A Blank Cash Flow Statement Template for Accounting provides a structured format for tracking cash inflows and outflows over a specific period. This template helps businesses monitor liquidity, manage expenses, and forecast future cash positions efficiently. Utilizing a clear and customizable template ensures accurate financial analysis and better decision-making.

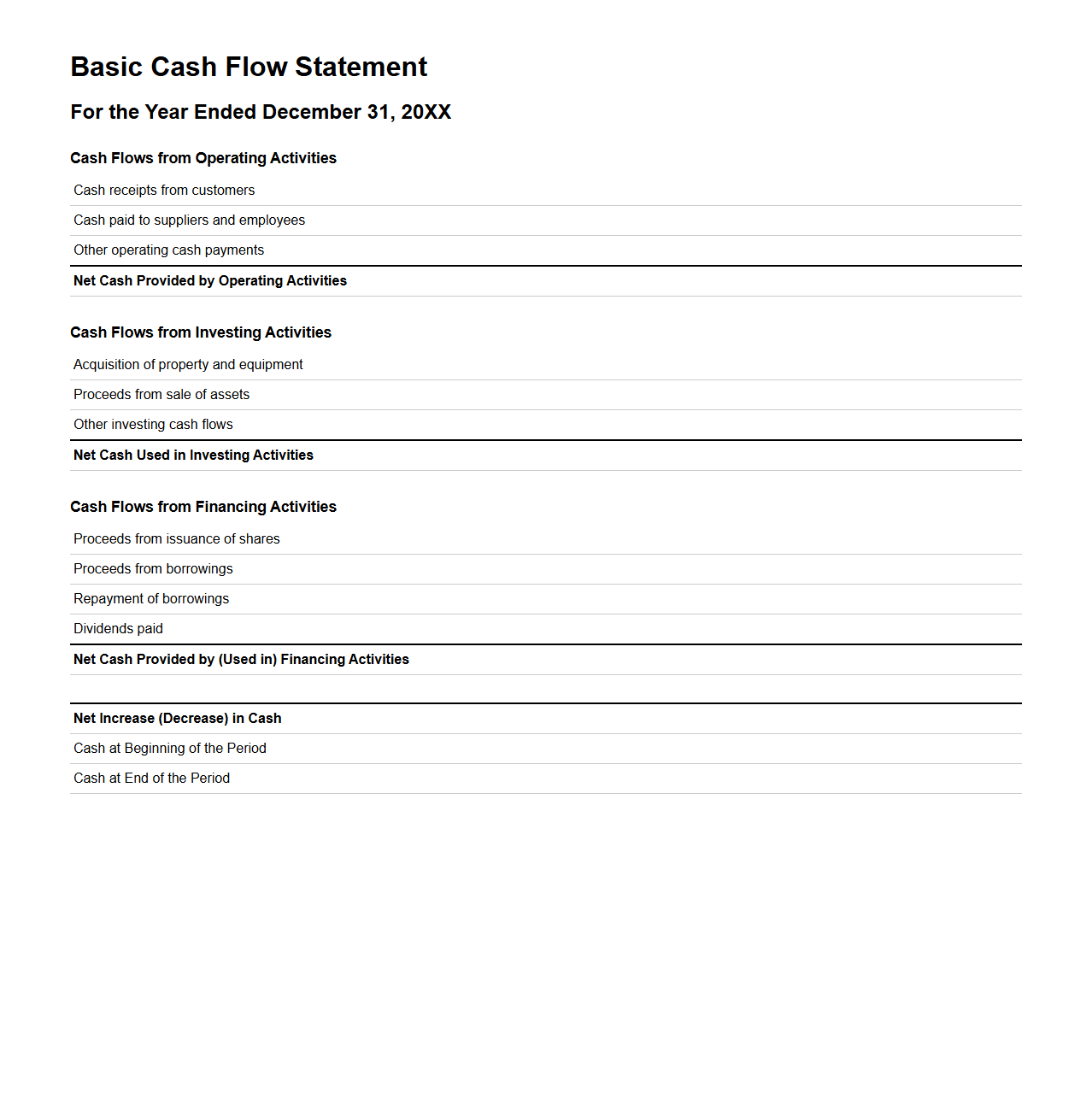

Basic Cash Flow Statement Format for Accountants

The

Basic Cash Flow Statement Format for accountants outlines the structured presentation of cash inflows and outflows, categorizing activities into operating, investing, and financing sections. This format enables clear tracking of liquidity by detailing cash generated from core business operations, cash used in asset acquisitions or sales, and cash movements related to debt or equity. Accountants rely on this format to provide stakeholders with vital insights into a company's financial health and cash management efficiency.

Simple Cash Flow Report Outline for Finance Tracking

A

Simple Cash Flow Report Outline for finance tracking is a structured template designed to monitor incoming and outgoing cash transactions over a specific period. It typically includes sections for cash inflows, cash outflows, net cash flow, and opening and closing balances, providing a clear snapshot of liquidity. This report helps businesses manage their finances efficiently by forecasting cash availability and identifying potential shortfalls.

