A Blank Financial Statement Template for Accounting provides a structured format to record essential financial data, including assets, liabilities, income, and expenses. It helps accountants and businesses maintain accurate and organized financial records for reporting and analysis. This template ensures consistency and ease in preparing balance sheets, income statements, and cash flow statements.

Blank Personal Balance Sheet Template for Financial Tracking

A

Blank Personal Balance Sheet Template for Financial Tracking document is a structured framework designed to help individuals systematically list their assets, liabilities, and net worth. It enables users to monitor their financial position over time, making it easier to identify trends and make informed decisions about savings, investments, and debt management. This tool is essential for accurately assessing personal financial health and planning future financial goals.

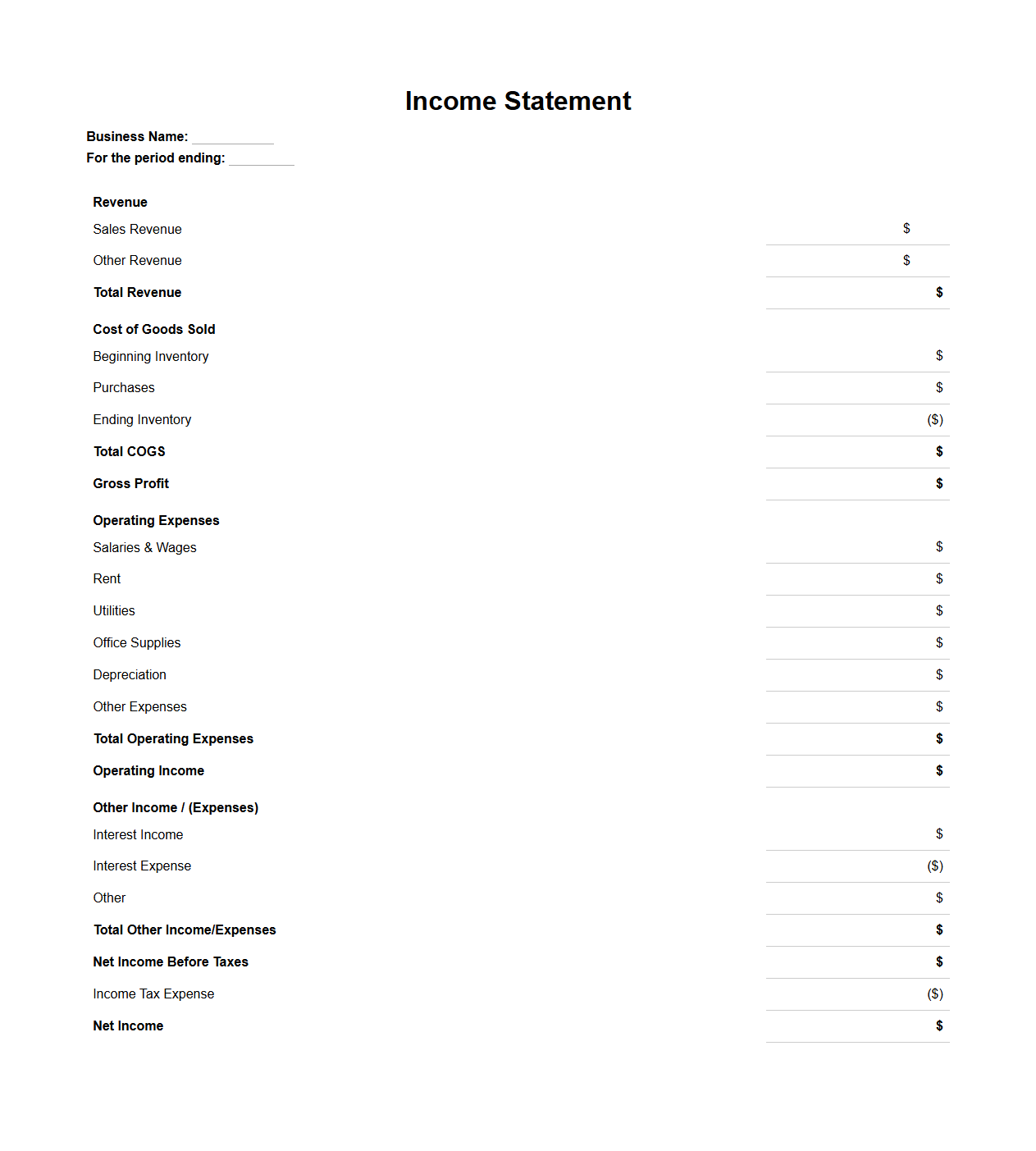

Blank Income Statement Template for Small Business Accounting

A

Blank Income Statement Template for Small Business Accounting is a pre-formatted document designed to help entrepreneurs systematically record revenues, expenses, and net profit or loss over a specific period. It simplifies financial tracking by organizing key data such as sales, cost of goods sold, operating expenses, and taxes, enabling accurate profit analysis. This template is essential for maintaining clear financial records and preparing reports for tax filings and business performance evaluation.

