A Blank Income Statement Template for Small Businesses provides a structured format to record revenues, expenses, and net profit or loss. This template helps entrepreneurs track financial performance clearly and consistently. Small businesses can customize it to fit their specific accounting needs and streamline financial reporting.

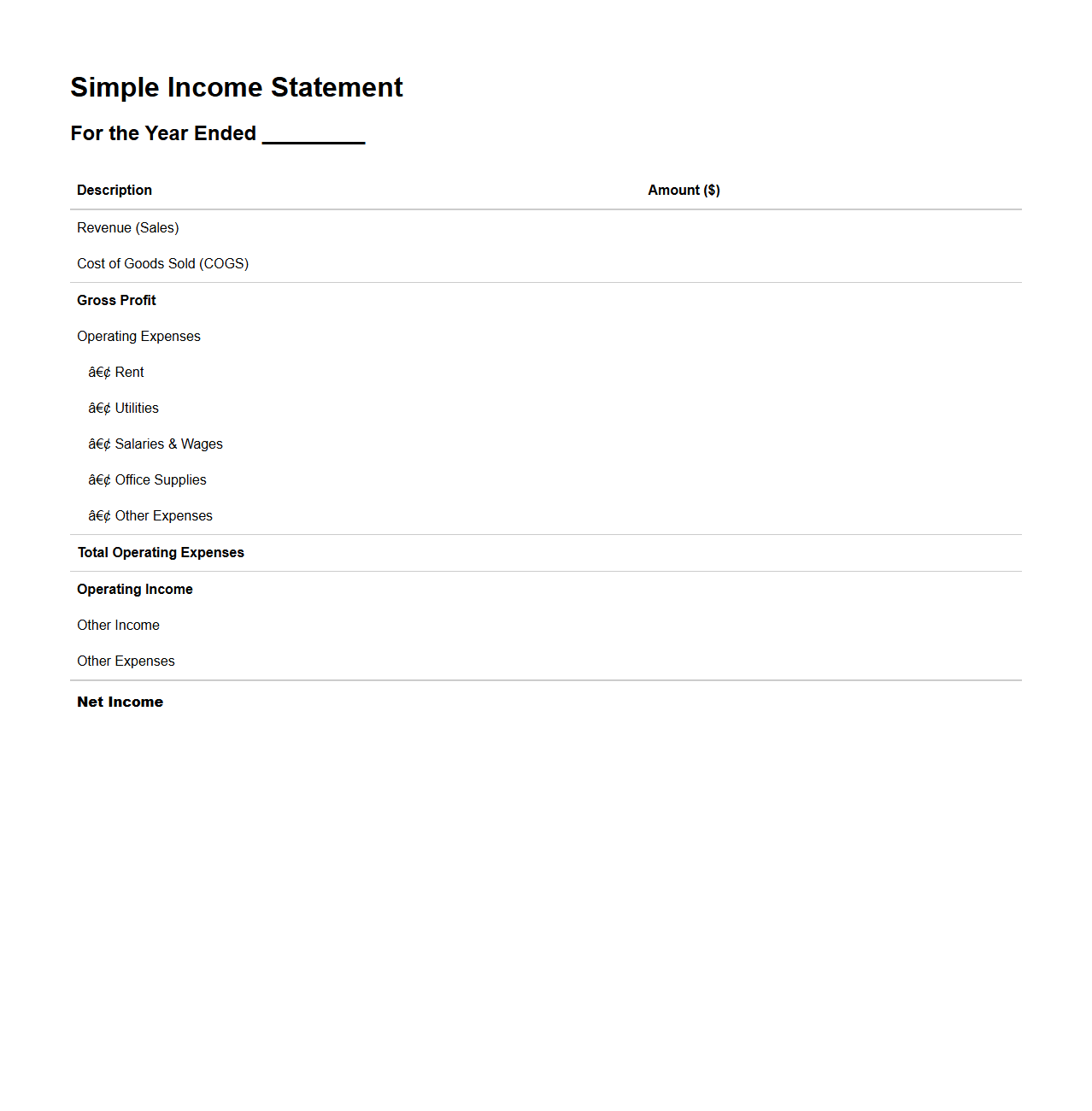

Simple Income Statement Template for Small Businesses

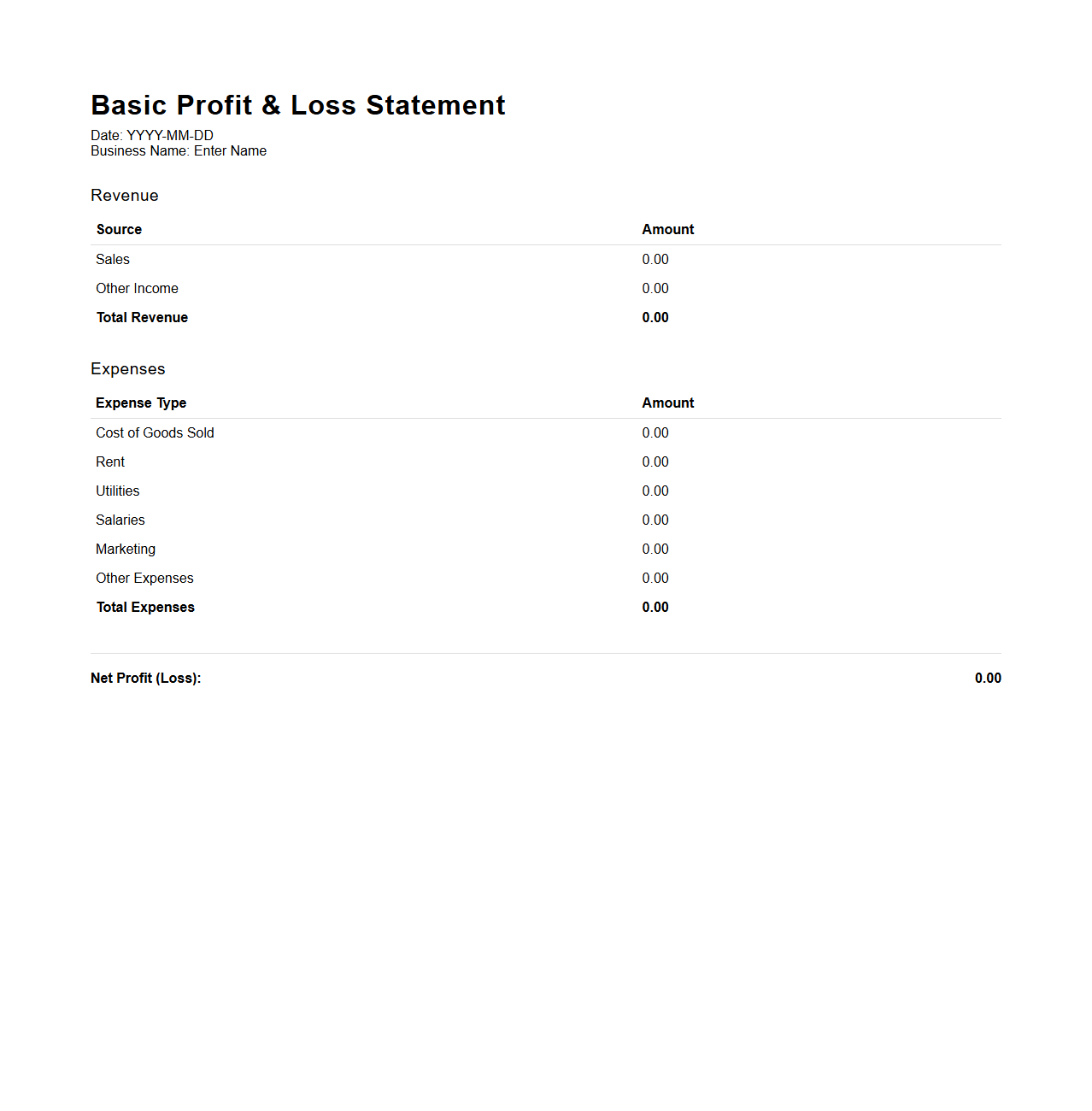

Basic Profit and Loss Statement for Entrepreneurs

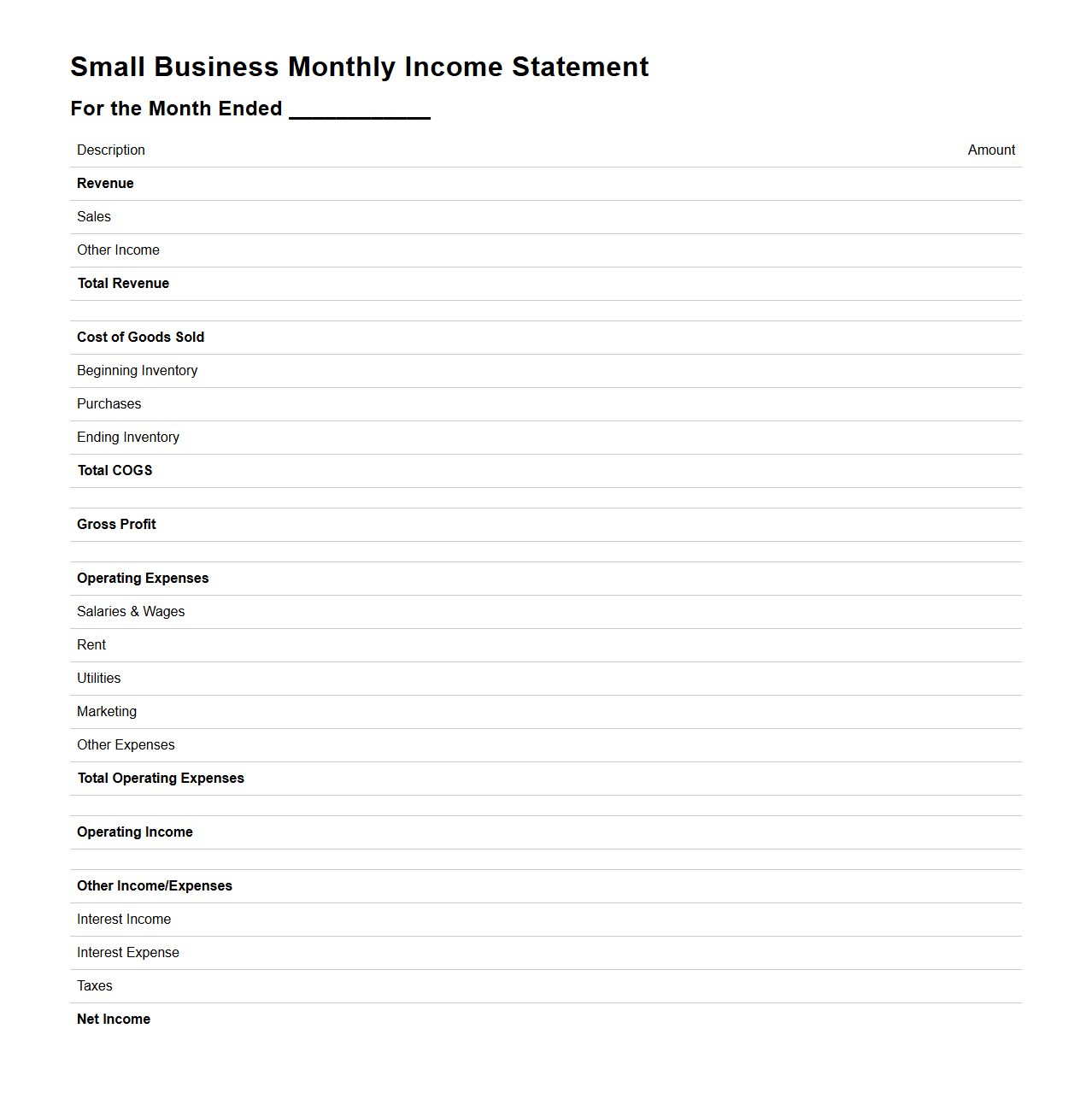

Small Business Monthly Income Statement Format

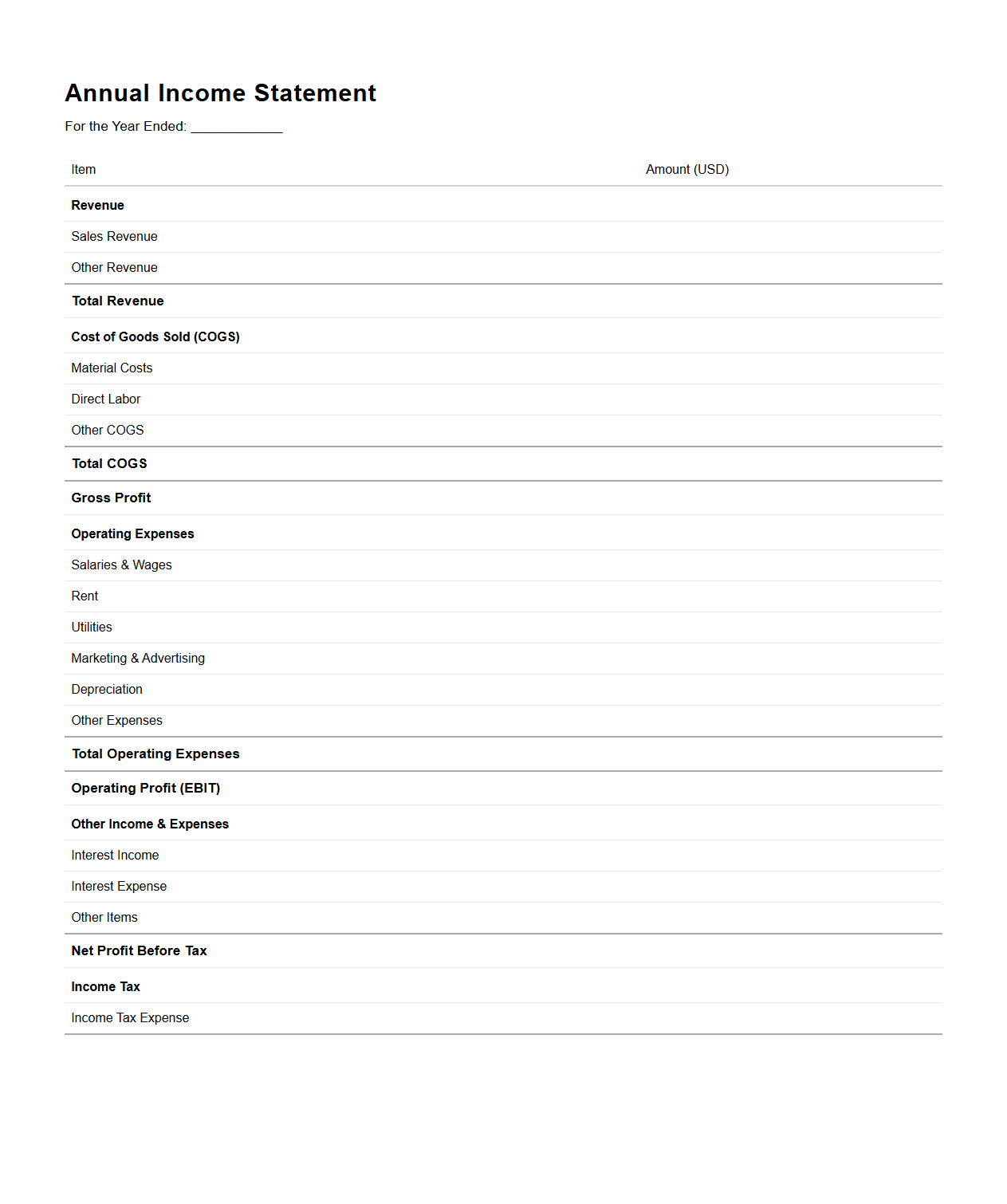

Annual Income Statement Sheet for Small Enterprises

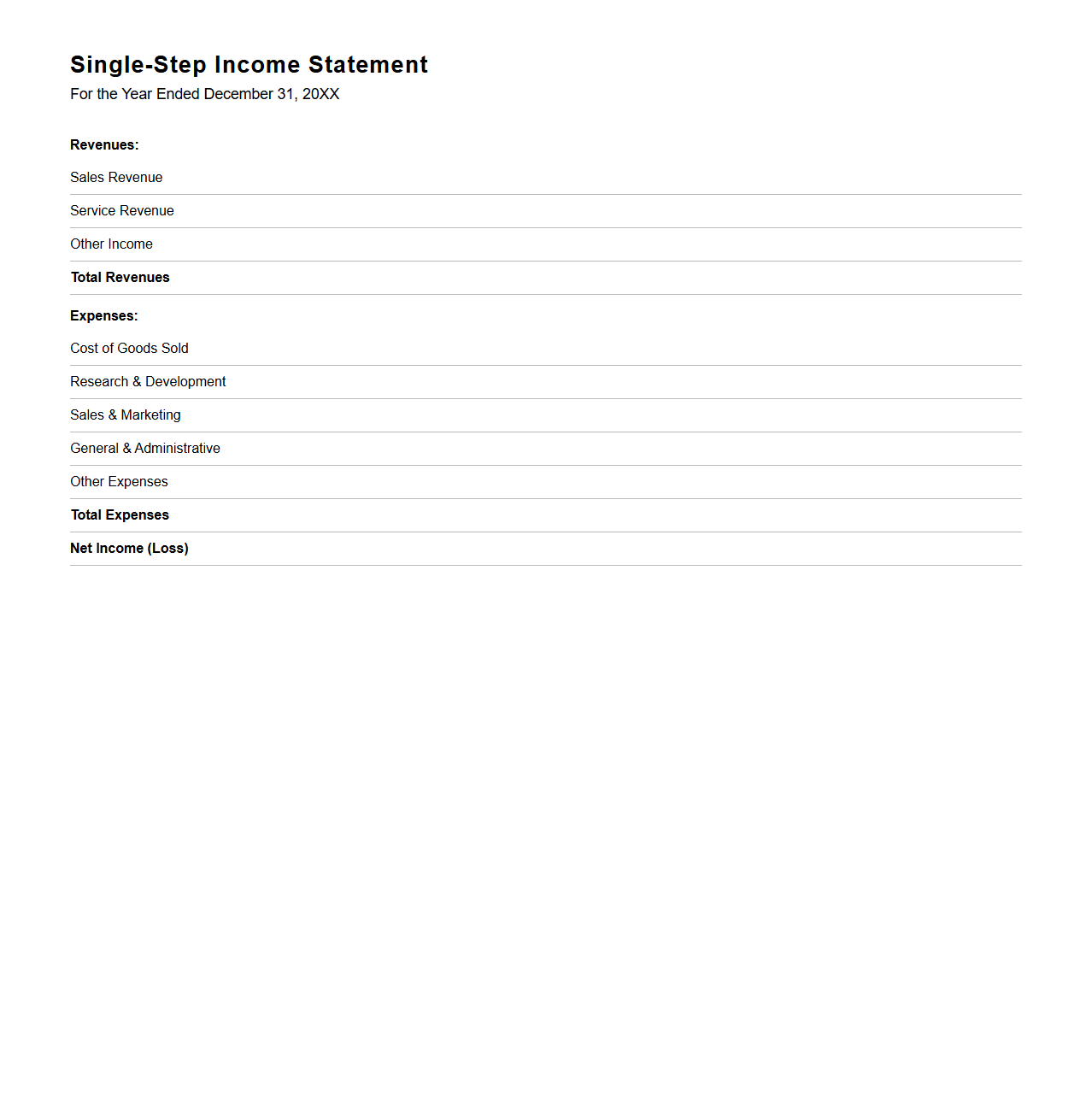

Single-Step Income Statement Outline for Startups

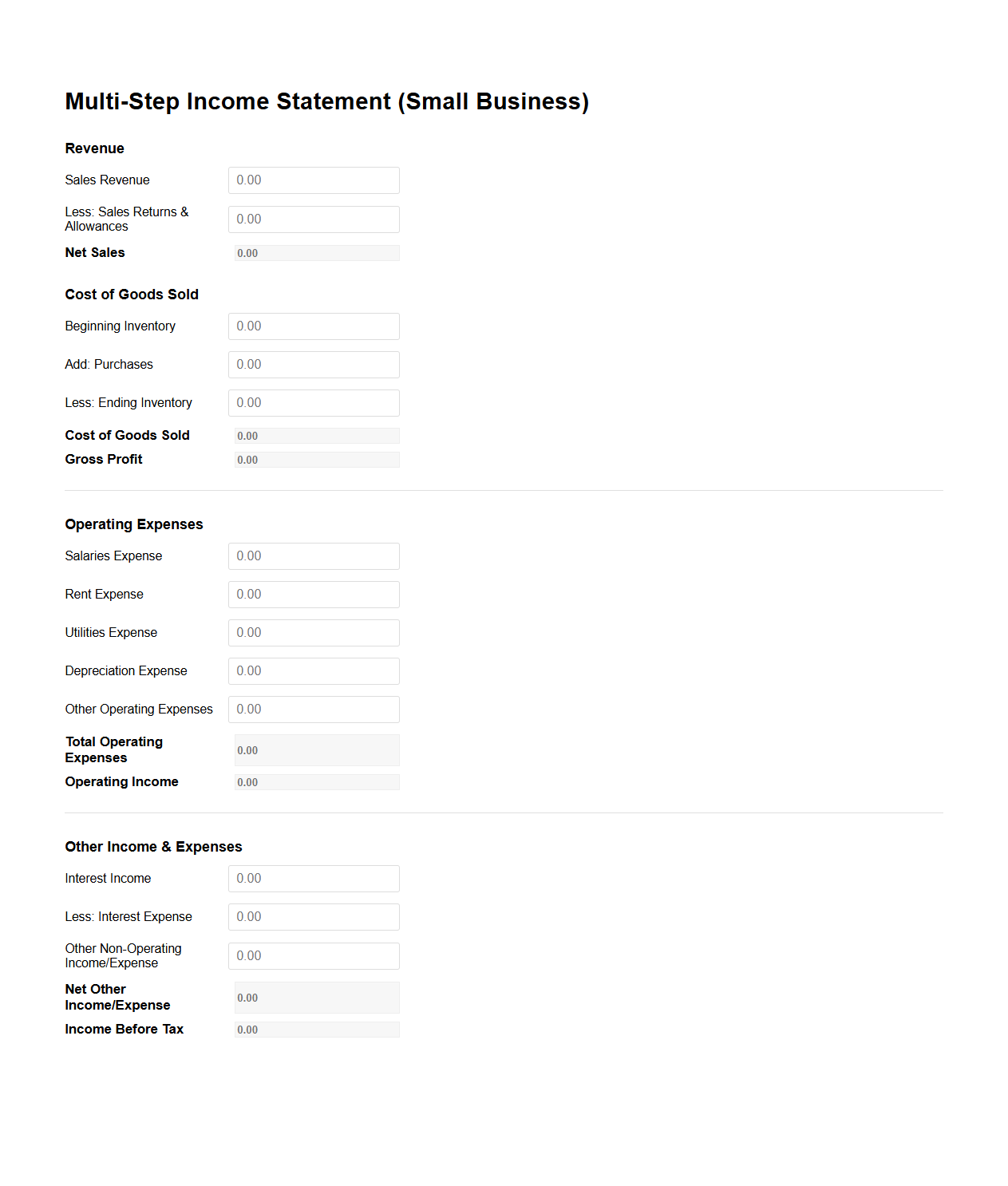