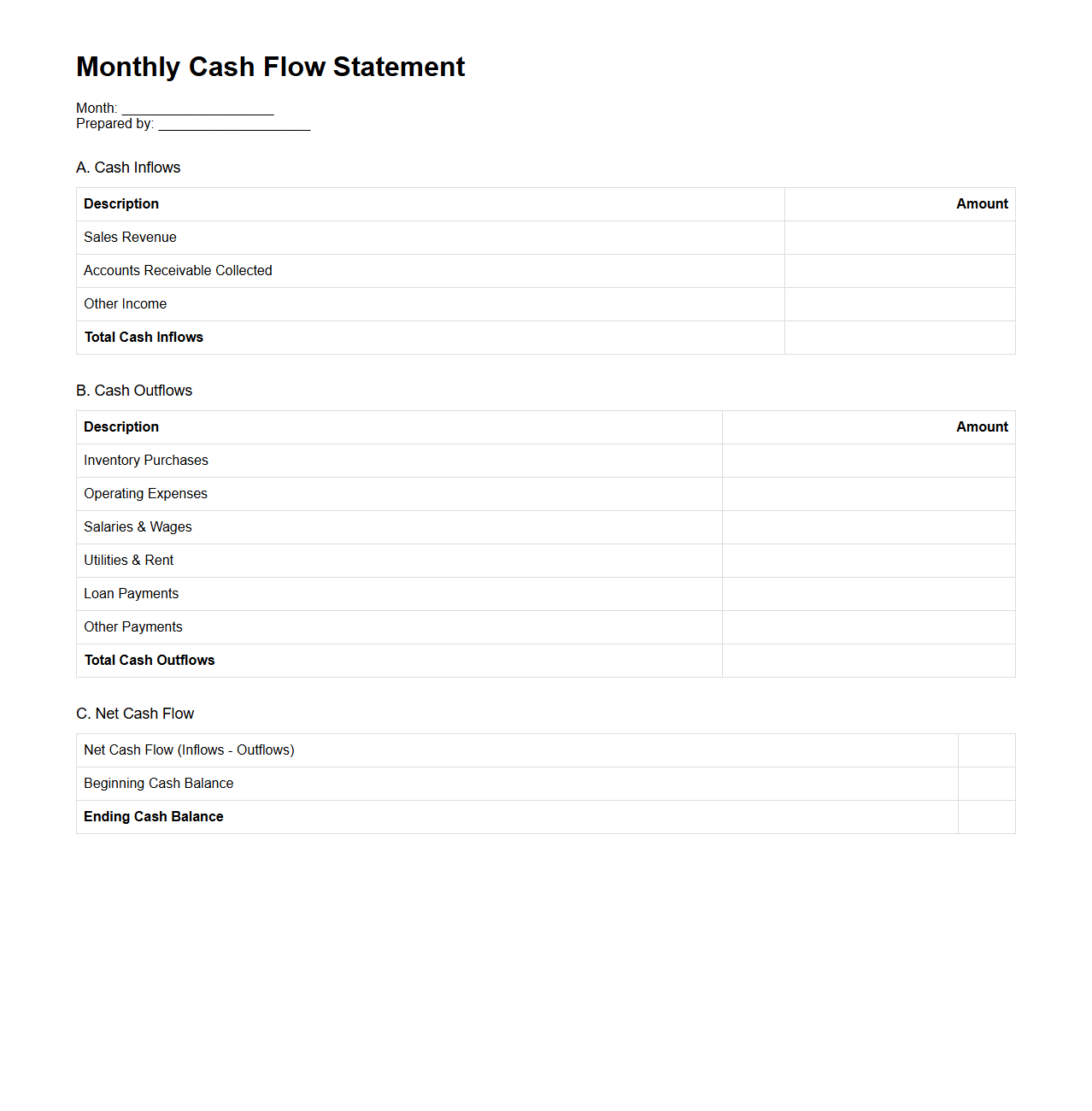

Monthly Cash Flow Statement Template for Bookkeeping

A

Monthly Cash Flow Statement Template for bookkeeping is a structured financial document designed to track the inflows and outflows of cash within a business over a one-month period. It helps accountants and business owners monitor liquidity, manage expenses, and forecast future cash needs by categorizing revenue, operating costs, investments, and financing activities. Utilizing this template ensures accurate cash management, facilitates timely financial decision-making, and supports comprehensive financial reporting.