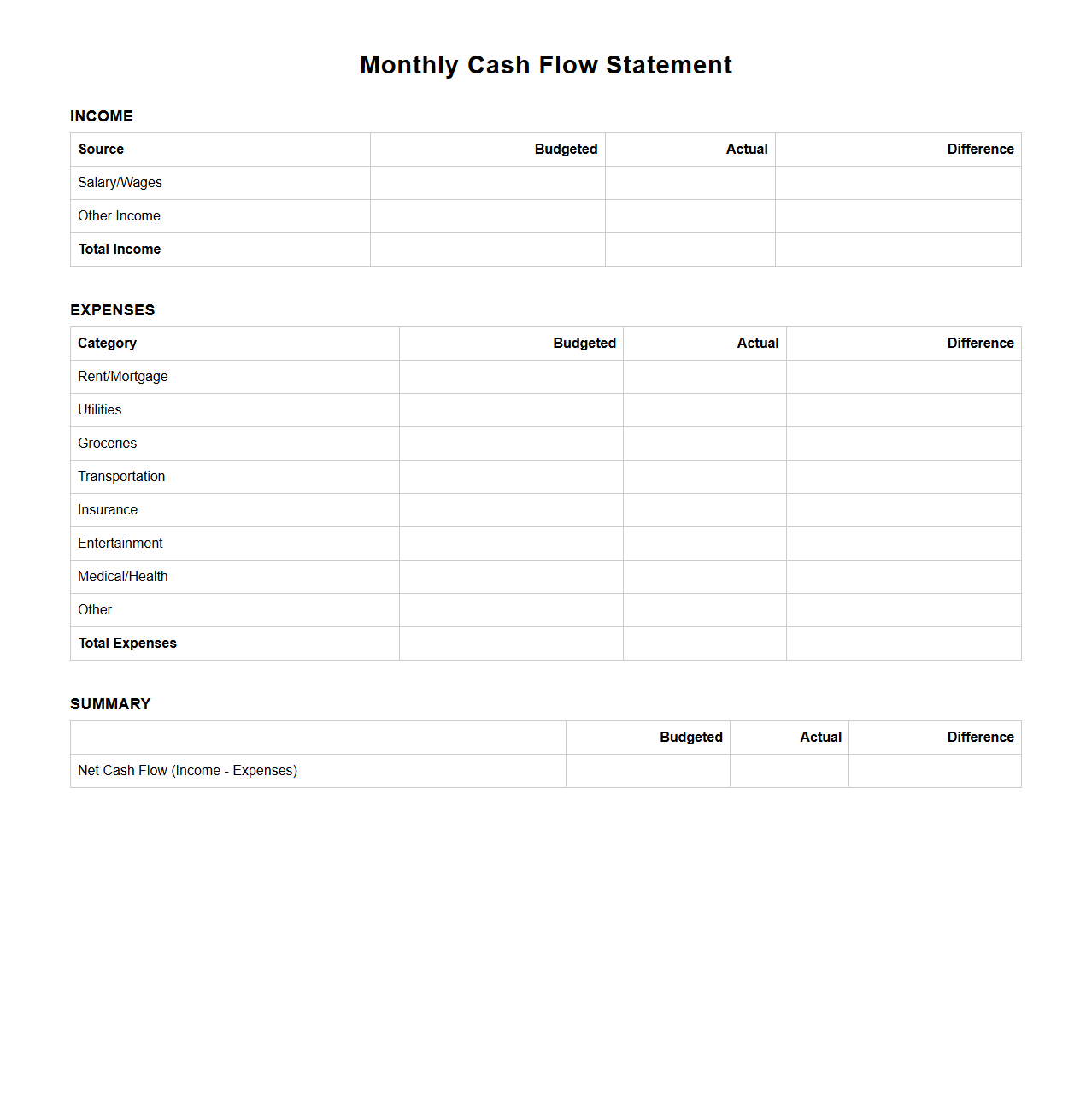

Blank Monthly Cash Flow Statement Template for Budgeting

A

Blank Monthly Cash Flow Statement Template for Budgeting is a financial tool designed to track and manage income and expenses on a monthly basis, helping individuals or businesses maintain a clear overview of their cash inflows and outflows. It facilitates accurate budgeting by allowing users to input projected and actual figures, ensuring better control over financial planning and decision-making. This template is essential for forecasting cash availability, managing debts, and identifying opportunities to optimize savings and expenditures.

