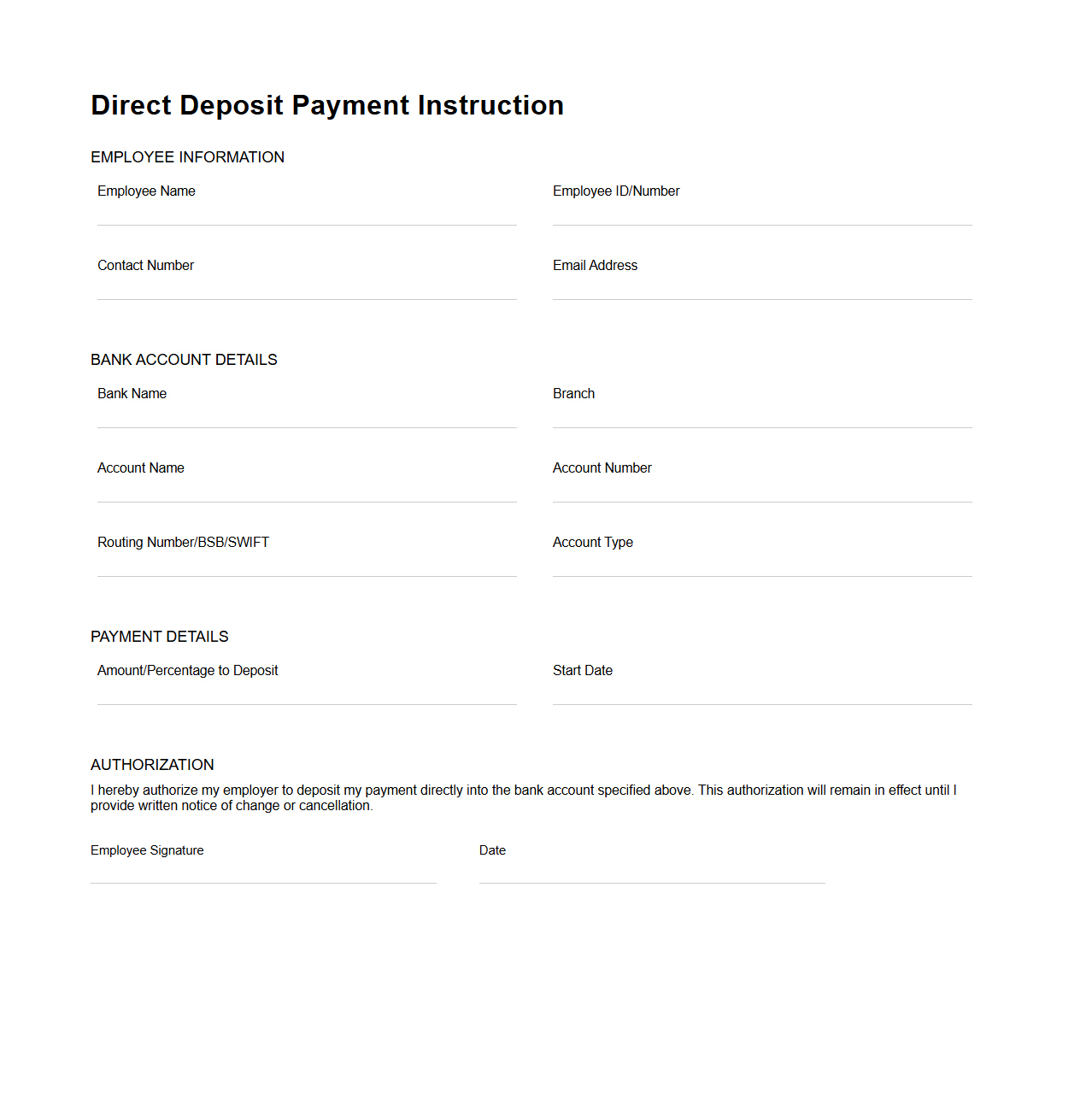

Blank Direct Deposit Payment Instruction Template

The

Blank Direct Deposit Payment Instruction Template document serves as a standardized form for employees or vendors to provide their banking details securely to employers or payers. It typically includes fields for account number, bank name, routing number, and account type, ensuring accurate and timely electronic fund transfers. Using this template minimizes errors and streamlines the payroll or payment process by facilitating automatic deposits directly into the recipient's bank account.

