A Blank Statement Template for Loan Repayment provides a structured format to track and document loan payment details clearly. This template aids borrowers and lenders in maintaining accurate records of installment amounts, payment dates, and outstanding balances. Using such a template ensures transparency and helps prevent disputes during the loan repayment process.

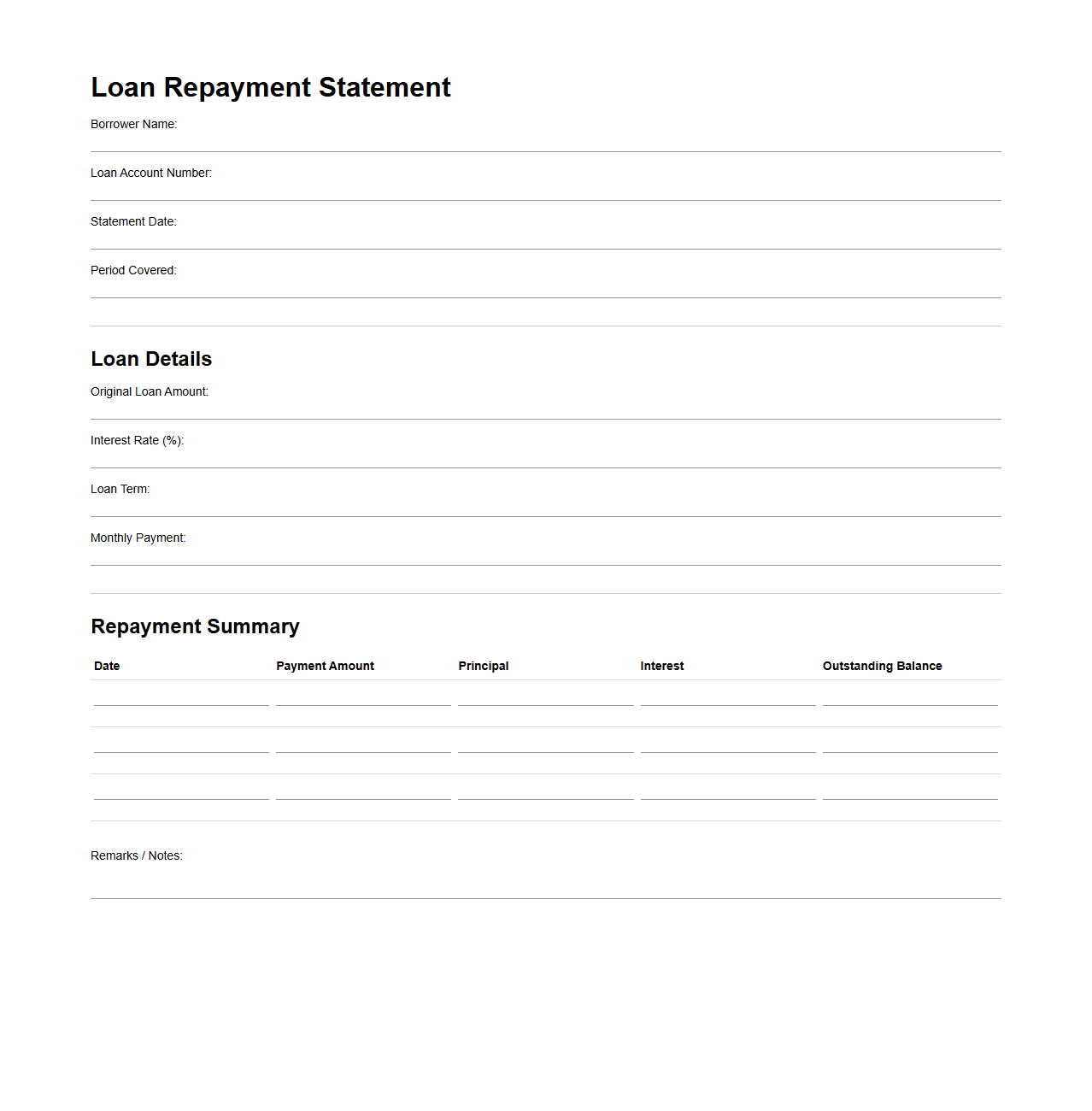

Blank Loan Repayment Statement Template

A

Blank Loan Repayment Statement Template is a pre-formatted document designed to track and report loan repayment details clearly and systematically. It includes sections for borrower information, loan amount, payment schedule, installment amounts, and outstanding balances, facilitating accurate and transparent financial record-keeping. This template helps lenders and borrowers maintain organized documentation for repayment progress and ensures clarity in loan management.

