A Blank Loan Agreement Template for Borrowers and Lenders provides a customizable framework to outline the terms and conditions of a loan between parties. This template ensures clear documentation of loan amount, interest rates, repayment schedules, and responsibilities, reducing potential disputes. Using such a template streamlines the loan process and protects the interests of both borrowers and lenders.

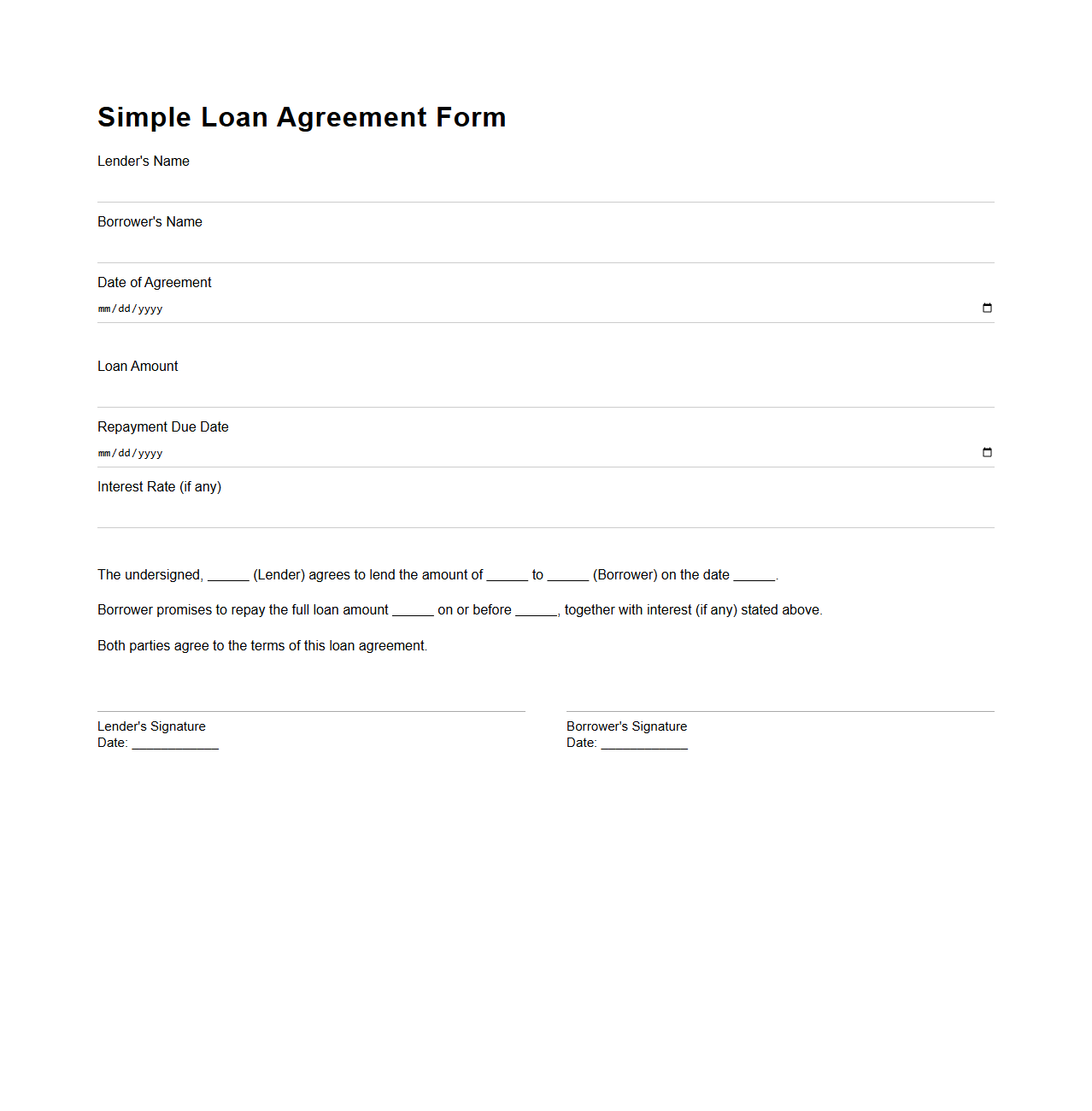

Simple Loan Agreement Form for Personal Lending

A

Simple Loan Agreement Form for Personal Lending is a legal document that outlines the terms and conditions of a loan between individuals, specifying the loan amount, interest rate, repayment schedule, and responsibilities of both lender and borrower. This form helps ensure clear communication and protects both parties by providing a written record of the agreement. It is essential for preventing disputes and facilitating smooth personal lending transactions.

