A Blank Bank Statement Template for Recordkeeping helps individuals and businesses organize their financial transactions efficiently. It provides a clear format to track deposits, withdrawals, and balances, ensuring accurate record maintenance. Using this template simplifies financial management and supports budgeting and auditing processes.

Blank Personal Bank Statement Template for Financial Tracking

A

Blank Personal Bank Statement Template for Financial Tracking is a customizable document designed to record and monitor individual income, expenses, and account balances. It helps users organize their financial transactions systematically, providing a clear overview of cash flow and budgeting. This template is essential for maintaining accurate financial records and supporting personal financial planning and management.

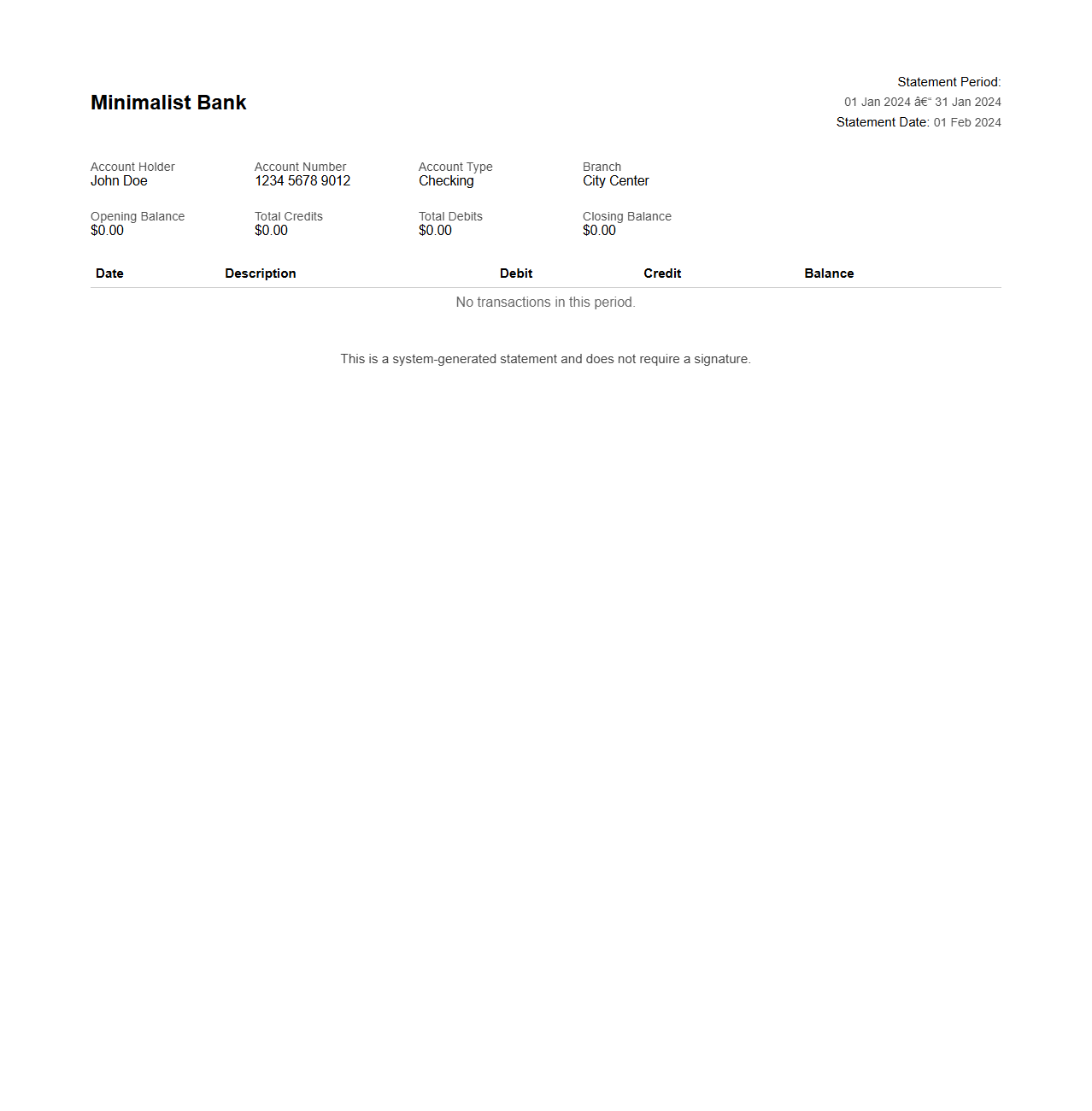

Minimalist Bank Statement Layout Template

The

Minimalist Bank Statement Layout Template is a clean and straightforward financial document design focused on presenting account transactions and balances with clarity. It emphasizes simplicity and ease of reading by using minimal graphics, ample white space, and clear typography to highlight essential details such as dates, descriptions, amounts, and balances. This template enhances financial transparency and is ideal for personal or business use where quick, organized access to banking information is required.