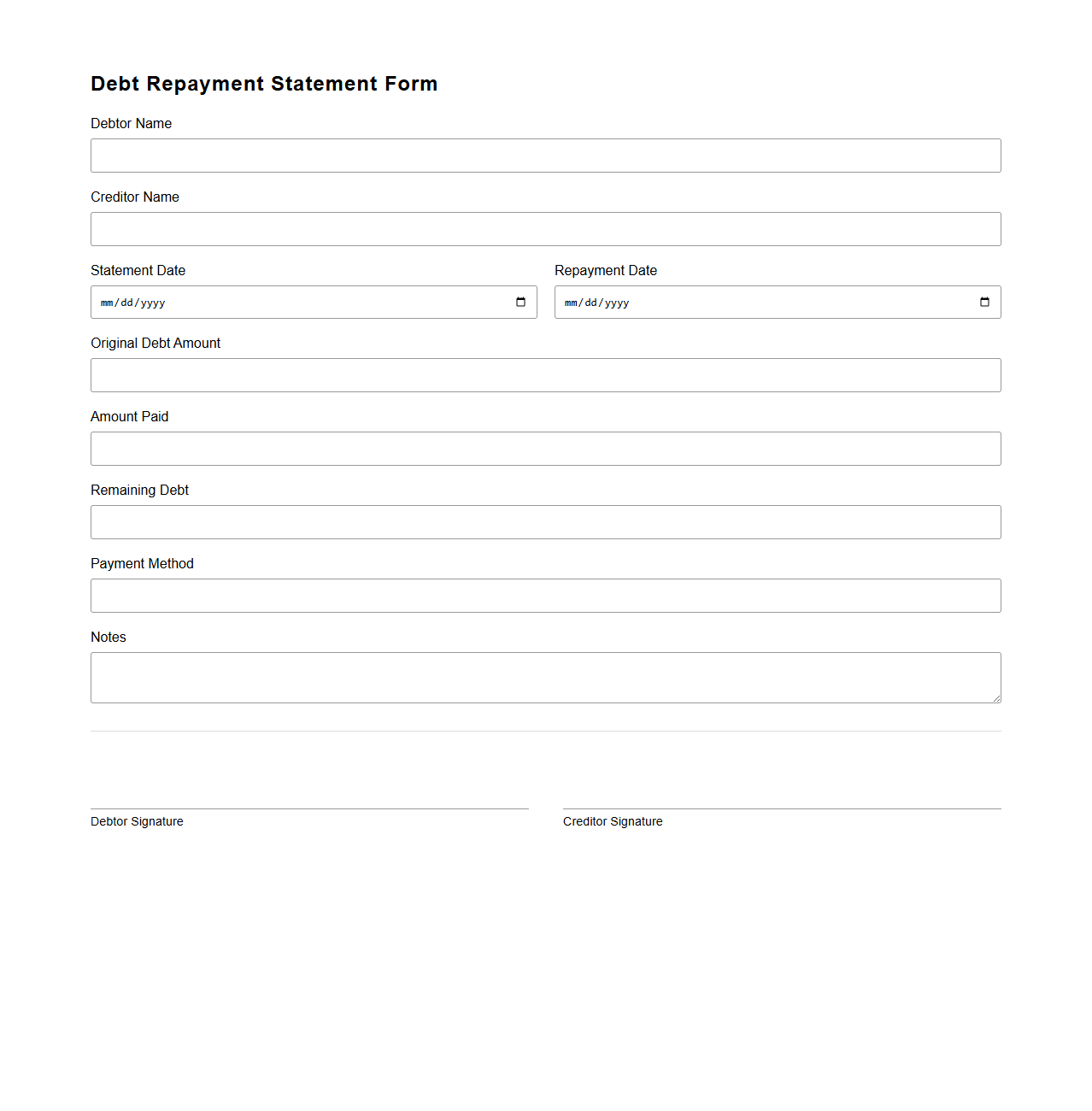

Blank Debt Repayment Statement Form

A

Blank Debt Repayment Statement Form document serves as a template for individuals or organizations to detail outstanding debts and repayment plans clearly. This form typically includes fields for creditor information, total debt amount, repayment schedule, and payment terms, facilitating transparent communication between debtor and creditor. Utilizing this form aids in organizing financial obligations and ensuring accountability in debt management.

