A Blank Loan Agreement Template for Financial Lending provides a customizable framework to outline the terms and conditions of a loan between a lender and borrower. This template typically includes sections for loan amount, interest rate, repayment schedule, and default consequences to ensure clarity and legal protection for both parties. Using a standardized agreement helps streamline the lending process and reduces the risk of misunderstandings or disputes.

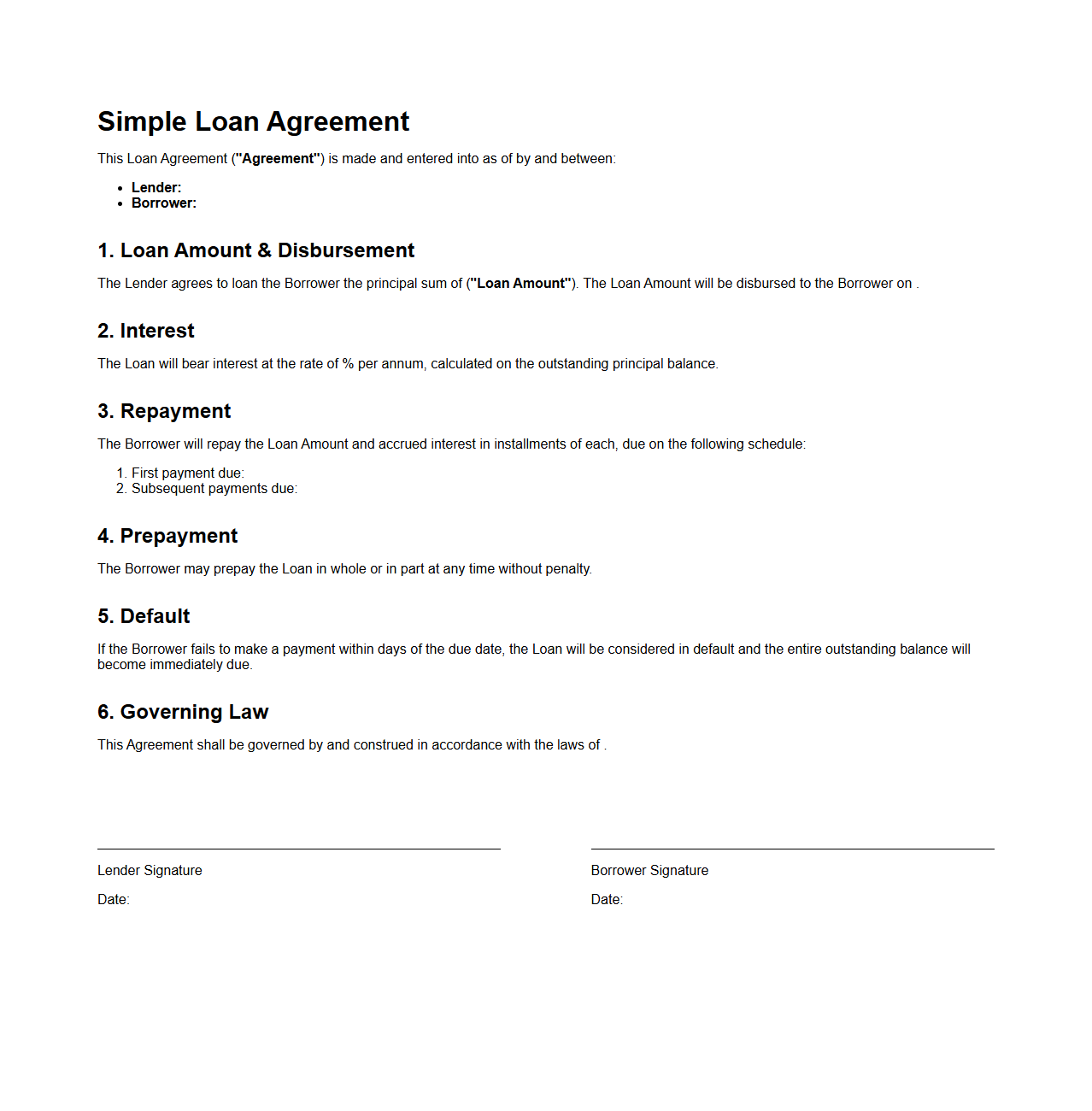

Simple Loan Agreement Template

A

Simple Loan Agreement Template document serves as a straightforward, legally binding contract that outlines the terms and conditions between a lender and borrower for a loan transaction. It typically includes details such as loan amount, repayment schedule, interest rate, and obligations of both parties to ensure clarity and protect interests. Using this template helps avoid misunderstandings and provides a clear framework for managing the loan.