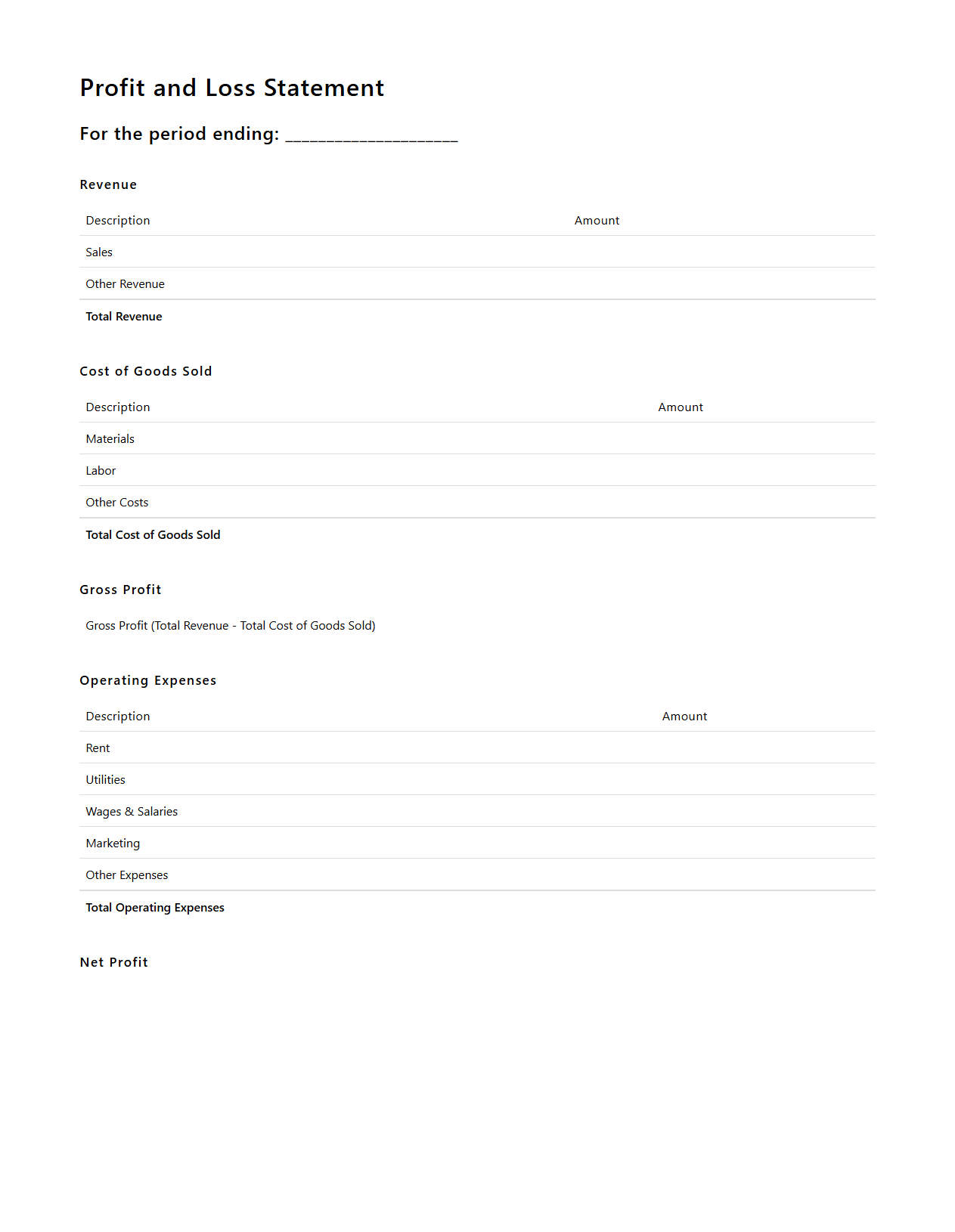

Blank Profit and Loss Statement Template for Entrepreneurs

A

Blank Profit and Loss Statement Template for entrepreneurs is a financial document designed to help track revenues, costs, and expenses over a specific period. This template enables startups and small businesses to analyze profitability by clearly outlining income streams and deducting operational expenses. Utilizing this tool promotes more accurate financial forecasting and informed decision-making for business growth.