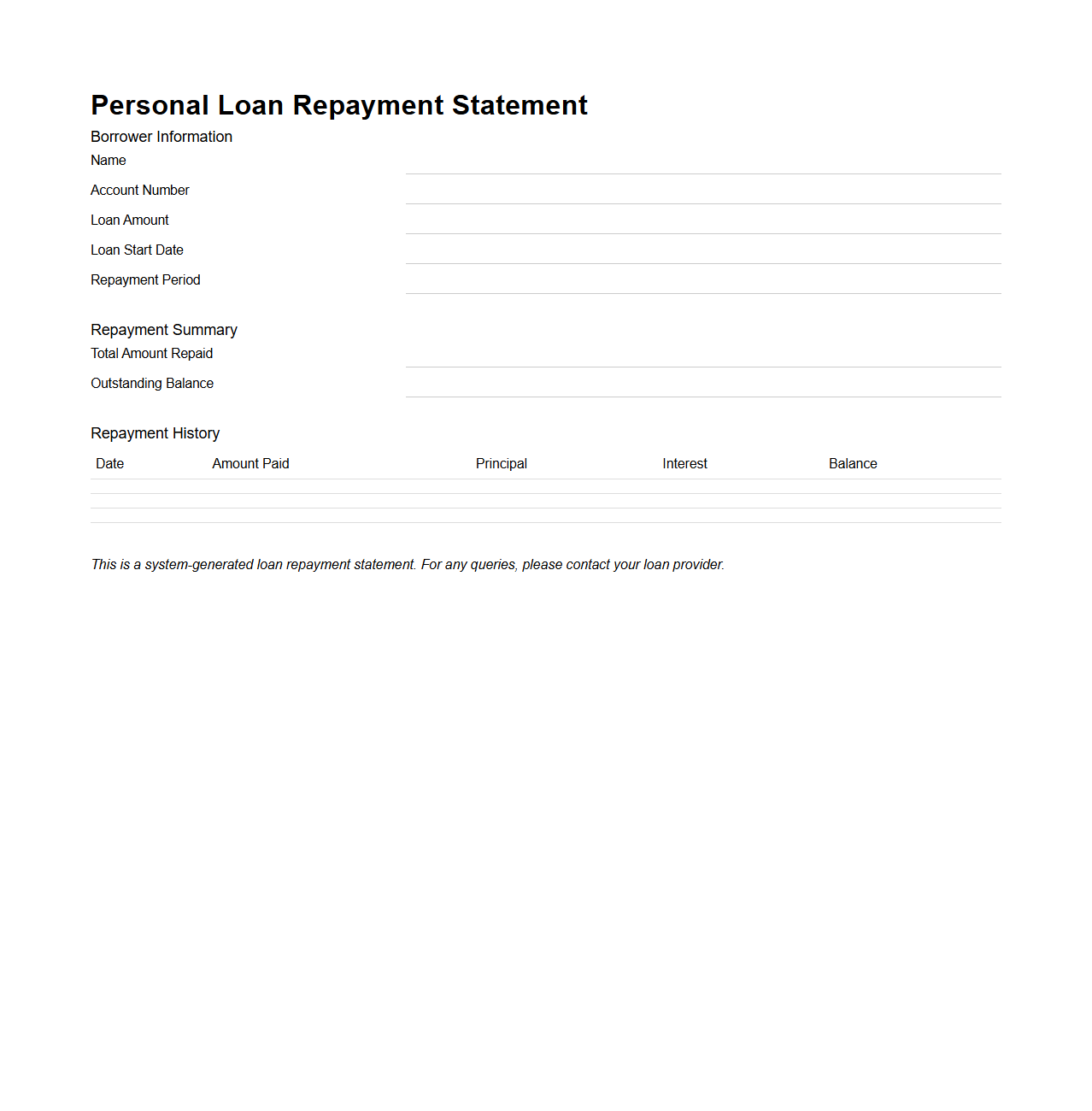

Blank Personal Loan Repayment Statement

A

Blank Personal Loan Repayment Statement document is a template that details the scheduled loan installments without any filled payment records. It helps borrowers track future due dates, principal amounts, interest rates, and total repayment obligations. Lenders and borrowers use this document to maintain clear financial records and ensure timely loan repayment.

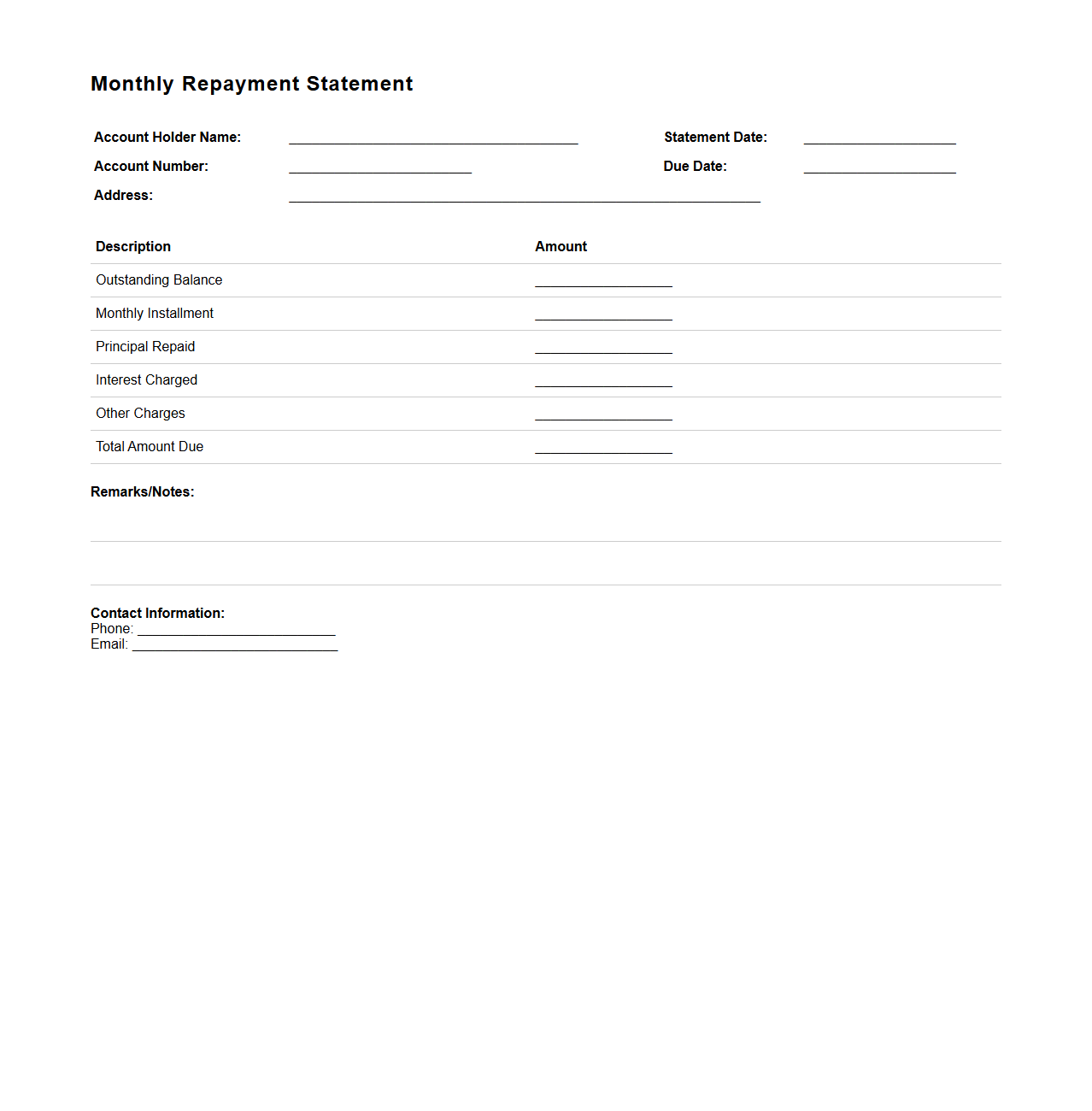

Blank Monthly Repayment Statement Template

A

Blank Monthly Repayment Statement Template document serves as a structured form for tracking monthly loan or credit repayments. It includes fields for borrower details, payment dates, amounts due, and outstanding balances, ensuring clear financial record-keeping. This template streamlines tracking and facilitates transparent communication between lenders and borrowers.

