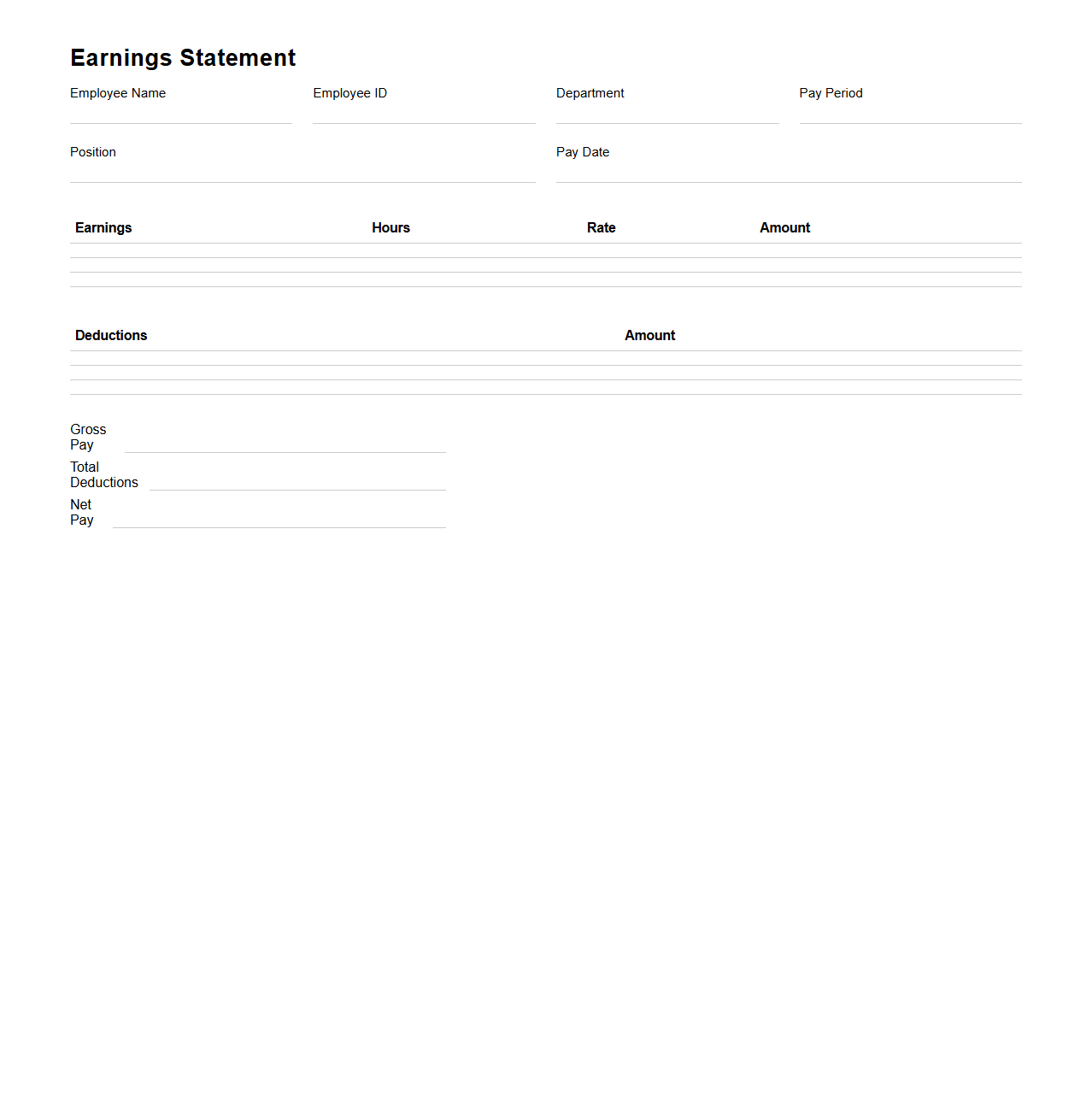

The Blank Statement Template for Employee Earnings provides a customizable format to detail an employee's income and deductions clearly. This template ensures accurate record-keeping and simplifies payroll reporting by organizing salary, bonuses, and tax withholdings. It is essential for maintaining transparency and facilitating financial audits in any organization.

