A Blank Donation Receipt Template for Charities provides a standardized format for acknowledging contributions, ensuring clear documentation for both donors and organizations. This template typically includes essential details such as donor information, donation amount, date, and a statement confirming the charitable nature of the donation. Using a well-designed receipt template helps charities maintain transparency and comply with tax regulations efficiently.

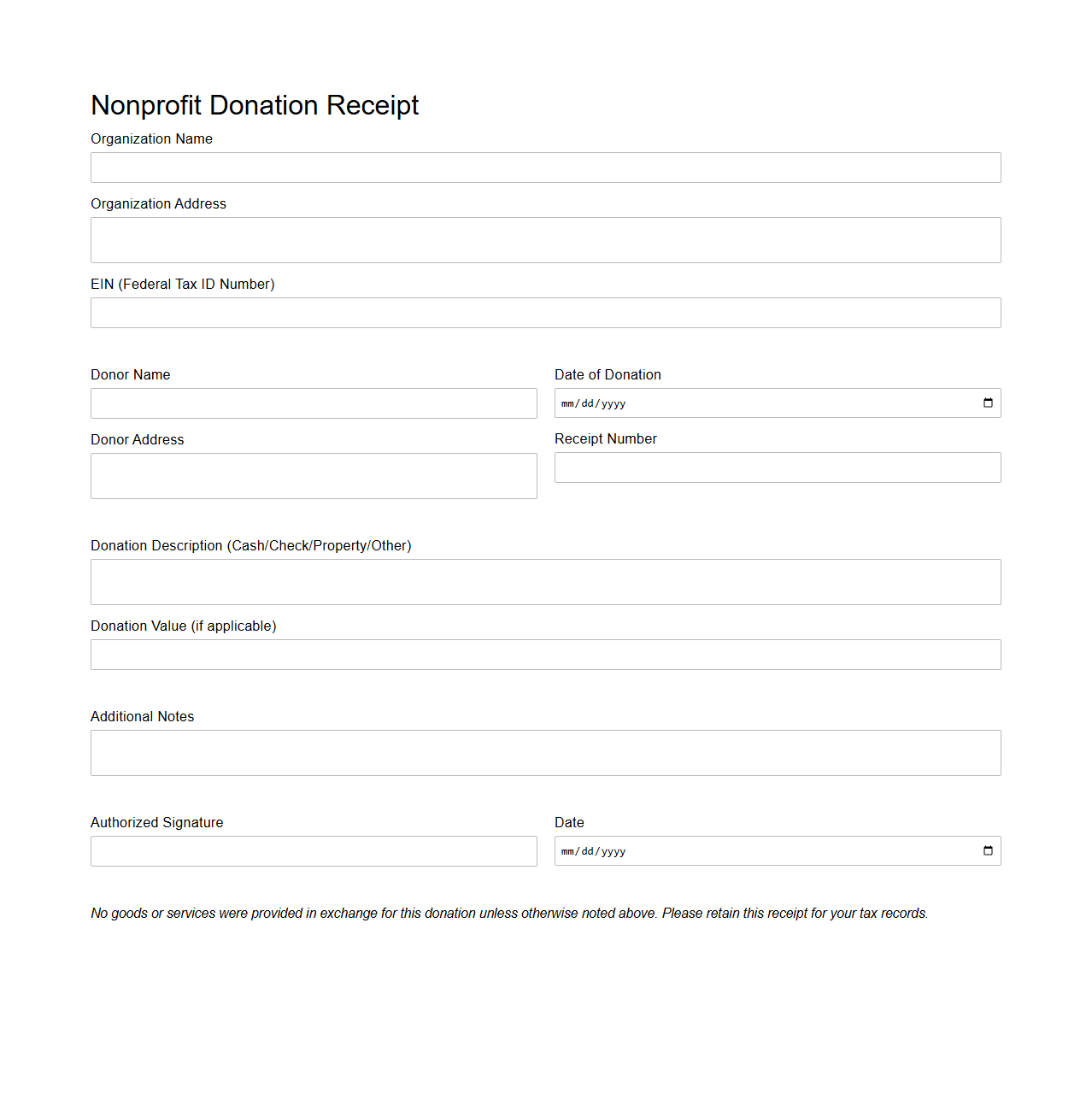

Blank Nonprofit Donation Receipt Form Template

A

Blank Nonprofit Donation Receipt Form Template document serves as an official proof of donation for contributors, outlining essential details such as donor information, donation amount, date, and purpose. This template ensures compliance with IRS regulations by providing clear and accurate records for tax deduction purposes. Nonprofits use this standardized form to maintain transparency and trust with donors while streamlining their financial documentation process.

