A Blank Statement of Assets Template for Loan Applications provides a clear and organized format for borrowers to list their financial assets when applying for a loan. This template helps ensure all relevant assets are accurately documented, facilitating a smoother loan approval process. Using a standardized template enhances clarity and efficiency for both applicants and lenders.

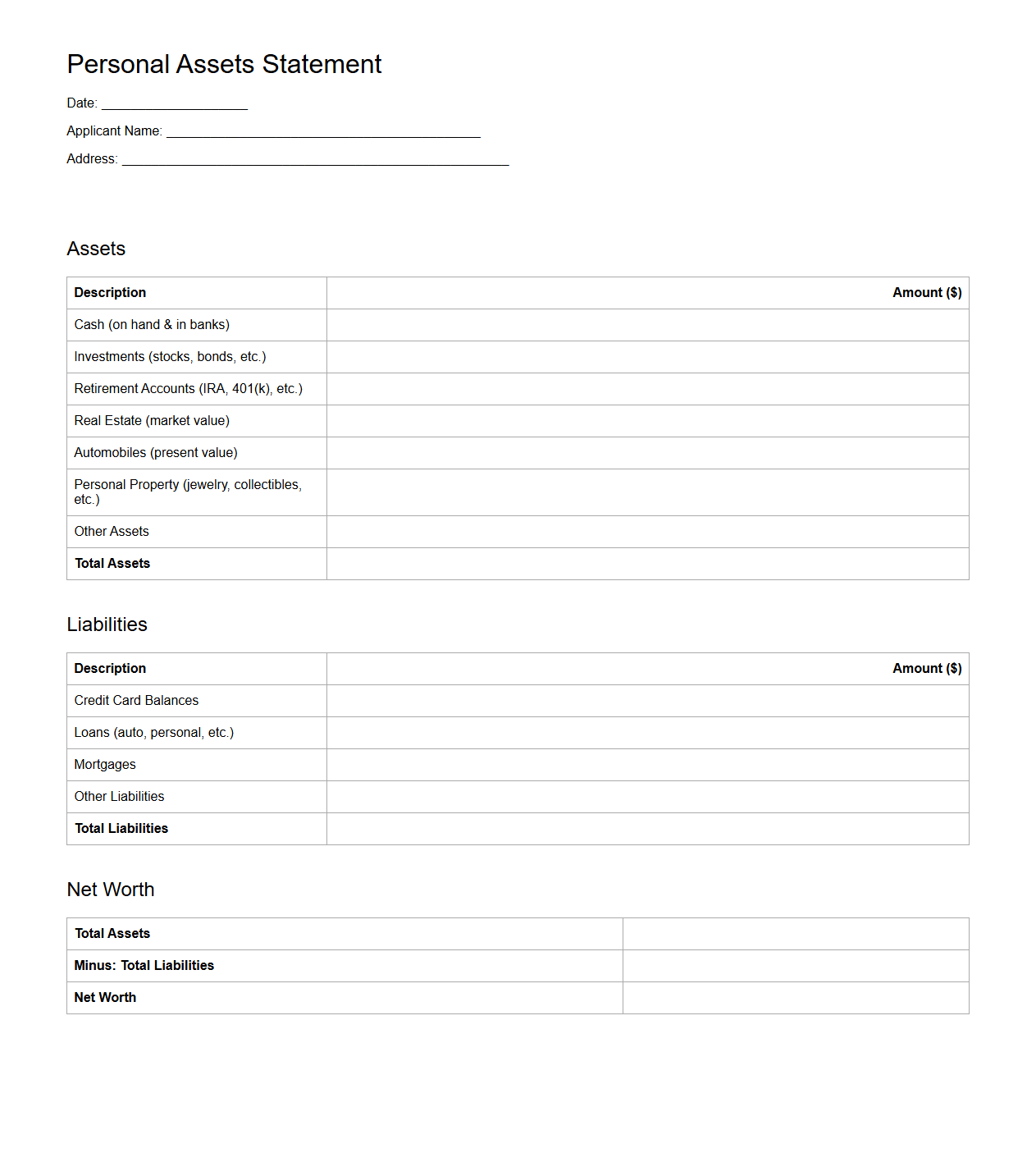

Blank Personal Assets Statement Template for Loan Applications

A

Blank Personal Assets Statement Template for Loan Applications is a standardized form used to list an individual's financial assets, such as bank accounts, investments, real estate, and personal property. This document helps lenders assess the borrower's financial stability and ability to repay a loan by providing a clear snapshot of available assets. Using a blank template ensures all necessary asset information is organized systematically for accurate evaluation during the loan approval process.