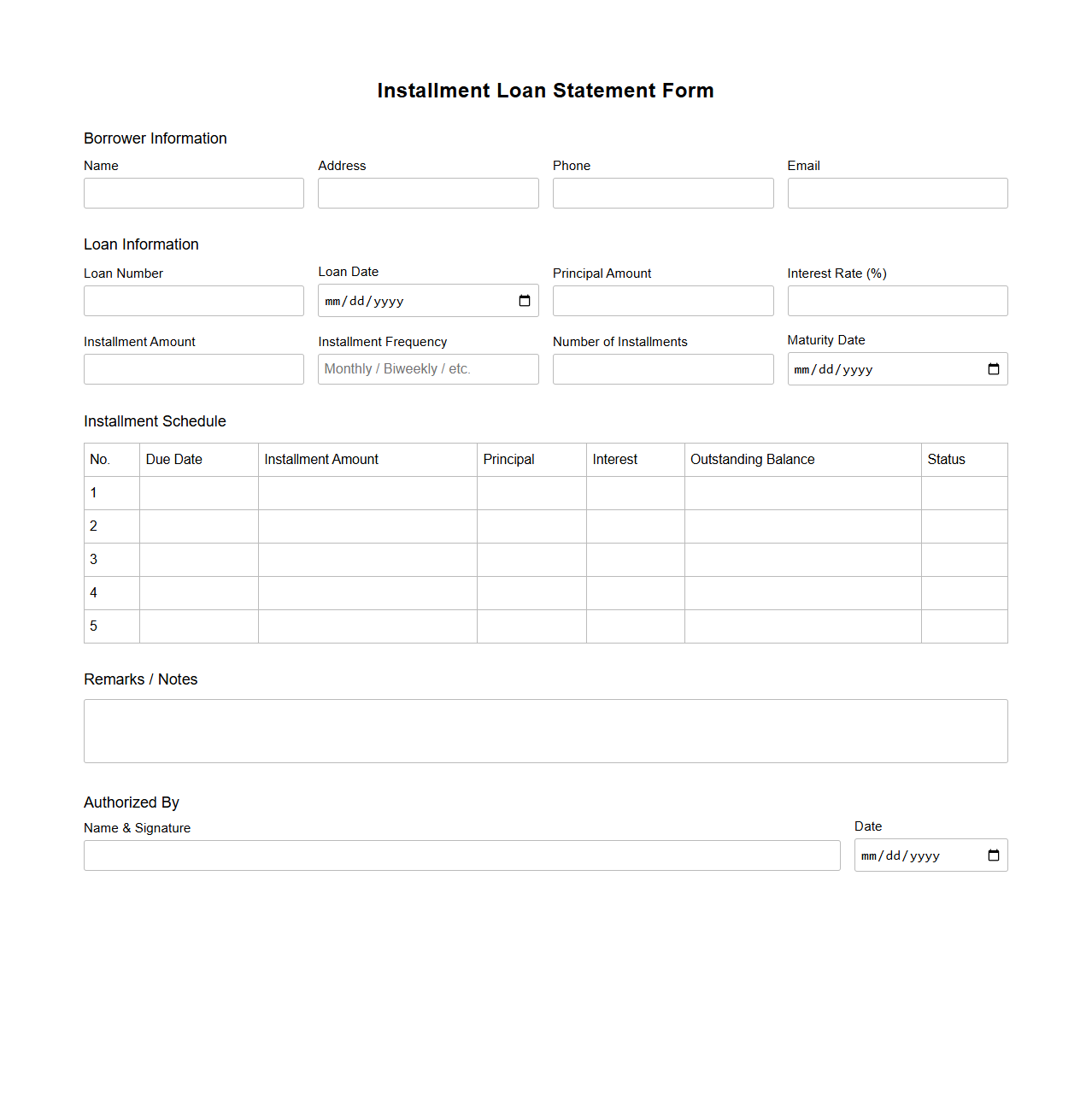

Blank Installment Loan Statement Form

A

Blank Installment Loan Statement Form document serves as a standardized template for recording the details of installment loan payments, including principal, interest, and remaining balance. It enables lenders and borrowers to track payment history, due dates, and loan status effectively. This form improves transparency and ensures accurate financial record-keeping for installment loan agreements.