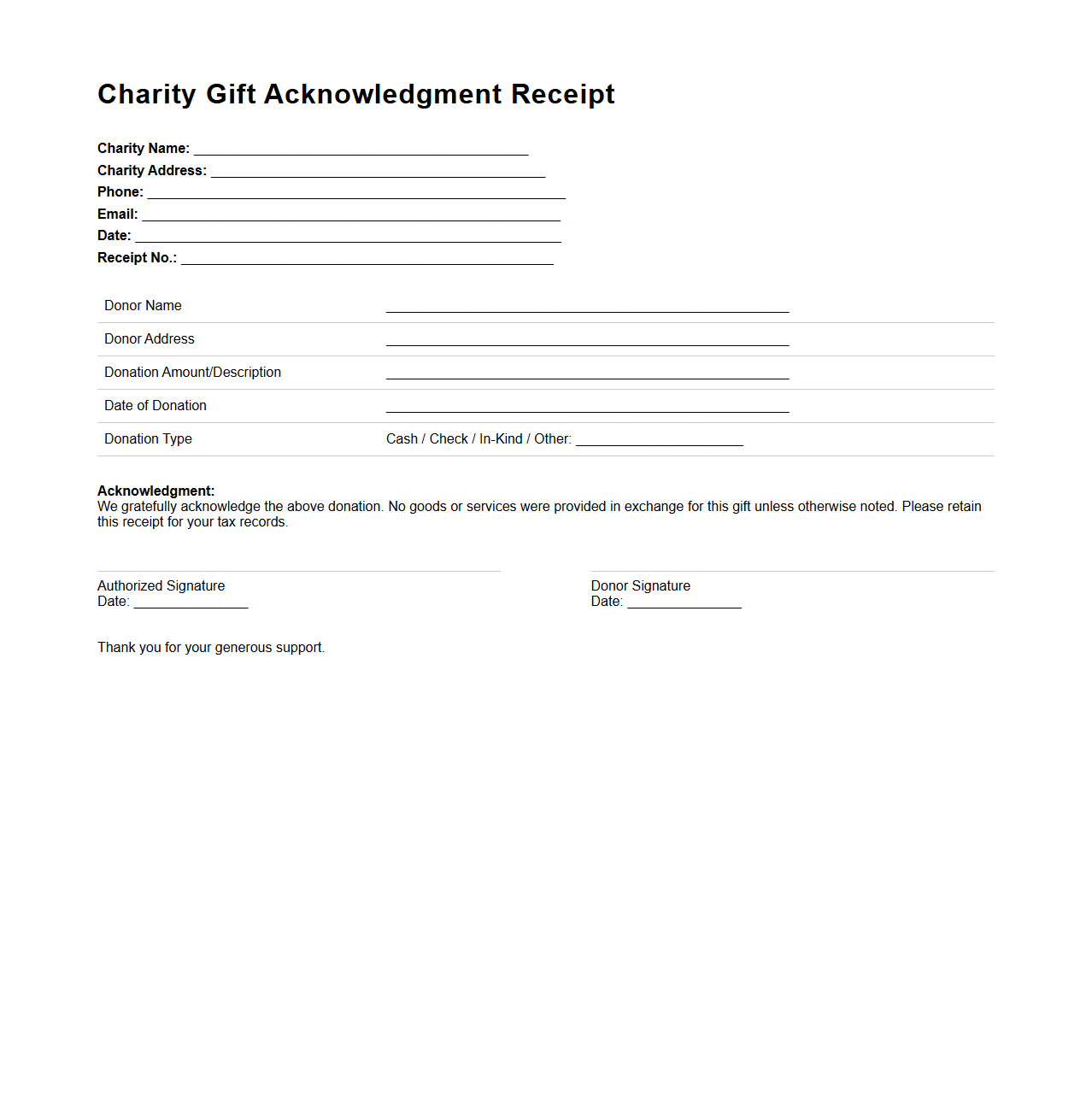

Charity Gift Acknowledgment Receipt Format

A

Charity Gift Acknowledgment Receipt Format document serves as formal proof of a donor's contribution to a charitable organization, essential for tax deduction purposes and legal compliance. It typically includes detailed information such as the donor's name, donation amount, date of the gift, and a statement confirming that no goods or services were received in exchange. This standardized format ensures transparency, facilitates record-keeping for both donors and charities, and supports regulatory reporting requirements.