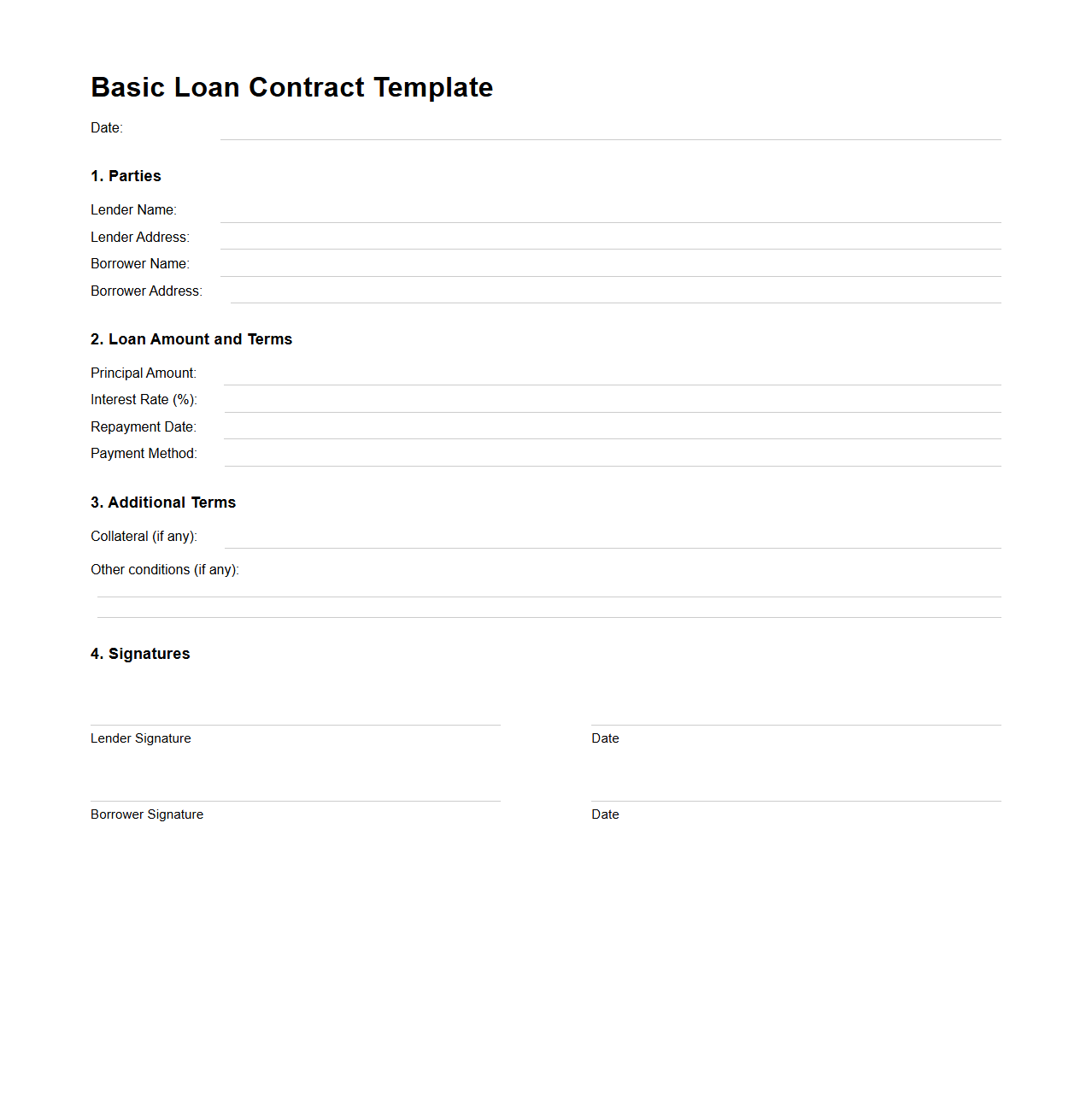

Basic Loan Contract Template for Private Parties

A

Basic Loan Contract Template for Private Parties is a legally binding document that outlines the terms and conditions under which one individual or private entity lends money to another. It specifies key details such as the loan amount, interest rate, repayment schedule, and obligations of both the lender and borrower to ensure clarity and protect the interests of both parties. This template serves as a straightforward framework to formalize personal loan agreements without involving financial institutions.