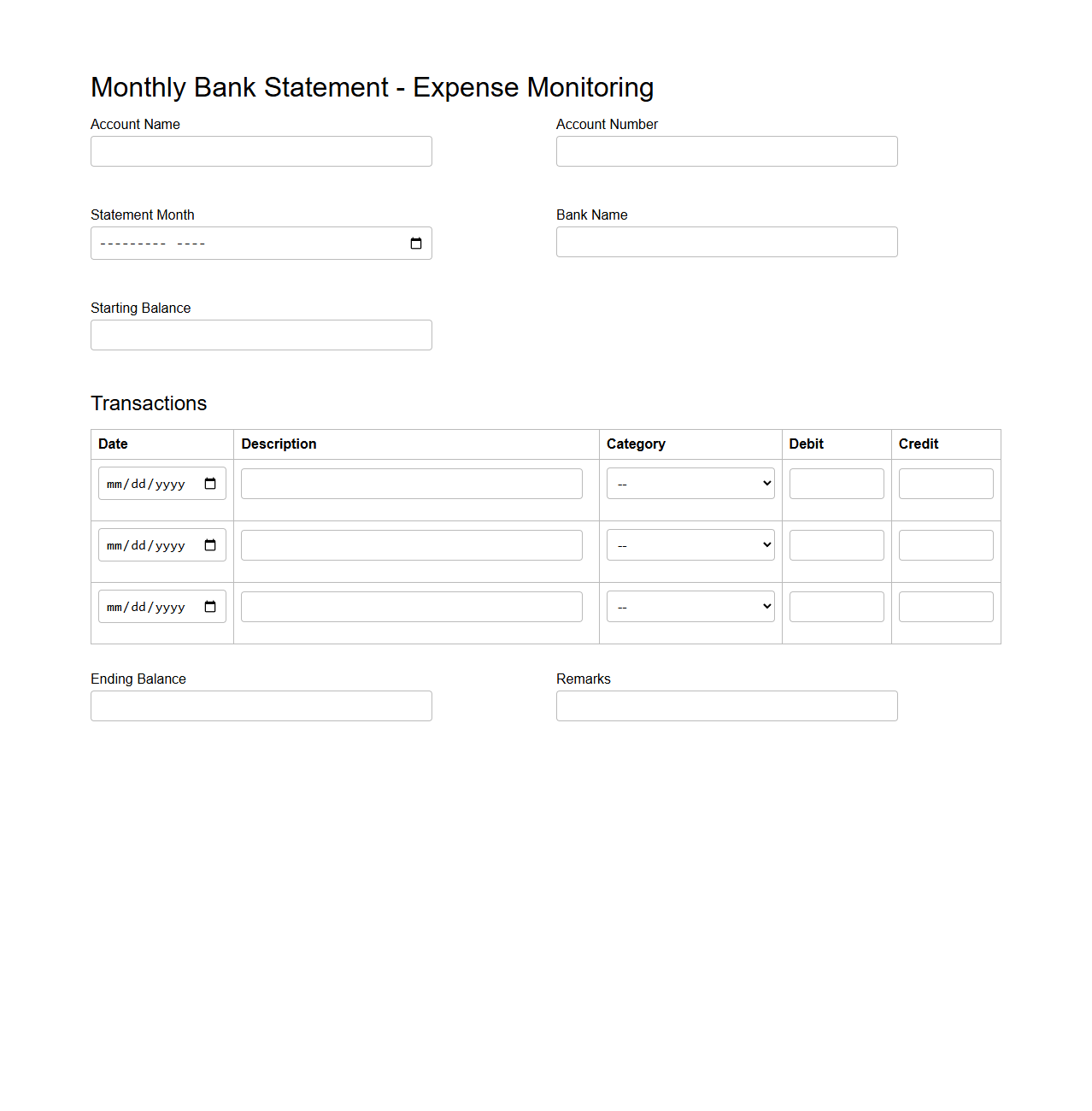

Monthly Bank Statement Blank Form for Expense Monitoring

A

Monthly Bank Statement Blank Form for Expense Monitoring is a financial document designed to systematically record and track monthly bank transactions and expenses. It helps individuals or businesses maintain accurate records by listing income, expenditures, balances, and transaction dates, ensuring effective budget management. This form enhances financial oversight, minimizes errors, and supports efficient expense reconciliation.