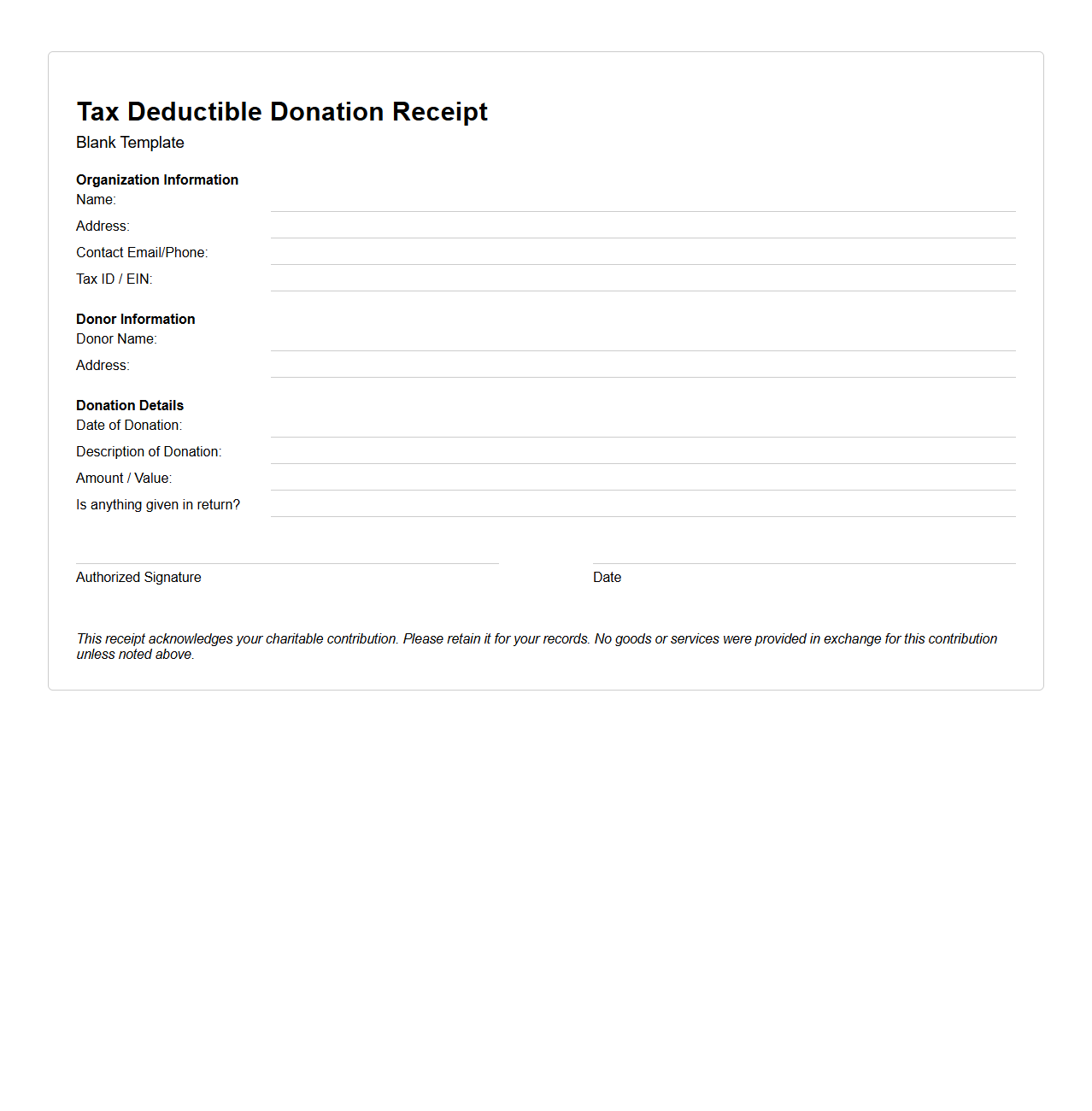

Tax Deductible Donation Receipt Template

A

Tax Deductible Donation Receipt Template is a standardized document used by nonprofits to provide donors with official proof of their charitable contributions. This receipt includes essential details such as the donor's name, donation amount, date, and the organization's tax identification number, ensuring compliance with tax regulations. It helps donors claim tax deductions by verifying their eligible charitable donations to tax authorities.

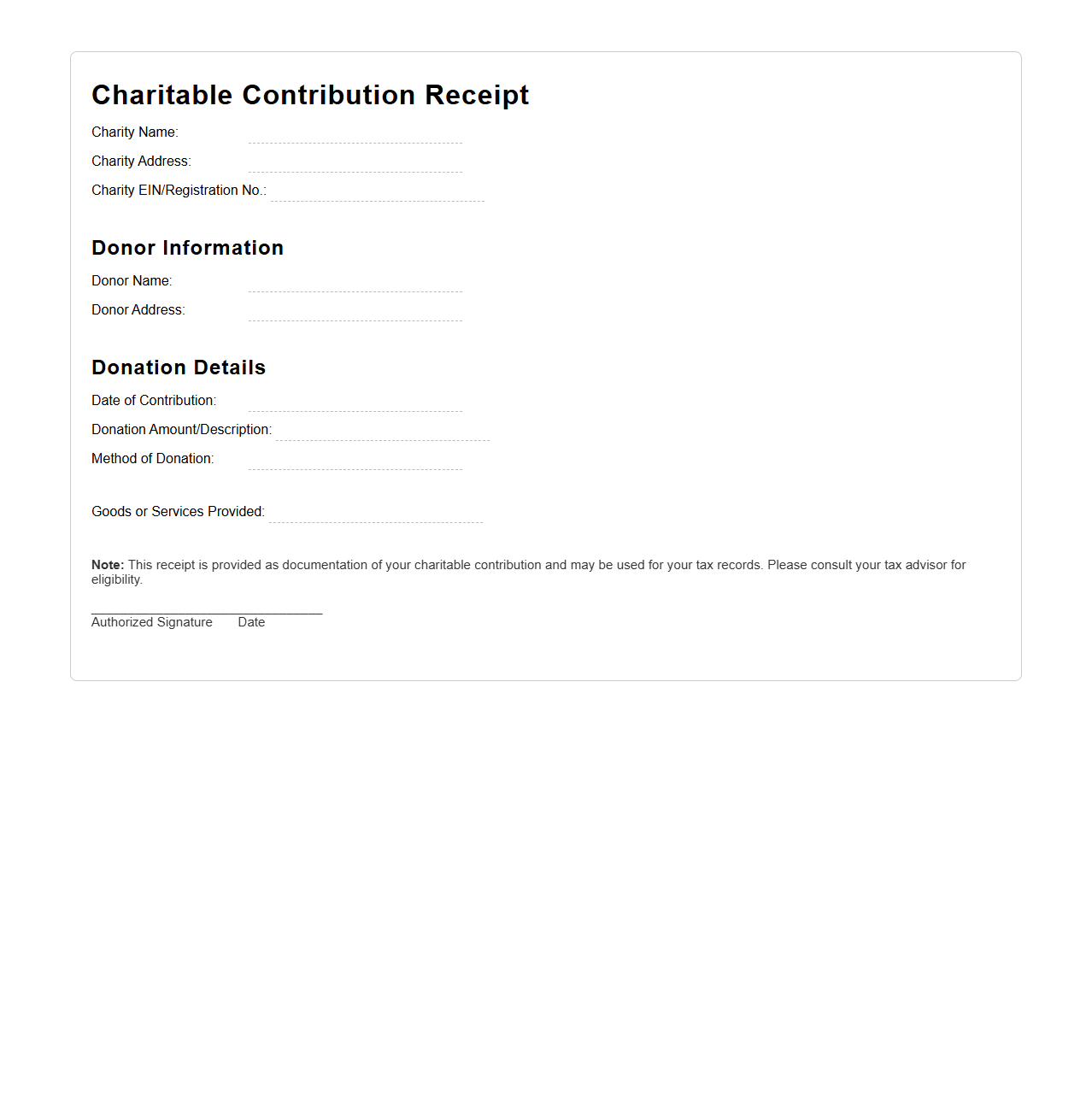

Receipt Template for Charitable Contributions

A

Receipt Template for Charitable Contributions document is a standardized form used by nonprofit organizations to acknowledge donations from supporters. It typically includes essential details such as donor information, donation amount, date, and a statement confirming that no goods or services were exchanged for the contribution, ensuring compliance with tax regulations. This template helps organizations maintain accurate records and provides donors with the necessary documentation for tax deduction purposes.

