A Blank Startup Budget Template for New Ventures provides a customizable framework to track initial expenses and forecast financial needs accurately. This template helps entrepreneurs allocate resources effectively, manage cash flow, and plan for growth without overlooking critical costs. Utilizing this tool ensures a clear overview of startup finances essential for strategic decision-making and investor presentations.

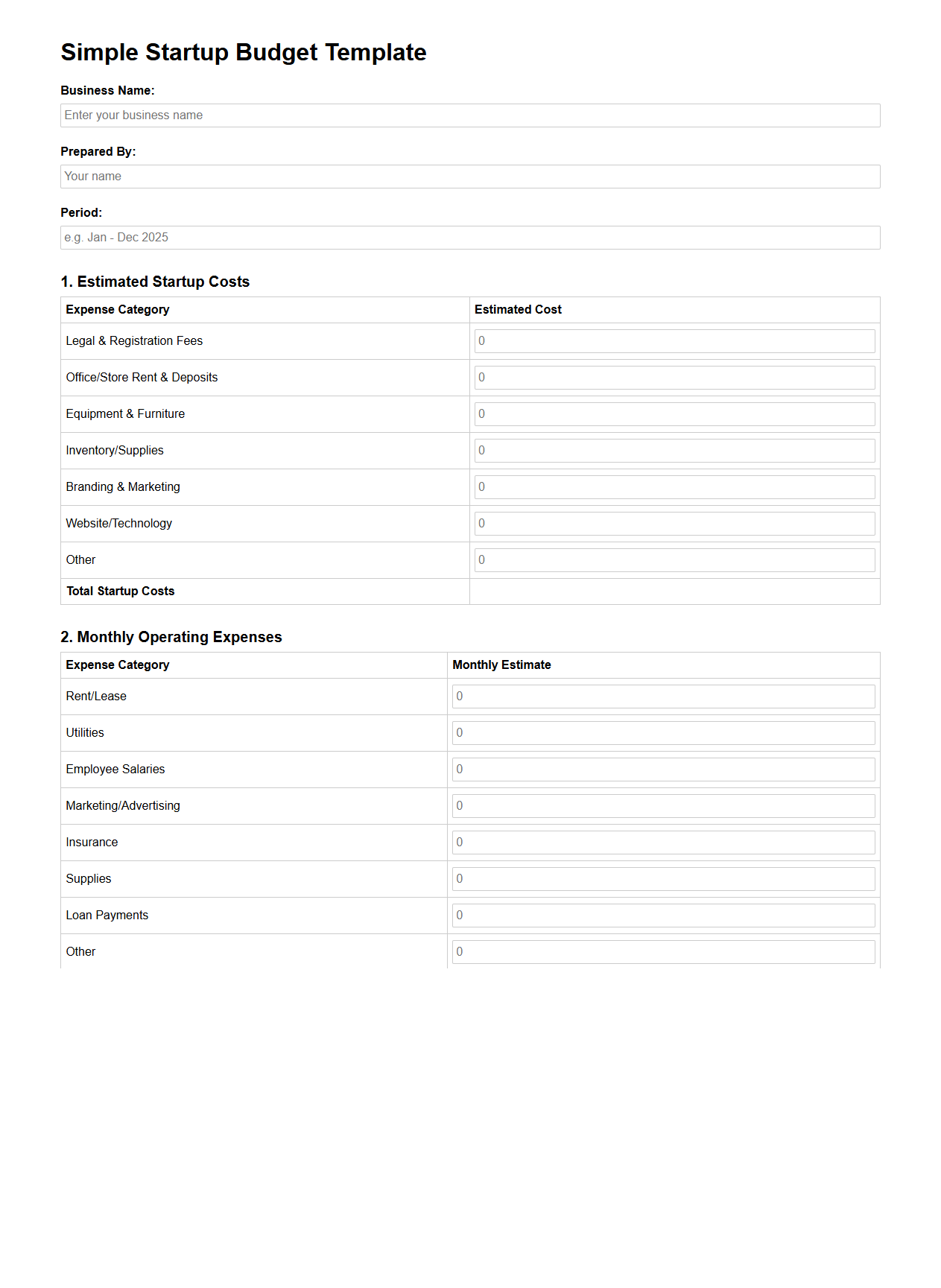

Simple Startup Budget Template for New Businesses

A

Simple Startup Budget Template for new businesses is a practical financial tool designed to help entrepreneurs outline initial costs, forecast expenses, and manage cash flow effectively. This document typically includes categories such as equipment, marketing, salaries, and operational costs, enabling clear tracking and planning during the critical early stages of a business. Utilizing this template supports informed decision-making and increases the likelihood of sustainable financial management.

