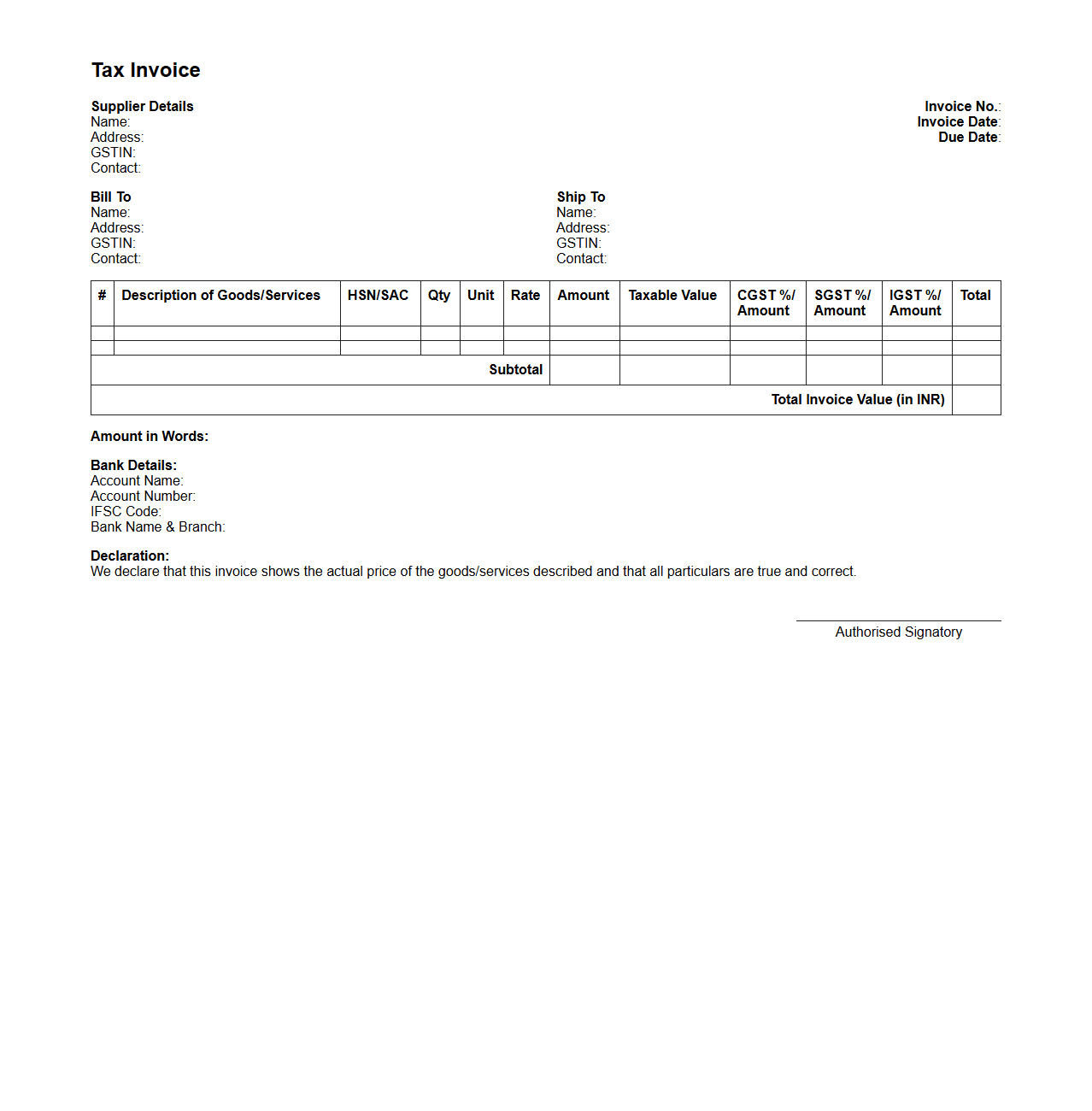

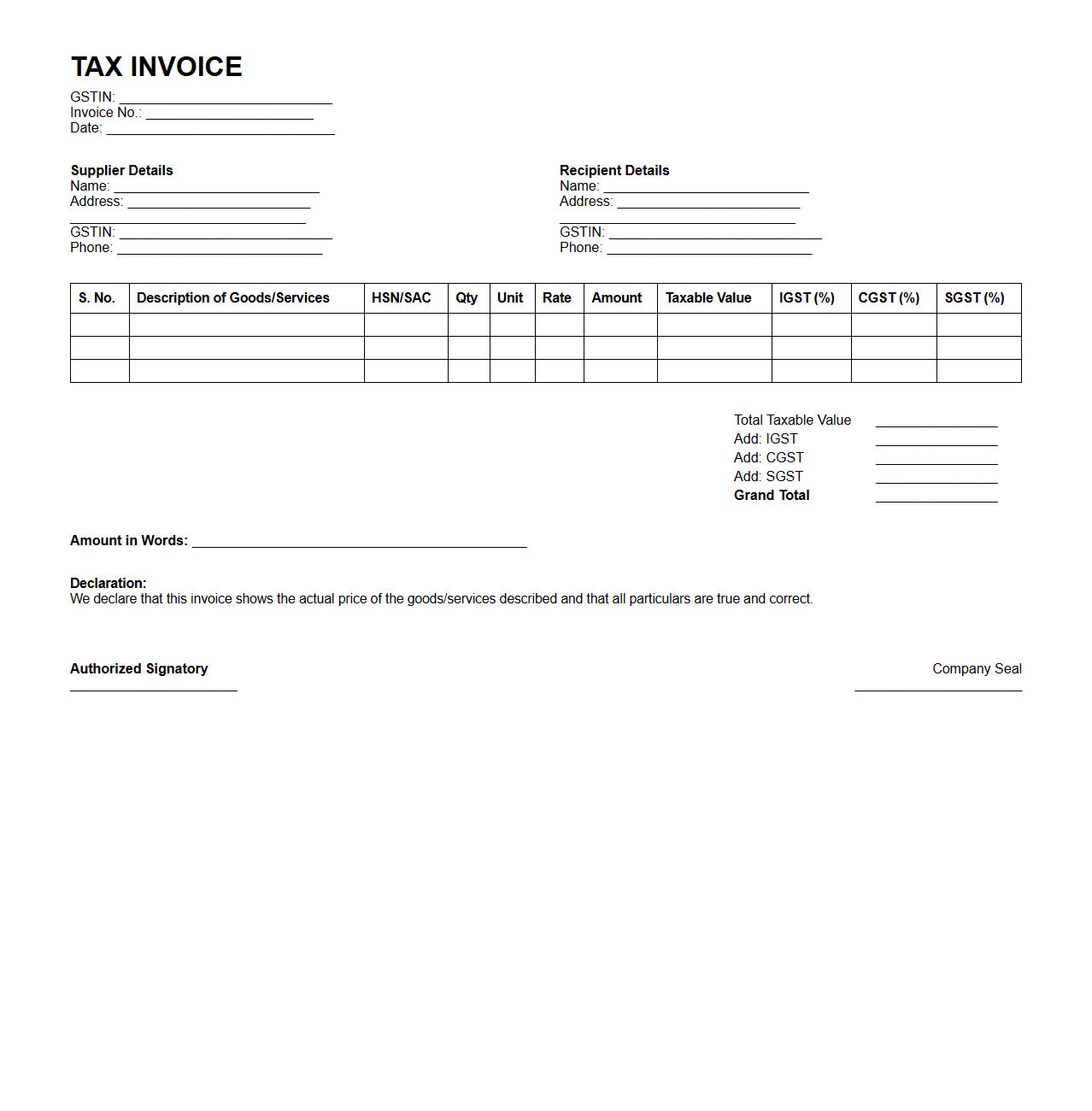

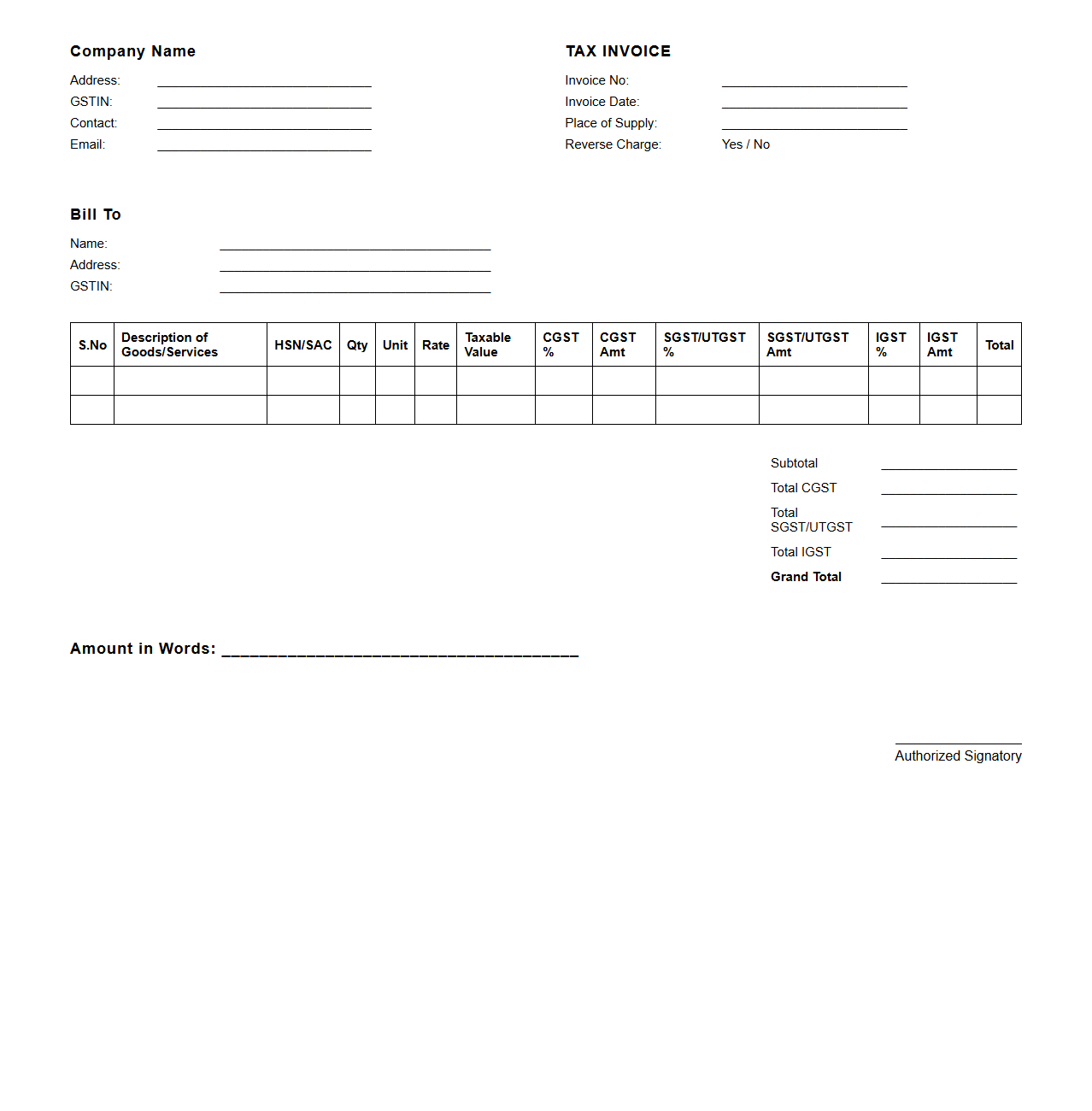

GST Compliant Tax Invoice Template Blank Format

A

GST Compliant Tax Invoice Template Blank Format is a standardized document used by businesses to generate invoices adhering to Goods and Services Tax regulations. This template includes essential fields like invoice number, date, supplier and recipient details, GSTIN, HSN/SAC codes, taxable value, and applicable GST rates, ensuring accurate tax reporting. Utilizing such a template helps maintain compliance with GST laws, simplifies audit processes, and enhances transparency in financial transactions.

