A Blank Investment Proposal Template for Startups provides a structured framework to present business ideas clearly and professionally to potential investors. It includes sections for financial projections, market analysis, and funding requirements tailored specifically for new ventures. Utilizing this template helps startups communicate their value proposition effectively and secure necessary capital.

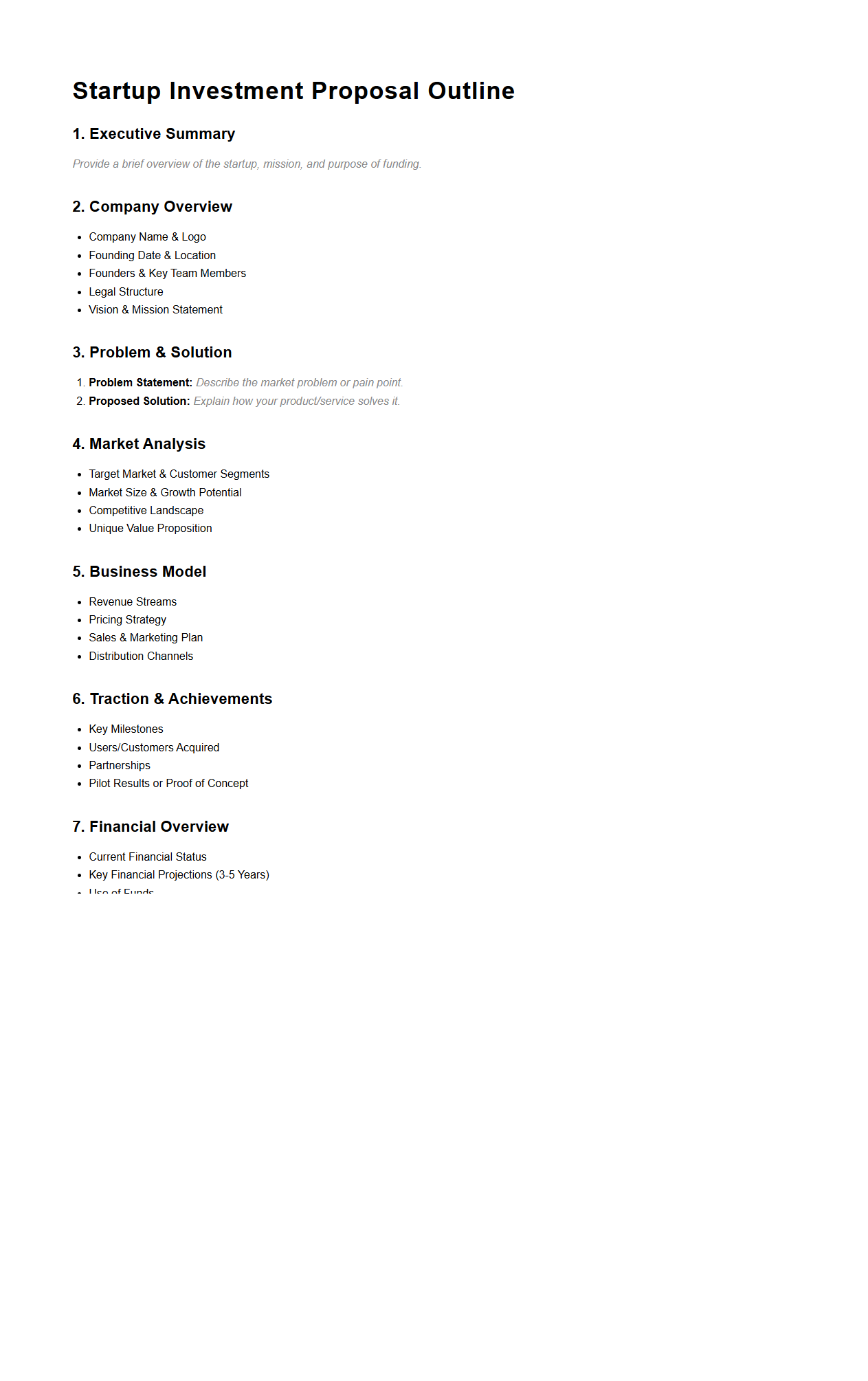

Startup Investment Proposal Outline Template

A

Startup Investment Proposal Outline Template document serves as a structured guide for entrepreneurs to present their business ideas clearly and persuasively to potential investors. It includes key sections such as executive summary, market analysis, business model, financial projections, and funding requirements, ensuring all critical aspects of the startup are covered. This template helps streamline the proposal creation process, making it easier to communicate the value proposition and investment potential effectively.