Multi-Step Income Statement Form for Small Businesses

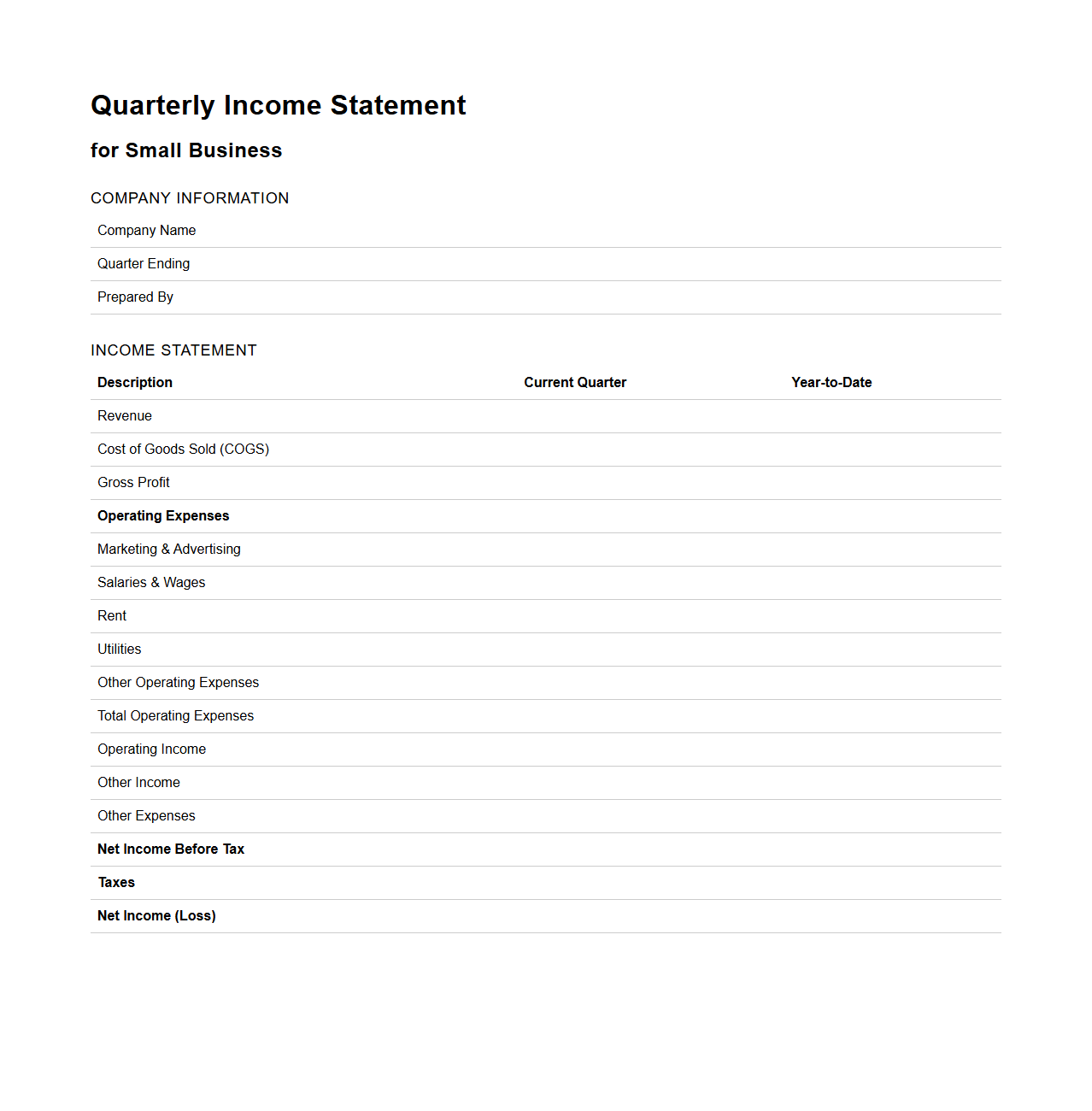

Quarterly Income Statement Structure for Small Firms

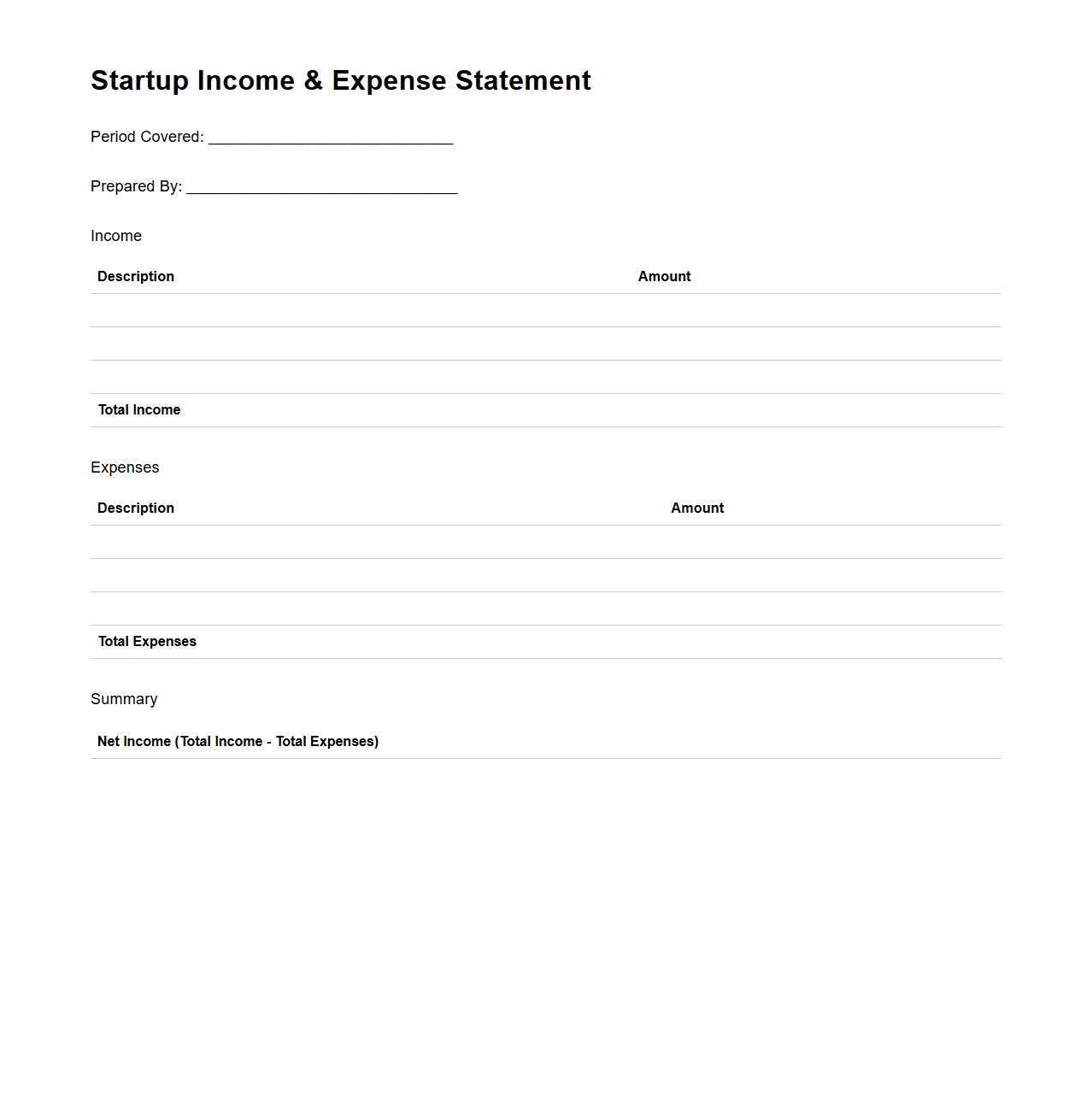

Startup Income and Expense Statement Template

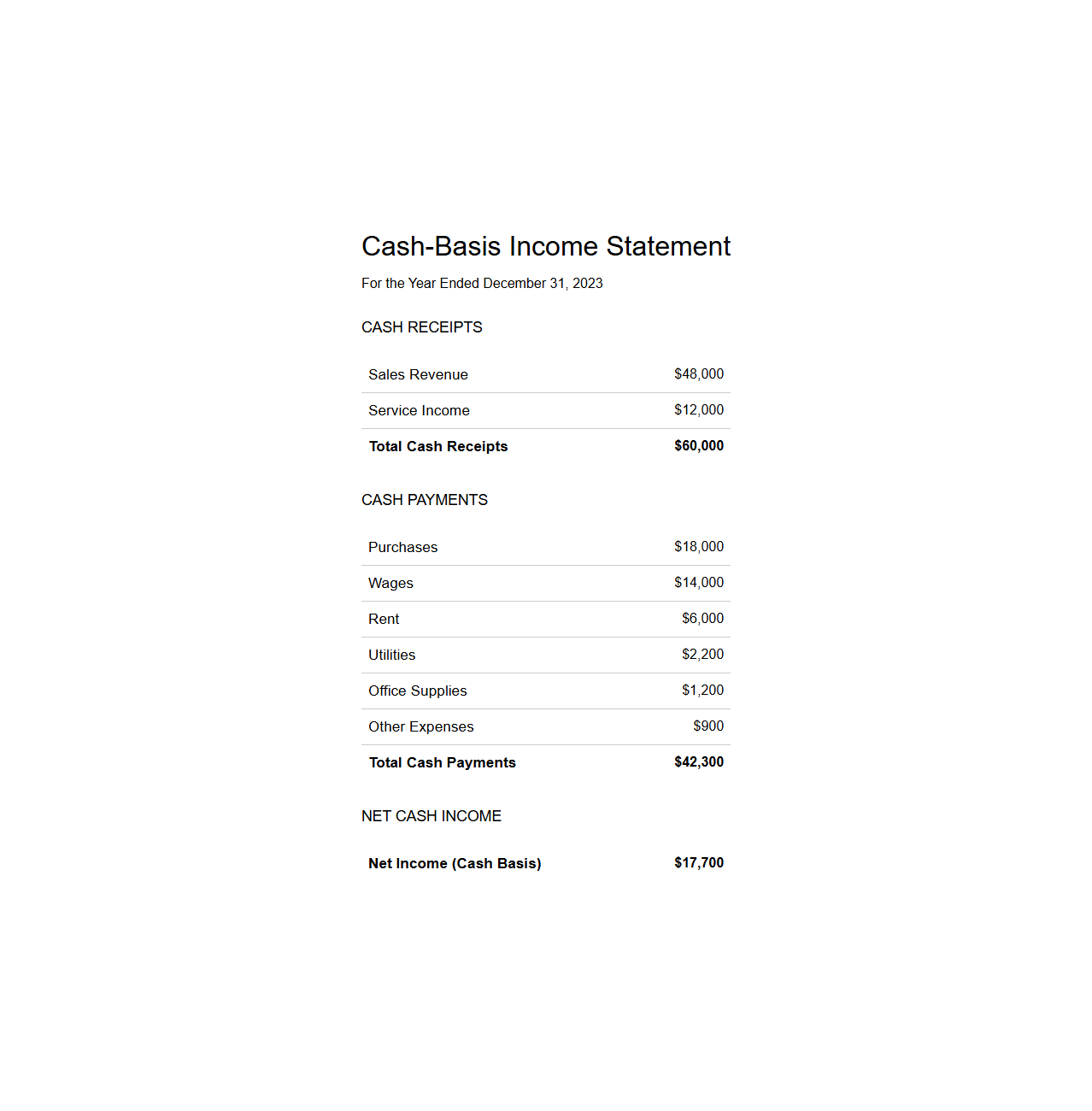

Cash-Basis Income Statement Example for Small Enterprises

Small Business Revenue and Expense Statement Sheet

What key sections should a blank income statement for small businesses include?

A blank income statement for small businesses should prominently feature revenue, expenses, and net income sections. Including all sources of income ensures accurate reflection of the business's financial performance. The expenses section must be detailed, covering operating costs, taxes, and interest payments.