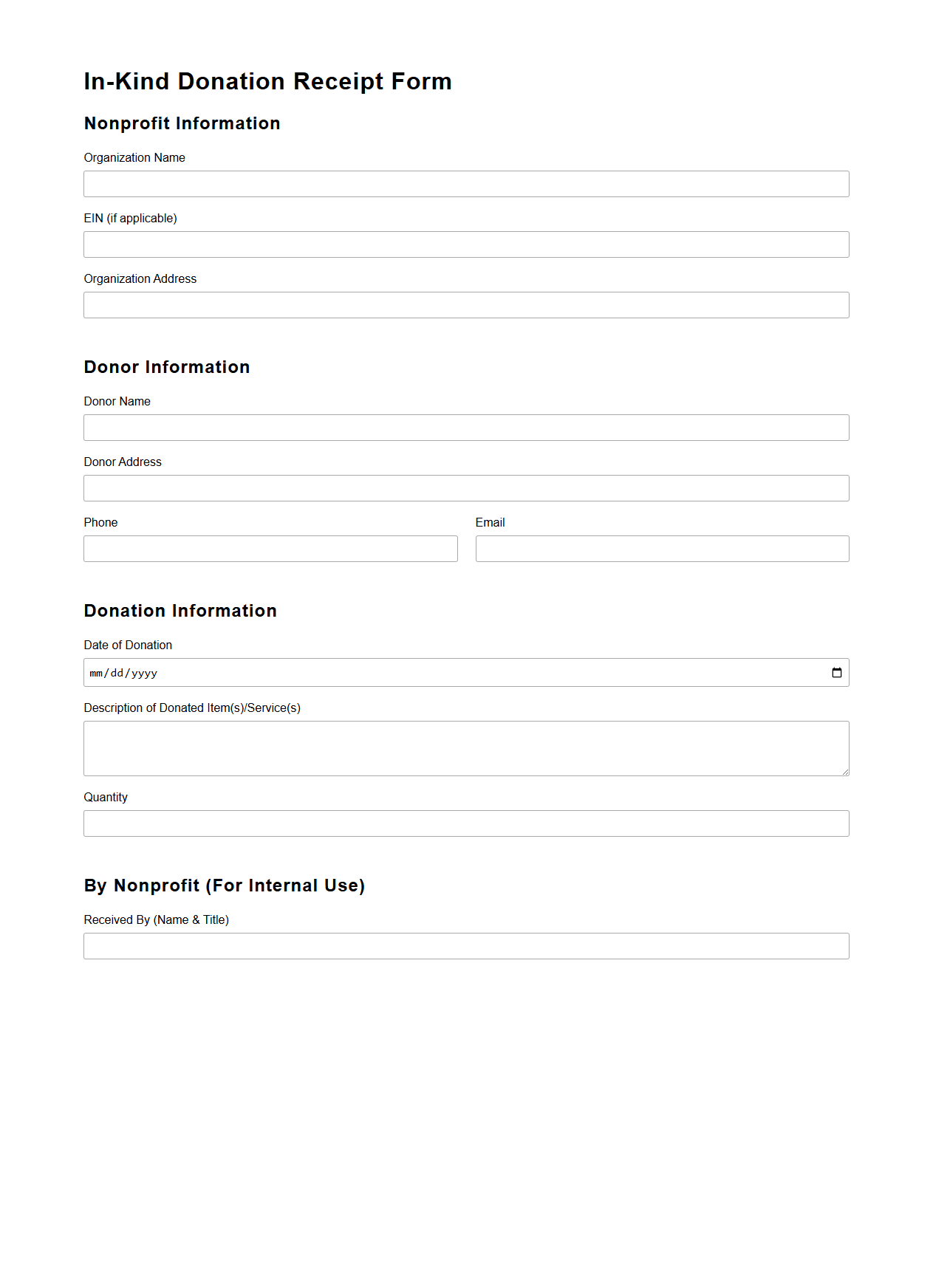

In-Kind Donation Receipt Form for Nonprofits

An

In-Kind Donation Receipt Form for Nonprofits documents non-monetary contributions such as goods or services donated to a charitable organization. This form records critical details including the donor's information, description of donated items, estimated fair market value, and date of donation, facilitating transparent donation tracking and tax compliance. Proper use of this receipt ensures donors receive valid acknowledgment for tax deduction purposes under IRS regulations.