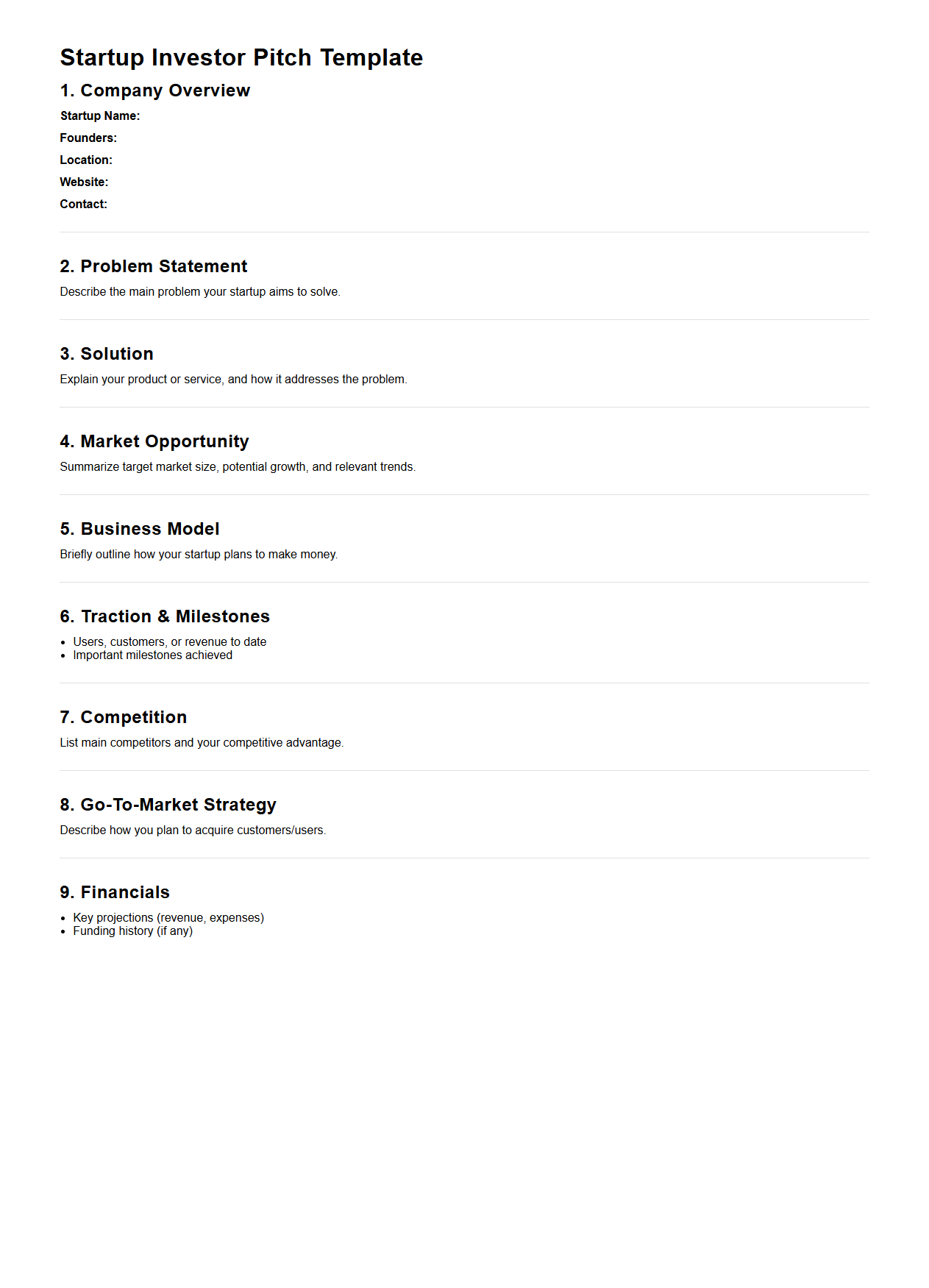

Investor Pitch Document Template for Startups

An Investor Pitch Document Template for Startups is a structured framework designed to help entrepreneurs present their business ideas clearly and compellingly to potential investors. This document typically includes key sections such as the problem statement, solution, market analysis, financial projections, and funding requirements. Using a

well-organized pitch template ensures startups effectively communicate their value proposition and increase their chances of securing investment.

