A Blank Itemized Receipt Template for Purchases provides a clear and organized format to document individual items bought, their quantities, prices, and total amount. This template ensures accurate record-keeping and simplifies expense tracking for both buyers and sellers. Customizable and easy to use, it helps maintain transparency in financial transactions.

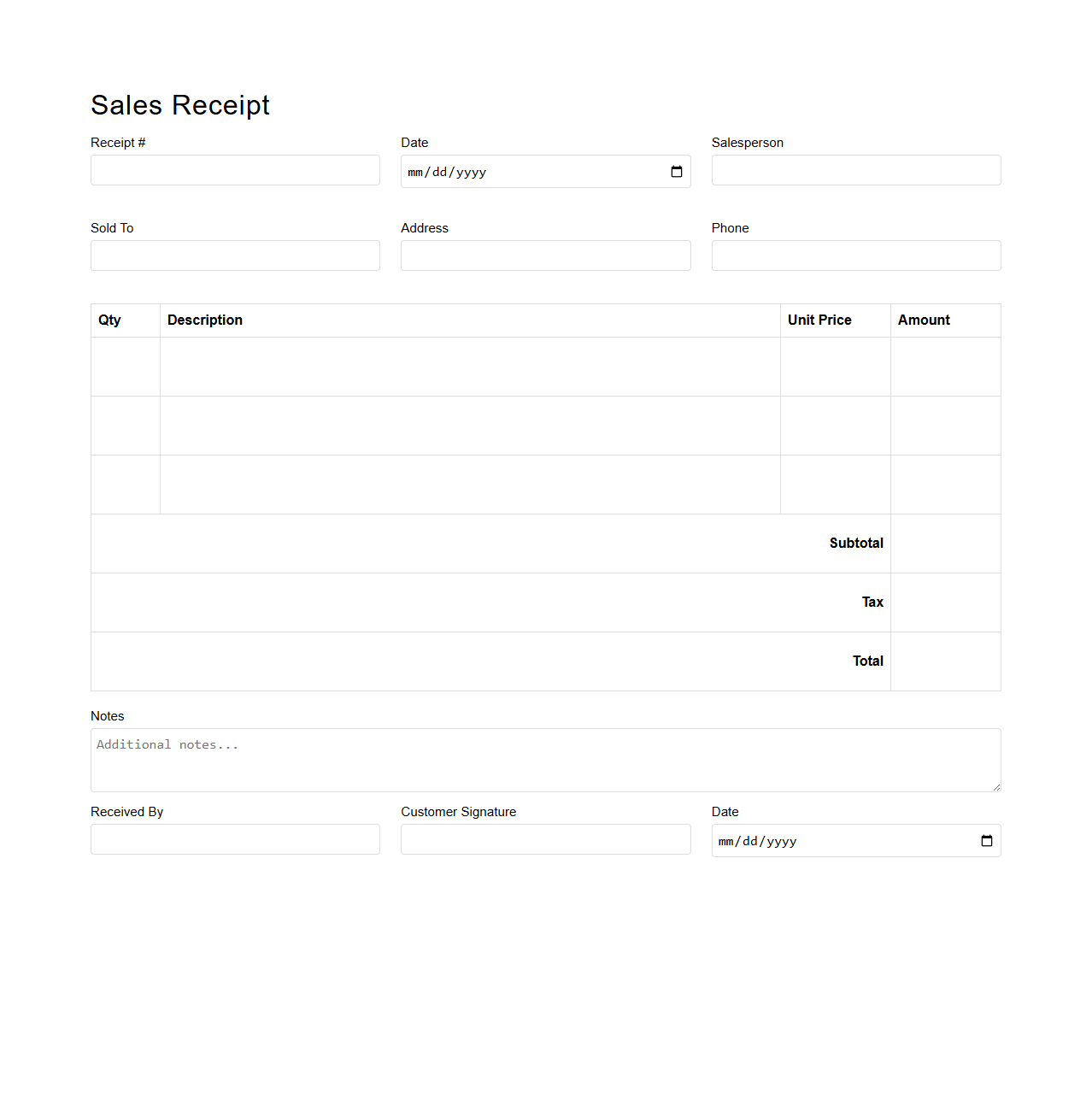

Blank Itemized Sales Receipt Template

A

Blank Itemized Sales Receipt Template document is a structured form used by businesses to provide detailed proof of transaction, listing each purchased item along with its price, quantity, and total cost. This template ensures clarity and transparency for both sellers and customers, facilitating accurate record-keeping and easy financial tracking. It can be customized to include company information, payment methods, and tax details to meet specific business needs.

