A Blank Financial Plan Template for Small Businesses provides a structured format to outline revenue, expenses, and cash flow projections. It helps entrepreneurs organize financial goals and track performance effectively. This template supports clear budgeting and strategic decision-making for sustainable growth.

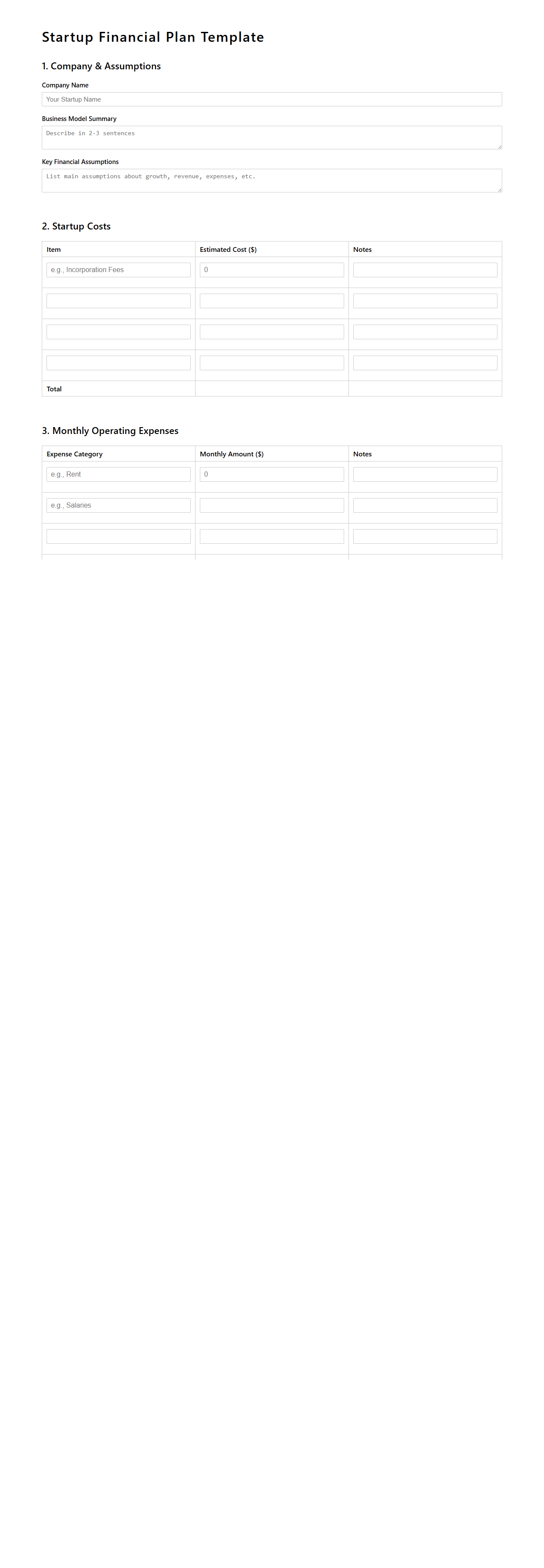

Blank Startup Financial Plan Template for Entrepreneurs

A

Blank Startup Financial Plan Template for Entrepreneurs is a comprehensive tool designed to help new business owners outline their projected revenues, expenses, and cash flows effectively. This template aids in creating detailed financial forecasts, budgeting, and funding plans essential for securing investments and managing resources efficiently. By utilizing this document, entrepreneurs can strategically plan their financial milestones and ensure sustainable business growth.