Seed Funding Proposal Format for New Ventures

A

Seed Funding Proposal Format for new ventures outlines the structured plan entrepreneurs use to request initial capital from investors or angel funds. This document typically includes detailed sections such as business objectives, market analysis, product description, financial projections, and funding requirements to clearly communicate the startup's potential and funding needs. A well-organized format helps establish credibility, align expectations, and increase the chances of securing early-stage investment.

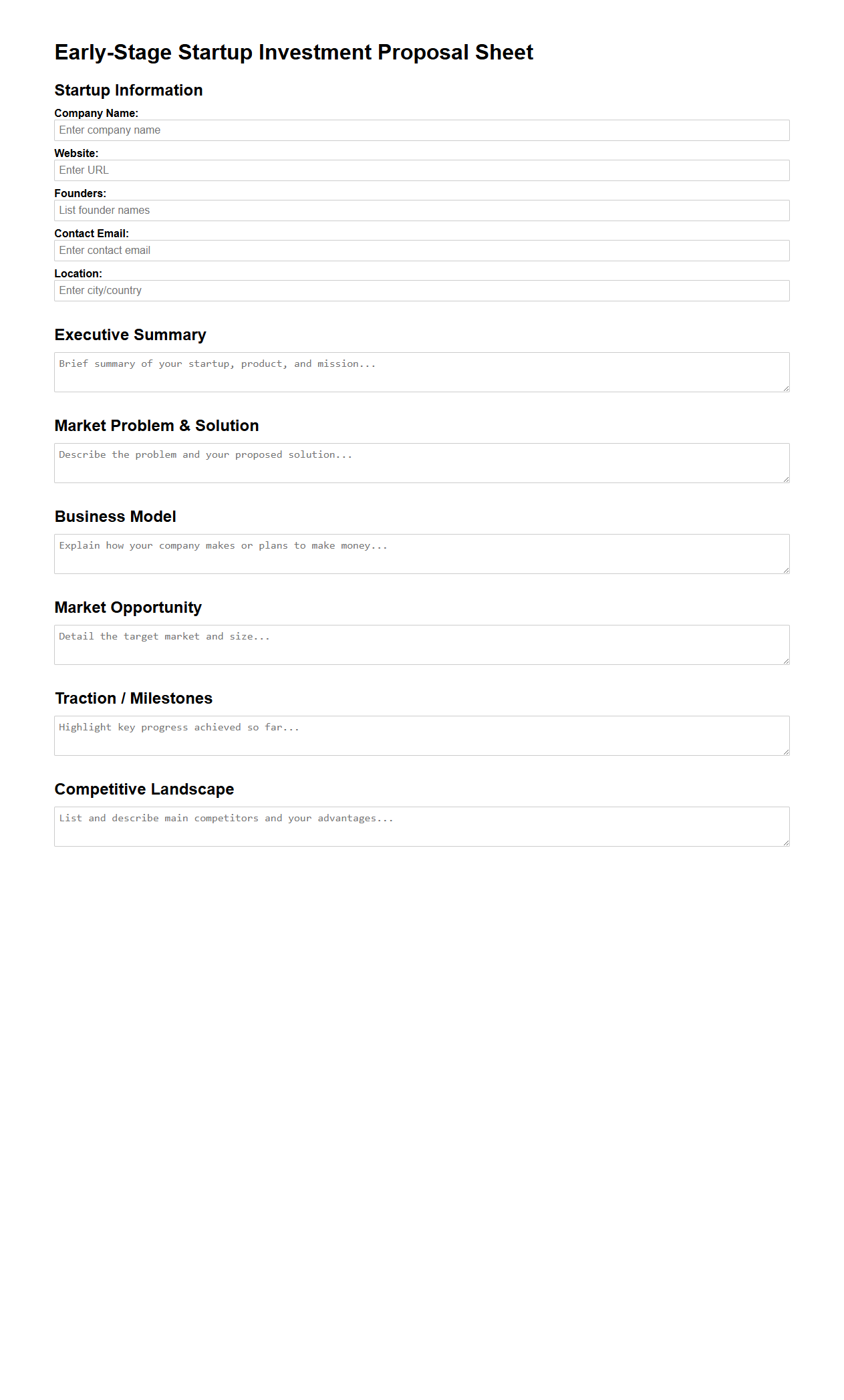

Early-Stage Startup Investment Proposal Sheet

An

Early-Stage Startup Investment Proposal Sheet is a concise document designed to present key information about a startup's business model, market opportunity, financial projections, and funding requirements to potential investors. It highlights the unique value proposition, team expertise, and growth potential, aiming to attract investment by clearly outlining how funds will be utilized to achieve critical milestones. This sheet serves as a foundational tool in investor communications, facilitating informed decision-making during the early financing rounds.