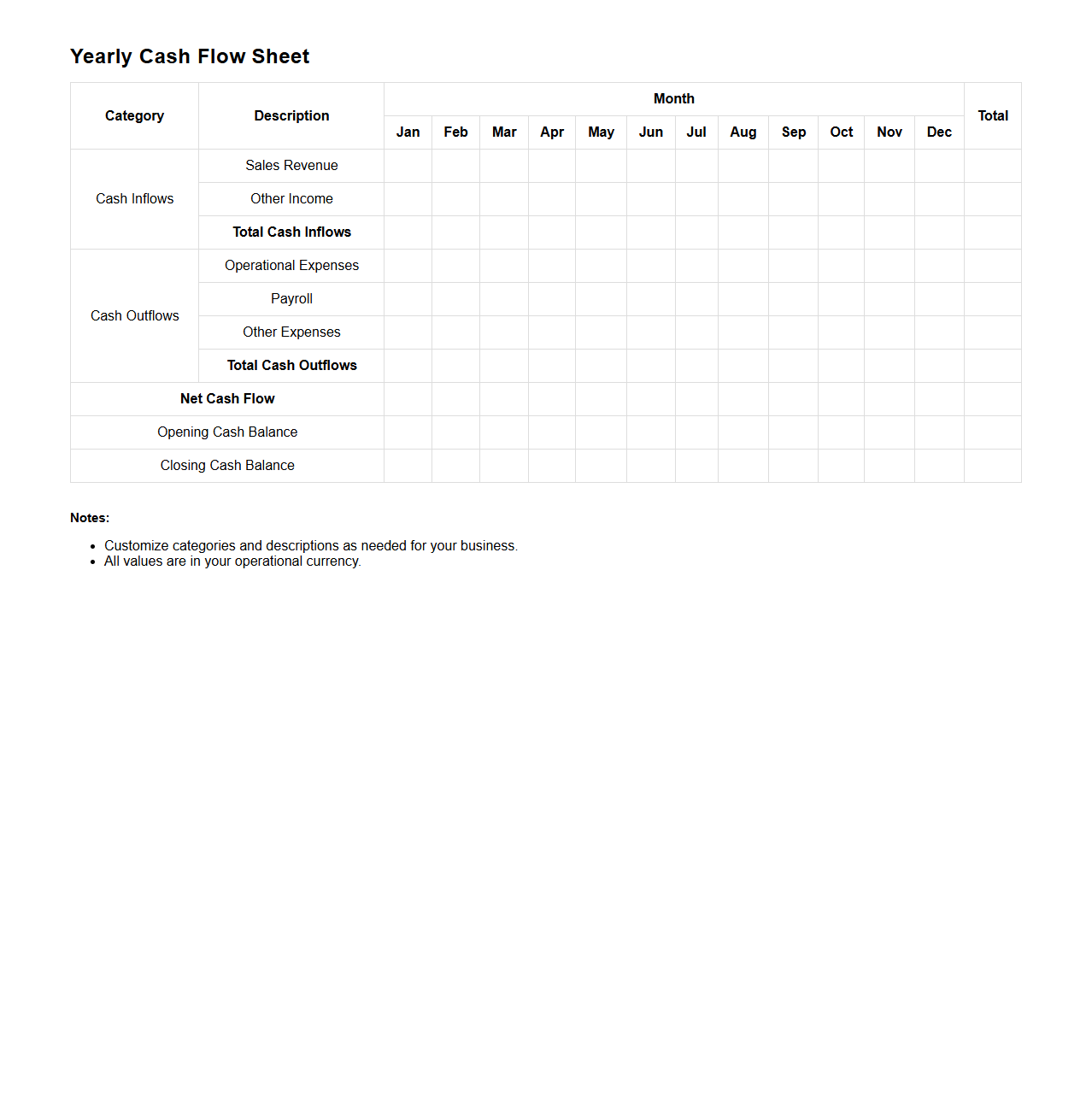

Yearly Cash Flow Sheet Format for Business Accounting

A

Yearly Cash Flow Sheet Format for business accounting is a structured document that tracks all cash inflows and outflows over a 12-month period, providing a clear overview of a company's liquidity and financial health. It helps businesses forecast future cash positions, manage budgets, and identify potential shortfalls or surpluses. This format typically includes sections for operating activities, investing activities, and financing activities, ensuring comprehensive cash flow analysis.