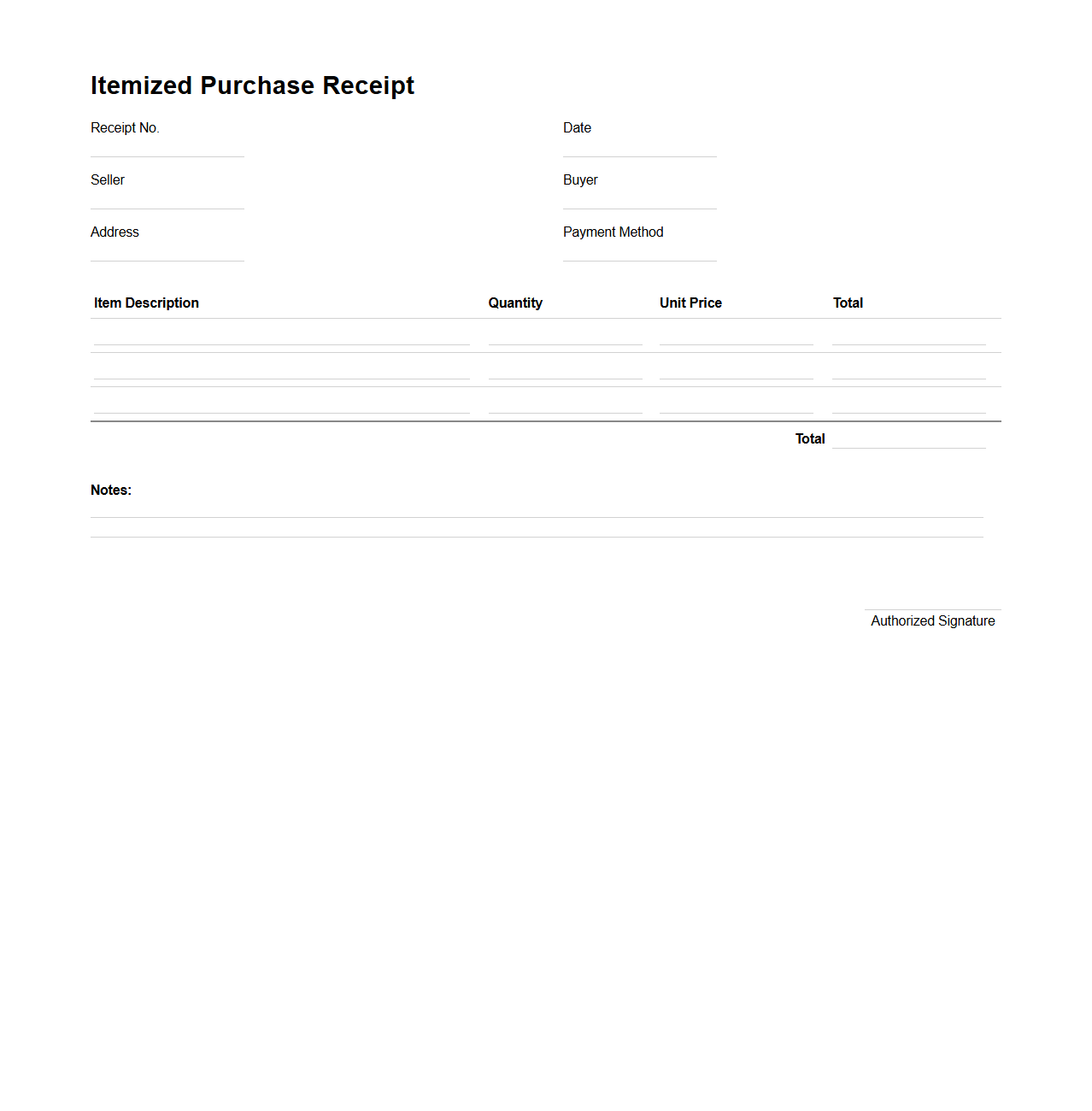

Blank Itemized Purchase Receipt Template

A

Blank Itemized Purchase Receipt Template is a customizable document used to record detailed transactions between a buyer and a seller, including individual item descriptions, quantities, prices, and total amounts. This template ensures accurate tracking of purchases for both accounting and inventory management purposes. It provides a clear and organized format to document each component of a purchase, facilitating transparency and ease of record-keeping.