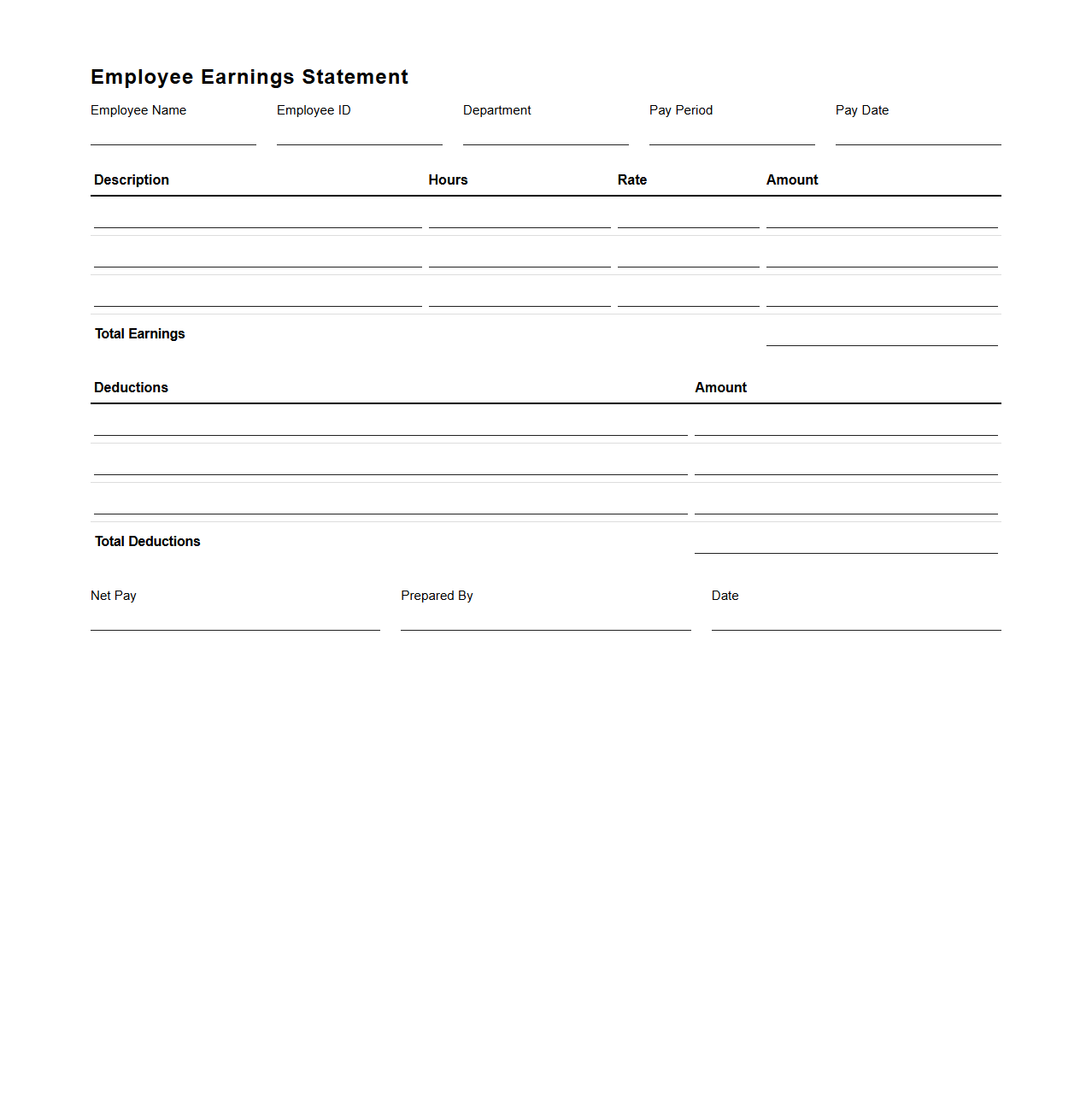

Employee Earnings Statement Form

An

Employee Earnings Statement Form is a document that provides a detailed breakdown of an employee's wages, including gross pay, deductions, taxes, and net income for a specific pay period. It serves as an official record for both employees and employers to track earnings and ensure accuracy in payroll processing. This form is essential for tax reporting, financial planning, and maintaining transparent payroll practices within organizations.