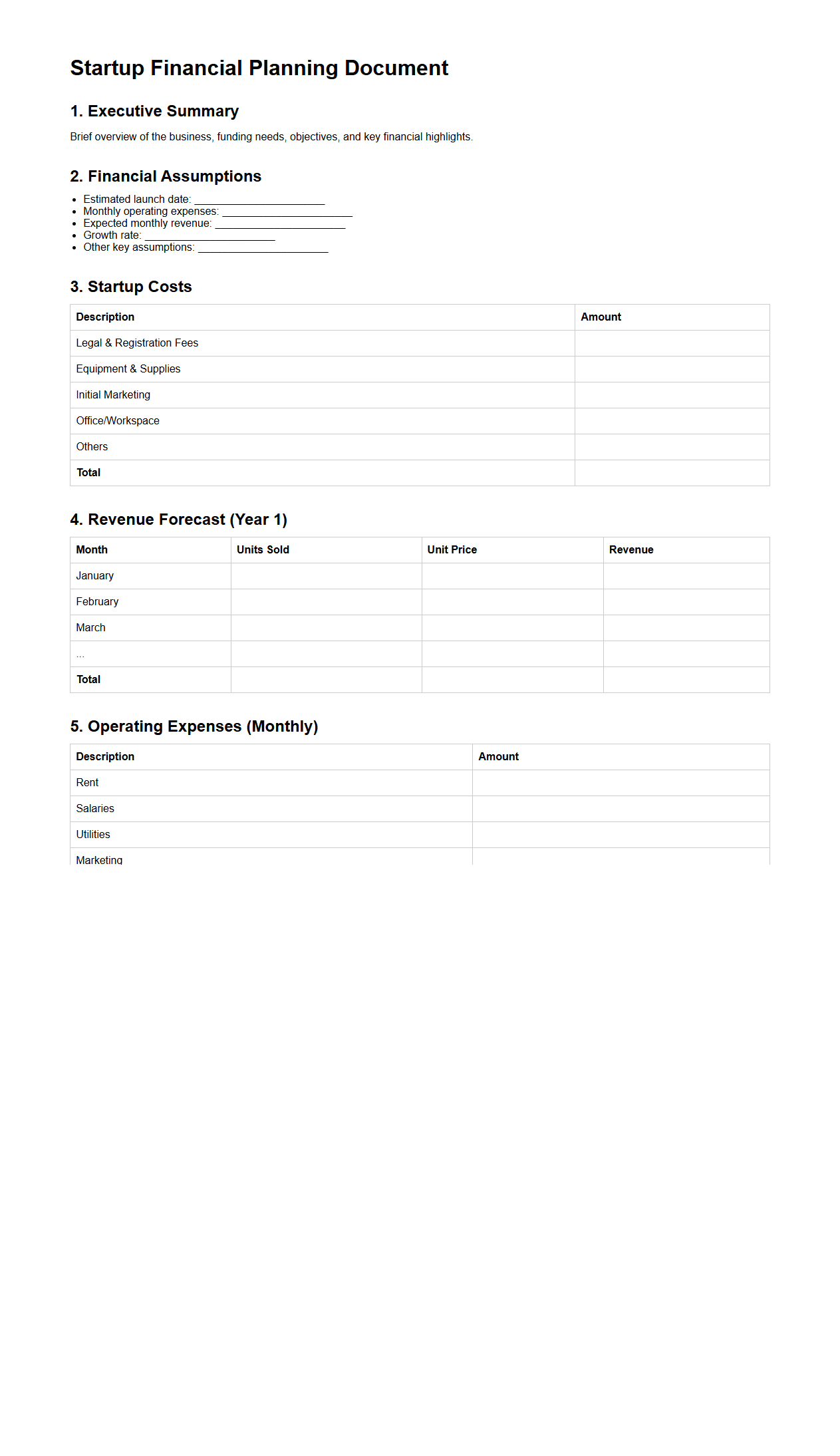

Basic Startup Financial Planning Document

A

Basic Startup Financial Planning Document outlines the essential financial projections and budget allocations necessary for launching a new business. It includes key components such as initial capital requirements, cash flow forecasts, expense estimates, and revenue projections to guide decision-making and attract investors. This document serves as a foundational tool for managing startup finances and ensuring sustainable growth during the early stages.