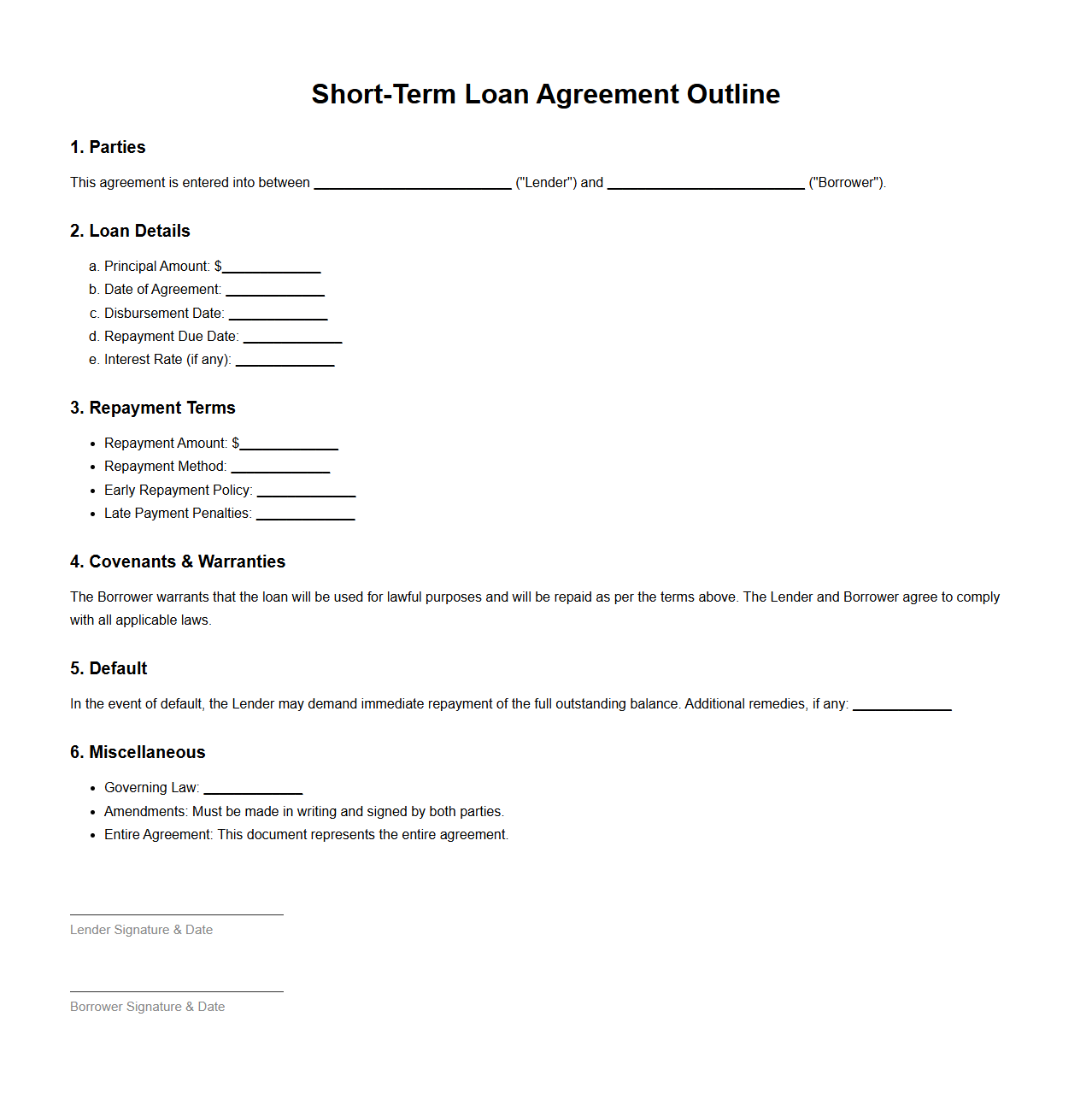

Short-Term Loan Agreement Outline for Individuals

A

Short-Term Loan Agreement Outline for Individuals document establishes the essential terms and conditions between a lender and borrower for a loan with a repayment period typically under one year. It details key elements such as loan amount, interest rate, repayment schedule, and default consequences, ensuring clarity and protection for both parties. This outline helps prevent misunderstandings by formalizing obligations and expectations in a legally binding format.

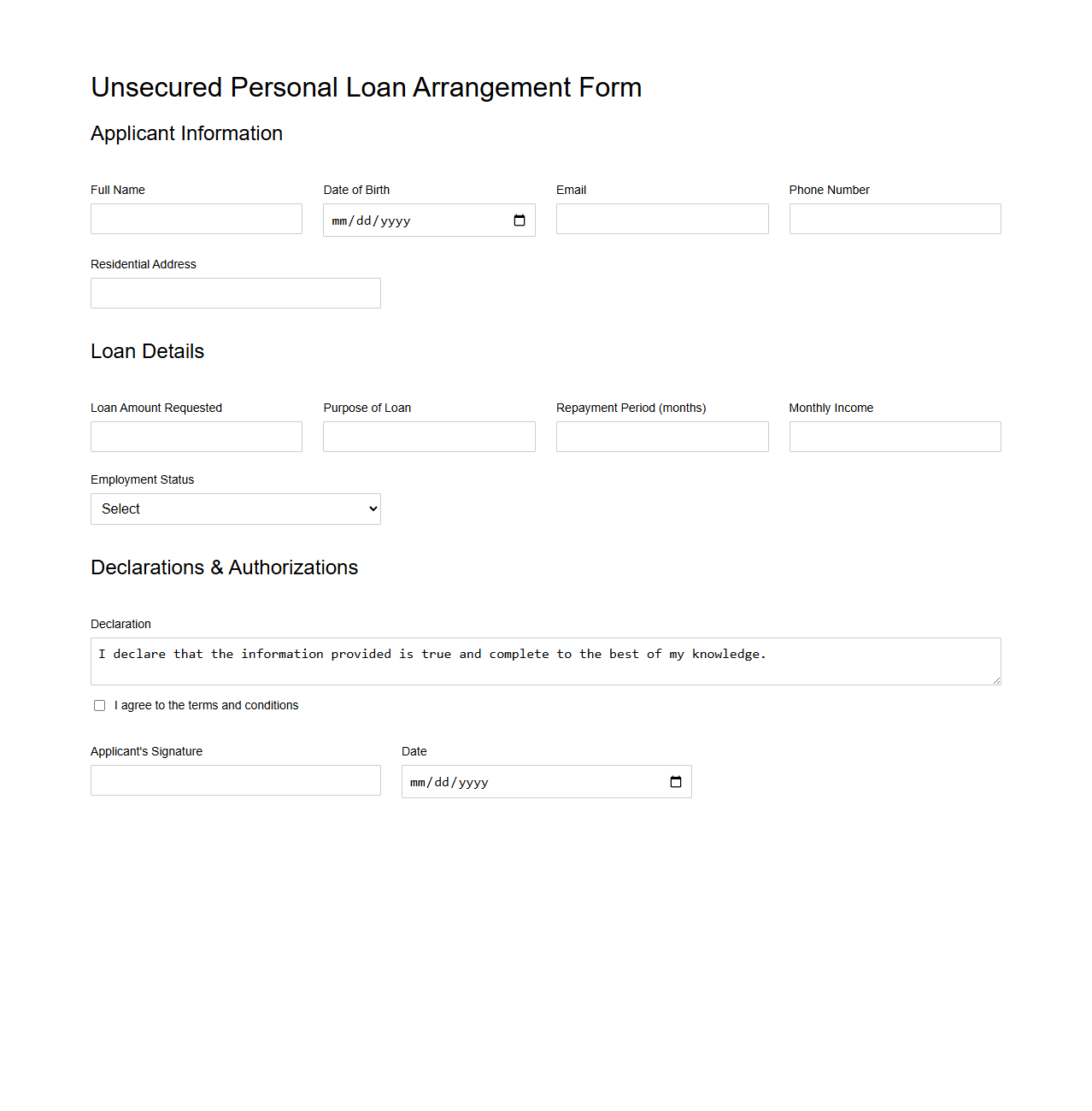

Unsecured Personal Loan Arrangement Form

An

Unsecured Personal Loan Arrangement Form is a legal document that outlines the terms and conditions agreed upon between the borrower and lender for a loan that does not require collateral. It includes essential details such as the loan amount, interest rate, repayment schedule, and any applicable fees. This document serves as a binding agreement to ensure clarity and protect the rights of both parties throughout the loan tenure.