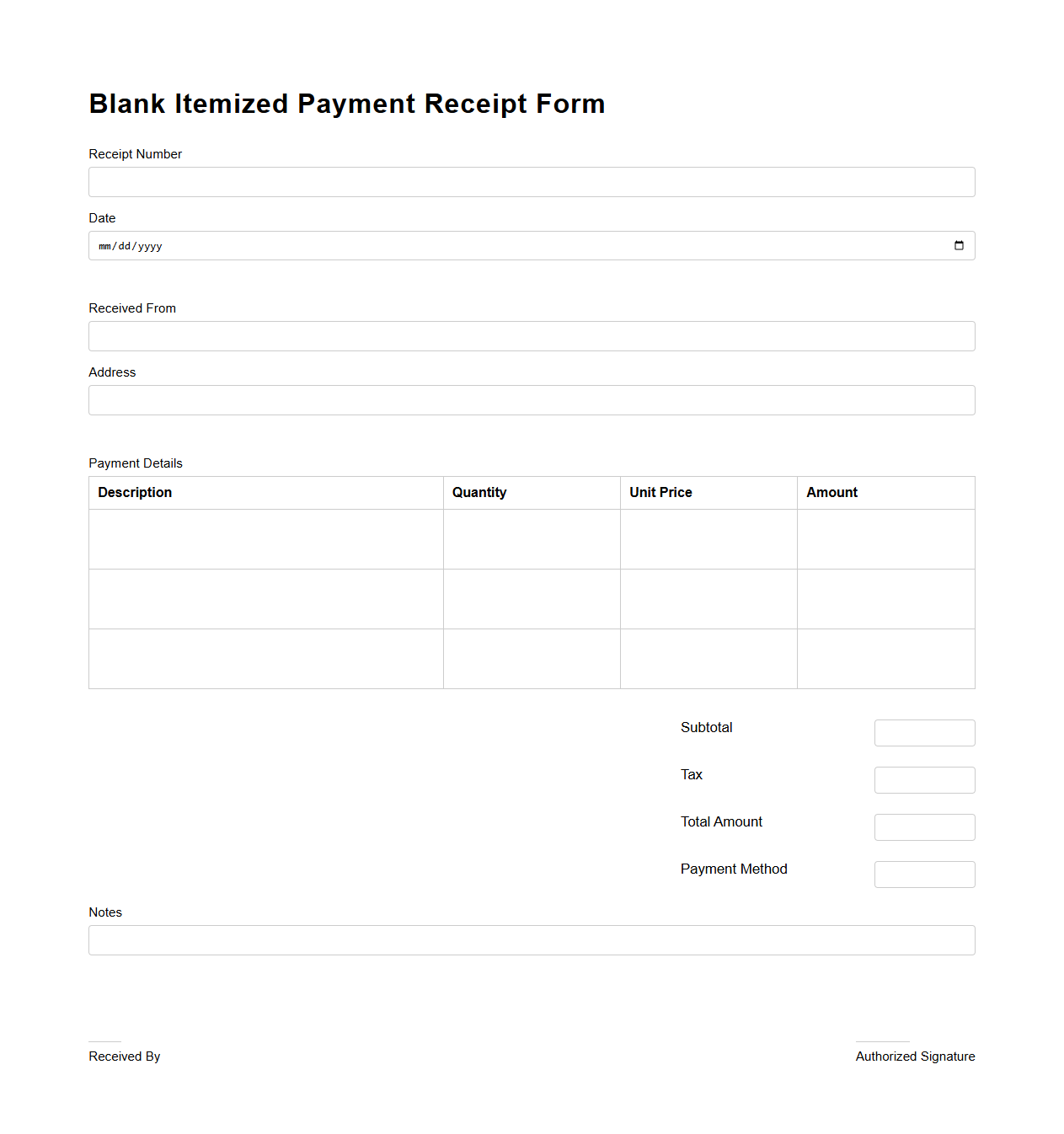

Blank Itemized Payment Receipt Form

A

Blank Itemized Payment Receipt Form is a document used to record detailed payment transactions, including individual items or services paid for, their quantities, unit prices, and total amounts. It allows businesses and individuals to provide transparent proof of payment while keeping track of financial exchanges accurately. This form helps in maintaining organized records for accounting and auditing purposes.