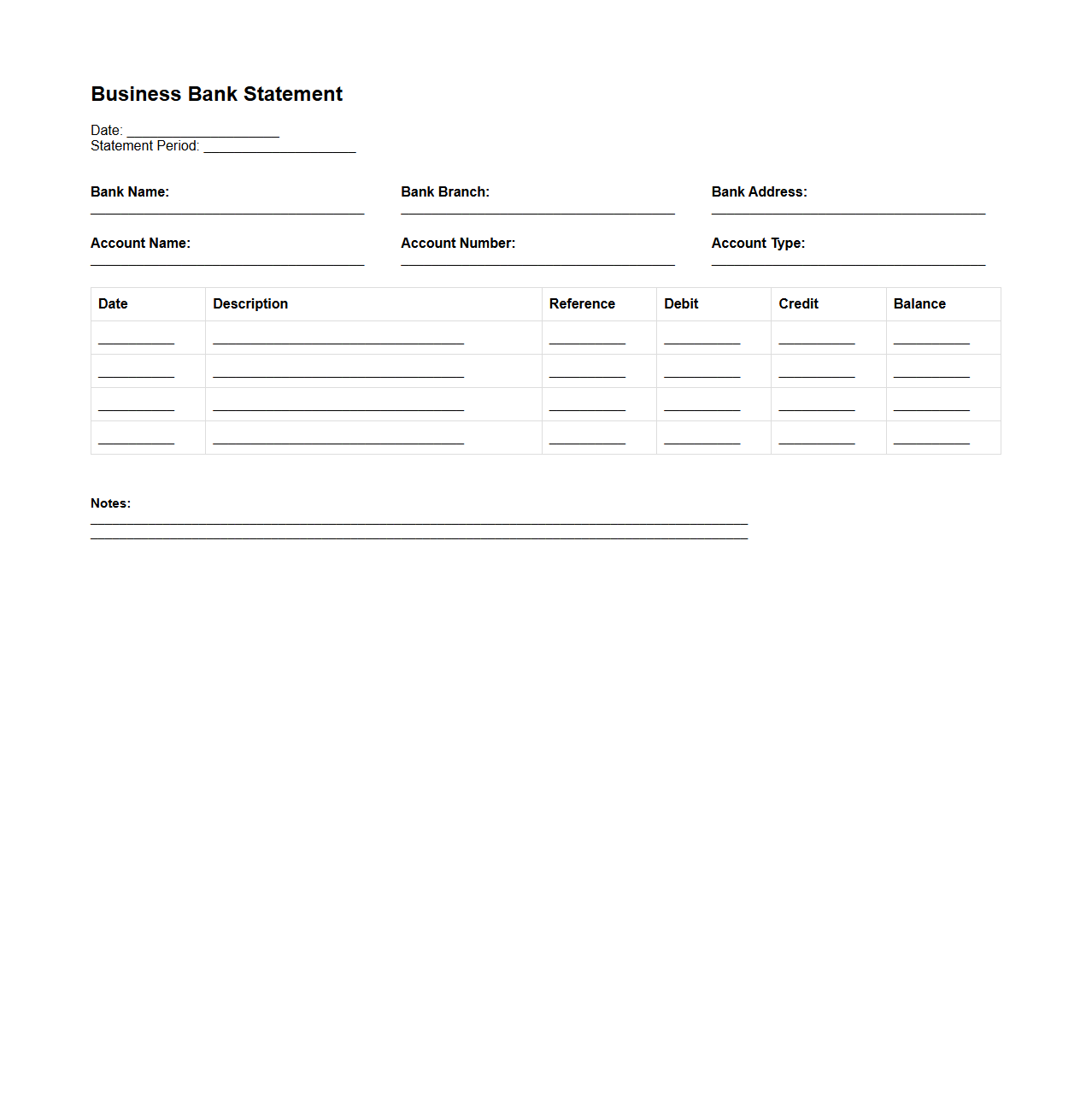

Blank Business Bank Statement Template for Accounting

A

Blank Business Bank Statement Template is a structured document used in accounting to record and summarize all financial transactions of a business within a specific period. It provides a clear format for tracking deposits, withdrawals, and balances, facilitating accurate financial reporting and reconciliation. This template helps accountants and financial managers maintain organized records essential for audits and budgeting.