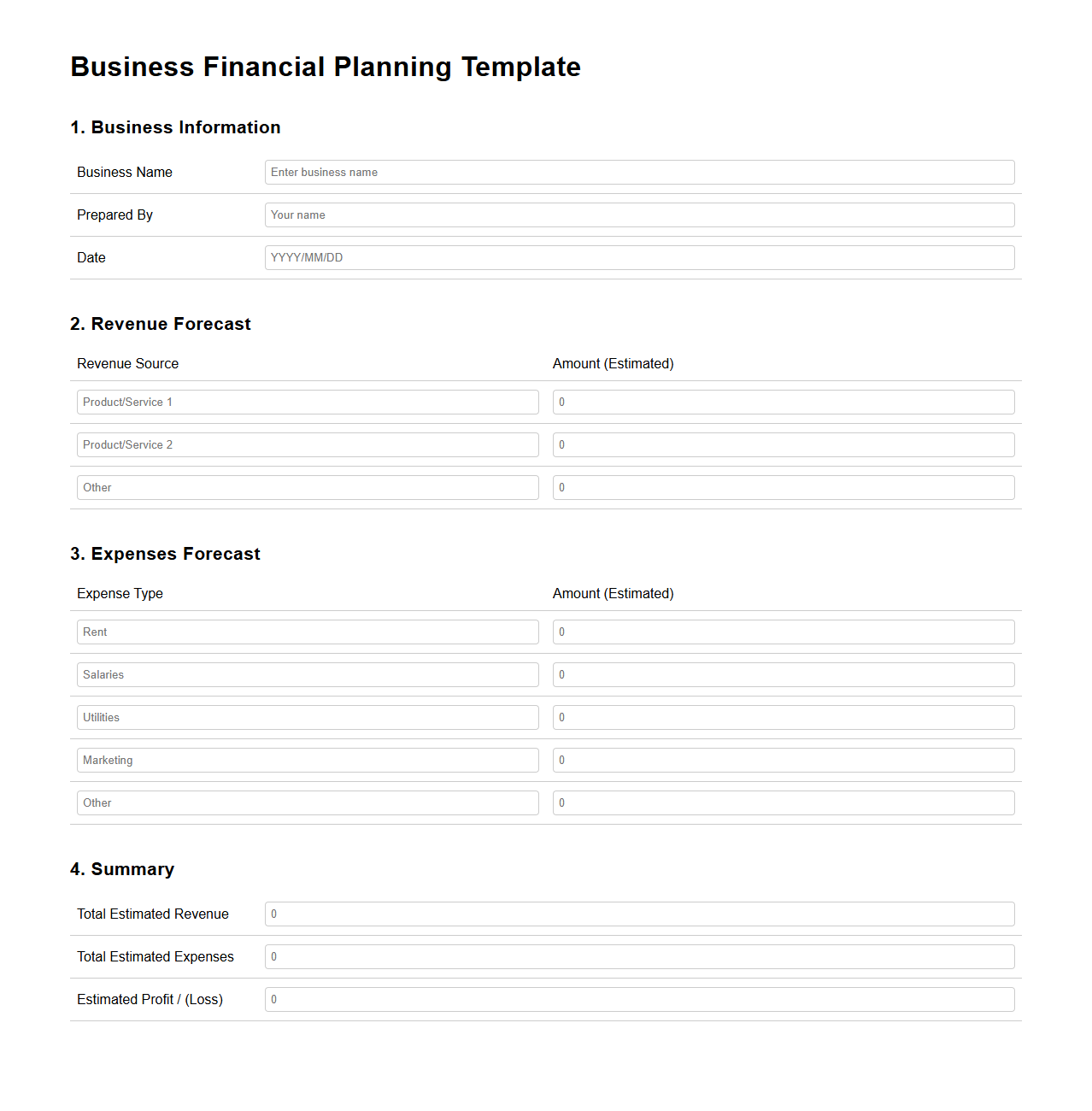

Basic Blank Business Financial Planning Template

The

Basic Blank Business Financial Planning Template document serves as a foundational tool for entrepreneurs and business owners to organize and forecast their financial data effectively. It typically includes sections for income statements, cash flow projections, and budget tracking, enabling precise financial analysis and decision-making. This template supports clear visualization of expenses and revenue streams, essential for strategic planning and securing investor confidence.