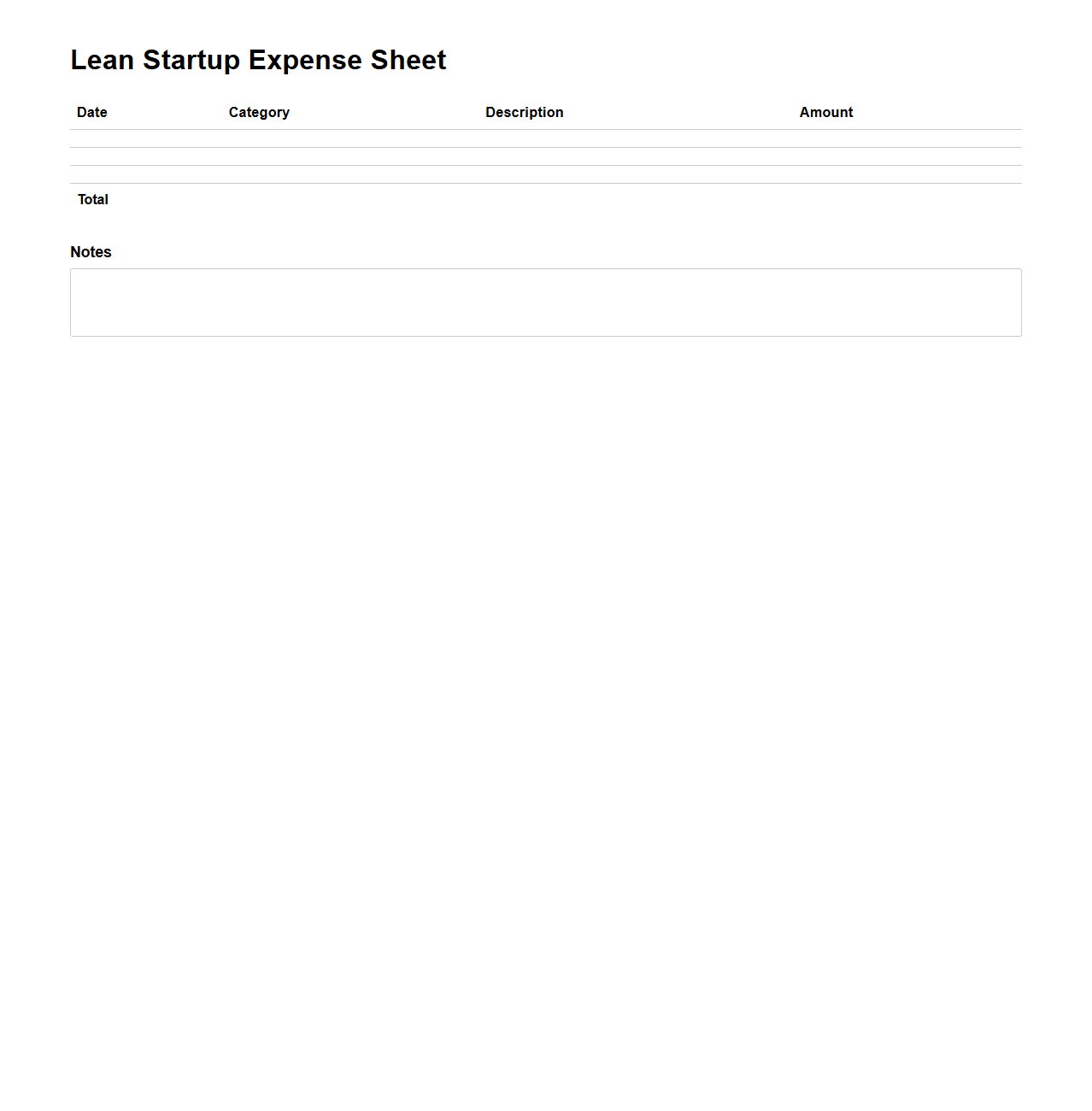

Lean Startup Expense Sheet

A

Lean Startup Expense Sheet document is a detailed financial tool used by entrepreneurs to track and manage early-stage business costs systematically. It focuses on capturing all essential startup expenses, helping founders maintain a clear overview of expenditures and optimize budget allocation. This sheet supports lean methodology by promoting efficient spending and continuous financial assessment during product development and market testing phases.

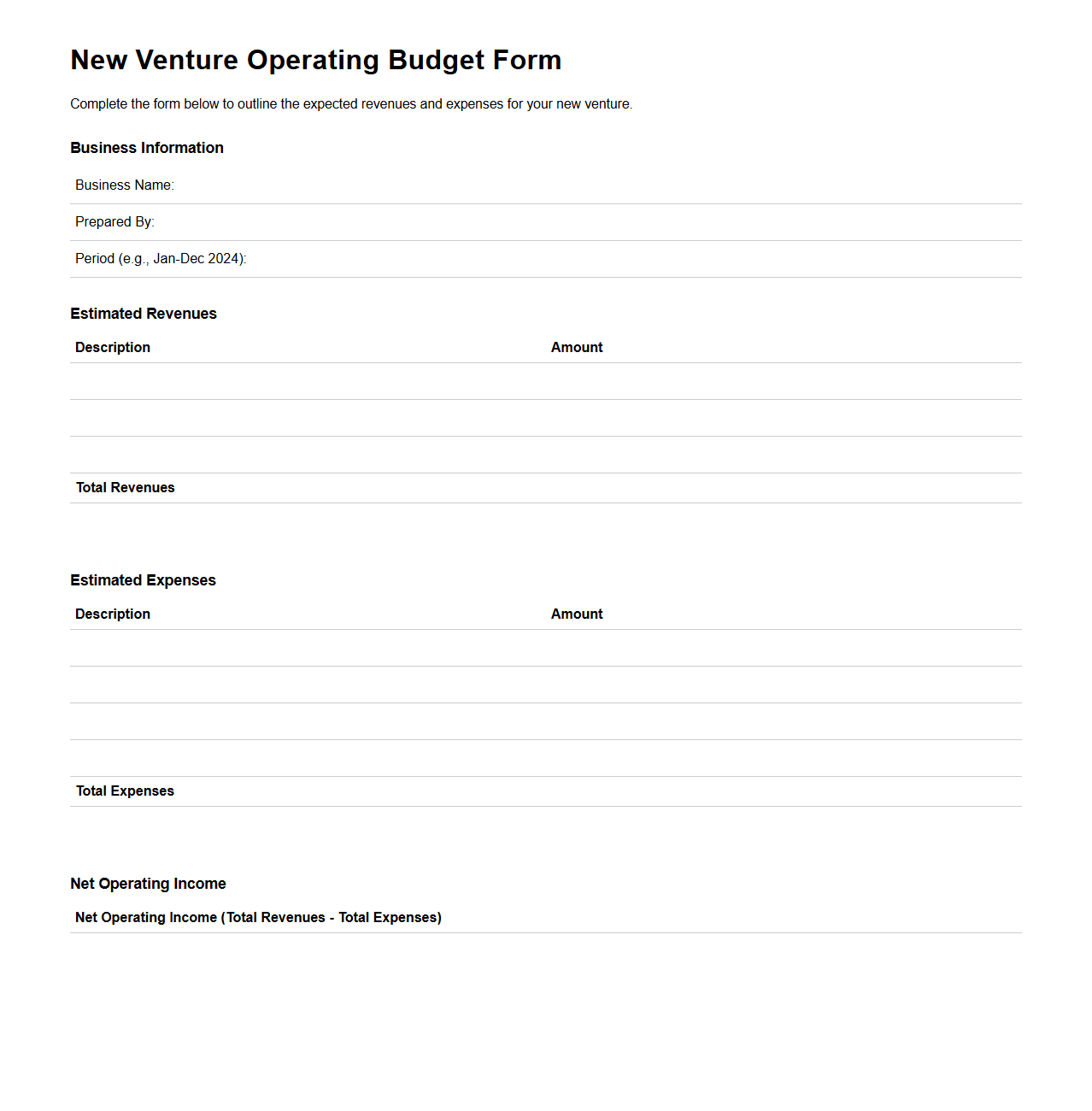

New Venture Operating Budget Form

The

New Venture Operating Budget Form is a critical financial planning document used by startups and new businesses to outline projected income and expenses. It helps entrepreneurs allocate resources efficiently, forecast cash flow, and set realistic financial goals for initial operations. This form supports strategic decision-making by providing a clear overview of anticipated costs and revenue streams during the early stages of business development.