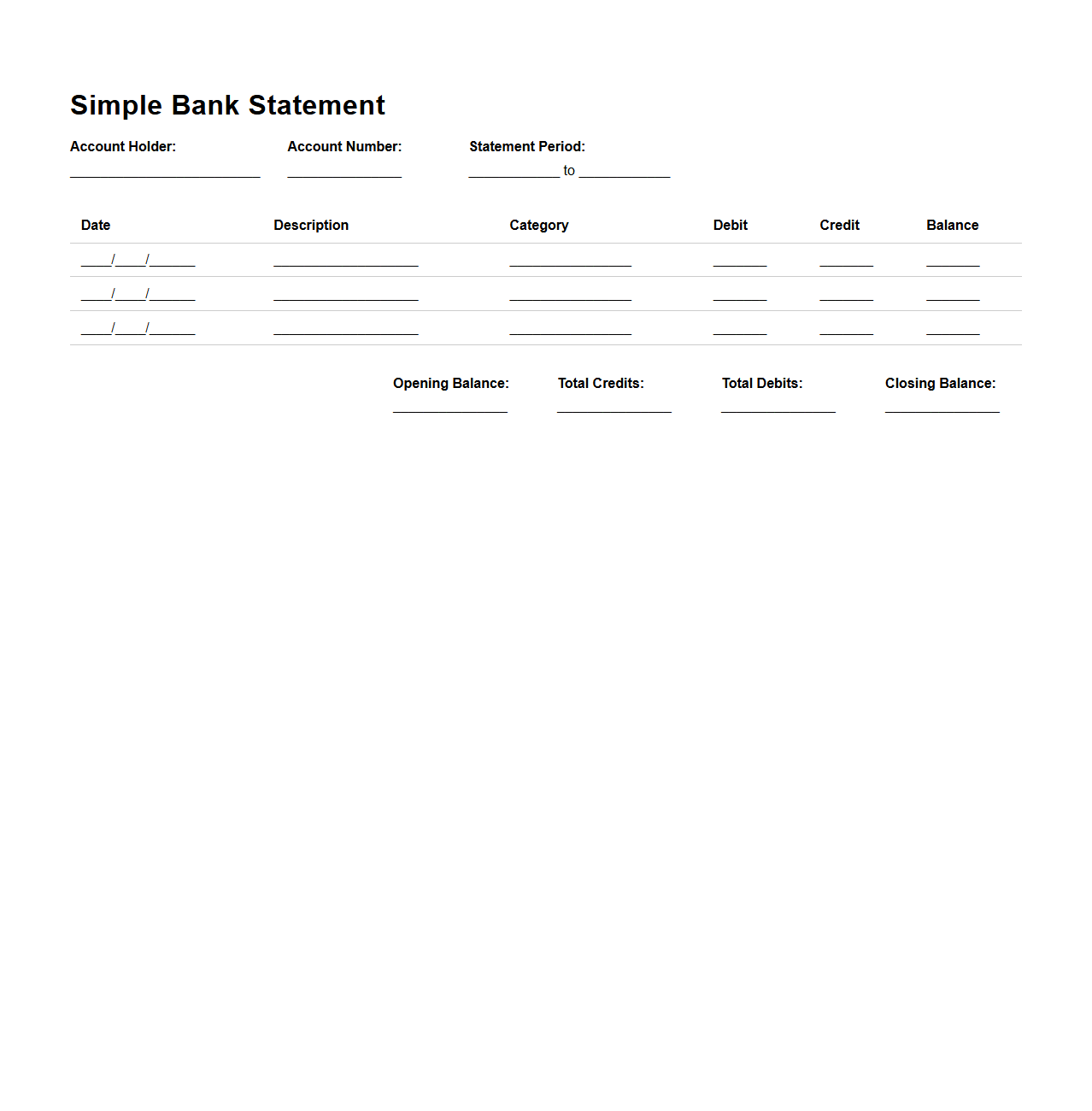

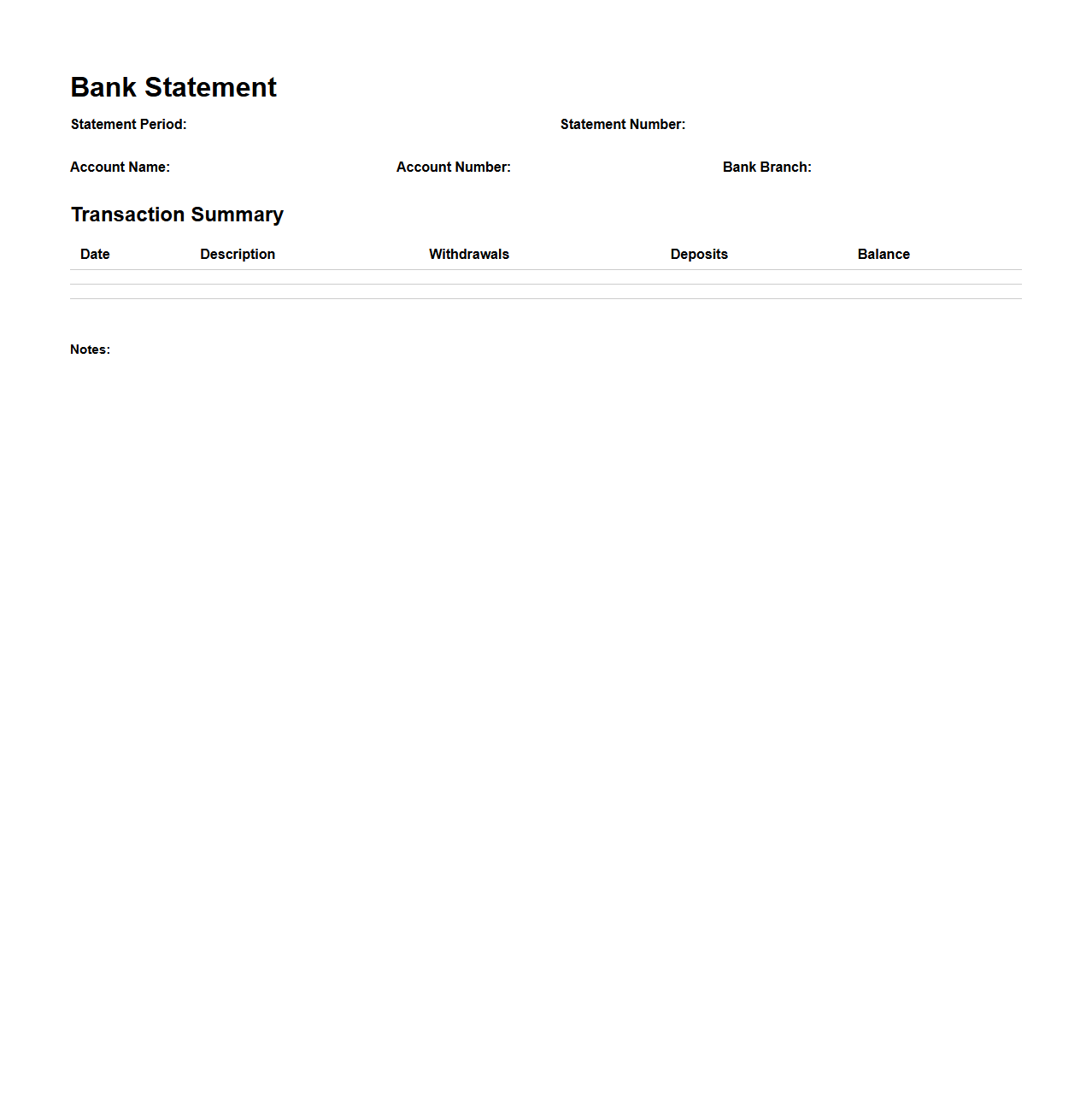

Simple Bank Statement Format for Budget Planning

A

Simple Bank Statement Format for budget planning is a streamlined document that organizes financial transactions into clear categories, making it easier to track income and expenses. This format typically includes essential details such as date, description, debit, credit, and balance, providing an accurate overview of cash flow. Using this concise structure helps individuals and businesses efficiently monitor spending habits and make informed budgeting decisions.