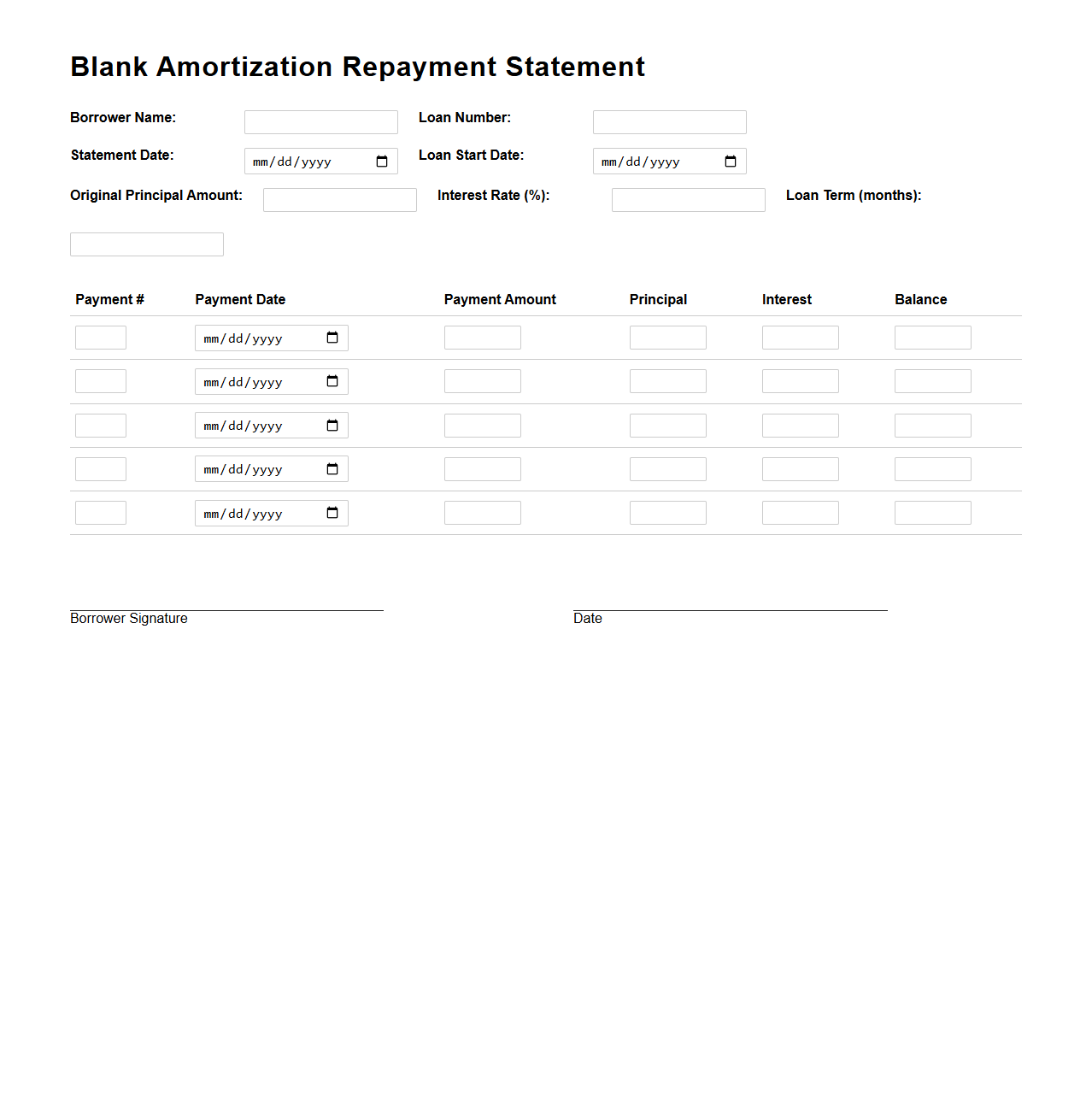

Blank Amortization Repayment Statement

A

Blank Amortization Repayment Statement document is a template used to outline the schedule of loan repayments, showing the division between principal and interest over time without pre-filled data. It helps borrowers and lenders track payment amounts, due dates, and remaining balances in a clear, structured manner. This document facilitates accurate financial planning and auditing by providing a customizable format for various loan terms and conditions.