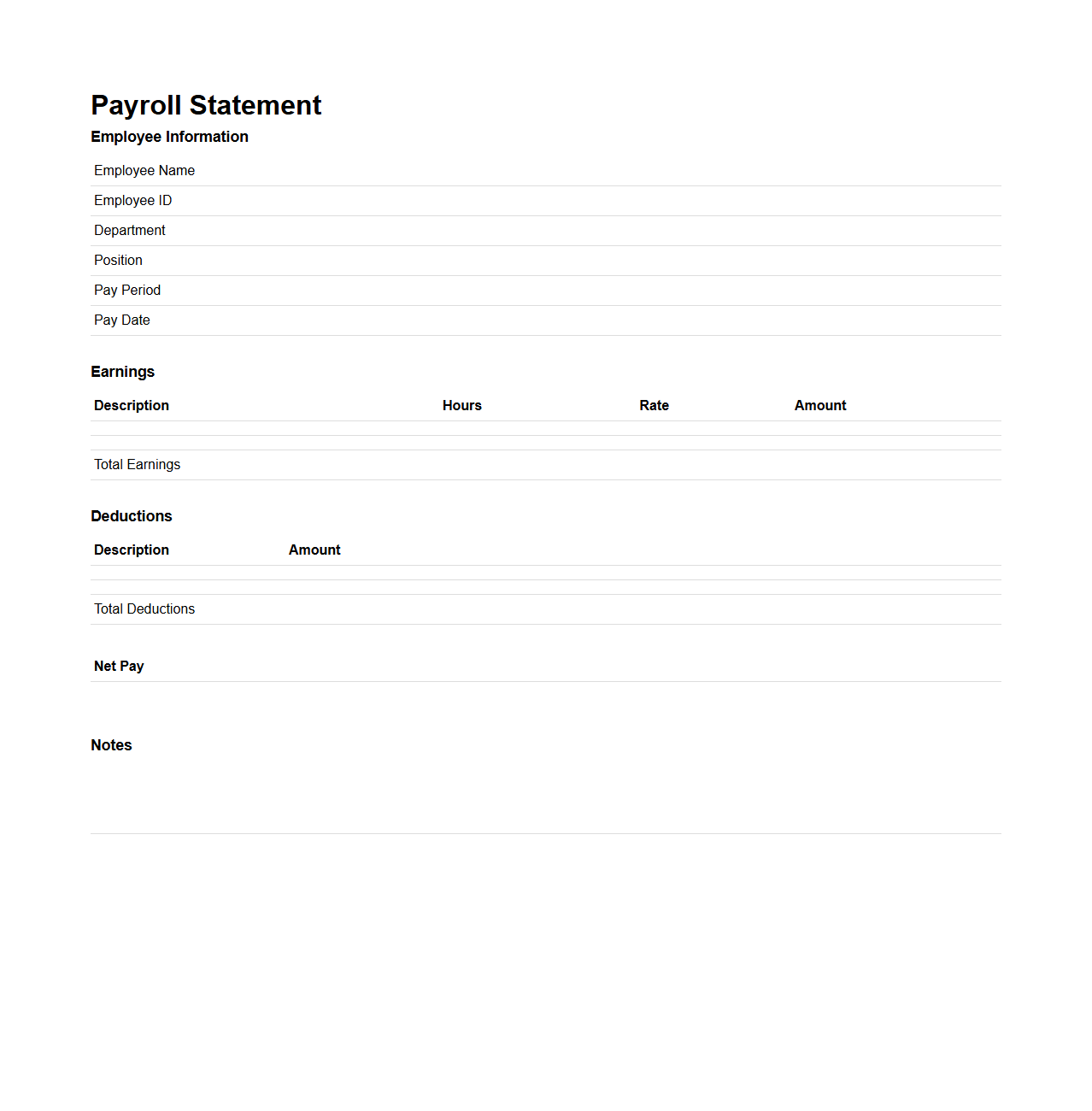

Blank Payroll Statement Template

A

Blank Payroll Statement Template document serves as a standardized format for recording employee wage details, deductions, and net pay. It ensures accuracy and consistency in payroll processing by providing predefined fields for essential data such as employee information, pay period, hours worked, tax withholdings, and benefits. This template simplifies payroll management and helps maintain compliance with financial and legal requirements.

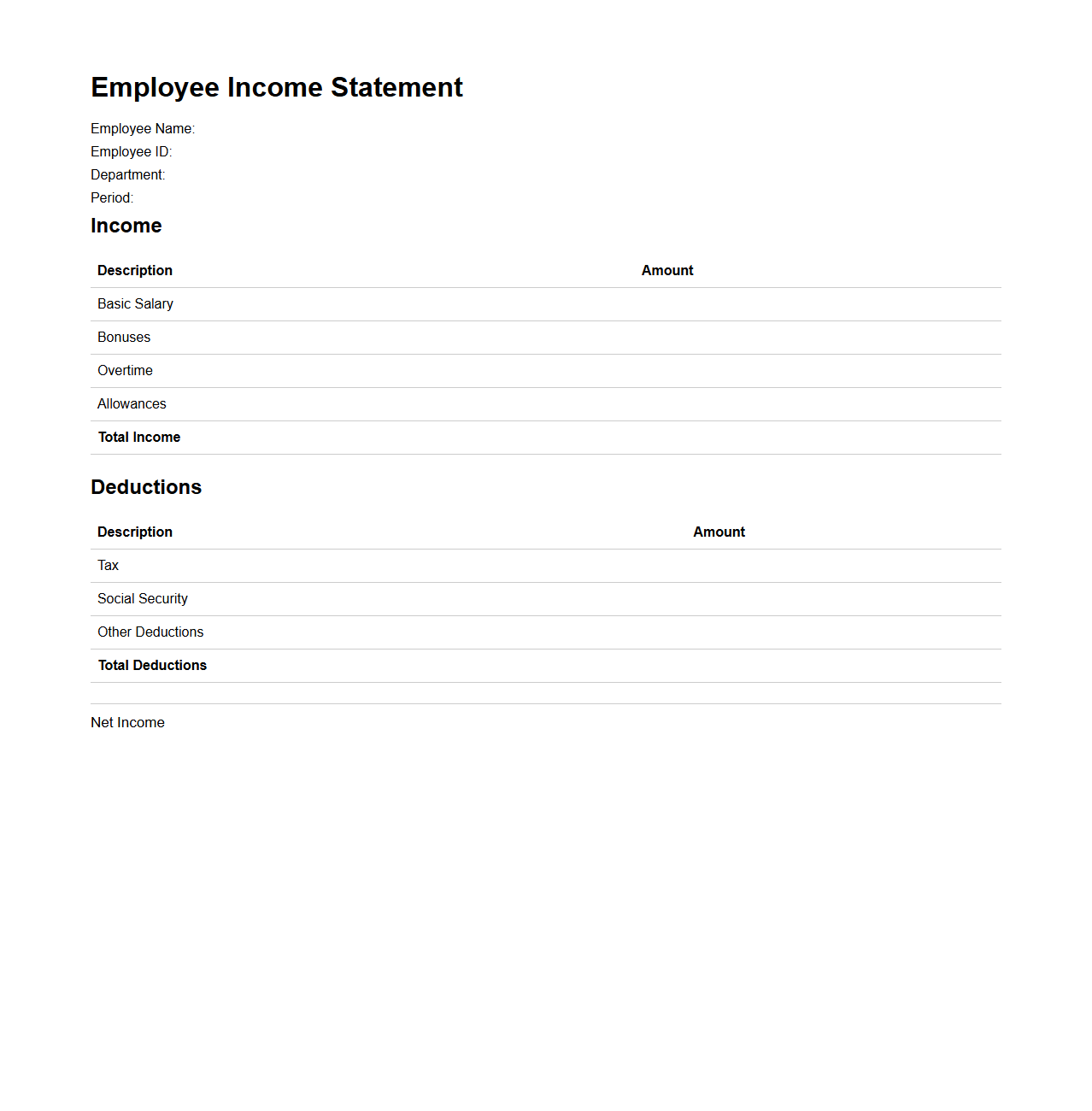

Employee Income Statement Sample

An

Employee Income Statement Sample document outlines an employee's earnings, deductions, and net pay over a specific period, providing a clear breakdown of salary components such as gross wages, taxes, and benefits. This document serves as a crucial reference for wage verification, tax filing, and financial planning. Employers use these statements to maintain transparent payroll records and ensure compliance with labor regulations.

