A Blank Invoice Template for Nonprofits is a customizable document designed specifically to help nonprofit organizations streamline their billing processes. It allows for clear itemization of services or goods provided while maintaining a professional appearance tailored to nonprofit needs. This template ensures accurate record-keeping and simplifies financial tracking for grant compliance and donor reporting.

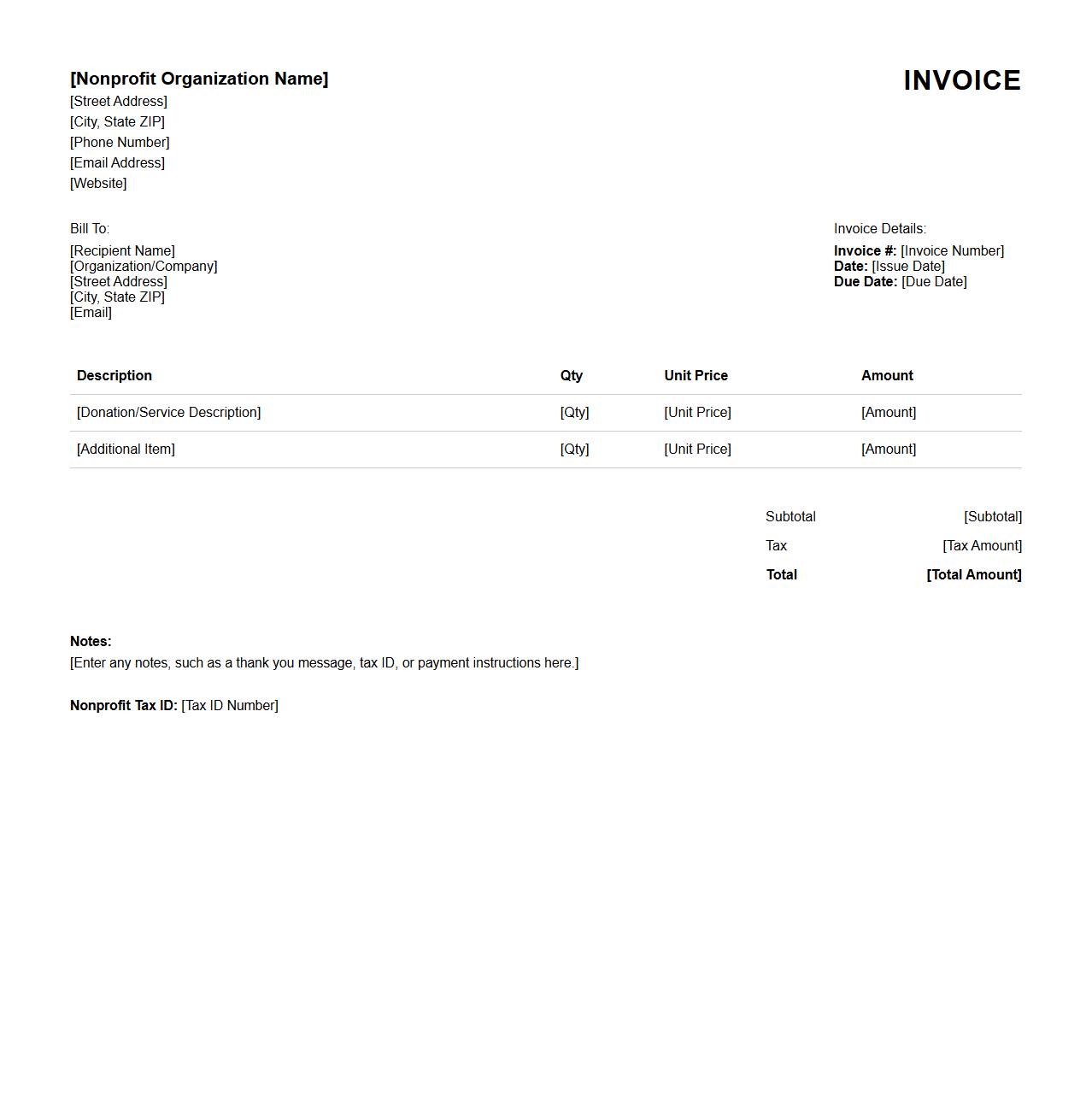

Nonprofit Organization Invoice Template

A

Nonprofit Organization Invoice Template is a structured document used by nonprofit entities to bill clients, donors, or partner organizations for services rendered or goods provided. It typically includes details such as the organization's name, contact information, invoice number, itemized list of services or products, and payment terms, ensuring transparency and accountability in financial transactions. Utilizing this template helps nonprofits maintain consistent and professional billing practices while tracking revenue for reporting and auditing purposes.