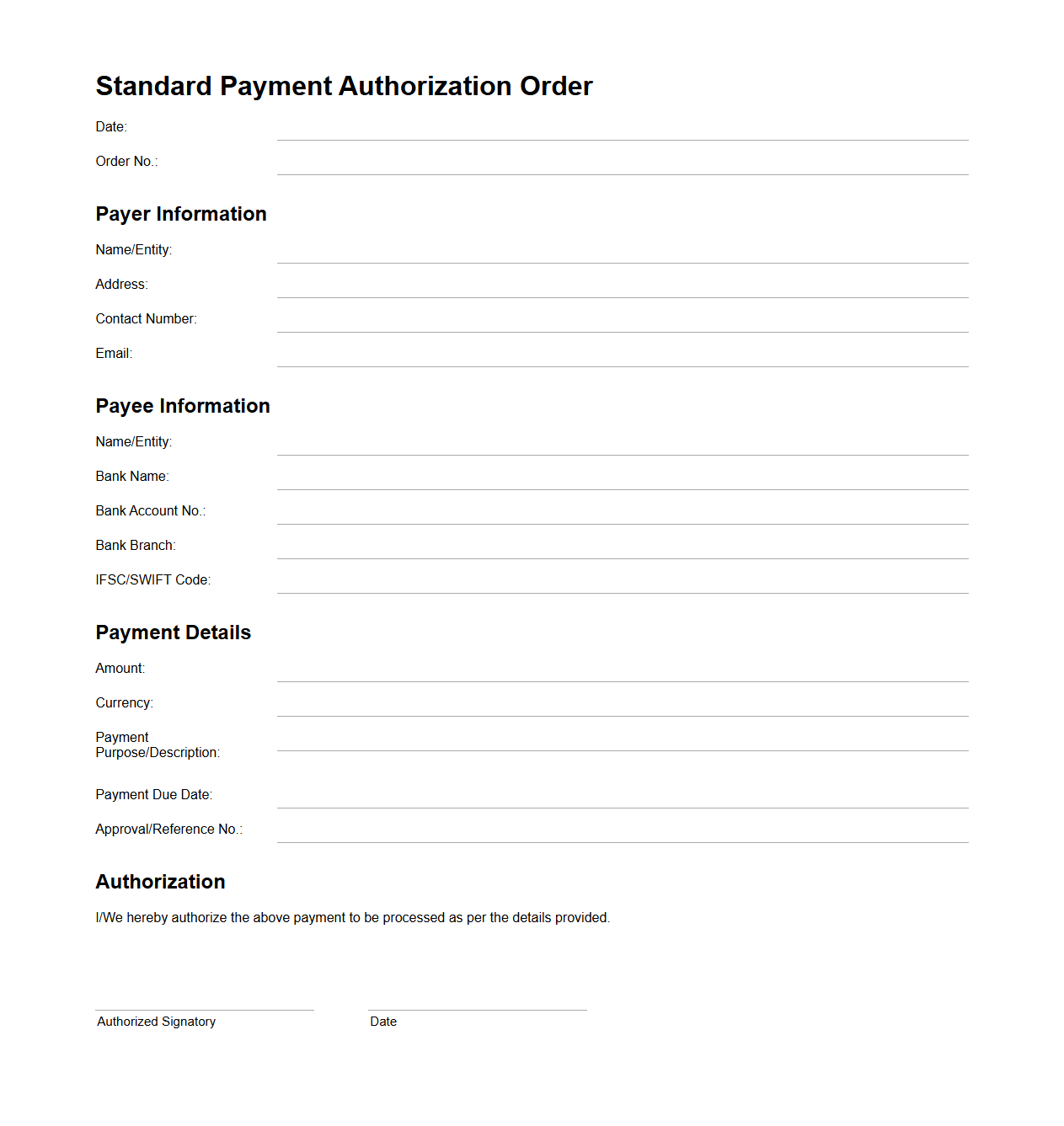

Standard Payment Authorization Order Template

The

Standard Payment Authorization Order Template is a formal document used to streamline and authorize payment transactions within organizations, ensuring accuracy and compliance. It details the payee information, payment amount, authorization signatures, and payment terms to control financial processes effectively. This template helps reduce errors, prevent fraud, and maintain clear audit trails for financial accountability.