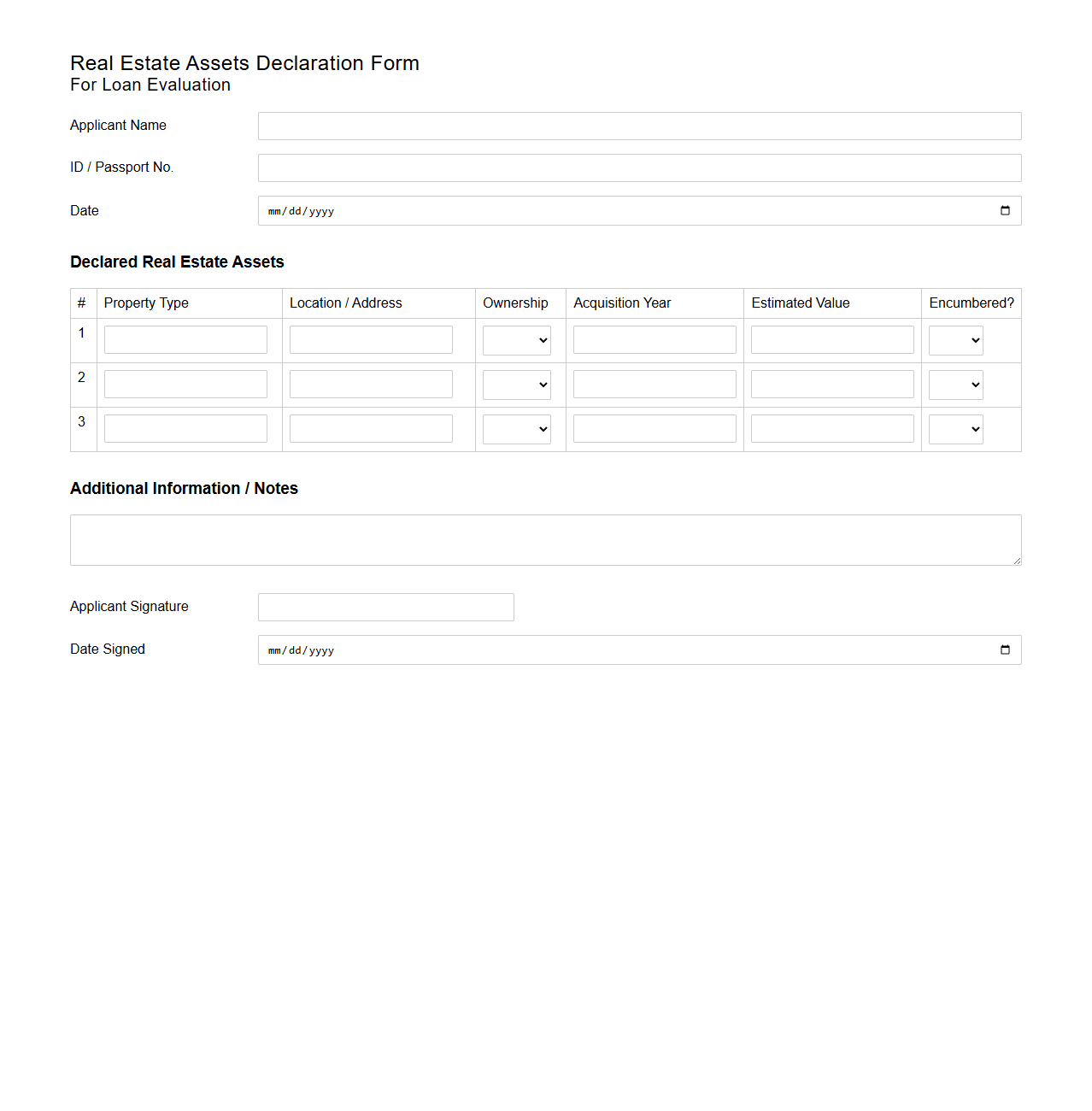

Blank Real Estate Assets Declaration Form for Loan Evaluation

The

Blank Real Estate Assets Declaration Form for loan evaluation is a standardized document used by financial institutions to collect comprehensive information about a borrower's real estate holdings. This form details property types, addresses, values, and ownership status, enabling accurate assessment of collateral value and borrower creditworthiness. Accurate completion of this form helps lenders make informed decisions on loan approvals and risk management.