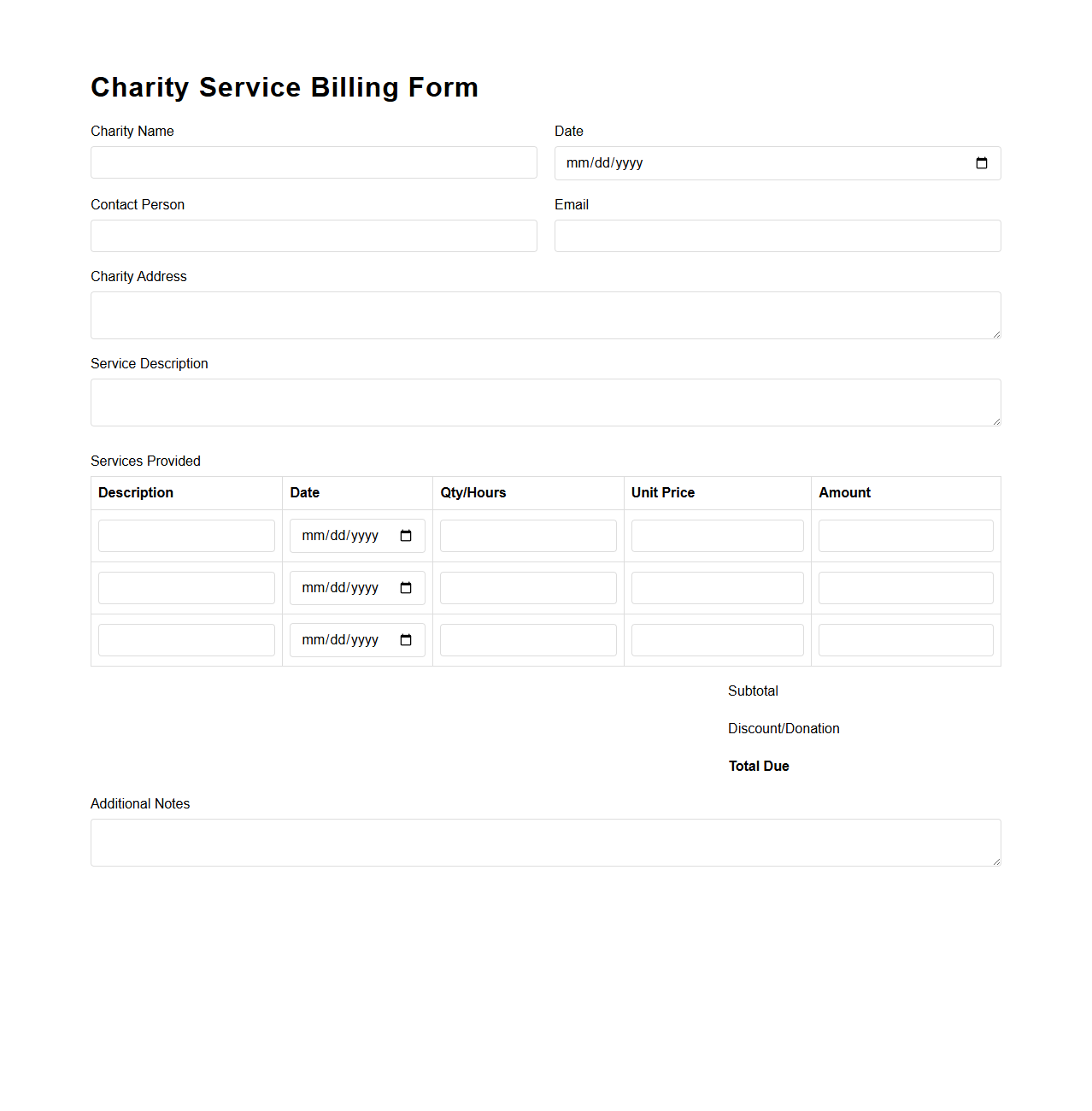

Charity Service Billing Form

The

Charity Service Billing Form document is used to itemize and record expenses related to charitable services provided by an organization or individual. It ensures accurate tracking of resources, donations, and costs associated with charitable activities, facilitating transparency and accountability. This form is essential for financial reporting and auditing purposes within nonprofit and charitable sectors.