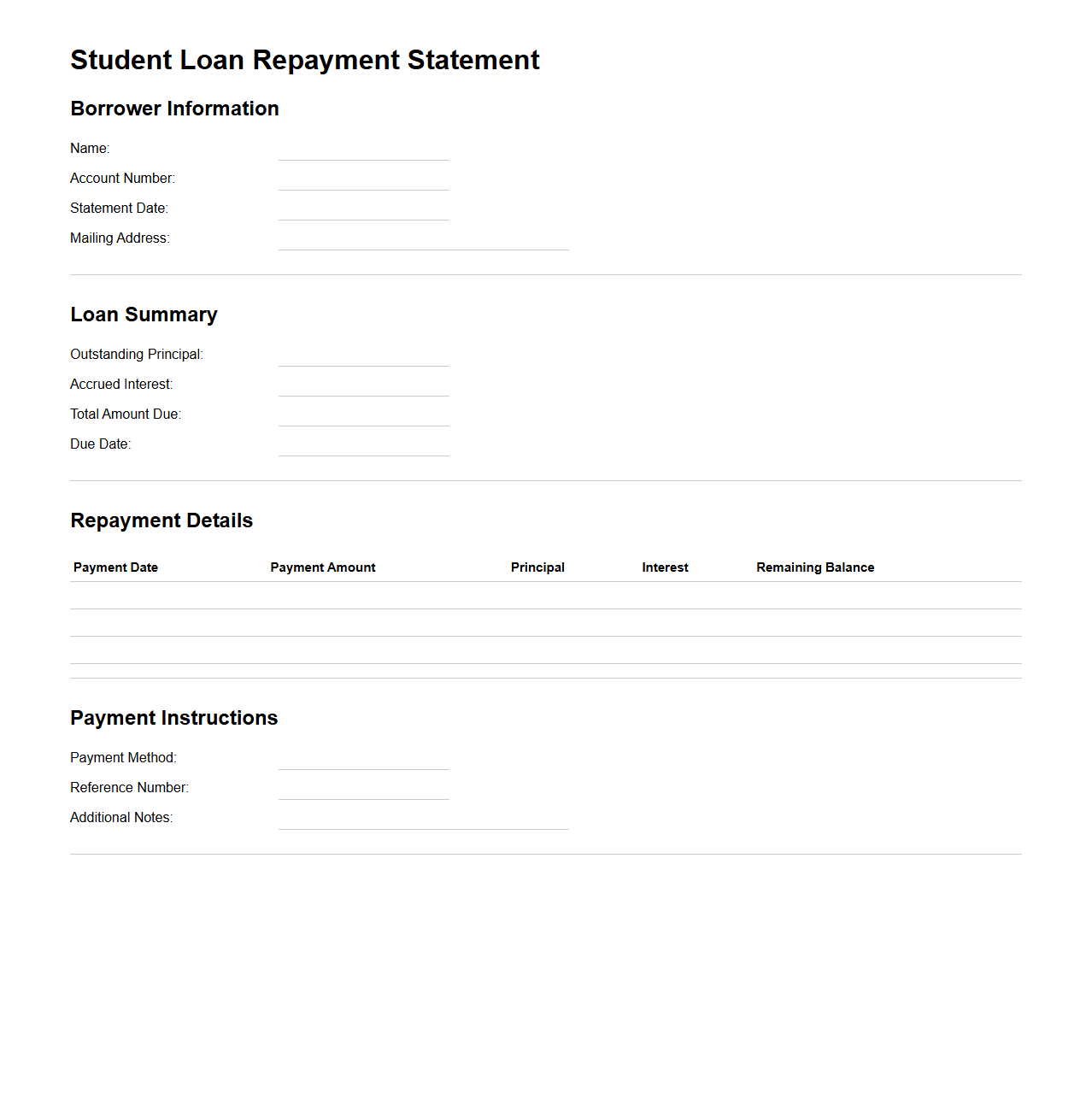

Blank Student Loan Repayment Statement

The

Blank Student Loan Repayment Statement is a standardized form used by borrowers to track and report their monthly student loan payments to lenders or loan servicers. This document typically includes fields for payment amounts, dates, interest accrued, and remaining balance, enabling clear and organized financial management. It serves as an essential tool for ensuring accurate repayment records and facilitating communication between borrowers and loan providers.