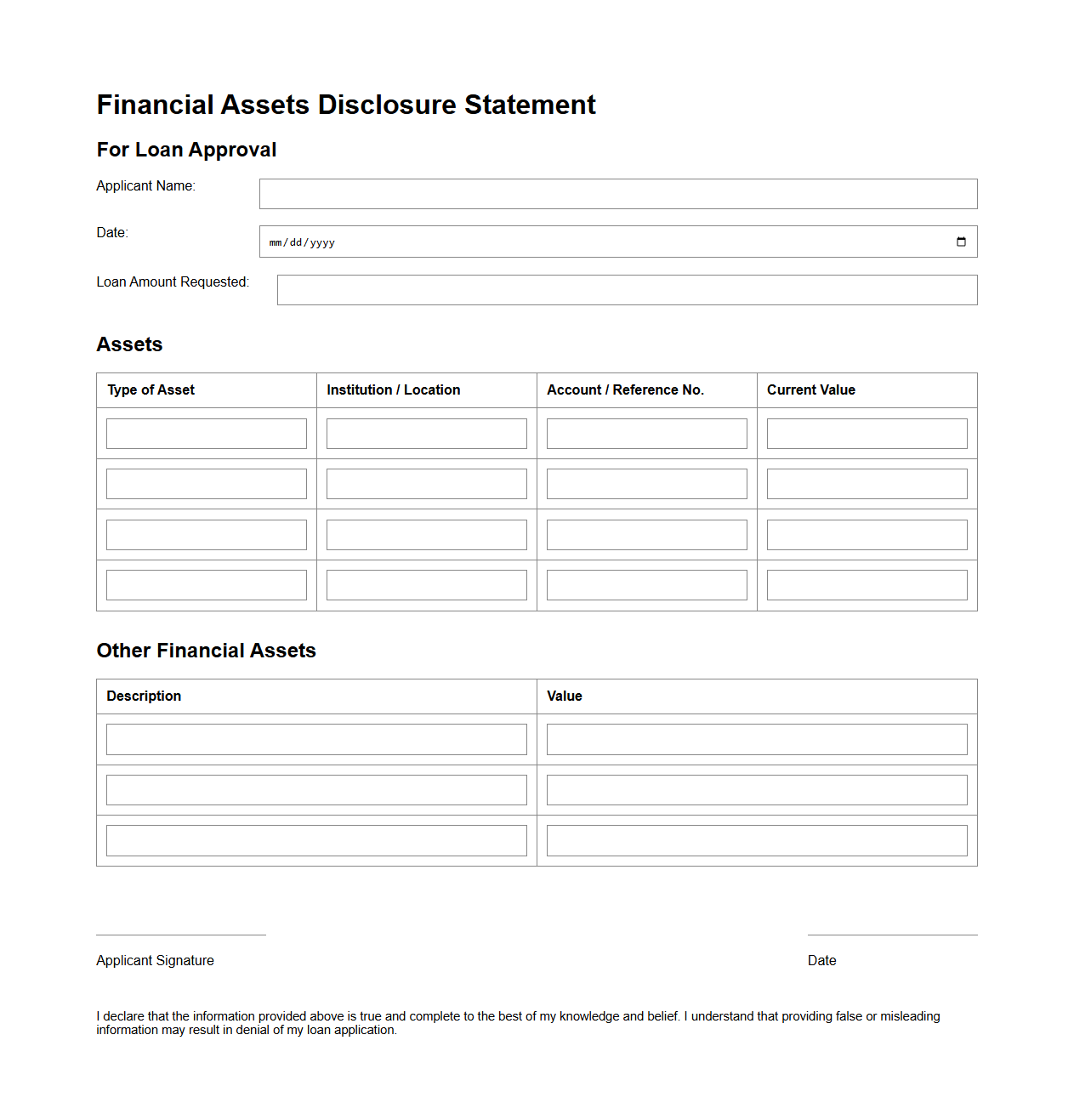

Blank Financial Assets Disclosure Statement for Loan Approval

A

Blank Financial Assets Disclosure Statement for loan approval is a standardized form used by lenders to assess an applicant's financial position by listing all assets without providing specific values initially. This document helps streamline the loan evaluation process by requiring borrowers to identify asset categories, ensuring transparency and completeness in financial reporting. Lenders use this statement to verify asset eligibility, liquidity, and overall financial stability before approving credit or loan applications.

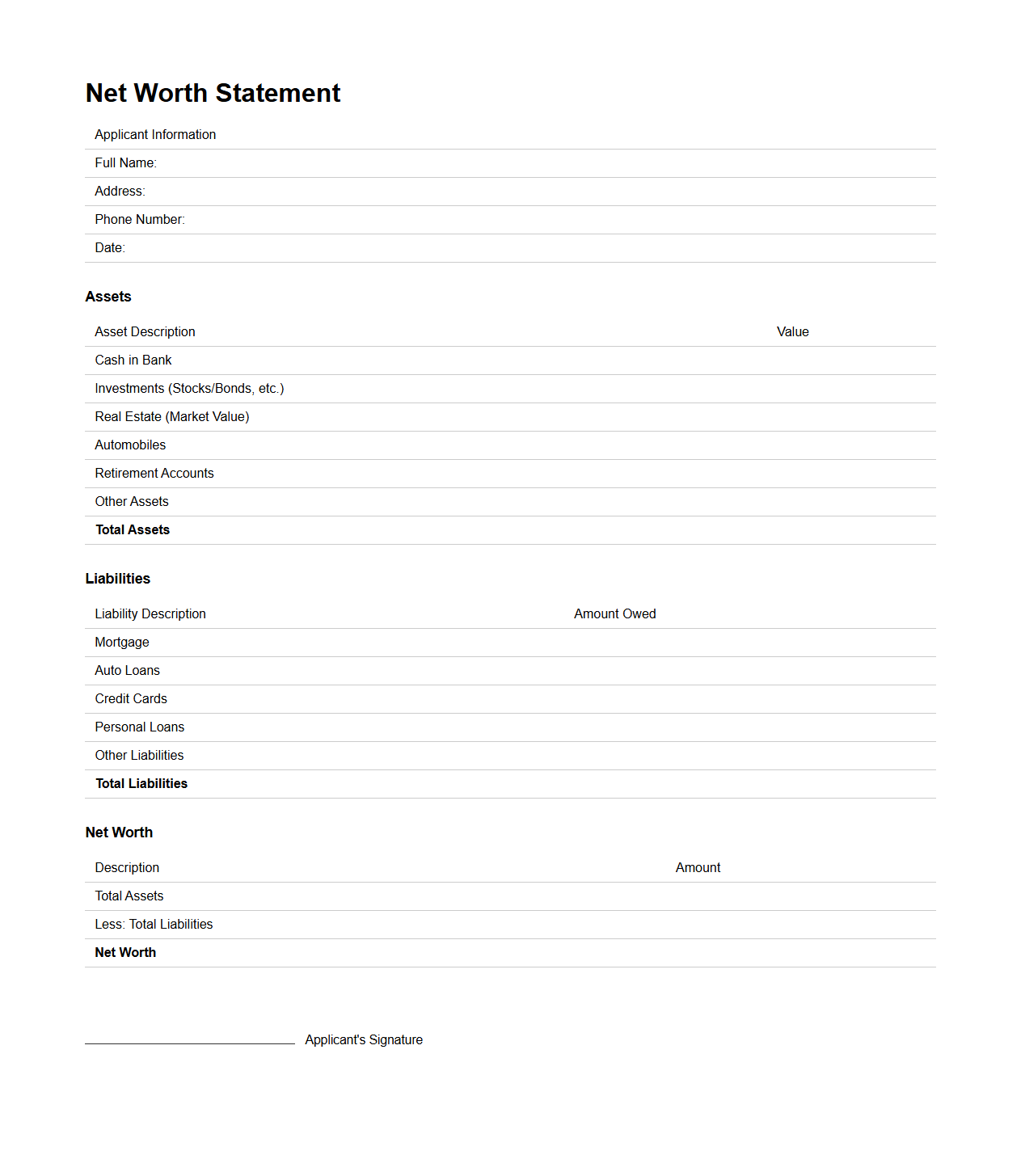

Blank Net Worth Statement Template for Loan Processing

A

Blank Net Worth Statement Template for loan processing is a structured document used to list an individual's or business's assets and liabilities to determine financial standing. It helps lenders assess the borrower's ability to repay the loan by providing clear details on total assets, debts, and net worth. This template ensures accuracy and consistency in the financial evaluation process, streamlining loan approval decisions.