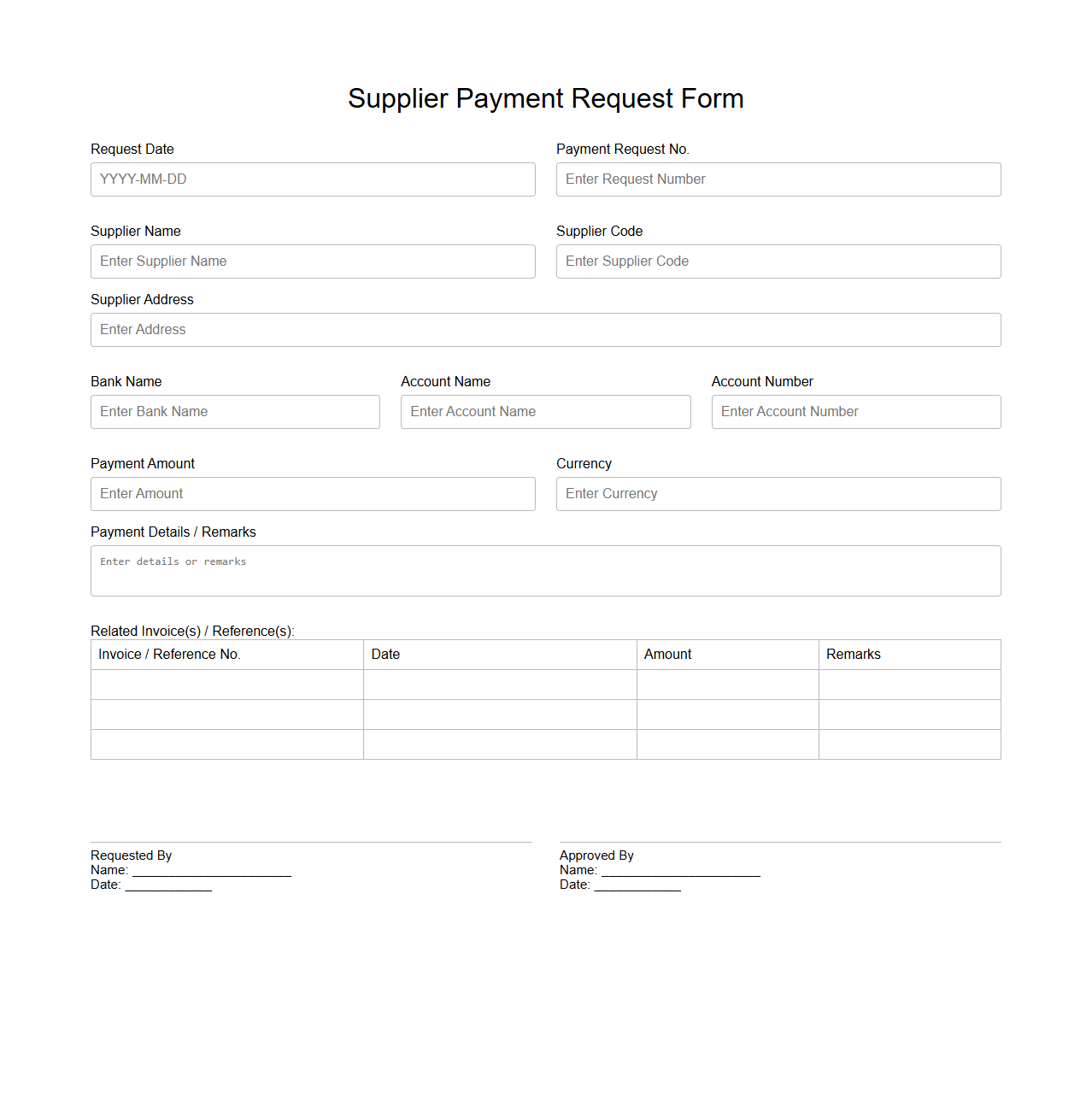

Blank Supplier Payment Request Form Template

A

Blank Supplier Payment Request Form Template is a standardized document used by businesses to request payment for goods or services provided by suppliers. This form captures essential details such as supplier information, invoice numbers, payment amounts, and approval signatures, ensuring accurate and efficient processing of supplier payments. Utilizing this template helps streamline accounting workflows and maintain clear records for financial auditing and compliance purposes.