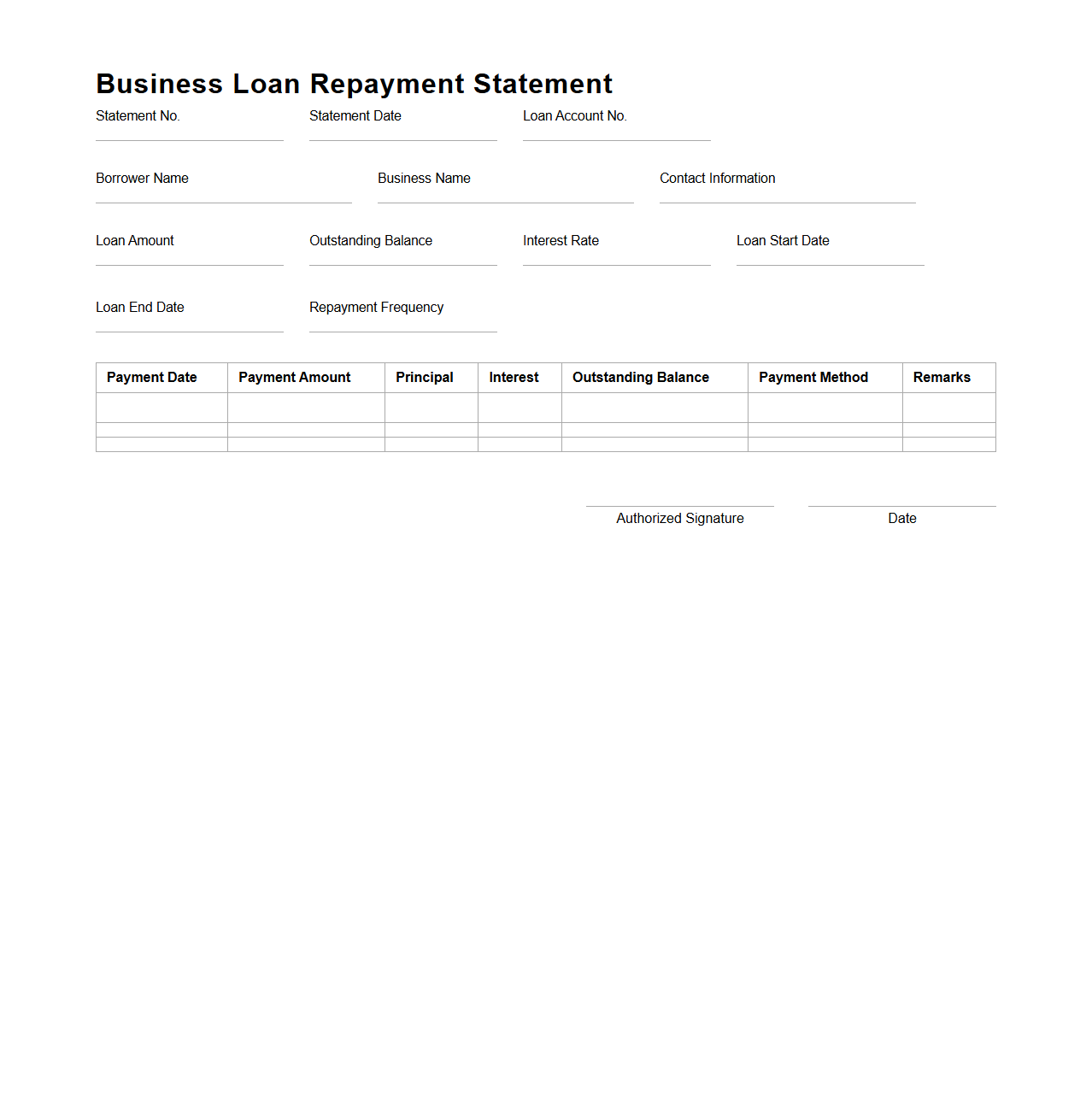

Blank Business Loan Repayment Statement

A

Blank Business Loan Repayment Statement is a standardized document used by businesses to track and manage loan repayments. It typically includes sections for recording payment dates, amounts paid, outstanding balances, and interest accrued to ensure accurate financial tracking. This document helps both lenders and borrowers maintain clear records, ensuring transparency and accountability throughout the loan repayment period.

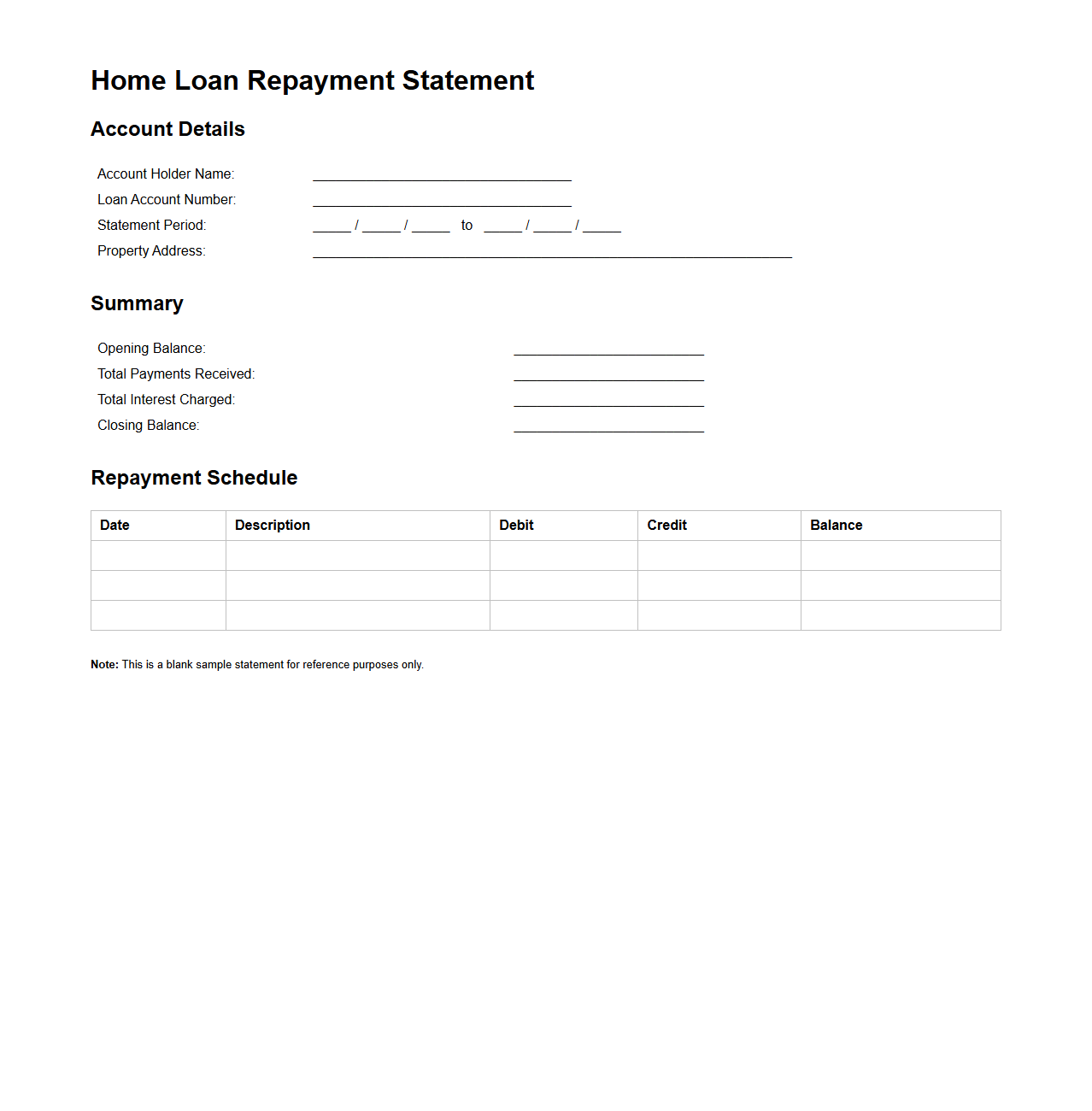

Blank Home Loan Repayment Statement

A

Blank Home Loan Repayment Statement is a document template used by lenders to provide borrowers with an overview of their loan repayment schedule without specific transaction details. It outlines the structure of monthly payments, including principal and interest components, allowing borrowers to estimate future obligations. This statement serves as a reference for managing home loan finances and planning repayments effectively.