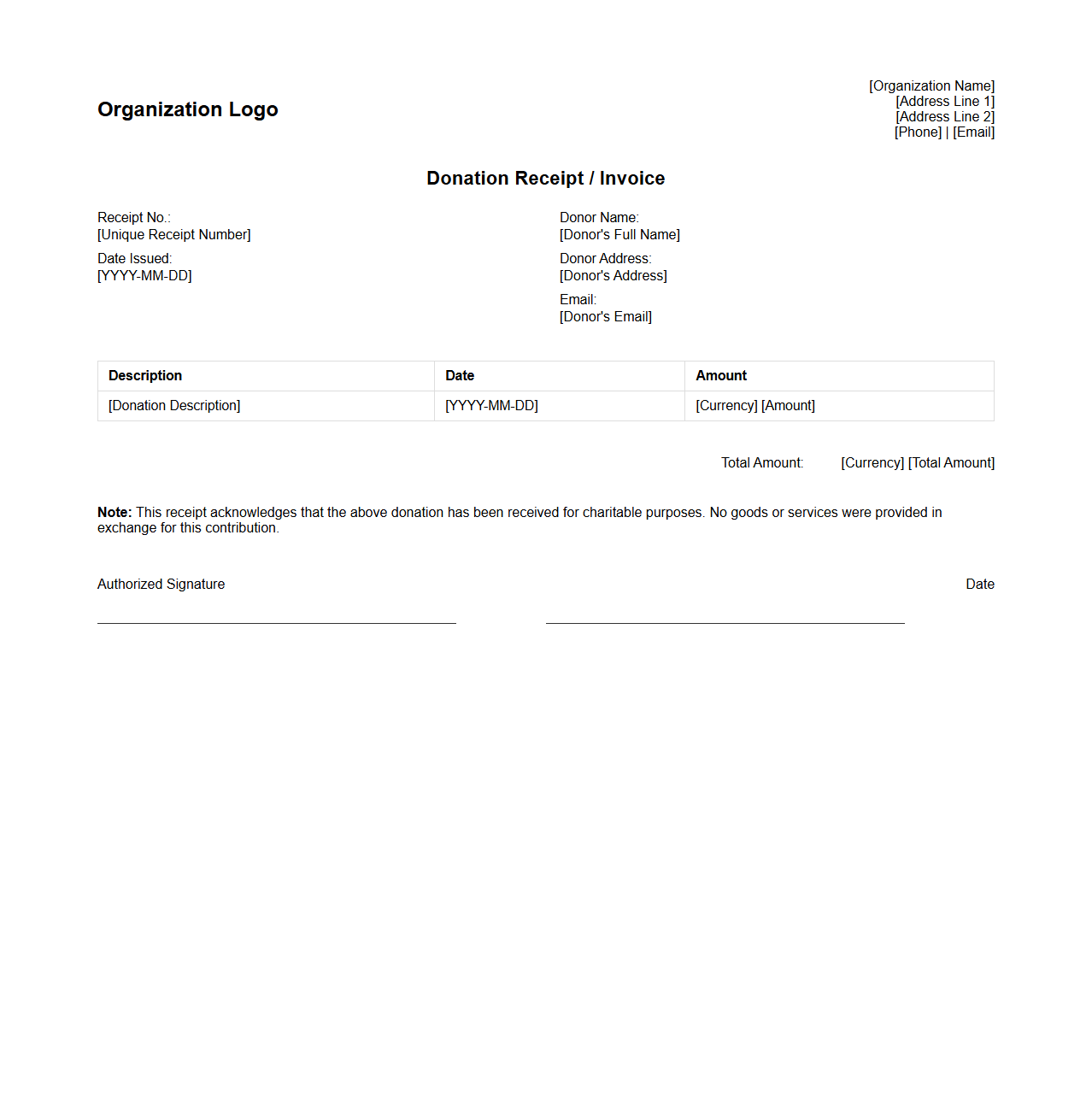

Donation Receipt Invoice Template

A

Donation Receipt Invoice Template document serves as an official record issued by nonprofit organizations to donors, confirming the receipt of a charitable contribution. It typically includes essential details such as the donor's name, donation amount, date of donation, and a statement verifying that no goods or services were provided in exchange. This document is crucial for donors to claim tax deductions and maintain accurate financial records.

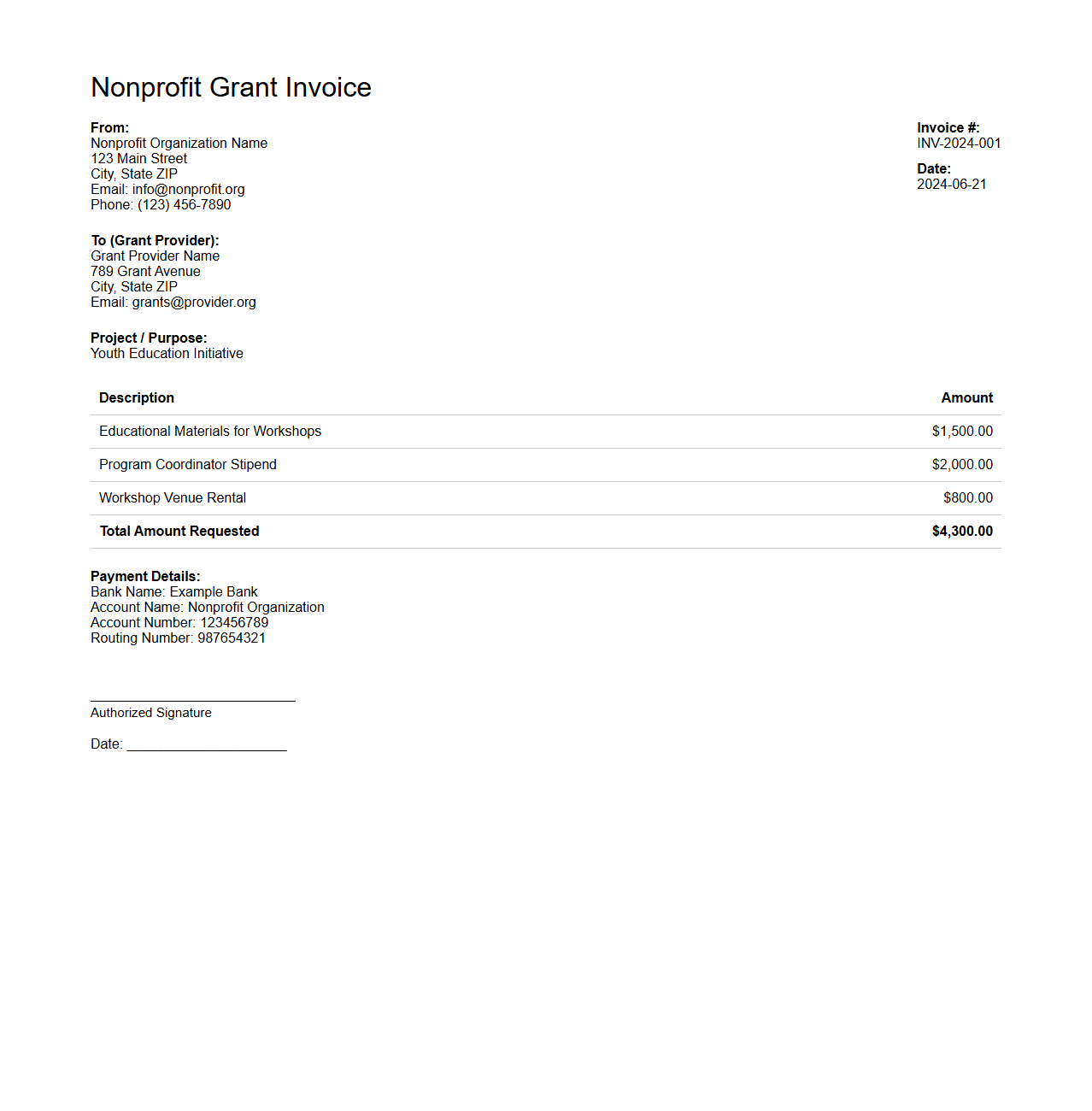

Nonprofit Grant Invoice Sample

A

Nonprofit Grant Invoice Sample document serves as a detailed request for payment submitted by a nonprofit organization to a grant provider, outlining the expenses incurred during a funded project. This invoice typically includes essential information such as grant number, project title, itemized costs, and payment terms to ensure transparency and facilitate the reimbursement process. Accurate documentation helps maintain compliance with funding requirements and supports effective financial tracking for both the nonprofit and the grantor.