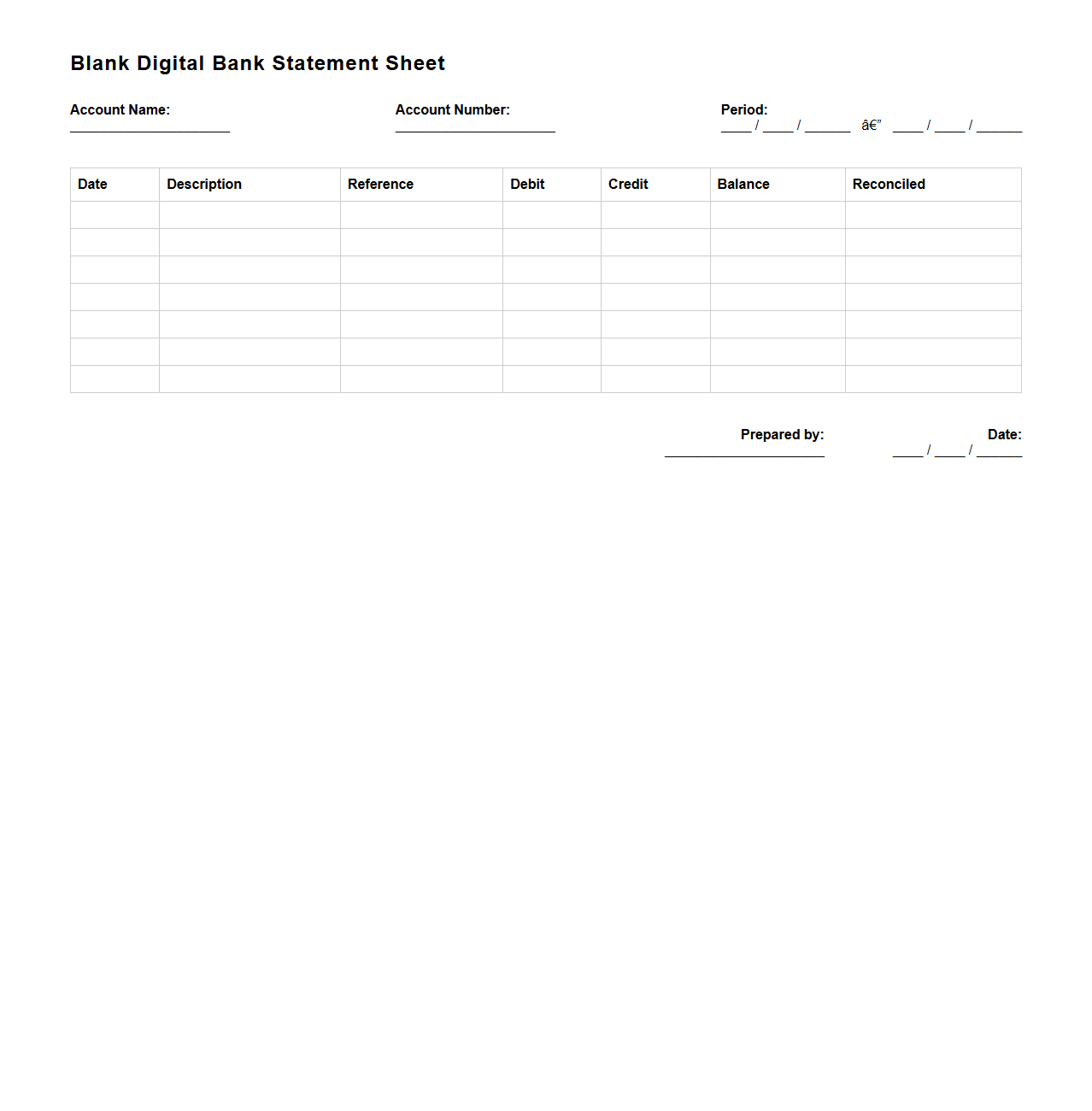

Blank Digital Bank Statement Sheet for Reconciliation

A

Blank Digital Bank Statement Sheet for Reconciliation is a predefined template used to organize and verify financial transactions between a company's accounting records and bank statements. It helps identify discrepancies such as unrecorded deposits, outstanding checks, or bank errors, ensuring accurate financial reporting and control. This document streamlines the reconciliation process by providing a structured format for detailed comparison and adjustment entries.