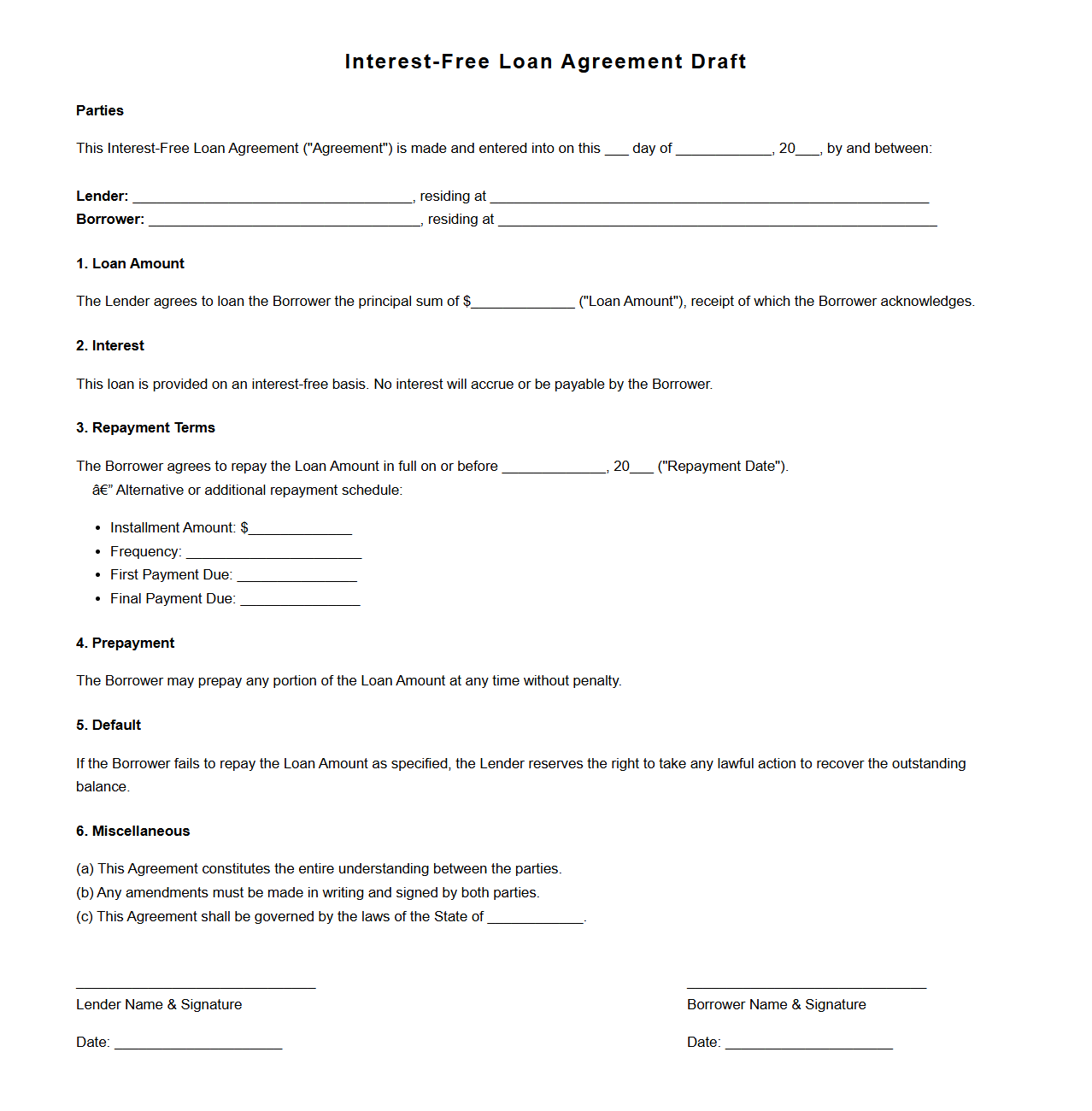

Interest-Free Loan Agreement Draft

An

Interest-Free Loan Agreement Draft document outlines the terms and conditions under which a lender provides a loan without charging interest to the borrower. It specifies the loan amount, repayment schedule, and obligations of both parties, ensuring clear legal protection and mutual understanding. This document is crucial for formalizing loans in personal or business contexts where financial assistance is extended without profit motives.