Earnings Statement Sheet for Employees

An

Earnings Statement Sheet for employees is a detailed document that outlines an individual's wages, deductions, taxes, and net pay for a specific pay period. It provides transparency on salary calculations and ensures employees can verify their earnings and withholdings. This statement is essential for personal financial management and tax reporting purposes.

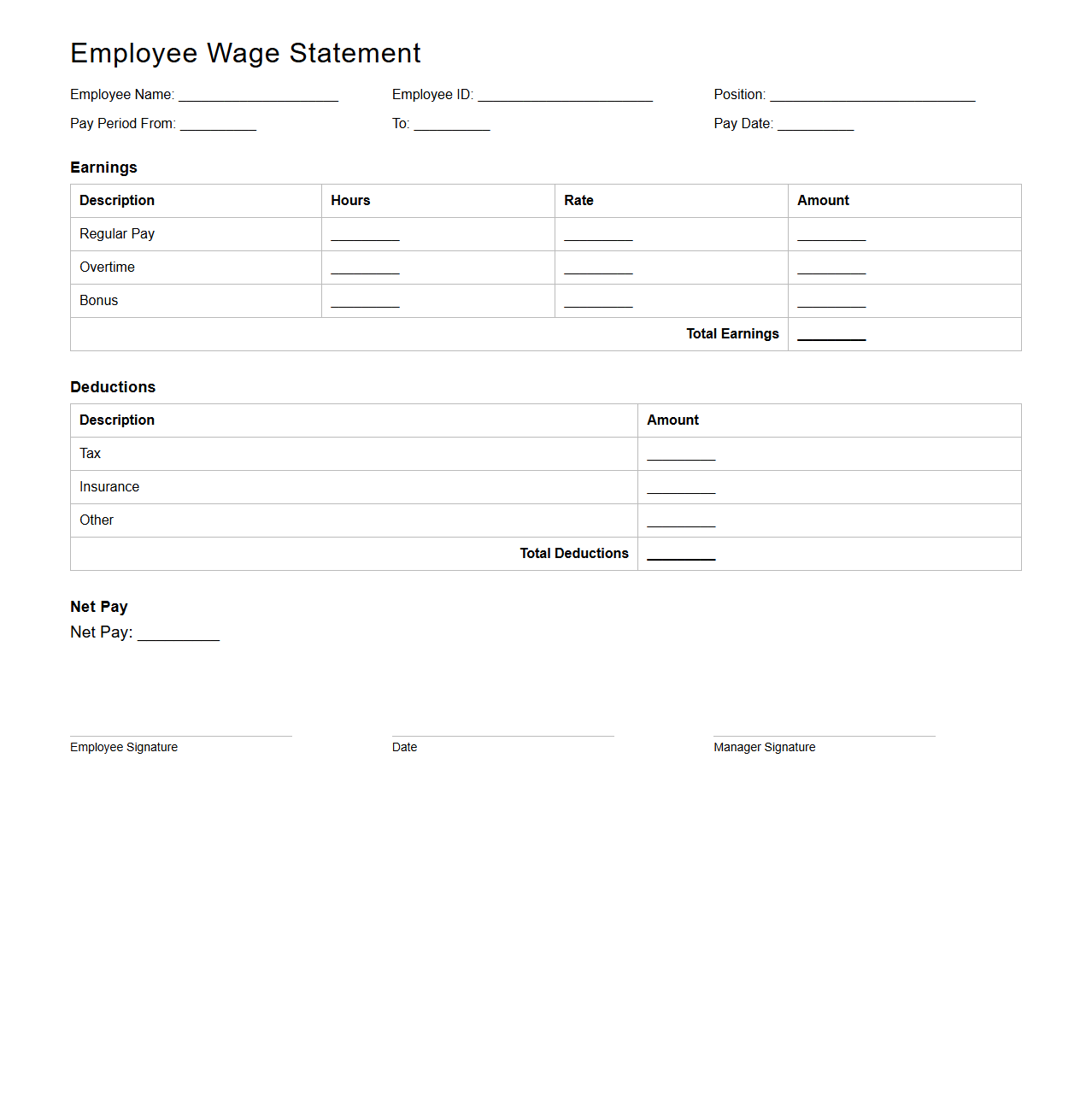

Employee Wage Statement Template

An

Employee Wage Statement Template is a standardized document used by employers to provide detailed information about an employee's earnings during a specific pay period. It typically includes data such as gross wages, deductions, net pay, tax withholdings, and hours worked. This template ensures transparency, helps maintain accurate payroll records, and complies with legal wage reporting requirements.