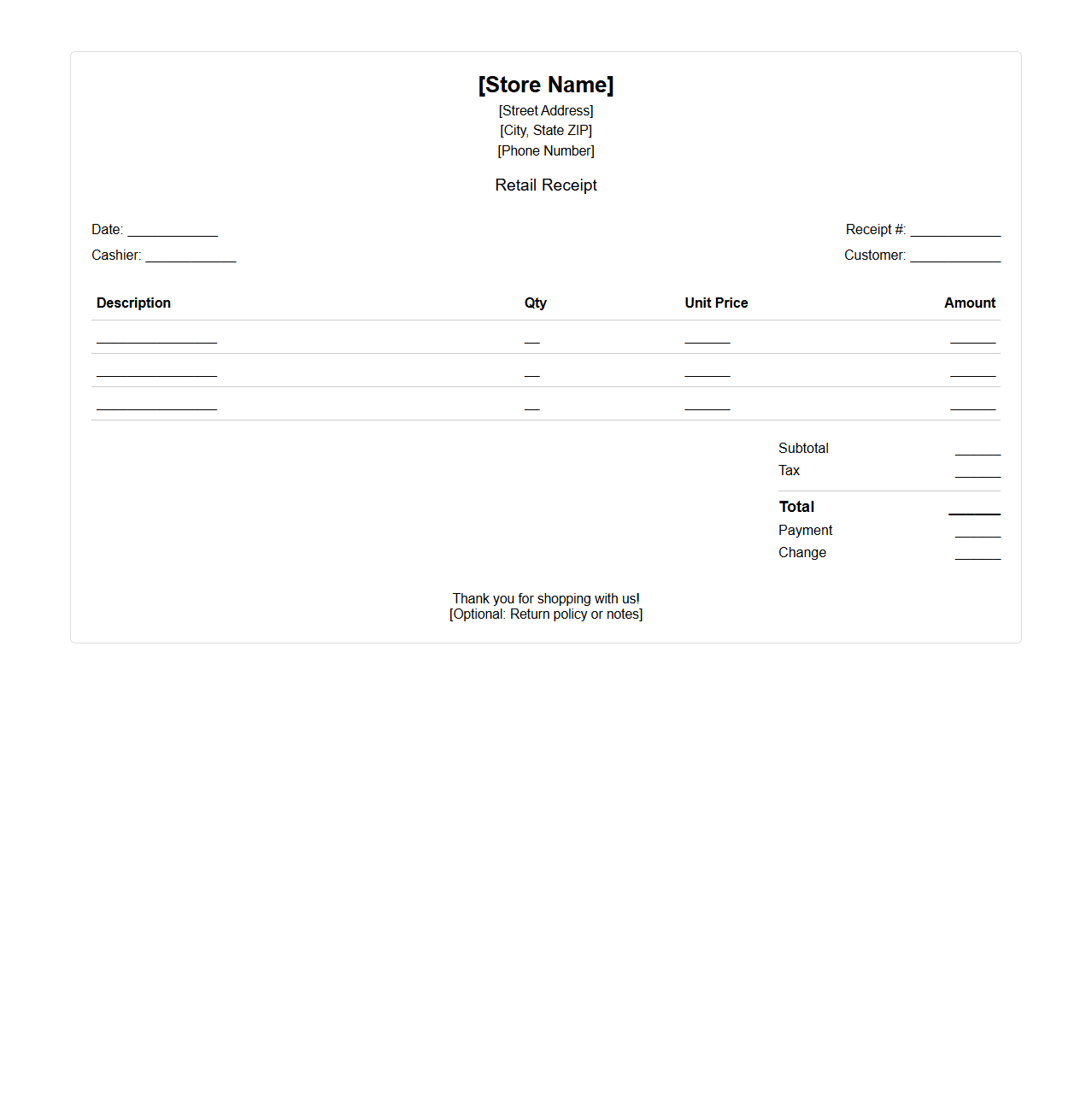

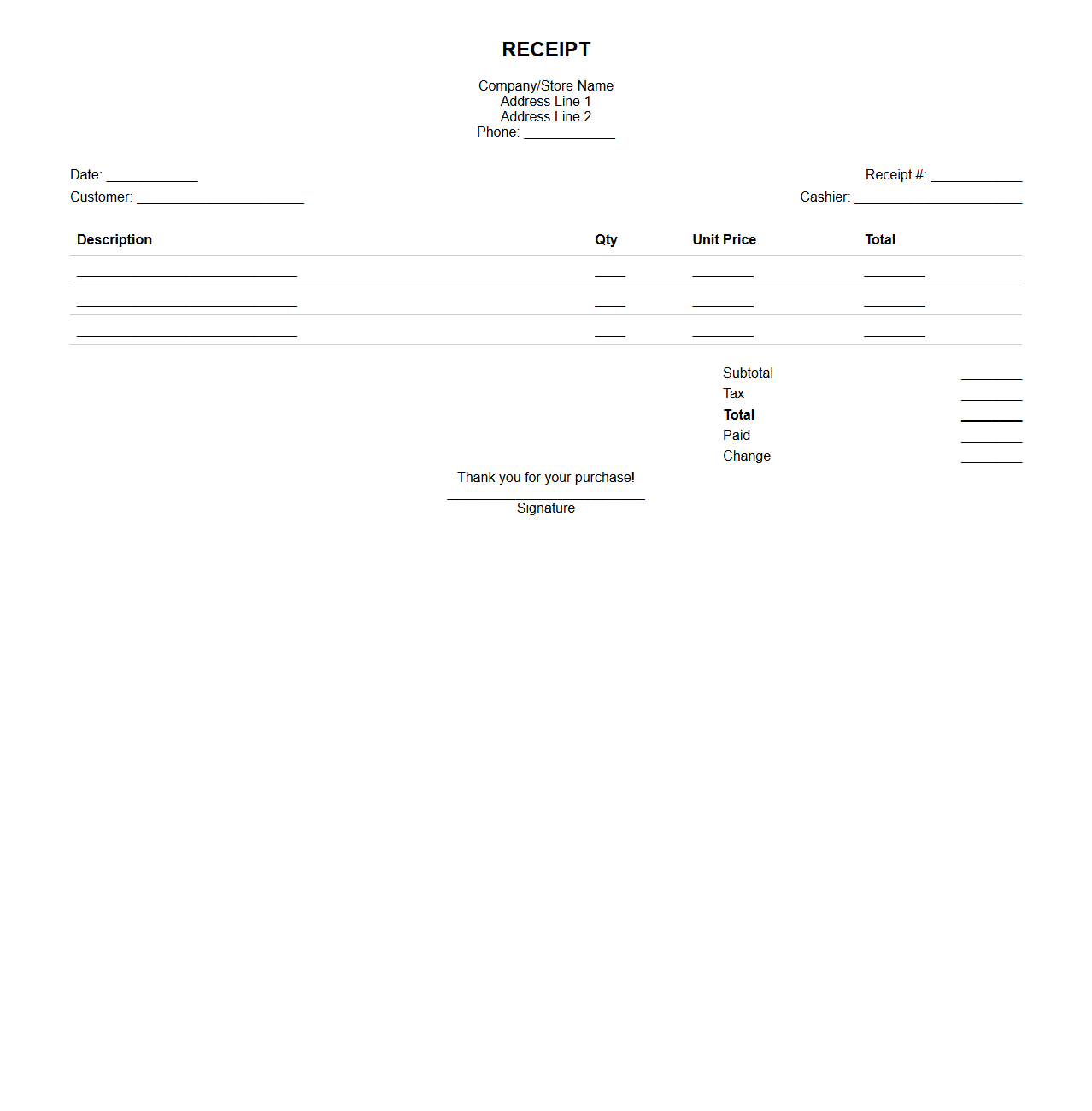

Blank Itemized Retail Receipt Template

A

Blank Itemized Retail Receipt Template is a customizable document designed to record detailed transactions between a retailer and a customer. It systematically lists individual items purchased, including descriptions, quantities, unit prices, and total costs, ensuring accurate transaction records. This template aids businesses in maintaining transparent sales documentation and simplifies customer returns or warranty claims.