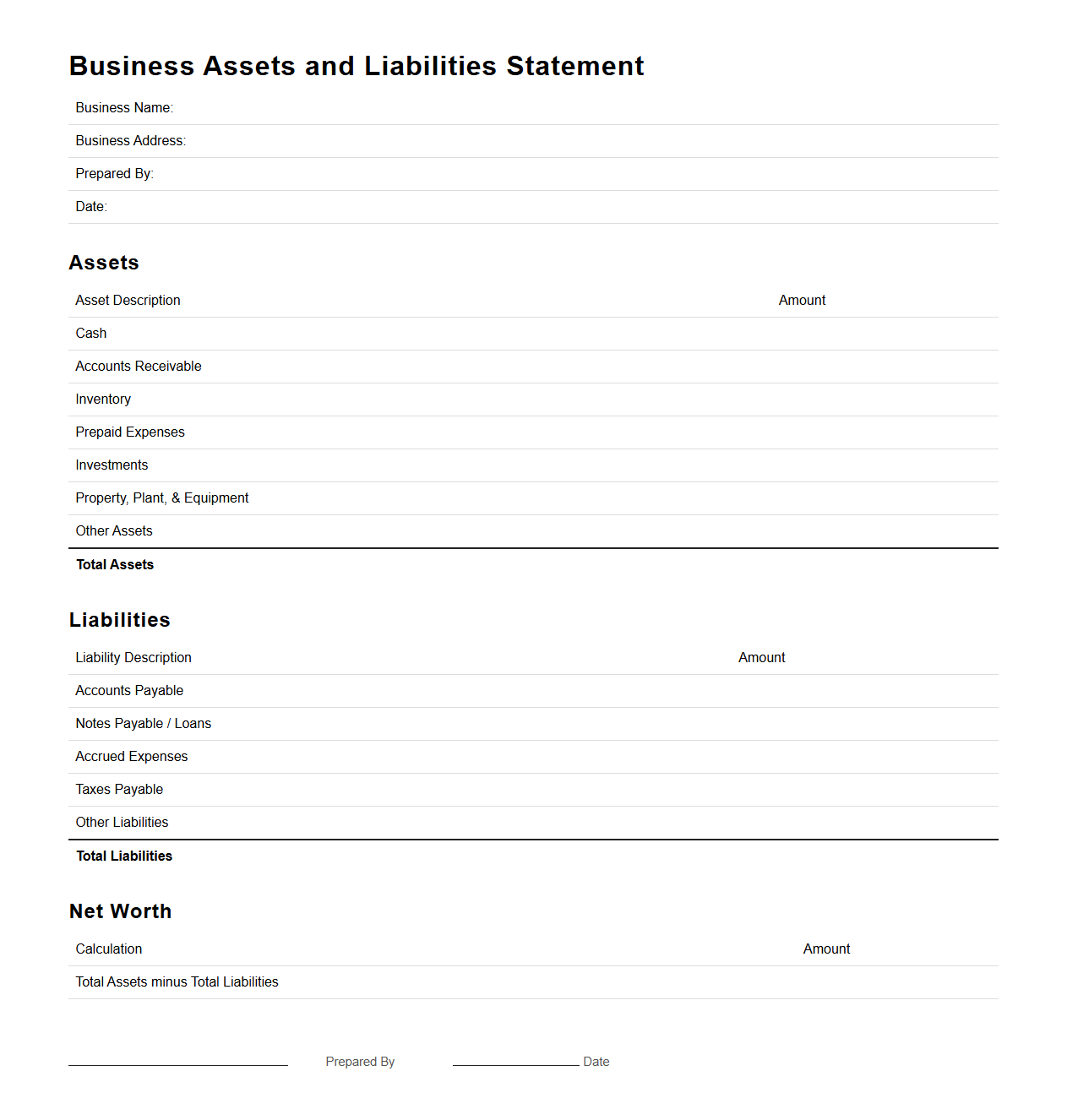

Blank Business Assets and Liabilities Statement for Loan Requests

A

Blank Business Assets and Liabilities Statement for Loan Requests is a financial document template used by businesses to provide a detailed overview of their current financial position when applying for loans. It lists all assets, including cash, accounts receivable, and inventory, alongside liabilities such as loans, accounts payable, and other debts. Lenders use this statement to assess the company's creditworthiness and ability to repay the loan based on its net worth and financial stability.