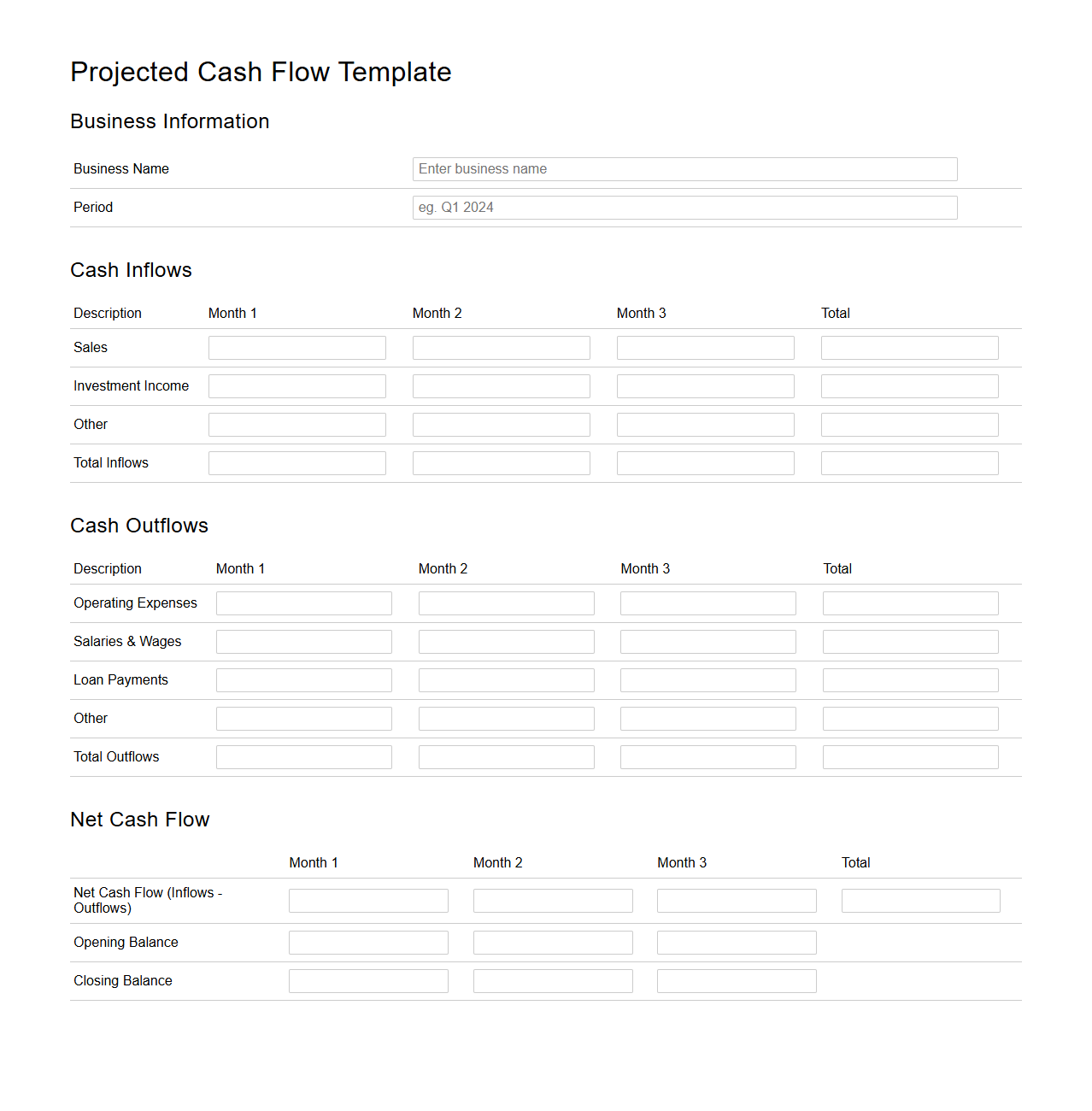

Projected Cash Flow Template for Financial Planning

A

Projected Cash Flow Template for financial planning is a tool used to forecast future cash inflows and outflows over a specific period, helping businesses and individuals manage liquidity effectively. It organizes expected revenues, expenses, and financing activities to predict net cash changes, ensuring informed decision-making and preventing liquidity shortfalls. This template supports budgeting, investment planning, and risk management by providing a clear view of cash availability and timing.