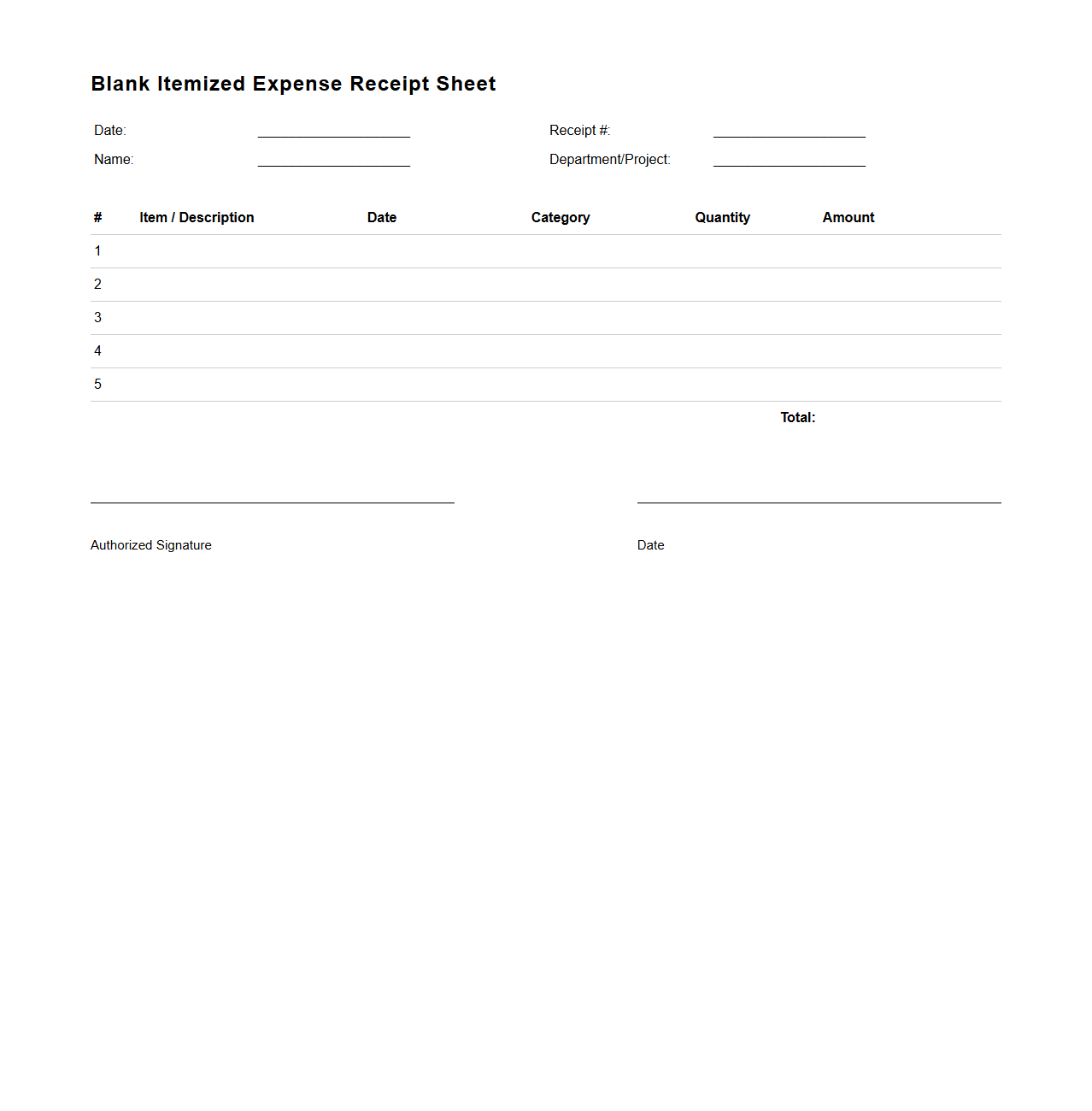

Blank Itemized Expense Receipt Sheet

A

Blank Itemized Expense Receipt Sheet is a detailed financial document used for recording individual expenses systematically, capturing key data such as date, description, amount, and payment method. This sheet facilitates accurate tracking and organization of expenditures for budgeting, reimbursement, or auditing purposes. It serves as a reliable tool for both personal finance management and business expense reporting.