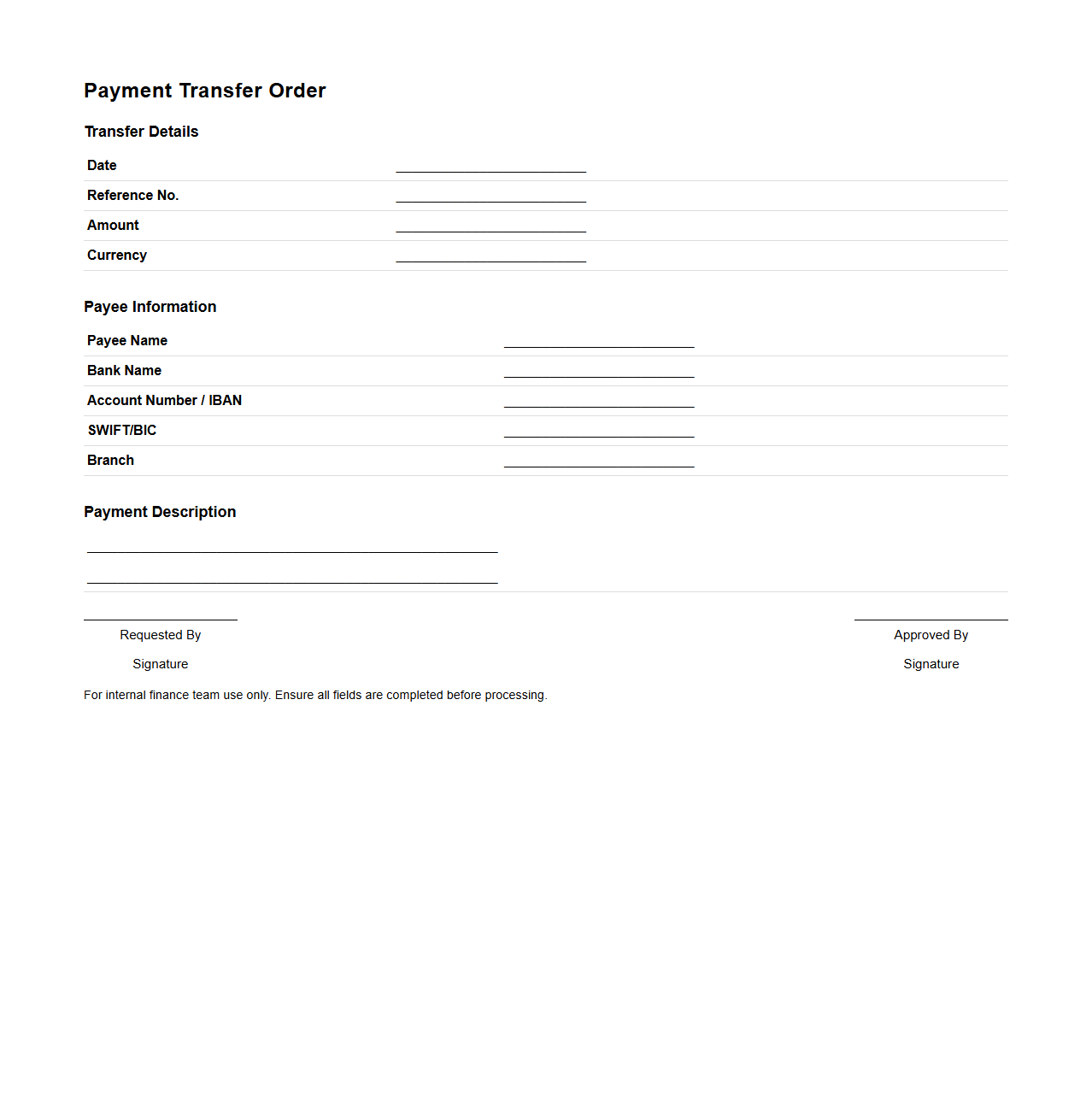

Basic Payment Transfer Order Template for Finance Teams

The

Basic Payment Transfer Order Template serves as a standardized document for finance teams to efficiently process and authorize payment transfers. It captures essential details such as payment amount, recipient information, approval signatures, and transaction references to ensure accuracy and compliance with internal financial controls. This template streamlines payment workflows, reduces errors, and enhances audit traceability within financial operations.