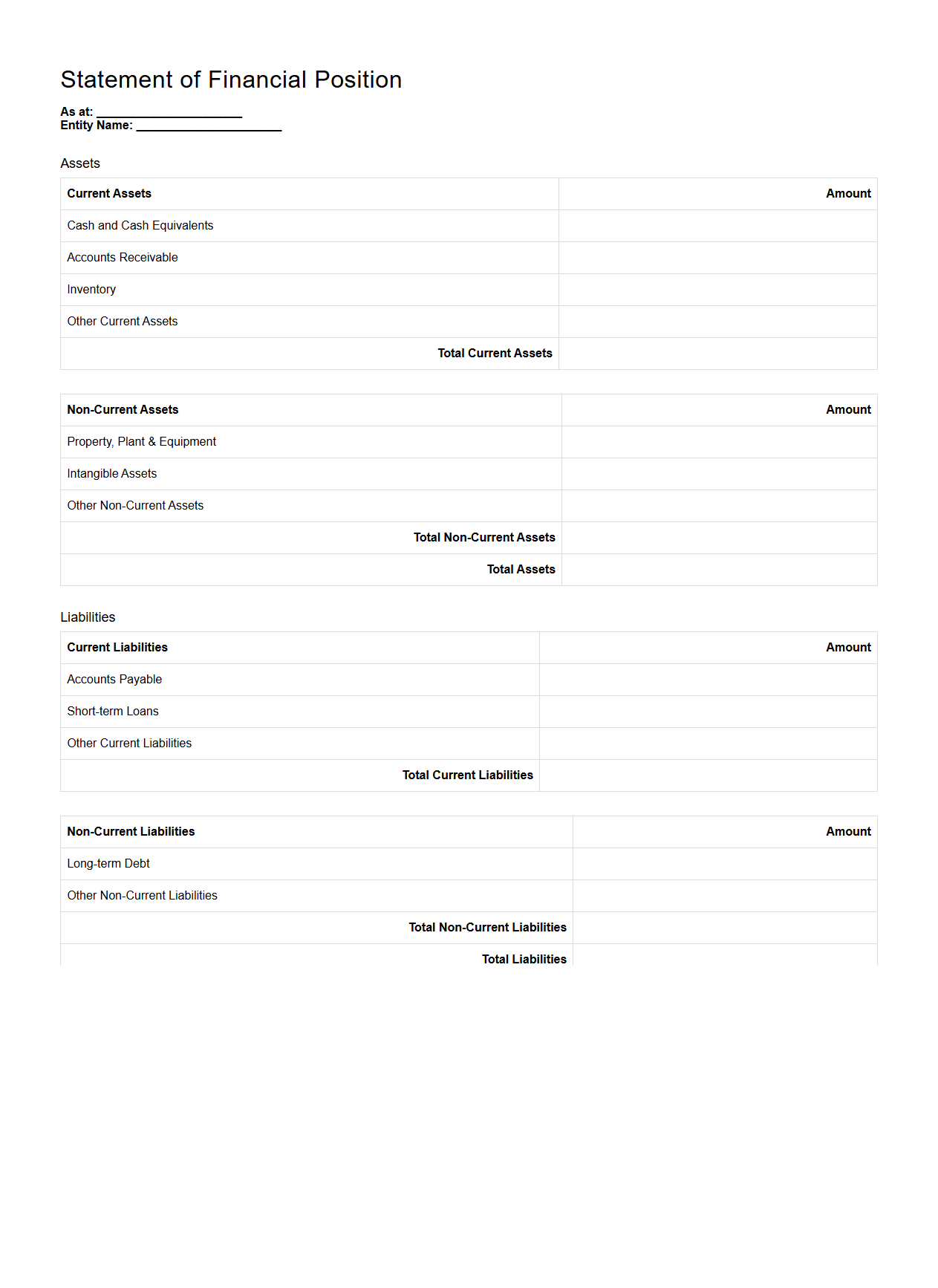

Blank Statement of Financial Position Template for Reporting

A

Blank Statement of Financial Position Template for reporting is a standardized document used by businesses to present their financial status at a specific point in time. It outlines assets, liabilities, and equity without pre-filled data, allowing organizations to customize it with their own figures for accurate financial analysis. This template facilitates consistent reporting, aiding in compliance with accounting standards and enhancing transparency for stakeholders.