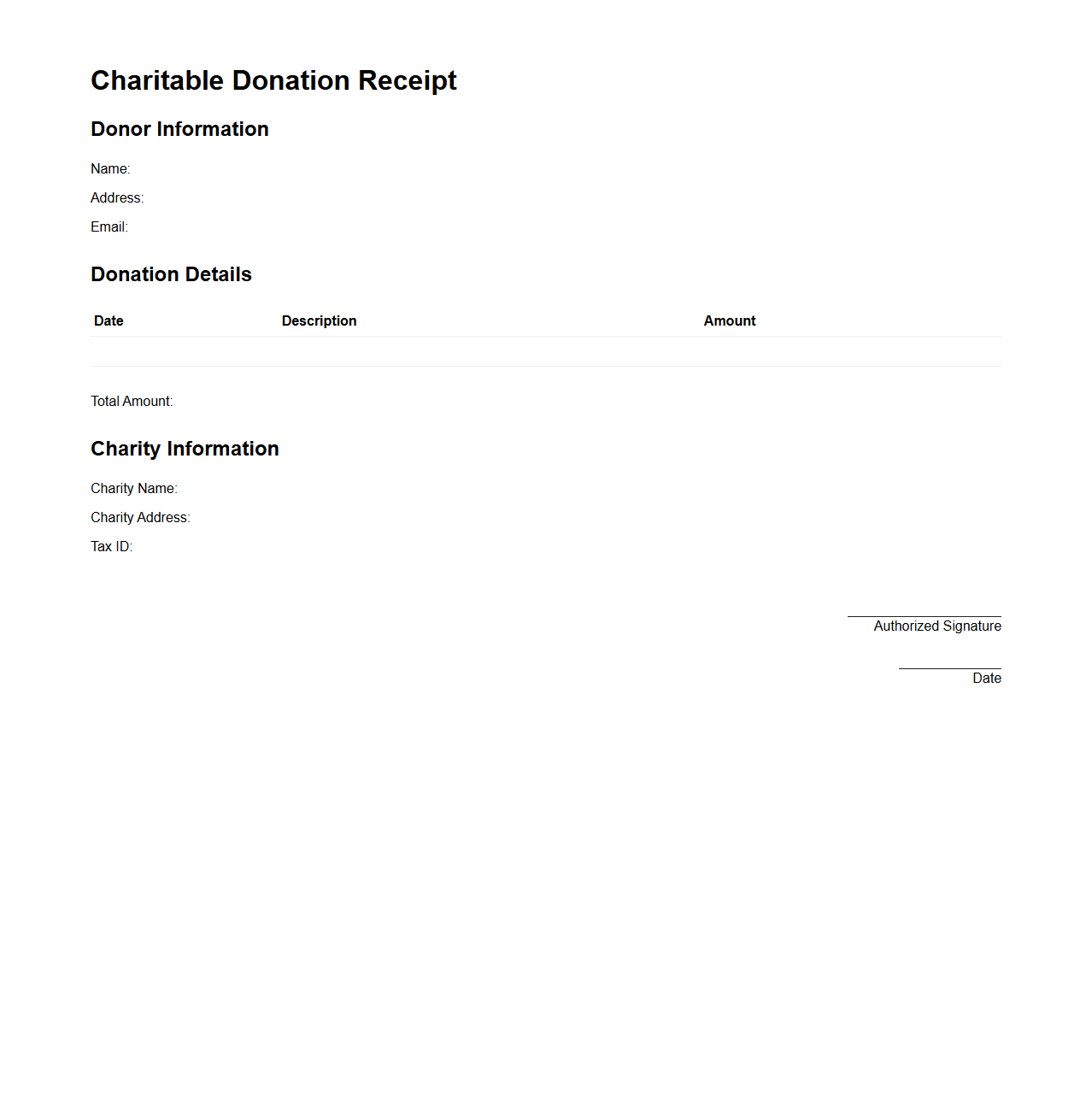

Simple Charitable Donation Receipt Layout

A

Simple Charitable Donation Receipt Layout document serves as a clear and concise template to acknowledge contributions made to a nonprofit organization. It includes essential details such as donor information, donation amount, date of contribution, and a statement confirming that no goods or services were exchanged. This layout ensures compliance with tax regulations and facilitates transparent record-keeping for both donors and charitable entities.