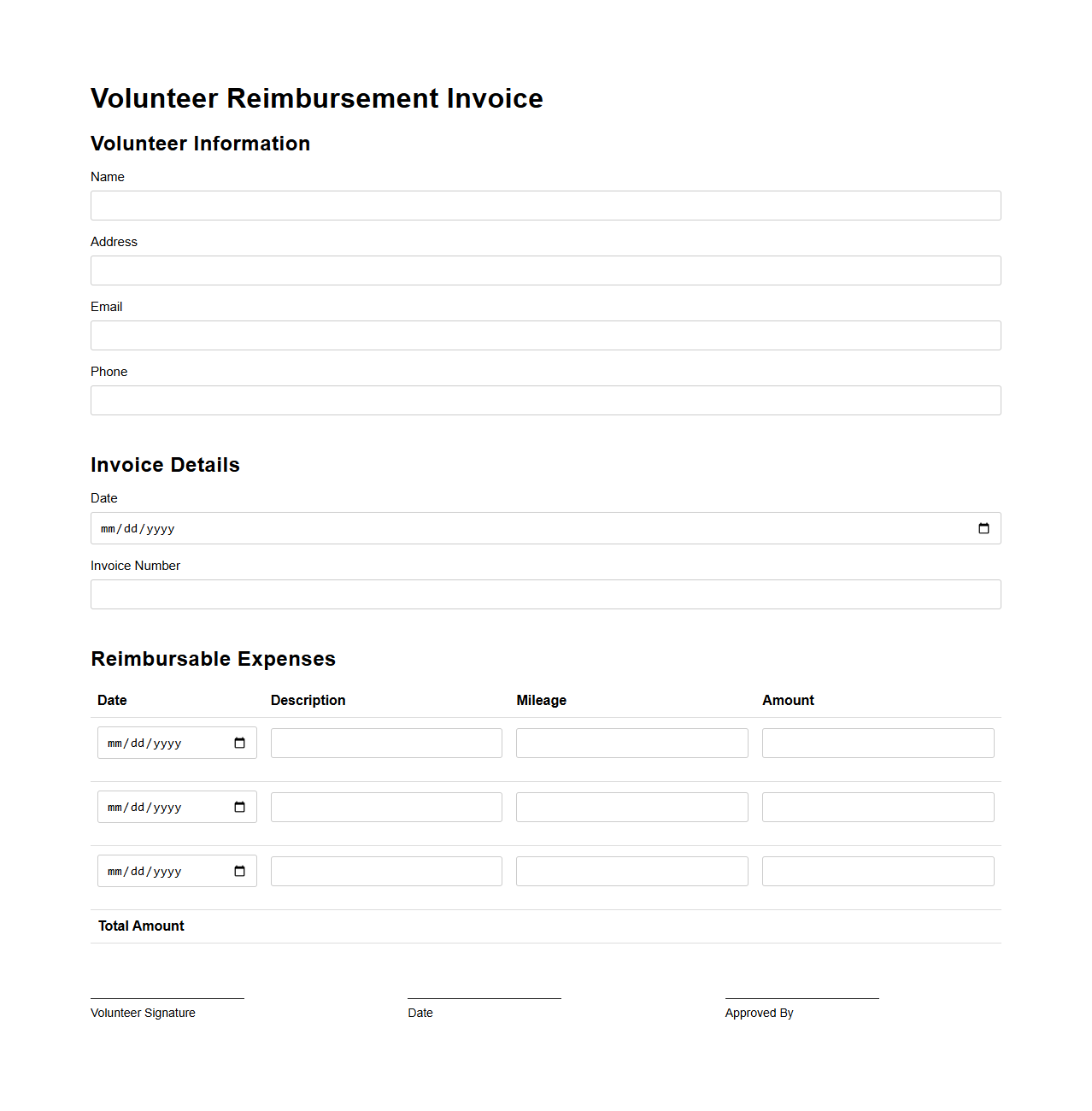

Volunteer Reimbursement Invoice Template

A

Volunteer Reimbursement Invoice Template is a structured document used to request repayment for out-of-pocket expenses incurred by volunteers during their service activities. It itemizes costs such as travel, supplies, or meals, ensuring transparency and proper accounting for nonprofit organizations. This template streamlines the reimbursement process, promoting accurate record-keeping and timely compensation.