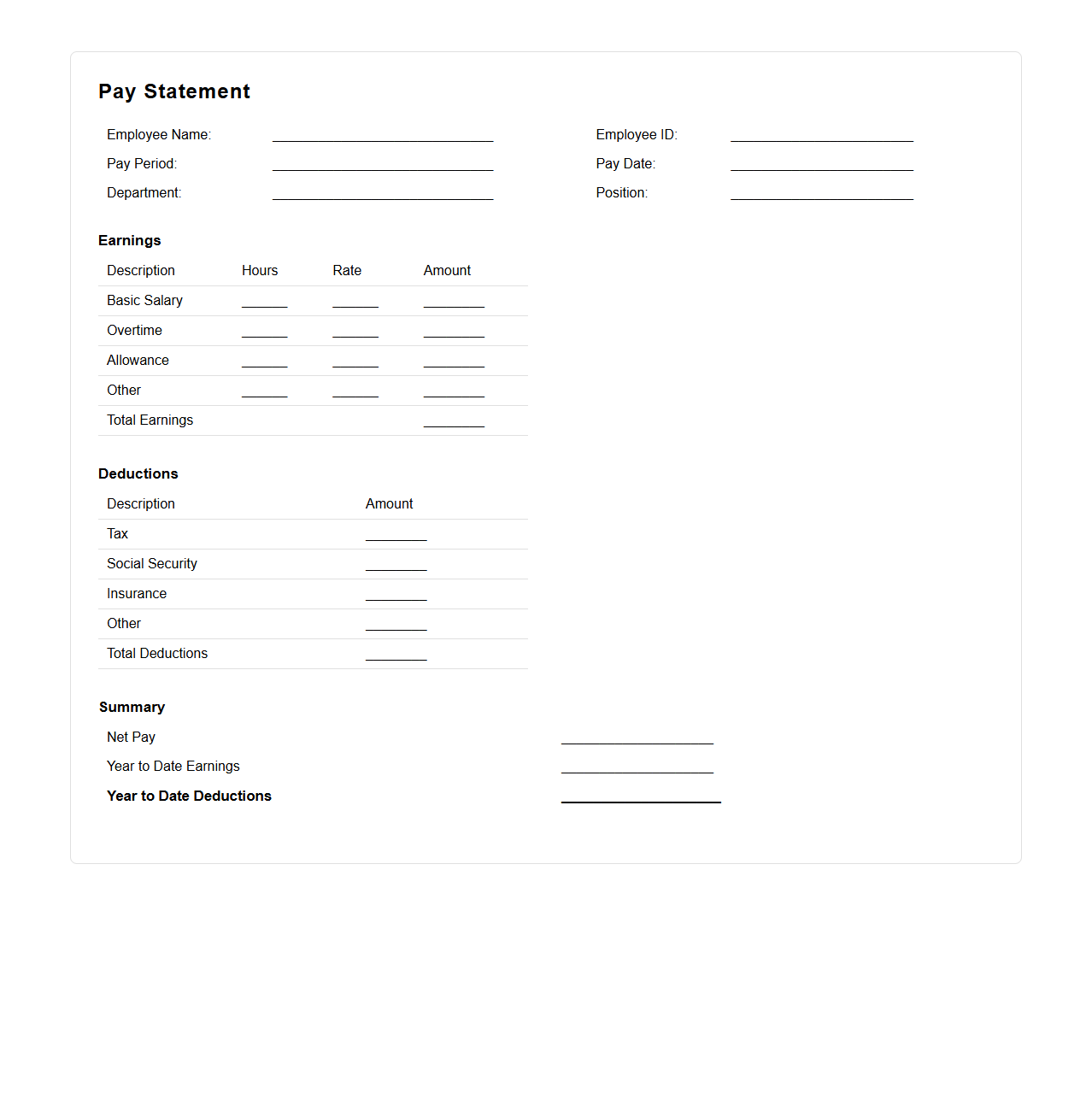

Pay Statement Format for Employees

A

Pay Statement Format for Employees document provides a standardized template detailing an employee's earnings, deductions, and net pay for a specific pay period. It typically includes information such as basic salary, overtime, bonuses, tax withholdings, and other deductions, ensuring transparency and compliance with payroll regulations. Employers use this format to maintain accurate payroll records and facilitate clear communication of payment details to employees.