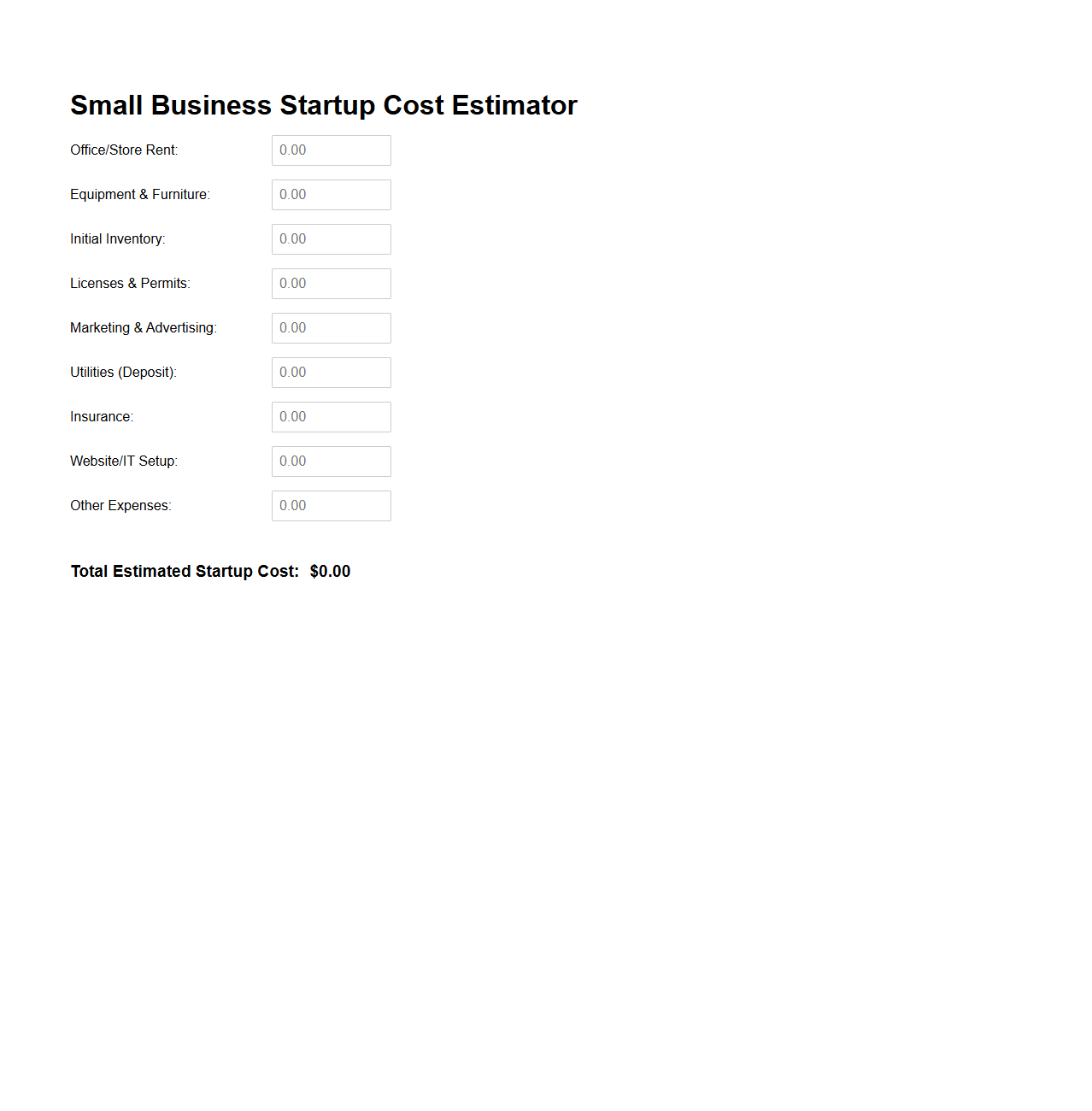

Small Business Startup Cost Estimator

The

Small Business Startup Cost Estimator document provides a detailed breakdown of the initial financial requirements needed to launch a new business. It includes estimated expenses such as equipment, permits, marketing, and operational costs to help entrepreneurs plan their budgets effectively. Using this tool can improve financial forecasting accuracy and support informed decision-making during the early stages of business development.