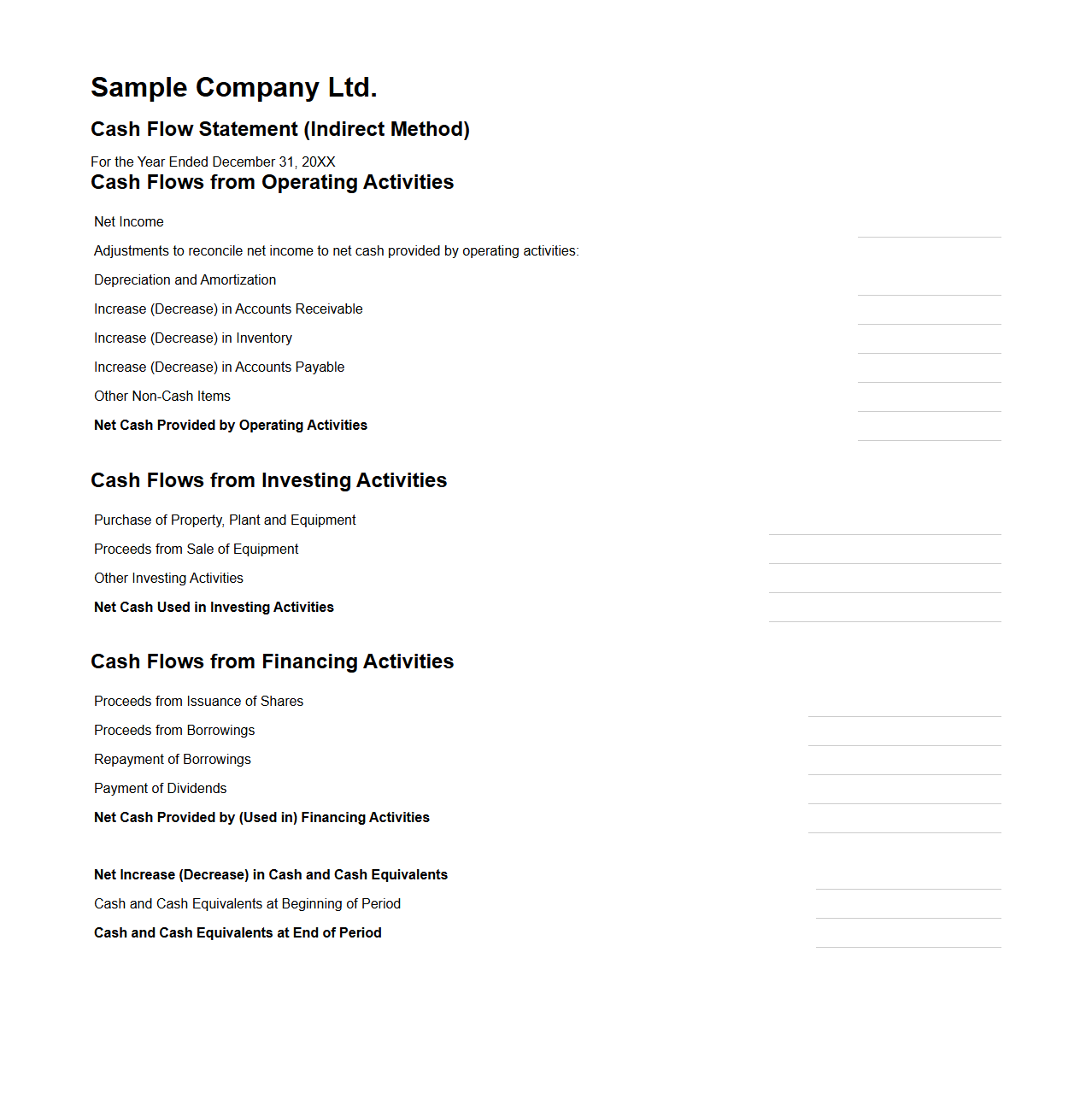

Indirect Method Cash Flow Statement Sample

An

Indirect Method Cash Flow Statement Sample document demonstrates how to prepare a cash flow statement by adjusting net income for changes in working capital and non-cash expenses. It highlights key components such as depreciation, accounts receivable, and inventory fluctuations to reconcile net income to net cash provided by operating activities. This sample serves as a practical guide for accountants and financial analysts to accurately report cash flows using the indirect method outlined in accounting standards.