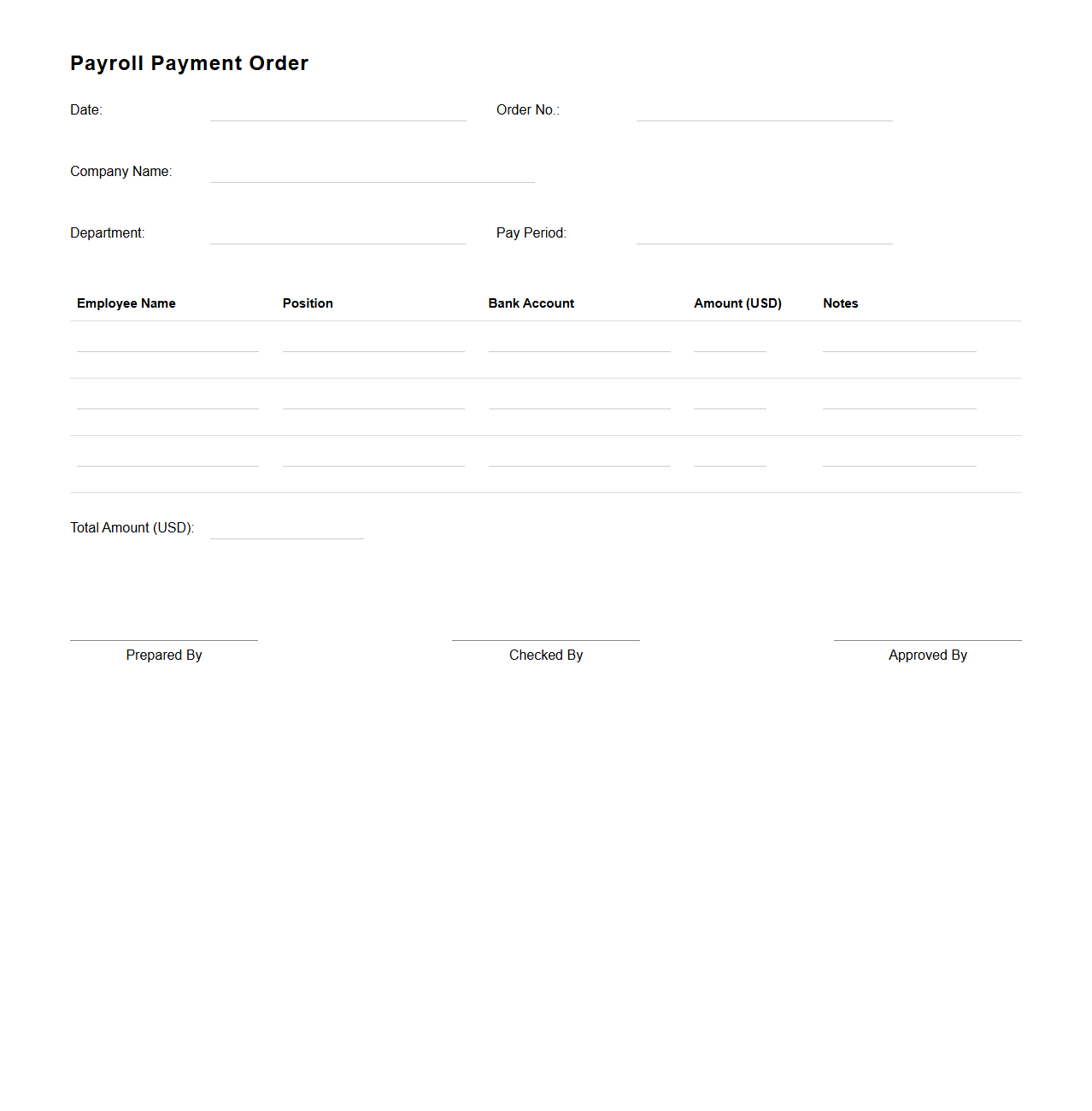

Blank Payroll Payment Order Template

The

Blank Payroll Payment Order Template is a standardized document used by organizations to authorize and record employee salary disbursements systematically. It typically includes fields for employee details, payment amounts, payment dates, and authorization signatures, ensuring accuracy and compliance in payroll processing. Utilizing this template streamlines payroll management, minimizes errors, and provides clear documentation for financial auditing.