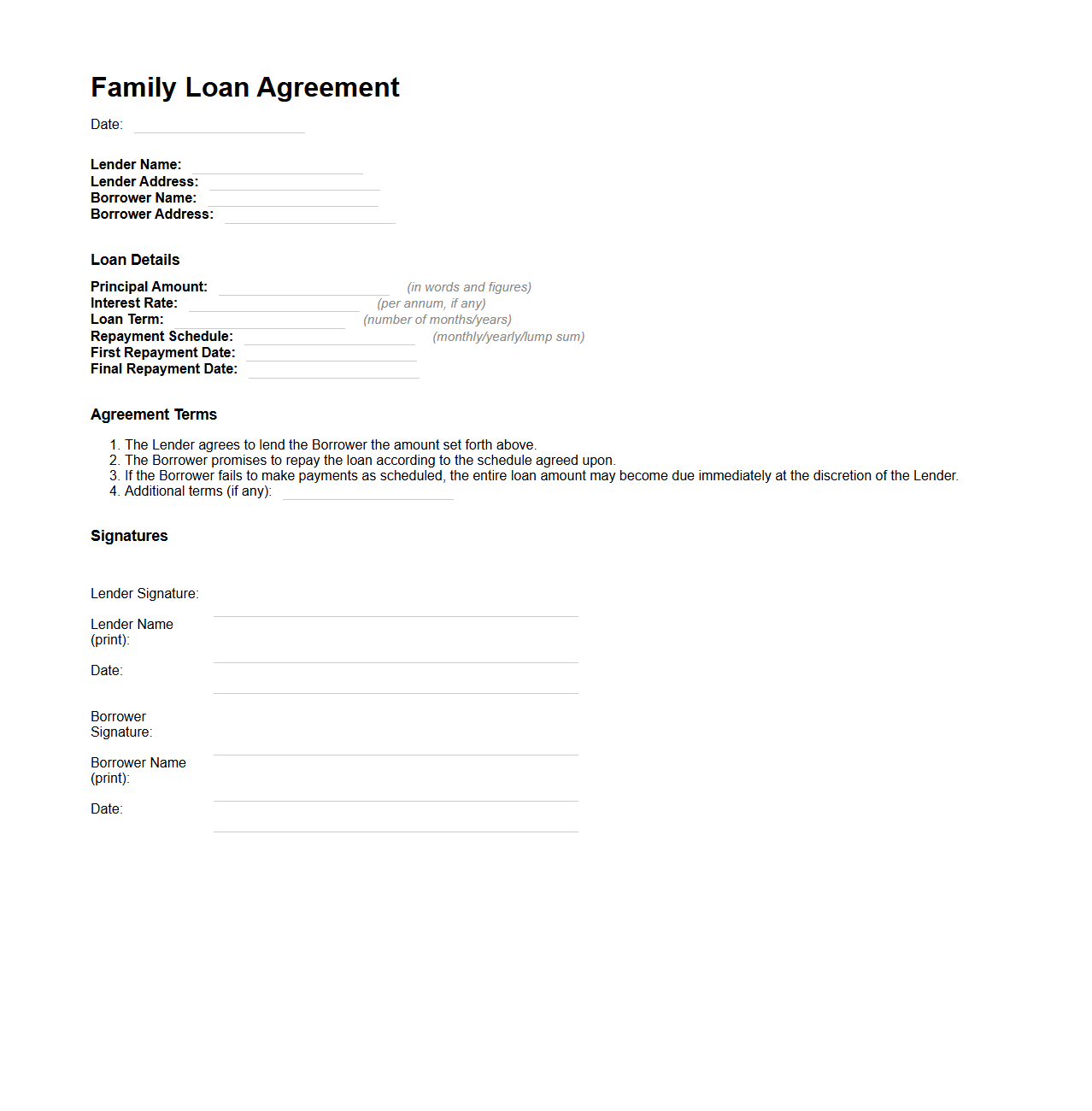

Family Loan Agreement Blank Format

A

Family Loan Agreement Blank Format document serves as a structured template to outline the terms and conditions of a loan between family members. It details key elements such as loan amount, repayment schedule, interest rate (if any), and obligations of both borrower and lender, ensuring clear communication and reducing potential conflicts. Utilizing this format helps formalize informal loans, protecting relationships and providing legal clarity.