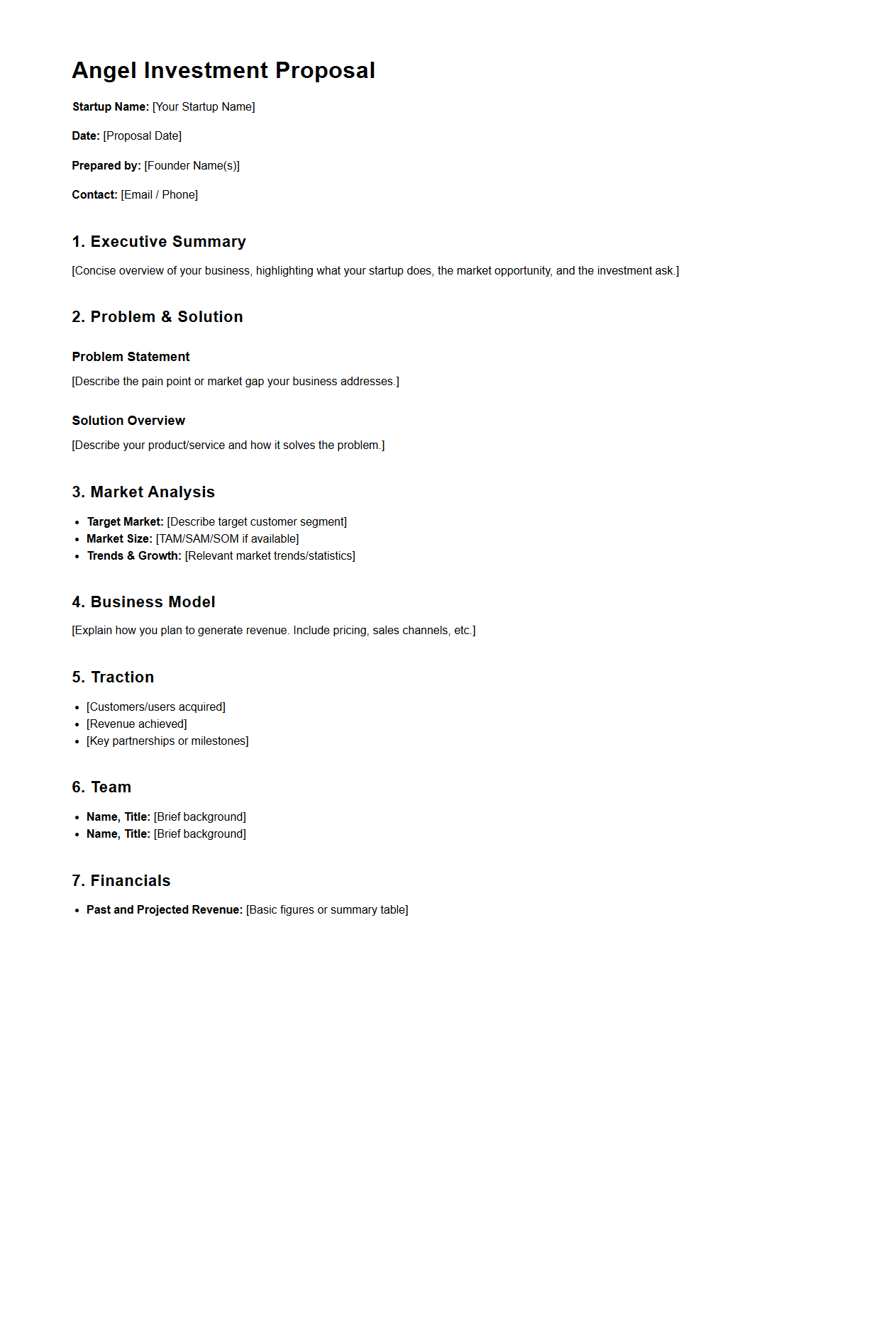

Angel Investment Proposal Sample for Entrepreneurs

An

Angel Investment Proposal Sample for Entrepreneurs is a structured document that outlines a startup's business plan, financial projections, and funding requirements aimed at attracting angel investors. It provides a clear overview of the company's value proposition, market opportunity, and growth strategy to demonstrate potential return on investment. This sample serves as a practical guide for entrepreneurs to effectively communicate their vision and secure early-stage capital from private investors.

Business Investment Request Template for Startups

A

Business Investment Request Template for Startups is a structured document designed to clearly outline a startup's funding needs, outlining its business model, financial projections, and growth potential to attract potential investors. It helps startups present their investment opportunity professionally, ensuring all critical information such as capital requirements, equity offered, and use of funds is communicated effectively. This template serves as a strategic tool to streamline the funding application process and enhance the chances of securing investment.