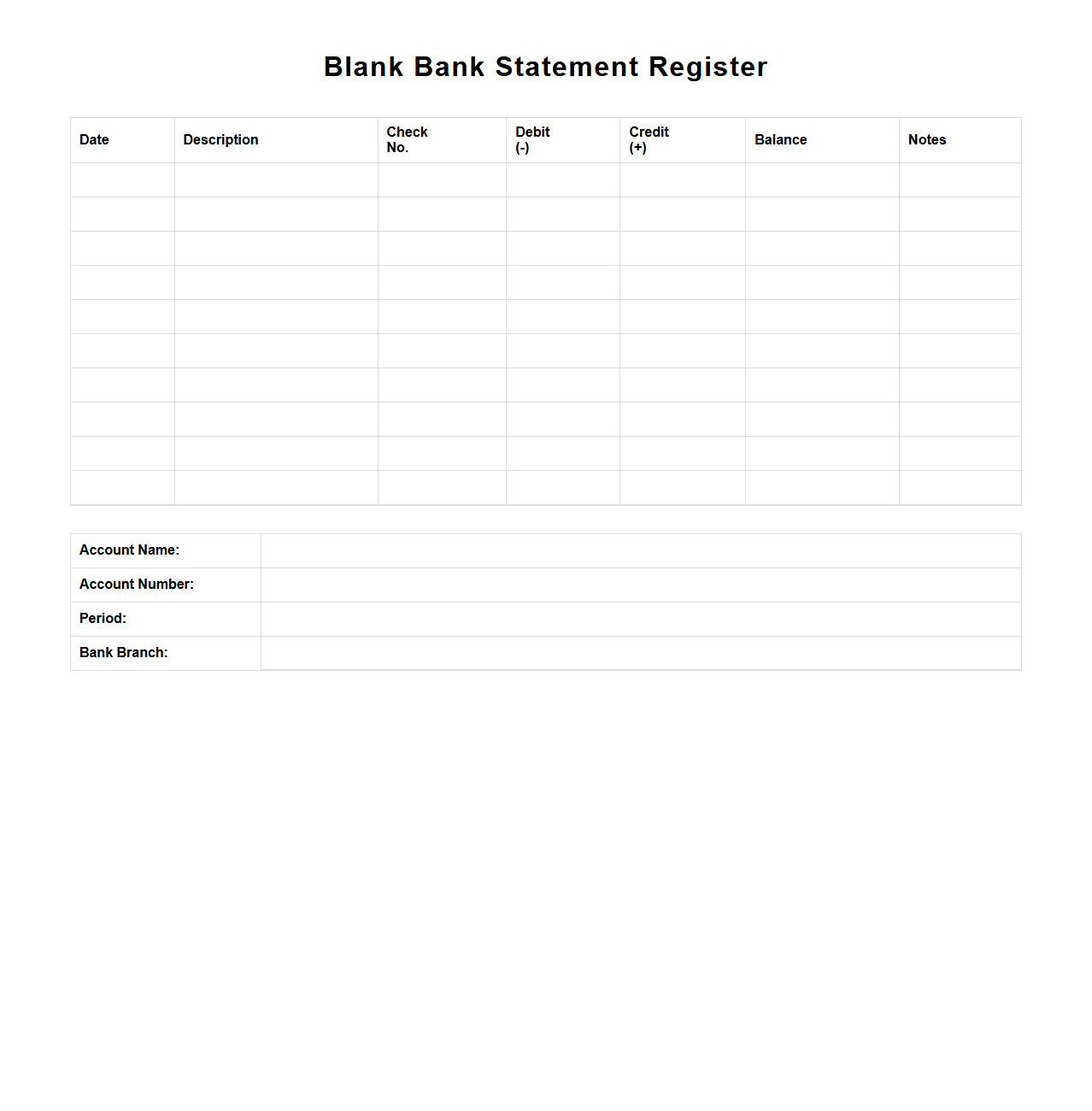

Blank Bank Statement Register for Transaction Recording

A

Blank Bank Statement Register is a financial document used to record and track individual banking transactions systematically. It serves as a tool for businesses and individuals to maintain accurate records of debits, credits, and balances for effective cash flow management. This register helps in reconciling bank statements, identifying discrepancies, and ensuring financial accountability.