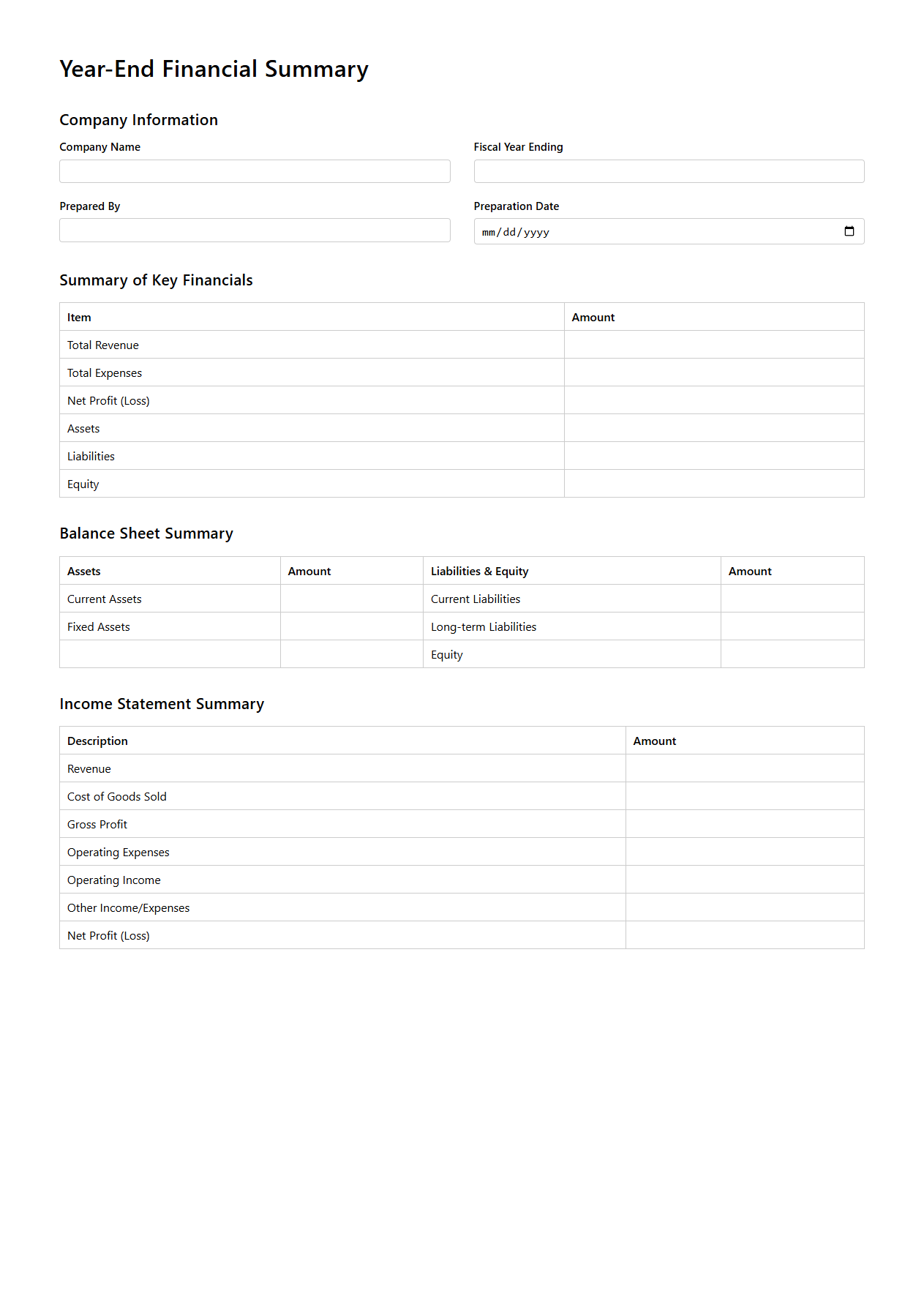

Blank Year-End Financial Summary Template for Accountants

A

Blank Year-End Financial Summary Template for Accountants is a structured document designed to compile and present comprehensive financial data at the close of a fiscal year. It includes sections for income, expenses, assets, liabilities, and equity, allowing accountants to accurately summarize financial performance and position. This template ensures consistency, accuracy, and efficiency in financial reporting, essential for audits, tax preparation, and strategic decision-making.