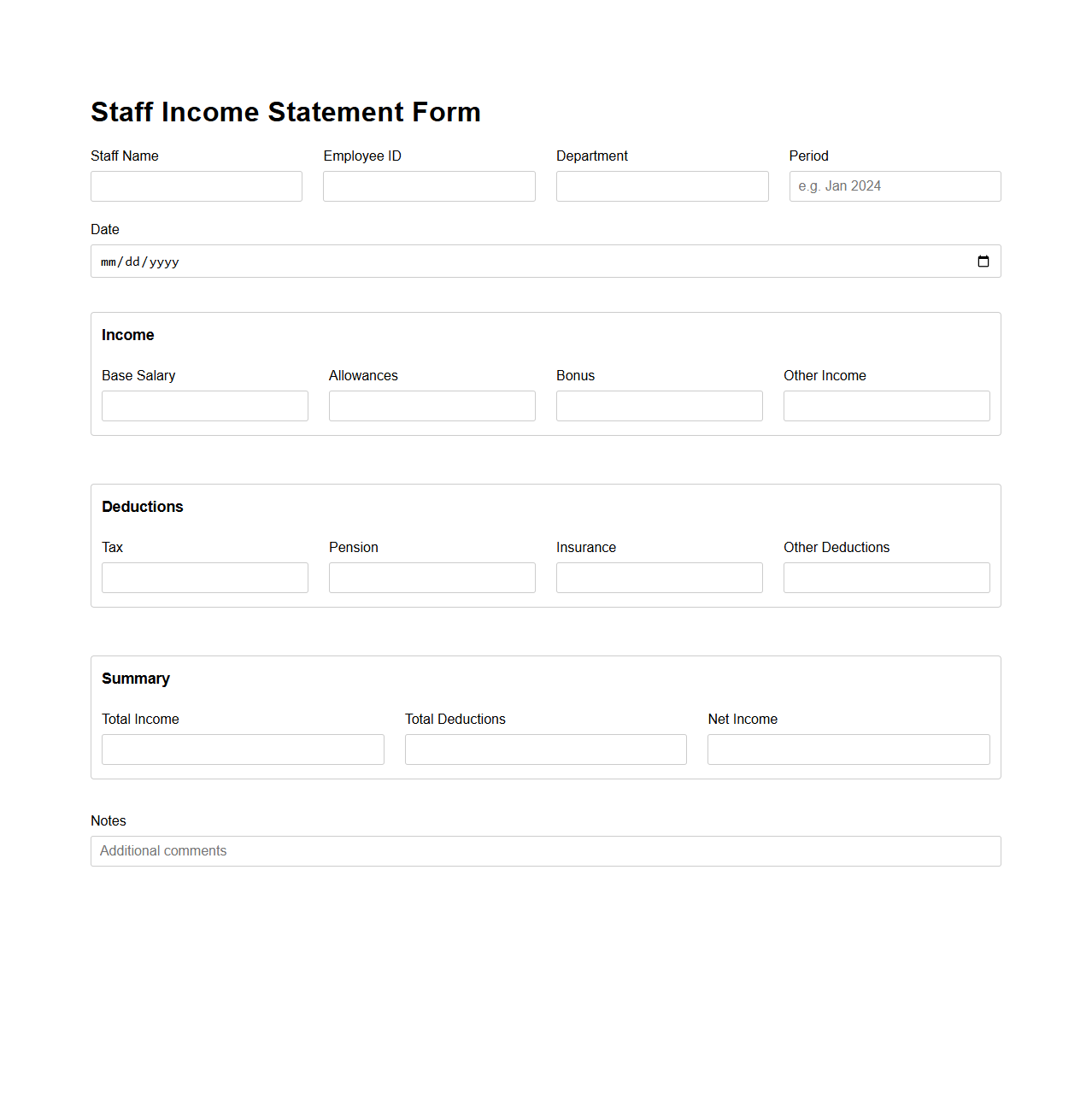

Staff Income Statement Form

The

Staff Income Statement Form is a document used by employees to declare their earnings, including salaries, bonuses, and other income sources, for tax or payroll purposes. It helps employers accurately calculate tax withholdings and benefits contributions by providing a detailed breakdown of individual income. This form ensures compliance with financial regulations and supports transparent employee compensation management.