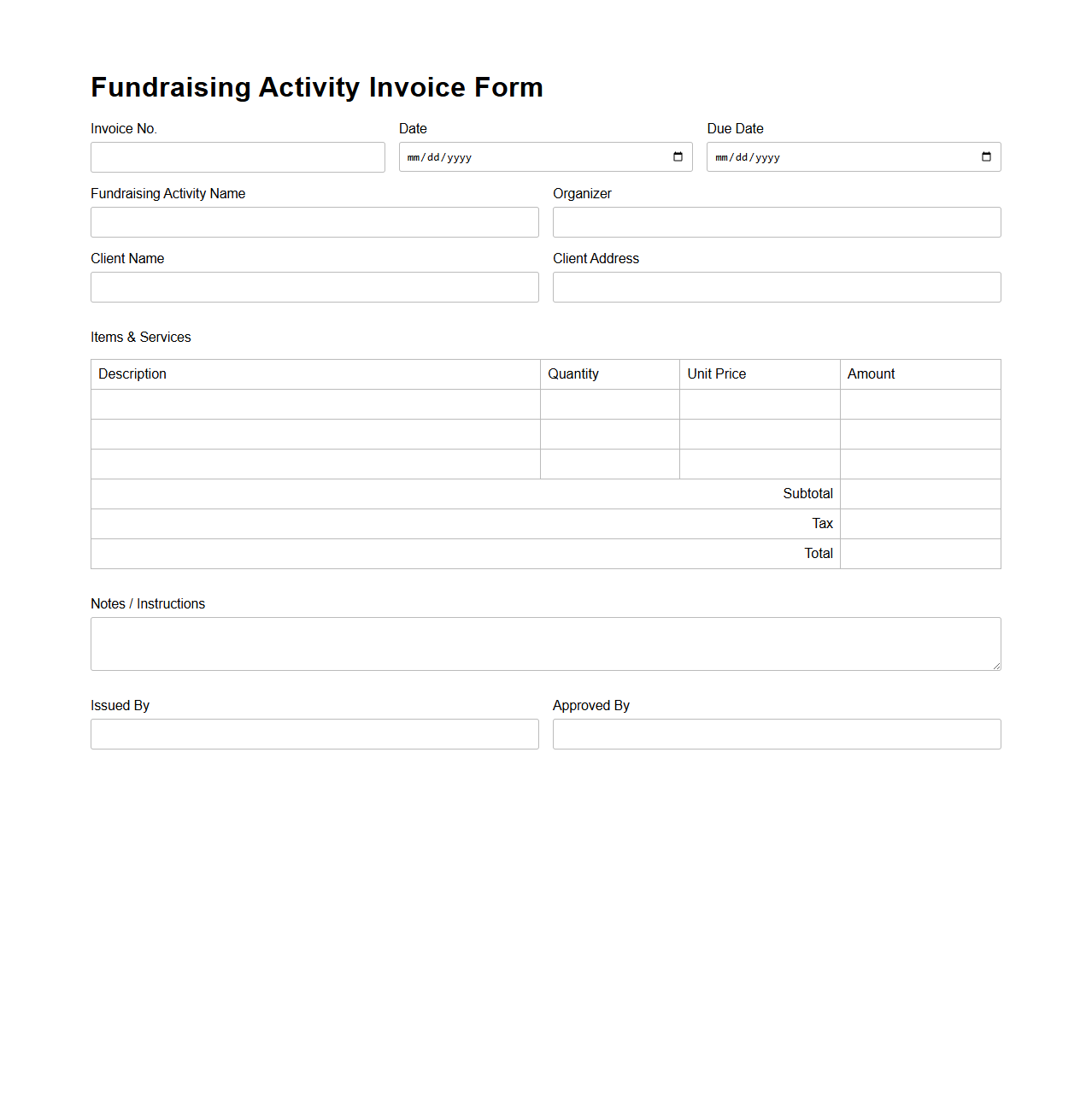

Fundraising Activity Invoice Form

A

Fundraising Activity Invoice Form document serves as an official record detailing expenses and revenues related to specific fundraising events or campaigns. It helps organizations track financial transactions, ensuring transparency and accountability for donors and regulatory bodies. Accurate completion of this form facilitates proper financial reporting and supports compliance with fundraising regulations.