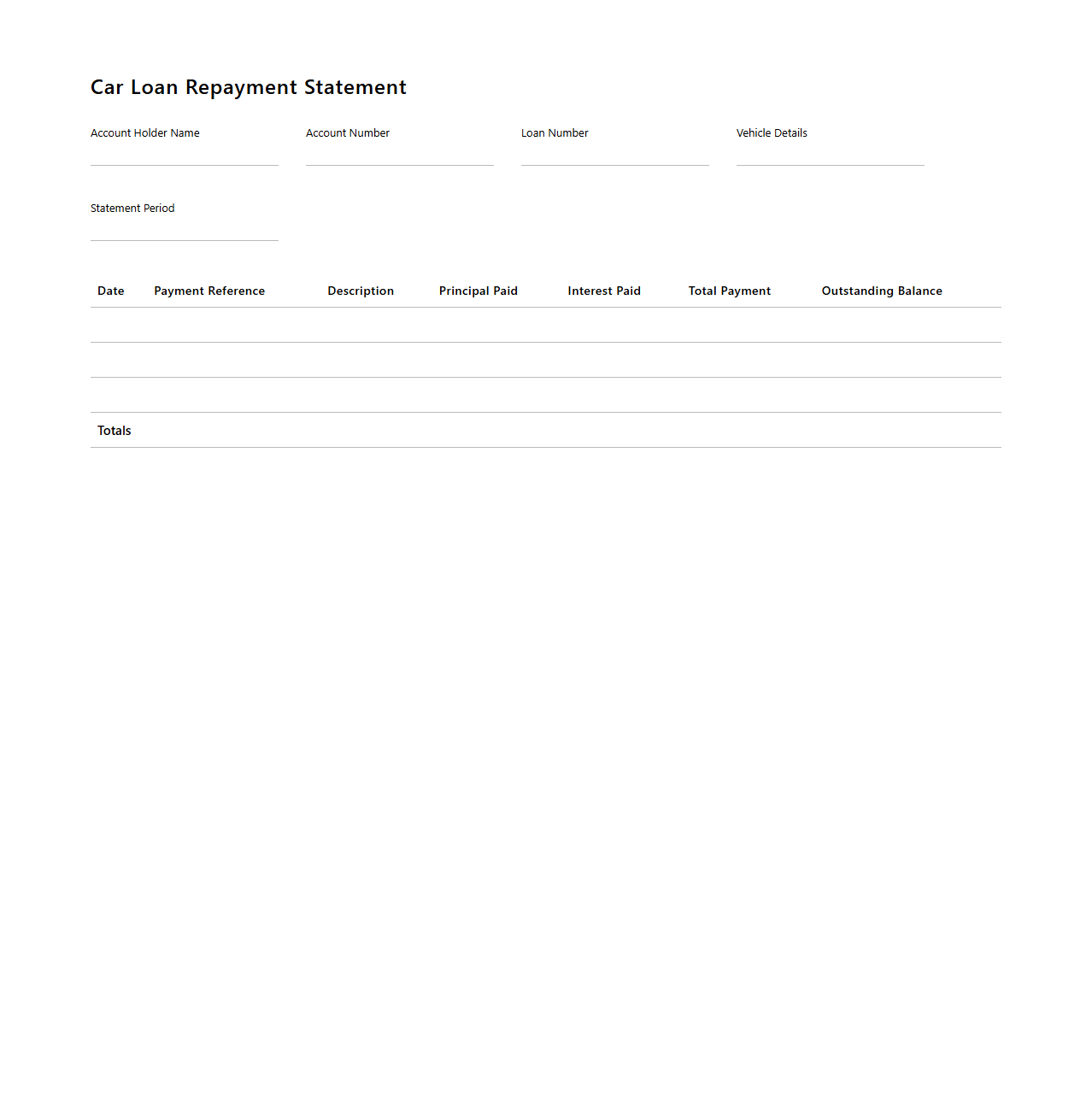

Blank Car Loan Repayment Statement

A

Blank Car Loan Repayment Statement document serves as a template that outlines the repayment schedule for an auto loan without including specific borrower details or payment history. It provides a clear format to track installments, interest rates, and due dates, facilitating accurate financial planning for both lenders and borrowers. Using this statement helps maintain transparent communication and ensures timely payment management throughout the loan tenure.

What details are required in a blank statement letter for loan repayment acknowledgment?

A loan repayment acknowledgment letter must include the borrower's full name and loan account number for accurate identification. It should state the exact outstanding balance and the date up to which repayments have been made. Additionally, the letter must contain the lender's contact information and a clear statement confirming receipt of payments.

How do you properly format a blank statement used for loan balance confirmation?

A properly formatted loan balance confirmation statement begins with the lender's name and address at the top for authenticity. The body of the statement should clearly specify the borrower's information, loan details, and the current outstanding balance. Finally, it must include a date, the lender's signature, and official stamp to validate the document.

Which sections must be included in a blank repayment statement for legal compliance?

For legal compliance, a repayment statement must feature sections like borrower identification, loan details, and a precise breakdown of payments made. It should also include a declaration of accuracy, a date of issuance, and terms concerning the remaining loan balance. The document must be signed and dated by an authorized representative to ensure its legality.

How can a borrower customize a blank loan repayment statement template?

A borrower can customize a blank loan repayment statement by adding personal details such as full name, loan account number, and repayment history. They may also insert specific dates and payment amounts to reflect current loan status accurately. Lastly, borrowers can request the lender's official signature and stamp to authenticate the customized document.

What supporting documents should accompany a blank statement for loan repayment verification?

Supporting documents to accompany a loan repayment verification statement include bank statements showing payment transactions and official receipts from the lender. Additionally, a copy of the original loan agreement helps verify terms and conditions. These documents collectively ensure transparency and confirm the accuracy of the repayment statement.