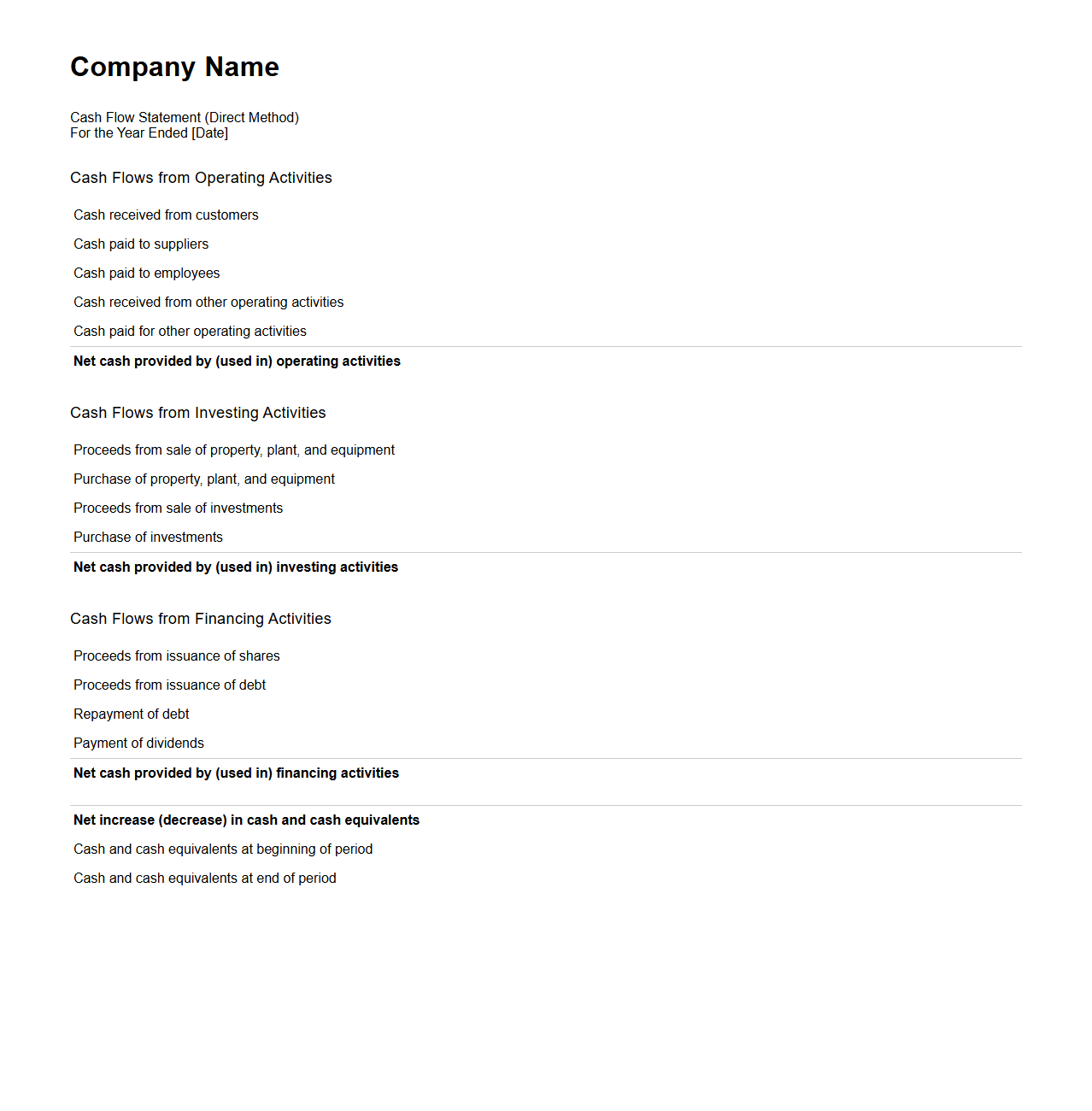

Direct Method Cash Flow Statement Layout

The

Direct Method Cash Flow Statement Layout document details cash inflows and outflows from operating activities by listing actual receipts and payments, providing clearer insight into how cash is generated and utilized. This layout separates cash transactions such as cash received from customers and cash paid to suppliers, enabling precise tracking of operational liquidity. Businesses and accountants use this document to improve financial analysis and cash flow management by presenting transparent and straightforward cash activity data.

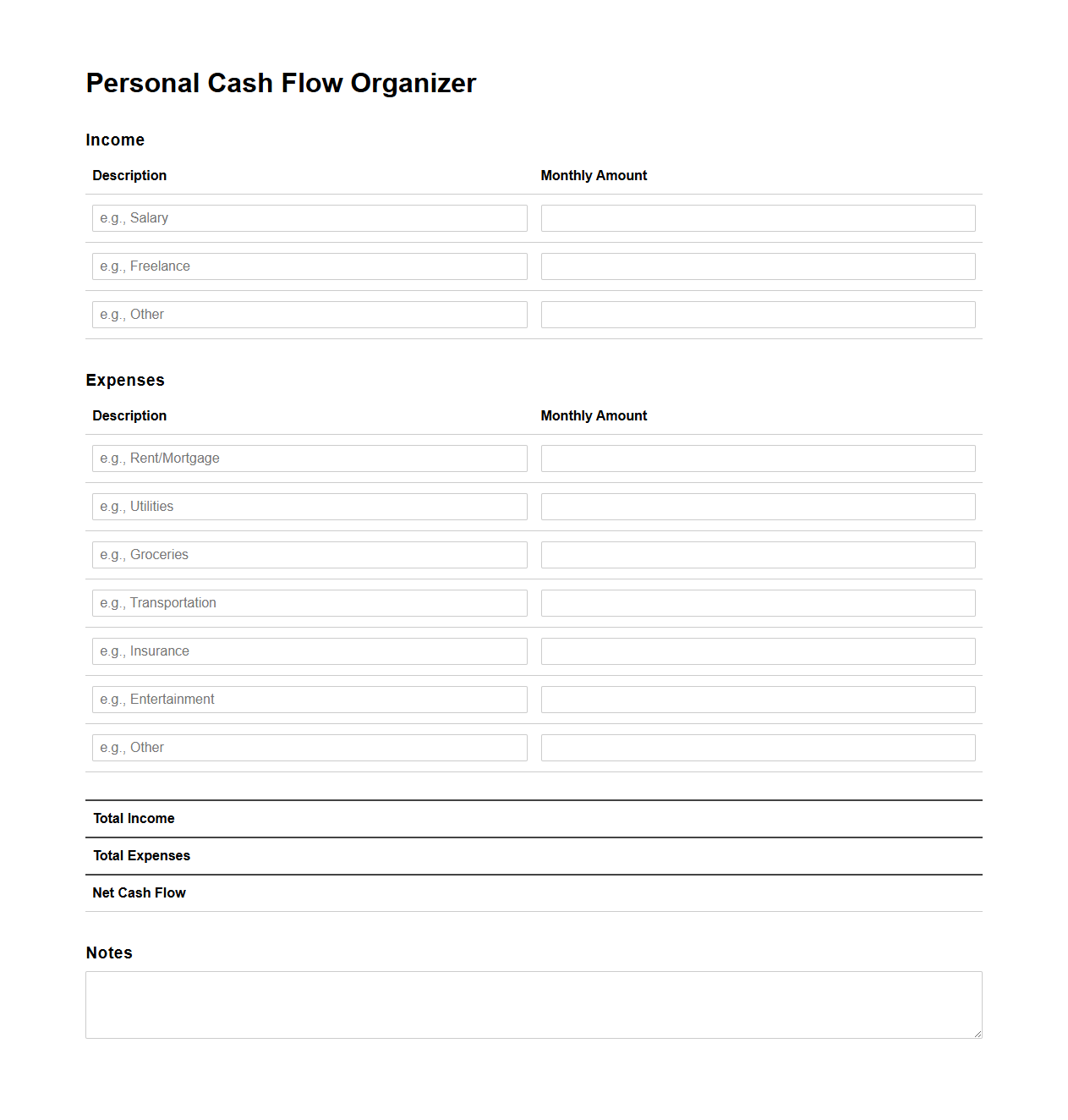

Personal Cash Flow Organizer for Budget Analysis

A

Personal Cash Flow Organizer for budget analysis is a financial tool designed to track and categorize income and expenses systematically. It helps individuals gain clear insights into their spending patterns and identify opportunities for saving or reallocating funds effectively. By using this organizer, users can make informed budgeting decisions and maintain better control over their personal finances.