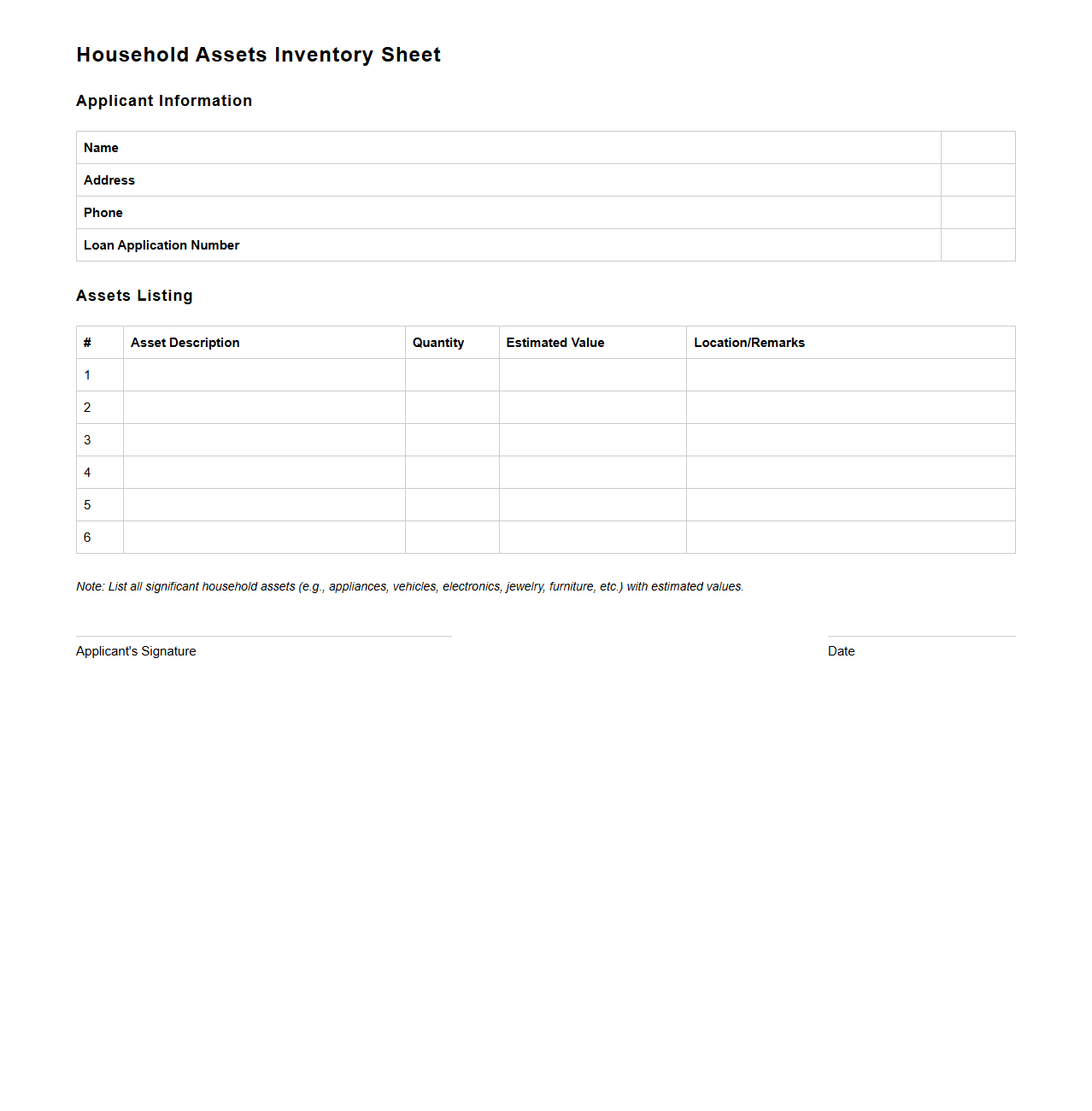

Blank Household Assets Inventory Sheet for Loan Application

The

Blank Household Assets Inventory Sheet for loan application is a detailed document used to list and assess all tangible and intangible assets owned by an applicant's household. It includes sections for recording items such as real estate, vehicles, savings, investments, and valuable personal property, helping lenders evaluate the borrower's financial stability and collateral value. Accurate completion of this sheet facilitates a more efficient and transparent loan approval process by providing a clear overview of the applicant's total assets.