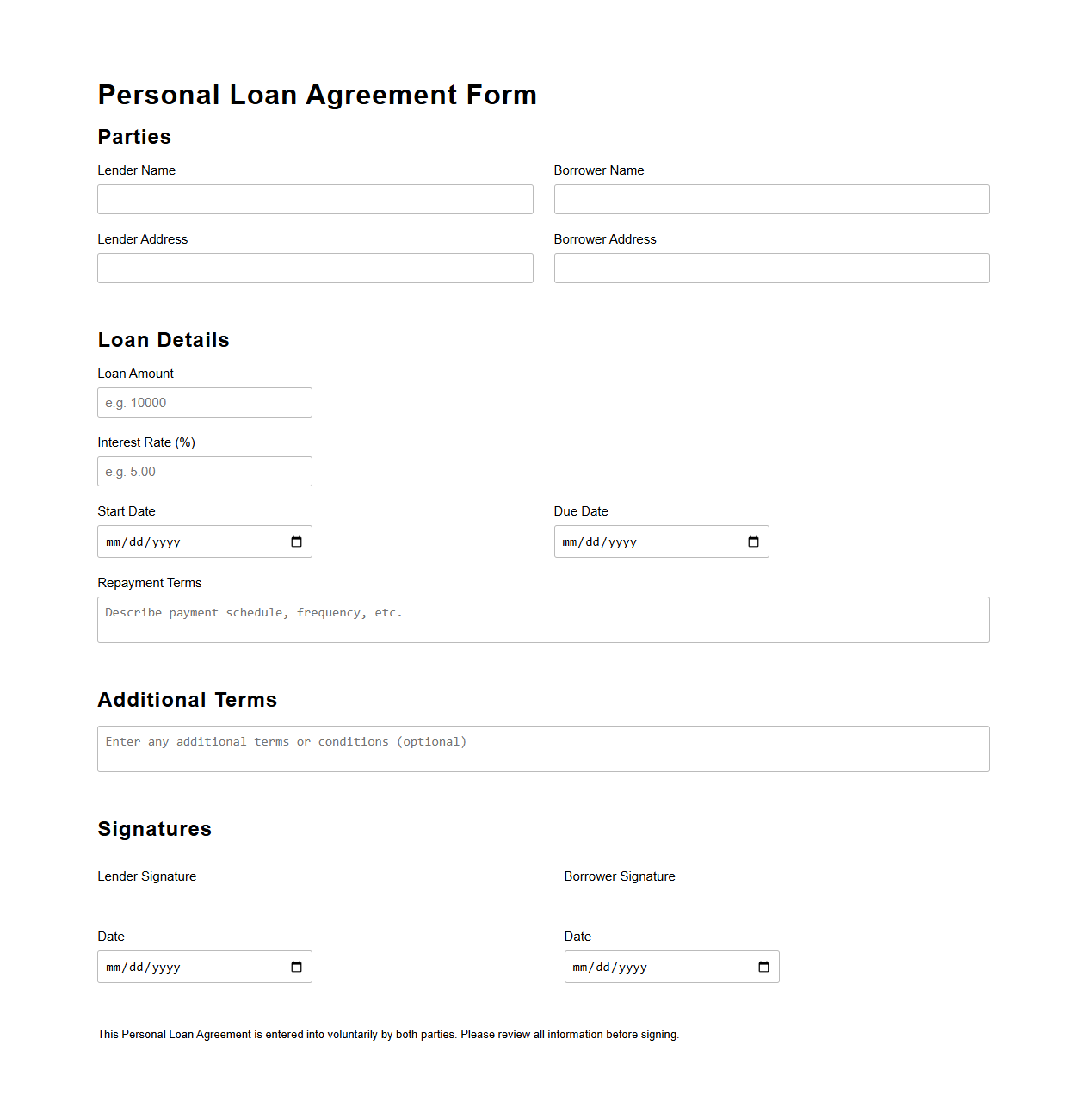

Personal Loan Agreement Form

A

Personal Loan Agreement Form document is a legally binding contract outlining the terms and conditions between a lender and borrower for a personal loan. It specifies key details such as the loan amount, interest rate, repayment schedule, and consequences of default. This document protects both parties by clearly defining obligations and ensuring transparent loan management.