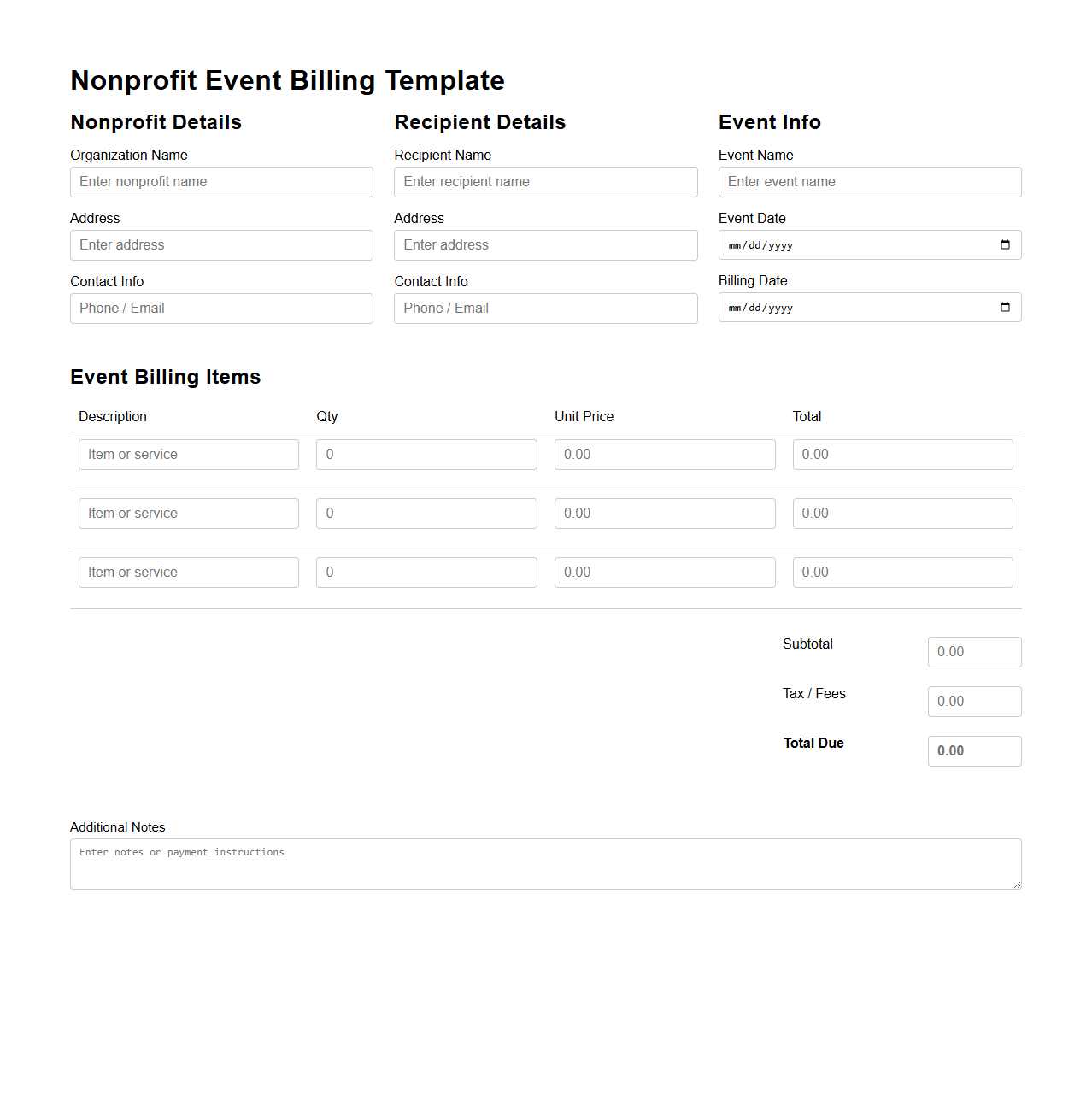

Nonprofit Event Billing Template

A

Nonprofit Event Billing Template document is a structured form designed to streamline the invoicing process for fundraising events or charity functions. It typically includes details such as event description, donor information, payment methods, and itemized charges, ensuring accuracy and transparency in financial transactions. Utilizing this template helps nonprofits maintain organized records and facilitates timely donor payments.