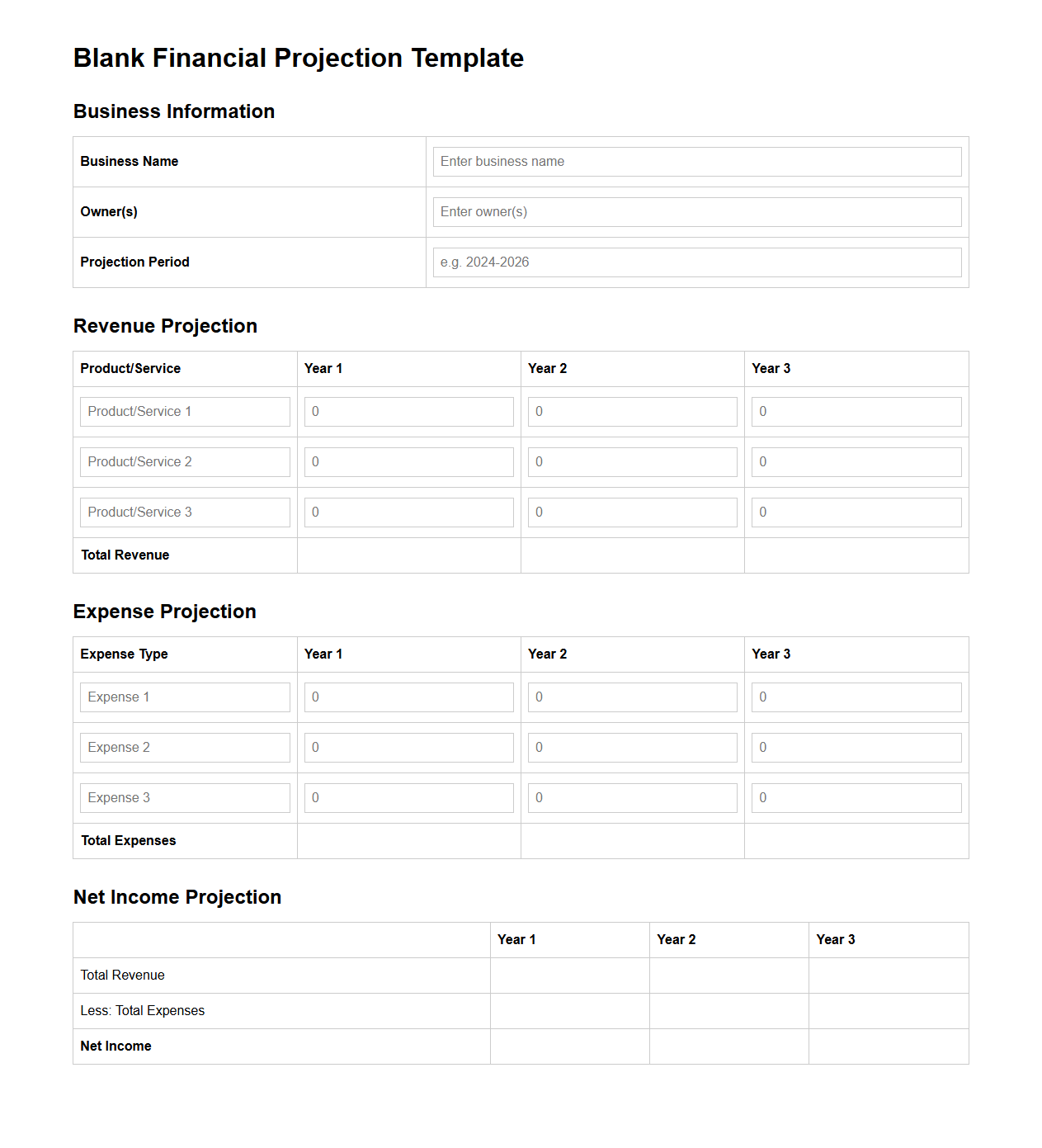

Blank Financial Projection Template for Business Planning

A

Blank Financial Projection Template for Business Planning is a structured spreadsheet designed to help entrepreneurs estimate future revenues, expenses, and cash flows over a specified period. It guides users in organizing financial data such as sales forecasts, operating costs, and capital expenditures, enabling clear visualization of profit margins and funding needs. This template is essential for creating accurate financial plans that support strategic decision-making and attract potential investors or lenders.

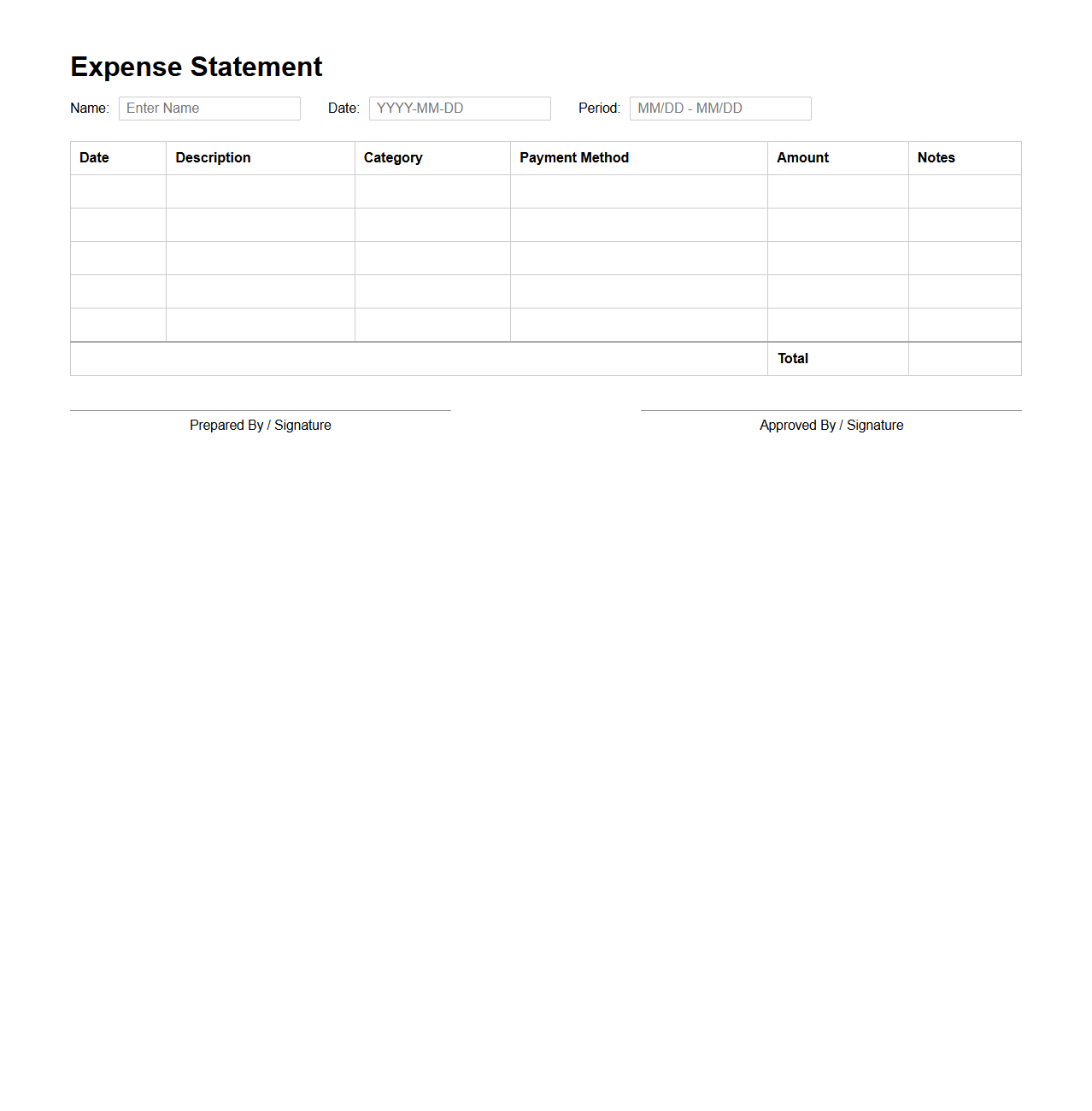

Blank Expense Statement Template for Finance Management

A

Blank Expense Statement Template for finance management is a crucial document used to systematically record and track business or personal expenditures. It allows users to input detailed information such as dates, categories, amounts, and descriptions of each expense, ensuring accurate financial reporting and budget monitoring. This template improves expense transparency and supports effective financial planning by organizing data in a clear, standardized format.