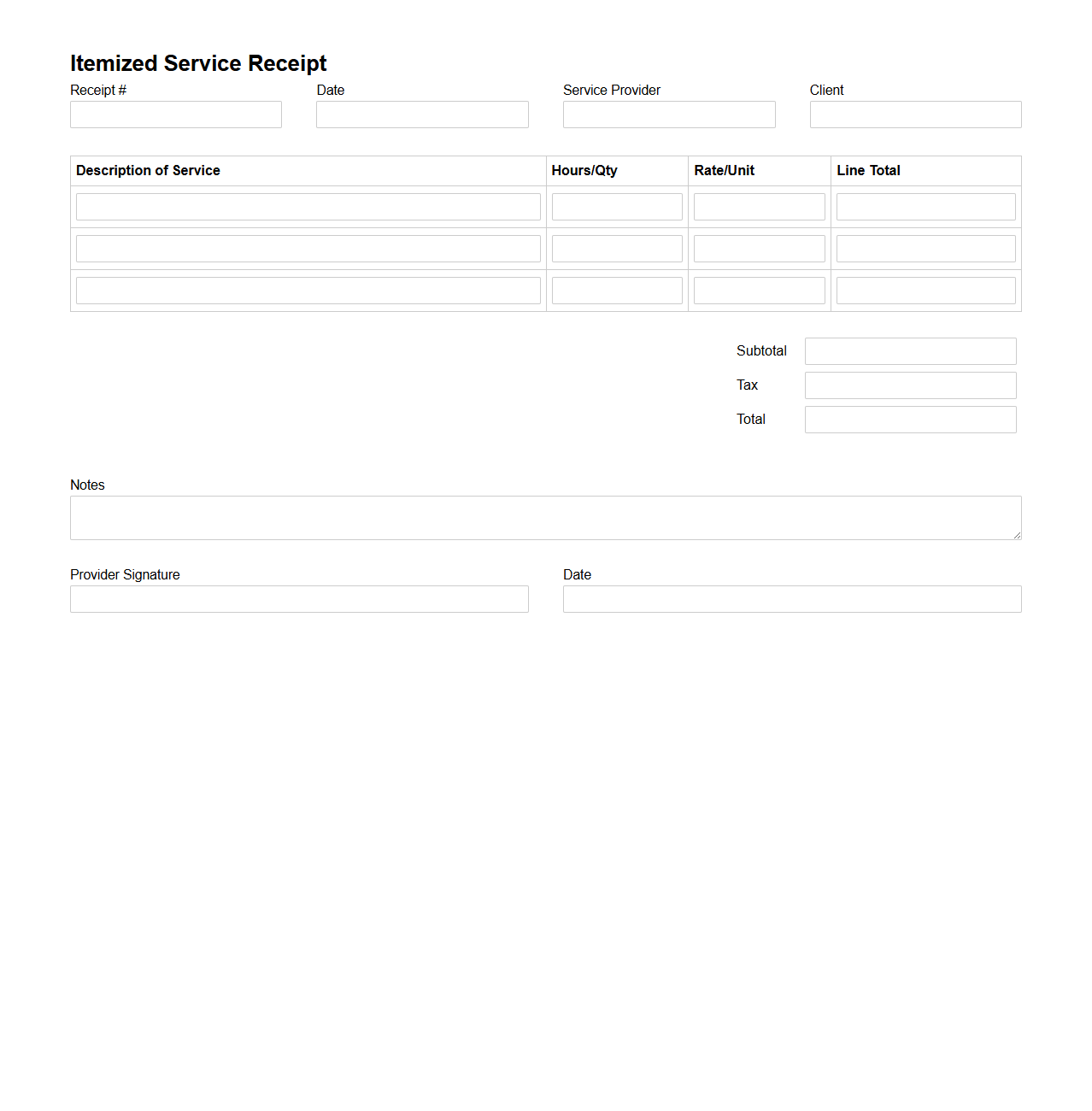

Blank Itemized Service Receipt Template

A

Blank Itemized Service Receipt Template is a structured document designed to detail and record services provided along with their corresponding costs. It allows businesses or service providers to list each service item separately, including descriptions, quantities, prices, and total amounts to ensure clear and transparent billing. This template facilitates accurate record-keeping, improves client communication, and helps maintain organized financial documentation.

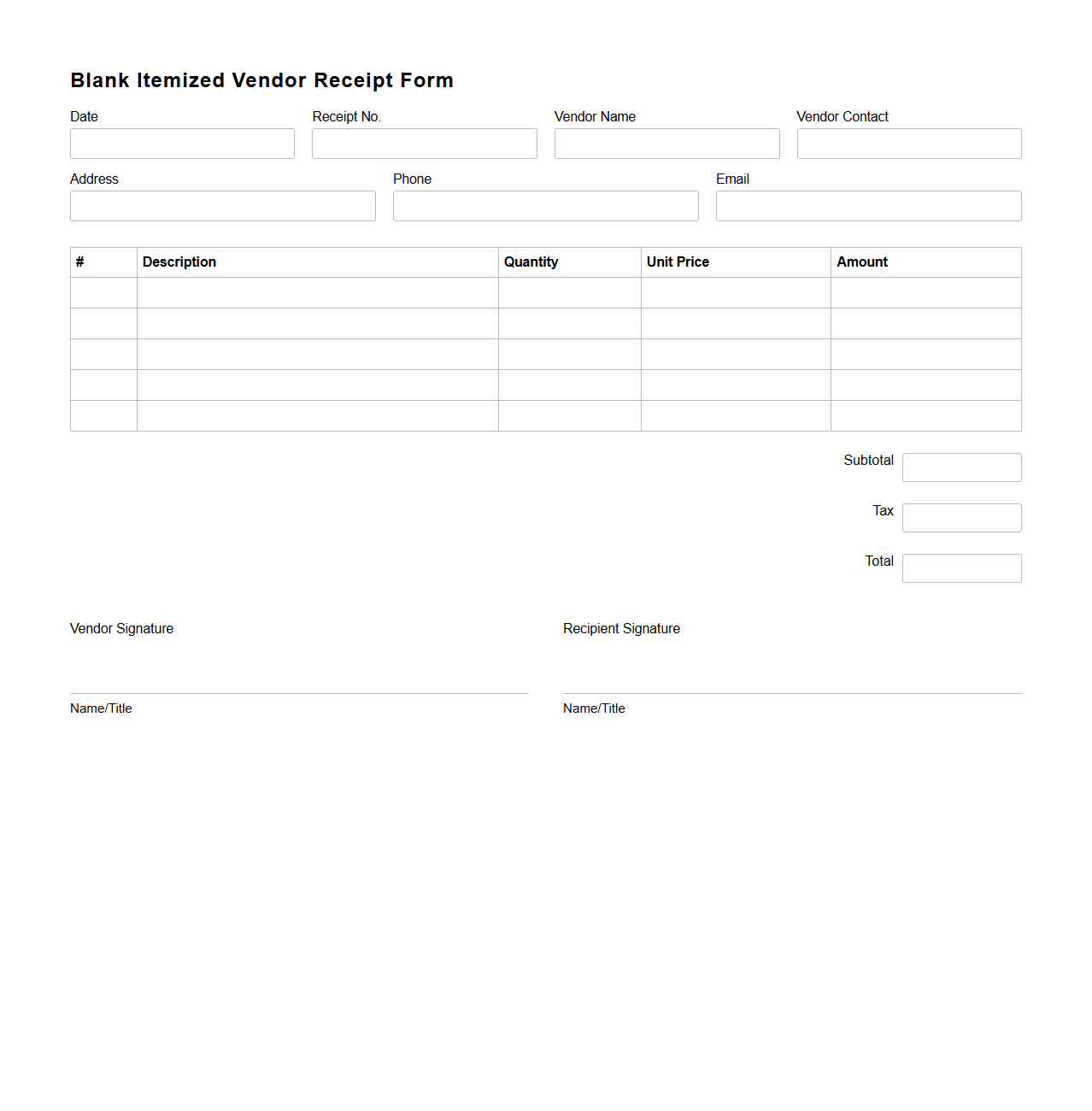

Blank Itemized Vendor Receipt Form

A

Blank Itemized Vendor Receipt Form is a template used to document detailed purchases from a vendor, listing each item acquired along with quantities, prices, and descriptions. This form facilitates accurate record-keeping for expense tracking and audit purposes by providing transparency in transactions. Businesses use it to verify received goods and ensure payments correspond with the itemized costs listed by the vendor.