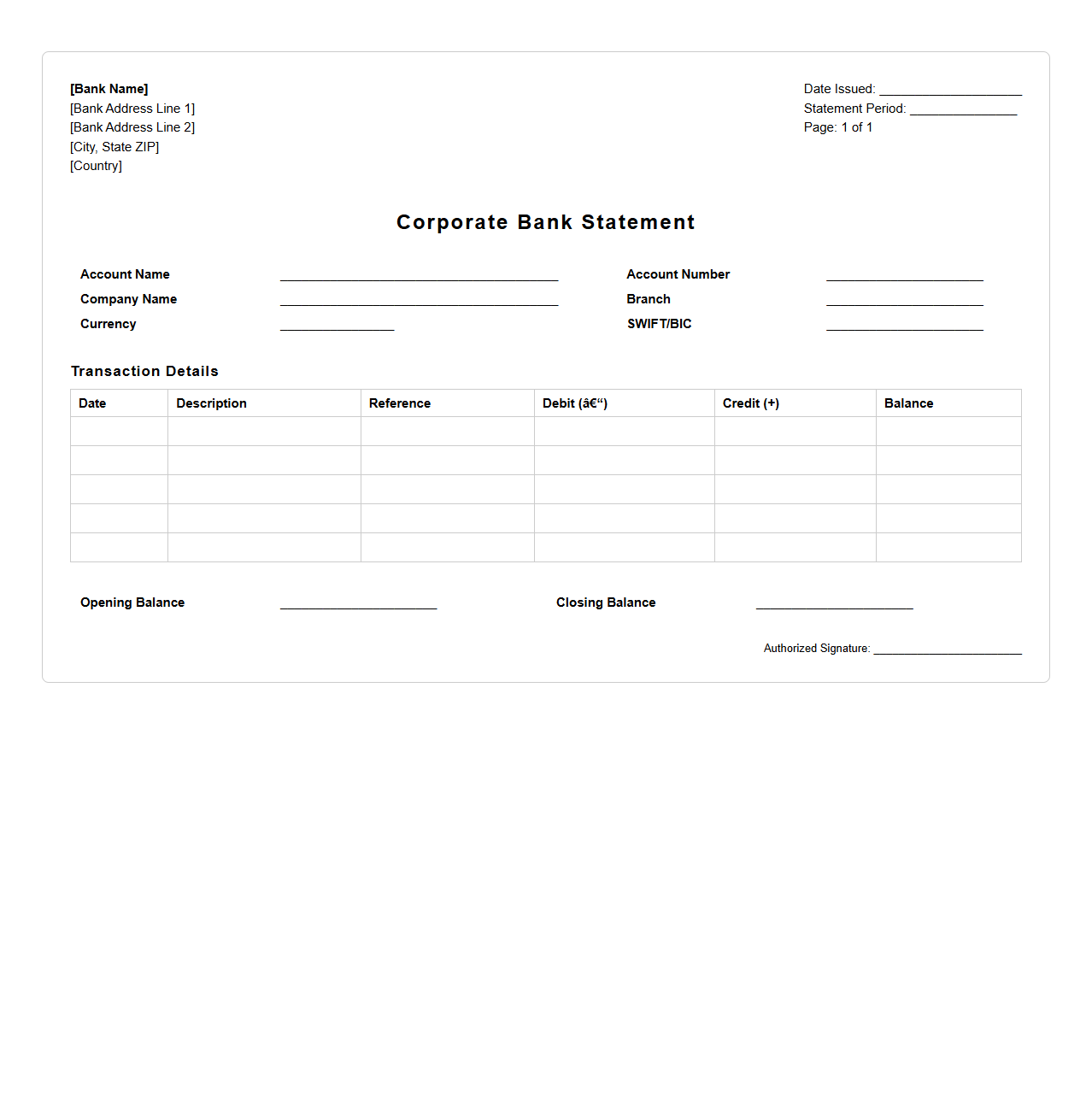

Blank Corporate Bank Statement Template for Audits

A

Blank Corporate Bank Statement Template for Audits is a structured financial document designed to simulate the format of an official bank statement used by corporations during audit processes. It provides auditors with a clear and organized overview of transactional data, including deposits, withdrawals, and balances, ensuring thorough financial verification. This template facilitates accurate financial tracking and compliance with regulatory requirements.

Basic Bank Statement Outline for Record Archives

A

Basic Bank Statement Outline for Record Archives document serves as a structured summary of financial transactions, capturing essential details such as dates, amounts, transaction types, and account balances. This outline facilitates efficient organization and retrieval of banking information for auditing, reconciliation, and compliance purposes. Maintaining a clear and concise bank statement outline enhances transparency and supports accurate financial record-keeping.