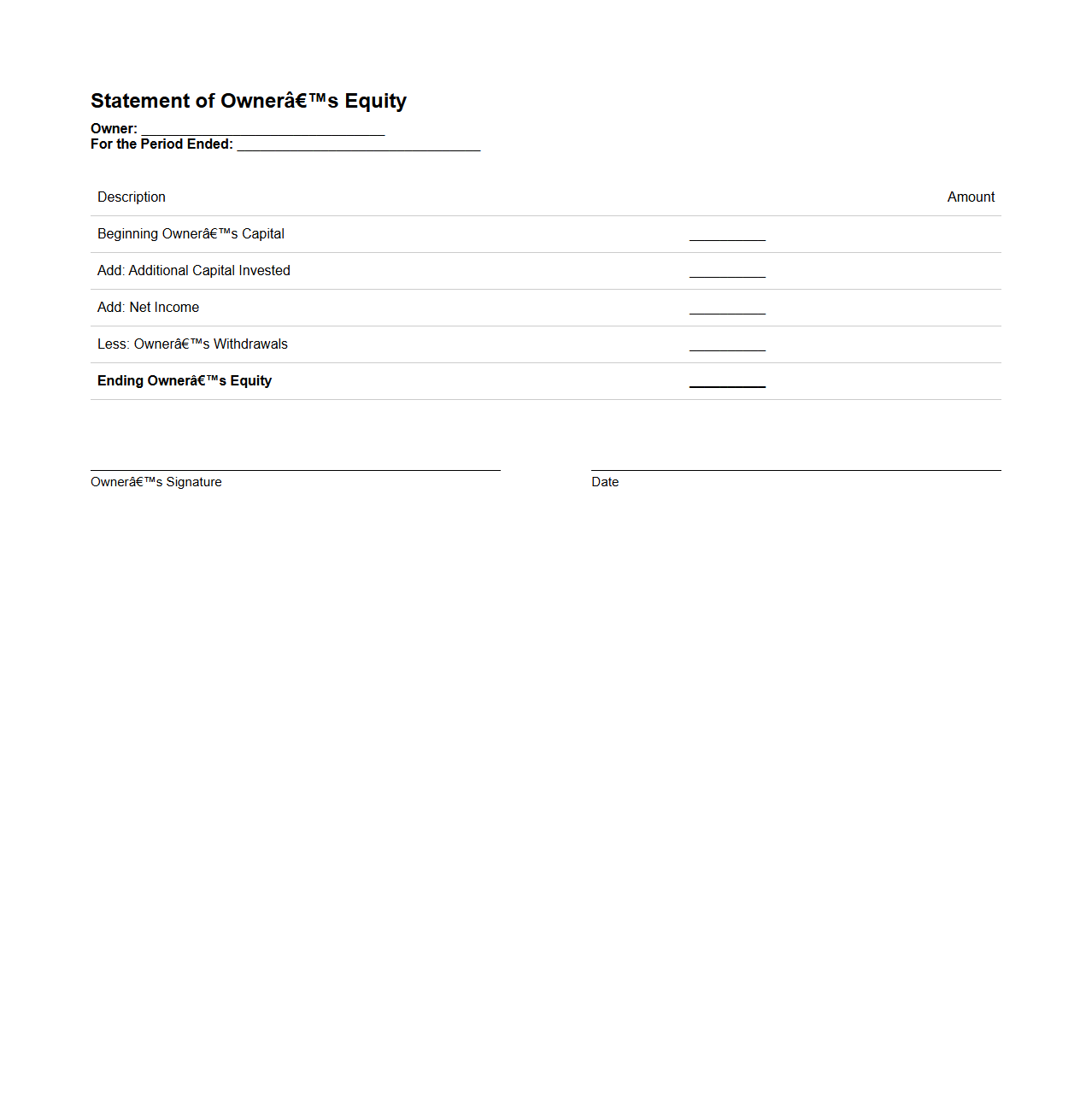

Blank Statement of Owner’s Equity Template for Analysis

A

Blank Statement of Owner's Equity Template for Analysis is a structured financial document designed to systematically track changes in owner's equity over a specific period. It helps businesses analyze contributions, withdrawals, net income, and other equity adjustments, providing a clear overview of the owner's financial interest in the company. This template supports accurate financial reporting and informed decision-making by capturing essential equity data in an organized format.