Blank Itemized Transaction Receipt Template

A

Blank Itemized Transaction Receipt Template is a customizable document designed to record detailed transaction information, including individual items, quantities, prices, and total amounts. It provides a clear and organized format for businesses and individuals to document sales or purchases accurately. This template ensures transparent communication between parties and serves as proof of transactions for accounting and record-keeping purposes.

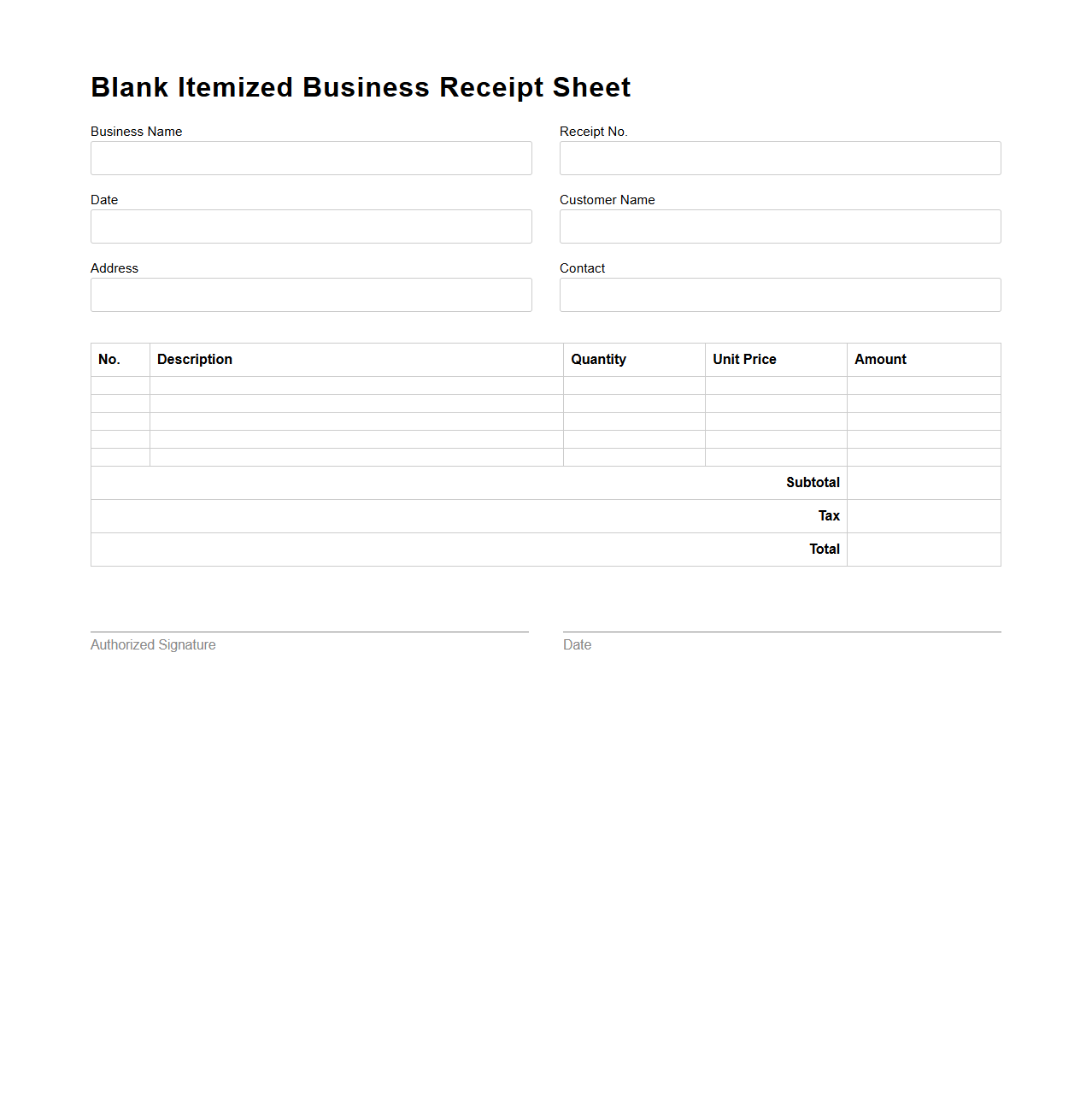

Blank Itemized Business Receipt Sheet

A

Blank Itemized Business Receipt Sheet is a document designed for recording detailed transactions between businesses and clients. It provides structured fields for listing individual items or services, quantities, prices, and total amounts, ensuring clear and professional financial documentation. This sheet is essential for accurate bookkeeping, expense tracking, and verifying purchases in a business environment.