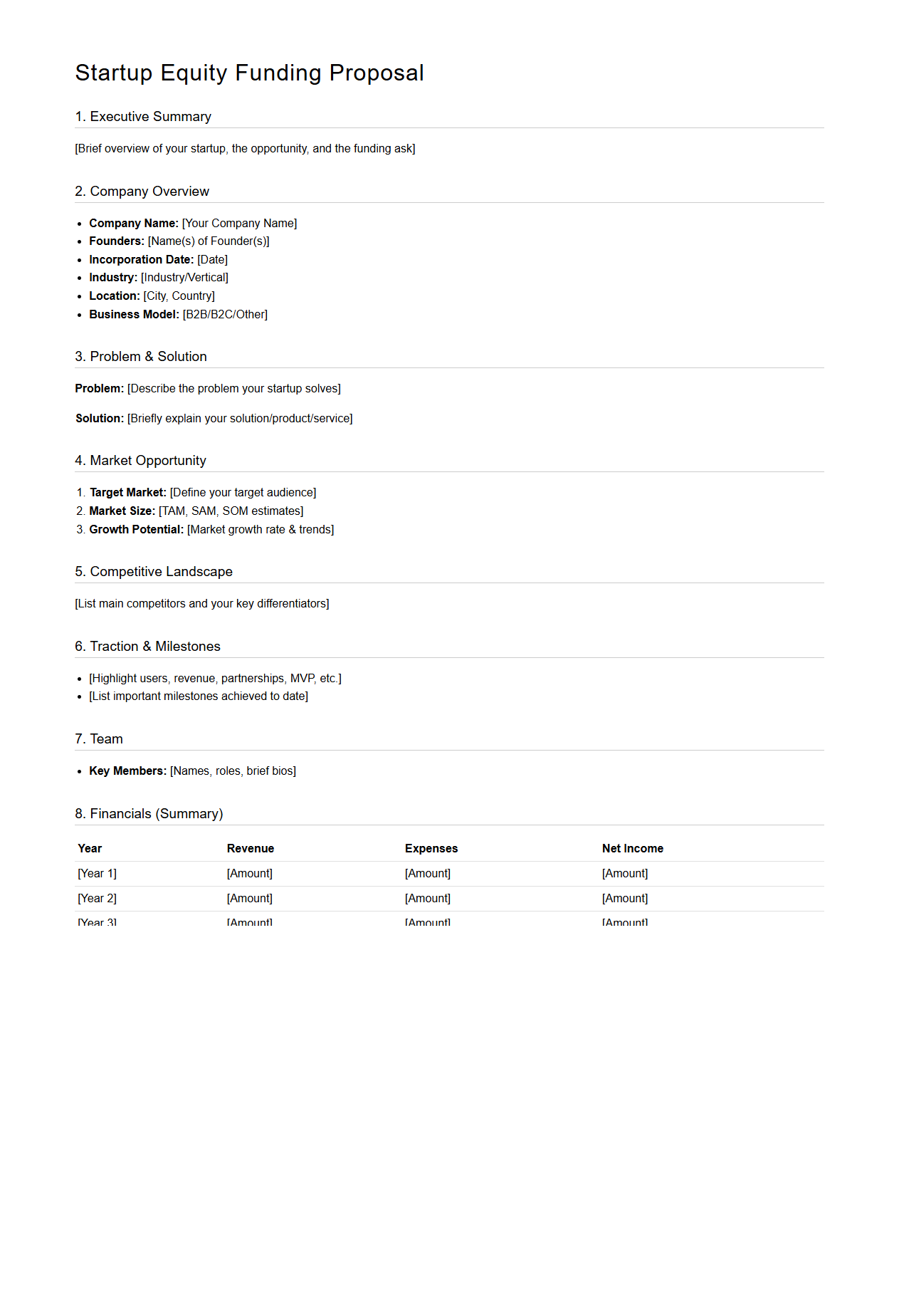

Startup Equity Funding Proposal Format

A

Startup Equity Funding Proposal Format document outlines the structured plan and terms under which a startup seeks investment from equity investors. It typically includes sections such as company overview, market opportunity, financial projections, funding requirements, and equity distribution. This format helps investors quickly assess the startup's value proposition and ownership stakes, facilitating informed investment decisions.