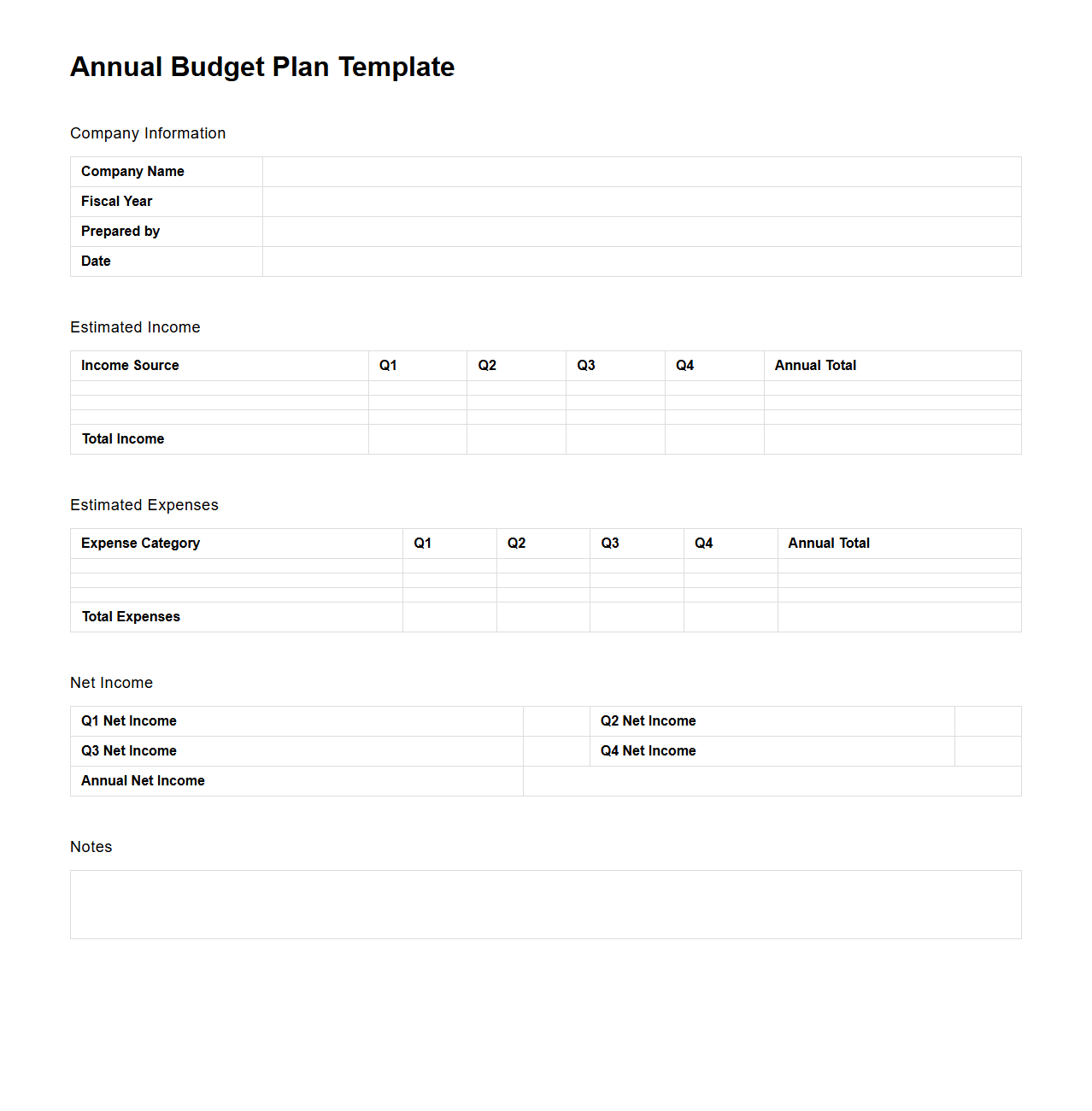

Blank Annual Budget Plan Template for Small Companies

A

Blank Annual Budget Plan Template for small companies is a structured document designed to help businesses outline their projected income, expenses, and financial goals for the upcoming year. It provides a clear framework for tracking revenue streams, managing operational costs, and allocating resources effectively to ensure financial stability and growth. This template is essential for small companies aiming to maintain organized financial planning and make informed budgetary decisions.

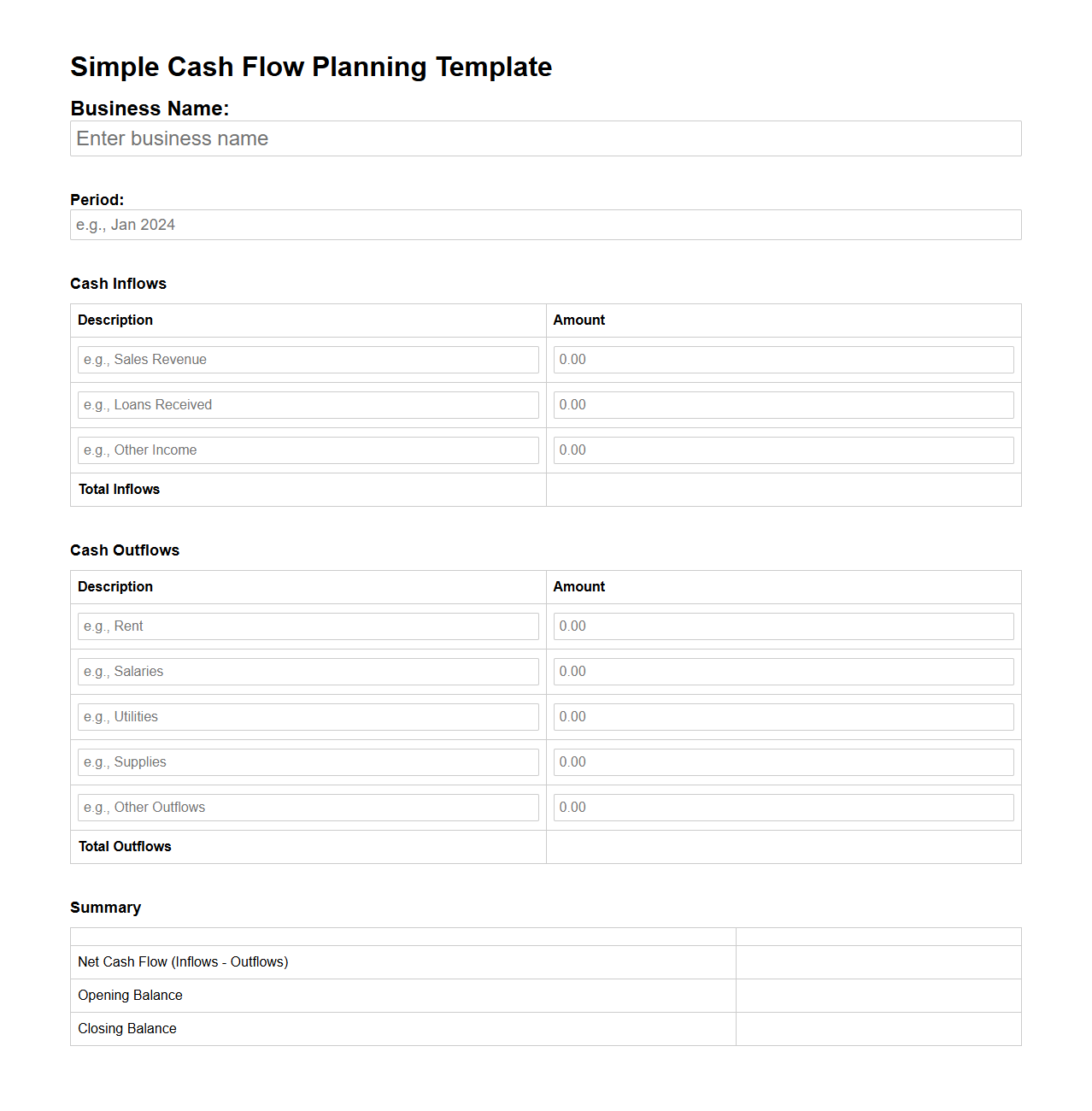

Simple Blank Cash Flow Planning Template for Small Businesses

The

Simple Blank Cash Flow Planning Template for small businesses is a streamlined financial tool designed to help entrepreneurs track and forecast their monthly income and expenditures. This template allows small business owners to visualize cash inflows and outflows, ensuring better management of liquidity and timely decision-making. It serves as a practical guide for maintaining financial stability and planning for growth by highlighting potential cash shortages or surpluses.