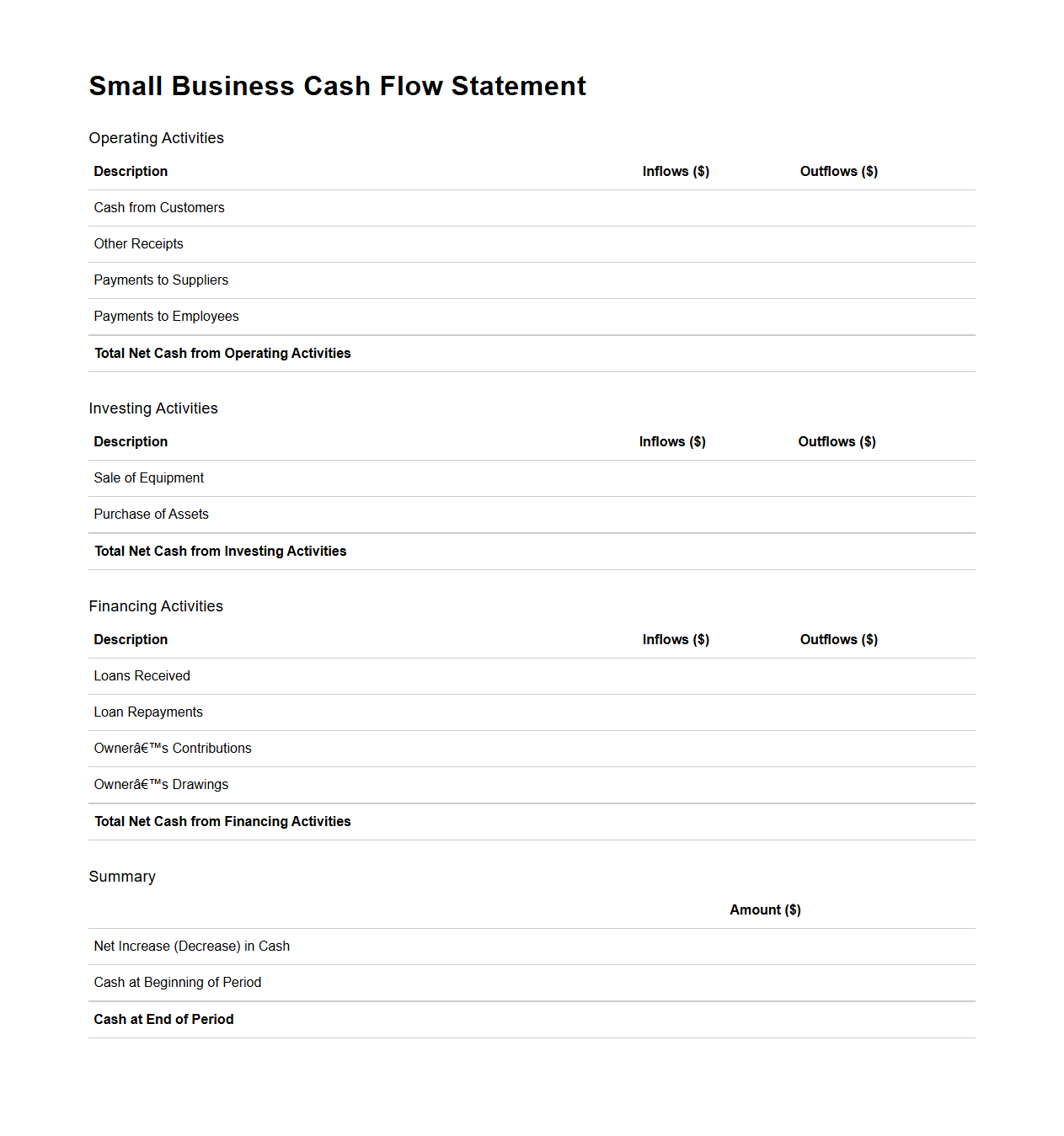

Small Business Cash Flow Statement Design

A

Small Business Cash Flow Statement Design document outlines the structure and format for tracking the inflows and outflows of cash within a small business. It specifies the categories, time frames, and reporting methods necessary for accurately reflecting the company's liquidity and financial health. This document is essential for creating consistent, transparent, and actionable financial reports that support effective cash management and decision-making.