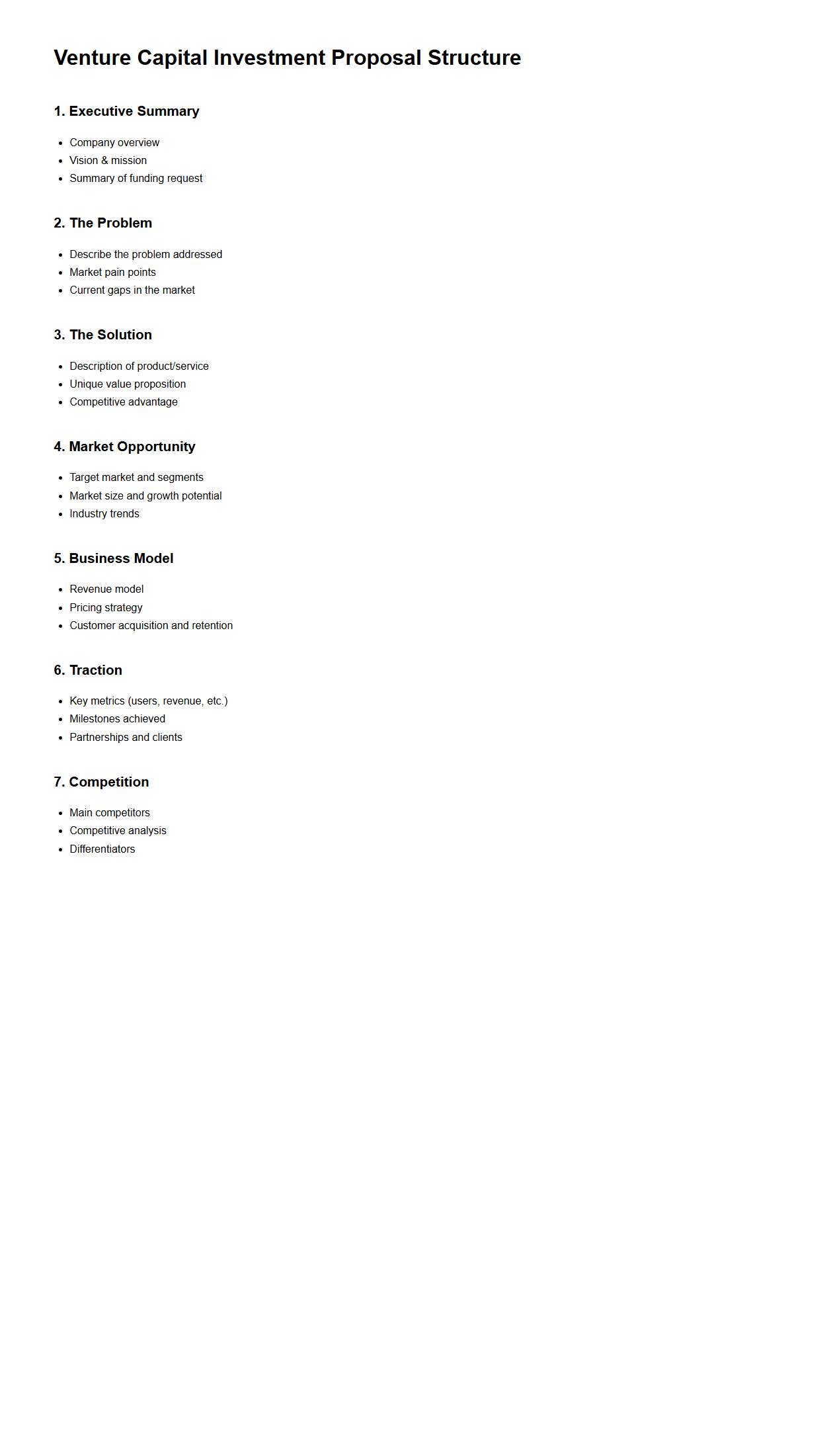

Venture Capital Investment Proposal Structure

A

Venture Capital Investment Proposal Structure document outlines the key elements and format required for presenting a business opportunity to potential investors. It typically includes sections such as the executive summary, market analysis, business model, financial projections, and funding requirements. This structured approach ensures clarity and effectiveness in communicating the startup's value proposition and growth potential.

Pre-Seed Startup Investment Pitch Template

A

Pre-Seed Startup Investment Pitch Template document is a structured guide designed to help early-stage entrepreneurs clearly present their business idea, market potential, and financial projections to potential investors. It typically includes sections on problem identification, solution description, target market, competitive landscape, revenue model, and funding requirements. This template streamlines the preparation process, ensuring founders effectively communicate key value propositions and investment opportunities.