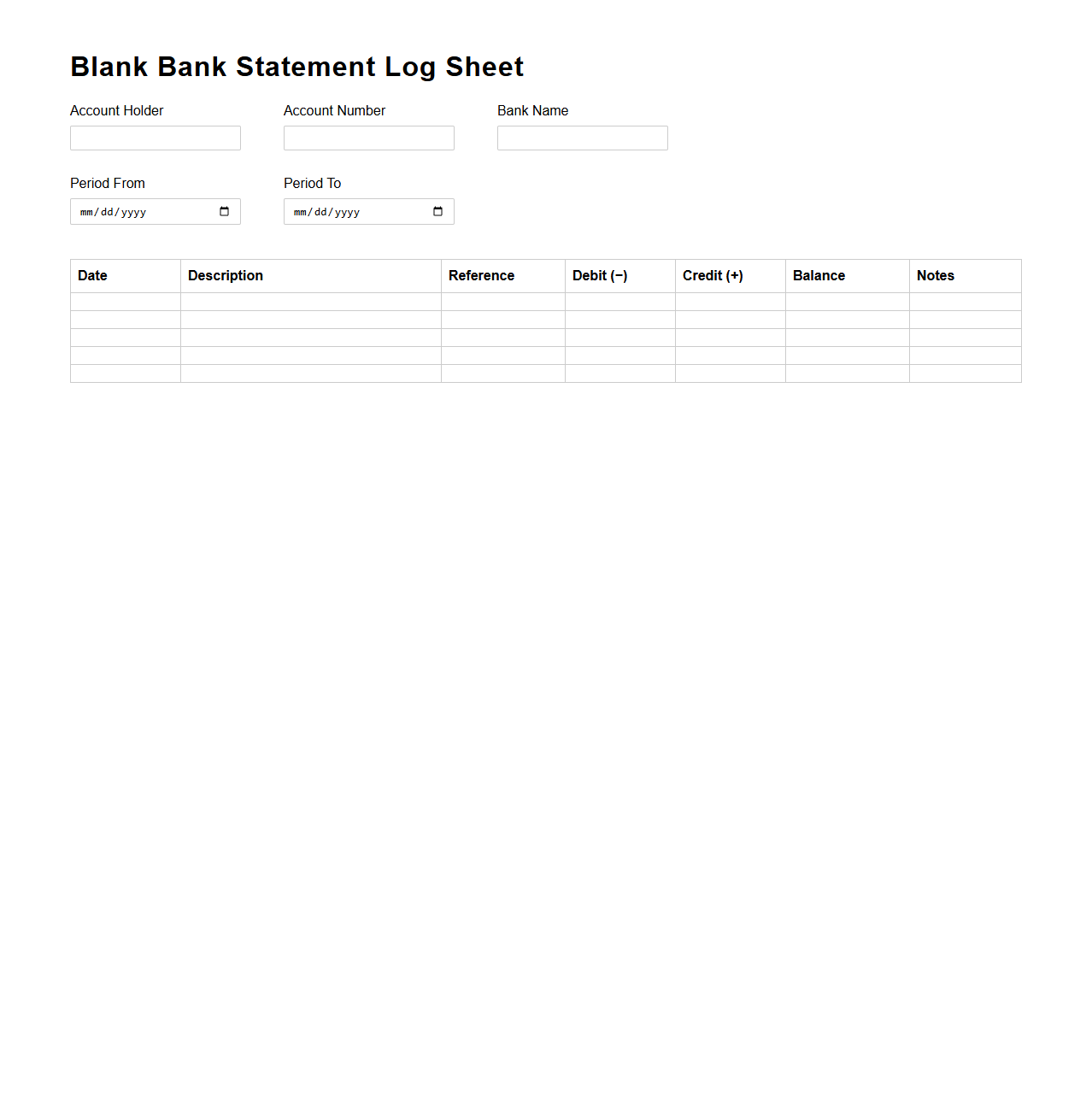

Blank Bank Statement Log Sheet for Personal Finance

The

Blank Bank Statement Log Sheet is a crucial tool for personal finance management that helps individuals systematically record and track all bank transactions, including deposits, withdrawals, and balances. This document allows for easy reconciliation of monthly bank statements, ensuring accurate budgeting and fraud detection. Using such a log sheet enhances financial transparency and supports effective money management by providing clear visibility into spending patterns and account activity.

What metadata should be included when archiving a blank bank statement template for compliance audits?

When archiving a blank bank statement template for compliance audits, key metadata such as creation date, version number, and author must be included. Additional metadata like document classification, retention period, and access permissions enhance audit readiness. This metadata ensures the document's authenticity and traceability during compliance reviews.

How can digital watermarking be applied to blank bank statements to prevent unauthorized use in recordkeeping systems?

Digital watermarking can be embedded into blank bank statements by inserting invisible or semi-visible marks that identify ownership and usage rights. This technique deters unauthorized duplication and tampering within digital recordkeeping systems. Watermarked documents maintain security without affecting the template's usability during legitimate processes.

Which file formats are most secure for storing blank bank statements for long-term archival?

For long-term archival, PDF/A and encrypted XML file formats are preferred due to their durability and built-in security features. These formats support metadata embedding and are resistant to unauthorized alterations over time. Maintaining files in such secure formats ensures compliance with data integrity and regulatory requirements.

What retention policies govern the storage of blank bank statement templates in corporate recordkeeping?

Corporate retention policies mandate that blank bank statement templates be stored for a specified period aligned with legal and regulatory standards, typically between 5 to 7 years. Policies also require secure access control and regular audits to ensure document preservation. Compliance with these retention schedules safeguards the organization against legal and operational risks.

How to verify the integrity of blank bank statement forms within document management software?

Integrity verification of blank bank statement forms involves utilizing checksums, digital signatures, or hash functions embedded within the document management software. These mechanisms detect any unauthorized changes or corruption over time. Regular integrity checks ensure that the forms remain unaltered and compliant with corporate governance standards.