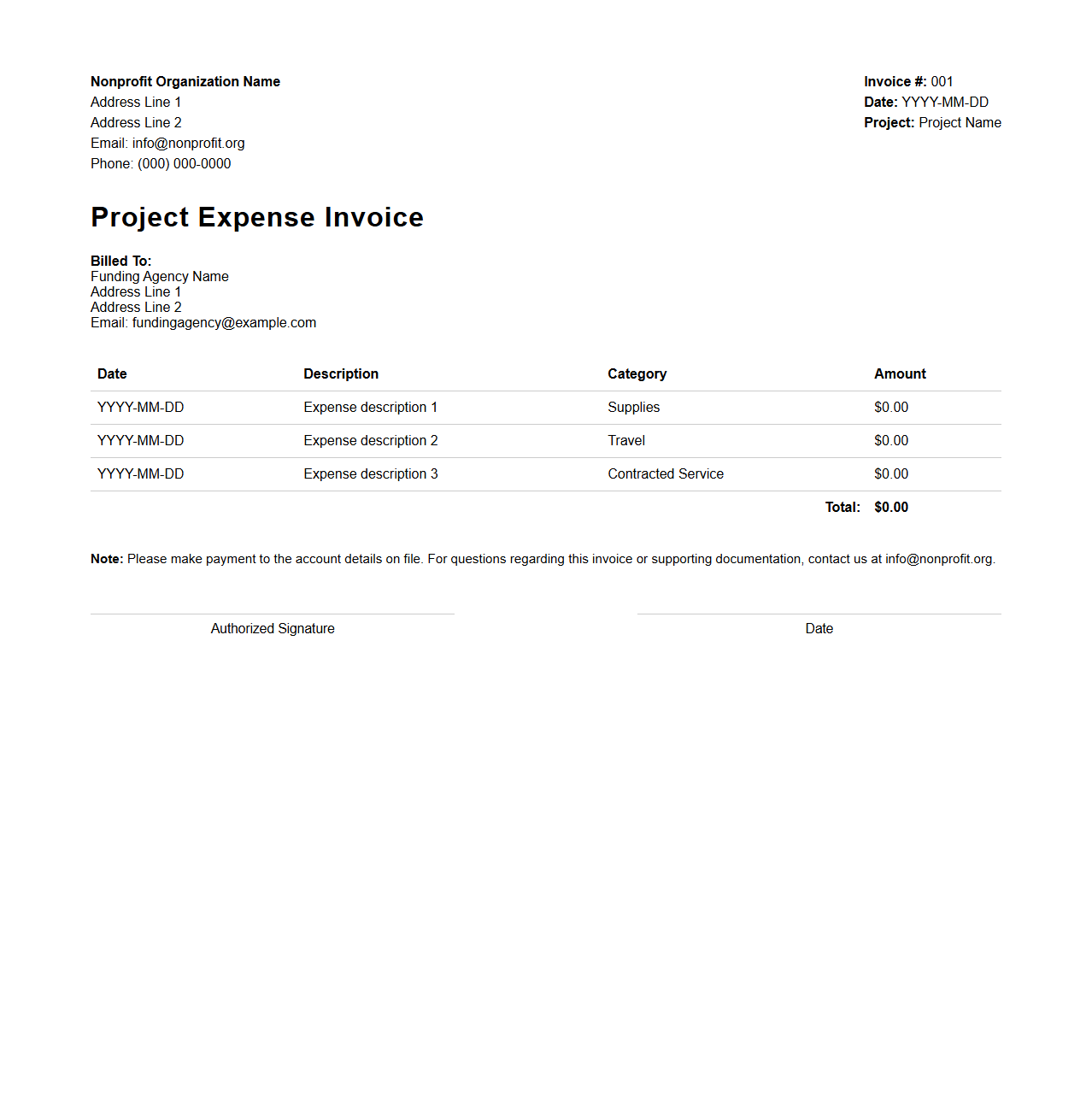

Project Expense Invoice for Nonprofits

A

Project Expense Invoice for nonprofits is a detailed financial document that records and itemizes costs incurred during a specific project. It helps organizations track expenditures, allocate funds accurately, and maintain transparency for donors and stakeholders. This invoice supports budgeting, financial reporting, and compliance with grant requirements.

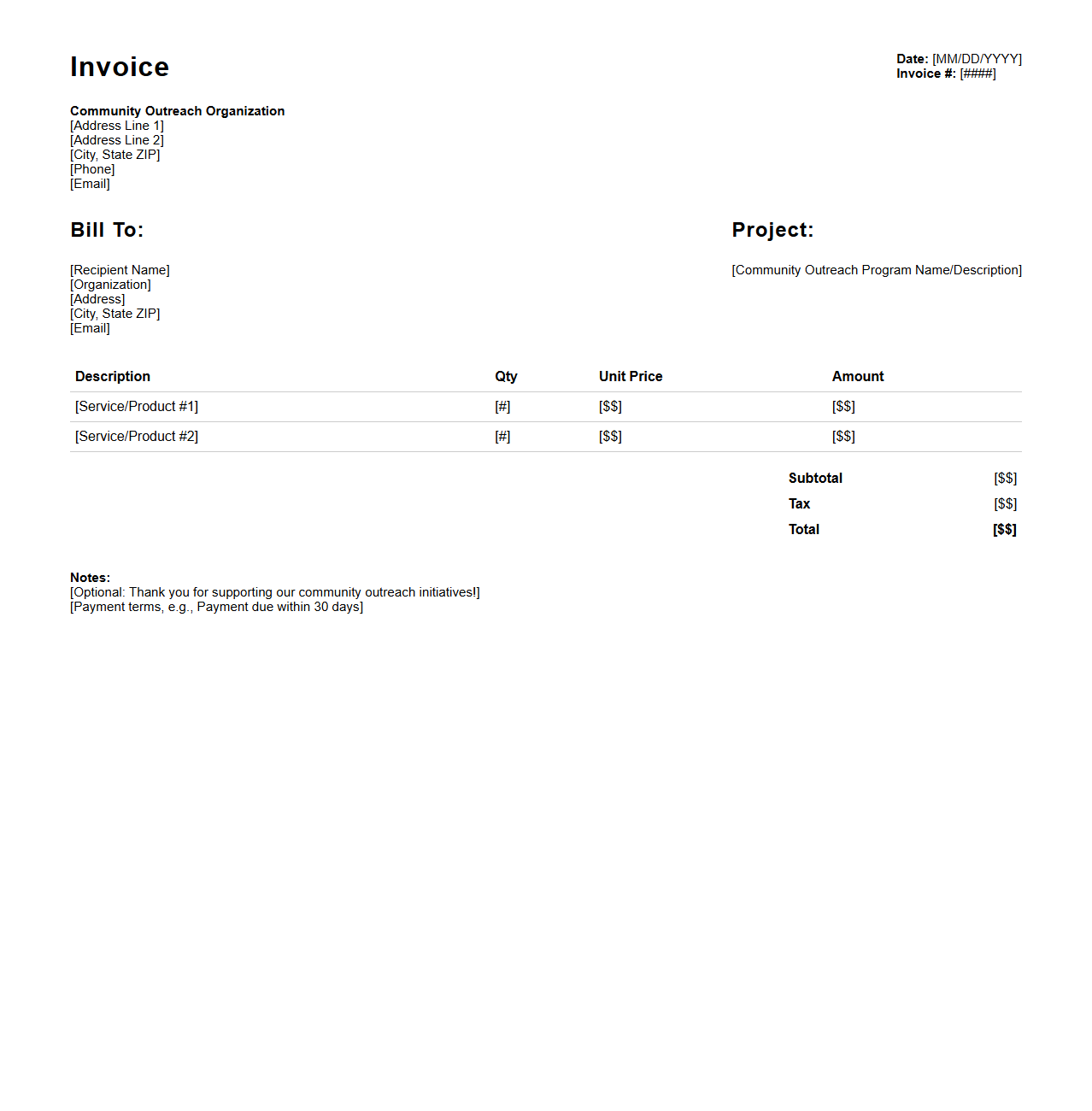

Community Outreach Invoice Template

A

Community Outreach Invoice Template is a structured document designed to itemize services and costs related to community outreach efforts, facilitating transparent billing and payment processes. It typically includes fields for service descriptions, dates, hours worked, rates, and total amounts due, ensuring clear communication between organizations and clients or sponsors. This template streamlines financial tracking and supports accountability in community engagement projects.