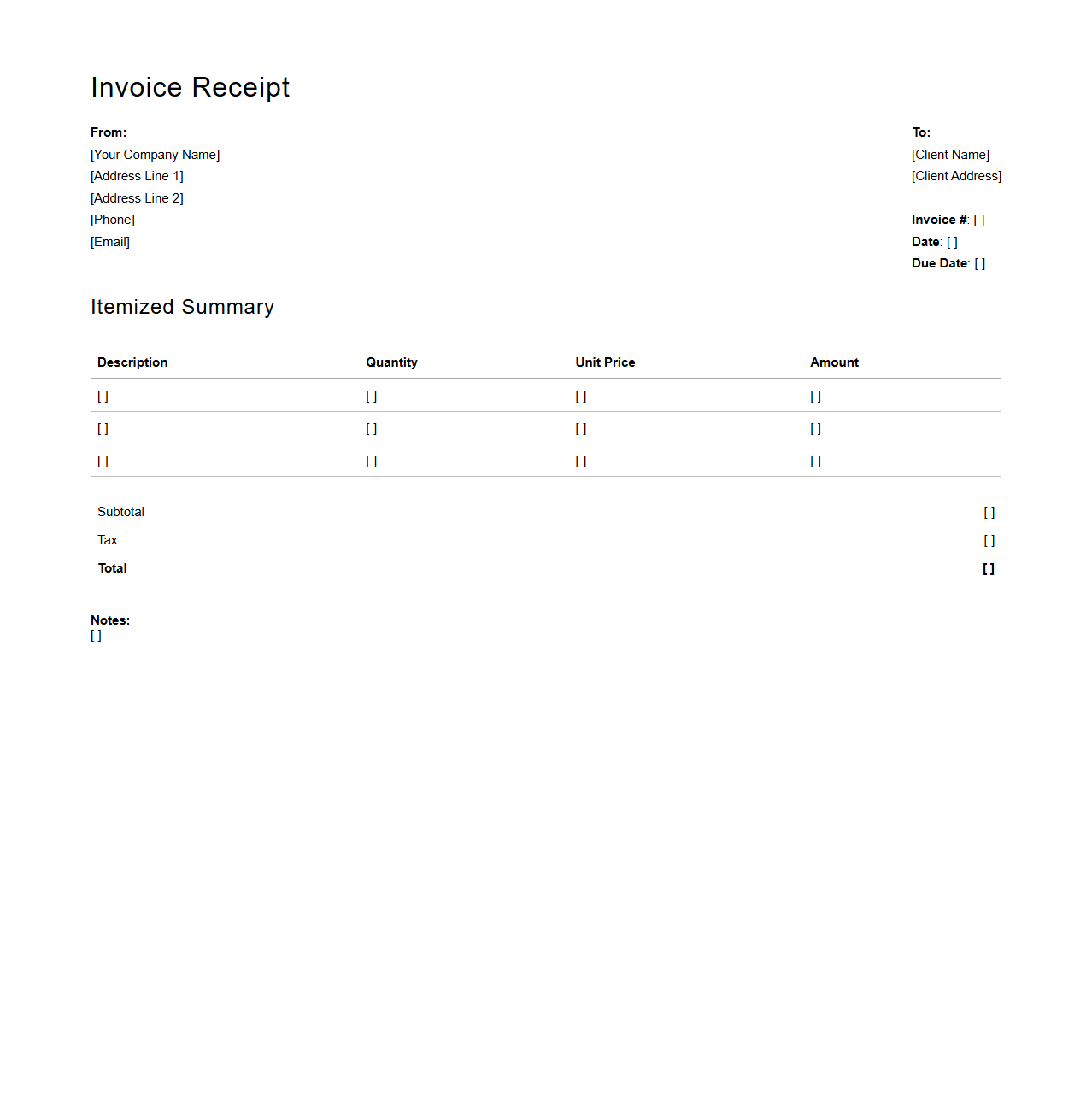

Blank Itemized Invoice Receipt Template

A

Blank Itemized Invoice Receipt Template is a customizable document used to detail and record individual items or services provided along with their respective costs. This template typically includes fields for quantities, descriptions, unit prices, and total amounts, ensuring accurate financial tracking and transparent communication between sellers and buyers. Businesses use this template to streamline invoicing processes and maintain organized payment records.

What essential fields should be included in a blank itemized receipt template for purchases?

A blank itemized receipt template must include the date of purchase to ensure accurate tracking of transactions. It should also contain the buyer and seller information to establish accountability. Finally, each item purchased must be listed with a description, quantity, price, and total amount to maintain detailed purchase records.

How can you customize a blank itemized receipt for different business types?

Customizing a blank itemized receipt involves tailoring the item descriptions to reflect the specific products or services offered by the business. Including unique business identifiers like a logo or specific tax registration numbers enhances authenticity. Additionally, adapting the layout to highlight relevant fields, such as service hours for consulting or serial numbers for electronics, improves usability.

Are digital or handwritten blank itemized receipts more legally acceptable for tax purposes?

Both digital and handwritten blank itemized receipts can be legally acceptable, provided they contain accurate and complete information. Digital receipts are often preferred for tax purposes due to their easier storage and retrieval capabilities. However, handwritten receipts remain valid as long as they are legible and properly documented.

What common errors occur when filling out a blank itemized receipt for multiple purchases?

Common errors include omitting the quantity or price details for each item, leading to inaccurate totals. Another frequent mistake is failing to include the date or buyer information, which can cause verification issues. Additionally, arithmetic errors when calculating the grand total are often overlooked, compromising receipt accuracy.

How do you securely store filled blank itemized receipts for accounting audits?

To ensure security, filled blank itemized receipts should be stored in a centralized, organized digital system with regular backups. Physical receipts must be kept in a fireproof and locked cabinet to prevent damage or loss. Employing access controls and audit trails further enhances protection against unauthorized access during accounting audits.