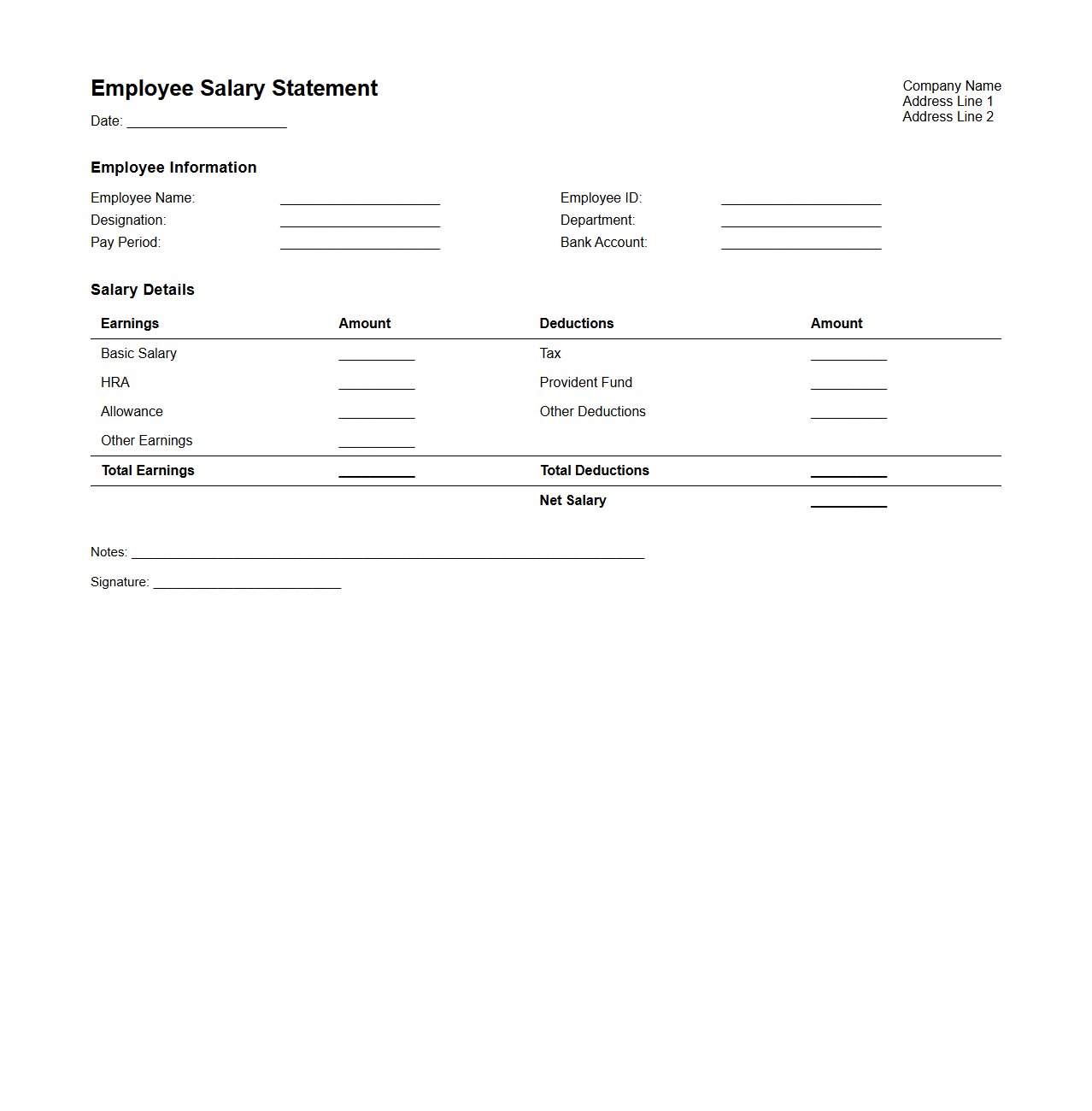

Employee Salary Statement Layout

The

Employee Salary Statement Layout document outlines the structured format used to present detailed salary information to employees, including basic pay, allowances, deductions, and net salary. This layout ensures clarity and transparency in payroll communication, facilitating accurate understanding and record-keeping. Employers utilize this standardized document to comply with legal requirements and enhance payroll process efficiency.

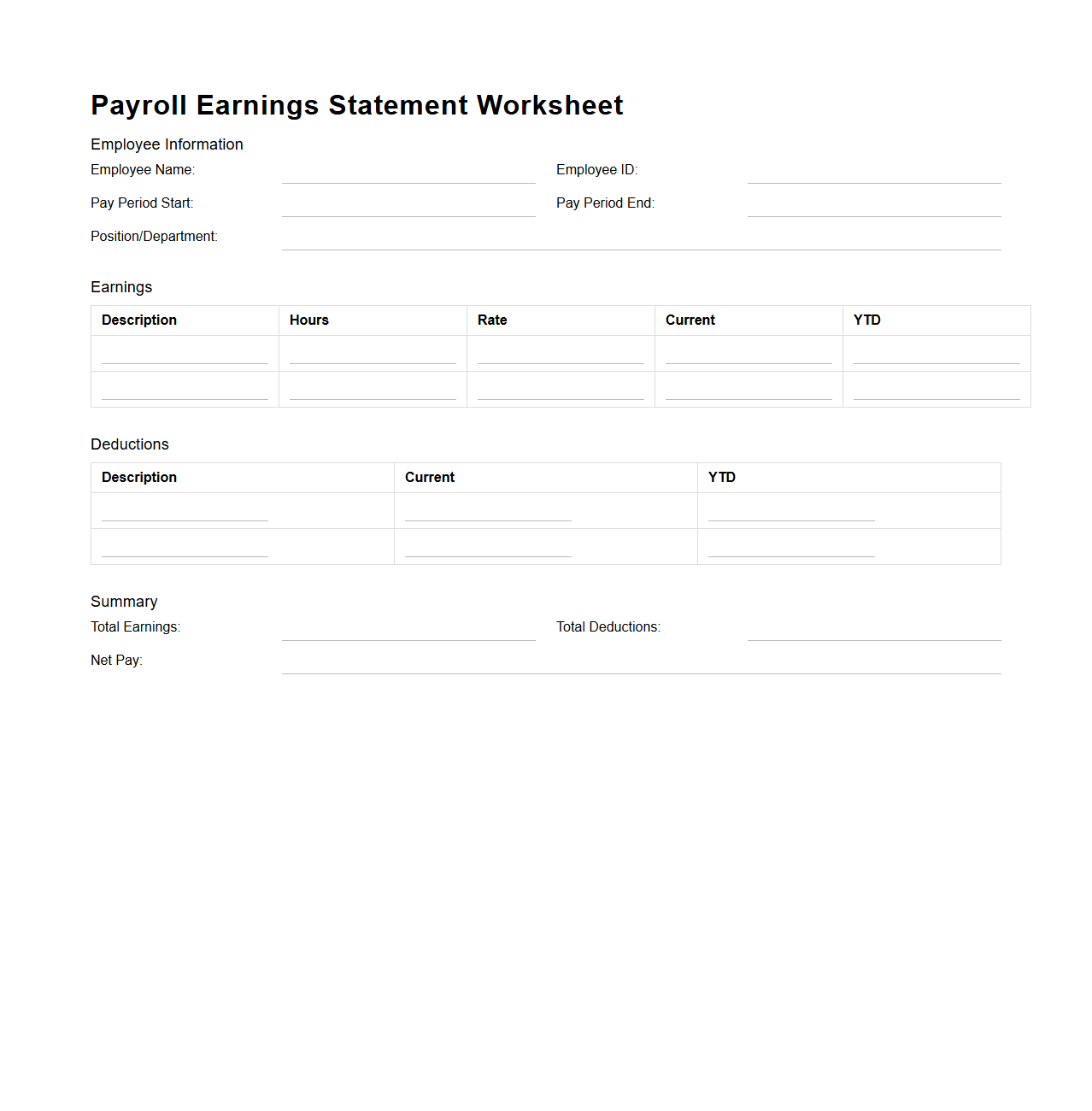

Payroll Earnings Statement Worksheet

A

Payroll Earnings Statement Worksheet is a detailed document used to track an employee's wages, overtime, bonuses, deductions, and net pay for a specific pay period. It serves as a comprehensive record for both employers and employees to verify payment accuracy and ensure compliance with tax and labor regulations. This worksheet helps streamline payroll processing by organizing all earning components in one accessible format.