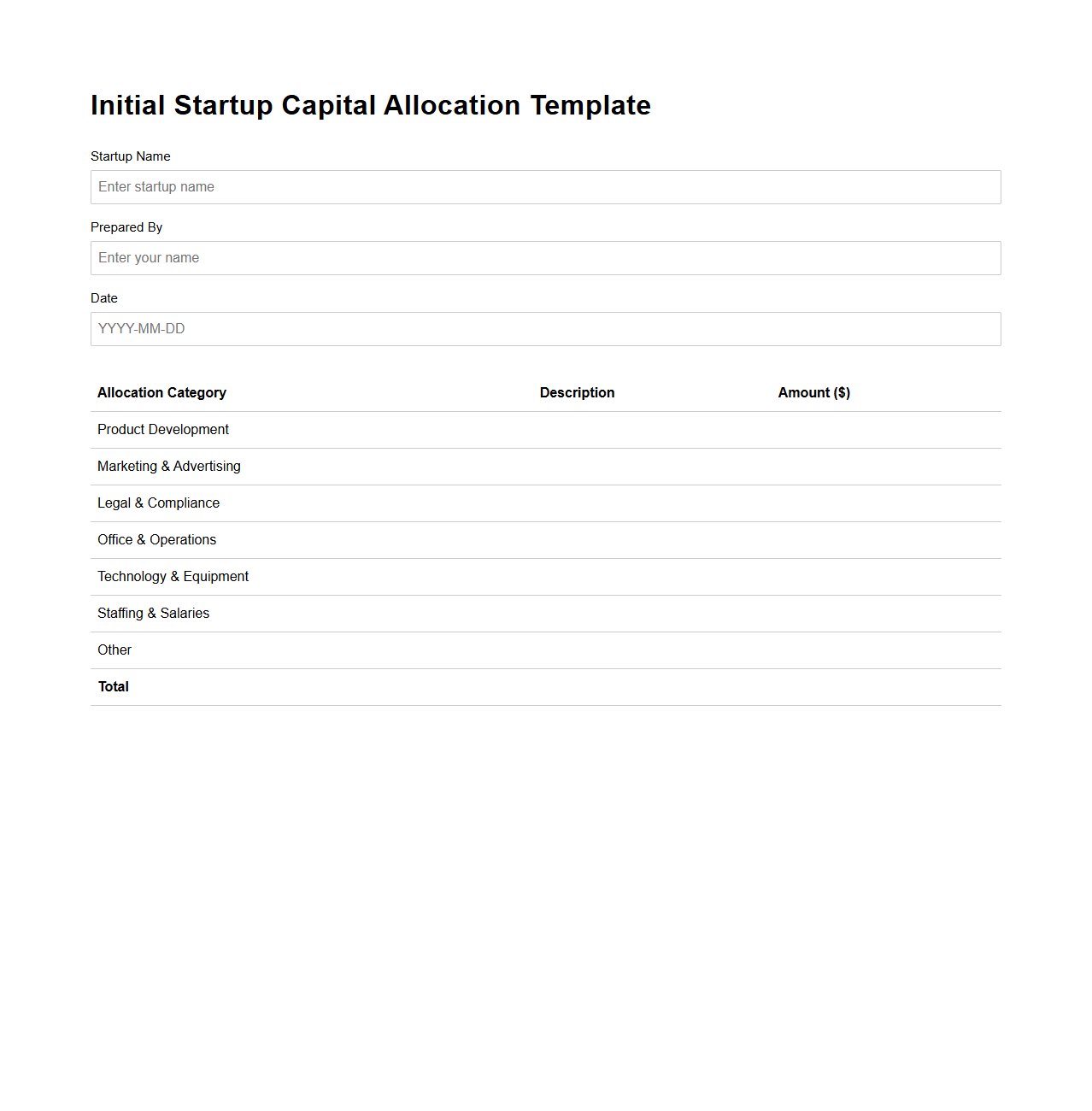

Initial Startup Capital Allocation Template

The

Initial Startup Capital Allocation Template document is a strategic financial tool designed to help entrepreneurs systematically distribute their startup funds across essential business areas, such as product development, marketing, operations, and legal expenses. It provides a clear breakdown of capital sources and planned expenditures, enabling better budget management and investor communication. Using this template ensures a balanced allocation of resources to optimize growth potential and minimize financial risks during the early stages of a startup.