Gross profit is a crucial metric calculated between revenue and cost of goods sold (COGS), providing insights into business efficiency. It's essential to include both operating and non-operating income to capture all financial activities. Lastly, the net income section summarizes the overall profitability, guiding future financial decisions.

Separating fixed and variable expenses helps in precise budgeting and forecasting. Including a section for depreciation and amortization aids in understanding asset-related costs. Finally, a subtotal for operating income clarifies the core business income before taxes and interest.

How does a blank income statement template differ for service-based versus product-based small businesses?

A blank income statement for service-based businesses excludes a detailed cost of goods sold (COGS) section, focusing instead on direct labor and service delivery costs. Conversely, product-based businesses require a comprehensive COGS section accounting for materials, manufacturing, and inventory expenses. Service businesses typically emphasize operational expenses like salaries and rent.

Product businesses often include inventory management in their income statements, which is not applicable to service providers. Additionally, product-based template designs may have sections for freight, shipping, and packaging costs. Service templates prioritize costs related to client acquisition and service execution.

The revenue section for product-based businesses distinguishes sales of goods versus returns or discounts. Service-based income statements might categorize revenue by types of services offered, offering more granular insights. This distinction ensures each business type captures relevant financial data effectively.

Which financial metrics are essential to include in a blank income statement for startups?

For startups, key financial metrics include gross profit margin, operating expenses, and net profit, highlighting how efficiently the business converts revenue into profit. Tracking burn rate is critical to understand cash consumption against available funding. Startups should also monitor EBITDA for operational profitability.

Including revenue growth rates can reveal early market traction and business scalability potential. Startups must account for one-time expenses or investments separately to assess ongoing operational costs. Break-even analysis sections help determine when the company will start generating profit.