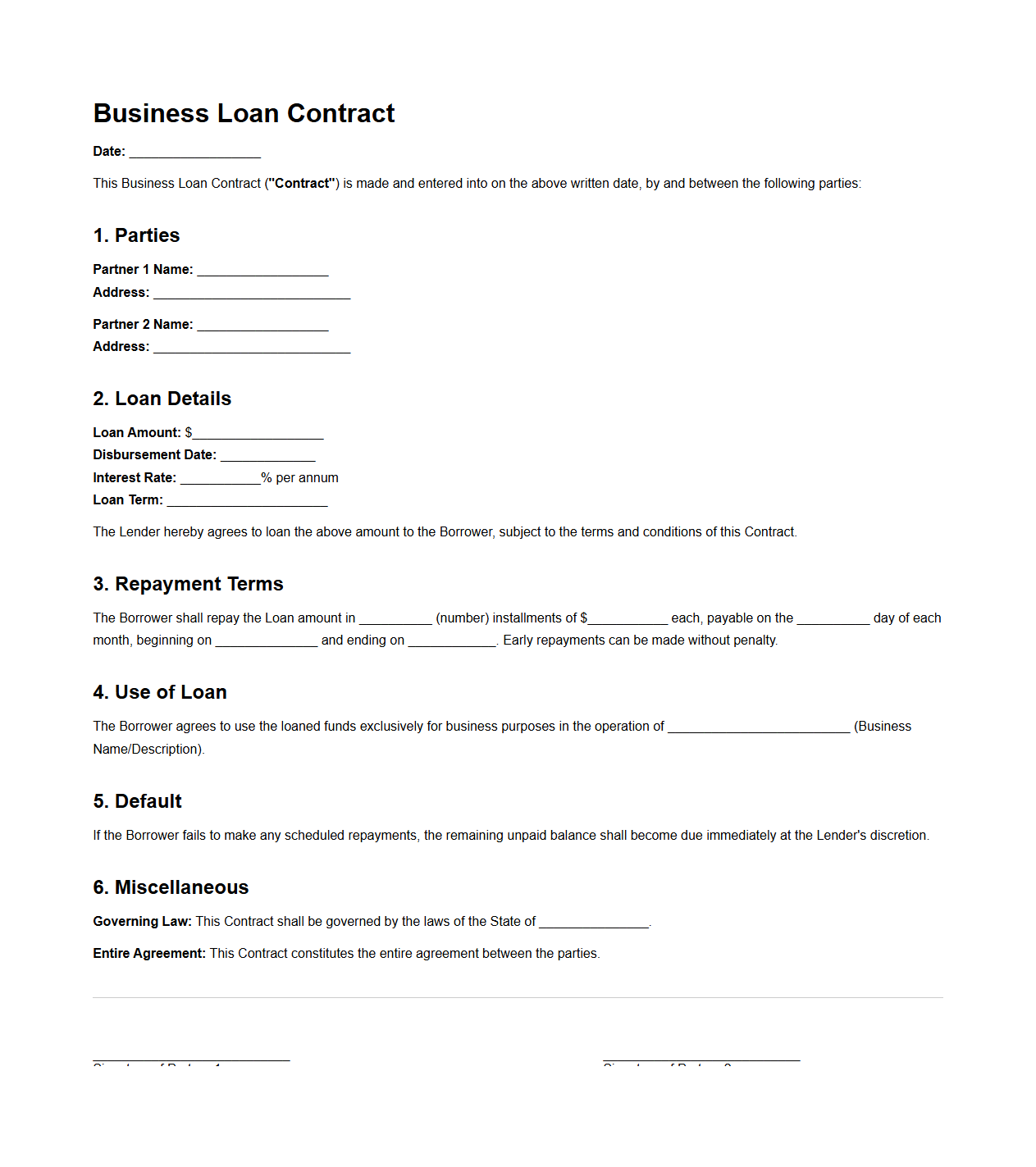

Business Loan Contract Sample for Partners

A

Business Loan Contract Sample for Partners is a legally binding document that outlines the terms and conditions under which partners agree to lend and borrow money within a business venture. It includes details such as loan amount, interest rate, repayment schedule, and responsibilities of each partner to prevent disputes. This contract ensures clarity and protection for all parties involved in financial transactions among business partners.