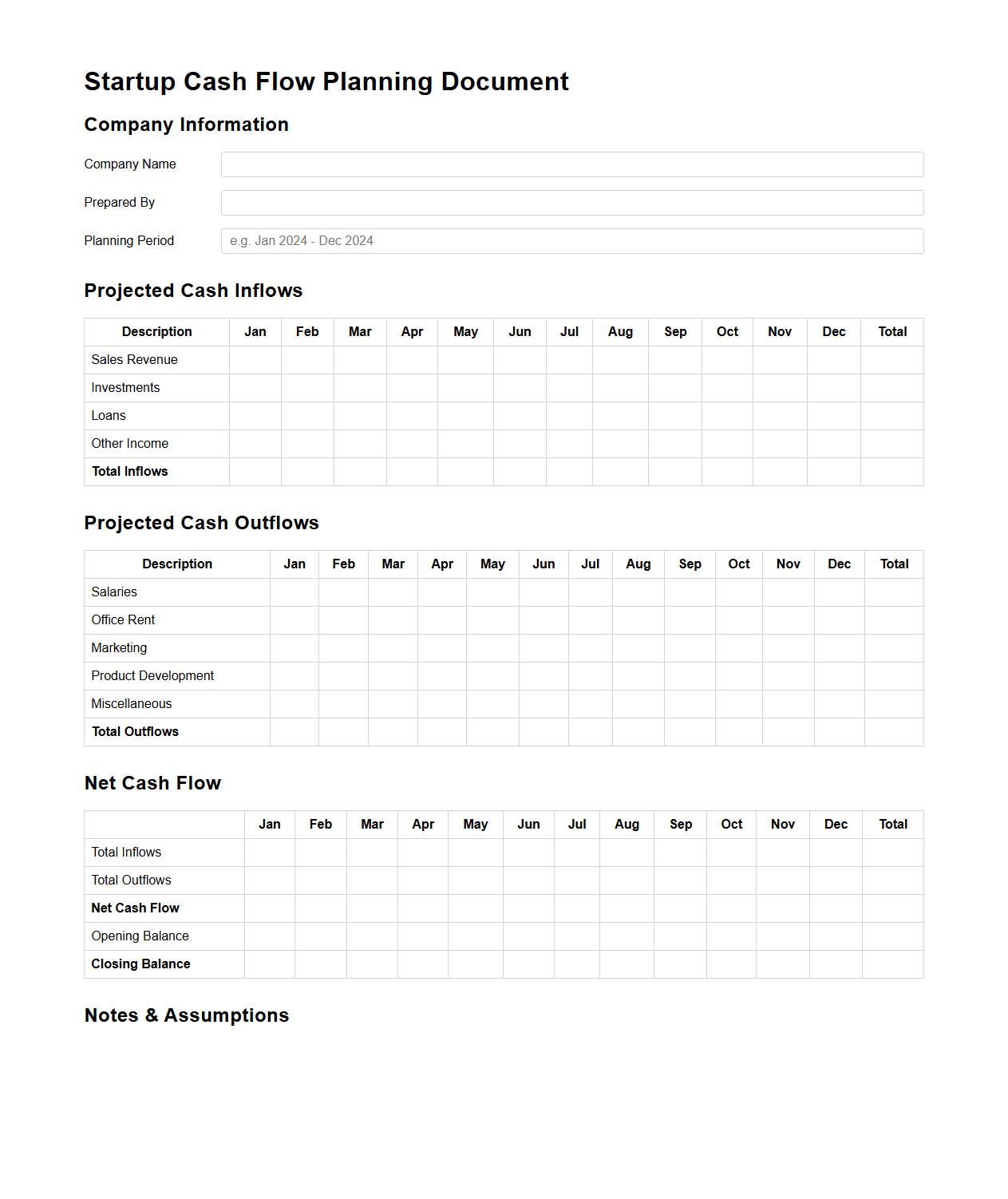

Startup Cash Flow Planning Document for Entrepreneurs

A

Startup Cash Flow Planning Document is a detailed financial tool that helps entrepreneurs forecast incoming and outgoing cash over a specific period. It enables business owners to anticipate liquidity needs, manage expenses, and ensure sufficient funds are available to support operations and growth. Proper cash flow planning reduces the risk of running out of capital and facilitates informed decision-making to maintain financial stability in the early stages of a startup.

What specific line items should be included in a blank cash flow statement template for small businesses?

A blank cash flow statement for small businesses should include the three main sections: Operating Activities, Investing Activities, and Financing Activities. Key line items under Operating Activities typically include cash receipts from customers and cash payments to suppliers and employees. Investing Activities cover cash spent on assets and cash received from asset sales, while Financing Activities track loans, repayments, and equity changes.

How can a blank cash flow statement assist in identifying seasonal cash shortages?

A blank cash flow statement helps small businesses visualize cash inflows and outflows over time, clarifying high and low cash periods. By regularly updating this template, businesses can predict periods of negative cash flow linked to seasonality. This advance insight enables better planning to manage funding needs during lean seasons.

Which accounting periods are most appropriate for populating a blank cash flow statement?

The most effective accounting periods for a blank cash flow statement are typically monthly or quarterly intervals. These periods provide sufficient detail to monitor cash trends while allowing businesses to respond quickly to cash flow changes. Yearly summaries are less useful for day-to-day cash management but good for strategic financial review.

How do you customize a blank cash flow statement for non-profit accounting needs?

Customizing a blank cash flow statement for non-profits requires emphasizing donor contributions, grants, and fundraising activities in the operating section. Non-profits must also separately track cash flows related to program services and administrative expenses for accurate fund accounting. Additionally, segmenting cash related to restricted and unrestricted funds improves transparency and compliance.

What key sections differentiate a direct vs. indirect blank cash flow statement layout?

The direct method lists specific cash receipts and payments, showing detailed inflows and outflows for major activities. The indirect method starts with net income and adjusts for non-cash transactions and changes in working capital to calculate cash from operations. The choice between these sections affects the clarity and granularity of cash flow reporting.