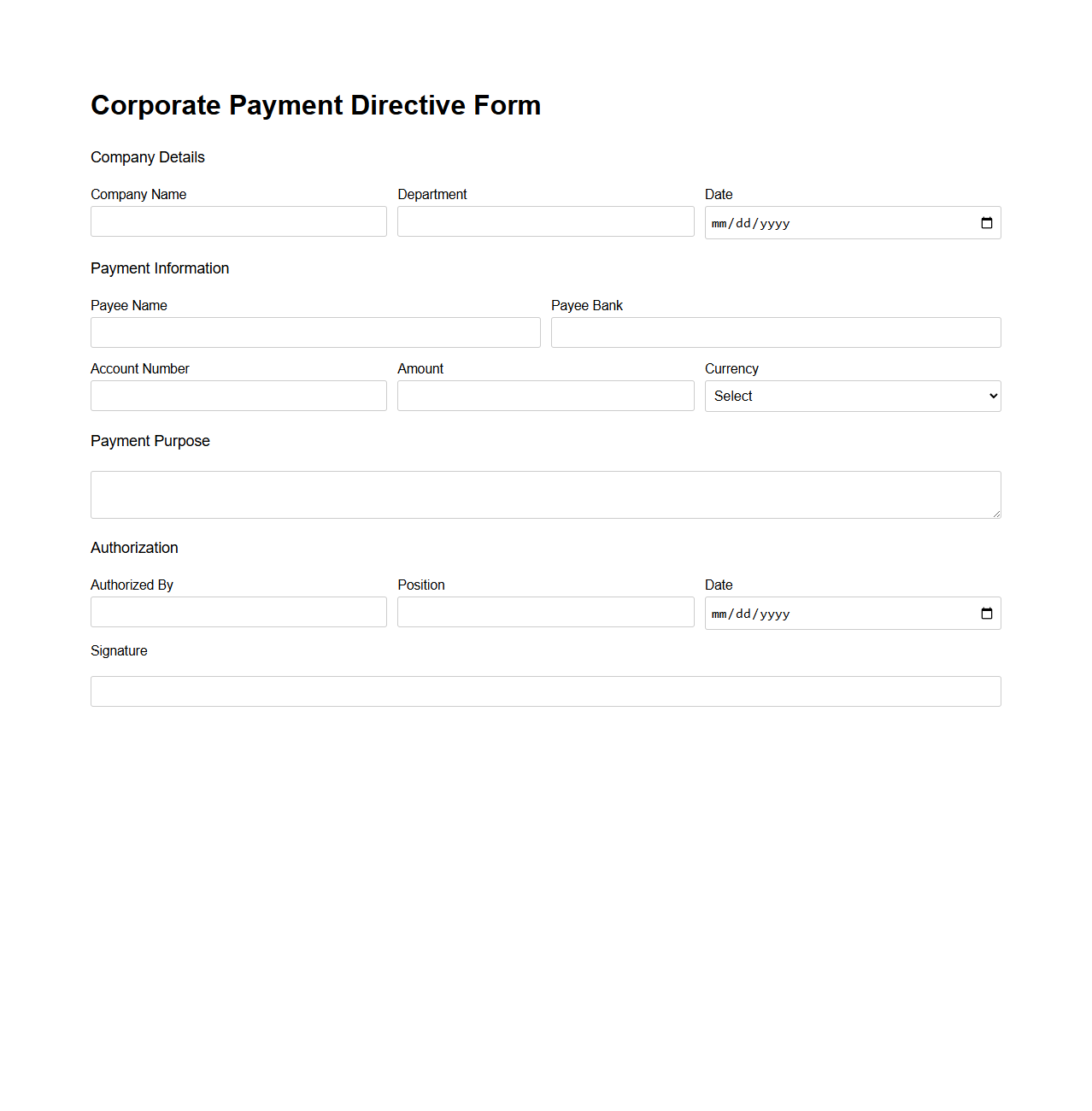

Corporate Payment Directive Form Template

A

Corporate Payment Directive Form Template is a standardized document used by businesses to authorize and instruct their financial institutions or payment processors to execute payments on their behalf. It outlines essential details such as the payee information, payment amount, payment date, and the authorized signatories, ensuring accuracy and compliance in corporate payment transactions. This template helps streamline the payment approval process, mitigate errors, and maintain an audit trail for financial controls and regulatory requirements.