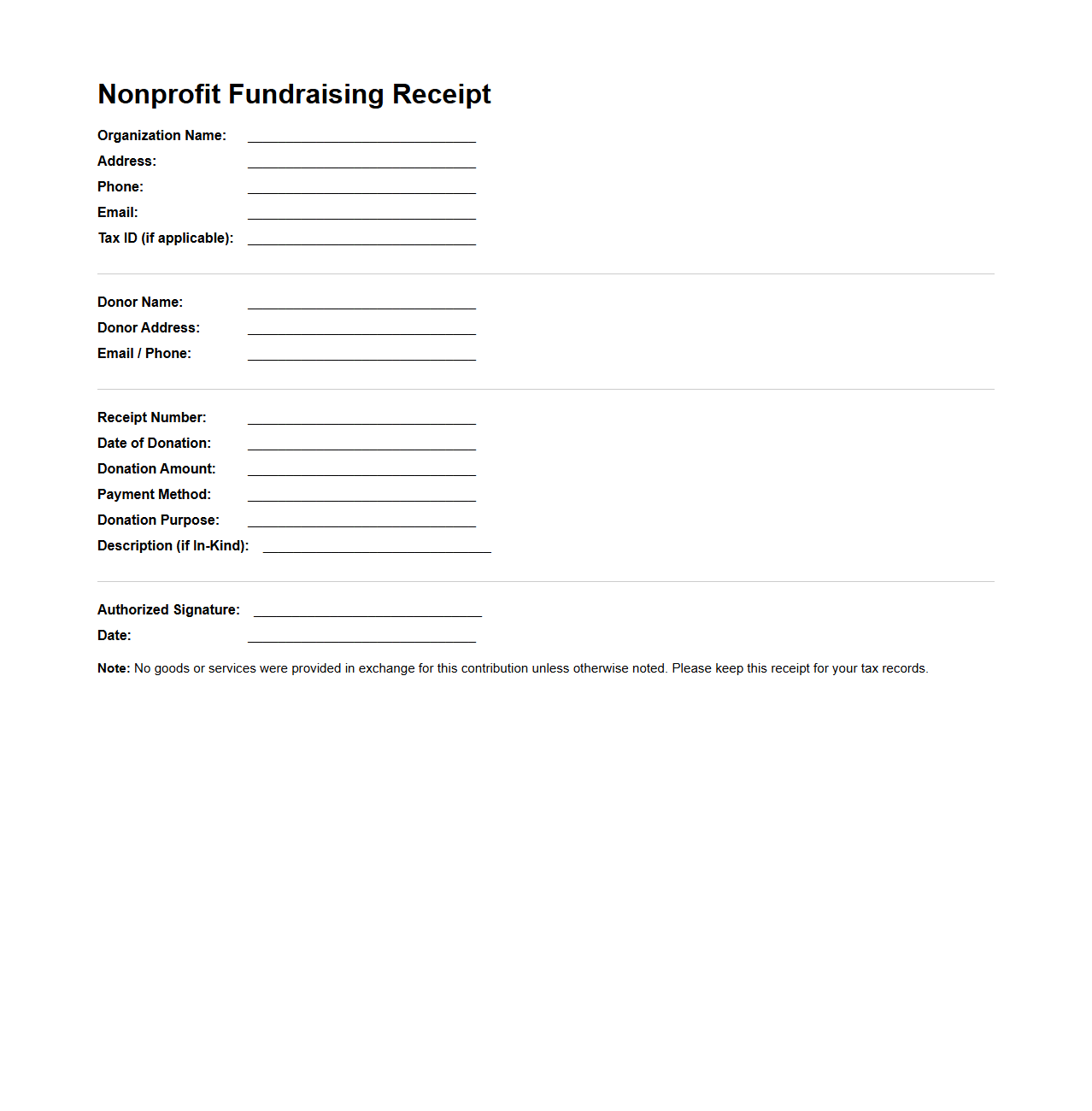

Nonprofit Fundraising Receipt Template

A

Nonprofit Fundraising Receipt Template is a standardized document used by nonprofit organizations to provide donors with official acknowledgment of their contributions. This receipt typically includes essential details such as the donor's name, donation amount, date of contribution, and a statement confirming the organization's tax-exempt status. Utilizing this template ensures compliance with IRS regulations and helps maintain transparent donor records for both the nonprofit and its supporters.