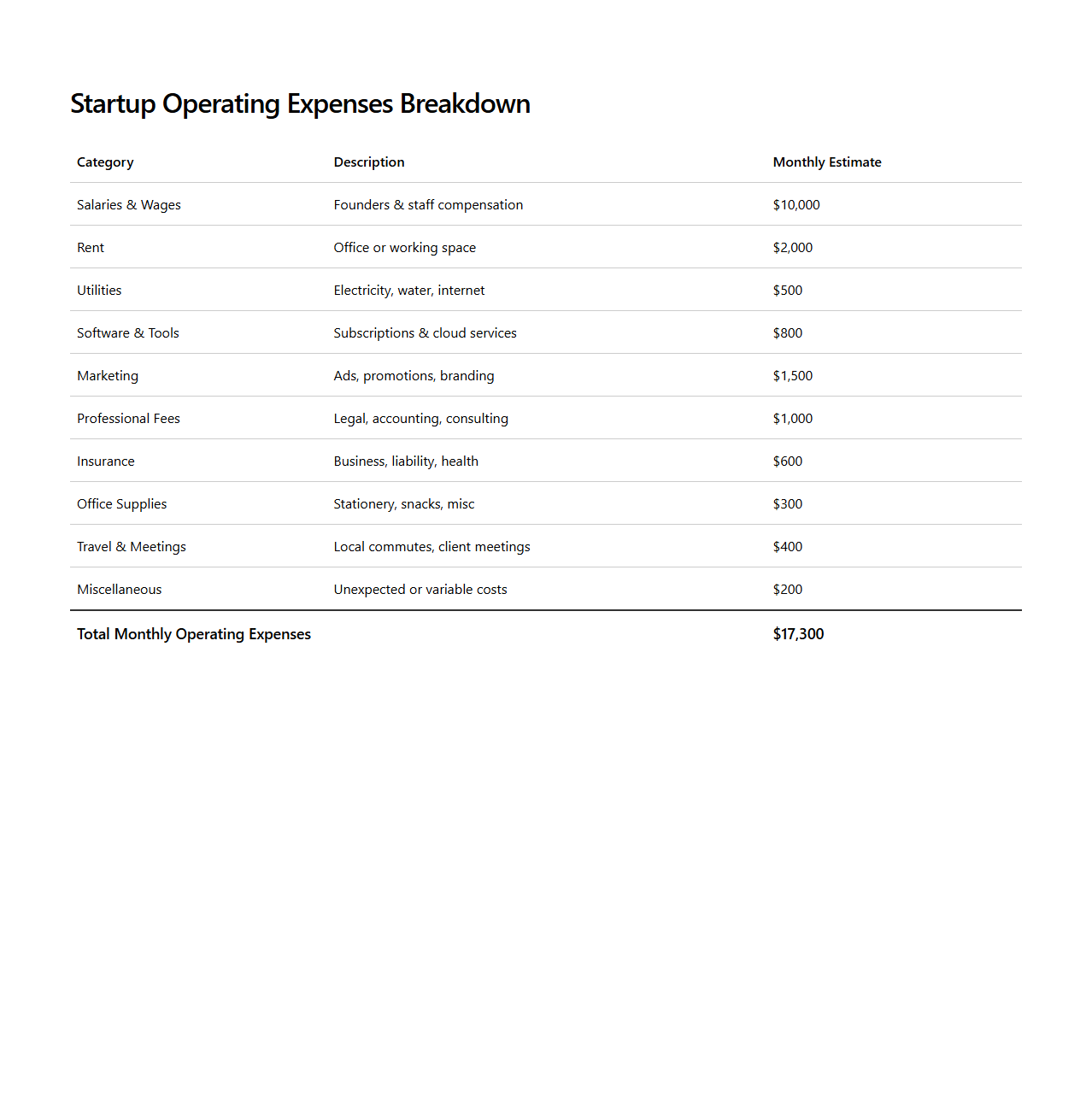

Startup Operating Expenses Breakdown

A

Startup Operating Expenses Breakdown document details all the costs associated with running a new business, categorizing expenses into fixed and variable costs such as salaries, rent, utilities, marketing, and technology. This financial tool helps founders and investors understand cash flow requirements, budget efficiently, and identify areas to optimize spending. Accurate expense breakdowns are essential for forecasting profitability and securing funding by demonstrating financial responsibility.