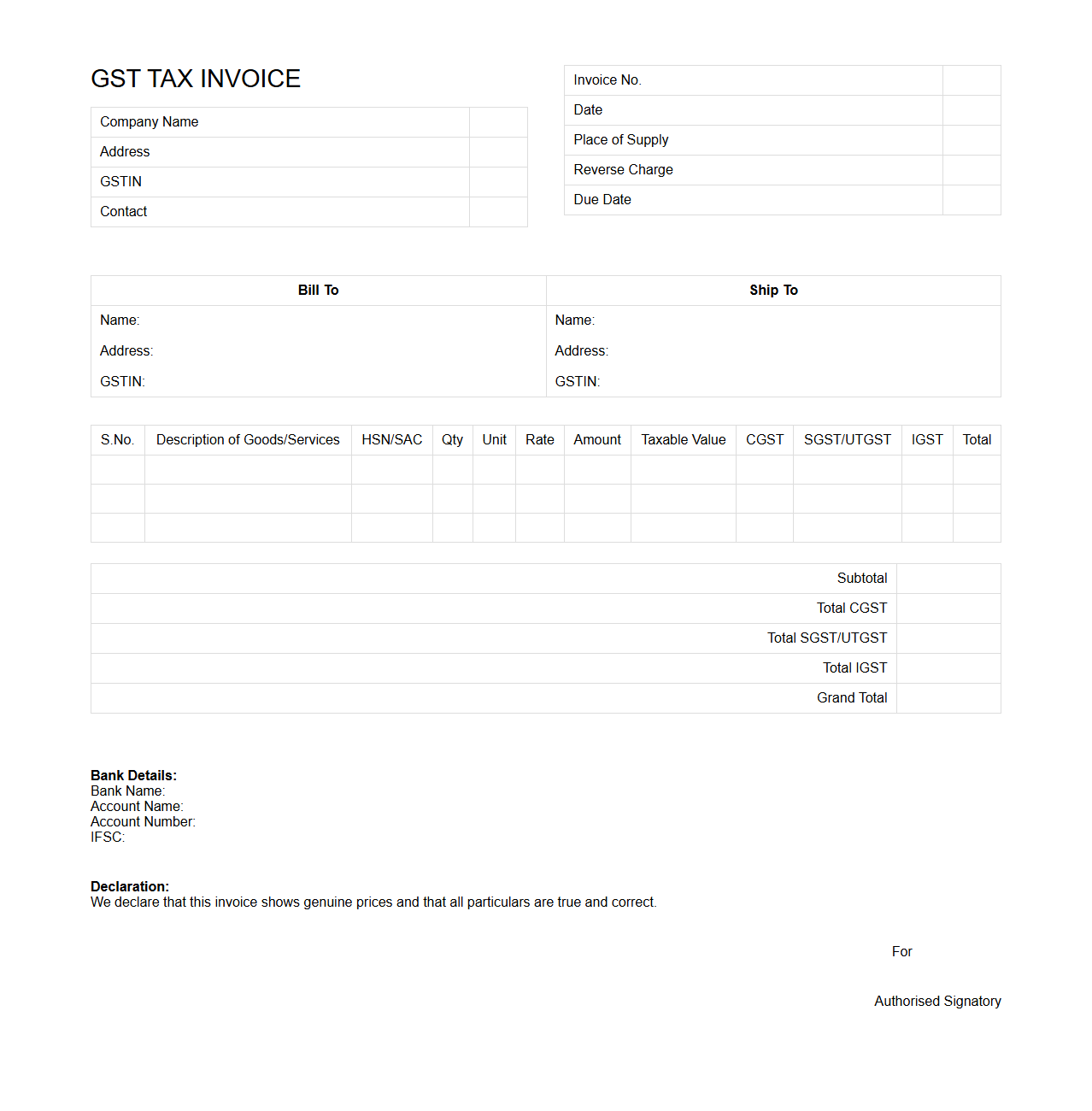

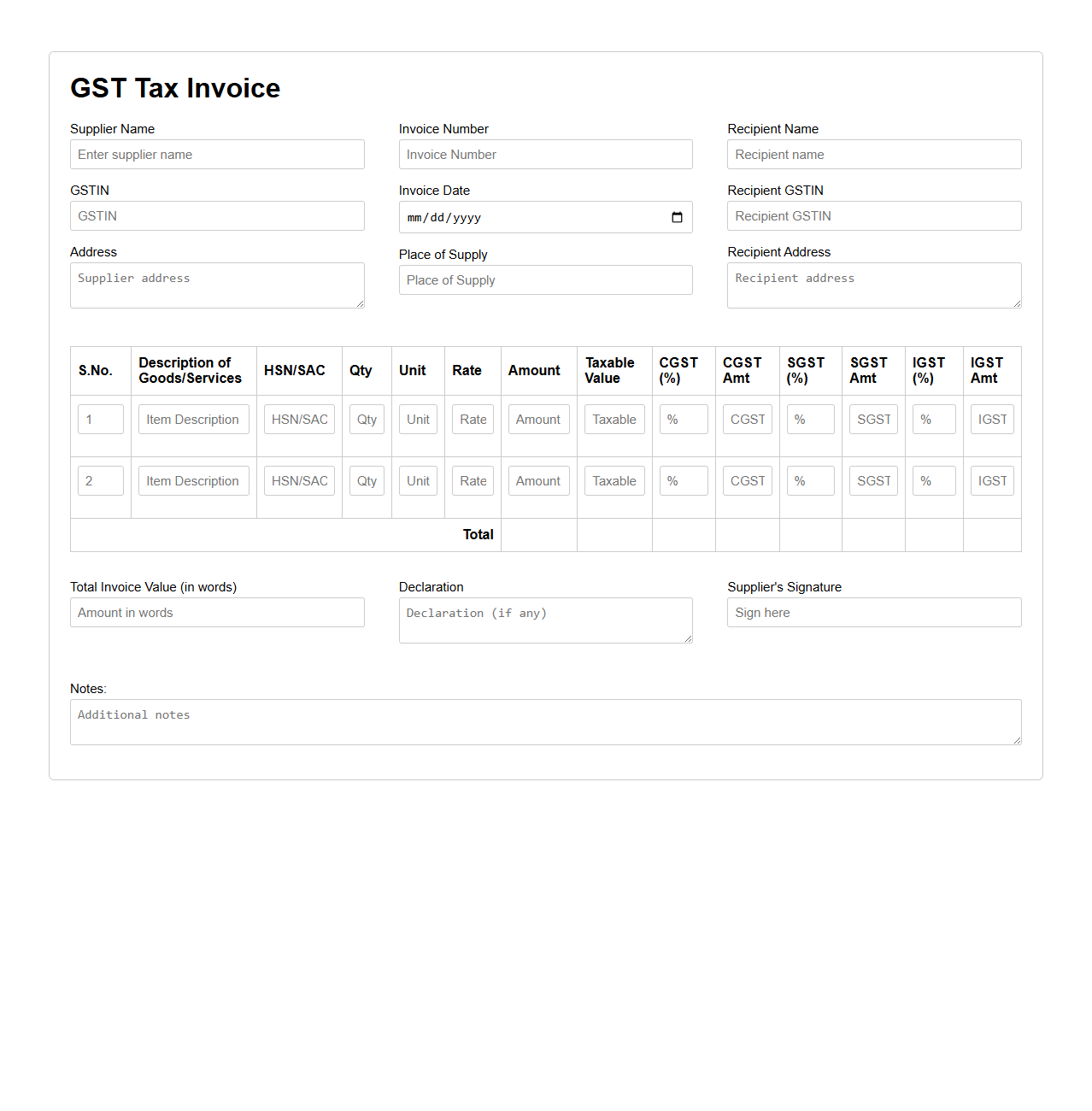

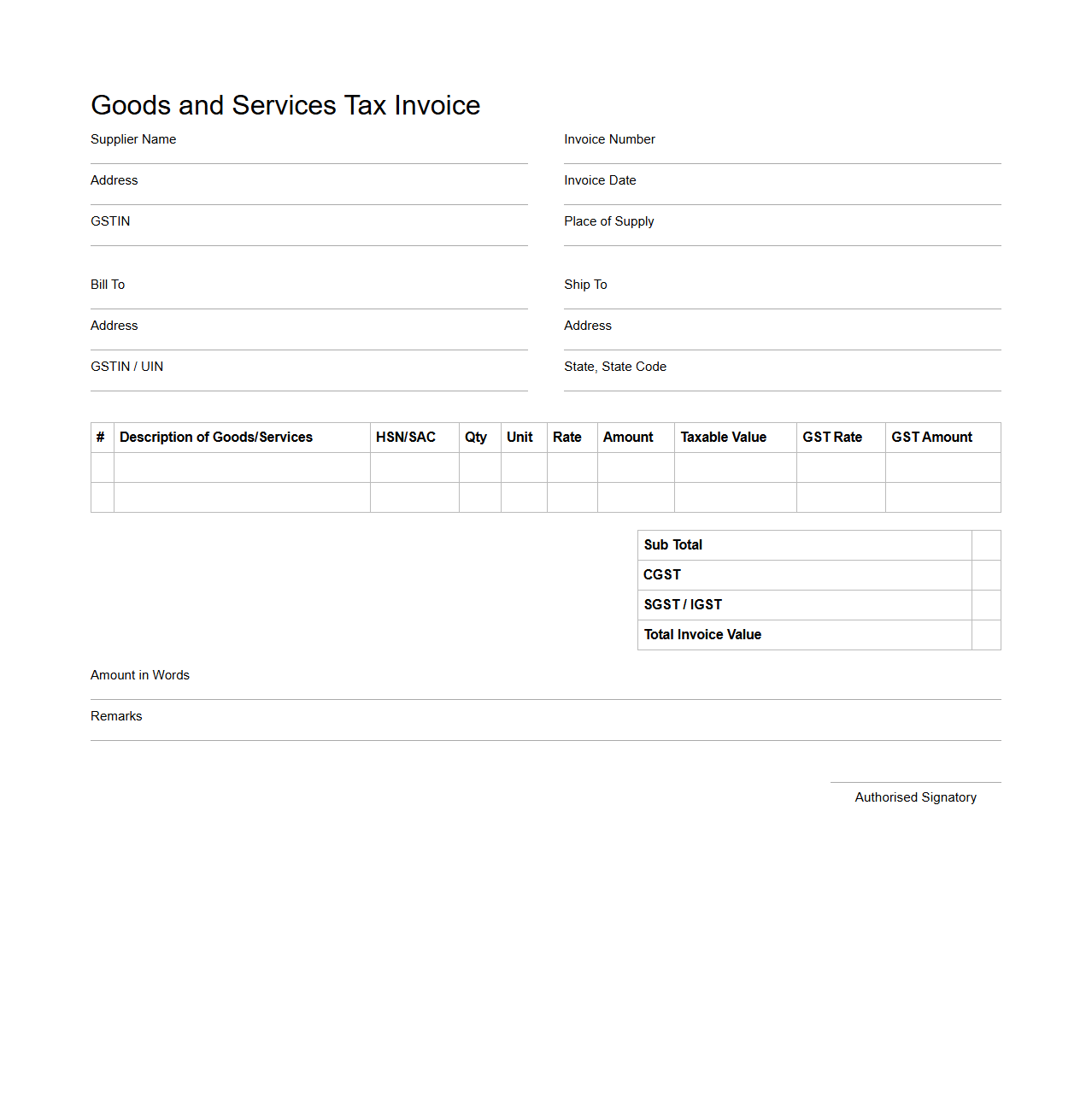

Minimal GST Tax Invoice Template Blank Sheet

A

Minimal GST Tax Invoice Template Blank Sheet is a simplified document designed for businesses to record and present transaction details while complying with GST regulations. It includes essential fields such as supplier and recipient