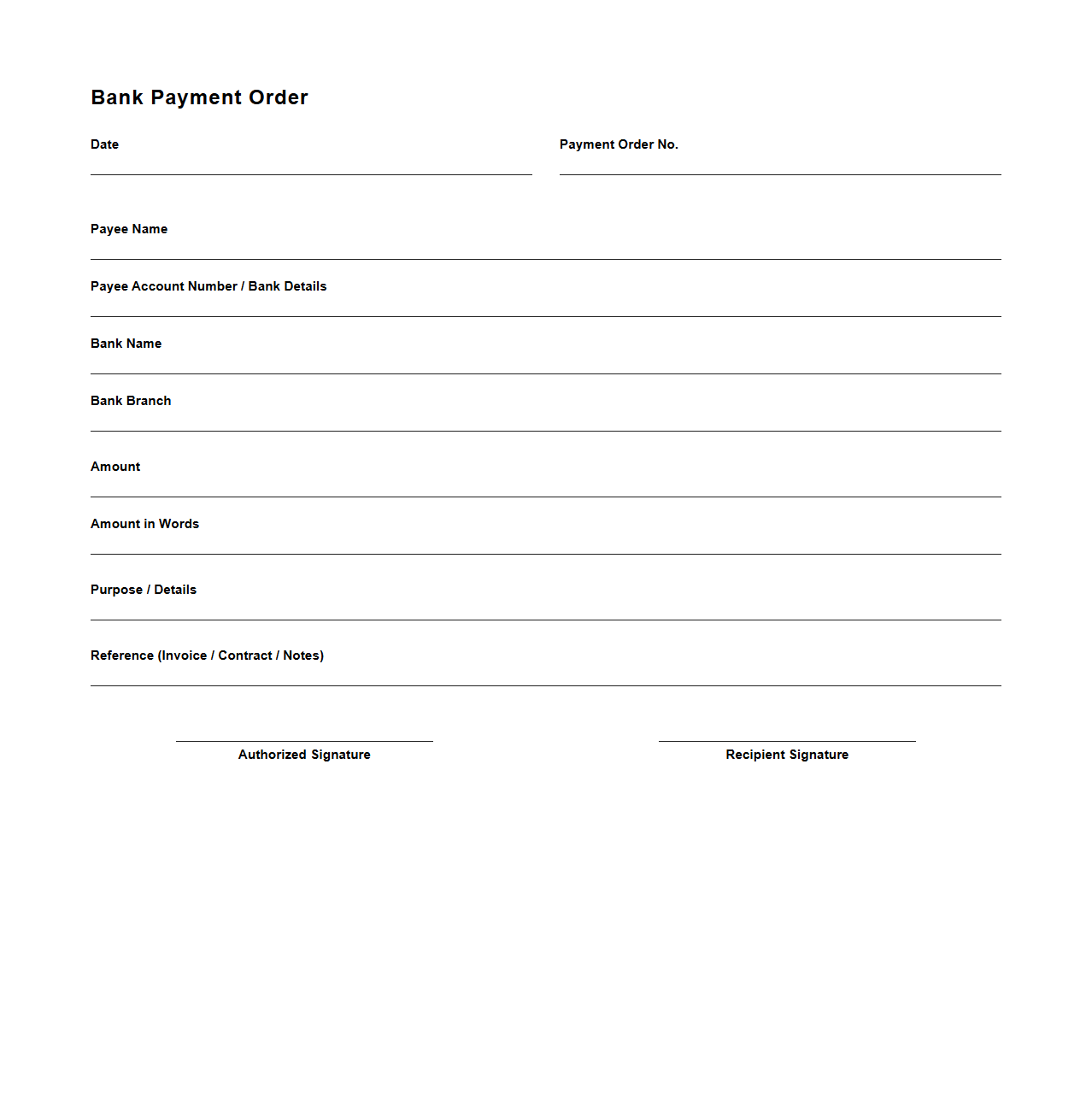

Simple Bank Payment Order Template

A

Simple Bank Payment Order Template document facilitates seamless financial transactions by providing a standardized format for instructing banks to transfer funds from one account to another. This template ensures accuracy and compliance by clearly specifying payment details such as amount, recipient information, payment date, and reference numbers. Utilizing this document minimizes errors and streamlines payment processing for businesses and individuals.