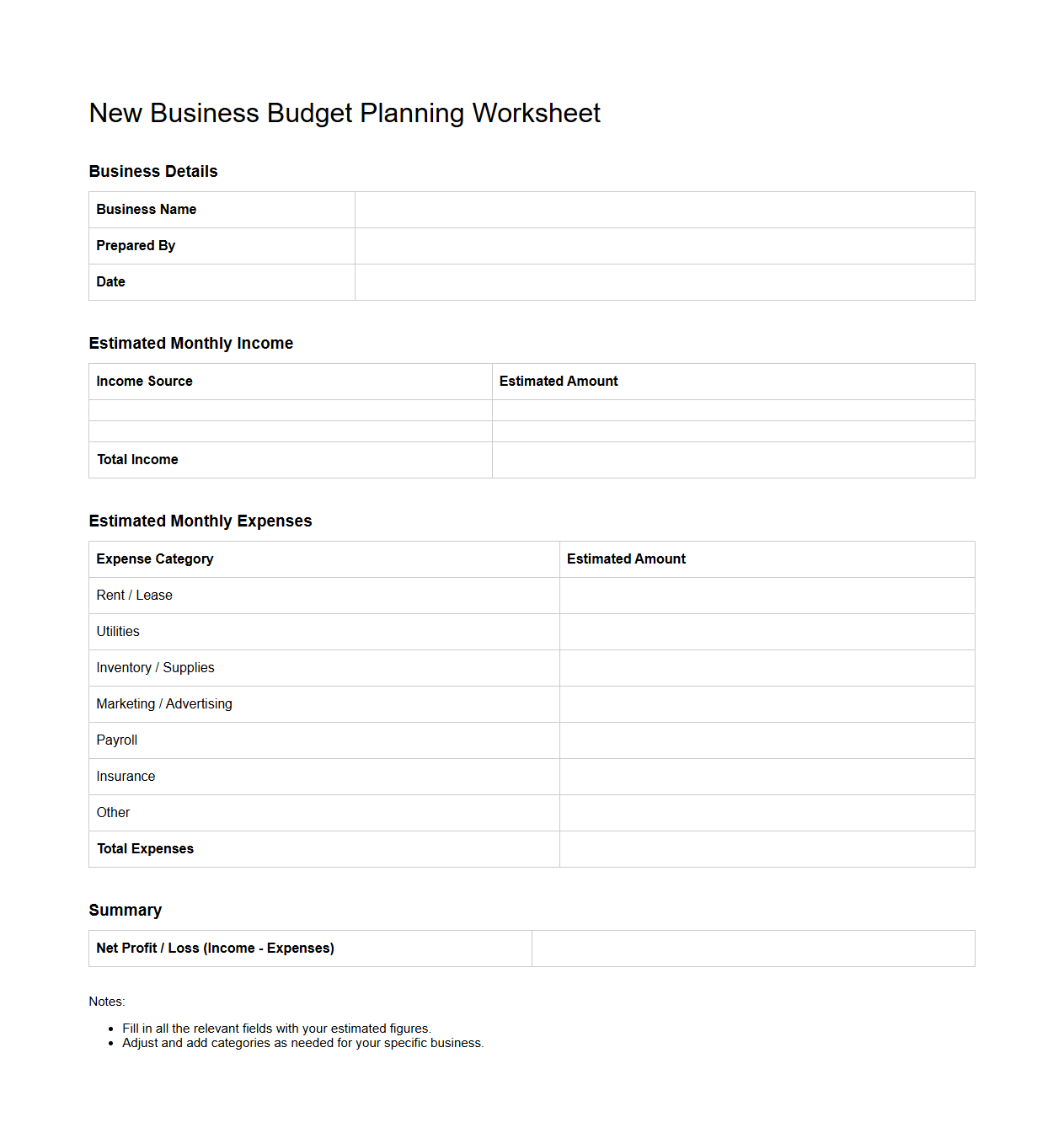

New Business Budget Planning Worksheet

A

New Business Budget Planning Worksheet is a strategic tool designed to help entrepreneurs and startups outline and allocate financial resources for various business activities. It includes detailed sections for estimating startup costs, operational expenses, marketing budgets, and revenue projections to facilitate effective financial management. This worksheet ensures comprehensive budgeting, promoting informed decision-making and resource optimization during the crucial early stages of business development.

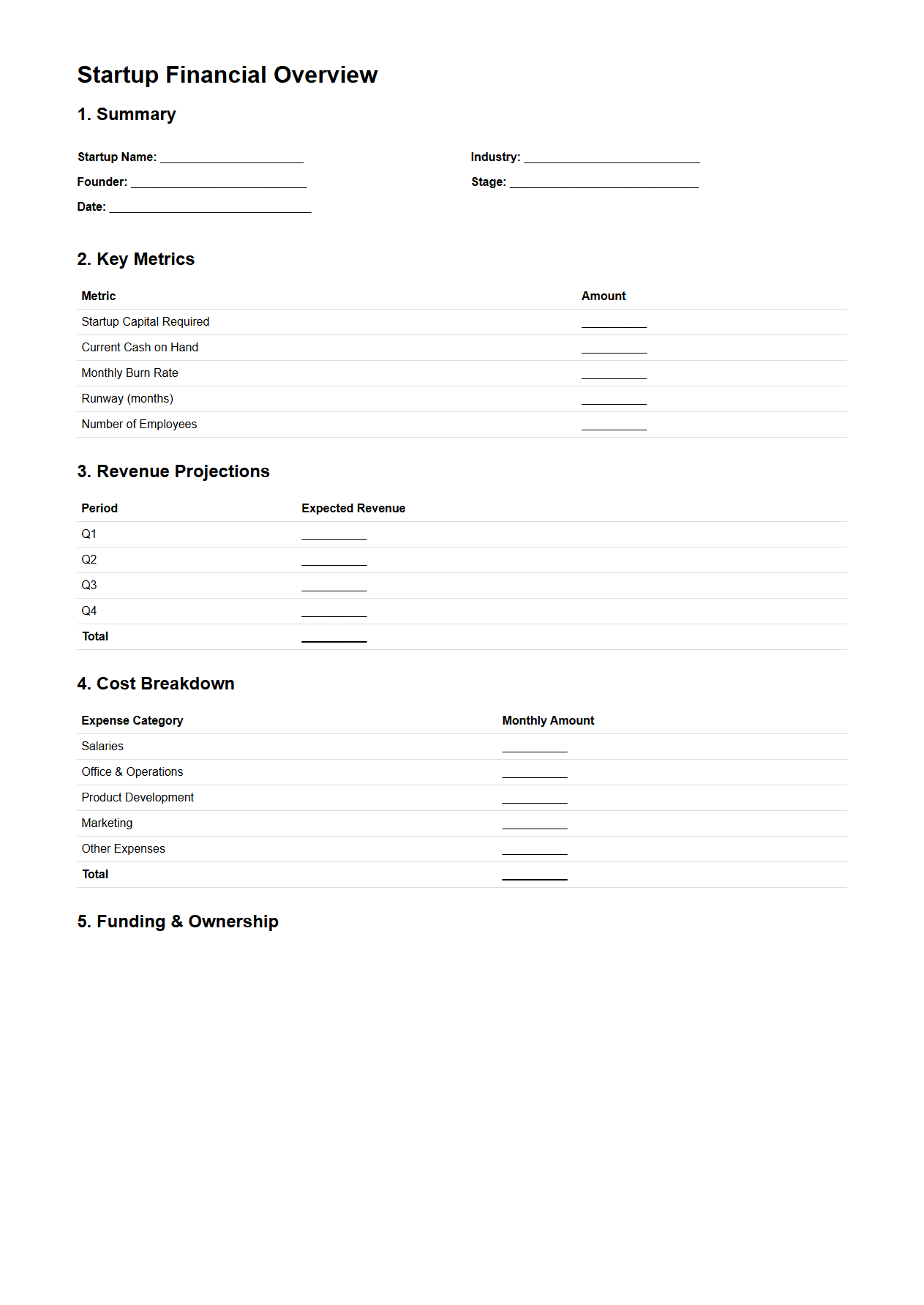

Entrepreneur Startup Financial Overview

An

Entrepreneur Startup Financial Overview document provides a comprehensive summary of a new business's financial status, including projected revenues, expenses, cash flow, and funding needs. It is essential for potential investors and stakeholders to evaluate the startup's viability and growth potential. Clear presentation of financial data, such as balance sheets, profit and loss statements, and break-even analysis, enhances decision-making and strategic planning.