information, invoice number, date, item descriptions, quantities, rates, and applicable GST rates without unnecessary embellishments. This blank template streamlines invoicing processes, ensuring accuracy and ease of customization for various business needs.

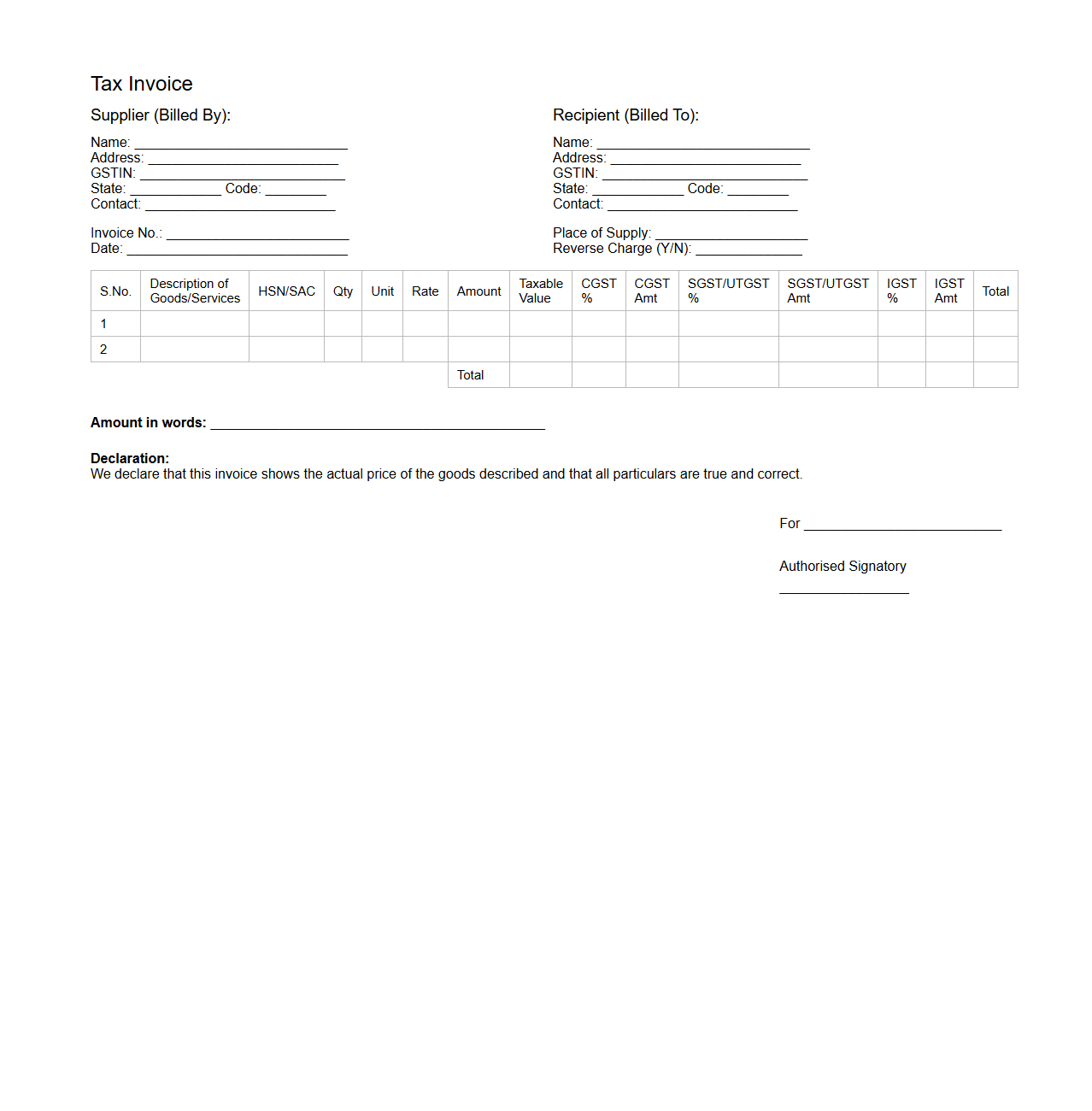

Blank B2B Tax Invoice Template for GST

A

Blank B2B Tax Invoice Template for GST is a customizable document designed for business-to-business transactions under the Goods and Services Tax (GST) system. It includes essential fields such as supplier and recipient details, GSTIN, invoice number, date, description of goods or services, taxable value, applicable GST rates, and total amount payable. This template ensures compliance with GST regulations while simplifying accurate invoicing and financial record-keeping for businesses.