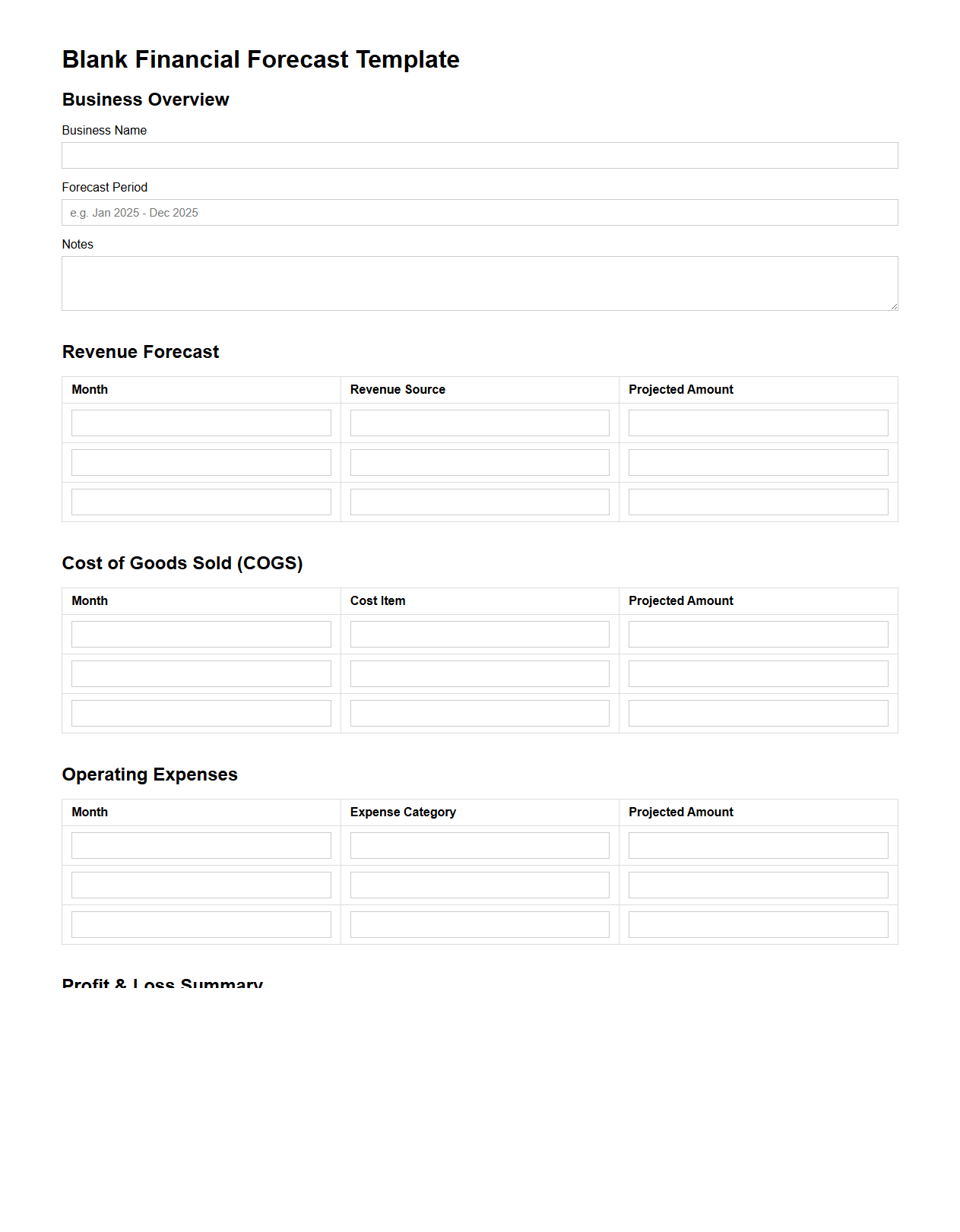

Blank Financial Forecast Template for Small Business Owners

A

Blank Financial Forecast Template for Small Business Owners is a structured tool designed to project future revenues, expenses, and cash flow, allowing entrepreneurs to plan and manage their finances effectively. This template helps identify potential financial gaps, set realistic goals, and make informed decisions based on expected economic conditions. It typically includes customizable sections for sales forecasts, operating costs, profit margins, and expenditure estimates, tailored to the specific needs of small businesses.