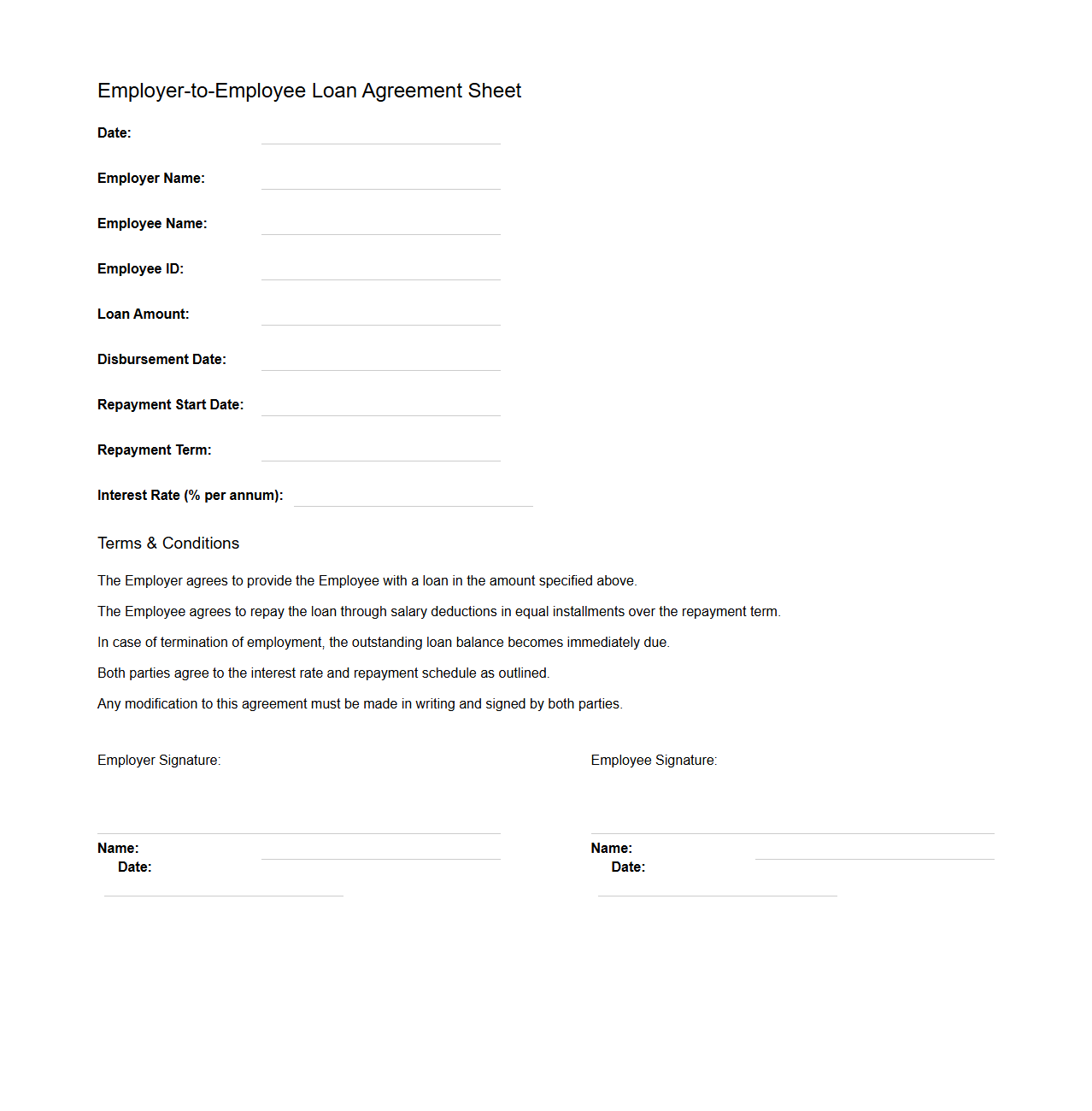

Employer-to-Employee Loan Agreement Sheet

An

Employer-to-Employee Loan Agreement Sheet is a formal document outlining the terms and conditions under which a company lends funds to its employees. It specifies the loan amount, repayment schedule, interest rates if applicable, and any conditions related to loan default or early repayment. This agreement helps ensure transparency, legal protection, and mutual understanding between the employer and employee regarding the financial transaction.

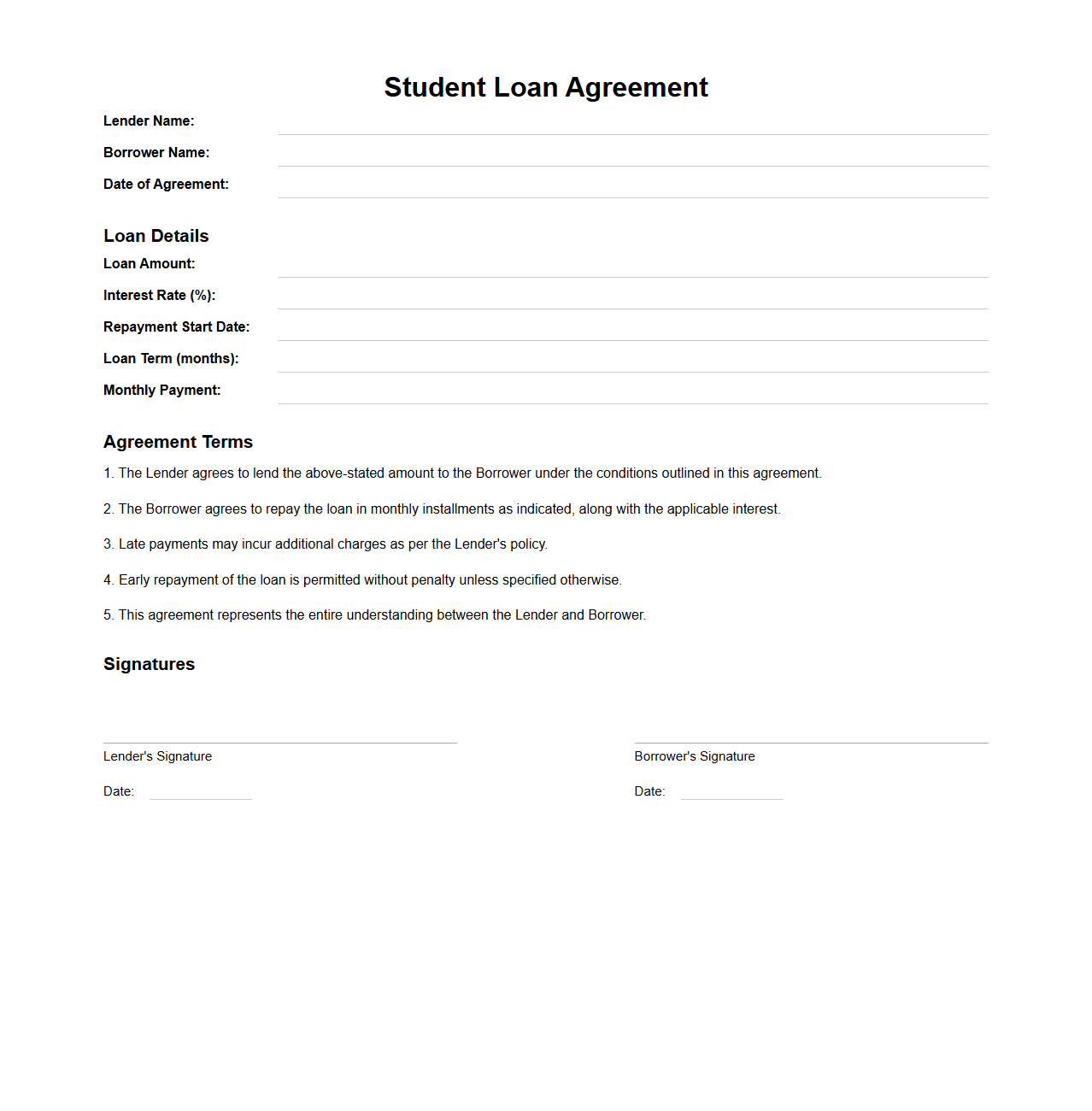

Student Loan Agreement Layout for Private Lenders

The

Student Loan Agreement Layout for Private Lenders is a structured document outlining the terms and conditions under which a private lender provides educational financing to a borrower. It details key elements such as loan amount, interest rates, repayment schedule, borrower obligations, and default consequences. This layout ensures clarity and legal protection for both parties in private student loan transactions.