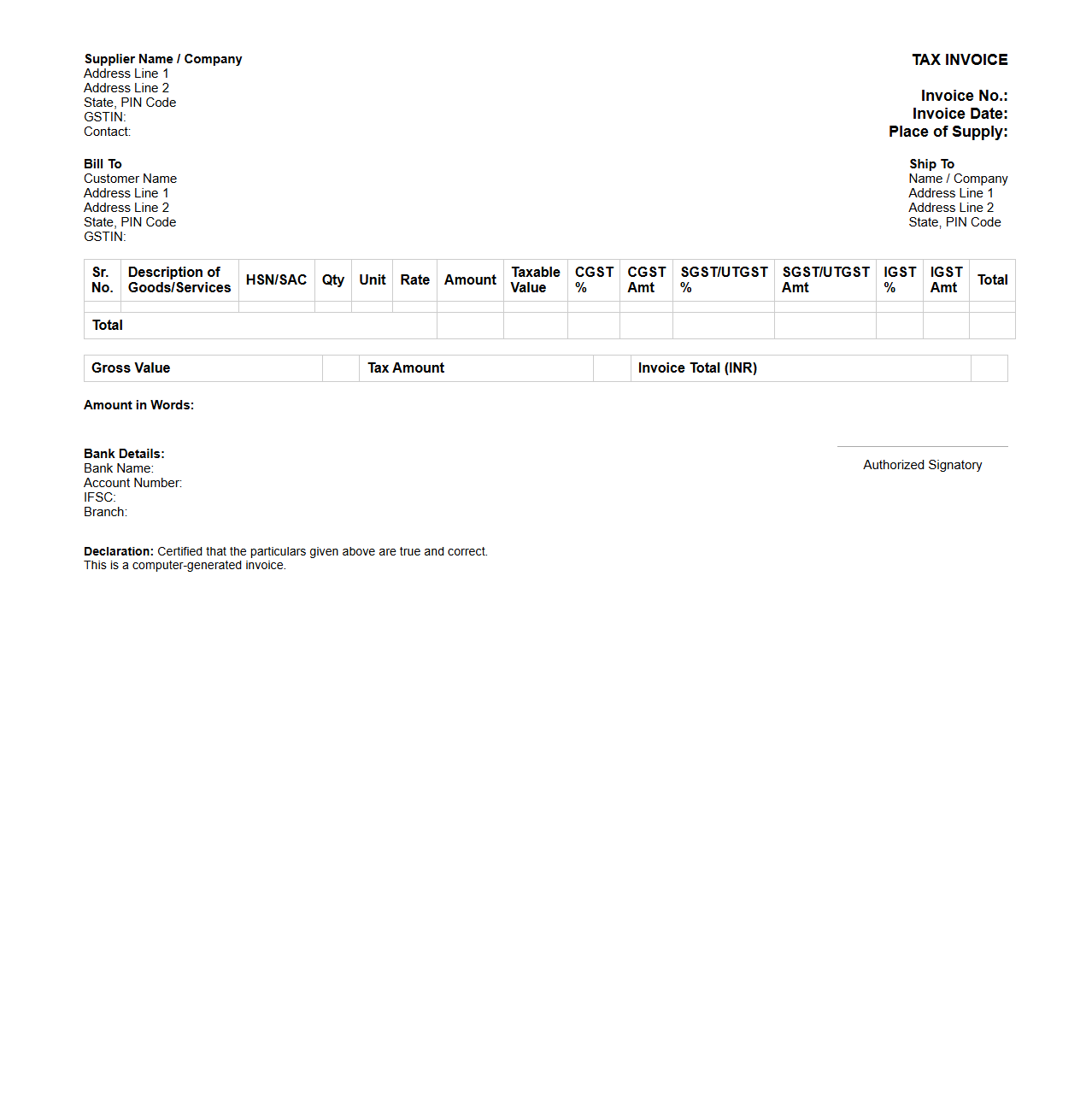

GST Tax Invoice Format Blank for Small Businesses

A

GST Tax Invoice Format Blank for small businesses is a pre-designed template that complies with Goods and Services Tax regulations, enabling sellers to accurately record sales transactions and tax details. It includes essential fields such as supplier and recipient information, invoice number, date, HSN/SAC codes, taxable value, GST rates, and tax amounts for CGST, SGST, or IGST. This document simplifies invoicing, ensures legal compliance, and aids in maintaining clear financial records for tax filing and audits.

Blank A4 Tax Invoice Template for GST Regulations

A

Blank A4 Tax Invoice Template for GST Regulations is a standardized document designed to comply with Goods and Services Tax requirements, ensuring accurate recording of sales transactions. It includes essential details such as supplier information, GSTIN, invoice number, date, description of goods or services, tax rates, and amounts, facilitating transparent and lawful taxation. This template aids businesses in maintaining proper GST documentation for audits and compliance.

Blank GST Tax Invoice Template with Itemized Fields

A

Blank GST Tax Invoice Template with Itemized Fields document is a pre-formatted billing form designed to comply with Goods and Services Tax (GST) regulations. It includes detailed sections for item-wise description, quantity, unit price, tax rates, and total amounts, ensuring accurate tax calculation and transparent invoicing. This template facilitates easy customization for businesses to generate professional GST-compliant invoices quickly and efficiently.