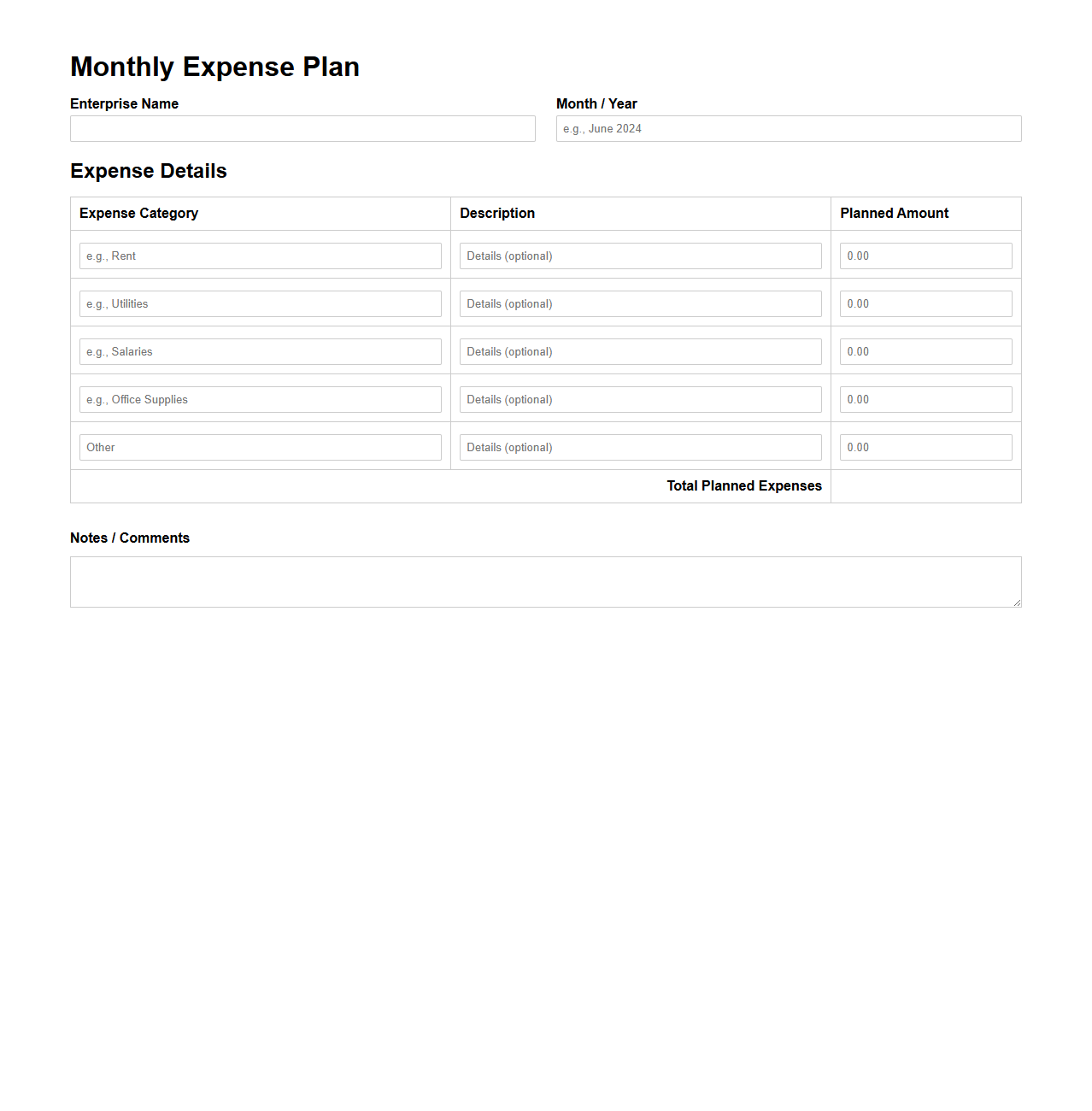

Blank Monthly Expense Plan Template for Small Enterprises

A

Blank Monthly Expense Plan Template for small enterprises is a structured document used to track and manage monthly spending efficiently. It helps business owners categorize expenses, forecast cash flow, and maintain budget control, promoting financial stability. This template is customizable to fit various small business needs, ensuring clear visibility of financial obligations and enabling informed decision-making.