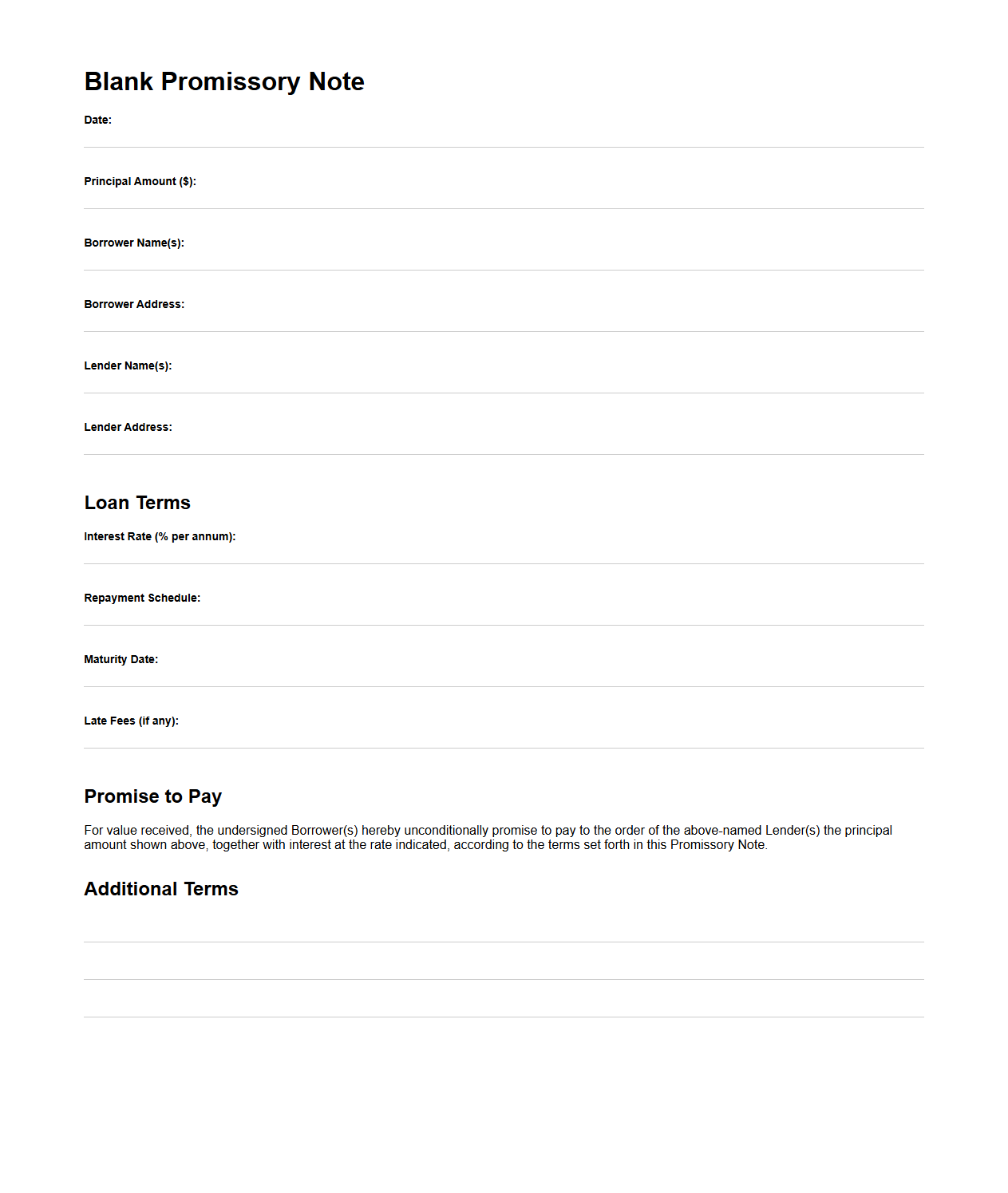

Blank Promissory Note Template for Loans

A

Blank Promissory Note Template for Loans is a customizable legal document used to formally outline the terms of a loan agreement between a lender and borrower. It includes key details such as the principal amount, interest rate, repayment schedule, and maturity date, ensuring clarity and enforceability of the loan terms. This template helps standardize the loan process while protecting the rights of both parties involved.

What clauses should a blank loan agreement include to protect both borrower and lender rights?

A blank loan agreement must include clear definitions of the parties involved and the loan amount to ensure mutual understanding. It should specify the interest rate, payment schedule, and loan term to protect both parties' financial interests. Additionally, clauses regarding early repayment and dispute resolution safeguard the rights of both the borrower and lender.

How can a blank loan agreement outline collateral provisions for secured loans?

The agreement should contain a detailed description of the collateral pledged to secure the loan, including its value and ownership status. It must specify the conditions under which the lender can take possession of the collateral in case of default. Clear terms for the return of collateral upon full repayment help maintain transparency between borrower and lender.

What are the critical repayment terms to specify in a blank loan agreement template?

The agreement must clearly state the repayment schedule, including the frequency and amount of each installment. It should outline acceptable payment methods and the consequences of late payments. Defining the loan maturity date ensures both parties are aware of the timeline for full repayment.

How should default and penalty clauses be worded in a blank loan agreement?

Default clauses need to clearly define what constitutes a default, such as missed payments or breach of terms. Penalty provisions should specify the fees or interest applicable in case of late payments or defaults. The wording should also describe the lender's rights to recover the loan through legal means if necessary.

What legal disclosures are mandatory in a blank loan agreement for compliance?

A blank loan agreement must include all required disclosures mandated by law, such as interest rate calculations and borrower's rights. It should comply with relevant consumer protection laws and financial regulations to avoid legal issues. Proper disclosures help ensure the agreement is enforceable and transparent for both parties.