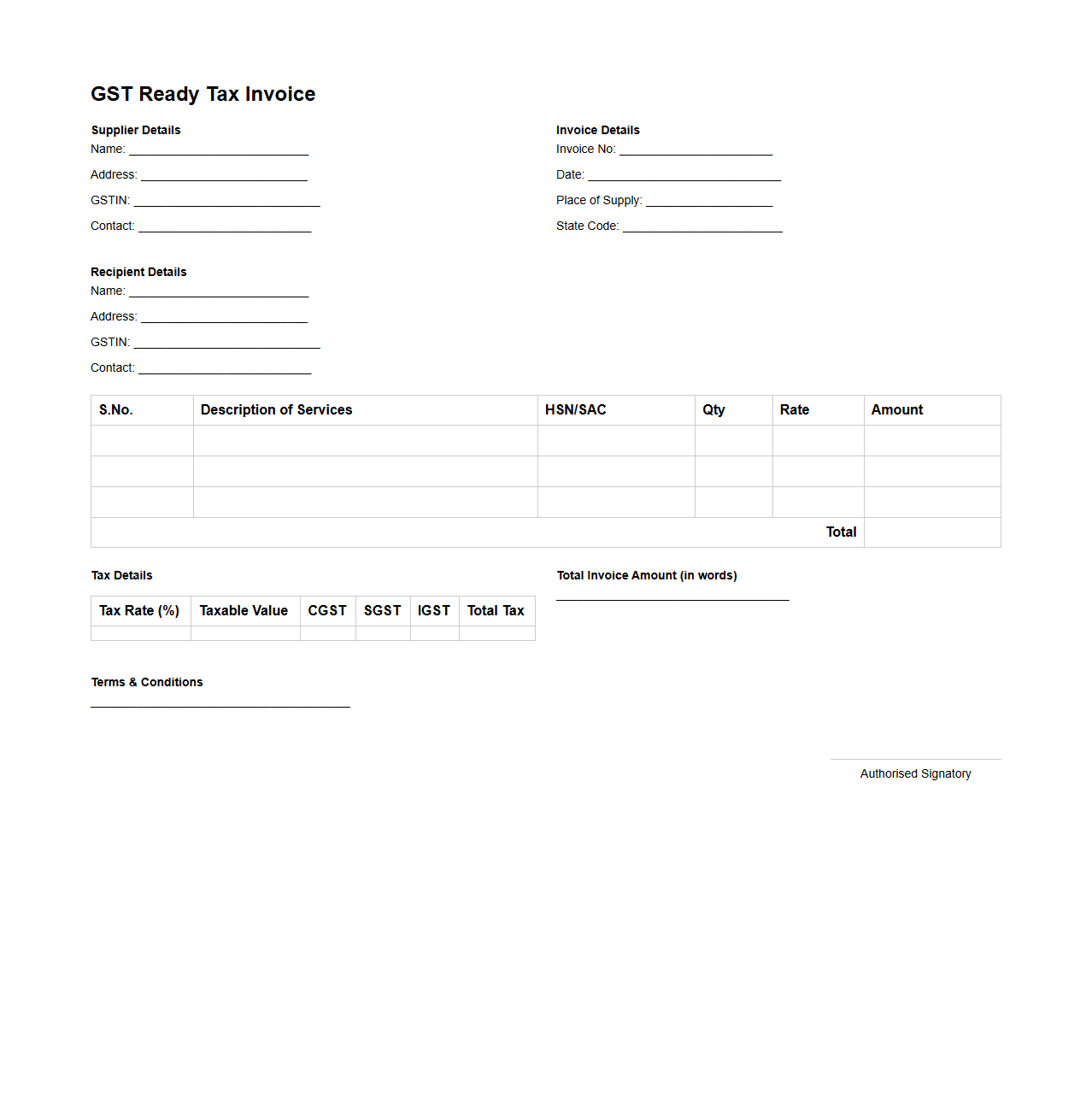

GST Ready Blank Tax Invoice Template for Services

A

GST Ready Blank Tax Invoice Template for Services is a pre-formatted document designed to meet Goods and Services Tax (GST) compliance requirements for service-based businesses. It includes essential fields such as supplier and recipient details, GSTIN, invoice number, date, service description, taxable value, GST rate, and amount. This template streamlines billing processes, ensuring accurate tax calculations and easy record-keeping for GST audits and returns.