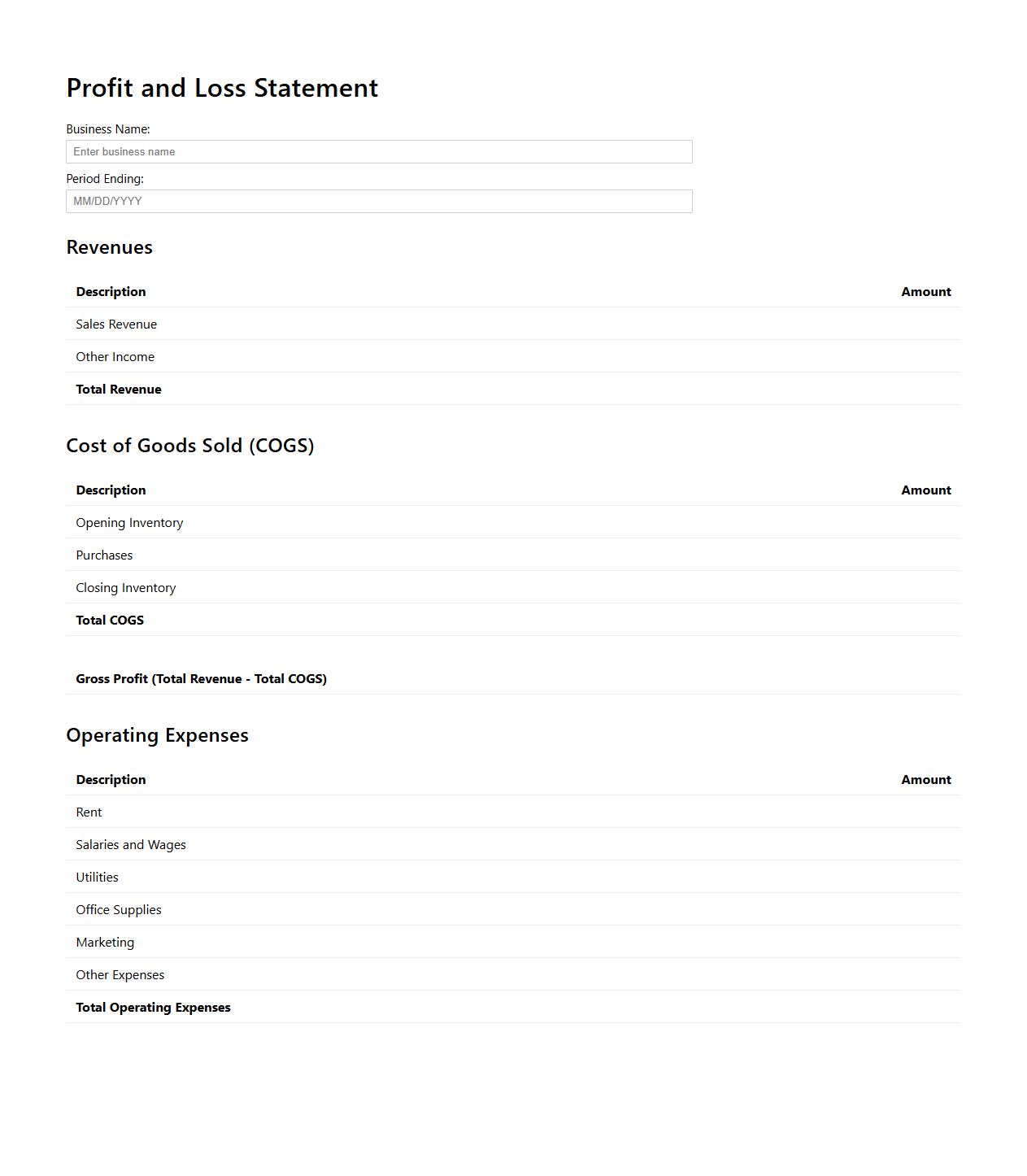

Blank Profit and Loss Statement Template for Small Businesses

A

Blank Profit and Loss Statement Template for Small Businesses is a financial document designed to help entrepreneurs track their revenue, expenses, and net profit over a specific period. This template allows small business owners to organize their income and costs systematically, facilitating clear insights into financial performance and profitability. Utilizing such a template supports accurate financial analysis and informed decision-making for business growth.

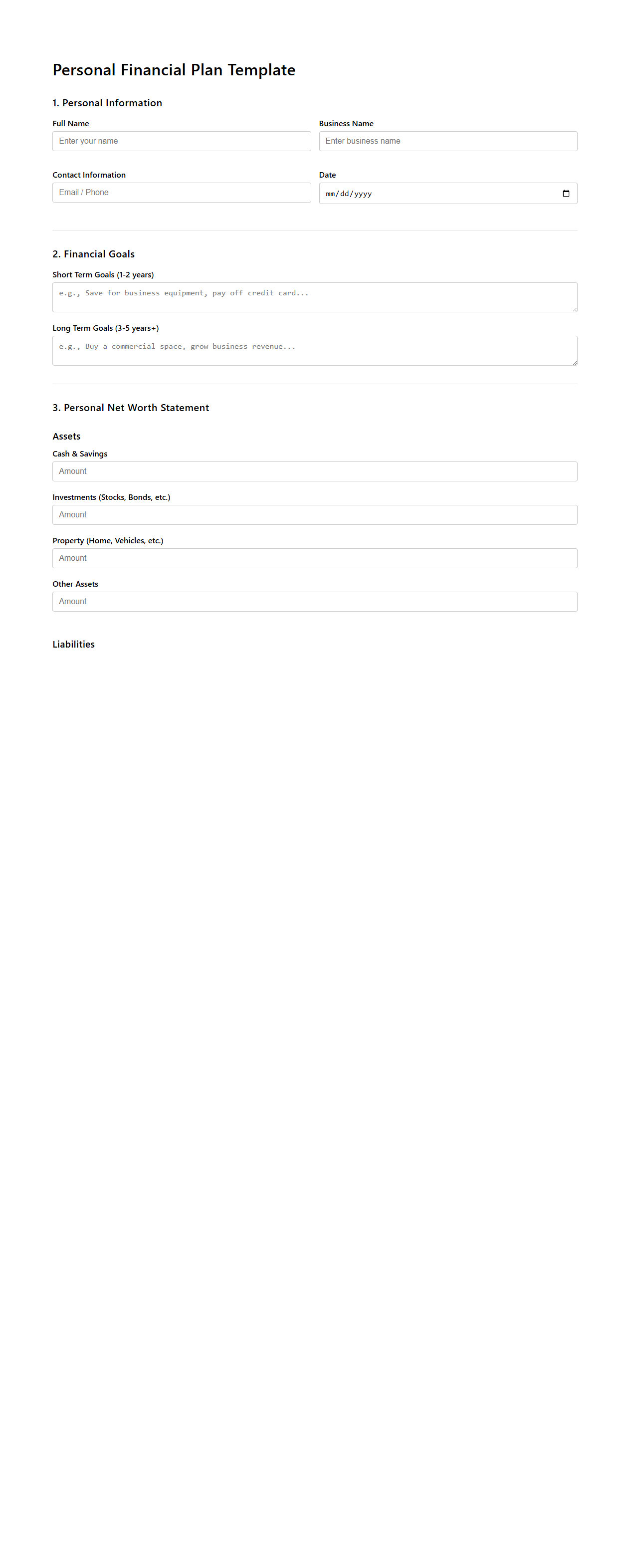

Blank Personal Financial Plan Template for Small Business Owners

A

Blank Personal Financial Plan Template for small business owners is a structured document designed to help individuals organize and manage their personal finances alongside their business financials. It typically includes sections for budgeting, tracking income and expenses, setting financial goals, and planning for taxes and retirement. This template aids in creating a clear overview of personal financial health, supporting better decision-making and long-term financial stability.