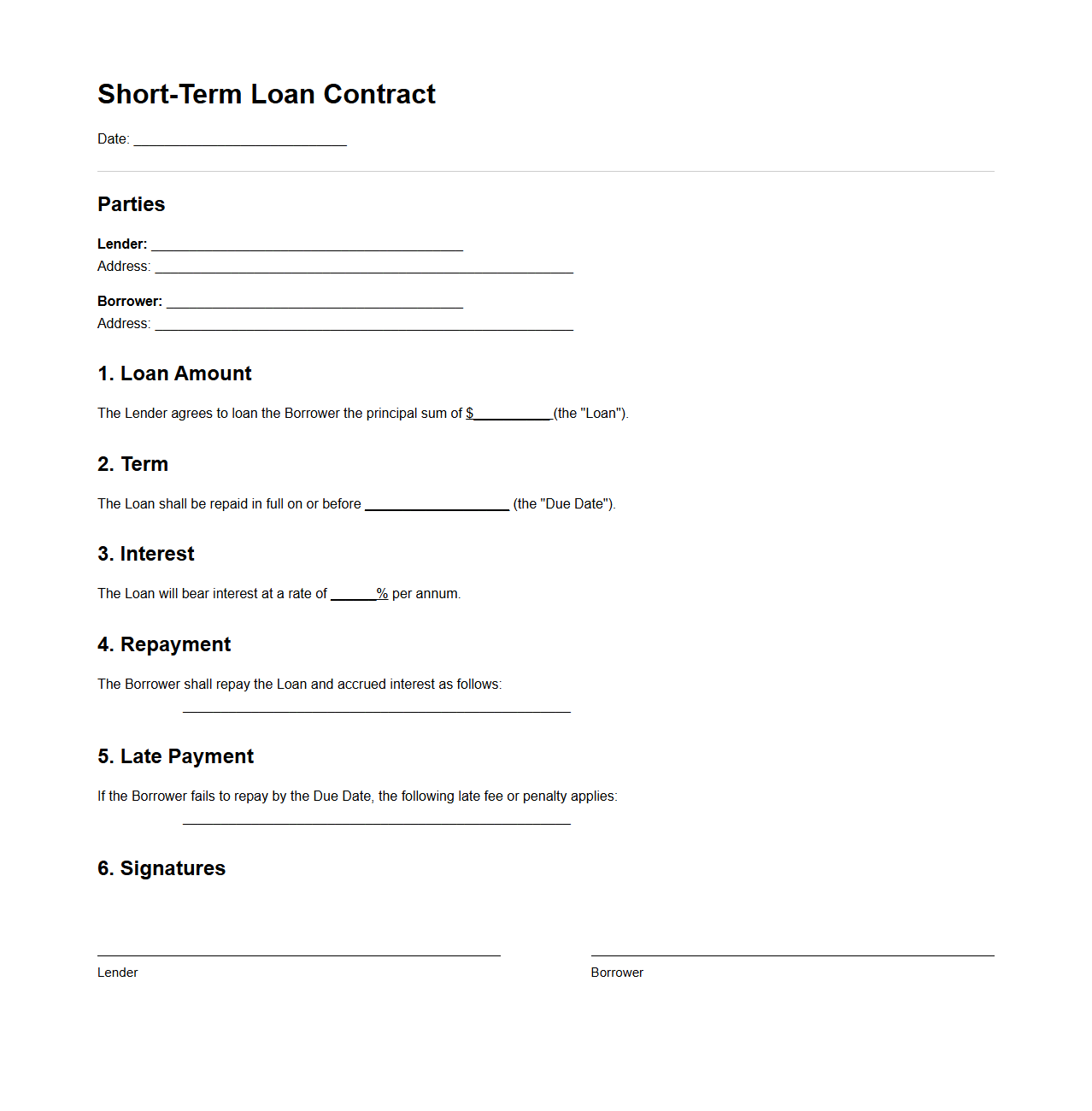

Short-Term Loan Contract Template

A

Short-Term Loan Contract Template document serves as a legally binding agreement between a lender and borrower outlining the terms and conditions for a loan with a repayment period typically under one year. It specifies essential elements such as loan amount, interest rate, repayment schedule, and default consequences to ensure clarity and protect both parties. This template helps streamline loan processing by providing a clear, standardized framework for short-term financial agreements.

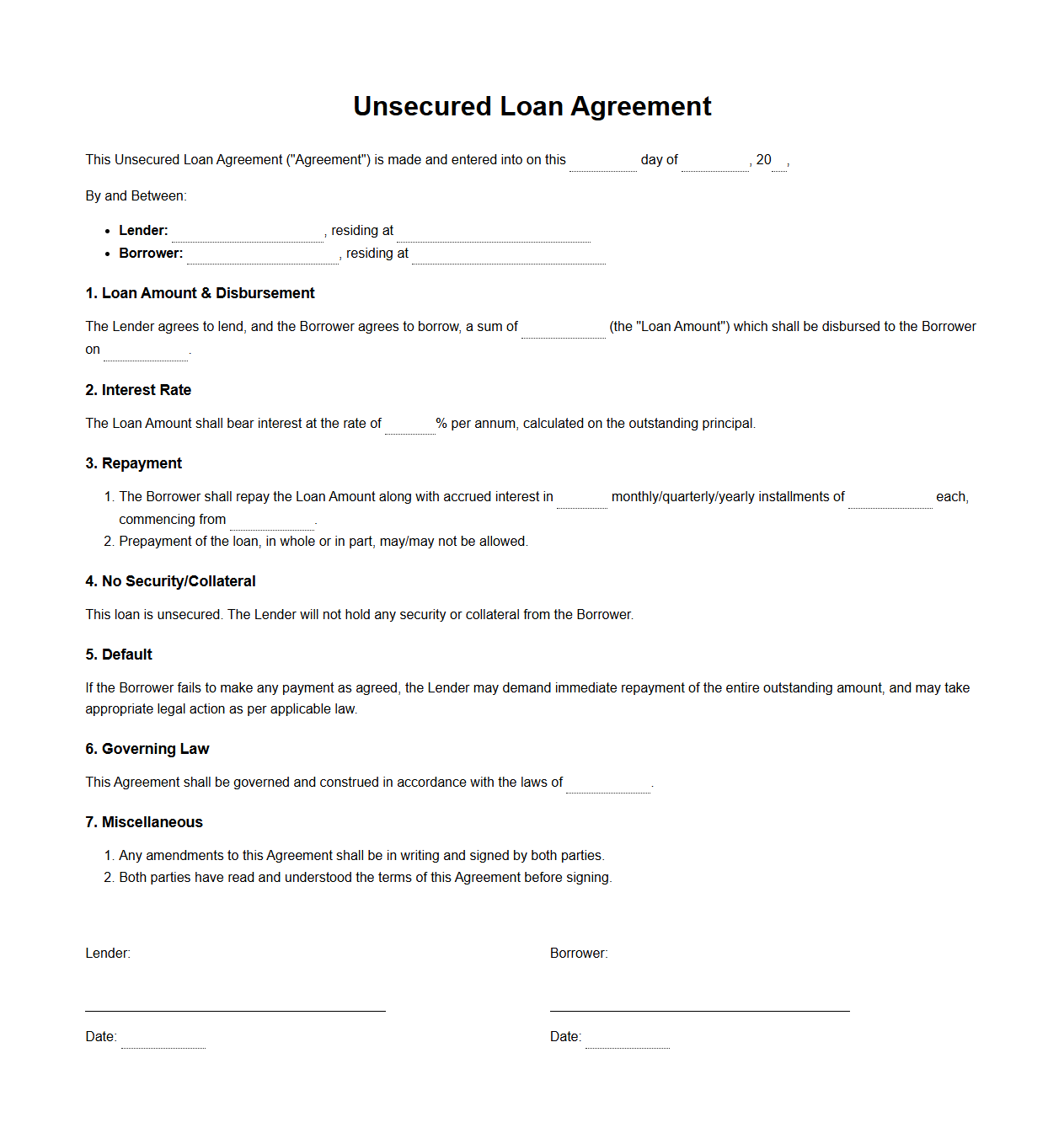

Unsecured Loan Agreement Format

An

Unsecured Loan Agreement Format document outlines the terms and conditions between a lender and borrower for a loan without collateral. It specifies the loan amount, interest rate, repayment schedule, and legal obligations to protect both parties. This format ensures clarity and enforceability of the agreement in financial transactions.