Startups benefit from including detailed expense categories such as marketing, research and development, and administrative costs. Monitoring operating cash flow alongside net income provides clarity on liquidity status. Finally, presenting metrics like customer acquisition cost and lifetime value can enhance strategic financial planning.

Can a blank income statement be customized for different fiscal periods (monthly, quarterly, annually)?

A blank income statement is fully customizable for different fiscal periods such as monthly, quarterly, or annually, depending on reporting needs. Monthly statements provide detailed insights for short-term financial management. Quarterly and annual reports offer broader perspectives, important for trend analysis and investor communication.

Adjusting the template involves changing date ranges and aggregating figures accordingly while maintaining consistent section formats. Businesses often customize income statements for tax reporting cycles or internal performance evaluations. Flexibility in period selection enhances the statement's usefulness for various stakeholders.

Different fiscal periods impact the granularity of data, with shorter periods requiring more frequent updates. Customizing periods can also affect budget comparisons and forecasting accuracy. Consequently, having a template adaptable to multiple reporting intervals is essential for proactive financial management.

What common errors should small business owners watch for when filling out a blank income statement?

Small business owners should avoid omitting significant revenue streams or underreporting expenses, which can distort net income calculations. Misclassifying costs, such as mixing operating and capital expenses, leads to inaccurate financial analysis. Failure to update the statement regularly can result in outdated financial information.

Common errors include neglecting non-operating income and expenses, which impact overall profitability. Owners often make mistakes in accounting for tax liabilities and depreciation, affecting final profit figures. Overlooking small but recurring expenses can accumulate and skew results over time.

Using inconsistent accounting methods between periods reduces comparability and complicates financial planning. It's crucial to double-check entries for calculation errors and ensure adherence to accounting standards. Implementing periodic reviews and professional audits can help mitigate these common pitfalls.