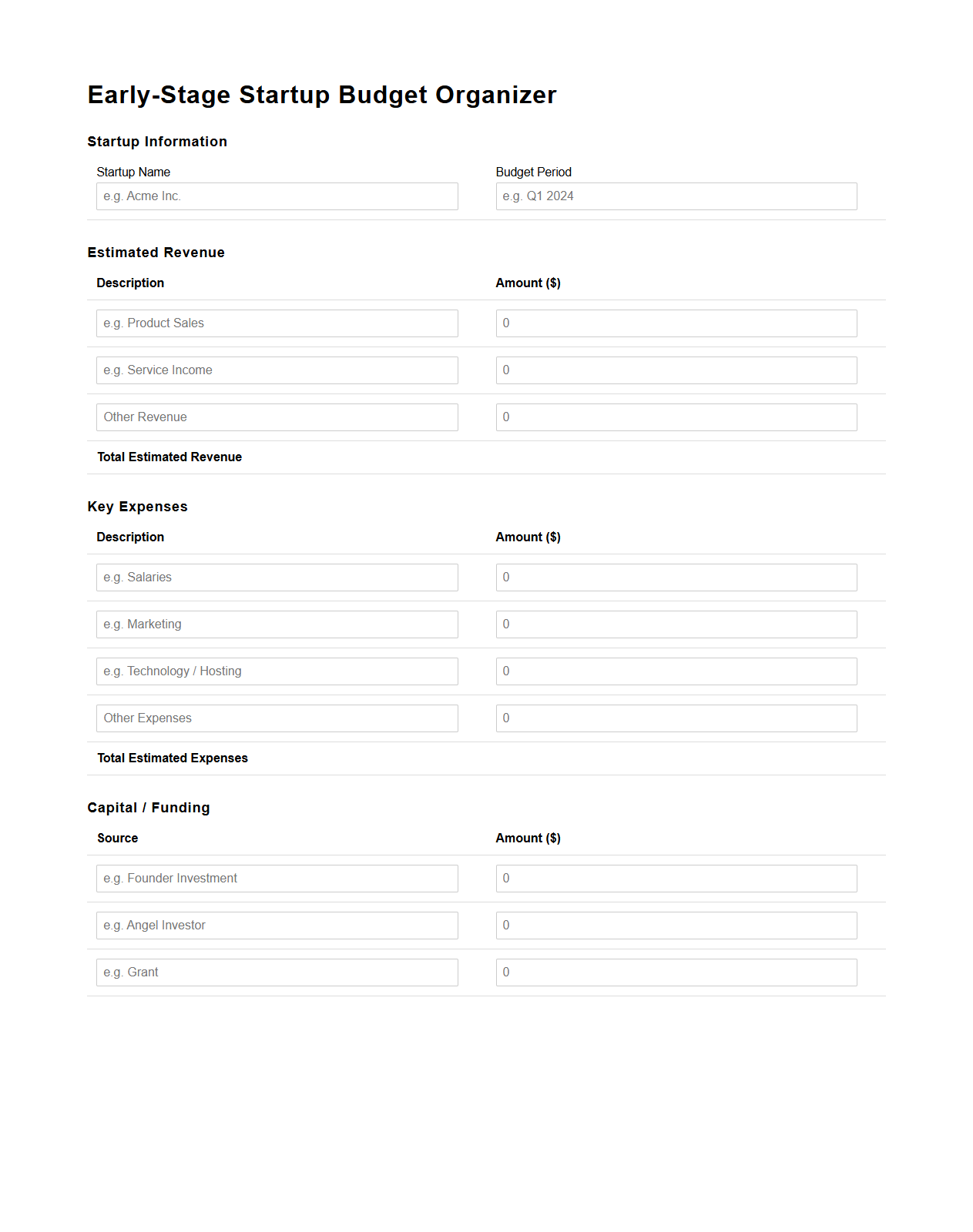

Early-Stage Startup Budget Organizer

The

Early-Stage Startup Budget Organizer document is a strategic financial tool designed to help new businesses effectively plan and allocate their limited resources. It outlines projected expenses, including operational costs, marketing, product development, and staffing, allowing founders to maintain financial discipline and track cash flow accurately. Utilizing this organizer enables startups to make informed funding decisions and prepare for investor presentations with clear, data-backed budgeting plans.

Essential Line Items in a Blank Startup Budget Template for Tech Ventures

A startup budget template for tech ventures typically includes categories such as product development, marketing expenses, and operational costs. It should also account for salaries, software licenses, and hardware purchases. Including these line items helps create a clear financial roadmap for early-stage growth.

Estimating Initial Operating Expenses in a New Venture Budget Letter

Founders should base their estimates on detailed market research and vendor quotes to ensure accuracy. It is important to include all fixed and variable costs like rent, utilities, and employee salaries. Being conservative with these estimates helps avoid unexpected financial shortfalls.

Supporting Documents for a Startup Budget Letter for Investor Review

Investors expect to see financial statements such as projected income statements, cash flow forecasts, and balance sheets. Additionally, including market analysis reports and vendor contracts adds credibility. These documents provide transparency and build investor confidence.

Justifying Projected Revenue Streams in Startup Budget Documentation

Founders can justify revenue projections by using historical data, customer acquisition strategies, and realistic market penetration assumptions. Including competitive analysis strengthens the case for revenue growth. Clear explanations help investors understand the revenue generation potential.

Common Budgeting Mistakes New Founders Should Avoid

New founders often underestimate operating expenses or set overly optimistic revenue goals, leading to cash flow issues. Ignoring contingency funds and neglecting to update the budget regularly can also be detrimental. Careful planning and routine reviews are essential to maintain financial health.