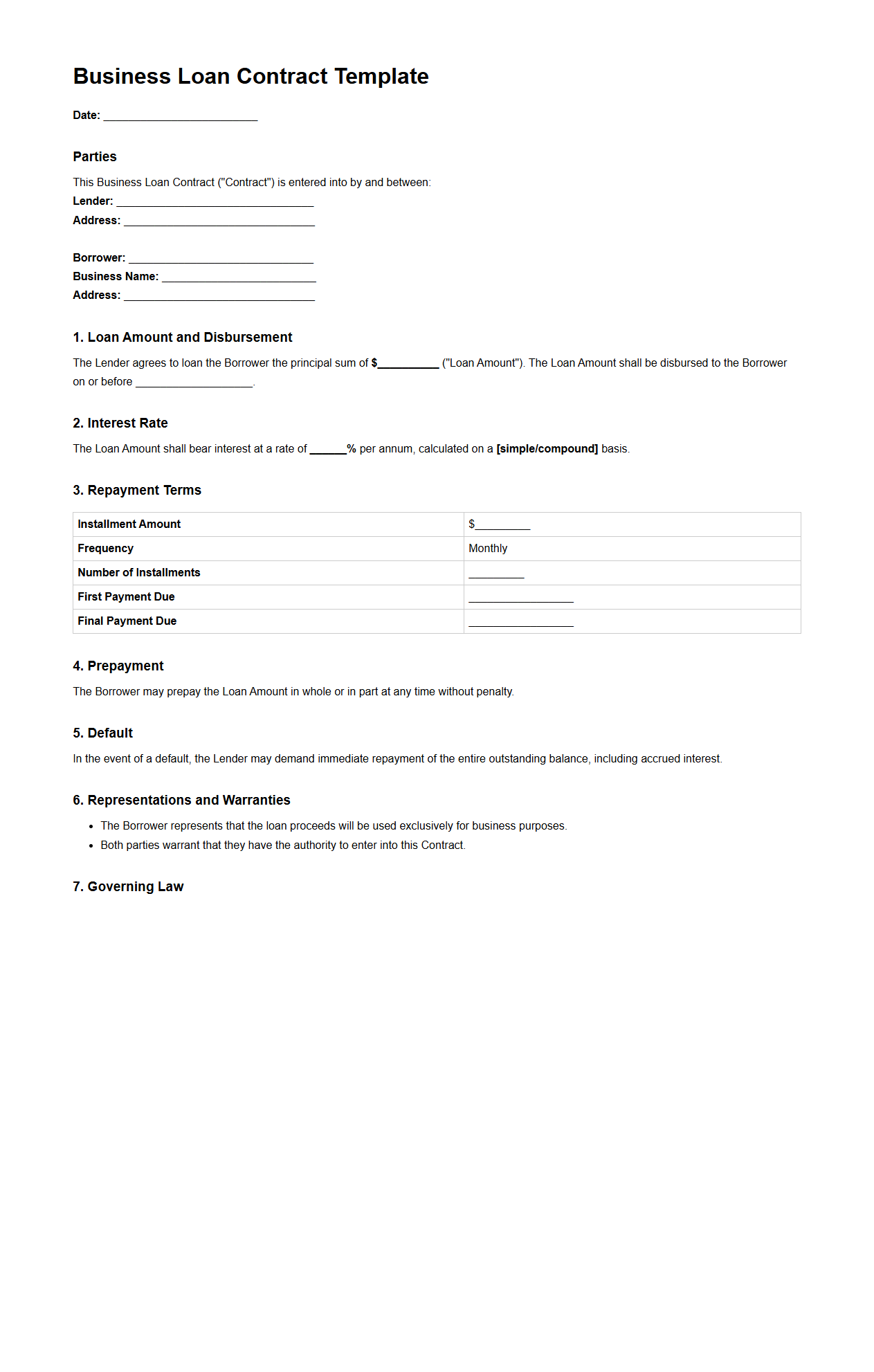

Business Loan Contract Template

A

Business Loan Contract Template is a pre-designed legal document that outlines the terms and conditions between a lender and a borrower for a business loan. It typically includes key elements such as loan amount, interest rate, repayment schedule, and default consequences. Using this template ensures clarity, reduces risks, and streamlines the loan agreement process for both parties.