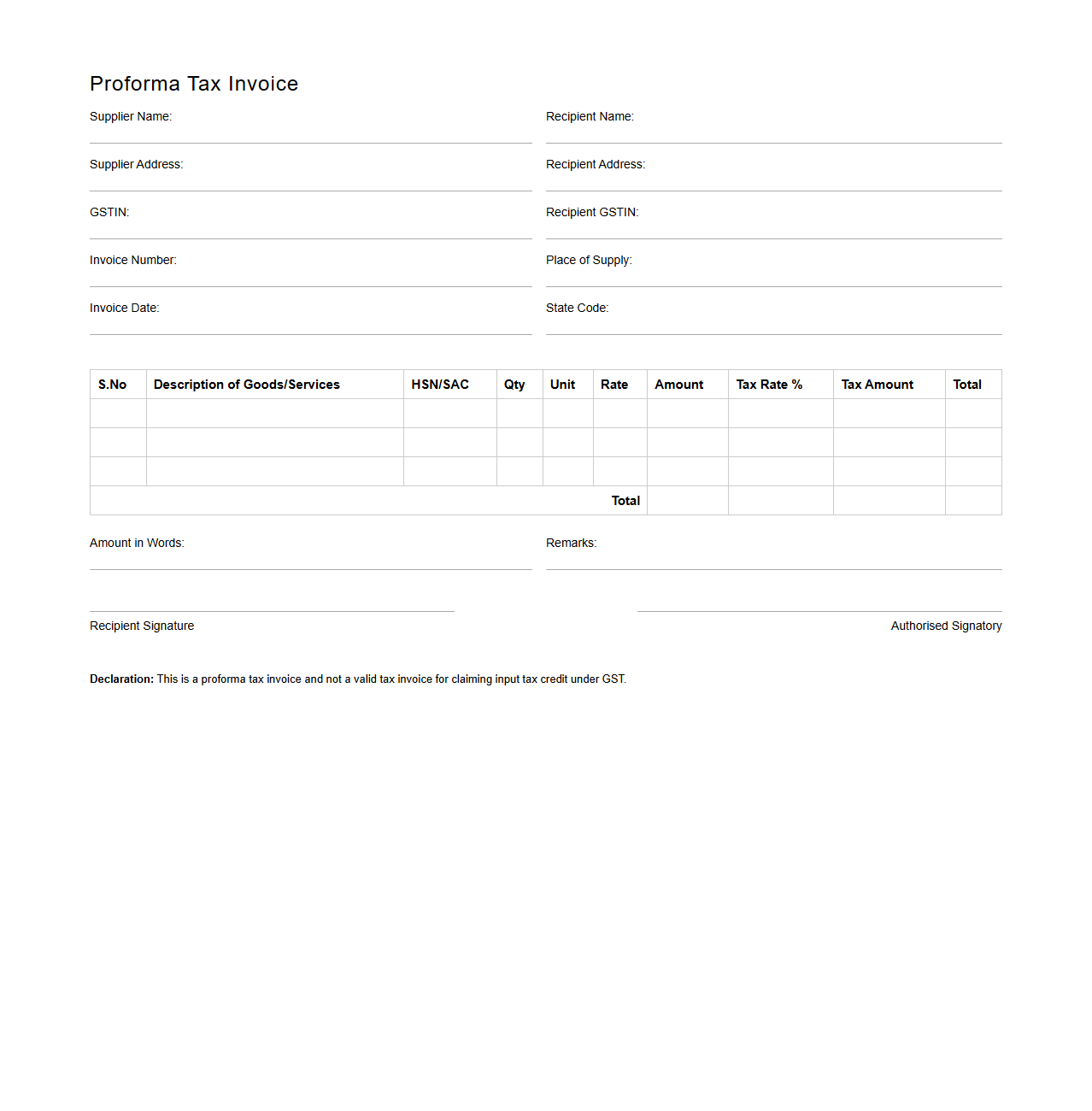

Blank Proforma Tax Invoice Template for GST Compliance

A

Blank Proforma Tax Invoice Template for GST Compliance is a pre-designed document used by businesses to provide a preliminary invoice outline before the final sale is confirmed under GST regulations. It includes essential fields such as supplier and recipient details, GSTIN numbers, item descriptions, quantities, tax rates, and calculated GST amounts, ensuring accurate tax reporting and legal adherence. This template helps maintain transparency and streamlines invoicing processes in line with Goods and Services Tax compliance requirements.

GST Business Tax Invoice Template Blank Layout

A

GST Business Tax Invoice Template Blank Layout document is a structured digital or printable form designed to facilitate accurate and compliant invoicing under the Goods and Services Tax (GST) regime. It typically includes fields for essential details such as supplier and recipient information, GSTIN numbers, invoice number, date, itemized list of goods or services, tax rate, and total amount. This template ensures consistency, legal adherence, and simplifies the billing process for businesses across GST-implemented regions.

Blank Goods and Services Tax Invoice Template

A

Blank Goods and Services Tax (GST) Invoice Template is a pre-designed document used by businesses to record and communicate sales transactions involving taxable goods and services. It includes essential fields such as supplier details, GSTIN, invoice number, date, item descriptions, quantity, rate, taxable value, and applicable GST rates (CGST, SGST, IGST). This template ensures compliance with GST regulations by providing a standardized format for accurate tax calculation and transparent invoicing.

What essential fields must a blank tax invoice contain for GST compliance?

A blank tax invoice must include the supplier's name, GSTIN, and address to comply with GST regulations. It should also have fields for the recipient's details, such as name and GSTIN if registered. Additionally, crucial invoice details like invoice number, date, and taxable value must be present.

How should a blank tax invoice be formatted for audit readiness?

For audit readiness, a blank tax invoice should maintain a clear, consistent layout with designated spaces for all mandatory data points. It is important to include serially numbered invoices to ensure traceability. The format must allow easy verification of tax calculations and GST rates.

Are there penalties for issuing incomplete or blank tax invoices under GST laws?

Issuing incomplete or blank tax invoices under GST laws can lead to strict penalties, including fines and denial of input tax credit. It is considered a compliance violation that can attract scrutiny from tax authorities. Businesses must ensure invoices are fully completed to avoid such legal consequences.

Can electronic blank tax invoice templates be used for GST records?

Electronic blank tax invoice templates are permissible for GST records if they comply with GST invoicing rules and formats. These templates should support digital signatures and proper data entry to maintain authenticity. Using electronic formats improves record-keeping efficiency and audit readiness.

What are the risks of pre-signing a blank tax invoice for GST purposes?

Pre-signing a blank tax invoice poses risks of misuse and fraudulent issuance under GST laws. It can result in inadvertent acceptance of illegal transactions or tax evasion penalties. Ensuring invoices are signed post-completion guarantees accuracy and compliance.