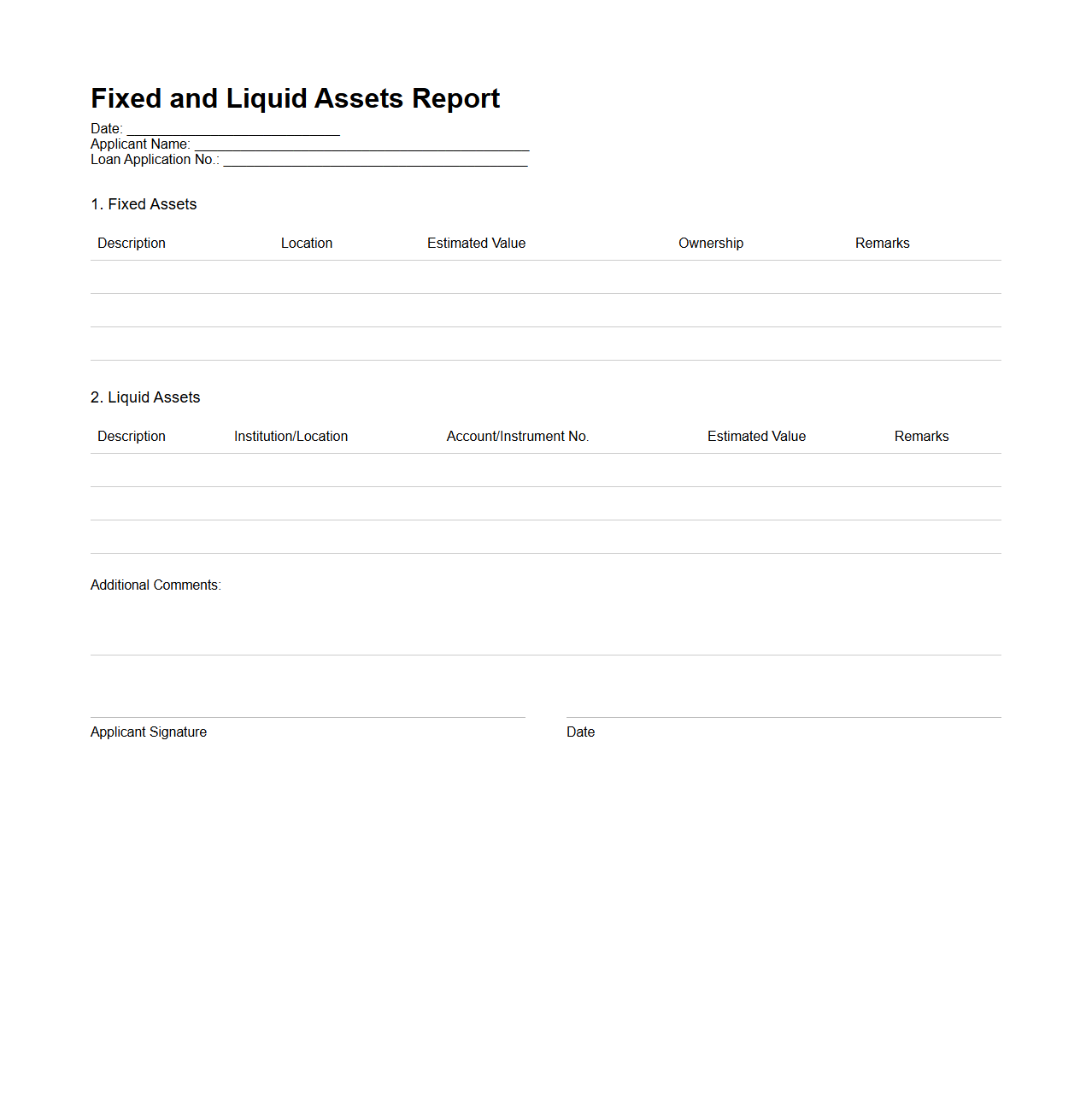

Blank Fixed and Liquid Assets Report for Loan Assessment

The

Blank Fixed and Liquid Assets Report for Loan Assessment is a financial document that details an individual's or organization's tangible assets such as property, machinery, and inventory, alongside liquid assets like cash, bank balances, and marketable securities. This report provides lenders with a clear snapshot of the borrower's financial strength, enabling accurate evaluation of repayment capacity and risk. Accurate asset valuation within this document is crucial for determining loan eligibility and terms.