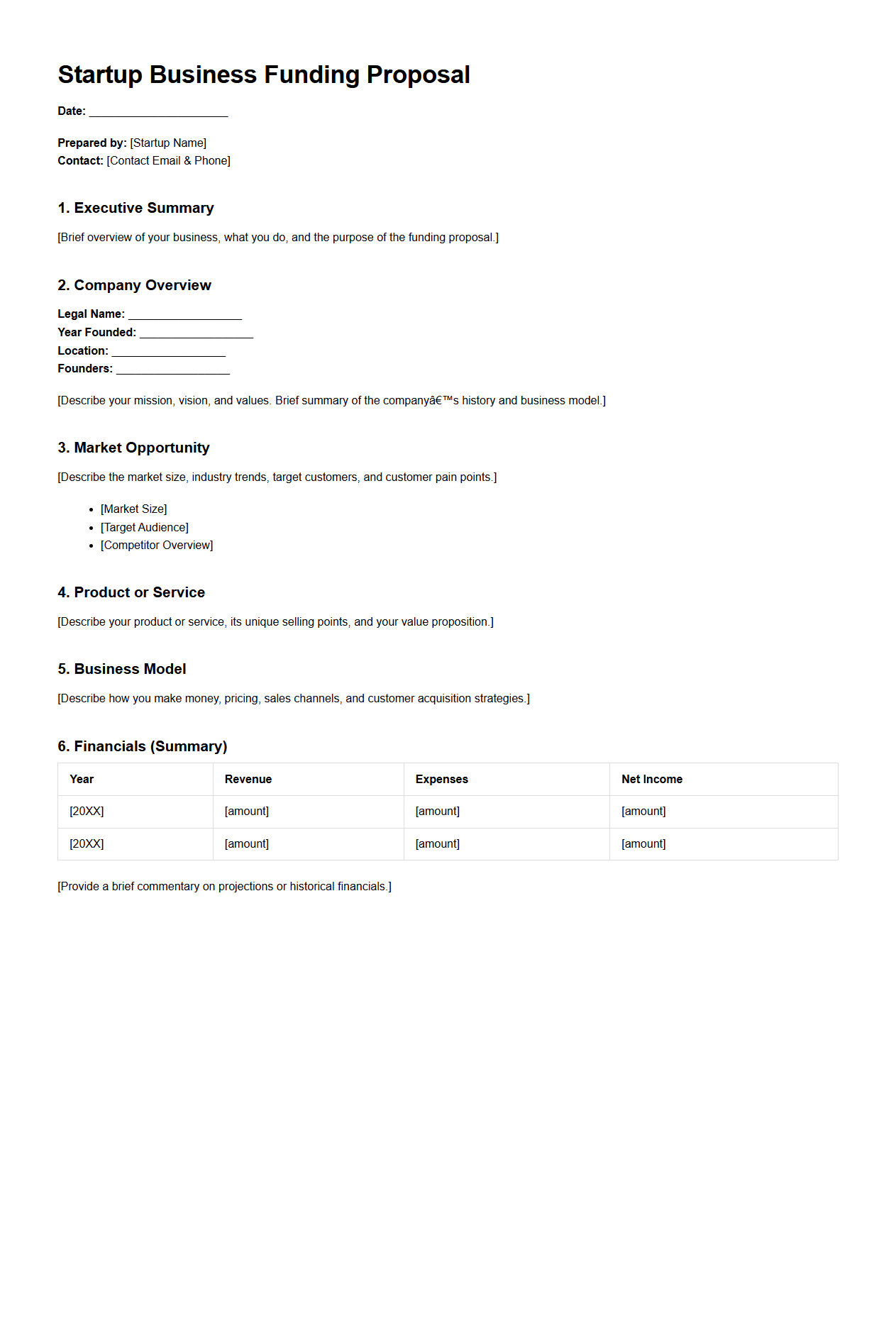

Startup Business Funding Proposal Document

A

Startup Business Funding Proposal Document is a detailed plan presented to potential investors or financial institutions outlining the business idea, market analysis, financial projections, and funding requirements needed for a new venture. It includes clear goals, the amount of capital sought, and how the funds will be utilized to ensure growth and profitability. This document serves as a critical tool to attract investment by demonstrating the startup's potential and strategic planning.

What essential sections should a blank investment proposal template for startups include?

A blank investment proposal template for startups should include an executive summary that briefly describes the business concept and value proposition. It must feature a detailed market analysis section to demonstrate the opportunity and competitive landscape. Additionally, the template should outline the business model, financial projections, and investment requirements clearly.

How can founders customize a blank proposal to highlight unique market opportunities?

Founders can customize a blank proposal by emphasizing their unique market opportunities through tailored market research and data specific to their industry. Highlighting proprietary technology, innovative approaches, or niche customer segments makes the proposal more compelling. Adding case studies or testimonials that validate the opportunity can further personalize the document.

Which financial metrics are most compelling to showcase in a blank startup investment proposal?

Key financial metrics to include are projected revenue growth, gross margin, and EBITDA to illustrate profitability potential. Founders should also present customer acquisition costs and lifetime value to demonstrate sustainable growth. Including a clear break-even analysis and cash flow forecast builds investor confidence.

What supporting documents are commonly attached to a blank investment proposal for startups?

Common supporting documents include detailed financial statements, market research reports, and a comprehensive business plan. Founders often attach legal documents such as incorporation certificates and intellectual property filings. Customer testimonials, product demos, and team bios help provide credibility and depth.

How should risk factors be transparently addressed in a blank investment proposal letter?

Risk factors should be openly acknowledged by outlining potential challenges and uncertainties related to the market, technology, or operations. The proposal must include mitigation strategies to show proactive management of these risks. Transparency builds investor trust by demonstrating awareness and preparedness.