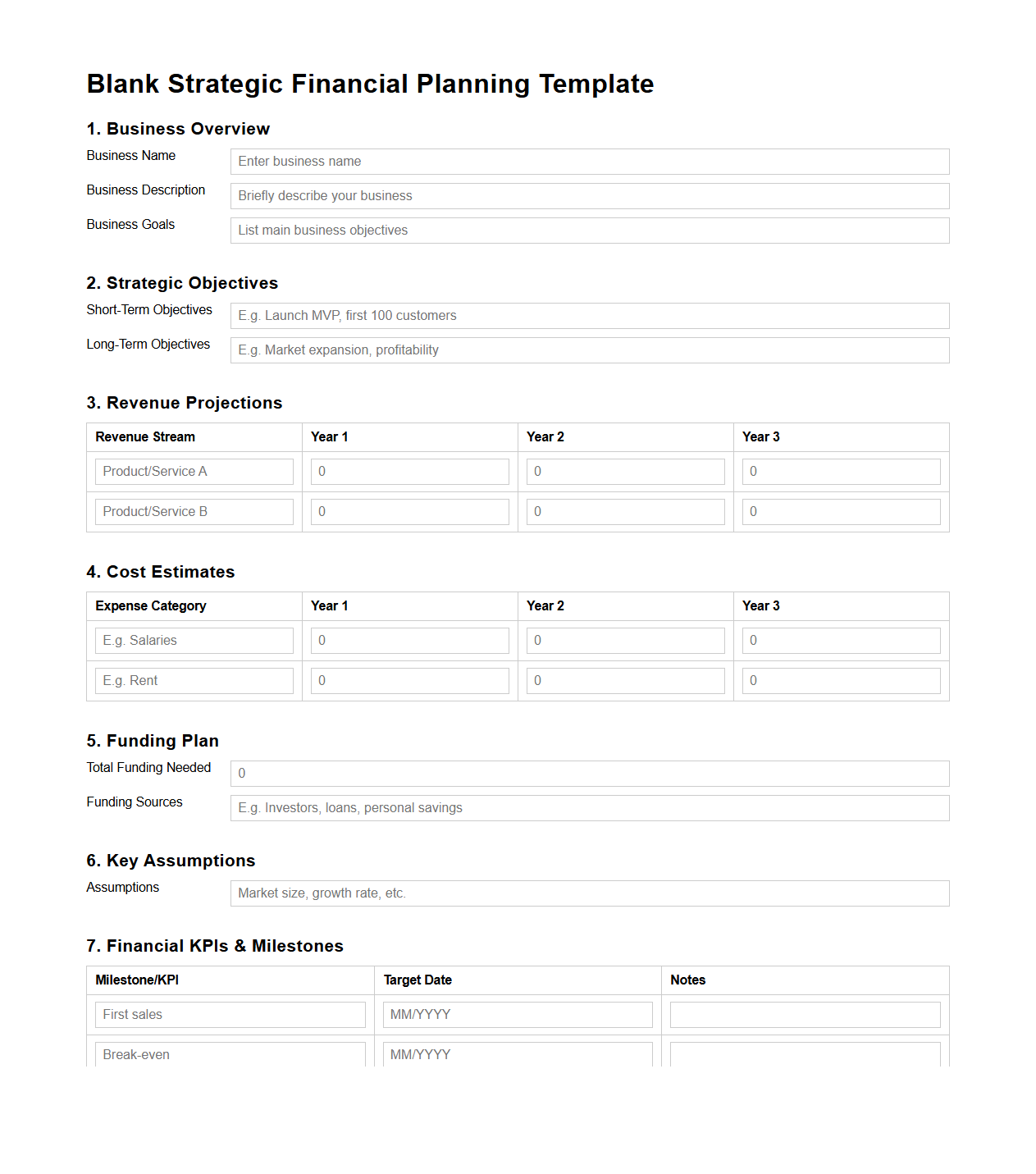

Blank Strategic Financial Planning Template for New Businesses

The

Blank Strategic Financial Planning Template for New Businesses is a comprehensive tool designed to help startups outline detailed financial goals, budgets, and projections. It provides structured sections for forecasting revenue, managing expenses, and analyzing cash flow to ensure sustainable growth. This template serves as a critical framework for making informed financial decisions and attracting potential investors.