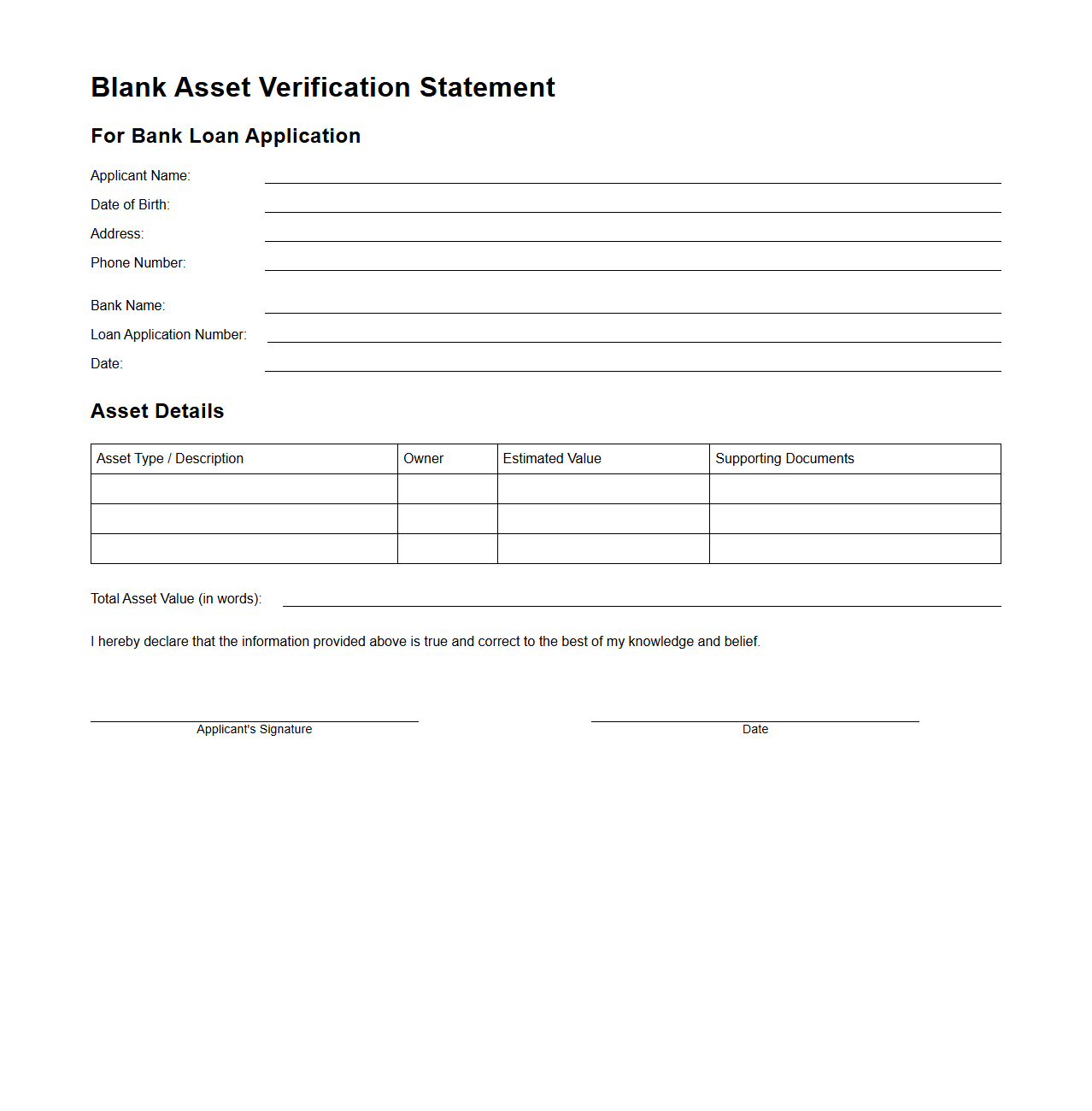

Blank Asset Verification Statement for Bank Loan Application

A

Blank Asset Verification Statement for a bank loan application is a document used to confirm that an applicant has no assets to declare or verify. It serves as a formal attestation that the borrower does not possess any verifiable property, savings, or investments relevant to the loan evaluation process. This statement helps banks ensure transparency and accuracy in assessing the applicant's financial standing during credit risk analysis.

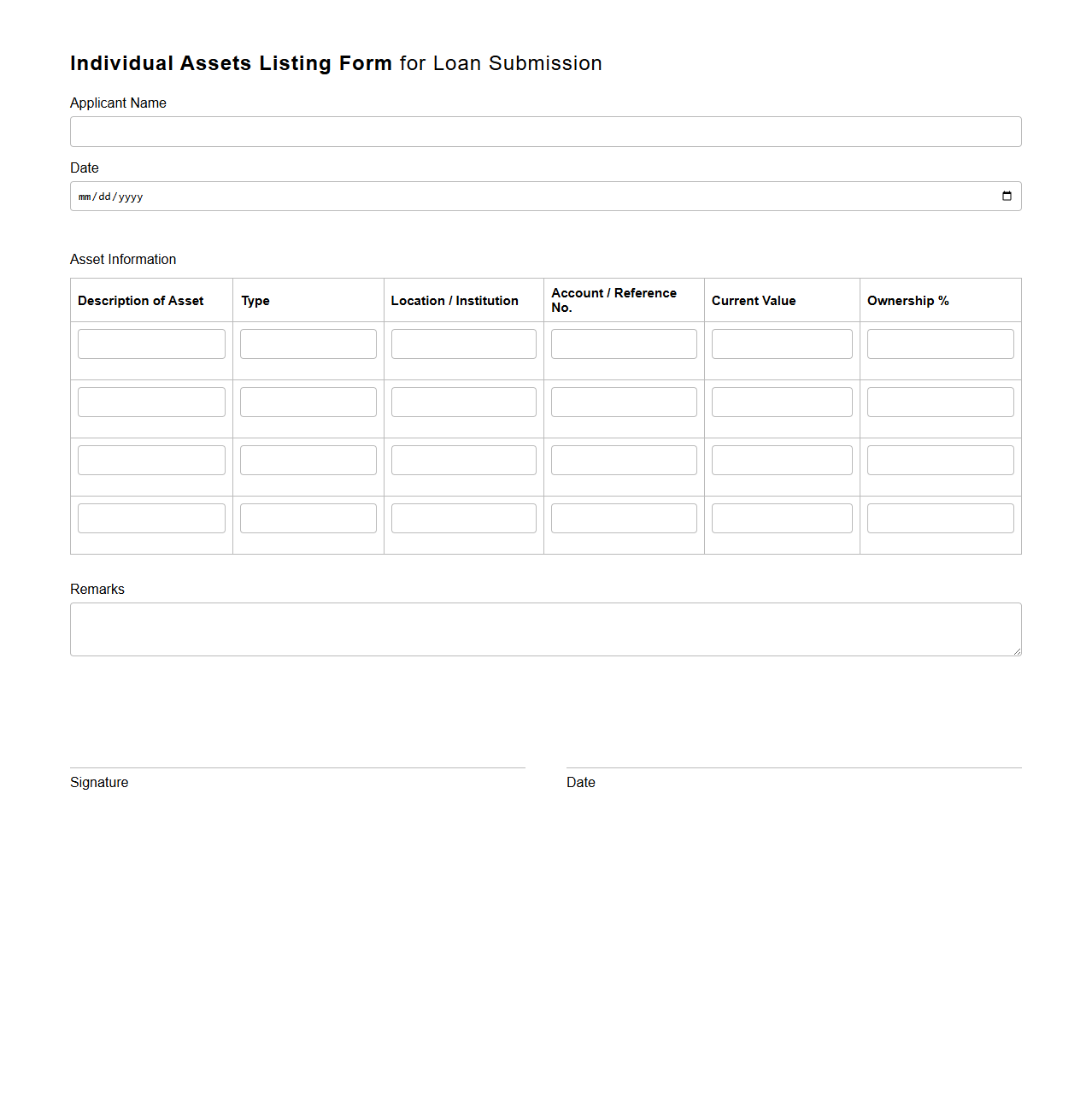

Blank Individual Assets Listing Form for Loan Submission

The

Blank Individual Assets Listing Form for Loan Submission is a crucial document used to detail a borrower's personal assets during the loan application process. This form helps lenders assess the borrower's financial stability by itemizing cash, investments, real estate, and other valuable possessions. Accurate completion of this form ensures a thorough evaluation of the applicant's net worth, improving the chances of loan approval.