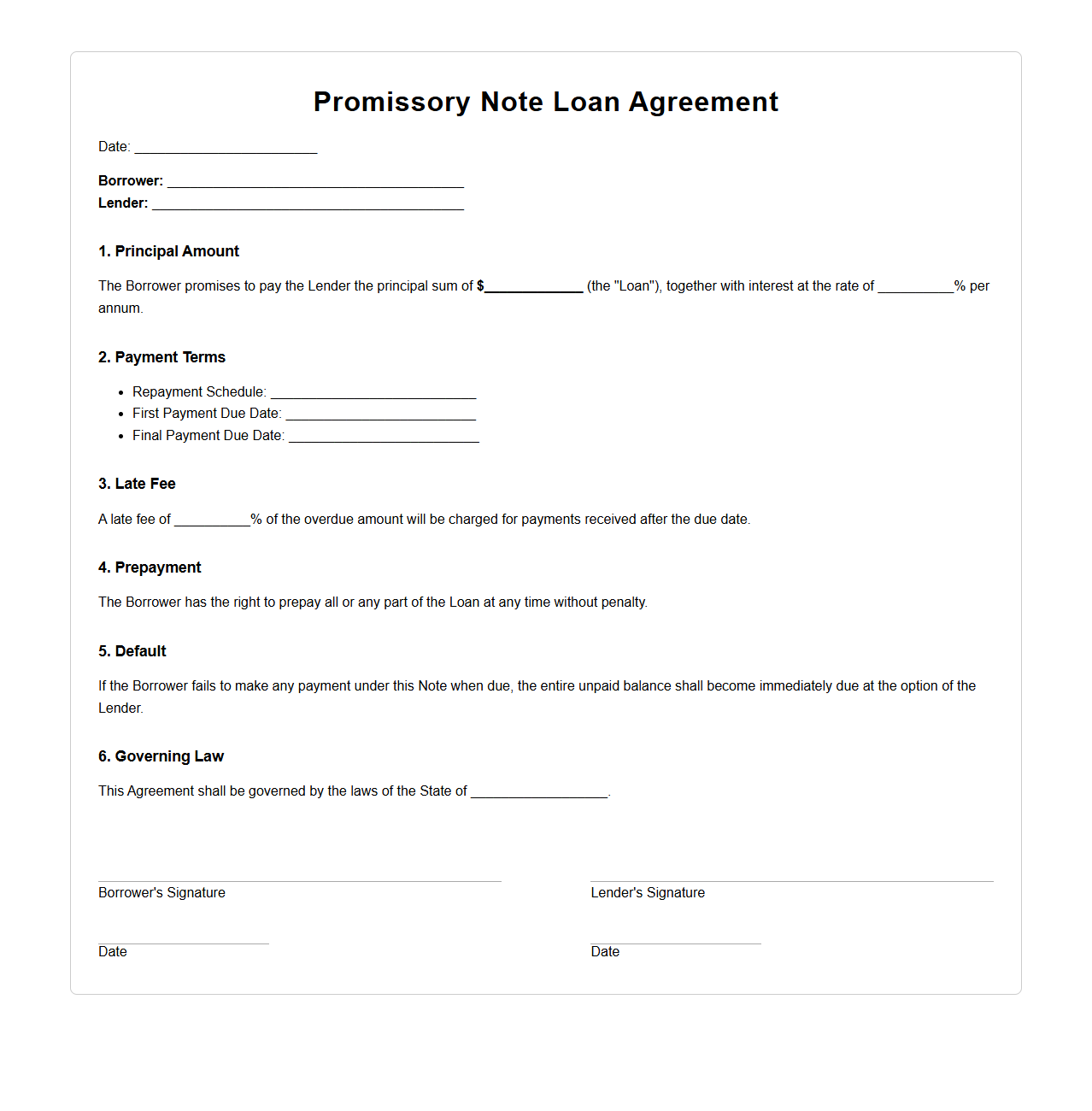

Promissory Note Loan Agreement

A

Promissory Note Loan Agreement is a legally binding document outlining the terms under which a borrower promises to repay a specified loan amount to a lender. It includes key details such as the principal amount, interest rate, repayment schedule, and maturity date, ensuring clarity and enforceability. This agreement protects both parties by clearly defining obligations and remedies in case of default.