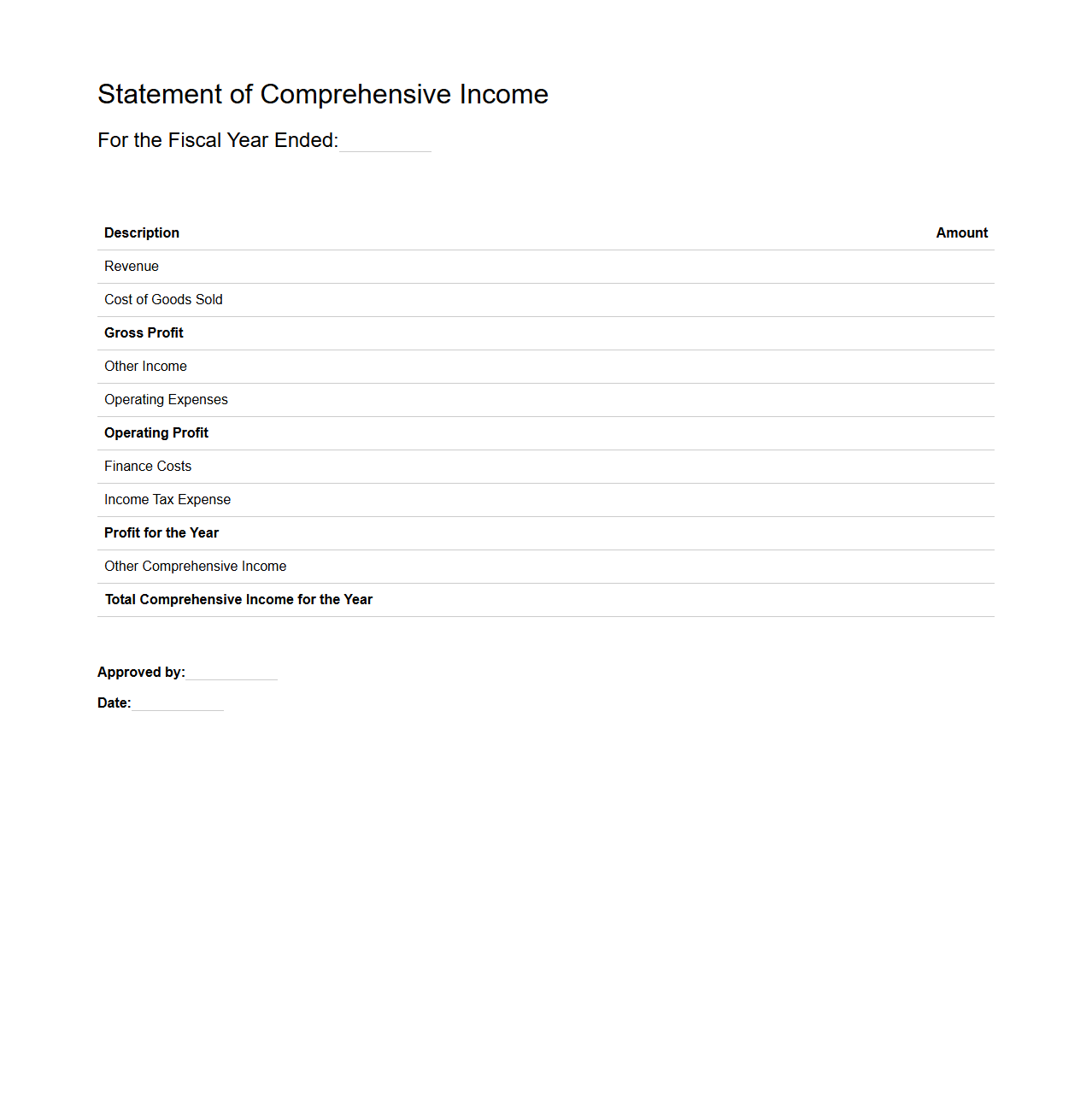

Blank Statement of Comprehensive Income Template for Fiscal Review

A

Blank Statement of Comprehensive Income Template for Fiscal Review is a structured financial document designed to capture a company's total income, expenses, gains, and losses over a specific fiscal period without pre-filled data. This template facilitates accurate tracking and analysis of net profit, other comprehensive income, and overall financial performance essential for internal audits, fiscal planning, and regulatory compliance. Utilizing a standard template ensures consistency and clarity in presenting comprehensive income details for stakeholder review and decision-making.

What supporting documents are necessary when submitting a Blank Financial Statement for auditing purposes?

When submitting a Blank Financial Statement for auditing, it is crucial to provide supporting documents that validate the reported figures. These often include bank statements, invoices, receipts, and contracts to substantiate the data. Auditors rely heavily on these documents to ensure accuracy and compliance with accounting standards.

How should non-monetary assets be reported on a Blank Financial Statement template?

Non-monetary assets must be listed with their fair market value on a Blank Financial Statement to provide a realistic portrayal of the company's resources. This includes property, equipment, and intangible assets like patents or trademarks. Clear descriptions and valuation methods should accompany these entries for transparency.

Which line items are mandatory for compliance on a Blank Financial Statement in small business accounting?

Mandatory line items typically include assets, liabilities, equity, revenues, and expenses to meet regulatory and reporting requirements. Small businesses must ensure these categories are fully detailed to provide an accurate financial picture. Omitting these can lead to non-compliance and auditing issues.

How does a Blank Financial Statement accommodate deferred tax liabilities?

A Blank Financial Statement should include a designated line item under liabilities for deferred tax liabilities reflecting taxes accrued but not yet paid. This ensures the company's tax obligations are accurately represented in the financial position. Proper classification helps in forecasting future cash outflows.

What are common errors to avoid when filling out a Blank Financial Statement form?

Common mistakes include omitting required supporting documentation, misclassifying assets or liabilities, and failing to update figures accurately. Ensuring completeness and precision prevents audit delays and financial misrepresentation. Double-checking all entries against source documents is essential.