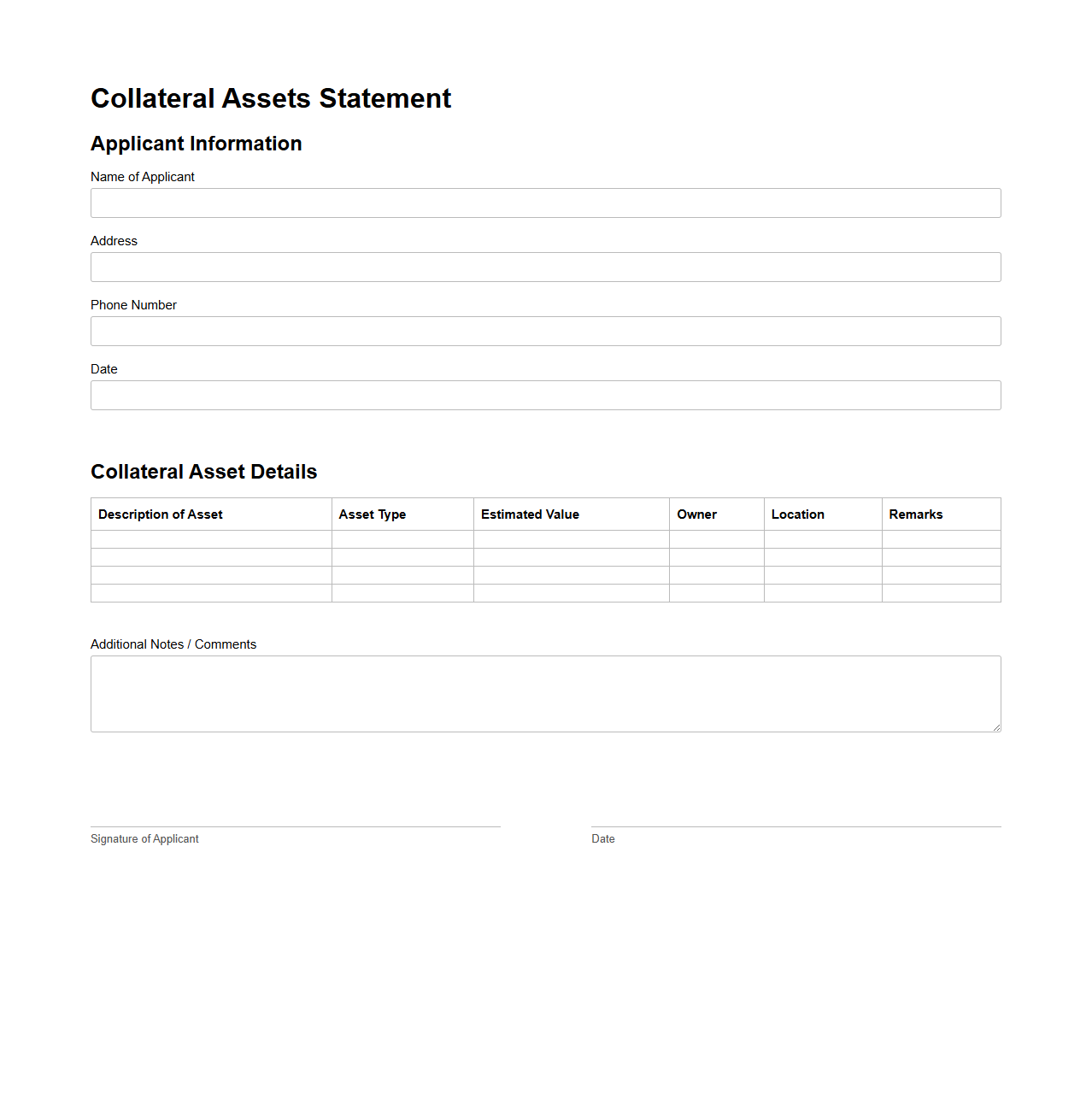

Blank Collateral Assets Statement Template for Loan Officers

A

Blank Collateral Assets Statement Template for Loan Officers is a standardized document used to itemize and evaluate a borrower's assets pledged as collateral for a loan. It helps loan officers systematically capture details such as asset type, value, ownership, and current status, ensuring accurate risk assessment and regulatory compliance. Utilizing this template improves documentation consistency and expedites loan underwriting by providing clear, organized asset information.

What supporting documents are required with a blank statement of assets for loan approval?

When submitting a blank statement of assets for loan approval, it is essential to include recent bank statements, proof of investment holdings, and property ownership documents. Lenders often require official documents to verify the accuracy of declared assets and ensure financial stability. Including up-to-date tax returns and pay slips further strengthens the loan application.

How should joint ownership assets be disclosed in a blank statement for loan applications?

Joint ownership assets must be clearly identified in the blank statement of assets with the names of all parties involved. The applicant should specify their percentage of ownership to provide a precise valuation. Proper disclosure prevents misunderstandings and aligns with lender requirements for transparency.

Are digital assets (e.g., cryptocurrency) accepted on asset statements for loans?

Many lenders are beginning to accept digital assets such as cryptocurrency on asset statements, but this varies widely. Proper documentation, like wallet balances and transaction histories, is required to validate these assets. It's important to confirm with the lender beforehand whether digital assets qualify as acceptable collateral.

What common mistakes lead to loan rejection when submitting a blank statement of assets?

Common errors include omitting joint assets, failing to provide supporting documentation, and overstating asset values, all of which can cause loan rejection. Incomplete or inaccurate information damages the credibility of the loan application. Ensuring full transparency and precise disclosure helps avoid these pitfalls.

How do lenders verify the information provided in a blank asset statement form?

Lenders verify the details by cross-checking submitted documents like bank statements, property titles, and investment account summaries. They may also employ third-party verification services to confirm authenticity and ownership. This thorough process ensures the accuracy of asset declarations and mitigates lending risks.