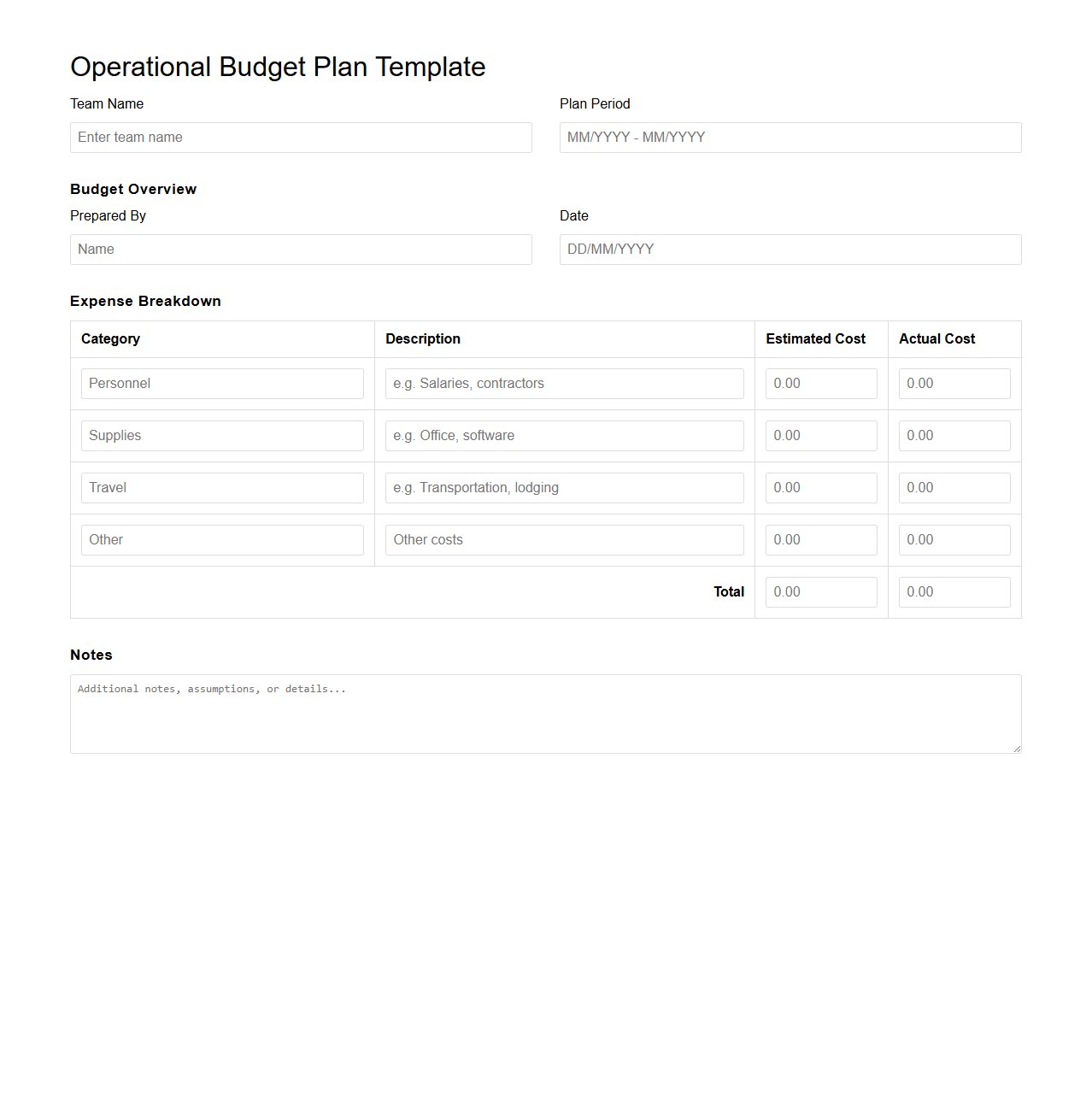

Blank Operational Budget Plan Template for Small Teams

A

Blank Operational Budget Plan Template for Small Teams is a structured document designed to help small teams systematically allocate and manage their financial resources. It provides customizable sections for forecasting expenses, projecting revenues, and tracking budget variances, ensuring efficient fund utilization. This template enhances financial planning accuracy and supports strategic decision-making for small-scale operations.

What key sections should be included in a blank financial plan template for small businesses?

A blank financial plan template for small businesses must include income statements, balance sheets, and cash flow statements to provide a comprehensive view of financial health. It should also feature sections for sales forecasts, budgeting, and financial goals to guide business strategy. Including areas for financial ratios and break-even analysis ensures critical financial metrics are easily accessible.

How does a blank financial plan address cash flow projections specific to startups?

A blank financial plan incorporates detailed cash flow projections tailored to the unique needs of startups, such as variable expenses and initial funding inflows. It allows startups to estimate monthly inflows and outflows, helping to identify potential cash shortages early. This helps startups plan for operational sustainability by adjusting spending or seeking additional financing as needed.

What customizable line items are essential for expense tracking in a small business financial plan letter?

Essential customizable line items for expense tracking include rent, utilities, payroll, marketing, and inventory costs to reflect the specific expenses of the business accurately. Additionally, it is important to track one-time and recurring expenses separately for better financial management. Customizing these categories enables more precise budgeting and financial analysis tailored to business needs.

How can a blank financial plan help small businesses prepare for loan applications?

A blank financial plan provides a structured format for presenting financial projections and supporting data clearly to potential lenders. It helps small businesses demonstrate their ability to generate revenue, manage expenses, and service debt effectively. Providing organized financial documents within the plan increases credibility and improves the chances of loan approval.

What supporting documents should be referenced in a blank financial plan letter for small enterprises?

Supporting documents typically referenced include tax returns, bank statements, sales receipts, and proof of assets to substantiate the financial information presented. Business licenses, contracts, and loan agreements may also be included for completeness. Referencing these documents adds transparency and supports the accuracy of the financial plan.