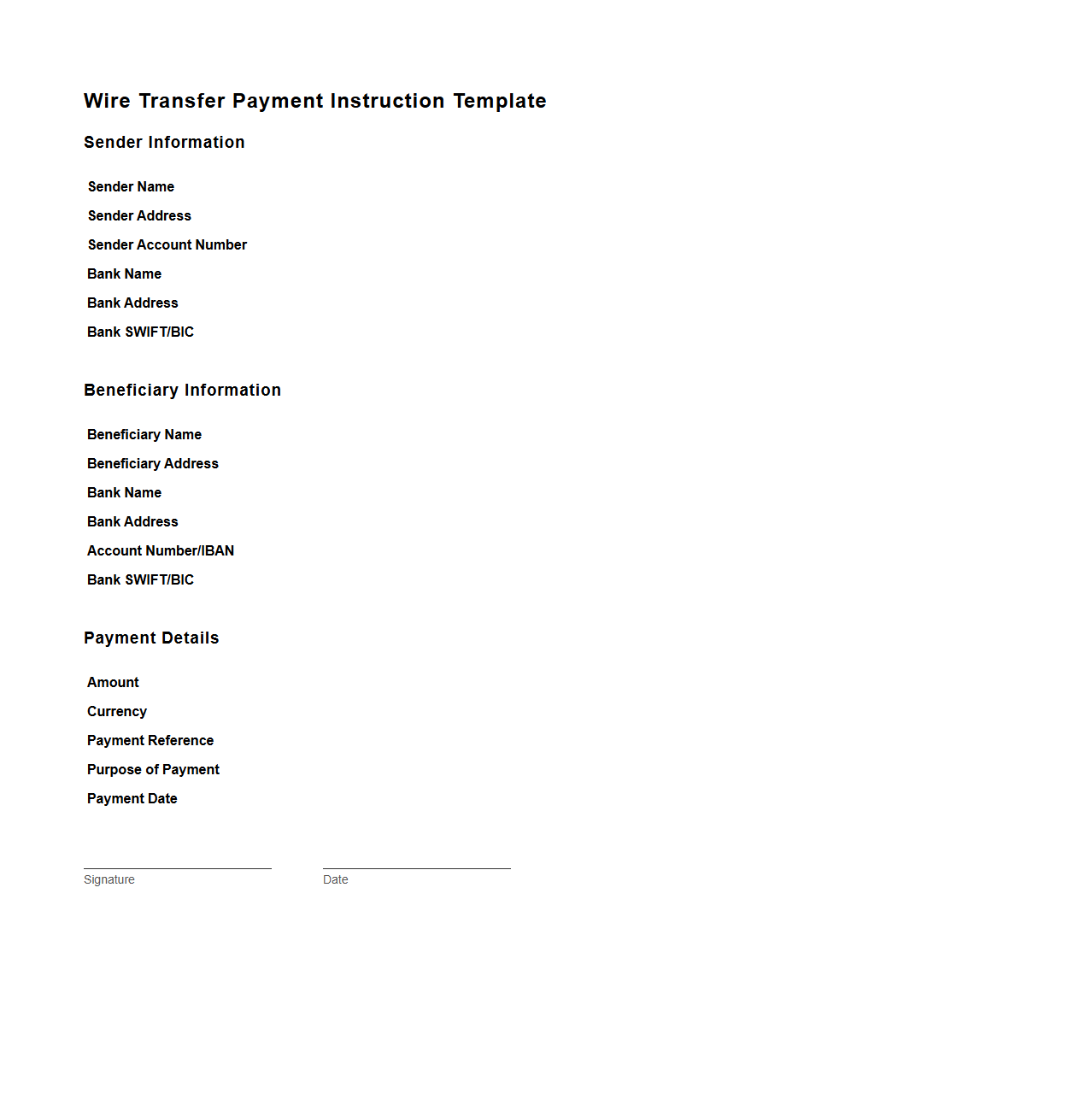

Blank Wire Transfer Payment Instruction Template

A

Blank Wire Transfer Payment Instruction Template document serves as a standardized form that outlines the necessary details for initiating a wire transfer, including sender and recipient information, bank account numbers, SWIFT codes, and transfer amounts. This template ensures accuracy and consistency in financial transactions, reducing errors and facilitating smooth processing by banks. It is essential for businesses and individuals to securely communicate payment instructions and streamline cross-border money transfers.

How to securely fill and issue a blank payment order for cross-border transactions?

To securely fill and issue a blank payment order for cross-border transactions, always ensure the document is handled by authorized personnel only. Use encrypted communication channels to transmit payment order details and confirm the recipient's banking information before issuing the order. Additionally, implement dual control procedures to minimize the risk of unauthorized alterations.

What are the legal implications of misusing blank payment order documents in corporate finance?

Misusing blank payment order documents can lead to severe legal consequences, including charges of fraud and financial misconduct. Corporations may face hefty fines, criminal prosecution, and damage to reputation as a result of such misuse. It is crucial to enforce strict compliance and internal controls to avoid legal liabilities.

Which security features should be included in blank payment orders to prevent fraud?

Effective security features in blank payment orders include watermarks, holograms, and secure serial numbering to prevent forgery. Digital signatures and QR codes can further enhance authenticity and traceability. Incorporating these elements helps protect against fraudulent alterations and unauthorized use.

How do banks verify the authenticity of blank payment order letters during high-value transactions?

Banks verify authenticity through multi-layered checks including cross-referencing signatures, verifying account details, and confirming transaction authorization with the issuing party. Advanced technologies like blockchain and AI-driven anomaly detection are increasingly used to confirm legitimacy during high-value transactions. This ensures the payment order has not been tampered with or fraudulently issued.

What audit trails are required when managing blank payment order documents in financial institutions?

Financial institutions must maintain comprehensive audit trails that log every access, modification, and issuance of blank payment order documents. This includes timestamps, user identification, and system-generated records to ensure accountability and transparency. Proper audit trails are essential for regulatory compliance and fraud prevention.