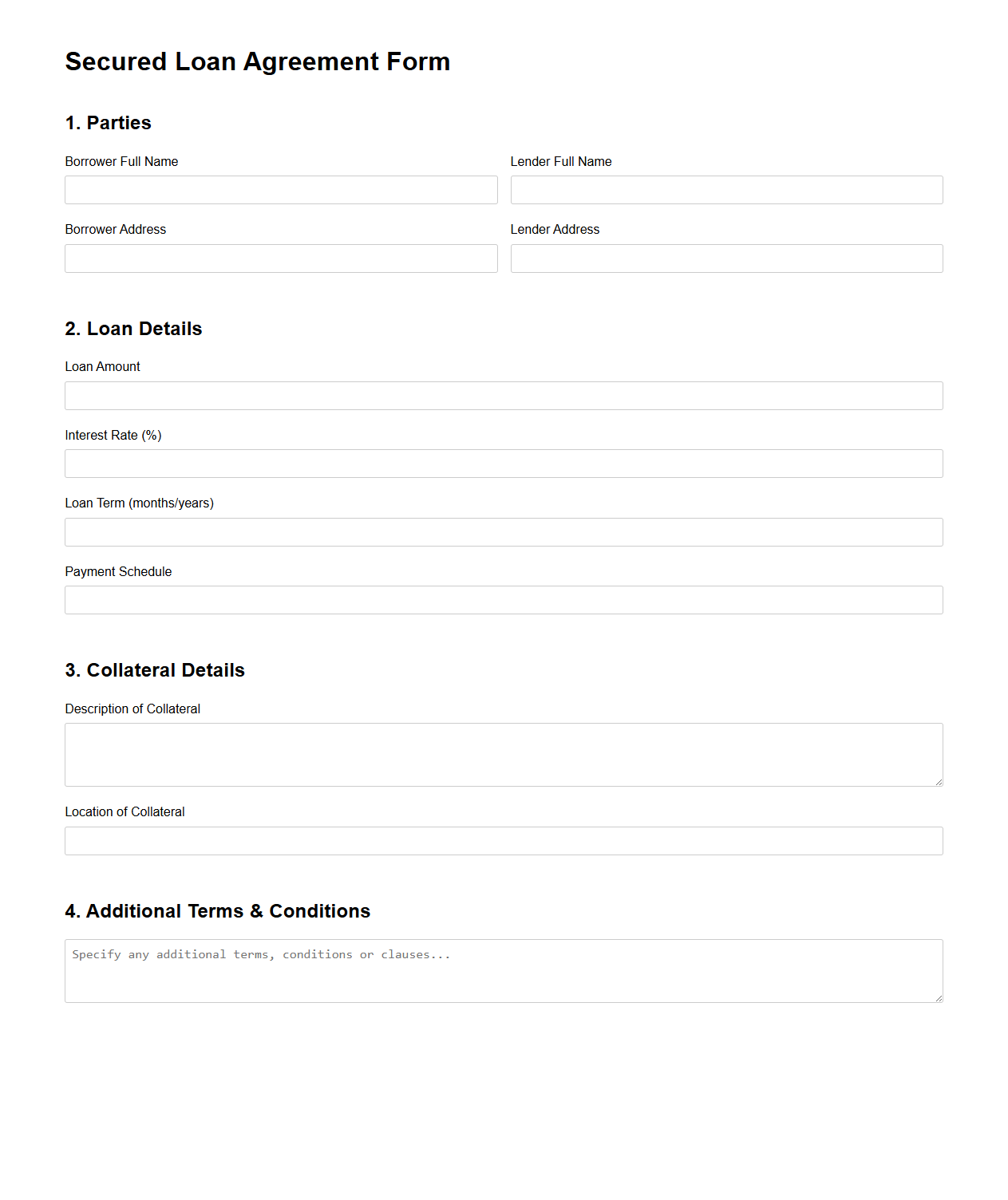

Secured Loan Agreement Form

A

Secured Loan Agreement Form is a legal document that outlines the terms and conditions between a lender and borrower where the loan is backed by collateral. This form specifies the loan amount, interest rate, repayment schedule, and details of the secured asset to protect the lender's investment. It ensures both parties clearly understand their obligations and the consequences of default, providing a framework for enforcing the loan agreement.