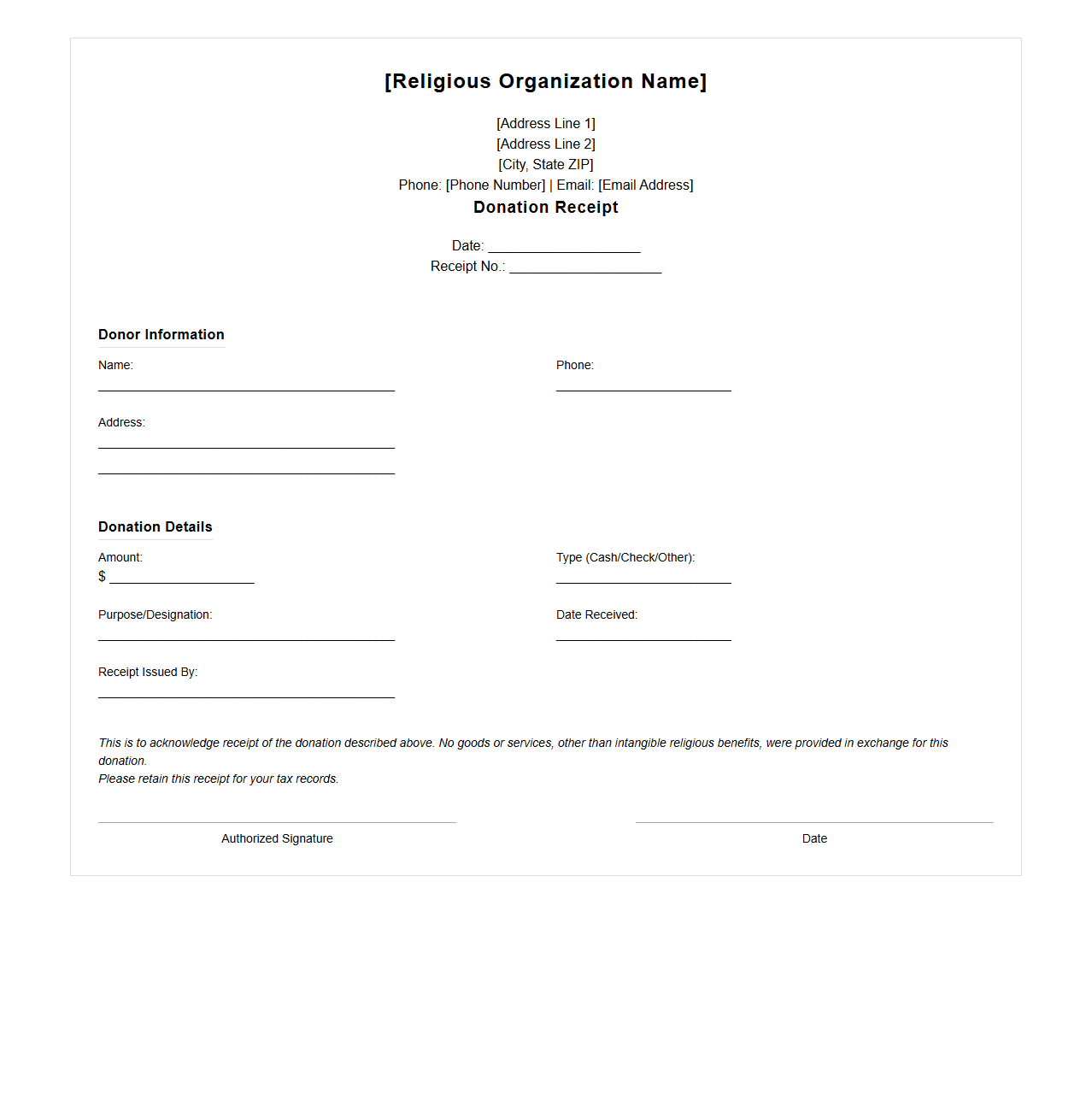

Religious Organization Donation Receipt Template

A

Religious Organization Donation Receipt Template is a standardized document used by faith-based groups to acknowledge and record contributions from donors. This template includes vital information such as the donor's name, donation amount, date, and purpose of the gift, ensuring compliance with tax regulations. It serves as an official record for both the organization and the donor to facilitate accurate financial reporting and tax deductions.

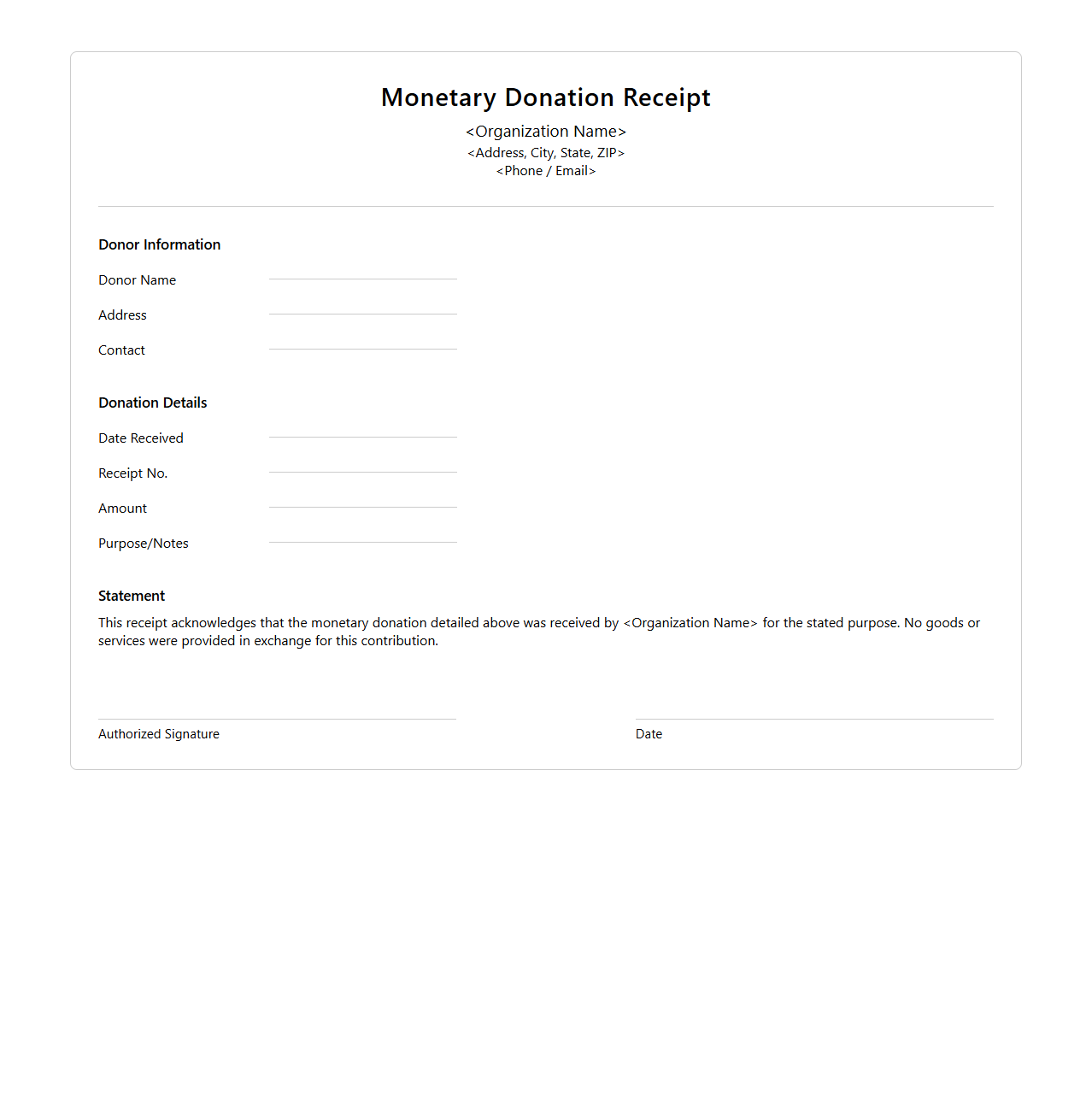

Blank Monetary Donation Receipt Design

A

Blank Monetary Donation Receipt Design document serves as a template for issuing standardized receipts to donors. It outlines the layout, essential fields such as donor name, donation amount, date, and organization details, ensuring compliance with financial regulations and transparency. This design facilitates accurate record-keeping and enhances donor trust by providing clear, professional acknowledgment of contributions.