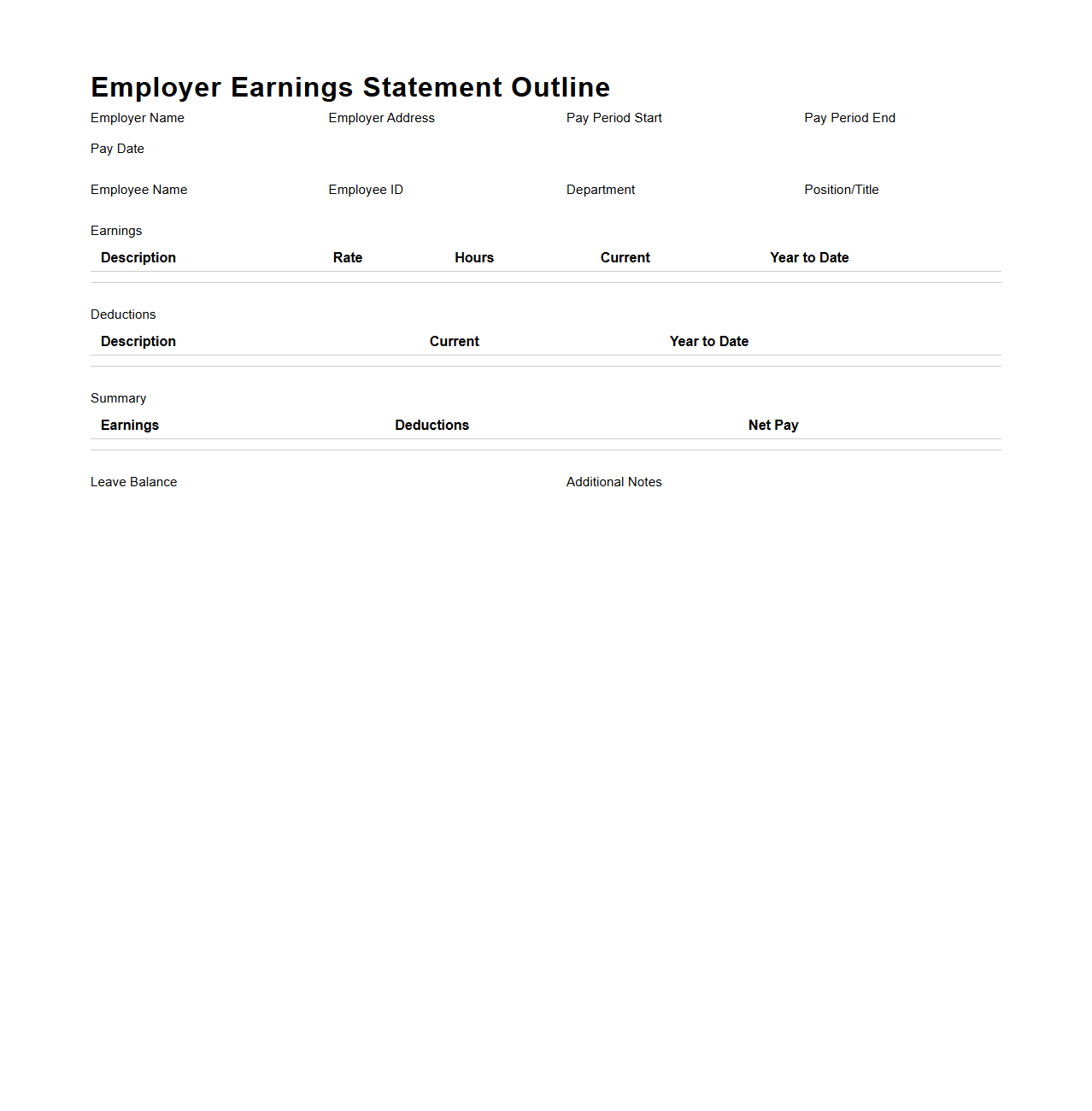

Employer Earnings Statement Outline

An

Employer Earnings Statement Outline document provides a structured summary of an employee's income, including wages, bonuses, deductions, and tax withholdings. It is essential for both employers and employees to ensure accurate payroll processing and financial record-keeping. This document supports compliance with labor laws and aids in transparent communication regarding compensation details.

What details must be included in a blank employee earnings statement template?

A blank employee earnings statement template should include key fields such as employee name, pay period, and employee ID. It must have sections for gross pay, deductions, taxes withheld, and net pay to provide a complete overview of earnings. Additionally, space for employer details and payment dates is essential for accurate record-keeping and verification.

How can a blank earnings statement ensure data privacy compliance?

A blank earnings statement must avoid including sensitive personal information until filled, minimizing data exposure risks. It should comply with data privacy regulations like GDPR by using secure storage and restricted access protocols. Implementing encryption and anonymization techniques during data entry further strengthens compliance and protects employee privacy.

What typical errors occur when filling in a blank employee earnings document?

Common errors in filling employee earnings documents include incorrect wage calculations, missed deductions, and inputting erroneous tax information. Misalignment of pay periods or failure to update employee details often leads to inconsistencies. These mistakes can cause payroll discrepancies and affect employee trust and legal compliance.

How do payroll systems generate a blank statement for manual earnings entry?

Payroll systems generate a blank earnings statement by using pre-configured templates that match company payroll policies. These templates allow manual input while ensuring all necessary fields are present for accurate payroll processing. The system also validates entries to minimize errors before finalizing the statement.

Which legal regulations affect the format of blank employee earnings statements?

Legal regulations such as the Fair Labor Standards Act (FLSA) and local labor laws dictate minimum formatting requirements for earnings statements. These laws require transparent disclosure of hours worked, pay rates, and deductions to protect employees' rights. Compliance with these statutes ensures standardized, fair, and legal payroll documentation practices.