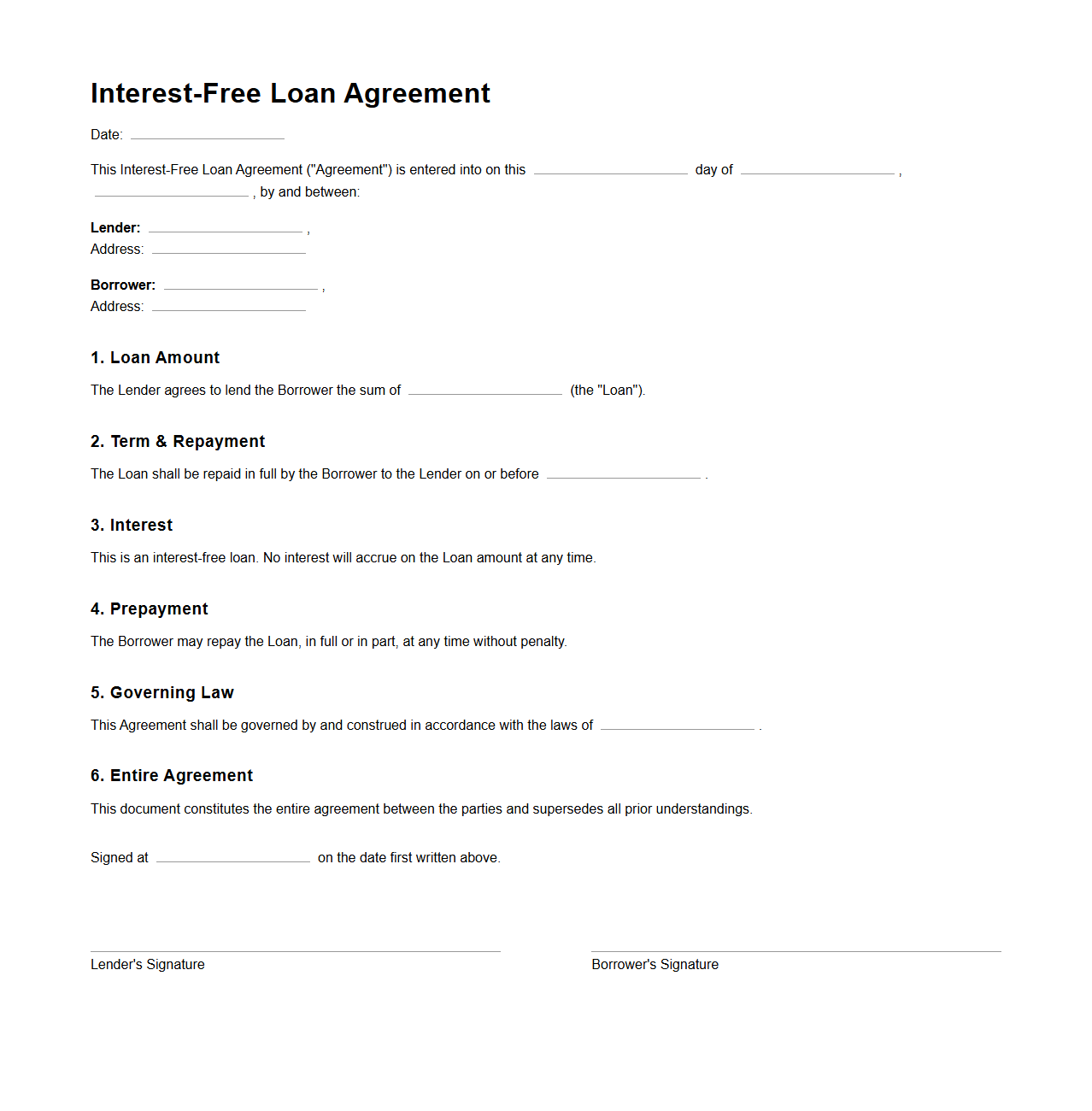

Interest-Free Loan Agreement Template

An

Interest-Free Loan Agreement Template document is a legally binding contract used to outline the terms and conditions of a loan provided without interest charges. It specifies the loan amount, repayment schedule, borrower and lender details, and any collateral or guarantees involved. This template helps ensure clarity and protects both parties by clearly defining their responsibilities and expectations.

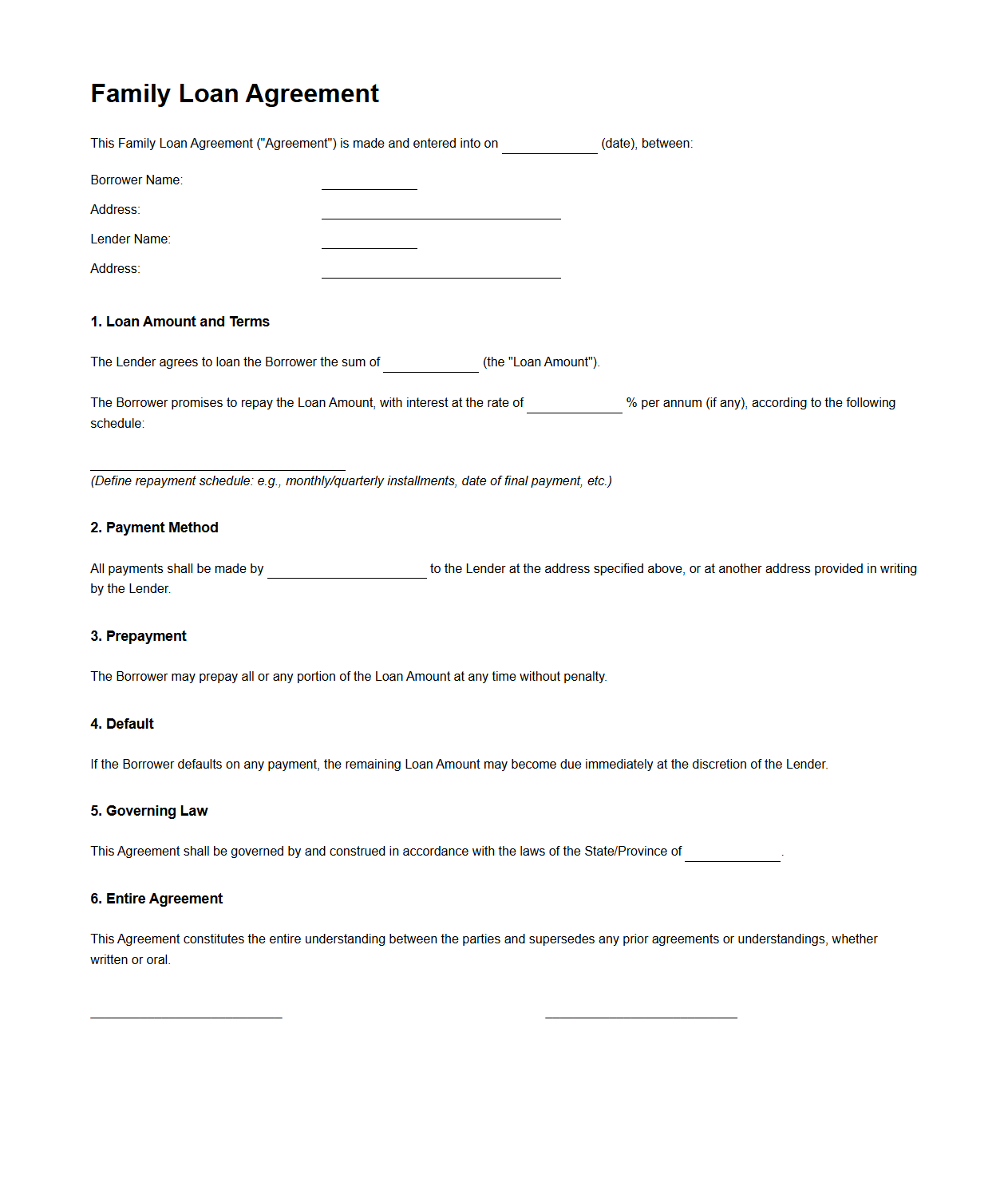

Family Loan Agreement Document

A

Family Loan Agreement Document is a legal contract that outlines the terms and conditions of a loan between family members, ensuring clarity and preventing disputes. It typically includes details such as the loan amount, interest rate, repayment schedule, and consequences of default. This document helps protect both lender and borrower by providing a formal record of the transaction.