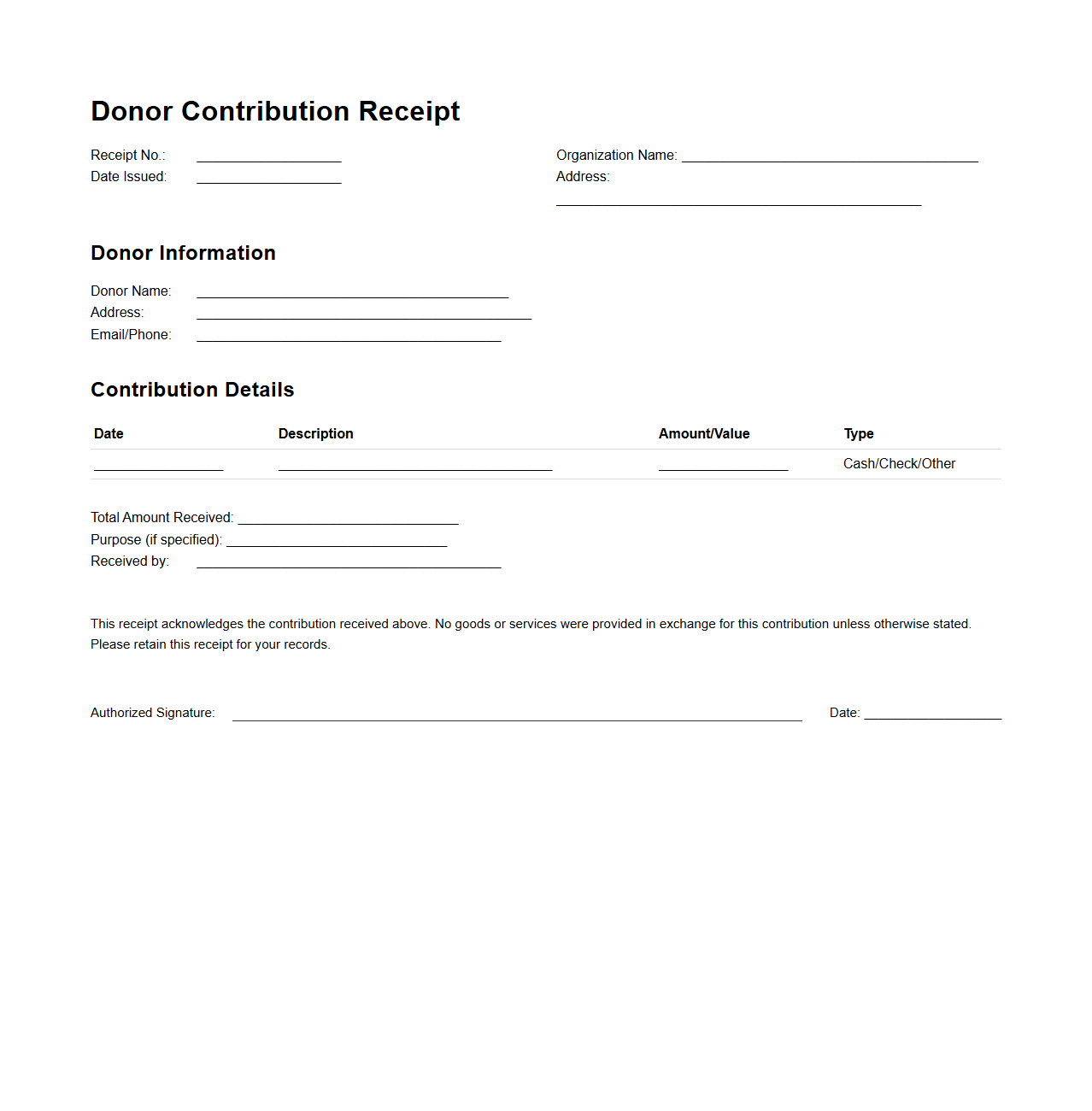

Donor Contribution Receipt Template for Organizations

A

Donor Contribution Receipt Template for organizations is a standardized document used to acknowledge and record donations received from donors. It serves as proof of contribution for tax deduction purposes and ensures transparency and accountability in financial reporting. This template typically includes donor details, donation amount, date of contribution, and the organization's information.

What specific IRS-required details must be included on a blank donation receipt template for 501(c)(3) charities?

A blank donation receipt template for 501(c)(3) charities must include the charity's name, address, and federal tax ID number. It should clearly state the date of the donation and the amount of cash or a description of non-cash contributions. The receipt must also include a statement confirming whether any goods or services were provided in exchange for the donation.

How can charities customize donation receipt letters for recurring monthly donors?

Charities can customize donation receipt letters for recurring monthly donors by including a summary of all monthly contributions made during the year. The letter should specify the total amount donated and the dates of each payment. Personalizing the receipt with the donor's name and a thank-you message enhances engagement and donor retention.

What language should a blank donation receipt use to clarify non-monetary gifts or in-kind donations?

A blank donation receipt should clearly state that the charity received non-monetary gifts or in-kind donations and describe the items donated. It must specify that the donor is responsible for determining the value of such items for tax purposes. The receipt should also include a disclaimer that no goods or services were received in exchange unless explicitly stated.

How long should a charity retain copies of issued blank donation receipts for audit purposes?

Charities are recommended to retain copies of issued blank donation receipts for at least seven years to comply with IRS audit requirements. This retention policy helps ensure documentation is available in case of inquiries or audits. Maintaining organized records protects both the charity and its donors.

What digital signing options are acceptable for electronic blank donation receipt letters to ensure compliance?

Acceptable digital signing options for electronic donation receipt letters include certified e-signatures compliant with the E-SIGN Act. Platforms like DocuSign and Adobe Sign provide legally binding signatures recognized by the IRS. Ensuring the digital signature's authenticity enhances trust and regulatory compliance.