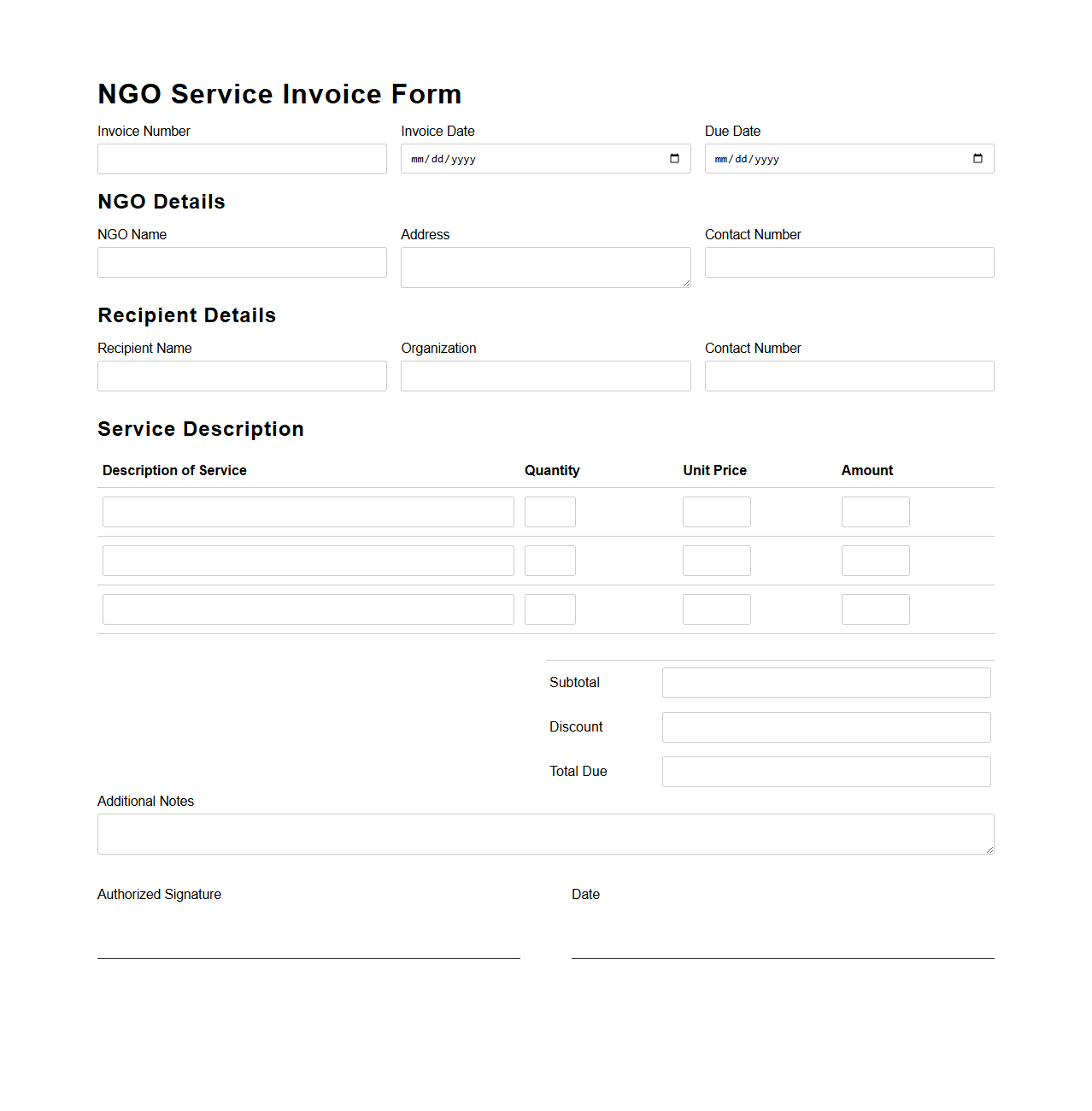

NGO Service Invoice Form

An

NGO Service Invoice Form is a crucial document used by non-governmental organizations to record and itemize the services provided to clients or partners. This form includes details such as service descriptions, dates, quantities, rates, and total amounts to ensure transparent financial transactions and proper accounting. Accurate completion of the invoice form facilitates efficient tracking of payments, budgeting, and compliance with donor or regulatory requirements.

What essential fields should be included in a blank invoice template for nonprofits?

A blank invoice template for nonprofits must include fields for the organization's name and contact details. It should have space for the recipient's information and a unique invoice number for tracking. Essential financial details include the date, description of services or goods, amounts, and total due.

How do nonprofits customize invoice letters to comply with grant reporting requirements?

Nonprofits customize invoice letters by incorporating specific grant reference numbers and funding period details. They ensure that each invoice aligns with budget categories stipulated in the grant agreement. Additionally, clear narratives explaining expenses help satisfy grant reporting standards.

What legal disclaimers are recommended on nonprofit blank invoice documents?

Nonprofit invoices should include disclaimers addressing the tax-exempt status of the organization. They often clarify that the invoice does not constitute a tax receipt or donation acknowledgment. It is also recommended to include payment terms and liability clauses to protect the organization legally.

How can a blank nonprofit invoice reference specific project or donor allocations?

Invoices can feature designated fields for project codes or grant IDs to track expenditures accurately. Including a section for donor restrictions or fund allocations ensures transparency. This customization aids in financial reporting and donor accountability.

Which invoicing software best supports template creation for nonprofit organizations?

Software like QuickBooks Nonprofit offers tailored templates designed for nonprofit needs. FreshBooks and Wave also provide flexibility in customizing invoices to include nonprofit-specific fields. These platforms facilitate easy tracking, reporting, and compliance with nonprofit financial requirements.