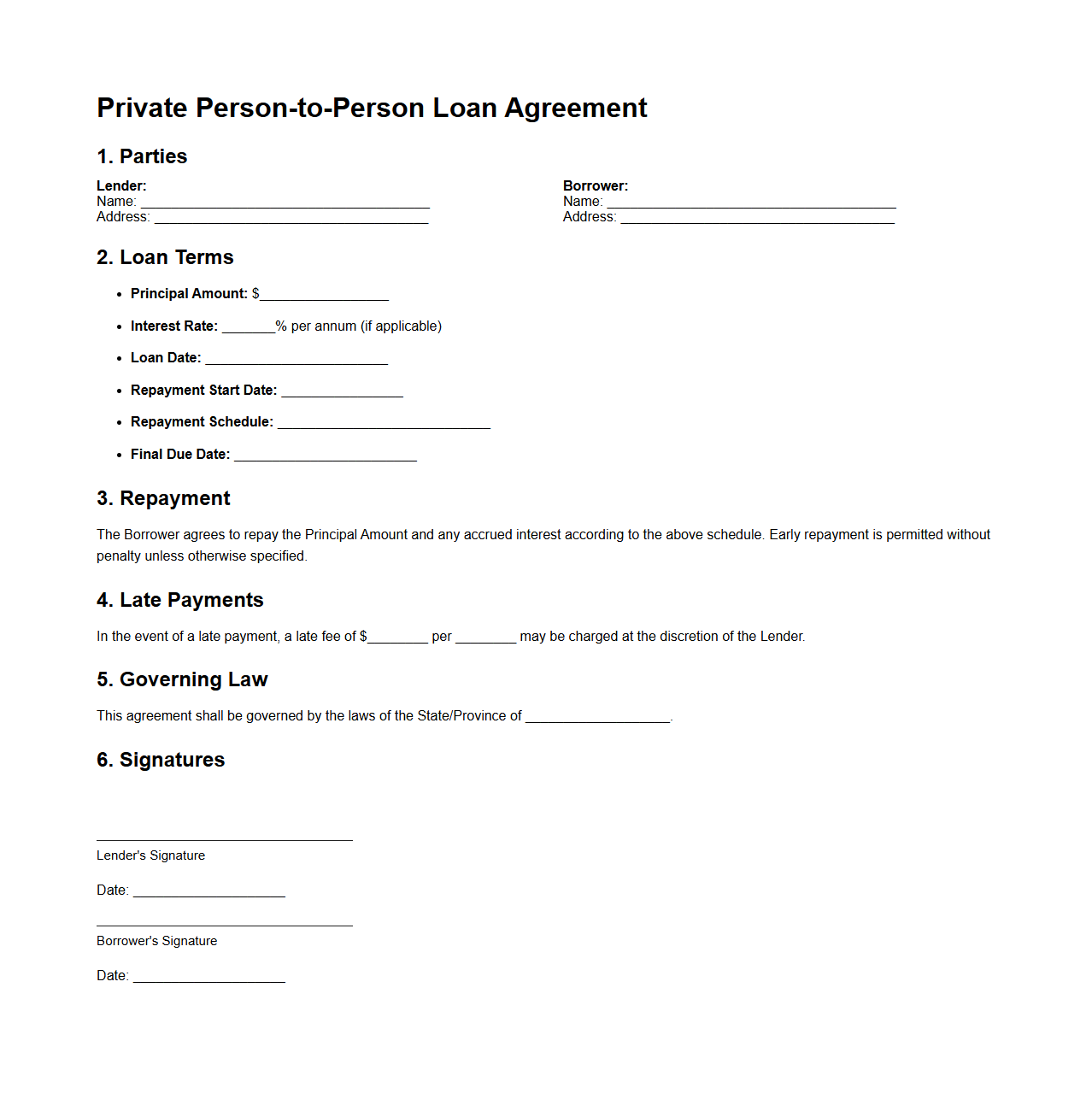

Private Person-to-Person Loan Agreement

A

Private Person-to-Person Loan Agreement document is a legally binding contract between two individuals outlining the terms and conditions of a personal loan. It specifies the loan amount, interest rate, repayment schedule, and any collateral involved, ensuring clarity and protection for both lender and borrower. This agreement helps prevent disputes by clearly documenting obligations and expectations without involving financial institutions.

What essential clauses should be included in a blank loan agreement for peer-to-peer lending?

A blank loan agreement for peer-to-peer lending must include clauses defining the loan amount, interest rate, and repayment schedule. It should clearly specify the borrower's and lender's obligations to prevent disputes. Additionally, including a default clause protects both parties in case of non-payment.

How can you customize a blank loan agreement template for short-term business loans?

To customize a blank loan agreement for short-term business loans, tailor the repayment terms to align with the business's cash flow cycle. Incorporate specific clauses related to late fees and penalties relevant to commercial transactions. Ensure the agreement reflects any collateral or guarantees provided by the business.

What are the legal risks of using a generic blank loan agreement for family loans?

Using a generic blank loan agreement for family loans can lead to legal risks such as ambiguity in terms and lack of enforceability. Without clear repayment schedules and interest rates, disputes may arise that strain family relationships. Furthermore, improper documentation may weaken the lender's position in a legal dispute.

Which details ensure enforceability in a blank loan agreement for secured lending?

To ensure enforceability in a blank loan agreement for secured lending, the agreement must clearly describe the collateral provided. It should include steps the lender can take if the borrower defaults, such as repossession rights. Legal descriptions and asset values should be detailed to avoid ambiguity.

How should repayment terms be documented in a blank loan agreement for personal loans?

Repayment terms in a blank loan agreement for personal loans should explicitly state the payment amount, frequency, and due dates. Including provisions for early repayment or late payment fees helps maintain clarity between parties. Clear documentation of these terms reduces the risk of misunderstandings and legal complications.